Table of Contents

As filed with the Securities and Exchange Commission on May 22, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ATHENE HOLDING LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 6311 | 98-0630022 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

96 Pitts Bay Road

Pembroke, HM08, Bermuda

(441) 279-8400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address and telephone number, including area code, of agent for service)

Copies to:

| Perry J. Shwachman Samir A. Gandhi Sidley Austin LLP One South Dearborn Chicago, Illinois 60603 Telephone: (312) 853-7000 Telecopy: (312) 853-7036 |

Charles G.R. Collis Conyers Dill & Pearman Clarendon House, 2 Church Street, PO Box HM 666 Hamilton, HM CX Bermuda Telephone: (441) 295-1422 Telecopy: (441) 292-4720 |

Daniel J. Bursky Mark Hayek Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 Telephone: (212) 859-8000 Telecopy: (212) 859-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee | ||

| Class A Common Shares, $0.001 par value |

$100,000,000 | $11,590 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes shares that the underwriter has the option to purchase. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated May 22, 2017.

Shares

Athene Holding Ltd.

Class A Common Shares

Certain shareholders of Athene Holding Ltd. identified in this prospectus are selling Class A common shares of Athene Holding Ltd. We will not receive any proceeds from the sale of the Class A common shares to be offered in this offering.

Our Class A common shares are listed on the New York Stock Exchange under the symbol “ATH.” The last reported sale price of our Class A common shares on May 19, 2017 was $51.12 per share. The public offering price for the shares being sold in this offering will be determined by negotiation between us and the underwriter.

Investing in our Class A common shares involves risks. See “Risk Factors” beginning on page 28 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling shareholders |

$ | $ | ||||||

| (1) | See “Underwriting” for a detailed description of compensation payable to the underwriter. |

We currently have two classes of voting shares outstanding, Class A common shares and Class B common shares. Each Class A common share and Class B common share is economically equivalent to each other—the dollar value of one Class A common share is equal to the dollar value of one Class B common share. However, Class A common shares and Class B common shares differ in terms of voting power. The Class A common shares currently account for 55% of our aggregate voting power and the Class B common shares currently account for the remaining 45% of our aggregate voting power. See “Description of Share Capital—Common Shares.” Only Class A common shares are being sold in this offering.

The selling shareholders have granted the underwriter an option to purchase, within 30 days of the date of this prospectus, up to additional Class A common shares from certain of the selling shareholders, at the public offering price, less the underwriting discount.

The underwriter expects to deliver the Class A common shares against payment in New York, New York on or about , 2017.

| Goldman Sachs & Co. LLC |

The date of this prospectus is , 2017.

Table of Contents

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. Neither we, the selling shareholders nor the underwriter have authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. This prospectus is an offer to sell only the Class A common shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume the information contained in this prospectus and any free writing prospectus we authorize to be delivered to you is accurate only as of their respective dates or the date or dates specified in those documents. Our business, financial condition, results of operations or prospects may have changed since those dates.

For investors outside the United States: neither we, the selling shareholders nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Class A common shares and the distribution of this prospectus outside the United States.

i

Table of Contents

We obtained the industry, market and competitive position data throughout this prospectus and the reports incorporated by reference herein from (1) our own internal estimates and research, (2) industry and general publications and research, (3) studies and surveys conducted by third parties and (4) other publicly available information. Independent research reports and industry publications generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. While we believe that the information included and incorporated by reference in this prospectus from such publications, research, studies and surveys is reliable, neither we, the selling shareholders nor the underwriter have independently verified data from these third-party sources. In addition, while we believe our internal estimates and research are reliable and the definitions of our market and industry are appropriate, neither such estimates and research nor such definitions have been verified by any independent source. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties as the other forward-looking statements in this prospectus.

ENFORCEMENT OF CIVIL LIABILITIES UNDER U.S. FEDERAL SECURITIES LAWS

We are incorporated under the laws of Bermuda. In addition, some of our directors and officers may reside outside the United States, and all or a substantial portion of our assets and the assets of these persons are, or may be, located in jurisdictions outside the United States. Therefore, it may be difficult for investors to recover against us or our non-United States based directors and officers, or obtain judgments of U.S. courts, including judgments predicated upon the civil liability provisions of U.S. federal securities laws. Although we may be served with process in the United States with respect to actions against us arising out of or in connection with violations of U.S. federal securities laws relating to offers and sales of Class A common shares made by this prospectus by serving CT Corporation, our U.S. agent irrevocably appointed for that purpose, it may be difficult for investors to effect service of process within the United States on our directors and officers who reside outside the United States.

We have been advised by our Bermuda counsel that there is no treaty in force between the United States and Bermuda providing for the reciprocal recognition and enforcement of judgments in civil and commercial matters. A judgment for the payment of money rendered by a court in the United States based on civil liability would not be automatically enforceable in Bermuda. A final and conclusive judgment obtained in a court of competent jurisdiction in the United States under which a sum of money is payable as compensatory damages may be the subject of an action in a Bermuda court under the common law doctrine of obligation, by action on the debt evidenced by the U.S. court judgment without examination of the merits of the underlying claim. In order to maintain an action in debt evidenced by a U.S. court judgment, the judgment creditor must establish that:

| • | the court that gave the judgment over the defendant was competent to hear the claim in accordance with private international law principles as applied in the courts in Bermuda; and |

| • | the judgment is not contrary to public policy in Bermuda and was not obtained contrary to the rules of natural justice in Bermuda. |

In addition, and irrespective of jurisdictional issues, the Bermuda courts will not enforce a U.S. federal securities law that is either penal or contrary to Bermuda public policy. It is the advice of our Bermuda counsel that an action brought pursuant to a public or penal law, the purpose of which is the enforcement of a sanction, power or right at the instance of the state in its sovereign capacity, will not be entertained by a Bermuda court. Certain remedies available under the laws of U.S. jurisdictions, including certain remedies under U.S. federal securities laws, would not be available under Bermuda law or enforceable in a Bermuda court, as they would be contrary to Bermuda public policy. U.S. judgments for multiple damages may not be recoverable in Bermuda court enforcement proceedings under the provisions of the Protection of Trading Interests Act 1981. A claim to enforce the compensatory damages before the multiplier was applied would be maintainable in the Bermuda

ii

Table of Contents

court. Further, no claim may be brought in Bermuda against us or our directors and officers in the first instance for violation of federal securities laws because these laws have no extraterritorial jurisdiction under Bermuda law and do not have force of law in Bermuda. A Bermuda court may, however, impose civil liability on us or our directors and officers if the facts alleged in a complaint constitute or give rise to a cause of action under Bermuda law. See “Comparison of Shareholder Rights—Differences in Corporate Law—Shareholders’ Suits.”

iii

Table of Contents

This summary highlights information contained elsewhere and incorporated by reference in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our Class A common shares. You should carefully read this prospectus in its entirety, as well as the information incorporated by reference herein, before making an investment decision. In particular, you should read the section entitled “Risk Factors” beginning on page 28 of this prospectus, the information under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is included in our Annual Report on Form 10-K for the year ended December 31, 2016 (our “Annual Report”), our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017 (our “Quarterly Report”) and our consolidated financial statements and related notes included in such reports, each of which is incorporated by reference herein, before making an investment decision. As used in this prospectus, unless the context otherwise indicates, any reference to “Athene,” “our company,” “the company,” “us,” “we” and “our” refers to Athene Holding Ltd. together with its consolidated subsidiaries and any reference to “AHL” refers to Athene Holding Ltd. only.

Unless otherwise indicated, the information included or incorporated by reference in this prospectus assumes (1) the sale of our Class A common shares in this offering at the public offering price set forth on the cover of this prospectus and (2) that the underwriter has not exercised its option to purchase up to additional Class A common shares from certain of the selling shareholders.

In this prospectus, we refer to a number of terms to describe our insurance and reinsurance businesses and financial and operating metrics such as “base of earnings,” “investment margin,” “VOBA,” “invested assets” and “alternative investments,” among others. For a detailed explanation of these terms and other terms used in this prospectus and not otherwise defined, please refer to “Glossary of Selected Terms” in our Annual Report and our Quarterly Report.

In this prospectus and the documents incorporated by reference herein, we make certain forward-looking statements, including expectations relating to our future performance. These expectations reflect our management’s view of our prospects and are subject to the risks described under “Risk Factors” in this prospectus, in our Annual Report and in our Quarterly Report and are further subject to the risks described under “Special Note Regarding Forward-Looking Statements and Market Data” in this prospectus. Our expectations of our future performance may change after the date of this prospectus and there is no guarantee that such expectations will prove to be accurate.

Our Company

We are a leading retirement services company that issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs. We generate attractive financial results for our policyholders and shareholders by combining our two core competencies of (1) sourcing long-term, generally illiquid liabilities and (2) investing in a high quality investment portfolio, which takes advantage of the illiquid nature of our liabilities. Our steady and significant base of earnings generates capital that we opportunistically invest across our business to source attractively-priced liabilities and capitalize on opportunities. Our differentiated investment strategy benefits from our strategic relationship with Apollo Global Management, LLC (“Apollo”) and its indirect subsidiary, Athene Asset Management, L.P. (“AAM”). AAM provides a full suite of services for our investment portfolio, including direct investment management, asset allocation, mergers and acquisition asset diligence and certain operational support services, including investment compliance, tax, legal and risk management support. Our relationship with Apollo and AAM also provides us with access to Apollo’s investment professionals across the world as well as Apollo’s global asset management infrastructure that, as of March 31, 2017, supported more than $197 billion of assets under management (“AUM”) across a broad array of asset classes. We are led by a highly skilled management

Table of Contents

team with extensive industry experience. We are based in Bermuda with our U.S. subsidiaries’ headquarters located in Iowa.

We began operating in 2009 when the burdens of the financial crisis and resulting capital demands caused many companies to exit the retirement market, creating the need for a well-capitalized company with an experienced management team to fill the void. Taking advantage of this market dislocation, we have been able to acquire substantial blocks of long-duration liabilities and reinvest the related investments to produce profitable returns. We have been able to generate strong financial returns in a multi-year low rate environment. We believe we have fewer legacy liability issues than our peers given that all of our retail and flow reinsurance liabilities were underwritten after the financial crisis, and the majority of the liabilities we acquired through our acquisitions and block reinsurance were acquired at a discount to book value.

We have established a significant base of earnings and, as of March 31, 2017, have an expected annual investment margin of 2-3% over the 7.9 year weighted-average life of our deferred annuities, which make up a substantial portion of our reserve liabilities. Even as we have grown to $75.1 billion in investments, including related parties, $73.6 billion in invested assets and $89.2 billion of total assets as of March 31, 2017, we have continued to approach both sides of the balance sheet with an opportunistic mindset because we believe quickly identifying and capitalizing on market dislocations allows us to generate attractive, risk-adjusted returns for our shareholders. Further, our multiple distribution channels support growing origination across market environments and better enable us to achieve continued balance sheet growth while maintaining attractive profitability. We believe that in a typical market environment, we will be able to profitably grow through our organic channels, including retail, flow reinsurance (a transaction in which the ceding company cedes a portion of newly issued policies to the reinsurer) and institutional products. In more challenging market environments, we believe that we will see additional opportunities to grow through our inorganic channels, including acquisitions and block reinsurance (a transaction in which the ceding company cedes all or a portion of a block of previously issued annuity contracts through a reinsurance agreement), due to market stress during those periods. We are diligent in setting our return targets based on market conditions and risks inherent to our products offered and acquisitions or block reinsurance transactions. In general, we may accept lower returns on products which may provide more certain return characteristics, such as funding agreements, and we may require higher returns for products or transactions where there is more inherent risk in meeting our return targets, such as with acquisitions. Generally, we target mid-teen returns for sources of organic growth and higher returns for sources of inorganic growth. If we are unable to source liabilities with our desired return profile in one of our channels, we generally will not sacrifice profitability solely for the sake of increasing market share and instead we will typically focus on our other channels to identify growth opportunities that meet our preferred risk and return profile.

As a result of our focus on issuing, reinsuring and acquiring attractively-priced liabilities, our differentiated investment strategy and our significant scale, for the three months ended March 31, 2017 and the year ended December 31, 2016, in our Retirement Services segment described below, we generated an investment margin on deferred annuities of 2.85% (on an annualized basis) and 2.77%, respectively, and operating return on equity (“ROE”) excluding accumulated other comprehensive income (loss) (“AOCI”) of 22.8% (on an annualized basis) and 19.1%, respectively. We currently maintain what we believe to be high capital ratios for our rating and hold more than $1.5 billion of capital in excess of the level we believe is needed to support our current operating strategy, and view this excess as strategic capital available to reinvest into organic and inorganic growth opportunities. Because we hold this strategic capital to implement our opportunistic strategy and to enable us to explore deployment opportunities as they arise, and because we are investing for future growth, our consolidated ROE for the three months ended March 31, 2017 and the year ended December 31, 2016 was 20.6% (on an annualized basis) and 13.1%, respectively, and our consolidated operating ROE excluding AOCI for the same periods was 15.3% (on an annualized basis) and 12.5%, respectively, in each case, without the benefit of any financial leverage or capital returns through dividends or share buyback programs. On a consolidated basis, for the three months ended March 31, 2017 and the year ended December 31, 2016, we generated net income

2

Table of Contents

available to AHL shareholders of $373 million and $805 million, respectively, and operating income, net of tax, of $258 million and $760 million, respectively. Investment margin, operating income, net of tax, and operating ROE excluding AOCI are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). See “—Non-GAAP Measures” for additional discussions regarding these non-GAAP measures.

As of March 31, 2017, we had $7.6 billion of total AHL shareholders’ equity and $6.9 billion of total AHL shareholders’ equity excluding AOCI. Our top-level U.S. insurance subsidiary, Athene Annuity & Life Assurance Company (formerly known as Liberty Life Insurance Corporation, “AADE”), had a risk based capital ratio (“U.S. RBC ratio”) of 478% and our Bermuda reinsurer, Athene Life Re Ltd. (“ALRe”), had a Bermuda Solvency Capital Requirement (“BSCR”) ratio of 228%, each as of December 31, 2016. Our ALRe RBC ratio, which is used in evaluating our capital position and the amount of capital needed to support our Retirement Services segment, was 529% as of December 31, 2016 when applying the National Association of Insurance Commissioners (“NAIC”) risk-based capital (“RBC”) factors. As of March 31, 2017, our estimated U.S. RBC ratio and estimated ALRe RBC ratio remained strong at 466% and 530%, respectively. Our main insurance subsidiaries are rated A by A.M. Best Company, Inc. (“A.M. Best”) and are rated A- for financial strength by each of Standard & Poor’s Financial Services LLP (“S&P”) and Fitch Ratings, Inc. (“Fitch”), each with a stable outlook. AHL has a counterparty credit rating of BBB from S&P, an issuer default rating of BBB from Fitch and an issuer credit rating of bbb from A.M. Best, each with a stable outlook. We currently have no financial leverage, and have an undrawn $1.0 billion credit facility in place to provide an additional liquidity cushion in challenging economic or business environments or to provide additional capital support.

We operate our core business strategies out of one reportable segment, Retirement Services. In addition to Retirement Services, we report certain other operations in Corporate and Other. Retirement Services is comprised of our U.S. and Bermuda operations, which issue and reinsure retirement savings products and institutional products. Retirement Services has retail operations, which provide annuity retirement solutions to our policyholders. Retirement Services also has reinsurance operations, which reinsure multi-year guaranteed annuities (“MYGAs”), fixed indexed annuities (“FIAs”), traditional one year guarantee fixed deferred annuities, immediate annuities and institutional products from our reinsurance partners. In addition, our funding agreements are included in our Retirement Services segment. Corporate and Other includes certain other operations related to our corporate activities and our German operations, which is primarily comprised of participating long-duration savings products. In addition to our German operations, included in Corporate and Other are corporate allocated expenses, merger and acquisition costs, debt costs, certain integration and restructuring costs, certain stock-based compensation and intersegment eliminations. In Corporate and Other we also hold more than $1.5 billion of capital in excess of the level of capital we hold in Retirement Services to support our operating strategy.

We believe we hold a sufficient amount of capital in our Retirement Services segment to support our core operating strategies. This level of capital may fluctuate depending on the mix of both our assets and our liabilities, and also reflects the level of capital needed to support or improve our current ratings as well as our risk appetite based on our internal risk models. The level of capital we currently allocate to our Corporate non-reportable segment is our U.S. subsidiaries’ statutory capital in excess of a U.S. RBC ratio of 400% as well as the Bermuda capital for ALRe in excess of 400% RBC when also applying NAIC RBC factors. We view this excess as strategic capital, which we expect to deploy for additional organic and inorganic growth opportunities as well as expect to contribute to ratings improvements over time. We manage our capital to levels which we believe would remain consistent with our current ratings in a recessionary environment. For additional information regarding our segments, including financial information related thereto, refer to “Note 19—Segment Information” to our audited consolidated financial statements and notes thereto in our Annual Report and “Note 14—Segment Information” to our unaudited condensed consolidated financial statements and notes thereto in our Quarterly Report, each of which is incorporated by reference to this prospectus.

We have developed organic and inorganic channels to address the retirement services market and grow our assets and liabilities. By focusing on the retirement services market, we believe that we will benefit from several

3

Table of Contents

demographic and economic trends, including the increasing number of retirees in the United States, the lack of tax advantaged alternatives for people trying to save for retirement and expectations of a rising interest rate environment. To date, most of our products sold and acquired have been fixed annuities, which offer people saving for retirement a product that is tax advantaged, has a minimum guaranteed rate of return or minimum cash value and provides protection against investment loss. Our policies often include surrender charges (86% of our deferred annuity products, as of March 31, 2017) or market value adjustments (“MVAs”) (73% of our deferred annuity products, as of March 31, 2017), both of which increase persistency (the probability that a policy will remain in force from one period to the next) and protect our ability to meet our obligations to policyholders.

Our organic channels have provided deposits of $1.9 billion and $1.6 billion for the three months ended March 31, 2017 and 2016, respectively, and $8.8 billion, $3.9 billion and $2.9 billion for the years ended December 31, 2016, 2015 and 2014, respectively. Withdrawals on our deferred annuities were $1.2 billion and $1.0 billion for the three months ended March 31, 2017 and 2016, respectively, and $4.2 billion, $4.4 billion and $4.4 billion for the years ended December 31, 2016, 2015 and 2014, respectively. Maturities and paydowns on our funding agreements were $232 million and $144 million for the three months ended March 31, 2017 and 2016, respectively, and $425 million, $159 million and $100 million for the years ended December 31, 2016, 2015 and 2014, respectively. While there can be no assurance that we will meet our growth targets, we believe that our new deposits should continue to significantly surpass our withdrawals as we continue to grow our retail and flow reinsurance channels. Absent any significant unexpected market conditions or regulatory impacts and assuming we can meet our pricing targets, we believe that with our ratings and the strong growth in our organic channel in 2016, new deposits from our organic channels and withdrawal experience with respect to our deferred annuities should be similar in the near-to-mid-term to our 2016 production and withdrawal experience, respectively. Within our organic channels, we have focused on developing a diverse suite of products that allow us to meet our risk and return profiles, even in today’s low rate environment. As a result, not only were we able to deliver strong organic growth in 2016, but we were able to do so without sacrificing profitability. Going forward, we believe the recent upgrade by A.M. Best to a financial strength rating of A in April 2017 and the 2015 upgrade of our financial strength ratings to A- by each of S&P and Fitch, and our recent FIA and MYGA new product launches, will continue to enable us to increase penetration in our existing organic channels and access new markets within our retail channel, such as selling through financial institutions. This increased penetration will allow us to source additional volumes of profitably underwritten liabilities. Our organic channels currently include:

| • | Retail, from which we provide retirement solutions to our policyholders primarily through approximately 65 independent marketing organizations (“IMOs”). Within our retail channel we had fixed annuity sales of $1.1 billion and $663 million for the three months ended March 31, 2017 and 2016, respectively, and $5.3 billion, $2.5 billion and $2.5 billion for the years ended December 31, 2016, 2015 and 2014, respectively. |

| • | Flow reinsurance, which provides a diversified channel for us to source long-term liabilities with attractive crediting rates. Within our flow reinsurance channel, we generated $166 million and $912 million in deposits for the three months ended March 31, 2017 and 2016, respectively, and $3.5 billion, $1.1 billion and $349 million for the years ended December 31, 2016, 2015 and 2014, respectively. |

| • | Institutional products, which include funding agreements and pension risk transfer transactions. In October 2015, we sold a $250 million funding agreement in our inaugural transaction under our funding agreement backed note (“FABN”) program. During the three months ended March 31, 2017 and during April 2017, we continued to grow our institutional channel as we issued funding agreements in the aggregate principal amount of $650 million and $1.1 billion, respectively. We are pursuing pension risk transfer transactions in 2017. |

Our inorganic channels, including acquisitions and block reinsurance, have contributed significantly to our growth. We believe our internal acquisitions team, with support from Apollo, has an industry-leading ability to

4

Table of Contents

source, underwrite and expeditiously close transactions, which makes us a competitive counterparty for acquisition or block reinsurance transactions. We are highly selective in the transactions that we pursue; ultimately closing only those that are well aligned with our core competencies and pricing discipline. Since our inception, we have evaluated a significant number of merger and acquisition opportunities and have closed on five acquisitions. In connection with our five acquisitions through March 31, 2017, we sourced reserve liabilities backed by approximately $65.9 billion in total assets (net of $9.3 billion in assets ceded through reinsurance). The aggregate purchase price of our acquisitions was less than the aggregate statutory book value of the businesses acquired.

We have sourced a high quality portfolio of invested assets. Because we have remained disciplined in underwriting attractively priced liabilities, we have the ability to invest in a broad range of high quality assets and generate attractive earnings. As of March 31, 2017, 93.0% of our available for sale (“AFS”) fixed maturity securities, including related parties, were rated NAIC 1 or NAIC 2, the two highest credit rating designations under the NAIC’s criteria (with investments of our German operations rated by applying nationally recognized statistical ratings organization (“NRSRO”) equivalent ratings to map NAIC ratings). In addition to our core fixed income portfolio, we opportunistically allocate 5-10% of our portfolio to alternative investments where we primarily focus on fixed income-like, cash flow-based investments. For instance, our alternative investment positions include significant equity stakes in two asset platforms that originate high quality credit assets (such as residential mortgage loans (“RMLs”), leveraged loans and mortgage servicing rights) that are well aligned with our investment strategy. Our relationship with AAM and Apollo allows us to take advantage of our generally illiquid liability profile and identify asset opportunities with an emphasis on earning incremental yield by taking liquidity risk and complexity risk, rather than assuming solely credit risk. While alternative investments are a relatively small portion of our overall portfolio, our alternative investments strategy has been an important driver of returns. In general, we target returns for alternative investments of 10% or higher on an internal rate of return (“IRR”) basis over the expected lives of such investments.

Through our efficient corporate structure and operations, we believe we have built a cost-effective platform to support our growth opportunities. We believe our fixed operating cost structure supports our ability to maintain an attractive financial profile across market environments. Additionally, we believe we have designed our platform to be highly scalable and support growth without significant incremental investment in infrastructure, which allows us to scale our business production up or down because of our cost-effective platform. As a result, we believe we will be able to convert a significant portion of our new business spread into operating income.

Our operating income, net of tax for our Retirement Services segment was as follows for the periods presented below:

| (In millions) | Three months ended March 31, 2017 | Year ended December 31, 2016 | ||||||

| Retirement Services |

||||||||

| Net investment earnings |

$ | 780 | $ | 2,955 | ||||

| Cost of crediting on deferred annuities |

(263) | (1,019) | ||||||

| Other liability costs(1) |

(189) | (967) | ||||||

| Operating expenses |

(52) | (206) | ||||||

|

|

|

|

|

|||||

| Operating income, before tax |

276 | 763 | ||||||

| Income tax (expense) benefit – operating income |

(9) | 46 | ||||||

|

|

|

|

|

|||||

| Operating income, net of tax |

$ | 267 | $ | 809 | ||||

|

|

|

|

|

|||||

| * | Refer to “—Non-GAAP Measures” for discussion on operating income, net of taxes. |

| (1) | Other liability costs include DAC, DSI and VOBA amortization and change in guaranteed living withdrawal benefits (“GLWB”) and guaranteed minimum death benefits (“GMDB”) reserves for all products, the cost of liabilities on products other than deferred annuities including offsets for premiums, product charges and other revenues. |

5

Table of Contents

Relationship with Apollo

We have a strategic relationship with Apollo which allows us to leverage the scale of its asset management platform. Apollo’s indirect subsidiary, AAM, serves as our investment manager. In addition to co-founding the company, Apollo assists us in identifying and capitalizing on acquisition opportunities that have been critical to our ability to significantly grow our business. The “Apollo Group” consists of (1) Apollo, (2) AAA Guarantor – Athene, L.P. (the “AAA Investor”), (3) any investment fund or other collective investment vehicle whose general partner or managing member is owned, directly or indirectly, by Apollo or one or more of Apollo’s subsidiaries, (4) BRH Holdings GP, Ltd. and its shareholders and (5) any affiliate of any of the foregoing (except that for purposes of this definition, AHL and its subsidiaries and employees of AHL, its subsidiaries or AAM are not members of the Apollo Group). Members of the Apollo Group are significant owners of our common shares and Apollo employees serve on our board of directors. We expect our strategic relationship with Apollo to continue for the foreseeable future. See “Certain Relationships and Related Transactions, and Director Independence—Relationships and Related Party Transactions with Apollo or its Affiliates” in our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 20, 2017 (our “Proxy Statement”), which is incorporated by reference herein, and the sections entitled “Principal and Selling Shareholders” and “Shares Eligible for Future Sale—Lock-Up Agreements” of this prospectus.

The Apollo Group controls and is expected, subsequent to the completion of this offering, to continue to control 45% of the total voting power of AHL and five of our 12 directors are employees of or consultants to Apollo or its affiliates, including our Chairman, Chief Executive Officer and Chief Investment Officer, who is a dual employee of both AHL and AAM. Further, our bye-laws generally limit the voting power of our Class A common shares (and certain other of our voting securities) such that no person owns (or is treated as owning) more than 9.9% of the total voting power of our common shares (with certain exceptions). See “Description of Share Capital—Common Shares.”

Our Market Opportunity

The number of individuals reaching retirement age is growing rapidly while some traditional retirement funding sources have declined in the wake of the financial crisis and the ensuing prolonged low interest rate environment. Our tax-efficient savings products are well positioned to meet this increasing customer demand.

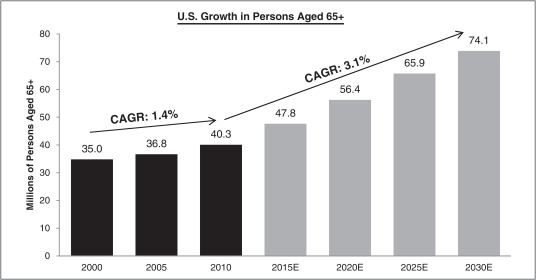

| • | Increasing Retirement-Age Population. Over the next three decades, the retirement-age population is expected to experience unprecedented growth. According to the U.S. Census Bureau, there were approximately 40 million Americans age 65 and older in 2010, representing 13% of the U.S. population. By 2030, this segment of the population is expected to increase by 34 million or 85% to approximately 74 million, which would represent approximately 21% of the U.S. population. Technological advances and improvements in healthcare are projected to continue to contribute to increasing average life expectancy, and aging individuals must be prepared to fund retirement periods that will last longer than ever before. Furthermore, many working households in the United States do not have adequate retirement savings. Demand for traditional fixed rate annuities and FIAs will likely |

6

Table of Contents

| be bolstered by this gap resulting from the growing need for guaranteed income streams and the expanding retirement population’s insufficient savings base. |

|

|

| Source: U.S. Census Bureau. |

| • | Increasing Demand for Tax-efficient Savings Products. According to a 2015 report published by the Government Accountability Office, approximately 50% of individuals age 55 and older have no retirement savings. As a tool for addressing the unmet need for retirement planning, we believe that many Americans have begun to look to tax-efficient savings products with low-risk or guaranteed return features and potential equity market upside, particularly as federal, state and local marginal tax rates have increased. As interest rates rise, we expect to benefit from increased demand for our tax-efficient savings products as crediting and participation rates become more attractive on an absolute basis, and relative to alternative fixed income and savings vehicles such as certificates of deposit (“CDs”) and corporate bonds. |

| • | Shift in the Competitive Environment. Products with guarantees require superior asset and risk management expertise to balance policyholder security, regulatory demands and shareholder returns on equity. Since the financial crisis, many companies have placed their fixed annuity businesses in run-off and have sold substantial blocks to third parties including us. The current market and regulatory environment, including the newly-issued U.S. Department of Labor (“DOL”) regulations regarding fiduciary obligations of distributors of products to retirement accounts could provide us additional sources of growth through reinsurance and/or acquisitions to the extent that competitors divest in-force blocks of business as a result of such environment. However, we have also seen and may in the future see additional competitors enter the market who could compete for such sources of growth. |

| • | Increasing Asset Opportunities. Regulatory changes in the wake of the financial crisis have made it less profitable for banks and other traditional lenders to hold certain illiquid and complex asset classes, notwithstanding the fact that these assets may have prudent credit characteristics. This market pullback has resulted in a supply-demand imbalance, which has created the opportunity for knowledgeable investors to acquire high-quality assets that offer attractive returns. As these institutions continue to comply with these new rules, we believe additional assets will become available which could be attractive for our business. |

7

Table of Contents

| • | Large Market Opportunity. The distribution channels we have developed provide us access to large markets for our products. Increasing demand for tax-efficient retirement savings products suggests that these markets will remain robust while many companies are still hesitant to commit significant capital to these channels due to increasing regulation, capital requirements and the low interest rate environment. We believe these market dynamics will enable us to continue to profitably gain share in each of the markets on which we focus. For example, within the retail channel, according to LIMRA, for the year ended December 31, 2016, we were the 5th largest company in sales of fixed annuities with a 4.5% market share and the 3rd largest company in sales of FIAs with a 7.4% market share. We believe we will benefit from both the growth in the overall market as the market expands to meet the increased demand for tax-efficient retirement savings products and from gains in our market share as we continue to build our capabilities, strengthen our relationships and enter new markets within our existing channels. |

| Retail & Flow Reinsurance |

FABN | Total U.S. Pension Assets |

||||||||||

| Market Size |

$117 billion(1) | $59 billion(2) | $3.3 trillion(3) | |||||||||

| (1) | Source: LIMRA – total fixed annuity sales in 2016. |

| (2) | Source: S&P Global Ratings – Article dated July 18, 2016 entitled “Funding Agreement – Backed Note Issuance Totaled $6.8 Billion in First Half 2016.” |

| (3) | Source: Federal Reserve Statistical Release, Q4 2016 – U.S. private defined benefit pension assets. |

Competitive Strengths

We believe the following strengths will allow us to capitalize on the growth prospects for our business:

| • | Ideal Platform to Capitalize on Positive Demographic and Market Trends. We have designed our products to capitalize on the growing need for retirement savings solutions. Our products provide protection against market downturns and offer interest which compounds on a tax-deferred basis until funds are distributed. Many of our products also provide the potential to earn interest based on the performance of a market index. These features provide distinct advantages over traditional savings vehicles such as bank CDs and variable annuities. Despite a challenging interest rate environment, we were able to profitably source $1.1 billion and $5.3 billion of fixed annuity products through our retail channel for the three months ended March 31, 2017 and the year ended December 31, 2016, respectively, by leveraging our product design capabilities, our investment acumen, which allows us to invest at appropriate investment margins, and our scalable operating platform. We offer prudent product features at attractive prices. If investment rates increase due to a rise in interest rates or widening credit spreads, we would be able to offer higher crediting rates, which we believe would generate additional demand for our products and therefore increased sales. Even in a long-term low rate environment, we believe our underwriting expertise and ability to find and compete in areas of the market that are rationally priced will allow us to maintain strong operating results. For example, in prior years, our retail operations have generally not competed aggressively in the guaranteed income rider segment as we historically believed that such riders were not priced within our pricing discipline. However, more recently, competitors have been issuing annuities with what we believe are more rationally-priced lifetime income benefit features. In the current environment, we believe that we can grow our retail sales by offering competitive guaranteed income rates while earning an attractive return. |

| • | Multiple Distribution Channels. We have four dedicated distribution channels to capitalize on retirement services opportunities across market environments and grow our liabilities. Our key distribution channels are retail, reinsurance (including flow and block reinsurance), institutional products (focused on the sale of funding agreements and pension risk transfer transactions) and acquisitions. We intend to maintain a presence within each of these distribution channels with the |

8

Table of Contents

| ability to underwrite liabilities. However, we do not have any market share targets across our organization, which we believe provides us flexibility to respond to changing market conditions in one or more channels and to opportunistically grow liabilities that generate our desired levels of profitability. In a rising interest rate environment, we believe we will be able to profitably increase the volume of our retail, flow reinsurance and institutional product sales and we believe we will see increased acquisition and block reinsurance opportunities in more challenging market environments. We are diligent in setting our return targets based on market conditions and risks inherent to our products offered and acquisitions or block reinsurance transactions. In general, we may accept lower returns on products which may provide more certain return characteristics, such as funding agreements, and we may require higher returns for products or transactions where there is more inherent risk in meeting our return targets, such as with acquisitions. If market conditions or risks inherent to a product or transaction create return profiles that are not acceptable to us, we generally will not sacrifice our profitability merely to facilitate growth. |

| • | Superior and Unique Investment Capabilities. We believe our relationships with AAM and Apollo provide access to superior and unique investment capabilities that allow us to invest a portion of our assets in securities that earn us incremental yield by taking liquidity risk and complexity risk, capitalizing on our long-dated and persistent liability profile to prudently achieve higher net investment earned rates, rather than assuming solely credit risk. Our investing capabilities support our ability to sell fixed annuities profitably and to price acquisitions competitively while meeting our return targets. Through AAM, we have access to more than 100 investment and operations professionals who are highly familiar with our business objectives and funding structure. This enables AAM to customize asset allocations and select investments for us that are most appropriate for our business. In addition, our strategic relationship with Apollo provides us with access to Apollo’s broad credit and alternative investment platforms and allows us to leverage the scale, sourcing and investing capabilities, and infrastructure of an asset manager with more than $197 billion of AUM, which includes approximately $72.3 billion of our invested assets as of March 31, 2017. Apollo’s global asset sourcing capabilities in a diverse array of asset classes provide AAM with the opportunity to capitalize on attractive investments for us. |

| • | In each of our U.S. acquisitions, we have successfully reinvested our acquired investment portfolio with the objective of achieving higher returns than were achieved on such investments prior to the acquisition. For example, we have reinvested a substantial portion of the investment portfolio acquired in our acquisition of Aviva USA Corporation (“Aviva USA,” now known as Athene USA Corporation, “Athene USA”), which contributed to the increase in fixed income and other net investment earned rates on this block of business to 4.12% for the year ended December 31, 2015 from 3.50% (on an annualized basis) for the fourth quarter of 2013. |

| • | Apollo and AAM work collaboratively to identify and quickly capitalize on opportunities in various asset classes. For example, we were an early investor in distressed non-agency residential mortgage-backed securities (“RMBS”) during 2009 and 2010, prior to the strong recovery of that market in later years. By the end of 2010, we had acquired a portfolio of $448 million (approximately 24% of our total invested assets at such time) of non-agency RMBS at discounts to par, well in advance of the significant price improvements in these investments. Today, RMBS continues to represent an important asset class within our investment portfolio. As of March 31, 2017, 14.6% of our invested assets were invested in RMBS, with such securities having an amortized book price of 84% of aggregate par value. This asset class contributed a net investment earned rate of 5.45% (on an annualized basis) and 5.18% for the three months ended March 31, 2017 and the year ended December 31, 2016, respectively, with 97.7% and 98.0% rated NAIC 1 or NAIC 2 as of March 31, 2017 and December 31, 2016, respectively. Total structured securities contributed a net investment earned rate of 4.95% (on an annualized basis) and 5.12% for the three months ended March 31, 2017 |

9

Table of Contents

| and the year ended December 31, 2016, respectively, with 92.4% and 93.0% rated NAIC 1 or NAIC 2 as of March 31, 2017 and December 31, 2016, respectively. |

| • | AAM selects investments and develops investment strategies prior to our purchase in accordance with our investment limits, and works in concert with our risk management team to stress-test the underwritten assets and asset classes under various negative scenarios. For the three months ended March 31, 2017 and the year ended December 31, 2016, our other-than-temporary-impairment (“OTTI”) as a percentage of our average invested assets was 1 basis point (on an annualized basis) and 4 basis points, respectively. |

| • | We also have access to expertise and capabilities to directly originate a wide range of asset classes through AAM and Apollo. Direct origination allows the selection of assets that meet our liability profile and the sourcing of better quality investments. |

| • | Efficient Corporate Platform to Support Profitability. We believe we have designed an efficient corporate platform to support our portfolio of $72.2 billion of reserve liabilities as of March 31, 2017. Over the 7.9 year weighted average life of our deferred annuities, we expect to generate an annual investment margin of 2-3%. |

In addition, our corporate platform enables us to be highly scalable and allows us to onboard incremental business without significant additional investment in infrastructure and with low incremental fixed operating cost. As a result, we believe we should be able to convert a significant portion of incremental net investment income from additional invested assets and liabilities into operating income.

| • | Strength of Balance Sheet. We believe the strength of our balance sheet provides confidence to our policyholders and business partners and positions us for continued growth. We presently hold over $1.5 billion in excess capital and have no financial leverage. We maintain what we believe to be high capital ratios for our rating, with our top level insurance subsidiary, AADE, having a U.S. RBC ratio of 478% and ALRe having a BSCR ratio of 228%, each as of December 31, 2016. Our ALRe RBC ratio was 529% as of December 31, 2016 when applying the NAIC RBC factors. As of March 31, 2017, our estimated U.S. RBC ratio and estimated ALRe RBC ratio remained strong at 466% and 530%, respectively. To further reinforce our strong liquidity profile, we have access to a $1.0 billion revolving credit facility that is currently undrawn. Our invested assets comprise what we believe to be a highly rated and well diversified portfolio. As of March 31, 2017, 93.0% of our AFS fixed maturity securities, including related parties, were rated NAIC 1 or NAIC 2. These assets are managed against what we believe to be prudently underwritten liabilities, which were, in each case, priced by us after the financial crisis. |

| • | Robust Risk Management. We have established a comprehensive enterprise risk management (“ERM”) framework and risk management controls throughout our organization, which are further supported by AAM’s and Apollo’s own risk management capabilities that are intended to help us maintain our continued financial strength. We manage our business, capital and liquidity profile with the objective of withstanding severe adverse shocks, such as the 2007-2008 financial crisis, while maintaining a meaningful buffer above regulatory minimums and above certain capital thresholds to meet our desired credit ratings. Risk management is embedded in all of our business decisions and processes, including acquisitions, asset purchases, product design and underwriting, liquidity and liability management. Certain of the key attributes of our risk management profile are: |

| • | We maintain a risk committee of the board of directors charged with the oversight of the development and implementation of systems and processes designed to identify, manage and mitigate reasonably foreseeable material risks and with the duty to assist our board of directors and our other board committees with fulfilling their oversight responsibilities for our risk management function. |

10

Table of Contents

| • | We believe that we underwrite liabilities and manage new product development prudently. Further, we believe that our strong fixed annuity underwriting provides us with long-dated and persistent liabilities, which we believe are priced at desirable levels to enable us to achieve attractive, risk-adjusted returns. |

| • | We believe we have designed our asset liability management (“ALM”) procedures to protect the company, within limits, against significant changes in interest rates. |

| • | As of March 31, 2017, approximately 86% of our deferred annuity products had surrender charges and 73% had MVAs, each of which provide stability to our reserve liabilities. |

| • | As of March 31, 2017, 29% of our invested assets were floating rate investments which would allow us the flexibility to quickly increase our crediting rates in a rising interest rate environment, if desired. |

| • | We believe that we maintain an appropriate amount of assets that could be quickly liquidated, if needed, and have an additional liquidity cushion through a $1.0 billion revolving credit facility, which is undrawn as of the date hereof. |

| • | We believe we hold a high-quality portfolio, with 93.0% of our AFS fixed maturity securities, including related parties, rated as NAIC 1 or NAIC 2 as of March 31, 2017 (with investments of our German operations rated by applying NRSRO equivalent ratings to map NAIC ratings). |

| • | AAM evaluates our structured securities at the time of acquisition using AAM’s proprietary credit models. |

| • | Even during periods of moderate economic stress, based on our modeled estimates, we maintain what we believe to be an appropriate amount of liquidity to invest in opportunities as they arise. |

| • | Highly Experienced Management Team with Demonstrable Track Record. Our highly successful, entrepreneurial senior management team has extensive experience in building companies, insurance operations, and investment management. We have assembled a management team of individuals who bring strong capabilities and experience to each facet of running our company. We are led by three well known and well respected industry executives with an average of 30 years of experience. James R. Belardi, our Chairman and founder, spent the majority of his career as the President of SunAmerica Life Insurance Company and Chief Investment Officer of American International Group, Inc. (“AIG”) Retirement Services, Inc. William J. Wheeler, our President, served as President of the Americas Group and Chief Financial Officer at MetLife Inc. (“MetLife”) prior to joining our company, and Martin P. Klein, our Chief Financial Officer, was previously Chief Financial Officer of Genworth Financial, Inc. Our management team oversees the company’s activities and its day-to-day management, including through various committees designed to manage our strategic initiatives, risk appetite and investment portfolio. See “Corporate Governance—Committees of the Board of Directors—Management Committees” in our Proxy Statement. |

Growth Strategy

The key components of our growth strategy are as follows:

| • | Continue Organic Growth by Expanding Our Distribution Channels. We plan to grow organically by expanding our retail, reinsurance and institutional product distribution channels. We believe that we have the right people, infrastructure and scale to position us for continued growth. We aim to grow our retail channel in the United States by deepening our relationships with our approximately 65 IMOs and approximately 33,000 independent agents. Our strong financial position and capital efficient products allow us to be a dependable partner with IMOs and consistently write new business. We work with our IMOs to develop customized, and at times exclusive, products that help drive sales. |

11

Table of Contents

We expect our retail channel to benefit from our recent financial strength rating upgrade by A.M. Best to A and to continue to benefit from the rating upgrades in 2015. We also expect our retail channel to benefit from our improving credit profile and recent product launches. We believe this should support growth in sales at our desired cost of crediting through increased volumes via current IMOs and access to new distribution channels, including small to mid-sized banks and regional broker-dealers. We are implementing the necessary technology platform, hiring and training a specialized sales force, and have created products to capture new potential distribution opportunities.

Our reinsurance channel also benefited from the 2015 ratings upgrades and we expect to further benefit from the A.M. Best upgrade to a financial strength rating of A in April 2017. We target reinsurance business consistent with our preferred liability characteristics, and as such, reinsurance provides another opportunistic channel for us to source long-term liabilities with attractive crediting rates. For the three months ended March 31, 2017 and 2016, we generated deposits through our flow reinsurance channel of $166 million and $912 million, respectively, and $3.5 billion, $1.1 billion and $349 million for the years ended December 31, 2016, 2015 and 2014, respectively. We believe the decrease in flow reinsurance has been impacted by the recent decline in overall MYGA volumes over the last several months, reflective of the recent stock market rally and expectations that interest rates will increase. As we continue to source additional reinsurance partners, we expect to further diversify our flow reinsurance channel and expect that our recent ratings upgrade by A.M. Best and our improving credit profile will help us attract additional reinsurance partners.

In our institutional channel, we sold our first funding agreement under our FABN program in 2015. During the three months ended March 31, 2017 and in April 2017, we issued funding agreements in the aggregate principal amount of $650 million and $1.1 billion, respectively. We expect our institutional channel to continue to grow over time as we issue additional funding agreements and pursue pension risk transfer transactions.

Through our multiple distribution channels, we have grown our reserve liabilities to $72.2 billion as of March 31, 2017. The following summarizes our reserve liabilities by product:

| (In millions, except percentages) | March 31, 2017 | December 31, 2016 | ||||||||||||||

| Annuities |

||||||||||||||||

| Fixed indexed annuities |

$ | 44,502 | 61.6% | $ | 43,501 | 61.3% | ||||||||||

| Fixed rate annuities |

13,398 | 18.6% | 13,490 | 19.0% | ||||||||||||

| Payout annuities |

5,378 | 7.4% | 5,446 | 7.7% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total annuities products |

63,278 | 87.6% | 62,437 | 88.0% | ||||||||||||

| Funding agreements |

1,376 | 1.9% | 957 | 1.4% | ||||||||||||

| Life and other (excluding German products) |

2,181 | 3.1% | 2,176 | 3.0% | ||||||||||||

| German products |

5,367 | 7.4% | 5,381 | 7.6% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total reserve liabilities |

$ | 72,202 | 100.0% | $ | 70,951 | 100.0% | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| • | Pursue Attractive Acquisitions. We plan to continue leveraging our expertise in sourcing and evaluating transactions to grow our business profitably. From our founding through March 31, 2017, we have grown to $73.6 billion in invested assets and $72.2 billion in reserve liabilities, primarily through acquisitions and block reinsurance transactions. We believe that our demonstrated ability to successfully consummate complex transactions, as well as our relationship with Apollo, provide us with distinct advantages relative to other acquirers and reinsurance companies. Furthermore, our business has achieved sufficient scale to provide meaningful operational synergies for the businesses and blocks of business that we acquire. Consequently, we believe we are often sought out by companies looking to transact in the acquisitions and block reinsurance markets. |

In furtherance of our strategy of growth through acquisitions, we routinely review and conduct investigations of potential acquisitions of business or blocks of business, some of which may be

12

Table of Contents

material. When we believe a favorable opportunity exists, we seek to enter into discussions with target companies or sellers regarding the possibility of such acquisitions. At any given time, we may be in discussions with one or more counterparties. There can be no assurances that any such negotiations will lead to definitive agreements, or if such agreements are reached, that any transactions would be consummated.

| • | Expand Our Product Offering and International Presence. Our efforts to date have focused on developing and sourcing retirement savings products and we are continuing such efforts by expanding our retail product offerings. On April 11, 2016, we launched our largest new retail product initiative, whereby we: (1) enhanced our most popular accumulation product, “Performance Elite,” with two new indices, (2) announced a new MYGA product designed for the bank and broker-dealer channel and (3) introduced an income-focused product, “Ascent Pro.” With the introduction of our new MYGA product and Ascent Pro, our retail channel is now competing in a much broader segment of the overall retirement market. For the nine months during which these new products were on the market in 2016, new MYGA sales in the IMO and financial institution channels were $603 million and Ascent Pro sales were $1.3 billion. See “Business—Products” in our Annual Report. |

Additionally, while our organic growth initiatives and acquisitions have largely been focused on opportunities in the United States, our acquisition of Delta Lloyd Deutschland AG (“DLD,” now known as Athene Deutschland GmbH, “AD”) in October 2015 demonstrated the geographic scalability of our strategy and our ability to capitalize quickly on international market environments as well. While we continue to believe that the European market provides a compelling growth opportunity to amass liabilities at one of the most favorable costs of funding in a number of years, we have come to realize that the opportunity over the next several years is larger than we initially anticipated. We have concluded that, in order to fully capitalize on this opportunity, we would need to commit capital to the European market at a level in excess of our targeted investment size, creating the need for third party capital to support growth. See “Business—Products—German Products—AGER Equity Offering” in our Annual Report and “Note 15—Subsequent Events” in the unaudited condensed consolidated financial statements and notes thereto in our Quarterly Report.

Recently, we have also developed our capabilities to undertake pension risk transfer transactions. Pension risk transfer transactions usually involve the issuance of a group annuity contract, sometimes through a separate account, in exchange for the transfer of pension liabilities from a terminating defined benefit plan. U.S. pension liabilities are estimated to be $2 to $3 trillion with an estimated $1 trillion of liabilities that may become available for closeout, with approximately $15 to $20 billion of expected annual closeout activity over the next several years. We are focused on medium- and large-sized deals where we believe that we can be competitive. We believe that we can leverage our sourcing expertise to underwrite these transactions and maintain our focus on writing profitable new business.

| • | Leverage Our Unique Relationship with Apollo and AAM. We intend to continue leveraging our unique relationship with Apollo and AAM to source high-quality assets with attractive risk-adjusted returns. Apollo’s global scale and reach provide us with broad market access across environments and geographies and allow us to actively source assets that exhibit our preferred risk and return characteristics. For instance, through our relationship with Apollo and AAM, we have indirectly invested in companies including MidCap FinCo Limited (“MidCap”) and AmeriHome Mortgage Company, LLC (“AmeriHome”). In 2013, Apollo presented us with an opportunity to fund the acquisition of MidCap, a middle-market lender focused on asset-backed loans, leveraged loans, real estate, rediscount loans and venture loans. Our equity investment in MidCap provides us with an alternative investment that meets the key characteristics we look for including an attractive risk-return profile. Our equity investment in MidCap is held indirectly through an investment fund, AAA Investments (Co-Invest VII), L.P. (“CoInvest VII”), of which MidCap constituted the majority of the fund’s investments. CoInvest VII returned an annualized net investment earned rate of 11.74% and |

13

Table of Contents

| 15.15% for the three months ended March 31, 2017 and the year ended December 31, 2016, respectively. As of March 31, 2017, our equity investment and loans to Midcap were valued at $528 million and $238 million, respectively. |

Similarly in 2013, AAM proposed that Athene and an Apollo co-investor fund and launch AmeriHome, a mortgage lender and servicer with expertise in mortgage industry fundamentals that we believe are key to operating a successful and sustainable mortgage lender/servicer. Like our investment in MidCap, our equity investment in AmeriHome meets the key characteristics we look for in an alternative investment. Our equity investment in AmeriHome is held indirectly through an investment fund, A-A Mortgage Opportunities, L.P. (“A-A Mortgage”), and AmeriHome is currently A-A Mortgage’s only investment. Abiding by its core principles, AmeriHome has grown profitably, with A-A Mortgage returning an annualized net investment earned rate of 10.11% and 11.62% for the three months ended March 31, 2017 and the year ended December 31, 2016, respectively. As of March 31, 2017, our equity investment in A-A Mortgage was valued at $449 million.

| • | Dynamic Approach to Asset Allocation during Market Dislocations. As we have done successfully in the past, we plan to fully capitalize on future market dislocations to opportunistically reposition our portfolio to capture incremental yield. For example, during 2009-2010, we reinvested a significant portion of our portfolio into RMBS. Additionally, regulatory changes in the wake of the financial crisis have made it more expensive for banks and other traditional lenders to hold certain illiquid and complex assets, notwithstanding the fact that these assets may have prudent credit characteristics. This change in demand has provided opportunities for investors to acquire high-quality assets that offer attractive returns. For example, we see emerging opportunities as banks retreat from direct mortgage lending, structured and asset-backed products, and middle-market commercial loans. We intend to maintain a flexible approach to asset allocation, which will allow us to act quickly on similar opportunities that may arise in the future across a wide variety of asset types. |

| • | Maintain Risk Management Discipline. Our risk management strategy is to proactively manage our exposure to risks associated with interest rate duration, credit risk and structural complexity of our invested assets. We address interest rate duration and liquidity risks through managing the duration of the liabilities we source with the assets we acquire, and through ALM modeling. We assess credit risk by modeling our liquidity and capital under a range of stress scenarios. We manage the risks related to the structural complexity of our invested assets through AAM’s modeling efforts. The goal of our risk management discipline is to be able to continue growth and to achieve profitable results across various market environments. |

Additional Information

Athene is an exempted company organized under the laws of Bermuda. Our principal executive offices are located at Chesney House, First Floor, 96 Pitts Bay Road, Pembroke, HM08, Bermuda, and our telephone number is (441) 279-8400. Our website address is www.athene.com. Information contained on our website or connected thereto does not constitute a part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

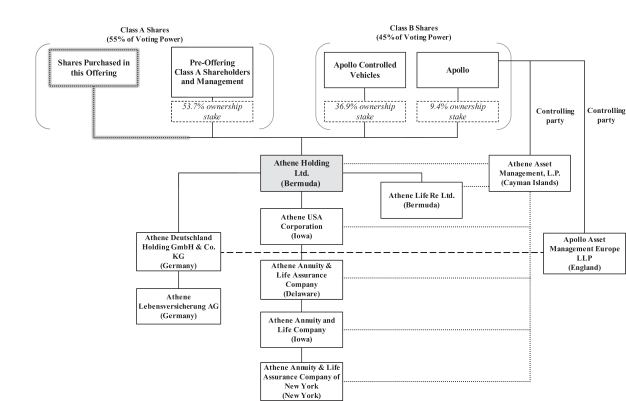

Organizational Chart

Below is an organizational chart that summarizes our ownership and corporate structure. We have two classes of voting shares outstanding, Class A common shares and Class B common shares. Each such Class A common share and Class B common share is economically equivalent—the dollar value of one Class A common share is equivalent to the dollar value of one Class B common share. However, Class A common shares and Class B common shares differ in terms of voting power. The Class A common shares currently account for 55%

14

Table of Contents

of our aggregate voting power and the Class B common shares currently account for the remaining 45% of our aggregate voting power. The Class B common shares are held by members of the Apollo Group, which includes funds managed by affiliates of Apollo, and accordingly, the Apollo Group beneficially owns or exercises voting control over all of the Class B common shares. Holders of the Class B common shares may convert any or all of their Class B common shares into Class A common shares on a one-to-one basis, at any time, including upon a sale of their shares (subject to any applicable lock-up restrictions), upon notice to us. So long as any member of the Apollo Group owns at least one Class B common share, such member will still be able to assert voting control over 45% of our aggregate voting power. See “Description of Share Capital—Common Shares—Voting Rights.”

As a result of certain regulatory and tax limitations, our bye-laws prohibit holders of Class A common shares and their Control Groups (as defined herein) and certain other classes of common shares (other than those owned by the Apollo Group) from having more than 9.9% of the total voting power of our common shares. Any amounts in excess of such 9.9% will be reallocated proportionately among all other of our Class A common shareholders who were not members of the relevant Control Group so long as such reallocation does not cause such other shareholder or its related Control Group to hold more than 9.9% of the total voting power of our shares. See “Description of Share Capital—Common Shares—Voting Rights—Class A Common Shares.”

AAM acts as the investment manager to our U.S. and Bermuda companies. AAME acts as the investment adviser to our German subsidiaries.

The dotted lines connecting AAM to AHL and certain of its subsidiaries and the dashed line connecting AAME to Athene Deutschland Holding GmbH & Co. KG (“ADKG”) denote our investment management and advisory relationships, respectively.

15

Table of Contents

The ownership percentages shown reflect our percentage ownership prior to the offering.(1)(2)

| (1) | The organizational chart shows AHL and its material insurance company and holding company subsidiaries and omits certain of its subsidiaries, including certain insurance companies and intermediate holding companies. For a complete list of subsidiaries of AHL, please see Exhibit 21.1 to our Annual Report. |

| (2) | The ownership structure of AHL shown in the organizational chart is representational only and does not include the names of the direct or beneficial owners of our common shares. For more information about certain beneficial owners of our common shares, please see “Principal and Selling Shareholders.” |

16

Table of Contents

| The Offering

| ||

| Class A common shares offered by the selling shareholders in this offering | Class A common shares (plus up to an additional Class A common shares that the selling shareholders may sell upon the exercise of the underwriter’s option to purchase additional Class A common shares). | |

| Class A common shares outstanding as of April 17, 2017 | 101,618,993 shares. | |

| Class B common shares outstanding as of April 17, 2017 | 87,740,079 shares. | |

| Class M common shares outstanding as of April 17, 2017 | 11,078,924 shares. The Class M common shares are convertible, once vested and the conversion price paid, on a one-for-one basis into Class A common shares. | |

| Voting Rights | The Class A common shares collectively represent 55% of the total voting power of our common shares, subject to certain voting restrictions and adjustments. The Class B common shares, which are beneficially owned by members of the Apollo Group, represent, in aggregate, 45% of the total voting power of our common shares, subject to certain adjustments. Our Class A common shares may be subject to a cap of the voting power attributable to such shares or may be deemed to be non-voting depending upon whether a holder of such shares is subject to the restrictions set forth in our bye-laws. See “Description of Share Capital—Common Shares—Voting Rights.” | |

| Use of proceeds | We will not receive any proceeds from the sale of the selling shareholders’ Class A common shares. | |