NEXALIN TECHNOLOGY, INC.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

NEXALIN TECHNOLOGY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☑ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Nexalin Technology, Inc.

1776 Yorktown, Suite 550

Houston, Texas 77056

Notice of Annual Meeting of Stockholders

To be held on August 26, 2024

To our Stockholders:

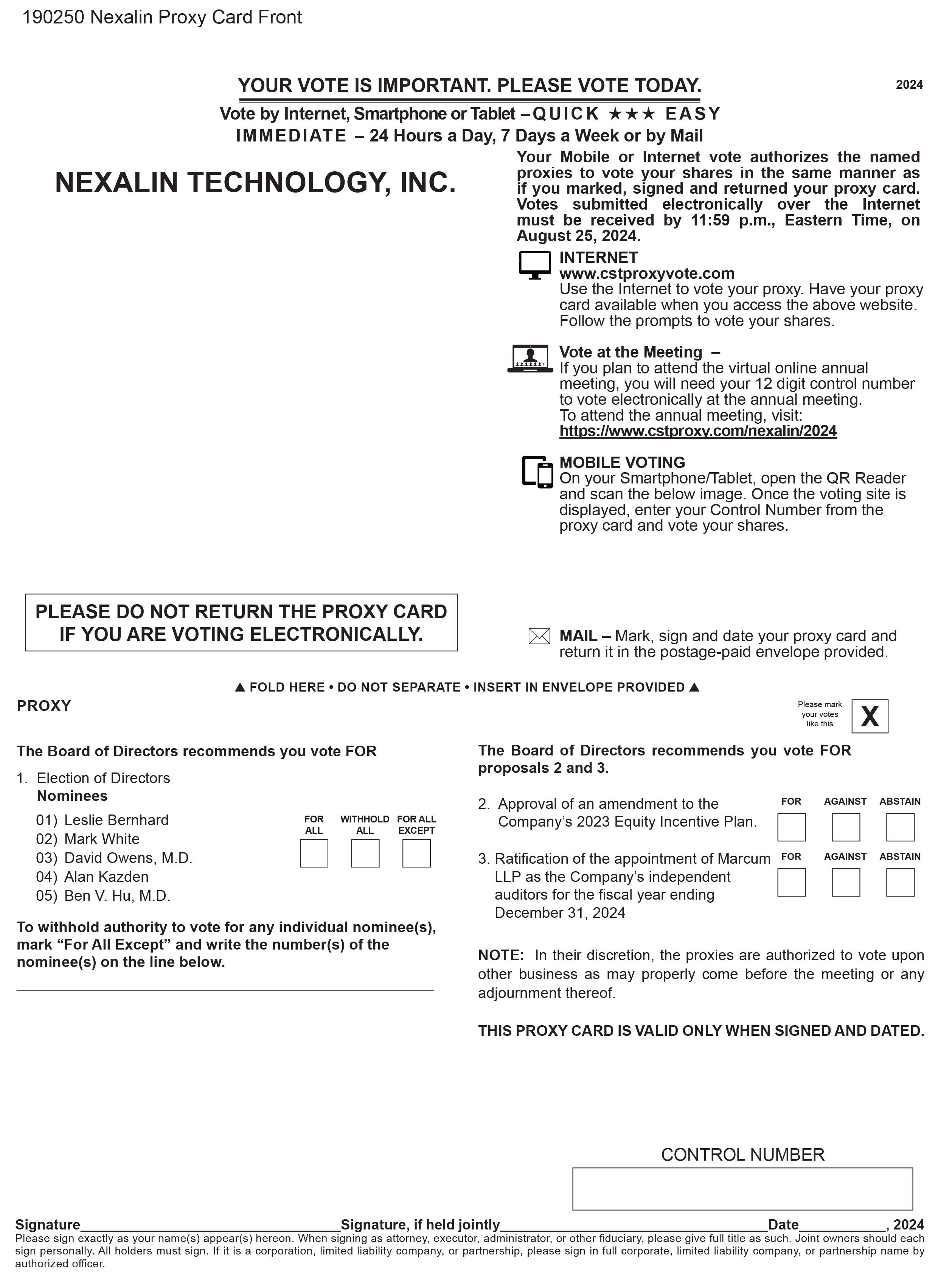

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Nexalin Technology, Inc. (“Nexalin Technology” or the “Company”) will be held in a virtual-only meeting format conducted via live audio webcast located at https://www.cstproxy.com/nexalin/2024 on August 26, 2024 at 10:00 a.m. (Eastern Standard Time).

The following items are scheduled for consideration and action at the Annual Meeting.

| 1. | Election of five (5) directors; | |

| 2. | Approval of an amendment to the Company’s 2023 Equity Incentive Plan; | |

| 3. | Ratification of the appointment of Marcum LLP as the Company’s independent auditors for the fiscal year ending December 31, 2024; and | |

| 4. | Such other business as may legally come before the Annual Meeting and any adjournments or postponements thereof. |

The Board of Directors has fixed the close of business on July 17, 2024 as the record date for determining the stockholders having the right to notice of and to vote at the Annual Meeting.

Attending the Virtual Meeting

As described in the proxy materials for the Annual Meeting, you are entitled to attend and participate in the virtual Annual Meeting if you were a stockholder of record as of the close of business on July 17, 2024, the record date, or if you hold a legal proxy for the Annual Meeting provided by your bank, broker-dealer, or other similar organization. The accompanying proxy materials include instructions on how to participate in the Annual Meeting and how to vote your shares of the Company’s common stock in the Annual Meeting.

Stockholders attending the Annual Meeting will be in a listen-only mode. However, virtual attendees will be able to vote and submit questions during the Annual Meeting using the virtual Annual Meeting website.

Your vote is important. Whether or not you plan to attend the Annual Meeting, you are encouraged to vote as soon as possible to ensure that your shares are represented at the Annual Meeting.

| By order of the Chairman of the Board | |

| /s/ Leslie Bernhard | |

| Leslie Bernhard |

Houston, Texas

July 29, 2024

IMPORTANT: IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING REGARDLESS OF THE NUMBER OF SHARES YOU HOLD. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, WE URGE YOU TO SUBMIT YOUR VOTE VIA THE INTERNET, TELEPHONE OR MAIL AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN BE VOTED AT THE ANNUAL MEETING IN ACCORDANCE WITH YOUR INSTRUCTIONS. IF YOU RECEIVE MORE THAN ONE PROXY CARD BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY CARD SHOULD BE SIGNED AND RETURNED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

We appreciate your giving this matter your prompt attention.

Important Notice Regarding Availability of Proxy Materials

for the Stockholder Meeting to be held on August 26, 2024:

THE PROXY MATERIALS FOR THE ANNUAL MEETING, INCLUDING THE ANNUAL REPORT AND

THE PROXY STATEMENT (COLLECTIVELY, THE “PROXY MATERIALS”)

ARE ALSO AVAILABLE AT HTTPS://WWW.CSTPROXY.COM/NEXALIN/2024.

NEXALIN TECHNOLOGY, INC.

1776 Yorktown, Suite 550

Houston, Texas 77056

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be Held on August 26, 2024

Proxies in the form enclosed with this statement are solicited by the Board of Directors (the “Board”) of Nexalin Technology, Inc. (“we,” “us,” “our,” the “Company” or “Nexalin Technology”) to be used at the Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments thereof, to be held on a virtually via the Internet on August 26, 2024 at 10:00 a.m., Eastern Standard Time, for the purposes set forth in the Notice of Meeting and this Proxy Statement. The Company’s principal executive offices are located at 1776 Yorktown, Suite 550, Houston, Texas 77056. The approximate date on which this Proxy Statement and the accompanying Proxy will be mailed to stockholders is July 29, 2024.

THE VOTING AND VOTE REQUIRED

Record Date and Quorum

Only stockholders of record at the close of business on July 17, 2024 (the “Record Date”) are entitled to notice of and vote at the Annual Meeting. On the Record Date, there were 10,586,562 outstanding shares of common stock, par value $.001 per share (“Common Stock”). Each share of Common Stock is entitled to one vote. Shares represented by each properly executed, unrevoked proxy received in time for the Annual Meeting will be voted as specified. A quorum will be present at the Annual Meeting if stockholders owning not less than one-third of the shares issued and outstanding on the Record Date are present at the Annual Meeting in person or by proxy.

Voting of Proxies

The persons acting as proxies pursuant to the enclosed proxy will vote the shares represented as directed in the signed proxy. Unless otherwise directed in the proxy, the proxyholders will vote the shares represented by the proxy: (i) for the election of the five (5) director nominees named in this Proxy Statement; (ii) for the approval of an amendment to the Company’s 2023 Equity Incentive Plan to increase the number of shares reserved for issuance thereunder; (iii) for the ratification of the appointment of Marcum LLP as Nexalin Technology’s independent auditors for the fiscal year ending December 31, 2024; and (iv) in the proxyholders’ discretion, on any other business that may come before the Annual Meeting and any adjournments thereof.

All votes will be tabulated by the Inspector of Elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions, and broker non-votes. Under Nexalin Technology’s Bylaws and Delaware law: (1) shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee that are represented at the Annual Meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum; (2) there is no cumulative voting, and the director nominees receiving the highest number of votes, up to the number of directors to be elected, are elected and, accordingly, abstentions, broker non-votes and withholding of authority to vote will not affect the election of directors; (3) proxies that reflect abstentions will be treated as voted for purposes of determining approval of that proposal and will be counted as votes against that proposal; and (4) proxies that reflect broker non-votes will be treated as not voted for purposes of determining approval of that proposal and may, in some circumstances, be counted as votes against that proposal.

1

Voting Requirements

Election of Directors. The election of the director nominees will require a plurality of the votes cast on the matter at the Annual Meeting. With respect to the election of directors, votes may be cast in favor of or withheld with respect to each nominee. Votes that are withheld will be excluded entirely from the vote and will have no effect on the outcome of the vote.

Approval of an Amendment to the 2023 Equity Incentive Plan. The affirmative vote of the majority of the votes cast by stockholders entitled to vote at the Annual Meeting is required to approve this matter. An abstention will be treated as “present” for quorum purposes. Abstentions will have the same effect as an against vote on the matter and broker non-votes will have no effect on the matter.

Ratification of the Appointment of Independent Auditors. The affirmative vote of a majority of the votes cast at the Annual Meeting by stockholders entitled to vote at the Annual Meeting is required to approve this matter. An abstention will be treated as “present” for quorum purposes. Abstentions will have the same effect as an against vote on the matter and broker non-votes will have no effect on the matter.

Revocability of Proxy

A proxy may be revoked by the stockholder giving the proxy at any time before it is voted by delivering oral or written notice to the Corporate Secretary of Nexalin Technology at or prior to the Annual Meeting, and a prior proxy is automatically revoked by a stockholder giving a subsequent proxy or attending and voting at the Annual Meeting. Attendance at the Annual Meeting in and of itself does not revoke a prior proxy.

Expenses of Solicitation

Nexalin Technology will pay the expenses of the preparation of proxy materials and the solicitation of proxies for the Annual Meeting. In addition to the solicitation of proxies by mail, solicitation may be made by certain directors, officers, or employees of Nexalin Technology telephonically, electronically or by other means of communication. Nexalin Technology will reimburse brokers and other nominees for costs incurred by them in mailing proxy materials to beneficial owners in accordance with applicable rules.

Virtual Meeting Instructions/Q&A

| Q: | How can I attend the Annual Meeting? |

| A: | The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted by webcast and by telephone access (listen-only). You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date or if you hold a valid Proxy for the Annual Meeting. There is no physical location for the Annual Meeting. |

You will be able to attend the Annual Meeting online and submit your questions during the Annual Meeting by visiting https://www.cstproxy.com/nexalin/2024. You also will be able to vote your Common Stock online by attending the Annual Meeting by webcast.

2

To attend the Annual Meeting by telephone (listen-only), you may utilize the following:

Within the U.S. and Canada: 1 800-450-7155 (toll-free)

Outside of the U.S. and Canada: +1 857-999-9155 (standard rates apply)

Conference ID: 9068095#

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your Proxy card or on the instructions that accompanied your Proxy Materials.

If you hold your Common Shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The Annual Meeting will begin promptly at 10:00 a.m., Eastern Standard Time. If you plan to attend the Annual Meeting, we encourage you to log-in prior to the start time, leaving ample time for check-in. Please follow the registration instructions as outlined in this Proxy Statement.

| Q: | How do I register to attend the Annual Meeting virtually on the Internet? |

| A: | If you are a registered stockholder (i.e., you hold your Common Stock through our transfer agent, Continental Stock Transfer & Trust), you do not need to register to attend the Annual Meeting virtually on the Internet. |

If you hold your Common Shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must obtain a Legal Proxy from your intermediary, confirming your power to vote the Common Stock, and submit a copy of such Legal Proxy reflecting your ownership of Common Stock along with your name and email address to Continental Stock Transfer & Trust, the Company’s registrar and transfer agent. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Standard Time, on August 21, 2024.

You will receive a confirmation of your registration by email after receipt of your registration materials.

| Q: | Why are you holding a virtual meeting instead of an in-person meeting? |

| A: | We believe that holding a virtual meeting will enable more of our stockholders to attend and participate in the Annual Meeting since our stockholders can participate from any location around the world with Internet access. Virtual meetings provide expanded access, improved communication and cost savings for us and our stockholders. |

3

PROPOSAL 1

ELECTION OF DIRECTORS

(ITEM 1 ON THE PROXY CARD)

Five (5) directors are to be elected at the Annual Meeting. All directors are elected for a term of one year and hold office until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified.

It is intended that votes pursuant to the enclosed proxy will be cast for the election of the nominees named below. If any such nominee should become unable or unwilling to serve as a director, the proxy will be voted for the election of such person, if any, as shall be designated by the Board. Management has no reason to believe that any of these nominees will not be available to serve as a director if elected or re-elected, as applicable.

The following table sets forth the names and ages of each nominee and the positions and period during which each has served as a director of Nexalin Technology. Information as to the stock ownership of each nominee is set forth under “Security Ownership of Certain Beneficial Owners and Management.” All the director nominees have been approved and nominated by the Nominating Committee (described below), with the concurrence of a majority of the Board, for election and/or re-election to the Board.

The names, ages and titles of our director nominees, as of the Record Date, are as follows:

| Name | Age | Position | Director Since | Term Ends |

| Leslie Bernhard(1)(2)(3) | 80 | Chairman of the Board | 2023 | 2024 |

| Mark White | 63 | President, Chief Executive Officer, Chief Financial Officer and Director | 2022 | 2024 |

| David Owens, M.D. | 63 | Chief Medical Officer and Director | 2022 | 2024 |

| Alan Kazden(1)(2)(3) | 63 | Director | 2022 | 2024 |

| Ben V. Hu, M.D.(1)(2)(3) | 66 | Director | 2022 | 2024 |

| (1) | Member of the Audit Committee | |

| (2) | Member of the Compensation Committee | |

| (3) | Member of the Nominating and Corporate Governance Committee |

Set forth below is a brief description of the background and business experience of our director nominees:

Leslie Bernhard, Chairman of the Board

Ms. Leslie Bernhard joined the Board of Nexalin Technology in November 2023 and has served as Chairman since her election to the Board. Ms. Bernhard is the founder of AdStar, Inc., an electronic ad intake service to the newspaper industry, and previously served as its president, chief executive officer and executive director. Her current and prior service on other public company boards includes Milestone Scientific, Inc., where, in addition to being chair, Ms. Bernhard was also interim chief executive officer; Sachem Capital Corp., a Connecticut-based real estate investment trust; Universal Power Group, Inc., a global supplier of power solutions; and SharpLink Gaming, Inc., a Minnesota-based online performance marketing company, where Ms. Bernhard also serves as chair of the audit committee. Ms. Bernhard holds a B.S. Degree in Education from St. John’s University. We believe that Ms. Bernhard’s experience as an entrepreneur and her service as a director of other public corporations will enable her to make an important contribution to the Board.

4

Mark White, President Chief Executive Officer, Chief Financial Officer, Director

Mr. Mark White has been with Nexalin Technology since 2012, first as an independent consultant from 2012 to 2018, and then as President and Chief Executive Officer from 2018 to present. Mr. White is a versatile health technology executive with over twenty-five years in leadership roles spanning medical device development, clinical operations and business development. Prior to joining the Company, he owned and operated his own clinics and addiction centers, where he witnessed the positive results the technology achieves. Early in his career, Mr. White spent several years building companies and recruiting successful management teams to accelerate growth across several industries. Mr. White attended the University of Houston. We believe that Mr. White’s experience in our business since its inception and his professional background in medical device development make him an important part of our management team and make him a worthy candidate to serve on the Board.

David Owens, M.D., Chief Medical Officer, Director

Dr. David Owens has been with Nexalin Technology since 2017 when he was named Chief Medical Officer of the Company. Dr. Owens has been involved in numerous medical and software ventures over the past decade. Prior to joining the Company, he served with Empiric Systems, LLC, a software company specializing in radiology information systems and PACS viewing systems. He received a degree in chemistry and physics from Furman University and later an M.D. from the Medical University of South Carolina in Charleston. He completed his residency and fellowship at Emory University Hospital in Neuroradiology and Interventional Neuroradiology. We believe that his medical and software background and experience make Dr. Owens well qualified to serve as a member of the Board.

Alan Kazden, Director

Mr. Alan Kazden was an original investor in Nexalin Technology and has served as a Director since 2019. Mr. Kazden has over 30 years of diverse experience consulting with emerging growth companies in strategic business planning, partnering, raising capital, and acting as a virtual CFO. Prior to joining the Company, Mr. Kazden worked in various industries such as technology, manufacturing & distribution, real estate, health care, entertainment, and emerging growth companies. He also served as a consultant to the Mayor’s Office and Los Angeles City Council on local tax issues. We believe that Mr. Kazden’s background and experience will provide the Board with a perspective on corporate finance matters. Given his financial experience, the Board has also determined that Mr. Kazden qualifies as the Audit Committee financial expert, pursuant to Item 407(d)(5) of Regulation S-K promulgated by the SEC.

Ben V. Hu., M.D., Director

Dr. Ben V. Hu is a founding investor and stockholder in Nexalin Technology. Dr. Hu is currently in private practice in Ohio, focusing on Ophthalmology. Since 2018, he has advised the Company’s executive team on market development strategies and clinical trial structures to support marketing and distribution at a global level. Dr. Hu is also an advisor and member of the Board of Directors to Med-logics Inc. a company developing a surgical technology for cataract surgery utilizing a new patented technology. Dr. Hu was awarded his Doctor of Medicine in 1983 from Case Western University and his Chemical Engineering degree from MIT School of Chemical Engineering. We believe that Dr. Hu’s medical and scientific background and experience make him well qualified to serve as a member of the Board.

The Board of Directors recommends a vote “FOR” the election of each director nominee and

Proxies that are signed and returned will be so voted, unless otherwise instructed.

************

5

EXECUTIVE OFFICERS

The following table identifies our current executive officers:

| Name | Age | Position |

| Mark White(1) | 63 | President, Chief Executive Officer, Chief Financial Officer and Director |

| David Owens, M.D.(2) | 63 | Chief Medical Officer and Director |

| Michael Nketiah | 49 | Senior Vice-President of Quality, Regulatory and Clinical Affairs |

| (1) | Biographical information is provided above. | |

| (2) | Biographical information is provided above. |

Michael Nketiah, Senior Vice-President of Quality, Regulatory and Clinical Affairs

Mr. Michael Nketiah joined Nexalin Technology as Senior Vice President of Quality, Regulatory and Clinical Affairs in November 2022. Prior to joining the Company, he was Vice President Regulatory Affairs at InterVenn Biosciences, VP of Quality and Regulatory Affairs at Tivic Health System, Inc. and VP of Clinical, Quality and Regulatory Affairs with ClearPath Surgical, Inc. Mr. Nketiah received a B.S. in Chemistry from Midwestern State University in 1998, a B.S. in Mechanical Engineering from San Jose State University in 2008, and an M.B.A. from Saint Mary’s College of California in 2015.

Code of Ethics

Nexalin Technology has adopted a code of ethics that applies to its directors, principal executive officer, principal financial officer and other persons performing similar functions. This code of ethics is posted on Nexalin Technology’s web site at https://nexalin.com/code-of-business-conduct-and-ethics. Nexalin Technology will also provide a copy of the Code of Ethics to any person without charge, upon written request addressed to the Chairman of the Board, at the Company’s principal executive office, located at 1776 Yorktown, Suite 550, Houston, Texas 77056.

Board Leadership Structure

The Board believes that the segregation of the roles of Board Chairman and the Chief Executive Officer ensures better overall governance of the Company and provides meaningful checks and balances regarding its overall performance. This structure allows our Chief Executive Officer to focus on developing and implementing the Company’s business plans and supervising the Company’s day-to-day business operations and allows our chairman to lead the Board in its oversight and advisory roles. Because of the many responsibilities of the Board and the significant time and effort required by each of the Chairman and the Chief Executive Officer to perform their respective duties, the Company believes that having separate persons in these roles enhances the ability of each to discharge those duties effectively and enhances the Company’s prospects for success. The Company also believes that having separate positions provides a clear delineation of responsibilities for each position and fosters greater accountability of management. For the foregoing reasons, the Board has determined that its leadership structure is appropriate and in the best interest of stockholders.

6

The Board’s Oversight of Risk Management

The Board recognizes that all companies face a variety of risks, including, liquidity/capital accessibility risk, medical product acceptance risk, and operational risk and, in the Company’s case, China operation risk. The Board believes an effective risk management system will (1) timely identify the material risks that we face; (2) communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committees; (3) implement appropriate and responsive risk management strategies consistent with the Company’s risk profile; and (4) integrate risk management into the Company’s decision-making. The Board encourages, and management promotes, a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. The Board also continually works, with the input of management and executive officers, to assess and analyze the most likely areas of future risk for the Company.

Committees of the Board

The current members of the Board are Leslie Bernhard, Mark White, David Owens, M.D., Alan Kazden, and Ben Hu, M.D. The Board has standing audit, compensation, and nominating and corporate governance committees (respectively, the “Audit Committee,” the “Compensation Committee,” and the “Nominating Committee”).

Audit Committee

The Audit Committee meets with management and the Company’s independent accountants to determine the adequacy of internal controls and other financial reporting matters. The Audit Committee’s purpose is to: (A) assist the Board in its oversight of: (i) the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) our independent auditors’ qualifications and independence; (iv) the performance of our internal audit function and independent auditors to decide whether to appoint, retain or terminate our independent auditors; and (v) the preparation of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”); and (B) to pre-approve all audit, audit-related and other services, if any, to be provided by the independent auditors. The current members of the Audit Committee are Alan Kazden Leslie Bernhard, and Ben Hu M.D., all of whom are independent as defined in the listing standards of NASDAQ and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Kazden serves as Chairman of the Audit Committee. A copy of the Audit Committee Charter is available on our website at https://nexalin.com/wp-content/uploads/2022/07/Nexalin-Audit-Commitee-Charter.pdf.

Audit Committee Financial Expert

The Board has determined that Alan Kazden is an “audit committee financial expert,” as that term is defined in Item 407(d)(5) of Regulation S-K, and “independent” for purposes of the listing standards of NASDAQ and Section 10A(m)(3) of the Exchange Act.

Compensation Committee

The Compensation Committee reviews and recommends to the Board the compensation and benefits of all officers of the Company, reviews general policy matters relating to compensation and benefits of employees of the Company, and administers the issuance of stock options to the Company’s officers, employees, directors, and consultants. The Compensation Committee is comprised of three directors, Leslie Bernhard, Alan Kazden and Ben Hu, M.D. Ms. Bernhard serves as Chairman of the Compensation Committee. A copy of the Compensation Committee Charter has been posted on our website at https://nexalin.com/wp-content/uploads/2022/09/Nexalin-Compensation-Comm-Charter-5-19-22.pdf.

7

Nominating Committee

The Nominating Committee identifies potential director nominees and evaluates their suitability to serve on the Board. Based on its evaluation, it recommends to the Board the director nominees for Board membership. In addition, the Nominating Committee also evaluates each existing Board member’s suitability for continued service as a director. The current members of the Nominating Committee are Leslie Bernhard, Alan Kazden, and Ben Hu, M.D. Ms. Bernhard serves as Chairman of the Nominating Committee. A copy of the Nominating Committee Charter can be found on our website at https://nexalin.com/wp-content/uploads/2022/09/Nexalin-Nominating-Comm-charter-5-19-22-.pdf.

The Nominating Committee believes that the minimum qualifications for service as a director of the Company are that a nominee possess an ability, as demonstrated by recognized success in his or her field, to make meaningful contributions to the Board’s oversight of the business and affairs of the Company and an impeccable reputation of integrity and competence in his or her personal or professional activities. The Nominating Committee’s criteria for evaluating potential candidates include the following: (i) an understanding of the Company’s business environment; and (ii) the possession of such knowledge, skills, expertise and diversity of experience so as to enhance the Board’s ability to manage and direct the affairs and business of the Company including, when applicable, to enhance the ability of committees of the Board to fulfill their duties and/or satisfy any independence requirements imposed by law, regulation or listing requirements.

The Nominating Committee considers director candidates recommended by stockholders. In considering candidates submitted by stockholders, the Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Nominating Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a candidate considered by the Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information: the name of the stockholder and evidence of the person’s ownership of Company stock, including the number of shares owned and the length of time of ownership; the name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company; and, the person’s consent to be named as a director if selected by the Nominating Committee and nominated by the Board.

The Nominating Committee may also receive suggestions from current Board members, the Company’s executive officers or other sources, which may be either unsolicited or in response to requests from the Nominating Committee for such candidates. The Nominating Committee also, from time to time, may engage firms that specialize in identifying director candidates.

Once a person has been identified by the Nominating Committee as a potential candidate, it may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Nominating Committee determines that the candidate warrants further consideration, the Chairman or another member of the Nominating Committee may contact the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Nominating Committee may request information from the candidate, review the person’s accomplishments and qualifications and may conduct one or more interviews with the candidate. The Nominating Committee may consider all such information in light of all other information about other candidates that it might be evaluating for membership on the Board. In certain instances, Nominating Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Nominating Committee’s evaluation process does not vary based on whether a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

8

Board Diversity Matrix

The table below provides an enhanced disclosure regarding the diversity of the members and nominees of our Board of Directors. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

| Board Diversity Matrix (As of July 29, 2024) | ||||

| Total Number of Directors | 5 | |||

| Female | Male | Non-Binary | Gender Undisclosed | |

| Directors | 1 | 4 | - | - |

| Demographic Information: | ||||

| African American or Black | - | - | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | - | 1 | - | - |

| Hispanic or Latinx | - | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 1 | 3 | - | - |

| LGBTQ+ | - | - | - | - |

Attendance at Committee and Board Meetings

In 2023, the Board held a total of three (3) meetings and acted by written consent three (3) times. Each of our directors attended at least 75% of the Board meetings. Our Audit Committee met three (3) times in 2023; our other committees did not meet in 2023. It is our policy to invite and encourage all the directors to attend the Annual Meeting.

Director Independence

The Board has determined that Alan Kazden, Ben Hu M.D. and Leslie Bernhard (the “Independent Directors”) are independent, as that term is defined in the listing standards of NASDAQ. The NASDAQ criteria for director independence include various objective standards and a subjective test. A member of the Board of Directors is not considered independent under the objective standards if, for example, he or she is, or at any time during the past three years was, employed by the Company. The subjective test under NASDAQ criteria for director independence requires that each independent director not have a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The subjective evaluation of director independence by the Board of Directors was made in the context of the objective standards referenced above. In making its independence determinations, the Board of Directors considered the transactions and other relationships between the Company and each director and his or her family members and affiliated entities, as well as, all equity awards, if any, to the Independent Directors for the year ended December 31, 2023, disclosed in “Non-Employee Director Compensation” below. The Board of Directors determined that there were no transactions or other relationships that exceeded NASDAQ objective standards and none would otherwise interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Stockholder Communication with the Board

The Board has established a process to receive communications from stockholders. Stockholders and other interested parties may contact any member (or all members) of the Board, or the non-management directors as a group, any Board committee, or any chair of any such committee by mail or electronically. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent to the Company, “c/o Corporate Secretary” at 1776 Yorktown, Suite 550, Houston, Texas 77056. All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary of the Company for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, patently offensive material, or matters deemed inappropriate for the Board will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Company’s Corporate Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope is addressed.

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

The following table, together with the accompanying footnotes, sets forth information, as of the Record Date, regarding stock ownership of all persons known by Nexalin Technology to own beneficially more than five percent (5%) of Nexalin Technology’s outstanding common stock, “Named Executive Officers” (as defined on page 12 herein), all directors, and all directors and executive officers of Nexalin Technology as a group:

| Names

of Beneficial Owner(1) Executive Officers and Directors |

Shares

of Common Stock Beneficially Owned(2) |

Percentage |

| Mark White | 1,094,753(3) | 9.19% |

| David Owens, M.D. | 507,235(4) | 4.26% |

| Marilyn Elson and Leonard Osser | 971,244(5) | 8.16% |

| Alan Kazden | 85,631(6) | 0.72% |

| Ben V. Hu, M.D. | 165,636(7) | 1.39% |

| Leslie Bernhard | - | - |

| Michael Nketiah | 33,557(8) | 0.28% |

| All directors & executive officers as a group (seven persons) | 2,858,056 | 24.00% |

| (1) | The addresses of the persons named in this table are as follows: Mark White, David Owens, M.D., Marilyn Elson and Leonard Osser, Alan Kazden, Ben V. Hu, M.D., Leslie Bernhard, and Michael Nketiah: 1776 Yorktown, Suite 550, Houston, Texas 77056. |

| (2) | A person is deemed to be a beneficial owner of securities that can be acquired by such person within 60 days from the record date, July 17, 2024, upon the exercise of options and warrants or conversion of convertible securities as applicable. Each beneficial owner’s percentage ownership is determined by assuming that options, warrants and convertible securities that are held by such person (but not held by any other person) and that are exercisable or convertible within sixty (60) days from July 17, 2024, have been exercised or converted. Except as otherwise indicated, and subject to applicable community property and similar laws, each of the persons named has sole voting and investment power with respect to the shares shown as beneficially owned. The percentages for each beneficial owner are determined based on dividing the number of shares of common stock beneficially owned by the sum of the outstanding shares of common stock on July 17, 2024 and the number of shares underlying options exercisable and convertible securities convertible within sixty (60) days from July 17, 2024 held by the beneficial owner. |

| (3) |

Includes 760,626 shares to be issued to Mr. White pursuant to stock option grants under the terms and conditions of his employment agreement and 25,000 warrants to purchase common stock. |

| (4) | Includes 357,942 shares to be issued to Dr. Owens pursuant to stock option grants under the terms and conditions of his employment agreement and 2,500 warrants to purchase common stock. |

| (5) | Includes 835,244 shares and 136,000 warrants to purchase common stock held jointly by Ms. Elson and Leonard Osser, her spouse. |

| (6) | Includes 2,500 warrants to purchase common stock. All shares and warrants are owned by the Alan and Natalie Kazden Family Trust. Mr. Kazden has voting and dispositive control over all of such shares. |

| (7) |

Includes 161,470 shares and shares held by Mr. Hu, 3,582 shares held jointly by Mr. Hu and Amy Lun Hu, his spouse, and 584 shares held jointly by Mr. Hu and David D. Hu, his son. |

| (8) | Includes 33,557 shares to be issued to Mr. Nketiah pursuant to stock option grants under the terms and conditions of his employment agreement. |

10

SUMMARY COMPENSATION TABLE

The following Summary Compensation Table sets forth all compensation earned, in all capacities, during the fiscal years ended December 31, 2022 and 2023 by Nexalin Technology’s (i) chief executive officer and (ii) highly compensated executive officers, other than the chief executive officer, who were serving as executive officers at the end of the 2023 fiscal year and whose salary as determined by Regulation S-K, Item 402, exceeded $100,000 (the individuals falling within categories (i) and (ii) are collectively referred to as the “Named Executive Officers”).

| Name and Principal Position | Year | Salary | Board Fee and Consulting |

Bonus | Stock

/ Option Awards(2)(3) |

Total |

| Mark White | 2022 | $191,292 | - | - | - | $191,292 |

| Chief Executive Officer/Chief Financial Officer | 2023 | $272,500 | - | $170,000 | $237,315 | $679,815 |

| David Owens, M.D.(1) | 2022 | - | - | - | - | - |

| Chief Medical Officer | 2023 | - | $42,800 | - | $111,678 | $154,478 |

| Michael Nketiah | 2022 | $32,080 | - | - | - | $32,080 |

| Senior Vice-President of Quality, Clinical and Regulatory | 2023 | $250,000 | - | $30,000 | $10,470 | $290,470 |

| (1) | Dr, David Owens had no 2022 compensation due to waiver of his compensation. |

| (2) | The amounts reported in this column is the aggregate fair value of each stock and option award in the applicable year. |

| (3) | Messrs.. White and Nketiah’s option awards include their one-time sign-on bonus and year one of performance-based option award earned in 2023. Dr. Owens’ option awards are his year one performance-based option award earned in 2023. |

Non-Employee Director Compensation

Each non-employee director elected to our board of directors is entitled to receive shares or options to purchase shares of our common stock equal to $35,000 per annum. In December 2023, Dr. Owens and Mr. Kazden were each awarded options to purchase 262,500 shares of the Company’s stock for their 2023 and 2024 services. Ms. Bernhard was paid $17,500 and was awarded 19,935 shares of the Company’s stock for her 2023 and 2024 services and Dr. Hu was awarded 175,000 shares of the Company’s stock for his 2023 and 2024 services. The grant and issuance of the options and shares described in this paragraph are subject to stockholder approval of an amendment to the 2023 Plan to increase the number of shares available under such Plan.

Our policy of compensating our non-employee directors is intended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders.

Employment Contracts

The Company entered into an employment agreement with Mark White, as Chief Executive Officer, in July 2023. Pursuant to the employment agreement, Mr. White is compensated at the annual rate of $300,000. Mr. White is eligible to receive an annual bonus of up to $120,000 based on performance criteria set by the Compensation Committee, in addition to certain stock option grants under the 2023 Equity Incentive Plan. The Company also provides a monthly $1,500 automobile allowance to Mr. White.

11

In July 2023, the Company entered into a services agreement with David Owens, M.D. Pursuant to that services agreement, Dr. Owens’s compensation is composed of certain stock option grants under the 2023 Equity Incentive Plan. The Company also provides a monthly $1,300 automobile allowance to Dr. Owens.

In July 2023, the Company entered into a services agreement with Michael Nketiah, as Senior Vice President, Quality, Regulatory and Clinical Affairs. Pursuant to that employment agreement, Mr. Nketiah is compensated at the annual rate of $250,000. Mr. Nketiah is eligible to receive an annual bonus of up to $30,000 based on performance criteria set by the Compensation Committee, in addition to certain stock option grants under the 2023 Equity Incentive Plan.

Objective of Executive Compensation Program

The primary objective of the executive compensation program is to attract and retain qualified, energetic managers who are enthusiastic about the mission and culture of Nexalin Technology. A further objective of the compensation program is to provide incentives and reward each manager for their contribution. In addition, Nexalin Technology strives to promote an ownership mentality among key leadership and the Board of Directors.

The Compensation Committee reviews and approves, or in some cases recommends for the approval of the full Board, the annual compensation procedures for the Named Executive Officers.

The compensation program is designed to reward teamwork, as well as each manager’s individual contribution. In measuring the Named Executive Officers’ contribution, the Compensation Committee considers numerous factors including the growth of strategic business relationships and financial performance. Regarding most compensation matters, including executive and director compensation, management provides recommendations to the Compensation Committee; however, the Compensation Committee does not delegate any of its functions to others in setting compensation. Nexalin Technology does not currently engage any consultant to advise on executive and/or director compensation matters.

Stock price performance has not been a factor in determining annual compensation because the price of Nexalin Technology’s common stock is subject to a variety of factors outside of Nexalin Technology’s control. Nexalin Technology does not have an exact formula for allocating between cash and non-cash compensation.

Annual CEO compensation consists of a base salary component and a bonus component (payable in a mix of cash and stock option grants). It is the Compensation Committee’s intention to set totals for the CEO for cash compensation sufficiently high enough to attract and retain a strong motivated leadership team, but not so high that it creates a negative perception with the other stakeholders.

The CEO’s current and prior compensation is considered in setting future compensation. To some extent, the compensation plan is based on the market and the companies that compete for executive management. The elements of the plan (e.g., base salary, bonus, and equity incentive compensation) are like the elements used by many companies. The exact base pay, long term equity incentives, and bonus amounts are chosen to balance the competing objectives of fairness to all stakeholders and attracting and retaining executive managers.

12

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our officers and directors, and persons who own more than ten percent (10%) of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than ten percent (10%) stockholders are required by SEC regulation to furnish us with copies of all forms they file pursuant to Section 16(a) of the Exchange Act.

To the best of the Company’s knowledge, based solely on review of the copies of such forms furnished to us, or written representations that no other forms were required, we believe that all filing requirements applicable to its officers, directors and greater than 10% stockholders pursuant to Section 16(a) of the Exchange Act were complied with during the year ended December 31, 2023.

Delinquent Section 16(a) Reports

Under U.S. securities laws, directors, certain officers and persons holding more than 10% of our common stock must report their initial ownership of our common stock and any changes in their ownership to the SEC. The SEC has designated specific due dates for these reports and we must identify in this Proxy Statement those persons who did not file these reports when due. Based solely on our review of copies of the reports filed with the SEC and the written representations of our directors and executive officers, we believe that all reporting requirements for fiscal year 2022 were complied with by each person who at any time during the 2022 fiscal year was a director or an executive officer or held more than 10% of our common stock.

Certain Relationships and Related Transactions

On May 9, 2018, the Company entered into a five-year consulting agreement with U.S. Asian Consulting Group, LLC (“U.S. Asian”). The consulting agreement was extended for an additional period of eight years upon the closing of our initial public offering. The two members of U.S. Asian are shareholders in the Company, with Marilyn Elson also serving as our Chief Financial Officer until November 1, 2023, and as our Controller since such date.

Pursuant to the consulting agreement, U.S. Asian provides consulting services to the Company with regard to, among other things, corporate development and financing arrangements. The Company pays U.S. Asian $10,000 per month for services rendered pursuant to the consulting agreement. The Company recorded consulting expenses related to the consulting agreement of $120,000 for each of the twelve months ended December 30, 2023 and 2022, respectively, on the Company’s consolidated statements of operations and comprehensive loss. At December 31, 2023 and December 31, 2022, U.S. Asian was owed $0 and $260,000, respectively, for accrued and unpaid services.

Our principle executive office is located at 1776 Yorktown, Suite 550, Houston, Texas 77056. Under ASC 842 “Leases”, we have two separate sub-leases (through IIcom Strategic Inc. controlled and owned by our Chief Executive Officer) totaling approximately 4,000 square feet of office space under operating leases. Management and supporting staff are hosted at this location. Our lease payment for each of fiscal years 2023 and 2022 was $54,000. The sub-leases expired in 2024. The Company has entered a new short-term sub-lease for approximately 4,000 square feet of office space. Pursuant to the sublease, we pay the third party landlord (not the sub landlord) all direct and indirect rent costs under the primary lease directly for the leased premises. No additional payments are made to the Chief Executive Officer or the entity controlled by him.

13

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO THE COMPANY’S 2023 EQUITY INCENTIVE PLAN

(ITEM 2 ON THE PROXY CARD)

On June 30, 2023, the Board, upon recommendation of the Compensation Committee, approved and adopted, subject to approval by our stockholders, the Nexalin Technology, Inc. 2023 Equity Incentive Plan (the “2023 Plan”). The 2023 Plan became effective on June 30, 2023. The 2023 Plan permits the grant of up to 1,500,000 non-statutory and incentive stock options, restricted stock awards, performance awards, stock bonus awards, non-employee director awards, and other stock-based awards. The 2023 Plan was approved by the stockholders of the Company on November 10, 2023.

Upon the adoption and approval of the 2023 Plan, the Board issued stock options to purchase an aggregate of 1,152,125 shares of our common stock to Mark White, Dr. David Owens and Michael Nketiah pursuant to their respective employment contracts (all of which options are now vested). Under such contracts, Messrs. White, Owens and Nketiah could earn stock options to purchase up to an additional 1,129,754 shares of our common stock (none of which have been earned). In addition, the Board has awarded, in lieu of cash compensation, 2,661,435 shares of our common stock, subject to stockholder approval, as stock grants and/or options to certain consultants, directors, employees, and executive officers.

Accordingly, to (i) reserve sufficient shares under the 2023 Plan for those that may be earned under the employment contracts, (ii) effect the grant of the awards to consultants, directors, employees, and executive officers described above, and (iii) provide for potential additional awards, Proposal No. 2 increases the number of shares reserved for issuance under the 2023 Plan from 1,500,000 to 6,000,000. The approval of the Company’s stockholders is required for such an amendment to the 2023 Plan.

Summary of the 2023 Equity Compensation Plan

Purpose. The purpose of the 2023 Plan is to provide incentives to employees, directors and consultants whose performance will contribute to our long-term success and growth, to strengthen the Company’s ability to attract and retain employees, directors and consultants of high competence, to increase the identity of interests of such people with those of its stockholders and to help build loyalty to the Company through recognition and the opportunity for stock ownership.

Types of Awards. The 2023 Plan provides for the grant of incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), non-qualified stock options and restricted stock awards.

Administration. The 2023 Plan is administered by the Compensation Committee of the Board of Directors (the “Committee”), which may in turn delegate administrative authority to one or more of our executive officers.

Stock Reserved Under the Stock Plan. The aggregate number of shares of Common Stock that may be issued pursuant to equity awards granted under the 2023 Plan currently may not exceed 1,500,000 shares as adjusted for stock splits, stock dividends, combinations and the like). If any outstanding award granted under the 2023 Plan should for any reason expire, be cancelled or be forfeited without having been exercised in full, the shares of Common Stock allocable to the unexercised, cancelled or terminated portion of such award shall become available for subsequent grants of awards under the 2023 Plan.

Vote Required and Recommendation of the Board

The affirmative vote of at least a majority of the votes cast at the Annual Meeting is required to approve this Proposal No. 2.

The Board of Directors recommends a vote “FOR” approval of the amendment of the Company’s 2023

Equity Incentive Plan to increase the number of shares reserved for issuance thereunder and

Proxies that are signed and returned will be so voted, unless otherwise instructed.

************

14

PROPOSAL NO. 3

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

(ITEM 3 ON THE PROXY CARD)

The independent registered public accounting firm, Friedman LLP (“Friedman”), had been our independent auditor since 2020. Effective September 1, 2022, Friedman combined with Marcum LLP (“Marcum”) and continued to operate as an independent registered public accounting firm. On October 13, 2022, the Audit Committee of the Company approved the dismissal of Friedman and the engagement of Marcum to serve as the independent registered public accounting firm of the Company. The services previously provided by Friedman will now be provided by Marcum LLP.

Marcum’s audit report appears in the Annual Report. A representative of Marcum will be at the Annual Meeting and will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

Selection of the independent accountants is not required to be submitted to a vote of our stockholders for ratification. In addition, the Sarbanes-Oxley Act of 2002 requires the Audit Committee to be directly responsible for the appointment, compensation, and oversight of the audit work of the independent auditors. The Audit Committee expects to appoint Marcum to serve as independent auditors to conduct an audit of Nexalin Technology’s financial statements for the 2024 fiscal year. However, the Board is submitting this matter to Nexalin Technology’s stockholders as a matter of good corporate practice. If the stockholders fail to vote on an advisory basis in favor of the selection, the Audit Committee will take that into consideration when deciding whether to retain Marcum and may retain that firm or another without re-submitting the matter to the stockholders. Even if stockholders vote on an advisory basis in favor of the appointment, the Audit Committee may, in its discretion, direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of Nexalin Technology and the stockholders.

Vote Required and Recommendation of the Board

The affirmative vote of at least a majority of the votes cast at the Annual Meeting is required to approve this Proposal No. 3.

The Board of Directors recommends a vote “FOR” ratification of the appointment of the independent auditors and

Proxies that are signed and returned will be so voted, unless otherwise instructed.

************

15

Audit Fees

Nexalin Technology incurred aggregate audit and financial statement review fees of approximately $120,750 from Marcum for 2023. Nexalin Technology incurred audit and financial statement review fees of approximately $146,250 from Marcum for 2022 (which included $76,250 of fees billed by Friedman LLP, the predecessor in interest to Marcum. These fees include fees for professional services rendered for the audit of our annual financial statements and the review of financial statements included in our reports on Form 10-Q, or services that are normally provided in connection with statutory and regulatory filings and fees related to registration statements.

Tax Fees

Nexalin Technology did not incur tax fees from Marcum in either 2023 or 2022.

Audit-Related Fees

Nexalin Technology did not incur audit-related fees from Marcum in either 2023 or 2022.

All Other Fees

Nexalin Technology did not incur other accounting fees from Marcum in either 2023 or 2022.

Audit Committee Administration of the Engagement

The engagement with Marcum as the Company’s principal accountants were approved in advance by the Board and the Audit Committee. No non-audit or non-audit related services were approved by the Audit Committee in either 2023 or 2022.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee charter provides that the Audit Committee will pre-approve audit services and non-audit services to be provided by the independent auditors before the accountant is engaged to render these services. The Audit Committee may consult with management in the decision-making process but may not delegate this authority to management. The Audit Committee may delegate its authority to preapprove services to one or more committee members, provided that the designees present the pre-approvals to the full committee at the next committee meeting. All audit and non-audit services performed by the independent accountants have been pre-approved by the Audit Committee to assure that such services do not impair the auditors’ independence from us.

Changes in Company’s Independent Registered Public Accountant

During the two most recent fiscal years ended December 31, 2023 and 2022, and the subsequent interim period through March 31, 2024, there were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) with Marcum on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum, would have caused Marcum to make reference to the subject matter of the disagreements in connection with its reports on the Company’s consolidated financial statements for such years. Also, during this time, there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K.

Marcum’s reports on the consolidated financial statements of the Company as of and for the fiscal years ended December 31, 2023 and 2022 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2023 and 2022 and through July 29, 2024, neither the Company nor anyone on its behalf consulted with Marcum regarding (i) the application of accounting principles to any specified transaction, either completed or proposed or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Marcum concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, or (ii) any matter that was either the subject of a “disagreement,” as defined in Item 304(a)(1)(iv) of Regulation S-K, or a “reportable event,” as defined in Item 304(a)(1)(v) of Regulation S-K.

16

AUDIT COMMITTEE REPORT

The Audit Committee’s purpose is to assist the Board in its oversight of (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) our independent auditors’ qualifications and independence, and (iv) the performance of our internal audit function and independent auditors to decide whether to appoint, retain or terminate our independent auditors, and to pre-approve all audit, audit-related and other services, if any, to be provided by the independent auditors; and to prepare this Report.

Management is responsible for the preparation, presentation and integrity of our financial statements, accounting and financial reporting principles and the establishment and effectiveness of internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditors are responsible for performing an independent audit of the financial statements in accordance with generally accepted auditing standards. The independent auditors have free access to the Audit Committee to discuss any matters they deem appropriate.

The Audit Committee reviewed our audited financial statements for the year ended December 31, 2023 and met with management to discuss such audited financial statements. The Audit Committee has discussed with our independent accountants, Marcum LLP, the matters required to be discussed by the Statement on Auditing Standards No. 16, as adopted by the Public Company Accounting Oversight Board. The Audit Committee has received the written disclosures and the letter from Marcum LLP required by the Independence Standards Board Standard No. 1, as may be modified or supplemented. The Audit Committee has discussed with Marcum LLP its independence from Nexalin Technology and its management. Marcum LLP had full and free access to the Audit Committee. Based on its review and discussions, the Audit Committee recommended to the Board that the audited financial statements be included in the Annual Report.

| Submitted by the Audit Committee: | |

| Alan Kazden | |

| Leslie Bernhard | |

| Ben V. Hu, M.D. |

The above Audit Committee report is not deemed to be “soliciting material,” and is not “filed” with the SEC.

17

OTHER BUSINESS

As of the date of this Proxy Statement, we know of no other business that will be presented for consideration at the Annual Meeting other than the items referred to above. If any other matter is properly brought before the Annual Meeting for action by stockholders, the persons designated as proxies will vote all shares in accordance with the recommendation of the Board or, in the absence of such a recommendation, in accordance with their best judgment.

ADDITIONAL INFORMATION

Householding

The SEC’s rules permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. Some brokers household proxy materials and annual reports, delivering a single proxy statement and annual report to multiple stockholders sharing an address, although each stockholder will receive a separate proxy card. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If at any time you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, please notify your broker. If you would like to receive a separate copy of this year’s Proxy Statement or Annual Report, please address your request for delivery of the Proxy Statement and/or Annual Report to Corporate Secretary, Nexalin Technology, Inc., 1776 Yorktown, Suite 550, Houston, Texas 77056.

Requirements, Including Deadlines, for Submission of Proxy Proposals, Nomination of Directors, and Other Business of Stockholders

Stockholders interested in presenting a proposal or nominating a person for election as a director for consideration at the annual meeting of stockholders in 2025 (the “2025 Meeting”) must follow the procedures found in Rule 14a-8 under the Exchange Act. To be eligible for inclusion in the Company’s proxy materials for the 2024 Meeting, the stockholder must give the Company written notice of the proposal and/or director nominee which must be received by our Corporate Secretary no later than January 1, 2025. A stockholder who wishes to make a proposal at the next annual meeting of stockholders without including the proposal in our proxy statement must notify us not less than thirty (30) days and not more than sixty (60) days prior to the scheduled annual meeting, regardless of any postponements, deferrals or adjournments of that meeting to a later date; provided, however, that if less than forty (40) days’ notice or prior public disclosure of the date of the scheduled annual meeting is given or made, notice by the stockholder, to be timely, must be so delivered or received not later than the close of business on the tenth (10th) day following the earlier of the day on which such notice of the date of the scheduled annual meeting was mailed or the day on which such public disclosure was made. If a stockholder fails to give notice by this date, then the persons named as proxies in the proxies solicited by us for the next annual meeting of stockholders will have discretionary authority to vote on the proposal. Stockholder proposals should be addressed to the Corporate Secretary, Nexalin Technology, Inc., 1776 Yorktown, Suite 550, Houston, Texas 77056.

EVERY STOCKHOLDER, WHETHER OR NOT HE OR SHE EXPECTS TO ATTEND THE ANNUAL MEETING IN PERSON, IS URGED TO EXECUTE THE PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED BUSINESS REPLY ENVELOPE.

18

Electronic Availability of Proxy Statement and Annual Report

As required by SEC rules, we are making this Proxy Statement and our Annual Report available to stockholders electronically via the Internet at https://www.cstproxy.com/nexalin/2024.

If you received a paper copy of this Proxy Statement by mail and you wish to receive a notice of availability of next year’s proxy statement either in paper form or electronically via e-mail, you can elect to receive a paper notice of availability by mail or an e-mail message that will provide a link to these documents on https://www.cstproxy.com/nexalin/2024. By opting to receive the notice of availability and accessing your proxy materials online, you will save the Company the cost of producing and mailing documents to you reduce the amount of mail you receive and help preserve environmental resources. Registered stockholders may elect to receive electronic proxy and annual report access or a paper notice of availability for future annual meetings by registering online at https://www.cstproxy.com/nexalin/2024. If you received electronic or paper notice of availability of these proxy materials and wish to receive paper delivery of a full set of future proxy materials, you may do so at the same location. Beneficial or “street name” stockholders who wish to elect one of these options may also do so at https://www.cstproxy.com/nexalin/2024.

The Annual Report accompanies the proxy materials being provided to all stockholders. We will provide without charge to each person being solicited by this Proxy Statement, on the written request of any such person, additional copies of the Annual Report including the financial statements and financial statement schedules included therein. All such requests should be directed to Corporate Secretary, Nexalin Technology, Inc., 1776 Yorktown, Suite 550, Houston, Texas 77056.

| By order of the Chairman of the Board | |

| /s/ Leslie Bernhard | |

| Leslie Bernhard | |

| Houston, Texas | |

| July 29, 2024 |

19