UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For the quarterly period ended

or

For the transition period from ________to ________

Commission File No.

(exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification Number) |

(

(

(

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading symbol(s) |

| Name of each exchange on which registered |

None |

| N/A |

| N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ |

| x | |

Non-accelerated filer | ¨ |

| Smaller reporting company | |

Emerging growth company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of August 3, 2020, NuZee, Inc. had

1

Table of Contents

2

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report includes “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Such forward-looking statements reflect the views of NuZee, Inc. (hereinafter "NuZee" or the "Company") with respect to future events and financial performance. These forward-looking statements are subject to certain uncertainties and other factors that could cause actual results to differ materially from such statements. From time to time, our management or persons acting on our behalf may make forward-looking statements to inform existing and potential security holders about our Company. All statements other than statements of historical facts included in this report regarding our financial position, business strategy, plans and objectives of management for future operations, industry conditions, and indebtedness covenant compliance, or any other matters, are forward-looking statements. When used in this report, forward-looking statements are generally accompanied by terms or phrases such as "estimate," "expects", "project," "predict," "believe," "expect," "anticipate," "target," "plan," "intend," "seek," "goal," "will," "should," "may," "targets" or other words and similar expressions that convey the uncertainty of future events or outcomes. Items contemplating or making assumptions about, actual or potential future sales, market size, collaborations, and trends or operating results also constitute such forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Forward-looking statements involve inherent risks and uncertainties, and important factors (many of which are beyond our control) that could cause actual results to differ materially from those set forth in the forward-looking statements, including the following: dilution of shareholder investments as a result of necessary capital raises, expenditures to produce and distribute our product, changes in sale levels, changes in the nutritional beverage market, competitor growth, third-party relationship dependent growth, general economic or industry conditions, nationally and/or in the communities in which we conduct business, changes in the interest rate environment, legislation or regulatory requirements, conditions of the securities markets, changes in accounting principles, policies or guidelines, financial or political instability, acts of war or terrorism, other economic, competitive, governmental, regulatory and technical factors affecting our operations, products, services, and prices.

We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Accordingly, results actually achieved may differ materially from expected results in these statements. Forward-looking statements speak only as of the date they are made. You should consider carefully the statements in the section of our Annual Report on Form 10-K/A filed with the SEC on December 31, 2019 entitled "Risk Factors" and sections of this report that describe factors that could cause our actual results to differ from those set forth in the forward-looking statements.

Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

3

Item 1. Financial Statements.

NuZee, Inc.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| June 30, 2020 |

| September 30, 2019 | |

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash |

| $ |

| $ |

Accounts receivable, net |

|

| ||

Accounts receivable - Related party |

|

| ||

Inventories, net |

|

| ||

Deferred offering costs |

|

| ||

Other current assets |

|

| ||

Other current assets - Related party |

|

| ||

Total current assets |

|

| ||

|

|

|

|

|

Property and equipment, net |

|

| ||

|

|

|

|

|

Other assets: |

|

|

|

|

Right-of-use asset - operating lease |

| $ |

| $ |

Right-of-use asset - finance lease |

|

| ||

Investment |

|

| ||

Other asset |

|

| ||

Total other assets |

|

| ||

|

|

|

|

|

Total assets |

| $ |

| $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

| $ |

| $ |

Current portion of long-term loan payable |

|

| ||

Accrued expenses and other current liabilities |

|

| ||

Current portion of lease liability - operating lease |

|

| ||

Current portion of lease liability - finance lease |

|

| ||

Other current liabilities - Related party |

|

| ||

Total current liabilities |

|

| ||

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

Lease liability - operating lease, net of current portion |

|

| ||

Lease liability - finance lease, net of current portion |

|

| ||

Loan payable - long term, net of current portion |

|

| ||

Other noncurrent liabilities |

|

| ||

Total non-current liabilities |

|

| ||

|

|

|

|

|

Total liabilities |

|

| ||

|

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

Common stock; |

|

| ||

Additional paid in capital |

|

| ||

Accumulated deficit |

| ( |

| ( |

Accumulated other comprehensive loss |

| ( |

| ( |

Total NuZee, Inc. stockholders' equity |

|

| ||

Noncontrolling interest |

|

| ||

Total stockholders' equity |

|

| ||

|

|

|

|

|

Total liabilities and stockholders' equity |

| $ |

| $ |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

4

NuZee, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

| Three Months Ended |

| Three Months Ended |

| Nine Months Ended |

| Nine Months Ended |

Revenues |

| $ |

| $ |

| $ |

| $ |

Cost of sales |

|

|

|

| ||||

Gross Profit (Loss) |

| ( |

|

| ( |

| ||

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

| ||||

Loss from operations |

| ( |

| ( |

| ( |

| ( |

|

|

|

|

|

|

|

|

|

Other income |

|

|

|

| ||||

Other expense |

| ( |

| ( |

| ( |

| ( |

Interest expense |

| ( |

| ( |

| ( |

| ( |

Net loss |

| ( |

| ( |

| ( |

| ( |

Net income (loss) attributable to noncontrolling interest |

|

|

| ( |

| |||

Net loss attributable to NuZee, Inc. |

| $ ( |

| $ ( |

| $ ( |

| $ ( |

|

|

|

|

|

|

|

|

|

Basic and diluted loss per common share |

| $ ( |

| $ ( |

| $ ( |

| $ ( |

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average number of common stock outstanding |

|

|

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

5

NuZee, Inc.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

|

| NuZee, Inc. |

| Noncontrolling |

| Total | ||||||

For the three months ended June 30 |

| 2020 |

| 2019 |

| 2020 |

| 2019 |

| 2020 |

| 2019 |

Net income (loss) |

| $ ( |

| $ ( |

| $ |

| $ |

| $ ( |

| $ ( |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

| ( |

|

| ( |

|

| ( | |||

Total other comprehensive income (loss), net of tax |

|

| ( |

|

| ( |

|

| ( | |||

Comprehensive income (loss) |

| $ ( |

| $ ( |

| $ |

| $ ( |

| $ ( |

| $ ( |

|

| NuZee, Inc. |

| Noncontrolling |

| Total | ||||||

For the nine months ended June 30 |

| 2020 |

| 2019 |

| 2020 |

| 2019 |

| 2020 |

| 2019 |

Net income (loss) |

| $ ( |

| ( |

| $ ( |

| $ |

| $ ( |

| $ ( |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

| ( |

| ( |

|

|

|

| ( | |||

Total other comprehensive income (loss), net of tax |

| ( |

| ( |

|

|

|

| ( | |||

Comprehensive income (loss) |

| $ ( |

| $ ( |

| $ |

| $ |

| $ ( |

| $ ( |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

6

NuZee , Inc.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

| Accumulated |

|

|

|

|

|

|

|

| Additional |

|

|

|

|

| other |

|

|

|

| Common stock |

| paid-in |

| Accumulated |

| Noncontrolling |

| comprehensive |

|

| ||

| Shares |

| Amount |

| capital |

| deficit |

| interest |

| income (loss) |

| Total | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance September 30, 2019 |

|

| $ |

| $ |

| $( |

| $ |

| $( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for cash |

|

|

|

|

|

|

| |||||||

Stock option expense |

|

|

|

|

|

|

| |||||||

Other comprehensive gain |

|

|

|

|

|

|

| |||||||

Net loss for ther period |

|

|

|

| ( |

| ( |

|

| ( | ||||

Balance December 31, 2019 |

|

| $ |

| $ |

| $( |

| $ |

| $( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option expense |

|

|

|

|

|

|

| |||||||

Other comprehensive gain / (loss) |

|

|

|

|

|

| ( |

| ( | |||||

Net loss for the period |

|

|

|

| ( |

| ( |

|

| ( | ||||

Balance March 31, 2020 |

|

| $ |

| $ |

| $( |

| $ |

| $( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Common stock issued for cash |

|

|

|

|

|

|

| |||||||

Stock option expense |

|

|

|

|

|

|

| |||||||

Other comprehensive gain |

|

|

|

|

|

|

| |||||||

Net income (loss) for ther period |

|

|

|

| ( |

|

|

| ( | |||||

Balance June 30, 2020 |

|

| $ |

| $ |

| $( |

| $ |

| $( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

| Accumulated |

|

|

|

|

|

|

|

| Additional |

|

|

|

|

| other |

|

|

|

| Common stock |

| paid-in |

| Accumulated |

| Noncontrolling |

| comprehensive |

|

| ||

| Shares |

| Amount |

| capital |

| deficit |

| interest |

| income (loss) |

| Total | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance September 30, 2018 |

|

| $ |

| $ |

| $( |

| $ |

| $( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares issued for cash |

|

|

|

|

|

|

| |||||||

Common stock issued to settle payables |

|

|

|

|

|

|

| |||||||

Stock option expense |

|

|

|

|

|

|

| |||||||

NuZee foreign currency gain (loss) |

|

|

|

|

|

|

| |||||||

Net loss for the period |

|

|

|

| ( |

| ( |

|

| ( | ||||

Balance December 31, 2018 |

|

|

|

| ( |

|

| ( |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Common shares issued for cash |

|

|

|

|

|

|

| |||||||

Stock issuance costs |

|

|

| ( |

|

|

|

| ( | |||||

Common stock issued for services |

|

|

|

|

|

|

| |||||||

Common stock issued to settle payables |

|

|

|

|

|

|

| |||||||

Stock option expense |

|

|

|

|

|

|

| |||||||

NuZee foreign currency gain (loss) |

|

|

|

|

|

| ( |

| ||||||

Net loss for the period |

|

|

|

| ( |

|

|

| ( | |||||

Balance March 31, 2019 |

|

| $ |

| $ |

| $( |

| $ |

| $( |

| $ | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares issued for cash |

|

|

|

|

|

|

| |||||||

Stock option expense |

|

|

|

|

|

|

| |||||||

NuZee foreign currency gain (loss) |

|

|

|

|

| ( |

| ( |

| ( | ||||

Net income (loss) for the period |

|

|

|

| ( |

|

|

| ( | |||||

Balance June 30, 2019 |

|

| $ |

| $ |

| $( |

| $ |

| $( |

| $ | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

7

NuZee, Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Nine Months Ended |

| Nine Months Ended | |

|

|

|

|

|

Operating activities: |

|

|

|

|

Net loss |

| $( |

| $( |

Adjustments to reconcile net loss to net cash used by operating activities: |

|

|

|

|

Depreciation and Amortization |

|

| ||

Noncash lease expense |

|

| ||

Option expense |

|

| ||

Inventory impairment |

|

| ||

Allowance for sales return |

|

| ||

Loss on sale of assets |

|

| ||

Loss on settlement of payable |

|

| ||

Common stock issued for services |

|

| ||

Change in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

| ( | |

Accounts receivable - Related party |

| ( |

| |

Inventories |

|

| ( | |

Other current assets |

| ( |

| ( |

Other current assets - Related party |

|

| ( | |

Other asset |

| ( |

| ( |

Accounts payable |

| ( |

| |

Other current liabilities - related party |

| ( |

| ( |

Other noncurrent liabilities |

|

| ( | |

Lease liability - operating lease |

| ( |

| |

Accrued expense and other current liabilities |

|

| ( | |

Net cash used by operating activities |

| ( |

| ( |

|

|

|

|

|

Investing activities: |

|

|

|

|

Purchase of equipment |

| ( |

| ( |

Proceeds from sales of equipment |

|

| ||

Net cash provided (used) in investing activities |

|

| ( | |

|

|

|

|

|

Financing activities: |

|

|

|

|

Repayment of finance lease |

| ( |

| |

Repayment of loans |

| ( |

| ( |

Borrowing of loans |

|

| ||

Stock issuance costs |

|

| ( | |

Proceeds from issuance of common stock |

|

| ||

Net cash provided by financing activities |

|

| ||

|

|

|

|

|

Effect of foreign exchange on cash and cash equivalents |

|

| ||

|

|

|

|

|

Net change in cash |

|

| ||

Cash, beginning of period |

|

| ||

Cash, end of period |

| $ |

| $ |

|

|

|

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

Cash paid for interest |

| $ |

| $ |

Cash paid for taxes |

| $ |

| $ |

Noncash investing and financing activities: |

|

|

|

|

Stock issued to settle payables |

| $ |

| $ |

Equipment purchased through debt |

| $ |

| $ |

Equipment purchased on credit |

| $ |

| $ |

Recognition of right-of-use asset and lease liability upon adoption of ASU 2016-02 |

| $ |

| $ |

Recognition of right-of-use asset and lease liability during the period |

| $ |

| $ |

Reclassification of common stock offering costs to additional paid-in capital |

| $1,150,989 |

|

|

Finance lease of equipment to pay off accounts payable |

| $ |

| $ |

Investment in NLA |

| $ |

| $ |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

8

NuZee, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited) June 30, 2020

1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited interim consolidated financial statements of NuZee, Inc. (together with its subsidiaries, referred to herein as the "Company", "we" or "NuZee") have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"), and rules of the Securities and Exchange Commission (the "SEC"), and should be read in conjunction with the audited consolidated financial statements and notes thereto contained in the Company's Annual Report on Form 10-K/A for the year ended September 30, 2019 as filed with the SEC on December 31, 2019. In the opinion of management, all adjustments, consisting of recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosure contained in the audited financial statements as reported in the annual report on Form 10-K have been omitted.

Reclassification

Certain amounts in the prior period financial statements have been reclassified to conform to the presentation of the current period financial statements. These reclassifications had no effect on the previously reported net loss.

Principles of Consolidation

The Company prepares its financial statements on the accrual basis of accounting. The accompanying consolidated financial statements include the accounts of the Company, its wholly owned subsidiaries and its majority owned subsidiary, which has a fiscal year end of September 30. All significant intercompany accounts, balances and transactions have been eliminated upon consolidation.

The Company has three international subsidiaries in NuZee KOREA Ltd. ("NuZee KR"), NuZee JAPAN Co., Ltd ("NuZee JP") and NuZee Investment Co., Ltd. ("NuZee INV"). NuZee KR and NuZee INV are wholly owned subsidiaries of the Company, and NuZee JP is a majority owned subsidiary of the Company.

Stock Split

On October 28, 2019, we completed a l-for-3 reverse stock split, which became effective on November 12, 2019. All share and per share information included in these financial statements and notes thereto give effect to the reverse stock split.

Earnings per Share

Basic earnings per common share is equal to net earnings or loss divided by the weighted average of shares outstanding during the reporting period. Diluted earnings per share reflects the potential dilution that could occur if stock options and other commitments to issue common stock were exercised or equity awards vest resulting in the issuance of common stock that could share in the earnings of the Company. As of June 30, 2020 and June 30, 2019, the total number of common stock equivalents was

Going Concern and Capital Resources

Since its inception on July 15, 2011, the Company has devoted substantially all of its efforts to business planning, research and development, recruiting management and technical staff, acquiring operating assets and raising capital. The Company has generated limited revenues from its principal operations, and there is no assurance of future revenues.

As of June 30, 2020, the Company had cash of $

The accompanying consolidated financial statements have been prepared in accordance with GAAP, which contemplates continuation of the Company as a going concern. The Company has had limited revenues, recurring losses, and an accumulated deficit and is dependent on sales of its equity, including to its majority shareholder, to provide additional funding for operating expenses. These items raise substantial doubt as to the Company's ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. The Company's continued existence is dependent upon management's ability to develop profitable operations, continued contributions from its majority shareholder to finance its operations and the ability to obtain additional funding sources to explore potential strategic relationships and to provide capital and other resources for the further development and marketing of the Company's products and business.

9

Major Customers

In the nine months ended June 30, 2020 and 2019, revenue was primarily derived from major customers disclosed below.

Nine months ended June 30, 2020:

Customer Name | Sales Amount | % of Total Revenue | Accounts Receivable Amount | % of Total Accounts Receivable |

Customer K | $ | $ | ||

Customer WP | $ | $ | ||

Customer J | $ | | $ | |

Nine months ended June 30, 2019:

Customer Name | Sales Amount | % of Total Revenue | Accounts Receivable Amount | % of Total Accounts Receivable |

Customer J | $ | $ | ||

Customer WP | $ | $ | | |

Customer C | $ | $ |

Lease

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), to provide guidance on recognizing lease assets and lease liabilities on the consolidated balance sheet and disclosing key information about leasing arrangements, specifically differentiating between different types of leases. The core principle of Topic 842 is that a lessee should recognize the assets and liabilities that arise from all leases. The recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly changed from previous GAAP. There continues to be a differentiation between finance leases and operating leases. However, the principal difference from previous guidance is that the lease assets and lease liabilities arising from operating leases should be recognized in the consolidated balance sheet. The accounting applied by a lessor is largely unchanged from that applied under previous GAAP. The amendments will be effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, and early adoption is permitted. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. The modified retrospective approach includes a number of optional practical expedients that entities may elect to apply. These practical expedients relate to the identification and classification of leases that commenced before the effective date, initial direct costs for leases that commenced before the effective date, and the ability to use hindsight in evaluating lessee options to extend or terminate a lease or to purchase the underlying asset. An entity that elects to apply the practical expedients will, in effect, continue to account for leases that commence before the effective date in accordance with previous GAAP unless the lease is modified, except that lessees are required to recognize a right-of-use asset and a lease liability for all operating leases at each reporting date based on the present value of the remaining minimum rental payments that were tracked and disclosed under previous GAAP. The Company implemented ASU No. 2016-02 on October 1, 2019.

The Company elected the practical expedient under ASU 2018-11 “Leases: Targeted Improvements” which allows the Company to apply the transition provision for Topic 842 at the Company’s adoption date instead of at the earlies comparative period presented in the financial statements. Therefore, the Company recognized and measured leases existing at October 1, 2019 but without retrospective application. In addition, the Company elected the optional practical expedient permitted under the transition guidance which allows the Company to carry forward the historical accounting treatment for existing lease upon adoption. No impact was recorded to the income statement or beginning retained earnings for Topic 842.

Beginning October 1, 2019, operating ROU assets and operating lease liabilities are recognized based on the present value of lease payments, including annual rent increases, over the lease term at commencement date. Operating leases in effect prior to October 1, 2019 were recognized at the present value of the remaining payments on the remaining lease term as of October 1, 2019. Because the lease in question did not have an implicit rate of return, we used our incremental secured borrowing rate based on lease term information available as of the adoption date or lease commencement date in determining the present value of lease payments. The incremental borrowing rate on ROU Asset lease is 5%.

The Company does a quarterly analysis of leases to determine if there are any operating leases that require recognition under ASC 842. As of October 1, 2019, the Company had one significant long-term operating lease for office and manufacturing space in Plano, Texas. The leased property in Plano, Texas, has a remaining lease term through June of 2024. The lease has an option to extend beyond the stated termination date, but exercise of this option is not probable. The Company did not apply the recognition requirements of ASC 842 to operating leases with a remaining lease term of 12 months or less.

10

The impact of ASU No. 2016-02 (“Leases (Topic 842)” on our consolidated balance sheet beginning October 1, 2019, through the recognition of ROU assets and lease liabilities for operating leases are as follows:

| October 1, 2019 | |

ROU Assets |

| $ |

Lease Liability |

| $ |

During the June 30, 2020 analysis of leases, we determined to renew the office and manufacturing space in Vista, CA through January 31, 2022, which was previously scheduled to be vacated at June 30, 2020. Additionally, the Korean office and manufacturing space lease was extended through June 2022 and an apartment lease was signed through June 2022. Accordingly, we have added ROU assets and lease liabilities related to those leases at June 30, 2020.

The direct-leased property in Vista, California has a remaining lease term through January of 2022. The leased properties in both Korea and Vista, California have options to extend beyond the stated termination date, but exercise of these options are not probable. The sub-leased property in Vista, California, is leased month-to-month and has been calculated as a ROU Asset co-terminous with the direct-leased property.

As of June 30, 2020, our operating leases had a weighted average remaining lease term of 3.1 years. Other information related to our operating leases is as follows:

| ||

ROU Asset – October 1, 2019 |

| $ |

ROU Asset added during the period |

| |

Amortization during the period |

| ( |

ROU Asset – June 30, 2020 |

| $ |

|

|

|

Lease Liability – October 1, 2019 |

| $ |

Lease Liability added during the period |

| |

Amortization during the period |

| ( |

Lease Liability – June 30, 2020 |

| $ |

| ||

Lease Liability – Short-Term |

| $ |

Lease Liability – Long-Term |

| |

Lease Liability – Total |

| $ |

During the nine months ended June 30, 2020, we had the following cash and non-cash activities associated with our leases:

|

|

|

Cash paid for amounts included in the measurement of lease liabilities: |

|

|

Operating cash flows from operating leases |

| $ |

Operating cash flows from finance leases |

| $ |

Financing cash flows from finance leases |

| $ |

|

|

|

Non-cash transactions: |

|

|

Recognition of ROU asset and lease liability of operating lease |

| $ |

|

|

|

Additions to ROU assets obtained from: |

|

|

New operating lease: |

| $ |

New finance lease: |

| $ |

The table below reconciles the fixed component of the undiscounted cash flows for each of the first five years and the total remaining years to the lease liabilities recorded on the Consolidated Balance Sheet as of June 30, 2020:

Amounts due within 12 months of June 30,

| ||

2021 |

| $ |

2022 |

| |

2023 |

| |

2024 |

| |

2025 |

| |

Total Minimum Lease Payments |

| |

Less Effect of Discounting |

| |

Present Value of Future Minimum Lease Payments |

| |

Less Current Portion of Operating Lease Obligations |

| |

Long-Term Operating Lease Obligations |

| $ |

11

NuZee JP is the lessee of certain equipment under a finance lease extending through January 2021. The asset and liability under the finance lease are recorded at the lower of the present value of the minimum lease payments, or the fair value of the asset. Leased equipment is depreciated over a 6-year life. The leased equipment is reported in the accompanying consolidated balance sheets in property and equipment of $4,536 as of June 30, 2020. The finance lease liability is included in other current liabilities on the consolidated balance sheets.

Future minimum lease payments under finance lease obligations as of June 30, 2020 for each of the remaining fiscal years are as follows:

| ||

2020 |

| $ |

2021 |

| $ |

Total Minimum Lease Payments |

| $ |

On October 9, 2019, the Company entered into a lease agreement with Alliance Funding Group which provided for a sale lease back on certain packing equipment. The terms of this agreement require us to pay $2,987 per month for the next 60 months. As part of this agreement, Alliance Funding Group provided our equipment supplier with $124,540 for the purchase of this equipment. This transaction was accounted for as a financing lease.

The following summarizes ROU assets under finance leases at June 30, 2020:

| ||

ROU asset-finance lease at October 9, 2019 |

| $ |

Amortization |

| ( |

ROU asset-finance lease at June 30, 2020 |

| $ |

The table below summarizes future minimum finance lease payments at June 30, 2020 for the 12 months ended June 30 of each year indicated:

| ||

2021 |

| $ |

2022 |

| |

2023 |

| |

2024 |

| |

2025 |

| |

Total Minimum Lease Payments |

| |

Amount representing interest |

| ( |

Present Value of Minimum Lease Payments |

| |

Current Portion of Finance Lease Obligations |

| |

Finance Lease Obligations, Less Current Portion |

| $ |

The Company leases office space with terms ranging from month to month to 61 months. Rent expense included in general and administrative expense for the nine months ended June 30, 2020 and 2019 was $

Future minimum rents for the office space leased as of June 30, 2020, for each of the remaining fiscal years are as follows:

2020 |

| $ |

2021 |

| $ |

2022 |

| $ |

2023 |

| $ |

2024 |

| $ |

Total Minimum Lease Payments |

| $ |

Loans

On

On

On

12

The loan payments required for the next five remaining fiscal years are as follows:

|

|

| Nihon | Ford |

|

|

|

|

| Tono Shinyo | Seisaku | Motor | ShinHan |

|

|

|

| Kinko Bank | Kouko | Credit | Bank |

| Total |

|

| ||||||

2020 |

| $ | $ | $ | $ |

|

|

2021 |

|

|

| ||||

Total Current Portion |

| $ 27,835 | $ 18,816 | $ 7,446 | $ 47,248 |

| $ 101,345 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

| $ | $ | $ |

|

|

2022 |

|

|

|

| |||

2023 |

|

|

|

|

|

| |

2024 |

|

|

|

|

|

| |

Total Long Term Portion |

|

| $ 11,244 | $ 22,311 | $ 47,248 |

| $ 80,803 |

Grand Total |

| $ | $ | $ | $ |

| $ |

Revenue Recognition

We determine revenue recognition through the following steps in accordance with FASB Accounting Standards Update No. 2014-09 (Topic 606) "Revenue from Contracts with Customers", which we adopted as of October 1, 2018 on a modified retrospective basis:

·identification of the contract, or contracts, with a customer;

·identification of the performance obligations in the contract;

·determination of the transaction price;

·allocation of the transaction price to the performance obligations in the contract; and

·recognition of revenue when, or as, we satisfy a performance obligation.

Revenue is recognized when control of the promised goods or services are transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services.

Foreign Currency Translation

The financial position and results of operations of each of the Company's foreign subsidiary are measured using the foreign subsidiary's local currency as the functional currency. Revenues and expenses of each such subsidiary have been translated into U.S. dollars at average exchange rates prevailing during the period. Assets and liabilities have been translated at the rates of exchange on the balance sheet date. The resulting translation gain and loss adjustments are recorded directly as a separate component of stockholders' equity unless there is a sale or complete liquidation of the underlying foreign investment. Foreign currency translation adjustments comprising accumulated other comprehensive loss amounted to $(

Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Inventories

Inventory, consisting principally of raw materials, work in process and finished goods held for production and sale, is stated at the lower of cost or net realizable value, cost being determined using the weighted average cost method. The Company reviews inventory levels at least quarterly and records a valuation allowance when appropriate. At June 30, 2020 and September 30, 2019, the carrying value of inventory of $274,975 and $500,986 respectively, reflected on the consolidated balance sheets is net of this adjustment.

| June 30, 2020 |

| September 30, 2019 | |

Raw materials |

| $ |

| $ |

Finished goods |

|

| ||

Less – Inventory reserve |

|

| ||

Total |

| $ |

| $ |

Recent Accounting Pronouncements

In June 2018, the FASB issued ASU 2018-07 which simplifies several aspects of the accounting for non-employee transactions by stipulating that the existing accounting guidance for share-based payments to employees (accounted for under ASC Topic 718, "Compensation-Stock

13

Compensation") will also apply to non-employee share-based transactions (accounted for under ASC Topic 505, "Equity"). ASU 2018-07 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The Company implemented ASU 2018-07 on October 1, 2019 and the impact of the implementation is not material to the financial statements.

In July 2017, the FASB issued ASU No. 2017-11, Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Non-controlling Interests with a Scope Exception. The ASU was issued to address the complexity associated with applying GAAP for certain financial instruments with characteristics of liabilities and equity. The ASU, among other things, eliminates the need to consider the effects of down round features when analyzing convertible debt, warrants and other financing instruments. As a result, a freestanding equity-linked financial instrument (or embedded conversion option) no longer would be accounted for as a derivative liability at fair value as a result of the existence of a down round feature. The amendments are effective for fiscal years beginning after December 15, 2018, and should be applied retrospectively. Early adoption is permitted, including adoption in an interim period. The Company implemented ASU 2017-11 on October 1, 2019, and the impact of the implementation is not material to the financial statements.

Joint Venture

On January 9, 2020, a joint venture agreement was signed between Industrial Marino, S.A. de C.V. (50%) and the Company (50%) forming NuZee LATIN AMERICA, S.A. de C.V. ("NLA"). NLA was formed pursuant to the laws of Mexico, with corporate domicile in Mazatlan, Mexico. As part of the capitalization of NLA, the Company contributed two machines to the joint venture. These machines had an aggregate carrying cost of $313,012. The Company received $110,000 in cash for this contribution and recorded an investment in NLA of $

The Company will account for NLA using the equity method of accounting. As of June 30, 2020, the only activity in NLA was the contribution of two machines as described above.

2. GEOGRAPHIC CONCENTRATION

The Company is organized based on fundamentally one geographic segment although it does sell its products on a world-wide basis. Information about the Company’s geographic operations are as follows:

Geographic Concentrations | Nine Months Ended |

| Nine Months Ended |

June 30, 2020 |

| June 30, 2019 | |

Net Revenue: |

|

|

|

North America | $ |

| $ |

Japan |

| ||

South Korea |

| ||

$ |

| $ | |

|

|

|

|

Property and equipment, net: | As of June 30, 2020 |

| As of September 30, 2019 |

North America | $ |

| $ |

Japan |

| ||

South Korea |

| ||

$ |

| $ |

3. RELATED PARTY TRANSACTIONS

Sales, Purchases and Operating Expenses

For the nine months ended June 30, 2020 and 2019, NuZee JP sold their products to Eguchi Holdings Co., Ltd ("EHCL"), and the sales to them totaled approximately $

Rent

During October 2016, NuZee JP entered into a rental agreement of an office space with NuZee Co., Ltd., an entity 100% beneficially owned by our chief executive officer. The Company pays $1,169 per month for the office on the last day of each month on behalf of NuZee JP. There is no set expiration date on the agreement. As of June 30, 2020, and September 30, 2019, NuZee JP had a payable balance to NuZee Co., Ltd. of $1,503 and $1,552, respectively.

14

During September 2016, the Company entered into a rental agreement of an office space and warehouse with EHCL. The Company pays $609 per month for the office and the warehouse on the last day of each month. The lease expired on December 31, 2019, and is expected to continue on a month-to-month basis. At June 30, 2020 and September 30, 2019, the payable balance under this lease was $

During February 2015, the Company entered into a rental agreement of a warehouse with Eguchi Steel Co.,Ltd ("ESCL"). The Company pays $449 per month for the warehouse on the last day of each month. There is no set expiration date on the agreement.

4. COMMON STOCK

During the nine months ended June 30, 2020, the

5. STOCK OPTIONS AND WARRANTS

The following table summarizes stock option activity for nine months ended June 30, 2020:

|

|

|

| Weighted |

| Weighted |

|

|

|

|

|

| Average |

| Average |

|

|

|

| Number of |

| Exercise |

| Remaining |

| Aggregate |

|

| Shares |

| Price |

| Contractual Life (years) |

| Intrinsic Value |

Outstanding at September 30, 2019 |

|

| $ |

|

| $ | ||

Granted |

|

|

|

|

|

| ||

Exercised |

| |

| |

|

|

|

|

Expired |

|

|

|

|

|

| ||

Forfeited |

| ( |

|

|

|

|

| |

Outstanding at June 30, 2020 |

|

| $ |

|

| |||

|

|

|

|

|

|

|

|

|

Exercisable at June 30, 2020 |

|

| $ |

|

| $ |

The Company is expensing these stock option awards on a straight-line basis over the requisite service period. The Company recognized stock option expenses of $4,505,498 for the nine months ended June 30, 2020. Unamortized option expense as of June 30, 2020, for all options outstanding amounted to $4,566,831. These costs are expected to be recognized over a weighted- average period of 2.1 years. The Company recognized stock option expenses of $10,608,751 for the nine months ended June 30, 2019.

On June 23, 2020, as part of our agreement with Benchmark Company, LLC the underwriter of the Company’s registered public offering of common stock, we issued 40,250 warrants to purchase our common stock at an exercise price of $9.00 a share. These warrants are exercisable beginning on December 23, 2020 and expire on June 18, 2025.

A summary of the status of the Company’s nonvested options as of June 30, 2020, is presented below:

Nonvested options |

|

|

|

|

|

|

| Number of |

|

| Nonvested Shares |

Nonvested shares at September 30, 2019 | ||

Granted |

| |

Exercised |

| |

Forfeited |

| ( |

Vested |

| ( |

Nonvested shares at June 30, 2020 |

| |

15

The following table summarizes warrant activity for the nine months ended June 30, 2020:

|

|

|

| Weighted |

| Weighted |

|

|

|

|

|

| Average |

| Average |

|

|

|

| Number of |

| Exercise |

| Remaining |

| Aggregate |

|

| Warrants |

| Price |

| Contractual Life (years) |

| Intrinsic Value |

Outstanding at September 30, 2019 |

|

| $ |

|

| $ | ||

Granted |

|

|

|

|

|

| ||

Exercised |

|

|

|

|

|

| ||

Expired |

|

|

|

|

|

| ||

Forfeited |

|

|

|

|

|

| ||

Outstanding at June 30, 2020 |

|

| $ |

|

| |||

|

|

|

|

|

|

|

|

|

Exercisable at June 30, 2020 |

|

| $ |

|

| $ |

6. SUBSEQUENT EVENT

Exercise of over-allotment option

On

Exercise of options

On

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following plan of operation provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto. This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward- looking statements. These forward-looking statements are subject to certain risk s and uncertainties that could cause actual results to differ materially from our predictions.

Overview

We are a specialty coffee company and, we believe, the leading single serve pour over coffee co-packer in the United States. Our mission is to leverage our position as a co-packer at the forefront of the North American single serve pour over coffee market to revolutionize the way single serve coffee is enjoyed in the United States. While the United States is our core market, we also have single serve pour over coffee sales operations in Japan as well as manufacturing and sales operations in Korea and a joint venture in Latin America. In addition, we plan to opportunistically leverage our strengths and relationships to grow our proprietary NuZee and Coffee Blenders brands in the United States and select international markets.

We believe we are the only commercial-scale producer of single serve drip cup coffee and that we have certain advantages in place within the North American market. We intend to leverage our position to be the commercial manufacturer of choice for major companies seeking to enter the single serve drip cup market in North America. We target existing large, high-margin companies and are paid per- package based on the number of single serve pour over drip cups produced by us. Accordingly, we consider our business model to be a form of tolling arrangement, as we receive a fee for every single serve drip cup our co-packing customers sell in the North American market. While we financially benefit from the success of our manufacturing customers through the sales of their respective single serve drip cup products, we are also able to avoid the risks associated with owning and managing the product and its related inventory. As these companies gain market acceptance of single serve drip cup coffee in North America, we plan to leverage that market expansion to further grow our own brands.

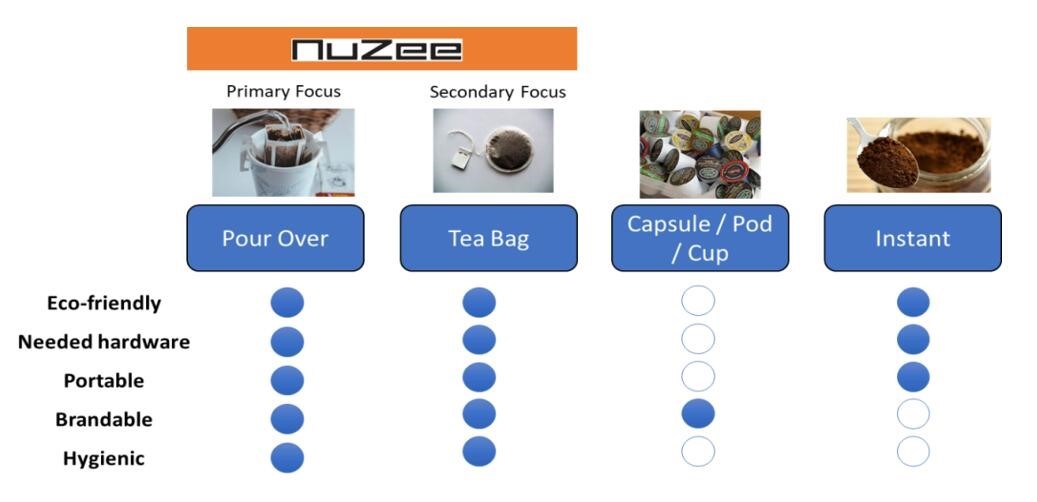

Our primary focus is the development of single serve pour over coffee in the North American market targeting the individual consumer for use at home and office or other settings that would benefit from single serve pour over products, such as our recent expansion into the lodging market through our arrangement with Royal Cup Coffee & Tea, and positioning ourselves as the leading commercial-scale co- packer of single serve pour over coffee products. We may also look to co-package other products that are complementary to single serve pour over drip coffee and provide us with a deeper access to our customers, such as tea bag coffee. The competitive landscape for our services and products can be illustrated as follows:

Since 2016, we have been primarily focused on single serve pour over coffee production. Over this time we have developed expertise in the operation of our sophisticated packing equipment and the related production of the single serve pour over product at both our Vista, California facility and at our production operations in Korea. We plan to carry over this expertise to our recently announced Plano, Texas manufacturing facility, which will serve as our new single serve pour over co-packing hub and corporate headquarters to capture the location’s logistical advantages and lower cost structure.

17

Recent Developments

Expiration of Exclusivity Agreement with FUSO Industries Co. Ltd.

We were engaged in negotiations with FUSO Industries Co. Ltd. (“FUSO”) to extend the term of the exclusivity agreement between us and FUSO (the “FUSO Agreement”). We acquired certain of the machines we use in the production of our single serve pour over coffee products pursuant to the terms of the FUSO Agreement. The FUSO Agreement expired pursuant to its terms on June 30, 2020.

Employees

During March 2020, we terminated the employment of two part-time and three full-time employees located in the U.S. Each such employee was offered two weeks’ pay as a severance package. We do not expect the departure of these employees to adversely impact our ability to provide our top-quality services and products.

Geographic Concentration

Our operations are primarily split between two geographic areas: North America and Asia.

For the three months ended June 30, 2020, net revenues attributable to our operations in North America totaled $119,313 compared to $420,083 of net revenues attributable to our operations in North America for the three months ended June 30, 2019. For the nine months ended June 30, 2020, net revenues attributable to our operations in North America totaled $756,000 compared to $715,702 of net revenues attributable to our operations in North America for the nine months ended June 30, 2019. Additionally, as of June 30, 2020, $1,459,948 of our Property and equipment, net was attributable to our North American operations, compared to $1,471,859 attributable to our North American operations as of September 30, 2019.

For the three months ended June 30, 2020, net revenues attributable to our operations in Asia totaled $72,649 compared to $165,119 of net revenues attributable to our operations in Asia during the three months ended June 30, 2019. For the nine months ended June 30, 2020, net revenues attributable to our operations in Asia totaled $375,562 compared to $588,864 of net revenues attributable to our operations in Asia during the nine months ended June 30, 2019. Additionally, as of June 30, 2020, $276,484 of our Property and equipment, net was attributable to our Asian operations, compared to $403,732 attributable to our Asian operations as of September 30, 2019.

Results of Operations

Comparison of three months ended June 30, 2020 and 2019:

Revenue

|

| Three months ended |

|

| Change |

| ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % |

| ||||

Revenue |

| $ 191,962 |

|

|

| $ | 585,202 |

|

| $ (393,240) |

|

|

| (67%) |

|

|

For the three months ended June 30, 2020, our revenue decreased by $393,240, or approximately 67%, compared with the three months ended June 30, 2019. This decrease was related to the loss of a major co-packing in North America and in Japan as well the worldwide impacts of COVID-19.

Cost of sales and gross margin

|

| Three months ended |

|

| Change | ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % | ||||

Cost of sales |

| $ 331,039 |

|

|

|

| $ 469,045 |

|

| ($138,006) |

|

|

| (29%) |

|

Gross margin |

| ($139,077) |

|

|

|

| $ 116,157 |

|

| ($255,234) |

|

|

| (220%) |

|

Gross margin % |

| (72%) |

|

|

|

| 20 % |

|

|

|

|

|

|

|

|

For the three months ended June 30, 2020, we incurred a total gross loss of $139,077, from sales of our products and co-packing services, compared to a total gross profit of $116,157 for the three months ended June 30, 2019. The gross margin rate was (72%) for the three months ended June 30, 2020, and 20% for the three months ended June 30, 2019. This decrease in margin was driven primarily by significantly reduced revenues and greater operating capacity during the period compared to the prior year with significantly higher revenues with lower operating capacity. Greater operating capacity has increased our labor and other expenses.

18

Operating Expenses

|

| Three months ended |

|

| Change |

| ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % |

| ||||

Operating Expenses |

| $ 2,378,947 |

|

|

| $ 9,514,003 |

|

|

| ($7,135,056) |

|

|

| (75%) |

|

|

For the three months ended June 30, 2020, the Company’s operating expenses totaled $2,378,947 compared to $9,514,003 for the three months ended June 30, 2019, representing a 75% decrease. This decrease is primarily attributable to a decrease in stock based compensation expense.

Net Loss

|

| Three months ended |

|

| Change |

| ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % |

| ||||

Net Loss attributable to NuZee, Inc. |

| $ 2,542,418 |

|

|

| $ | 9,406,503 |

|

| $ (6,864,085) |

|

|

|

| (73%) |

|

For the three months ended June 30, 2020, we generated net losses attributable to NuZee, Inc. of $2,542,418 versus $9,406,503 for the three months ended June 30, 2019. This improvement in net losses is primarily attributable to lower stock compensation expense.

Comparison of nine months ended June 30, 2020 and 2019:

Revenue

|

| Nine months ended |

|

| Change |

| ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % |

| ||||

Revenue |

| $ 1,131,562 |

|

|

| $ | 1,304,566 |

|

| $ (173,004) |

|

|

| (13%) |

|

|

For the nine months ended June 30, 2020, our revenue decreased by $173,004, or approximately 13%, compared with the nine months ended June 30, 2019. This decrease was primarily related to a decrease in co-packing revenues attributable to a loss of a major customer in North America and Japan during the current period.

Cost of sales and gross margin

|

| Nine months ended |

|

| Change | ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % | ||||

Cost of sales |

| $ 1,250,904 |

|

|

|

| $ 923,903 |

|

| $ 327,001 |

|

|

| 35 % |

|

Gross profit |

| $ (119,342) |

|

|

|

| $ 380,663 |

|

| $ (500,005) |

|

|

| (131%) |

|

Gross profit margin % |

| (11%) |

|

|

|

| 29 % |

|

|

|

|

|

|

|

|

For the nine months ended June 30, 2020, we incurred a total gross loss $119,342 from sales of our products and co-packing services, compared to a total gross profit of $380,663 for the nine months ended June 30, 2019. The gross margin rate was (11%) for the nine months ended June 30, 2020, and 29% for the nine months ended June 30, 2019. This decrease in margin was driven primarily by significantly reduced revenues and greater operating capacity during the period compared to the prior year with significantly higher revenues with lower operating capacity.

Operating Expenses

|

| Nine months ended |

|

| Change | ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % | ||||

Operating Expenses |

| $ 8,342,412 |

|

|

| $ | 13,668,299 |

|

| $ (5,325,887) |

|

|

|

| (39%) |

For the nine months ended June 30, 2020, the Company’s operating expenses totaled $8,342,412, compared to $13,668,299 for the nine months ended June 30, 2019, representing a 39% decrease. This decrease is primarily attributable to a decrease in stock based compensation expense.

19

Net Loss

|

| Nine months ended |

|

| Change |

| ||||||||||

|

| 2020 |

|

| 2019 |

|

| Dollars |

|

| % |

| ||||

Net Loss attributable to NuZee, Inc. |

| $ 8,453,901 |

|

|

| $ 13,436,197 |

|

|

| $ (4,982,296) |

|

|

|

| (37%) |

|

For the nine months ended June 30, 2020, we generated net losses attributable to NuZee, Inc. of $8,453,901, versus $13,436,197 for the nine months ended June 30, 2019. This improvement in net losses is primarily attributable to lower stock compensation expense.

Liquidity and Capital Resources

Since our inception in 2011, we have incurred significant losses, and as of June 30, 2020, we had an accumulated deficit of approximately $33 million. We have not yet achieved profitability, and anticipate that we will continue to incur significant sales and marketing expenses prior to recording sufficient revenue from our operations to offset these expenses. In the United States, we expect to incur additional losses as a result of the costs associated with operating as an exchange-listed public company in the future.

To date, we have funded our operations primarily with proceeds from the public and private sale of shares of our common stock.

Our principal use of cash is to fund our operations, which includes the commercialization of our pour over coffee products, the continuation of efforts to improve our products, administrative support of our operations and other working capital requirements.

We may need to raise additional funds to support our operating activities, and such funding may not be available to us on acceptable terms, or at all. If we are unable to raise additional funds when needed, our operations and ability to execute our business strategy could be adversely affected. We may seek to raise additional funds through equity, equity-linked or debt financings. If we raise additional funds through the incurrence of indebtedness, such indebtedness would have rights that are senior to holders of our equity securities and could contain covenants that restrict our operations. Any additional equity financing may be dilutive to our stockholders.

As of June 30, 2020, we had a cash balance of $5,215,809.

Summary of Cash Flows

|

|

| Nine Months Ended |

| |||||

|

|

| 2020 |

|

| 2019 |

| ||

Cash used in operating activities |

|

|

| $(3,003,714) |

|

|

| $(2,949,569) |

|

Cash provided (used) in investing activities |

|

|

| $93,694 |

|

|

| $(1,220,333) |

|

Cash provided by financing activities |

|

|

| $6,777,931 |

|

|

| $5,422,065 |

|

Effect of foreign exchange on cash |

|

|

| $21,858 |

|

|

| $2,601 |

|

Net increase in cash |

|

|

| $3,889,769 |

|

|

| $1,254,764 |

|

Operating Activities

We used $3,003,714 and $2,949,569 of cash in operating activities during the nine months ended June 30, 2020 and 2019, respectively, principally to fund our operating loss. Excluding the impact of stock compensation expense, the increase in cash used in operating activities of $54,145 was primarily attributable to the increase in net loss for the nine months ended June 30, 2020 as compared to the nine months ended June 30, 2019 partially offset by an improvement in cash flow from accounts receivables and inventories.

Investing Activities

We provided $93,694 of cash versus used $1,220,333 of cash in investing activities during the nine months ended June 30, 2020 and 2019, respectively, principally to fund the purchase of equipment.

Financing Activities

Historically, we have funded our operations primarily through the issuance of our common stock.

Cash provided by financing activities increased to $6,777,931 for the nine months ended June 30, 2020 from $5,422,065 for the nine months ended June 30, 2019. During the nine months ended June 30, 2020, we issued 811,738 shares of common stock which generated net cash proceeds of $6,867,786.

20

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Item 4. Controls and Procedures

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed by our Company is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC, and that such information is collected and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. Our Chief Executive Officer and Chief Financial Officer are responsible for establishing and maintaining disclosure controls and procedures for our Company. In designing and evaluating our disclosure controls and procedures, management recognizes that no matter how well conceived and operated, disclosure controls and procedures can provide only reasonable, not absolute, assurance that the objectives of the disclosure controls and procedures are met.

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, carried out an evaluation of the effectiveness of our "disclosure controls and procedures" (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this Quarterly Report on Form 10-Q (the "Evaluation Date") Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of the Evaluation Date, our disclosure controls and procedures are not effective, at the reasonable assurance level, to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported, within the time periods specified in the SEC rules and forms and (ii) is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure, in part due to the material weaknesses in our internal control over financial reporting described in our Annual Report on Form 10-K/A for the year ended September 30, 2019 filed with the SEC on December 31, 2019, which have not yet been remediated. Management is responsible for implementing changes and improvements to internal control over financial reporting and for remediating the control deficiencies that gave rise to the material weaknesses. We will not consider these material weaknesses fully remediated until management has tested those internal controls and found them to be operating effectively.

Changes in Internal Control Over Financial Reporting

Other than as described above, there have been no changes in our internal control over financial reporting during the three-month period ended June 30, 2020 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

21

PART II.

Item 1. Legal Proceedings

From time to time, we may be subject to legal proceedings and claims in the ordinary course of business. The results of any future litigation cannot be predicted with certainty, and regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources, and other factors.

Item 1A. Risk Factors

Except as set forth below, there have been no changes to our risk factors from those disclosed in our annual report on Form 10-K/A filed with the SEC on December 31, 2019.

The COVID-19 pandemic is significantly affecting our operations and financial condition, and our liquidity could also be negatively impacted, particularly if the U.S. economy remains unstable for a significant amount of time.

The novel coronavirus (“COVID-19”) global pandemic is significantly affecting our business operations, as well as the U.S. economy and financial markets. As the COVID-19 crisis is still rapidly evolving, much of its impact remains unknown and difficult to predict. The COVID-19 crisis may have an adverse impact on our business and financial results that we are not currently able to fully quantify.

Broad economic factors resulting from the current COVID-19 pandemic, including increasing unemployment rates and reduced consumer spending, may affect our revenues and our ability to collect outstanding receivables. Business closings and layoffs, along with travel bans and restrictions and shelter-in-place or similar orders issued to combat the spread of COVID-19, may adversely affect demand for our products, as well as the ability of our customers to pay for goods delivered. Any increase in the amount or deterioration in the collectability of accounts receivable will adversely affect our cash flows and results of operations, requiring an increased level of working capital. If general economic conditions continue to deteriorate or remain uncertain for an extended period of time, our liquidity may be harmed and the trading price of our common stock could decline significantly.

In addition, our results and financial condition may be adversely affected by federal or state laws, regulations, orders, or other governmental or regulatory actions addressing the current COVID-19 pandemic which, if adopted, could result in direct or indirect restrictions to our business, financial condition, results of operations and cash flow. We may also be subject to lawsuits from employees and others exposed to COVID-19 at our facilities. Such actions may involve large demands, as well as substantial defense costs. Our professional and general liability insurance may not cover all claims against us.

The COVID-19 pandemic is significantly affecting our business operations.

In December 2019, COVID-19 originated in Wuhan, China, and quickly spread to infect many people in the city and surrounding area. In some cases, COVID-19 causes severe illness and even death. Since its discovery, COVID-19 has spread worldwide and significantly impacted global economies. Restrictive measures that have been implemented in the United States and other countries to combat the virus and its spread, such as travel bans, social distancing, quarantines and shelter-in-place orders may also adversely affect our ability to produce as well as the demand for our products and therefore have an adverse effect on our operations, business and financial condition.

We have a sales office in Japan and a manufacturing and sales office in Korea, and we source our manufacturing equipment and filters from East Asian companies. The continued spread of COVID-19 and implementation of restrictive measures may adversely affect our operations in North America and Asia and our business generally, depending on the extent of its spread of the virus, the rate of infection, the severity of illness and the probability of lethality, the relative effect on various portions of the population (such as the aged), the effect on international trade and commerce and on foreign and domestic travel generally of any measures taken to combat the virus, any action taken (such as the lowering of interest rates) by government entities to combat the negative macroeconomic effects of these measures, the timing and availability of any vaccine for the virus, and other factors. If such circumstances continue to deteriorate, our production capabilities and demand for our products may decline, which would have an adverse effect on our results of operations and financial condition.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

22

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

None.

Item 6. Exhibits

EXHIBIT NO. | DESCRIPTION |

31.1* | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

31.2* | Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

32.1** | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

32.2** | Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

101*** | Interactive Data Files |

101.INS | XBRL Instance Document |

101.SCH | XBRL Taxonomy Extension Schema Document |

101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

* Filed herewith

** Furnished herewith

** Furnished herewith. Pursuant to Rule 406T of Regulation S-T, the Interactive Data Files on Exhibit 101 hereto are deemed not filed or part of any registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, are deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, and otherwise are not subject to liability under those sections.

23

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.