UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8‑K/A

AMENDMENT NO. 4

TO

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 19, 2013

NUZEE, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

|

333-176684 |

|

38-3849791 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

16955 Via Del Campo, Suite 260

San Diego, CA 92127

(Address of principal executive offices, including zip code)

(858) 549-6893 or toll-free 855-936-8933

(Registrant's telephone number, including area code)

HAVANA FURNISHINGS, INC.

Edificio Ultramar Plaza, Apt. #4A 47th Street, Panama City, Panama

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This document contains forward-looking statements which reflect the views of NuZee, Inc. (formerly, Havana Furnishings, Inc.) (hereinafter "NuZee" or the "Company") and with respect to future events and financial performance. These forward-looking statements are subject to certain uncertainties and other factors that could cause actual results to differ materially from such statements. From time to time, our management or persons acting on our behalf may make forward-looking statements to inform existing and potential security holders about our Company. All statements other than statements of historical facts included in this report regarding our financial position, business strategy, plans and objectives of management for future operations, industry conditions, and indebtedness covenant compliance are forward-looking statements. When used in this report, forward-looking statements are generally accompanied by terms or phrases such as "estimate," "expects", "project," "predict," "believe," "expect," "anticipate," "target," "plan," "intend," "seek," "goal," "will," "should," "may," "targets" or other words and similar expressions that convey the uncertainty of future events or outcomes. Items contemplating or making assumptions about, actual or potential future sales, market size, collaborations, and trends or operating results also constitute such forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Forward-looking statements involve inherent risks and uncertainties, and important factors (many of which are beyond our control) that could cause actual results to differ materially from those set forth in the forward-looking statements, including the following: general economic or industry conditions, nationally and/or in the communities in which we conduct business, changes in the interest rate environment, legislation or regulatory requirements, conditions of the securities markets, our ability to raise capital, changes in accounting principles, policies or guidelines, financial or political instability, acts of war or terrorism, other economic, competitive, governmental, regulatory and technical factors affecting our operations, products, services, and prices.

We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Accordingly, results actually achieved may differ materially from expected results in these statements. Forward-looking statements speak only as of the date they are made. You should consider carefully the statements in the section below entitled "Risk Factors" and other sections of this report, which describe factors that could cause our actual results to differ from those set forth in the forward-looking statements. We do not undertake, and specifically disclaims, any obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

2

FORM 10 DISCLOSURES

As disclosed elsewhere in this report, on April 19, 2013, Havana Furnishings, Inc. (the "Company", or "HVFI" acquired NuZee Co., Ltd. ("NuZee") for stock. Item 2.01(f) of Form 8-K states that: if the registrant was a shell company, as we were immediately before the acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10, if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of NuZee.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On April 19, 2013, Havana Furnishings, Inc., a Nevada corporation (the "Company") entered into a Share Exchange Agreement (the "Share Exchange Agreement") with NuZee Co., Ltd., a California corporation ("NuZee"), and the NuZee shareholders (the "NuZee Shareholders"). Pursuant to the terms of the Share Exchange Agreement, we agreed to acquire all of the issued and outstanding shares of NuZee's common stock in exchange for the issuance by our Company of 33,733,333 shares of our common stock to the NuZee Shareholders. As a result of the Share Exchange Agreement, NuZee became a wholly-owned subsidiary of the Company and the Company now carries on the business of NuZee as its primary business. The Share Exchange Agreement contains customary representations, warranties and conditions to closing. The closing of the Share Exchange Agreement (the “Closing”) occurred on April 19, 2013 (the “Closing Date”).

As a result of the Share Exchange Agreement:

(a) each outstanding NuZee Share was cancelled, extinguished and converted into and became the right to receive a pro rata portion of Company Shares which equaled the number of NuZee Shares held by each NuZee Shareholder multiplied by the exchange ratio of 1:1 (the “Exchange Ratio”), rounded, if necessary, up to the nearest whole share. Based on the Exchange Ratio, as a result of the Share Exchange Agreement, the NuZee Shareholders own a total of 33,733,333 restricted shares of common stock of the Company.

(b) Haisam Hamie irrevocably cancelled a total of 4,000,000 restricted shares of common stock of the Company.

A description of the specific terms and conditions of the Share Exchange Agreement is set forth in the Share Exchange Agreement filed herewith as Exhibit 2.01.

3

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

THE MERGER

The information provided in Item 1.01 of this Current Report on Form 8-K related to the aforementioned Share Exchange Agreement is incorporated by reference into this Item 2.01.

As a result of the Share Exchange Agreement, (i) our principal business became the business of NuZee; and (ii) NuZee became a wholly-owned subsidiary of the Company. As the NuZee Shareholders obtained the majority of the outstanding shares of the Company through the acquisition, the acquisition is accounted for as a reverse merger or recapitalization of the Company. As such, NuZee is considered the acquirer for accounting purposes.

As of the date of the Share Exchange Agreement, there were no material relationships between the Company and NuZee or between the Company and any of NuZee’s respective affiliates, directors, or officers, or associates thereof, other than in respect of the Share Exchange Agreement.

DESCRIPTION OF BUSINESS

As used in this Current Report on Form 8-K, all references to “we”, “our” and “us” for periods prior to the closing of the Exchange refer to NuZee Co., Ltd. as a privately owned company, and for periods subsequent to the closing of the Exchange, refer to the Company and its subsidiaries (including NuZee).

HISTORY

NuZee Co. Ltd. was incorporated in the State of California in November, 2011 and is headquartered in San Diego, California. NuZee was started by its Chairman Mr. Masa Higashida, after the devastating tsunami that hit Japan in March 2011. At the time, Mr. Higashida’s singular goal was to provide safe bottled drinking water to help in the recovery effort. That humanitarian effort led to the establishment and launch of NuZee.

Since its inception, NuZee has engaged in the importation and distribution of bottled spring water from New Zealand. On September 17, 2012, NuZee purchased all rights to the proprietary formula for an energy drink from its creator, Travis Gorney of Point Blank Beverage, Inc. NuZee currently produces and markets its energy drink under the name "Torque." In addition, NuZee is exploring the importation and distribution of a line of natural skincare products. NuZee is expanding its operations across the United States by delivering products that fit one or more of the following product categories: “Protection”, “Performance”, and “Pristine.” The mission of NuZee is to produce and/or market products in these three product categories that satisfy the needs of consumers who demand high quality products with natural and organically sourced ingredients packaged for convenience and “on-the-go” use.

As described above, on April 19, 2013, NuZee entered into the Share Exchange Agreement with Havana Furnishings, Inc. "Havana") whereby NuZee became a wholly owned subsidiary of Havana. Pursuant to the Share Exchange Agreement, Havana has Filed Amended Articles of Incorporation to change its name to NuZee, Inc. The Amended Articles shall become effective on May 2, 2013.

4

PRODUCTS

NuZee's focus is in three product categories: “Protection”, “Performance”, and “Pristine.”

5

Performance Category - Energy Drinks

In 2012, NuZee purchased all rights to a proprietary formulation for the energy supplement drink it markets under the name "Torque." The Company’s Torque product has launched in select markets and is being tested using a variety of consumer promotions to gain shelf-space in retail distribution. The Company plans to expand the product line to include new flavors and derivatives to address unmet market demand.

NuZee plans to distribute its performance products through a traditional two-step distribution channel of wholesalers and distributors to retailers. The Company is building out a national footprint of stores with plans to eventually have more than 50,000 store-fronts operational using a combination of convenience, grocery, and mass merchant chains.

The Energy Supplement product category, which falls into the NuZee Performance Category, is enjoying sustainable growth for existing and new entrants. The U.S. energy supplement market surpassed $1 Billion in Sales in 2011 (Source: Forbes, 2012) and is growing at or above the beverage industry average growth rate according to independent research by Nielsen.

The market is currently dominated by Living Essentials, LLC who distributes and markets 5-Hour Energy® with more than 90 percent market share followed by a handful of smaller companies. Management believes that if it executes on its product and distribution plans it can solidify a meaningful market share percentage in categories not presently addressed by current competition.

NuZee maintains an efficient cost structure by employing contract manufacturers to source its proprietary formulated performance products allowing for flexible scale and growth. NuZee’s primary suppliers include multiple bottlers, ingredient suppliers, and co-packers located across the United States. In exchange for developing our proprietary energy blend NuZee has entered into a verbal agreement to purchase its raw materials from one of its beverage architect for a period of three (3) years.

Our current and primary suppliers for our Energy/Performance Products are:

· Flavorman (www.flavorman.com) is our "beverage architect" and provides our raw ingredients and formulation science

· Arizona Production and Packaging (www.azpack.com) is our co-packer

· Amcor Landsberg (www.landsberg.com) is our bottle and packaging supplier

As the energy related product line evolves NuZee plans to monitor and respond to any US FDA or individual state licensing authorities to maintain compliance regarding energy related food and beverage regulations. As the company is currently in the development stage, our energy products did not contribute significantly to our revenues in FY 2012. However, management believes that the energy products will become the dominate revenue producing product line on moving forward.

NuZee’s acquisition of Point Blank Beverage’s intellectual and proprietary property assisted the Company in acquiring an energy shot and beverage formula foundation that minimized its required capital investment and shorten its development time to market. The Company expects to continue to invest in new derivative formulas through a partnership with its energy beverage architects. The Company plans to recover its development cost over the product life cycle. This approach to new product development will be applied to a new innovative line of energy based creamer supplement products called Coffee BlendersTM.

6

NuZee will continue to monitor the social and public perception as well as the government compliance regulations associated with the energy product market. To date, there are no specific FDA regulations or certification regarding the manufacturing and distribution of energy shots as they are currently classified as dietary supplements; as such the Company will continue comply with the general labeling regulations regarding dietary supplements. For more information, see "Government Regulations" below.

Protection Category - Organic Skin Care

For NuZee, the Protection Category includes NuZee's skin care related products. Both the NuZee Natural and NuZee Organic product lines are made in New Zealand and produced under strict oversight and requirements to comply with BioGro Certified Organic and the USDA Organic guidelines.

For NuZee, the Protection Category includes NuZee's skin care related products. Both the NuZee Natural and NuZee Organic product lines are made in New Zealand and produced under strict oversight and requirements to comply with BioGro Certified Organic and the USDA Organic guidelines.

Our Natural Skin Care line contains up to 98.6% all natural ingredients, and contains no synthetic color, ethyl alcohol, silicon oil or added paraben preservatives. Our Organic Skin Care line contains up to 100% certified organic natural ingredients and contains no synthetic oils, added paraben preservatives, artificial fragrances, colors or Peg Emulsifiers.

The NuZee Natural and Organic Skin Care product lines are produced by CNS Laboratories New Zealand Ltd., using a proprietary formula exclusive to our distribution partner iSpring. All of our skin care products are purchased through iSpring, a New Zealand company owned by one of our Directors, Masa Higashida. iSpring has authorized NuZee to market the skin care products for North America distribution and private label opportunities globally. .

In 2011, the organic skin care market in the United States surpassed more than $1.7 billion in annual sales and the entire category is growing at a rate of greater than 10% year over year, with projected sales at $5.8 Billion in 2016 (Source: Kline Group, 2012) NuZee is evaluating the market opportunity for the Skin Care business and plans to employ a strategy of working with established brands for custom private label programs rather than building a new brand in the United States.

While the Company is currently in development stage, the revenues associated with our skin care product sales did not contribute to revenues in 2012.

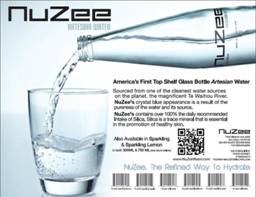

Pristine Category – Bottled Water

The Company is proud of the source and origin of its NuZee artesian and sparkling water. NuZee water is pure New Zealand spring water sourced from an unground Blue Spring that is revered for its minerality properties, clarity, and blue hues. The water that flows from the Blue Spring is just to the east of Putaruru in the North Island of New Zealand and is rich in Silica (76g/Liter) a mineral that is prized for its health benefits. The Plateau gathers rain that fell over 100 years ago which makes its way underground into layered aquifers within fractured rock and volcanic sand aquifers. The water gushes out of the spring into the Waihou River at a rate of 42 cubic meters per minute (9,240 gallons per minute) and is a constant 11 degrees Celsius (51.8 degrees Fahrenheit) all year.

7

The entire area is protected and cared for and the Blue Spring is recognized as one of the purest water acquirers in the world with a TDS (Total Dissolved Solids) measured at 129 ppm parts per million. For example, filtered and treated tap water averages 200-400 ppm (US EPA Maximum Level is 500 ppm). Source: New Zealand Department of Conservation (http://www.doc.govt.nz/parks-and-recreation/tracks-and-walks/bay-of-plenty/rotorua-lakes/te-waihou-walkway/); Hamilton & Waikato Tourism (http://www.hamiltonwaikato.com/things-to-do/articles/walking-hiking-biking/blue-spring-te-waihou-walkway); Putaruru Visitor Information (http://www.putaruru.co.nz/Things-to-Do/Walks).

NuZee is the exclusive U.S. distributor for NuZee bottled spring water, which is bottled in New Zealand and shipped to our distribution center in California. Currently all bottled water products are purchased through iSpring, a New Zealand company owned by one of our Directors, Masa Higashida. NuZee plans to work directly with its bottlers to improve efficiency and stream line processes whereby iSpring will source from NuZee. The NuZee Pristine products are currently in market trials to measure sell-through and fine-tune the business model. Presently the Company plans to focus its water business sales to private label partners whereby only contracting with established brands that already have distribution and marketing capabilities as the cost of a new water entrant is capital intensive. The Company is pursuing a host of strategic partnerships with US based beverage firms that may materialize over the course of 2013.

Through NuZee’s New Zealand water source/bottler partnership we are able to achieve license and certification with local and state government agencies. The Company plans to continue to support its iSpring distribution partnership whereby iSpring utilitizes NuZee branding for its products sold throughout Asia with primary focus on Japan and South Korea.

While the Company is currently in development stage, the revenues associated with our bottled water product sales accounted for 86% of our revenue in 2012.

Government Regulations

The Company is complying with general regulations such as the product packaging and labeling requirements established by the FDA regarding our energy, water and skin care product lines. Notably, we have retained GreenbergTraurig a firm that specializes in regulatory and business practices in the food, cosmetic and dietary supplement industries to ensure compliance with statutes and regulations enforced by the Food and Drug Administration. Specifically the Company is following the mandatory guidelines for Statement of Identity (Pursuant to 21 CFR 101.3), Class of Filing, Product Display Panel, Net Quantity of Contents Statement (NQCS), Supplement Disclaimer, Product Functional Claims among others.

FDA Regulation — Dietary Supplements

The Dietary Supplement Health and Education Act of 1994, or DSHEA, amended the FDCA by establishing regulatory standards with respect to dietary supplements, and defining dietary supplements as a new category of food. Dietary supplements include vitamins, minerals, amino acids, nutritional supplements, herbs and botanicals intended for ingestion that are labeled as dietary supplements and are not represented for use as a conventional food or as a sole item of a meal or the diet. Under DSHEA, a firm that manufactures or distributes dietary supplements must determine that such products are safe and that any representations or claims made about the products are substantiated by adequate evidence to show that the claims are not false or misleading.

8

DSHEA does not require manufacturers or distributors to seek approval from the FDA before producing or selling a dietary supplement unless the supplement contains one or more ingredients that are considered to be a “new dietary ingredient.” A “new dietary ingredient” is one that was not marketed in the United States before October 15, 1994. The manufacturer or distributor of a dietary supplement that contains a “new dietary ingredient” must provide the FDA with information, including any citations to published articles, demonstrating why the ingredient is reasonably expected to be safe for use in a dietary supplement at least 75 days before the dietary supplement is introduced or delivered for introduction into interstate commerce. This requirement does not apply if the ingredient has been recognized as a food substance and is present in the food supply.

FDA regulations also require that certain information appear on dietary supplement labels, including the name of the dietary supplement, the amount of the dietary supplement, nutrition labeling, a complete list of ingredients and the name and place of business of the manufacturer, packer or distributor.

The manufacturer, packer, or distributor of a dietary supplement must submit to the FDA any report it receives of a serious adverse event associated with the dietary supplement when used in the United States, accompanied by a copy of the label of the dietary supplement, no later than 15 business days after the report is received. A “serious adverse event” is an adverse event that results in death, a life-threatening experience, inpatient hospitalization, a persistent or significant disability or incapacity, a congenital anomaly or birth defect, or requires, based on a reasonable medical judgment, medical or surgical intervention to prevent such outcomes.

The FDA may take action to restrict use of a dietary supplement or to remove it from the marketplace if the agency believes the supplement presents a significant or unreasonable risk of illness or injury under conditions of use suggested in the labeling or under ordinary conditions of use. Under DSHEA, the FDA bears the burden of proof to show that a dietary supplement presents a significant or unreasonable risk of illness or injury. The FDA also may take enforcement action against a dietary supplement manufacturer or distributor for unlawful promotion of a dietary supplement, such as making claims that a supplement treats, prevents or cures a specific disease or condition. These claims would subject the dietary supplement to regulation as a drug product. If dietary supplements do not meet applicable requirements, the manufacturer may need to undertake a voluntary recall.

FDA Regulation — Skincare

Our cosmetic products are regulated for safety by the FDA, which requires that ingredients meet industry standards for non-allergenicity and non-toxicity. Performance claims for cosmetics may not be "therapeutic."

FDA Regulation — Bottled Water

The FDA regulates bottled waters as a food. Our bottled water product must meet FDA requirements of safety for human consumption, labeling, processing, and distribution under sanitary conditions and production in accordance with the FDA "good manufacturing practices." In addition, all drinking water products must meet Environmental Protection Agency standards established under the Safe Drinking Water Act for mineral and chemical concentration and drinking water quality and treatment which are enforced by the FDA. We also must meet state regulations in a variety of areas. These regulations set standards for approved water sources and the information that must be provided and the basis on which any therapeutic claims for water may be made.

9

Patents and Trademarks

NuZee has entered into an agreement to purchase TORQ ® and TORQ WRENCHTM trademarks in the United States from the HydroPouch Corporation. In addition, NuZee has received trademark registration for the TORQUE mark in New Zealand. Separately, NuZee has filed for trademark registration for Coffee BlendersTM in preparation for a new derivative line of products. A copy of the Trademark Purchase and License Agreement between NuZee Co., Ltd. And HydroPouch Corporation is attached as Exhibit 10.3.

Employees

We currently employ five (5) full-time employees with four (4) employees based in San Diego and one remote satellite employee.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operations of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site, www.sec.gov.

Our website address is www.nuzeeskincare.com. Information on our website does not constitute part of this Report or any other report we file or furnish with the SEC.

RISK FACTORS

RISKS RELATED TO OUR COMPANY

We Will Be Reorganized as a Start Up Company

Havana Furnishings, Inc. is reorganizing to engage in a new and different business. If successful, of which there is no assurance, the newly reorganized business, will still be deemed to be a start-up company that has generated a limited amount of revenue its inception. We expect to incur operating losses for the foreseeable future, and there can be no assurance that we will be able to validate and market products in the future that will generate revenues or that any revenues generated will be sufficient for us to become profitable or thereafter maintain profitability.

We Have Limited Operating History Upon Which to Evaluate Our Potential for Future Success.

The Company has only a limited operating history on which to base an evaluation of its business and prospects. In addition, the Company’s revenue model is evolving and relies substantially on the assumption that the Company will be able to successfully complete development of and sell its products and services in the marketplace. The Company’s prospect must be considered in light of the risk, uncertainties, expenses and difficulties frequently encountered by companies in the earliest stages of development. To be successful in the market, the Company must among other things:

· Complete development of and introduce functional and attractive product offerings;

· Attract and maintain distribution partners and their commitments;

· Establish and increase awareness of the Company’s brand and develop customer loyalty;

10

· Provide desirable products and services to customers at attractive prices;

· Establish and maintain relationships with manufacturing, sourcing and logistics partners and affiliates;

· Rapidly respond to regulatory and governmental requirements;

· Be in compliance with changing FDA regulations;

· Maintain cross boarder commerce and distribution operations;

· Be in compliance with changes in import and export regulations, taxes and tariffs;

· Build operations and customer service structure to support the Company’s business; and

· Attract, retain, and motivate qualified personnel.

The Company cannot guarantee that it will be able to achieve these goals and is failure to do so could have a material adverse effect on the Company’s business, results of operations and financial condition. Moreover, there can be no assurance that the Company will be able to obtain additional funding when the Company’s financial resources are exhausted. The Company expects that its revenues and operating results will fluctuate in the future. There can be no assurance that any or all of the Company’s efforts will be successful.

Our Independent Registered Public Accounting Firm Has Expressed Substantial Doubt About Our Ability To Continue As A Going Concern.

Working capital at March 31, 2013 was of $14,660 and have recognized net loss of $730,458 for the cumulative period from November 9, 2011(inception) to March 31, 2013. Although the Company has a revenue stream, it has only be operational for less than one year and has no historical operations to base our anticipated future cash flows. The future of our Company is dependent upon future profitable operations from the sales of our media. Our management will need to seek additional financing in the future in order to expand our operations. These conditions raise substantial doubt about our company's ability to continue as a going concern. Although there are no assurances that our plans will be realized, our management believes that we will be able to continue operations in the future.

Based on our current monthly expenses and product revenue contributions we forecast the business will only be able to sustain its current operating structure for 90-120 days without additional working capital.

Our Success is Dependent on Collaborative Arrangements.

The development and commercialization of the Company’s products and services depends in large part upon the Company’s ability to selectively enter into and maintain collaborative arrangements with manufacturers, distributors, partners, providers, etc.

Because we do not have written agreements with our beverage architect, we may be unable to effectively manufacture and distribute our products or distribute them at all, which would adversely affect our reputation and materially reduce our revenues.

We do not own or operate any manufacturing facilities. Rather, we have an agreement with our beverage architect to formulate and manufacture our energy products. Our agreement with our beverage architect has not yet been reduced to writing. Because we do not have any written agreements in place, our beverage architect could refuse to supply some or all of our products, reduce the number of products that they supply or change the terms and prices under which they normally supply our products. The occurrence of any such conditions will have a materially negative effect upon our reputation and our ability to distribute our products, which will cause a material reduction in our revenues.

11

Need of Additional Financing; Limited Resources.

The Company’s financial resources are limited and the amount of funding that it will require developing and commercializing its products and technologies is highly uncertain. Adequate funds may not be available when needed or on term satisfactory to the Company. Lack of funds may cause the Company to delay, reduce and/or abandon certain or all aspects of its research and development programs.

Early to Market Challenge is Critical.

The success of the Company is dependent on its ability to quickly get to market and establish an early mover advantage. The Company must implement an aggressive sales and marketing campaign to solicit customers and strategic partners. Any delay could seriously affect its ability to establish and exploit effectively its early-to-market-strategy.

We face intense competition within the premium bottled water market as well as from other beverage and energy supplement providers. If we are unable to compete effectively, our business could be harmed.

The premium bottled water market is highly competitive. Our products currently represent less than 1% of this market. Many of our competitors have greater financial, marketing and other resources than we currently do, and therefore may be able to devote greater resources to the marketing and sale of their products, generate national brand recognition or adopt more aggressive pricing policies than we can, which would put us at a competitive disadvantage. Our competitors have products that have already gained wide customer acceptance in the marketplace and preferred shelf space at retail locations.

Our products also compete with less expensive, non-premium bottled water products offered by major beverage bottling companies. If consumers purchasing premium water switch to these non-premium alternatives, or other non-premium water alternatives such as residential countertop filtration systems, our business would be harmed. If we are unable to meet the competition faced by our industry, our competitive position and our business could suffer.

Increases in transportation costs would reduce profit margins, negatively impacting profitability.

We deliver our bottled water products to retailors through a third party transportation provider on a delivered price basis. If the price of fuel increases, freight costs will increase. As a result, our freight cost is directly impacted by changes in fuel prices. Increases in fuel prices and surcharges and other factors have increased freight costs and may continue to increase freight costs in the future. The inflationary pressure of higher fuel costs and continued increases in transportation-related costs could have a material adverse effect on our profit margins and profitability.

The source of water for our business is a natural spring in New Zealand and any disruption in the flow of this spring, including exhaustion of the aquifers from which they flow, would have an adverse impact on our ability to operate.

All of our bottled water products originate from a natural spring in New Zealand. In the event there are geological shifts or other changes, natural or otherwise, that affect the flow of the spring, our ability to satisfy future customer demand and to meet our prior obligations for bottled water would be adversely affected, which would in turn adversely impact our business and results of operations. The deep aquifers from which our water springs are limited resources, and while we believe our water supply from these aquifers are more than sufficient to support our operations and any anticipated expansion thereof, we could at some point in the future experience water flow levels too low to make it economically feasible to collect, bottle and distribute our bottled water products.

12

We Have Not Yet Formed Any Strategic Partnerships or Agreements For Custom Private Labeling

As described above, we are pursuing a host of strategic partnerships for our Organic Skin Care and plan to employ a strategy of working iwth established brands for custom private label programs. At this time, we are evaluating opportunities in these areas, and do not have any formal agreements with any established brands or other third parties. If we are unsuccessful at establishing strategic partnerships and/or contracting with established brands for private labeling, our business will not expand as anticipated.

Risks Relating to Regulatory and Legal Issues

The bottled water industry is regulated at both the state and federal level. If we are unable to continue to comply with applicable regulations and standards in any jurisdiction, we might not be able to sell our products in that jurisdiction, and our business could be seriously harmed.

The United States Food and Drug Administration ("FDA") regulates bottled water as a food. Our bottled water must meet FDA requirements of safety for human consumption, labeling, processing and distribution under sanitary conditions and production in accordance with FDA "good manufacturing practices." In addition, all drinking water must meet Environmental Protection Agency standards established under the Safe Drinking Water Act for mineral and chemical concentration and drinking water quality and treatment, which are enforced by the FDA.

We also must meet state regulations in a variety of areas. These regulations set standards for approved water sources and the information that must be provided and the basis on which any therapeutic claims for water may be made. Failure to comply with such laws and regulations could result in fines against us, or, even in the absence of governmental action, loss of revenue as a result of adverse market reaction to negative publicity. Any such event could have a material adverse effect on our business. We cannot

assure you that we have been or will at all times be in compliance with all regulatory requirements or that we will not incur material costs or liabilities in connection with regulatory requirements.

Our Officers and Directors Own a Majority of Our Outstanding Common Stock. Investors May Find That Corporate Decisions Influenced By Our Directors Are Inconsistent With The Best Interests Of Other Stockholders

Our officers and directors currently own a majority of the outstanding shares of our common stock. Accordingly, they have power in deciding every aspect of our business, including the power to elect members of our Board of Directors.

RISKS RELATING TO OUR COMMON STOCK

Risks Relating to Low Priced Stocks

Although the Company's Common Stock is approved for trading on the OTC Bulletin Board, there has only been little if any trading activity in the stock. Accordingly, there is no history on which to estimate the future trading price range of the Common Stock. If the Common Stock trades below $5.00 per share, trading in the Common Stock will be subject to the requirements of certain rules promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which require additional disclosure by broker-dealers in connection with any trades involving a stock defined as a penny stock (generally, any non-FINRA equity security that has a market price share of less than $5.00 per share, subject to certain exceptions). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally defined as an investor with a net worth in excess of $1,000,000 or annual income exceeding $200,000 individually or $300,000 together with a spouse). For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in the Common Stock which could severely limit the market liquidity of the Common Stock and the ability of holders of the Common Stock to sell it.

13

The Market Price of Our Common Stock is Volatile, Leading to the Possibility of its Value Being Depressed at a Time When Shareholder May Want to Sell Their Holdings.

The market price of our common stock can become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include:

· our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors;

· changes in financial estimates by us or by any securities analysts who might cover our stock;

· speculation about our business in the press or the investment community;

· significant developments relating to our relationships with our consultants and out-sourced contracting companies which will be utilized for most of exploration services;

· stock market price and volume fluctuations of other publicly traded companies customer demand for our products;

· investor perceptions of the entertainment industry in general and our Company in particular;

· the operating and stock performance of comparable companies;

· general economic conditions and trends;

· announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures;

· changes in accounting standards, policies, guidance, interpretation or principles;

· loss of external funding sources;

· sales of our common stock, including sales by our directors, officers or significant stockholders; and

· additions or departures of key personnel.

Securities class action litigation is often instituted against companies following periods of volatility in their stock price. Should this type of litigation be instituted against us, it could result in substantial costs to us and divert our management's attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to the operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our Company at a time when you want to sell your interest in us.

14

Because We Were a "Shell Company" Certain Investors in Our Company Will Not Be Able to Utilize Rule 144 to Sell Their Shares Until at Least One Year After We Cease To Be a Shell Company.

The Shares issued to investors in the Company cannot be sold pursuant to Rule 144 promulgated under the Securities Act until one year after the Company ceases to be a shell company. In general, under Rule 144 as currently in effect, a person (or persons whose shares are aggregated) who has beneficially owned restricted securities shares for at least six months, including persons who may be deemed "affiliates" of the Company, as that term is defined under the Securities Act, would be entitled to sell within any three month period a number of shares that does not exceed the greater of 1% of the then outstanding shares or the average weekly trading volume of shares during the four calendar weeks preceding such sale. Sales under Rule 144 are also subject to certain manner-of-sale provisions, notice requirements and the availability of current public information about the Company. A person who has not been an affiliate of the Company at any time during the three months preceding a sale, and who has beneficially owned his shares for at least one year, would be entitled under Rule 144 to sell such shares without regard to any volume limitations under Rule 144.

Havana Furnishings, Inc. was a shell company prior to filing this periodic report on Form 8-K and therefore a majority of its shareholders may not currently utilize Rule 144 to sell their shares. Rule 144 is not available for sales of shares of companies that are or have been "shell companies" except under certain conditions. The Company completed an acquisition and has removed its status as a shell company by filing this report on Form 8-K. Shareholders are able to utilize Rule 144 one year after the filing of this Form 8-K, assuming it files the documents it is required to file as a reporting company. Investors in the Company whose shares were registered in a registration statement will be able to sell their shares pursuant to said registration statement.

Potential Issuance of Additional Common and Preferred Stock.

The Company will be authorized to issue up to 100,000,000 shares of Common Stock. To the extent of such authorization, the board of directors of the Company will have the ability, without seeking stockholder approval, to issue additional shares of Common Stock in the future for such consideration as the board of directors may consider sufficient. The issuance of additional Common Stock in the future will reduce the proportionate ownership and voting power of the Common Stock offered hereby. The Company will also be authorized to issue up to 100,000,000 shares of preferred stock, the rights and preferences of which may be designated in series by the board of directors. To the extent of such authorization, such designations may be made without stockholder approval. The designation and issuance of series of preferred stock in the future would create additional securities which would have dividend and liquidation preferences over the Common Stock offered hereby. In addition, the ability to issue any future class or series of preferred stock could impede a non-negotiated change in control and thereby prevent stockholders from obtaining a premium for their Common Stock. See "Description of Securities."

No Assurance of a Liquid Public Market For Securities.

Although the Company's shares of Common Stock are currently eligible for quotation on the OTC Bulletin Board, there has been no trading of our stock. There has been no long term established public trading market for the Common Stock hereto, and there can be no assurance that a regular and established market will be developed and maintained for the securities. There can also be no assurance as to the depth or liquidity of any market for the Common Stock or the prices at which holders may be able to sell the shares.

15

We Do Not Expect to Pay Dividends in the Foreseeable Future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. Investors cannot be assured of a positive return on investment or that they will not lose the entire amount of their investment in our common stock.

FINANCIAL INFORMATION

SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following plan of operation provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto. This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Plan of Operations

Short Term Goals (12 Months)

Over the next 12 months, the Company’s growth plans include continuing efforts to:

· Build a network for our products by signing the top 3-5 distributors serving our retail segments;

· Increase points of retail product availability to number in the thousands of locations;

· Establish the NuZee brand as a leader in natural and organic Performance, Protective and Pristine products and supplements.

We also plan to hire seasoned sales and marketing professionals with working knowledge of the US channels that we wish to distribute and market our product within. We have already started developing working relationships with key global and national brands in the beverage industry who would are interested in partnering on both a product and distribution level. While these discussions are preliminary they provide alternate methods to launch products in the US.

In order to build distribution the Company is first determining the total distribution launch cost among the potential channels as each has their own upfront and recurring cost structure. Under investigation are the following company directed channels:

16

-Mass/Drug

-Grocery

-Convenience

-Sports/Specialty

-Military

-e-commerce

-Club/Other

-Discount/Liquidation

Each of the above is compared using a host of costing parameters not limited to the following: product slotting fees, overall margin requirements, market development fees, return/warranty allowances, broadcast advertising and promotional marketing plans, in-store and channel detailing, product sampling and customer demoing as well as transportation and logistics cost, cross dock fees, shelf-life expiration swaps, and initial and recurring inventory loading levels.

In conjunction with the above channel assessment, the Company is also exploring custom and private labeling whereby the company licenses the product formulation, trademarks, and other assets in two ways:

1. Retail Chains – for example manufacturer on behalf of Wal-Mart for product extensions of their Great Value and Equate private brands.

2. Product Brands – for example license to Maxwell House the Coffee Blender product as a new product line served through their existing and established distribution.

The Company plans going forward include the following milestones:

|

Milestone |

Timing |

Est. Cost/Funding Source |

|

1. Finalize Products & Pricing |

April – June |

$25,000 Sell of Equities |

|

2. Hire Key Staff |

May – July |

$15,000/Mth Recurring Sell of Equities |

|

3. Launch Market and Promotion Plan |

June – Ongoing |

$250,000-$500,000 Annually Sell of Equities + Product Contribution |

|

4. Explore OEM/Private Label Opportunities |

June – Ongoing |

n/a |

|

5. OEM Private Launch |

TBD |

TBD |

If we are unable to receive funding our plans will be dramatically and negatively impacted such that we will prioritize go to market strategies based on reduced operations and available capital.

17

Long Term Goals (Five Years)

The Company believes that there will be significant expansion opportunities in existing markets through new products as well as in new regions outside of the United States in a combination of market development and product licensing.

The Company believes that our limited resources may pose a challenge to our expansion goals and therefore anticipates that it may require additional capital in future years to fund expansion. There can be no assurance that our expansion strategy will be accretive to our earnings within a reasonable period of time. However, the Company believes that it can improve its operational efficiencies and reduce the need for new capital by carefully managing the business based on the following economic fundamentals within accretive margin and cost contribution modeling.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Results of Operations

From inception on November 9, 2011 through December 31, 2012, we have accumulated losses of $604,573 We are presently in the start-up phase of our business and we can provide no assurance that we will be able to attain profitability.

From inception through December 31, 2012, we earned revenues of $36,825 from sales of our products and incurred operating expenses in the amount of $198,078. These operating expenses included the research and the preparation of our business plan in addition to general and administrative expenses. We anticipate our operating expenses will increase as we further undertake our plan of operations.

The increase will be attributed to costs associated with production, storage and delivery of our products as well as research and development of new products.

Liquidity and Capital Resources

As of December 31, 2012 we had cash (operating capital) of $13,508. We have not attained profitable operations since inception. We are relying on sales of our products to cover our costs over the next 12 months. For these reasons, our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern. Based on our current monthly expenses and product revenue contributions we forecast the business will only be able to sustain its current operating structure for 90-120 days without additional working capital.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

18

PROPERTIES

NuZee leases space for its executive office and warehouse, which are located at 7940 Silverton Ave. #109, San Diego, CA 92126.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 15, 2013 , the beneficial ownership of our common stock by each executive officer and director, by each person known by us to beneficially own more than 5% of the our common stock and by the executive officers and directors as a group. Except as otherwise indicated, all shares are owned directly and the percentage shown is based on 35,933,333 shares of common stock issued and outstanding on April 15, 2013 .

|

Title of Class |

Name and Address of Beneficial Owner |

Amount of Beneficial Ownership |

Percent of Class(1) |

|

Executive Officers and Directors | |||

|

Common |

Masa Higashida |

24,917,333 |

69.34 |

|

Common |

Arata Matsushima |

1,520,000 |

4.23 |

|

Common |

Satoru Yukie |

1,520,000 |

4.23 |

|

Common |

Craig Hagopian |

1,216,000 |

3.40 |

|

Total of All Executive Officers and Directors |

29,173,333 |

81.2 | |

|

Shareholders Holding 5% or Greater | |||

|

Common |

Masa Higashida |

24,917,333 |

69.34 |

|

Common |

Point Blank Beverage, Inc. ("PBB") (2) |

3,040,000 |

8.46 |

|

Total of All Shareholders With 5% or Greater |

25,221,333 |

77.80 | |

|

|

|

| |

(1) As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of, a security). In addition, for purposes of this table, a person is deemed, as of any date, to have "beneficial ownership" of any security that such person has the right to acquire within 60 days after such date.

The persons named above have full voting and investment power with respect to the shares indicated. Under the rules of the Securities and Exchange Commission, a person (or group of persons) is deemed to be a "beneficial owner" of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. A person is also deemed to be a beneficial owner of any security, which that person has the right to acquire within 60 days, such as options or warrants to purchase our common stock.

(2) Travis Gorney is the owner of 60% of PBB's outstanding common stock

19

DIRECTORS AND EXECUTIVE OFFICERS

Our executive officers and directors and their respective ages as of April 19, 2013 are as follows:

|

NAME |

AGE |

POSITION(S) AND OFFICE(S) HELD |

|

Craig Hagopian |

48 |

President, Chief Executive Officer, Director |

|

Satoru Yukie |

57 |

Chief Financial Officer, Treasurer, Secretary, Chief Operations Officer, Director |

|

Fernando Corona |

52 |

Director |

|

Masa Higashida |

41 |

Director (Chairman) |

|

Arata Matsushima |

51 |

Director |

Set forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Craig Hagopian, President, CEO, Director

Mr. Hagopian possesses more than twenty-five years of sales and marketing experience and management experience. Since 1998 Mr. Hagopian has managed organizations with full-line P&L responsibility of $30-40 million annually, including Founder and CMO of xAd, a national digital advertising firm (2009-2012), President of V-Enable (2005-2009), CMO of Axesstel (OTCQB: AXST) (2001-2004), and GM/VP of SkyTel consumer products group (1994-2001). Mr. Hagopian is also the general partner with Bernardo International, Inc., a global investment and management firm. We believe that Mr. Hagopian's experience enables him to provide vision and leadership to NuZee’s high-growth business plans.

Mr. Hagopian earned a Bachelor of Science in Business Administration from the University of Southern California (1987) with a dual emphasis in Financial Management and Entrepreneurship and an MBA from Duke University Fuqua School of Business in 2006.

Satoru Yukie, CFO, Treasurer, COO, Secretary and Director

Satoru Yukie is an experienced executive and for many successful companies in the past. He successfully closed several rounds of fund raising and assisted in completing reverse mergers through which two start-ups, Axesstel, Inc.(OTCQB: AXST) and Franklin Wireless, Inc.(OTCBB:FKWL), became public companies. From 2005 till 2008, Mr. Yukie was CEO of UI Magic, Inc., an advanced mobile application development company, and was responsible for the development of corporate structure, securing seed funds, managing projects with major mobile operators and international business development. Since 2008, He has been Managing Director of Bernardo International, Inc., and aggressively pursuing his management and investment practice and is acting as an executive, advisor, and a member of the Board of Directors of several venture companies.

Masa Higashida, Director and Chairman of the Board

Masa Higashida is a successful business executive who has started numerous companies in the financial and consumer product industries. Mr. Higashida started his career in the financial industry in Nagoya Japan and quickly saw an opportunity to expand operations and moved to Seoul, Korea where he established Won Cashing in 2002. He served as their CEO and grew Won Cashing became the number three consumer loan company in Korea. He successfully sold the company to a major financial institution in October of 2010. Following Won Cashing exit, Mr. Higashida established FROM EAST PTE LTD., in Singapore as an investment company where he is the Managing Director. Mr. Higashida then moved to New Zealand and established iSpring LTD. to help provide quality drinking water in Japan following the Tsunami of 2011. From iSpring Mr. Higashida helped establish NuZee to market and distribute quality products in the United States.

20

Fernando Corona, Director

Fernando Corona brings 30 years of experience in the IT and Wireless industry with Fortune 500 and startup companies to the NuZee board. He has worked with both, consumer and commercial products as well as various channels that include retail, distribution, Internet, and MNOs. Mr. Corona has held the following CEO and senior executive positions: VP/GM at Cricket Wireless 2005-2011, CEO at V-Enable 2002-2005 SVP at Packet Video 2000-2002, CEO at Tandberg Data 1998-2000, VP/GM at Allied Telesyn 1995-1997, VP at Western Digital 1989-1995, Director at Maxtor (1987-1989) and National Account Manager at AST Research (1983-1987)

Arata Matsushima, Director

Mr. Matsushima is a 25 year veteran of the broadcast media industry. Since 2009, Mr. Matsushima has served as the president of Pine Isle Inc. a consulting company based in Santa Monica, California where he provides advisory services to the Sony Group, Dentsu, and the Japanese Foreign Ministry. Prior to Pine Isle Inc., Mr. Matsushima has held executive positions in Sony group as the VP of CEO strategic office based in Tokyo, VP of Strategic Planning and Business Alliance in Sony Corporation of America based in New York, VP in Sony Pictures Entertainment based in Culver City.

From 2007 to 2009, Mr. Matsushima worked with Borden & Rosenbush Entertainment where he developed and executive produced several movies and television series including “American Pastime” distributed by Warner Brothers, “American Mall” released by MTV, and “Dance” distributed by Telemundo. From 2001 through 2007 he has held various executive positions in Sony group as the VP the strategic office at Sony Corporation headquarters in Tokyo, VP at Strategic Planning and Business Alliances at Sony Corporation of America based in New York, VP at Sony Pictures Entertainment based in Culver City, California. Between 1985 and 2002, he worked for TV Tokyo Corporation, a Japanese TV Network as a journalist and business news producer. Various executive positions including Bureau Chief of Brussels 1991-1994, Bureau Chief of Moscow 1994-1997, Bureau Chief of New York 2000-2001.

He earned a Bachelor of Science in Political Sciences at the Law Faculty from the Keio University in Tokyo Japan.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

Travis Gorney, Vice President of Sales (Through June 14, 2013)

Mr. Gorney brings a wealth of beverage industry experience to the NuZee management team with nearly 12 years of leading and building brands. Most notably he was a founding partner of Point Blank Beverage, Inc., (PBB) where he operated as their President and CEO responsible for overseeing production, logistics, and new product development, as well as building the sales and distribution channel. At PBB he is credited with launching one of the industry first energy beverages in 2004. Prior to PBB, Mr. Gorney has held sales positions with consumer and beverage companies as a regional sales manager/southwestern sales responsible for opening both large format retailers as well as convenience store distribution.

21

Mr. Gorrney left the Company subsequent to the filing of the original 8-K (filed on April 25, 2013).

Bob Gilbert, Vice President of Sales & Marketing (May 1, 2013 - Present)

Mr Gilbert joined the Company on May 1, 2013 as our Vice President of Sales and Marketing responsible for driving top line revenues, channel strategy and product marketing. Mr. Gilbert brings executive sales leadership developed over a successful 28 year career in consumer packaged goods and products from both multi-national and emerging brands. His strong customer relationships in major trade and channel classes from retailers to brokers and distributors will help accelerate NuZee time to market.

Prior to joining NuZee, Mr. Gilbert served as the Vice President of Sales for Premier Nutrition (6/2005-12/2012), a successful brand that specialized in Protein Bars, Shakes and Powders in Carlsbad, CA. During his six years at Premier led the company growth by dramatically increasing product availability in all classes of trade and number of outlets.

Earlier in his career, he served as Vice President of Next Proteins, Inc (12/2002-5/2005), Vice President of Sales-Alternate Channels for Campbell Soup Company (1996-10/2002), where he oversaw the sales of Campbell Soup Company products to the Club, Mass, Drug, and Dollar Store Channels nationally, a business representing over $270 million in sales annually. Prior to Campbell Soup Company, he held a number of positions with Coca Cola Foods Company (1984-1996).

Family Relationships

There are no family relationships among our directors or officers

Involvement in Certain Legal Proceedings.

To our knowledge, during the past ten years, no present director or executive officer of our company: (1) filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent, or similar officer appointed by a court for the business or present of such a person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer within two years before the time of such filing; (2) was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting the following activities: (i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliated person, director of any investment company, or engaging in or continuing any conduct or practice in connection with such activity; (ii) engaging in any type of business practice; (iii) engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodity laws; (4) was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described above under this Item, or to be associated with persons engaged in any such activity; (5) was found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission to have violated any federal or state securities law and the judgment was not subsequently reversed, suspended or vacated; (6) was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated.

22

Limitation of Liability of Directors

Pursuant to Nevada Law, our Articles of Incorporation exclude personal liability for our Directors for monetary damages based upon any violation of their fiduciary duties as Directors, except as to liability for any breach of the duty of loyalty, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, or any transaction from which a Director receives an improper personal benefit. This exclusion of liability does not limit any right which a Director may have to be indemnified and does not affect any Director's liability under federal or applicable state securities laws. We have agreed to indemnify our directors against expenses, judgments, and amounts paid in settlement in connection with any claim against a Director if he acted in good faith and in a manner he believed to be in our best interests.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid by us for the last three fiscal years. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any. The compensation discussed addresses all compensation awarded to, earned by, or paid or named executive officers.

|

|

|

|

|

|

|

Non- |

Nonqualified |

|

|

|

|

|

|

|

|

|

Equity |

Deferred |

All |

|

|

Name |

|

|

|

|

|

Incentive |

Compensa- |

Other |

|

|

and |

|

|

|

Stock |

Option |

Plan |

tion |

Compen- |

|

|

Principal |

|

Salary |

Bonus |

Awards |

Awards |

Compensation |

Earnings |

sation |

Total |

|

Position |

Year |

(US$) |

(US$) |

(US$) |

(US$) |

(US$) |

(US$) |

(US$) |

(US$) |

|

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

(g) |

(h) |

(i) |

(j) |

|

|

|

|

|

|

|

|

|

|

|

|

Craig Hagopian (1) |

2012 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

2011 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 | |

|

|

2010 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Satoru Yukie (2) |

2012 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

2011 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

2010 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Haisam Hamie (3) |

2012 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

2011 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

2010 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

(1) Craig Hagopian was appointed as our President and Chief Executive Officer on April 19, 2013.

23

(2) Satoru Yukie was appointed as our Chief Financial Officer, Treasurer, Secretary, Chief Operations Officer on April 19, 2013.

(3) Haisam Hammie resigned as the Company's sole officer on the closing of the Share Exchange Agreement on April 19, 2013.

The compensation discussed herein addresses all compensation awarded to, earned by, or paid to our named executive officers.

Narrative Disclosure to the Summary Compensation Table

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. Our directors and executive officers may receive stock options at the discretion of our board of directors in the future. We do not have any material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of our board of directors from time to time. We have no plans or arrangements in respect of remuneration received or that may be received by our executive officers to compensate such officers in the event of termination of employment (as a result of resignation, retirement, change of control) or a change of responsibilities following a change of control.

Outstanding Equity Awards At Fiscal Year-End

No named executive officer or director received any equity awards, or holds exercisable or unexercisable options, as of the years ended September 30, 2012 and 2011.

Executive Employment Agreements as a Result of the Share Exchange

Mr. Hagopian and Mr. Yukie entered into Executive Employment Agreements with the Company on the date of the Share Exchange to be effective on May 1, 2013. The terms of the agreements are:

Craig Hagopian: Mr. Hagopian will be employed at will. For services as President and Chief Executive Officer, Mr. Hagopian will receive a salary of $150,000 per year plus health insurance reimbursement. Mr. Hagopian may also be eligible to receive quarterly bonuses up to $25,000 based on milestones to be agreed upon by both the Company and Mr. Hagopian. Upon approval by the Board of an Equity and Incentive Plan (which is not in existence at present), Mr. Hagopian will be given an option to purchase no less than 4.5% of the Company's stock ("Option"), based on the fully-diluted capitalization of the Company as of the date Mr. Hagopian entered into the Employment Agreement. Mr. Hagopian's Options shall vest as follows: 25% upon execution of Executive Employment Agreement, and the balance in equal installments on the last day of each month for eighteen months thereafter, subject to Mr. Hagopian's ongoing employment with the Company. A copy of Mr. Hagopian's Executive Employment Agreement is included with this filing as Exhibit 10.1.

Satoru Yukie: Mr. Yukie will be employed at will. For services as Chief Financial Officer, Chief Financial Officer, Treasurer, Secretary, and Chief Operations Officer. Mr. Yukie will receive a salary of $150,000 per year plus health insurance reimbursement. Mr. Yukie may also be eligible to receive quarterly bonuses up to $25,000 based on milestones to be agreed upon by both the Company and Mr. Yukie. Upon approval by the Board of an Equity and Incentive Plan (which is not in existence at present), Mr. Yukie will be given an option to purchase no less than 4% of the Company's stock ("Option"), based on the fully-diluted capitalization of the Company as of the date Mr. Yukie entered into the Employment Agreement. Mr. Yukie's Options shall vest as follows: 25% upon execution of Executive Employment Agreement, and the balance in equal installments on the last day of each month for eighteen months thereafter, subject to Mr. Yukie's ongoing employment with the Company. A copy of Mr. Yukie's Executive Employment Agreement is included with this filing as Exhibit 10.2.

24

COMPENSATION OF DIRECTORS

No director received or accrued any compensation for his or her services as a director since our inception. We have no formal plan for compensating our directors for their services in their capacity as directors. Our directors are entitled to reimbursement for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of our board of directors. Our board of directors may award special remuneration to any director undertaking any special services on our behalf other than services ordinarily required of a director.

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

AND DIRECTOR INDEPENDENCE

THE COMPANY

As of January 31, 2013, the Company received advances from its sole officer and director in the amount of $22,015 to pay for general operating expenses. The amounts due to the related party are unsecured and non-interest bearing with no set terms of repayment. As a result of the Share Exchange Agreement with the Company described above under Item 1.01 of this Report, the amounts owed to the Director were forgiven.

NUZEE

During the period from November 9, 2011 (inception) through September 30, 2012, NuZee purchased $10,454 of skin care products, for resale, from iSpring, which is a separate entity controlled by NuZee’s majority shareholder and Director, Mr. Masa Higashida. We operate with iSpring on a commercial level using purchase orders for our products. We use verbal instructions and standard payment procedures for most orders of 50% payment upon order and 50% payment upon receipt based on CIF shipping. Those items are included in inventory at September 30, 2012.

NuZee has received advances, from its majority shareholder and Director, Masa Higashida, totaling, $150,014, due on demand, which are included with other liabilities on the Balance Sheet for the period ending September 30, 2012. There are no other loan terms, and no formal contract or agreement.