Document

false--12-31FY20162016-12-310001524472YesLarge Accelerated FilerNoYesP16YP1YP7YP5YP3YP25YP10YP18YP4Y33000000300000000.017500000007500000001902000001914000000.00590.00354000000005000000000.043750.0325P11YP5YP12Y400000010000000.30.400.60.60.1500.200.20.20P2YP1Y10M24DP1Y8M12DP5YP5YP12YP14YP16YP25YP1Y001100000001600000P40YP5YP10YP2YP7YP3YP10YP2YP3Y045.34P5Y7M6DP5Y6M29DP5Y7M6DP5Y8M12DP6Y9M18DP6Y10M24DP6Y10M24D11800000119000000P5Y2000000008000000003.50P6M<div>Text selection found with no content.<br></div>

0001524472

2016-01-01

2016-12-31

0001524472

2016-06-30

0001524472

2017-02-17

0001524472

2014-01-01

2014-12-31

0001524472

2015-01-01

2015-12-31

0001524472

2015-12-31

0001524472

2016-12-31

0001524472

2014-12-31

0001524472

2013-12-31

0001524472

us-gaap:RetainedEarningsMember

2013-12-31

0001524472

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-12-31

0001524472

us-gaap:CommonStockMember

2016-12-31

0001524472

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:RetainedEarningsMember

2016-01-01

2016-12-31

0001524472

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2014-12-31

0001524472

us-gaap:RetainedEarningsMember

2016-12-31

0001524472

us-gaap:TreasuryStockMember

2015-01-01

2015-12-31

0001524472

us-gaap:AdditionalPaidInCapitalMember

2014-01-01

2014-12-31

0001524472

us-gaap:RetainedEarningsMember

2015-01-01

2015-12-31

0001524472

us-gaap:AdditionalPaidInCapitalMember

2015-01-01

2015-12-31

0001524472

us-gaap:NoncontrollingInterestMember

2014-12-31

0001524472

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

us-gaap:AdditionalPaidInCapitalMember

2016-12-31

0001524472

us-gaap:TreasuryStockMember

2015-12-31

0001524472

us-gaap:RetainedEarningsMember

2015-12-31

0001524472

us-gaap:TreasuryStockMember

2016-01-01

2016-12-31

0001524472

us-gaap:TreasuryStockMember

2016-12-31

0001524472

us-gaap:RetainedEarningsMember

2014-12-31

0001524472

us-gaap:AdditionalPaidInCapitalMember

2013-12-31

0001524472

us-gaap:TreasuryStockMember

2013-12-31

0001524472

us-gaap:CommonStockMember

2013-12-31

0001524472

us-gaap:NoncontrollingInterestMember

2016-12-31

0001524472

us-gaap:TreasuryStockMember

2014-01-01

2014-12-31

0001524472

us-gaap:CommonStockMember

2015-12-31

0001524472

us-gaap:AdditionalPaidInCapitalMember

2016-01-01

2016-12-31

0001524472

us-gaap:NoncontrollingInterestMember

2013-12-31

0001524472

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:RetainedEarningsMember

2014-01-01

2014-12-31

0001524472

us-gaap:NoncontrollingInterestMember

2016-01-01

2016-12-31

0001524472

us-gaap:CommonStockMember

2014-12-31

0001524472

us-gaap:NoncontrollingInterestMember

2015-12-31

0001524472

us-gaap:AdditionalPaidInCapitalMember

2015-12-31

0001524472

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-12-31

0001524472

us-gaap:TreasuryStockMember

2014-12-31

0001524472

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2013-12-31

0001524472

us-gaap:AdditionalPaidInCapitalMember

2014-12-31

0001524472

xyl:ForeignCurrencyMember

2015-12-31

0001524472

xyl:ForeignCurrencyMember

2016-12-31

0001524472

us-gaap:FurnitureAndFixturesMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

us-gaap:BuildingAndBuildingImprovementsMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

us-gaap:FurnitureAndFixturesMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

us-gaap:EquipmentLeasedToOtherPartyMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

us-gaap:MachineryAndEquipmentMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

us-gaap:BuildingAndBuildingImprovementsMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

us-gaap:MachineryAndEquipmentMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

us-gaap:EquipmentLeasedToOtherPartyMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

xyl:CustomerandDistributorRelationshipsMember

2016-11-01

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:TradeNamesMember

2016-11-01

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2016-11-01

0001524472

xyl:SensusWorldwideLimitedMember

2016-11-01

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:LicensingAgreementsMember

2016-11-01

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:OtherIntangibleAssetsMember

2016-11-01

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2016-11-01

0001524472

xyl:SensusWorldwideLimitedMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

2015-01-01

2015-12-31

0001524472

xyl:WolverhamptonMember

2014-07-02

2014-07-02

0001524472

xyl:SensusWorldwideLimitedMember

2016-11-01

2016-11-01

0001524472

xyl:VIsentiMember

2016-10-18

0001524472

xyl:HypackMember

2016-12-31

0001524472

xyl:HypackMember

2016-01-01

2016-12-31

0001524472

xyl:TidelandSignalCorporationMember

2016-02-01

2016-02-01

0001524472

xyl:SensusWorldwideLimitedMember

2016-11-01

2016-12-31

0001524472

xyl:HypackMember

2015-10-22

2015-10-22

0001524472

xyl:WolverhamptonMember

2015-01-01

2015-12-31

0001524472

xyl:VIsentiMember

2016-10-18

2016-10-18

0001524472

xyl:TidelandSignalCorporationMember

2016-02-01

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:OtherIntangibleAssetsMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

xyl:CustomerandDistributorRelationshipsMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:OtherIntangibleAssetsMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:TechnologyBasedIntangibleAssetsMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:TradeNamesMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:TradeNamesMember

us-gaap:MaximumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

us-gaap:TechnologyBasedIntangibleAssetsMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

xyl:CustomerandDistributorRelationshipsMember

us-gaap:MinimumMember

2016-01-01

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

2015-12-31

0001524472

xyl:WaterInfrastructureMember

2016-12-31

0001524472

xyl:AppliedWaterMember

2016-12-31

0001524472

us-gaap:CorporateAndOtherMember

2015-12-31

0001524472

xyl:RegionalSellingLocationsMember

2016-12-31

0001524472

us-gaap:CorporateAndOtherMember

2016-12-31

0001524472

xyl:AppliedWaterMember

2015-12-31

0001524472

xyl:WaterInfrastructureMember

2015-12-31

0001524472

xyl:RegionalSellingLocationsMember

2015-12-31

0001524472

xyl:SensusWorldwideLimitedMember

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

2015-01-01

2015-12-31

0001524472

xyl:WaterInfrastructureMember

2015-01-01

2015-12-31

0001524472

us-gaap:CorporateAndOtherMember

2015-01-01

2015-12-31

0001524472

xyl:SensusWorldwideLimitedMember

2016-01-01

2016-12-31

0001524472

xyl:WaterInfrastructureMember

2014-01-01

2014-12-31

0001524472

xyl:AppliedWaterMember

2016-01-01

2016-12-31

0001524472

xyl:AppliedWaterMember

2014-01-01

2014-12-31

0001524472

us-gaap:CorporateAndOtherMember

2014-01-01

2014-12-31

0001524472

xyl:SensusWorldwideLimitedMember

2014-01-01

2014-12-31

0001524472

us-gaap:CorporateAndOtherMember

2016-01-01

2016-12-31

0001524472

xyl:WaterInfrastructureMember

2016-01-01

2016-12-31

0001524472

xyl:AppliedWaterMember

2015-01-01

2015-12-31

0001524472

xyl:TwoThousandFifteenRestructuringPlanMember

xyl:AppliedWaterMember

2016-12-31

0001524472

xyl:TwoThousandSixteenRestructuringPlanMember

xyl:AppliedWaterMember

2016-01-01

2016-12-31

0001524472

xyl:TwoThousandFourteenRestructuringPlanMember

xyl:WaterInfrastructureMember

2016-01-01

2016-12-31

0001524472

xyl:TwoThousandSixteenRestructuringPlanMember

xyl:WaterInfrastructureMember

2016-01-01

2016-12-31

0001524472

xyl:TwoThousandFifteenRestructuringPlanMember

xyl:WaterInfrastructureMember

2016-01-01

2016-12-31

0001524472

xyl:TwoThousandFifteenRestructuringPlanMember

xyl:WaterInfrastructureMember

2015-01-01

2015-12-31

0001524472

xyl:TwoThousandSixteenRestructuringPlanMember

xyl:AppliedWaterMember

2016-12-31

0001524472

xyl:TwoThousandFourteenRestructuringPlanMember

us-gaap:CorporateMember

2015-01-01

2015-12-31

0001524472

xyl:TwoThousandFourteenRestructuringPlanMember

xyl:AppliedWaterMember

2015-12-31

0001524472

xyl:TwoThousandFifteenRestructuringPlanMember

xyl:WaterInfrastructureMember

2016-12-31

0001524472

xyl:TwoThousandSixteenRestructuringPlanMember

xyl:SensusWorldwideLimitedMember

2016-01-01

2016-12-31

0001524472

xyl:TwoThousandSixteenRestructuringPlanMember

xyl:SensusWorldwideLimitedMember

2016-12-31

0001524472

xyl:TwoThousandFourteenRestructuringPlanMember

xyl:WaterInfrastructureMember

2015-12-31

0001524472

xyl:TwoThousandSixteenRestructuringPlanMember

us-gaap:CorporateNonSegmentMember

2016-12-31

0001524472

xyl:TwoThousandSixteenRestructuringPlanMember

xyl:WaterInfrastructureMember

2016-12-31

0001524472

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2014-01-01

2014-12-31

0001524472

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2015-12-31

0001524472

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2015-01-01

2015-12-31

0001524472

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2013-12-31

0001524472

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2016-01-01

2016-12-31

0001524472

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2014-12-31

0001524472

us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember

2016-12-31

0001524472

xyl:DeferredTaxAssetForeignCurrencyAdjustmentsMember

2016-12-31

0001524472

us-gaap:StateAndLocalJurisdictionMember

2016-12-31

0001524472

us-gaap:ForeignCountryMember

2016-12-31

0001524472

us-gaap:InternalRevenueServiceIRSMember

2016-12-31

0001524472

us-gaap:PerformanceSharesMember

2016-01-01

2016-12-31

0001524472

us-gaap:RestrictedStockMember

2016-01-01

2016-12-31

0001524472

us-gaap:RestrictedStockMember

2014-01-01

2014-12-31

0001524472

us-gaap:RestrictedStockMember

2015-01-01

2015-12-31

0001524472

us-gaap:EmployeeStockOptionMember

2015-01-01

2015-12-31

0001524472

us-gaap:PerformanceSharesMember

2014-01-01

2014-12-31

0001524472

us-gaap:EmployeeStockOptionMember

2014-01-01

2014-12-31

0001524472

us-gaap:PerformanceSharesMember

2015-01-01

2015-12-31

0001524472

us-gaap:EmployeeStockOptionMember

2016-01-01

2016-12-31

0001524472

us-gaap:EmployeeStockOptionMember

2016-01-01

2016-12-31

0001524472

us-gaap:RestrictedStockMember

2016-01-01

2016-12-31

0001524472

us-gaap:EmployeeStockOptionMember

2014-01-01

2014-12-31

0001524472

us-gaap:RestrictedStockMember

2014-01-01

2014-12-31

0001524472

us-gaap:EmployeeStockOptionMember

2015-01-01

2015-12-31

0001524472

us-gaap:RestrictedStockMember

2015-01-01

2015-12-31

0001524472

us-gaap:RestatementAdjustmentMember

2015-12-31

0001524472

us-gaap:ConstructionInProgressMember

2016-12-31

0001524472

us-gaap:EquipmentLeasedToOtherPartyMember

2016-12-31

0001524472

us-gaap:LandBuildingsAndImprovementsMember

2016-12-31

0001524472

us-gaap:FurnitureAndFixturesMember

2015-12-31

0001524472

us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember

2015-12-31

0001524472

us-gaap:ConstructionInProgressMember

2015-12-31

0001524472

us-gaap:EquipmentLeasedToOtherPartyMember

2015-12-31

0001524472

us-gaap:FurnitureAndFixturesMember

2016-12-31

0001524472

us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember

2016-12-31

0001524472

us-gaap:MachineryAndEquipmentMember

2015-12-31

0001524472

us-gaap:LandBuildingsAndImprovementsMember

2015-12-31

0001524472

us-gaap:MachineryAndEquipmentMember

2016-12-31

0001524472

xyl:SensusWorldwideLimitedMember

2014-12-31

0001524472

us-gaap:PensionPlansDefinedBenefitMember

2016-01-01

2016-12-31

0001524472

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2016-01-01

2016-12-31

0001524472

xyl:AppliedWaterMember

2014-12-31

0001524472

xyl:WaterInfrastructureMember

2014-12-31

0001524472

us-gaap:OtherIntangibleAssetsMember

2015-12-31

0001524472

us-gaap:OtherIntangibleAssetsMember

2016-12-31

0001524472

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2016-12-31

0001524472

xyl:CustomerandDistributorRelationshipsMember

2015-12-31

0001524472

us-gaap:TrademarksMember

2015-12-31

0001524472

xyl:ProprietaryTechnologyMember

2016-12-31

0001524472

xyl:ProprietaryTechnologyMember

2015-12-31

0001524472

xyl:CustomerandDistributorRelationshipsMember

2016-12-31

0001524472

us-gaap:TrademarksMember

2016-12-31

0001524472

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2015-12-31

0001524472

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2016-01-01

2016-12-31

0001524472

us-gaap:OtherIntangibleAssetsMember

2016-01-01

2016-12-31

0001524472

xyl:ProprietaryTechnologyMember

2016-01-01

2016-12-31

0001524472

us-gaap:TrademarksMember

2016-01-01

2016-12-31

0001524472

xyl:CustomerandDistributorRelationshipsMember

2016-01-01

2016-12-31

0001524472

us-gaap:OtherAssetsMember

us-gaap:DesignatedAsHedgingInstrumentMember

2016-12-31

0001524472

us-gaap:OtherAssetsMember

us-gaap:DesignatedAsHedgingInstrumentMember

2015-12-31

0001524472

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:DesignatedAsHedgingInstrumentMember

2015-12-31

0001524472

us-gaap:OtherNoncurrentLiabilitiesMember

us-gaap:DesignatedAsHedgingInstrumentMember

2016-12-31

0001524472

xyl:SellUSDBuyEURMember

2015-12-31

0001524472

us-gaap:LongTermDebtMember

us-gaap:DesignatedAsHedgingInstrumentMember

2016-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyThreeMember

us-gaap:SeniorNotesMember

2016-03-11

0001524472

xyl:SellUSDBuyEURMember

us-gaap:DesignatedAsHedgingInstrumentMember

2016-09-23

0001524472

xyl:SellEurBuySekForwardMember

2015-12-31

0001524472

us-gaap:ForeignExchangeContractMember

2015-12-31

0001524472

xyl:SellGBPBuyEURMember

2015-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyThreeMember

2016-12-31

0001524472

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:OtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:ForeignExchangeContractMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

xyl:ForeignCurrencyDenominatedDebtMember

us-gaap:OtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:ForeignExchangeContractMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

us-gaap:ForeignExchangeContractMember

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:ForeignExchangeContractMember

us-gaap:OtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:OtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:ForwardContractsMember

us-gaap:OtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:ForeignExchangeContractMember

us-gaap:OtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:ForwardContractsMember

us-gaap:OtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

xyl:ForeignCurrencyDenominatedDebtMember

us-gaap:OtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

us-gaap:ForwardContractsMember

us-gaap:OtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:ForeignExchangeContractMember

us-gaap:OtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

xyl:ForeignCurrencyDenominatedDebtMember

us-gaap:OtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:OtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

xyl:RiskSharingFinanceFacilityAgreementMember

2016-12-31

0001524472

us-gaap:RevolvingCreditFacilityMember

2016-01-01

2016-12-31

0001524472

us-gaap:LineOfCreditMember

2016-10-24

0001524472

xyl:SeniorNotesDueTwoThousandAndSixteenMember

2015-12-31

0001524472

xyl:RiskSharingFinanceFacilityAgreementMember

2015-12-03

0001524472

us-gaap:RevolvingCreditFacilityMember

2016-01-01

2016-09-30

0001524472

us-gaap:RevolvingCreditFacilityMember

2015-03-27

0001524472

us-gaap:SeniorNotesMember

2011-09-19

2011-09-20

0001524472

xyl:SeniorNotesDueTwoThousandAndSixteenMember

2016-01-01

2016-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndSixteenMember

2011-09-20

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyOneMember

us-gaap:FairValueInputsLevel1Member

2016-12-31

0001524472

us-gaap:LetterOfCreditMember

2015-03-27

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyOneMember

us-gaap:FairValueInputsLevel1Member

2015-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndSixteenMember

2016-04-11

2016-04-11

0001524472

us-gaap:LineOfCreditMember

2016-10-28

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyOneMember

2011-09-20

0001524472

xyl:SeniorNotesDueTwoThousandTwentySixMember

2016-12-31

0001524472

xyl:RiskSharingFinanceFacilityAgreementMember

2015-12-31

0001524472

xyl:SeniorNotesDueTwoThousandFortySixMember

2016-12-31

0001524472

2016-08-15

0001524472

xyl:TermLoanMember

2015-12-31

0001524472

us-gaap:CommercialPaperMember

2016-12-31

0001524472

us-gaap:CommercialPaperMember

2015-12-31

0001524472

xyl:SeniorNotesDueTwoThousandFortySixMember

2015-12-31

0001524472

xyl:ResearchandDevelopmentFacilityAgreementMember

2015-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyThreeMember

2015-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndSixteenMember

2016-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyOneMember

2016-12-31

0001524472

xyl:SeniorNotesDueTwoThousandTwentySixMember

2015-12-31

0001524472

xyl:OtherLongTermDebtMember

2015-12-31

0001524472

xyl:ResearchandDevelopmentFacilityContractMember

2015-12-31

0001524472

xyl:SeniorNotesDueTwoThousandAndTwentyOneMember

2015-12-31

0001524472

xyl:OtherLongTermDebtMember

2016-12-31

0001524472

xyl:TermLoanMember

2016-12-31

0001524472

xyl:ResearchandDevelopmentFacilityAgreementMember

2016-12-31

0001524472

xyl:ResearchandDevelopmentFacilityContractMember

2016-12-31

0001524472

xyl:EuropeanInvestmentBankResearchandDevelopmentFinanceContractMember

2016-01-01

2016-12-31

0001524472

xyl:RiskSharingFinanceFacilityAgreementMember

us-gaap:LoansPayableMember

2016-01-01

2016-12-31

0001524472

xyl:FiveYearRevolvingCreditFacilityMember

2016-01-01

2016-12-31

0001524472

xyl:RiskSharingFinanceFacilityAgreementMember

2016-01-01

2016-12-31

0001524472

xyl:EuropeanInvestmentBankResearchandDevelopmentFinanceContractMember

2016-12-31

0001524472

xyl:SeniorNotesDueTwoThousandTwentySixMember

2016-10-11

0001524472

xyl:SeniorNotesDueTwoThousandFortySixMember

2016-10-11

0001524472

xyl:EURIBORMember

2016-01-01

2016-12-31

0001524472

us-gaap:UnitedStatesPensionPlansOfUSEntityDefinedBenefitMember

2015-12-31

0001524472

us-gaap:ForeignPostretirementBenefitPlansDefinedBenefitMember

2015-01-01

2015-12-31

0001524472

us-gaap:ForeignPostretirementBenefitPlansDefinedBenefitMember

2016-01-01

2016-12-31

0001524472

us-gaap:UnitedStatesPensionPlansOfUSEntityDefinedBenefitMember

2016-12-31

0001524472

us-gaap:UnitedStatesPensionPlansOfUSEntityDefinedBenefitMember

2015-01-01

2015-12-31

0001524472

us-gaap:UnitedStatesPensionPlansOfUSEntityDefinedBenefitMember

2014-12-31

0001524472

us-gaap:ForeignPostretirementBenefitPlansDefinedBenefitMember

2016-12-31

0001524472

us-gaap:ForeignPostretirementBenefitPlansDefinedBenefitMember

2014-12-31

0001524472

us-gaap:UnitedStatesPensionPlansOfUSEntityDefinedBenefitMember

2016-01-01

2016-12-31

0001524472

us-gaap:ForeignPostretirementBenefitPlansDefinedBenefitMember

2015-12-31

0001524472

us-gaap:PrivateEquityFundsMember

2016-12-31

0001524472

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2015-01-01

2015-12-31

0001524472

us-gaap:HedgeFundsMember

2016-12-31

0001524472

2015-09-30

0001524472

us-gaap:HedgeFundsMember

2015-12-31

0001524472

us-gaap:PrivateEquityFundsMember

2015-12-31

0001524472

us-gaap:ForeignPostretirementBenefitPlansDefinedBenefitMember

2014-01-01

2014-12-31

0001524472

us-gaap:UnitedStatesPensionPlansOfUSEntityDefinedBenefitMember

2014-01-01

2014-12-31

0001524472

us-gaap:PensionPlansDefinedBenefitMember

2015-01-01

2015-12-31

0001524472

us-gaap:PensionPlansDefinedBenefitMember

2014-01-01

2014-12-31

0001524472

us-gaap:ForeignPensionPlansDefinedBenefitMember

2016-01-01

2016-12-31

0001524472

us-gaap:ForeignPensionPlansDefinedBenefitMember

2015-01-01

2015-12-31

0001524472

us-gaap:ForeignPensionPlansDefinedBenefitMember

2014-01-01

2014-12-31

0001524472

us-gaap:ForeignPensionPlansDefinedBenefitMember

2014-12-31

0001524472

us-gaap:ForeignPensionPlansDefinedBenefitMember

2015-12-31

0001524472

us-gaap:ForeignPensionPlansDefinedBenefitMember

2016-12-31

0001524472

us-gaap:CashAndCashEquivalentsMember

2015-12-31

0001524472

us-gaap:CashAndCashEquivalentsMember

2016-12-31

0001524472

us-gaap:EquitySecuritiesMember

2015-12-31

0001524472

us-gaap:FixedIncomeFundsMember

2015-12-31

0001524472

us-gaap:EquitySecuritiesMember

2016-12-31

0001524472

us-gaap:FixedIncomeFundsMember

2016-12-31

0001524472

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2015-12-31

0001524472

us-gaap:PensionPlansDefinedBenefitMember

2016-12-31

0001524472

us-gaap:PensionPlansDefinedBenefitMember

2015-12-31

0001524472

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2016-12-31

0001524472

xyl:OtherAssetCategoriesMember

us-gaap:FairValueInputsLevel3Member

2015-01-01

2015-12-31

0001524472

xyl:OtherAssetCategoriesMember

us-gaap:FairValueInputsLevel3Member

2016-01-01

2016-12-31

0001524472

xyl:OtherAssetCategoriesMember

us-gaap:FairValueInputsLevel3Member

2015-12-31

0001524472

xyl:OtherAssetCategoriesMember

us-gaap:FairValueInputsLevel3Member

2014-12-31

0001524472

xyl:OtherAssetCategoriesMember

us-gaap:FairValueInputsLevel3Member

2016-12-31

0001524472

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2014-12-31

0001524472

us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember

2014-01-01

2014-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

2016-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2016-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

2016-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:PlanAssetsMeasuredatNetAssetValueMember

2015-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

2015-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:DerivativeMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:DerivativeMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

xyl:PlanAssetsMeasuredatNetAssetValueMember

2016-12-31

0001524472

xyl:InsuranceContractsAndOtherMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2015-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

2015-12-31

0001524472

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

2015-12-31

0001524472

xyl:EmergingMarketsFundsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

xyl:GlobalStockFundsAndSecuritiesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:HedgeFundsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

2016-12-31

0001524472

us-gaap:ExchangeTradedFundsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2015-12-31

0001524472

us-gaap:CorporateDebtSecuritiesMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2016-12-31

0001524472

us-gaap:EquitySecuritiesMember

2016-01-01

2016-12-31

0001524472

us-gaap:CashAndCashEquivalentsMember

2016-01-01

2016-12-31

0001524472

us-gaap:FixedIncomeFundsMember

2016-01-01

2016-12-31

0001524472

us-gaap:PrivateEquityFundsMember

2016-01-01

2016-12-31

0001524472

us-gaap:HedgeFundsMember

2016-01-01

2016-12-31

0001524472

us-gaap:PerformanceSharesMember

xyl:TotalShareholderReturnPerformanceBasedSharesMember

2016-01-01

2016-12-31

0001524472

us-gaap:PerformanceSharesMember

xyl:ReturnonInvestedCapitalPerformanceBasedSharesMember

2016-12-31

0001524472

us-gaap:PerformanceSharesMember

xyl:ReturnonInvestedCapitalPerformanceBasedSharesMember

2016-01-01

2016-12-31

0001524472

us-gaap:PerformanceSharesMember

xyl:ReturnonInvestedCapitalPerformanceBasedSharesMember

2015-12-31

0001524472

us-gaap:PerformanceSharesMember

xyl:TotalShareholderReturnPerformanceBasedSharesMember

2016-12-31

0001524472

us-gaap:PerformanceSharesMember

xyl:TotalShareholderReturnPerformanceBasedSharesMember

2015-12-31

0001524472

us-gaap:RestrictedStockMember

2016-12-31

0001524472

us-gaap:RestrictedStockMember

2015-12-31

0001524472

us-gaap:PerformanceSharesMember

2016-12-31

0001524472

us-gaap:PerformanceSharesMember

2016-01-01

2016-12-31

0001524472

us-gaap:EmployeeStockOptionMember

2016-12-31

0001524472

xyl:A2011OmnibusIncentivePlanMember

2016-12-31

0001524472

xyl:A2011OmnibusIncentivePlanMember

2011-10-31

0001524472

xyl:TwoThousandThirteenStockRepurchaseProgramMember

2013-08-20

0001524472

xyl:SettlementofEmployeeTaxWithholdingObligationsMember

2015-01-01

2015-12-31

0001524472

xyl:TwoThousandTwelveStockRepurchaseProgramMember

2015-01-01

2015-12-31

0001524472

xyl:TwoThousandTwelveStockRepurchaseProgramMember

2016-12-31

0001524472

xyl:TwoThousandfifteenStockRepurchaseProgramMember

2015-08-24

0001524472

xyl:TwoThousandThirteenStockRepurchaseProgramMember

2015-01-01

2015-12-31

0001524472

xyl:SettlementofEmployeeTaxWithholdingObligationsMember

2016-01-01

2016-12-31

0001524472

xyl:TwoThousandfifteenStockRepurchaseProgramMember

2016-12-31

0001524472

xyl:TwoThousandTwelveStockRepurchaseProgramMember

2012-08-18

0001524472

xyl:TwoThousandTwelveStockRepurchaseProgramMember

2016-01-01

2016-12-31

0001524472

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2015-01-01

2015-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2015-12-31

0001524472

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2015-01-01

2015-12-31

0001524472

xyl:OtherNonOperatingExpenseMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2015-01-01

2015-12-31

0001524472

xyl:OtherNonOperatingExpenseMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2015-01-01

2015-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2014-01-01

2014-12-31

0001524472

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2014-01-01

2014-12-31

0001524472

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-01-01

2016-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2015-01-01

2015-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2016-12-31

0001524472

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2013-12-31

0001524472

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2015-12-31

0001524472

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2015-01-01

2015-12-31

0001524472

us-gaap:AccumulatedTranslationAdjustmentMember

2016-01-01

2016-12-31

0001524472

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:SalesMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2014-01-01

2014-12-31

0001524472

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2016-01-01

2016-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:AccumulatedTranslationAdjustmentMember

2014-12-31

0001524472

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-12-31

0001524472

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2014-01-01

2014-12-31

0001524472

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2014-12-31

0001524472

us-gaap:SalesMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2015-01-01

2015-12-31

0001524472

xyl:OtherNonOperatingExpenseMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2014-01-01

2014-12-31

0001524472

us-gaap:SalesMember

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2016-01-01

2016-12-31

0001524472

us-gaap:AccumulatedTranslationAdjustmentMember

2015-12-31

0001524472

us-gaap:AccumulatedTranslationAdjustmentMember

2015-01-01

2015-12-31

0001524472

us-gaap:AccumulatedTranslationAdjustmentMember

2016-12-31

0001524472

us-gaap:SalesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-01-01

2016-12-31

0001524472

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2015-01-01

2015-12-31

0001524472

us-gaap:SalesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:ResearchAndDevelopmentExpenseMember

2015-01-01

2015-12-31

0001524472

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2014-12-31

0001524472

us-gaap:OtherNonoperatingIncomeExpenseMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2014-01-01

2014-12-31

0001524472

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2013-12-31

0001524472

xyl:OtherNonOperatingExpenseMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-01-01

2016-12-31

0001524472

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2016-01-01

2016-12-31

0001524472

us-gaap:SalesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:AccumulatedTranslationAdjustmentMember

2014-01-01

2014-12-31

0001524472

us-gaap:CostOfSalesMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2016-01-01

2016-12-31

0001524472

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2015-01-01

2015-12-31

0001524472

us-gaap:SellingGeneralAndAdministrativeExpensesMember

us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember

2014-01-01

2014-12-31

0001524472

us-gaap:CrossCurrencyInterestRateContractMember

us-gaap:AccumulatedTranslationAdjustmentMember

2016-01-01

2016-12-31

0001524472

us-gaap:OtherNonoperatingIncomeExpenseMember

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2014-01-01

2014-12-31

0001524472

us-gaap:AccumulatedTranslationAdjustmentMember

2013-12-31

0001524472

2014-12-17

2014-12-17

0001524472

2016-12-01

2016-12-31

0001524472

us-gaap:JudicialRulingMember

2015-01-01

2015-01-31

0001524472

us-gaap:AffiliatedEntityMember

2014-01-01

2014-12-31

0001524472

us-gaap:AffiliatedEntityMember

2015-01-01

2015-12-31

0001524472

us-gaap:AffiliatedEntityMember

2016-01-01

2016-12-31

0001524472

us-gaap:EuropeMember

2014-12-31

0001524472

us-gaap:AsiaPacificMember

2014-12-31

0001524472

country:US

2015-12-31

0001524472

xyl:OtherCountriesMember

2015-12-31

0001524472

xyl:OtherCountriesMember

2014-12-31

0001524472

us-gaap:AsiaPacificMember

2016-12-31

0001524472

country:US

2016-12-31

0001524472

us-gaap:AsiaPacificMember

2015-12-31

0001524472

us-gaap:EuropeMember

2015-12-31

0001524472

xyl:OtherCountriesMember

2016-12-31

0001524472

us-gaap:EuropeMember

2016-12-31

0001524472

country:US

2014-12-31

0001524472

xyl:RegionalSellingLocationsMember

2014-12-31

0001524472

us-gaap:CorporateAndOtherMember

2014-12-31

0001524472

us-gaap:EuropeMember

2014-01-01

2014-12-31

0001524472

us-gaap:EuropeMember

2016-01-01

2016-12-31

0001524472

us-gaap:AsiaPacificMember

2015-01-01

2015-12-31

0001524472

country:US

2016-01-01

2016-12-31

0001524472

xyl:OtherCountriesMember

2016-01-01

2016-12-31

0001524472

us-gaap:AsiaPacificMember

2016-01-01

2016-12-31

0001524472

xyl:OtherCountriesMember

2014-01-01

2014-12-31

0001524472

xyl:OtherCountriesMember

2015-01-01

2015-12-31

0001524472

us-gaap:EuropeMember

2015-01-01

2015-12-31

0001524472

country:US

2015-01-01

2015-12-31

0001524472

us-gaap:AsiaPacificMember

2014-01-01

2014-12-31

0001524472

country:US

2014-01-01

2014-12-31

0001524472

xyl:RegionalSellingLocationsMember

2015-01-01

2015-12-31

0001524472

xyl:RegionalSellingLocationsMember

2014-01-01

2014-12-31

0001524472

xyl:RegionalSellingLocationsMember

2016-01-01

2016-12-31

0001524472

xyl:PumpsAccessoriesPartsAndServiceMember

2016-01-01

2016-12-31

0001524472

xyl:OtherProductsAndServicesMember

2016-01-01

2016-12-31

0001524472

xyl:OtherProductsAndServicesMember

2015-01-01

2015-12-31

0001524472

xyl:PumpsAccessoriesPartsAndServiceMember

2014-01-01

2014-12-31

0001524472

xyl:PumpsAccessoriesPartsAndServiceMember

2015-01-01

2015-12-31

0001524472

xyl:OtherProductsAndServicesMember

2014-01-01

2014-12-31

0001524472

us-gaap:AllowanceForDoubtfulAccountsMember

2015-12-31

0001524472

us-gaap:AllowanceForDoubtfulAccountsMember

2014-12-31

0001524472

us-gaap:AllowanceForDoubtfulAccountsMember

2015-01-01

2015-12-31

0001524472

us-gaap:AllowanceForDoubtfulAccountsMember

2016-12-31

0001524472

us-gaap:AllowanceForDoubtfulAccountsMember

2016-01-01

2016-12-31

0001524472

us-gaap:AllowanceForDoubtfulAccountsMember

2013-12-31

0001524472

us-gaap:AllowanceForDoubtfulAccountsMember

2014-01-01

2014-12-31

0001524472

2015-07-01

2015-09-30

0001524472

2015-10-01

2015-12-31

0001524472

2015-01-01

2015-03-31

0001524472

2015-04-01

2015-06-30

0001524472

2016-07-01

2016-09-30

0001524472

2016-04-01

2016-06-30

0001524472

2016-01-01

2016-03-31

0001524472

2016-10-01

2016-12-31

xyl:employee

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:pure

iso4217:EUR

xyl:Segment

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

| | | | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

| | For the fiscal year ended December 31, 2016 | | |

| | or | | |

¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

For the transition period from to

Commission file number: 1-35229

Xylem Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Indiana | | 45-2080495 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

1 International Drive, Rye Brook, NY 10573 |

(address of principal executive offices and zip code) |

(914) 323-5700 |

(Registrant's telephone number, including area code) |

|

Securities registered pursuant to Section 12(b) of the Act: |

| |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

2.250% Senior Notes due 2023 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer þ Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the common stock of the registrant held by non-affiliates of the registrant as of June 30, 2016 was approximately $8.0 billion. As of February 17, 2017, there were 179,471,405 outstanding shares of the registrant’s common stock, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2017 Annual Meeting of Shareowners, to be held in May 2017, are incorporated by reference into Part II and Part III of this Report.

Xylem Inc.

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2016

Table of Contents

|

| | |

| | |

ITEM | PAGE |

PART I | |

| | |

1 | | |

1A. | | |

1B. | | |

2 | | |

3 | | |

4 | | |

* | | |

| | |

| |

PART II | |

| | |

5 | | |

6 | | |

7 | | |

7A. | | |

8 | | |

9 | | |

9A. | | |

9B. | | |

| |

PART III | |

| | |

10 | | |

11 | | |

12 | | |

13 | | |

14 | | |

16 | | |

| |

PART IV | |

| | |

15 | | |

| | |

| | |

|

| |

* | Included pursuant to Instruction 3 of Item 401(b) of Regulation S-K. |

PART I

The following discussion should be read in conjunction with the consolidated financial statements, including the notes thereto, included in this Annual Report on Form 10-K (this "Report"). Xylem Inc. was incorporated in Indiana on May 4, 2011. Except as otherwise indicated or unless the context otherwise requires, “Xylem,” “we,” “us,” “our” and “the Company” refer to Xylem Inc. and its subsidiaries. References in the consolidated financial statements to "ITT" or the "former parent" refer to ITT Corporation (now ITT LLC) and its consolidated subsidiaries (other than Xylem Inc.) as of the applicable periods.

Forward-Looking Statements

This Report contains information that may constitute “forward-looking statements" within the meaning of the Private Securities Litigation Act of 1995. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Generally, the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “forecast,” “believe,” “target,” “will,” “could,” “would,” “should” and similar expressions identify forward-looking statements, which generally are not historical in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. These forward-looking statements include statements about the capitalization of the Company, the Company’s restructuring and realignment, future strategic plans and other statements that describe the Company’s business strategy, outlook, objectives, plans, intentions or goals. All statements that address operating or financial performance, events or developments that we expect or anticipate will occur in the future - including statements relating to orders, revenue, operating margins and earnings per share growth, and statements expressing general views about future operating results - are forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed or implied in, or reasonably inferred from, such forward-looking statements.

Factors that could cause results to differ materially from those anticipated include: overall economic and business conditions, political and other risks associated with our international operations, including military actions, economic sanctions or trade embargoes that could affect customer markets, and non-compliance with laws, including foreign corrupt practice laws, export and import laws and competition laws; potential for unexpected cancellations or delays of customer orders in our reported backlog; our exposure to fluctuations in foreign currency exchange rates; competition and pricing pressures in the markets we serve; the strength of housing and related markets; ability to retain and attract key members of management; our relationship with and the performance of our channel partners; our ability to successfully identify, complete and integrate acquisitions, including the integration of Sensus; our ability to borrow or to refinance our existing indebtedness and availability of liquidity sufficient to meet our needs; changes in the value of goodwill or intangible assets; risks relating to product defects, product liability and recalls; governmental investigations; security breaches or other disruptions of our information technology systems; litigation and contingent liabilities; and other factors set forth below under “Item 1A. Risk Factors” and those described from time to time in subsequent reports filed with the Securities and Exchange Commission (“SEC”).

All forward-looking statements made in this Report are based on information available to the Company as of the date of this Report. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

ITEM 1. BUSINESS

Business Overview

Xylem, with 2016 revenue of $3.8 billion and approximately 16,000 employees, is a leading global water technology company. We design, manufacture and service highly engineered solutions ranging across a wide variety of critical applications. For example, our broad portfolio of solutions addresses customer needs across the water cycle, from the delivery and use of drinking water to the collection and treatment of wastewater to the return of water to the environment.

We have differentiated market positions in core application areas including transport, treatment, test, smart metering, building services, industrial processing and irrigation. Setting us apart is a unique set of global assets which include:

| |

• | Fortress brands with leading market positions, some of which have been operating for more than 100 years |

| |

• | Far-reaching global distribution networks consisting of direct sales forces and independent channel partners that collectively serve a diverse customer base in more than 150 countries |

| |

• | A substantial installed base that provides for steady recurring revenue |

| |

• | A strong financial position and cash generation profile that enable us to fund strategic organic and inorganic growth initiatives, and consistently return capital to shareholders |

Key tenets of our long-term strategy include (1) accelerate profitable growth; (2) increase profitability by driving continuous improvement initiatives; (3) leadership and talent development; and (4) focus on execution and accountability.

Company History and Certain Relationships

On October 31, 2011 (the "Distribution Date"), ITT completed the Spin-off (the “Spin-off”) of Xylem, formerly ITT’s water equipment and services businesses. The Spin-off was completed pursuant to a Distribution Agreement, dated as of October 25, 2011 (the “Distribution Agreement”), among ITT (now ITT LLC), Exelis Inc., acquired by Harris Inc. on May 29, 2015, (“Exelis”) and Xylem.

On October 31, 2016, Xylem Inc. completed the acquisition of all of the direct and indirect subsidiaries of Sensus Worldwide Limited (other than Sensus Industries) (“Sensus”), pursuant to the terms of the Share Purchase Agreement dated as of August 15, 2016, and the first Amendment to the Share Purchase Agreement dated as of October 31, 2016 (together, the “Purchase Agreement”). The aggregate consideration paid for the acquisition was approximately $1.7 billion in cash, subject to certain adjustments as provided in the Purchase Agreement. The consideration was funded with a combination of cash on hand, proceeds from issuances under the Company’s existing commercial paper program, borrowings under a new euro-denominated term loan and the issuance of $500 million aggregate principal amount of 3.250% Senior Notes due 2026 and $400 million aggregate principal amount of 4.375% Senior Notes due 2046.

Our Industry

Our planet faces serious water challenges. Less than 1% of the total water available on earth is fresh water, and these supplies are under threat due to factors such as the draining of aquifers, increased pollution and the effects of climate change. Demand for fresh water is rising rapidly due to population growth, industrial expansion, and increased agricultural development, with consumption estimated to double every 20 years. By 2025, more than 30% of the world’s population is expected to live in areas without adequate water supply. Even in developed countries with sufficient clean water supply, existing infrastructure for water supply is aging and inadequately funded. In the United States, deteriorating pipe systems lose approximately one out of every six gallons of water between the treatment plant and the end customer part of a national (and global) problem of ‘non-revenue water’ that is a major financial challenge of many utilities. These challenges create opportunities for growth in the global water industry, which we estimate to have a total market size of approximately $550 billion.

We compete in areas that are pivotal to improving water productivity, water quality and resilience. Water productivity refers to the more efficient delivery and use of clean water. Water quality refers to the efficient and effective management of wastewater. Resilience refers to the management of water-related risks and the resilience of water infrastructure. The Company’s customers often face all three of these challenges, ranging from inefficient and aging water distribution networks (which require increases in “water productivity”); energy-intensive or unreliable wastewater management systems (which require increases in “water quality”); or exposure to natural disasters such as floods or droughts (which require increases in “resilience”). Additionally, through the recent acquisition of Sensus, we now also provide solutions to enhance efficiency, improve safety and conserve resources to customers in the electric and gas sectors. Delivering value in these areas creates significant opportunity for the Company. We estimate our total served market size to be approximately $54 billion.

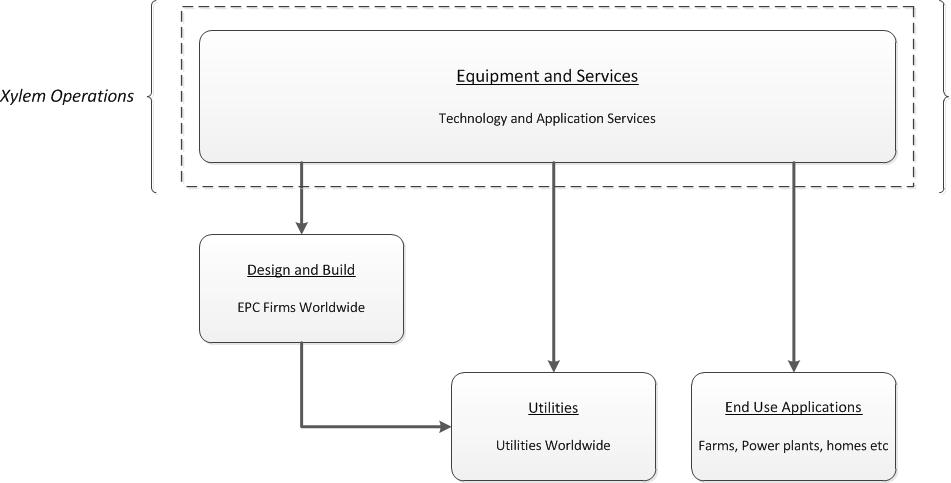

The Global Water Industry Value Chain

The water industry value chain is comprised of Equipment and Services companies, like Xylem, which address the unique challenges and demands of a diverse customer base. This customer base includes utilities that supply water through an infrastructure network, and engineering, procurement and construction or "EPC" firms, which work with utilities to design and build water and wastewater infrastructure networks, as depicted below. Utilities and EPC customers are looking for technology and application expertise from their Equipment and Services providers to address trends such as rising pollution, stricter regulations, and the increased outsourcing of process knowledge. In addition to utilities and EPC customers, Equipment and Service providers also provide distinct technologies to a wide array of entities, including farms, mines, power plants, industrial facilities and residential buildings.

Water Industry Supply Chain

Business Strategy

Our strategy is to enhance shareholder value by providing distinctive solutions for our customers' most important water productivity, quality and resilience challenges, enabling us to grow revenue, organically and through strategic acquisitions, as we streamline our cost structure. Key elements of our strategy are summarized below:

| |

• | Accelerate Profitable Growth. To accelerate growth, we are focusing on several priorities: |

| |

• | Emerging Markets - We seek to accelerate our growth in priority emerging markets through increased focus on product localization and channel development. |

| |

▪ | Innovation & Technology - We seek to enhance the Company’s innovation efforts with increased focus on technologies and innovation that can significantly improve customers’ productivity, quality and resilience. |

| |

• | Commercial Leadership - We are strengthening our capabilities by simplifying our commercial processes and supporting information technology systems. |

| |

• | Mergers and Acquisitions - We continue to evaluate and, where appropriate, will act upon attractive acquisition candidates to accelerate our growth, including into adjacent markets. |

| |

• | Drive Continuous Improvement. We seek to embed continuous improvement into our culture and simplify our organization to make the Company more agile, more profitable and create room to reinvest in growth. To accomplish this, we will continue to strengthen our lean six sigma and global procurement capabilities and continue to optimize our cost structure through business simplification, eliminating structural, process and product complexity. |

| |

• | Leadership and Talent Development. We seek to continue to invest in attracting, developing and retaining world-class talent with an increased focus on leadership and talent development programs. We will continue to align individual performance with the objectives of the Company and its shareholders. |

| |

• | Focus on Execution and Accountability. We seek to ensure the impact of these strategic focus areas by holding our people accountable and streamlining our performance management and goal deployment systems. |

Business Segments, Distribution and Competitive Landscape

We have three reportable business segments that are aligned around the critical market applications they provide: Water Infrastructure, Applied Water and Sensus. See Note 20, “Segment and Geographic Data,” in our consolidated financial statements for financial information about segments and geographic areas.

The table and descriptions below provide an overview of our business segments. |

| | | | | | | | | | | | | |

| | Market Applications | | 2016 Revenue (in millions) | | % Revenue | | Major Products | | Primary Brands |

Water Infrastructure | | Transport | | $ | 1,599 |

| | 71 | % | | • Water and wastewater pumps • Filtration, disinfection and biological treatment equipment • Test equipment • Controls | | • Flygt • Wedeco • Godwin • WTW • Sanitaire • YSI • Leopold |

| Treatment | | 333 |

| | 15 | % | |

| Test | | 314 |

| | 14 | % | |

| | | | | | | |

| | | | $ | 2,246 |

| | 100 | % | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

Applied Water | | Building Services | | $ | 764 |

| | 55 | % | | • Pumps • Valves • Heat exchangers • Controls • Dispensing equipment systems | | • Goulds Water Technology • Bell & Gossett • A-C Fire Pump • Standard Xchange • Lowara • Jabsco • Flojet • Flowtronex |

| Industrial Water | | 540 |

| | 39 | % | | |

| Irrigation | | 89 |

| | 6 | % | | |

| | | | | | | | |

| | | | $ | 1,393 |

| | 100 | % | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | |

Sensus | | Water | | $ | 74 |

| | 56 | % | |

• Smart meters • Networked communications software • Base stations • Regulators • Data analytics

| |

• Sensus • Smith Blair

|

| Electric | | 27 |

| | 20 | % | | |

| Gas | | 16 |

| | 12 | % | | |

| | Software and Services/Other | | 15 |

| | 11 | % | | |

| | (a) | | $ | 132 |

| | 100 | % | | |

| | | | | | | | |

(a) | | Includes revenue from November 1, 2016 through December 31, 2016 | | |

Water Infrastructure

Our Water Infrastructure segment supports the process that collects water from a source and distributes it to users, and then returns the wastewater responsibly to the environment through three closely linked applications: Transport, Treatment and Test. The Transport application also includes sales and rental of specialty dewatering pumps and related equipment and services, which provide the safe removal or draining of groundwater and surface water from a riverbed, construction site or mine shaft and bypass pumping for the repair of aging public utility infrastructure, as well as emergency water removal during severe weather events.

The customer base consists of two primary end markets: public utility and industrial. The public utility market includes public, private and public-private entities that support water and wastewater networks. The industrial market includes customers who require similar water and wastewater infrastructure networks to support various industrial operations.

Water Infrastructure provides the majority of its sales through direct channels with remaining sales through indirect channels and service capabilities. Both public utility and industrial facility customers increasingly require our teams’ global but locally proficient expertise to use our equipment in their specific applications. Several trends are increasing the need for this application expertise: (i) the increase in both the type and amount of contaminants found in the water supply, (ii) increasing environmental regulations, (iii) the need to increase system efficiencies to optimize energy costs, (iv) the retirement of a largely aging water industry workforce that has not been systematically replaced at utilities and other end-user customers, and (v) the build-out of water infrastructure in the

emerging markets. We estimate our served market size in this sector to be approximately $23 billion.

Given the highly fragmented nature of the water industry, the Water Infrastructure segment competes with a large number of businesses. We differentiate ourselves in the market by focusing on product performance, reliability and innovation, application expertise, brand reputation, energy efficiency, product life-cycle cost, timeliness of delivery, proximity of service centers, effectiveness of our distribution channels and price. In the sale of products and services, we benefit from our large installed base, which requires maintenance, repair and replacement parts due to the critical application and nature of the products and the conditions under which they operate. Timeliness of delivery, quality and the proximity of service centers are important customer considerations when selecting a provider for after-market products and services as well as equipment rentals. In geographic regions where we are locally positioned to provide a quick response, customers have historically relied on us, rather than our competitors, for after-market products relating to our highly engineered and customized solutions. Our key competitors within the Water Infrastructure segment include KSB Inc., Sulzer Ltd., Evoqua Water Technologies and Danaher Corporation.

Applied Water

Applied Water encompasses the uses of water and serves a diverse set of end markets including: residential, commercial, industrial and agricultural. Residential consumers represent the end users in the residential market, while owners and managers of properties such as apartment buildings, retail stores, institutional buildings, restaurants, schools, hospitals and hotels are examples of end users in the commercial market. The industrial market includes OEMs, exploration and production firms, and developers and managers of industrial facilities, such as electrical power generators, chemical manufacturers, machine shops, clothing manufacturers, beverage dispensing and food processing firms, and car washes. Agricultural end users include owners and operators of crop and livestock farms, aquaculture, golf courses, and other turf applications.

In the Applied Water segment end-use areas vary widely so specialized distribution partners are often preferred. Our products in the Applied Water segment are sold through our global direct sales and strong indirect channels with the majority of revenue going through indirect channels. We have long-standing relationships with many of the leading independent distributors in the markets we serve, and we provide incentives to distributors, such as specialized loyalty and training programs.

We estimate our served market size in this sector to be approximately $19 billion. Population growth, urbanization and regulatory requirements are macro growth drivers of these markets, driving the need for housing, food, community services and retail goods within growing city centers.