UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant: x Filed by a Party other than the Registrant: o

Check the appropriate box:

o | Preliminary Proxy Statement | |||||||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| x | Definitive Proxy Statement | |||||||

o | Definitive Additional Materials | |||||||

o | Soliciting Material Pursuant to §240.14a-12 | |||||||

ATHENE HOLDING LTD.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||||||||||||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

o | Fee paid previously with preliminary materials. | |||||||||||||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

ATHENE HOLDING LTD.

Second Floor, Washington House, 16 Church Street, Hamilton HM 11, Bermuda

NOTICE OF 2021 ANNUAL GENERAL MEETING OF SHAREHOLDERS

OF ATHENE HOLDING LTD.

Hamilton, Bermuda

July 22, 2021

Dear Shareholder:

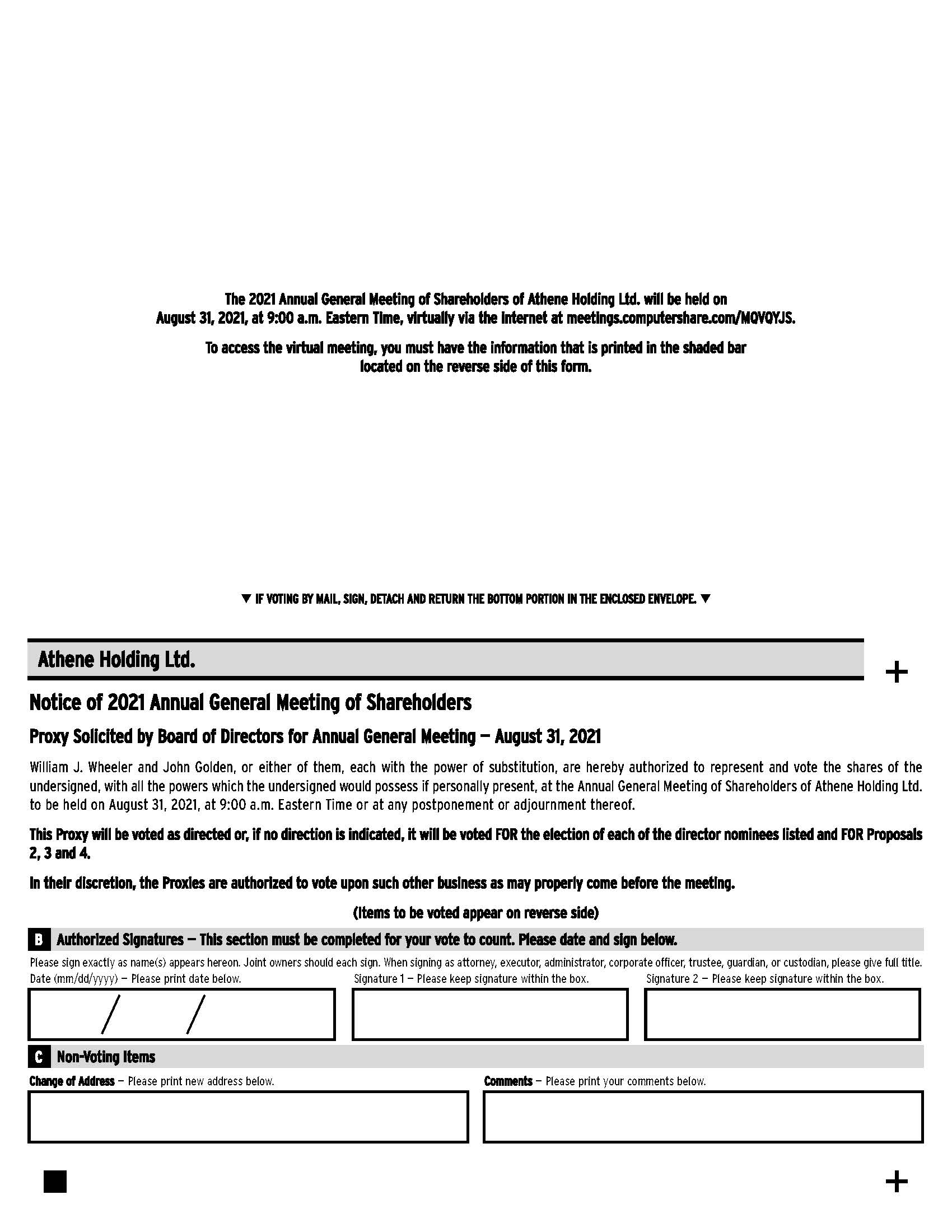

Notice is hereby given that the annual general meeting of the holders of Class A common shares (the “Shareholders”) of Athene Holding Ltd. (“AHL” and together with its consolidated subsidiaries, the “Company,” “our,” “us,” or “we”) is to be held on August 31, 2021 at 9:00 a.m. Eastern Time. In light of public health concerns regarding the coronavirus (COVID-19) pandemic, we will be hosting a completely virtual annual general meeting, which will be conducted solely online via live webcast. You will be able to attend and participate in the annual general meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: meetings.computershare.com/MQVQYJS at the meeting date and time stated above. You will need the control number included on your proxy card to access the meeting. The annual general meeting will held for the following purposes:

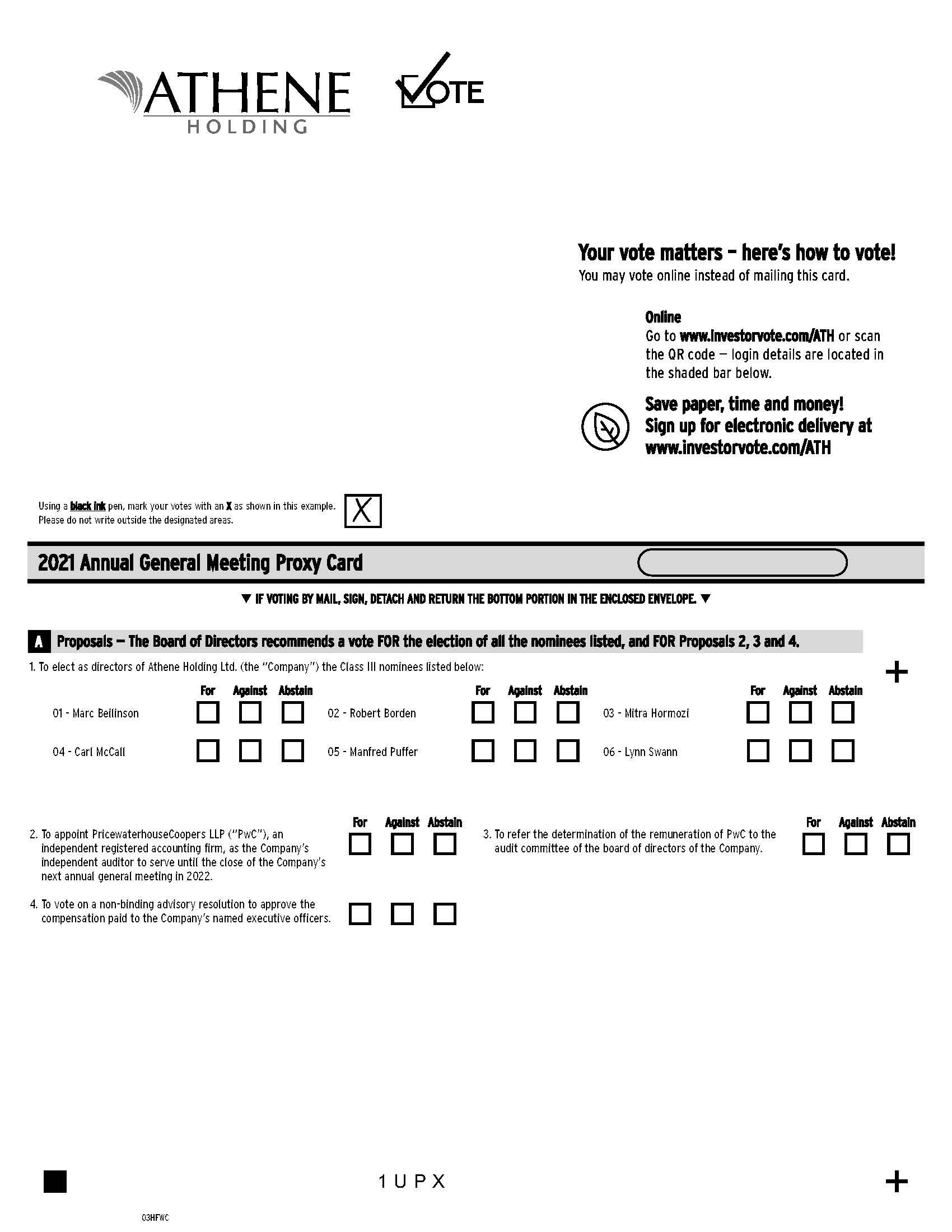

1.to elect the directors of Athene Holding Ltd. named in the accompanying proxy statement;

2.to appoint PricewaterhouseCoopers LLP (“PwC”), an independent registered accounting firm, as the Company’s independent auditor to serve until the close of the Company’s next annual general meeting in 2022;

3.to refer the determination of the remuneration of PwC to the audit committee of the board of directors of the Company; and

4.to vote on a non-binding advisory resolution to approve the compensation paid to the Company’s named executive officers (“Say on Pay”).

The board of directors recommends a vote FOR each of Items 1 through 4. The Company will also present the Company’s audited consolidated financial statements for the year ended December 31, 2020 at the annual general meeting pursuant to the Bermuda Companies Act 1981, as amended, and Bye-law 78 of the Company’s Thirteenth Amended and Restated Bye-laws (the “Bye-laws”).

On March 8, 2021, the Company and Apollo Global Management, Inc. (“AGM”) agreed to effect an all-stock merger transaction to combine their respective businesses, subject to the terms and conditions of a merger agreement. A special meeting of the Shareholders entitled to vote thereon will be held at a later date for the purpose of approving such merger agreement and the transactions contemplated thereby. Such transactions, if approved, may impact certain items voted upon at this annual general meeting. However, until the transactions have been completed, the Company will continue to function as an independent public company and therefore we are filing this notice and proxy statement for the annual general meeting in the ordinary course. For more information regarding the merger transaction, see “Certain Relationships and Related Transactions—Merger Agreement.”

Only Shareholders of record, as shown by the Register of Shareholders and the records of Computershare and the Company at the close of business on July 14, 2021 (the “Record Date”) are entitled to receive notice and only those Shareholders as of the Record Date are entitled to vote at the annual general meeting. THE VOTING RIGHTS OF A SHAREHOLDER’S CLASS A COMMON SHARES ARE SUBJECT TO ADJUSTMENT IN ACCORDANCE WITH THE BYE-LAWS AND AS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. THE ADJUSTMENTS MAY, IN CERTAIN CIRCUMSTANCES, RESULT IN A SHAREHOLDER’S CLASS A COMMON SHARES CARRYING NO VOTES AT THE ANNUAL GENERAL MEETING. PLEASE SEE “IMPORTANT VOTING INFORMATION” IN THE ACCOMPANYING PROXY STATEMENT FOR A DESCRIPTION OF THE VOTING RIGHTS APPLICABLE TO THE CLASS A COMMON SHARES.

The proxy statement and accompanying materials are first being made available to Shareholders on or about July 22, 2021.

Under Bermuda law, if an item set out in this Notice is no longer applicable at the time of the meeting, the Chairman of the meeting may decide not to put such resolution to a vote at the meeting.

YOU MAY COMPLETE YOUR PROXY BY INTERNET OR MAIL AS SET FORTH ON THE ENCLOSED PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. YOU MAY ALSO ATTEND THE MEETING AND VOTE VIA THE LIVE WEBCAST OF THE MEETING AVAILABLE AT MEETINGS.COMPUTERSHARE.COM/MQVQYJS. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT. YOUR SHARES WILL BE VOTED PURSUANT TO THE INSTRUCTIONS CONTAINED IN YOUR COMPLETED PROXY. IF YOU RETURN A SIGNED PROXY CARD AND NO INSTRUCTIONS ARE GIVEN, YOUR SHARES WILL BE VOTED “FOR” ITEMS 1 THROUGH 4.

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting to be Held on August 31, 2021: the proxy statement for Shareholders is also available at www.investorvote.com/ATH.

| By order of the board of directors, | ||

| /s/ Natasha Scotland Courcy | ||

| Natasha Scotland Courcy | ||

| Corporate Secretary | ||

| TABLE OF CONTENTS | PAGE | ||||

ATHENE HOLDING LTD.

PROXY STATEMENT

FOR

THE ANNUAL GENERAL MEETING OF HOLDERS OF CLASS A COMMON SHARES

TO BE HELD ON AUGUST 31, 2021

IMPORTANT INFORMATION ABOUT THE ANNUAL GENERAL MEETING

AND PROXY PROCEDURES

The accompanying proxy is solicited by the board of directors of Athene Holding Ltd. (“AHL” and together with its consolidated subsidiaries, the “Company,” “our,” “us,” or “we”) to be voted at the annual general meeting (“Annual General Meeting”) of holders of the Company’s Class A common shares (the “Shareholders” and the “Shares,” respectively) to be held on August 31, 2021 at 9:00 a.m. Eastern Time, and any adjournments thereof. In light of public health concerns regarding the coronavirus (COVID-19) pandemic, we will be hosting a completely virtual Annual General Meeting, which will be conducted solely online via live webcast. You will be able to attend and participate in the Annual General Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: meetings.computershare.com/MQVQYJS at the meeting date and time stated above. You will need the control number included on your proxy card to access the meeting. There is no physical location for the Annual General Meeting. This proxy statement and the accompanying materials are first being made available to Shareholders on or about July 22, 2021.

The Purpose of the Annual General Meeting

At the Annual General Meeting, the Shareholders will vote in person (via the live webcast) or by proxy on the following matters as set forth in the notice of the meeting:

1.to elect the directors of Athene Holding Ltd. named in this proxy statement;

2.to appoint PricewaterhouseCoopers LLP (“PwC”), an independent registered accounting firm, as the Company’s independent auditor to serve until the close of the Company’s next annual general meeting in 2022;

3.to refer the determination of the remuneration of PwC to the audit committee of the board of directors of the Company; and

4.to vote on a non-binding advisory resolution to approve the compensation paid to the Company’s named executive officers (“Say on Pay”).

The Annual General Meeting does not relate to the special meeting of Shareholders that will be held in connection with the pending merger transaction with AGM. A separate proxy statement will be delivered, and a separate special meeting of Shareholders will be held, in connection with such transaction. For more information regarding the merger transaction, see “Certain Relationships and Related Transactions—Merger Agreement.”

Presentation of Financial Statements

In accordance with the Bermuda Companies Act 1981, as amended, and Bye-law 78 of the Company’s Thirteenth Amended and Restated Bye-laws (the “Bye-laws”), the Company’s audited consolidated financial statements for the year ended December 31, 2020 prepared in accordance with accounting principles generally accepted in the United States will be presented at the Annual General Meeting and will be made available not later than five (5) business days prior to the Annual General Meeting. The board of directors of the Company has approved these financial statements. There is no requirement under Bermuda law that these financial statements be approved by Shareholders, and no such approval will be sought at the Annual General Meeting.

Shareholders Entitled to Vote at the Annual General Meeting

Shareholders of record as of the close of business on July 14, 2021 (the “Record Date”) that are eligible to vote will be entitled to vote at the Annual General Meeting. As of the Record Date, there were 191,970,001 outstanding Class A common shares. Each Class A common share entitles the holder of record thereof to vote at the Annual General Meeting, subject to

1

certain adjustments and limitations, including those set forth in the Company’s Bye-laws and as described herein under “IMPORTANT VOTING INFORMATION—Adjustments to Voting Rights of Class A Common Shares.”

Questions and Answers About the Virtual Annual General Meeting

| Q: | Why are you holding a virtual meeting instead of a physical meeting? | ||||

| A: | In light of public health and safety concerns as well as certain travel restrictions related to the COVID-19 pandemic, our Annual General Meeting will be a virtual meeting where shareholders can participate by accessing a website using the Internet. There will not be a physical meeting location. | ||||

| Q: | How can I attend the Annual General Meeting with the ability to ask a question and/or vote? | ||||

| A: | The Annual General Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual General Meeting only if, as of the close of business on the Record Date, you were a shareholder of the Company and you held your shares directly with the Company’s transfer agent, Computershare (“Registered Holder”), or you are a beneficial holder and hold your shares through an intermediary, such as a bank or broker (“Beneficial Holder”) and hold a valid proxy for the Annual General Meeting. No physical meeting will be held. As a Registered Holder, you will be able to attend the Annual General Meeting online, ask a question and vote by visiting meetings.computershare.com/MQVQYJS and following the instructions on your notice, proxy card, or on the instructions that accompanied your proxy materials. To participate in the Annual General Meeting, you will need the control number included on your notice or proxy card. If you are a Beneficial Holder and want to attend the Annual General Meeting online by webcast (with the ability to ask a question and/or vote, if you choose to do so), you must register in advance using the following instructions: | ||||

Submit proof of your proxy power (“Legal Proxy”) from your broker or bank reflecting your Athene Holding Ltd. holdings along with your name and email address to Computershare. Requests for registration as set forth above must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on August 26, 2021. You will receive a confirmation of your registration by email after we receive your registration materials. Requests for registration should be directed to us at the following: By email: Forward the email from your broker granting you a Legal Proxy, or attach an image of your Legal Proxy, to legalproxy@computershare.com By mail: Computershare Athene Legal Proxy P.O. Box 43001 Providence, RI 02940-3001 | |||||

| The online meeting will begin promptly at 9:00 a.m., Eastern Time on the August 31, 2021 meeting date. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement. | |||||

| Q: | Do I need to register to attend the Annual General Meeting virtually? | ||||

| A: | Registration is only required if you are a Beneficial Holder, as set forth above. | ||||

2

| Q: | How can I vote online at the meeting? | ||||

| A: | If you are a Registered Holder, follow the instructions on the notice, email or proxy card that you received to access the meeting. If you are a Beneficial Holder, please see the registration instructions set forth above. Online voting will be available during the meeting. | ||||

| Q: | What if I have trouble accessing the Annual General Meeting virtually? | ||||

| A: | The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance should you need it you may call 1-888-724-2416. | ||||

| Q: | Am I being asked to approve the merger agreement and transactions contemplated thereby during the Annual General Meeting? | ||||

| A: | No. A special meeting of the Shareholders entitled to vote on the merger agreement, separate from the Annual General Meeting, will be held at a later date for the purpose of approving the merger agreement and the transactions contemplated thereby. Such transactions, if approved, may impact certain items voted upon at the Annual General Meeting. However, until the transactions have been completed, the Company will continue to function as an independent public company and therefore we are filing this notice and proxy statement for the Annual General Meeting in the ordinary course. For more information regarding the merger transaction, see “Certain Relationships and Related Transactions—Merger Agreement.” | ||||

| Q: | Who pays for this proxy solicitation? | ||||

| A: | We will pay the expenses of soliciting proxies. In addition to solicitation by mail, proxies may be solicited in person or by telephone or other means by our directors or associates for no additional compensation. We will reimburse brokerage firms and other nominees, custodians and fiduciaries for costs incurred by them in mailing these proxy materials to the Beneficial Holders. In addition, we have retained Okapi Partners LLC to assist in the solicitation of proxies and otherwise in connection with the Annual General Meeting for an estimated fee of $10,000, plus reimbursement of certain reasonable expenses. | ||||

3

IMPORTANT VOTING INFORMATION

Voting Procedures; Quorum

You can ensure that your Shares are properly voted at the meeting by completing, signing, dating and returning the enclosed proxy card to Proxy Services, c/o Computershare Investor Services, P.O. Box 505008, Louisville, KY 40233-9814. Shareholders may also complete their proxy via the internet in accordance with the instructions on your proxy card.

A Shareholder has the right to appoint another person (who need not be a Shareholder) to represent the Shareholder at the Annual General Meeting by completing an alternative form of proxy which can be obtained from the Corporate Secretary or by notifying the Inspectors of Election. See “—Inspectors of Election” below. Every Shareholder entitled to vote has the right to do so either in person (via the live webcast) or by one or more persons authorized by a written proxy executed by such Shareholder and filed with the Corporate Secretary. Any proxy duly executed will continue in full force and effect unless revoked by the person executing it in writing or by the filing of a subsequent proxy. See “—Revocation of Proxies” below.

A Shareholder of record can vote their Shares at the Annual General Meeting by attending the meeting and completing a ballot or by proxy in one of two ways: (1) by dating, signing and completing the proxy card and returning it in accordance with the instructions provided on the proxy card; or (2) electronically via the internet as described in the proxy card. Proxy cards must be either returned by mail or electronically.

Each of Items 1, 2 and 3 to be voted upon at the Annual General Meeting requires the affirmative vote of a majority of the total voting power attributable to all shares of the Company cast at the Annual General Meeting, in each case provided there is a quorum (consisting of Shareholders present in person (via the live webcast) or by proxy entitled to cast a majority of the total votes attributable to all shares of the Company issued and outstanding). Shares owned by Shareholders electing to abstain from voting with respect to any proposal and “broker non-votes” will be counted towards the presence of a quorum but will not be considered votes cast with respect to matters to be voted upon at the Annual General Meeting. Therefore, assuming a quorum is achieved, abstentions and “broker non-votes” will have no effect on the outcome of the matters to be voted upon at the Annual General Meeting. A “broker non-vote” occurs when a nominee, such as a broker, holding Shares in “street name” for a beneficial owner, does not vote on a particular proposal because that nominee does not have discretionary voting power with respect to a proposal and has not received instructions from the beneficial owner. A Shareholder of Shares held in “street name” that would like to instruct their broker how to vote their Shares should follow the directions provided by their broker.

Item 4 to be voted upon at the Annual General Meeting is an advisory vote, and the result will not be binding. However, our compensation committee will consider the outcome of the vote with respect to Item 4 when evaluating the effectiveness of our compensation principles and in connection with its compensation decisions. With respect to Item 4, shares owned by Shareholders electing to abstain from voting and “broker non-votes” will be counted towards the presence of a quorum but will not be considered votes cast. Therefore, assuming a quorum is achieved, abstentions and “broker non-votes” will have no effect on the outcome of Item 4.

If you hold your Shares through a broker, bank or other financial institution, in order for your vote to be counted on any matter, you must provide specific voting instructions to your broker, bank or financial institution by following your broker, bank or financial institution’s instructions for completing and returning the proxy card to your broker, bank or financial institution or following your broker, bank or financial institution’s instructions to vote your Shares via the Internet. Voting deadlines vary by institution. Please check with your broker, bank or other financial institution for its voting cut-off date for the Annual General Meeting.

4

Revocation of Proxies

Any Shareholder giving a proxy has the power to revoke it prior to its exercise by: (1) giving notice of such revocation in writing to the Corporate Secretary of the Company at Athene Holding Ltd., Second Floor, Washington House, 16 Church Street, Hamilton HM 11, Bermuda; (2) by attending and voting in person (via the live webcast) at the Annual General Meeting; or (3) by executing a subsequent proxy, provided that any such action is taken in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the votes are taken. Sending in a signed proxy will not affect your right to attend the meeting and vote. If a Shareholder attends the meeting and votes in person (via the live webcast), any previously submitted proxy will be considered revoked. If a Shareholder holds their Shares in “street name” by a broker and has directed its broker to vote its Shares, such Shareholder should instruct its broker to change its vote or obtain a proxy to vote its Shares if such Shareholder wishes to cast its vote in person (via the live webcast) at the Annual General Meeting.

Adjustments to Voting Rights of Class A Common Shares

The Bye-laws generally provide that Shareholders are entitled to vote, on a non-cumulative basis, at all annual general and special meetings of Shareholders with respect to matters on which Class A common shares are eligible to vote. The Class A common shares collectively represent 100% of the total votes attributable to all shares of the Company issued and outstanding, and subject to certain voting restrictions and adjustments set forth in Bye-Law 4.3 (described below), each Class A common share is entitled to one vote.

Bye-law 4.3 sets out certain adjustments to the voting power of the Class A common shares, pursuant to which a Shareholder’s Class A common shares may carry no votes or be entitled to more or less than one vote per share. The adjustments apply automatically and depend on the identity and characteristics of the holder of the shares as of the Record Date; for example, Class A common shares that carry no votes at the 2021 Annual General Meeting may be entitled to vote at a later meeting of Shareholders as a result of a change in facts. The adjustments are applicable only until any date that is identified as the “Restriction Termination Date” for purposes of the Bye-laws by at least 75% of the board of directors. As of the date hereof, no such “Restriction Termination Date” has been identified. Further, the adjustments do not apply if the number and relationships of the Company’s shareholders would make it impossible to fully reallocate all the vote that would be reduced pursuant to the voting adjustments.

The specific Class A common share voting adjustments are as follows:

•In the event that any Tentative 9.9% Shareholder exists, then (A) the votes of the Controlled Shares of each such Tentative 9.9% Shareholder will be reduced pro rata to the extent necessary such that the aggregate votes of such Controlled Shares constitute no more than 9.9% of the total votes attributable to all shares of the Company issued and outstanding; and (B) the votes of all Restricted Common Shares will be reduced to zero.

•The votes of all Class A common shares whose votes were not reduced pursuant to the adjustments above will be increased pro rata based on their then current voting power, in an aggregate amount equal to the aggregate reduction in votes of Class A common shares pursuant to the adjustments above; provided, that the increase will be limited as to any Class A common share to the extent necessary to avoid (A) causing any person other than a Permitted 9.9% Shareholder to be a 9.9% Shareholder or (B) creating a RPII Control Group.

The following definitions apply for purposes of these adjustments:

•“9.9% Shareholder” means a person whose Controlled Shares constitute more than nine and nine-tenths percent (9.9%) of the total votes attributable to all shares of the Company issued and outstanding.

•“Apollo Group” means, (i) Apollo Global Management, Inc. (“AGM”), (ii) AAA Guarantor - Athene, L.P., (iii) any investment fund or other collective investment vehicle whose general partner or managing member is owned, directly or indirectly, by AGM or by one or more of AGM’s subsidiaries, (iv) BRH Holdings GP, Ltd. and its shareholders, (v) any executive officer or employee of AGM or its subsidiaries, (vi) any Shareholder that has granted to AGM or any of its affiliates a valid proxy with respect to all of such Shareholder’s Class A common shares pursuant to Bye-law 34 and (vii) any affiliate of a person described in clauses (i), (ii), (iii), (iv), (v) or (vi) above; provided, that none of the Company or its subsidiaries will be deemed to be a member of the Apollo Group.

•“Controlled Shares” means, in reference to any person, all Class A common shares owned by such person or any of its affiliates beneficially within the meaning of Section 13(d)(3) of the Exchange Act and the rules and regulations promulgated thereunder.

•“Permitted 9.9% Shareholder” means a person that has received consent of at least 75% of the board of directors to be a 9.9% Shareholder. As of the Record Date, only members of the Apollo Group have been designated as Permitted 9.9% Shareholders.

5

•“Restricted Common Shares” means a Class A common share that is treated (for purposes of Section 954(d)(3) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), as applicable for purposes of Section 953(c) of the Code) as owned (in whole or in part) by any person (other than a member of the Apollo Group (without regard to clause (v) of the definition of “Apollo Group”)) who is treated (for purposes of Section 954(d)(3) of the Code, as applicable for purposes of Section 953(c) of the Code) as owning any stock of AGM.

•“RPII Control Group” means any RPII Shareholder, or any person or persons who control (within the meaning of Section 954(d)(3) of the Code, as applicable for purposes of Section 953(c) of the Code) a RPII Shareholder, who would be treated (for purposes of Section 954(d)(3) of the Code, as applicable for purposes of Section 953(c) of the Code) as owning more than 49.9% of the total voting power of all classes of stock entitled to vote of the Company or any Subsidiary of the Company but not more than 50% of the total value of the stock of the Company or such Subsidiary, respectively, but for the application of these voting adjustments.

•“RPII Shareholder” means a U.S. Person who owns (within the meaning of Section 958(a) of the Code) any stock of the Company.

•“Tentative 9.9% Shareholder” means a person that, but for these adjustments to the voting rights of Class A common shares, would be a 9.9% Shareholder; provided, that in no event will a Permitted 9.9% Shareholder be a Tentative 9.9% Shareholder.

•“U.S. Person” means a “United States person”, as such term is defined in Section 957(c) of the Code.

Based on our searches of public filings and other inquiries, as of the Record Date, the Company does not believe any Tentative 9.9% Shareholder exists and therefore voting adjustments shall not apply to the voting rights of the holders of the Class A common shares at the Annual General Meeting.

In general, the Bye-laws provide that the board of directors may determine that certain shares shall have different voting rights or carry no voting rights as it determines appropriate to avoid the existence of any 9.9% Shareholder other than any Permitted 9.9% Shareholder or, upon the request of a Shareholder, to avoid adverse tax, legal or regulatory consequences for such Shareholder or any of its affiliates or direct or indirect owners. In addition, the board of directors has the authority under the Bye-laws to request information from any Shareholder for the purpose of determining whether any person’s voting rights are to be adjusted pursuant to the Bye-laws, and a Shareholder is required to provide such information as promptly as reasonably practicable. IF A SHAREHOLDER FAILS TO REASONABLY RESPOND TO SUCH A REQUEST, OR SUBMITS INCOMPLETE OR INACCURATE INFORMATION IN RESPONSE TO SUCH A REQUEST, THE COMPANY MAY, IN ITS SOLE AND ABSOLUTE DISCRETION, DETERMINE THAT THE SHAREHOLDER’S CLASS A COMMON SHARES WILL CARRY NO VOTING RIGHTS OR REDUCED VOTING RIGHTS.

Restrictions on Holding Class A Common Shares

The Bye-laws also contain certain restrictions on holders of Class A common shares. Bye-law 5.1 provides that:

•No Shareholder (or, to its actual knowledge, any direct or indirect beneficial owner thereof) who is a “United States shareholder” of the Company (within the meaning of Section 953(c) of the Code), nor any “related person” (within the meaning of Section 953(c) of the Code) to such Shareholder (or such owner), shall at any time knowingly permit itself to be a Related Insured Entity. For these purposes, a “Related Insured Entity” is any person who is (directly or indirectly) insured or reinsured by any of the Company’s subsidiaries as specified in Schedule 1 hereto or by any ceding company as specified in Schedule 2 hereto to which the Company’s subsidiaries provide reinsurance (as such Schedules may be amended by the board of directors from time to time and published on the Company’s website).

•No Shareholder who is a U.S. Person shall knowingly permit itself (or, to its actual knowledge, any direct or indirect beneficial owner thereof) to own (directly, indirectly or constructively pursuant to Section 958 of the Code) shares of the Company possessing 50% or more of the total voting power or total value of the Company’s stock.

6

•No Shareholder (or, to its actual knowledge, any direct or indirect beneficial owner thereof) nor any “related person” (within the meaning of Section 953(c) of the Code) to such Shareholder (or such owner) (in all cases, excluding any member of the Apollo Group) may (i) acquire any interests (for this purpose, including any instrument or arrangement that is treated as an equity interest for U.S. federal income tax purposes) in AGM or (ii) make any investment, or enter into a transaction, that, to the actual knowledge of such Shareholder at the time such Shareholder, owner or related person becomes bound to make the investment or enter into the transaction, would cause such Shareholder, owner or related person, or any other U.S. Person, to own (directly, indirectly or constructively pursuant to Section 958 of the Code) shares of the Company possessing 50% or more of the total voting power or total value of the Company’s stock.

Inspectors of Election

Computershare Trust Company, N.A., P.O. Box 505000, Louisville, KY 40233-5000, United States of America, has been appointed as Inspectors of Election for the Annual General Meeting. Representatives of Computershare will be available during the Annual General Meeting to facilitate the voting of ballots and determine the results of the vote.

Availability of Proxy Materials

Proxy materials for the Annual General Meeting, including the Notice of 2021 Annual General Meeting and this proxy statement are available online for viewing and downloading at: www.investorvote.com/ATH.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Principal Shareholders

The following table sets forth information as of June 30, 2021 regarding the beneficial ownership of our Class A common shares by (1) each person or group who is known by us to own beneficially more than 5% of our outstanding Class A common shares (including any securities convertible or exchangeable within 60 days into Class A common shares), (2) each of our named executive officers (“NEOs”), (3) each of our directors and (4) all of our current executive officers and directors as a group.

Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”). These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. In addition, the voting power of our shareholders may be restricted or adjusted as described in “IMPORTANT VOTING INFORMATION” above. Additionally, in some cases, certain Class A common shares may be deemed non-voting. See “IMPORTANT VOTING INFORMATION—Adjustments to Voting Rights of Class A Common Shares.”

To our knowledge, each person named in the table below has sole voting and investment power with respect to all of the Class A common shares shown as beneficially owned by such person, except as otherwise set forth in the notes to the table and pursuant to applicable community property laws. Unless otherwise indicated in the table or footnotes below, the address for each officer and director listed in the table is c/o Athene Holding Ltd., Second Floor, Washington House, 16 Church Street, Hamilton HM 11, Bermuda.

8

| Amount and Nature of Beneficial Ownership | ||||||||||||||

| Class A Common Shares Beneficially Owned | ||||||||||||||

| Number of Shares | Percent(1) | |||||||||||||

Apollo Holders(3) | 62,792,393 | (2) | 31.6 | % | ||||||||||

| Wellington Management Group LLP | 14,980,016 | (4) | 7.8 | % | ||||||||||

| The Vanguard Group | 10,804,002 | (5) | 5.6 | % | ||||||||||

| Executive Officers and Directors | ||||||||||||||

| James R. Belardi | 5,510,831 | (6) | 2.8 | % | ||||||||||

| William J. Wheeler | 3,051,297 | (7) | 1.6 | % | ||||||||||

| Grant Kvalheim | 1,968,160 | (8) | 1.0 | % | ||||||||||

| Martin P. Klein | 358,839 | (9) | * | |||||||||||

| John L. Golden | 126,823 | (10) | * | |||||||||||

| John M. Rhodes | 141,702 | (11) | * | |||||||||||

| Marc Rowan | 1,681,075 | (12) | * | |||||||||||

| Marc Beilinson | 82,102 | (13) | * | |||||||||||

| Gernot Lohr | — | (14) | * | |||||||||||

| Matthew R. Michelini | 63,267 | (15) | * | |||||||||||

| Robert Borden | 47,103 | (16) | * | |||||||||||

| Hope Taitz | 72,047 | (17) | * | |||||||||||

| Lawrence J. Ruisi | 52,914 | (18) | * | |||||||||||

| Dr. Manfred Puffer | 23,373 | (19) | * | |||||||||||

| H. Carl McCall | 18,035 | (20) | * | |||||||||||

| Brian Leach | 28,360 | (21) | * | |||||||||||

| Arthur Wrubel | 28,390 | (22) | * | |||||||||||

| Fehmi Zeko | 9,787 | (23) | * | |||||||||||

| Mitra Hormozi | 7,645 | (24) | * | |||||||||||

| Scott Kleinman | 257,258 | (25) | * | |||||||||||

| Lynn Swann | 1,223 | (26) | * | |||||||||||

| All directors and executive officers as a group (22 persons) | 13,536,780 | (27) | 6.8 | % | ||||||||||

* Represents less than 1%

(1)The percentage of beneficial ownership of our Class A common shares is based on 191,930,002 Class A common shares outstanding as of June 30, 2021.

(2)Consists of shares held of record by the following members of the Apollo Group (as defined herein) (the “Apollo Holders”): 80,096 Class A common shares held of record by Apollo Palmetto Advisors, L.P.; 220,000 Class A common shares held of record by Apollo Principal Holdings V, L.P.; 24,749,728 Class A common shares held of record by Apollo Principal Holdings VIII, L.P.; 1,569,625 Class A common shares held of record by AAA Holdings, L.P.; one Class A common share held of record by Apollo Insurance Solutions Group LP; 2,614 Class A common shares that have been granted to employees of Apollo Insurance Solutions Group LP and are held of record by Apollo Management Holdings, L.P. as custodian; all Class A common shares beneficially owned by Mr. Belardi and Mr. Wheeler, pursuant to a voting agreement among Apollo Management Holdings, L.P., Mr. Belardi, and Mr. Wheeler, to which Mr. Belardi and Mr. Wheeler irrevocably appointed Apollo Management Holdings, L.P. as its proxy to vote all such shares at any meeting of the Company’s shareholders; 2,882,191 Class A common shares held of record by APH I Holdings - Wednesday Sub (Cayman), LLC; 126,144 Class A common shares held of record by APH II Holdings - Wednesday Sub (Cayman), LLC; 440,296 Class A common shares held of record by APH III Holdings - Wednesday Sub (Cayman), LLC; 498,872 Class A common shares held of record by APH IV Holdings - Wednesday Sub (Cayman), LLC; 70,584 Class A common shares held of record by APH V Holdings - Wednesday Sub (Cayman), LLC; 375,365 Class A common shares held of record by APH VI Holdings - Wednesday Sub (Cayman), LLC; 182,050 Class A common shares held of record by APH VII Holdings - Wednesday Sub (Cayman), LLC; 1,262,505 Class A common shares held of record by APH VIII Holdings - Wednesday Sub (Cayman), LLC; 202,951 Class A common shares held of record by APH IX Holdings - Wednesday Sub (Cayman), LLC; 36,457 Class A common shares held of record by APH X Holdings - Wednesday Sub (Cayman), LLC; 1,309,203 Class A common shares held of record by APH XI Holdings - Wednesday Sub (Cayman), LLC; 283,829 Class A common shares held of record by APH XII Holdings - Wednesday Sub (Cayman), LLC; and 20,288,737 Class A common shares held of record by AMH Holdings - Wednesday Sub (Cayman), LLC.

The Apollo Holders are investment funds and management entities affiliated with Apollo Global Management, Inc., a New York Stock Exchange listed company.

9

The number of shares reported as beneficially owned by the Apollo Holders do not include shares held by the founders, employees and consultants of Apollo Global Management, Inc. As of June 30, 2021, the Apollo Holders and these Apollo related parties held in the aggregate approximately 35% of the outstanding Class A common shares issued on a fully diluted basis. The number of shares reported as beneficially owned by the Apollo Holders also do not include the number of shares Apollo Management Holdings, L.P. may acquire upon the exercise of a right under a Shareholders Agreement among certain Apollo Holders and the Company to purchase up to that number of Class A common shares that would increase by five percentage points the percentage of the issued and outstanding Class A common shares beneficially owned by the Apollo Holders and other persons associated with Apollo Global Management, Inc., calculated on a fully diluted basis.

(3)The address of each of Apollo Principal Holdings V, L.P., Apollo Principal Holdings VIII, L.P., APH I Holdings - Wednesday Sub (Cayman), LLC; APH II Holdings - Wednesday Sub (Cayman), LLC; APH III Holdings - Wednesday Sub (Cayman), LLC; APH IV Holdings - Wednesday Sub (Cayman), LLC; APH V Holdings - Wednesday Sub (Cayman), LLC; APH VI Holdings - Wednesday Sub (Cayman), LLC; APH VII Holdings - Wednesday Sub (Cayman), LLC; APH VIII Holdings - Wednesday Sub (Cayman), LLC; APH IX Holdings - Wednesday Sub (Cayman), LLC; APH X Holdings - Wednesday Sub (Cayman), LLC; APH XI Holdings - Wednesday Sub (Cayman), LLC; APH XII Holdings - Wednesday Sub (Cayman), LLC; and AMH Holdings - Wednesday Sub (Cayman), LLC is c/o Walkers Corporate Limited, Cayman Corporate Center, 27 Hospital Road, Georgetown, KY1-9008, Grand Cayman, Cayman Islands. The address of AAA Holdings, L.P. is Trafalgar Court, Les Banques, GY1 3QL, St. Peter Port, Guernsey, Channel Islands. The address of Athene Insurance Solutions Group LP is 2121 Rosecrans Ave., Suite 5300, El Segundo, CA 90245. The address of each of Apollo Palmetto Advisors, L.P., AAA Guarantor-Athene, L.P., Apollo Management Holdings, L.P., and Apollo Global Management, Inc. is 9 West 57th Street, 43rd Floor, New York, New York 10019.

(4)The number of shares listed for Wellington Management Group LLP is based on the Schedule 13G filed by Wellington Management Group LLP on February 3, 2021. The address of Wellington Management Group LLP is c/o Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210.

(5)The number of shares listed for The Vanguard Group is based on the Schedule 13G filed by The Vanguard Group on February 10, 2021. The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, Pennsylvania 19355.

(6)Consists of (1) 833,080 Class A common shares held of record by the James and Leslie Belardi Family Trust, (2) 16,657 Class A common shares held of record by the Belardi Family Irrevocable Trust, (3) 200,000 Class A common shares held of record by the Belardi 2020 GRAT, (4) 159,696 Class A common shares held of record by JB Athene Investments, LLC, (5) options to acquire 323,590 Class A common shares vested as of August 29, 2021, (6) warrants held of record by the Belardi Family Irrevocable Trust exercisable for 334,325 Class A common shares, (7) warrants held of record by JB Athene Investments, LLC exercisable for 1,607,409 Class A common shares and (8) warrants held of record by the Belardi 2019 GRAT exercisable for 2,036,073 Class A common shares. Excludes 128,457 restricted Class A common shares, 51,838 Class A restricted stock units and options to acquire 119,033 Class A common shares which are unvested as of August 29, 2021. Mr. Belardi disclaims beneficial ownership of all common shares of Athene held by the Belardi Family Irrevocable Trust and the members of the Apollo Group. Mr. Belardi has entered into a voting agreement with Apollo Management Holdings, L.P., pursuant to which Mr. Belardi irrevocably appointed Apollo Management Holdings, L.P as its proxy to vote all of such Class A common shares beneficially owned by Mr. Belardi at any meeting of the Company’s shareholders. For the avoidance of doubt, all Class A common shares beneficially owned by Mr. Belardi and subject to the voting agreement are included in the number of shares reported as beneficially owned by the Apollo Holders.

(7)Consists of (1) 482,529 Class A common shares, (2) options to acquire 193,768 Class A common shares vested as of August 29, 2021 and (3) warrants exercisable for 2,375,000 Class A common shares. Excludes 35,345 restricted Class A common shares, 66,933 Class A restricted stock units and options to acquire 101,095 Class A common shares which are unvested as of August 29, 2021. Mr. Wheeler has entered into a voting agreement with Apollo Management Holdings, L.P., pursuant to which Mr. Wheeler irrevocably appointed Apollo Management Holdings, L.P as its proxy to vote all of such Class A common shares beneficially owned by Mr. Wheeler at any meeting of the Company’s shareholders. For the avoidance of doubt, all Class A common shares beneficially owned by Mr. Wheeler and subject to the voting agreement are included in the number of shares reported as beneficially owned by the Apollo Holders.

(8)Consists of (1) 1,610,505 Class A common shares, (2) options to acquire 125,193 Class A common shares vested as of August 29, 2021 and (3) warrants exercisable for 232,462 Class A common shares. Excludes 30,927 restricted Class A common shares, 60,678 Class A restricted stock units and options to acquire 91,539 Class A common shares which are unvested as of August 29, 2021.

(9)Consists of (1) 98,312 Class A common shares, (2) options to acquire 127,611 Class A common shares vested as of August 29, 2021 and (3) warrants exercisable for 132,916 Class A common shares. Excludes 30,043 restricted Class A common shares, 57,497 Class A restricted stock units and options to acquire 86,811 Class A common shares which are unvested as of August 29, 2021.

(10)Consists of (1) 41,054 Class A common shares, (2) options to acquire 60,823 Class A common shares vested as of August 29, 2021 and (3) warrants exercisable for 24,946 Class A common shares. Excludes 40,525 Class A restricted stock units and options to acquire 45,200 Class A common shares which are unvested as of August 29, 2021.

(11)Consists of (1) 28,563 Class A common shares and (2) warrants exercisable for 113,139 Class A common shares.

(12)Consists of Class A common shares held by entities directly or indirectly controlled by Mr. Rowan. The reported amount does not include, and Mr. Rowan disclaims beneficial ownership of, Class A common shares owned by the Apollo Holders. Mr. Rowan does not have the power to vote or dispose of any Athene common shares that may from time to time be held by the Apollo Holders and therefore is not deemed to beneficially own such shares.

(13)Excludes 5,588 restricted Class A common shares which are unvested as of August 29, 2021.

(14)In March 2021, Mr. Lohr transferred his ownership of Cardinal Holdings Limited (“Cardinal”), an entity which holds all his common shares of Athene, to a trust for estate planning purposes. In addition, an agency agreement between Cardinal and Mr. Lohr that previously allowed for Mr. Lohr to retain all voting rights and dispositive power with respect to the shares held at Cardinal was terminated in early 2021. As a result of these events, Mr. Lohr no longer beneficially owns any common shares of Athene. Mr. Lohr disclaims beneficial ownership of all common shares of Athene held of record or beneficially owned by the Apollo Holders or any other member of the Apollo Group.

(15)Mr. Michelini disclaims beneficial ownership of all common shares of Athene held of record or beneficially owned by the Apollo Holders or any other member of the Apollo Group.

(16)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(17)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(18)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(19)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(20)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(21)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(22)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(23)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

(24)Excludes 5,151 restricted Class A common shares which are unvested as of August 29, 2021.

10

(25)Mr. Kleinman disclaims beneficial ownership of all common shares of Athene held of record or beneficially owned by the Apollo Holders or any other member of the Apollo Group.

(26)Excludes 3,573 restricted Class A common shares which are unvested as of August 29, 2021.

(27)Totals include restricted common shares, warrants and options held by such individuals which have vested or will vest as of August 29, 2021.

Change of Control

As discussed in greater detail in “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS” herein, on March 8, 2021, the Company and AGM have agreed to effect an all-stock merger transaction to combine their respective businesses, subject to certain terms and conditions. The merger transaction, if consummated, would result in a change in control of the Company.

11

CORPORATE GOVERNANCE

Corporate Governance

Our business and affairs are managed under the direction of our board of directors. Our board of directors currently consists of 16 members. Six of our directors are employees of or consultants to Apollo or its affiliates (including Mr. Belardi, our Chairman, Chief Executive Officer and Chief Investment Officer, who is also Chairman and Chief Executive Officer of Apollo Insurance Solutions Group LP (“ISG”, formerly known as Athene Asset Management LLC). We believe that it is appropriate, given Mr. Belardi’s in-depth knowledge of the Company and our business and industry and his ability to formulate and implement strategic initiatives, that the offices of Chief Executive Officer and Chairman have been vested in Mr. Belardi.

Under our Bye-laws, our board of directors may consist of not less than two and not more than 17 directors. Our board size is currently set at 16 members. If there is a vacancy on our board of directors due to the death, disability, disqualification, removal or resignation of a director, or there is an increase in the number of our directors or a failure to elect a director at a shareholder meeting, the board of directors may appoint any person as a member of the board of directors on an interim basis until the next annual general meeting provided that such person has been approved by a majority of the nominating and corporate governance committee. At the next annual general meeting, the newly appointed director will be put to a shareholder vote. Persons appointed by the board of directors to fill vacancies must be approved by a majority of the board of directors.

Director Independence

Our board of directors has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that Messrs. Beilinson, Borden, Leach, McCall, Ruisi, Swann, Wrubel, Zeko and Ms. Hormozi do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors meets the independence requirements of the NYSE listing rules. Consequently, a majority of our directors are independent directors. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director and non-Apollo director has with our Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our common shares by such director and any transactions involving them described under “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS” herein.

Board Meetings and Committees; Attendance at Annual General Meeting

The board of directors held eight meetings in 2020 consisting of regularly scheduled, full agenda meetings and special, limited agenda meetings held on short notice. During 2020, the audit committee met nine times, the compensation committee met four times, the nominating and corporate governance committee met four times, the risk committee met four times, the legal and regulatory committee met six times, the executive committee met four times and the conflicts committee met nineteen times. Each director attended at least 75% of his or her board and committee meetings that such director was eligible to attend.

Eight directors of the Company attended the 2020 annual general meeting. As a public company, the Company encourages directors to use best efforts to attend all annual general meetings.

Classified Board of Directors

Our Bye-laws provide for our board of directors to be divided into three classes with members of each class serving staggered three-year terms. Only one class of directors will be elected at each annual general meeting of Shareholders, with directors in other classes continuing for the remainder of their respective three-year terms. Our current directors are divided among the three classes as follows:

•our Class I directors are Messrs. Belardi, Leach, Lohr, Michelini and Rowan and their terms will expire at our annual general meeting to be held in 2022;

•our Class II directors are Messrs. Kleinman, Ruisi, Wrubel and Zeko and Ms. Taitz and their terms will expire at our annual general meeting to be held in 2023; and

•our Class III directors are Messrs. Beilinson, Borden, McCall and Swann and Dr. Puffer and Ms. Hormozi and their terms will expire at our annual general meeting to be held in 2021.

12

Mr. Swann has been appointed to the board of directors subject to being nominated and elected by Shareholders at the Annual General Meeting. If elected at the Annual General Meeting, Mr. Swann will be a Class III director eligible to hold office until the 2024 annual general meeting.

Our directors hold office until their successors have been elected and qualified or until the earlier of their death, resignation or removal. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

The classification of our board of directors may have the effect of delaying or preventing changes of control of our Company.

Lead Independent Director

Mr. Beilinson is our Lead Independent Director. In this role, the Lead Independent Director, among other things, presides at executive sessions of the independent directors, serves as liaison between the chairman and the independent directors, reviews board meeting schedules and agendas, reviews information sent to the board and is authorized to call meetings of the independent directors.

Committees of the Board of Directors

Our board of directors has the authority to appoint committees to perform certain management and administration functions. Our board of directors has seven standing committees: audit, compensation, nominating and corporate governance, legal and regulatory, conflicts, executive and risk. The table below shows the membership for each of the board of directors’ standing committees.

| Audit Committee | Compensation Committee | Conflicts Committee | Legal and Regulatory Committee | |||||||||||||||||

| Lawrence J. Ruisi (Chair)* | Marc Beilinson (Chair)* | Marc Beilinson* | Mitra Hormozi (Chair)* | |||||||||||||||||

| Robert Borden* | Mitra Hormozi* | Robert Borden* | Marc Beilinson* | |||||||||||||||||

| Brian Leach* | Arthur Wrubel* | Hope Taitz | Matthew Michelini | |||||||||||||||||

| Hope Taitz | ||||||||||||||||||||

| Executive Committee | Nominating and Corporate Governance Committee | Risk Committee | ||||||||||||||||||

| James R. Belardi | Arthur Wrubel (Chair)* | Manfred Puffer (Chair) | ||||||||||||||||||

| Marc Rowan | H. Carl McCall* | Robert Borden* | ||||||||||||||||||

| Matthew Michelini | Fehmi Zeko* | Brian Leach* | ||||||||||||||||||

| Matthew Michelini | ||||||||||||||||||||

| Lawrence J. Ruisi* | ||||||||||||||||||||

| Hope Taitz | ||||||||||||||||||||

| * Independent director for purposes of the NYSE corporate governance listing requirements. | ||||||||||||||||||||

The board of directors also formed a special committee comprised of independent directors to review and negotiate the merger transaction with AGM. For more information regarding the merger transaction, see “Certain Relationships and Related Transactions—Merger Agreement.”

Audit Committee

The audit committee’s duties include, but are not limited to, assisting the board of directors with its oversight and monitoring responsibilities regarding:

•the integrity of the Company’s consolidated financial statements and financial and accounting processes;

•compliance with the audit, legal, accounting and internal controls requirements by AHL and its subsidiaries;

•the independent auditor’s qualifications, independence and performance;

•related party transactions other than transactions between AHL and its subsidiaries, on the one hand, and Apollo and its affiliates (other than AHL and its subsidiaries), on the other hand, and other related party transactions ancillary thereto that are required to be reviewed by the conflicts committee or by the disinterested directors on our board of directors as described under “—Conflicts Committee” below, or are expressly exempt from such review under our internal policies;

13

•the performance of the Company’s internal control over financial reporting and its subsidiaries’ internal control over financial reporting (including monitoring and reporting by subsidiaries) and the function of the Company’s internal audit department;

•the Company’s legal and regulatory compliance and ethical standards;

•procedures to receive, retain and treat complaints regarding accounting, internal controls over financial reporting or auditing matters and to receive confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and

•the review of the Company’s financial disclosure and public filings.

Our audit committee is currently comprised of Messrs. Leach, Ruisi and Borden. Mr. Ruisi is the chair of the audit committee. The board of directors has determined that each of Messrs. Ruisi, Leach and Borden meet the independence requirements of the NYSE rules and the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act of 1934, as amended. The board of directors has determined that each member of our audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. The chair of our audit committee, Mr. Ruisi, is an independent director and an “audit committee financial expert” as that term is defined in the rules and regulations of the SEC. Our board of directors has approved a written charter under which the audit committee will operate. A copy of the charter of our audit committee is available on our principal corporate website at www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this proxy statement.

Pre-Approval Policies and Procedures of the Audit Committee

The audit committee has adopted procedures for pre-approving all audit and permissible non-audit services provided by the Company’s independent auditor. The audit committee will, on an annual basis, review and pre-approve the audit, review, attestation and permitted non-audit services to be provided during the next audit cycle by the Company’s independent auditor. To the extent practicable, the audit committee will also review and approve a budget for such services. Services proposed to be provided by the independent auditor that have not been pre-approved during the annual review and the fees for such proposed services must be approved by the audit committee. All requests or applications for the independent auditor to provide services to the Company over certain thresholds shall be submitted to the audit committee or the Chairperson thereof. The audit committee considered whether the provision of non-audit services performed by the Company’s independent auditor was compatible with maintaining the independent auditor’s independence during 2020. The audit committee concluded in 2020 that the provision of these services was compatible with the maintenance of the independent auditor’s independence in the performance of its auditing functions during 2020. All services were approved by the audit committee or were pre-approved under the audit committee’s pre-approval policy.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following Report of the Audit Committee of the Board of Directors of the Company does not constitute soliciting material and should not be deemed filed or incorporated by reference into any future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act, except to the extent the Company specifically incorporates this Report by reference.

The audit committee has reviewed and discussed the audited consolidated financial statements of the Company for the year ended December 31, 2020 with management and the independent auditors. The independent auditors have discussed with the audit committee the matters required to be discussed by the independent auditors under the rules adopted by the Public Company Accounting Oversight Board and the SEC. The independent auditors have also provided to the audit committee the written disclosures and the letter required by the applicable rules of the Public Company Accounting Oversight Board regarding the independent auditors’ communications with the audit committee concerning independence, and the audit committee has discussed with the independent auditors their independence from the Company. The independent auditors and the Company’s internal auditors had full access to the audit committee, including meetings without management present as needed.

Based on the audit committee’s review and discussions referred to above, the audit committee recommended to the board of directors that the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

AUDIT COMMITTEE

Lawrence J. Ruisi, Chairman

Brian Leach

Robert Borden

14

Compensation Committee

The purposes of the compensation committee are generally to:

•review and approve annually corporate goals and objectives, including financial and other performance targets, relevant to Chief Executive Officer and executive officer compensation;

•review and approve annually corporate goals and objectives, including financial and other performance targets, relevant to compensation paid to the other executive officers and key employees of the Company and its subsidiaries;

•review, approve and, when necessary, make recommendations to the board of directors regarding the Company’s compensation plans for executive officers and key employees, including with respect to incentive compensation plans and share-based plans, policies and programs;

•review and administer the Company’s share incentive plans and any other share-based plan and any incentive-based plan of the Company and its subsidiaries, including approving grants and/or awards of restricted stock, stock options and other forms of equity-based compensation under any such plans to executive officers, and, at its discretion, delegate authority to senior management to administer such plans for employees of the Company who are not executive officers and key employees;

•review and approve, for the Chief Executive Officer and other executive officers of the Company, when and if appropriate, employment agreements, severance agreements, consulting agreements and change in control or termination agreements and any benefits or perquisites not broadly applicable to the employee population;

•prepare the compensation committee report to be included in an annual report or proxy statement, as required by applicable SEC and NYSE rules;

•review periodically the Company’s compensation plans, policies and programs to assess whether such policies encourage excessive or inappropriate risk-taking or earnings manipulation;

•review the results of any advisory stockholder votes on executive compensation and consider whether to recommend adjustments to the Company’s executive compensation policies and practices as a result of such vote; and

•monitor compliance with stock ownership guidelines for the Chief Executive Officer and other executive officers of the Company.

Our compensation committee is comprised of Messrs. Beilinson and Wrubel and Ms. Hormozi. Mr. Beilinson is the chair of the compensation committee. The board of directors has determined that each of Messrs. Beilinson and Wrubel and Ms. Hormozi meet the independence requirements of the NYSE rules and therefore all members of the compensation committee are independent directors. Our board of directors has approved a written charter under which the compensation committee will operate. A copy of the charter of our compensation committee is available on our principal corporate website at www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this proxy statement.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The compensation committee has reviewed and discussed the section entitled “Compensation Discussion and Analysis” with management. Based on this review and discussion, the compensation committee recommended to the board of directors that the section entitled “Compensation Discussion and Analysis” be included in this proxy statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

COMPENSATION COMMITTEE

Marc A. Beilinson, Chairman

Mitra Hormozi

Arthur Wrubel

Nominating and Corporate Governance Committee

The purposes of the nominating and corporate governance committee are to:

•identify, evaluate and recommend individuals qualified to become members of our board of directors, consistent with criteria approved by our board of directors;

•select, or recommend that our board of directors select, the director nominees to stand for election at each annual general meeting of shareholders of the Company or to fill vacancies on our board of directors;

•develop and recommend to our board of directors a set of corporate governance guidelines applicable to the Company and its subsidiaries; and

•oversee the annual performance evaluation of our board of directors and each of its committees.

15

The nominating and corporate governance committee recommends directors eligible to serve on the committees of our board of directors. The nominating and corporate governance committee also reviews and evaluates, in accordance with our Bye-laws, all shareholder director nominees. All shareholder director nominations must be made in accordance with the requirements of our Bye-laws, which specify the appropriate period of notice (as described below in “MORE INFORMATION—Shareholders’ Proposals and Director Nominees for the 2022 Annual General Meeting”) and enumerate certain required disclosures the shareholder must include with his or her notice of intent to the Company when making a director nomination.

In recommending directors and evaluating shareholder director nominees, the nominating and corporate governance committee as a general matter seeks to compose the Company’s board to be of effective size and composition with a diversity of backgrounds, skills and experiences. The nominating and corporate governance committee, considers several additional factors, including the potential directors’:

•fitness and propriety for the position, including a high level of professional ethics, integrity, leadership values and the ability to exercise sound judgment;

•useful qualifications, industry experience, technical expertise; education and other skills and expertise, as well as the interplay of those factors with the qualifications and experience of incumbent directors;

•a willingness and ability to devote the time necessary to carry out the duties and responsibilities of board membership;

•a desire to oversee that the operations and financial reporting are effected in an accurate and transparent manner and in compliance with applicable laws, rules and regulations;

•diversity, including gender, race, national origin, ethnicity and age; and

•a dedication to the representation of the best interests of the Company and its shareholders.

Our nominating and corporate governance committee is comprised of Messrs. Wrubel, McCall, and Zeko. Mr. Wrubel is the chair of the nominating and corporate governance committee. The board of directors has determined that each of Messrs. Wrubel, McCall, and Zeko meet the independence requirements of the NYSE rules and therefore all members of our nominating and corporate governance committee are independent directors. A copy of the charter of our nominating and corporate governance committee is available on our principal corporate website at www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this proxy statement.

Legal and Regulatory Committee

The purposes of the legal and regulatory committee are generally to provide oversight and monitoring of:

•material litigation and other disputes;

•material regulatory matters, including investigations, enforcement actions and other inquiries;

•compliance with material laws and regulations;

•material compliance, legal and regulatory programs, policies and procedures; and

•environmental, governance and corporate social responsibility matters.

The committee’s oversight responsibilities complement those of the audit committee (with respect to the Company’s compliance with legal and regulatory requirements) and the nominating and corporate governance committee (with respect to the Company’s corporate governance). Our legal and regulatory committee is comprised of Messrs. Beilinson and Wrubel, and Mses. Taitz and Hormozi. Ms. Hormozi is the chair of the legal and regulatory committee.

Conflicts Committee

Because the Apollo Group has a significant voting interest in AHL, and because AHL and its subsidiaries have entered into, and will continue in the future to enter into, transactions with Apollo and its affiliates, our Bye-laws require us to maintain a conflicts committee designated by our board of directors, comprised solely of directors who are not general partners, directors, managers, officers or employees of the Apollo Group. The conflicts committee meets at least quarterly and consists of Messrs. Beilinson and Borden and Ms. Taitz. The conflicts committee reviews and approves material transactions by and between AHL and its subsidiaries, on the one hand, and members of the Apollo Group, on the other hand, including any modification or waiver of the IMAs (as defined herein) with ISG, subject to certain exceptions. The conflicts committee is also responsible for the review and approval of related party transactions that are incidental or ancillary to the foregoing transactions and other related party transactions relating to or involving, directly or indirectly, Apollo or any member of the Apollo Group. For a description of the functions of the conflicts committee and such exceptions, see “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS—Related Party Transaction Policy.”

16

Executive Committee

The executive committee is responsible for facilitating the approval of certain actions that do not require consideration by the full board of directors or that are specifically delegated by the board of directors to the executive committee. The executive committee possesses and may exercise all powers of the board of directors in the management and direction of the Company’s business consistent with our Bye-laws, applicable law (including any applicable rule of any stock exchange or quotation system on which our common shares are then listed) and our operating guidelines, except that the executive committee shall not perform such functions that are expressly delegated to other committees of the board of directors. The executive committee does not have the power to:

•declare dividends on or distributions of or in respect of shares of the Company that, in each case, is not within the scope of authority previously delegated to the executive committee by action of the board of directors;

•issue shares or authorize or approve the issuance or sale, or contract for sale, of shares or determine the designation and relative rights, preferences and limitations of a series or class of shares unless specifically delegated by action of the board of directors to the executive committee or a subcommittee of the executive committee;

•recommend to Shareholders any action that requires Shareholder approval;

•recommend to Shareholders a dissolution or winding up of the Company or a revocation of a dissolution or winding up of the Company;

•amend or repeal any provision of the memorandum of association or Bye-laws;

•agree to the settlement of any litigation, dispute, investigation or other similar matter with respect to the Company that is not within the scope of authority previously delegated to the executive committee by the board of directors;

•approve the sale or lease of real or personal property assets with a fair value greater than a threshold amount specifically delegated to the executive committee by the board of directors;

•authorize mergers (other than a merger of any wholly-owned subsidiary with the Company), acquisitions, joint ventures, consolidations or dispositions of assets or any business of the Company or any investment in any business or Company by the Company with a fair value in excess of a threshold amount specifically delegated to the executive committee by the board of directors; or approve the sale, lease, exchange or encumbrance of any material asset of the Company that, in each case, is not within the scope of authority previously delegated to the executive committee by action of the board of directors; or

•amend, alter or repeal, or take any action inconsistent with any resolution or action of the board of directors.

Our executive committee is comprised of Messrs. Belardi, Michelini and Rowan.

Risk Committee

The risk committee’s duties are to oversee the development and implementation of systems and processes designed to identify, manage and mitigate reasonably foreseeable material risks to the Company; assist our board of directors and our board committees in fulfilling their oversight responsibilities for the risk management function of the Company; approve the stress test assumption and limits utilized in our stress test scenario analyses and engage in such activities as it deems necessary or appropriate in connection with the foregoing. In assessing risk, the risk committee assesses the risk of the Company and its subsidiaries as a whole. The risk committee’s role is one of oversight. Management of the Company is responsible for developing and implementing the systems and processes designed to identify, manage and mitigate risk. Members of the risk committee are selected for their experience in managing risks in financial and/or insurance enterprises. Our risk committee meets quarterly and is comprised of Messrs. Borden, Leach, Michelini and Ruisi, Ms. Taitz and Dr. Puffer. Dr. Puffer is the chair of the risk committee.

Management Committees

An integral component of our corporate governance structure is our management committees. Management committees report to our senior officers, including our Chief Executive Officer, President, Chief Financial Officer, and Chief Risk Officer and to committees of our board of directors. Management committees are comprised of members of senior management and are designed to oversee business initiatives and to manage business risk and processes, with each committee focused on a discrete area of our business. The following is a description of certain of our management committees:

•Management Executive Committee: oversees all of our strategic initiatives and our overall financial condition.

•Management Risk Committee: oversees overall corporate risk, including credit risk, interest rate risk, equity risk, business risk, operational risk and other risks we confront. The committee reports to the board risk committee.

•Operational Risk Committee: a subcommittee of the Management Risk Committee which oversees operational risk, including information security, disaster recovery, trading activities and operational management of our annuity portfolio.

17

•Management Investment and Asset Liability Committee: focuses on strategic decisions involving our investment portfolio and asset allocation, such as approving investment limits, new asset classes and our allocation strategy, reviewing large asset transactions as well as monitoring investment, credit, liquidity and asset/liability risks. The committee reports to the board risk committee.

•Management Balance Sheet Committee: a subcommittee of the Management Executive Committee which operates as a forum for senior management to oversee and provide guidance on sources and uses of the Company’s capital, review transactions above certain thresholds and provide recommendations to our board of directors, review balance sheet structure and review other matters having material impacts to financial statements.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2020, Messrs. Wrubel and Beilinson, and Ms. Hormozi each served on our compensation committee.

None of our executive officers currently serves, or has served during the last completed fiscal year, as a member of the board of directors or compensation committee of any entity that has an executive officer serving as a member of our compensation committee or as a director on our board of directors.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

We have adopted corporate governance guidelines and a code of business conduct and ethics that applies to all of our directors, officers and employees. These documents are available at www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this proxy statement.

Communications with the Board of Directors

Shareholders and other interested parties may communicate with members of the board of directors (either individually or as a body) by addressing correspondence to that individual or body to Athene Holding Ltd., Second Floor, Washington House, 16 Church Street, Hamilton HM 11, Bermuda.

Shareholders and other interested parties may specifically direct their communications to any of the independent directors, including the Committee Chairs and the Lead Independent Director, by addressing correspondence to that individual or body to Athene Holding Ltd., Second Floor, Washington House, 16 Church Street, Hamilton HM 11, Bermuda.

Risk Management Oversight