Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22582

Western Asset Middle Market Income Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place,

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 777-0102

Date of fiscal year end: April 30

Date of reporting period: October 31, 2016

Table of Contents

| ITEM 1. | REPORT TO STOCKHOLDERS. | |

| The Semi-Annual Report to Stockholders is filed herewith. | ||

Table of Contents

| Semi-Annual Report | October 31, 2016 |

WESTERN ASSET

MIDDLE MARKET

INCOME FUND INC.

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Table of Contents

Fund objectives

The Fund’s primary investment objective is to provide high income. As a secondary investment objective, the Fund seeks capital appreciation.

The Fund seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its managed assets (the net assets of the Fund plus the principal amount of any borrowings and any preferred stock that may be outstanding) in securities, including loans, issued by middle market companies. For investment purposes, “middle market” refers to companies with annual revenues of between $100 million and $1 billion at the time of investment by the Fund. Securities of middle market issuers are typically considered below investment grade (also commonly referred to as “junk bonds”).

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset Middle Market Income Fund Inc. for the six-month reporting period ended October 31, 2016. Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| • | Fund prices and performance, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

November 30, 2016

| II | Western Asset Middle Market Income Fund Inc. |

Table of Contents

Economic review

The pace of U.S. economic activity fluctuated during the six months ended October 31, 2016 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that first and second quarter 2016 U.S. gross domestic product (“GDP”)i growth was 0.8% and 1.4%, respectively. The U.S. Department of Commerce’s second reading for third quarter 2016 GDP growth — released after the reporting period ended — was 3.2%. The improvement in GDP growth in the third quarter 2016 reflected an increase in private inventory investment, an acceleration in exports, an upturn in federal government spending and smaller decreases in state and local government spending.

While there was a pocket of weakness in May 2016, job growth in the U.S. was solid overall and a tailwind for the economy during the reporting period. When the period ended on October 31, 2016, the unemployment rate was 4.9%, as reported by the U.S. Department of Labor. However, the percentage of longer-term unemployed edged slightly higher over the period. In October 2016, 25.2% of Americans looking for a job had been out of work for more than six months, versus 25.1% when the period began.

| Western Asset Middle Market Income Fund Inc. | III |

Table of Contents

Investment commentary (cont’d)

Market review

Q. How did the Federal Reserve Board (the “Fed”)ii respond to the economic environment?

A. Looking back, after an extended period of maintaining the federal funds rateiii at a historically low range between zero and 0.25%, the Fed increased the rate at its meeting on December 16, 2015. This marked the first rate hike since 2006. In particular, the U.S. central bank raised the federal funds rate to a range between 0.25% and 0.50%. At its meeting that concluded on November 2, 2016 (after the reporting period ended), as well as during the prior meetings of the year, the Fed kept rates on hold. In the Fed’s statement after the November meeting it said, “The Committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.”

Q. Did Treasury yields trend higher or lower during the six months ended October 31, 2016?

A. Short-term Treasury yields moved higher, whereas long-term Treasury yields were relatively flat overall during the six months ended October 31, 2016. Two-year Treasury yields began the reporting period at 0.77% and ended the period at 0.86%. Their peak of 0.92% took place on May 24 and May 25, 2016 and their low of 0.56% occurred on July 5, 2016. Ten-year Treasury yields began the reporting period at 1.83% and ended the period at 1.60%. Their peak of 1.88% took place on May 2, 2016 and their low of 1.37% occurred on July 5 and July 8, 2016.

Q. What factors impacted the spread sectors (non-Treasuries) during the reporting period?

A. The spread sectors generally posted positive results during the reporting period. Performance fluctuated with investor sentiment given signs of moderating global growth, shifting expectations for future Fed monetary policy, Brexit and several geopolitical issues. The broad U.S. bond market, as measured by the Bloomberg Barclays U.S. Aggregate Indexiv, gained 1.51% during the six months ended October 31, 2016. Higher risk segments of the market generated the best returns during the reporting period.

Q. How did the high-yield bond market perform over the six months ended October 31, 2016?

A. The U.S. high-yield bond market, as measured by the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Indexv, gained 7.59% for the six months ended October 31, 2016. The high-yield market posted positive returns during all six months of the reporting period. This was driven by several factors, including robust demand from investors looking to generate incremental yield in the low interest rate environment, stabilizing oil prices and the Fed reducing its expectations for rate hikes in 2016.

Q. How did the emerging markets debt asset class perform over the reporting period?

A. The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi gained 5.71% during the six months ended October 31, 2016. While there were several bouts of weakness, the asset class generated positive returns during four of the six months of the reporting period. Supporting the asset class were stabilizing oil prices, accommodative

| IV | Western Asset Middle Market Income Fund Inc. |

Table of Contents

global monetary policy and overall solid investor demand.

Performance review

For the six months ended October 31, 2016, Western Asset Middle Market Income Fund Inc. returned 16.76% based on its net asset value (“NAV”)vii. The Fund’s unmanaged benchmark, the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component Indexviii returned 13.52% for the same period. The Lipper High Yield (Leveraged) Closed-End Funds Category Average ix returned 9.66% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the reporting period, the Fund made distributions to shareholders totaling $45.00 per share. As of October 31, 2016, the Fund estimates that 86.7% of the distributions were sourced from net investment income and 13.3% constitutes a return of capital.* The performance table shows the Fund’s six-month total return based on its NAV as of October 31, 2016. Past performance is no guarantee of future results.

| Performance Snapshot

as of October 31, 2016 (unaudited) |

||||

| Price Per Share | 6-Month Total Return** |

|||

| $779.45 (NAV) | 16.76 | %† | ||

All figures represent past performance and are not a guarantee of future results. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

** Total return is based on changes in NAV. Return reflects the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Return does not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the disposition of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

Looking for additional information?

The Fund’s daily NAV is available on-line under the symbol “XWMFX” on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV and other information.

Thank you for your investment in Western Asset Middle Market Income Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Jane Trust, CFA

Chairman, President and

Chief Executive Officer

November 30, 2016

| * | These estimates are not for tax purposes. The Fund will issue a Form 1099 with final composition of the distributions for tax purposes after year-end. A return of capital is not taxable and results in a reduction in the tax basis of a shareholder’s investment. For more information about a distribution’s composition, please refer to the Fund’s distribution press release or, if applicable, the Section 19 notice located in the press release section our website, www.lmcef.com (click on the name of the Fund). |

| Western Asset Middle Market Income Fund Inc. | V |

Table of Contents

Investment commentary (cont’d)

RISKS: An investment in the Fund involves a high degree of risk. The Fund should be considered an illiquid investment. This Fund is not publicly traded and is closed to new investors. The Fund does not intend to apply for an exchange listing, and it is highly unlikely that a secondary market will exist for the purchase and sale of the Fund’s shares. Investors could lose some or all of their investment. An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. The Fund is designed as a long-term investment for investors who are prepared to hold the Fund’s Common Stock until the expiration of its term, and is not a trading vehicle. Fixed-income securities are subject to numerous risks, including but not limited to, credit, inflation, income, prepayment and interest rates risks. As interest rates rise, the value of fixed-income securities falls. Middle market companies have additional risks due to their limited operating histories, limited financial resources, less predictable operating results, narrower product lines and other factors. Securities of middle market issuers are typically considered high-yield. High-yield fixed income securities of below-investment-grade quality are regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. High-yield bonds (“junk bonds”) are subject to higher credit risk and a greater risk of default. The Fund may invest all or a portion of its managed assets in illiquid securities. The Fund may make significant investments in securities for which there are no observable market prices; the prices must be estimated by Western Asset, the Fund’s subadviser and approved by the Legg Mason North Atlantic Fund Valuation Committee. Investments in foreign securities involve risks, including the possibility of losses due to changes in currency exchange rates and negative developments in the political, economic or regulatory structure of specific countries or regions. These risks are greater in emerging markets. Leverage may result in greater volatility of the net asset value of common shares and increases a shareholder’s risk of loss. Derivative instruments can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Distributions are not guaranteed and are subject to change.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| VI | Western Asset Middle Market Income Fund Inc. |

Table of Contents

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The Bloomberg Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| v | The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| vi | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| vii | Net asset value (“NAV”) is calculated by subtracting total liabilities, including liabilities associated with financial leverage (if any), from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. |

| viii | The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index and is comprised of the Caa-rated securities included in this Index. |

| ix | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended October 31, 2016, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 35 funds in the Fund’s Lipper category. |

| Western Asset Middle Market Income Fund Inc. | VII |

Table of Contents

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of October 31, 2016 and April 30, 2016. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at anytime. |

| ‡ | Effective August 31, 2016, the Financials sector was redefined to exclude Real Estate and a Real Estate sector was created. |

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 1 |

Table of Contents

Economic exposure — October 31, 2016

| Total Spread Duration | ||

| XWMFX | — 2.54 years | |

| Benchmark | — 3.32 years | |

Spread duration measures the sensitivity to changes in spreads. The spread over Treasuries is the annual risk-premium demanded by investors to hold non-Treasury securities. Spread duration is quantified as the % change in price resulting from a 100 basis points change in spreads. For a security with positive spread duration, an increase in spreads would result in a price decline and a decline in spreads would result in a price increase. This chart highlights the market sector exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| Benchmark | — Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component Index | |

| EM | — Emerging Markets | |

| HY | — High Yield | |

| XWMFX | — Western Asset Middle Market Income Fund Inc. |

| 2 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

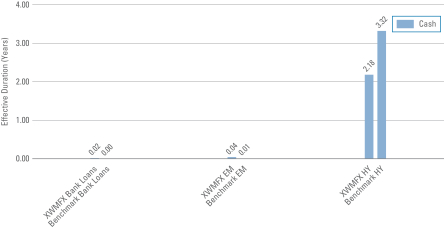

Effective duration (unaudited)

Interest rate exposure — October 31, 2016

| Total Effective Duration | ||

| XWMFX | — 2.24 years | |

| Benchmark | — 3.33 years | |

Effective duration measures the sensitivity to changes in relevant interest rates. Effective duration is quantified as the % change in price resulting from a 100 basis points change in interest rates. For a security with positive effective duration, an increase in interest rates would result in a price decline and a decline in interest rates would result in a price increase. This chart highlights the interest rate exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| Benchmark | — Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Caa Component Index | |

| EM | — Emerging Markets | |

| HY | — High Yield | |

| XWMFX | — Western Asset Middle Market Income Fund Inc. |

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 3 |

Table of Contents

Schedule of investments (unaudited)

October 31, 2016

Western Asset Middle Market Income Fund Inc.

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Corporate Bonds & Notes — 114.0% | ||||||||||||||||

| Consumer Discretionary — 20.7% | ||||||||||||||||

| Diversified Consumer Services — 0.3% |

||||||||||||||||

| Cengage Learning Inc., Senior Notes |

9.500 | % | 6/15/24 | $ | 640,000 | $ | 606,400 | (a) | ||||||||

| Hotels, Restaurants & Leisure — 11.4% |

||||||||||||||||

| 24 Hour Holdings III LLC, Senior Notes |

8.000 | % | 6/1/22 | 2,500,000 | 2,087,500 | (a)(b) | ||||||||||

| CEC Entertainment Inc., Senior Notes |

8.000 | % | 2/15/22 | 4,000,000 | 4,040,000 | (b) | ||||||||||

| Golden Nugget Inc., Senior Notes |

8.500 | % | 12/1/21 | 5,000,000 | 5,275,000 | (a)(b) | ||||||||||

| Greektown Holdings LLC/Greektown Mothership Corp., Senior Secured Notes |

8.875 | % | 3/15/19 | 5,000,000 | 5,312,500 | (a)(b) | ||||||||||

| Inn of the Mountain Gods Resort & Casino, Senior Secured Notes |

9.250 | % | 11/30/20 | 3,491,169 | 3,159,508 | (a)(b) | ||||||||||

| Nathan’s Famous Inc., Senior Secured Notes |

10.000 | % | 3/15/20 | 220,000 | 241,725 | (a) | ||||||||||

| Scientific Games Corp., Senior Subordiinated Notes |

8.125 | % | 9/15/18 | 1,330,000 | 1,341,637 | |||||||||||

| Viking Cruises Ltd., Senior Notes |

8.500 | % | 10/15/22 | 4,990,000 | 5,052,375 | (a)(b) | ||||||||||

| Total Hotels, Restaurants & Leisure |

26,510,245 | |||||||||||||||

| Household Durables — 2.5% |

||||||||||||||||

| APX Group Inc., Senior Notes |

8.750 | % | 12/1/20 | 6,000,000 | 5,835,000 | (b) | ||||||||||

| Leisure Products — 0.3% |

||||||||||||||||

| Gibson Brands Inc., Senior Secured Notes |

8.875 | % | 8/1/18 | 1,111,000 | 824,918 | (a)(b) | ||||||||||

| Media — 1.7% |

||||||||||||||||

| New Cotai LLC/New Cotai Capital Corp., Senior Secured Notes |

10.625 | % | 5/1/19 | 6,504,037 | 3,869,902 | (a)(b)(c) | ||||||||||

| Multiline Retail — 0.8% |

||||||||||||||||

| Neiman Marcus Group Ltd. LLC, Senior Notes |

8.000 | % | 10/15/21 | 740,000 | 614,200 | (a) | ||||||||||

| Neiman Marcus Group Ltd. LLC, Senior Notes |

8.750 | % | 10/15/21 | 1,670,000 | 1,322,431 | (a)(c) | ||||||||||

| Total Multiline Retail |

1,936,631 | |||||||||||||||

| Specialty Retail — 2.4% |

||||||||||||||||

| Guitar Center Inc., Senior Secured Bonds |

6.500 | % | 4/15/19 | 3,500,000 | 3,158,750 | (a) | ||||||||||

| Hot Topic Inc., Senior Secured Notes |

9.250 | % | 6/15/21 | 1,200,000 | 1,278,000 | (a)(b) | ||||||||||

| HT Intermediate Holdings Corp., Senior Notes |

12.000 | % | 5/15/19 | 1,250,000 | 1,275,000 | (a)(b)(c) | ||||||||||

| Total Specialty Retail |

5,711,750 | |||||||||||||||

| Textiles, Apparel & Luxury Goods — 1.3% |

||||||||||||||||

| Empire Today LLC/Empire Today Finance Corp., Senior Secured Notes |

11.375 | % | 2/1/17 | 3,020,000 | 3,035,100 | (a) | ||||||||||

| Total Consumer Discretionary |

48,329,946 | |||||||||||||||

| Consumer Staples — 5.4% | ||||||||||||||||

| Beverages — 0.5% |

||||||||||||||||

| Carolina Beverage Group LLC/Carolina Beverage Group Finance Inc., Secured Notes |

10.625 | % | 8/1/18 | 1,300,000 | 1,215,500 | (a)(b) | ||||||||||

See Notes to Financial Statements.

| 4 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

Western Asset Middle Market Income Fund Inc.

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Food & Staples Retailing — 2.0% |

||||||||||||||||

| Beverages & More Inc., Senior Secured Notes |

10.000 | % | 11/15/18 | $ | 4,750,000 | $ | 4,601,563 | (a)(b) | ||||||||

| Food Products — 1.1% |

||||||||||||||||

| Simmons Foods Inc., Secured Notes |

7.875 | % | 10/1/21 | 2,500,000 | 2,525,000 | (a) | ||||||||||

| Tobacco — 1.8% |

||||||||||||||||

| Alliance One International Inc., Secured Notes |

9.875 | % | 7/15/21 | 5,000,000 | 4,193,750 | (b) | ||||||||||

| Total Consumer Staples |

12,535,813 | |||||||||||||||

| Energy — 15.8% | ||||||||||||||||

| Energy Equipment & Services — 2.1% |

||||||||||||||||

| CGG, Senior Notes |

6.500 | % | 6/1/21 | 4,000,000 | 2,040,000 | |||||||||||

| Pride International Inc., Senior Notes |

7.875 | % | 8/15/40 | 2,750,000 | 2,206,875 | |||||||||||

| Sierra Hamilton LLC/Sierra Hamilton Finance Inc., |

12.250 | % | 12/15/18 | 1,500,000 | 613,350 | (a)(b)(d)(e) | ||||||||||

| Total Energy Equipment & Services |

4,860,225 | |||||||||||||||

| Oil, Gas & Consumable Fuels — 13.7% |

||||||||||||||||

| Berry Petroleum Co., Senior Notes |

6.375 | % | 9/15/22 | 10,119,000 | 5,616,045 | *(b)(e)(f) | ||||||||||

| Blue Racer Midstream LLC/Blue Racer Finance Corp., Senior Notes |

6.125 | % | 11/15/22 | 2,379,000 | 2,337,367 | (a)(b) | ||||||||||

| Endeavor Energy Resources LP/EER Finance Inc., |

7.000 | % | 8/15/21 | 40,000 | 40,900 | (a) | ||||||||||

| Magnum Hunter Resources Corp. Escrow |

— | — | 6,090,000 | 0 | *(d)(e)(g) | |||||||||||

| MEG Energy Corp., Senior Notes |

6.500 | % | 3/15/21 | 500,000 | 433,750 | (a) | ||||||||||

| MEG Energy Corp., Senior Notes |

6.375 | % | 1/30/23 | 1,500,000 | 1,245,000 | (a) | ||||||||||

| Murray Energy Corp., Senior Secured Notes |

11.250 | % | 4/15/21 | 2,000,000 | 1,545,000 | (a)(b) | ||||||||||

| Natural Resource Partners LP/Natural Resource Partners Finance Corp., Senior Notes |

9.125 | % | 10/1/18 | 4,465,000 | 4,130,125 | (b) | ||||||||||

| Oasis Petroleum Inc., Senior Notes |

7.250 | % | 2/1/19 | 1,000,000 | 1,012,500 | |||||||||||

| Oasis Petroleum Inc., Senior Notes |

6.500 | % | 11/1/21 | 4,088,000 | 4,082,890 | (b) | ||||||||||

| Oasis Petroleum Inc., Senior Notes |

6.875 | % | 3/15/22 | 210,000 | 208,950 | |||||||||||

| Oasis Petroleum Inc., Senior Notes |

6.875 | % | 1/15/23 | 2,607,000 | 2,567,895 | (b) | ||||||||||

| Parsley Energy LLC/Parsley Finance Corp., Senior Notes |

7.500 | % | 2/15/22 | 1,410,000 | 1,505,175 | (a) | ||||||||||

| Parsley Energy LLC/Parsley Finance Corp., Senior Notes |

6.250 | % | 6/1/24 | 720,000 | 759,600 | (a) | ||||||||||

| Rice Energy Inc., Senior Notes |

6.250 | % | 5/1/22 | 500,000 | 511,250 | (b) | ||||||||||

| Rice Energy Inc., Senior Notes |

7.250 | % | 5/1/23 | 1,490,000 | 1,586,850 | |||||||||||

| Sanchez Energy Corp., Senior Notes |

6.125 | % | 1/15/23 | 5,060,000 | 4,351,600 | (b)(e) | ||||||||||

| Total Oil, Gas & Consumable Fuels |

31,934,897 | |||||||||||||||

| Total Energy |

36,795,122 | |||||||||||||||

See Notes to Financial Statements.

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 5 |

Table of Contents

Schedule of investments (unaudited) (cont’d)

October 31, 2016

Western Asset Middle Market Income Fund Inc.

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Financials — 7.1% | ||||||||||||||||

| Capital Markets — 1.5% |

||||||||||||||||

| Jefferies Finance LLC/JFIN Co.-Issuer Corp., Senior Notes |

7.375 | % | 4/1/20 | $ | 3,500,000 | $ | 3,491,250 | (a)(b) | ||||||||

| Consumer Finance — 3.5% |

||||||||||||||||

| Stearns Holdings Inc., Senior Secured Notes |

9.375 | % | 8/15/20 | 4,695,000 | 4,718,475 | (a)(b) | ||||||||||

| TMX Finance LLC/TitleMax Finance Corp., Senior Secured Notes |

8.500 | % | 9/15/18 | 4,500,000 | 3,397,500 | (a)(b) | ||||||||||

| Total Consumer Finance |

8,115,975 | |||||||||||||||

| Diversified Financial Services — 2.1% |

||||||||||||||||

| NewStar Financial Inc., Senior Notes |

7.250 | % | 5/1/20 | 5,000,000 | 5,025,000 | |||||||||||

| Total Financials |

16,632,225 | |||||||||||||||

| Health Care — 10.7% | ||||||||||||||||

| Biotechnology — 1.1% |

||||||||||||||||

| AMAG Pharmaceuticals Inc., Senior Notes |

7.875 | % | 9/1/23 | 2,869,000 | 2,704,032 | (a)(b) | ||||||||||

| Health Care Equipment & Supplies — 3.8% |

||||||||||||||||

| DJO Finance LLC/DJO Finance Corp., Secured Notes |

10.750 | % | 4/15/20 | 3,500,000 | 3,010,000 | |||||||||||

| Greatbatch Ltd., Senior Notes |

9.125 | % | 11/1/23 | 510,000 | 490,875 | (a) | ||||||||||

| Immucor Inc., Senior Notes |

11.125 | % | 8/15/19 | 5,700,000 | 5,386,500 | (b) | ||||||||||

| Total Health Care Equipment & Supplies |

8,887,375 | |||||||||||||||

| Health Care Providers & Services — 5.8% |

||||||||||||||||

| BioScrip Inc., Senior Notes |

8.875 | % | 2/15/21 | 6,000,000 | 5,580,000 | (b) | ||||||||||

| IASIS Healthcare LLC/IASIS Capital Corp., Senior Notes |

8.375 | % | 5/15/19 | 3,000,000 | 2,872,500 | |||||||||||

| Universal Hospital Services Inc., Secured Notes |

7.625 | % | 8/15/20 | 5,155,000 | 4,974,575 | (b) | ||||||||||

| Total Health Care Providers & Services |

13,427,075 | |||||||||||||||

| Total Health Care |

25,018,482 | |||||||||||||||

| Industrials — 28.5% | ||||||||||||||||

| Aerospace & Defense — 4.0% |

||||||||||||||||

| CBC Ammo LLC/CBC FinCo Inc., Senior Notes |

7.250 | % | 11/15/21 | 3,254,000 | 3,180,785 | (a)(b) | ||||||||||

| Heligear Acquisition Co., Senior Secured Bonds |

10.250 | % | 10/15/19 | 1,241,000 | 1,304,601 | (a)(e) | ||||||||||

| LMI Aerospace Inc., Secured Notes |

7.375 | % | 7/15/19 | 4,872,000 | 4,908,540 | (b) | ||||||||||

| Total Aerospace & Defense |

9,393,926 | |||||||||||||||

| Air Freight & Logistics — 1.5% |

||||||||||||||||

| Air Medical Group Holdings Inc., Senior Notes |

6.375 | % | 5/15/23 | 3,685,000 | 3,528,388 | (a)(b) | ||||||||||

| Building Products — 1.0% |

||||||||||||||||

| Builders FirstSource Inc., Senior Notes |

10.750 | % | 8/15/23 | 2,000,000 | 2,310,000 | (a) | ||||||||||

| Commercial Services & Supplies — 2.6% |

||||||||||||||||

| Garda World Security Corp., Senior Notes |

7.250 | % | 11/15/21 | 2,610,000 | 2,505,600 | (a)(b) | ||||||||||

| Monitronics International Inc., Senior Notes |

9.125 | % | 4/1/20 | 3,650,000 | 3,476,625 | (b) | ||||||||||

| Total Commercial Services & Supplies |

5,982,225 | |||||||||||||||

See Notes to Financial Statements.

| 6 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

Western Asset Middle Market Income Fund Inc.

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Construction & Engineering — 8.6% |

||||||||||||||||

| Ausdrill Finance Pty Ltd., Senior Notes |

6.875 | % | 11/1/19 | $ | 5,000,000 | $ | 5,087,500 | (a)(b) | ||||||||

| Brundage-Bone Concrete Pumping Inc., Senior Secured Notes |

10.375 | % | 9/1/21 | 5,000,000 | 5,450,000 | (a)(b) | ||||||||||

| HC2 Holdings Inc., Senior Secured Notes |

11.000 | % | 12/1/19 | 4,500,000 | 4,455,000 | (a)(b) | ||||||||||

| Michael Baker Holdings LLC/Michael Baker Finance Corp., Senior Notes |

8.875 | % | 4/15/19 | 5,492,830 | 4,971,011 | (a)(b)(c) | ||||||||||

| Total Construction & Engineering |

19,963,511 | |||||||||||||||

| Electrical Equipment — 2.5% |

||||||||||||||||

| Interface Grand Master Holdings Inc., Senior Notes |

19.000 | % | 8/15/19 | 2,044,506 | 1,983,171 | (c)(d)(e) | ||||||||||

| International Wire Group Inc., Senior Notes |

10.750 | % | 8/1/21 | 3,000,000 | 2,842,500 | (a) | ||||||||||

| NES Rentals Holdings Inc., Senior Secured Notes |

7.875 | % | 5/1/18 | 1,000,000 | 985,000 | (a)(b) | ||||||||||

| Total Electrical Equipment |

5,810,671 | |||||||||||||||

| Machinery — 2.3% |

||||||||||||||||

| Accuride Corp., Senior Secured Notes |

9.500 | % | 8/1/18 | 2,500,000 | 2,506,250 | |||||||||||

| CTP Transportation Products LLC/CTP Finance Inc., Senior Secured Notes |

8.250 | % | 12/15/19 | 430,000 | 328,950 | (a) | ||||||||||

| SPL Logistics Escrow LLC/SPL Logistics Finance Corp., Senior Secured Notes |

8.875 | % | 8/1/20 | 3,000,000 | 2,565,000 | (a) | ||||||||||

| Total Machinery |

5,400,200 | |||||||||||||||

| Marine — 1.4% |

||||||||||||||||

| Navios Maritime Acquisition Corp./Navios Acquisition Finance U.S. Inc., Senior Secured Notes |

8.125 | % | 11/15/21 | 4,260,000 | 3,237,600 | (a) | ||||||||||

| Road & Rail — 3.2% |

||||||||||||||||

| Flexi-Van Leasing Inc., Senior Notes |

7.875 | % | 8/15/18 | 2,150,000 | 2,010,250 | (a)(b) | ||||||||||

| Florida East Coast Holdings Corp., Senior Notes |

9.750 | % | 5/1/20 | 5,500,000 | 5,472,500 | (a)(b) | ||||||||||

| Total Road & Rail |

7,482,750 | |||||||||||||||

| Trading Companies & Distributors — 0.7% |

||||||||||||||||

| Ahern Rentals Inc., Secured Notes |

7.375 | % | 5/15/23 | 2,500,000 | 1,650,000 | (a)(b) | ||||||||||

| Transportation — 0.7% |

||||||||||||||||

| Jack Cooper Enterprises Inc., Senior Notes |

10.500 | % | 3/15/19 | 5,601,177 | 1,512,318 | (a)(b)(c) | ||||||||||

| Total Industrials |

66,271,589 | |||||||||||||||

| Information Technology — 2.5% | ||||||||||||||||

| Electronic Equipment, Instruments & Components — 2.5% |

||||||||||||||||

| Interface Security Systems Holdings Inc./Interface Security Systems LLC, Senior Secured Notes |

9.250 | % | 1/15/18 | 2,340,000 | 2,348,775 | (b) | ||||||||||

| KEMET Corp., Senior Secured Notes |

10.500 | % | 5/1/18 | 3,500,000 | 3,510,938 | (b) | ||||||||||

| Total Information Technology |

5,859,713 | |||||||||||||||

See Notes to Financial Statements.

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 7 |

Table of Contents

Schedule of investments (unaudited) (cont’d)

October 31, 2016

Western Asset Middle Market Income Fund Inc.

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Materials — 15.4% | ||||||||||||||||

| Chemicals — 4.2% |

||||||||||||||||

| Eco Services Operations LLC/Eco Finance Corp., Senior Notes |

8.500 | % | 11/1/22 | $ | 1,500,000 | $ | 1,608,750 | (a)(b) | ||||||||

| Jac Holding Corp., Senior Secured Notes |

11.500 | % | 10/1/19 | 6,271,000 | 6,913,778 | (a)(b) | ||||||||||

| Techniplas LLC, Senior Secured Notes |

10.000 | % | 5/1/20 | 1,400,000 | 1,193,500 | (a)(b) | ||||||||||

| Total Chemicals |

9,716,028 | |||||||||||||||

| Construction Materials — 1.2% |

||||||||||||||||

| NWH Escrow Corp., Senior Secured Notes |

7.500 | % | 8/1/21 | 1,930,000 | 1,408,900 | (a)(b) | ||||||||||

| U.S. Concrete Inc., Senior Notes |

6.375 | % | 6/1/24 | 1,460,000 | 1,522,050 | |||||||||||

| Total Construction Materials |

2,930,950 | |||||||||||||||

| Containers & Packaging — 4.9% |

||||||||||||||||

| BWAY Holding Co., Senior Notes |

9.125 | % | 8/15/21 | 3,500,000 | 3,675,000 | (a)(b) | ||||||||||

| Consolidated Container Co., LLC/Consolidated Container Capital Inc., Senior Notes |

10.125 | % | 7/15/20 | 4,000,000 | 4,060,000 | (a)(b) | ||||||||||

| PaperWorks Industries Inc., Senior Secured Notes |

9.500 | % | 8/15/19 | 3,890,000 | 3,607,975 | (a)(b) | ||||||||||

| Total Containers & Packaging |

11,342,975 | |||||||||||||||

| Metals & Mining — 5.1% |

||||||||||||||||

| Barminco Finance Pty Ltd., Senior Notes |

9.000 | % | 6/1/18 | 5,230,000 | 5,354,212 | (a)(b) | ||||||||||

| Coeur Mining Inc., Senior Notes |

7.875 | % | 2/1/21 | 6,303,000 | 6,492,090 | (b) | ||||||||||

| Total Metals & Mining |

11,846,302 | |||||||||||||||

| Total Materials |

35,836,255 | |||||||||||||||

| Real Estate — 2.3% | ||||||||||||||||

| Equity Real Estate Investment Trusts (REITs) — 1.4% |

||||||||||||||||

| Communications Sales & Leasing Inc., Senior Notes |

8.250 | % | 10/15/23 | 3,000,000 | 3,180,000 | (b) | ||||||||||

| Real Estate Management & Development — 0.9% |

||||||||||||||||

| Caesars Entertainment Resort Properties LLC, Secured Notes |

11.000 | % | 10/1/21 | 2,000,000 | 2,160,000 | |||||||||||

| Total Real Estate |

5,340,000 | |||||||||||||||

| Telecommunication Services — 4.6% | ||||||||||||||||

| Diversified Telecommunication Services — 2.4% |

||||||||||||||||

| Cogent Communications Holdings Inc., Senior Notes |

5.625 | % | 4/15/21 | 1,750,000 | 1,763,125 | (a)(b) | ||||||||||

| Intelsat Jackson Holdings SA, Senior Notes |

7.250 | % | 4/1/19 | 2,000,000 | 1,622,500 | |||||||||||

| Intelsat Luxembourg SA, Senior Bonds |

8.125 | % | 6/1/23 | 2,000,000 | 670,000 | |||||||||||

| Windstream Services LLC, Senior Notes |

7.500 | % | 6/1/22 | 1,500,000 | 1,425,000 | (b) | ||||||||||

| Total Diversified Telecommunication Services |

5,480,625 | |||||||||||||||

| Wireless Telecommunication Services — 2.2% |

||||||||||||||||

| CSC Holdings LLC, Senior Notes |

10.125 | % | 1/15/23 | 590,000 | 666,700 | (a) | ||||||||||

| CSC Holdings LLC, Senior Notes |

10.875 | % | 10/15/25 | 890,000 | 1,025,725 | (a)(b) | ||||||||||

See Notes to Financial Statements.

| 8 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

Western Asset Middle Market Income Fund Inc.

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Wireless Telecommunication Services — continued |

||||||||||||||||

| Sprint Communications Inc., Senior Notes |

11.500 | % | 11/15/21 | $ | 815,000 | $ | 957,625 | |||||||||

| Sprint Corp., Senior Notes |

7.875 | % | 9/15/23 | 2,520,000 | 2,501,100 | (b) | ||||||||||

| Total Wireless Telecommunication Services |

5,151,150 | |||||||||||||||

| Total Telecommunication Services |

10,631,775 | |||||||||||||||

| Utilities — 1.0% | ||||||||||||||||

| Independent Power and Renewable Electricity |

||||||||||||||||

| Mirant Mid Atlantic LLC, Pass-Through Certificates, Secured Bonds |

10.060 | % | 12/30/28 | 2,922,883 | 2,312,731 | (b) | ||||||||||

| Total Corporate Bonds & Notes (Cost — $263,635,231) |

|

265,563,651 | ||||||||||||||

| Senior Loans — 21.2% | ||||||||||||||||

| Consumer Discretionary — 5.2% | ||||||||||||||||

| Diversified Consumer Services — 1.6% |

||||||||||||||||

| Affinion Group Inc., Second Lien Term Loan |

8.500 | % | 10/31/18 | 4,000,000 | 3,673,332 | (h)(i) | ||||||||||

| Hotels, Restaurants & Leisure — 1.5% |

||||||||||||||||

| Affinity Gaming LLC, Second Lien Term Loan |

— | 9/14/24 | 3,490,000 | 3,420,200 | (j) | |||||||||||

| Specialty Retail — 0.7% |

||||||||||||||||

| Outerwall Inc., Second Lien Term Loan |

9.750 | % | 9/27/24 | 1,200,000 | 1,197,000 | (h)(i)(j) | ||||||||||

| Spencer Gifts LLC, Second Lien Term Loan |

9.250 | % | 6/29/22 | 690,000 | 569,250 | (h)(i) | ||||||||||

| Total Specialty Retail |

1,766,250 | |||||||||||||||

| Textiles, Apparel & Luxury Goods — 1.4% |

||||||||||||||||

| TOMS Shoes LLC, Term Loan B |

6.500 | % | 10/28/20 | 4,481,949 | 3,294,232 | (h)(i) | ||||||||||

| Total Consumer Discretionary |

12,154,014 | |||||||||||||||

| Consumer Staples — 3.3% | ||||||||||||||||

| Food Products — 3.3% |

||||||||||||||||

| CSM Bakery Solutions LLC, Second Lien Term Loan |

8.750 | % | 7/3/21 | 4,000,000 | 3,615,000 | (h)(i) | ||||||||||

| Shearer’s Foods Inc., Second Lien Term Loan |

7.750 | % | 6/30/22 | 4,500,000 | 4,140,000 | (h)(i) | ||||||||||

| Total Consumer Staples |

7,755,000 | |||||||||||||||

| Energy — 2.0% | ||||||||||||||||

| Oil, Gas & Consumable Fuels — 2.0% |

||||||||||||||||

| Magnum Hunter Resources Inc., Exit Term Loan |

8.000 | % | 5/6/19 | 571,698 | 568,839 | (e)(h)(i) | ||||||||||

| Westmoreland Coal Co., Term Loan B |

7.500 | % | 12/16/20 | 4,952,424 | 3,974,321 | (h)(i) | ||||||||||

| Total Energy |

4,543,160 | |||||||||||||||

| Health Care — 2.4% | ||||||||||||||||

| Health Care Equipment & Supplies — 1.0% |

||||||||||||||||

| Lantheus Medical Imaging Inc., Term Loan |

7.000 | % | 6/30/22 | 2,268,231 | 2,232,318 | (h)(i) | ||||||||||

| Health Care Providers & Services — 1.4% |

||||||||||||||||

| Radnet Management Inc., Second Lien Term Loan |

8.000 | % | 3/25/21 | 3,266,667 | 3,246,250 | (h)(i) | ||||||||||

| Total Health Care |

5,478,568 | |||||||||||||||

See Notes to Financial Statements.

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 9 |

Table of Contents

Schedule of investments (unaudited) (cont’d)

October 31, 2016

Western Asset Middle Market Income Fund Inc.

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Industrials — 2.2% | ||||||||||||||||

| Aerospace & Defense — 0.2% |

||||||||||||||||

| WP CPP Holdings LLC, New Second Lien Term Loan |

8.750 | % | 4/30/21 | $ | 492,500 | $ | 446,944 | (h)(i) | ||||||||

| Marine — 2.0% |

||||||||||||||||

| Commercial Barge Line Co., 2015 First Lien Term Loan |

9.750 | % | 11/12/20 | 4,887,342 | 4,752,940 | (h)(i) | ||||||||||

| Total Industrials |

5,199,884 | |||||||||||||||

| Information Technology — 4.3% | ||||||||||||||||

| Electronic Equipment, Instruments & Components — 1.7% |

||||||||||||||||

| Allflex Holdings III Inc., New Second Lien Term Loan |

8.000 | % | 7/19/21 | 4,000,000 | 3,995,000 | (h)(i) | ||||||||||

| Internet Software & Services — 2.2% |

||||||||||||||||

| Ancestry.com Operations Inc., Second Lien Term Loan |

— | 10/11/24 | 4,940,000 | 5,026,450 | (j) | |||||||||||

| IT Services — 0.4% |

||||||||||||||||

| CompuCom Systems Inc., REFI Term Loan B |

4.250 | % | 5/9/20 | 1,313,900 | 967,359 | (h)(i) | ||||||||||

| Total Information Technology |

9,988,809 | |||||||||||||||

| Utilities — 1.8% | ||||||||||||||||

| Electric Utilities — 1.8% |

||||||||||||||||

| Green Energy Partners/Stonewall LLC, Term Loan B1 |

6.500 | % | 11/13/21 | 1,000,000 | 977,500 | (e)(h)(i) | ||||||||||

| Panda Temple Power LLC, 2015 Term Loan B |

7.250 | % | 3/4/22 | 3,654,350 | 3,288,915 | (e)(h)(i) | ||||||||||

| Total Utilities |

4,266,415 | |||||||||||||||

| Total Senior Loans (Cost — $50,584,797) |

49,385,850 | |||||||||||||||

| Shares | ||||||||||||||||

| Common Stocks — 1.6% | ||||||||||||||||

| Energy — 1.6% | ||||||||||||||||

| Oil, Gas & Consumable Fuels — 1.6% |

||||||||||||||||

| Magnum Hunter Resources Corp. |

312,368 | 3,748,416 | *(e) | |||||||||||||

| Convertible Preferred Stocks — 0.8% | ||||||||||||||||

| Health Care — 0.8% | ||||||||||||||||

| Pharmaceuticals — 0.8% |

||||||||||||||||

| Allergan PLC (Cost — $2,041,812) |

5.500 | % | 2,500 | 1,922,500 | ||||||||||||

| Total Investments before Short-Term Investments (Cost — $323,950,109) |

|

320,620,417 | ||||||||||||||

| Short-Term Investments — 2.7% | ||||||||||||||||

| State Street Institutional Treasury Plus Money Market Fund, Premier Class (Cost — $6,274,401) |

0.233 | % | 6,274,401 | 6,274,401 | ||||||||||||

| Total Investments — 140.3% (Cost — $330,224,510#) |

326,894,818 | |||||||||||||||

| Liabilities in Excess of Other Assets — (40.3)% |

(93,937,372 | ) | ||||||||||||||

| Total Net Assets — 100.0% |

$ | 232,957,446 | ||||||||||||||

See Notes to Financial Statements.

| 10 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

Western Asset Middle Market Income Fund Inc.

| * | Non-income producing security. |

| (a) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

| (b) | All or a portion of this security is pledged as collateral pursuant to the loan agreement (See Note 6). |

| (c) | Payment-in-kind security for which the issuer has the option at each interest payment date of making interest payments in cash or additional debt securities. |

| (d) | Security is valued in good faith in accordance with procedures approved by the Board of Directors (See Note 1). |

| (e) | Illiquid security. |

| (f) | The coupon payment on these securities is currently in default as of October 31, 2016. |

| (g) | Value is less than $1. |

| (h) | Senior loans may be considered restricted in that the Fund ordinarily is contractually obligated to receive approval from the agent bank and/or borrower prior to the disposition of a senior loan. |

| (i) | Interest rates disclosed represent the effective rates on senior loans. Ranges in interest rates are attributable to multiple contracts under the same loan. |

| (j) | All or a portion of this loan is unfunded as of October 31, 2016. The interest rate for fully unfunded term loans is to be determined. |

| # | Aggregate cost for federal income tax purposes is substantially the same. |

See Notes to Financial Statements.

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 11 |

Table of Contents

Statement of assets and liabilities (unaudited)

October 31, 2016

| Assets: | ||||

| Investments, at value (Cost — $330,224,510) |

$ | 326,894,818 | ||

| Cash |

6,480 | |||

| Interest receivable |

7,233,016 | |||

| Receivable for securities sold |

1,783,902 | |||

| Prepaid expenses |

3,507 | |||

| Total Assets |

335,921,723 | |||

| Liabilities: | ||||

| Loan payable (Note 6) |

94,000,000 | |||

| Payable for securities purchased |

8,514,700 | |||

| Investment management fee payable |

347,819 | |||

| Interest payable |

35,580 | |||

| Directors’ fees payable |

3,736 | |||

| Accrued expenses |

62,442 | |||

| Total Liabilities |

102,964,277 | |||

| Total Net Assets | $ | 232,957,446 | ||

| Net Assets: | ||||

| Par value ($0.001 par value; 298,874 shares issued and outstanding; 100,000,000 shares authorized) |

$ | 299 | ||

| Paid-in capital in excess of par value |

303,548,136 | |||

| Undistributed net investment income |

1,336,810 | |||

| Accumulated net realized loss on investments |

(68,598,107) | |||

| Net unrealized depreciation on investments |

(3,329,692) | |||

| Total Net Assets | $ | 232,957,446 | ||

| Shares Outstanding | 298,874 | |||

| Net Asset Value | $779.45 | |||

See Notes to Financial Statements.

| 12 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

Statement of operations (unaudited)

For the Six Months Ended October 31, 2016

| Investment Income: | ||||

| Interest |

$ | 15,898,079 | ||

| Dividends |

27,968 | |||

| Total Investment Income |

15,926,047 | |||

| Expenses: | ||||

| Investment management fee (Note 2) |

1,967,814 | |||

| Interest expense (Note 6) |

503,332 | |||

| Legal fees |

75,139 | |||

| Audit and tax fees |

41,012 | |||

| Transfer agent fees |

36,540 | |||

| Shareholder reports |

31,915 | |||

| Directors’ fees |

29,215 | |||

| Fund accounting fees |

18,154 | |||

| Insurance |

2,404 | |||

| Custody fees |

1,204 | |||

| Miscellaneous expenses |

7,545 | |||

| Total Expenses |

2,714,274 | |||

| Net Investment Income | 13,211,773 | |||

| Realized and Unrealized Gain (Loss) on Investments (Notes 1 and 3): | ||||

| Net Realized Loss From Investment Transactions |

(11,516,519) | |||

| Change in Net Unrealized Appreciation (Depreciation) From Investments |

33,871,186 | |||

| Net Gain on Investments | 22,354,667 | |||

| Increase in Net Assets From Operations | $ | 35,566,440 | ||

See Notes to Financial Statements.

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 13 |

Table of Contents

Statements of changes in net assets

| For the Six Months Ended October 31, 2016 (unaudited) and the Year Ended April 30, 2016 |

2016 | 2016 | ||||||

| Operations: | ||||||||

| Net investment income |

$ | 13,211,773 | $ | 27,578,654 | ||||

| Net realized loss |

(11,516,519) | (49,926,430) | ||||||

| Change in net unrealized appreciation (depreciation) |

33,871,186 | (14,917,626) | ||||||

| Increase (Decrease) in Net Assets From Operations |

35,566,440 | (37,265,402) | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Net investment income |

(13,912,785) | (28,679,760) | ||||||

| Decrease in Net Assets From Distributions to Shareholders |

(13,912,785) | (28,679,760) | ||||||

| Fund Share Transactions: | ||||||||

| Reinvestment of distributions (1,674 and 2,898 shares issued, respectively) |

1,233,808 | 2,135,424 | ||||||

| Cost of shares repurchased through tender offer (15,458 and 7,993 shares repurchased, respectively) (Note 5) |

(11,525,260) | (5,343,720) | ||||||

| Decrease in Net Assets From Fund Share Transactions |

(10,291,452) | (3,208,296) | ||||||

| Increase (Decrease) in Net Assets |

11,362,203 | (69,153,458) | ||||||

| Net Assets: | ||||||||

| Beginning of period |

221,595,243 | 290,748,701 | ||||||

| End of period* |

$ | 232,957,446 | $ | 221,595,243 | ||||

| *Includes undistributed net investment income of: |

$1,336,810 | $2,037,822 | ||||||

See Notes to Financial Statements.

| 14 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

Statement of cash flows (unaudited)

For the Six Months Ended October 31, 2016

| Increase (Decrease) in Cash: | ||||

| Cash Provided (Used) by Operating Activities: | ||||

| Net increase in net assets resulting from operations |

$ | 35,566,440 | ||

| Adjustments to reconcile net increase in net assets resulting from operations |

||||

| Purchases of portfolio securities |

(103,756,482) | |||

| Sales of portfolio securities |

66,772,884 | |||

| Net purchases, sales and maturities of short-term investments |

(6,274,401) | |||

| Payment-in-kind |

(674,761) | |||

| Net amortization of premium (accretion of discount) |

(1,757,654) | |||

| Decrease in receivable for securities sold |

6,099,950 | |||

| Increase in interest receivable |

(195,789) | |||

| Increase in prepaid expenses |

(1,805) | |||

| Increase in payable for securities purchased |

8,514,700 | |||

| Increase in investment management fee payable |

72,872 | |||

| Decrease in Directors’ fees payable |

(1,105) | |||

| Increase in interest payable |

19,109 | |||

| Decrease in accrued expenses |

(54,278) | |||

| Net realized loss on investments |

11,516,519 | |||

| Change in net unrealized appreciation (depreciation) of investments |

(33,871,186) | |||

| Net Cash Used in Operating Activities* |

(18,024,987) | |||

| Cash Flows From Financing Activities: | ||||

| Distributions paid on common stock |

(12,678,977) | |||

| Increase in loan payable |

41,000,000 | |||

| Payment for shares repurchased through tender offer |

(11,525,260) | |||

| Net Cash Provided by Financing Activities |

16,795,763 | |||

| Net Decrease in Cash | (1,229,224) | |||

| Cash at Beginning of Period |

1,235,704 | |||

| Cash at End of Period |

$ | 6,480 | ||

| Non-Cash Financing Activities: | ||||

| Proceeds from reinvestment of distributions |

$ | (1,233,808) | ||

| * | Included in operating expenses is cash of $484,223 paid for interest on borrowings. |

See Notes to Financial Statements.

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 15 |

Table of Contents

| For a share of capital stock outstanding throughout each year ended April 30, unless otherwise noted: | ||||||||||||

| 20161,2 | 20161 | 20151,3 | ||||||||||

| Net asset value, beginning of period | $708.75 | $915.01 | $998.00 | 4 | ||||||||

| Income (loss) from operations: | ||||||||||||

| Net investment income |

42.97 | 86.64 | 50.82 | |||||||||

| Net realized and unrealized gain (loss) |

72.73 | (202.90) | (92.81) | |||||||||

| Total income (loss) from operations |

115.70 | (116.26) | (41.99) | |||||||||

| Less distributions from: | ||||||||||||

| Net investment income |

(45.00) | 5 | (90.00) | (41.00) | ||||||||

| Total distributions |

(45.00) | (90.00) | (41.00) | |||||||||

| Net asset value, end of period | $779.45 | $708.75 | $915.01 | |||||||||

| Total return, based on NAV6 |

16.76 | % | (12.74) | % | (4.11) | % | ||||||

| Net assets, end of period (000s) | $232,957 | $221,595 | $290,749 | |||||||||

| Ratios to average net assets: | ||||||||||||

| Gross expenses |

2.34 | %7 | 1.83 | % | 1.55 | %7 | ||||||

| Net expenses |

2.34 | 7 | 1.83 | 1.55 | 7 | |||||||

| Net investment income |

11.40 | 7 | 11.20 | 7.99 | 7 | |||||||

| Portfolio turnover rate | 22 | % | 39 | % | 29 | % | ||||||

| Supplemental data: | ||||||||||||

| Loan Outstanding, End of Period (000s) |

$94,000 | $53,000 | $53,000 | |||||||||

| Asset Coverage Ratio for Loan Outstanding8 |

348 | % | 518 | % | 649 | % | ||||||

| Asset Coverage, per $1,000 Principal Amount of Loan Outstanding8 |

$3,478 | $5,181 | $6,486 | |||||||||

| Weighted Average Loan (000s) |

$82,446 | $53,000 | $40,118 | 9 | ||||||||

| Weighted Average Interest Rate on Loan |

1.21 | % | 1.00 | % | 0.89 | %9 | ||||||

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended October 31, 2016 (unaudited). |

| 3 | For the period August 26, 2014 (commencement of operations) to April 30, 2015. |

| 4 | Initial public offering price of $1,000.00 per share, exclusive of sales load, less offering costs of $2.00 per share. |

| 5 | The actual source of the Fund’s current fiscal year distributions may be from net investment income, return of capital or a combination of both. Shareholders will be informed of the tax characteristics of the distributions after the close of the fiscal year. |

| 6 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | Annualized. |

| 8 | Represents value of net assets plus the loan outstanding at the end of the period divided by the loan outstanding at the end of the period. |

| 9 | Weighted average based on the number of days that the Fund had a loan outstanding. |

See Notes to Financial Statements.

| 16 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Western Asset Middle Market Income Fund Inc. (the “Fund”) was incorporated in Maryland on June 29, 2011 and is registered as a non-diversified, limited-term, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on August 26, 2014. The Fund’s primary investment objective is to provide high income. As a secondary objective, the Fund seeks capital appreciation. The Fund seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its managed assets (the net assets of the Fund plus the principal amount of any borrowings and any preferred stock that may be outstanding) in securities, including loans, issued by middle market companies. For investment purposes, “middle market” refers to companies with annual revenues of between $100 million and $1 billion at the time of investment by the Fund. Securities of middle market issuers are typically considered below investment grade (also commonly referred to as “junk bonds”). It is anticipated that the Fund will terminate on December 30, 2022. Upon its termination, it is anticipated that the Fund will have distributed substantially all of its net assets to stockholders, although securities for which no market exists or securities trading at depressed prices, if any, may be placed in a liquidating trust.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Short-term fixed income securities that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 17 |

Table of Contents

Notes to financial statements (unaudited) (cont’d)

or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

The Board of Directors is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Directors, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Directors. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Directors, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Directors quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — quoted prices in active markets for identical investments |

| 18 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

| • | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| ASSETS | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Long-term investments†: | ||||||||||||||||

| Corporate bonds & notes: |

||||||||||||||||

| Energy |

— | $ | 36,181,772 | $ | 613,350 | $ | 36,795,122 | |||||||||

| Industrials |

— | 64,288,418 | 1,983,171 | 66,271,589 | ||||||||||||

| Other corporate bonds & notes |

— | 162,496,940 | — | 162,496,940 | ||||||||||||

| Senior Loans: |

||||||||||||||||

| Consumer discretionary |

— | 10,387,764 | 1,766,250 | 12,154,014 | ||||||||||||

| Energy |

— | 3,974,321 | 568,839 | 4,543,160 | ||||||||||||

| Industrials |

— | 4,752,940 | 446,944 | 5,199,884 | ||||||||||||

| Utilities |

— | — | 4,266,415 | 4,266,415 | ||||||||||||

| Other senior loans |

— | 23,222,377 | — | 23,222,377 | ||||||||||||

| Common stocks |

— | 3,748,416 | — | 3,748,416 | ||||||||||||

| Convertible preferred stocks |

$ | 1,922,500 | — | — | 1,922,500 | |||||||||||

| Total long-term investments | $ | 1,922,500 | $ | 309,052,948 | $ | 9,644,969 | $ | 320,620,417 | ||||||||

| Short-term investments† | 6,274,401 | — | — | 6,274,401 | ||||||||||||

| Total investments | $ | 8,196,901 | $ | 309,052,948 | $ | 9,644,969 | $ | 326,894,818 | ||||||||

| † | See Schedule of Investments for additional detailed categorizations. |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| Corporate Bonds & Notes | ||||||||

| Investments in Securities | Energy | Industrials | ||||||

| Balance as of April 30, 2016 | — | $ | 1,872,444 | |||||

| Accrued premiums/discounts | — | 9,311 | ||||||

| Realized gain (loss)1 | — | — | ||||||

| Change in unrealized appreciation (depreciation)2 | — | 81,174 | ||||||

| Purchases | $ | 0 | * | 20,242 | ||||

| Sales | — | — | ||||||

| Transfers into Level 33 | 613,350 | — | ||||||

| Transfers out of Level 3 | — | — | ||||||

| Balance as of October 31, 2016 | $ | 613,350 | $ | 1,983,171 | ||||

| Net change in unrealized appreciation (depreciation) for investments in securities still held at October 31, 20162 |

— | $ | 81,174 | |||||

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 19 |

Table of Contents

Notes to financial statements (unaudited) (cont’d)

| Senior Loans | ||||||||||||||||||||||||||||||||

| Investments In Securities (cont’d) |

Consumer Discretionary |

Consumer Staples |

Energy | Health Care | Industrials | Materials | Utilities | Total | ||||||||||||||||||||||||

| Balance as of April 30, 2016 | $ | 519,750 | $ | 7,922,500 | $ | 4,453,871 | $ | 2,407,750 | — | $ | 693,550 | $ | 3,287,246 | $ | 21,157,111 | |||||||||||||||||

| Accrued premiums/discounts | 671 | 16,290 | 143,860 | 16,298 | — | 23,906 | 6,306 | 216,642 | ||||||||||||||||||||||||

| Realized gain (loss)1 | — | — | (2,133,567) | 4,567 | — | 15,836 | 312 | (2,112,852) | ||||||||||||||||||||||||

| Change in unrealized appreciation (depreciation)2 | 10,279 | (183,790) | 2,073,014 | 225,695 | — | 30,259 | 26,101 | 2,262,732 | ||||||||||||||||||||||||

| Purchases | 1,235,550 | — | 2,044,898 | — | — | 16,438 | 965,000 | 4,282,128 | ||||||||||||||||||||||||

| Sales | — | — | (2,038,916) | (421,992) | — | (779,989) | (18,550) | (3,259,447) | ||||||||||||||||||||||||

| Transfers into Level 33 | — | — | — | — | $ | 446,944 | — | — | 1,060,294 | |||||||||||||||||||||||

| Transfers out of Level 34 | — | (7,755,000) | (3,974,321) | (2,232,318) | — | — | — | (13,961,639) | ||||||||||||||||||||||||

| Balance as of October 31, 2016 | $ | 1,766,250 | — | $ | 568,839 | — | $ | 446,944 | — | $ | 4,266,415 | $ | 9,644,969 | |||||||||||||||||||

| Net change in unrealized appreciation (depreciation) for investments in securities still held at October 31, 20162 | $ | 10,279 | — | $ | 11,513 | — | — | — | $ | 26,101 | $ | 129,067 | ||||||||||||||||||||

The Fund’s policy is to recognize transfers between levels as of the end of the reporting period.

| * | Amount represents less than $1. |

| 1 | This amount is included in net realized gain (loss) from investment transactions in the accompanying Statement of Operations. |

| 2 | This amount is included in the change in net unrealized appreciation (depreciation) in the accompanying Statement of Operations. Change in unrealized appreciation (depreciation) includes net unrealized appreciation (depreciation) resulting from changes in investment values during the reporting period and the reversal of previously recorded unrealized appreciation (depreciation) when gains or losses are realized. |

| 3 | Transferred into Level 3 as a result of the unavailability of a quoted price in an active market for an identical investment or the unavailability of other significant observable inputs. |

| 4 | Transferred out of Level 3 as a result of the availability of a quoted price in an active market for an identical investment or the availability of other significant observable inputs. |

(b) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets

| 20 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(c) Loan participations. The Fund may invest in loans arranged through private negotiation between one or more financial institutions. The Fund’s investment in any such loan may be in the form of a participation in or an assignment of the loan. In connection with purchasing participations, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement related to the loan, or any rights of off-set against the borrower and the Fund may not benefit directly from any collateral supporting the loan in which it has purchased the participation.

The Fund assumes the credit risk of the borrower, the lender that is selling the participation and any other persons interpositioned between the Fund and the borrower. In the event of the insolvency of the lender selling the participation, the Fund may be treated as a general creditor of the lender and may not benefit from any off-set between the lender and the borrower.

(d) Unfunded loan commitments. The Fund may enter into certain credit agreements where all or a portion of which may be unfunded. The Fund is obligated to fund these commitments at the borrower’s discretion. The commitments are disclosed in the accompanying Schedule of Investments. At October 31, 2016, the Fund had sufficient cash and/or securities to cover these commitments.

(e) Cash flow information. The Fund invests in securities and distributes dividends from net investment income and net realized gains, which are paid in cash and may be reinvested at the discretion of shareholders. These activities are reported in the Statement of Changes in Net Assets and additional information on cash receipts and cash payments are presented in the Statement of Cash Flows.

(f) Foreign investment risks. The Fund’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(g) Credit and market risk. The Fund invests in high-yield and emerging market instruments that are subject to certain credit and market risks. The yields of high-yield and emerging market debt obligations reflect, among other things, perceived credit and market risks. The Fund’s investments in securities rated below investment grade typically involve

| Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report | 21 |

Table of Contents

Notes to financial statements (unaudited) (cont’d)

risks not associated with higher rated securities including, among others, greater risk related to timely and ultimate payment of interest and principal, greater market price volatility and less liquid secondary market trading. The consequences of political, social, economic or diplomatic changes may have disruptive effects on the market prices of investments held by the Fund. The Fund’s investments in non-U.S. dollar denominated securities may also result in foreign currency losses caused by devaluations and exchange rate fluctuations.

(h) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(i) Distributions to shareholders. Distributions from net investment income of the Fund, if any, are declared and paid on a quarterly basis. The actual source of the Fund’s current fiscal year distributions may be from net investment income, return of capital or a combination of both. Shareholders will be informed of the tax characteristics of the distributions after the close of the fiscal year. Distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(j) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(k) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of April 30, 2016, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

| 22 | Western Asset Middle Market Income Fund Inc. 2016 Semi-Annual Report |

Table of Contents

(l) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager. Western Asset Management Company (“Western Asset”) is the Fund’s subadviser. Western Asset Management Company Limited (“Western Asset Limited”), Western Asset Management Company Pte. Ltd. (“Western Singapore”) and Western Asset Management Company Ltd. (“Western Japan”) serve as an additional subadvisers to the Fund, pursuant to separate subadvisory agreements with Western Asset. LMPFA, Western Asset, Western Asset Limited, Western Singapore and Western Japan are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).