Exhibit 99.2

GLOBAL NET LEASE October 2018 Investor Presentation NETSCOUT – ALLEN, TX

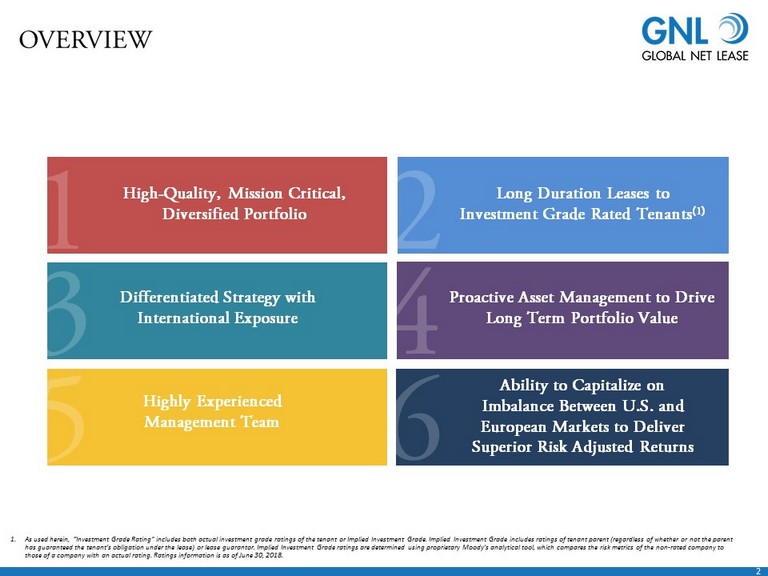

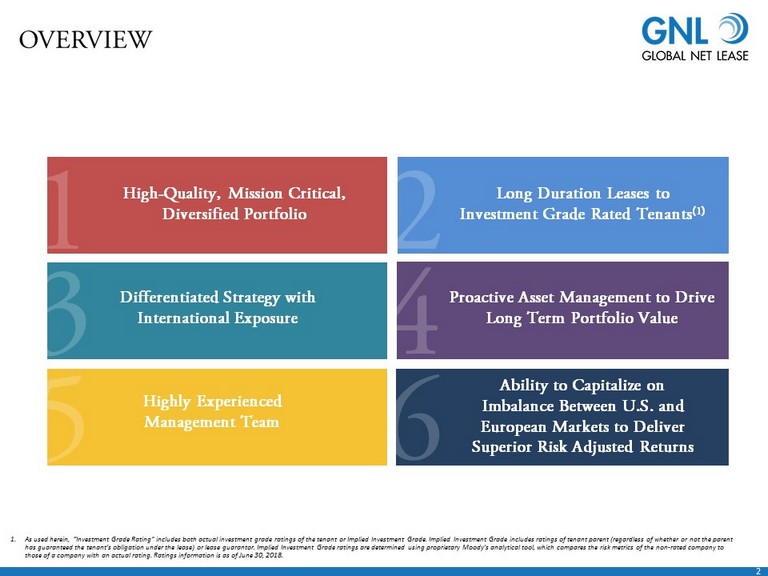

2 OVERVIEW Long Duration Leases to Investment Grade Rated Tenants (1) Proactive Asset Management to Drive Long Term Portfolio Value High - Quality, Mission Critical, Diversified Portfolio Differentiated Strategy with International Exposure Highly Experienced Management Team Ability to Capitalize on Imbalance Between U.S. and European Markets to Deliver Superior Risk Adjusted Returns 1. As used herein, “Investment Grade Rating” includes both actual investment grade ratings of the tenant or Implied Investment G rad e. Implied Investment Grade includes ratings of tenant parent (regardless of whether or not the parent has guaranteed the tenant’s obligation under the lease) or lease guarantor. Implied Investment Grade ratings are determined u sin g proprietary Moody’s analytical tool, which compares the risk metrics of the non - rated company to those of a company with an actual rating. Ratings information is as of June 30, 2018.

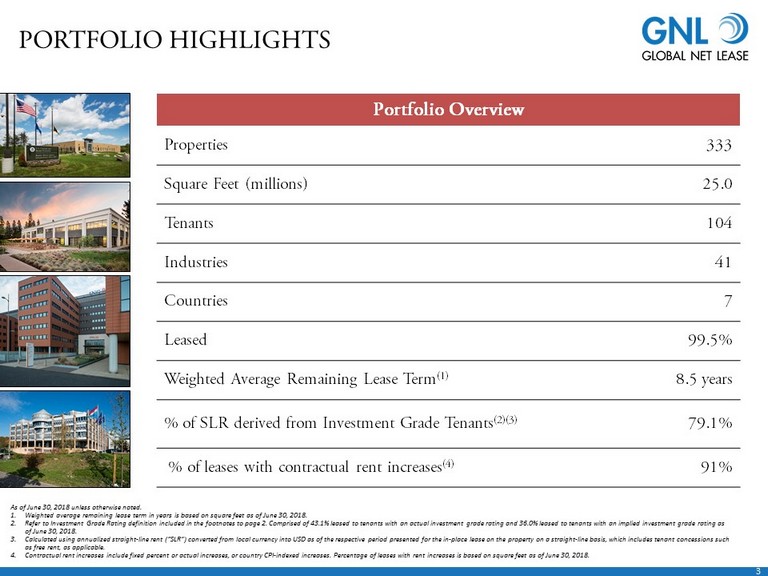

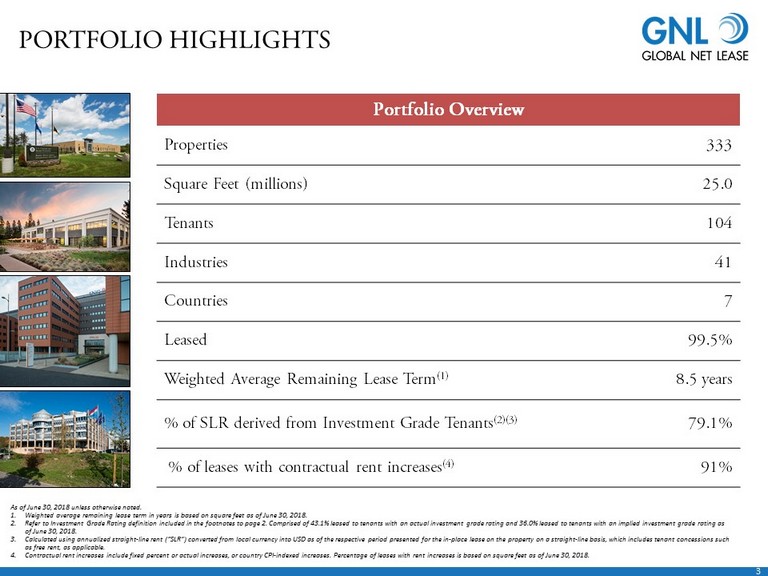

3 PORTFOLIO HIGHLIGHTS Properties 333 Square Feet (millions) 25.0 Tenants 104 Industries 41 Countries 7 Leased 99.5% Weighted Average Remaining Lease Term (1) 8.5 years % of SLR derived from Investment Grade Tenants (2)(3) 79.1% % of leases with contractual rent increases (4) 91% Portfolio Overview As of June 30 , 2018 unless otherwise noted. 1. Weighted average remaining lease term in years is based on square feet as of June 30, 2018. 2. Refer to Investment Grade Rating definition included in the footnotes to page 2. Comprised of 43.1% leased to tenants with an actual investment grade rating and 36.0% leased to tenants with an implied investment grade rating as of June 30, 2018. 3. Calculated using annualized straight - line rent (“SLR”) converted from local currency into USD as of the respective period presen ted for the in - place lease on the property on a straight - line basis, which includes tenant concessions such as free rent, as applicable. 4. Contractual rent increases include fixed percent or actual increases, or country CPI - indexed increases. Percentage of leases wit h rent increases is based on square feet as of June 30, 2018.

4 Non Investment Grade 17.4% Investment Grade 79.1% Not Rated 3.5% United States 51% United Kingdom 21% The Netherlands 7% Germany 8% Finland 6% France 5% Luxembourg 2% WELL BALANCED PORTFOLIO As of June 30, 2018 1. Me tric based on SLR. Refer to SLR definition included in the footnotes to page 3. 2. Refer to Investment Grade Rating definition included in the footnotes to page 2. Credit Rating (1) Tenant Industry (1) Geography (1) Asset Type (1) (2) Office 56% Industrial/Distribution 35% Retail 9% US: 67 % EUR: 33% US: 55% EUR: 45% US: 41% EUR: 59% Financial Services 13% Telecommunications 6% Discount Retail 6% Aerospace 6% Government Services 6% Technology 5% Healthcare 5% Freight 5% Utilities 5% Energy 5% Metal Processing 5% All Other 33%

5 WELL DIVERSIFIED TENANT BASE Top Ten Tenants As of June 30, 2018. *Represents Moody’s Implied Rating. ** Represents Tenant Parent Rating. 1. Metric based on SLR. Refer to SLR definition included in the footnotes to page 3. Top Ten Tenants Represent Only 38 % of SLR (1) Tenant Rating Country Property Type % of SLR (1) Baa2** U.S. Distribution 5% Aaa** U.S. Office 5% Baa3* U.K. Office 4% Baa3 GER Office 4% Aa3 NETH Office 4% Aa1** FIN Industrial 4% Baa3 U.S. Retail 3% Baa3* U.K. Distribution 3% Aa3 U.S. Office 3% Steel Service Supplier Baa3* U.S. Industrial 3%

6 Financial Service Providers Government Services Multinational Corporations FOCUS ON HIGH - QUALITY TENANTS Only Focused on Markets with Quality Sovereign Debt Ratings (S&P) U.S. Luxembourg Germany The Netherlands Finland U.K. France AA+ AAA AAA AAA AA+ AA AA Best - in - class portfolio leased to largely Investment G rade Rated T enants (1) in well established markets in the U.S. and Europe 1. Refer to Investment Grade Rating definition included in the footnotes to page 2.

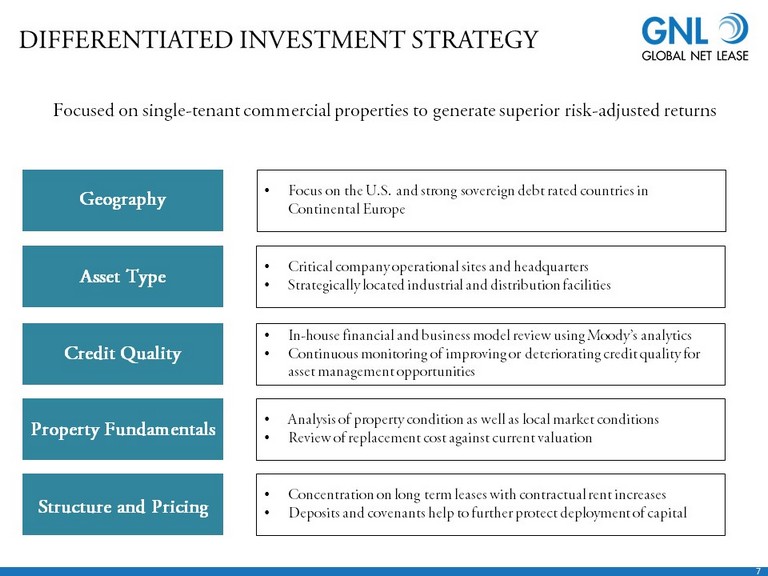

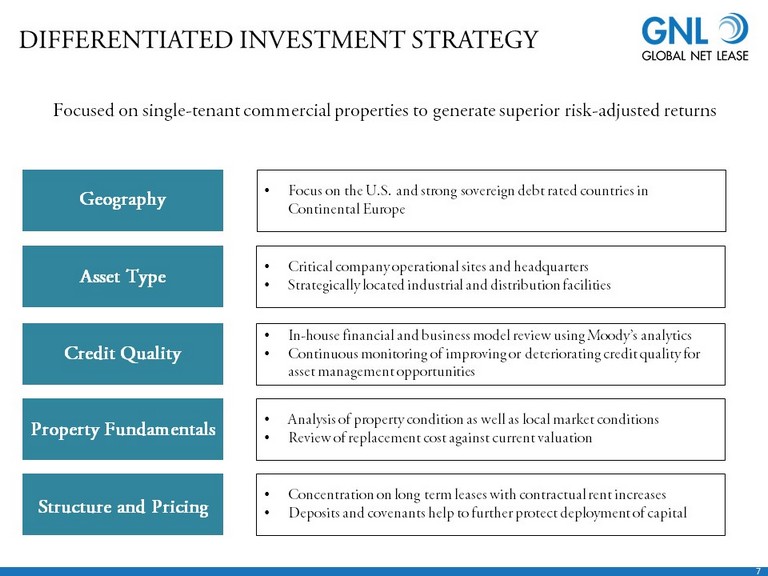

7 DIFFERENTIATED INVESTMENT STRATEGY Geography Asset Type Property Fundamentals Credit Quality Structure and Pricing Focused on single - tenant commercial properties to generate superior risk - adjusted returns • Focus on the U.S. and strong sovereign debt rated countries in Continental Europe • Critical company operational sites and headquarters • Strategically located industrial and distribution facilities • In - house financial and business model review using Moody’s analytics • Continuous monitoring of improving or deteriorating credit quality for asset management opportunities • Analysis of property condition as well as local market conditions • Review of replacement cost against current valuation • Concentration on long term leases with contractual rent increases • Deposits and covenants help to further protect deployment of capital

8 2018 INVESTMENT ACTIVITY Tenant Closing Date Properties Asset Type Purchase Price (millions) Average GAAP Cap Rate (1) Acquisitions Chemours Company, FC LLC 2/26/2018 1 Distribution $18.6 6.96% Lee Steel Holdings, LLC 3/21/2018 1 Industrial $8.8 8.31% LSI Steel Processing 3/29/2018 3 Industrial $17.8 8.21% FCA US, LLC (Fiat Chrysler) 3/29/2018 1 Industrial $18.2 8.56% Steel Service Supplier 5/16/2018 5 Industrial $83.0 8.19% FedEx Freight – Blackfoot, ID 6/1/2018 1 Distribution $6.5 6.76% DuPont Pioneer 6/13/2018 1 Industrial $8.1 7.27% Rubbermaid 7/27/2018 1 Industrial $21.4 7.43% NetScout 8/13/2018 1 Office $54.0 7.36% FedEx Freight 9/28/2018 1 Distribution $11.0 6.70% Furniture Manufacturer 9/28/2018 1 Industrial $19.0 8.21% T otal 17 $266.4 7.87% • Acquired 17 properties in 2018 through September 28 th for $ 266 .4 million, at a weighted average GAAP cap rate of 7.87 %, based upon square feet as of the date of acquisition • 100% of assets acquired were industrial, distribution and office assets GNL continued to identify what it believes to be accretive acquisition opportunities to grow organically, adding an additional $266.4 million of properties in 2018 through September 28 th 1. Refer to Average GAAP Cap Rate definition included in the footnotes to page 15.

9 ROBUST PIPELINE *Represents Moody’s Implied Rating. ** Represents Tenant Parent Rating. 1. The acquisitions of $134 .5 million in contract purchase price of properties are subject to customary closing conditions, and there can be no assurance t he y will be competed on their current terms, or at all. 2. Refer to Average GAAP Cap Rate definition included in the footnotes to page 15 . 3. Represents remaining lease term in years as of 6/30/18 for all properties that closed prior to the end of the quarter. Remain ing lease term for the properties that closed subsequent to quarter end are based on values as of closing date. 4. Refer to Investment Grade Rating definition included in the footnotes to page 2 and page 3. Approximately $63.4 million of assets closed in Q1 2018, $97.6 million of assets closed in Q2 2018 and an additional $105.4 million of assets closed in Q3 2018 through September 28 th . The pipeline represents management’s ability to leverage direct relationships with landlords and developers into primarily off - market transactions, allowing the Company to achieve what it believes to be better than market cap rates. (1) As of June 30, 2018 After Pipeline % Change No. of Properties 333 339 +1.8% Investment Grade and Implied Investment Grade (4 ) 79.1% 78.1% - 1.3% Square Feet 25.0 million 27.0 million +8.1% Purchase Price $3.3 billion $3.6 billion +7.2% Lease Term Remaining 8.5 years 8.9 years +4.6% Deal Name Expected Closing Date Credit Rating Property Type Purchase Price (in millions) Average GAAP Cap Rate (2) Lease Term Remaining (3) Chemours Closed - 1Q 2018 Ba2** Distribution $18.6 6.96% 9.6 Lee Steel Holdings Closed - 1Q 2018 B3* Industrial $8.8 8.31% 10.2 LSI Steel Processing 3 - Pack Closed - 1Q 2018 Baa1* Industrial $17.8 8.21% 9.7 FCA US, LLC (Fiat Chrysler) Closed - 1Q 2018 Baa2 Industrial $18.2 8.56% 9.7 Steel Service Supplier 5 - Pack Closed - 2Q 2018 Baa3* Industrial $83.0 8.19% 10.0 FedEx Freight Closed - 2Q 2018 Baa2 Distribution $6.5 6.76% 14.3 DuPont Pioneer Closed - 2Q 2018 A3** Industrial $8.1 7.27% 10.5 Rubbermaid Closed - 3Q 2018 Baa3 Industrial $21.4 7.43% 10.0 NetScout Closed - 3Q 2018 Ba3* Office $54.0 7.36% 12.0 FedEx Freight Closed - 3Q 2018 Baa2 Distribution $11.0 6.70% 15.0 Furniture Manufacturer Closed - 3Q 2018 Ba1* Industrial $19.0 8.21% 20.0 Penske 4Q 2018 Baa2 Distribution $124.9 6.71% 10.0 VersaFlex 4Q 2018 Ba1* Industrial $9.7 8.33% 20.0 Total 78.1% Inv. Grade $401.0 7.72% 11.3

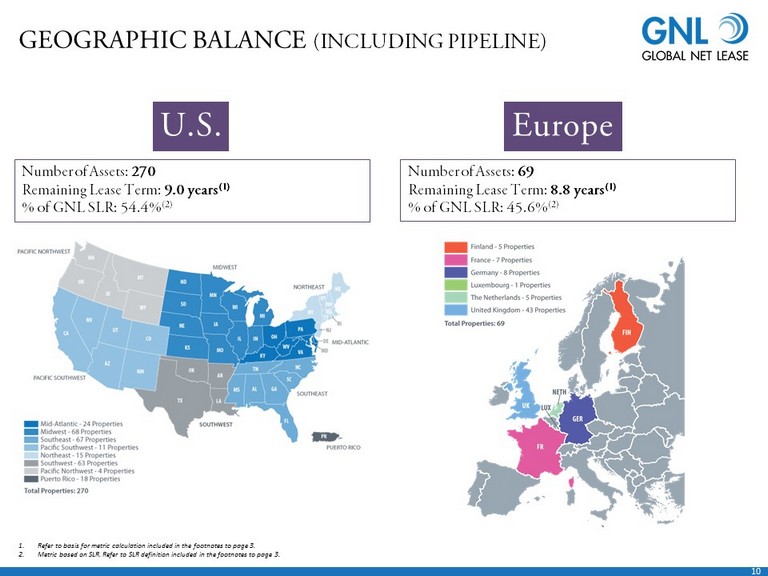

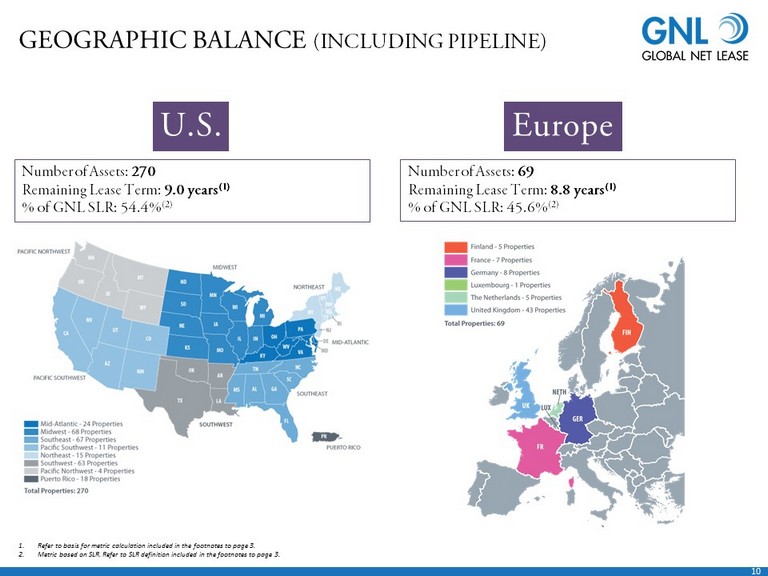

10 GEOGRAPHIC BALANCE (INCLUDING PIPELINE) 1. Refer to basis for metric calculation included in the footnotes to page 3. 2. Metric based on SLR. Refer to SLR definition included in the footnotes to page 3. U.S. Number of Assets: 270 Remaining Lease Term: 9.0 years (1) % of GNL SLR: 54.4% (2) Europe Number of Assets: 69 Remaining Lease Term: 8.8 years (1) % of GNL SLR: 45.6 % (2)

11 PRO FORMA PORTFOLIO COMPOSITION WITH PIPELINE Continued Focus towards United States Industrial and Distribution Properties Geographic concentration split changes from 51% and 49% to 54% and 46%, for the United States and Europe, respectively with the addition of the 2018 pipeline. Office 53% Industrial/Distribution 38% Retail 9% Office 56% Industrial/Distribution 35% Retail 9% United States 54% Europe 46% United States 51% Europe 49% Property Type Concentration (1) Geographic Concentration (1) As of 6/30/2018 As of 6/30/2018 Pro Forma with Pipeline Pro Forma with Pipeline 1. Metric based on SLR. Refer to SLR definition included in the footnotes to page 3. 3% increase for the portfolio’s Industrial/Distribution Property Type with the addition of the 2018 pipeline.

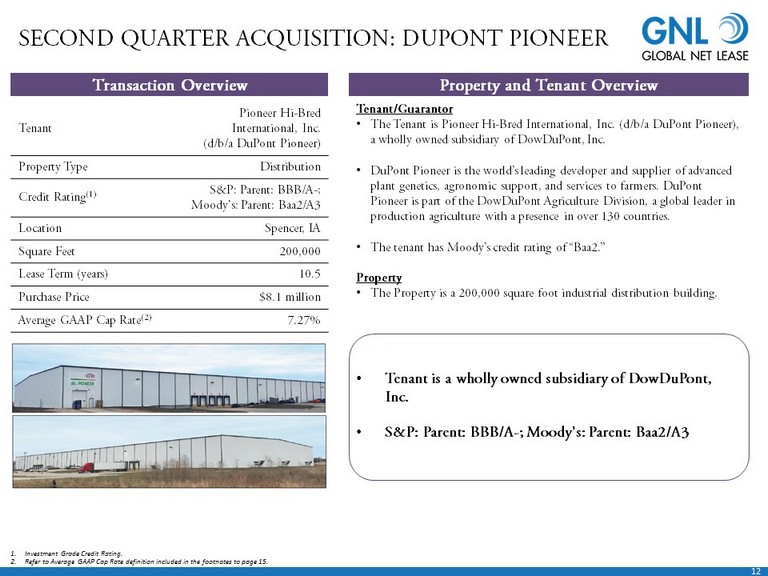

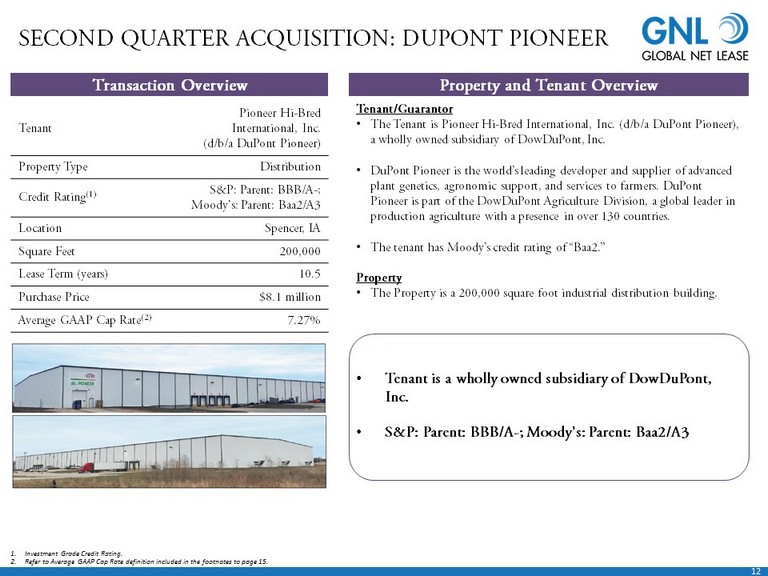

12 SECOND QUARTER ACQUISITION: DUPONT PIONEER Transaction Overview Property and Tenant Overview Tenant Pioneer Hi - Bred International, Inc. (d/b/a DuPont Pioneer) Property Type Distribution Credit Rating (1) S&P: Parent: BBB/A - ; Moody's: Parent: Baa2/A3 Location Spencer, IA Square Feet 200,000 Lease Term (years) 10.5 Purchase Price $8.1 million Average GAAP Cap Rate (2) 7.27% Tenant/Guarantor • The Tenant is Pioneer Hi - Bred International, Inc. (d/b/a DuPont Pioneer), a wholly owned subsidiary of DowDuPont, Inc. • DuPont Pioneer is the world’s leading developer and supplier of advanced plant genetics, agronomic support, and services to farmers. DuPont Pioneer is part of the DowDuPont Agriculture Division, a global leader in production agriculture with a presence in over 130 countries. • The tenant has Moody’s credit rating of “Baa2.” Property • The Property is a 200,000 square foot industrial distribution building. • Tenant is a wholly owned subsidiary of DowDuPont, Inc. • S&P: Parent: BBB/A - ; Moody's: Parent: Baa2/A3 1. Investment Grade Credit Rating. 2. Refer to Average GAAP Cap Rate definition included in the footnotes to page 15.

13 Transaction Overview Tenant NetScout Systems Texas, LLC Property Type Office Credit Rating (1)(3) S&P: N/A; Moody's: Implied: Ba3 Location Allen, TX Square Feet 145,000 Lease Term (years) 12.0 Purchase Price $54 million Average GAAP Cap Rate (2) 7.36% Tenant/Guarantor • NetScout Systems Texas, LLC, the Tenant, is a wholly owned subsidiary of NetScout Systems, Inc. (NASDAQ: NTCT), the Guarantor. With headquarters in Westford, MA, NetScout is a leading provider of application and network performance management products. NetScout has been in the network performance monitoring space for 30 years. Property • The newly constructed subject Property is located within a 17 - acre multi - phase, corporate office campus • Allen, TX is a city in Collin County, TX, a northern suburb of Dallas. The city is located 25 miles north of Dallas, TX and 55 miles northeast of Fort Worth, TX. • The lease has a going - in cap rate of 6.58% and an average GAAP cap rate of 7.36%. (2) • The double - net lease includes annual rent escalations of 2.00%. 1. Investment Grade Credit Rating. 2. Refer to Average GAAP Cap Rate and going - in cap rate definition included in the footnotes to page 15 . 3. Refer to Investment Grade Rating definition included in the footnotes to page 2 and page 3. Property and Tenant Overview THIRD QUARTER ACQUISITION: NETSCOUT

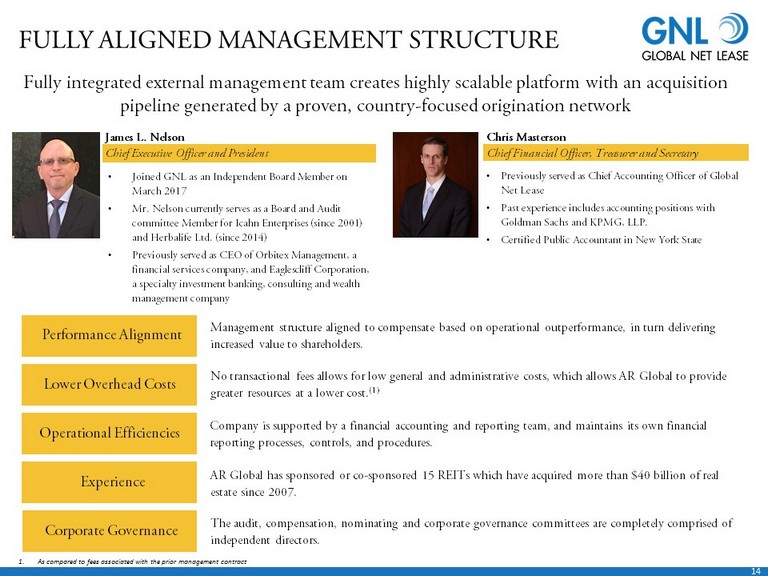

14 Chris Masterson Chief Financial Officer, Treasurer and Secretary FULLY ALIGNED MANAGEMENT STRUCTURE Fully integrated external management team creates highly scalable platform with an acquisition pipeline generated by a proven, country - focused origination network No transactional fees allows for low general and administrative costs, which allows AR Global to provide greater resources at a lower cost. (1) Lower Overhead Costs AR Global has sponsored or co - sponsored 15 REITs which have acquired more than $40 billion of real estate since 2007. Experience The audit, compensation, nominating and corporate governance committees are completely comprised of independent directors. Corporate Governance Performance Alignment Management structure aligned to compensate based on operational outperformance, in turn delivering increased value to shareholders. Company is supported by a financial accounting and reporting team, and maintains its own financial reporting processes, controls, and procedures. Operational Efficiencies James L. Nelson Chief Executive Officer and President • Joined GNL as an Independent Board Member on March 2017 • Mr. Nelson currently serves as a Board and Audit committee Member for Icahn Enterprises (since 2001) and Herbalife Ltd. (since 2014) • Previously served as CEO of Orbitex Management, a financial services company, and Eaglescliff Corporation, a specialty investment banking, consulting and wealth management company • Previously served as Chief Accounting Officer of Global Net Lease • Past experience includes accounting positions with Goldman Sachs and KPMG, LLP. • Certified Public Accountant in New York State 1. As compared to fees associated with the prior management contract

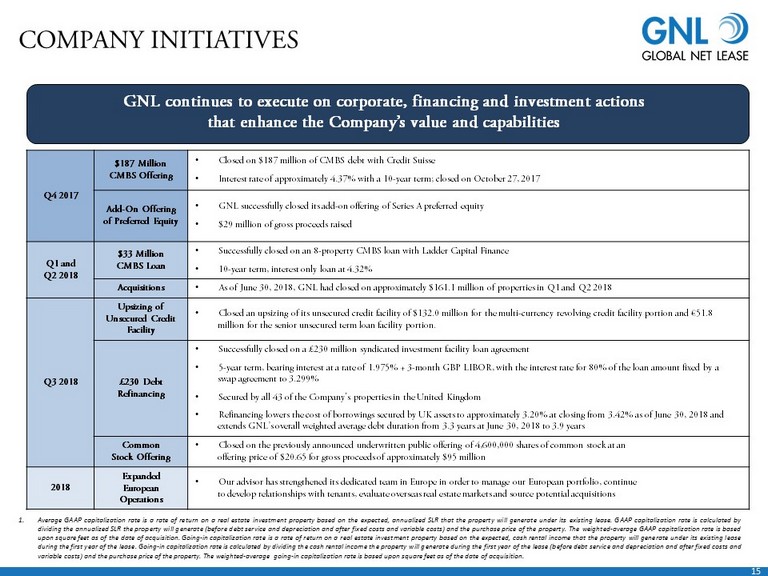

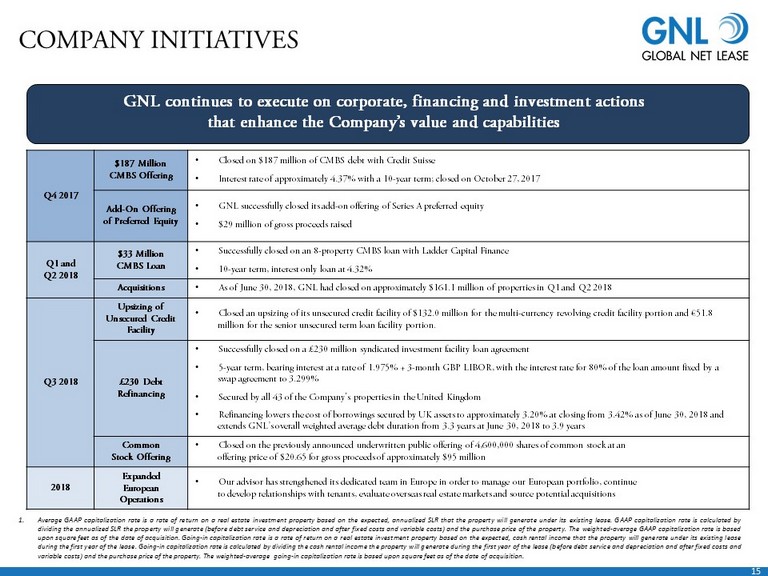

15 COMPANY INITIATIVES GNL continues to execute on corporate, financing and investment actions that enhance the Company’s value and capabilities Q4 2017 $187 Million CMBS Offering • Closed on $187 million of CMBS debt with Credit Suisse • Interest rate of approximately 4.37% with a 10 - year term; closed on October 27, 2017 Add - On Offering of Preferred Equity • GNL successfully closed its add - on offering of Series A preferred equity • $29 million of gross proceeds raised Q1 and Q2 2018 $33 Million CMBS Loan • Successfully closed on an 8 - property CMBS loan with Ladder Capital Finance • 10 - year term, interest only loan at 4.32% Acquisitions • As of June 30, 2018, GNL had closed on approximately $161.1 million of properties in Q1 and Q2 2018 Q3 2018 Upsizing of Unsecured Credit Facility • Closed an upsizing of its unsecured credit facility of $132.0 million for the multi - currency revolving credit facility portion a nd €51.8 million for the senior unsecured term loan facility portion. £230 Debt Refinancing • Successfully closed on a £230 million syndicated investment facility loan agreement • 5 - year term, bearing interest at a rate of 1.975% + 3 - month GBP LIBOR, with the interest rate for 80% of the loan amount fixed b y a swap agreement to 3.299% • Secured by all 43 of the Company's properties in the United Kingdom • Refinancing lowers the cost of borrowings secured by UK assets to approximately 3.20% at closing from 3.42% as of June 30, 20 18 and extends GNL’s overall weighted average debt duration from 3.3 years at June 30, 2018 to 3.9 years Common Stock Offering • Closed on the previously announced underwritten public offering of 4,600,000 shares of common stock at an offering price of $20.65 for gross proceeds of approximately $95 million 2018 Expanded European Operations • Our advisor has strengthened its dedicated team in Europe in order to manage our European portfolio, continue to develop relationships with tenants, evaluate overseas real estate markets and source potential acquisitions 1. Average GAAP capitalization rate is a rate of return on a real estate investment property based on the expected, annualized SLR that the property will generate under its existing lease . GAAP capitalization rate is calculated by dividing the annualized SLR the property will generate (before debt service and depreciation and after fixed costs and variable costs) and the purchase price of the property . The weighted - average GAAP capitalization rate is based upon square feet as of the date of acquisition . Going - in capitalization rate is a rate of return on a real estate investment property based on the expected, cash rental income that the property will generate under its existing lease during the first year of the lease . Going - in capitalization rate is calculated by dividing the cash rental income the property will generate during the first year of the lease (before debt service and depreciation and after fixed costs and variable costs) and the purchase price of the property . The weighted - average going - in capitalization rate is based upon square feet as of the date of acquisition .

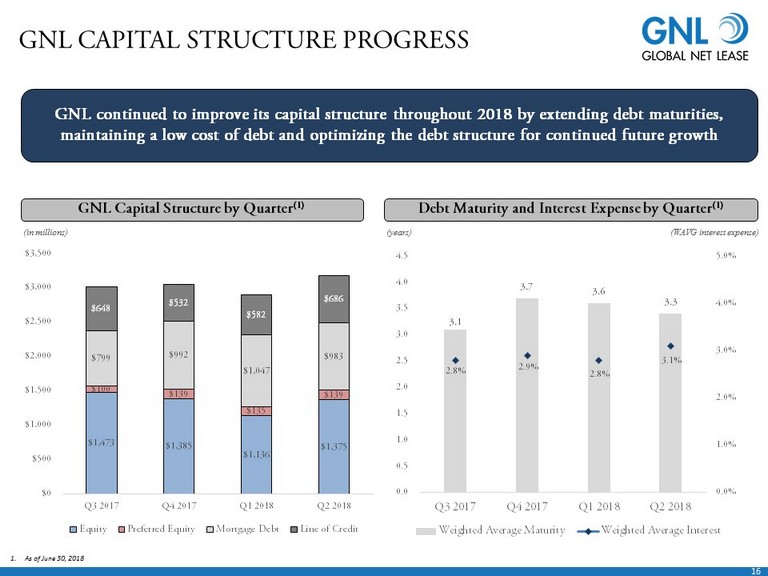

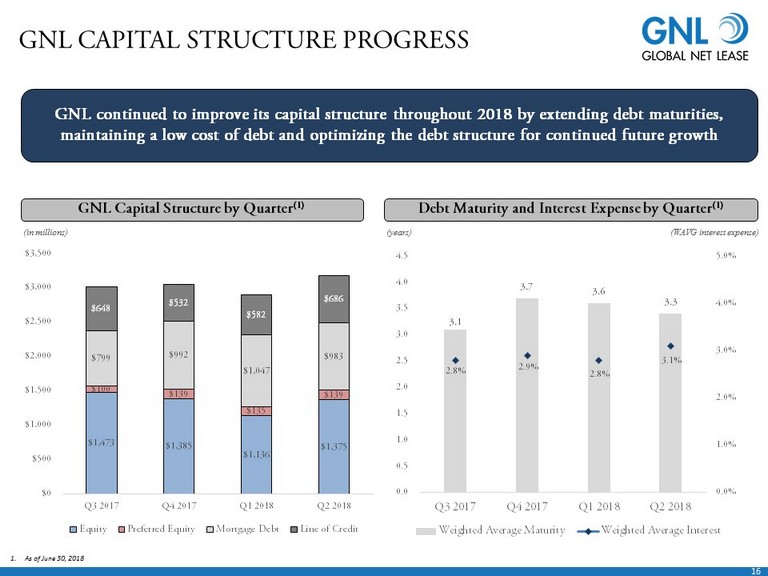

16 GNL CAPITAL STRUCTURE PROGRESS GNL continued to improve its capital structure throughout 2018 by extending debt maturities, maintaining a low cost of debt and optimizing the debt structure for continued future growth $1,473 $1,385 $1,136 $1,375 $100 $139 $135 $139 $799 $992 $1,047 $983 $648 $532 $582 $686 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Equity Preferred Equity Mortgage Debt Line of Credit Debt Maturity and Interest Expense by Quarter (1) GNL Capital Structure by Quarter (1) (in millions) (years) (WAVG interest expense) 3.1 3.7 3.6 3.3 2.8% 2.9% 2.8% 3.1% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Weighted Average Maturity Weighted Average Interest 1. As of June 30, 2018

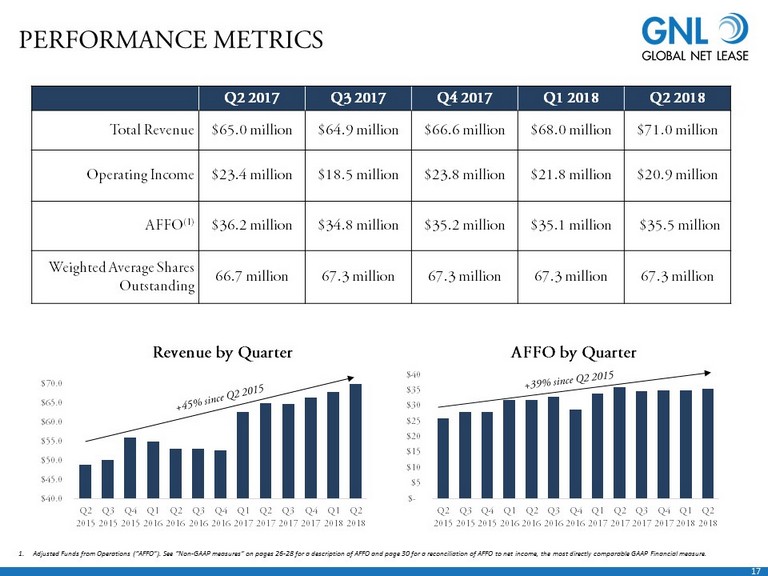

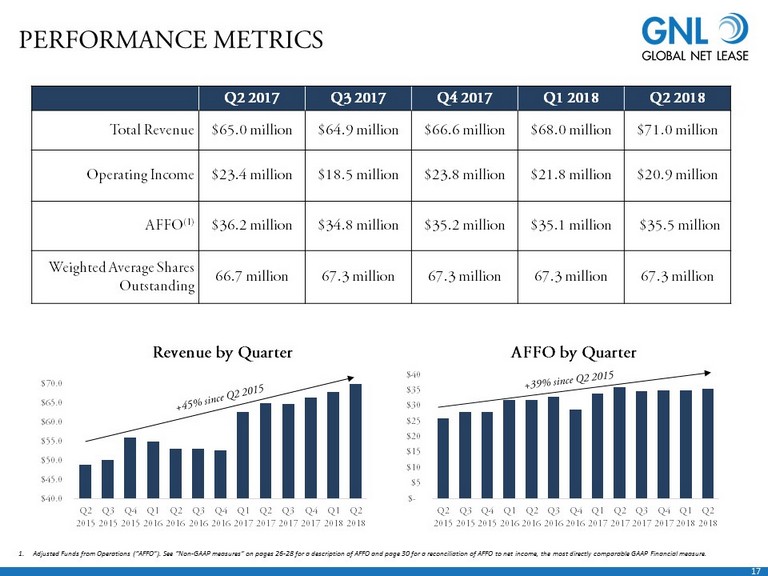

17 $- $5 $10 $15 $20 $25 $30 $35 $40 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 PERFORMANCE METRICS Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Total Revenue $65.0 million $64.9 million $66.6 million $68.0 million $71.0 million Operating Income $23.4 million $18.5 million $23.8 million $21.8 million $20.9 million AFFO (1) $36.2 million $34.8 million $35.2 million $35.1 million $35.5 million Weighted Average Shares Outstanding 66.7 million 67.3 million 67.3 million 67.3 million 67.3 million AFFO by Quarter $40.0 $45.0 $50.0 $55.0 $60.0 $65.0 $70.0 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Revenue by Quarter 1. Adjusted Funds from Operations (“AFFO”). See “Non - GAAP measures” on pages 26 - 28 for a description of AFFO and page 30 for a reco nciliation of AFFO to net income, the most directly comparable GAAP Financial measure.

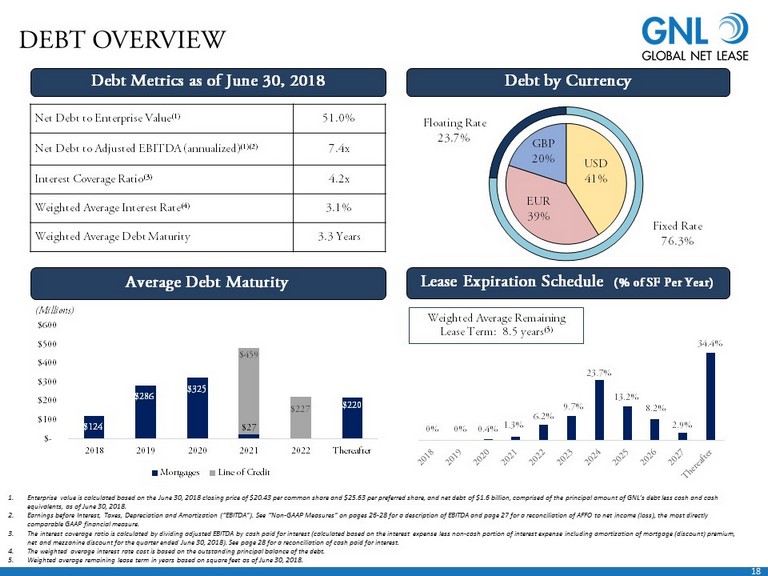

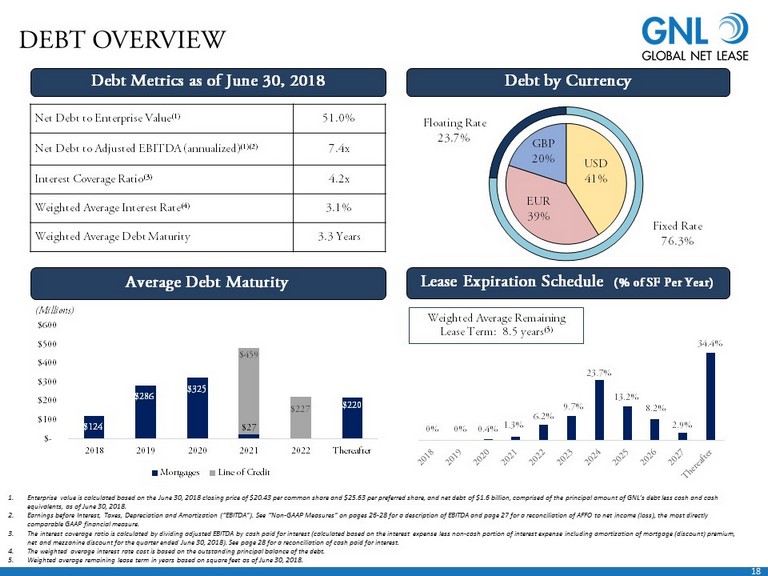

18 Fixed Rate 76.3% Floating Rate 23.7% USD 41% EUR 39% GBP 20% DEBT OVERVIEW Net Debt to Enterprise Value (1) 51.0% Net Debt to Adjusted EBITDA (annualized) (1)(2) 7.4x Interest Coverage Ratio (3) 4.2x Weighted Average Interest Rate (4) 3.1% Weighted Average Debt Maturity 3.3 Years Debt Metrics as of June 30, 2018 Debt by Currency Average Debt Maturity 1. Enterprise value is calculated based on the June 30, 2018 closing price of $20.43 per common share and $25.63 per preferred s har e, and net debt of $1.6 billion, comprised of the principal amount of GNL’s debt less cash and cash equivalents, as of June 30, 2018. 2. Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”). See “Non - GAAP Measures” on pages 26 - 28 for a descript ion of EBITDA and page 27 for a reconciliation of AFFO to net income (loss), the most directly comparable GAAP financial measure. 3. The interest coverage ratio is calculated by dividing adjusted EBITDA by cash paid for interest (calculated based on the inte res t expense less non - cash portion of interest expense including amortization of mortgage (discount) premium, net and mezzanine discount for the quarter ended June 30, 2018). See page 28 for a reconciliation of cash paid for interest. 4. The weighted average interest rate cost is based on the outstanding principal balance of the debt. 5. Weighted average remaining lease term in years based on square feet as of June 30, 2018. ( Millions ) Weighted Average Remaining Lease Term: 8.5 years (5) Lease Expiration Schedule (% of SF Per Year) $124 $286 $325 $27 $220 $459 $227 $- $100 $200 $300 $400 $500 $600 2018 2019 2020 2021 2022 Thereafter Mortgages Line of Credit 0% 0% 0.4% 1.3% 6.2% 9.7% 23.7% 13.2% 8.2% 2.9% 34.4%

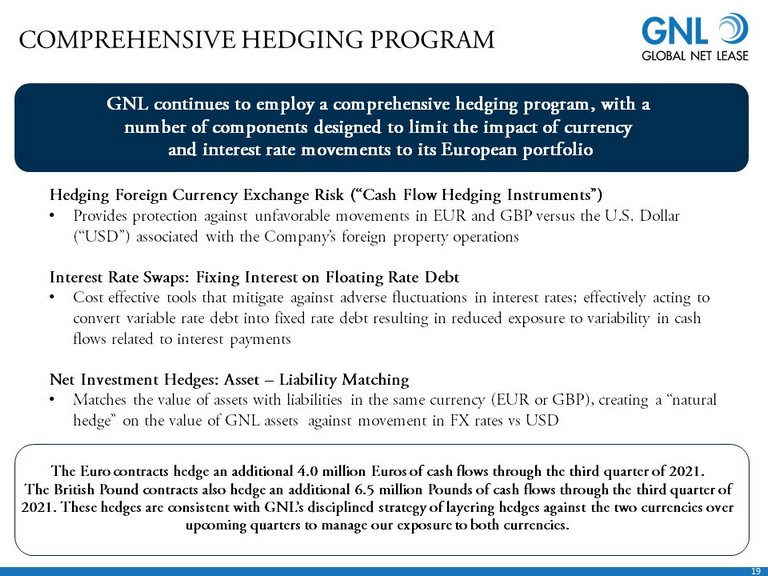

19 COMPREHENSIVE HEDGING PROGRAM GNL continues to employ a comprehensive hedging program, with a number of components designed to limit the impact of currency and interest rate movements to its European portfolio Hedging Foreign Currency Exchange Risk (“Cash Flow Hedging Instruments”) • Provides protection against unfavorable movements in EUR and GBP versus the U.S. Dollar (“USD”) associated with the Company’s foreign property operations Interest Rate Swaps: Fixing Interest on Floating Rate Debt • Cost effective tools that mitigate against adverse fluctuations in interest rates; effectively acting to convert variable rate debt into fixed rate debt resulting in reduced exposure to variability in cash flows related to interest payments Net Investment Hedges: Asset – Liability Matching • Matches the value of assets with liabilities in the same currency (EUR or GBP), creating a “natural hedge” on the value of GNL assets against movement in FX rates vs USD The Euro contracts hedge an additional 4.0 million Euros of cash flows through the third quarter of 2021. The British Pound contracts also hedge an additional 6.5 million Pounds of cash flows through the third quarter of 2021. These hedges are consistent with GNL’s disciplined strategy of layering hedges against the two currencies over upcoming quarters to manage our exposure to both currencies.

INVESTOR INQUIRIES 1 - 866 - 902 - 0063 investorrelations@globalnetlease.com www.GlobalNetLease.com

21 FORWARD LOOKING STATEMENTS This presentation contains certain statements that are the Company’s and Management’s hopes, intentions, beliefs, expectations, or projections of the future and might be considered to be forward - looking statements under Federal Securities laws . Prospective investors are cautioned that any such forward - looking statements are not guarantees of future performance, and involve risks and uncertainties . The company’s actual future results may differ significantly from the matters discussed in these forward - looking statements, and we may not release revisions to these forward - looking statements to reflect changes after we’ve made the statements . Factors and risks that could cause actual results to differ materially from expectations are disclosed from time to time in greater detail in the company’s filings with the SEC including, but not limited to, the Company’s report on Form 10 - K, as well as company press releases .

22 RISK FACTORS The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements . See the section entitled “Item 1 A . Risk Factors” in GNL’s Annual Report on Form 10 - K for the year ended December 31 , 2017 filed with the SEC on February 27 , 2018 for a discussion of the risks which should be considered in connection with your investment . • All of our executive officers are also officers, managers, employees or holders of a direct or indirect controlling interest in the Advisor and other entities affiliated with AR Global Investments, LLC ("AR Global") . As a result, our executive officers, the Advisor and its affiliates face conflicts of interest, including significant conflicts created by the Advisor's compensation arrangements with us and other investment programs advised by AR Global affiliates and conflicts in allocating time among these investment programs and us . These conflicts could result in unanticipated actions . • Because investment opportunities that are suitable for us may also be suitable for other investment programs advised by affiliates of AR Global, the Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investments and these conflicts may not be resolved in our favor . • We are obligated to pay fees which may be substantial to the Advisor and its affiliates . • We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic viability of our tenants . • Increases in interest rates could increase the amount of our debt payments and limit our ability to pay dividends to our stockholders . • The Advisor may not be able to identify a sufficient number of property acquisitions satisfying our investment objectives on acceptable terms and prices, or at all . • We may be unable to continue to raise additional debt or equity financing on attractive terms, or at all, and there can be no assurance we will be able to fund the acquisitions contemplated by our investment objectives . • We may be unable to repay, refinance, restructure or extend our indebtedness as it becomes due . • Adverse changes in exchange rates may reduce the value of our properties located outside of the United States ("U . S . ") .

23 RISK FACTORS (CONTINUED) • Provisions in in our credit facility, may limit our ability to pay dividends on our common stock, $ 0 . 01 par value per share ("“Common Stock"”), our 7 . 25 % Series A Cumulative Redeemable Preferred Stock, $ 0 . 01 par value per share ("“Series A Preferred Stock"”) or any other stock we may issue . • We may be unable to pay or maintain cash dividends or increase dividends over time . • We may not generate cash flows sufficient to pay dividends to our stockholders or fund our operations, and, as such, we may be forced to borrow at unfavorable rates to pay dividends to our stockholders or fund our operations . • Any dividends that we pay on our Common Stock, Series A Preferred Stock or any other stock we may issue may exceed cash flow from operations, reducing the amount of capital available to invest in properties and other permitted investments . • We are subject to risks associated with our international investments, including risks associated with compliance with and changes in foreign laws, fluctuations in foreign currency exchange rates and inflation . Our ability to refinance or sell properties located in the United Kingdom and continental Europe may be impacted by the economic and political uncertainty caused by the Brexit Process . • We are subject to risks associated with any dislocations or liquidity disruptions that may exist or occur in the credit markets of the U . S . and Europe from time to time . • We may fail to continue to qualify, as a real estate investment trust for U . S . federal income tax purposes ("REIT"), which would result in higher taxes, may adversely affect operations and would reduce the trading price of our Common Stock and Series A Preferred Stock and our cash available for dividends . • We may be exposed to risks due to a lack of tenant diversity, investment types and geographic diversity . • The revenue derived from, and the market value of, properties located in the United Kingdom and continental Europe may decline as a result of the U . K . 's discussions with respect to exiting the European Union (the “Brexit Process”) . • We may be exposed to changes in general economic, business and political conditions, including the possibility of intensified international hostilities, acts of terrorism, and changes in conditions of U . S . or international lending, capital and financing markets, including as a result of the Brexit Process .

24 PROJECTIONS • This presentation includes estimated projections of future operating results . These projections were not prepared in accordance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections . This information is not fact and should not be relied upon as being necessarily indicative of future results ; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong . Important factors that may affect actual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors described in the “Risk Factors” section of GNL's Annual Report on Form 10 - K for the year ended December 31 , 2017 filed with the SEC on February 27 , 2018 , and in GNL's future filings with the SEC . The projections also reflect assumptions as to certain business decisions that are subject to change . As a result, actual results may differ materially from those contained in the estimates . Accordingly, there can be no assurance that the estimates will be realized . • This presentation also contains estimates and information concerning our industry, including market position, market size, an d g rowth rates of the markets in which we participate, that are based on industry publications and reports. This information involves a numb er of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently ver ifi ed the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate i s s ubject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” section of GNL ’s Annual Report on Form 10 - K for the year ended December 31, 2017 filed with the SEC on February 27, 2018, and in GNL's future filings with the SEC. These and other factors could cause results to differ materially from those expressed in these publications and repo rts .

25 DEFINITIONS • Due to certain unique operating characteristics of real estate companies, as discussed below, the National Association of Real Estate Investment Trusts ("NAREIT"), an industry trade group, has promulgated a measure known as funds from operations ("FFO"), which we believe to be an appropriate supplemental measure to reflect the operating performance of a REIT . FFO is not equivalent to net income or loss as determined under accounting principles generally accepted in the United States ("GAAP") . • We define FFO, a non - GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, as revised in February 2004 (the "White Paper") . The White Paper defines FFO as net income or loss computed in accordance with GAAP, excluding gains or losses from sales of property but including asset impairment write - downs, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures . Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO . Our FFO calculation complies with NAREIT's definition . • The historical accounting convention used for real estate assets requires straight - line depreciation of buildings and improvements, and straight - line amortization of intangibles, which implies that the value of a real estate asset diminishes predictably over time, especially if not adequately maintained or repaired and renovated as required by relevant circumstances or as requested or required by lessees for operational purposes in order to maintain the value disclosed . We believe that, because real estate values historically rise and fall with market conditions, including inflation, interest rates, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting for depreciation and certain other items may be less informative . Historical accounting for real estate involves the use of GAAP . Any other method of accounting for real estate such as the fair value method cannot be construed to be any more accurate or relevant than the comparable methodologies of real estate valuation found in GAAP . Nevertheless, we believe that the use of FFO, which excludes the impact of real estate related depreciation and amortization, among other things, provides a more complete understanding of our performance to investors and to management, and when compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses, and interest costs, which may not be immediately apparent from net income . However, FFO, core funds from operations ("Core FFO") and adjusted funds from operations (“AFFO”), as described below, should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income or in its applicability in evaluating our operating performance . The method utilized to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operational performance and considered more prominently than the non - GAAP FFO, Core FFO and AFFO measures and the adjustments to GAAP in calculating FFO, Core FFO and AFFO . Other REITs may not define FFO in accordance with the current NAREIT definition (as we do) or may interpret the current NAREIT definition differently than we do or calculate Core FFO or AFFO differently than we do . Consequently, our presentation of FFO, Core FFO and AFFO may not be comparable to other similarly titled measures presented by other REITs . • We consider FFO, Core FFO and AFFO useful indicators of our performance . Because FFO calculations exclude such factors as depreciation and amortization of real estate assets and gains or losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful - life estimates), FFO facilitates comparisons of operating performance between periods and between other REITs in our peer group .

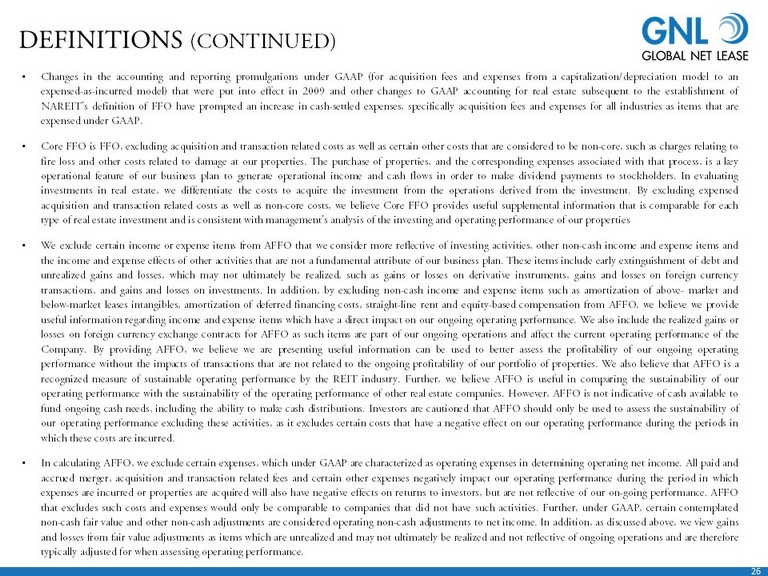

26 DEFINITIONS (CONTINUED) • Changes in the accounting and reporting promulgations under GAAP (for acquisition fees and expenses from a capitalization/depreciation model to an expensed - as - incurred model) that were put into effect in 2009 and other changes to GAAP accounting for real estate subsequent to the establishment of NAREIT's definition of FFO have prompted an increase in cash - settled expenses, specifically acquisition fees and expenses for all industries as items that are expensed under GAAP . • Core FFO is FFO, excluding acquisition and transaction related costs as well as certain other costs that are considered to be non - core, such as charges relating to fire loss and other costs related to damage at our properties . The purchase of properties, and the corresponding expenses associated with that process, is a key operational feature of our business plan to generate operational income and cash flows in order to make dividend payments to stockholders . In evaluating investments in real estate, we differentiate the costs to acquire the investment from the operations derived from the investment . By excluding expensed acquisition and transaction related costs as well as non - core costs, we believe Core FFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management's analysis of the investing and operating performance of our properties • We exclude certain income or expense items from AFFO that we consider more reflective of investing activities, other non - cash income and expense items and the income and expense effects of other activities that are not a fundamental attribute of our business plan . These items include early extinguishment of debt and unrealized gains and losses, which may not ultimately be realized, such as gains or losses on derivative instruments, gains and losses on foreign currency transactions, and gains and losses on investments . In addition, by excluding non - cash income and expense items such as amortization of above - market and below - market leases intangibles, amortization of deferred financing costs, straight - line rent and equity - based compensation from AFFO, we believe we provide useful information regarding income and expense items which have a direct impact on our ongoing operating performance . We also include the realized gains or losses on foreign currency exchange contracts for AFFO as such items are part of our ongoing operations and affect the current operating performance of the Company . By providing AFFO, we believe we are presenting useful information can be used to better assess the profitability of our ongoing operating performance without the impacts of transactions that are not related to the ongoing profitability of our portfolio of properties . We also believe that AFFO is a recognized measure of sustainable operating performance by the REIT industry . Further, we believe AFFO is useful in comparing the sustainability of our operating performance with the sustainability of the operating performance of other real estate companies . However, AFFO is not indicative of cash available to fund ongoing cash needs, including the ability to make cash distributions . Investors are cautioned that AFFO should only be used to assess the sustainability of our operating performance excluding these activities, as it excludes certain costs that have a negative effect on our operating performance during the periods in which these costs are incurred . • In calculating AFFO, we exclude certain expenses, which under GAAP are characterized as operating expenses in determining operating net income . All paid and accrued merger, acquisition and transaction related fees and certain other expenses negatively impact our operating performance during the period in which expenses are incurred or properties are acquired will also have negative effects on returns to investors, but are not reflective of our on - going performance . AFFO that excludes such costs and expenses would only be comparable to companies that did not have such activities . Further, under GAAP, certain contemplated non - cash fair value and other non - cash adjustments are considered operating non - cash adjustments to net income . In addition, as discussed above, we view gains and losses from fair value adjustments as items which are unrealized and may not ultimately be realized and not reflective of ongoing operations and are therefore typically adjusted for when assessing operating performance .

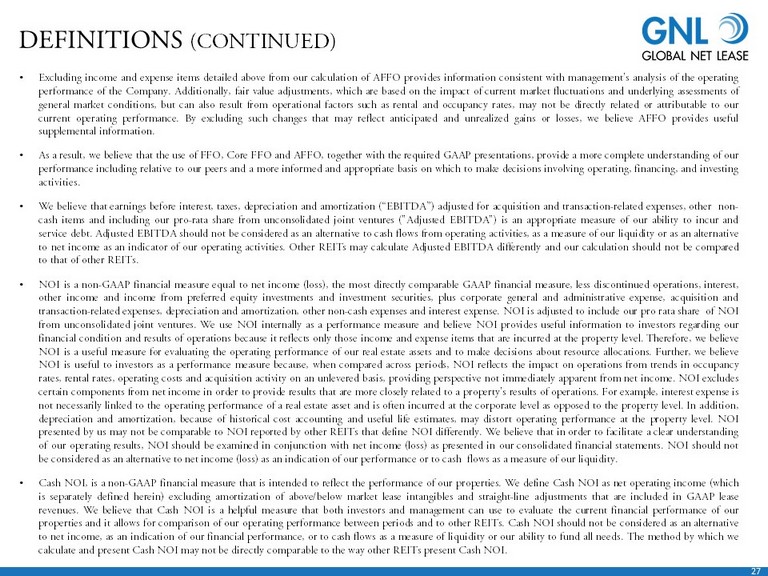

27 DEFINITIONS (CONTINUED) • Excluding income and expense items detailed above from our calculation of AFFO provides information consistent with management's analysis of the operating performance of the Company . Additionally, fair value adjustments, which are based on the impact of current market fluctuations and underlying assessments of general market conditions, but can also result from operational factors such as rental and occupancy rates, may not be directly related or attributable to our current operating performance . By excluding such changes that may reflect anticipated and unrealized gains or losses, we believe AFFO provides useful supplemental information . • As a result, we believe that the use of FFO, Core FFO and AFFO, together with the required GAAP presentations, provide a more complete understanding of our performance including relative to our peers and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities . • We believe that earnings before interest, taxes, depreciation and amortization (“EBITDA”) adjusted for acquisition and transaction - related expenses, other non - cash items and including our pro - rata share from unconsolidated joint ventures ("Adjusted EBITDA") is an appropriate measure of our ability to incur and service debt . Adjusted EBITDA should not be considered as an alternative to cash flows from operating activities, as a measure of our liquidity or as an alternative to net income as an indicator of our operating activities . Other REITs may calculate Adjusted EBITDA differently and our calculation should not be compared to that of other REITs . • NOI is a non - GAAP financial measure equal to net income (loss), the most directly comparable GAAP financial measure, less discontinued operations, interest, other income and income from preferred equity investments and investment securities, plus corporate general and administrative expense, acquisition and transaction - related expenses, depreciation and amortization, other non - cash expenses and interest expense . NOI is adjusted to include our pro rata share of NOI from unconsolidated joint ventures . We use NOI internally as a performance measure and believe NOI provides useful information to investors regarding our financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level . Therefore, we believe NOI is a useful measure for evaluating the operating performance of our real estate assets and to make decisions about resource allocations . Further, we believe NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition activity on an unlevered basis, providing perspective not immediately apparent from net income . NOI excludes certain components from net income in order to provide results that are more closely related to a property's results of operations . For example, interest expense is not necessarily linked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level . In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level . NOI presented by us may not be comparable to NOI reported by other REITs that define NOI differently . We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements . NOI should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity . • Cash NOI, is a non - GAAP financial measure that is intended to reflect the performance of our properties . We define Cash NOI as net operating income (which is separately defined herein) excluding amortization of above/below market lease intangibles and straight - line adjustments that are included in GAAP lease revenues . We believe that Cash NOI is a helpful measure that both investors and management can use to evaluate the current financial performance of our properties and it allows for comparison of our operating performance between periods and to other REITs . Cash NOI should not be considered as an alternative to net income, as an indication of our financial performance, or to cash flows as a measure of liquidity or our ability to fund all needs . The method by which we calculate and present Cash NOI may not be directly comparable to the way other REITs present Cash NOI .

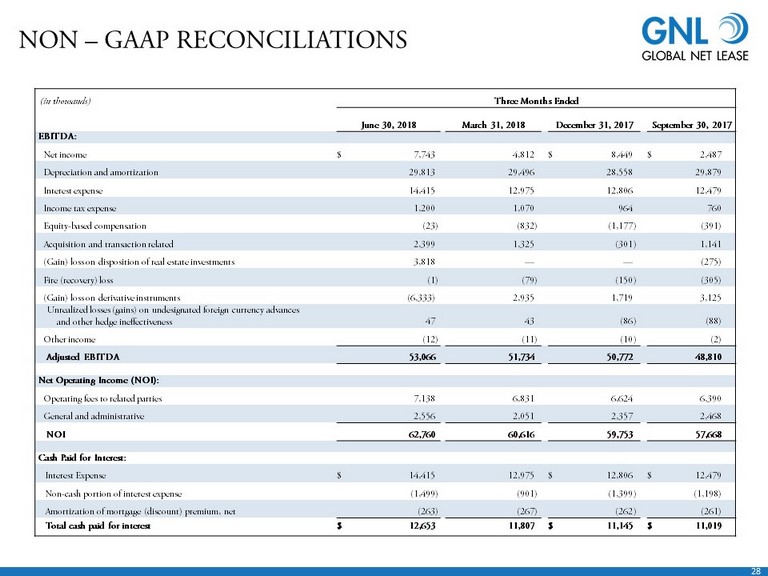

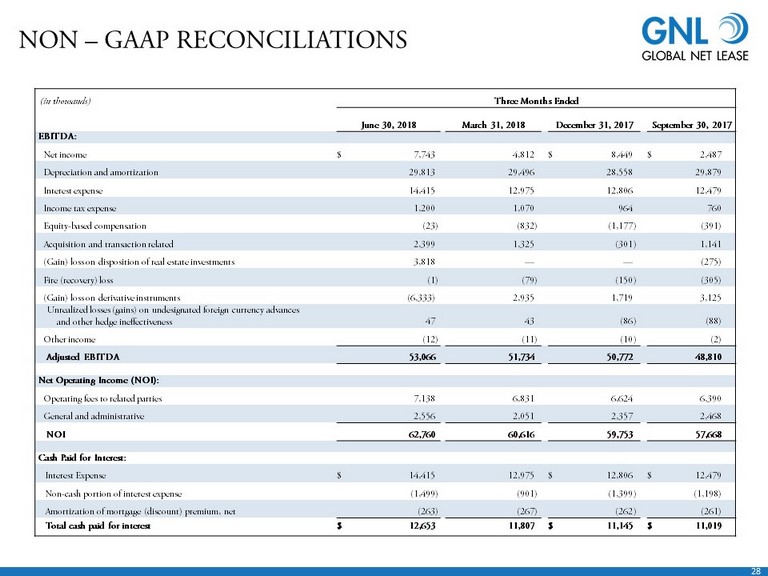

28 NON – GAAP RECONCILIATIONS (in thousands) Three Months Ended June 30, 2018 March 31, 2018 December 31, 2017 September 30, 2017 EBITDA: Net income $ 7,743 4,812 $ 8,449 $ 2,487 Depreciation and amortization 29,813 29,496 28,558 29,879 Interest expense 14,415 12,975 12,806 12,479 Income tax expense 1,200 1,070 964 760 Equity - based compensation (23 ) (832 ) (1,177 ) (391) Acquisition and transaction related 2,399 1,325 (301 ) 1,141 (Gain) loss on disposition of real estate investments 3,818 — — (275) Fire (recovery) loss (1 ) (79 ) (150 ) (305) (Gain) loss on derivative instruments (6,333) 2,935 1,719 3,125 Unrealized losses (gains) on undesignated foreign currency advances and other hedge ineffectiveness 47 43 (86 ) (88) Other income (12 ) (11 ) (10 ) (2) Adjusted EBITDA 53,066 51,734 50,772 48,810 Net Operating Income (NOI): Operating fees to related parties 7,138 6,831 6,624 6,390 General and administrative 2,556 2,051 2,357 2,468 NOI 62,760 60,616 59,753 57,668 Cash Paid for Interest: Interest Expense $ 14,415 12,975 $ 12,806 $ 12,479 Non - cash portion of interest expense (1,499 ) (901 ) (1,399 ) (1,198) Amortization of mortgage (discount) premium, net (263 ) (267 ) (262 ) (261) Total cash paid for interest $ 12,653 11,807 $ 11,145 $ 11,019

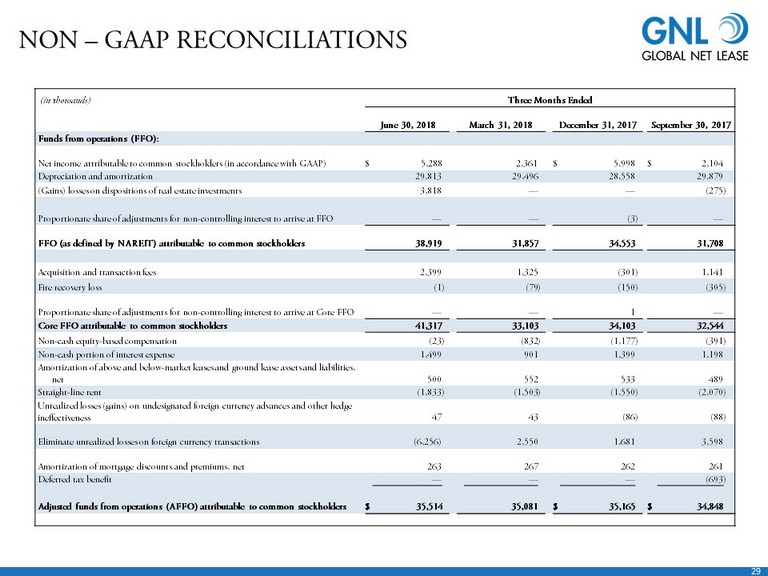

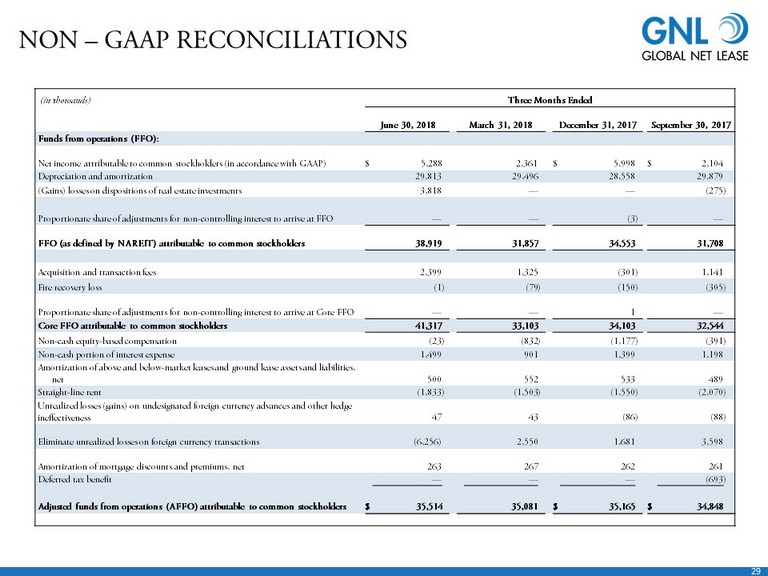

29 NON – GAAP RECONCILIATIONS (in thousands) Three Months Ended June 30, 2018 March 31, 2018 December 31, 2017 September 30, 2017 Funds from operations (FFO): Net income attributable to common stockholders (in accordance with GAAP) $ 5,288 2,361 $ 5,998 $ 2,104 Depreciation and amortization 29,813 29,496 28,558 29,879 (Gains) losses on dispositions of real estate investments 3,818 — — (275 ) Proportionate share of adjustments for non - controlling interest to arrive at FFO — — (3 ) — FFO (as defined by NAREIT) attributable to common stockholders 38,919 31,857 34,553 31,708 Acquisition and transaction fees 2,399 1,325 (301 ) 1,141 Fire recovery loss (1 ) (79 ) (150 ) (305 ) Proportionate share of adjustments for non - controlling interest to arrive at Core FFO — — 1 — Core FFO attributable to common stockholders 41,317 33,103 34,103 32,544 Non - cash equity - based compensation (23 ) (832 ) (1,177 ) (391 ) Non - cash portion of interest expense 1,499 901 1,399 1,198 Amortization of above and below - market leases and ground lease assets and liabilities, net 500 552 533 489 Straight - line rent (1,833 ) (1,503 ) (1,550 ) (2,070 ) Unrealized losses (gains) on undesignated foreign currency advances and other hedge ineffectiveness 47 43 (86 ) (88 ) Eliminate unrealized losses on foreign currency transactions (6,256) 2,550 1,681 3,598 Amortization of mortgage discounts and premiums, net 263 267 262 261 Deferred tax benefit — — — (693 ) Adjusted funds from operations (AFFO) attributable to common stockholders $ 35,514 35,081 $ 35,165 $ 34,848