UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934

For the transition period from ________to __________

Commission file number: 000-55199

GLOBAL SEED CORPORATION

(Exact name of registrant as specified in its charter)

| Texas | 27-3028235 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

3906- 3907, Vanke ITC Center, Chang’an, Dongguan, China |

523845 | |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number, including area code: (852) 65533834

Securities Registered Under Section 12(b) of the Exchange Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Securities Registered Under Section 12(g) of the Exchange Act: Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☒ No ☐

The aggregate market value of voting common stock held by non-affiliates of the registrant as of December 31, 2018, the last business day of the registrant’s second fiscal quarter, was approximately $1,143,000.

The number of shares of common stock outstanding as of October 10, 2019 was 5,000,000.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

GLOBAL SEED CORPORATION

TABLE OF CONTENTS

FORM 10-K

INDEX

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements, including but not limited to statements regarding our projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond our control. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “will,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties we face that could cause our actual results to differ materially from those projected or anticipated, including but not limited to the following:

| ● | Our ability to timely and properly deliver our products and services among others; | |

| ● | Our dependence on a limited number of major customers and related parties; | |

| ● | Political and economic factors in China and its relationship with U.S.; | |

| ● | Our ability to expand and grow our lines of business; | |

| ● | Unanticipated changes in general market conditions or other factors which may result in cancellations or reductions in the need for our products and services; | |

| ● | The effect of terrorist acts, or the threat thereof, on consumer confidence and spending or the production and distribution of product and raw materials which could, as a result, adversely affect our services, operations and financial performance; | |

| ● | The acceptance in the marketplace of our new lines of services; | |

| ● | The foreign currency exchange rate fluctuations; | |

| ● | Our ability to identify and successfully execute cost control initiatives; and | |

| ● | Our ability to attract, retain and motivate skilled personnel; |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information. Nonetheless, the Company reserves the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this report. No such update shall be deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

ii

Business Overview

Global Seed Corporation (the “Company”) was incorporated in the State of Texas on July 13, 2010. We had been engaged principally in the distribution of a monthly journal prior to our change in control consummated on June 2, 2018.

On May 21, 2018, Leung Kwok Hei, Chi Siu On, Leung Siu Hung and Chan Hiu (collectively, the “Purchasers”) and various shareholders (the “Sellers”) of the Company entered into a share purchase agreement, pursuant which the Sellers transferred to the Purchasers an aggregate of 4,492,000 shares of common stock (the “Common Stock”) of the Company (such transaction, the “Share Purchase”). The Share Purchase was closed on June 1, 2018.

At the closing of the Share Purchase, there was a change in our board and executive officers. Ms. Jia Tian, the sole director, President, Treasurer and Secretary of the Company appointed Leung Kwok Hei to serve as a director and Chief Executive Officer and Chan Hiu as a director and Chief Financial Officer of the Company, with such appointment effective on June 1, 2018. Ms. Jia Tian resigned from all her positions with the Company effective on June 1, 2018.

Prior to our change in control, our product was the Global Seed Journal. It is a monthly journal published in Chinese for its presentation of Asian community news, advertising content, and articles written by contributors.

On October 1, 2019, the Company entered into a share exchange agreement (the “Share Exchange Agreement”) with Well Benefit International Limited (“Well Benefit”), a British Virgin Islands company, and all of the shareholders of Well Benefit (the “Shareholders”) to acquire all of the issued and outstanding capital stock of Well Benefit in exchange for the issuance to the Shareholders an aggregate of 252,874,025 shares of Common Stock (the “Reverse Merger”). The Reverse Merger is expected to be closed by the end of October 2019.

Dongguan Zhenghao Industrial Investment Company Limited (“Zhenghao”), a company formed under the laws of the People’s Republic of China, is a wholly-owned subsidiary of Well Benefit. Upon closing of the Reverse Merger, we plan to provide healthy coffee and beverage products to customers in China through Zhenghao under its established brand, “Ka Su Le”.

1

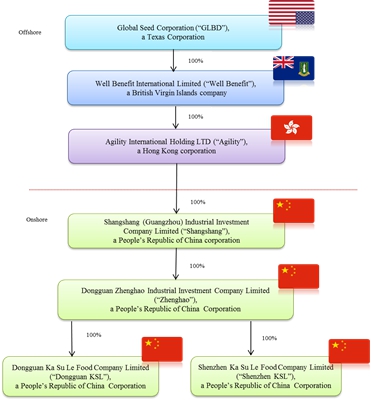

Corporate Structure

The Company currently does not have any subsidiary. Upon closing of the Reverse Merger, Well Benefit will become our wholly-owned subsidiary and we expect our new corporate structure to be as follows.

Sales and Marketing

Given our current stage of development, we have not yet established commercial organization or distribution capabilities. We plan to build up a national network after we close the Reverse Merger.

Competition

The coffee and health beverage industry we plan to be in is highly competitive and subject to rapid change. Key competitive factors affecting the commercial success of our products are likely to be store network, product quality and safety, product pricing, brand recognition and reputation and customer experience.

Employees

As of the date of this report, we do not have any employees, other than Mr. Leung Kwok Hei and Mr. Chan Hiu.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 1B. UNSOLVED STAFF COMMENTS.

None.

We maintained our principal office at 3906- 3907, Vanke ITC Center, Changan, Dongguan, China 523845. We believe that the condition of our principal office is satisfactory, suitable and adequate for current needs.

As of the date of this report, the Company is not a party to any legal proceeding that could reasonably be expected to have material impact on its operations or finances.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

2

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our common stock is currently quoted on the OTC Pink tier of the OTC Markets Group, an inter-dealer quotation and trading system under the symbol “GLBD”. These quotations reflect inter-dealer prices without retail mark-up, mark-down or commissions and may not reflect actual transactions.

Holders of Our Common Stock

As of October 10, 2019, we had 16 holders of record of our common stock. There were 5,000,000 shares issued and outstanding.

Outstanding Options, Conversions, and Planned Issuance of Common Stock.

As of October 10, 2019, there were no warrants or options outstanding to acquire any shares of our common stock.

Dividends and Related Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our future dividend policy will be determined from time to time by our board of director.

Transfer Agent and Registrar

Our transfer agent is OTR, Inc., located at 1050 SW 6th Ave, Ste. 1230, Portland, OR 97204. Their telephone number is (503)2250375.

Recent Sales of Unregistered Securities

We did not sell any equity securities which were not registered under the Securities Act during the year ended June 30, 2019. As disclosed above, on October 1, 2019, the Company entered into a Share Exchange Agreement with Well Benefit and the Shareholders of Well Benefit to acquire all of the issued and outstanding capital stock of Well Benefit in exchange for the issuance to the Shareholders an aggregate of 252,874,025 shares of Common Stock. The Reverse Merger is expected to be closed by the end of October 2019.

Upon issuing these securities to the Shareholders, we will claim an exemption from the registration requirements of the Securities Act of 1933, as amended for the offering of the shares of our common stock to them pursuant to Regulation S promulgated thereunder

Purchases of Equity Securities by the Issuer and Affiliated Purchasers.

None.

Item 6. Selected Financial Data.

Not applicable.

3

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following is management’s discussion and analysis of certain significant factors which have affected our financial position and operating results during the periods included in the accompanying financial statements, as well as information relating to the plans of our current management and should be read in conjunction with the accompanying financial statements and their related notes included in this report. References in this section to “we,” “us,” “our,” or the “Company” are to Global Seed Corporation.

The management’s discussion and analysis contains forward-looking statements. Generally, the words “believes,” “anticipates,” “may,” “will,” “should,” “expects,” “intends,” “estimates,” “continues,” “project,” “goal,” “seek,” “strategy,” “future,” “likely,” and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, including the matters set forth in this report or other reports or documents we file with the SEC from time to time, which could cause actual results or outcomes to differ materially from those projected. Undue reliance should not be placed on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to update these forward-looking statements unless required by the applicable rules and regulations.

BUSINESS OVERVIEW

Global Seed Corporation was incorporated in the State of Texas on July 13, 2010. We had been engaged principally in the distribution of a monthly journal prior to our change in control consummated on June 2, 2018. As discussed above, on October 1, 2019, we entered into a Share Exchange Agreement with a British Virgin Islands company and its shareholders to acquire all of its issued and outstanding shares. Upon closing of the Reverse Merger, we plan to engage in the business of selling coffee and other healthy beverage products.

Given our current stage of development, we have not yet established commercial organization or distribution capabilities. We plan to build up a national network for selling coffee and other healthy beverage products after we close the Reverse Merger.

CRITICAL ACCOUNTING POLICIES, ESTIMATES AND ASSUMPTIONS

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with the generally accepted accounting principles in the United States of America (“U.S. GAAP”). The preparation of our financial statements in conformity with U.S. GAAP requires our management to make estimates and assumptions that affect the amounts reported in our financial statements and accompanying notes. Actual results could differ materially from those estimates.

Our audited financial statements and the notes thereto contain more details of critical accounting policies and other disclosures required by U.S. GAAP.

RESULTS OF OPERATIONS

Revenue

No revenue was generated for the years ended June 30, 2019 and 2018.

General and Administrative Expenses

General and administrative expenses for the years ended June 30, 2019 and 2018 amounted to $47,662 and $10,611, respectively. The general and administrative expenses for the two periods primarily represent professional fees incurred for SEC filings.

Net Loss

For the years ended June 30, 2019 and 2018, net losses were $47,756 and $12,932 respectively. The Company continues to carefully control its expenses and overall costs as it moves its business development plan forward.

4

PLAN OF OPERATION

As of June 30, 2019, we had a stockholders’ deficiency of $47,530.

We have not generated any revenues and have relied on shareholder advances to finance our operating and capital expenses. We have incurred operating losses since inception. The working capital requirements of any new business activities may be substantial and may depend on the terms of our potential acquisitions, whether for stock, debt or cash, or a combination, as appropriate.

As discussed above, we are expecting to close the Reverse Merger by the end of October 2019, upon which we plan to engage in the business of selling coffee and other healthy beverage products. However, there can be no assurance that the closing will happen as planned, or at all.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2019, we had no assets. We do not have any third-party banking or financing agreements in place to provide us with a source of liquidity.

GOING-CONCERN CONSIDERATION

Our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

The Company’s financial statements are prepared using U.S. GAAP to a going concern, which contemplates the realization of assets and liquidation as of liabilities in the normal course of business. The Company has accumulated losses of $128,125 as of June 30, 2019. The Company had no cash at June 30, 2019. Management’s plans to continue as a going concern include raising additional capital through sales of Common Stock and to consummate the Reverse Merger. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described above and eventually secure other sources of financing and attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

OFF-BALANCE SHEET ARRANGEMENTS

The Company has no material transactions, arrangements, obligations or other relationships with entities or other persons that have or are reasonably likely to have a material current or future impact on its financial condition, changes in financial condition, results of operations, liquidity, capital expenditures, capital resources, or significant components of revenues or expenses, other than those disclosed above.

5

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOURES ABOUT MARKET RISK.

Not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company’s financial statements and the related notes, together with the report of WWC, P.C., are set forth following the signature pages of this report.

ITEM 9. CHANGE IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

None.

ITEM 9A. CONTROLS AND PROCEDURES

We maintain disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) that are designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC. This information is accumulated to allow our management to make timely decisions regarding required disclosure. In designing and evaluating our disclosure controls and procedures, our management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and our management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Our management, including our principal executive officer and principal accounting officer, does not expect that our disclosure controls or our internal controls over financial reporting will prevent all error and fraud. A control system, no matter how well conceived and operated, can provide only reasonable, but not absolute, assurance that the objectives of a control system are met. Further, any control system reflects limitations on resources and the benefits of a control system must be considered relative to its costs. These limitations also include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people or by management override of a control. The design of a control system is also based upon certain assumptions about potential future conditions; over time controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

As of June 30, 2019, the year covered by this report, we carried out an evaluation, under the supervision and participation of our management, including our principal executive officer and our principal financial officer, to determine the effectiveness of the design and operation of our disclosure controls and procedures. Based on the foregoing, our Chief Financial Officer concluded that our disclosure controls and procedures were not effective as of the end of the year covered by this report.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (“ICFR”) as defined in Rule 13a-15(f) under the Exchange Act. Our management assessed the effectiveness of our ICFR as of June 30, 2019. In making this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework in 2013 (the “2013 COSO Framework”). A material weakness is a deficiency or a combination of deficiencies, in ICFR, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. We have identified the following material weaknesses.

6

| 1. | As of June 30, 2019, we did not maintain effective controls over the control environment. Specifically, we have not developed a framework for accounting policies and procedures given we have only one officer, Further, the Board of Directors does not currently have any independent members and no director qualifies as an audit committee financial expert as defined in Item 407(d)(5)(ii) of Regulation S-K. Since these entity level programs have a pervasive effect across the organization, management has determined that these circumstances constitute a material weakness. |

| 2. | As of June 30, 2019, we did not maintain effective controls over financial statement disclosure. Specifically, controls were not designed and in place to ensure that all disclosures required were originally addressed in our financial statements. Accordingly, management has determined that this control deficiency constitutes a material weakness. |

Because of these material weaknesses, our Chief Financial Officer has concluded that the Company did not maintain effective internal control over financial reporting as of June 30, 2019, based on the criteria established in 2013 COSO Framework. Due to the size and operations of the Company, we are unable to remediate these deficiencies until we acquire or merge with another company.

The Company believes that the financial statements fairly present, in all material respects, the Company’s balance sheets as of June 30, 2019 and 2018 and the related statements of operations and comprehensive loss, stockholders’ deficiency, and cash flows for the years ended June 30, 2019 and 2018 in conformity with U.S. GAAP, notwithstanding the material weaknesses we identified.

This annual report on Form 10-K does not include an attestation report of the Company’s registered public accounting firm regarding ICFR. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act that permit the Company to provide only management’s report in this report.

Changes in Internal Control Over Financial Reporting

There had been no changes in the Company’s ICFR identified in connection with the above evaluation that occurred during the last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the Company’s ICFR.

None.

7

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERANCE

Information about our directors and executive officers as of the date of this report is set forth as follows.

| Name | Position Held with our Company |

Age | Date First Elected or Appointed | |||

| Leung Kwok Hei | Director & CEO | 33 | June 1, 2018 | |||

| Chan Hiu | Director & CFO | 46 | June 1, 2018 |

Leung Kwok Hei, director and CEO

Mr. Leung, age 33, has been serving as Chief Operating Officer of Zheng Gong Trading Ltd Co in DongGuan, China since 2016. Prior to that, He was a sales manager of Amadio Wines China at Dongguan, China from 2013 to 2016 and an assistant manager of Vancouver Chinatown Merchants Association from 2006 to 2011. Mr. Leung studied Criminology in Simon Fraser University at Vancouver, BC.

Chan Hiu, director and CFO

Mr. Chan, age 46, has been serving as Financial Controller of Zheng Gong Trading Ltd Co in DongGuan, China since 2016. Mr. Chan was a financial advisor of Shenzhen Long Fu Capital based in Shenzhen, China from 2009 to 2016, and he consulted with clients for financial needs and helped them develop marginal investment plans. Prior to that, He was an owner and financial controller of Motoring Concept Distribution in Orlando, Florida from 2001 and 2008. Mr. Chan received his Bachelor of Business Accounting degree from University of Central Florida in Orlando, Florida in 2000.

Meetings of Our Board of Directors

Our board of directors (the “Board”) took all actions by written consent during the years ended June 30, 2019.

Significant Employees

Other than the director and officer described above, we do not expect any other individuals to make a significant contribution to our business.

Involvement in Legal Proceedings

None of our directors, persons nominated to become a director, executive officers or control persons have been involved in any of the following events during the past 10 years:

| ● | Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of bankruptcy or within two years prior to that time; or |

| ● | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offences); or |

| ● | Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| ● | Being found by a court of competent jurisdiction (in a civil violation), the SEC or the Commodity Future Trading Commission to have violated a federal or state securities or commodity law, and the judgment has not been reversed, suspended, or vacated; or |

| ● | Being the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: any Federal or State securities or commodities law or regulation; or any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity. This violation does not apply to any settlement of a civil proceeding among private litigants; or |

| ● | Being the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

8

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires that our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater-than-ten percent stockholders are required by SEC regulations to furnish us with all Section 16(a) forms they file. Based solely on our review of the copies of the forms received by us and written representations from certain reporting persons that they have complied with the relevant filing requirements, we believe that, during the year ended June 30, 2019, Mr. Leung Kwok Hei, Mr. Chan Hiu, Mr. Leung Siu Hung and Ms. Chi Siu On filed their respective Form 3 on July 12, 2018, subsequent to the triggering date of June 1, 2018.

Code of Ethics

We currently do not have a Code of Ethics because we presently only have limited size of the Board and management. We plan to adopt a Code of Ethics when the size of the Board and management increases.

Board Committees

The Company does not have an audit committee or an audit committee financial expert (as defined in Item 407 of Regulation S-K) serving on its Board. The Company has not yet employed an audit committee financial expert on its Board due to the inability to attract such a person.

The Company intends to establish an audit committee of the Board, which will consist of independent directors. The audit committee’s duties will be to recommend to the Company’s Board the engagement of an independent registered public accounting firm to audit the Company’s financial statements and to review the Company’s accounting and auditing principles. The audit committee will review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent registered public accounting firm, including their recommendations to improve the system of accounting and internal controls. The audit committee will at all times be composed exclusively of directors who are, in the opinion of the Company’s Board, free from any relationship which would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

9

ITEM 11. EXECUTIVE COMPENSATION

Summary Compensation Table

The Summary Compensation Table shows certain compensation information for services rendered in all capacities for the fiscal year ended June 30, 2019 and 2018. No executive officer’s salary and bonus exceeded $100,000 in any of the applicable years. The following information includes the dollar value of base salaries, bonus awards, the number of stock options granted and certain other compensation, if any, whether paid or deferred.

| Name and Principal Position |

Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||

| Leung Kwok Hei, CEO | 2019 | -0- | -0- | -0- | -0- | -0- | -0- | -0- | -0- | |||||||||||||||||||||||||

| 2018 | -0- | -0- | -0- | -0- | -0- | -0- | -0- | -0- | ||||||||||||||||||||||||||

| Chan Hiu, CFO | 2019 | -0- | -0- | -0- | -0- | -0- | -0- | -0- | -0- | |||||||||||||||||||||||||

| 2018 | -0- | -0- | -0- | -0- | -0- | -0- | -0- | -0- | ||||||||||||||||||||||||||

Director Compensation

Directors are permitted to receive fixed fees and other compensation for their services as directors. The Board has the authority to fix the compensation of directors. No amounts have been paid to, or accrued to, directors in such capacity as of the date of this report.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The following table sets forth certain information regarding beneficial ownership of shares of our common stock as of October 10, 2019, by (i) each person known to beneficially own more than 5% of our outstanding common stock, (ii) each of our directors, (iii) each of our named executive officers, and (iv) all of our directors and executive officers as a group. Except as otherwise indicated, the persons named in the table below have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws, where applicable.

| Title of Class | Beneficiary Owner (1) | Number of Shares | % of Ownership (1) | |||||||

| Executive Officers and Directors | ||||||||||

| Common Stock | Leung Kwok Hei | 789,000 | 15.8 | % | ||||||

| Common Stock | Chan Hiu | 789,000 | 15.8 | % | ||||||

| All Officers and Directors (2 persons) | 1,578,000 | 31.6 | % | |||||||

| Owner of more than 5% of Class | ||||||||||

| Common Stock | Leung Siu Hung | 789,000 | 15.8 | % | ||||||

| Common Stock | Chi Siu On | 2,125,000 | 42.5 | % | ||||||

| (1) | Each beneficial owner has sole power to vote and dispose of its shares and the address of each beneficial owner is 3906- 3907, Vanke ITC Center, Chang’an, Dongguan, China 523845. |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

There were no related transactions with our director, executive officer, or stockholder holding at least 5% of shares of our common stock, or any family member thereof during the years ended June 30, 2019 and 2018 that exceeds $120,000.

As disclosed above, on October 1, 2019, the Company entered into a Share Exchange Agreement with Well Benefit and the Shareholders of Well Benefit to acquire all of the issued and outstanding capital stock of Well Benefit in exchange for the issuance to the Shareholders an aggregate of 252,874,025 shares of Common Stock. Mr. Leung Kwok Hei and Mr. Chan Hiu are among the Shareholders and will respectively receive 10,880,000 shares and 10,090,000 shares of Common Stock of the Company upon closing of the Reverse Merger in accordance with the Share Exchange Agreement.

10

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

On August 12, 2019, we dismissed M&K CPAS, PLLC (“M&K”) as our independent registered public accounting firm and on the same date, we engaged WWC, P.C. (“WWC”) as our new independent registered public accounting firm.

The following table shows the fees that we paid for audit and other services provided by M&K, our former independent registered public accounting firm, for fiscal years 2019 and 2018.

| Fiscal 2019 | Fiscal 2018 | |||||||

| Audit Fees | $ | 2,000 | $ | 4,000 | ||||

| Audit-Related Fees | $ | 2,500 | $ | 3,750 | ||||

| Tax Fees | — | — | ||||||

| All Other Fees | — | — | ||||||

| Total | $ | 4,500 | $ | 7,750 | ||||

The following table shows the fees that we paid for audit and other services provided by WWC for fiscal years 2019 and 2018.

| Fiscal 2019 | Fiscal 2018 | |||||||

| Audit Fees | $ | 8,277 | $ | — | ||||

| Audit-Related Fees | — | — | ||||||

| Tax Fees | — | — | ||||||

| All Other Fees | — | — | ||||||

| Total | $ | 8,277 | $ | — | ||||

The Company does not currently have a separate audit committee. Rather, the Board serves as the audit committee. Our Board has reviewed and approved the above fees and believes such fees are compatible with the independent registered public accountants’ independence.

11

PART IV

(a)(1) Financial Statements

See “Index to Financial Statements” set forth following the signature paged of this report.

(a)(2) Financial Statement Schedules

None. The financial statement schedules are omitted because they are inapplicable or the requested information is shown in our financial statements or related notes thereto.

Exhibits

The following exhibits of the Company are included herein.

| * | Filed herewith. |

12

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GLOBAL SEED CORPORATION |

Date: October 15, 2019

| BY: | /s/ Leung Kwok Hei | |

| Leung Kwok Hei | ||

| Chief Executive Officer | ||

| (Principal Executive Officer) |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| BY: | /s/ Leung Kwok Hei | Director and Chief Executive Officer | Date: October 15, 2019 | ||

| Leung Kwok Hei | (Principal Executive Officer) | ||||

| BY: | /s/ Chan Hiu | Chief Financial Officer | Date: October 15, 2019 | ||

| Chan Hiu | (Principal Executive Officer and Principal Financial Officer) |

13

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| To: | The Board of Directors and Stockholders of |

GLOBAL SEED CORPORATION

Opinion on the Financial Statements

We have audited the accompanying balance sheets of GLOBAL SEED CORPORATION (the “Company”) as of June 30, 2019, and the related statements of operations, stockholders’ equity, and cash flows for the year ended June 30, 2019, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2019, and the results of its operations and its cash flows for the year ended June 30, 2019, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company had incurred substantial losses and has a working capital deficit, which raises substantial doubt about its ability to continue as a going concern. Management’s plan in regards to these matters are also described in Note 9 These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ WWC, P.C.

WWC, P.C.

Certified Public Accountants

We have served as the Company’s auditor since August 12, 2019

San Mateo, California

October 15, 2019

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Global Seed, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheet of Global Seed Corporation (the Company) as of June 30, 2018 and the related statements of operations, stockholders’ equity (deficit), and cash flows for the period ended June 30, 2018 and the related notes and schedules (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30, 2018 and the results of its operations and its cash flows for the year ended June 30, 2018, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company suffered losses from operations which raise substantial doubt about its ability to continue as a going concern. Managements plans regarding those matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ M&K CPAS, PLLC

We have served as the Company’s auditor since 2017.

Houston, TX

October 12, 2018

F-2

GLOBAL SEED CORPORATION

Balance Sheets

(Audited)

| June 30, 2019 |

June 30, 2018 |

|||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and Cash Equivalent | $ | - | $ | 132 | ||||

| Prepaid expenses | $ | 10,094 | $ | - | ||||

| TOTAL ASSETS | $ | 10,940 | $ | 132 | ||||

| LIABILITIES AND STOCKHOLDER’S DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accrual | 15,500 | - | ||||||

| Due to related party | $ | 42,124 | $ | - | ||||

| TOTAL LIABILITIES | 57,624 | - | ||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Preferred Stock 9,989,886,988, par Value $0.0001; -0- issued and outstanding | ||||||||

| Common Stock 8,999,886,999 shares authorized: $0.0001 par value; 5,000,000 shares issued and Outstanding as of June 30, 2019 and 2018 | 500 | 500 | ||||||

| Additional Paid-in Capital | 80,095 | 80,001 | ||||||

| Accumulated Deficit | (128,125 | ) | (80,369 | ) | ||||

| Total stockholders’ Equity | (47,530 | ) | 132 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 10,940 | $ | 132 | ||||

The accompanying notes are an integral part of these financial statements

F-3

GLOBAL SEED CORPORATION

Statements of Operations

(Audited)

| Year Ended June 30, 2019 |

Year Ended June 30, 2018 |

|||||||

| OPERATING EXPENSES: | ||||||||

| General and Administrative Expenses | $ | 47,662 | $ | 10,611 | ||||

| Total Operating Expenses | 47,662 | 10,611 | ||||||

| Loss from Operations | (47,662 | ) | (10,611 | ) | ||||

| Imputed Interest | 94 | 2,321 | ||||||

| Net Loss | $ | (47,756 | ) | $ | (12,932 | ) | ||

| Loss per Common Shares -Basic and Diluted | $ | (0.00 | ) | $ | (0.00 | ) | ||

| Weight Average Number of Shares outstanding-Basic and Diluted | 5,000,000 | 5,000,000 | ||||||

The accompanying notes are an integral part of these financial statements

F-4

GLOBAL SEED CORPORATION

Statements of Cash Flows

(Audited)

| Year Ended June 30, 2019 |

Year Ended June 30, 2018 |

|||||||

| OPERATING ACTIVITIES: | ||||||||

| Net Loss | $ | (47,756 | ) | $ | (12,932 | ) | ||

| Adjustments to reconcile net loss to net cash used by operating activities: | ||||||||

| Imputed Interest | 94 | 2,321 | ||||||

| Change in operating assets and liabilities: | ||||||||

| Prepaid expenses | (10,094 | ) | - | |||||

| Accrual | 15,500 | - | ||||||

| Forgiveness of Due to Related Party | - | 26,700 | ||||||

| Due to Related Party | 42,124 | (16,200 | ) | |||||

| Cash used in operating activities | (132 | ) | (111 | ) | ||||

| Net decrease in cash | (132 | ) | (111 | ) | ||||

| Cash at Beginning of Year: | 132 | 243 | ||||||

| Cash at End of Year: | $ | - | $ | 132 | ||||

| Supplemental Cash Flow Disclosure: | ||||||||

| Interest Paid | $ | - | $ | - | ||||

| Taxes paid | $ | - | $ | - | ||||

The accompanying notes are an integral part of these financial statements

F-5

GLOBAL SEED CORPORATION

Statements of Stockholders’ Equity

Years ended June 30, 2019 and 2018

(Audited)

| Common shares | Common Stock |

Additional Paid-in Capital |

Accumulated Deficit |

Total | ||||||||||||||||

| Balance on June 30, 2017 | 5,000,000 | $ | 500 | $ | 50,980 | $ | (67,437 | ) | $ | (15,957 | ) | |||||||||

| Forgiveness of debt Due to Related Party | - | - | 26,700 | - | 26,700 | |||||||||||||||

| Imputed Interest | - | - | 2,321 | - | 2,321 | |||||||||||||||

| Net Loss | - | - | - | (12,932 | ) | (12,932 | ) | |||||||||||||

| Balance on June 30, 2018 | 5,000,000 | 500 | 80,001 | (80,369 | ) | 132 | ||||||||||||||

| Imputed Interest | - | - | 94 | - | 94 | |||||||||||||||

| Net Loss | - | - | - | (47,756 | ) | (47,756 | ) | |||||||||||||

| Balance on June 30, 2019 | 5,000,000 | $ | 500 | $ | 80,095 | $ | (128,125 | ) | $ | (47,530 | ) | |||||||||

The accompanying notes are an integral part of these financial statements

F-6

NOTE 1 – BUSINESS AND CONTINUED OPERATIONS

ORGANIZATION

Global Seed Corporation (the “Company”) was incorporated on July 13, 2010 in the State of Texas. The initial operations of the Company included organization and incorporation, target market identification, new business development, marketing plans, fund raising, and capital formation. A substantial portion of the Company’s activities had involved developing a business plan and establishing contacts and visibility in the Asian communities in Houston, Texas. Prior to the change in control on June 2, 2018, the Company was a publishing company that publishes a monthly journal called the Global Seed Journal. On October 1, 2019, the Company entered into a share exchange agreement with a British Virgin Islands company and its shareholders to acquire all of its issued and outstanding shares. Upon closing of the share exchange agreement, the Company plans to engage in the business of selling coffee and other healthy beverage products.

The fiscal year end of the Company is June 30.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying financial statements for Global Seed Corporation have been prepared in accordance with accounting principles generally accepted in the United States of America and in accordance with Regulation S-X promulgated by the Securities and Exchange Commission.

USE OF ESTIMATES

The preparation of the Company’s financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

F-7

FAIR VALUE MEASUREMENTS

The Company adopted the provisions of ASC Topic 820, “Fair Value Measurements and Disclosures”, which defines fair value as used in numerous accounting pronouncements, establishes a framework for measuring fair value and expands disclosure of fair value measurements.

The estimated fair value of certain financial instruments, including cash and cash equivalents, deposits, prepaid expenses, notes payable, and accrued expenses are carried at historical cost basis, which approximates their fair values because of the short-term nature of these instruments. The Company has no other financial instruments.

ASC 820 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 describes three levels of inputs that may be used to measure fair value:

* level l - quoted prices in active markets for identical assets or liabilities

* level 2 - quoted prices for similar assets and liabilities in active markets or inputs that are observable

* level 3 - inputs that are unobservable (for example cash flow modeling inputs based on assumptions)

INCOME TAXES

The Company utilizes FASB ASC 740, “Income Taxes,” which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the difference between the tax basis of assets and liabilities and their financial reporting amounts based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. A valuation allowance is recorded when in the opinion of management, it is “more likely-than-not” that a deferred tax asset will not be realized.

F-8

BASIC AND DILUTED NET LOSS PER SHARE

Net loss per share is calculated in accordance with ASC 260, Earnings Per Share, for the period presented. Basic net loss per share is based upon the weighted average number of common shares outstanding. Diluted net loss per share is based on the assumption that all dilative convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

As of June 30, 2019 and 2018, the Company had no potentially dilutive securities.

NOTE 3 – GOING CONCERN

The Company’s financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation as of liabilities in the normal course of business. The Company has accumulated deficit of $128,125 as of June 30, 2019. Management’s plans to continue as a going concern include raising additional capital through sales of common stock and consummate the Reverse Merger as defined under Note 9 herein. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described above and eventually secure other sources of financing and attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

F-9

NOTE 4 – RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In May, 2016, the Financial Accounting Standards Board (the “FASB”) issued ASU No.2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients. The amendments in this Update affect the guidance in Accounting Standards Update 2014-09, Revenue from Contracts with Customers (Topic 606), which is not yet effective. The effective date and transition requirements for the amendments in this Update are the same as the effective date and transition requirements for Topic 606 (and any other Topic amended by Update 2014-09). Accounting Standards Update 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, defers the effective date of Update 2014-09 by one year.

August 2014, the FASB issued ASU 2014-15, “Presentation of Financial Statements – Going Concern (Topic 205-40)”, which requires management to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern for each annual and interim reporting period. If substantial doubt exists, additional disclosure is required. This new standard is effective for the Company for annual and interim periods beginning after December 15, 2016.

NOTE 5 – DEFERED INCOME TAX

The Company maintains deferred tax assets and liabilities that reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The deferred tax assets at June 30, 2019 and 2018 consist of net operating loss carryforwards. The net deferred tax asset has been fully offset by a valuation allowance because of the uncertainty of the attainment of future taxable income. The items accounting for the difference between income taxes at the effective statutory rate and the provision for income taxes for the year ended June 30, 2019 and 2018 were as follows:

| Year Ended June 30, 2019 |

Year Ended June 30 2018 |

|||||||

| Income tax benefit at statutory rate | $ | 26,399 | $ | 16,390 | ||||

| Total Provision for income tax | $ | 26,399 | $ | 16,390 | ||||

F-10

The Company’s approximate net deferred tax asset as of June 30, 2019 and 2018 was as follows:

| June 30, 2019 |

June 30, 2018 |

|||||||

| Deferred Tax Asset: | ||||||||

| Net Operating Loss Carryforward | $ | 125,710 | $ | 78,048 | ||||

| Valuation Allowance | (125,710 | ) | (78,048 | ) | ||||

| Net deferred tax asset | $ | - | $ | - | ||||

The net operating loss carryforward was $125,710 at June 30, 2019. The Company provided a valuation allowance equal to the deferred income tax asset for the years ended June 30, 2019 and 2018 because it was not known whether future taxable income will be sufficient to utilize the loss carryforward. The allowance was $125,710 at June 30, 2019. The potential tax benefit arising from the loss carryforward will expire in 2037.

Additionally, the future utilization of the net operating loss carryforward to offset future taxable income may be subject to an annual limitation as a result of ownership changes that could occur in the future. If necessary, the deferred tax assets will be reduced by any carryforward that expires prior to utilization as a result of such limitations, with a corresponding reduction of the valuation allowance.

The Company does not have any uncertain tax positions or events leading to uncertainty in a tax position.

The Company’s income tax rate computed at the statutory federal rate of 21%, applied to our net operating loss carryforward of $125,710 provided a deferred tax asset of $26,399 which will begin to expire in 2037 unless utilized first. An allowance of $26,399 has been established, since it is more likely than not that some or all of the deferred tax credit will not be realized.

NOTE 6 – COMMITMENTS AND CONTINGENCIES

The Company does not have any commitments nor contingencies.

NOTE 7 – RELATED PARTY TRANSACTIONS

There was $42,124 in due to related party liability at June 30, 2019. The Company imputed interest of $94 and $2,321 respectfully for the years ended June 30, 2019 and 2018. During the year ended June 30, 2018, $26,700 was forgiven resulting in an increase in additional paid in capital and decrease due to related parties of $26,700.

NOTE 8 – LITIGATION

There were no legal proceedings against the Company with respect to matters arising in the ordinary course of business. Neither the Company nor any of its officers or directors is involved in any other litigation either as plaintiffs or defendants, and have no knowledge of any threatened or pending litigation against them or any of the officers or directors.

NOTE 9 – SUBSEQUENT EVENTS

On October 1, 2019, the Company entered into a share exchange agreement with Well Benefit International Limited (“Well Benefit”), a British Virgin Islands company, and all of the shareholders of Well Benefit (the “Shareholders”) to acquire all of the issued and outstanding capital stock of Well Benefit in exchange for the issuance to the Shareholders an aggregate of 252,874,025 shares of common stock of the Company (the “Reverse Merger”). The Reverse Merger is expected to be closed by the end of October 2019.

F-11