SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INVESTMENT COMPANIES

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

Section 19(a) Notices

|

June 30, 2016

|

|||||||||

| Total Cumulative Distribution |

% Breakdown of the Total Cumulative

|

||||||||

|

For the Fiscal Year

|

Distributions for the Fiscal Year

|

||||||||

|

Net

|

Net

|

Net

|

Net

|

||||||

|

Realized

|

Realized

|

Realized

|

Realized

|

||||||

|

Net

|

Short-Term | Long-Term |

Total per

|

Net

|

Short-Term |

Long-Term

|

Total Per

|

||

|

Investment

|

Capital

|

Capital

|

Return of

|

Common

|

Investment

|

Capital

|

Capital

|

Return of

|

Common

|

|

Income

|

Gains

|

Gains

|

Capital

|

Share

|

Income

|

Gains

|

Gains

|

Capital

|

Share

|

|

$0.0887

|

$0.0000

|

$0.3488

|

$0.0000

|

$0.4375

|

20.3%

|

0.0%

|

79.7%

|

0.00%

|

100.0%

|

If the Fund has distributed more than its income and net realized capital gains, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of a shareholder’s investment in a Fund is returned to the shareholder. A return of capital distribution does not necessarily reflect a Fund’s investment performance and should not be confused with “yield” or “income.”

Section 19(b) Disclosure

....YOUR LINK TO THE LATEST, MOST UP-TO-DATE

INFORMATION ABOUT GUGGENHEIM EQUAL WEIGHT

ENHANCED EQUITY INCOME FUND

|

(Unaudited)

|

June 30, 2016

|

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 5

|

DEAR SHAREHOLDER: (Unaudited) continued

|

June 30, 2016

|

President and Chief Executive Officer

Guggenheim Equal Weight Enhanced Equity Income Fund

July 31, 2016

6 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited)

|

June 30, 2016

|

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 7

|

QUESTIONS & ANSWERS (Unaudited) continued

|

June 30, 2016

|

8 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

June 30, 2016

|

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 9

|

QUESTIONS & ANSWERS (Unaudited) continued

|

June 30, 2016

|

10 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

June 30, 2016

|

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 11

|

FUND SUMMARY (Unaudited)

|

June 30, 2016

|

|||

|

Fund Statistics

|

||||

|

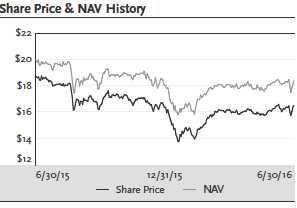

Share Price

|

$16.50

|

|||

|

Net Asset Value

|

$18.38

|

|||

|

Discount to NAV

|

-10.23%

|

|||

|

Net Assets ($000)

|

$161,241

|

|

AVERAGE ANNUAL TOTAL RETURNS

|

||||

|

FOR THE PERIOD ENDED JUNE 30, 2016

|

||||

|

Six Month

|

Since

|

|||

|

(non-

|

One

|

Three

|

Inception

|

|

|

annualized)

|

Year

|

Year

|

(10/27/11)

|

|

|

Guggenheim Equal Weight Enhanced

|

||||

|

Equity Income Fund

|

||||

|

NAV

|

4.65%

|

2.29%

|

6.59%

|

7.96%

|

|

Market

|

3.73%

|

-0.50%

|

6.57%

|

5.14%

|

12 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

FUND SUMMARY (Unaudited) continued

|

June 30, 2016

|

|

Portfolio Breakdown

|

% of Net Assets

|

|

Investments:

|

|

|

Consumer, Non-cyclical

|

26.3%

|

|

Financial

|

23.5%

|

|

Consumer, Cyclical

|

19.4%

|

|

Industrial

|

16.7%

|

|

Technology

|

11.9%

|

|

Energy

|

10.3%

|

|

Communications

|

8.3%

|

|

Utilities

|

7.6%

|

|

Basic Materials

|

5.0%

|

|

Diversified

|

0.3%

|

|

Short term investments

|

3.9%

|

|

Total Investments

|

133.2%

|

|

Options Written

|

-2.3%

|

|

Other Assets & Liabilities, net

|

-30.9%

|

|

Net Assets

|

100.0%

|

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 13

|

FUND SUMMARY (Unaudited) continued

|

June 30, 2016

|

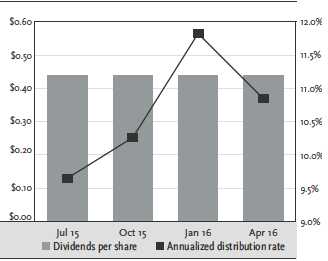

Annualized Distribution Rate

14 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited)

|

June 30, 2016

|

|||||||

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3%

|

||||||||

|

Consumer, Non-cyclical – 26.3%

|

||||||||

|

Hershey Co.1

|

4,331

|

$

|

491,525

|

|||||

|

Tyson Foods, Inc. — Class A1

|

6,893

|

460,384

|

||||||

|

General Mills, Inc.1

|

6,383

|

455,236

|

||||||

|

Mead Johnson Nutrition Co. — Class A1

|

4,983

|

452,207

|

||||||

|

Constellation Brands, Inc. — Class A1

|

2,722

|

450,219

|

||||||

|

McCormick & Company, Inc.1

|

4,183

|

446,201

|

||||||

|

Eli Lilly & Co.1

|

5,646

|

444,622

|

||||||

|

Campbell Soup Co.1

|

6,659

|

443,023

|

||||||

|

JM Smucker Co.1

|

2,895

|

441,227

|

||||||

|

Automatic Data Processing, Inc.1

|

4,794

|

440,424

|

||||||

|

Reynolds American, Inc.1

|

8,164

|

440,285

|

||||||

|

Hormel Foods Corp.1

|

12,012

|

439,639

|

||||||

|

Quest Diagnostics, Inc.1

|

5,391

|

438,881

|

||||||

|

Centene Corp.*

|

6,147

|

438,711

|

||||||

|

Clorox Co.1

|

3,168

|

438,420

|

||||||

|

Kimberly-Clark Corp.1

|

3,188

|

438,286

|

||||||

|

Dr Pepper Snapple Group, Inc.1

|

4,528

|

437,542

|

||||||

|

Monster Beverage Corp.*,1

|

2,719

|

436,970

|

||||||

|

Stryker Corp.1

|

3,645

|

436,779

|

||||||

|

Kellogg Co.1

|

5,345

|

436,419

|

||||||

|

CR Bard, Inc.1

|

1,853

|

435,751

|

||||||

|

Altria Group, Inc.1

|

6,314

|

435,413

|

||||||

|

Sysco Corp.1

|

8,559

|

434,284

|

||||||

|

Cintas Corp.1

|

4,417

|

433,440

|

||||||

|

AmerisourceBergen Corp. — Class A1

|

5,461

|

433,167

|

||||||

|

Kraft Heinz Co.1

|

4,892

|

432,844

|

||||||

|

Johnson & Johnson1

|

3,568

|

432,797

|

||||||

|

Equifax, Inc.1

|

3,370

|

432,708

|

||||||

|

Intuitive Surgical, Inc.*,1

|

651

|

430,579

|

||||||

|

Church & Dwight Company, Inc.

|

4,180

|

430,080

|

||||||

|

Verisk Analytics, Inc. — Class A*

|

5,301

|

429,805

|

||||||

|

PepsiCo, Inc.1

|

4,042

|

428,209

|

||||||

|

Abbott Laboratories1

|

10,873

|

427,417

|

||||||

|

ConAgra Foods, Inc.1

|

8,893

|

425,174

|

||||||

|

Procter & Gamble Co.1

|

5,018

|

424,874

|

||||||

|

Mallinckrodt plc*,1

|

6,986

|

424,609

|

||||||

|

Danaher Corp.1

|

4,204

|

424,604

|

||||||

|

Baxter International, Inc.1

|

9,385

|

424,390

|

||||||

|

DaVita HealthCare Partners, Inc.*,1

|

5,488

|

424,332

|

||||||

|

Brown-Forman Corp. — Class B1

|

4,251

|

424,080

|

||||||

|

Boston Scientific Corp.*,1

|

18,138

|

423,885

|

||||||

See notes to financial statements.

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 15

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Consumer, Non-cyclical – 26.3% (continued)

|

||||||||

|

AbbVie, Inc.1

|

6,845

|

$

|

423,774

|

|||||

|

Colgate-Palmolive Co.1

|

5,789

|

423,755

|

||||||

|

UnitedHealth Group, Inc.1

|

2,999

|

423,459

|

||||||

|

Merck & Company, Inc.1

|

7,350

|

423,434

|

||||||

|

Hologic, Inc.*

|

12,230

|

423,158

|

||||||

|

Aetna, Inc.1

|

3,464

|

423,058

|

||||||

|

Medtronic plc1

|

4,872

|

422,743

|

||||||

|

Bristol-Myers Squibb Co.1

|

5,747

|

422,692

|

||||||

|

Total System Services, Inc.1

|

7,950

|

422,225

|

||||||

|

Mondelez International, Inc. — Class A1

|

9,274

|

422,060

|

||||||

|

Zimmer Biomet Holdings, Inc.1

|

3,502

|

421,571

|

||||||

|

St. Jude Medical, Inc.1

|

5,398

|

421,044

|

||||||

|

McKesson Corp.1

|

2,251

|

420,149

|

||||||

|

Philip Morris International, Inc.1

|

4,122

|

419,290

|

||||||

|

Becton Dickinson and Co.1

|

2,466

|

418,209

|

||||||

|

Zoetis, Inc.

|

8,810

|

418,123

|

||||||

|

Laboratory Corporation of America Holdings*,1

|

3,204

|

417,385

|

||||||

|

Kroger Co.1

|

11,343

|

417,309

|

||||||

|

Cigna Corp.1

|

3,260

|

417,247

|

||||||

|

Anthem, Inc.1

|

3,175

|

417,005

|

||||||

|

Express Scripts Holding Co.*,1

|

5,500

|

416,900

|

||||||

|

Pfizer, Inc.1

|

11,831

|

416,570

|

||||||

|

S&P Global, Inc.1

|

3,883

|

416,491

|

||||||

|

Archer-Daniels-Midland Co.1

|

9,703

|

416,162

|

||||||

|

Estee Lauder Companies, Inc. — Class A1

|

4,561

|

415,142

|

||||||

|

Cardinal Health, Inc.1

|

5,317

|

414,779

|

||||||

|

PayPal Holdings, Inc.*,1

|

11,355

|

414,571

|

||||||

|

Universal Health Services, Inc. — Class B

|

3,089

|

414,235

|

||||||

|

Henry Schein, Inc.*

|

2,341

|

413,889

|

||||||

|

Illumina, Inc.*

|

2,948

|

413,840

|

||||||

|

Western Union Co.1

|

21,567

|

413,655

|

||||||

|

Gilead Sciences, Inc.1

|

4,944

|

412,428

|

||||||

|

Coca-Cola Co.1

|

9,079

|

411,551

|

||||||

|

Quanta Services, Inc.*,1

|

17,790

|

411,305

|

||||||

|

Amgen, Inc.1

|

2,697

|

410,349

|

||||||

|

Edwards Lifesciences Corp.*,1

|

4,113

|

410,189

|

||||||

|

Biogen, Inc.*,1

|

1,696

|

410,127

|

||||||

|

Molson Coors Brewing Co. — Class B1

|

4,027

|

407,251

|

||||||

|

Dentsply Sirona, Inc.1

|

6,564

|

407,231

|

||||||

|

Thermo Fisher Scientific, Inc.1

|

2,751

|

406,488

|

||||||

|

Mylan N.V.*,1

|

9,376

|

405,419

|

||||||

16 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Consumer, Non-cyclical – 26.3% (continued)

|

||||||||

|

Avery Dennison Corp.1

|

5,415

|

$

|

404,771

|

|||||

|

HCA Holdings, Inc.*

|

5,249

|

404,225

|

||||||

|

Patterson Companies, Inc.1

|

8,418

|

403,138

|

||||||

|

Varian Medical Systems, Inc.*,1

|

4,895

|

402,516

|

||||||

|

Humana, Inc.1

|

2,235

|

402,032

|

||||||

|

Allergan plc*,1

|

1,733

|

400,479

|

||||||

|

Celgene Corp.*,1

|

4,057

|

400,142

|

||||||

|

Nielsen Holdings plc

|

7,674

|

398,818

|

||||||

|

Global Payments, Inc.

|

5,586

|

398,729

|

||||||

|

Robert Half International, Inc.1

|

10,444

|

398,543

|

||||||

|

H&R Block, Inc.1

|

17,232

|

396,336

|

||||||

|

Endo International plc*

|

25,336

|

394,988

|

||||||

|

Moody's Corp.1

|

4,199

|

393,488

|

||||||

|

Vertex Pharmaceuticals, Inc.*

|

4,564

|

392,595

|

||||||

|

Regeneron Pharmaceuticals, Inc.*,1

|

1,122

|

391,836

|

||||||

|

United Rentals, Inc.*

|

5,839

|

391,797

|

||||||

|

Whole Foods Market, Inc.1

|

12,169

|

389,651

|

||||||

|

Perrigo Company plc1

|

4,238

|

384,259

|

||||||

|

Alexion Pharmaceuticals, Inc.*,1

|

3,079

|

359,504

|

||||||

|

Total Consumer, Non-cyclical

|

42,503,551

|

|||||||

|

Financial – 23.5%

|

||||||||

|

UDR, Inc. REIT

|

12,375

|

456,886

|

||||||

|

Essex Property Trust, Inc. REIT1

|

1,994

|

454,811

|

||||||

|

General Growth Properties, Inc. REIT1

|

15,205

|

453,412

|

||||||

|

Macerich Co. REIT1

|

5,307

|

453,165

|

||||||

|

Simon Property Group, Inc. REIT1

|

2,085

|

452,237

|

||||||

|

Apartment Investment & Management Co. — Class A REIT1

|

10,226

|

451,580

|

||||||

|

Realty Income Corp. REIT

|

6,493

|

450,354

|

||||||

|

Crown Castle International Corp. REIT

|

4,436

|

449,944

|

||||||

|

Kimco Realty Corp. REIT1

|

14,265

|

447,636

|

||||||

|

Iron Mountain, Inc. REIT1

|

11,227

|

447,172

|

||||||

|

Equity Residential REIT1

|

6,481

|

446,411

|

||||||

|

Digital Realty Trust, Inc. REIT

|

4,081

|

444,788

|

||||||

|

SL Green Realty Corp. REIT

|

4,177

|

444,726

|

||||||

|

Cincinnati Financial Corp.1

|

5,925

|

443,722

|

||||||

|

Ventas, Inc. REIT1

|

6,088

|

443,328

|

||||||

|

AvalonBay Communities, Inc. REIT1

|

2,455

|

442,857

|

||||||

|

Public Storage REIT1

|

1,727

|

441,404

|

||||||

|

Welltower, Inc. REIT1

|

5,788

|

440,872

|

||||||

|

Federal Realty Investment Trust REIT

|

2,659

|

440,197

|

||||||

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 17

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Financial – 23.5% (continued)

|

||||||||

|

Host Hotels & Resorts, Inc. REIT1

|

27,113

|

$

|

439,502

|

|||||

|

Equinix, Inc. REIT

|

1,128

|

437,359

|

||||||

|

Aflac, Inc.1

|

6,055

|

436,928

|

||||||

|

Travelers Companies, Inc.1

|

3,669

|

436,758

|

||||||

|

Extra Space Storage, Inc. REIT

|

4,712

|

436,048

|

||||||

|

American Tower Corp. — Class A REIT1

|

3,838

|

436,035

|

||||||

|

Vornado Realty Trust REIT1

|

4,349

|

435,422

|

||||||

|

Chubb Ltd.1

|

3,319

|

433,826

|

||||||

|

Allstate Corp.1

|

6,189

|

432,920

|

||||||

|

Loews Corp.1

|

10,493

|

431,157

|

||||||

|

Marsh & McLennan Companies, Inc.1

|

6,293

|

430,819

|

||||||

|

Boston Properties, Inc. REIT1

|

3,256

|

429,466

|

||||||

|

HCP, Inc. REIT1

|

12,127

|

429,053

|

||||||

|

Torchmark Corp.1

|

6,938

|

428,907

|

||||||

|

Progressive Corp.1

|

12,784

|

428,264

|

||||||

|

CME Group, Inc. — Class A1

|

4,384

|

427,002

|

||||||

|

Berkshire Hathaway, Inc. — Class B*,1

|

2,945

|

426,407

|

||||||

|

Assurant, Inc.1

|

4,925

|

425,077

|

||||||

|

Morgan Stanley1

|

16,348

|

424,721

|

||||||

|

Hartford Financial Services Group, Inc.1

|

9,539

|

423,341

|

||||||

|

M&T Bank Corp.1

|

3,552

|

419,953

|

||||||

|

T. Rowe Price Group, Inc.1

|

5,733

|

418,336

|

||||||

|

Aon plc1

|

3,818

|

417,040

|

||||||

|

Goldman Sachs Group, Inc.1

|

2,786

|

413,944

|

||||||

|

BB&T Corp.1

|

11,624

|

413,931

|

||||||

|

Arthur J Gallagher & Co.

|

8,693

|

413,787

|

||||||

|

XL Group plc — Class A1

|

12,390

|

412,711

|

||||||

|

Franklin Resources, Inc.1

|

12,357

|

412,353

|

||||||

|

BlackRock, Inc. — Class A1

|

1,203

|

412,064

|

||||||

|

Nasdaq, Inc.1

|

6,367

|

411,754

|

||||||

|

Prologis, Inc. REIT1

|

8,364

|

410,171

|

||||||

|

Intercontinental Exchange, Inc.1

|

1,598

|

409,024

|

||||||

|

Wells Fargo & Co.1

|

8,637

|

408,789

|

||||||

|

Willis Towers Watson plc

|

3,287

|

408,607

|

||||||

|

JPMorgan Chase & Co.1

|

6,540

|

406,396

|

||||||

|

Weyerhaeuser Co. REIT1

|

13,649

|

406,331

|

||||||

|

Prudential Financial, Inc.1

|

5,678

|

405,069

|

||||||

|

Principal Financial Group, Inc.1

|

9,829

|

404,070

|

||||||

|

SunTrust Banks, Inc.1

|

9,829

|

403,775

|

||||||

|

Citigroup, Inc.1

|

9,511

|

403,171

|

||||||

|

American International Group, Inc.1

|

7,593

|

401,594

|

||||||

18 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Financial – 23.5% (continued)

|

||||||||

|

U.S. Bancorp1

|

9,951

|

$

|

401,324

|

|||||

|

Bank of America Corp.1

|

30,190

|

400,621

|

||||||

|

Discover Financial Services1

|

7,416

|

397,424

|

||||||

|

Fifth Third Bancorp1

|

22,533

|

396,355

|

||||||

|

Bank of New York Mellon Corp.1

|

10,124

|

393,318

|

||||||

|

PNC Financial Services Group, Inc.1

|

4,799

|

390,591

|

||||||

|

American Express Co.1

|

6,426

|

390,444

|

||||||

|

People's United Financial, Inc.1

|

26,594

|

389,868

|

||||||

|

Northern Trust Corp.1

|

5,882

|

389,741

|

||||||

|

Comerica, Inc.1

|

9,457

|

388,966

|

||||||

|

Visa, Inc. — Class A1

|

5,207

|

386,203

|

||||||

|

MasterCard, Inc. — Class A1

|

4,385

|

386,143

|

||||||

|

MetLife, Inc.1

|

9,690

|

385,953

|

||||||

|

Navient Corp.1

|

32,242

|

385,292

|

||||||

|

Legg Mason, Inc.1

|

12,987

|

382,987

|

||||||

|

Unum Group1

|

12,019

|

382,084

|

||||||

|

State Street Corp.1

|

7,055

|

380,406

|

||||||

|

E*TRADE Financial Corp.*,1

|

16,177

|

379,997

|

||||||

|

Alliance Data Systems Corp.*,1

|

1,937

|

379,497

|

||||||

|

Capital One Financial Corp.1

|

5,961

|

378,583

|

||||||

|

Ameriprise Financial, Inc.1

|

4,194

|

376,831

|

||||||

|

KeyCorp1

|

34,084

|

376,628

|

||||||

|

Lincoln National Corp.1

|

9,701

|

376,108

|

||||||

|

Invesco Ltd.1

|

14,691

|

375,208

|

||||||

|

Huntington Bancshares, Inc.1

|

41,963

|

375,149

|

||||||

|

Zions Bancorporation1

|

14,917

|

374,864

|

||||||

|

Regions Financial Corp.1

|

43,859

|

373,240

|

||||||

|

Charles Schwab Corp.1

|

14,676

|

371,450

|

||||||

|

Citizens Financial Group, Inc.1

|

18,590

|

371,428

|

||||||

|

CBRE Group, Inc. — Class A*,1

|

14,011

|

371,011

|

||||||

|

Affiliated Managers Group Inc*,1

|

2,615

|

368,114

|

||||||

|

Synchrony Financial

|

13,556

|

342,696

|

||||||

|

Total Financial

|

37,965,908

|

|||||||

|

Consumer, Cyclical – 19.4%

|

||||||||

|

The Gap, Inc.1

|

22,068

|

468,282

|

||||||

|

Coach, Inc.1

|

11,031

|

449,402

|

||||||

|

Ross Stores, Inc.1

|

7,785

|

441,332

|

||||||

|

Advance Auto Parts, Inc.1

|

2,729

|

441,087

|

||||||

|

Wyndham Worldwide Corp.1

|

6,171

|

439,561

|

||||||

|

AutoZone, Inc.*,1

|

553

|

438,994

|

||||||

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 19

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Consumer, Cyclical – 19.4% (continued)

|

||||||||

|

Genuine Parts Co.1

|

4,327

|

$

|

438,109

|

|||||

|

Urban Outfitters, Inc.*,1

|

15,864

|

436,260

|

||||||

|

Starbucks Corp.1

|

7,610

|

434,684

|

||||||

|

Best Buy Company, Inc.1

|

14,182

|

433,969

|

||||||

|

O'Reilly Automotive, Inc.*,1

|

1,599

|

433,489

|

||||||

|

Dollar Tree, Inc.*,1

|

4,571

|

430,771

|

||||||

|

Kohl's Corp.1

|

11,346

|

430,241

|

||||||

|

Target Corp.1

|

6,151

|

429,463

|

||||||

|

Dollar General Corp.1

|

4,566

|

429,204

|

||||||

|

Wal-Mart Stores, Inc.1

|

5,869

|

428,554

|

||||||

|

WW Grainger, Inc.1

|

1,877

|

426,547

|

||||||

|

Leggett & Platt, Inc.1

|

8,324

|

425,440

|

||||||

|

Harley-Davidson, Inc.1

|

9,389

|

425,322

|

||||||

|

Ulta Salon Cosmetics & Fragrance, Inc.*

|

1,740

|

423,934

|

||||||

|

PulteGroup, Inc.1

|

21,724

|

423,401

|

||||||

|

Costco Wholesale Corp.1

|

2,696

|

423,380

|

||||||

|

Newell Brands, Inc.1

|

8,708

|

422,948

|

||||||

|

Macy's, Inc.1

|

12,561

|

422,175

|

||||||

|

Lowe's Companies, Inc.1

|

5,332

|

422,135

|

||||||

|

DR Horton, Inc.1

|

13,408

|

422,084

|

||||||

|

Walgreens Boots Alliance, Inc.1

|

5,063

|

421,596

|

||||||

|

Mattel, Inc.1

|

13,434

|

420,350

|

||||||

|

Yum! Brands, Inc.1

|

5,061

|

419,658

|

||||||

|

TJX Companies, Inc.1

|

5,425

|

418,973

|

||||||

|

NIKE, Inc. — Class B1

|

7,576

|

418,195

|

||||||

|

Starwood Hotels & Resorts Worldwide, Inc.

|

5,651

|

417,891

|

||||||

|

Marriott International, Inc. — Class A1

|

6,280

|

417,369

|

||||||

|

Fastenal Co.1

|

9,368

|

415,846

|

||||||

|

CarMax, Inc.*,1

|

8,478

|

415,676

|

||||||

|

Johnson Controls, Inc.1

|

9,391

|

415,645

|

||||||

|

Chipotle Mexican Grill, Inc. — Class A*,1

|

1,030

|

414,843

|

||||||

|

Bed Bath & Beyond, Inc.1

|

9,592

|

414,566

|

||||||

|

Michael Kors Holdings Ltd.*

|

8,377

|

414,494

|

||||||

|

Home Depot, Inc.1

|

3,241

|

413,843

|

||||||

|

CVS Health Corp.1

|

4,319

|

413,501

|

||||||

|

Staples, Inc.1

|

47,937

|

413,217

|

||||||

|

AutoNation, Inc.*,1

|

8,766

|

411,827

|

||||||

|

Foot Locker, Inc.

|

7,497

|

411,285

|

||||||

|

LKQ Corp.*

|

12,955

|

410,674

|

||||||

|

McDonald's Corp.1

|

3,412

|

410,600

|

||||||

|

Lennar Corp. — Class A1

|

8,899

|

410,244

|

||||||

20 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Consumer, Cyclical – 19.4% (continued)

|

||||||||

|

Tractor Supply Co.

|

4,496

|

$

|

409,945

|

|||||

|

Tiffany & Co.1

|

6,759

|

409,866

|

||||||

|

VF Corp.1

|

6,664

|

409,769

|

||||||

|

L Brands, Inc.1

|

6,104

|

409,762

|

||||||

|

Nordstrom, Inc.1

|

10,739

|

408,619

|

||||||

|

Hasbro, Inc.1

|

4,859

|

408,107

|

||||||

|

PVH Corp.1

|

4,320

|

407,074

|

||||||

|

General Motors Co.1

|

14,368

|

406,614

|

||||||

|

Mohawk Industries, Inc.*,1

|

2,138

|

405,707

|

||||||

|

Ford Motor Co.1

|

31,873

|

400,644

|

||||||

|

PACCAR, Inc.1

|

7,607

|

394,575

|

||||||

|

Whirlpool Corp.1

|

2,352

|

391,937

|

||||||

|

Carnival Corp.1

|

8,855

|

391,391

|

||||||

|

Harman International Industries, Inc.1

|

5,443

|

390,916

|

||||||

|

Goodyear Tire & Rubber Co.1

|

15,227

|

390,725

|

||||||

|

Hanesbrands, Inc.

|

15,545

|

390,646

|

||||||

|

Ralph Lauren Corp. — Class A1

|

4,358

|

390,564

|

||||||

|

Darden Restaurants, Inc.

|

6,157

|

389,984

|

||||||

|

Delphi Automotive plc1

|

6,201

|

388,183

|

||||||

|

Signet Jewelers Ltd.

|

4,685

|

386,091

|

||||||

|

Royal Caribbean Cruises Ltd.1

|

5,648

|

379,263

|

||||||

|

Wynn Resorts Ltd.1

|

4,157

|

376,790

|

||||||

|

Southwest Airlines Co.1

|

9,570

|

375,240

|

||||||

|

United Continental Holdings, Inc.*

|

9,061

|

371,863

|

||||||

|

BorgWarner, Inc.1

|

12,404

|

366,166

|

||||||

|

Alaska Air Group, Inc.

|

6,239

|

363,671

|

||||||

|

Delta Air Lines, Inc.1

|

9,932

|

361,823

|

||||||

|

American Airlines Group, Inc.

|

12,599

|

356,678

|

||||||

|

Under Armour, Inc. — Class A*

|

5,629

|

225,892

|

||||||

|

Under Armour, Inc. — Class C*

|

5,669

|

206,352

|

||||||

|

Total Consumer, Cyclical

|

31,325,918

|

|||||||

|

Industrial – 16.7%

|

||||||||

|

Waste Management, Inc.1

|

6,668

|

441,888

|

||||||

|

General Electric Co.1

|

13,899

|

437,542

|

||||||

|

Vulcan Materials Co.1

|

3,615

|

435,101

|

||||||

|

Stericycle, Inc.*,1

|

4,172

|

434,389

|

||||||

|

3M Co.1

|

2,477

|

433,772

|

||||||

|

Republic Services, Inc. — Class A1

|

8,423

|

432,184

|

||||||

|

Martin Marietta Materials, Inc.1

|

2,250

|

432,000

|

||||||

|

Lockheed Martin Corp.1

|

1,735

|

430,575

|

||||||

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 21

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Industrial – 16.7% (continued)

|

||||||||

|

United Parcel Service, Inc. — Class B1

|

3,995

|

$

|

430,341

|

|||||

|

Harris Corp.1

|

5,155

|

430,133

|

||||||

|

Northrop Grumman Corp.1

|

1,921

|

427,000

|

||||||

|

Allegion plc1

|

6,148

|

426,855

|

||||||

|

Waters Corp.*,1

|

3,025

|

425,467

|

||||||

|

Kansas City Southern1

|

4,718

|

425,045

|

||||||

|

CH Robinson Worldwide, Inc.1

|

5,720

|

424,710

|

||||||

|

Fortune Brands Home & Security, Inc.

|

7,323

|

424,514

|

||||||

|

Norfolk Southern Corp.1

|

4,965

|

422,670

|

||||||

|

Snap-on, Inc.1

|

2,678

|

422,642

|

||||||

|

TransDigm Group, Inc.*

|

1,599

|

421,640

|

||||||

|

United Technologies Corp.1

|

4,093

|

419,737

|

||||||

|

L-3 Communications Holdings, Inc.1

|

2,856

|

418,947

|

||||||

|

J.B. Hunt Transport Services, Inc.

|

5,157

|

417,356

|

||||||

|

FLIR Systems, Inc.1

|

13,482

|

417,268

|

||||||

|

Corning, Inc.1

|

20,347

|

416,707

|

||||||

|

Garmin Ltd.1

|

9,822

|

416,649

|

||||||

|

Caterpillar, Inc.1

|

5,492

|

416,349

|

||||||

|

Honeywell International, Inc.1

|

3,578

|

416,193

|

||||||

|

WestRock Co.

|

10,706

|

416,142

|

||||||

|

Expeditors International of Washington, Inc.1

|

8,476

|

415,663

|

||||||

|

Raytheon Co.1

|

3,055

|

415,327

|

||||||

|

Roper Technologies, Inc.1

|

2,425

|

413,608

|

||||||

|

Masco Corp.1

|

13,365

|

413,513

|

||||||

|

Boeing Co.1

|

3,184

|

413,506

|

||||||

|

Emerson Electric Co.1

|

7,918

|

413,003

|

||||||

|

Ingersoll-Rand plc1

|

6,474

|

412,264

|

||||||

|

Acuity Brands, Inc.

|

1,659

|

411,366

|

||||||

|

Stanley Black & Decker, Inc.1

|

3,697

|

411,180

|

||||||

|

Rockwell Automation, Inc.1

|

3,578

|

410,826

|

||||||

|

General Dynamics Corp.1

|

2,950

|

410,758

|

||||||

|

Union Pacific Corp.1

|

4,703

|

410,337

|

||||||

|

Pentair plc1

|

7,031

|

409,837

|

||||||

|

Ball Corp.1

|

5,667

|

409,667

|

||||||

|

Dover Corp.1

|

5,908

|

409,543

|

||||||

|

Tyco International plc1

|

9,601

|

409,003

|

||||||

|

Agilent Technologies, Inc.1

|

9,205

|

408,334

|

||||||

|

PerkinElmer, Inc.1

|

7,777

|

407,670

|

||||||

|

CSX Corp.1

|

15,591

|

406,613

|

||||||

|

Xylem, Inc.1

|

9,093

|

406,003

|

||||||

|

Eaton Corporation plc1

|

6,776

|

404,730

|

||||||

22 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Industrial – 16.7% (continued)

|

||||||||

|

Cummins, Inc.1

|

3,599

|

$

|

404,672

|

|||||

|

Jacobs Engineering Group, Inc.*,1

|

8,098

|

403,362

|

||||||

|

Amphenol Corp. — Class A1

|

7,021

|

402,514

|

||||||

|

Illinois Tool Works, Inc.1

|

3,863

|

402,370

|

||||||

|

Parker-Hannifin Corp.1

|

3,705

|

400,325

|

||||||

|

AMETEK, Inc.1

|

8,641

|

399,473

|

||||||

|

Rockwell Collins, Inc.1

|

4,690

|

399,307

|

||||||

|

Sealed Air Corp.1

|

8,670

|

398,560

|

||||||

|

Deere & Co.1

|

4,874

|

394,989

|

||||||

|

Fluor Corp.1

|

8,012

|

394,831

|

||||||

|

Textron, Inc.1

|

10,775

|

393,934

|

||||||

|

FedEx Corp.1

|

2,595

|

393,869

|

||||||

|

TE Connectivity Ltd.1

|

6,804

|

388,576

|

||||||

|

Ryder System, Inc.1

|

6,354

|

388,484

|

||||||

|

Owens-Illinois, Inc.*,1

|

21,489

|

387,017

|

||||||

|

Flowserve Corp.1

|

8,214

|

371,026

|

||||||

|

Total Industrial

|

26,859,876

|

|||||||

|

Technology – 11.9%

|

||||||||

|

Micron Technology, Inc.*,1

|

34,393

|

473,248

|

||||||

|

Paychex, Inc.1

|

7,653

|

455,353

|

||||||

|

Akamai Technologies, Inc.*,1

|

7,918

|

442,854

|

||||||

|

Oracle Corp.1

|

10,778

|

441,144

|

||||||

|

Cerner Corp.*,1

|

7,508

|

439,969

|

||||||

|

Seagate Technology plc1

|

18,044

|

439,551

|

||||||

|

Activision Blizzard, Inc.1

|

11,055

|

438,110

|

||||||

|

Intuit, Inc.1

|

3,923

|

437,845

|

||||||

|

Intel Corp.1

|

13,031

|

427,417

|

||||||

|

Qorvo, Inc.*

|

7,728

|

427,050

|

||||||

|

Fiserv, Inc.*,1

|

3,925

|

426,765

|

||||||

|

Lam Research Corp.1

|

5,069

|

426,100

|

||||||

|

NVIDIA Corp.1

|

9,038

|

424,876

|

||||||

|

Texas Instruments, Inc.1

|

6,744

|

422,512

|

||||||

|

Western Digital Corp.1

|

8,912

|

421,181

|

||||||

|

KLA-Tencor Corp.1

|

5,745

|

420,821

|

||||||

|

Electronic Arts, Inc.*,1

|

5,546

|

420,165

|

||||||

|

NetApp, Inc.1

|

17,049

|

419,235

|

||||||

|

International Business Machines Corp.1

|

2,740

|

415,877

|

||||||

|

Applied Materials, Inc.1

|

17,346

|

415,784

|

||||||

|

QUALCOMM, Inc.1

|

7,757

|

415,542

|

||||||

|

CA, Inc.1

|

12,656

|

415,496

|

||||||

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 23

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Technology – 11.9% (continued)

|

||||||||

|

Analog Devices, Inc.1

|

7,330

|

$

|

415,171

|

|||||

|

Microsoft Corp.1

|

8,111

|

415,040

|

||||||

|

Fidelity National Information Services, Inc.1

|

5,616

|

413,787

|

||||||

|

Xilinx, Inc.1

|

8,935

|

412,172

|

||||||

|

Adobe Systems, Inc.*,1

|

4,300

|

411,897

|

||||||

|

Linear Technology Corp.1

|

8,803

|

409,604

|

||||||

|

EMC Corp.1

|

15,068

|

409,398

|

||||||

|

Microchip Technology, Inc.1

|

7,991

|

405,623

|

||||||

|

salesforce.com, Inc.*,1

|

5,102

|

405,150

|

||||||

|

Dun & Bradstreet Corp.1

|

3,320

|

404,509

|

||||||

|

Apple, Inc.1

|

4,225

|

403,910

|

||||||

|

Broadcom Ltd.

|

2,596

|

403,418

|

||||||

|

CSRA, Inc.

|

17,211

|

403,254

|

||||||

|

Skyworks Solutions, Inc.

|

6,370

|

403,094

|

||||||

|

Autodesk, Inc.*,1

|

7,432

|

402,368

|

||||||

|

Pitney Bowes, Inc.1

|

22,484

|

400,215

|

||||||

|

Accenture plc — Class A1

|

3,530

|

399,914

|

||||||

|

Xerox Corp.1

|

42,048

|

399,036

|

||||||

|

Hewlett Packard Enterprise Co.1

|

21,837

|

398,962

|

||||||

|

Cognizant Technology Solutions Corp. — Class A*,1

|

6,928

|

396,559

|

||||||

|

Red Hat, Inc.*,1

|

5,428

|

394,073

|

||||||

|

Citrix Systems, Inc.*,1

|

4,854

|

388,757

|

||||||

|

HP, Inc.1

|

30,928

|

388,146

|

||||||

|

Teradata Corp.*,1

|

14,992

|

375,849

|

||||||

|

Total Technology

|

19,126,801

|

|||||||

|

Energy – 10.3%

|

||||||||

|

Marathon Oil Corp.1

|

31,113

|

467,006

|

||||||

|

Newfield Exploration Co.*,1

|

10,475

|

462,785

|

||||||

|

Transocean Ltd.1

|

38,840

|

461,808

|

||||||

|

Spectra Energy Corp.1

|

12,501

|

457,911

|

||||||

|

Murphy Oil Corp.1

|

14,207

|

451,072

|

||||||

|

Kinder Morgan, Inc.1

|

23,845

|

446,378

|

||||||

|

ONEOK, Inc.1

|

9,239

|

438,391

|

||||||

|

Marathon Petroleum Corp.1

|

11,471

|

435,440

|

||||||

|

Exxon Mobil Corp.1

|

4,640

|

434,954

|

||||||

|

Hess Corp.1

|

7,236

|

434,884

|

||||||

|

Cimarex Energy Co.1

|

3,641

|

434,444

|

||||||

|

Apache Corp.1

|

7,801

|

434,282

|

||||||

|

Helmerich & Payne, Inc.1

|

6,446

|

432,720

|

||||||

|

Devon Energy Corp.1

|

11,889

|

430,976

|

||||||

24 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Energy – 10.3% (continued)

|

||||||||

|

Chevron Corp.1

|

4,094

|

$

|

429,174

|

|||||

|

Cabot Oil & Gas Corp. — Class A1

|

16,668

|

429,034

|

||||||

|

Equities Corp.1

|

5,529

|

428,110

|

||||||

|

EOG Resources, Inc.1

|

5,119

|

427,027

|

||||||

|

Halliburton Co.1

|

9,408

|

426,088

|

||||||

|

Schlumberger Ltd.1

|

5,317

|

420,468

|

||||||

|

Anadarko Petroleum Corp.1

|

7,878

|

419,504

|

||||||

|

Occidental Petroleum Corp.1

|

5,534

|

418,149

|

||||||

|

Diamond Offshore Drilling, Inc.1

|

17,168

|

417,697

|

||||||

|

First Solar, Inc.*,1

|

8,607

|

417,267

|

||||||

|

Columbia Pipeline Group, Inc.1

|

16,355

|

416,889

|

||||||

|

Range Resources Corp.1

|

9,663

|

416,862

|

||||||

|

Concho Resources, Inc.*

|

3,486

|

415,775

|

||||||

|

Phillips 661

|

5,215

|

413,758

|

||||||

|

Baker Hughes, Inc.1

|

9,089

|

410,187

|

||||||

|

Noble Energy, Inc.1

|

11,433

|

410,102

|

||||||

|

Williams Companies, Inc.1

|

18,944

|

409,759

|

||||||

|

ConocoPhillips1

|

9,381

|

409,012

|

||||||

|

FMC Technologies, Inc.*,1

|

15,199

|

405,358

|

||||||

|

Tesoro Corp.1

|

5,408

|

405,167

|

||||||

|

Chesapeake Energy Corp.1

|

94,465

|

404,310

|

||||||

|

National Oilwell Varco, Inc.1

|

11,919

|

401,074

|

||||||

|

Southwestern Energy Co.*,1

|

31,752

|

399,440

|

||||||

|

Valero Energy Corp.1

|

7,815

|

398,565

|

||||||

|

Pioneer Natural Resources Co.1

|

2,617

|

395,717

|

||||||

|

Total Energy

|

16,567,544

|

|||||||

|

Communications – 8.3%

|

||||||||

|

Symantec Corp.1

|

24,135

|

495,733

|

||||||

|

CenturyLink, Inc.1

|

15,487

|

449,278

|

||||||

|

AT&T, Inc.1

|

10,353

|

447,353

|

||||||

|

Verizon Communications, Inc.1

|

7,927

|

442,644

|

||||||

|

TEGNA, Inc.1

|

19,057

|

441,551

|

||||||

|

Comcast Corp. — Class A1

|

6,649

|

433,448

|

||||||

|

CBS Corp. — Class B1

|

7,918

|

431,056

|

||||||

|

VeriSign, Inc.*,1

|

4,932

|

426,421

|

||||||

|

Yahoo!, Inc.*,1

|

11,337

|

425,818

|

||||||

|

Walt Disney Co.1

|

4,289

|

419,550

|

||||||

|

Time Warner, Inc.1

|

5,671

|

417,045

|

||||||

|

Amazon.com, Inc.*,1

|

581

|

415,775

|

||||||

|

Expedia, Inc.1

|

3,909

|

415,527

|

||||||

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 25

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Communications – 8.3% (continued)

|

||||||||

|

Cisco Systems, Inc.1

|

14,383

|

$

|

412,648

|

|||||

|

Viacom, Inc. — Class B1

|

9,936

|

412,046

|

||||||

|

Level 3 Communications, Inc.*,1

|

7,988

|

411,302

|

||||||

|

Juniper Networks, Inc.1

|

18,193

|

409,161

|

||||||

|

Facebook, Inc. — Class A*,1

|

3,580

|

409,122

|

||||||

|

Motorola Solutions, Inc.1

|

6,191

|

408,420

|

||||||

|

Omnicom Group, Inc.1

|

5,010

|

408,265

|

||||||

|

Netflix, Inc.*,1

|

4,454

|

407,452

|

||||||

|

Scripps Networks Interactive, Inc. — Class A1

|

6,528

|

406,498

|

||||||

|

eBay, Inc.*,1

|

17,346

|

406,070

|

||||||

|

Frontier Communications Corp.1

|

81,709

|

403,642

|

||||||

|

Interpublic Group of Companies, Inc.1

|

17,383

|

401,547

|

||||||

|

TripAdvisor, Inc.*,1

|

6,211

|

399,367

|

||||||

|

F5 Networks, Inc.*,1

|

3,497

|

398,098

|

||||||

|

Priceline Group, Inc.*,1

|

316

|

394,498

|

||||||

|

News Corp. — Class A1

|

28,081

|

318,720

|

||||||

|

Twenty-First Century Fox, Inc. — Class A1

|

10,413

|

281,672

|

||||||

|

Discovery Communications, Inc. — Class C*,1

|

10,000

|

238,500

|

||||||

|

Alphabet, Inc. — Class C*,1

|

290

|

200,709

|

||||||

|

Alphabet, Inc. — Class A*,1

|

285

|

200,506

|

||||||

|

Discovery Communications, Inc. — Class A*,1

|

6,307

|

159,126

|

||||||

|

Twenty-First Century Fox, Inc. — Class B

|

4,011

|

109,300

|

||||||

|

News Corp. — Class B

|

7,966

|

92,963

|

||||||

|

Total Communications

|

13,350,831

|

|||||||

|

Utilities – 7.6%

|

||||||||

|

AES Corp.1

|

37,280

|

465,255

|

||||||

|

American Water Works Company, Inc.1

|

5,387

|

455,255

|

||||||

|

NiSource, Inc.1

|

16,768

|

444,688

|

||||||

|

Dominion Resources, Inc.1

|

5,692

|

443,578

|

||||||

|

CMS Energy Corp.1

|

9,640

|

442,090

|

||||||

|

SCANA Corp.1

|

5,833

|

441,325

|

||||||

|

Eversource Energy1

|

7,366

|

441,223

|

||||||

|

Pinnacle West Capital Corp.1

|

5,442

|

441,129

|

||||||

|

Duke Energy Corp.1

|

5,139

|

440,875

|

||||||

|

DTE Energy Co.1

|

4,446

|

440,688

|

||||||

|

NextEra Energy, Inc.1

|

3,372

|

439,709

|

||||||

|

Ameren Corp.1

|

8,193

|

438,981

|

||||||

|

Exelon Corp.1

|

12,067

|

438,756

|

||||||

|

Public Service Enterprise Group, Inc.1

|

9,412

|

438,693

|

||||||

|

Edison International1

|

5,645

|

438,447

|

||||||

26 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS† – 129.3% (continued)

|

||||||||

|

Utilities – 7.6% (continued)

|

||||||||

|

Southern Co.1

|

8,169

|

$

|

438,103

|

|||||

|

American Electric Power Company, Inc.1

|

6,246

|

437,782

|

||||||

|

Xcel Energy, Inc.1

|

9,767

|

437,366

|

||||||

|

WEC Energy Group, Inc.1

|

6,677

|

436,008

|

||||||

|

Sempra Energy1

|

3,821

|

435,670

|

||||||

|

Consolidated Edison, Inc.1

|

5,412

|

435,341

|

||||||

|

CenterPoint Energy, Inc.1

|

18,044

|

433,056

|

||||||

|

FirstEnergy Corp.1

|

12,390

|

432,535

|

||||||

|

Entergy Corp.1

|

5,309

|

431,887

|

||||||

|

PG&E Corp.1

|

6,625

|

423,470

|

||||||

|

NRG Energy, Inc.1

|

28,022

|

420,050

|

||||||

|

Alliant Energy Corp.

|

10,508

|

417,168

|

||||||

|

PPL Corp.1

|

10,619

|

400,867

|

||||||

|

Total Utilities

|

12,229,995

|

|||||||

|

Basic Materials – 5.0%

|

||||||||

|

Newmont Mining Corp.1

|

11,666

|

456,374

|

||||||

|

Freeport-McMoRan, Inc.1

|

40,302

|

448,964

|

||||||

|

Sherwin-Williams Co.1

|

1,430

|

419,948

|

||||||

|

Albemarle Corp.

|

5,279

|

418,677

|

||||||

|

Praxair, Inc.1

|

3,671

|

412,584

|

||||||

|

Ecolab, Inc.1

|

3,472

|

411,780

|

||||||

|

International Paper Co.1

|

9,669

|

409,772

|

||||||

|

International Flavors & Fragrances, Inc.1

|

3,243

|

408,845

|

||||||

|

Nucor Corp.1

|

8,268

|

408,522

|

||||||

|

Alcoa, Inc.1

|

43,997

|

407,852

|

||||||

|

Mosaic Co.1

|

15,481

|

405,293

|

||||||

|

Air Products & Chemicals, Inc.1

|

2,852

|

405,098

|

||||||

|

EI du Pont de Nemours & Co.1

|

6,180

|

400,465

|

||||||

|

PPG Industries, Inc.1

|

3,822

|

398,061

|

||||||

|

Monsanto Co.1

|

3,824

|

395,440

|

||||||

|

FMC Corp.1

|

8,408

|

389,374

|

||||||

|

Eastman Chemical Co.1

|

5,727

|

388,863

|

||||||

|

Dow Chemical Co.1

|

7,822

|

388,832

|

||||||

|

LyondellBasell Industries N.V. — Class A1

|

5,188

|

386,091

|

||||||

|

CF Industries Holdings, Inc.1

|

14,284

|

344,244

|

||||||

|

Total Basic Materials

|

8,105,079

|

|||||||

|

Diversified – 0.3%

|

||||||||

|

Leucadia National Corp.1

|

24,107

|

417,774

|

||||||

|

Total Common Stocks

|

||||||||

|

(Cost $194,810,453)

|

208,453,277

|

|||||||

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 27

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

|

Shares

|

Value

|

|||||||

|

SHORT TERM INVESTMENTS† – 3.9%

|

||||||||

|

Dreyfus Treasury Prime Cash Management Institutional Shares, 0.16%1,2

|

6,294,624

|

$

|

6,294,624

|

|||||

|

Total Short Term Investments

|

||||||||

|

(Cost $6,294,624)

|

6,294,624

|

|||||||

|

Total Investments – 133.2%

|

||||||||

|

(Cost $201,105,077)

|

$

|

214,747,901

|

||||||

|

Contracts

|

Value

|

|||||||

|

OPTIONS WRITTEN† – (2.3)%

|

||||||||

|

Call options on:

|

||||||||

|

Consumer Discretionary Select Sector SPDR Fund Expiring July 2016

|

||||||||

|

with strike price of $78.00

|

664

|

$

|

(59,096

|

)

|

||||

|

Industrial Select Sector Fund SPDR Expiring July 2016

|

||||||||

|

with strike price of $56.00

|

932

|

(60,114

|

)

|

|||||

|

Financial Select Sector SPDR Fund Expiring July 2016

|

||||||||

|

with strike price of $23.00

|

2,288

|

(60,632

|

)

|

|||||

|

NASDAQ 100 Index Expiring July 2016 with strike price of $4,450.00

|

83

|

(243,190

|

)

|

|||||

|

Dow Jones Industrial Average Index Expiring July 2016

|

||||||||

|

with strike price of $176.00

|

2,936

|

(1,123,020

|

)

|

|||||

|

S&P 500 Index Expiring July 2016 with strike price of $2,065.00

|

501

|

(2,099,190

|

)

|

|||||

|

Total Call Options Written

|

||||||||

|

(Premiums received $3,400,078)

|

(3,645,242

|

)

|

||||||

|

Other Assets & Liabilities, net – (30.9)%

|

(49,861,357

|

)

|

||||||

|

Total Net Assets – 100.0%

|

$

|

161,241,302

|

||||||

|

*

|

Non-income producing security.

|

|

|

†

|

Value determined based on Level 1 inputs — See Note 4.

|

|

|

1

|

All or a portion of these securities have been physically segregated in connection with borrowings and/or written options. As of June 30, 2016, the total value of segregated securities was $165,572,019.

|

|

|

2

|

Rate indicated is the 7-day yield as of June 30, 2016.

|

|

N.V.

|

Publicly Traded Company

|

|

|

plc

|

Public Limited Company

|

|

|

REIT

|

Real Estate Investment Trust

|

|

|

S&P

|

Standard & Poor’s

|

See notes to financial statements.

28 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS (Unaudited) continued

|

June 30, 2016

|

|

Level 2

|

Level 3

|

|||

|

Level 1

|

Significant

|

Significant

|

||

|

Quoted

|

Observable

|

Unobservable

|

||

|

Description

|

Prices

|

Inputs

|

Inputs

|

Total

|

|

Assets:

|

||||

|

Common Stocks

|

$208,453,277

|

$ —

|

$ —

|

$208,453,277

|

|

Short Term Investments

|

6,294,624

|

—

|

—

|

6,294,624

|

|

Total

|

$214,747,901

|

$ —

|

$ —

|

$214,747,901

|

|

Liabilities:

|

||||

|

Call Options Written

|

$3,645,242

|

$ —

|

$ —

|

$3,645,242

|

|

Total

|

$3,645,242

|

$ —

|

$ —

|

$3,645,242

|

GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 29

|

STATEMENT OF ASSETS AND LIABILITIES (Unaudited)

|

June 30, 2016

|

|||

|

ASSETS:

|

||||

|

Investments, at value (cost $201,105,077)

|

$

|

214,747,901

|

||

|

Receivables:

|

||||

|

Investments sold

|

834,996

|

|||

|

Dividends

|

248,441

|

|||

|

Reclaims receivable

|

3,523

|

|||

|

Other assets

|

69,637

|

|||

|

Total assets

|

215,904,498

|

|||

|

LIABILITIES:

|

||||

|

Borrowings

|

49,500,000

|

|||

|

Options written, at value (premiums received of $3,400,078)

|

3,645,242

|

|||

|

Due to custodian

|

280,455

|

|||

|

Interest payable on borrowings

|

69,263

|

|||

|

Payable for:

|

||||

|

Investments purchased

|

835,845

|

|||

|

Investment advisory fees

|

190,279

|

|||

|

Fund accounting fees

|

8,625

|

|||

|

Administration fees

|

4,663

|

|||

|

Other liabilities

|

128,824

|

|||

|

Total liabilities

|

54,663,196

|

|||

|

NET ASSETS

|

$

|

161,241,302

|

||

|

NET ASSETS CONSIST OF:

|

||||

|

Common stock, $0.01 par value per share; unlimited number of shares authorized,

|

||||

|

8,774,050 shares issued and outstanding

|

$

|

87,741

|

||

|

Additional paid-in capital

|

147,171,183

|

|||

|

Accumulated net realized gain on investments and options

|

2,338,695

|

|||

|

Net unrealized appreciation on investments and options

|

13,397,660

|

|||

|

Distributions in excess of net investment income

|

(1,753,977

|

)

|

||

|

NET ASSETS

|

$

|

161,241,302

|

||

|

Net Asset Value

|

$

|

18.38

|

||

30 l GEQ l GUGGENHEIM EQUAL WEIGHT ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

|

STATEMENT OF OPERATIONS

|

June 30, 2016

|

||

|

For the Six Months Ended June 30, 2016 (Unaudited)

|

|

INVESTMENT INCOME

|

||||

|

Dividends (net of foreign withholding taxes of $2,010)

|

$

|

2,296,458

|

||

|

Total income

|

2,296,458

|

|||

|

EXPENSES:

|

||||

|

Investment advisory fees

|

1,012,346

|

|||

|

Interest expense

|

314,475

|

|||

|

Trustee fees and expenses*

|

38,948

|

|||

|

Fund accounting fees

|

32,349

|

|||

|

Professional fees

|

29,279

|

|||

|

Administration fees

|

27,644

|

|||

|

Printing fees

|

24,925

|

|||

|

Custodian fees

|

13,008

|

|||

|

NYSE listing fees

|

11,830

|

|||

|

Transfer agent fees

|

6,378

|

|||

|

Other expenses

|

7,334

|

|||

|

Total expenses

|

1,518,516

|

|||

|

Net investment income

|

777,942

|

|||

|

REALIZED AND UNREALIZED GAIN (LOSS):

|

||||

|

Net realized gain on:

|

||||

|

Investments

|

6,846,322

|

|||

|

Written Options

|

(2,540,821

|

)

|

||

|

Net realized gain

|

4,305,501

|

|||

|

Net change in unrealized appreciation (depreciation) on:

|

||||

|

Investments

|

2,493,491

|

|||

|

Written Options

|

(313,177

|

)

|

||

|

Net change in unrealized appreciation (depreciation)

|

2,180,314

|

|||

|

Net realized and unrealized gain

|

6,485,815

|

|||

|

Net increase in net assets resulting from operations

|

$

|

7,263,757

|

||

|

* Relates to Trustees not deemed “interested persons” within the meaning of section 2(a)(19) of the 1940 Act.

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

June 30, 2016

|

|

|

For the

|

||||||||

|

Period Ended

|

For the

|

|||||||

|

June 30, 2016

|

Year Ended

|

|||||||

|

(Unaudited)

|

December 31, 2015

|

|||||||

|

INCREASE (DECREASE) IN NET ASSETS RESULTING

|

||||||||

|

FROM OPERATIONS:

|

||||||||

|

Net investment income

|

$

|

777,942

|

$

|

1,100,897

|

||||

|

Net realized gain on investments

|

4,305,501

|

16,422,532

|

||||||

|

Net change in unrealized appreciation (depreciation)

|

||||||||

|

on investments

|

2,180,314

|

(23,444,315

|

)

|

|||||

|

Net increase (decrease) in net assets resulting from operations

|

7,263,757

|

(5,920,886

|

)

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

||||||||

|

Net investment income

|

(3,838,647

|

)

|

(1,080,681

|

)

|

||||

|

Capital gains

|

—

|

(18,110,838

|

)

|

|||||

|

Total distributions

|

(3,838,647

|

)

|

(19,191,519

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Reinvestment of dividends

|

—

|

77,952

|

||||||

|

Net increase from capital shares transactions

|

—

|

77,952

|

||||||

|

Net increase (decrease) in net assets

|

3,425,110

|

(25,034,453

|

)

|

|||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

157,816,192

|

182,850,645

|

||||||

|

End of period

|

$

|

161,241,302

|

$

|

157,816,192

|

||||

|

Undistributed (distributions on excess of) net investment income

|

||||||||

|

at end of period

|

$

|

(1,753,977

|

)

|