Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on August 29, 2011

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NEW ENTERPRISE STONE & LIME CO., INC.

and the Guarantors listed on Schedule A hereto

(Exact name of registrant as specified in its

charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

1400 (Primary Standard Industrial Classification Code Number) |

23-1374051 (I.R.S. Employer Identification Number) |

||

3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 (Address, including zip code, and telephone number, including area code, of registrants' principal executive offices) |

||||

| Paul I. Detwiler, III President, Chief Financial Officer and Secretary New Enterprise Stone & Lime Co., Inc. |

||||

3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

||||

| With a copy to: Cary S. Levinson, Esq. Brian M. Katz, Esq. Pepper Hamilton LLP 3000 Two Logan Square Eighteenth and Arch Streets Philadelphia, PA 19103-2799 (215) 981-4000 |

||||

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.:

| Large Accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

*If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per note |

Proposed maximum aggregate offering price |

Amount of registration fee |

||||

|---|---|---|---|---|---|---|---|---|

11% Senior Notes due 2018 |

$250,000,000 | 100.0%(1) | $250,000,000(2) | $29,025.00 | ||||

Guarantees of 11% Senior Notes due 2018 |

(3) | |||||||

|

||||||||

- (1)

- The

proposed maximum offering price per note is based on the book value of the notes as of August 29, 2011, in the absence of a public market for the

notes, in accordance with Rule 457(f)(2) promulgated under the Securities Act of 1933, as amended (the "Securities Act").

- (2)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457 promulgated under the Securities Act.

- (3)

- Pursuant to Rule 457(n), no additional registration fee is payable with respect to the guarantees.

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Exact name of registrant as specified in its charter

|

State or other jurisdiction of incorporation or organization |

Primary standard industrial classification code number |

IRS employer identification no. |

Address, including zip code and telephone number, including area code, of registrant's principal executive office |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

ASTI Transportation Systems, Inc. |

Delaware | 7359 | 51-0349197 | 3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 |

||||||

EII Transport Inc. |

Pennsylvania | 7359 | 25-1810626 | 3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 |

||||||

Gateway Trade Center Inc. |

New York | 7359 | 16-1266682 | 3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 |

||||||

Precision Solar Controls Inc. |

Texas | 7359 | 75-2312461 | 3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 |

||||||

Protection Services Inc. |

Pennsylvania | 7359 | 23-2001976 | 3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 |

||||||

SCI Products Inc. |

Pennsylvania | 7359 | 20-0200094 | 3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 |

||||||

Work Area Protection Corp. |

Illinois | 7359 | 52-1488457 | 3912 Brumbaugh Road P.O. Box 77 New Enterprise, PA 16664 (814) 766-2211 |

||||||

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted.

Subject to completion, dated August 29, 2011

PROSPECTUS

New Enterprise Stone & Lime Co., Inc.

Offer to Exchange

$250,000,000 in aggregate principal amount of 11% Senior Notes due 2018 which have been registered under the Securities Act of 1933 for $250,000,000 in aggregate principal amount of outstanding 11% Senior Notes due 2018.

We hereby offer, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal (which together constitute the "exchange offer"), to exchange up to $250,000,000 in aggregate principal amount of our registered 11% Senior Notes due 2018, which we refer to as the exchange notes, for a like principal amount of our outstanding 11% Senior Notes due 2018, which we refer to as the old notes. We refer to the old notes and the exchange notes collectively as the notes. The terms of the exchange notes are identical to the terms of the old notes in all material respects, except for the elimination of some transfer restrictions, registration rights and additional interest provisions relating to the old notes.

The exchange notes will bear interest at a rate of 11% per annum. Interest on the exchange notes, like the old notes, will be payable in cash semiannually in arrears on March 1 and September 1, commencing on March 1, 2011. The exchange notes will mature on September 1, 2018. We may redeem some or all of the exchange notes in whole or in part, at any time on or after September 1, 2014 at the redemption prices set forth in this prospectus. We may also redeem some or all of the exchange notes at any time prior to September 1, 2014, at 100% of their principal amount, together with any accrued and unpaid interest, plus a "make whole" premium. In addition, at any time prior to September 1, 2013, we may, at our option, redeem up to 35% of the outstanding notes with the net cash proceeds from certain equity offerings. If we undergo a change of control or the sale of certain assets, we will be required to purchase the exchange notes from holders at a purchase price equal to 101.000% of the principal amount plus accrued interest.

The exchange notes and guarantees thereof, like the old notes and guarantees thereof, will be our and the guarantors' senior obligations. The exchange notes will rank equally in right of payment with all of our existing and future unsubordinated debt, senior to all of our existing and future subordinated debt and effectively junior to the debt outstanding under our secured credit obligations, including our senior secured credit facilities, to the extent of the value of our assets securing such obligations. The guarantees will rank equally in right of payment with all of the guarantors' existing and future unsubordinated debt, senior to all of their existing and future subordinated debt and effectively junior to the secured obligations of the guarantors, to the extent of the value of the guarantors' assets securing such obligations. The exchange notes will be structurally subordinated to all existing and future liabilities of each of our subsidiaries that do not guarantee the exchange notes.

We will exchange any and all old notes that are validly tendered and not validly withdrawn prior to 5:00 p.m., New York City time, on , 2011, unless extended.

We have not applied, and do not intend to apply, for listing of the notes on any national securities exchange or automated quotation system.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"). This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days from which the registration statement is declared effective, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

You should carefully consider the risk factors beginning on page 21 of this prospectus before participating in this exchange offer.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011

You should rely only on the information contained in this document. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our exchange notes. In this prospectus, unless otherwise indicated or the context otherwise requires, references in this prospectus to "NESL," "the Company," "we," "us" and "our" refer to New Enterprise Stone & Lime Co., Inc. and its subsidiaries.

Until , 2011 (90 days after the date of this prospectus), all dealers effecting transactions in the exchange notes, whether or not participating in the exchange offer, may be required to deliver a prospectus.

i

WHERE YOU CAN FIND MORE INFORMATION

We will be required to file annual and quarterly reports and other information with the SEC after the registration statement described below is declared effective by the SEC. You may read and copy any reports, statements and other information that we file with the SEC at the SEC's public reference room located at 100 F Street, N.E. Room 1580, Washington, D.C. 20549. You may request copies of the documents, upon payment of a duplicating fee, by writing the Public Reference Section of the SEC. Please call 1-800-SEC-0330 for further information on the public reference rooms. Our filings with the SEC are also available to the public from commercial document retrieval services and at the web site maintained by the SEC at http://www.sec.gov.

We have filed a registration statement on Form S-4 to register with the SEC the exchange notes to be issued in exchange for the old notes and guarantees thereof. This prospectus is part of that registration statement. As allowed by the SEC's rules, this prospectus does not contain all of the information you can find in the registration statement or the exhibits to the registration statement. You should note that where we summarize in the prospectus the material terms of any contract, agreement or other document filed as an exhibit to the registration statement, the summary information provided in the prospectus is less complete than the actual contract, agreement or document. You should refer to the exhibits filed to the registration statement for copies of the actual contract, agreement or document.

We have not authorized anyone to give you any information or to make any representations about us or the transactions we discuss in this prospectus other than those contained in this prospectus. If you are given any information or representations about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer or sell securities under applicable law.

INDUSTRY RANKING AND MARKET DATA

Unless otherwise indicated, all information contained in this prospectus concerning the industry in general, including information regarding: (1) our market position and market share within our industry, (2) historical data concerning trends and sales in our industry, (3) expectations regarding trends and future growth of sales in our industry and (4) market statistics and public sector budget analysis, is based on management's estimates using internal data, data from industry related publications, consumer research and marketing studies and other externally obtained data that we believe to be reliable. However, certain industry and market data is subject to change and cannot always be verified with complete certainty due to, among other factors, limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey.

This prospectus includes "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), with respect to our financial condition, results of operations and business and our expectations or beliefs concerning future events. Such statements include, in particular, statements about our plans, strategies and prospects under the headings "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business." You can identify certain forward-looking statements by our use of forward-looking terminology such as, but not limited to, "believes," "expects," "anticipates," "estimates," "intends," "plans," "targets," "likely," "will," "would," "could" and similar expressions that identify forward-looking statements. All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in our industry and markets. Others are more specific to our operations. The occurrence of the events described and the achievement of the expected

ii

results depend on many events, some or all of which are not predictable or within our control. Actual results may differ materially from the forward-looking statements contained in this prospectus. Factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

- •

- risks associated with the cyclical nature of our business and dependence on activity within the construction industry;

- •

- declines in public sector construction and reductions in governmental funding which could adversely affect our operations

and results;

- •

- our reliance on private investment in infrastructure and a slower than normal recovery will adversely affect our results;

- •

- a decline in the funding of PennDOT, the Pennsylvania Turnpike Commission, the New York State Thruway or other state

agencies;

- •

- difficult and volatile conditions in the credit markets may adversely affect our financial position, results of operations

and cash flows;

- •

- the potential to inaccurately estimate the overall risks, requirements or costs when we bid on or negotiate a contract

that is ultimately awarded to us, which may result in a lower than anticipated profit or incur a loss on the contract;

- •

- the weather, which can materially affect our business and makes us subject to seasonality;

- •

- our operation in a highly competitive industry within our local markets;

- •

- our dependence upon securing and permitting aggregate reserves in strategically located areas;

- •

- risks related to our ability to acquire other businesses in our industry and successfully integrating them with our

existing operations;

- •

- risks associated with our capital-intensive business;

- •

- risks related to our failure to meet schedule or performance requirements of our contracts;

- •

- changes to environmental, health and safety laws and which may have a material adverse effect on our business, financial

condition and results of operations;

- •

- our dependence on our senior management, which may materially harm our business if we lose any member of our senior

management;

- •

- the potential risks if we are unable to recruit additional management and other personnel and are not able to grow our

business effectively or successfully implement our growth plans;

- •

- the potential for labor disputes to disrupt operations of our businesses;

- •

- special hazards related to our operations that may cause personal injury or property damage, which may subject us to

liabilities and possible losses which may not be covered by insurance;

- •

- unexpected self-insurance claims and reserve estimates which could adversely affect our business;

- •

- material costs and losses as a result of claims that our products do not meet regulatory requirements or contractual

specifications;

- •

- material weaknesses and significant deficiencies in our internal controls over financial reporting;

- •

- cancellation of significant contracts or our disqualification from bidding for new contracts;

- •

- general business and economic conditions, particularly an economic downturn; and

- •

- the other factors discussed in the section of this prospectus titled "Risk Factors."

iii

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this prospectus may not in fact occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

PRESENTATION OF FINANCIAL INFORMATION AND OTHER DATA

References throughout this prospectus to fiscal years 2011, 2010, 2009, 2008 and 2007 are to the twelve month period ended February 28, February 28, February 28, February 29 and February 28, respectively, of such years.

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

iv

The following summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information and financial statements and related notes included in this prospectus. You should carefully read this prospectus, including the section entitled "Risk Factors" and our audited and consolidated financial statements and related notes included elsewhere in this prospectus.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to "NESL," "the Company," "we," "us" and "our" refer to New Enterprise Stone & Lime Co., Inc. and its subsidiaries. References throughout this prospectus to fiscal years 2011, 2010, 2009, 2008 and 2007 are to the twelve month period ended February 28, February 28, February 28, February 29 and February 28, respectively, of such years.

Our Company

We are a leading privately held, vertically integrated construction materials supplier and heavy/highway construction contractor in Pennsylvania and western New York and a national traffic safety services and equipment provider. Founded in 1924, we are one of the top 15 construction aggregates producers and top 30 heavy contractors in the United States, according to industry surveys.

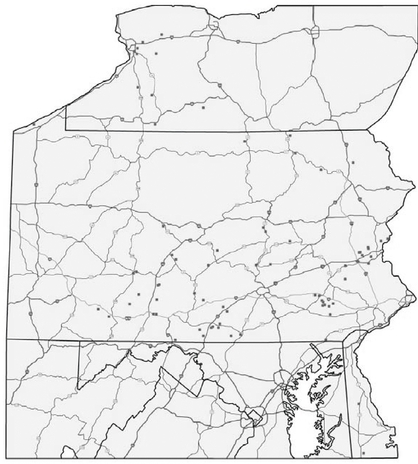

We operate in three segments based upon the nature of our products and services: construction materials, heavy/highway construction and traffic safety services and equipment. Our construction materials operations are comprised of: aggregate production, including crushed stone and construction sand and gravel; hot mix asphalt production; ready mixed concrete production; and the production of concrete products, including precast/prestressed structural concrete components and masonry blocks. Another of our core businesses, heavy/highway construction, includes heavy construction, blacktop paving and other site preparation services. Our heavy/highway construction operations are primarily supplied with construction materials from our construction materials operation. Our third core business, traffic safety services and equipment, consists primarily of sales and leasing of general and specialty traffic control and work zone safety equipment and devices to industrial construction end-users. Our core businesses operate primarily in Pennsylvania and western New York, except for our traffic safety services and equipment business, which maintains a national sales network for our traffic safety equipment and provides traffic maintenance and protection services primarily in the eastern United States.

Our revenue is derived from multiple end-use markets, including highway construction and maintenance, residential and non-residential construction and energy production, including the coal and natural gas industries. We believe we are the only heavy/highway contractor in Pennsylvania with the diversity of construction materials and services that we offer. As a result, we are able to meet a wide range of customer requirements on a local scale. A significant portion of our revenues, both through direct and indirect sales, are generated from the Pennsylvania Department of Transportation, which we refer to as PennDOT, the Pennsylvania Turnpike Commission, the New York State Thruway Authority and other agencies in the Commonwealth of Pennsylvania. |

|

1

Through four generations of family management, we have grown both organically and by acquisitions and now operate 53 quarries and sand deposits, 32 hot mix asphalt plants, 20 fixed and portable ready mixed concrete plants, four concrete products production plants, three lime distribution centers and seven construction supply centers. Our traffic safety services and equipment business operates five manufacturing facilities and has sales facilities throughout the continental United States. We believe our extensive operating history and industry expertise, combined with strategically located operations and substantial aggregate reserves throughout Pennsylvania and western New York, enable us to be a low-cost supplier, as well as an operator with an established execution track record.

Our vertically integrated construction materials and heavy/highway construction businesses operate in competitive regional markets. Many of our contracts are awarded based on a "sealed bid" process, which dictates that the lowest price bidder must be chosen. This dynamic forces us to compete against major, national suppliers and smaller, local operators. We believe that our extensive operational footprint and local market knowledge allow us to bid effectively on jobs, to obtain a unique understanding of our customers' evolving needs and, most critically, to maintain favorable positions in the markets for our products and services, enabling us to submit lower price bids while maintaining our profitability.

We maintain strategically located construction materials operations across Pennsylvania and western New York. We also provide heavy/highway construction services, primarily in Pennsylvania and, to a lesser degree, into Maryland, West Virginia and Virginia. We operate traffic safety equipment manufacturing facilities and sell these products across the United States and we provide maintenance and traffic protection services primarily in the eastern United States.

Our Competitive Strengths

The following characteristics provide us with competitive advantages relative to others that operate in our markets. While our competitors may possess one or more of these strengths, we believe we are a leader in our markets because of our full complement of these attributes. Our strengths include:

Leading Market Positions

We are one of the top 15 construction aggregates producers and top 30 heavy contractors in the United States, according to industry surveys. These leading market positions are driven by our regionally focused operational footprint, which facilitates efficient, low-cost product delivery and responsiveness to customer demands, which are essential to maintaining existing customers and securing new business.

Vertically Integrated Business Model

We generate revenue across a spectrum of related products and services. We are able to mine our quarries to extract aggregates that we use to produce ready mixed concrete and hot mix asphalt materials, which may be utilized by our heavy/highway construction business to service end customers. Our vertically integrated business model enables us to operate as a single source provider of materials and construction capabilities, creating cost, convenience and reliability advantages for our customers, while at the same time creating significant cross-marketing opportunities among our interrelated businesses. Our vertical integration model, combined with the breadth of our construction materials offerings, enhances our position as a construction materials supplier and as a bidder on complex multi-discipline construction projects. In instances where we may not win a local construction contract, for example, we may often serve as a subcontractor or significant supplier to the winning bidder, creating additional revenue opportunities.

2

Favorable Market Fundamentals

We work extensively for PennDOT and other governmental entities within Pennsylvania which are responsible for the state's roads and highways. Pennsylvania's diversified economy is heavily reliant on the state's approximately 121,000 miles of interstate, state and local roads, and approximately 55,000 bridges. Pennsylvania has the nation's sixth largest gross state product and the nation's fourth largest road network, which serves as a critical highway transportation route connecting midwestern manufacturing centers and the northeast corridor. The Pennsylvania State Transportation Advisory Committee, in its report dated May 2010, identified over $3.0 billion of annual unmet state and local highway and bridge funding needs in excess of currently available funding levels. Pennsylvania's bridges are the fourth oldest in the nation and the state ranked first in 2009 in the number of structurally deficient bridges. We believe our construction materials locations, understanding of various specifications, project management and skilled labor position us to take advantage of these favorable dynamics and enable us to provide competitive bids on most public sector projects in Pennsylvania.

Substantial Reserve Life

We estimate that we currently own or have under lease approximately 2.1 billion tons of proven and probable aggregate reserves, with an average estimated useful life of 113 years at current production levels. These reserves are located across our market area, creating a balanced distribution of reserves to serve customers across our markets. With our long operating experience and local knowledge, we believe we are highly qualified to efficiently identify and develop new quarry opportunities or quarries that become available for acquisition.

High Barriers to Entry

We benefit from barriers to entry that affect both potential new market entrants and existing competitors operating within or near our markets. The high weight-to-value ratio of aggregates and concrete products and the time in which hot mix asphalt and ready mixed concrete begin to set limit the efficient distribution range for these products to roughly a one-hour haul time. Our regionally focused operational footprint allows us to maintain lower transportation costs and compete effectively against large and small players in our local markets.

Quarry and construction operations are inherently asset intensive and require significant investments in land, high-cost equipment and machinery, resulting in significant start-up costs for a new business. We own most of the equipment and machinery used at our facilities, creating an advantage over potential market entrants. The complex regulatory environment and time-consuming permitting process, especially for opening new quarries, add further start-up costs and uncertainty for new market entrants.

Our regional focus and local knowledge, acquired through decades of operating experience, enhance our ability to bid effectively and win profitable contracts. We believe our experience allows us to distinguish ourselves from other competitors in this regard.

Experienced and Dedicated Management Team

Our senior management team includes certain third and fourth generation members of our founding family, the Detwiler family, who have spent a significant portion of their professional careers in the aggregate and heavy construction businesses and are complemented and supported by highly trained and experienced senior managers who came to us through various acquisitions and internal advancement. Our Chairman, Paul Detwiler, Jr., and our Vice Chairman and Chief Executive Officer, Donald Detwiler, have spent their entire careers working at NESL (53 and 46 years, respectively), with Paul's expertise centered on the operation of the plants and quarries and Donald's focused on the heavy/highway construction business. Two of Paul, Jr.'s sons, Paul Detwiler, III and Steven Detwiler,

3

and Donald's son-in-law, James W. Van Buren, hold executive officer positions and serve on our Board of Directors and Executive Committee. Our President and Chief Financial Officer, Paul Detwiler, III, joined us in 1981. Our Executive Vice President and Chief Operating Officer, James W. Van Buren, joined us in 1991. Steven Detwiler joined us in 1990 and currently serves as Senior Vice President-Construction Materials. G. Dennis Wiseman joined us in 1984 and currently serves as our Chief Accounting Officer and Assistant Secretary. The senior management team is complemented and supported by a large number of talented, highly trained and experienced senior managers with an average of approximately 33 years of experience. Our senior management team makes joint decisions on all major operating issues including capital deployments, acquisitions and expansions. Other corporate responsibilities are divided among the senior management group to ensure adequate contingency planning and leadership across all of our business lines and divisions. We continue to focus on succession planning and focus on growing our company management from our internal ranks. Accordingly, we believe our management team has served and will continue to serve a critical role in our growth and profitability. Management remains dedicated to continuing to develop our operations and executing our business strategy as we continue to grow the business. We have management and leadership training programs in place and have trained hundreds of employees over the years so that we are not dependent on the outside market place to fill open positions. Members of the Detwiler family, who control all of the voting equity of NESL, have demonstrated a commitment to continued reinvestment in NESL. With the exception of certain tax-related dividends, we have not issued a dividend to any of our equity holders in 10 years.

Our Business Strategy

We are focused on growing our sales, profitability and cash flow and strengthening our balance sheet by capitalizing on our competitive strengths, reinvesting in our core businesses and pursuing selective acquisitions in contiguous markets. Key elements of our business strategy include:

Leverage Our Vertically Integrated Business Model

We generate revenue across a spectrum of related products and services, many of which comprise a vertically integrated business that provides both raw materials and construction services. By maintaining production and cost control over this vertically integrated supply chain, we believe we are better able to serve our customers and be a low-cost supplier. We intend to leverage this vertical integration to continue to minimize our costs, improve our customer service and win profitable new business.

Maintain A Competitive Position in Our Markets

We are competitive in the areas we serve due to our extensive network of quarries and related operations that facilitate efficient distribution throughout our geographical market area. We believe that our vertically integrated model, including our network of operational facilities, as well as our tightly managed costs, project management, safety and educational training, technological improvements and value engineering focus all further drive our low-cost position. We continuously work to exploit new technologies, such as implementing improved global positioning systems to monitor truck delivery activity and increase precision in construction projects. These technological improvements, coupled with our comprehensive employee training program and health and safety training programs and policies, allow us to make optimal use of our employees and equipment, operate safely and lower our insurance claims. Our extensive operating experience allows us to identify value engineering opportunities on certain projects, allowing us to propose enhancements to project specifications which we believe save our customers money and enhance our profitability. The mechanics of the "sealed bid" process that govern many of our contract awards require that we submit a bid that is low enough to win the business, but also includes a margin sufficient to maintain profitability. We will continue to manage our

4

business aggressively to minimize costs to ensure that we are positioned to continue to win competitive, profitable new business in our markets.

Capitalize on Our Strategically Located Operations to Expand Market Share

We believe our existing operational footprint places us in proximity to some of the strongest market opportunities in the mid-Atlantic and western New York regions. Our proximity to areas of high construction activity, including the extensive Pennsylvania and western New York road networks and the Pennsylvania coal and gas industries, creates attractive revenue opportunities for which we are particularly well positioned relative to both major, national and smaller, local competitors. Our strategically situated construction materials locations create an inherent competitive advantage for us in our markets. We intend to continue to capitalize on these advantages to increase revenues and drive profitability. In those instances where our construction materials locations do not create an inherent competitive advantage, we remain competitive through our local knowledge of required specifications and industry expertise.

Drive Profitable Growth Through Reinvestment and Strategic Acquisitions

Through over 85 years of operations, we have developed significant experience and expertise in identifying and executing new growth opportunities. We expect to continue to enhance our overall competitive position and customer base by reinvesting in our business. Additionally, we will use our ability to generate cash flow to continue to repay debt and de-leverage our balance sheet so that we are positioned to opportunistically pursue accretive acquisitions of complementary construction materials businesses in contiguous markets that may become available to us. We also anticipate that we will leverage our experience to develop more greenfield quarry locations within or adjacent to our current markets.

Our Industry

Our core construction materials, heavy/highway construction and traffic safety services and equipment businesses are organized to deliver customers products and services from six interrelated industry sectors:

- •

- aggregates;

- •

- hot mix asphalt;

- •

- ready mixed concrete;

- •

- concrete products;

- •

- heavy/highway construction; and

- •

- traffic safety services and equipment.

Competitors in these industries range from small, privately held firms that produce a single product, to multinational corporations that offer a comprehensive suite of construction materials and services, including design, engineering, construction and installation. However, day-to-day execution for construction materials for all competitors remains local or regional in nature based upon typical value-to-weight ratios which limit the distance construction materials can be transported in a cost effective manner.

Transportation infrastructure projects represent a substantial portion of the overall U.S. infrastructure market. These projects are driven by both state and federal funding programs. The current federal funding program, Safe, Accountable, Flexible, Efficient Transportation Equity Act, which we refer to as SAFETEA-LU, was enacted in August 2005. SAFETEA-LU authorizes funds for

5

the Highway Trust Fund, and these funds, which are allocated to states pursuant to specified formulas, are utilized for the maintenance of highways and roads. On March 4, 2011, SAFETEA-LU was extended through September 30, 2011, which maintained the Highway Trust Fund spending of $42 billion annually. With approximately 121,000 miles of interstate, state and local roads and approximately 55,000 state and local bridges, Pennsylvania currently receives approximately $1.8 billion each year in federal funds for its highway and transit programs.

Infrastructure funding is also available under the American Recovery and Reinvestment Act, which we refer to as ARRA, which was enacted in February 2009. ARRA allocates a portion of funds for transportation purposes as well as for general infrastructure purposes. As of June 30, 2011, Pennsylvania has invested or committed for investment $16.7 billion of the $31.0 billion it received in ARRA funds. Of this amount, approximately $1.1 billion will be invested in transportation infrastructure with approximately $875.7 million already invested at June 30, 2011. We expect some of the remaining ARRA funding to be incorporated into infrastructure, public works and new building projects through 2011.

In addition to federal funding, highway construction and maintenance funding is also available through state agencies. In Pennsylvania, new highway and bridge construction and maintenance is coordinated by PennDOT. During its fiscal year ended June 30, 2010, PennDOT spent approximately $6.5 billion on transportation projects and administration, which includes its federal funds allocation. For its fiscal year ended June 30, 2011, PennDOT had $6.5 billion available to spend on transportation projects and administration and has proposed a budget of $6.3 billion for the next fiscal year. Typically the federal government funds a portion of PennDOT's annual budget, while Pennsylvania funds the balance through the Motor License Fund, which we refer to as MLF. MLF funds are mandated per the state constitution to fund expenditures on highways and bridges and may not be reallocated to other state funding needs in the annual budgeting process. The Pennsylvania Turnpike Commission has a budget that is currently separate from PennDOT. The Pennsylvania Turnpike Commission's 2011 fiscal year construction and maintenance budget is approximately $420.0 million.

PennDOT and the Pennsylvania Turnpike Commission have historically provided consistent demand for construction materials and projects in our markets. In addition, we also bid on purchase order contracts for hot mix asphalt and aggregates supplied directly to PennDOT maintenance districts and municipalities.

Construction Materials

Aggregates

The aggregates industry generated over $17.5 billion in sales through the production and shipment of 2.0 billion metric tons in 2010 in the United States, according to the United States Geological Survey, which we refer to as USGS. Aggregates include materials such as gravel, crushed stone, limestone and sand, which are primarily incorporated into construction materials, such as hot mix asphalt, cement and ready mixed concrete. Aggregates are also used for various applications and products, such as railroad ballast, filtration, roofing granules and in solutions for snow and ice control. The U.S. aggregate industry is highly fragmented with numerous participants operating in localized markets. The USGS reported that a total of 1,600 companies operating 4,000 quarries and 91 underground mines produced or sold crushed stone in 2010 in the United States.

Hot Mix Asphalt

Hot mix asphalt is the most commonly utilized pavement surface. Hot mix asphalt is produced by mixing asphalt cement and aggregate. The asphalt cement is heated to increase its viscosity and the aggregate is dried to remove moisture from it prior to mixing. Paving and compaction must be performed while the asphalt is sufficiently hot, typically within a one-hour haul from the production

6

facility. In many parts of the country, including the market in which we operate, paving is generally not performed in the winter months because of cold temperatures. The United States has approximately 4,000 asphalt plants. Each year, these plants produce 500 to 550 million tons of asphalt pavement material worth in excess of $30 billion.

Ready Mixed Concrete

Demand for ready mixed concrete is driven by its highly versatile end use applications. The ready mixed concrete industry generated approximately $30 billion in sales in 2010 through the shipment of approximately 257 million cubic yards in the United States, according to the National Ready Mixed Concrete Association. Ready mixed concrete is created through the combination of coarse and fine aggregates with water, various chemical admixtures and cement. Given the high weight-to-value ratio, delivery of ready mixed concrete is typically limited to a one-hour haul from a production plant location and is further limited by a 90 minute window in which newly mixed concrete must be poured to maintain quality and desired performance characteristics. Most industry participants produce ready mixed concrete in batch plants and use concrete mixer trucks to deliver the concrete to customers' job sites. Ready mixed concrete, which is poured in place at a construction site, can compete with other precast concrete products and concrete masonry block products.

Concrete Products

Precast and prestressed concrete products are utilized in highway construction to build bridges and decks and in non-residential construction to build a broad range of large structures such as parking garages, prison cells and sports stadium risers. Precast and prestressed concrete products offer many building advantages, including flexibility in design, speed to completion and low maintenance.

Masonry blocks are widely used in the construction of buildings, such as foundations, arches and retaining walls. Masonry blocks continue to grow in popularity because of their durability and relative low cost. Most of the companies that produce masonry blocks, such as ours, also produce other concrete-related products, including architectural block, pavers and franchised building systems such as Anchor® Segmental Retaining Walls, which can be manufactured centrally and shipped to the point of installation.

Heavy/Highway Construction

Heavy/highway construction businesses provide a broad range of transportation and site preparation construction services, including grading and drainage, building bridge structures and concrete and blacktop paving services. While we provide services for a range of projects from driveway construction to the construction of new interstate highways, our business is primarily focused on structures, road construction and maintenance and blacktop/concrete paving. In general, the highway construction industry's growth rate is directly related to federal and state transportation agencies' funding of road, highway and bridge maintenance and construction. While public sector spending for highway construction has increased over the past two years, primarily as a result of federal stimulus money released under the ARRA, the simultaneous decrease in private sector spending has resulted in a contraction of the overall market.

Traffic Safety Services and Equipment

The traffic safety services and equipment industry is comprised of companies that produce, sell and set up traffic safety equipment in the United States. Traffic safety products generally consist of portable products such as message boards, arrow boards and speed awareness monitors, as well as traffic cones, barrels and signs. Demand for traffic safety services and equipment is particularly sensitive to changes in activity in the highway construction end-market. While significant challenges to the traffic safety

7

equipment industry remain due to the recent economic downturn, we believe that the long-term growth prospects for the industry are favorable, given increasingly stringent highway and workplace safety regulations and standards, in addition to an anticipated cyclical recovery in highway spending.

Recent Developments

On May 18, 2011, we amended our second amended and restated credit agreement to amend the way that the fixed charge coverage ratio is calculated and to provide greater cushion under our financial covenants. Under these amendments, we effectively reduced our fixed charge coverage ratio covenant to at least 1.05 to 1 through August 31, 2012 and 1.10 to 1 thereafter. We rendered it easier to satisfy our total leverage covenant (as described below) by increasing the relevant ratios to no more than 5.50 to 1.00 through May 31, 2011, 5.90 to 1.00 through August 31, 2011, 5.60 to 1.00 through May 31, 2012 and 5.50 to 1.00 thereafter. Under this amendment we also agreed to limit capital expenditures to a maximum of $25.0 million per year. Our total leverage ratio for any relevant period is defined as the ratio of "Average Indebtedness" for that period to "EBITDAR" for that period. "Average Indebtedness" for any period means, (a) with respect to revolving loans, (i) the average daily outstanding principal amount of our revolving loans during such period less (ii) if such period ends within twelve months of August 18, 2010, $43.5 million and, (b) with respect to all other indebtedness, the outstanding principal amount of such indebtedness (or the equivalent amount for lease obligations) at the end of such period. "EBITDAR" for any period means net income (as defined in the second amended and restated credit agreement) plus the sum of the following (to the extent deducted in the computation of such net income and without duplication): (a) depreciation expense and cost depletion; (b) amortization expense; (c) interest expense; (d) the sum (without duplication) of all taxes payable by us and our subsidiaries and restricted payments permitted in respect of taxes to our shareholders (but, if there is a net tax benefit, such tax benefit shall be deducted from net income in calculating EBITDAR); and (e) all expenses relating to synthetic leases and operating leases.

On July 18, 2011, we amended our second amended and rested credit agreement to increase the allowable amount of unsecured loans from $8.0 million to $20.0 million.

On August 22, 2011, the stockholders of the Company amended the stock restriction agreement which, among other things, required the Company to purchase, at any time, all or some of a stockholder's common stock at the option of the individual stockholders. The amendment eliminated the stockholder's right to require the Company to purchase the common stock on a prospective basis.

On August 26, 2011, we entered into the eleventh amendment to our second amended and restated credit agreement. The eleventh amendment allows for additional secured borrowings under a new secured credit facility of up to $20.0 million, increased the leverage covenant from 5.60 to 1.00 to 5.90 to 1.00 through maturity, increased the amount of annual capital expenditures from $25.0 million to $30.0 million and increased the aggregate principal amount of outstanding revolving credit borrowings allowable during the clean down period from $75.0 million to $85.0 million. On the same date, we entered into a new $20.0 million credit facility which matures on March 1, 2012, and bears an interest rate of LIBOR plus a 5.0% margin. Additionally, in conjunction with the $20.0 million borrowing, certain properties not previously encumbered were used as collateral.

See "Use of Proceeds" and see "Description of Other Indebtedness—Senior Secured Credit Facilities."

Corporate Structure

New Enterprise Stone & Lime Co., Inc. is a Delaware corporation initially formed as a partnership in 1924. Our principal executive offices are located at 3912 Brumbaugh Road, P.O. Box 77, New Enterprise, PA 16664, and our telephone number is (814) 766-2211. Our website address is

8

http://www.NESL.com. Our website and the information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus.

The chart below illustrates a summary of the Company and its consolidated subsidiaries. The exchange notes will be guaranteed on a senior unsecured basis by all of our existing and future domestic subsidiaries, with the exception of certain subsidiaries. The exchange notes will be initially guaranteed, on a senior unsecured basis, by each of our subsidiaries that guarantee payment by us of any indebtedness under our senior secured credit facilities. For a description of our senior secured credit facilities and existing borrowing arrangements, see "Description of Other Indebtedness."

- *

- Rock

Solid Insurance Company, NESL II, LLC, Kettle Creek Partners GP, LLC and Kettle Creek Partners L.P. are

non-guarantors.

- **

- Minority owned and therefore does not qualify as a subsidiary under the indenture.

9

The Exchange Offer

The following summary contains basic information about the exchange offer and the exchange notes. It does not contain all of the information that is important to you. For a more complete understanding of the notes, please refer to the sections of this prospectus entitled "The Exchange Offer" and "Description of the Notes."

Exchange Offer |

In connection with the issuance of the old notes, we and the guarantors of the old notes entered into a registration rights agreement with the initial purchasers of the old notes. Under that agreement, we agreed to use commercially reasonable efforts to file a registration statement related to the exchange of old notes for exchange notes with the SEC on or prior to the 360th day after August 18, 2010 and to cause the registration statement to become effective under the Securities Act on or prior to the 480th day after August 18, 2010. | |

|

The registration statement of which this prospectus forms a part was filed in compliance with the obligations under this registration rights agreement. |

|

|

You are entitled to exchange in this exchange offer your old notes for exchange notes which are identical in all material respects to the old notes except that: |

|

|

• the exchange notes have been registered under the Securities Act and will be freely tradable by persons who are not affiliated with us; |

|

|

• the exchange notes are not entitled to registration rights which are applicable to the old notes under the registration rights agreement; and |

|

|

• our obligation to pay additional interest on the old notes as described in the registration rights agreement does not apply to the exchange notes. |

|

Senior Notes |

We are offering to exchange up to $250,000,000 in aggregate principal amount of our 11% Senior Notes due 2018 which have been registered under the Securities Act for up to $250,000,000 in aggregate principal amount of our old notes which were issued on August 18, 2010. The old notes may be exchanged only in integral amounts of $1,000. |

|

Resales |

Based on interpretations by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to this exchange offer in exchange for old notes may be offered for resale, resold and otherwise transferred by you (unless you are our "affiliate" within the meaning of Rule 405 under the Securities Act) without compliance with the registration provisions of the Securities Act, provided that you: |

|

|

• are acquiring the exchange notes in the ordinary course of business, and |

10

|

• have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

|

|

Each participating broker-dealer that receives exchange notes for its own account pursuant to this exchange offer in exchange for the old notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. See "Plan of Distribution." |

|

|

Any holder of the exchange notes who |

|

|

• is our affiliate, |

|

|

• does not acquire the exchange notes in the ordinary course of business, or |

|

|

• tenders in this exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes, |

|

|

cannot rely on the position of the staff of the SEC expressed in Exxon Capital Holdings Corporation, Morgan Stanley & Co. Incorporated or similar no-action letters and, in the absence of an exemption, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with the resale of the exchange notes. |

|

Expiration, Withdrawal of Tenders |

This exchange offer will expire at 5:00 p.m., New York City time, , 2011, or such later date and time to which we extend it. We do not currently intend to extend the expiration date. A tender of old notes pursuant to this exchange offer may be withdrawn at any time prior to the expiration date. Any old notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of this exchange offer. |

|

Accrued Interest on the Exchange Notes and Old Notes |

The exchange notes will bear interest from August 18, 2010 (or the most recent date prior to the closing of the exchange offer on which interest was paid on the old notes). The right to receive interest on the exchange notes will replace the right to receive any payment in respect of interest on old notes accepted for exchange that accrued to the date of issuance of the exchange notes. |

|

Delivery of the Exchange Notes |

The exchange notes issued pursuant to this exchange offer will be delivered to the holders who tender old notes promptly following the expiration date. |

|

Conditions to this Exchange Offer |

This exchange offer is subject to customary conditions, some of which we may waive. See "The Exchange Offer—Certain Conditions to this Exchange Offer." |

11

Procedures for Tendering Old Notes |

If you wish to accept this exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must also mail or otherwise deliver the letter of transmittal, or the facsimile, together with the old notes and any other required documents, to the exchange agent at the address set forth on the cover of the letter of transmittal. If you hold old notes through The Depository Trust Company ("DTC") and wish to participate in this exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the letter of transmittal. |

|

|

By signing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: |

|

|

• any exchange notes that you will receive will be acquired in the ordinary course of your business; |

|

|

• you have no arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

|

|

• if you are a broker-dealer that will receive exchange notes for your own account in exchange for old notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes; and |

|

|

• you are not our "affiliate" as defined in Rule 405 under the Securities Act. |

|

Special Procedures for Beneficial Holders |

If you beneficially own old notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the exchange offer, you should contact such registered holder promptly and instruct it to tender on your behalf. If you wish to tender on your own behalf, you must, before completing and executing the letter of transmittal for the exchange offer and delivering your old notes, either arrange to have your old notes registered in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership make take considerable time. |

12

Guaranteed Delivery Procedures |

If you wish to tender your old notes and your old notes are not immediately available or you cannot deliver your old notes, the letter of transmittal or any other documents required by the letter of transmittal to the exchange agent or if you cannot comply with the applicable procedures under DTC's Automated Tender Offer Program prior to the expiration date, you must tender your old notes according to the guaranteed delivery procedures set forth in this prospectus under "The Exchange Offer—Guaranteed Delivery Procedures." |

|

Effect on Holders of Old Notes |

As a result of the making of, and upon acceptance for exchange of all validly tendered old notes pursuant to the terms of, this exchange offer, we will have fulfilled our covenants under the registration rights agreement and, accordingly, you will no longer be entitled to any exchange or, except in limited circumstances, registration rights with respect to the old notes, and the exchange notes will not provide for liquidated damages. If you are a holder of old notes and do not tender your old notes in this exchange offer, you will continue to hold such old notes and you will be entitled to all the rights and limitations applicable to the old notes in the indenture, except for any rights under the registration rights agreement that by their terms terminate upon the consummation of this exchange offer. |

|

Consequences of Failure to Exchange |

All untendered old notes will continue to be subject to the restrictions on transfer provided for in the old notes and in the indenture governing the old notes. In general, the old notes may not be offered or sold unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with this exchange offer, or as otherwise required under certain limited circumstances pursuant to the terms of the registration rights agreement, we do not currently anticipate that we will register the old notes under the Securities Act. |

|

Certain U.S. Federal Income Tax Considerations |

The exchange of old notes for exchange notes in this exchange offer should not be a taxable event for U.S. federal income tax purposes. See "Certain U.S. Federal Income Tax Considerations." |

|

Use of Proceeds |

We will not receive any cash proceeds from the issuance of the exchange notes in this exchange offer. |

13

Accounting Treatment |

The exchange notes will be recorded as the same debt obligations as the old notes as reflected in our accounting records. Accordingly, no gain or loss for accounting purposes will be recognized by us. The expenses of the exchange offer and the unamortized expenses related to the issuance of the exchange notes will be amortized over the term of the exchange notes. See "The Exchange Offer—Accounting Treatment." |

|

Exchange Agent |

Wells Fargo Bank National Association is the exchange agent for this exchange offer. The address and telephone number of the exchange agent are set forth in the section captioned "The Exchange Offer—Exchange Agent." |

14

Summary of the Terms of the Exchange Notes

| Issuer | New Enterprise Stone & Lime Co., Inc. | |

Exchange Notes Offered |

$250,000,000 in aggregate principal amount of 11% senior notes due 2018. |

|

Maturity Date |

September 1, 2018. |

|

Interest |

11% per annum, payable semi-annually in cash in arrears on March 1 and September 1 of each year. |

|

Guarantees |

The exchange notes will be guaranteed, on a joint and several basis, by all of our existing and future domestic subsidiaries, with the exception of certain subsidiaries. The exchange notes will be initially guaranteed, on a senior unsecured basis, by each of our subsidiaries that guarantee payment by us of any indebtedness under our senior secured credit facilities and the old notes. See "Description of the Notes—Guarantees by Domestic Subsidiaries." Our existing domestic subsidiaries who are currently guarantors consist of ASTI Transportation Systems, Inc., EII Transport Inc., Gateway Trade Center Inc., Precision Solar Controls Inc., Protection Services Inc., SCI Products Inc., and Work Area Protection Corp. |

|

Ranking |

The exchange notes and guarantees thereof will rank: |

|

|

• equally in right of payment with all of our and the guarantors' existing and future unsubordinated debt; |

|

|

• senior in right of payment to all of our and the guarantors' existing and future subordinated debt; |

|

|

• effectively junior in right of payment to the debt outstanding under our secured obligations, including under our senior secured credit facilities, to the extent of the value of the assets securing such debt, and effectively junior to the secured obligations of the guarantors, including their guarantees of the senior secured credit facilities, to the extent of the value of the guarantors' assets securing such obligations; and |

|

|

• effectively junior to any debt of our non-guarantor subsidiaries. |

|

As of May 31, 2011, we had approximately $553.3 million of total debt outstanding (including the notes), $297.0 million of which was secured debt. In addition, we had an additional $25.5 million of secured debt available for borrowing under our revolving credit facility. |

15

| Our non-guarantor subsidiaries did not account for any net revenue during fiscal year 2011. As of May 31, 2011, our non-guarantor subsidiaries accounted for $26.4 million, or 3.2%, of our assets (excluding intercompany eliminations) and $18.2 million, or 2.4%, of our liabilities (excluding intercompany eliminations). | ||

Optional Redemption |

The exchange notes will be redeemable, in whole or in part, at any time on or after September 1, 2014, at the redemption prices specified under "Description of the Notes—Optional Redemption." |

|

At any time prior to September 1, 2013, we may, at our option, redeem up to 35% of the exchange notes with the net cash proceeds from certain equity offerings at a price equal to 111.000% of the principal amount thereof, together with accrued and unpaid interest, if any, to, but not including, the redemption date as described under "Description of the Notes—Optional Redemption." |

||

We may also redeem some or all of the exchange notes at any time prior to September 1, 2014 at a redemption price equal to 100% of the principal amount plus accrued and unpaid interest, if any, to, but not including, the redemption date, plus a "make-whole" premium as described under "Description of the Notes—Optional Redemption." |

||

Change of Control |

Upon the occurrence of certain changes in control, we must offer to repurchase the exchange notes at 101% of the principal amount, plus accrued interest, if any, to, but not including, the purchase date. See "Description of the Notes—Change of Control." |

|

Certain Covenants |

The indenture governing the exchange notes contains covenants that limit, among other things, the ability of our and our restricted subsidiaries to: |

|

|

• incur additional debt; |

|

|

• pay dividends or make other distributions or repurchase capital stock or make other restricted payments; |

|

|

• make certain investments; |

|

|

• incur liens; |

|

|

• merge, amalgamate or consolidate, or sell transfer, lease or dispose of all or substantially all of our assets; and |

|

|

• enter into certain transactions with affiliates. |

|

These covenants are subject to important exceptions and qualifications, which are described in "Description of the Notes—Certain Covenants." |

16

| Listing | We do not intend to list the exchange notes on any securities exchange or include the exchange notes in any automated quotation system. Accordingly, there can be no assurance that a market for the exchange notes will develop or as to the liquidity of any markets that may develop. | |

Risk Factors |

Potential investors in the exchange notes should carefully consider the matters set forth under the caption "Risk Factors," as well as the other information included in this prospectus, prior to making an investment decision with respect to the exchange notes. |

17

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth a summary of our historical consolidated financial and other data as of and for the periods presented. The summary historical financial information, except for "Other Financial Data," as of February 28, 2011 and 2010 and for our three fiscal years 2009, 2010 and 2011 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary historical consolidated balance sheet data at February 28, 2009 from our consolidated balance sheet as of February 28, 2009 which is not presented in this prospectus. The summary historical financial information, except for "Other Financial Data," for the three month periods ended May 31, 2011 and May 31, 2010 have been derived from unaudited interim condensed financial statements included elsewhere in this prospectus. In the opinion of our management, the unaudited interim financial data includes all adjustments, consisting only of normal non-recurring adjustments considered necessary for a fair presentation of this information. Our historical results included below and elsewhere in this prospectus are not necessarily indicative of our future performance. In addition, the results of operations for the interim periods is not necessarily indicative of the results that may be expected for the entire year. The following summary historical consolidated financial and other data are qualified in their entirety by reference to, and should be read in conjunction with, our audited consolidated financial statements and the accompanying notes, included elsewhere in this prospectus, and the information under "Selected Historical Consolidated

18

Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and other financial information included in this prospectus.

| |

Fiscal Year Ended | Three Months Ended | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

February 28, 2009 | February 28, 2010 | February 28, 2011 | May 31, 2010 | May 31, 2011 | |||||||||||||

| |

(dollars in thousands) |

|||||||||||||||||

Consolidated Statement of Operations Data: |

||||||||||||||||||

Revenue |

$ | 785,775 | $ | 737,118 | $ | 725,999 | $ | 166,070 | $ | 146,771 | ||||||||

Operating costs and expenses: |

||||||||||||||||||

Costs of revenue |

620,145 | 580,612 | 578,611 | 138,785 | 123,119 | |||||||||||||

Depreciation, depletion and amortization |

42,279 | 43,742 | 45,917 | 10,487 | 11,345 | |||||||||||||

Intangible asset impairment |

44,873 | — | — | — | — | |||||||||||||

Pension and profit sharing |

8,895 | 9,690 | 8,907 | 2,159 | 1,715 | |||||||||||||

Selling, administrative and general expenses |

59,223 | 64,779 | 61,547 | 15,296 | (1) | 11,793 | (1) | |||||||||||

Total operating costs and expenses |

775,415 | 698,823 | 694,982 | 166,727 | 147,972 | |||||||||||||

Operating Profit |

10,360 | 38,295 | 31,017 | (657 | ) | (1,201 | ) | |||||||||||

Other income (expense): |

||||||||||||||||||

Interest income |

667 | 593 | 318 | 50 | 4 | |||||||||||||

Interest expense |

(40,185 | ) | (29,536 | )(2) | (41,586 | )(3) | (7,003 | ) | (11,600 | ) | ||||||||

Total other expense |

(39,518 | ) | (28,943 | ) | (41,268 | ) | (6,953 | ) | (11,596 | ) | ||||||||

Income (loss) before income taxes |

(29,158 | ) | 9,352 | (10,251 | ) | (7,610 | ) | (12,797 | ) | |||||||||

Income tax expense (benefit) |

1,060 | 392 | (4,478 | ) | (2,238 | ) | (8,235 | ) | ||||||||||

Net income (loss) |

(30,218 | ) | 8,960 | (5,773 | ) | (5,372 | ) | (4,562 | ) | |||||||||

Noncontrolling interest in net (income) loss |

(1,214 | ) | (1,165 | ) | (1,195 | ) | (298 | ) | (299 | ) | ||||||||

Net income (loss) attributable to stockholders |

$ | (31,432 | ) | $ | 7,795 | $ | (6,968 | ) | $ | (5,670 | ) | $ | (4,861 | ) | ||||

Other financial data: |

||||||||||||||||||

Depreciation and cost depletion |

41,639 | 43,102 | 45,277 | 10,327 | 11,185 | |||||||||||||

Cash capital expenditures |

28,263 | 24,331 | 31,777 | (8,951 | ) | (12,830 | ) | |||||||||||

Cash and cash equivalents, beginning of period |

6,385 | 16,507 | 10,773 | 10,773 | 20,029 | |||||||||||||

Balance Sheet Data: |

||||||||||||||||||

Cash, restricted cash and cash equivalents |

$ | 18,219 | $ | 12,573 | $ | 21,916 | $ | 18,359 | $ | 21,898 | ||||||||

Inventories |

118,745 | 127,214 | 129,422 | 127,585 | 133,113 | |||||||||||||

Property, plant, and equipment, net |

408,590 | 390,530 | 382,965 | 391,203 | 383,576 | |||||||||||||

Total assets |

764,511 | 750,234 | 768,078 | 824,930 | 838,856 | |||||||||||||

Long-term debt, including current portion |

518,080 | 484,896 | 500,846 | 521,559 | 553,277 | |||||||||||||

Total liabilities |

688,904 | 665,788 | 690,907 | 746,271 | 766,665 | |||||||||||||

Redeemable common stock |

143,411 | 183,318 | 130,241 | 177,290 | 140,954 | |||||||||||||

Total deficit |

(67,804 | ) | (98,872 | ) | (53,070 | ) | (98,631 | ) | (68,763 | ) | ||||||||

19

| |

Fiscal Year Ended | Three Months Ended | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

February 28, 2009 | February 28, 2010 | February 28, 2011 | May 31, 2010 | May 31, 2011 | |||||||||||||

| |

(dollars in thousands) |

|||||||||||||||||

Consolidated Statement of Cash Flows: |

||||||||||||||||||

Net cash provided by (used in): |

||||||||||||||||||

Operating activities |

$ | 23,928 | $ | 58,078 | $ | 47,503 | $ | (17,973 | ) | $ | (38,697 | ) | ||||||

Investing activities |

(26,145 | ) | (24,374 | ) | (31,549 | ) | (8,847 | ) | (19,926 | ) | ||||||||

Financing activities |

12,339 | (39,438 | ) | (6,698 | ) | 32,573 | 50,245 | |||||||||||

Cash paid for capital expenditures |

(28,263 | ) | (24,331 | ) | (31,777 | ) | (8,951 | ) | (12,830 | ) | ||||||||

Selected Business Line Data: |

||||||||||||||||||

Revenue: |

||||||||||||||||||

Construction materials |

$ | 559,174 | $ | 499,186 | $ | 512,743 | $ | 108,913 | $ | 104,487 | ||||||||

Heavy/highway construction |

338,885 | 349,856 | 337,620 | 69,211 | 52,811 | |||||||||||||

Traffic safety services & equipment |

83,085 | 81,102 | 78,181 | 22,411 | 21,961 | |||||||||||||

Other non-core business operations |

11,459 | 12,719 | 15,220 | 2,916 | 2,833 | |||||||||||||

Gross revenue |

992,603 | 942,863 | 943,764 | 203,451 | 182,092 | |||||||||||||

Intercompany eliminations |

(206,828 | ) | (205,745 | ) | (217,765 | ) | (37,381 | ) | (35,321 | ) | ||||||||

Revenue |

$ | 785,775 | $ | 737,118 | $ | 725,999 | $ | 166,070 | $ | 146,771 | ||||||||

- (1)

- Selling,

administrative and general expenses for the three months ended May 31, 2011 and May 31, 2010 includes $1.2 million and $0.2 million,

respectively, of gain associated with the disposal of property and equipment.

- (2)

- The

decrease in interest expense from fiscal year 2009 to fiscal year 2010 was primarily the result of lower interest rates year over year.

- (3)

- The increase in interest expense during fiscal year 2011 was a result of an overall increase in borrowings and interest rates, primarily related to the issuance of our old notes in August 2010.

20

You should carefully consider the risks described below, in addition to the other information contained in this prospectus, before electing to exchange your old notes for the exchange notes. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently consider less significant may also impair our business operations. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The value of the exchange notes could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Our business depends on activity within the construction industry.