| MB APPROVAL | |

| OMB Number:

3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22595 |

| FSI Low Beta Absolute Return Fund |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

Paul F. Leone

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (918) 585-5858 |

| Date of fiscal year end: | August 31 | |

| Date of reporting period: | August 31, 2020 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

FSI

LOW BETA ABSOLUTE

RETURN FUND

Annual Report

August 31, 2020

Investment Adviser |

Administrator |

This report and the financial statements contained herein are provided for the general information of the unitholders of the FSI Low Beta Absolute Return Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s unitholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive unitholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive unitholder reports and other communications from the Fund electronically by contacting the Fund at 1-877-379-7380 or, if you own these units through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your unitholder reports by contacting the Fund at 1-877-379-7380. If you own units through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your unitholder reports. Your election to receive reports in paper will apply to all Funds held or at your financial intermediary.

FSI LOW BETA ABSOLUTE RETURN FUND Shareholder Letter August 31, 2020 (Unaudited) |

We are pleased to provide the annual report for the FSI Low Beta Absolute Return Fund (the “Fund”) for the twelve-month reporting period ended August 31, 2020 (the “Period”). Please read on for Fund performance and a brief overview of the economic and market conditions during the Fund’s reporting period.

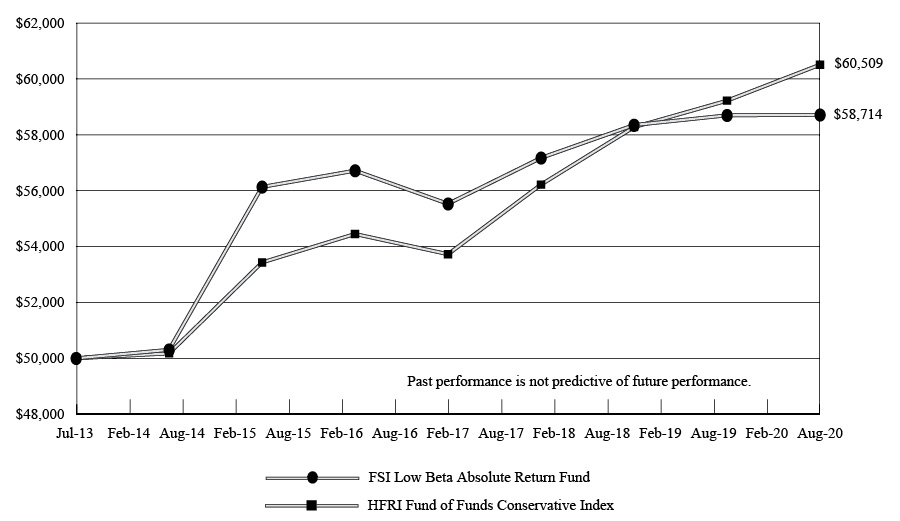

For the Period, the Fund posted a 0.03% return, compared to 2.17% for its benchmark, the HFRI Fund of Funds Conservative Index (the “Benchmark”). Since the Fund’s inception in July 2013, it has posted a cumulative return of 17.43%, compared to 21.02% for the Benchmark.

We have consistently hedged the Fund against expected market corrections. For the Period the Fund hedging is the largest driver of underperformance relative to the Benchmark. Hedging activity later in the period aided in portfolio recovery. We expect that conservatively hedging the Fund will produce long term effective results. We continue to believe the Fund is well positioned to take advantage of what we foresee as a strong hedge fund environment going forward. Specifically, the variety of hedge fund managers that we employ, and the various alternative investment strategies utilized by the Fund should be able to benefit from opportunities across asset classes.

During the Period, unprecedented stimulus from the Federal Reserve and Congress has driven equity and bond markets even in the midst of the biggest economic shutdown in memory and future economic uncertainty. Volatility persisted throughout both market rallies and selloffs. The markets are at or near all-time highs even while economic instability still plagues main street America. Geopolitical risks remain; a Chinese trade war, the global pandemic, and worldwide economic struggles remain fluid and the long-term impacts remain unclear.

In 2020 the Fed announced a new interest rate target using average future inflation expectations; with no specific formula the Fed will not necessarily raise rates if the economy overheats from an inflation standpoint. During the current eleven-year bull cycle, excessive liquidity created by global quantitative easing has been the primary asset price driver. This Monetary stimulus alongside the largest ever Fiscal stimulus ($2bb, with more expected imminently) caused markets to recover from the pandemic-led selloff in the shortest time ever seen.

The divergence between value (S&P Value 1 year +4.2%) and growth (S&P Growth 1 year +37.3%) as well as large caps (S&P 500 1 year +22.2%) and small caps (Russell 2000 1 year +7.1%) continued to be a theme for the Period. Fixed income rates are at all-time lows, and the forward expectation is for muted volatility.

AN INVESTMENT IN THE FUND SHOULD BE CONSIDERED A SPECULATIVE INVESTMENT THAT ENTAILS A HIGH DEGREE OF RISK AND UNITS OF THE FUND ARE ONLY AVAILABLE FOR PURCHASE BY CERTAIN ELIGIBLE INVESTORS. IT IS POSSIBLE THAT AN INVESTOR MAY LOSE SOME OR ALL OF ITS INVESTMENT AND THAT THE FUND MAY NOT ACHIEVE ITS INVESTMENT OBJECTIVE. FOR A COMPLETE DESCRIPTION OF THE RISKS INVOLVED AND THE ELIGILIBITY CRITERIA FOR INVESTORS, PLEASE REFER TO THE FUND’S CURRENT PROSPECTUS.

A FUND UNITHOLDER DOES NOT HAVE THE RIGHT TO REQUIRE THE FUND TO REDEEM OR REPURCHASE ITS UNITS AND MAY NOT HAVE ACCESS TO THE MONEY IT INVESTS FOR AN INDEFINITE PERIOD OF TIME. REPURCHASES WILL BE MADE AT SUCH TIMES, AND IN SUCH AMOUNTS, AND ON SUCH TERMS AS MAY BE DETERMINED BY THE FUND’S BOARD OF TRUSTEES, IN ITS SOLE DISCRETION. FUND UNITS ARE NOT, AND ARE NOT EXPECTED TO BE, LISTED FOR TRADING ON ANY SECURITIES EXCHANGE AND, TO THE FUND’S KNOWLEDGE, THERE IS NO, NOR WILL THERE BE, A SECONDARY TRADING MARKET FOR THE UNITS. UNITS ARE SUBJECT TO SUBSTANTIAL RESTRICTIONS ON TRANSFERABILITY AND RESALE, AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE FUND’S AGREEMENT AND DECLARATION OF TRUST, AS MAY BE AMENDED OR AMENDED AND RESTATED FROM TIME TO TIME. A

1

FSI LOW BETA ABSOLUTE RETURN FUND Shareholder Letter (Continued) August 31, 2020 (Unaudited) |

UNITHOLDER SHOULD NOT EXPECT TO BE ABLE TO SELL ITS UNITS REGARDLESS OF HOW THE FUND PERFORMS. BECAUSE A UNITHOLDER MAY BE UNABLE TO SELL ITS UNITS, THE UNITHOLDER WILL BE UNABLE TO REDUCE ITS EXPOSOSURE TO THE FUND ON ANY MARKET DOWNTURN.

THE PAST PERFORMANCE OF ANY INVESTMENT, INVESTMENT STRATEGY, OR INVESTMENT STYLE IS NOT INDICATIVE OF FUTURE PERFORMANCE. RESULTS OF AN INVESTMENT IN THE FUND MADE TODAY MAY DIFFER SUBSTANTIALLY FROM THE FUND’S HISTORICAL PERFORMANCE. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT AN INVESTOR’S UNITS, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN ORIGINAL COST. TOTAL RETURN FIGURES FOR THE FUND INCLUDE THE REINVESTMENT OF DIVIDENDS AND CAPITAL GAINS, AS APPLICABLE, AND ARE NET OF FEES. REFERENCES TO THE BENCHMARK ARE FOR COMPARATIVE PURPOSES ONLY.

THE VIEWS IN THIS REPORT ARE THOSE OF FINANCIAL SOLUTIONS, INC. (“FSI”), THE FUND’S INVESTMENT ADVISER. THESE VIEWS ARE FOR THE PERIOD ENDED AUGUST 31, 2020 AND MAY NOT REFLECT FSI’S VIEWS ON THE DATE THIS REPORT IS FIRST PUBLISHED OR ANYTIME THEREAFTER.

THE HFRI FUND OF FUNDS CONSERVATIVE INDEX REPRESENTS FUND OF FUNDS THAT EXHIBIT ONE OR MORE OF THE FOLLOWING CHARACTERISTICS: INVESTS IN A VARIETY OF STRATEGIES AMONG MULTIPLE MANAGERS; A STANDARD DEVIATION GENERALLY LOWER THAN THE HFRI FUND OF FUND COMPOSITE INDEX; DEMONSTRATES GENERALLY CLOSE PERFORMANCE AND RETURNS DISTRIBUTION CORRELATION TO THE HFRI FUND OF FUND COMPOSITE INDEX. A FUND IN THE HFRI FUND OF FUND CONSERVATIVE INDEX SHOWS GENERALLY CONSISTENT PERFORMANCE REGARDLESS OF MARKET CONDITIONS. FUND OF FUNDS INVEST WITH MULTIPLE MANAGERS THROUGH FUNDS OR MANAGED ACCOUNTS. THE STRATEGY DESIGNS A DIVERSIFIED PORTFOLIO OF MANAGERS WITH THE OBJECTIVE OF SIGNIFICANTLY LOWERING THE RISK (VOLATILITY) OF INVESTING WITH AN INDIVIDUAL PORTFOLIO MANAGER. THE FUND OF FUNDS MANAGER HAS DISCRETION IN CHOOSING WHICH STRATEGIES TO INVEST IN FOR THE PORTFOLIO.

BETA IS A QUANTITATIVE MEASURE OF VOLATILITY OF A SECURITY OR STRATEGY RELATIVE TO A MARKET INDEX. AN INVESTMETN WITH A BETA LESS THAN 1.0 IS LESS VOLATILE THAN THE MARKET WHILE AN INVESTMENT WITH A BETA GREATER THAN 1.0 IS MORE VOLATILE THAN THE MARKET.

2

FSI LOW BETA ABSOLUTE RETURN FUND Performance Information August 31, 2020 (Unaudited) |

Comparison of the Change in Value of a $50,000 Investment in FSI Low Beta Absolute Return Fund

and the HFRI Fund of Funds Conservative Index

Average Annual Total Returns |

|||

1 Year |

5 Years |

Since |

|

FSI Low Beta Absolute Return Fund (a) |

0.03% |

0.69% |

2.27% |

HFRI Fund of Funds Conservative Index |

2.17% |

2.13% |

2.70% |

|

(a) |

The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. |

|

* |

Represents the period from the commencement of operations (July 1, 2013) through August 31, 2020. |

3

FSI LOW BETA ABSOLUTE RETURN FUND Schedule of Investments August 31, 2020 |

Shares |

Private Funds (a) — 99.8% |

Initial |

Cost |

Value |

||||||||||||

Event Driven Strategies — 26.3% |

||||||||||||||||

| 806 | Corre Opportunities Offshore Fund, Ltd., Series AU 2015-05 |

5/1/2015 | $ | 838,685 | $ | 1,138,642 | ||||||||||

| 9,796 | Omni Event Fund Ltd., Class B |

4/1/2019 | 1,004,993 | 957,462 | ||||||||||||

| 3,537 | Pluscios Offshore Fund, SPC, Class F, Series 2020-01 (b) |

9/1/2013 | 3,734,882 | 3,862,085 | ||||||||||||

| 5,578,560 | 5,958,189 | |||||||||||||||

Long/Short Equity Strategies — 8.8% |

||||||||||||||||

| 1,300 | Eminence Fund, Ltd., Class A, Initial Series |

7/1/2014 | 928,798 | 1,151,413 | ||||||||||||

| 603 | Miura Global Fund, Ltd., Class AA, Sub Class I, Top Series |

7/1/2013 | 497,570 | 841,802 | ||||||||||||

| 1,426,368 | 1,993,215 | |||||||||||||||

Multi Strategies — 49.3% |

||||||||||||||||

| 20,681 | Lanx Offshore Partners, Ltd., Class A, Series 0114 III R8 |

1/1/2014 | 2,149,547 | 3,559,169 | ||||||||||||

| 368 | Lanx Offshore Partners, Ltd., Class A, Series 0114 III R8 (RE) |

1/1/2014 | 25,316 | 36,007 | ||||||||||||

| 5 | Lanx Offshore Partners, Ltd., Class A, Series 0720 III R8 |

1/1/2014 | — | 573 | ||||||||||||

| 2,709 | Lanx Offshore Partners, Ltd., Class X, Series 0114 III R8 |

1/1/2014 | 186,178 | 238,104 | ||||||||||||

| 1,116 | Millenium International, Ltd., Class EE , Series 01A |

8/1/2013 | 1,661,599 | 3,054,977 | ||||||||||||

| 15,299 | Titan Masters International Fund, Ltd., Class M 10-18 |

6/1/2014 | 2,632,277 | 3,103,024 | ||||||||||||

| 529 | Verition International Multi-Strategy Fund Ltd., Class C, Series 1 (2014.06) |

1/31/2018 | 750,000 | 1,157,554 | ||||||||||||

| 7,404,917 | 11,149,408 | |||||||||||||||

Relative Value Strategies: Fixed Income Hedge and Fixed Income Arbitrage — 4.0% |

||||||||||||||||

| 537 | Varadero International, Ltd., Class A, Series 0113, Tranche 2 |

1/2/2018 | 750,000 | 910,919 | ||||||||||||

Relative Value Strategies: General — 11.4% |

||||||||||||||||

| 114 | Hildene Opportunities Offshore Fund, Ltd., Class ST-A, Series 17 |

9/1/2013 | 427,611 | 760,792 | ||||||||||||

| 19 | Kawa Off-Shore Feeder Fund, Ltd., Ordinary Shares, Lead Series |

11/1/2013 | 476,800 | 741,302 | ||||||||||||

| 13 | Pine River Fixed Income Fund, Ltd., Class A, Series 60 |

6/1/2014 | 12,986 | 8,732 | ||||||||||||

| 492 | Rose Grove Offshore Fund I, Ltd., Class A, Series 1019 |

10/1/2019 | 1,000,000 | 1,074,703 | ||||||||||||

| 1,917,397 | 2,585,529 | |||||||||||||||

Total Private Funds |

$ | 17,077,242 | $ | 22,597,260 | ||||||||||||

See accompanying notes to financial statements.

4

FSI LOW BETA ABSOLUTE RETURN FUND SCHEDULE OF INVESTMENTS (Continued) August 31, 2020 |

Shares |

Money Market Funds — 11.0% |

Cost |

Value |

|||||||||

| 546,643 | BlackRock Liquidity Funds - T-Fund, Institutional Shares, 0.05% (c) |

$ | 546,643 | $ | 546,643 | |||||||

| 1,942,604 | Goldman Sachs Financial Square Government Fund - FST Shares, 0.02% (c) |

1,942,604 | 1,942,604 | |||||||||

Total Money Market Funds |

$ | 2,489,247 | $ | 2,489,247 | ||||||||

Investments in Securities, at Value — 110.8% (Note 2) |

$ | 19,566,489 | $ | 25,086,507 | ||||||||

Liabilities in Excess of Other Assets — (10.8%) |

(2,453,064 | ) | ||||||||||

Net Assets — 100.0% |

$ | 22,633,443 | ||||||||||

|

(a) |

Private Funds include investment funds that are organized outside of the United States and are not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and investment funds that invest in other investment funds that are not registered under the 1940 Act. All are non-income producing securities. |

|

(b) |

Managed by Pluscios Management LLC, an investment sub-adviser to the Fund (a “Sub-Adviser”) (Note 4). |

|

(c) |

The rate shown is the 7-day effective yield as of August 31, 2020. |

See accompanying notes to financial statements.

5

FSI LOW BETA ABSOLUTE RETURN FUND SCHEDULE OF INVESTMENTS (Continued) August 31, 2020 |

Value (e) |

Strategy |

Redemption |

Redemption |

Unfunded |

||||||||||||

| $ | 5,958,189 | Event Driven Strategies (f) |

Monthly-Quarterly | 45-90 | $ | — | ||||||||||

| 1,993,215 | Long/Short Equity Strategies (g) |

Monthly-Quarterly | 45-60 | — | ||||||||||||

| 11,149,408 | Multi Strategies (h) |

Quarterly | 45-90 | — | ||||||||||||

| 910,919 | Relative Value Strategies: Fixed Income Hedge and Fixed Income Arbitrage (i) |

Quarterly | 90 | — | ||||||||||||

| 2,585,529 | Relative Value Strategies: General (j) |

Monthly-Quarterly | 45-180 | — | ||||||||||||

|

(e) |

Values of Private Funds have been estimated using the net asset value per share (practical expedient) as of August 31, 2020 (Note 2). |

|

(f) |

Event Driven Strategies include strategies that invest in: (1) equity and/or fixed income securities of U.S. and/or foreign issuers based on how certain events such as mergers, consolidations, acquisitions, transfers of assets, tender offers, exchange offers, re-capitalizations, liquidations, divestitures, spin-offs and other similar transactions are expected to affect the value of such securities (Merger/Risk Arbitrage Strategy); and/or (2) equity and/or fixed income securities of financially troubled U.S. and/or foreign issuers (i.e., companies involved in bankruptcy proceedings, financial reorganizations or other similar financial restructurings) (Bankruptcy/Distressed Strategy). These strategies may utilize long and short positions and portfolios typically have a long or short bias. 19% of the value of the Private Funds employing these strategies can be redeemed with no restrictions but redemptions of 90% or more of their total value are subject to an audit holdback until completion of the audit as of August 31, 2020. The remaining Private Funds employing these strategies can be redeemed with no restrictions as of August 31, 2020. |

|

(g) |

Long/Short Equity Strategies include strategies that purchase long and sell short equity securites of U.S. and foreign issuers. Investments may focus on specific regions, sectors or types of equity securities. Long and short positions may not be invested in equal amounts and, as such, may not seek to neutralize general market risk. Portfolios typically have a long or short bias. 58% of the Private Funds employing these strategies can be redeemed with no restrictions but are subject to a 5% audit holdback as of August 31, 2020. The remaining Private Funds employing these strategies can be redeemed with no restrictions. |

|

(h) |

Multi Strategies include strategies that dynamically allocate capital among several different strategies typically employed by unregistered (private) funds (i.e. Relative Value Strategies (see (i or j) below) and Long/Short Equity Strategies (see (g) above). 38% of the value of the Private Funds employing these strategies can be redeemed with no restrictions but are subject to a quarterly 25% investor level gate as of August 31, 2020. The remaining Private Funds employing these strategies can be redeemed with no restrictions as of August 31, 2020. |

|

(i) |

Relative Value Strategies: Fixed Income Hedge and Fixed Income Arbitrage include strategies that: (1) generally purchase fixed income securities of U.S. and foreign issuers including corporations, governments and financial institutions as well as mortgage-related securities that are perceived to be undervalued and sell short such fixed income securities that are perceived to be overvalued (Fixed Income Hedge Strategy); and/or (2) purchase and sell short fixed income securities issued by U.S. and/or foreign issuers such as banks, corporations, governments and financial institutions as well as mortgage-backed securities to capitalize on perceived pricing discrepancies within and across types of fixed income securities (Fixed Income Arbitrage Strategy). 100% of the value of the Private Funds employing these strategies can be redeemed with no restrictions but are subject to a quarterly 25% investor level gate as of August 31, 2020. |

|

(j) |

Relative Value Strategies: General include strategies that: (1) employ Fixed Income Hedge or Fixed Income Arbitrage Strategies (see (i) above); and/or (2) simultaneously purchase convertible securities of U.S. and foreign issuers and then sell short the corresponding underlying common stocks (or equivalent thereof) to capitalize on perceived pricing discrepancies between the convertible securities and the underlying common stocks (Convertible Arbitrage Strategy). 42% of the Private Funds employing these strategies cannot be redeemed within 12 months of purchase without payment of a redemption penalty ranging from 3% to 5% of the net asset value of the interests being liquidated. The remaining restriction period for these investments is 1 month as of August 31, 2020. 29% of the Private Funds employing these strategies can be redeemed with no restrictions but are subject to a 20% investor level gate as of August 31, 2020. Less than 1% of the Private Funds employing these strategies are in the process of being fully liquidated and are no longer accepting redemption requests. The remaining Private Funds employing these strategies can be redeemed with no restrictions as of August 31, 2020. |

See accompanying notes to financial statements.

6

FSI LOW BETA ABSOLUTE RETURN FUND Statement of Assets and Liabilities August 31, 2020 |

||||

ASSETS |

||||

Investments in securities: |

||||

At cost |

$ | 19,566,489 | ||

At value (Note 2) |

$ | 25,086,507 | ||

Deposits with brokers |

904 | |||

Dividends receivable |

160 | |||

Receivable for investment securities sold |

27,452 | |||

Other assets |

19,200 | |||

Total assets |

25,134,223 | |||

LIABILITIES |

||||

Payable for units tendered |

2,439,954 | |||

Payable to Adviser (Note 4) |

41,526 | |||

Accrued fund services fees (Note 4) |

4,300 | |||

Other accrued expenses |

15,000 | |||

Total liabilities |

2,500,780 | |||

NET ASSETS |

$ | 22,633,443 | ||

NET ASSETS CONSIST OF: |

||||

Paid-in capital |

$ | 25,564,596 | ||

Accumulated deficit |

(2,931,153 | ) | ||

NET ASSETS |

$ | 22,633,443 | ||

UNITS OUTSTANDING (unlimited units authorized, $0.001 par value) |

244,730 | |||

NET ASSET VALUE PER UNIT (Note 2) |

$ | 92.48 | ||

See accompanying notes to financial statements.

7

FSI LOW BETA ABSOLUTE RETURN FUND Statement of Operations For the Year Ended August 31, 2020 |

||||

INVESTMENT INCOME |

||||

Dividends |

$ | 33,502 | ||

EXPENSES |

||||

Investment adviser fees (Note 4) |

284,699 | |||

Fund services fees (Note 4) |

51,600 | |||

Legal fees |

48,000 | |||

Audit and tax services fees |

29,500 | |||

Trustees’ fees and expenses (Note 4) |

25,007 | |||

Insurance expense |

23,937 | |||

Custodian fees |

15,788 | |||

Registration and filing fees |

9,336 | |||

Other |

3,370 | |||

Total expenses |

491,237 | |||

NET INVESTMENT LOSS |

(457,735 | ) | ||

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND OPTION CONTRACTS |

||||

Net realized gains (losses) from: |

||||

Investments |

335,259 | |||

Options contracts (Notes 2 and 5) |

(644,463 | ) | ||

Net change in unrealized appreciation (depreciation) on: |

||||

Investments |

461,411 | |||

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS AND OPTION CONTRACTS |

152,207 | |||

NET DECREASE IN NET ASSETS FROM OPERATIONS |

$ | (305,528 | ) | |

See accompanying notes to financial statements.

8

FSI LOW BETA ABSOLUTE RETURN FUND Statements of Changes in Net Assets |

||||||||

Year Ended |

Year Ended |

|||||||

FROM OPERATIONS |

||||||||

Net investment loss |

$ | (457,735 | ) | $ | (445,093 | ) | ||

Net realized gains (losses) on investments and options contracts |

(309,204 | ) | 585,809 | |||||

Net change in unrealized appreciation (depreciation) on investments and options contracts |

461,411 | 125,410 | ||||||

Net increase (decrease) in net assets from operations |

(305,528 | ) | 266,126 | |||||

DISTRIBUTIONS TO UNITHOLDERS (Note 2) |

(442,913 | ) | (1,902,358 | ) | ||||

CAPITAL UNIT TRANSACTIONS |

||||||||

Proceeds from units sold |

— | 2,050,001 | ||||||

Net asset value of units issued in reinvestment of distributions to unitholders (Notes 2 and 6) |

442,913 | 1,902,358 | ||||||

Payments for units tendered (Note 6) |

(5,186,785 | ) | (5,000,480 | ) | ||||

Net decrease in net assets from capital unit transactions |

(4,743,872 | ) | (1,048,121 | ) | ||||

NET DECREASE IN NET ASSETS |

(5,492,313 | ) | (2,684,353 | ) | ||||

NET ASSETS |

||||||||

Beginning of year |

28,125,756 | 30,810,109 | ||||||

End of year |

$ | 22,633,443 | $ | 28,125,756 | ||||

UNIT TRANSACTIONS |

||||||||

Units sold |

— | 21,296 | ||||||

Units reinvested |

4,839 | 20,887 | ||||||

Units redeemed (Note 6) |

(59,460 | ) | (49,677 | ) | ||||

Net decrease in units outstanding |

(54,621 | ) | (7,494 | ) | ||||

Units outstanding at beginning of year |

299,351 | 306,845 | ||||||

Units outstanding at end of year |

244,730 | 299,351 | ||||||

See accompanying notes to financial statements.

9

FSI LOW BETA ABSOLUTE RETURN FUND Financial Highlights Per Unit Data for a Unit Outstanding Throughout Each Year |

||||||||||||||||||||

Year Ended |

Year Ended |

Year Ended |

Year Ended |

Year Ended |

||||||||||||||||

Net asset value, beginning of year |

$ | 93.96 | $ | 100.41 | $ | 101.94 | $ | 99.01 | $ | 102.15 | ||||||||||

Income (loss) from investment operations: |

||||||||||||||||||||

Net investment loss (a) |

(1.62 | ) | (1.51 | ) | (1.49 | ) | (1.51 | ) | (1.58 | ) | ||||||||||

Net realized and unrealized gains (losses) on investments, options contracts and futures contracts |

1.63 | 1.89 | 3.54 | 4.44 | (0.56 | ) | ||||||||||||||

Total from investment operations |

0.01 | 0.38 | 2.05 | 2.93 | (2.14 | ) | ||||||||||||||

Less distributions: |

||||||||||||||||||||

In excess of net investment income |

(1.49 | ) | (6.83 | ) | (3.58 | ) | — | (0.80 | ) | |||||||||||

From net realized capital gains from investment transactions |

— | — | — | — | (0.20 | ) | ||||||||||||||

Total distributions |

(1.49 | ) | (6.83 | ) | (3.58 | ) | — | (1.00 | ) | |||||||||||

Net asset value, end of year |

$ | 92.48 | $ | 93.96 | $ | 100.41 | $ | 101.94 | $ | 99.01 | ||||||||||

Total return (b) |

0.03 | % | 0.60 | % | 2.06 | % | 2.96 | % | (2.09 | %) | ||||||||||

Ratios/supplementary data: |

||||||||||||||||||||

Net assets at end of year (000’s omitted) |

$ | 22,633 | $ | 28,126 | $ | 30,810 | $ | 53,302 | $ | 53,369 | ||||||||||

Ratios to average net assets: |

||||||||||||||||||||

Net investment loss (c) |

(1.79 | %) | (1.60 | %) | (1.49 | %) | (1.52 | %) | (1.61 | %) | ||||||||||

Net expenses (c) |

1.92 | % | 1.88 | % | 1.72 | % | 1.59 | % | 1.63 | % | ||||||||||

Portfolio turnover rate |

4 | % | 4 | % | 0 | % | 7 | % | 16 | % | ||||||||||

|

(a) |

Calculated based on average units outstanding during the period. |

|

(b) |

Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gain distributions are reinvested in units of the Fund. The returns shown do not reflect the deduction of taxes a unitholder would pay on Fund distributions, if any, or the redemption of Fund units. |

|

(c) |

Does not include the expenses of the Private Funds in which the Fund invests. |

See accompanying notes to financial statements.

10

FSI LOW BETA ABSOLUTE RETURN FUND Notes to Financial Statements August 31, 2020 |

1. Organization

The FSI Low Beta Absolute Return Fund (the “Fund”) is a continuously offered, non-diversified, closed-end management investment company, organized as a Delaware statutory trust on August 3, 2011. The Fund is authorized to issue an unlimited number of units at the net asset value per unit (“NAV”). The Fund’s investment objective is to seek attractive risk-adjusted rates of return, “Alpha,” with a risk profile and volatility similar to that of the Bloomberg Barclays U.S. Aggregate Bond Index. The Fund principally invests its assets in investment funds that are not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and that are organized outside of the United States (also known as hedge funds, each a “Private Fund”) and Private Funds that invest in other investment funds that are not registered under the 1940 Act.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Security Valuation – The Fund computes its NAV as of the last business day of each month. In determining its NAV, the Fund values its investments as of such month-end. The Board of Trustees (the “Board”) has approved procedures pursuant to which the Fund’s Valuation Committee will value the Fund’s investments in Private Funds at fair value. As a general matter, the fair value of the Fund’s interest in a Private Fund will represent the amount that the Fund could reasonably expect to receive from a Private Fund if the Fund’s interest was redeemed at the time of valuation, based on information reasonably available at the time the valuation is made and that the Fund believes to be reliable. In accordance with these procedures, fair value as of each month-end ordinarily will be the value determined as of such month-end for each Private Fund in accordance with the Private Fund’s valuation policies and reported at the time that the Valuation Committee values the Private Fund. In the unlikely event that a Private Fund does not report a month-end value to the Fund on a timely basis, the Valuation Committee would determine the fair value of such Private Fund based on the most recent value reported by the Private Fund, as well as any other relevant information available at the time the Fund values its portfolio. Using the nomenclature of the hedge fund industry, any value reported as “estimated” or “final” values will reasonably reflect market values of securities for which market quotations are available or fair value as of the date the Valuation Committee values the Private Fund.

Consistent with the Fund’s valuation procedures, option contracts are valued at the closing price on the exchanges on which they are primarily traded; if no closing price is available at the time of valuation, the option will be valued at the mean of the closing bid and ask prices for that day. Futures contracts which are traded on a commodities exchange are valued at their closing settlement price on the exchange on which they are primarily traded and over-the-counter futures contracts for which market quotations are readily available are valued based on quotes received from third party pricing services or one or more dealers that make markets in such securities. If quotes are not available from a third party pricing service or one or more dealers, quotes shall be determined based on the fair value of such securities as determined by the Valuation Committee in accordance with the Fund’s valuation procedures.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurement.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

|

● |

Level 1 – quoted prices in active markets for identical assets |

|

● |

Level 2 – other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.) |

11

FSI LOW BETA ABSOLUTE RETURN FUND NOTES TO FINANCIAL STATEMENTS (Continued) |

|

● |

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments, by security type, and other financial instruments as of August 31, 2020:

Value per |

Fair Value Measurements at the End |

|||||||||||||||

8/31/20 |

Level 1 |

Level 2 |

Level 3 |

|||||||||||||

Investments in Securities: |

||||||||||||||||

Private Funds* |

||||||||||||||||

Event Driven Strategies |

$ | 5,958,189 | $ | — | $ | — | $ | — | ||||||||

Long/Short Equity Strategies |

1,993,215 | — | — | — | ||||||||||||

Multi Strategies |

11,149,408 | — | — | — | ||||||||||||

Relative Value Strategies: Fixed Income Hedge and Fixed Income Arbitrage |

910,919 | — | — | — | ||||||||||||

Relative Value Strategies: General |

2,585,529 | — | — | — | ||||||||||||

Money Market Funds |

2,489,247 | — | 2,489,247 | — | ||||||||||||

Total |

$ | 25,086,507 | $ | — | $ | 2,489,247 | $ | — | ||||||||

|

* |

Investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy in accordance with ASU 2015-07. |

The Fund did not hold any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended August 31, 2020.

Unit Valuation – The NAV per unit of the Fund is calculated monthly by dividing the total value of the Fund’s assets, less liabilities, by the number of units outstanding. The offering price and redemption price per unit of the Fund is equal to the NAV per unit.

Investment Income – Dividend income is recorded on the ex-dividend date.

Investment Transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investment securities sold are determined on a specific identification basis.

Distributions to Unitholders – Distributions to unitholders arising from net investment income and net realized capital gains, if any, are declared and paid at least annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund. Dividends and distributions to unitholders are recorded on the ex-dividend date. The tax character of distributions paid to unitholders during the years ended August 31, 2020 and 2019 was ordinary income.

12

FSI LOW BETA ABSOLUTE RETURN FUND NOTES TO FINANCIAL STATEMENTS (Continued) |

Option Contracts – The Fund may purchase put options on broad-based stock indices. Put options on indices are settled in cash and gain or loss depends on changes in the index in question. When the Fund buys a put on an index, it pays a non-refundable premium and has the right, but not the obligation, prior to the expiration date, to receive, upon exercise of the option, an amount of cash if the closing level of the index upon which the option is based is less than the exercise price of the option. This amount of cash is equal to the excess of the closing price of the index over the exercise price of the option, which also may be multiplied by a formula value. In purchasing a put option, the Fund will seek to benefit from a decline in the market price of the underlying index.

Futures Contracts – The Fund may invest in U.S. Treasury futures to provide exposure to the market value change of a high quality fixed income portfolio and to seek to mitigate volatility attributable to investments in the Private Funds. When the Fund purchases or sells a futures contract, no price is paid to or received by the Fund. Instead, the Fund is required to deposit with the futures commission merchant an amount of cash or qualifying securities currently ranging from 5% to 10% of the contract amount. This is called the “initial margin deposit.” Subsequent payments, known as “variation margin,” are made or received by the Fund, depending on the fluctuations in the fair value of the futures contract. The Fund recognizes an unrealized gain or loss equal to the variation margin. If market conditions move unexpectedly, the Fund may not achieve the anticipated benefits of the futures contracts and may realize a loss. The initial margin deposits for futures contracts and the variation margin receivable or payable, if any, are reported on the Statement of Assets and Liabilities. Additionally, the Fund is required to maintain, on a daily basis, cash or liquid securities in an amount equal to the current market value of the futures in which it invests minus any amounts paid to brokers toward such position.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal Income Tax – The Fund has qualified and intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of August 31, 2020:

Tax cost of portfolio investments |

$ | 25,177,089 | ||

Gross unrealized appreciation |

$ | — | ||

Gross unrealized depreciation |

(90,582 | ) | ||

Net unrealized depreciation |

(90,582 | ) | ||

Undistributed ordinary income |

384,202 | |||

Capital loss carrryforwards |

(3,224,773 | ) | ||

Accumulated deficit |

$ | (2,931,153 | ) |

The difference between the federal income tax cost of portfolio investments and the financial statement cost of portfolio investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to holdings classified as passive foreign investment companies (“PFICs”).

13

FSI LOW BETA ABSOLUTE RETURN FUND NOTES TO FINANCIAL STATEMENTS (Continued) |

As of August 31, 2020, the Fund had a short-term capital loss carryforward of $802,916 and a long-term capital loss carryforward of $2,421,857 for federal income tax purposes. These capital loss carryforwards, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to unitholders.

For the year ended August 31, 2020, the following reclassification was made on the Statement of Assets and Liabilities for the Fund:

Paid-in capital |

$ | (1 | ) | |

Accumulated deficit |

1 |

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

3. Investment Transactions

During the year ended August 31, 2020, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $1,004,993 and $2,644,044, respectively.

4. Transactions with Related Parties and Other Service Providers

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Financial Solutions, Inc. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Adviser receives an advisory fee from the Fund at an annual rate of 1.11% of the Fund’s average monthly net assets and pays any sub-advisory fees out of the fees it receives.

SUB-ADVISERS

Meritage Capital, LLC (“Meritage”) and Pluscios Management LLC (“Pluscios”) serve as sub-advisers to the Fund. The Adviser pays Meritage and Pluscios any sub-advisory fees out of the fees it receives pursuant to the Investment Advisory Agreement.

Pluscios serves as the investment manager of Pluscios Offshore Fund, SPC, Class F. The Fund maintained investment interests in this Private Fund during the year ended August 31, 2020. During the year ended August 31, 2020, information regarding investments in this Private Fund by the Fund is as follows:

Shares as |

Value as of |

Cost of |

Proceeds |

Realized |

Change in |

Value as of |

||||||||||||||||||||||

Pluscios Offshore Fund, SPC, Class F |

3,537 | $ | 4,023,845 | $ | — | $ | — | $ | — | $ | (161,760 | ) | $ | 3,862,085 | ||||||||||||||

TRUSTEE COMPENSATION

Each Trustee who is not an “interested person” of the Fund (“Independent Trustee”) receives annual compensation of $10,000 from the Fund. Each Independent Trustee is also reimbursed for travel and related expenses incurred in attending Board meetings. No officer of the Fund is compensated by the Fund.

14

FSI LOW BETA ABSOLUTE RETURN FUND NOTES TO FINANCIAL STATEMENTS (Continued) |

FUND SERVICES AGREEMENT

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance and transfer agency services to the Fund. Ultimus also provides a Principal Financial Officer, a Chief Compliance Officer and an Anti-Money Laundering Compliance Officer to the Fund, as well as certain additional compliance support functions. The Fund pays Ultimus fees in accordance with a Services Agreement for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage and supplies.

DISTRIBUTION AGREEMENT

Ultimus Fund Distributors, LLC (the “Distributor”) serves as the Fund’s principal underwriter. The Distributor is a wholly-owned subsidiary of Ultimus.

PRINCIPAL HOLDERS OF FUND UNITS

As of August 31, 2020, the following unitholders owned of record 25% or more of the outstanding units of the Fund:

Name of Record Owner |

% Ownership |

Vernon Investment Fund LLC |

36% |

A beneficial owner of 25% or more of the Fund’s outstanding units may be considered a controlling person. That unitholder’s vote could have a more significant effect on matters presented at a unitholders’ meeting.

5. Derivatives Transactions and Related Risks

The Fund may purchase put options on broad-based stock indices. Put options on indices are settled in cash and gain or loss depends on changes in the index in question. When the Fund buys a put on an index, it pays a non-refundable premium and has the right, but not the obligation, prior to the expiration date, to receive, upon exercise of the option, an amount of cash if the closing level of the index upon which the option is based is less than the exercise price of the option. This amount of cash is equal to the excess of the closing price of the index over the exercise price of the option, which also may be multiplied by a formula value. In purchasing a put option, the Fund will seek to benefit from a decline in the market price of the underlying index.

The purchaser of a put option runs the risk of losing the purchaser’s entire investment, paid as the premium, if the option is not sold at a gain or cannot be exercised at a gain prior to expiration. A successful use of options on stock indices will be subject to the Adviser’s ability to predict correctly movements in volatility and the direction of the stock market generally or of a particular industry or market segment. This requires different skills and techniques than predicting changes in the price of individual stocks.

In seeking attractive risk adjusted rates of return, the Fund may invest in U.S. Treasury futures to provide exposure to the market value change of a high quality fixed income portfolio. The price of a futures contract may change rapidly in response to changes in the markets and the general economic environment as well as in response to changes in the value of the underlying U.S. Treasury securities. Futures may entail investment exposures that are greater than their cost would suggest, meaning that a small investment in futures could have a large potential effect on the performance of the Fund. Changes in the liquidity of U.S. Treasury futures (due to, among other things, price fluctuations or position limitations imposed by U.S. commodity exchanges) and rising interest rates may cause the value of U.S. Treasury futures to decline.

15

FSI LOW BETA ABSOLUTE RETURN FUND NOTES TO FINANCIAL STATEMENTS (Continued) |

If the Fund invests in U.S. Treasury futures at inopportune times or the Adviser misjudges market conditions, the Fund’s investments in the U.S. Treasury futures may lower the Fund’s return or result in a loss to the Fund. The Fund could also experience losses if the U.S. Treasury futures do not offset losses incurred by the Fund on its investments in the Private Funds or if the Fund is not able to timely liquidate its positions in U.S. Treasury futures due to an illiquid secondary market. It is also possible that the U.S. Commodity Futures Trading Commission may suspend trading in a particular contract, order immediate liquidation and settlement of a particular contract or order that trading in a particular contract be conducted for liquidation only.

The Fund holds no positions in derivative instruments as of August 31, 2020.

The average monthly notional value of index put options purchased during the year ended August 31, 2020 was $5,569,624. The average monthly notional value generally represents the Fund’s derivative activity throughout the period.

The Fund’s transactions in derivative instruments during the year ended August 31, 2020 are recorded in the following locations on the Statement of Operations:

Type of Derivative |

Risk |

Location |

Realized |

Location |

Change in |

||||||

Index put options purchased |

Equity |

Net realized losses from options contracts |

$ | (644,463 | ) | Net change in unrealized appreciation (depreciation) on option contracts |

$ | — | |||

6. Offering of Fund Units; Repurchase Offers

Fund units may be purchased by investors who meet certain eligibility requirements set forth in the Fund’s current prospectus as of the first business day of each calendar month; however, Fund units may be offered more or less frequently as determined by the Board in its sole discretion. Fund units are sold at the current NAV per unit. Generally, the minimum initial investment in the Fund is $50,000 and the minimum additional investment is $5,000. The Fund may accept investments for lesser amounts under certain circumstances, including where a unitholder has significant assets under the management of the Adviser or an affiliate and other special circumstances that may arise. There are no initial or subsequent investment minimums for accounts maintained by financial institutions for the benefit of their clients who purchase units through investment programs such as employee benefit plans. Certain selling broker-dealers and financial advisers may impose higher minimums.

Unless a unitholder elects to receive a distribution in the form of cash, all distributions are reinvested in full and fractional units at the NAV per unit next determined on the payable date of such distributions. A unitholder may elect to receive a distribution in the form of cash by submitting a written request to the Fund no later than 90 days prior to the payable date of such distribution.

Because the Fund is a closed-end fund, unitholders do not have the right to require the Fund to redeem any or all of their units. To provide a limited degree of liquidity to unitholders, the Fund may from time to time offer to repurchase units pursuant to written repurchase offers but is not obligated to do so. Repurchases will be made at such times, in such amounts and on such terms as may be determined by the Board, in its sole discretion, pursuant to written repurchase offers. In determining whether the Fund should offer to repurchase units, the Board will consider a variety of operational, business and economic factors. The Board convenes quarterly to consider whether or not to authorize a repurchase offer. The Board expects that repurchase offers, if authorized, will be made no more frequently than on a quarterly basis and will typically have a valuation date as of March 31, June 30, September 30 or December 31 (or, if any such date is not a business day, on the last business day of such calendar quarter).

16

FSI LOW BETA ABSOLUTE RETURN FUND NOTES TO FINANCIAL STATEMENTS (Continued) |

During the year ended August 31, 2020, the Board authorized and the Fund completed four quarterly repurchase offers. In these offers, the Fund offered to repurchase up to 10% of the number of its outstanding units as of the Repurchase Pricing Dates. The results of those repurchase offers were as follows:

Repurchase |

Repurchase |

Repurchase |

Repurchase |

|||||||||||||

Commencement Date |

May 31, 2019 | August 21, 2019 | November 15, 2019 | March 2, 2020 | ||||||||||||

Repurchase Request Deadline |

June 28, 2019 | September 18, 2019 | December 13, 2019 | March 27, 2020 | ||||||||||||

Repurchase Pricing Date |

September 30, 2019 | December 31, 2019 | March 31, 2020 | June 30, 2020 | ||||||||||||

Value of Units Repurchased |

$ | 239,811 | $ | — | $ | 2,507,021 | $ | 2,439,953 | ||||||||

Units Repurchased |

2,592 | — | 29,676 | 27,192 | ||||||||||||

% of Units Accepted by the Fund for Tender |

1 | % | 0 | % | 10 | % | 10 | % | ||||||||

7. Principal Investment Risks

An investment in the Fund should be considered a speculative investment that entails a high degree of risk and units of the Fund are only available for purchase by certain eligible investors. It is possible that an investor may lose money and that the Fund may not achieve its investment objective.

The Fund is non-diversified and the Fund’s investment in the securities of a limited number of issuers exposes the Fund to greater market risk and potentially greater market losses than if its investments were diversified in securities issued by a greater number of issuers.

The Private Funds invest in a variety of different assets and employ a number of different strategies which in turn subject their investors, including the Fund, to certain risks including those associated with: (1) investing in equities, fixed income securities and convertible securities of U.S. and foreign issuers, derivatives, commodities and currencies; (2) participating in short sale transactions; and (3) employing arbitrage and leverage. The Fund may also implement leverage and invest directly in derivatives which will directly expose the Fund to the risks associated with the employment of leverage and investments in derivatives.

The Fund may not be able to withdraw its investment in a Private Fund promptly after it has made a decision to do so. Fund unitholders do not have the right to require the Fund to redeem or repurchase its units and may not have access to the money they invest for an indefinite period of time. Repurchases will be made at such times, and in such amounts, and on such terms as may be determined by the Board, in its sole discretion.

The units are not, and are not expected to be, listed for trading on any securities exchange and, to the Fund’s knowledge, there is no secondary trading market for the units, nor is there expected to be in the future. Units are subject to substantial restrictions on transferability and resale and may not be transferred or resold except as permitted under the Fund’s Agreement and Declaration of Trust, as may be amended from time to time. A unitholder should not expect to be able to sell its units regardless of how the Fund performs. Because a unitholder may be unable to sell its units, the unitholder will be unable to reduce its exposure on any market downturn.

For a complete description of the principal risks involved and the eligibility criteria for investors, please refer to the Fund’s current prospectus.

17

FSI LOW BETA ABSOLUTE RETURN FUND NOTES TO FINANCIAL STATEMENTS (Continued) |

8. Contingencies and Commitments

The Fund indemnifies its officers and Trustees for certain liabilities that might arise from the performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

9. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events, except as reflected in the following paragraphs:

The Board has authorized the Fund to repurchase up to 10% of the number of its outstanding shares as of the Repurchase Pricing Date. The following table describes the details of such outstanding tender offers:

Repurchase Offer |

|

Commencement Date |

June 1, 2020 |

Repurchase Request Deadline |

June 30, 2020 |

Repurchase Pricing Date |

September 30, 2020 |

% of Units to be Tendered |

10.00% |

18

FSI LOW BETA ABSOLUTE RETURN FUND Report of Independent Registered Public Accounting Firm |

To the Unitholders and the Board of Trustees of FSI Low Beta Absolute Return Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of FSI Low Beta Absolute Return Fund (the “Fund”), including the schedule of investments, as of August 31, 2020, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2020, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2020 by correspondence with the custodian, individual underlying investment companies and other appropriate parties. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the FSI Low Beta Absolute Return Fund since 2013.

Philadelphia, Pennsylvania

October 30, 2020

19

FSI LOW BETA ABSOLUTE RETURN FUND Other Information (Unaudited) |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-877-379-7380, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-877-379-7380, or on the SEC’s website at www.sec.gov.

The Fund files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to Form N- PORT. These filings are available upon request by calling 1-877-379-7380. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov.

20

FSI LOW BETA ABSOLUTE RETURN FUND Dividend Reinvestment Plan (Unaudited) |

Under the Fund’s Dividend Reinvestment Plan (the “Plan”), all unitholders of the Fund are automatically enrolled in the Plan. The Fund’s annual distributions, if any, are reinvested in full and fractional Units at the NAV per unit next determined on the payable date of such annual distributions. There is no sales load or other charge for reinvestment. The Fund’s unitholders may elect to receive an annual distribution in the form of cash by submitting a written request to the Fund no later than 90 days prior to the payable date of such annual distribution. Any such cash payment will be made by check, ACH or wire as soon as practicable after the last calendar day of the calendar year in which the annual distribution is declared.

The automatic reinvestment of annual distributions does not relieve unitholders of any U.S. federal income tax that may be payable (or required to be withheld) on such annual distributions. A unitholder that receives units pursuant to a distribution generally has a tax basis in such units equal to the amount of cash that would have been received instead of units as described above and a holding period in such units that begins on the Business Day following the payment date for the distribution.

A unitholder may terminate its participation in the Plan at any time by sending a written notice to the Fund’s administrator, who, upon receipt of such notice, will cause the unitholder to receive both income dividends and capital gain distributions, if any, in cash. A unitholder holding units through an intermediary may elect to receive cash by notifying the intermediary (who should be directed to inform the Fund). A unitholder is free to change this election at any time. If, however, a unitholder requests to change its election within 90 days prior to a distribution, the request will be effective only with respect to distributions after the 90 day period. The administrator’s service fee for handling distributions will be paid by the Fund.

Questions regarding the Fund’s Plan should be directed to the Fund’s transfer agent at 1-877-379-7380 or by mail as follows:

Regular Mail: |

Overnight Delivery: |

FSI Low Beta Absolute Return Fund |

FSI Low Beta Absolute Return Fund |

PO Box 46707 |

c/o Ultimus Fund Solutions, LLC |

Cincinnati, OH 45246 |

225 Pictoria Dr, Suite 450 |

|

Cincinnati, OH 45246 |

21

FSI LOW BETA ABSOLUTE RETURN FUND Board of Trustees and Executive Officers (Unaudited) |

The Board provides broad oversight over the operations and affairs of the Fund, and has overall responsibility to manage and control the business affairs of the Fund, including the complete and exclusive authority to establish policies regarding the management, conduct and operation of the Fund’s business. The Board exercises the same powers, authority and responsibilities on behalf of the Fund as are customarily exercised by the board of directors of a registered investment company organized as a corporation.

Trustees are not required to invest in the Fund or to hold units of the Fund or an interest in the Fund. A majority of the Trustees are persons who are not “interested persons” (as defined in the Investment Company Act of 1940) of the Fund (each an “Independent Trustee”). The Independent Trustees perform the same functions for the Fund as are customarily exercised by the non-interested directors of a registered income company organized as a corporation.

The identity of the Trustees and executive officers of the Fund and brief biographical information regarding each Trustee and officer during the past five years is set forth below. The address for each Trustee and officer is c/o Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. Each Trustee serves until his or her retirement, resignation or removal from the Board. Trustees may be removed in accordance with the Declaration of Trust with or without cause by written instrument signed by a majority of the Trustees, or by a vote of a majority of the unitholders at a meeting at which at least two-thirds (2/3) of outstanding units are present.

Name and Age |

Position(s) Held with Fund |

Principal Occupation(s) |

Number of |

Interested Trustee: |

|||

Gary W. Gould* |

Principal Executive Officer and Trustee since 2011 |

Managing Principal of Financial Solutions, Inc. from 1998 to present and of Corporate Consulting Group, Inc. (an investment advisor) from 1985 to present |

1 |

|

* |

Mr. Gould is considered an “interested person” of the Fund and thus an Interested Trustee because of his position as Managing Principal of Financial Solutions, Inc., the Fund’s investment adviser. |

22

FSI LOW BETA ABSOLUTE RETURN FUND BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued) |

Name and Age |

Position(s) Held with Fund |

Principal Occupation(s) |

Number of |

Independent Trustees: |

|||

Carol Befanis O’Donnell |

Trustee since 2012 |

General Counsel of Boothbay Fund Management, LLC (December 2019 to present); Chief Executive Officer and Chief Compliance Officer of Protégé Partners, LLC and MOV37, LLC (both investment advisory firms) from 2017 to present; General Counsel and Chief Compliance Officer of Protégé Partners, LLC from 2016 to 2017; Director of Legal and Compliance and Secretary of Dara Capital U.S., Inc. (wealth advisory) from 2013 to 2016; Trustee of The Geiger Trust from 1989 to 2016; Trustee of The Tors Trust from 2013 to present; Trustee of Old Beach Trust from 2015 to present; Director of Sono-Tek Corporation from 2018 to present |

1 |

William S. Reeser |

Trustee since 2012 |

Chief Executive Officer and Chief Investment Officer of the University of Florida Investment Corporation from 2014 to present; Chief Investment Officer of American Lebanese Syrian Associated Charities, Inc. from 2006 to 2014; President of Reeser Advisory Services, Inc. from 1997 to present |

1 |

23

FSI LOW BETA ABSOLUTE RETURN FUND BOARD OF TRUSTEES AND EXECUTIVE OFFICERS (Unaudited) (Continued) |

Name, Address |

Position(s) Held with Fund |

Principal Occupation(s) During Past 5 Years |

Executive Officers: |

||

Theresa M. Bridge |

Treasurer and Principal Financial Officer since 2019 |

Senior Vice President, Financial Administration of Ultimus Fund Solutions, LLC |

Matthew J. Beck |

Secretary since 2020 |

Vice President, Senior Legal Counsel of Ultimus Fund Solutions, LLC (2018 to present); Chief Compliance Officer of OBP Capital, LLC (2015 to 2018); Vice President and General Counsel of The Nottingham Company (2014 to 2018) |

Martin R. Dean |

Chief Compliance Officer since 2016 |

Senior Vice President, Head of Fund Compliance of Ultimus Fund Solutions, LLC (2016 to present); Senior Vice President and Compliance Group Manager, Huntington Asset Services, Inc. (2013 to 2015) |

Additional information about members of the Board and executive officers is available in the Fund’s Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call 1-877-379-7380.

24

Privacy Policy |

Rev. 12/18/2012 |

|||

FACTS |

WHAT DOES FSI LOW BETA ABSOLUTE RETURN FUND DO WITH YOUR PERSONAL INFORMATION? |

||

Why? |

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

||

What? |

The types of personal information we collect and share depend on the product or service you have with us. This information can include:

● Social Security number and ● Account balances and ● Account transactions and ● Checking account information and ● Retirement assets and ● Wire transfer instructions. When you are no longer our customer, we continue to share your information as described in this notice. |

||

How? |

All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons FSI Low Beta Absolute Return Fund chooses to share; and whether you can limit this sharing. |

||

Reasons we can share your personal information |

Does FSI Low Beta Absolute Return Fund share? |

Can you limit this sharing? |

|

For our everyday business purposes— |

Yes |

No |

|

For our marketing purposes— |

No |

We do not share |

|

For joint marketing with other financial companies |

No |

We do not share |

|

For our affiliates’ everyday business purposes— |

Yes |

No |

|

For our affiliates’ everyday business purposes— |

No |

We do not share |

|

For non-affiliates to market to you |

No |

We do not share |

|

Questions? |

Call toll-free 1-877-379-7380 |

||

Page 2 |

Who we are |

|

Who is providing this notice? |

FSI Low Beta Absolute Return Fund |

What we do |

|

How does FSI Low Beta Absolute Return Fund protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

How does FSI Low Beta Absolute Return Fund collect my personal information? |

We collect your personal information, for example, when you

● open an account or ● provide account information or ● make deposits or withdrawals from your account or ● make a wire transfer or ● tell us where to send the money. We also collect your personal information from other companies. |

Why can’t I limit all sharing? |

Federal law gives you the right to limit only

● sharing for affiliates’ everyday business purposes—information about your credit worthiness ● affiliates from using your information to market to you ● sharing for non-affiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions |

|

Affiliates |

Companies related by common ownership or control. They can be financial and nonfinancial companies.

● Financial Solutions, Inc., the investment adviser to FSI Low Beta Absolute Return Fund, and Centennial Partners, LLC/Meritage Capital, LLC and Pluscios Management LLC, each a subadviser to FSI Low Beta Absolute Return Fund, are affiliates. |

Non-affiliates |

Companies not related by common ownership or control. They can be financial and nonfinancial companies.

● FSI Low Beta Absolute Return Fund does not share with non-affiliates so they can market to you. |

Joint marketing |

A formal agreement between non-affiliated financial companies that together market financial products or services to you.

● FSI Low Beta Absolute Return Fund does not jointly market. |

THIS PAGE INTENTIONALLY LEFT BLANK

THIS PAGE INTENTIONALLY LEFT BLANK

THIS PAGE INTENTIONALLY LEFT BLANK

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 13(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on its audit committee. The name of the audit committee financial expert is Carol Befanis O’Donnell. Ms. Befanis O’Donnell is “independent” for purposes of this Item.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $25,500 and $25,500 with respect to the registrant’s fiscal years ended August 31, 2020 and August 31, 2019, respectively. |

| (b) | Audit-Related Fees. No fees were billed in either of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees. The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $3,000 and $3,000 with respect to the registrant’s fiscal years ended August 31, 2020 and August 31, 2019, respectively. The services comprising these fees are the preparation of the registrant’s federal income and excise tax returns. |

| (d) | All Other Fees. No fees were billed in either of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. |

| (e)(1) | The Audit Committee reviews and approves in advance all audit and “permissible non-audit services” (as that term is defined by the rules and regulations of the Securities and Exchange Commission) to be rendered to the Registrant. Pre-approval of “permissible non-audit services” to the Registrant is not required if: (i) the aggregate amount of all such permissible non-audit services provided to the Registrant constitutes not more than 5% of the total amount of expenses paid by the Registrant to the Registrant’s principal accountant during the fiscal year in which such services are provided; (ii) the permissible non-audit services were not recognized by the Registrant at the time of the engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the Audit Committee and approved by the Audit Committee, or its authorized delegates, prior to the completion of the audit. |

| In addition, the Audit Committee reviews and approves in advance all “permissible non-audit services” to be provided to the Registrant’s investment adviser (other than a Sub-Adviser), or any entity controlling, controlled by or under common control with the Registrant’s investment adviser that provides on-going services to the Registrant (“Affiliate”), by the Registrant’s principal accountant if the engagement relates directly to the operations and financial reporting of the Registrant. Pre-approval by the Audit Committee of permissible non-audit services rendered to the Registrant’s investment adviser or an Affiliate is not required if the aggregate amount of all such services constitutes no more than 5% of the total amount of expenses paid by the Registrant, the Registrant’s investment adviser and its Affiliates to the Registrant’s principal accountant during the fiscal year in which the permissible non-audit services are provided. The Audit Committee considers whether fees paid by the Registrant’s investment adviser or an Affiliate to the Registrant’s principal accountant for audit and permissible non-audit services are consistent with the principal accountant’s independence. |

| (e)(2) | None of the services described in paragraph (b) through (d) of this Item were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Less than 50% of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. |

| (g) | During the fiscal years ended August 31, 2020 and 2019, aggregate non-audit fees of $3,000 and $3,000, respectively, were billed by the registrant’s principal accountant for services rendered to the registrant. No non-audit fees were billed in the last two fiscal years by the registrant’s principal accountant for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant. |

| (h) | The principal accountant has not provided any non-audit services to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant. |

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Schedule of Investments.

| (a) | Not applicable [schedule filed with Item 1] |

| (b) | Not applicable |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The Registrant’s proxy voting procedures are filed under Item 13(a)(5) hereto. The Registrant delegates proxy voting decisions to its investment adviser and each Sub-Adviser with respect to the Registrant’s assets allocated to each for investment. The proxy voting procedures of the Registrant’s investment adviser and each Sub-Adviser are filed under Items 13(a)(6)-(8).

Item 8. Portfolio Managers of Closed-End Management Investment Companies.