| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of Each Class |

Trading Symbol ( s ) |

Name of Each Exchange on Which Registered | ||

The Stock Exchange of Hong Kong Limited |

☒ |

Accelerated filer |

☐ | ||||

Non-accelerated filer |

☐ |

Emerging growth company |

||||

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

| |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

| • | “ADSs” are to our American depositary shares, each of which represents one Class A ordinary share, par value US$0.01 per share, before our variation of share capital in 2021, and four ordinary shares, par value US$0.0025 per share, after our variation of share capital in 2021; |

| • | “CAGR” refers to compound annual growth rate; |

| • | “CCASS” are to the Central Clearing and Settlement System established and operated by Hong Kong Securities Clearing Company Limited, a wholly-owned subsidiary of Hong Kong Exchange and Clearing Limited; |

| • | “China” or the “PRC” are to the People’s Republic of China, excluding, for the purpose of this annual report only, Hong Kong, Macau and Taiwan; |

| • | “CSRC” are to the China Securities Regulatory Commission; |

| • | “HK$” or “Hong Kong dollars” or “HK dollars” are to Hong Kong dollars, the lawful currency of Hong Kong; |

| • | “Hong Kong” or “HK” or “Hong Kong S.A.R.” are to the Hong Kong Special Administrative Region of the PRC; |

| • | “Hong Kong Listing Rules” are to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended or supplemented from time to time; |

| • | “Hong Kong Share Registrar” are to Computershare Hong Kong Investor Services Limited; |

| • | “Hong Kong Stock Exchange” are to The Stock Exchange of Hong Kong Limited; |

| • | “Main Board” are to the stock market (excluding the option market) operated by the Hong Kong Stock Exchange which is independent from and operated in parallel with the Growth Enterprise Market of the Hong Kong Stock Exchange; |

| • | “Ping An Group” refers to Ping An Insurance (Group) Company of China, Ltd. (HKEX: 2318; SHA: 601318), a company organized under the laws of the PRC whose H shares and A shares are listed on the Hong Kong Stock Exchange and the Shanghai Stock Exchange, respectively; |

| • | “RMB” and “Renminbi” are to the legal currency of China; |

| • | “SFC” are to the Securities and Futures Commission of Hong Kong; |

| • | “SFO” are to the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), as amended or supplemented from time to time; |

| • | “shares” or “ordinary shares” are our Class A ordinary shares, par value US$0.01 per share, before our variation of share capital in 2021, and ordinary shares, par value US$0.0025 per share, after our variation of share capital in 2021; |

| • | “VIEs” and “VIE Entities” are the variable interest entities; |

| • | “we,” “us,” “our,” “our company” or “the Company” are to Autohome Inc., its predecessors, subsidiaries and, in the context of describing our operations and consolidated financial information, the VIEs in China; |

| • | “U.S. GAAP” refers to generally accepted accounting principles in the United States; and |

| • | “$,” “dollars,” “US$” or “U.S. dollars” refers to the legal currency of the United States. |

| • | our ability to attract and retain users and customers; |

| • | our business strategies and initiatives as well as our new business plans; |

| • | our future business development, financial condition and results of operations; |

| • | our ability to further enhance our brand recognition; |

| • | our ability to attract, retain and motivate key personnel; |

| • | competition in our industry in China; and |

| • | relevant government policies and regulations relating to our industry. |

ITEM 1 |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

ITEM 2 |

OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3 |

KEY INFORMATION |

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Intercompany due from/(to) amounts |

||||||||||||||||

| Amounts from parent to offshore subsidiaries (1) |

55,208 | 101,785 | 3,523,478 | 552,911 | ||||||||||||

| Capital contributions from offshore subsidiaries to onshore subsidiaries |

— | — | 163,755 | 25,697 | ||||||||||||

| Amounts transferred among onshore subsidiaries (2) |

— | — | 1,060,098 | 166,352 | ||||||||||||

| Amounts transferred among VIEs and onshore subsidiaries (3) |

— | — | 538,794 | 84,549 | ||||||||||||

| Dividend (paid) by onshore subsidiaries to offshore subsidiaries/parent company |

||||||||||||||||

| Dividend paid by onshore subsidiaries to offshore subsidiaries |

— | (649,551 | ) | (681,427 | ) | (106,931 | ) | |||||||||

| Dividend paid by offshore subsidiaries to parent company |

— | (634,078 | ) | (682,188 | ) | (107,050 | ) | |||||||||

| Amounts paid / (received) by subsidiaries to / (from) VIEs |

||||||||||||||||

| Cash paid by onshore subsidiaries to the VIEs (4) |

245,693 | 121,156 | 251,369 | 39,445 | ||||||||||||

| Cash paid by VIEs to onshore subsidiaries (5) |

601,458 | 231,420 | 587,771 | 92,234 | ||||||||||||

| (1) | It represented temporary operating cash support and the proceeds in connection with our Hong Kong Offering in March, 2021, which was transferred from parent company to offshore subsidiaries. |

| (2) | It represented temporary operating cash support, which was transferred among onshore subsidiaries. |

| (3) | It represented temporary operating cash support, which was transferred among VIEs and onshore subsidiaries. |

| (4) | It mainly represented service fees paid by the WFOEs and other subsidiaries to the VIEs for information services. |

| (5) | It mainly represented service fees paid by VIEs to the WFOEs and other subsidiaries for technological development and promotion service. |

A. |

Selected Financial Data |

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands, except for number of shares and per share data) |

||||||||||||||||||||||||

| Selected Consolidated Statements of Operations Data: |

||||||||||||||||||||||||

| Net revenues (1) |

6,210,181 |

7,233,151 |

8,420,751 |

8,658,559 |

7,237,004 |

1,135,644 |

||||||||||||||||||

| Cost of revenues (2) |

(1,358,685 | ) | (820,288 | ) | (960,292 | ) | (961,170 | ) | (1,047,892 | ) | (164,437 | ) | ||||||||||||

| Gross profit |

4,851,496 |

6,412,863 |

7,460,459 |

7,697,389 |

6,189,112 |

971,207 |

||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||

| Sales and marketing expenses (2) |

(1,647,519 | ) | (2,435,236 | ) | (3,093,345 | ) | (3,246,507 | ) | (2,759,905 | ) | (433,089 | ) | ||||||||||||

| General and administrative expenses (2) |

(281,951 | ) | (314,846 | ) | (317,967 | ) | (381,843 | ) | (543,799 | ) | (85,334 | ) | ||||||||||||

| Product development expenses (2) |

(878,773 | ) | (1,135,247 | ) | (1,291,054 | ) | (1,364,227 | ) | (1,398,037 | ) | (219,383 | ) | ||||||||||||

| Total operating expenses |

(2,808,243 |

) |

(3,885,329 |

) |

(4,702,366 |

) |

(4,992,577 |

) |

(4,701,741 |

) |

(737,806 |

) | ||||||||||||

| Other operating income, net |

8,577 | 341,391 | 477,699 | 443,215 | 294,241 | 46,173 | ||||||||||||||||||

| Operating profit |

2,051,830 |

2,868,925 |

3,235,792 |

3,148,027 |

1,781,612 |

279,574 |

||||||||||||||||||

| Interest and investment income, net |

220,282 | 347,794 | 464,529 | 521,731 | 395,245 | 62,022 | ||||||||||||||||||

| Earnings/(loss) from equity method investments |

(10,571 | ) | 24,702 | 685 | (1,246 | ) | 301 | 47 | ||||||||||||||||

| Income before income taxes |

2,261,541 |

3,241,421 |

3,701,006 |

3,668,512 |

2,177,158 |

341,643 |

||||||||||||||||||

| Income tax expense |

(267,082 | ) | (377,890 | ) | (500,361 | ) | (260,945 | ) | (34,006 | ) | (5,336 | ) | ||||||||||||

| Net income |

1,994,459 |

2,863,531 |

3,200,645 |

3,407,567 |

2,143,152 |

336,307 |

||||||||||||||||||

| Net (income)/loss attributable to noncontrolling interests |

7,160 | 7,484 | (679 | ) | (2,338 | ) | 105,633 | 16,576 | ||||||||||||||||

| Net income attributable to Autohome Inc. |

2,001,619 |

2,871,015 |

3,199,966 |

3,405,229 |

2,248,785 |

352,883 |

||||||||||||||||||

| Accretion of mezzanine equity. |

— | — | — | — | (411,792 | ) | (64,619 | ) | ||||||||||||||||

| Accretion attributable to noncontrolling interests. |

— | — | — | — | 311,573 | 48,893 | ||||||||||||||||||

| Net income attributable to ordinary shareholders |

2,001,619 |

2,871,015 |

3,199,966 |

3,405,229 |

2,148,566 |

337,157 |

||||||||||||||||||

| Earnings per share for ordinary shares (3) |

||||||||||||||||||||||||

| Basic |

4.30 | 6.10 | 6.75 | 7.13 | 4.30 | 0.67 | ||||||||||||||||||

| Diluted |

4.24 | 6.02 | 6.69 | 7.10 | 4.29 | 0.67 | ||||||||||||||||||

| Earnings per ADS attributable to ordinary shareholders (one ADS equals four ordinary shares) |

||||||||||||||||||||||||

| Basic |

17.20 | 24.40 | 26.99 | 28.53 | 17.19 | 2.70 | ||||||||||||||||||

| Diluted |

16.95 | 24.08 | 26.77 | 28.40 | 17.17 | 2.69 | ||||||||||||||||||

| Weighted average number of shares used to compute earnings per share (4) |

||||||||||||||||||||||||

| Ordinary shares: |

||||||||||||||||||||||||

| Basic |

465,519,384 | 470,687,884 | 474,328,384 | 477,467,268 | 499,861,764 | 499,861,764 | ||||||||||||||||||

| Diluted |

472,235,424 | 476,941,516 | 478,060,988 | 479,686,380 | 500,481,540 | 500,481,540 | ||||||||||||||||||

| Dividend per share (5) |

— | — | — | — | — | — | ||||||||||||||||||

| (1) | In May 2014, the Financial Accounting Standards Board issued ASC 606, Revenue from Contracts with Customers, a new standard related to revenue recognition. The most significant impact on our company is the change of the presentation of value-added tax from gross basis to net basis. We adopted this guidance effective from January 1, 2018 using the modified retrospective method. The comparative information has not been restated and continues to be reported under the accounting standards in effect for the relevant periods. As a result, the operating results for the years ended December 31, 2017 have not been restated and are presented on a gross basis with value-added tax being included in the net revenues and cost of revenues in such years, while the operating results for the years ended December 31, 2018, 2019, 2020 and 2021 are presented on net basis, with the value-added tax being excluded from the net revenues and cost of revenues in such year, and value-added tax refunds being presented as a component of other operating income, net. |

| (2) | Including share-based compensation expenses as follows: |

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Allocation of share-based compensation expenses |

||||||||||||||||||||||||

| Cost of revenues |

15,166 | 16,112 | 15,508 | 21,372 | 23,142 | 3,631 | ||||||||||||||||||

| Sales and marketing expenses |

53,064 | 61,599 | 46,081 | 40,103 | 46,823 | 7,348 | ||||||||||||||||||

| General and administrative expenses |

59,954 | 55,992 | 62,884 | 55,868 | 48,803 | 7,658 | ||||||||||||||||||

| Product development expenses |

49,602 | 68,622 | 79,535 | 93,863 | 87,292 | 13,698 | ||||||||||||||||||

| Total share-based compensation expenses |

177,786 |

202,325 |

204,008 |

211,206 |

206,060 |

32,335 |

||||||||||||||||||

| (3) | Par value per share and the number of shares have been retrospectively adjusted for the share split and the ADS ratio change that were effective on February 5, 2021 as detailed in Note 2(a) of “Item 18. Financial Statements.” |

| (4) | Earnings per share for ordinary shares (diluted) for each year from 2017 to 2021 were computed after taking into account the dilutive effect of the shares underlying our employees’ share-based awards. |

| (5) | The special cash dividends declared in November 2017 to the holders of our ordinary shares of record as of the close of business on January 4, 2018 were paid in the amount of US$0.76 per share (inclusive of applicable fees payable to our depositary bank) on or about January 15, 2018. The cash dividends declared in February 2020 to the holders of our ordinary shares of record as of the close of business on April 15, 2020 were paid in the amount of US$0.77 per share (inclusive of applicable fees payable to our depositary bank) on or about April 22, 2020. The cash dividends declared in February 2021 to the holders of our ordinary shares of record as of the close of business on February 25, 2021 were paid in the amount of US$0.87 per ADS (inclusive of applicable fees payable to our depositary bank) on or about March 5, 2021. The cash dividends declared in February 2022 to holders of our ordinary shares of record as of the close of business on March 21, 2022 were paid in an amount of US$0.1325 per share (or US$0.53 per ADS) on March 31, 2022. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy.” |

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Selected Consolidated Balance Sheet Data: |

||||||||||||||||||||||||

| Cash and cash equivalents, restricted cash, current and short-term investments |

8,154,224 | 10,061,458 | 12,795,110 | 14,629,398 | 20,822,623 | 3,267,523 | ||||||||||||||||||

| Accounts receivable, net |

1,893,737 | 2,795,835 | 3,231,486 | 3,124,197 | 2,139,471 | 335,730 | ||||||||||||||||||

| Total current assets |

10,258,586 | 13,141,317 | 16,358,382 | 18,364,080 | 23,325,718 | 3,660,314 | ||||||||||||||||||

| Total assets (1) |

12,294,975 |

15,756,201 |

19,155,865 |

23,730,845 |

28,529,006 |

4,476,824 |

||||||||||||||||||

| Deferred revenue |

1,409,485 | 1,510,726 | 1,370,953 | 1,315,667 | 1,553,013 | 243,702 | ||||||||||||||||||

| Total current liabilities |

3,889,316 | 4,164,769 | 3,965,903 | 4,185,683 | 3,986,219 | 625,524 | ||||||||||||||||||

| Total non-current liabilities |

470,373 | 479,989 | 584,021 | 736,370 | 605,417 | 95,004 | ||||||||||||||||||

| Total liabilities (1) |

4,359,689 |

4,644,758 |

4,549,924 |

4,922,053 |

4,591,636 |

720,528 |

||||||||||||||||||

| Mezzanine equity |

— |

— |

— |

1,056,237 |

1,468,029 |

230,366 |

||||||||||||||||||

| Total Autohome Inc. shareholders’ equity |

7,951,637 |

11,135,278 |

14,629,097 |

17,625,734 |

22,754,419 |

3,570,665 |

||||||||||||||||||

| Total equity |

7,935,286 |

11,111,443 |

14,605,941 |

17,752,555 |

22,469,341 |

3,525,930 |

||||||||||||||||||

| Total liabilities, mezzanine equity and equity |

12,294,975 |

15,756,201 |

19,155,865 |

23,730,845 |

28,529,006 |

4,476,824 |

||||||||||||||||||

| (1) | In February 2016, the Financial Accounting Standards Board issued ASU No. 2016-02, Leases, or ASU 2016-02. Under the new provisions, all lessees will report a right-of-use right-of-use right-of-use non-current assets) of RMB133.4 million (US$20.9 million), operating lease liabilities, current (included in accrued expenses and other payables) of RMB96.2 million (US$15.1 million) and operating lease liabilities, non-current (included in other liabilities) of RMB28.6 million (US$4.5 million) were recognized on our consolidated balance sheet. |

For the Year Ended December 31, 2021 |

||||||||||||||||||||||||

Autohome Inc. |

Other Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||||||

| -Third-party revenues |

— | 6,081,662 | 206,822 | 948,520 | — | 7,237,004 | ||||||||||||||||||

| -Inter-company revenues (1) |

— | 18,446 | 1,085,139 | 131,524 | (1,235,109 | ) | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenue |

— | 6,100,108 |

1,291,961 |

1,080,044 |

(1,235,109 |

) |

7,237,004 |

|||||||||||||||||

| Total Cost and expense |

(36,007 |

) |

(4,671,667 |

) |

(1,100,250 |

) |

(1,176,818 |

) |

1,235,109 |

(5,749,633 |

) | |||||||||||||

| Share of income of subsidiaries and VIEs (2) : |

||||||||||||||||||||||||

| -Share of income of subsidiaries |

2,326,018 | 130,868 | 26,825 | — | (2,483,711 | ) | — | |||||||||||||||||

| -Share of income of VIEs |

— | — | (89,397 | ) | — | 89,397 | — | |||||||||||||||||

| Others, Income/(loss) |

(41,226 | ) | 725,283 | 3,869 | 1,861 | — | 689,787 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes |

2,248,785 |

2,284,592 |

133,008 |

(94,913 |

) |

(2,394,314 |

) |

2,177,158 |

||||||||||||||||

| Income tax expense |

— | (64,207 | ) | 24,685 | 5,516 | — | (34,006 | ) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) |

2,248,785 |

2,220,385 |

157,693 |

(89,397 |

) |

(2,394,314 |

) |

2,143,152 |

||||||||||||||||

| Net loss/(income) attributable to noncontrolling interests |

— | 105,633 | — | — | — | 105,633 | ||||||||||||||||||

| Net income attributable to Autohome Inc. |

2,248,785 |

2,326,018 |

157,693 |

(89,397 |

) |

(2,394,314 |

) |

2,248,785 |

||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | It represents the elimination of the intercompany service charge at the consolidation level. |

| (2) | It represents the elimination of incurrence of losses by parent company and its subsidiaries for, or the receipt of economic benefits by parent company and its subsidiaries from, their respective subsidiaries and the VIEs. |

For the Year Ended December 31, 2020 |

||||||||||||||||||||||||

Autohome Inc. |

Other Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||||||

| -Third-party revenues |

— | 7,642,110 | 315,841 | 700,608 | — | 8,658,559 | ||||||||||||||||||

| -Inter-company revenues (1) |

— | 10,623 | 900,900 | 173,299 | (1,084,822 | ) | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenue |

— | 7,652,733 |

1,216,741 |

873,907 |

(1,084,822 |

) |

8,658,559 |

|||||||||||||||||

| Total Cost and expense |

(21,109 |

) |

(5,252,144 |

) |

(887,750 |

) |

(877,566 |

) |

1,084,822 |

(5,953,747 |

) | |||||||||||||

| Share of income of subsidiaries and VIEs (2) : |

||||||||||||||||||||||||

| -Share of income of subsidiaries |

3,361,422 | 482,106 | 9,172 | — | (3,852,700 | ) | — | |||||||||||||||||

| -Share of income of VIEs |

— | — | 23,342 | — | (23,342 | ) | — | |||||||||||||||||

| Others, Income/(loss) |

64,916 | 752,063 | 131,438 | 15,283 | — | 963,700 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes |

3,405,229 |

3,634,758 |

492,943 |

11,624 |

(3,876,042 |

) |

3,668,512 |

|||||||||||||||||

| Income tax expense |

— | (270,998 | ) | (1,665 | ) | 11,718 | — | (260,945 | ) | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) |

3,405,229 |

3,363,760 |

491,278 |

23,342 |

(3,876,042 |

) |

3,407,567 |

|||||||||||||||||

| Net loss/(income) attributable to noncontrolling interests |

— | (2,338 | ) | — | — | — | (2,338 | ) | ||||||||||||||||

| Net income attributable to Autohome Inc. |

3,405,229 |

3,361,422 |

491,278 |

23,342 |

(3,876,042 |

) |

3,405,229 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | It represents the elimination of the intercompany service charge at the consolidation level. |

| (2) | It represents the elimination of incurrence of losses by parent company and its subsidiaries for, or the receipt of economic benefits by parent company and its subsidiaries from, their respective subsidiaries and the VIEs. |

For the Year Ended December 31, 2019 |

||||||||||||||||||||||||

Autohome Inc. |

Other Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||||||

| -Third-party revenues |

— | 7,385,579 | 333,132 | 702,040 | — | 8,420,751 | ||||||||||||||||||

| -Inter-company revenues (1) |

— | 22,113 | 1,055,078 | 113,430 | (1,190,621 | ) | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenue |

— | 7,407,692 |

1,388,210 |

815,470 |

(1,190,621 |

) |

8,420,751 |

|||||||||||||||||

| Total Cost and expense |

(14,757 |

) |

(4,996,916 |

) |

(1,016,710 |

) |

(824,896 |

) |

1,190,621 |

(5,662,658 |

) | |||||||||||||

| Share of income of subsidiaries and VIEs (2) : |

||||||||||||||||||||||||

| -Share of income of subsidiaries |

3,140,537 | 462,075 | 15,057 | — | (3,617,669 | ) | — | |||||||||||||||||

| -Share of income of VIEs |

— | — | (848 | ) | — | 848 | — | |||||||||||||||||

| Others, Income/(loss) |

74,186 | 752,344 | 102,141 | 14,242 | — | 942,913 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes |

3,199,966 |

3,625,195 |

487,850 |

4,816 |

(3,616,821 |

) |

3,701,006 |

|||||||||||||||||

| Income tax expense |

— | (483,979 | ) | (10,718 | ) | (5,664 | ) | — | (500,361 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) |

3,199,966 |

3,141,216 |

477,132 |

(848 |

) |

(3,616,821 |

) |

3,200,645 |

||||||||||||||||

| Net loss/(income) attributable to noncontrolling interests |

— | (679 | ) | — | — | — | (679 | ) | ||||||||||||||||

| Net income attributable to Autohome Inc. |

3,199,966 |

3,140,537 |

477,132 |

(848 |

) |

(3,616,821 |

) |

3,199,966 |

||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | It represents the elimination of the intercompany service charge at the consolidation level. |

| (2) | It represents the elimination of incurrence of losses by parent company and its subsidiaries for, or the receipt of economic benefits by parent company and its subsidiaries from, their respective subsidiaries and the VIEs. |

As of December 31, 2021 |

||||||||||||||||||||||||

Autohome Inc. |

Other Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Cash and cash equivalents, restricted cash and short-term investments |

320,639 | 16,968,899 | 3,074,976 | 458,109 | — | 20,822,623 | ||||||||||||||||||

| Amounts due from Group companies |

3,862,063 | 2,295,176 | 1,156,827 | 183,335 | (7,497,401 | ) | — | |||||||||||||||||

| Other current assets |

7,117 | 2,342,777 | 58,677 | 94,524 | — | 2,503,095 | ||||||||||||||||||

| Total current assets |

4,189,819 |

21,606,852 |

4,290,480 |

735,968 |

(7,497,401 |

) |

23,325,718 |

|||||||||||||||||

| Investment in subsidiaries and VIEs |

||||||||||||||||||||||||

| -Investment in subsidiaries (1) |

18,606,902 | 3,009,373 | 395,800 | — | (22,012,075 | ) | — | |||||||||||||||||

| -Investment in VIE (1) |

— | — | 1,697,324 | — | (1,687,324 | ) | — | |||||||||||||||||

| |

|

|||||||||||||||||||||||

| Other non-current assets |

— | 3,135,986 | 144,454 | 1,922,848 | — | 5,203,288 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-current assets |

18,606,902 |

6,145,359 |

2,237,578 |

1,922,848 |

(23,709,399 |

) |

5,203,288 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total assets |

22,796,721 |

27,752,211 |

6,528,058 |

2,658,816 |

(31,206,800 |

) |

28,529,006 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Amounts due to Group companies |

22,740 | 4,713,764 | 2,235,914 | 524,983 | (7,497,401 | ) | — | |||||||||||||||||

| Accrued expenses and other payables |

19,562 | 1,529,808 | 271,463 | 255,661 | — | 2,076,494 | ||||||||||||||||||

| Advance from customers |

— | 34,610 | 61 | 88,699 | — | 123,370 | ||||||||||||||||||

| Deferred revenue |

— | 1,495,984 | 25,544 | 31,485 | — | 1,553,013 | ||||||||||||||||||

| Income tax payable |

— | 115,154 | 118,188 | — | — | 233,342 | ||||||||||||||||||

| Total current liabilities |

42,302 |

7,889,320 |

2,651,170 |

900,828 |

(7,497,401 |

) |

3,986,219 |

|||||||||||||||||

| |

|

|||||||||||||||||||||||

| Total non-current liabilities |

— | 73,038 |

471,715 |

60,664 |

— |

605,417 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

42,302 |

7,962,358 |

3,122,885 |

961,492 |

(7,497,401 |

) |

4,591,636 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Mezzanine equity |

— | 1,468,029 | — | — | — | 1,468,029 | ||||||||||||||||||

| |

|

|||||||||||||||||||||||

| Total Autohome Inc. shareholders’ equity |

22,754,419 |

18,606,902 |

3,405,173 |

1,697,324 |

(23,709,399 |

) |

22,754,419 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Noncontrolling interests |

— | (285,078 | ) | — | — | — | (285,078 | ) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total shareholders’ equity |

22,754,419 |

18,321,824 |

3,405,173 |

1,697,324 |

(23,709,399 |

) |

22,469,341 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities, mezzanine equity and equity |

22,796,721 |

27,752,211 |

6,528,058 |

2,658,816 |

(31,206,800 |

) |

28,529,006 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | It represents the elimination of the equity investment in subsidiaries and VIEs by parent company, other subsidiaries, and primary beneficiary of VIEs. |

As of December 31, 2020 |

||||||||||||||||||||||||

Autohome Inc. |

Other Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Cash and cash equivalents, restricted cash and short-term investments |

281,379 | 10,313,540 | 3,776,289 | 258,190 | — | 14,629,398 | ||||||||||||||||||

| Amounts due from Group companies |

— | 2,482,058 | 1,440,420 | 129,223 | (4,051,701 | ) | — | |||||||||||||||||

| Other current assets |

815,934 | 3,316,548 | 228,311 | 171,028 | (797,139 | ) | 3,734,682 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total current assets |

1,097,313 |

16,112,146 |

5,445,020 |

558,441 |

(4,848,840 |

) |

18,364,080 |

|||||||||||||||||

| Investment in subsidiaries and VIEs |

||||||||||||||||||||||||

| -Investment in subsidiaries (1) |

16,540,687 | 4,097,465 | 368,975 | — | (21,007,127 | ) | — | |||||||||||||||||

| -Investment in VIE (1) |

— | — | 1,854,526 | — | (1,854,526 | ) | — | |||||||||||||||||

| Other non-current assets |

— | 3,153,357 | 135,639 | 2,077,769 | — | 5,366,765 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-current assets |

16,540,687 |

7,250,822 |

2,359,140 |

2,077,769 |

(22,861,653 |

) |

5,366,765 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total assets |

17,638,000 |

23,362,968 |

7,804,160 |

2,636,210 |

(27,710,493 |

) |

23,730,845 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Accrued expenses and other payables |

12,266 | 2,596,144 | 348,591 | 497,742 | (797,139 | ) | 2,657,604 | |||||||||||||||||

| Advance from customers |

— | 39,464 | 167 | 87,604 | — | 127,235 | ||||||||||||||||||

| Deferred revenue |

— | 1,287,351 | 10,672 | 17,644 | — | 1,315,667 | ||||||||||||||||||

| Income tax payable |

— | 85,177 | — | — | — | 85,177 | ||||||||||||||||||

| Amounts due to Group companies |

— | 1,464,087 | 2,484,221 | 103,393 | (4,051,701 | ) | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total current liabilities |

12,266 |

5,472,223 |

2,843,651 |

706,383 |

(4,848,840 |

) |

4,185,683 |

|||||||||||||||||

| Total non-current liabilities |

— | 167,000 |

494,069 |

75,301 |

— | 736,370 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

12,266 |

5,639,223 |

3,337,720 |

781,684 |

(4,848,840 |

) |

4,922,053 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Mezzanine equity: |

— | 1,056,237 | — | — | — | 1,056,237 | ||||||||||||||||||

| Total Autohome Inc. shareholders’ equity |

17,625,734 |

16,540,687 |

4,466,440 |

1,854,526 |

(22,861,653 |

) |

17,625,734 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Noncontrolling interests |

— | 126,821 | — | — | — | 126,821 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total shareholders’ equity |

17,625,734 |

16,667,508 |

4,466,440 |

1,854,526 |

(22,861,653 |

) |

17,752,555 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities, mezzanine equity and equity |

17,638,000 |

23,362,968 |

7,804,160 |

2,636,210 |

(27,710,493 |

) |

23,730,845 |

|||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | It represents the elimination of the equity investment in subsidiaries and VIEs by parent company, other subsidiaries, and primary beneficiary of VIEs. |

For the Year Ended December 31, 2021 |

||||||||||||||||||||||||

Parent Only |

Other Equity Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Net cash (used in)/provided by operating activities |

(10,770 | ) | 2,852,900 | 269,838 | 411,966 | — | 3,523,934 | |||||||||||||||||

| Net cash (used in)/provided by investing activities |

(2,841,291 | ) | (4,681,424 | ) | 173,535 | (386,343 | ) | 3,922,510 | (3,813,013 | ) | ||||||||||||||

| Net cash (used in)/provided by financing activities |

2,898,296 | 3,886,326 | (127,240 | ) | 163,424 | (3,922,510 | ) | 2,898,296 | ||||||||||||||||

For the Year Ended December 31, 2020 |

||||||||||||||||||||||||

Parent Only |

Other Equity Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Net cash (used in)/provided by operating activities |

(1,188 | ) | 1,481,771 | 1,821,901 | 23,147 | — | 3,325,631 | |||||||||||||||||

| Net cash (used in)/provided by investing activities |

532,293 | (727,798 | ) | (1,801,299 | ) | 193,190 | (1,181,844 | ) | (2,985,458 | ) | ||||||||||||||

| Net cash (used in)/provided by financing activities |

(546,967 | ) | (532,293 | ) | (649,551 | ) | — | 1,181,844 | (546,967 | ) | ||||||||||||||

For the Year Ended December 31, 2019 |

||||||||||||||||||||||||

Parent Only |

Other Equity Subsidiaries |

Primary Beneficiary of VIEs |

VIEs and VIEs’ subsidiaries |

Eliminations |

Consolidated Total |

|||||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||||||

| Net cash (used in)/provided by operating activities |

(498 | ) | 2,691,648 | 644,577 | (446,358 | ) | — | 2,889,369 | ||||||||||||||||

| Net cash (used in)/provided by investing activities |

218,406 | (1,951,026 | ) | 30,632 | 478,513 | 55,208 | (1,168,267 | ) | ||||||||||||||||

| Net cash (used in)/provided by financing activities |

68,676 | 55,208 | — | — | (55,208 | ) | 68,676 | |||||||||||||||||

B. |

Capitalization and Indebtedness |

C. |

Reasons for the Offer and Use of Proceeds |

D. |

Risk Factors |

| • | We are dependent on China’s automotive industry for substantially all of our revenues and future growth, the prospects of which are subject to many uncertainties, including government regulations and policies and health epidemics. |

| • | We face significant competition, and if we fail to compete effectively, we may lose market share and our business, prospects and results of operations may be materially and adversely affected. |

| • | We may not be able to maintain our current level of growth or ensure the success of our expansion and new business initiatives. |

| • | If we fail to attract and retain users and customers or if our services do not gain market acceptance or result in the loss of our current customer base, our business and results of operations may be materially and adversely affected. |

| • | Our business depends on strong brand recognition, and failure to maintain or enhance our brands could adversely affect our business and prospects. |

| • | Our business is subject to complex and evolving Chinese laws and regulations regarding data privacy and cybersecurity, many of which are subject to changes and uncertain interpretations. Any changes in these laws could cause changes to our business practices and increased cost of operations, and any security breaches or our actual or perceived failure to comply with such laws could result in claims, penalties, damages to our reputation and brand, declines in user growth or engagement, or otherwise harm our business, results of operations and financial condition. |

| • | A limited number of automaker customers have accounted for, and are expected to continue to account for, a large portion of our revenues. Failure to maintain or to increase revenues from these customers could harm our prospects. |

| • | We are a Cayman Islands holding company with no equity ownership in the VIEs and we conduct our operations in China primarily through our subsidiaries and VIEs, with which we have maintained contractual arrangements. Investors in our ordinary shares and ADSs thus are not purchasing equity interest in the VIEs in China but instead are purchasing equity interest in a Cayman Islands holding company. If the PRC government finds that the agreements that establish the structure for operating our services in China do not comply with PRC governmental restrictions on foreign investment in internet businesses, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations, and we may face significant disruption to our business operations. Our holding company, VIEs and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect the financial performance of the VIEs and our company as a whole. The PRC regulatory authorities could disallow the variable interest entities structure, which would likely result in a material adverse change in our operations, and our ordinary shares or our ADSs may decline significantly in value. |

| • | Our contractual arrangements with the VIEs may not be as effective in providing operational control as direct ownership. |

| • | The shareholders of the VIEs may breach, or cause the VIEs to breach, or refuse to renew, the existing contractual arrangements we have with them and the VIEs. Any failure by the VIEs or their shareholders to perform their obligations under our contractual arrangements with them would have a material adverse effect on our business and financial condition. |

| • | The contractual arrangements among our subsidiaries and the VIEs may be subject to scrutiny by the PRC tax authorities and a finding that we or the VIEs owe additional taxes could substantially reduce our consolidated net income and the value of your investment. |

| • | The interests of the individual nominee shareholders of the VIEs may be different from our interests, which may materially and adversely affect our business. |

| • | The PCAOB is currently unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections over our auditor deprives our investors with the benefits of such inspections. |

| • | Our ADSs will be delisted and prohibited from trading in the United States under the HFCAA, in 2024 if the PCAOB is unable to inspect or fully investigate auditors located in China, or in 2023 if proposed changes to the law are enacted. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. |

| • | The PRC government’s significant oversight and discretion over our business operations could result in a material adverse change in our operations and the value of our ADSs and/or ordinary shares. |

| • | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations. |

| • | Uncertainties with respect to the PRC legal system could adversely affect us. |

| • | Substantial uncertainties exist with respect to the interpretation and implementation of the PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. |

| • | We may be adversely affected by the complexity, uncertainties and changes in PRC regulation of internet business and companies. |

| • | The approval of and filing with the CSRC or other PRC government authorities may be required if we were to conduct offshore offerings in the future, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing. |

| • | The trading price of our ADSs and/or ordinary shares has been and is likely to continue to be, volatile, which could result in substantial losses to holders of our ADSs and/or ordinary shares. |

| • | We adopt different practices as to certain matters as compared with many other companies listed on the Hong Kong Stock Exchange. |

| • | We cannot guarantee that any share repurchase program will be fully consummated or that any share repurchase program will enhance long-term shareholder value, and share repurchases could increase the volatility of the price of our ADSs and/or ordinary shares and could diminish our cash reserves. |

| • | If securities or industry analysts do not publish research or reports about our business, or publish inaccurate or unfavorable research or reports about our business or if they adversely change their recommendations regarding our ADSs and/or ordinary shares, the market price for our ADSs and/or ordinary shares and trading volume could decline. |

| • | protecting the data in and hosted on our system, including against attacks on our system by outside parties or fraudulent behavior or improper use by our employees; |

| • | addressing concerns related to privacy and sharing, safety, security and other factors; and |

| • | complying with applicable laws, rules and regulations relating to the collection, use, storage, transfer, disclosure and security of personal information which are subject to change and new interpretations, including any requests from regulatory and government authorities relating to such data. |

| • | The Cyber Security Law of the PRC, or the PRC Cyber Security Law, which became effective in June 2017, created China’s first national-level data protection framework for “network operators.” However, it is subject to interpretations and clarifications by the regulator. It requires, among other things, that network operators take security measures to protect the network from interference, damage and unauthorized access and to prevent data from being divulged, stolen or tampered with. Network operators are also required to collect and use personal information in compliance with the principles of legitimacy, properness and necessity, expressly notify the purpose, methods and scope of such collection and use, and obtain the consent of the person whose personal information is to be collected. Substantial financial, managerial and human resources are required to comply with such legal requirements, enhance information security and address any issues caused by security failures. Even if our security measures are sufficient and in compliance, we nonetheless face the risk of security breaches or similar disruptions. |

| Due to the data assets we have, our platform is an attractive target and potentially vulnerable to cyberattacks, computer viruses, physical or electronic break-ins or similar disruptions. Because techniques used to sabotage or obtain unauthorized access to systems evolve continuously and frequently and generally are not recognized until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative counter-measures. In addition to advances in technology, an increased level of sophistication and diversity of our products and services, an increased level of expertise of hackers, new discoveries in the field of cryptography or other risks can result in the compromise or breach of our websites or our apps. If security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our technology infrastructure are exposed and exploited, user data or personal information could be stolen or misused, which could expose us to penalties or other administrative actions, time-consuming and expensive litigation and negative publicity, materially and adversely affect our business and reputation and deter potential users from using our products, each of which would have a material adverse impact on our results of operations, financial condition and business prospect. |

| • | In June 2021, the Standing Committee of the NPC promulgated the PRC Data Security Law, which took effect in September 2021. The PRC Data Security Law, among other things, provides for security review procedure for data-related activities that may affect national security. A series of regulations, guidelines and other measures have been and are expected to be adopted to implement the requirements created by the PRC Data Security Law. For example, in July 2021, the State Council promulgated the Regulations on Protection of Critical Information Infrastructure, which became effective on September 1, 2021. Pursuant to this regulation, a “critical information infrastructure” is defined as key network facilities or information systems of critical industries or sectors, such as public communication and information service, energy, transportation, water conservation, finance, public services, e-government affairs and national defense science, the damage, malfunction or data leakage of which may endanger national security, people’s livelihoods and the public interest. In December 2021, the CAC, together with other authorities, jointly promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022 and replaces its predecessor regulation. Pursuant to the Cybersecurity Review Measures, critical information infrastructure operators purchasing network products and services and internet platform operators carrying out data processing activities, in a manner which affects or may affect national security, are subject to cybersecurity review. The Cybersecurity Review Measures further provides that network platform operators that hold personal information of over one million users shall apply with the Cybersecurity Review Office for a cybersecurity review before any public offering at a foreign stock exchange. As of the date of this annual report, we have not been informed that we are a “critical information infrastructure operator” by any government authority. However, the exact scope of “critical information infrastructure operators” under the current regulatory regime remains unclear, and the PRC government authorities may have wide discretion in the interpretation and enforcement of the applicable laws. Therefore, it is uncertain whether we would be deemed to be a critical information infrastructure operator under PRC law. If we are deemed a “critical information infrastructure operator” under the PRC cybersecurity laws and regulations, we may be subject to obligations in addition to those with which we are currently obligated to comply. |

| • | In November 2021, the CAC released the Regulations on the Network Data Security (Draft for Comments), or the Draft Regulations on Network Data Security. The Draft Regulations on Network Data Security define “data processors” as individuals or organizations that can autonomously determine the purpose and the manner of data processing. In accordance with the Draft Regulations on Network Data Security, data processors shall apply for a cybersecurity review for certain activities, including, among other things, (i) seeking for listing abroad of data processors that process the personal information of more than one million users and (ii) any data processing activity that affects or may affect national security. However, there have been no clarifications from the relevant authorities as of the date of this annual report as to the standards for determining whether an activity is one that “affects or may affect national security” under the Draft Regulations on Network Data Security. In addition, the Draft Regulations on Network Data Security requires that data processors that process “important data” or which seeks for listing overseas must conduct an annual data security assessment by itself or authorize a data security service provider to do so, and submit the assessment report of the preceding year to the municipal cybersecurity department by the end of January each year. As of the date of this annual report, the Draft Regulations on Network Data Security were released for public comment only, and their respective provisions and anticipated adoption or effective date may be subject to change with substantial uncertainty. |

| • | The Guideline on Anti-monopoly of Platform Economy Sector published by the Anti-monopoly Committee of the State Council, effective on February 7, 2021, prohibits collection of unnecessary user information through coercive means by online platform operators. |

| • | In August 2021, the Standing Committee of the NPC promulgated the Personal Information Protection Law, which took effect on November 1, 2021. The Personal Information Protection Law further strengthened requirements on personal information protection, enhanced the punishment for illegal processing of personal information and consolidated various previously promulgated rules with respect to personal information rights and privacy protection. We update our privacy policies from time to time to meet the latest regulatory requirements of PRC government authorities and adopt technical measures to protect data and ensure cybersecurity in a systematic way. Nonetheless, the Personal Information Protection Law elevates the protection requirements for personal information processing, and many specific requirements of this law remain to be clarified by the CAC, other regulatory authorities, and courts in practice. We may be required to make adjustments to our business practices to comply with the personal information protection laws and regulations. |

| • | contract reduction, delay or cancelation by one or more significant customers and our failure to identify and acquire additional or replacement customers; |

| • | dissatisfaction with our services by one or more of our significant customers; |

| • | a substantial reduction by one or more of our significant customers in the price they are willing to pay for our services; and |

| • | financial difficulty of one or more of our significant customers who become unable to make timely payment for our services. |

| • | difficulties associated with developing a larger user base with demographic characteristics attractive to advertisers; |

| • | increased competition and potential downward pressure on online advertising prices; |

| • | difficulties in acquiring and retaining advertisers or dealer subscribers; |

| • | uncertainties and changes in regards to PRC regulations on internet advertisements; |

| • | failure to develop an independent and reliable means of verifying online traffic; and |

| • | decreased use of the internet or online marketing in China. |

| • | the failure to achieve the expected benefits of the acquisition, investment or alliance; |

| • | difficulties in, and the cost of, integrating operations, technologies, services and personnel; |

| • | write-offs of investments or acquired assets; |

| • | non-performance by, or conflicts of interest with, the parties with whom we enter into investments or alliances; |

| • | limited ability to monitor or control the actions of other parties with whom we enter into investments or alliances; |

| • | misuse of proprietary information shared in connection with an acquisition, investment or alliance; and |

| • | depending on the nature of the acquisition, investment or alliance, exposure to new regulatory risks. The realization of any of these risks could materially and adversely affect our business. To the extent any of our directors or officers also invests in a capacity other than as our director or officer, his or her interest may not be aligned with ours. |

| • | We only have contractual control over our websites and mobile applications. We do not own the websites or the mobile applications due to the restriction on foreign investment in value-added telecommunication services and internet content provision services. |

| • | There are uncertainties relating to the regulation of the internet industry in China, including evolving licensing requirements. This means that permits, licenses or operations at some of our subsidiaries and VIEs may be subject to challenge, or we may fail to obtain permits or licenses that applicable regulators may deem necessary for our operations, or we may not be able to obtain or renew permits or licenses. For example, the VIEs may be required to obtain additional licenses, including internet publishing licenses and internet news information service licenses, if the release of articles and information on our mobile applications and websites is deemed by the PRC regulatory authorities as being provision of internet publishing service, internet news information service. See “Item 4. Information on the Company—B. Business Overview—PRC Regulation—Regulations on Internet Publishing” and “Item 4. Information on the Company—B. Business Overview—PRC Regulation—Regulations on Internet News Information Service” for additional details. |

| • | The evolving PRC regulatory system for the internet industry may lead to the establishment of new regulatory agencies. For example, in March 2018, the State Council announced to transform the Central Leading Group for Cyberspace Affairs into a new department, the Office of the Central Cyberspace Affairs Commission. The primary role of this new agency is to facilitate the policy-making and legislative development in this field, to direct and coordinate with the relevant departments in connection with online content administration and to deal with cross-ministry regulatory matters in relation to the internet industry, and the National Computer Network and Information Security Management Center was adjusted to be managed by the Office of the Central Cyberspace Affairs Commission Office instead of the MIIT. |

| • | New laws and regulations may be promulgated to regulate internet activities. As such, additional licenses may be required for our operations. If our operations do not comply with these new regulations at the time they become effective, or if we fail to obtain any licenses required under these new laws and regulations, we could be subject to penalties. |

| • | New government policies and internal rules relating to the regulations on internet activities may negatively affect our user traffic growth. For example, the E-commerce Law, which took effect on January 1, 2019, provides that the character “advertisement” should be noticeably marked on the commodities or services ranked under competitive bidding. Complying with such requirements may negatively affect the growth rate of user traffic on our websites and mobile applications. The promulgation of laws and regulations relating to the internet activities may further impair our user traffic growth. |

| • | regulatory developments in our target markets affecting us, our customers or our competitors; |

| • | conditions in the entire automotive ecosystem; |

| • | conditions in the online industry; |

| • | actual or anticipated fluctuations in our quarterly results of operations and changes or revisions to our expected results; |

| • | changes in financial estimates by securities research analysts; |

| • | fluctuations of exchange rates among the RMB, the Hong Kong dollar and the U.S. dollar; |

| • | announcements of studies and reports relating to the quality of our services or those of our competitors; |

| • | changes in the economic performance or market valuations of other companies that provide online automotive related services; |

| • | announcements by us or our competitors of new solutions, acquisitions, strategic relationships, joint ventures or capital commitments; |

| • | additions to or departures of our senior management; |

| • | release or expiry of lock-up or other transfer restrictions on our outstanding ordinary shares or ADSs; |

| • | sales or perceived potential sales of additional ordinary shares or ADSs; |

| • | obtaining or revocation of any operating license or permit in relation to our business; |

| • | pending or potential litigation or administrative investigation; |

| • | publicity involving our business and the effectiveness of our sales and marketing activities; and |

| • | alleged untrue statement of a material fact or alleged omission to state a material fact in our public announcements or press releases or misinterpretation thereto. |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the selective disclosure rules by issuers of material nonpublic information under Regulation FD. |

| • | Cheerbright, a British Virgin Islands company that operates autohome.com.cn, which was launched in 2005; |

| • | Norstar Advertising Media Holdings Limited, or Norstar, a Cayman Islands company that, among other businesses, operated che168.com, which was launched in 2004; and |

| • | China Topside Limited, or China Topside, a British Virgin Islands company. |

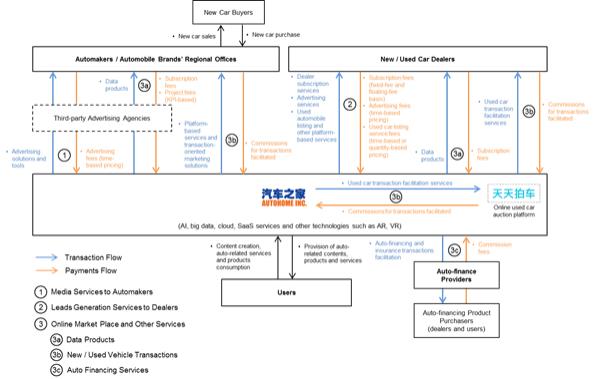

| • | Media services |

| • | Leads generation services |

| • | Online marketplace and others end-to-end |

1 |

As of December 31, 2021, the VIEs carried out primarily part of the leads generation services to dealers (used car listing services), part of used vehicles transaction services, and other comprehensive auto-related services. |

| • | opposes the fundamental principles stated in the PRC constitution; |

| • | compromises national security, divulges state secrets, subverts state power or damages national unity; |

| • | harms the dignity or interests of the state; |

| • | incites ethnic hatred or racial discrimination or damages inter-ethnic unity; |

| • | undermines the PRC’s religious policy or propagates heretical teachings or feudal superstitions; |

| • | disseminates rumors, disturbs social order or disrupts social stability; |

| • | disseminates obscenity or pornography, encourages gambling, violence, murder or fear or incites the commission of a crime; |

| • | insults or slanders a third party or infringes upon the lawful rights and interests of a third party; or |

| • | is otherwise prohibited by law or administrative regulations. |

| • | Foreign Currency Administration Rules (2008), or the Exchange Rules; and |

| • | Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), or the Administration Rules. |

| • | the Companies Law (2005, as amended in 2013 and 2018); |

| • | the Foreign Investment Law (2019); |

| • | the Implementation Regulation of the Foreign investment Law (2019). |

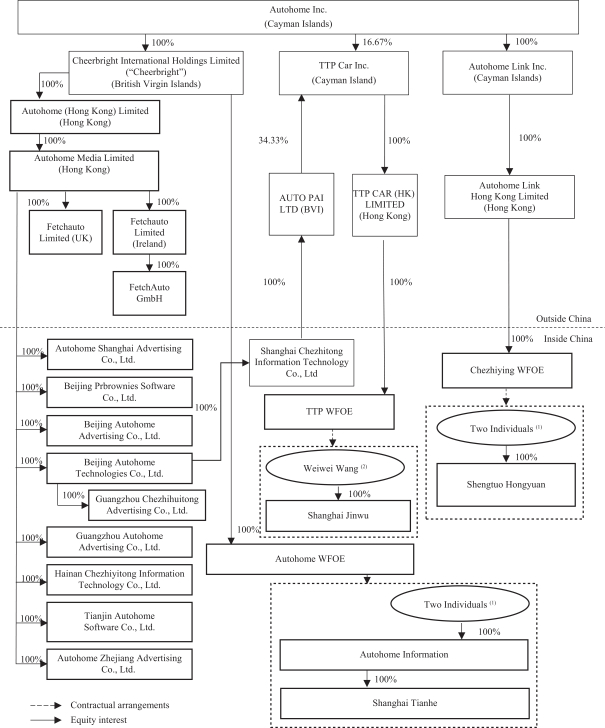

| (1) | The two individuals are Quan Long and Haiyun Lei, each a PRC citizen. Each of Quan Long and Haiyun Lei holds 50% of the equity interests in each of Autohome Information and Shengtuo Hongyuan. Quan Long is our director, chairman of the board of directors and chief executive officer. Haiyun Lei is an employee of Ping An Group. |

| (2) | Weiwei Wang, a PRC citizen, holds 100% of the equity interests in Shanghai Jinwu Auto Technology Consultant Co., Ltd.. Weiwei Wang is the founder of TTP Car Inc. |

D. |

Property, Plants and Equipment |

ITEM 4A |

UNRESOLVED STAFF COMMENTS |

ITEM 5 |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

A. |

Operating Results |

| • | Media services |

| • | Leads generation services |

| • | Online marketplace and others end-to-end |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except percentages) |

||||||||||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||||||||||

| Media services |

3,653,767 | 43.4 | 3,455,056 | 39.9 | 2,011,446 | 315,640 | 27.8 | |||||||||||||||||||||

| Leads generation services |

3,275,544 | 38.9 | 3,198,832 | 36.9 | 2,988,075 | 468,894 | 41.3 | |||||||||||||||||||||

| Online marketplace and others |

1,491,440 | 17.7 | 2,004,671 | 23.2 | 2,237,483 | 351,110 | 30.9 | |||||||||||||||||||||

| Total net revenues |

8,420,751 |

100.0 |

8,658,559 |

100.0 |

7,237,004 |

1,135,644 |

100.0 |

|||||||||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except percentages) |

||||||||||||||||||||||||||||

| Cost of revenues: |

||||||||||||||||||||||||||||

| Content-related costs (1) |

451,212 | 5.2 | 571,516 | 6.6 | 513,735 | 80,616 | 7.1 | |||||||||||||||||||||

| Depreciation and amortization expenses |

31,169 | 0.4 | 29,889 | 0.4 | 23,406 | 3,673 | 0.3 | |||||||||||||||||||||

| Bandwidth and IDC costs |

106,146 | 1.3 | 113,858 | 1.3 | 105,343 | 16,531 | 1.5 | |||||||||||||||||||||

| Tax surcharges |

189,935 | 2.3 | 96,958 | 1.1 | 39,240 | 6,158 | 0.5 | |||||||||||||||||||||

| Others |

181,830 | 2.2 | 148,949 | 1.7 | 366,168 | 57,459 | 5.1 | |||||||||||||||||||||

| Total cost of revenues |

960,292 |

11.4 |

961,170 |

11.1 |

1,047,892 |

164,437 |

14.5 |

|||||||||||||||||||||

| (1) | Including share-based compensation expenses of RMB15.5 million for 2019, RMB21.4 million for 2020 and RMB23.1 million (US$3.6 million) for 2021. |

For the Year Ended December 31 |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except percentages) |

||||||||||||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||||||

| Sales and marketing expenses (1) |

3,093,345 | 36.7 | 3,246,507 | 37.5 | 2,759,905 | 433,089 | 38.1 | |||||||||||||||||||||

| General and administrative expenses (2) |

317,967 | 3.8 | 381,843 | 4.4 | 543,799 | 85,334 | 7.5 | |||||||||||||||||||||

| Product development expenses (3) |

1,291,054 | 15.3 | 1,364,227 | 15.8 | 1,398,037 | 219,383 | 19.3 | |||||||||||||||||||||

| Total operating expenses |

4,702,366 |

55.8 |

4,992,577 |

57.7 |

4,701,741 |

737,806 |

64.9 |

|||||||||||||||||||||

| (1) | Including share-based compensation expenses of RMB46.1 million for 2019, RMB40.1 million for 2020 and RMB46.8 million (US$7.3 million) for 2021. |

| (2) | Including share-based compensation expenses of RMB62.9 million for 2019, RMB55.9 million for 2020 and RMB48.8 million (US$7.7 million) for 2021. |

| (3) | Including share-based compensation expenses of RMB79.5 million for 2019, RMB93.9 million for 2020 and RMB87.3 million (US$13.7 million) for 2021. |

For the Year Ended December 31 |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except percentages) |

||||||||||||||||||||||||||||

| VAT refunds |

293,008 | 3.5 | 218,412 | 2.5 | 231,452 | 36,320 | 3.2 | |||||||||||||||||||||

| Government grants |

147,694 | 1.8 | 210,022 | 2.4 | 51,685 | 8,111 | 0.7 | |||||||||||||||||||||

| Others |

36,997 | 0.4 | 14,781 | 0.2 | 11,104 | 1,742 | 0.2 | |||||||||||||||||||||

| Other Operating Income, net |

477,699 |

5.7 |

443,215 |

5.1 |

294,241 |

46,173 |

4.1 |

|||||||||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except percentages) |

||||||||||||||||||||||||||||

| Net revenues |

||||||||||||||||||||||||||||

| Media services |

3,653,767 | 43.4 | 3,455,056 | 39.9 | 2,011,446 | 315,640 | 27.8 | |||||||||||||||||||||

| Leads generation services |

3,275,544 | 38.9 | 3,198,832 | 36.9 | 2,988,075 | 468,894 | 41.3 | |||||||||||||||||||||

| Online marketplace and others |

1,491,440 | 17.7 | 2,004,671 | 23.2 | 2,237,483 | 351,110 | 30.9 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total net revenues |

8,420,751 |

100.0 |

8,658,559 |

100.0 |

7,237,004 |

1,135,644 |

100.0 |

|||||||||||||||||||||

| Cost of revenues(1) |

(960,292 | ) | (11.4 | ) | (961,170 | ) | (11.1 | ) | (1,047,892 | ) | (164,437 | ) | (14.5 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Gross Profit |

7,460,459 |

88.6 |

7,697,389 |

88.9 |

6,189,112 |

971,207 |

85.5 |

|||||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||||||

| Sales and marketing expenses(1) |

(3,093,345 | ) | (36.7 | ) | (3,246,507 | ) | (37.5 | ) | (2,759,905 | ) | (433,089 | ) | (38.1 | ) | ||||||||||||||

| General and administrative expenses(1) |

(317,967 | ) | (3.8 | ) | (381,843 | ) | (4.4 | ) | (543,799 | ) | (85,334 | ) | (7.5 | ) | ||||||||||||||

| Product development expenses(1) |

(1,291,054 | ) | (15.3 | ) | (1,364,227 | ) | (15.8 | ) | (1,398,037 | ) | (219,383 | ) | (19.3 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

(4,702,366 |

) |

(55.8 |

) |

(4,992,577 |

) |

(57.7 |

) |

(4,701,741 |

) |

(737,806 |

) |

(65.0 |

) | ||||||||||||||

| Other operating income, net |

477,699 | 5.7 | 443,215 | 5.1 | 294,241 | 46,173 | 4.1 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Operating profit |

3,235,792 |

38.5 |

3,148,027 |

36.4 |

1,781,612 |

279,574 |

24.6 |

|||||||||||||||||||||

| Interest and investment income, net |

469,529 | 5.5 | 521,731 | 6.0 | 395,245 | 62,022 | 5.5 | |||||||||||||||||||||

| Earnings/(loss) from equity method investments |

685 | 0.0 | (1,246 | ) | 0.0 | 301 | 47 | 0.0 | ||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before income taxes |

3,701,006 |

44.0 |

3,668,512 |

42.4 |

2,177,158 |

341,643 |

30.1 |

|||||||||||||||||||||

| Income tax expense |

(500,361 | ) | (5.9 | ) | (260,945 | ) | (3.0 | ) | (34,006 | ) | (5,336 | ) | (0.5 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

3,200,645 |

38.1 |

3,407,567 |

39.4 |

2,143,152 |

336,307 |

29.6 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss/(income) attributable to noncontrolling interests |

(679 | ) | 0.0 | (2,338 | ) | 0.0 | 105,633 | 16,576 | (1.5 | ) | ||||||||||||||||||

| Net income attributable to Autohome Inc. |

3,199,966 |

38.1 |

3,405,229 |

39.3 |

2,248,785 |

352,883 |

31.1 |

|||||||||||||||||||||

| Accretion of mezzanine equity. |

— | 0.0 | — | 0.0 | (411,792 | ) | (64,619 | ) | (5.7 | ) | ||||||||||||||||||

| Accretion attributable to noncontrolling interests. |

— | 0.0 | — | 0.0 | 311,573 | 48,893 | 4.3 | |||||||||||||||||||||

| Net income attributable to ordinary shareholders. |

3,199,966 |

38.1 |

3,405,229 |

39.3 |

2,148,566 |

337,157 |

29.7 |

|||||||||||||||||||||

| (1) | Including share-based compensation expenses as follows: |

For the Year Ended December 31 |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except percentages) |

||||||||||||||||||||||||||||

| Allocation of Share-Based Compensation Expenses |

||||||||||||||||||||||||||||

| Cost of revenues |

15,508 | 0.2 | 21,372 | 0.2 | 23,142 | 3,631 | 0.3 | |||||||||||||||||||||

| Sales and marketing expenses |

46,081 | 0.5 | 40,103 | 0.5 | 46,823 | 7,348 | 0.6 | |||||||||||||||||||||

| General and administrative expenses |

62,884 | 0.7 | 55,868 | 0.6 | 48,803 | 7,658 | 0.7 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Product development expenses |

79,535 | 0.9 | 93,863 | 1.1 | 87,292 | 13,698 | 1.2 | |||||||||||||||||||||

| Total share-based compensation expenses |

204,008 |

2.4 |

211,206 |

2.4 |

206,060 |

32,335 |

2.8 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

B. |

Liquidity and Capita l Resources |

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Net cash generated from operating activities |

2,889,369 | 3,325,631 | 3,523,934 | 552,981 | ||||||||||||

| Net cash used in investing activities |

(1,168,267 | ) | (2,985,458 | ) | (3,813,013 | ) | (598,345 | ) | ||||||||

| Net cash (used in)/generated from financing activities |

68,676 | (546,967 | ) | 2,898,296 | 454,806 | |||||||||||

| Effect of exchange rate changes on cash and cash equivalents and restricted cash |

(13,250 | ) | (17,556 | ) | (46,809 | ) | (7,345 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net (decrease)/increase in cash and cash equivalents and restricted cash |

1,776,528 | (224,350 | ) | 2,562,408 | 402,097 | |||||||||||

| Cash and cash equivalents and restricted cash at beginning of year |

216,970 | 1,993,498 | 1,769,148 | 277,618 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents and restricted cash at end of year |

1,993,498 | 1,769,148 | 4,331,556 | 679,715 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Payments Due by Period |

||||||||||||||||||||

Less than 1 Year |

1 to 3 Years |

3 to 5 Years |

More than 5 Years |

Total |

||||||||||||||||

(in thousands of RMB) |

||||||||||||||||||||

| Operating lease obligations (1) |

97,954 | 32,763 | 491 | — | 131,208 | |||||||||||||||

| (1) | Operating lease obligations related to the lease of office space and internet data centers. |

C. |

Research and Development, Patents and Licenses, etc. |

D. |

Trend Information |

E. |

Critical Accounting Estimates |

| • | identification of the contract, or contracts, with a customer; |

| • | identification of the performance obligations in the contract; |

| • | determination of the transaction price; |

| • | allocation of the transaction price to the performance obligations in the contract; and |

| • | recognition of revenue when, or as, we satisfy a performance obligation. |

As of December 31, 2021 |

||||||||

RMB |

US$ |

|||||||

(in thousands) |

||||||||