Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

|

| |

¨

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or |

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

Or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

|

| |

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 333-177693

Reynolds Group Holdings Limited

(Exact name of Registrant as specified in its charter)

|

| |

Not applicable | New Zealand |

(Translation of Registrant's name into English) | (Jurisdiction of incorporation or organization) |

Level Nine

148 Quay Street

Auckland 1010 New Zealand

(Address of principal executive offices)

|

|

c/o Reynolds Group Holdings Limited Level Nine 148 Quay Street Auckland 1010 New Zealand Attention: Joseph Doyle Tel 847 482 2409 Fax 847 615 6417 Email: enquiries@reynoldsgroupholdings.com |

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

þ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer," "accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer þ | | Emerging growth company ¨ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

| | | | |

U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board þ | | Other ¨ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes þ No

SIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this annual report on its behalf.

|

| |

| Reynolds Group Holdings Limited |

| (Registrant) |

| |

| /s/ ALLEN HUGLI |

| Allen Hugli |

| Chief Financial Officer |

| February 13, 2018 |

ANNUAL REPORT

For the fiscal year ended December 31, 2017

REYNOLDS GROUP HOLDINGS LIMITED

New Zealand

(Jurisdiction of incorporation or organization)

Reynolds Group Holdings Limited

Level Nine

148 Quay Street

Auckland 1010 New Zealand

Attention: Joseph Doyle

Tel: 847 482 2409

Fax: 847 615 6417

Email: enquiries@reynoldsgroupholdings.com

TABLE OF CONTENTS

|

| | | |

PART I | |

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | |

| ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | |

| ITEM 3. KEY INFORMATION | |

| | General Information | |

| | Presentation of Financial Information | |

| | Selected Historical Financial Data | |

| | Risk Factors | |

| ITEM 4. INFORMATION ON RGHL | |

| | Corporate Information | |

| | History and Development | |

| | Recent Developments | |

| | Business Overview | |

| | Organizational Structure | |

| | Property, Plants and Equipment | |

| ITEM 4A. UNRESOLVED STAFF COMMENTS | |

| ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | |

| | Key Factors Influencing Our Financial Condition and Results of Operations | |

| | Results of Operations | |

| | Differences Between the RGHL Group and BP I Group Results of Operations | |

| | Liquidity and Capital Resources | |

| | Quantitative and Qualitative Disclosures about Market Risk | |

| | Accounting Principles | |

| | Critical Accounting Policies | |

| | Recently Issued Accounting Pronouncements | |

| ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | |

| | Directors of RGHL and BP I and Senior Management of the RGHL Group | |

| | Directors' Compensation and Service Contracts | |

| | Directors' and Senior Management's Indemnification Agreements | |

| | Other | |

| ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | |

| | Major Shareholders and Beneficial Ownership | |

| | Related Party Transactions | |

| ITEM 8. FINANCIAL INFORMATION | |

| | Consolidated Financial Statements and Other Financial Information | |

| | Significant Changes | |

| ITEM 9. THE OFFER AND LISTING | |

| ITEM 10. ADDITIONAL INFORMATION | |

| | Constitution of RGHL | |

| | Material Contracts | |

| | Exchange Controls | |

| | Documents on Display | |

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | |

| | | |

|

| | | |

PART II | |

| ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | |

| ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | |

| ITEM 15. CONTROLS AND PROCEDURES | |

| ITEM 16. [RESERVED] | |

| ITEM 16A. AUDIT COMMITTEE FINANCIAL EXPERT | |

| ITEM 16B. CODE OF ETHICS | |

| ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | |

| ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | |

| ITEM 16F. CHANGE IN CERTIFYING ACCOUNTANT | |

| ITEM 16G. CORPORATE GOVERNANCE | |

| ITEM 16H. MINE SAFETY DISCLOSURE | |

PART III | |

| ITEM 17. FINANCIAL STATEMENTS | |

| ITEM 18. FINANCIAL STATEMENTS | |

| ITEM 19. EXHIBITS | |

| |

Introductory Note

In this annual report, references to “we,” “us,” “our” or the "RGHL Group" are to Reynolds Group Holdings Limited ("RGHL") and its consolidated subsidiaries, unless otherwise indicated.

We have prepared this annual report pursuant to (i) the requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), with respect to those of our outstanding notes covered by effective registration statements filed with the United States Securities and Exchange Commission (the “SEC”), (ii) the requirements of the indentures governing certain of our outstanding notes that are not covered by an effective registration statement filed with the SEC, and (iii) the credit agreement with our lenders governing our senior secured credit facilities (the “Credit Agreement”). Our outstanding notes include:

| |

• | Notes covered by an effective registration statement filed with the SEC, comprised of: |

| |

• | the 5.750% Senior Secured Notes due 2020; and |

| |

• | the 6.875% Senior Secured Notes due 2021; |

| |

• | Notes not covered by an effective registration statement filed with the SEC, comprised of: |

| |

• | the Floating Rate Senior Secured Notes due 2021; |

| |

• | the 5.125% Senior Secured Notes due 2023; |

| |

• | the 7.000% Senior Notes due 2024; and |

| |

• | the 6.400% Notes due 2018, the 7.950% Debentures due 2025 and the 8.375% Debentures due 2027 (collectively, the "Pactiv Notes"). |

The senior secured notes are referred to as the "Reynolds Senior Secured Notes." The senior notes are referred to as the "Reynolds Senior Notes." The Reynolds Senior Secured Notes and the Reynolds Senior Notes are collectively referred to as the "Reynolds Notes."

The indentures governing these notes, as well as our Credit Agreement, are described more fully in this annual report.

Change in Corporate Structure

During the year ended December 31, 2017, (i) Beverage Packaging Holdings (Luxembourg) II S.A. was liquidated; and (ii) Beverage Packaging Holdings (Luxembourg) I S.A. and certain of its subsidiaries that were incorporated in either the Netherlands or Luxembourg converted to companies governed by the laws of New Zealand. In connection with these conversions, among others:

| |

• | Beverage Packaging Holdings (Luxembourg) I S.A. changed its name to Beverage Packaging Holdings I Limited ("BP I"); |

| |

• | Beverage Packaging Holdings (Luxembourg) III S.à r.l. changed its name to Beverage Packaging Holdings III Limited ("BP III"); and |

| |

• | Reynolds Group Issuer (Luxembourg) S.A. changed its name to Reynolds Group Issuer (New Zealand) Limited ("NZ Issuer"). |

Non-GAAP Financial Measures

In this annual report, we utilize certain non-GAAP financial measures and ratios, including earnings before interest, tax, depreciation and amortization (“EBITDA”) and Adjusted EBITDA. Adjusted EBITDA, a measure used by our management to measure operating performance, is defined as EBITDA, adjusted to exclude certain items of a significant or unusual nature, including but not limited to acquisition costs, non-cash pension income or expense, restructuring costs, unrealized gains or losses on derivatives, gains or losses on the sale of non-strategic assets and asset impairments and write-downs and equity method profit not distributed in cash. These measures are presented because we believe that they and similar measures are widely used in the markets in which we operate as a means of evaluating a company’s operating performance and financing structure and, in certain cases, because those measures are used to determine compliance with covenants in our debt agreements and compensation of certain management. They may not be comparable to other similarly titled measures of other companies and are not measurements under International Financial Reporting Standards (“IFRS"), as issued by the International Accounting Standards Board (“IASB"), generally accepted accounting principles in the United States of America (“U.S. GAAP"), or other generally accepted accounting principles, are not measures of financial condition, liquidity or profitability and should not be considered as an alternative to profit from operations for the period or operating cash flows determined in accordance with IFRS, nor should they be considered as substitutes for the information contained in our historical financial statements prepared in accordance with IFRS included in this annual report. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow, as they do not take into account certain items such as interest and principal payments on our indebtedness, working capital needs, tax payments and capital expenditures. We believe that the inclusion of EBITDA and Adjusted EBITDA in this annual report is appropriate to provide additional information to investors about our operating performance and to provide a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. We believe that issuers of high yield debt securities present EBITDA and Adjusted EBITDA because investors, analysts and rating agencies consider these measures useful. For additional information regarding the non-GAAP financial measures used by management, refer to note 5 of the RGHL Group's audited consolidated financial statements included elsewhere in this annual report.

Forward-Looking Statements

This annual report includes forward-looking statements. Forward-looking statements include statements regarding our goals, beliefs, plans or current expectations, taking into account the information currently available to our management. Forward-looking statements are not statements of historical fact. For example, when we use words such as “believe,” “anticipate,” “expect,” “estimate," "plan," “intend,” “should,” “would,”

“could,” “may,” "might," “will” or other words that convey uncertainty of future events or outcomes, we are making forward-looking statements. We have based these forward-looking statements on our management's current view with respect to future events and financial performance and future business and economic conditions more generally. These views reflect the best judgment of our management, but involve a number of risks and uncertainties which could cause actual results to differ materially from those predicted in our forward-looking statements and from past results, performance or achievements. Although we believe that the estimates and the projections reflected in the forward-looking statements are reasonable, such estimates and projections may prove to be incorrect, and our actual results may differ from those described in our forward-looking statements as a result of the following risks, uncertainties and assumptions, among others:

| |

• | risks related to the future costs of raw materials, energy and freight; |

| |

• | risks related to economic downturns in our target markets; |

| |

• | risks related to changes in consumer lifestyle, eating habits, nutritional preferences and health-related and environmental concerns that may harm our business and financial performance; |

| |

• | risks related to complying with environmental, health and safety laws or as a result of satisfying any liability or obligation imposed under such laws; |

| |

• | risks related to the impact of a loss of any of our key manufacturing facilities; |

| |

• | risks related to our dependence on key management and other highly skilled personnel; |

| |

• | risks related to the consolidation of our customer bases, loss of a significant customer, competition and pricing pressure; |

| |

• | risks related to any potential supply of faulty or contaminated products; |

| |

• | risks related to exchange rate fluctuations; |

| |

• | risks related to dependence on the protection of our intellectual property and the development of new products; |

| |

• | risks related to our pension plans sponsored by us and others in our control group; |

| |

• | risks related to strategic transactions, including completed and future acquisitions or dispositions; |

| |

• | risks related to our hedging activities which may result in significant losses and in period-to-period earnings volatility; |

| |

• | risks related to our suppliers of raw materials and any interruption in our supply of raw materials; |

| |

• | risks related to information security, including a cyber-security breach or a failure of one or more of our information technology systems, networks, processes or service providers; |

| |

• | risks related to our substantial indebtedness and our ability to service our current and future indebtedness; |

| |

• | risks related to restrictive covenants in certain of our outstanding notes and our other indebtedness which could adversely affect our business by limiting our operating and strategic flexibility; |

| |

• | risks related to increases in interest rates which would increase the cost of servicing our variable rate debt instruments; and |

| |

• | risks related to other factors discussed or referred to in this annual report, including in "Item 3. Key Information — Risk Factors.” |

The risks described above and the risks disclosed in or referred to in this annual report are not exhaustive. Other sections of this annual report describe additional factors that could adversely affect our business, financial condition or results of operations. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above and included elsewhere in this annual report.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS.

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE.

Not applicable.

ITEM 3. KEY INFORMATION.

General Information

We are a leading global manufacturer and supplier of consumer food, beverage and foodservice packaging products. We sell our products to customers globally, including to a diversified mix of leading multinational companies, large national and regional companies and small local businesses. We primarily serve the consumer food, beverage and foodservice market segments.

We operate through five segments:

| |

• | Reynolds Consumer Products, which manufactures branded and store branded consumer products including aluminum foil, wraps, waste bags, food storage bags and disposable tableware and cookware; |

| |

• | Pactiv Foodservice, which manufactures foodservice and food packaging products; |

| |

• | Graham Packaging, which designs and manufactures blow-molded plastic containers for consumer products; |

| |

• | Evergreen, which manufactures fresh carton packaging for beverage products, primarily for the juice and milk markets; and |

| |

• | Closures, which manufactures plastic and aluminum beverage caps, closures and high speed rotary capping equipment, primarily for the carbonated soft drink, non-carbonated soft drink and bottled water markets. |

On March 13, 2015, we completed the sale of our SIG segment to Onex Corporation. We received net cash proceeds of $4,149 million, including the settlement of final closing adjustments. In November 2016, an additional amount of €150 million was paid by Onex Corporation based on the financial performance of SIG during fiscal year 2015. In June 2017, an additional amount of €10 million was paid by Onex Corporation based on the financial performance of SIG during fiscal year 2016. All eligible earn-out proceeds have now been received.

We are part of a group of private companies based in New Zealand that are wholly-owned by Mr. Graeme Hart, our strategic owner.

Presentation of Financial Information

RGHL was incorporated on May 30, 2006 under the Companies Act 1993 of New Zealand. RGHL is a holding company that operates through five segments that it acquired in a series of transactions. See "Item 4. Information on RGHL — Business Overview" for information regarding the history of each of the five segments.

The table below summarizes the selected financial information and audited consolidated financial statements that are presented herein, prepared in accordance with IFRS as issued by the IASB:

|

| | | | | |

| Year Ended December 31, |

| 2017 | 2016 | 2015 | 2014 | 2013 |

RGHL Group | Consolidated financial statements as of and for the year ended December 31, 2017 | Consolidated financial statements as of and for the year ended December 31, 2016 | Consolidated financial statements for the year ended December 31, 2015 and selected financial information as of December 31, 2015 | Selected financial information as of and for the year ended December 31, 2014 | Selected financial information as of and for the year ended December 31, 2013 |

BP I Group(1) | Consolidated financial statements as of and for the year ended December 31, 2017 | Consolidated financial statements as of and for the year ended December 31, 2016 | Consolidated financial statements as of and for the year ended December 31, 2015 | N/A | N/A |

| |

(1) | Included in this annual report pursuant to Rule 3-16 of Regulation S-X because the book value of the capital stock of BP I constitutes a substantial portion of the collateral that secures the Reynolds Notes. |

Selected Historical Financial Data

RGHL Group

The selected historical consolidated financial data of the RGHL Group as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015 have been derived from the RGHL Group's audited consolidated financial statements included elsewhere in this annual report. The selected historical consolidated financial information of the RGHL Group as of December 31, 2015, 2014 and 2013 and for the years ended December 31, 2014 and 2013 have been derived from the RGHL Group's audited consolidated financial statements, as adjusted for certain items in accordance with IFRS, which are not included in this annual report.

The following information should be read in conjunction with the RGHL Group's audited consolidated financial statements and related notes, and other financial information included elsewhere in this annual report, including “Item 5. Operating and Financial Review and Prospects” and “ — Risk Factors.”

|

| | | | | | | | | | | | | | | |

(In $ million) | | 2017 | | 2016 | | 2015 | | 2014(1) | | 2013 |

Income Statement Data | | | | | | | | | | |

Revenue | | 10,524 |

| | 10,646 |

| | 11,178 |

| | 11,666 |

| | 11,752 |

|

Gross profit | | 2,322 |

| | 2,387 |

| | 2,200 |

| | 2,016 |

| | 2,081 |

|

Profit from operating activities | | 1,222 |

| | 1,145 |

| | 1,246 |

| | 974 |

| | 946 |

|

Net financial expenses | | (701 | ) | | (873 | ) | | (1,540 | ) | | (1,449 | ) | | (1,216 | ) |

Profit (loss) from continuing operations before income tax | | 521 |

| | 272 |

| | (294 | ) | | (475 | ) | | (270 | ) |

Income tax (expense) benefit | | (81 | ) | | (105 | ) | | (60 | ) | | 70 |

| | (4 | ) |

Profit (loss) from continuing operations | | 440 |

| | 167 |

| | (354 | ) | | (405 | ) | | (274 | ) |

Profit (loss) from discontinued operations, net of income tax | | (1 | ) | | (6 | ) | | 2,672 |

| | 105 |

| | 206 |

|

Profit (loss) for the year | | 439 |

| | 161 |

| | 2,318 |

| | (300 | ) | | (68 | ) |

Balance Sheet Data | | | | | | | | | | |

Cash and cash equivalents | | 617 |

| | 932 |

| | 1,977 |

| | 1,588 |

| | 1,490 |

|

Trade and other receivables, net | | 1,136 |

| | 1,051 |

| | 1,095 |

| | 1,176 |

| | 1,508 |

|

Inventories | | 1,370 |

| | 1,245 |

| | 1,262 |

| | 1,453 |

| | 1,647 |

|

Assets held for sale | | 144 |

| | 26 |

| | 1 |

| | 2,767 |

| | 36 |

|

Property, plant and equipment | | 2,923 |

| | 3,010 |

| | 3,184 |

| | 3,412 |

| | 4,353 |

|

Intangible assets | | 9,659 |

| | 9,902 |

| | 10,192 |

| | 10,499 |

| | 12,055 |

|

Total assets | | 16,682 |

| | 16,954 |

| | 18,491 |

| | 21,750 |

| | 22,383 |

|

Trade and other payables — current | | 1,116 |

| | 1,182 |

| | 1,205 |

| | 1,396 |

| | 1,799 |

|

Liabilities directly associated with assets held for sale | | 34 |

| | 23 |

| | — |

| | 739 |

| | 38 |

|

Borrowings — current | | 470 |

| | 746 |

| | 977 |

| | 478 |

| | 471 |

|

Borrowings — non-current | | 10,919 |

| | 11,325 |

| | 12,785 |

| | 17,380 |

| | 17,466 |

|

Total liabilities | | 15,030 |

| | 15,997 |

| | 17,694 |

| | 22,875 |

| | 22,614 |

|

Net assets (liabilities) | | 1,652 |

| | 957 |

| | 797 |

| | (1,125 | ) | | (231 | ) |

Other Data | | | | | | | | | | |

Cash provided from (used in): | | | | | | | | | | |

Operating activities | | 840 |

| | 876 |

| | 654 |

| | 881 |

| | 785 |

|

Investing activities | | (359 | ) | | (157 | ) | | 3,820 |

| | (548 | ) | | (764 | ) |

Financing activities | | (785 | ) | | (1,749 | ) | | (4,156 | ) | | (96 | ) | | (101 | ) |

Capital expenditures | | 410 |

| | 324 |

| | 381 |

| | 687 |

| | 724 |

|

EBITDA from continuing operations | | 1,896 |

| | 1,852 |

| | 1,960 |

| | 1,772 |

| | 1,799 |

|

Adjusted EBITDA from continuing operations | | 2,078 |

| | 2,103 |

| | 2,019 |

| | 1,935 |

| | 2,068 |

|

Ratio of earnings to fixed charges(2) | | 1.8x |

| | 1.3x |

| | — |

| | — |

| | — |

|

| |

(1) | The assets and liabilities related to SIG as of December 31, 2014 have been presented as assets held for sale and liabilities directly associated with assets held for sale in the consolidated statement of financial position. Refer to note 7 of the RGHL Group’s audited consolidated financial statements included elsewhere in this annual report for additional information. |

| |

(2) | The ratio of earnings to fixed charges is calculated by dividing earnings from continuing operations before income taxes by fixed charges of continuing operations. For the years presented, fixed charges consisted of interest expense, amortization and the write-off of deferred financing costs and original issue discount, and management's estimate of interest within rent expense using an approximate interest factor. Due to pre-tax losses for the years ended December 31, 2015, 2014 and 2013, the ratio coverage was less than 1.0x. The RGHL Group would have needed to generate additional earnings of $299 million, $480 million and $276 million in 2015, 2014 and 2013, respectively, in order to achieve a ratio coverage of 1.0x. |

Risk Factors

Holders of our securities should carefully consider the following risk factors, in addition to the other information presented in this annual report, including the discussions set forth in "Item 4. Information on RGHL" and "Item 5. Operating and Financial Review and Prospects" and all the financial statements and related notes, in evaluating our business and an investment in the Reynolds Notes. Any of the following risks, as well as other risks and uncertainties, could harm our business and financial results and cause the value of such securities to decline, which in turn could cause you to lose all or part of your investment. The risks below are not the only ones facing our company. Additional risks not currently known to us or that we currently deem immaterial also may materially and adversely impact our business, financial condition or results of operations.

Risks Related to Our Business

Our business and financial performance may be harmed by fluctuations in raw material, energy and freight costs.

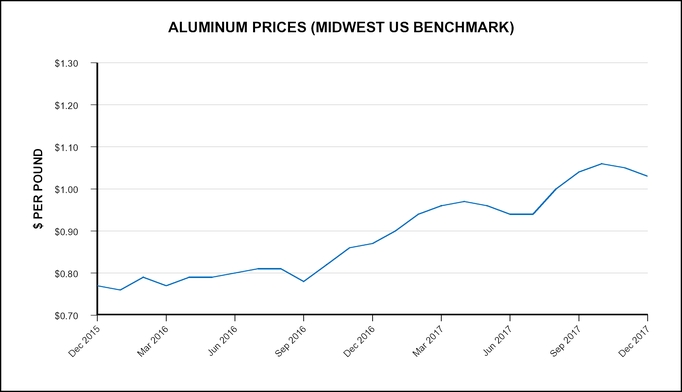

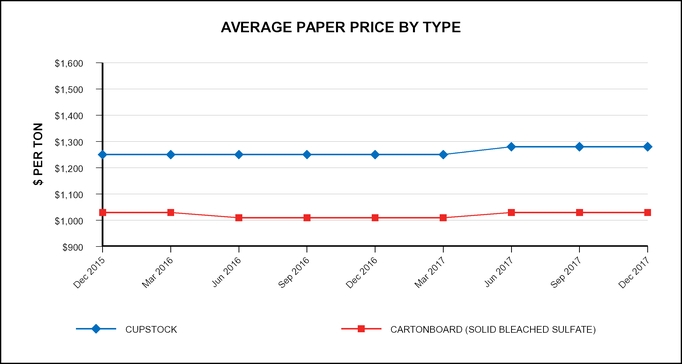

Raw material costs represent a significant portion of our cost of sales, so changes in raw material prices may impact our results of operations. The primary raw materials used to manufacture our products are plastic resins (particularly polypropylene (“PP”), polyethylene (“PE"), polystyrene ("PS") and polyethylene terephthalate ("PET")), aluminum, fiber (principally raw wood and wood chips) and paperboard (principally cartonboard and cupstock). The prices of our raw materials have fluctuated significantly in recent years. See "Item 5. Operating and Financial Review and Prospects — Key Factors Influencing our Financial Condition and Results of Operations — Raw Materials and Energy Prices."

Fluctuations in raw material costs can adversely affect our business. The fluctuations are generally due to movements in commodity market prices, which are reflected in published indices that are used in the negotiated rates with suppliers. We typically do not enter into long-term purchase contracts that provide for fixed prices for our principal raw materials. While we regularly enter into hedging agreements for some of our raw materials and energy sources, such as aluminum, resin (or components thereof), natural gas and diesel, to minimize the impact of such fluctuations, these hedging agreements do not cover all our needs, and hedging may reduce the positive impact we may otherwise receive when raw material prices decline. Although many of our customer pricing agreements include raw material cost pass-through mechanisms, which mitigate the impact of changes in raw material costs, the contractual price adjustments do not occur simultaneously with commodity price fluctuations. Additionally, some of our contracts, such as the contracts with customers for the branded products sold by Reynolds Consumer Products, generally do not contain such cost pass-through mechanisms in their customer pricing agreements. Furthermore, in the businesses that use such mechanisms, the contracts cover only a portion of the businesses' sales. Due to differences in timing between purchases of raw materials and sales to customers, there is often a lead-lag effect, during which margins are negatively impacted in periods of rising raw material costs and positively impacted in periods of falling raw material costs. We also use price increases, wherever possible, to mitigate the effect of raw material cost increases for customers that are not subject to raw material cost pass-through agreements. However, there is no assurance that increases in raw material costs may be covered by increases in pricing. As a result, we often are not able to pass on price increases to our customers on a timely basis, if at all, and consequently do not always recover the lost margin resulting from the price increases. Moreover, an increase in the selling prices for the products we produce resulting from a pass-through of increased raw material costs or freight costs could have an adverse impact on the volume of units we sell and decrease our revenue.

In addition to our dependence on primary raw materials, we are also dependent on different sources of energy for our operations, such as coal, fuel oil, electricity and natural gas. In particular, our Evergreen segment is susceptible to price fluctuations in natural gas, as it incurs significant natural gas costs to convert raw wood and wood chips to paper products and liquid packaging board. Historically, we have been able to mitigate the effect of higher energy-related costs with productivity improvements and other cost reductions. However, there is no assurance that we can sustain the level of productivity improvements and cost reduction measures in the future. In addition, if some of our large energy contracts were to be terminated for any reason or not renewed upon expiration, or if market conditions were to substantially change resulting in a significant increase in the price of coal, fuel oil, electricity and/or natural gas, we may not be able to find alternative, comparable suppliers or suppliers capable of providing coal, fuel oil, electricity and/or natural gas on terms or in amounts satisfactory to us. As a result of any of these events, our business, financial condition and operating results may suffer.

We are also dependent on third parties for the transportation of both our raw materials and the products we sell. In certain jurisdictions, we are exposed to import duties and freight costs, the latter of which is influenced by carrier availability and the fluctuating costs of oil and other transportation costs.

Our business and financial performance may be adversely affected by economic downturns in the markets that we serve.

Many of our products are packaging for products manufactured by other companies, so demand for our products is directly affected by consumer consumption of the products sold in the packages we produce. General economic conditions affect consumption in Graham Packaging's, Evergreen's and Closures' primary end-use markets, including beverage products, such as milk, other dairy products, juices, bottled water and carbonated and non-carbonated soft drinks, as well as the liquid food market and other packaged consumer products. Reynolds Consumer Products depends on the market conditions in the retail industry and consumer demand for its products which are also affected by general economic conditions. Similarly, demand for our Pactiv Foodservice products is impacted by market conditions in the foodservice industry, including restaurant demand.

Downturns or periods of economic weakness or increased prices in these consumer markets have resulted in the past, and could result in the future, in decreased demand for our products. In particular, our business has been in the past, and could be in the future, adversely affected by any economic downturn that results in difficulties for any of our major customers, including retailers. For example, uncertainty about future economic conditions globally, and in the United States and Europe in particular, could negatively impact our customers and adversely affect our results of operations. These conditions are beyond our control and may have an impact on our sales and results of operations. Macro-economic issues involving the broader financial markets, including the housing and credit systems and general liquidity issues in the securities markets, have negatively impacted the economy and may negatively affect our growth. In addition, weak economic conditions and declines in consumer spending and consumption have in the past harmed, and may in the future harm, our operating results.

Increased competition could reduce our sales and profitability and adversely affect our financial condition and results of operations.

All of our segments operate in highly competitive markets. Some of our competitors have significantly higher market shares than we do globally, or in the geographic markets in which we compete. Some of our competitors offer a more specialized variety of packaging materials and concepts and may serve more geographic regions through various distribution channels. Some of our competitors have lower costs or greater financial and other resources than we do and may be less adversely affected than we are by price declines or by increases in raw material costs or otherwise better withstand adverse economic or market conditions. The competitive issues faced by each of our segments are discussed in more detail in "Item 4. Information on RGHL — Business Overview — Competition."

Although in some of our businesses capital costs are significant and there are intellectual property and technological barriers to entry, in addition to existing suppliers, we also face the threat of competition from new entrants to our markets. To the extent there are new entrants, increasing or even maintaining our market shares or margins may be more difficult. In addition to other suppliers of similar products, our businesses also face

competition from packaging made from other substrates. The prices that we can charge for our products are therefore constrained by the availability and cost of substitutes.

The combination of these market influences has created an intensely competitive environment in which product pricing (including volume rebates, marketing allowances and other items impacting net pricing) is a key competitive factor. Our customers continuously evaluate their suppliers, often resulting in downward pricing pressure and increased pressure to continuously introduce and commercialize innovative new products, improve customer service, maintain strong relationships with our customers and, where applicable, maintain and support consumer-meaningful brands. We may lose customers in the future, which would adversely affect our business and results of operations. These competitive pressures could result in reduced sales and profitability and limit our ability to recover cost increases through price increases and, unless we are able to control our operating costs, our gross margin may be adversely affected.

We are affected by seasonality and cyclicality in certain of our businesses.

Demand for bottled beverages, and consequently the related packaging, caps and closures, may be affected by weather conditions, especially during the summer months when weather impacts cold beverage consumption. In addition, demand for our consumer products, and in some instances our packaging products, typically increases during the holiday season which leads to increased sales in the fourth quarter, and our school milk carton business is typically stronger during the North American school semesters and decreases during the holiday periods. The market for some of our products can be cyclical and sensitive to changes in general business conditions, industry capacity, consumer preferences and other factors. We have no control over these factors and they can significantly influence our financial performance.

Our business and financial performance may be harmed by changes in consumer lifestyle, eating habits, nutritional preferences and health-related and environmental concerns.

Many of our products are used by consumers in connection with food or beverage products. Any reduction in consumer demand for these product types as a result of lifestyle, environmental, nutritional or health considerations could have a significant impact on our customers and hence on our financial condition and results of operations. For example, there have been recent concerns about the environmental or health impact resulting from the manufacturing, shipping and/or disposal of resin-based products, such as plastic water bottles and polystyrene containers and packaging. Product stewardship and resource sustainability concerns, including the recycling of products and product packaging and restrictions on the use of potentially harmful materials in products, have received increased attention in recent years and are likely to play an increasing role in brand management and consumer purchasing decisions. In addition, changes in consumer lifestyle, such as the gradual decline of home cooking, may result in decreasing demand for certain of our consumer products and increasing demand for our foodservice products. Our financial position and results of operations might be adversely affected to the extent that such environmental concerns or changes in consumer lifestyle reduce demand for our products.

If we fail to maintain satisfactory relationships with our major customers, our results of operations could be adversely affected.

Many of our customers are large and possess significant market leverage, which results in significant downward pricing pressure, and often constrains our ability to pass through price increases. Reynolds Consumer Products generally sells its branded products pursuant to informal trading policies and its store branded products under one year or multi-year agreements. Pactiv Foodservice sells the majority of its products under agreements ranging from one to three years, with the balance sold pursuant to purchase orders or formal short-term supply agreements. In addition, we do not have written agreements with some of our customers and many of our agreements can be terminated on short notice. Graham Packaging's sales are made pursuant to long-term customer purchase orders and contracts which typically vary in length with terms up to ten years. The contracts are requirements contracts which generally do not obligate the customer to purchase any given amount of product from Graham Packaging. Prices under Graham Packaging's arrangements are tied to market standards and therefore vary with market conditions. Evergreen's and Closures' products are generally sold under multi-year supply agreements with many of their customers. If our major customers reduce purchasing volumes or stop purchasing our products, our business and results of operations would likely be adversely affected. It is possible that we will lose customers in the future, which may adversely affect our business and results of operations.

We could incur significant costs in complying with environmental, health and safety laws or permits or as a result of satisfying any liability or obligation imposed under such laws or permits.

Our operations are subject to various federal, state, local and foreign environmental, health and safety laws and regulations. Among other things, these laws regulate the emission or discharge of materials into the environment, govern the use, storage, treatment, disposal and management of hazardous substances and wastes, protect the health and safety of our employees and the end-users of our products, regulate the materials used in and the recycling of products and impose liability for the costs of investigating and remediating, and damages resulting from, present and past releases of hazardous substances, including releases by prior owners or operators of sites we currently own or operate. Violations of these laws and regulations or of any conditions contained in any environmental permit can result in substantial fines or penalties, injunctive relief, requirements to install pollution or other controls or equipment, civil and criminal sanctions, permit revocations and/or facility shutdowns. We could be held liable for the costs to address contamination of any real property we have ever owned, operated or used as a disposal site. We also could incur fines, penalties, sanctions or be subject to third-party claims for property damage, personal injury or nuisance or otherwise as a result of violations of or liabilities under environmental laws or in connection with releases of hazardous or other materials. In addition, changes in, or new interpretations of, existing laws, regulations or enforcement policies, the discovery of previously unknown contamination, or the imposition of other environmental liabilities or obligations in the future, including additional investigation or other obligations with respect to any potential health hazards of our products or business activities or the imposition of new permit requirements, may lead to additional compliance or other costs that could have a material adverse effect on our business, financial condition or results of operations.

Moreover, as environmental issues, such as climate change, have become more prevalent, federal, state and local governments, as well as foreign governments, have responded, and are expected to continue to respond, with increased legislation and regulation, which could negatively affect us. For example, the United States Congress has considered legislation to reduce emissions of greenhouse gases. In addition, the United States Environmental Protection Agency (“EPA”) is regulating certain greenhouse gas emissions under existing laws such as the Clean Air Act. These and other foreign, federal and state climate change initiatives may cause us to incur additional direct costs in complying with new environmental legislation or regulations, such as costs to upgrade or replace equipment, as well as increased indirect costs resulting from our suppliers, customers or both incurring additional compliance costs that could get passed through to us or impact product demand. Additionally, the EPA is continuing the

development of other new standards and programs that may be applicable to Evergreen's operations. In December 2012, the EPA finalized its rules regulating air emissions from industrial boilers and process heaters, commonly referred to as "Boiler MACT." Evergreen currently estimates capital costs to comply with the final Boiler MACT rules to be approximately $52 million; approximately $51 million of such costs will be spent in connection with the boiler at its Canton, North Carolina mill and $1 million in costs will be incurred in connection with a boiler at its Pine Bluff, Arkansas mill. As of December 31, 2017, approximately $43 million of Boiler MACT-related costs had been incurred. Evergreen expects to incur the remaining Canton costs by 2019. Evergreen does not expect either the Boiler MACT rules to have a material adverse effect on its business or the expenditures needed to achieve compliance to significantly increase the RGHL Group's capital expenditures during these periods.

In addition, a number of governmental authorities, both in the United States and abroad, have considered, and are expected to consider, legislation aimed at reducing the amount of plastic wastes disposed. Programs have included, for example, mandating certain rates of recycling and/or the use of recycled materials, imposing deposits or taxes on plastic packaging material and requiring retailers or manufacturers to take back packaging used for their products. Legislation, as well as voluntary initiatives similarly aimed at reducing the level of plastic wastes, could reduce the demand for certain plastic packaging, result in greater costs for plastic packaging manufacturers or otherwise impact our business. Some consumer products companies, including some of our customers, have responded to these governmental initiatives and to perceived environmental concerns of consumers by using containers made in whole or in part of recycled plastic. Future legislation and initiatives could adversely affect us in a manner that would be material to our results of operations.

We may not be able to achieve some or all of the benefits that we expect to achieve from our restructuring and cost savings programs.

We regularly review our businesses to identify opportunities to reduce our costs. When we identify such opportunities, we may develop a restructuring or cost savings program to attempt to capture those savings. We may not be able to realize some or all of the cost savings we expect to achieve in the future as a result of our restructuring and cost savings programs in the time frame we anticipate. A variety of factors could cause us not to realize some of the expected cost savings, including, among others, delays in the anticipated timing of activities related to our cost savings programs, lack of sustainability in cost savings over time, unexpected costs associated with operating our business, and lack of ability to eliminate duplicative back office overhead and redundant selling, general and administrative functions, obtain procurement related savings, rationalize our distribution and warehousing networks, rationalize manufacturing capacity and shift production to more economical facilities and avoid labor disruptions in connection with any integration, particularly in connection with any headcount reduction.

Our insurance may not protect us against business and operating risks.

We maintain insurance for some, but not all, of the potential risks and liabilities associated with our business. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive in relation to the risks presented. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially, and in some instances, certain insurance policies are economically unavailable or available only for reduced amounts of coverage. For example, we will not be fully insured against all risks associated with pollution and other environmental incidents or impacts. Moreover, we may not be able to maintain adequate insurance in the future at rates we consider reasonable or to obtain or renew insurance against certain risks. Any significant uninsured liability may require us to pay substantial amounts which would adversely affect our cash position and results of operations.

We may be involved in a number of legal proceedings that could result in substantial liabilities for us.

We are involved in several legal proceedings. It is difficult to predict with certainty the cost of defense or the outcome of these proceedings and their impact on our business, including remedies or damage awards. The outcomes of these legal proceedings and other contingencies could require us to take or refrain from taking certain actions, which actions or inactions could adversely affect our operations or could require us to pay substantial amounts of money or restrict our operations. If liabilities or fines resulting from these proceedings are substantial or exceed our expectations, our business, financial condition or results of operations may be adversely affected.

Loss of any of our key manufacturing facilities could have an adverse effect on our financial condition or results of operations.

While we manufacture most of our products in a number of diversified facilities, a loss of the use of all or a portion of any of our key manufacturing facilities due to an accident, labor issues, weather conditions, natural disaster or otherwise could have a material adverse effect on our financial condition or results of operations. In addition, certain of our products are produced at only one or at a small number of facilities, increasing the risks associated with a loss of use of such facilities. Examples of events that have caused plant shut-downs or disrupted production include (i) in September 2012, we ceased foil rolling operations at our Louisville, Kentucky plant (the only plant at which we perform the foil rolling phase of our foil manufacturing process) for 13 days because of a potential risk that we could have exceeded the limit under the plant's air emissions permit, (ii) storm damage and flooding from Hurricane Sandy in October 2012 at Pactiv Foodservice's Kearny, New Jersey plant, where injection molded products were manufactured, that led to the closure of that plant and the relocation of such production to other facilities, and (iii) a fire in May 2013 at Pactiv Foodservice's facility in Macon, Georgia, which manufactures molded fiber products (primarily egg cartons), that caused that plant to be closed for repairs until 2014. Other facilities have from time to time been impacted by adverse weather and other natural events, and while to date no such event has had a material adverse effect on our business, the prolonged loss of a key manufacturing facility could have such an effect.

Future government regulations and judicial decisions affecting products we produce or the products contained in or sealed with the packaging, caps or closures we produce could significantly reduce demand for our products.

Government regulations and judicial decisions that affect the products we produce or the products contained in or sealed with the packaging, caps or closures we produce could significantly reduce demand for our products. For example, several cities have banned the sale of polystyrene foam products. Other jurisdictions have imposed taxes on products bottled or packaged in our products which has affected the sales of our products. Future legislation could also limit the use of our products or impose certain taxes on the use of our products. Such legislation could significantly reduce demand for many of our products and adversely affect our sales.

Changes to health and food safety regulations could increase costs and may also have a material adverse effect on our sales if, as a result, the public's attitude towards our consumer products or the end-products for which we provide packaging, caps or closures is substantially affected.

Loss of our key management and other personnel, or an inability to attract new management and other personnel, could impact our business.

We depend on our senior executive officers and other key personnel to operate our businesses and on our in-house technical experts to develop new products and technologies and to service our customers. The loss of any of these officers or other key personnel could adversely affect our operations. Competition is intense for qualified employees among companies that rely heavily on engineering and technology, and the loss of qualified employees or an inability to attract, retain and motivate additional highly skilled employees required for the operation and expansion of our business could hinder our ability to successfully conduct research and development activities or develop and support marketable products.

Significant consolidation among our customers or the loss of a significant customer could decrease demand for our products or our profitability.

Consolidation among our customers could adversely affect our profitability. Over the last several years, there has been a trend toward consolidation among our customers in the food and beverage industry and in the retail and foodservice industries, and we expect that this trend will continue. Consolidation among our customers could increase their ability to apply price pressure, and thereby force us to reduce our selling prices or lose sales, which would impact our results of operations. Following a consolidation, our customers in the food and beverage industry may also close production facilities or switch suppliers of packaging, caps or closures which could impact sales of our filling and capping machines and other products, while our customers in the retail industry may close stores, reduce inventory or switch suppliers of consumer products.

Additionally, Reynolds Consumer Products, Pactiv Foodservice, Graham Packaging and Closures rely on a relatively small number of customers for a significant portion of their revenue. In 2017, (i) Reynolds Consumer Products' top ten customers accounted for 68% of its revenue, with one customer accounting for 39% of revenue, (ii) Pactiv Foodservice's top ten customers accounted for 53% of its revenue, with two customers, one of which was Reynolds Consumer Products, accounting for 13% and 11% of revenue, (iii) Graham Packaging's top ten customers accounted for 50% of its revenue, with one customer accounting for 10% of revenue, and (iv) Closures' top ten customers accounted for 51% of its revenue, with one customer accounting for 11% of the segment’s total revenue. The loss of any of our significant customers could have a material adverse effect on our business, financial condition and results of operations.

Supply of faulty or contaminated products could harm our reputation and business.

We have control measures and systems in place to ensure the maximum safety and quality of our products is maintained. The consequences of not being able to do so, due to accidental or malicious raw material contamination, or due to supply chain contamination caused by human error or faulty equipment, could be severe. Such consequences may include adverse effects on consumer health, reputation, loss of customers and market share, financial costs or loss of revenue. In addition, if any of our competitors or customers supply faulty or contaminated products to the market, or if manufacturers of the end-products that utilize our packaging produce faulty or contaminated products, our industry, or our end-products' industries, could be negatively impacted, which could have adverse effects on our business.

In addition, if any of our products are found to be defective, we could be required to recall such products, which could result in adverse publicity, significant expenses and a disruption in sales and could affect our reputation and that of our products. Although we maintain product liability insurance coverage, potential product liability claims may exceed the amount of insurance coverage or potential product liability claims may be excluded under the terms of the policy.

Currency exchange rate fluctuations could adversely affect our results of operations.

Our business is exposed to fluctuations in exchange rates. Although our reporting currency is U.S. dollars, we operate in multiple countries and transact in a range of currencies in addition to U.S. dollars. Where possible, we try to minimize the impact of exchange rate fluctuations by transacting in local currencies so as to create natural hedges. There can be no assurance that we will be successful in protecting against these risks. Under certain circumstances in which we are unable to naturally offset our exposure to these currency risks, we may enter into derivative transactions to reduce such exposures. Nevertheless, exchange rate fluctuations may either increase or decrease our revenue and expenses as reported in U.S. dollars. Given the volatility of exchange rates, we may not be able to manage our currency transaction risks effectively, and volatility in currency exchange rates may materially adversely affect our financial condition or results of operations.

We may not be successful in adequately protecting our intellectual property rights, including our unpatented proprietary knowledge and trade secrets, or in avoiding claims that we infringed on the intellectual property rights of others.

In addition to relying on the patent and trademark rights granted under the laws of the United States, countries in Europe and various other countries in which we operate, we rely on unpatented proprietary knowledge and trade secrets and employ various methods, including confidentiality agreements with employees and third parties, to protect our knowledge and trade secrets. However, these precautions and our patents and trademarks may not afford complete protection against infringement by third parties, and there can be no assurance that others will not independently develop the knowledge and trade secrets. Patent and trademark rights are territorial; thus, the patent and trademark protection we do have will only extend to those countries in which we have been issued patents and have registered trademarks. Even so, the laws of certain countries do not protect our intellectual property rights to the same extent as do the laws of the United States and various European countries. Further, we may not be able to prevent current and former employees, contractors and other parties from breaching confidentiality agreements and misappropriating proprietary information. It is possible that third parties may copy or otherwise obtain and use our information and proprietary technology without authorization or otherwise infringe on our intellectual property rights. Infringement of our intellectual property may adversely affect our results of operations and make it more difficult for us to establish a strong market position in countries which may not afford adequate protection of intellectual property. Additionally, we have licensed, and may license in the future, patents, trademarks, trade secrets and similar proprietary rights to third parties. While we attempt to ensure that our intellectual property and similar proprietary rights are protected when entering into business relationships, third parties may take actions that could materially and adversely affect our rights or the value of our intellectual property, similar proprietary rights or reputation. If necessary, we also rely on litigation to enforce our intellectual property rights and contractual rights, and, if not successful, we may not be able to protect the value of our intellectual property. Any litigation could be protracted and costly and could have a material adverse effect on our business and results of operations regardless of its outcome.

Our success depends in part on our ability to obtain, or license from third parties, patents, trademarks, trade secrets and similar proprietary rights without infringing on the proprietary rights of third parties. Although we believe that our intellectual property rights are sufficient to allow us to conduct our business without incurring liability to third parties, our products may infringe on the intellectual property rights of such persons and we may be subject to claims asserting infringement of intellectual property rights. No assurance can be given that we will not be subject to such additional claims seeking damages, the payment of royalties or licensing fees and/or injunctions against the sale of our products. Any such litigation could be protracted and costly and could have a material adverse effect on our business and results of operations regardless of its outcome.

If we are unable to stay abreast of changing technology in our industry, our profits may decline.

Our businesses are subject to frequent and sometimes significant changes in technology, and if we fail to anticipate or respond adequately to such changes, or do not have sufficient capital to invest in these developments, our profits may decline. Our future financial performance will depend in part upon our ability to develop and market new products and to implement and utilize technology successfully to improve our business operations. We cannot predict all the effects of future technological changes. The cost of implementing new technologies could be significant, and our ability to potentially finance these technological developments may be adversely affected by our debt servicing requirements or our inability to obtain the financing we require to develop or acquire competing technologies.

Employee slowdowns, strikes and similar actions could have a material adverse effect on our business and operations.

Approximately 26% of our employees are subject to collective bargaining agreements or are represented by work councils. The transportation and delivery of raw materials to our manufacturing facilities and of our products to our customers by workers that are members of labor unions is critical to our business. In many cases, before we take significant actions with respect to our production facilities, such as workforce reductions or closures, we must reach agreement with applicable labor unions and employee works councils. The failure to maintain satisfactory relationships with our employees and their representatives, or prolonged labor disputes, slowdowns, strikes or similar actions, could have a material adverse effect on our business and results of operations.

We face risks associated with certain pension obligations.

We have pension plans that cover many of our employees, former employees and employees of formerly affiliated businesses. Many of these pension plans are defined benefit pension plans, pursuant to which the participants receive defined payment amounts regardless of the value or investment performance of the assets held by such plans. Deterioration in the value of plan assets, including equity and debt securities, resulting from a general financial downturn or otherwise, or a change in the interest rate used to discount the projected benefit obligations, could cause an increase in the underfunded status of our defined benefit pension plans, thereby increasing our obligation to make contributions to the plans, which in turn would reduce the cash available for our business.

Our largest pension plan is the Pactiv Retirement Plan, of which Pactiv became the sponsor at the time of the Pactiv spin-off from Tenneco Inc. in 1999. This plan covers most of Pactiv's employees as well as employees (or their beneficiaries) of certain companies previously owned by Tenneco Inc. but not currently owned by us. As a result, while persons who are not current Pactiv employees do not accrue benefits under the plan, the total number of individuals/beneficiaries covered by this plan is much larger than if only Pactiv personnel were participants. For this reason, the impact of the pension plan on our net income and cash from operations is greater than the impact typically found at similarly sized companies. Changes in the following factors can have a disproportionate effect on our results of operations compared with similarly sized companies: (i) interest rate used to discount projected benefit obligations, (ii) governmental regulations related to funding of retirement plans in the United States and foreign countries, (iii) financial market performance and (iv) revisions to mortality tables as a result of changes in life expectancy. Additionally, we have merged certain other plans into the Pactiv Retirement Plan. As of December 31, 2017, Pactiv's U.S. pension plan was underfunded by approximately $764 million and subsequent adverse financial market performance and decreases in interest rates may significantly increase this deficit. Future contributions to our pension plans, including Pactiv's U.S. pension plan, could reduce the cash otherwise available to operate our business and could have an adverse effect on our results of operations.

We may pursue and execute acquisitions, which, if not successful, could adversely affect our business.

As part of our strategy, we may consider the acquisition of other companies, assets and product lines that either complement or expand our existing business. These acquisitions may be significant in size, scope or otherwise. However, we may not be able to continue to grow through acquisitions and cannot provide assurance that we will be able to consummate any acquisitions, or that any future acquisitions will be completed at acceptable prices and terms, or that the acquired businesses will be successfully integrated into our current operations. Acquisitions involve a number of specific risks, including:

| |

• | the diversion of management's attention to assimilating the acquired companies and their employees; |

| |

• | the disruption of management's focus on directing the expansion of operations; |

| |

• | the incorporation of acquired products into our product lines; |

| |

• | demands on our operational and financial systems; |

| |

• | demands on our financial resources; |

| |

• | possible adverse effects on our operating results; |

| |

• | the potential loss of customers of the acquired business; |

| |

• | the inability to retain key employees of the acquired business; and |

| |

• | failure to achieve the results we anticipate from such acquisitions. |

There are or may be liabilities associated with the businesses we have acquired or may acquire. Acquisitions have the risk that the obligations and liabilities of an acquired company may not be adequately released, indemnified or reflected in the historical financial statements of such company and the risk that such historical financial statements may contain errors. We may also become responsible for liabilities that we failed to or were unable to discover in the course of performing due diligence procedures in connection with our historical acquisitions and any future acquisitions. When possible, we require the sellers to indemnify us against certain undisclosed liabilities; however, we cannot be certain that these indemnification rights that we have obtained, or will obtain in the future, will be enforceable, collectible or sufficient in amount, scope or duration to fully offset the possible liabilities associated with the business or property acquired. Any of these liabilities, individually or in the aggregate, could have a material adverse effect on our business, financial condition or results of operations.

Our ability to successfully implement our business plan and achieve targeted financial results depends on our ability to successfully integrate businesses we have acquired in the past or may acquire in the future. Acquisitions inherently involve risks, including those associated with assimilating and integrating different business operations, corporate cultures, personnel, infrastructure and technologies or products and increasing the scope, geographic diversity and complexity of operations. There may be additional costs or liabilities associated with the acquisitions that we have consummated in recent years that we did not anticipate at the time such acquisitions were consummated, including an unexpected loss of key employees or customers and hiring additional management and other critical personnel. These acquisitions may also be disruptive to our ongoing business and may not be favorably received by our customers. Any of these risks could adversely affect our business, financial condition and results of operations.

We may sell some of our businesses from time to time.

From time to time we may sell some of our businesses. Sales involve a number of risks, including diversion of management’s attention to the sale process, costs associated with the sale process, risks associated with retained liabilities or indemnification obligations under the applicable sales agreements, loss of synergies that we enjoyed prior to the sale from having the sold business combined with our other businesses for certain costs and cost-sharing and the potential loss of benefits from having a more diverse group of businesses.

Sales also create risks relating to the use of sales proceeds. Under our Credit Agreement and bond indentures, we are generally required to either (a) reinvest the net sale proceeds in our businesses, or (b) use the net sale proceeds to reduce our indebtedness by prepaying loans under our Credit Agreement and/or repaying some of our outstanding notes. If there is a significant period of time between when the net proceeds are received and when they are used to reduce indebtedness or reinvested in a similar business, interest costs associated with holding the proceeds will exceed the earnings on such funds.

Changes in global conditions could adversely affect our business and results of operations.

Our financial results could be substantially affected by global market risks in the countries outside the United States in which we have manufacturing facilities or sell our products, primarily in Europe, Asia and South America. Our business and results of operations are materially affected by conditions in these economies. There can be no assurance that economic issues in these regions would not result in adverse effects that may be material to our cash flows, competitive position, financial condition, results of operations, or our ability to access capital. In addition, we have substantial manufacturing facilities in certain countries that are exposed to economic and political instability. Many of our raw materials, particularly plastic resins, are affected by changes in oil prices, and economic or political unrest in petroleum producing countries, such as those in the Middle East, will affect oil prices, which could affect our cost of raw materials and our results of operations. Downturns in economic activity, adverse foreign tax consequences or any changes in social, political or labor conditions in any of these countries or regions could negatively affect our results of operations.

Conditions in the global capital and credit markets and the economy in general may have a material adverse effect on our business, results of operations or financial position.

The global capital and credit markets have undergone periods of significant volatility and disruption. Our results of operations and financial position have been, and may continue to be, negatively affected by adverse changes in the global capital and credit markets and the economy in general, both in the United States and elsewhere around the world. Economic conditions may also adversely affect the ability of our lenders, customers and suppliers to continue to conduct their respective businesses and may affect our ability to operate our production facilities in an economical manner. Many of our customers rely on access to credit to fund their operations. The inability of our customers to access credit facilities may adversely affect our business by reducing our sales, increasing our exposure to accounts receivable bad debts and reducing our profitability.

Concerns about consumer confidence, the availability and cost of credit, reduced consumer spending and business investment, the volatility and strength of global capital and credit markets and inflation have affected, and may continue to affect, the business and economic environment and ultimately the profitability of our business. Economic downturns characterized by higher unemployment, lower family income, lower corporate earnings, lower business investment and lower consumer spending have resulted, and may continue to result, in decreased demand for our products. We are unable to predict the likely duration or severity of any disruption in global capital and credit markets and the economy in general, all of which are beyond our control and may have a significant impact on our business, results of operations, cash flows and financial position.

The global scope of our operations and our corporate and financing structure may expose us to potentially adverse tax consequences.

We are subject to taxation in and to the tax laws and regulations of multiple jurisdictions as a result of the global scope of our operations and our corporate and financing structure. We are also subject to intercompany pricing laws, including those relating to the flow of funds between our companies pursuant to, for example, purchase agreements, licensing agreements or other arrangements. Adverse developments in these laws or regulations, or any change in position regarding the application, administration or interpretation of these laws or regulations in any applicable jurisdiction, could have a material adverse effect on our business, financial condition and results of operations. In addition, the tax authorities in any applicable jurisdiction, including the United States, may disagree with the positions we have taken or intend to take regarding the tax treatment or characterization of any of our transactions, including the tax treatment or characterization of our indebtedness, including the Reynolds Notes, intercompany loans and guarantees. If any applicable tax authorities, including the U.S. tax authorities, were to successfully challenge the tax treatment or characterization of any of our transactions, it could result in the disallowance of deductions, the imposition of withholding taxes on

internal deemed transfers or other consequences that could have a material adverse effect on our business, financial condition and results of operations.

Our access to trade receivable financings could adversely impact our liquidity.

On March 22, 2017, the RGHL Group entered into a new $600 million receivables loan and security agreement (the "2017 Securitization Facility"). As of December 31, 2017, the RGHL Group had drawn $420 million under this facility. The amount that can be borrowed is calculated by reference to a funding base determined by the amount of eligible trade receivables of certain members of the RGHL Group. The funding base may vary, on a monthly basis, throughout the term of the 2017 Securitization Facility. To the extent the amount of eligible trade receivables decreases, we may be required to pay down existing borrowings under the 2017 Securitization Facility, which could require us to use cash on hand or revolver availability which may not be available or may be more expensive than borrowings under the 2017 Securitization Facility.

From time to time, we also may sell or factor some of our other accounts receivable. Our access to factoring programs depends on the availability of receivables insurance, and on our credit rating and the credit ratings of our customers and insurers. We may be unable to continue to utilize factoring programs or may only be able to do so on less desirable terms if either we are unable to obtain or renew receivables insurance or our credit rating or the credit ratings of our customers or insurers are negatively impacted. An inability to utilize factoring programs would slow our conversion of trade receivables to cash and increase our working capital requirements, which could require us to use revolver availability or cash on hand or to seek alternative sources of financing which may not be available or may be more expensive than our existing financing.

Our hedging activities may result in significant losses and in period-to-period earnings volatility.