____________________________________________________________________________________________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 10-K

_____________________________________

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Commission file number: 001-35878

____________________________________

(Exact name of registrant as specified in its charter)

_____________________________________

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||||||||||||||

| +352 | |||||||||||||||||

| (Address of principal executive offices, including zip code) | (Registrant’s telephone number, including area code) | ||||||||||||||||

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

OTC Pink Marketplace1 | ||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated Filer | ☐ | |||||||||||

☒ | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

_______________

1 On May 20, 2020, the New York Stock Exchange (“NYSE”) filed a Form 25 with the U.S. Securities and Exchange Commission to delist the common shares, $0.01 par value, of Intelsat S.A. (the “Registrant”) from the NYSE. The delisting became effective 10 days after the Form 25 was filed. The deregistration of the common shares under Section 12(b) of the Act became effective 90 days after the filing date of the Form 25, at which point the common shares were deemed registered under Section 12(g) of the Act. The Registrant’s common shares began trading on the OTC Pink Marketplace on May 19, 2020 under the symbol “INTEQ.”

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 762(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2020, the aggregate market value of the registrant’s common shares held by non-affiliates of the registrant was approximately $50.2 million.

As of March 26, 2021, 142,184,518 common shares, with a nominal value of $0.01 per share, were outstanding.

Documents incorporated by reference: Specified portions of the registrant’s proxy statement with respect to the registrant’s 2021 Annual Meeting of Shareholders, which is to be filed pursuant to Regulation 14A within 120 days after the end of the registrant’s fiscal year ended December 31, 2020, are incorporated by reference into Part III of this Annual Report on Form 10-K.

____________________________________________________________________________________________________________________________________________________________________________________

TABLE OF CONTENTS

| Page | ||||||||

| Item 1 | ||||||||

| Item 1A | ||||||||

| Item 1B | ||||||||

| Item 2 | ||||||||

| Item 3 | ||||||||

| Item 4 | ||||||||

| Item 5 | ||||||||

| Item 6 | ||||||||

| Item 7 | ||||||||

| Item 7A | ||||||||

| Item 8 | ||||||||

| Item 9 | ||||||||

| Item 9A | ||||||||

| Item 9B | ||||||||

| Item 10 | ||||||||

| Item 11 | ||||||||

| Item 12 | ||||||||

| Item 13 | ||||||||

| Item 14 | ||||||||

| Item 15 | ||||||||

| Item 16 | ||||||||

3

FORWARD-LOOKING STATEMENTS

Some of the statements in this Annual Report on Form 10-K, or Annual Report, and oral statements made from time to time by our representatives constitute forward-looking statements that do not directly or exclusively relate to historical facts. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements as long as they are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements.

When used in this Annual Report, the words “may,” “will,” “ might,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “intend,” “potential,” “outlook” and “continue,” and the negative of these terms, and other similar expressions are intended to identify forward-looking statements and information. Examples of these forward-looking statements include, but are not limited to, statements regarding the following: our belief that the growing worldwide demand for reliable broadband connectivity everywhere at all times, together with our leadership position in our attractive sector, global scale, efficient operating and financial profile, diversified customer sets and sizeable contracted backlog, provide us with a platform for long-term success; our ability to confirm and consummate a plan of reorganization in the Chapter 11 Cases (as defined below); the effects of the Chapter 11 Cases on our liquidity or results of operations or business prospects; other risks related to the Chapter 11 Cases as described further below; our belief that our next generation software-defined satellites (“SDS”) will provide differentiated inventory to help offset recent trends of pricing pressure, new capacity from other satellite operators, and improved access to fiber links in our network services business; our outlook that the increased volume of services provided by our high-throughput satellites (“HTS”) and SDS over time is expected to stabilize the level of business activity in the network services sector; our expectation that over time incremental demand for capacity to support the new 4K format, also known as ultra-high definition, could offset some of the reductions in demand related to use of compression technologies in our media business; our expectation that our new services and technologies will open new sectors that are much larger and faster growing than those we support today; our belief that supporting our video neighborhoods, employing a disciplined yield management approach across our business units, developing and maintaining strong customer relationships and distribution channels for our primary customer sets, and successfully executing on our business plan to deliver strong operational results will drive stability in our core business; our expectation that scaling our differentiated managed service offerings in targeted growth verticals and leveraging the global footprint, higher performance and better economics of our HTS and SDS platforms, in addition to the flexibility of our innovative terrestrial network, will drive revenue growth; our belief that completing targeted investments and partnerships in differentiated space and ground infrastructure will provide a seamless interface with the broader telecommunications ecosystem; our outlook that seeking partnerships and investments for vertical expansion in the growing mobility sector, for example, through our recent Gogo Transaction (as defined below), and in adjacent space-based businesses, will position us for longer-term growth; our belief that investing in and deploying innovative new technologies and platforms will change the types of applications we can serve and increase our share of the global demand for broadband connectivity; our projection that our government business will benefit over time from our agile satellite fleet serving the increasing demands for mobility services from the U.S. government for aeronautical and ground mobile requirements; our intention to maximize the value of our spectrum rights; our expectations as to our ability to comply with the final U.S. Federal Communications Commission (“FCC”) order regarding clearing C-band spectrum in North America, including the availability of adequate resources and funds required to comply and the receipt of accelerated clearing payments set forth in the FCC order; our belief that developing differentiated managed services and investing in related software- and standards-based technology will allow us to unlock opportunities that are essential to providing global broadband connectivity; the trends that we believe will impact our revenue and operating expenses in the future; our assessments regarding how long satellites that have experienced anomalies in the past should be able to provide service on their transponders; our belief as to the likelihood of the cause of the failure of Intelsat 29e in 2019 occurring on our other satellites; our assessment of the risks of future anomalies occurring on our satellites; our plans for satellite launches in the near-term; our expected capital expenditures in 2021 and during the next several years; our belief that the diversity of our revenue allows us to benefit from changing market conditions and lowers our risk from revenue fluctuations in our service applications and geographic regions; our belief that the scale of our fleet can reduce the financial impact of any satellite anomalies or launch failures and protect against service interruptions; and the impact on our financial position or results of operations of pending legal proceedings.

Forward-looking statements reflect our intentions, plans, expectations, anticipations, projections, estimations, predictions, outlook, assumptions and beliefs about future events. These forward-looking statements speak only as of their dates and are not guarantees of future performance or results and are subject to risks, uncertainties and other factors, many of which are outside of our control. These factors could cause actual results or developments to differ materially from the expectations expressed or implied in the forward-looking statements and include known and unknown risks. Known risks include, among others, the risks discussed in Item 1A—Risk Factors, the political, economic, regulatory and legal conditions in the markets we are targeting for communications services or in which we operate and other risks and uncertainties inherent in the telecommunications business in general and the satellite communications business in particular.

Other factors that may cause results or developments to differ materially from historical results or developments or the forward-looking statements made in this Annual Report include, but are not limited to:

•risks associated with operating our in-orbit satellites;

•satellite launch failures, satellite launch and construction delays and in-orbit failures or reduced satellite performance;

4

•potential changes in the number of companies offering commercial satellite launch services and the number of commercial satellite launch opportunities available in any given time period that could impact our ability to timely schedule future launches and the prices we pay for such launches;

•our ability to obtain new satellite insurance policies with financially viable insurance carriers on commercially reasonable terms or at all, as well as the ability of our insurance carriers to fulfill their obligations;

•possible future losses on satellites that are not adequately covered by insurance;

•U.S. and other government regulation;

•changes in our contracted backlog or expected contracted backlog for future services;

•pricing pressure and overcapacity in the markets in which we compete;

•our ability to access capital markets for debt or equity;

•the competitive environment in which we operate;

•customer defaults on their obligations to us;

•our international operations and other uncertainties associated with doing business internationally;

•the impact of the novel coronavirus (“COVID-19”) pandemic on our business, the economic environment and our expected financial results;

•our expectations as to the benefits and impact on our future financial performance associated with the Company’s recent purchase of the equity of Gogo Inc.’s (NASDAQ: GOGO) (“Gogo”) commercial aviation business (the “Gogo Transaction”);

•our ability to successfully integrate Gogo’s commercial aviation business;

•litigation; and

•other risks discussed under Item 1A—Risk Factors.

Further, many of the risks and uncertainties that we face are currently amplified by, and will continue to be amplified by, the risks and uncertainties regarding the Company and certain of its subsidiaries’ voluntary commencement of cases under title 11 (the “Chapter 11 Cases”) of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Eastern District of Virginia (the “Bankruptcy Court”), including but not limited to:

•our ability to improve our liquidity and long-term capital structure and to address our debt service obligations through the restructuring;

•our ability to obtain timely approval by the Bankruptcy Court with respect to the motions that we have filed or will file in the Chapter 11 Cases;

•objections to the Company’s restructuring process or other pleadings filed that could protract the Chapter 11 Cases or interfere with the Company’s ability to consummate the restructuring;

•our ability to retain the exclusive right to propose a Chapter 11 plan of reorganization and our ability to achieve confirmation of such plan;

•our ability to develop, obtain support for, confirm and consummate a Chapter 11 plan of reorganization, including the proposed plan of reorganization the Company filed in the Bankruptcy Court on February 12, 2021, as may be modified or amended;

•the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of the Chapter 11 Cases;

•our substantial level of indebtedness and related debt service obligations and restrictions, including those expected to be imposed by covenants in any exit financing, that may limit our operational and financial flexibility;

•the conditions to which our debtor-in-possession (“DIP”) financing is subject and the risk that these conditions may not be satisfied for various reasons, including for reasons outside of our control;

•our ability to develop and execute our business plan during the pendency of the Chapter 11 Cases;

•increased administrative and legal costs related to the Chapter 11 process;

•potential delays in the Chapter 11 process due to the effects of the COVID-19 pandemic; and

•our ability to continue as a going concern and our ability to maintain relationships with regulators, suppliers, customers, employees and other third parties as a result of such going concern, during the restructuring and the pendency of the Chapter 11 Cases.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, level of activity, performance or achievements. Because actual results could differ materially from our intentions, plans, expectations, anticipations, projections, estimations, predictions, outlook, assumptions and beliefs about the future, you are urged not to rely on forward-looking statements in this Annual Report and to view all forward-looking statements made in this Annual Report

5

with caution. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

INDUSTRY AND MARKET DATA

This Annual Report includes information with respect to regional and sector share and industry conditions from third-party sources, public filings and based upon our estimates using such sources when available. While we believe that such information and estimates are reasonable and reliable, we have not independently verified the data from third-party sources, including Euroconsult Satellite Connectivity and Video Markets Survey, 27th Edition (July 2020); NSR Government & Military Satellite Communications, 17th Edition (November 2020); Seradata Spacetrak (January 2021); NSR Global Satellite Capacity Supply and Demand Study, 17th Edition (June 2020); Euroconsult FSS Operators: Benchmarks & Performance Review, 12th Edition (November 2020); GSMA The Mobile Economy 2020 (March 2020); World Bank Group (December 2020); NSR Wireless Backhaul via Satellite, 14th Edition (February 2020); Euroconsult Prospects for In-Flight Entertainment and Connectivity, 8th Edition (September 2020); Prospects for Maritime Satellite Communications, 8th Edition (April 2020); NSR VSAT and Broadband Satellite Markets, 19th Edition (December 2020); NSR Aero Satcom Markets, 8th Edition (May 2020); NSR Maritime SATCOM Markets, 8th Edition (May 2020); Satellite Mobility Perspectives, Tim Farrar (June 2020); Lyngsat Q3 2020 Update (October 2020); GSMA Operator Rankings (January 2021); Valour In-Flight Connectivity Update: Q3 2020 (December 2020); Boeing Market Outlook 2020 (October 2020); and Global Data (January 2020). Unless otherwise specified, all references contained in this Annual Report to these third-party sources are as of the dates of these sources stated above. Similarly, our internal research is based upon our understanding of industry conditions, and such information has not been verified by independent sources. Specifically, when we refer to the relative size, regions served, number of customers contracted, experience and financial performance of our business as compared to other companies in our sector, our assertions are based upon public filings of other operators and comparisons provided by third-party sources, as outlined above.

Throughout this Annual Report, unless otherwise indicated, references to market positions are based on third-party market research. If a regional position or statement as to industry conditions is based on internal research, it is identified as management’s belief. Throughout this Annual Report, unless otherwise indicated, statements as to our relative positions as a provider of services to customers and regions are based upon our relative share. For additional information regarding our regional share with respect to our customer sets, services and regions, and the bases upon which we determine our share, see Item 1—Business.

6

PART I

Item 1. Business

Key Information

In this Annual Report unless otherwise indicated or the context otherwise requires, (1) the terms “we,” “us,” “our,” “the Company” and “Intelsat” refer to Intelsat S.A., and its subsidiaries on a consolidated basis, (2) the term “Intelsat Holdings” refers to our indirect subsidiary, Intelsat Holdings S.A., (3) the term “Intelsat Investments” refers to Intelsat Investments S.A., Intelsat Holdings’ direct wholly-owned subsidiary, (4) the term “Intelsat Luxembourg” refers to Intelsat (Luxembourg) S.A., Intelsat Investments’ direct wholly-owned subsidiary, (5) the term "Intelsat Envision" refers to Intelsat Envision Holdings LLC, Intelsat Luxembourg's direct wholly-owned subsidiary, (6) the terms “Intelsat Connect” and “ICF” refer to Intelsat Connect Finance S.A., Intelsat Envision’s direct wholly-owned subsidiary, (7) the term “Intelsat Jackson” refers to Intelsat Jackson Holdings S.A., Intelsat Connect’s direct wholly-owned subsidiary, and (8) the term “Intelsat” refers to specific Intelsat-satellites. We refer to Intelsat General Communications LLC, one of our subsidiaries, as “Intelsat General.” In this Annual Report, unless the context otherwise requires, all references to transponder capacity or demand refer to transponder capacity or demand in the C-band and Ku-band only.

Recent Developments

Voluntary Reorganization under Chapter 11

On May 13, 2020, Intelsat S.A. and certain of its subsidiaries (each, a “Debtor” and collectively, the “Debtors”) commenced voluntary cases (the “Chapter 11 Cases”) under title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Eastern District of Virginia (the “Bankruptcy Court”). Primary factors causing us to file for Chapter 11 protection included the Company’s intention to participate in the accelerated clearing process of C-band spectrum set forth in the U.S. Federal Communications Commission’s (“FCC”) March 3, 2020 final order (the “FCC Final Order”), requiring the Company to incur significant costs related to clearing activities well in advance of receiving reimbursement for such costs and the need for additional financing to fund the C-band clearing process, service our current debt obligations, and meet our operating requirements, as well as the economic slowdown impacting the Company and several of its end markets due to the novel coronavirus (“COVID-19”) pandemic.

On August 14, 2020, the Company filed its final C-band spectrum transition plan with the FCC. The FCC Final Order provides for monetary enticements for fixed satellite services (“FSS”) providers to clear a portion of the C-band spectrum on an accelerated basis (the “Acceleration Payments”). On September 17, 2020, the Company announced it finalized materially all of its required contracts with satellite manufacturers and launch-vehicle providers to move forward and meet the accelerated C-band spectrum clearing timelines established by the FCC. Under the FCC Final Order, the Company is eligible to receive Acceleration Payments of approximately $1.2 billion and $3.7 billion based on the milestone clearing certification dates of December 5, 2021 and December 5, 2023, with the respective payments expected to be received in the first half of each successive year, respectively, subject to the satisfaction of certain deadlines and other conditions set forth therein.

The Chapter 11 process can be unpredictable and involves significant risks and uncertainties. As a result of these risks and uncertainties, the amount and composition of the Company’s assets, liabilities, officers and/or directors could be significantly different following the outcome of the Chapter 11 Cases, and the description of the Company’s operations, properties and liquidity and capital resources included in this Annual Report may not accurately reflect its operations, properties and liquidity and capital resources following the Chapter 11 process.

Pursuant to various orders from the Bankruptcy Court, the Debtors have received approval from the Bankruptcy Court to generally maintain their ordinary course operations and uphold certain commitments to their stakeholders, including employees, customers, and vendors during the restructuring process, subject to the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code. For additional information regarding the Chapter 11 Cases, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments—Voluntary Reorganization under Chapter 11.

The filing of the Chapter 11 Cases constituted an event of default that accelerated substantially all of our obligations under the documents governing our prepetition existing indebtedness. For additional discussion regarding the impact of the Chapter 11 Cases on our debt obligations, see Item 8, Note 12—Debt.

On June 9, 2020, Intelsat Jackson received approval from the Bankruptcy Court (the “DIP Order”) to enter into a non-amortizing multiple draw superpriority secured debtor-in-possession term loan facility (the “DIP Facility”), in an aggregate principal amount of $1.0 billion on the terms and conditions as set forth in the DIP Facility credit agreement (the “DIP Credit Agreement”), which has since been amended. For additional information regarding the DIP Facility, DIP Credit Agreement, DIP Amendment No. 1 and DIP Amendment No. 2, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Debt.

7

On February 11, 2021, the Debtors entered into a plan support agreement (together with all exhibits and schedules thereto, the “PSA”), with certain of the Debtors’ prepetition secured and unsecured creditors (the “Consenting Creditors” and together with the Debtors, the “PSA Parties”). The PSA contains certain covenants on the part of the PSA Parties, including but not limited to the Consenting Creditors voting in favor of the Joint Chapter 11 Plan of Reorganization of Intelsat S.A. and Its Debtor Affiliates (as proposed, the “Plan”), and provides that the Debtors shall achieve certain milestones (unless extended or waived in writing). On February 12, 2021, the Debtors filed the Plan and the Disclosure Statement for the Joint Chapter 11 Plan of Reorganization of Intelsat S.A. and Its Debtor Affiliates (the “Disclosure Statement”), which describes a variety of topics related to the Chapter 11 Cases, including (i) events leading to the Chapter 11 Cases; (ii) significant events that took place during the Chapter 11 Cases; (iii) certain terms of the Plan; and (iv) certain anticipated risk factors associated with, and anticipated consequences of the Plan. The Bankruptcy Court is currently scheduled to determine the adequacy of the Disclosure Statement and whether the Plan meets the requirements of the Bankruptcy Code in the second quarter of 2021.

Business Overview

Overview

We operate one of the world’s largest satellite services businesses, providing a critical layer in the global communications infrastructure.

As the foundational architects of satellite technology, Intelsat operates the largest, most advanced satellite fleet and connectivity infrastructure in the world. We apply our unparalleled expertise and global scale to reliably and seamlessly connect people, devices and networks in even the most challenging and remote locations. We provide diversified communications services to the world’s leading media companies, fixed and wireless telecommunications operators, data networking service providers for enterprise and mobile applications in the air and on the seas, multinational corporations and Internet Service Providers (“ISPs”). We are also the leading provider of commercial satellite communication services to the U.S. government and other select military organizations and their contractors. Our network solutions are a critical component of our customers’ infrastructures and business models. Generally, our customers need the specialized connectivity that satellites provide to pursue their mission. In recent years, mobility services providers have contracted for services on our fleet that support broadband connections for passengers on commercial flights, cruise ships and commercial shipping, connectivity that in some cases is only available through our satellite network. Further, in December 2020, through our acquisition of Gogo’s commercial aviation business (“Gogo CA”), we became the largest direct provider of in-flight connectivity (“IFC”) services to commercial airlines. In addition, our satellite neighborhoods provide our media customers with efficient and reliable broadcast distribution that maximizes audience reach, a technical and economic benefit that is difficult for terrestrial services to match. In developing regions, our satellite solutions often provide higher reliability than is available from local terrestrial telecommunications services and allow our wireless and enterprise customers access to geographies that they would otherwise be unable to serve.

In the future, we expect our satellite network to be an integral part of machine-to-machine networks, especially those requiring massive software updates best delivered via broadcast. Additionally, our networks will play an instrumental role in delivering reliable and redundant connectivity solutions to autonomous and connected cars, as well as support for unmanned aerial vehicles in commercial applications. As we invest in new constellations, such as our next generation software-defined satellite (“SDS”) platform, partner on new earth observation technology, invest in new ground technologies, such as electronic antennas and standards-based modems, and integrate into the 5G network core, we are creating a portfolio of solutions that will be interoperable with other telecommunications technologies and seamlessly integrated with other telecommunications solutions to address the immense connectivity requirements of a fully-connected and converged landscape. Our objective is to transform the customer experience, and we are building a flexible, 5G enabled global network to realize this vision.

Through the Gogo Transaction, we became the global leader in providing IFC and wireless in-flight entertainment (“IFE”) solutions to the commercial aviation industry. Services provided by our Gogo CA business include passenger connectivity, which allows passengers to connect to the Internet from their personal Wi-Fi-enabled devices; passenger entertainment, which offers passengers the opportunity to enjoy a broad selection of IFE options on their laptops and personal Wi-Fi enabled devices; and Connected Aircraft Services (“CAS”), which offer airlines connectivity for various operations and currently include, among others, real-time credit card transaction processing, electronic flight bags and real-time weather information.

We hold the largest collection of rights to well-positioned geostationary orbital slots in the most valuable C- and Ku-band spectrums. From these locations, our satellites offer services in the established regions historically using the most satellite capacity, as well as the higher growth oceanic regions, supporting mobility services, and emerging regions, where approximately 74% of our capacity is currently focused.

We believe our global scale, high-performing satellite network, leadership position and valuable customer relationships enable us to benefit from growing demand for reliable broadband connectivity, resulting from trends such as:

•Global distribution of television entertainment and news programming to fixed and mobile devices;

8

•Completion and extension of international, national and regional data networks, fixed and wireless, notably in emerging and developed regions, and the upgrade of those networks to 3G/4G/5G as content is increasingly consumed on mobile devices;

•Universal access to broadband connectivity through fixed and mobile networks for consumers, corporations, government and other organizations;

•Increasing deployment of in-flight and on-board broadband access for consumer and business applications in the commercial, aviation and maritime sectors;

•Requirements for cost-efficient space-based network solutions for fixed and mobile government and military applications; and

•Global demand for services which enable connected devices, such as machine-to-machine communications and the Internet of Things (“IoT”), particularly with respect to connected car applications.

We believe that we have the largest, most reliable and most technologically advanced commercial communications network in the world. Our global communications system featured a fleet of 52 geosynchronous satellites as of December 31, 2020, covering more than 99% of the world’s populated regions. Our satellites primarily provide services in the C- and Ku-band frequencies, which form the largest part of the FSS sector.

Our next generation fleet of high-throughput satellites (“HTS”) and SDS is designed to reduce cost of service by increasing the flexibility of our service delivery, while optimizing performance and efficiency to the user. With these new assets, we offer existing and prospective commercial customers end-to-end service solutions including broadband connectivity that allow them to innovate, in turn transforming their businesses and expanding the territories and applications that they can profitably serve. Our new fleet is designed to commercial-grade standards. This allows us to offer committed information rates for our service provider customers and guarantee quality of service for direct end-users, as compared to satellite networks designed primarily to provide consumer “best effort”-grade services.

Our satellite capacity is complemented by our IntelsatOne terrestrial network and a growing suite of managed services optimized to the requirements of attractive vertical applications, including the enterprise, maritime and commercial and government aeronautical sectors. Recently we introduced fully-managed services under the Intelsat Flex brand for enterprise and commercial and government mobility applications. Our managed services combine satellite services with network management, access to our terrestrial network comprised of leased fiber optic cable, access to Internet points of presence (“PoPs”), as well as multiplexed video and data platforms. Our satellite-based networking solutions offer distinct technical and economic benefits to our target customers and provide a number of advantages over terrestrial communications systems, including the following:

•Fast, scalable and secure infrastructure deployments;

•Superior end-to-end network availability as compared to the availability of terrestrial networks, due to fewer potential points of failure;

•Highly reliable bandwidth and consistent application performance, as satellite beams provide near ubiquitous coverage across our service regions;

•Ability to extend beyond terrestrial network end points or provide an alternative path to terrestrial infrastructure;

•Efficient content distribution through the ability to broadcast high quality signals from a single location to many locations simultaneously;

•Maximizing potential distribution of television programming, video neighborhoods, or capacity at orbital locations with a large number of consumer dishes or cable headend dishes pointed to them; and

•Rapidly deployable communications infrastructure for disaster recovery.

We believe that our hybrid satellite-terrestrial network, combined with the world’s largest collection of FSS spectrum rights, is a unique and valuable asset that provides a competitive advantage over our peers.

Our network architecture is flexible and, coupled with our global scale, provides strong capital and operating efficiency. In certain circumstances we are able to re-deploy capacity, moving satellites or repositioning beams to capture demand. Demonstrating our ongoing focus on operational efficiency, we pioneered the first successful launch of a mission extension vehicle, extending the useful life of our Intelsat 901 satellite by five years. Our technology has utility across a number of dimensions with minimal customization to address diverse applications driving our capital efficiency.

We have a reputation for operational and engineering excellence, built on our experience of over 50 years in the communications sector. Our network delivered 99.998% network availability to our customers on our operational satellites in 2020. We operate our global network from a fully-integrated, centralized satellite operations facility, with regional sales and marketing offices located close to our customers. The operational flexibility of our network is an important element of our differentiation and our ability to compete effectively.

As of December 31, 2020, our contracted backlog, which is our expected future revenue under existing customer contracts, was approximately $6.1 billion, roughly three and a quarter times our 2020 annual revenue. For the year ended December 31, 2020, we

9

generated revenue of $1.9 billion and net loss attributable to Intelsat S.A. of $911.7 million. Our Adjusted EBITDA, which consists of EBITDA as adjusted to exclude or include certain unusual items, certain other operating expense items and certain other adjustments, was $1.3 billion, or 67% of revenue, for the year ended December 31, 2020.

In 2020, our financial results reflected the adverse economic impact of the COVID-19 pandemic, as well as lower volume of services due to non-renewals of certain contracts. The effect of lower prices in 2020 was muted as compared to prior years. Overall, we believe we benefit from a number of characteristics that allow us to effectively manage our business despite these competitive and geo-economic pressures:

•Significant long-term contracted backlog, providing a foundation for predictable revenue streams;

•Deployment of our next generation HTS and SDS platforms that were designed to support new services, representing $4.1 billion of potential incremental growth by 2025 from expanded enterprise, wireless infrastructure, mobility, and government applications;

•High operating leverage, which has allowed us to generate strong Adjusted EBITDA margins the past three years;

•Acquisition of the leading provider of IFC services, positioning us as a market leader in the fastest growing segment of satellite mobility; and

•A stable, efficient and sustainable tax profile for our global business.

We believe that our leadership position in our attractive sector, global scale, efficient operating and financial profile, diversified customer sets and sizeable contracted backlog, together with the growing worldwide demand for reliable broadband connectivity everywhere at all times, provide us with a platform for long-term success.

Our Sector

Satellite services are an integral and growing part of the global communications infrastructure. Through unique capabilities, such as the ability to quickly and effectively blanket service regions, offer point-to-multipoint distribution and provide a flexible architecture, satellite services complement, and for certain applications are preferable to, terrestrial telecommunications services, including fiber and wireless technologies. The FSS sector, excluding all consumer broadband, is expected to generate revenues of approximately $10.7 billion in 2021, and transponder service revenue is expected to grow by a compound annual growth rate (“CAGR”) of 2.3% from 2020 to 2025 according to a study issued in 2020 by Northern Sky Research (“NSR”), a leading international market research and consulting firm specializing in satellite and wireless technology and applications.

In recent years, the addressable market for FSS has expanded to include mobile applications because of satellite’s ability to provide the broadband access required by high bandwidth mobile platforms, such as for consumer broadband services on commercial ships and aircraft, as well as military mobility applications, including unmanned aerial vehicles.

Satellite services provide secure bandwidth capacity ideal for global in-theater communications since military operations often occur in locations without reliable communications infrastructure. According to a study by NSR, global revenue from government and military applications is expected to grow at a CAGR of 9.6% from 2020 to 2025.

Our sector is recognized for having favorable operating characteristics, including long-term contracts, high renewal rates and strong cash flows. The fundamentals of the sector are attractive, given the global need for connectivity everywhere and explosion of global content. The expected growth in demand for satellite-based solutions, combined with the high operating margins which are characteristic of the sector, provides a resilient business model.

There is a finite number of geostationary orbital slots in which FSS satellites can be located, and many orbital locations are already occupied by operational satellites pursuant to complex regulatory processes involving many international and national governmental bodies. These satellites typically are operated under coordination agreements designed to avoid interference with other operators’ satellites. See—Regulation below for a more detailed discussion of regulatory processes relating to the operation of satellites.

A resurgence of interest in low earth orbit (“LEO”) and mid-earth orbit constellations is resulting in the potential for new satellite-based solutions that will complement and, in some cases, compete with our services. We believe that the ability of our geostationary orbit (“GEO”) satellites to offer highly efficient point-to-multipoint services, and to concentrate throughput over areas of highest demand, provides us with competitive benefits that will be sustained even as new services come to market.

Today, there are only four FSS operators, including us, providing global services, which is important as multinationals and governments seek a turnkey solution for global connectivity. In addition, there are a number of operators with fewer satellites that provide regional and/or national services. We currently hold the largest number of rights to geostationary orbital slots in the most valuable C- and Ku-band spectrums.

10

We believe a number of fundamental trends in our sector are creating increasing demand for satellite services:

•Connectivity and broadband access are essential elements of infrastructure supporting the rapid economic growth of developing nations. Globally dispersed organizations and regional businesses often turn to satellite-based infrastructure to provide better access, reliability and control of broadband services. Penetration of broadband connectivity in less developed regions has been growing rapidly and is expected to continue. Over the past 10 years, broadband penetration including satellite connectivity in East Asia & the Pacific grew at a 12% CAGR, in Latin America & the Caribbean grew at a 10% CAGR, in the Middle East & North Africa grew at an 18% CAGR, and in Sub-Saharan Africa grew at a 17% CAGR, according to the World Bank.

•Wireless infrastructure in the global race to 5G represents a significant opportunity for satellite technology. Wireless telecommunications companies often use satellite-based solutions to extend networks into areas where geographic or low population density makes it economically unfeasible to deploy other technology. Further deployments of wireless telecom infrastructure and the migration from 2G to 3G, 4G and 5G networks, which adds content and data to basic voice communications, create incremental demand for satellite bandwidth. We believe that the emergence of 5G networks will result in a new growth vector for satellite connectivity. Satellite technology is uniquely responsive to the 5G requirement of ubiquitous coverage and fast deployments. We believe satellite systems will complement terrestrial networks and enable reliable and consistent global 5G user experience in a cost-effective manner. In 2018, 3GPP, the telecommunications standard development organization (“3GPP”), approved work item studies to incorporate satellite systems in 5G standards to demonstrate key satellite attributes, including broadcasting, multicasting, and ubiquity and global mobile connectivity. According to the Global System for Mobile Communications Association, 4G and 5G mobile connections are expected to increase from 52% to 76% of total connections for the period from 2019 to 2025.

•Mobility applications, such as maritime communications and aeronautical broadband services for commercial and government applications, are fueling demand for mobile connectivity. Commercial applications, such as broadband services for consumer flights and cruise ships, as well as broadband requirements from the maritime commercial shipping and oil and gas sectors, provide increased demand for satellite-based services. We entered the IFC market in December 2020 with our Gogo CA business, providing IFC services directly to commercial airlines and their passengers.

•The increasing demand for global broadband connectivity on commercial airlines is a key driver of satellite connectivity and services. 69% of North American aircraft provide IFC and IFE services, while about 17% of European, African, Asian-Pacific and South American aircraft were connected in 2020, according to Valour Consultancy and Boeing. Global satellite services revenue related to demand for broadband mobility applications from land, aeronautical and maritime customers is expected to grow at a CAGR of 14% for the period from 2020 to 2025, according to NSR.

•Globalization of economic activities is increasing the geographic expansion of corporations and the communications networks that support them, while creating new audiences for content. Globalization also increases the communications requirements for governments supporting embassy and military applications.

•The emergence of new content consumers resulting from economic growth in developing regions leads to increased demand for free-to-air and pay-TV content. According to NSR, the highest expected growth in television channels is from developing regions, including the Middle East and North Africa at 1.6%, Sub-Saharan Africa at 3.9%, and Asia-Pacific at 1.9% for the period from 2020 to 2025, respectively.

•Proliferation of formats and new sources of entertainment content results in increased bandwidth requirements, as content owners seek to maximize distribution to multiple viewing audiences across multiple technologies. High-definition (“HD”) television (“HDTV”), the introduction of ultra-high definition (“UHD”) television, Internet distribution of traditional television programming known as “Over the Top” or “OTT”, and video to mobile devices are all examples of the expanding format and distribution requirements of media programmers, the implementation of which varies greatly from developed to emerging regions. In its 2020 study, NSR forecasted that the number of standard definition (“SD”), HD, and UHD television channels distributed worldwide for cable, broadcast and direct-to-home (“DTH”) is expected to grow at a CAGR of 1% for the period from 2020 to 2025.

•Connected devices and vehicles, such as those contemplated by machine-to-machine communications, the IoT and other future technology trends, will require ubiquitous coverage that might be best provided by satellite technology for certain applications in certain regions, and also for applications where ubiquitous, global access is required, such as enabling software downloads for connected and autonomous cars marketed by the automotive sector or for the operations of connected vehicles, such as in agriculture applications. This represents an important potential source of longer-term demand.

In total, GEO FSS transponder service revenue (excluding consumer broadband) is expected to grow at a CAGR of 2.3% for the period from 2020 to 2025, according to NSR.

11

Our Customer Sets and Growing Applications

We focus on business-to-business services that indirectly enable enterprise, government and consumer applications through our customers. Our customer contracts offer four different service types: transponder services, managed services, channel services and mobile satellite services and other. See Item 7—Management's Discussion and Analysis—Revenue for further discussion of our service types. Characteristics of our customer sets are summarized below:

| Customer Set | Representative Customers | Year | Annual Revenue (1) (2) | % of 2020 Total Revenue (2) | % of 2020 Total Backlog (1) (2) | Backlog to 2020 Revenue Multiple | ||||||||||||||||||||||||||||||||

| Media | AT&T, MultiChoice, The Walt Disney Company, Discovery Communications, 21st Century Fox, Time Warner | 2018 | $ | 938 | ||||||||||||||||||||||||||||||||||

| 2019 | 883 | |||||||||||||||||||||||||||||||||||||

| 2020 | 813 | 42 | % | 59 | % | 4.5x | ||||||||||||||||||||||||||||||||

| Network Services | Marlink, KVH Industries, Speedcast, Global Eagle, Verizon, Hughes, Orange, Panasonic Corp, GCI Communications | 2018 | 798 | |||||||||||||||||||||||||||||||||||

| 2019 | 770 | |||||||||||||||||||||||||||||||||||||

| 2020 | 677 | 35 | % | 26 | % | 2.4x | ||||||||||||||||||||||||||||||||

| Government | Australian Defence Force, U.S. Department of Defense, U.S. Department of State, Leonardo | 2018 | 392 | |||||||||||||||||||||||||||||||||||

| 2019 | 378 | |||||||||||||||||||||||||||||||||||||

| 2020 | 393 | 21 | % | 12 | % | 1.8x | ||||||||||||||||||||||||||||||||

(1)Dollars in millions; backlog as of December 31, 2020.

(2)Does not include satellite-related services and other.

We provide satellite capacity and related communications services for the transmission of video, data and voice signals. Our customer contracts cover on- and off-network capacity with primarily three different service types:

On-Network:

•Transponder services

•Managed services

Off-Network:

•Transponder services

•Mobile satellite services and other

We also perform satellite-related consulting services and technical services for various third parties, such as operating satellites for other satellite owners.

Media

Media customers are our largest customer set and accounted for 42% of our revenue for the year ended December 31, 2020 and $3.6 billion of our contracted backlog as of December 31, 2020. Our business generated from the media sector is generally characterized by non-cancellable, long-term contracts with terms of up to 16 years with premier customers, including national and global broadcasters, content providers and distributors, television programmers and DTH platform operators.

We are the world’s largest provider of satellite capacity for media services, according to Euroconsult, with a 19% global share. We have delivered television programming to the world since the launch of our first satellite, Early Bird, in 1965. We provide satellite capacity for the transmission of entertainment, news, sports and educational programming for over 300 broadcasters, content providers and DTH platform operators worldwide. Our leadership and reputation have created well-established relationships with our media customers, and in some cases, we have distributed their content on our satellites for over 30 years.

Broadcasters, content providers and television programmers seek efficient distribution of their content to make it easily obtainable by affiliates, cable operators and DTH platforms; satellites’ point-to-multipoint capability is difficult to replicate via terrestrial alternatives. Our strong cable distribution neighborhoods offer media customers high penetration of regional and national audiences.

Broadcasters, content providers and television programmers also select us because our global capabilities enable the distribution or retrieval of content to or from virtually any point on earth. For instance, we regularly provide fully integrated global distribution networks for content providers that need to distribute their products across multiple continents. DTH platform operators use our services because of our attractive orbital locations and because the scale and flexibility of our fleet can improve speed to market and lower their operating risk, as we have multiple satellites serving every region.

12

We believe that we enjoy a strong reputation for delivering the high network reliability required to serve the demanding media sector. As our media customers invest in nascent distribution platforms and adopt new business models, ensuring the reliability and monetization of cable head-end and DTH distribution is paramount; our customers increasingly look to us to provide managed services in these areas.

Our fully integrated satellite, fiber and teleport facilities provide enhanced quality control for programmers. In addition to premium satellite services, we offer managed, value-added services under our IntelsatOne brand that include managed fiber services, digital encoding of video channels and up-linking and down-linking services to and from our satellites and teleport facilities. Our IntelsatOne bundled services address programmers’ interests in delivering content to multiple distribution channels, such as television and Internet, and their needs for launching programs to new regions in a cost-efficient manner.

Highlights of our media business include the following:

•Our fleet hosts over 35 premium video neighborhoods, offering programmers superior audience penetration, with ten serving North America, nine serving Latin America, nine serving Africa and the Middle East, six serving Asia and five serving Europe;

•We are a leading provider of services used in global content distribution to media customers, according to Euroconsult. Our top 10 video distribution customers buy services on our network, on average, across three geographic regions, demonstrating the value provided by the global reach of our network;

•We believe that we are the leading provider of satellite service capacity for the distribution of cable television programming in North America, with thousands of cable headends pointed to our satellites. Our Galaxy 13 satellite provided the first HD neighborhood in North America, and today, our Galaxy fleet distributes over 390 HD channels; globally, we distribute over 6,000 TV and radio channels, including approximately 1,500 HD channels, reaching over two billion people worldwide;

•We are a leading provider of satellite services for DTH providers, supporting 30 DTH platforms around the world with over 70 million subscribers, including Sky Brazil in Brazil, MultiChoice and Sentech in Africa, and Canal+ in multiple regions;

•We are a leading provider of services used in video contribution managed occasional use services, supporting coverage of major events for news and sports organizations, according to Euroconsult. For instance, we have carried programming on a global basis for every Olympiad since 1968; and

•In its 2020 study, NSR forecasted that the number of SD, HD, and UHD television channels distributed worldwide for cable, broadcast and DTH is expected to grow at a CAGR of 1% for the period from 2020 to 2025. The high growth in television channels is from developing regions: the Middle East and North Africa at 1.6%, Sub-Saharan Africa at 3.9%, and Asia-Pacific at 1.9% for the period from 2020 to 2025, respectively.

In 2020, non-renewals and volume reductions, coupled with a significant decline in occasional use video services as a result of COVID-19, caused our media business to underperform our expectations for the year. In 2021, we expect continuing pressure on our media business. Broadly, our global media customers increasingly seek to economize due to the need to support expanding infrastructure requirements and pressure on their distribution businesses related to expansion of OTT service platforms. We expect customers to use compression technologies, eliminate the distribution of SD feeds, and reduce commitments for contribution and ad hoc requirements, which will result in reduced volume for our business. In the future, we expect some incremental demand for capacity to support the new 4K format, also known as UHD, which could offset some of the reductions in demand related to compression technologies.

Network Services

Network services is our second largest customer set and accounted for 35% of our revenue for the year ended December 31, 2020 and $1.6 billion of our contracted backlog as of December 31, 2020. Our business generated from the network services sector is generally characterized by non-cancellable contracts, up to five years in length, with many of the world’s leading communications providers. This includes fixed and wireless telecommunications companies, such as global carriers and regional and national providers in emerging regions, corporate network service providers, such as very-small-aperture terminal (“VSAT”) services providers to vertical markets including banks, value-added services providers, such as those serving the aeronautical and maritime industries, as well as multinational corporations and other organizations operating globally.

According to Euroconsult, we are one of the world’s largest providers of satellite capacity for network services, with a 27% global share of regular FSS capacity. Our satellite services, comprised of satellite capacity, and terrestrial network comprised of leased fiber, teleports and data networking platforms, enable the transmission of video and data to and from virtually any point on the surface of the earth. Basic communications and broadband connectivity in developed and emerging regions are meaningful contributors to economic growth. We provide an essential element of the communications infrastructure, enabling the rapid expansion of wireless services that support businesses, communities and governments in many emerging regions.

13

Our network services offerings are an essential component of our customers’ services, providing backbone infrastructure, expanded service areas and connectivity where reliability or geography is a challenge. We believe that we are a preferred provider because of our global service capability and our expertise in delivering services with enterprise-grade network availability and efficient network control.

Furthermore, as mobile communications have become essential to global networking and Internet use, our satellite solutions are being used for mobility applications. This includes services ranging from maritime enterprise VSAT data services to consumer broadband connectivity for cruise ships. In addition to maritime applications, Intelsat’s satellite solutions are used by service providers to deliver broadband connectivity for IFC and IFE services for the aeronautical industry. In the future, these solutions will be augmented by capacity on our next generation SDS platform, offering greater agility, flexibility and performance to our customers. Further, through our Gogo CA business, we have rights to offer air-to-ground (“ATG”) and satellite connectivity, as well as entertainment services, directly to commercial aircraft flying routes within North America operated by Aeromexico, Air Canada, Air Canada Rouge, Alaska Airlines, American Airlines, Delta Air Lines, and United Airlines, and satellite and connectivity and entertainment services directly to commercial aircraft flying routes outside of North America operated by Aeromexico, Air Canada, Air Canada Rouge, Air France, British Airways, Cathay Dragon, Cathay Pacific, Delta Air Lines, GOL, Iberia, Japan Air Lines, JTA, KLM, LATAM Airlines, LEVEL and Virgin Atlantic Airways, in each case pursuant to long-term agreements.

Our managed services provide regional shared data networking platforms at our teleports that are connected to 20 of our satellites, with network transmissions managed by our operations team. In 2018, we introduced new platform as a service (PaaS) cloud-based offerings under the AgileCore brand, combining our satellite services with shared data platforms and our fiber network. As a result, our customers can quickly establish highly reliable services across multiple regions, while operating them on a centralized basis. Our satellite-based solutions allow customers to rapidly expand their service territories, flexibly customize the speed and capabilities for their existing networks and efficiently address new customer and end-user requirements. Since 2017, we have offered fully-managed services, called Flex, which address commercial and government aeronautical, maritime and land mobile applications.

Our leading position in network services has been pressured by additional capacity from other satellite operators and improved access to fiber links, changing the competitive environment in certain regions and resulting in lower prices. Our Intelsat Epic satellites provide differentiated inventory and help offset these recent trends, offering connectivity solutions that target wireless infrastructure, mobility and enterprise applications. In 2018, we successfully added new distribution channels in the maritime, business jet and wireless infrastructure verticals. In 2020, we committed to investments in next generation SDS and ground infrastructure to support capacity and future applications needed to expand our Gogo CA business as more passengers and airlines will likely put greater emphasis on being connected in-flight. As the volume of services sold on our HTS and SDS platforms increases over time, we believe that the level of business activity in this sector will stabilize.

Highlights of our network services business include the following:

•Our largest network services customer type is enterprise networking. We are one of the world’s largest providers of satellite capacity for satellite-based private data networks, including VSAT networks, according to Euroconsult;

•The fastest growing customer type in our network services business is mobility services for the aeronautical and maritime sectors;

•The Gogo Transaction positions us as the largest provider of IFC services directly to our airline customers. FSS revenue growth related to capacity demand for broadband aeronautical services is expected to grow from approximately $260 million to just under $1 billion annually for the period from 2020 to 2025 at a CAGR of 29%, according to Euroconsult. In addition, Euroconsult forecasted the growth in FSS aeronautical terminals (excluding mobile satellite services (“MSS”) and ATG technology) at a CAGR of 13% for the period from 2020 to 2025;

•We are the leader in the provision of FSS bandwidth for maritime broadband connectivity. 12% of the Company’s revenue for the year ended December 31, 2020 was derived from commercial mobility services, the largest segment of which was maritime. The number of FSS VSATs related to capacity demand for maritime broadband services (excluding MSS and non-GEO satellite systems) is expected to grow at a CAGR of 13% for the period from 2020 to 2025, according to Euroconsult. Of the world’s largest cruise vessels, Intelsat’s services are incorporated in the broadband infrastructure for a majority of ships, in substantially all cases as the exclusive or primary source of satellite services;

•Infrastructure for wireless operator services represents our third largest network services customer type. We believe we are a leading provider of satellite capacity for cellular backhaul applications in emerging regions, connecting cellular towers to the global telecommunications network, a global sector expected to generate over $1.2 billion in revenue in 2021, according to NSR. Over 80 of our customers use our satellite-based backhaul services as a core component of their network infrastructure due to unreliable or non-existent terrestrial infrastructure. Our cellular backhaul customers include six of the top ten mobile groups worldwide, which serve over a fifth of the world’s subscribers, excluding China;

•Over 100 value-added network operators use our IntelsatOne broadband hybrid infrastructure to deliver their regional and global services. Applications for these services include corporate networks for multinationals, Internet access and broadband

14

for maritime and commercial aeronautical applications. C-, Ku- and Ka-band and HTS revenue from capacity demand for mobility applications is expected to grow at a CAGR of 13.9% for the period from 2020 to 2025, according to NSR; and

•The fixed enterprise VSAT sector (excluding all non-GEO HTS bandwidth) is expected to generate capacity revenues of approximately $3.1 billion in 2021, and capacity revenues are expected to grow at a CAGR of 7% for the period from 2020 to 2025, according to NSR.

Government

We are the leading provider of commercial satellite services to the government sector, according to NSR, with a 24% share of military and government use of commercial satellite capacity worldwide. With more than 50 years of experience serving this customer set, we have built a reputation as a trusted partner for the provision of highly customized, secure and mission critical satellite-based solutions. The government sector accounted for 21% of our revenue for the year ended December 31, 2020 and $707 million of our contracted backlog as of December 31, 2020.

Our satellite communication services business generated from the U.S. government sector is generally characterized by single year contracts that are cancellable by the customer upon payment of termination for convenience charges, and include annual options to renew for periods of up to four additional years. In addition to communication services, our backlog includes some longer-term services, such as hosted payloads, which are characterized by contracts with originally contracted service periods extending up to the 15-year life of the satellite, cancellable upon payment of termination penalties defined by the respective contracts.

Our customer base includes the U.S. government’s military and civilian agencies, global government militaries, and commercial customers serving the defense sector. We consider each party within the U.S. Department of Defense and other U.S. government agencies that has the ability to initiate a purchase requisition and select a contractor to provide services to be a separate customer, although such party may not be the party that awards us the contract for the services.

We attribute our strength in serving U.S. military and government users to our global infrastructure of satellites, including the high-performance Intelsat Epic fleet, and our IntelsatOne network of teleports and fiber that complement the U.S. government’s own communications networks. Our fleet provides flexible, secure and resilient global network capacity, and critical surge capabilities. Our Intelsat Epic satellites provide high-throughput and performance in critical mission areas, such as (i) airborne intelligence, surveillance and reconnaissance (“ISR”), (ii) maritime command, control, communications, computers, cyber and ISR (Maritime C5ISR), (iii) full-motion HD video from unmanned systems and (iv) U.S. homeland security missions. In some instances, we provide our U.S. government customers managed, end-to-end secure networks, combining our resources in space and on the ground, for fixed and mobile applications.

In responding to certain unique customer requirements, we also procure and integrate satellite services provided by other satellite operators, either to supplement our capacity or to obtain capacity in frequencies not available on our fleet, such as L-band, X-band and other spectrums not available on our network. These off-network services are generally low risk in nature, typically with the terms and conditions of the third-party capacity and services we procure matched to contractual commitments from our customer. We are an attractive partner to the government sector because of our ability to leverage not only our assets but also other space-based solutions, providing a single contracting source for multiple, integrated technologies.

Highlights of our government business include the following:

•Our government business is fully engaged in the Intelsat managed services strategy, simplifying the use of high-throughput services to deliver fully integrated solutions to its customers. In 2019, we introduced FlexGround, a global end-to-end managed service providing cost-effective, high-performance connectivity for small land mobility applications, including airline checkable manpack terminals. This service leverages the Intelsat Epic HTS network, which has high-powered spot beams, enabling high data rate services to small terminals. Operating in the Ku-band, these terminals are designed to be set up and connected in minutes by non-technical users operating in remote environments, enabling communications across a wide spectrum of scenarios;

•The reliability and scale of our fleet and planned launches of new and replacement satellites allow us to address changing demand for satellite coverage and to provide mission-critical communications capabilities. The investment that we are making in next-generation software-defined networks (“SDNs”), both in space and on the ground, will offer a new level of flexibility and capability to service the most demanding customers. We are providing significant on-network capacity on our newest satellites, as well as off-network capacity to satisfy additional demand for our services in regions where our capacity is limited, with the express intent of bringing that capacity back on-network when the new fleet is available;

•The U.S. government, specifically the U.S. Department of Defense, continues to push to leverage commercial satellite communications, coupled with military satellite communications, in providing a total integrated satellite communications solution for the warfighter. The U.S. military continues to be one of the largest users of commercial satellites for government and military applications on a global basis. In 2020, we served approximately 80 customers consisting of U.S. government customers, resellers to U.S. government customers or integrators; and

15

•Global revenue from FSS used for government and military applications is expected to grow at a CAGR of 9.6% for the period from 2020 to 2025, according to NSR.

Overall, business activity in this customer set reflects the current tempo of our end-customers’ operations and the budgetary constraints of the U.S. government; visibility into the U.S. government’s planned contract awards remains low and the pace of new business and subsequent awards remains flat.

Over the mid-term, we believe our reputation as a provider of secure solutions, our global fleet including investments in our next generation SDN platform and affiliated managed services, our well-established customer relationships, our ability to provide turnkey services and our demonstrated willingness to reposition or procure third-party capacity to support specific requirements position us to successfully compete for commercial satellite solutions for bandwidth-intensive military and civilian applications. We expect our government business to benefit over time from our agile satellite fleet serving the increasing demands for mobility services from the U.S. government for aeronautical and ground mobile requirements.

Our Diverse Business

Our revenue and backlog diversity spans multiple customer sets and applications, as discussed above, as well as geographic regions and satellites. We believe our diversity allows us to recognize trends to capture new growth opportunities, and gain experience that can be transferred to customers in different regions. For further details regarding geographic distribution of our revenue, see Item 8, Note 5—Revenue to our consolidated financial statements.

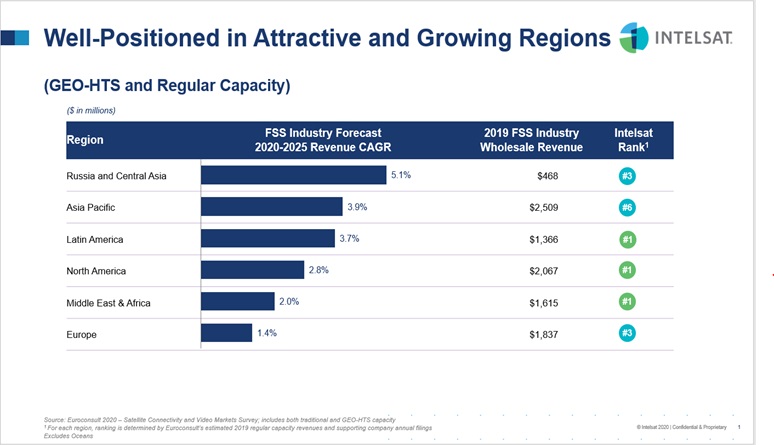

We believe we are the sector leader by transponder share in three of the geographic regions covered by our network. We are generally ranked first or second in the regions identified by industry analysts as those that either purchase the most satellite capacity or are regions with high growth prospects, such as North America and Latin America.

The scale of our fleet can also reduce the financial impact of satellite failures and protect against service interruption. No single satellite generated more than 7% of our revenue and no single customer accounted for more than 15% of our revenue for the year ended December 31, 2020.

16

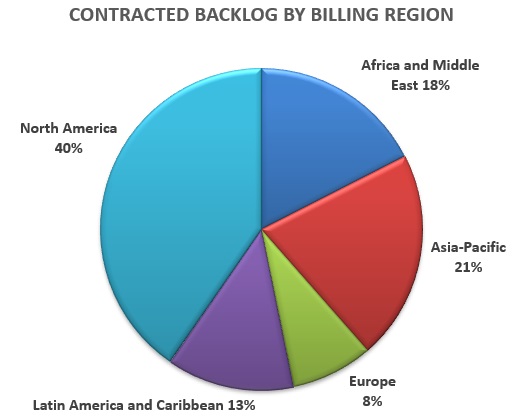

The following charts show the geographic diversity of our contracted backlog as of December 31, 2020 by service sector and region, based upon the billing address of the customer.

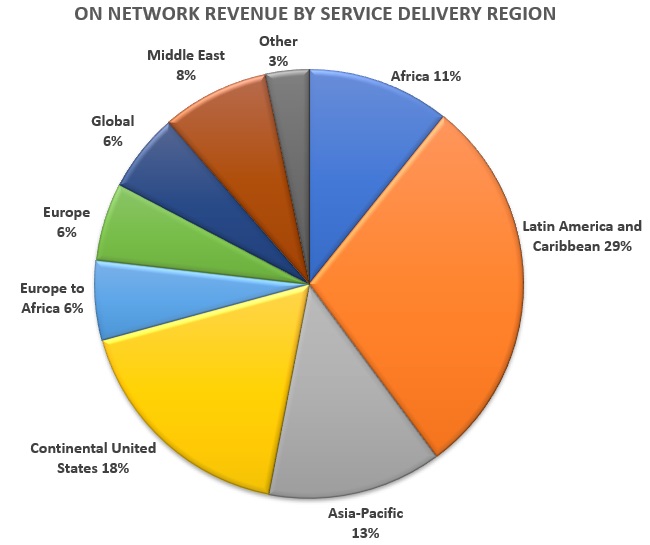

The majority of our on-network revenue aligns to emerging regions, based upon the position of our satellites and beams. The following chart shows the breakdown of our on-network revenue by the region in which the service was delivered as of December 31, 2020.

17

Gogo CA — Commercial Aviation

On December 1, 2020, Intelsat completed its purchase of Gogo’s commercial aviation business for $400.0 million in cash, subject to customary adjustments. The Gogo Transaction further propels Intelsat’s efforts in the growing commercial IFC market, pairing our high-capacity global satellite and ground network with Gogo CA’s installed base of more than 3,000 commercial aircraft to redefine the IFC experience. Gogo CA’s mission is to provide ground-like connectivity to every device on every flight around the globe enabling superior passenger experiences. To accomplish our mission, we utilize dedicated satellite and ATG networks, engineer, install and maintain in-flight systems of propriety hardware and software, and deliver customizable connectivity, wireless entertainment services, and global support capabilities to our aviation partners. Our leading global market share supports our continued investment in ongoing research and development and the global operating capabilities required to support our aviation partners’ needs. Our technology roadmap includes plans for continued rapid improvement in bandwidth speeds and other performance metrics of our in-flight systems.

We are the leading global commercial aviation provider of IFC and IFE services, with our equipment installed and services provided on approximately 3,000 commercial aircraft as of December 31, 2020. Our next generation 2Ku global satellite system (“2Ku”) has been installed on more than 1,495 commercial aircraft, with approximately 475 additional 2Ku commercial aircraft under existing contracts and awards not yet under contract as of December 31, 2020. The 2Ku system is capable of delivering peak speeds of 200 Mbps to the aircraft. We also anticipate using Gogo’s 5G ATG network (“Gogo 5G”), expected to be available in 2022, to improve the passenger experience by providing lower latency and higher throughput than the current ATG network on commercial regional jets and smaller mainline jets operating within the continental United States and Canada. Gogo 5G will support licensed, shared and unlicensed spectrum and high, low and middle bands and will allow us to take advantage of new advances in technology as they are developed. We will continue to provide service over the current ATG network in North America to provide redundancy to the Gogo 5G network when needed.

Our Strategy: Transforming Our Business and Our Sector

We are transforming our business and sector, investing in and deploying innovative new technologies and platforms that will change the types of applications that we can serve and increase our share of the global demand for broadband connectivity everywhere—for all communities and for all devices.

Our strategy is built around five competitive advantages that support our ability to reach our goals:

•Our operating scale, with over 50 satellites owned and managed, coupled with our long history of experience introducing and managing technology globally, is essential given that the fastest growing applications, such as mobility and upcoming 5G deployments, require ubiquitous, consistent network performance;

•Our global presence, including relationships with governments and operators around the world and service delivery in approximately 200 countries and territories illustrating our global reach, is important to new opportunities, such as connected and autonomous vehicles, machine-to-machine, land mobility and government applications, where service providers will look for global access. We believe the ability to serve these and other applications on a global basis creates new satellite-based communication solutions with multi-billion dollar revenue potential;

•Our innovative technology, especially our high-throughput fleet already in-orbit, and investments in new software-defined space assets and virtualization of our ground platform, balances our focus on flexibly deploying capacity where it is needed and continually advancing technology, allowing us to provide our customers first-to-market advantage and a transformational customer experience. In addition, we believe that completing targeted investments and partnerships in differentiated space and ground infrastructure to develop a standards-based ecosystem will provide a seamless interface with the broader telecommunications ecosystem;

•Our portfolio of spectrum rights provides unmatched flexibility and agility as we look at new opportunities; and