Exhibit 99.2

| Supplemental Financial Data Second Quarter 2020 |

| DISCLAIMER 2 This presentation contains statements that constitute "forward-looking statements," as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. These statements are based on management's current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements; Ready Capital Corporation (the "Company") can give no assurance that its expectations will be attained. Factors that could cause actual results to differ materially from the Company's expectations include those set forth in the Risk Factors section of the most recent Annual Report on Form 10-K filed with the SEC and other reports filed by the Company with the SEC, copies of which are available on the SEC's website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law. This presentation includes certain non-GAAP financial measures, including Core Earnings. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures in accordance with GAAP. Please refer to Appendix A for the most recent GAAP information. This presentation also contains market statistics and industry data which are subject to uncertainty and are not necessarily reflective of market conditions. These have been derived from third party sources and have not been independently verified by the Company or its affiliates. All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. All data is as of June 30, 2020 unless otherwise noted. |

| 3 COMPANY UPDATE .. Government sponsored lending segments remain active with SBA, Residential Mortgage Banking and Freddie Mac Multifamily originations fully operational .. Core CRE lending activities to resume in Q3 after Q2 pause due to uncertain capital markets and stressed underwriting conditions .. Acquisition efforts focused on identifying accretive investments post COVID-19 BUSINESS ACTIVITIES .. Cash of over $250 million .. Recourse mark-to-market liabilities reduced 26% to $1.25 billion including a 30% reduction in short-term repurchase obligations and a 25% reduction in warehouse lines supporting loans, held-for-investment .. Completed two securitizations which reduced recourse liabilities by over $430 million and generated approximately $60 million in cash LIQUIDITY .. Current $4.5 billion portfolio of over 4,500 loans remains stable: .. Weighted average LTV of ~ 60% .. 93% current through July 31, 2020 .. Low exposure to hospitality and retail .. 8% of loans in the CRE portfolio and 7% of loans in the residential portfolio are in forbearance; 87% of CRE loans in forbearance are paying current BOOK VALUE PRESERVATION PAYCHECK PROTECTION PROGRAM .. Facilitated the funding of ~ $2.7 billion of PPP loans consisting of over 40,000 applications with an average loan size of $66k .. Total earnings, net of initial operating expenses of $41.3 million .. $23.1 million, net, recognized in Q2 with remaining amount recognized in future periods |

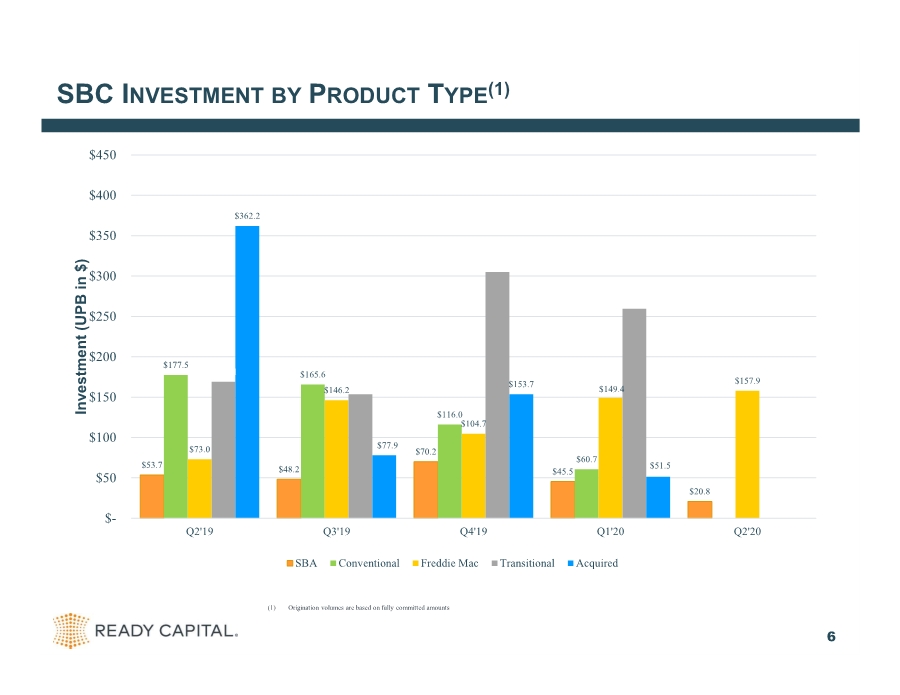

| SECOND QUARTER 2020 RESULTS 4 .. Net income of $34.7 million(1), or $0.62 per common share .. Core earnings of $39.2 million(1), or $0.70 per common share .. Declared dividend of $0.25 per share EARNINGS / DIVIDENDS .. Return on Equity(2) of 17.4% .. Core Return on Equity(3) of 19.7% .. Dividend Yield(4) of 11.5% RETURNS .. Freddie Mac loan originations of $157.9 million .. SBA loan originations of $20.8 million; PPP loan originations of ~ $2.7 billion .. Residential mortgage loan originations of $1.2 billion LOAN ORIGINATIONS(5) / ACQUISITIONS .. Adjusted net book value(6) of $14.46 per common share .. Reduced recourse leverage ratio from 2.8x at 3/31/20 to 2.1x at 6/30/20 .. 0.5x of leverage supporting government sponsored activity which remains elevated BALANCE SHEET (1) Inclusive of non-controlling interest (2) Return on Equity is an annualized percentage equal to quarterly net income over the average monthly total stockholders’ equity for the period (3) Core Return on Equity is an annualized percentage equal to core earnings over the average monthly total stockholders’ equity for the period. Refer to the “Core Earnings Reconciliation” slide for a reconciliation of GAAP Net Income to Core Earnings (4) Q2 Dividend yield for the period based on the 6/30/2020 closing share price of $8.69 (5) Represents fully committed amounts (6) Excludes the equity component of our 2017 convertible note issuance |

| RETURN ON EQUITY 5 1) Levered yield includes interest income, accretion of discount, MSR creation, income from unconsolidated joint ventures, realized gains (losses) on loans held for sale, unrealized gains (losses) on loans held for sale and servicing income net of interest expense and amortization of deferred financing costs on an annualized basis. 2) GAAP ROE is based on GAAP Net Income, while Core ROE is based on Core Earnings, which adjusts GAAP Net Income for certain items detailed on the “Core Earnings Reconciliation” slide. 3) ROE based on net income before tax of the Residential Mortgage Banking business line divided by the business line’s average monthly equity. Segment Loan Acquisitions 14.6 % 14.6 % 22.9 % SBC Originations 16.7 % 16.7 % 65.4 % SBA Originations, Acquisitions, & Servicing 39.7% 39.7% 5.6% Residential Mortgage Banking (3) 67.8 % 154.3 % 6.1 % (1.5) (1.8) (0.8) (0.3) 19.2% 8.7% 25.2% 16.8% (0.1) (5.8) (0.2) (5.7) 0.3 (19.3) (2.2) (2.1) 11.6 - 11.6 - (0.1) (1.0) - - (9.2) (9.2) (8.7) (7.4) (3.1) (1.2) (3.1) (1.2) (1.2) 2.9 (2.9) 0.2 17.4% -24.9% 19.7% 0.6% GAAP ROE (2) Core ROE (2) Levered Yield (1) Core Levered Yield (1) Equity Allocation Q2'20 Q1'20 Q2'20 Q1'20 20.7% 10.5% 26.0% 17.1% Corporate leverage, net of non-earning assets Return on equity Gross return on equity Realized & unrealized gains, net Non-recurring gains, losses and expenses Investment advisory fees Provision for income taxes Loan loss provision PPP revenue, net of direct expenses Operating expenses |

| SBC INVESTMENT BY PRODUCT TYPE(1) 6 (1) Origination volumes are based on fully committed amounts $53.7 $48.2 $70.2 $45.5 $20.8 $177.5 $165.6 $116.0 $60.7 $0.0 $73.0 $146.2 $104.7 $149.4 $157.9 $169.1 $153.5 $305.0 $259.6 $- $362.2 $77.9 $153.7 $51.5 $0.0 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Investment (UPB in $) SBA Conventional Freddie Mac Transitional Acquired |

| SBC ORIGINATIONS -SEGMENT SNAPSHOT 7 1) Represents fully committed amounts. 2) $ in millions, as of quarter end. 3) Represents fixed rate loans that have been securitized. 4) Includes interest income, accretion of discount, and servicing income net of interest expense and amortization of deferred financing costs. 5) Includes realized and unrealized gains (losses) on loans held for sale and MSR creation. • Freddie Mac loan originations of $157.9 million(1) • 93% of portfolio is current as of 6/30/20, only 2% > 60 days past due • Current quarter money up pipeline of $125.9 million, including July 2020 fundings of $31.2 million 9.6% 9.4% 10.1% 10.5% 12.8% 1.7% 2.8% 1.9% 2.0% 3.9% 0.0% 5.0% 10.0% 15.0% 20.0% Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Gross Levered Yield (ex. Gains) Gains on Loans, held for sale GROSS LEVERED YIELD CURRENT QUARTER HIGHLIGHTS (4) (5) Portfolio Metrics (Balance Sheet) Number of loans 485 501 537 593 568 Unpaid Principal Balance (3) $ 1,829 $ 2,064 $ 2,298 $ 2,581 $ 2,479 Carrying Value (3) $ 1,835 $ 2,070 $ 2,300 $ 2,580 $ 2,478 Weighted Average LTV 63% 65% 61% 64% 64% Weighted Average Coupon 6.1% 5.8% 6.2% 5.4% 5.5% Weighted Average Maturity 5 years 5 years 5 years 5 years 4 years Weighted Average Principal Balance (3) $ 3.7 $ 4.1 $ 4.3 $ 4.4 $ 4.4 Percentage of loans fixed / floating 55% / 45% 55% / 45% 53% / 47% 58% / 42% 48% / 52% Percentage of fixed, match funded (4) 69.4% 68.3% 84.9% 80.9% 80.9% Percentage of loans 30+ days delinquent 2.7% 1.4% 1.9% 2.6% 7.0% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 |

| SBA ORIGINATIONS, ACQUISITIONS, & SERVICING -SEGMENT SNAPSHOT 8 1) Represents fully committed amounts. 2) $ in millions, as of quarter end. 3) Includes interest income, accretion of discount, and servicing income net of interest expense and amortization of deferred financing costs. 4) Includes realized and unrealized gains (losses) on loans held for sale and MSR creation. 5) Reflects an increase in balances as a result of the Q4 2019 securitization and effects of the guaranteed loan financing gross up. • $18.6 million of SBA secondary market loans sales, with an average sale premium of 9.9% • SBA loan originations of $20.8 million(1) • PPP loan originations of ~ $2.7 billion • Origination pipeline of $183.2 million SBA loans, including $8.7 million of July 2020 fundings 22.1% 22.2% 27.6% 25.1% 26.9% 17.8% 16.7% 23.0% 18.6% 12.8% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Gross Levered Yield (ex. Gains) Gains on Loans, held for sale CURRENT QUARTER HIGHLIGHTS GROSS LEVERED YIELD (3) (4) Portfolio Metrics (Balance Sheet) Number of loans 1,902 1,875 1,880 1,813 1,804 Unpaid Principal Balance (2) $ 270 $ 278 $ 804 $ 701 $ 678 Carrying Value (2) $ 230 $ 240 $ 770 $ 664 $ 641 Weighted Average LTV 87% 88% 83% 84% 83% Weighted Average Coupon 7.4% 7.4% 6.9% 6.7% 5.2% Weighted Average Maturity 16 years 16 years 15 years 17 years 17 years Weighted Average Principal Balance (2) $ 0.1 $ 0.1 $ 0.4 $ 0.4 $ 0.4 Percentage of loans fixed / floating 1.0% / 99.0% 0.9% / 99.1% 3.3% / 96.7% 0.3% / 99.7% 0.3% / 99.7% Percentage of loans 30+ days delinquent 6.5% 6.0% 3.1% 5.3% 2.2% Q2 2019 Q3 2019 Q4 2019(5) Q1 2020(5) Q2 2020(5) |

| LOAN ACQUISITIONS -SEGMENT SNAPSHOT 9 1) Excludes joint venture investments. 2) $ in millions, as of quarter end. 3) Represents fixed rate loans that have been securitized. • 97% of portfolio is current as of 6/30/20 • Acquisition pipeline of $230.1 million SBC loans 11.3% 12.5% 12.1% 7.3% 13.7% 3.2% 1.6% 0.5% 0.0% 0.9% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Income on joint venture investments Gross Levered Yield (ex. Gains) CURRENT QUARTER HIGHLIGHTS GROSS LEVERED YIELD Portfolio Metrics(1) (Balance Sheet) Number of loans 2,385 2,363 2,231 2,212 2,126 Unpaid Principal Balance (2) $ 1,075 $ 1,068 $ 1,048 $ 1,073 $ 1,010 Carrying Value (2) $ 1,055 $ 1,056 $ 1,039 $ 1,066 $ 1,002 Weighted Average LTV 46% 42% 43% 40% 38% Weighted Average Coupon 6.3% 6.3% 6.1% 6.1% 6.0% Weighted Average Maturity 10 years 10 years 9 years 9 years 9 years Weighted Average Principal Balance (2) $ 0.5 $ 0.5 $ 0.5 $ 0.5 $ 0.5 Percentage of loans fixed / floating 48% / 52% 47% / 53% 45% / 55% 49% / 51% 49% / 51% Percentage of fixed, match funded (3) 61.0% 44.6% 52.3% 43.3% 74.5% Percentage of loans accrual / non-accrual 98% / 2% 98% / 2% 98% / 2% 98% / 2% 97% / 3% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 |

| RESIDENTIAL MORTGAGE BANKING –SEGMENT SNAPSHOT 10 1) $ in millions. Represents activity during the quarter. 2) Represents fully committed amounts • MSR portfolio of approximately $8.7 billion in UPB, up 5% compared to Q1 • Fair market value of $73.6 million • Originations of $1.2 billion(2) • Loan sales of $1.2 billion • Origination pipeline of $581.5 million • Q2 retention rate of 42% $7.8 $8.0 $8.2 $8.3 $8.7 $7.5 $7.8 $8.0 $8.3 $8.5 $8.8 $9.0 MSR PORTFOLIO (UPB IN $ BILLIONS)CURRENT QUARTER HIGHLIGHTS Fair Q2' 19 Q3' 19 Q4' 19 Q1' 20 Q2' 20 Value ($ mm) $ 85.7 $ 84.6 $ 91.2 $ 78.6 $ 73.6 Portfolio Metrics (quarterly activity) Unpaid principal balance (1) $ 518.2 $ 656.8 $ 586.3 $ 691.3 $ 1,192.9 % of Originations - Purchased 74.0% 60.5% 54.7% 51.2% 37.4% % of Originations - Refinanced 26.0% 39.5% 45.3% 48.8% 62.6% Channel - % Correspondent 36.4% 33.6% 37.9% 34.4% 32.6% Channel - % Retail 45.7% 50.9% 46.8% 50.3% 49.9% Channel - % Wholesale 17.9% 15.5% 15.3% 15.3% 17.5% Unpaid principal balance (1) $ 492.1 $ 631.9 $ 601.6 $ 643.9 $ 1,150.6 % of UPB - Fannie/ Freddie securitizations 69.7% 69.7% 66.6% 72.4% 78.8% % of UPB - Ginnie Mae securitizations 22.4% 25.1% 26.8% 17.3% 20.2% % of UPB - Other investors 7.9% 5.2% 6.6% 10.3% 1.0% Q1 2020 Q2 2020 Originations Sales Q2 2019 Q3 2019 Q4 2019 |

| DIVERSIFIED, COMPLEMENTARY, AND SCALABLE PLATFORMS (1) Assets include loans, MBS, servicing assets, JV investments, real estate owned, and purchased future receivables. (2) Based on QTD Core Earnings. Core earnings includes interest income, accretion of discount, MSR creation, income from unconsolidated joint ventures, realized gains (losses) on loans held for sale, unrealized gains (losses) on loans held for sale and servicing income net of interest expense and amortization of deferred financing costs on an annualized basis. (3) 11 PORTFOLIO BREAKDOWN(1) REVENUE BREAKDOWN(2) Acquisitions 24% SBC Originations - Fixed rate 25% SBC Originations - Bridge 27% SBC Originations - Freddie Mac 1% SBA Originations, Acquisitions, & Servicing 16% Residential Mortgage Banking 7% Acquisitions, $2,686 SBC Originations - Fixed rate, $(1,646) SBC Originations - Bridge, $12,152 SBC Originations - Freddie Mac, $3,768 SBA Originations, Acquisitions, & Servicing, $24,459 Residential Mortgage Banking, $18,471 $(5,000) $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 |

| LOAN PORTFOLIO COMPOSITION AS OF JUNE 30, 2020(1)(2) Geographic Location Lien Position (1) As a percent of unpaid principal balance (2) Excludes loans held-for-sale, at fair value (3) Collateral Type SBA Collateral Type 12 California 18% Texas 15% Florida 8% New York 9% Illinois 5% Other 45% First Mortgage 98.9% Subordinated Mortgage 0.8% Other 0.3% Multi-family 26% Retail 17% SBA 18% Office 12% Mixed Use 12% Other 15% Lodging 16% Offices of Physicians 13% Child Day Care Services 7% Eating Places 5% Veterinarians 3% Other 56% |

| 13 Total ending Q2 2020 allowance reserves of $57.1 million representing 1.4% of loan balances Net recovery of $0.9 million across our loan portfolios during the quarter: Acquired loans: Incremental net reserves of $2.0 million, consisting of certain specific impairment reserves due to collateral reductions or presence of junior lien positions SBA loans: Incremental net reserves on SBA loans due to higher probability of defaults in certain industries more severely impacted by COVID-19, due to closures or impaired in the ability to operate Originated Fixed Rate loans: Reduction in general reserves due to stabilized assumptions, no new loan originations during the period and a lower weighted average maturity of portfolio Originated Transitional loans: Reduction in general reserves due to stabilized assumptions, no new loan originations during the period, a lower weighted average maturity of portfolio, and lower LTVs within the portfolio (In Thousands) Originated SBC loans Originated Transitional loans Acquired loans Acquired SBA 7(a) loans Originated SBA 7(a) loans Originated Residential Agency loans Total held-for- investment loans Balance as of 3/31/2020 10,362 24,264 10,646 5,622 7,074 - 57,968 Provision for loan losses (1,388) (4,433) 1,960 190 2,580 500 (591) Charge-offs - - (42) (97) (204) - (343) Recoveries - - 29 - - 29 Ending balance - 6/30/2020 8,974 19,831 12,564 5,744 9,450 500 57,063 Loan balance - 6/30/2020 1,177,642 1,268,862 999,266 270,950 366,731 4,295 4,087,746 % of Loan balance - 6/30/2020 0.8% 1.6% 1.3% 2.1% 2.6% 11.6% 1.4% CURRENT EXPECTED CREDIT LOSSES |

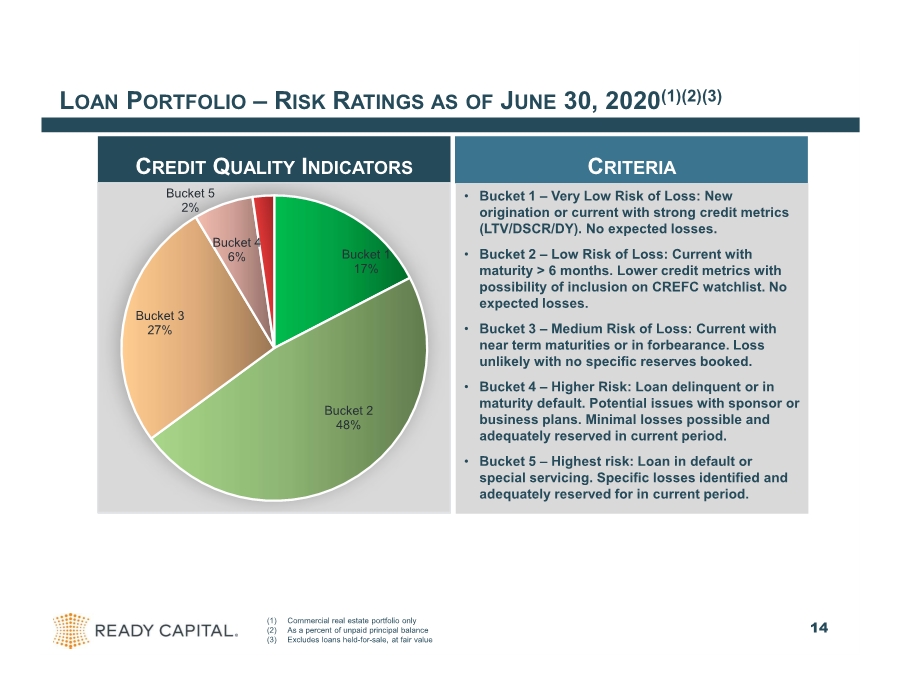

| LOAN PORTFOLIO –RISK RATINGS AS OF JUNE 30, 2020(1)(2)(3) CREDIT QUALITY INDICATORS (1) Commercial real estate portfolio only (2) As a percent of unpaid principal balance (3) Excludes loans held-for-sale, at fair value 14 Bucket 1 17% Bucket 2 48% Bucket 3 27% Bucket 4 6% Bucket 5 2% CRITERIA • Bucket 1 – Very Low Risk of Loss: New origination or current with strong credit metrics (LTV/DSCR/DY). No expected losses. • Bucket 2 – Low Risk of Loss: Current with maturity > 6 months. Lower credit metrics with possibility of inclusion on CREFC watchlist. No expected losses. • Bucket 3 – Medium Risk of Loss: Current with near term maturities or in forbearance. Loss unlikely with no specific reserves booked. • Bucket 4 – Higher Risk: Loan delinquent or in maturity default. Potential issues with sponsor or business plans. Minimal losses possible and adequately reserved in current period. • Bucket 5 – Highest risk: Loan in default or special servicing. Specific losses identified and adequately reserved for in current period. |

| CAPITAL STRUCTURE ► Approximate unencumbered cash of over $250 million ► Completed $405 million securitization of originated transitional loans in June 2020, with senior bonds pricing at LIBOR + 215 basis points ► Completed $204 million securitization of acquired SBC loans in June 2020, with senior bonds pricing at a fixed rate of 3.4% ► Successfully extended two warehouse lines at nominal increases in cost and decreases in advance rates 15 Total Debt + Equity LIQUIDITY UPDATE HISTORICAL CAPITAL STRUCTURE Total Debt + Equity ($M) Funding Mix $3,642 $3,915 $4,290 $4,608 $4,648 Convertible Notes $ 115.0 7.0% 7.0% Senior Secured Notes $ 180.0 7.5% 7.0% Baby Bonds $ 149.5 6.3% 6.2% Total $ 444.5 7.0% 6.7% Principal Balance Coupon YTM Corporate Financing (in $M) 21% 19% 20% 17% 17% 3% 3% 3% 2% 2% 6% 7% 8% 7% 7% 27% 34% 28% 37% 27% 43% 37% 42% 37% 46% Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Stockholders Equity Convertible senior notes Senior secured notes and Corporate debt Credit facilities and repurchase agreements Securitized debt obligations |

| FINANCING AND LEVERAGE 16 1.8x 2.3x 1.9x 2.8x 2.1x 3.9x 4.3x 4.1x 4.9x 4.7x - 1.0 2.0 3.0 4.0 5.0 6.0 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Historical Leverage Recourse Total HISTORICAL LEVERAGE Total Debt-to-Equity Ratio Secured borrowings (warehouse credit facilities and borrowings under repo transactions) $ 1,254 Securitized debt obligations 2,140 Senior secured notes and corporate bonds 330 Convertible notes 112 Total Debt $ 3,836 Total Stockholders' Equity $ 813 Total debt-to-equity ratio 4.7 Total recourse debt-to-equity ratio Total Debt $ 3,836 Less: Securitized debt obligations (2,140) Total recourse debt $ 1,696 Total Stockholders' Equity $ 813 Total recourse debt-to-equity ratio 2.1 6/30/2020 (in millions) |

| CREDIT AND REPURCHASE FACILITIES 17 (1) $ in thousands (2) Commitment size is €200.0 million, but has been converted for purposes of this disclosure. Lender Asset Class Maturity Pricing JPMorgan Acquired loans, SBA loans Jun-2021 1M L + 2.00 to 2.75% $ 250,000 $ 34,525 $ 215,475 Keybank Freddie Mac loans Feb-2021 1M L + 1.30% 100,000 15,071 84,929 East West Bank SBA loans Oct-2020 Prime - 0.821 to + 0.29% 50,000 33,887 16,113 Credit Suisse(2) Acquired loans (non USD) Dec-2021 Euribor + 2.50% 224,680 37,709 186,971 GMFS facilities Residential loans Sept-2020 - Mar-2021 Various 360,000 254,143 105,857 GMFS - MSR Residential MSRs Sep-2023 1M L + 2.50% 50,000 37,700 12,300 Other - various Various Jan-2021 - Jun-2021 Various 164,500 126,698 37,802 $ 1,199,180 $ 539,733 $ 659,447 Citibank Fixed rate, Transitional, Acquired loans Oct-2020 1M L + 1.875 to 2.125% $ 500,000 $ 132,257 $ 367,743 Deutsche Bank Fixed rate, Transitional loans Nov-2021 3M L + 2.00 to 2.40% 350,000 165,604 184,396 JPMorgan Transitional loans Dec-2020 1M L + 2.25 to 4.00% 400,000 182,293 217,707 Related Party Originated SBC, Originated transitional, Acquired loans Sep-2020 1ML +12.0% 35,000 35,000 - Various MBS Aug-2020 - Jan-2021 Various 199,008 199,008 - $ 1,484,008 $ 714,162 $ 769,846 Total Secured Borrowings $ 2,683,188 $ 1,253,895 $ 1,429,293 Borrowings under repurchase agreements Total Borrowings under repurchase agreements Total Borrowings under credit facilities Borrowings under credit facilities Available Capacity (1) Facility Size (1) Carrying Value(1) |

| READY CAPITAL SNAPSHOT ($ amounts in thousands, except per share data) 18 (5) Excludes the equity component of our 2017 convertible note issuance 1) Average carrying value includes average quarterly carrying value of loan and servicing asset balances 2) Gross yields include interest income, accretion of discount, MSR creation, income from our unconsolidated joint venture, realized gains (losses) on loans held for sale, unrealized gains (losses) on loans held for sale and servicing income net of interest expense and amortization of deferred financing costs on an annualized basis. 3) The Company finances the assets included in the Investment Type through securitizations, repurchase agreements, warehouse facilities and bank credit facilities. Interest expense is calculated based on interest expense and deferred financing amortization for the quarter ended 6/30/2020 on an annualized basis. 4) Excludes loans, held for sale, at fair value 5) Excludes the equity component of our 2017 convertible note issuance. SBA servicing rights - UPB $ 576,416 SBA servicing rights- carrying value $ 17,317 Freddie Mac servicing rights - UPB $ 1,399,652 Freddie Mac servicing rights - carrying value $ 16,799 Residential servicing rights - UPB $ 8,705,285 Residential servicing rights - carrying value $ 73,645 Servicing Portfolio Metrics Average Carrying Value(1) Debt Cost (3) Levered Yield Loan Acquisitions 1,043,171 $ 5.8% 834,287 $ 3.6% 14.6% SBC Originations 2,624,099 $ 6.6% 2,028,672 $ 3.7% 16.7% SBA Originations, Acquisitions, & Servicing 295,304 $ 10.3% 244,273 $ 4.2% 39.7% Total 3,962,574 $ 6.7% 3,107,232 $ 3.7% 17.6% Investment Type Gross Yield(2) Average Debt Balance Common Stockholders' equity $ 794,596 Common Stockholders' equity (adjusted)(5) $ 793,341 Total Common Shares outstanding 54,872,789 Net Book Value per Common Share $ 14.48 Adjusted Net Book Value per Common Share $ 14.46 Book Equity Value Metrics Net income (loss) | Core earnings $ 34,663 | $ 39,223 Earnings per share - Basic and diluted $ 0.62 Core Earnings per Common Share $ 0.70 Return on Equity per Common Share 17.4% Core Return on Equity per Common Share 19.7% Dividend Yield 11.5% Q2 2020 Earnings Data Metrics % Fixed vs Floating Rate 42.6% / 57.4% % Originated vs Acquired 69.8% / 30.2% Weighted Average LTV - SBC 64% Weighted Average LTV - SBA 83% Weighted Average LTV - Acquired 38% Loan Portfolio Metrics (4) |

| APPENDIX 19 |

| BALANCE SHEET BY QUARTER 20 (In Thousands) Assets Cash and cash equivalents $ 41,925 $ 52,727 $ 67,928 $ 122,265 $ 257,017 Restricted cash 38,019 45,303 51,728 93,164 91,539 Loans, net 1,002,676 1,380,359 1,727,984 1,969,052 1,432,807 Loans, held for sale, at fair value 177,507 203,110 188,077 306,328 297,669 Mortgage backed securities, at fair value 99,407 96,181 92,466 78,540 75,411 Loans eligible for repurchase from Ginnie Mae 69,101 71,528 77,953 77,605 186,197 Investment in unconsolidated joint venture 47,551 55,663 58,850 53,379 53,939 Purchased future receivables, net — — 43,265 49,150 27,190 Derivative instruments 3,670 4,181 2,814 17,756 19,037 Servicing rights 114,761 114,480 121,969 110,111 107,761 Real estate acquired in settlement of loans 65,834 60,807 58,573 48,292 47,009 Other assets 71,162 77,553 106,925 114,891 103,701 Assets of consolidated VIEs 2,108,710 1,961,127 2,378,486 2,229,517 2,761,655 Total Assets $ 3,840,323 $ 4,123,019 $ 4,977,018 $ 5,270,050 $ 5,460,932 Liabilities Secured borrowings 988,868 1,315,534 1,189,392 1,698,937 1,253,895 Securitized debt obligations of consolidated VIEs, net 1,567,113 1,465,539 1,815,154 1,692,074 2,140,009 Convertible notes, net 110,506 110,773 111,040 111,310 111,581 Senior secured notes and Corporate notes, net 227,881 283,630 329,275 329,461 329,868 Guaranteed loan financing 28,445 25,571 485,461 457,032 436,532 Liabilities for loans eligible for repurchase from Ginnie Mae 69,101 71,528 77,953 77,605 186,197 Derivative instruments 9,032 11,906 5,250 16,585 9,106 Dividends payable 18,292 18,292 21,302 21,747 14,524 Accounts payable and other accrued liabilities 73,679 81,235 97,407 89,740 166,174 Total Liabilities $ 3,092,917 $ 3,384,008 $ 4,132,234 $ 4,494,491 $ 4,647,886 Stockholders’ Equity Common stock 4 4 5 5 5 Additional paid-in capital 720,812 720,823 822,837 837,064 854,222 Retained earnings 14,914 9,173 8,746 (69,605) (49,755) Accumulated other comprehensive loss (7,703) (10,253) (6,176) (9,536) (9,876) Total Ready Capital Corporation equity 728,027 719,747 825,412 757,928 794,596 Non-controlling interests 19,379 19,264 19,372 17,631 18,450 Total Stockholders’ Equity $ 747,406 $ 739,011 $ 844,784 $ 775,559 $ 813,046 Total Liabilities and Stockholders’ Equity $ 3,840,323 $ 4,123,019 $ 4,977,018 $ 5,270,050 $ 5,460,932 Adjusted Book Value per Share $ 16.35 $ 16.16 $ 16.12 $ 14.52 $ 14.46 6/30/2020 6/30/2019 9/30/2019 12/31/2019 3/31/2020 |

| STATEMENT OF INCOME BY QUARTER 21 (1) Certain balances have been reclassified to match current period presentation (In thousands, except share data) Interest income $ 57,034 $ 59,723 $ 64,406 $ 69,551 $ 63,211 Interest expense (35,753) (39,390) (40,962) (46,930) (43,408) Net interest income before provision for loan losses $ 21,281 $ 20,333 $ 23,444 $ 22,621 $ 19,803 Provision for loan losses (1,348) (693) (1,125) (39,804) 591 Net interest income after provision for loan losses $ 19,933 $ 19,640 $ 22,319 $ (17,183) $ 20,394 Non-interest income Residential mortgage banking activities $ 21,021 $ 29,013 $ 18,918 $ 36,669 $ 80,564 Net realized gain on financial instruments 6,255 7,377 8,044 7,172 7,438 Net unrealized gain (loss) on financial instruments (7,006) (7,881) 3,009 (33,434) (13,744) Servicing income, net of amortization and impairment 7,811 7,449 8,653 8,097 8,982 Income on purchased future receivables, net — — 2,362 3,483 5,586 Income on unconsolidated joint venture 2,083 1,047 29 (3,537) 507 Other income 2,792 2,979 4,407 4,073 31,594 Total non-interest income $ 32,956 $ 39,984 $ 45,422 $ 22,523 $ 120,927 Non-interest expense Employee compensation and benefits (12,509) (13,438) (13,842) (18,936) (27,288) Allocated employee compensation and benefits from related party (1,250) (1,500) (1,870) (1,250) (1,250) Variable expenses on residential mortgage banking activities (13,501) (17,318) (11,765) (20,129) (36,446) Professional fees (1,586) (2,030) (1,989) (2,556) (1,919) Management fees – related party (2,495) (2,495) (2,591) (2,561) (2,666) Incentive fees – related party — — (106) — (3,506) Loan servicing expense (4,571) (4,866) (4,891) (5,570) (10,327) Merger related expenses (603) (51) (1,629) (47) (11) Other operating expenses (8,085) (8,144) (10,070) (13,744) (17,745) Total non-interest expense $ (44,600) $ (49,842) $ (48,753) $ (64,793) $ (101,158) Income before provision for income taxes $ 8,289 $ 9,782 $ 18,988 $ (59,453) $ 40,163 Provision for income (taxes) benefit 2,956 2,645 1,948 7,937 (5,500) Net income $ 11,245 $ 12,427 $ 20,936 $ (51,516) $ 34,663 Less: Net income attributable to non-controlling interest 276 323 508 (1,064) 810 Net income attributable to Ready Capital Corporation $ 10,969 $ 12,104 $ 20,428 $ (50,452) $ 33,853 Earnings per common share - basic $ 0.25 $ 0.27 $ 0.43 $ (0.98) $ 0.62 Earnings per common share - diluted $ 0.25 $ 0.27 $ 0.43 $ (0.98) $ 0.62 Weighted-average shares outstanding - Basic 44,425,598 44,438,652 46,446,573 51,984,040 53,980,451 Weighted-average shares outstanding - Diluted 44,431,263 44,467,801 46,482,470 51,990,013 54,013,958 Dividends declared per share of common stock $ 0.40 $ 0.40 $ 0.40 $ 0.40 $ 0.25 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 |

| CORE EARNINGS RECONCILIATION BY QUARTER 22 We believe that providing investors with Core Earnings, a non-U.S. GAAP financial measure, in addition to the related U.S. GAAP measures, gives investors greater transparency into the information used by management in our financial and operational decision-making. However, because Core Earnings is an incomplete measure of our financial performance and involves differences from net income computed in accordance with U.S. GAAP, it should be considered along with, but not as an alternative to, our net income as a measure of our financial performance. In addition, because not all companies use identical calculations, our presentation of Core Earnings may not be comparable to other similarly-titled measures of other companies. We calculate Core Earnings as GAAP net income (loss) excluding the following: i) any unrealized gains or losses on certain MBS ii) any realized gains or losses on sales of certain MBS iii) any unrealized gains or losses on Residential MSRs iv) any unrealized gains or losses resulting from a change in CECL impairment reserves on accrual loans v) one-time non-recurring gains or losses, such as gains or losses on discontinued operations, bargain purchase gains, or merger related expenses In calculating Core Earnings, Net Income (in accordance with U.S. GAAP) is adjusted to exclude unrealized gains and losses on MBS acquired by us in the secondary market, but is not adjusted to exclude unrealized gains and losses on MBS retained by us as part of our loan origination businesses, where we transfer originated loans into an MBS securitization and retain an interest in the securitization. In calculating Core Earnings, we do not adjust Net Income (in accordance with U.S. GAAP) to take into account unrealized gains and losses on MBS retained by us as part of our loan origination businesses because we consider the unrealized gains and losses that are generated in the loan origination and securitization process to be a fundamental part of this business and an indicator of the ongoing performance and credit quality of our historical loan originations. In calculating Core Earnings, Net Income (in accordance with U.S. GAAP) is adjusted to exclude realized gains and losses on certain MBS securities considered to be non-core. Certain MBS positions are considered to be non-core due to a variety of reasons which may include collateral type, duration, and size. In addition, in calculating Core Earnings, Net Income (in accordance with GAAP) is adjusted to exclude unrealized gains or losses on Residential MSRs, held at fair value. We treat our commercial MSRs and Residential MSRs as two separate classes based on the nature of the underlying mortgages and our treatment of these assets as two separate pools for risk management purposes. Servicing rights relating to our small business commercial business are accounted for under ASC 860, Transfer and Servicing, while our residential MSRs are accounted for under the fair value option under ASC 825, Financial Instruments. In calculating Core Earnings, we do not exclude realized gains or losses on either commercial MSRs or residential MSRs, held at fair value, as servicing income is a fundamental part of our business and is an indicator of the ongoing performance. (In Thousands) Net Income $ 11,245 $ 12,427 $ 20,936 $ (51,516) $ 34,663 Reconciling items: Unrealized (gain) loss on mortgage servicing rights $ 6,339 $ 7,582 $ (2,482) $ 16,437 $ 12,044 Change in CECL reserve on accrual loans — — — 35,438 (5,076) Non-recurring REO impairment — — — 2,969 106 Merger transaction costs and other non-recurring expenses 670 51 1,938 1,255 967 Unrealized loss on mortgage-backed securities 106 85 29 230 (45) Unrealized loss on de-designated cash flow hedges — — — 2,118 — Total reconciling items $ 7,115 $ 7,718 $ (515) $ 58,447 $ 7,996 Core earnings before income taxes $ 18,360 $ 20,145 $ 20,421 $ 6,931 $ 42,659 Income tax adjustments (1,585) (1,896) 544 (5,706) (3,436) Core earnings $ 16,775 $ 18,249 $ 20,965 $ 1,225 $ 39,223 Less: Core earnings attributable to non-controlling interests $ 412 $ 474 $ 509 $ 25 $ 917 Less: Income attributable to participating shares 79 79 413 463 285 Core earnings attributable to Common Stockholders $ 16,284 $ 17,696 $ 20,043 $ 736 $ 38,021 Core earnings per share $ 0.37 $ 0.40 $ 0.43 $ 0.01 $ 0.70 Weighted average common shares outstanding 44,425,598 44,438,652 46,446,573 51,984,040 53,980,451 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 |

|