XLS-2013.12.31-10K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

ANNUAL REPORT

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the fiscal year ended December 31, 2013

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the Transition period from to

Commission File No. 001-35228

EXELIS INC.

(Exact name of registrant as specified in its charter)

|

| | |

State of Indiana | | 45-2083813 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

(Address of principal executive offices)

(703) 790-6300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act, all of which are registered on The New York Stock Exchange, Inc.:

COMMON STOCK, $0.01 PAR VALUE

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the common stock of the registrant held by non-affiliates on the last business day of the registrant’s most recently completed second fiscal quarter (based on the closing price of the stock on the New York Stock Exchange on June 28, 2013) was approximately $2.6 billion.

The number of shares of common stock outstanding at February 25, 2014 was 189,517,028.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Securities and Exchange Commission within 120 days after the registrant's fiscal year ended December 31 ,2013 pursuant to Regulation 14A for its 2014 annual meeting of shareholders are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

|

| | | |

ITEM | | PAGE |

| PART I |

| 1 | | |

| 1A | | |

| 1B | | |

| 2 | | |

| 3 | | |

| 4 | | |

| * | | |

| PART II |

| 5 | | |

| 6 | | |

| 7 | | |

| 7A | | |

| 8 | | |

| 9 | | |

| 9A | | |

| 9B | | |

| | | |

| PART III |

| 10 | | |

| 11 | | |

| 12 | | |

| 13 | | |

| 14 | | |

| | | |

| PART IV |

| 15 | | |

| |

| |

PART I

ITEM 1. DESCRIPTION OF BUSINESS

(Dollars in millions, except per share amounts, unless otherwise stated)

Company Overview

Exelis Inc. (“Exelis” or the “Company”) is a diversified aerospace, defense, information and services company that leverages a 50-year legacy of deep customer knowledge and technical expertise to deliver affordable mission-critical solutions in the areas of imaging and analysis, electronic warfare, air traffic solutions, positioning and navigation, communications and information systems, logistics, and technical services to military, government and commercial customers in the United States and globally. We are focused on strategic growth in the areas of: critical networks; intelligence, surveillance, reconnaissance (ISR) and analytics; electronic warfare; and composite aerostructures. The Company's customers include the U.S. Department of Defense (DoD) and its prime contractors, U.S. Government intelligence agencies, the National Aeronautics and Space Administration (NASA), the Federal Aviation Administration (FAA), allied foreign governments and domestic and foreign commercial customers. As a prime contractor, subcontractor, or preferred supplier, Exelis participates in many high priority defense and civil government programs in the United States and internationally. Exelis conducts most of its business with the U.S. Government, principally the DoD.

We operate in two segments: Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR) Electronics and Systems, and Information and Technical Services. Our C4ISR Electronics and Systems segment provides engineered systems and solutions, including: ISR systems; integrated electronic warfare systems; radar and sonar systems; electronic attack and release systems; communications solutions; space systems; and composite aerostructures, for government and commercial customers around the world. Our Information and Technical Services segment provides a broad range of service solutions, including: systems integration; network design and development; air traffic management; cyber; intelligence; operations; sustainment; advanced engineering; logistics; and space launch and range-support, for a wide variety of U.S. military and U.S. Government customers.

We employ approximately 17,200 people on four continents, led by an experienced management team with a proven ability to execute on existing programs, win new contracts, enter adjacent markets, drive operating efficiency, and lead development of advanced technologies and solutions.

On December 11, 2013, Exelis announced that its Board of Directors approved a plan to spin-off part of its military and government services business ("Mission Systems") through a transaction that is intended to be tax-free to Exelis and its shareholders. The spin-off is subject to final approval of the Company’s Board of Directors. Following completion of the spin-off, Mission Systems will be an independent, publicly traded company. Mission Systems is currently part of the Company’s Information and Technical Services segment and includes the following major program areas: Infrastructure Asset Management; Logistics and Supply Chain Management; and Information Technology and Network Communication Services.

Our Business Strategy and Core Strengths

We create value by being an agile, efficient and reliable supplier of critical systems, components and services for our U.S. Government customers as well as our international government and commercial customer base. We view the following strategies as our fundamental means for value-creation:

Leveraging our Core Strengths

We have created a culture which emphasizes innovation, technical expertise, operating performance and efficiency, and intimate knowledge of our customers’ needs. We emphasize an ability to provide affordable and ready-to-deploy solutions for our customers’ most pressing needs. Our portfolio is largely “platform-agnostic,” in that we provide essential systems and components on a wide variety of aircraft, ships, ground vehicles, unmanned systems and spacecraft, so that our business prospects are not tied directly to the future of any single program or market. In 2013, we completed a strategic alignment of our differentiated capabilities with our enduring customer and market needs, resulting in the selection of four Strategic Growth Platforms (SGPs), which serve as an organizing mechanism for growth and investment across the Exelis portfolio. The SGPs are: Critical Networks; ISR & Analytics; Electronic Warfare;

and Composite Aerostructures. These growth platforms are supported by the Company’s most differentiated and enduring capabilities. We see our diversified portfolio as an advantage in the current U.S. Government budget environment, as we have strong incumbent positions on many key programs, with a robust pipeline of competitive opportunities. For the year ended December 31, 2013, no single program accounted for more than 8% of our total revenue. Our core strengths are further explained below:

| |

• | Operating performance and efficiency: Lean and Six Sigma programs are embedded in our culture and operating ethic. In 2013, we initiated and completed an action to reduce the size of our workforce and consolidate our facilities footprint to align our cost structure more closely to customer and market conditions. We intend to continue to aggressively reduce costs, minimize overhead, increase productivity, and align our footprint to ensure optimum utilization of our facilities. |

| |

• | Customer relationships: Understanding our customers’ needs is essential to winning and sustaining their trust and earning repeat business. Our innovative culture, domain expertise, experienced employees and deep understanding of customer needs are essential to developing and delivering tailored, reliable customer solutions. |

| |

• | Diverse portfolio and breadth of programs: Our systems and components provide a wide array of mission-enabling technologies on defense and commercial platforms in the air, at sea, on the ground, and in space. |

| |

◦ | In the air, our systems (spanning electronics, antennas, and structural systems) are on a broad range of domestic and international aircraft, including: the F-35 Joint Strike Fighter (JSF), F/A-18C/D/E/F, F-22, F-16, F-15E, EA-18, EA-6B, E-2C, B-1B, B-2, B-52, C-130, CH-53K, C17, AV-8B, P-8, AH-64, MQ-9 Reaper (UAV), and a variety of NATO aircraft including Tornado, Eurofighter and Gripen. Our composite aerostructures and antennas are widely used on commercial jets made by Boeing and Airbus, and Sikorsky commercial and military helicopters. |

| |

◦ | In air traffic management, we are the prime contractor for the FAA’s Automated Dependent Surveillance-Broadcast (ADS-B) contract, which we believe will improve the safety, capacity and efficiency of aviation while accommodating future air traffic growth. We are also extending our position in the commercial aviation market by integrating real time surveillance data from ADS-B and other sources into our next-generation airport operations management system called Symphony. We believe our diversified platform and program exposure, extending from deep space to undersea, is a core strength that mitigates risk to specific defense program cuts and creates multiple opportunities for growth. |

| |

◦ | At sea, our systems and technologies are essential to the U.S. Navy’s aircraft carriers, submarines and Littoral Combat Ships, as well as several classes of Royal Australian Navy vessels. |

| |

◦ | On the ground, we provide communications and electronic force protection systems for over 120 ground vehicle and weapon system types, including HMMWVs, MRAPs, M-ATVs, and various armored combat vehicles. As a leading supplier of night vision goggles, we help military and law enforcement personnel around the word to “own the night,” whether operating aboard the many platforms noted above or on foot. |

| |

◦ | In space, our positioning, navigation and meteorological systems are on board every U.S. Government global positioning systems (GPS) and weather monitoring satellite, and we are a leader in advanced optical systems for aerospace applications. |

| |

• | Experienced leadership team: Our senior corporate team, division presidents, and business unit general managers have an average of 22 years of experience in the aerospace and defense industry. Approximately 24% of our employees have engineering degrees and approximately 180 of our employees hold Ph.Ds. |

Proactive portfolio management

We take a proactive and disciplined approach to our portfolio by aligning our businesses with enduring and growing customer needs. Our multifaceted defense portfolio has been well-positioned to support the critical needs of the DoD through a decade of heavy deployments and overseas conflicts. We are addressing the reality of tighter defense budgets by broadening our customer base to include other U.S. Government agencies, allied international governments and commercial customers. We are particularly focused on product and service offerings in areas of

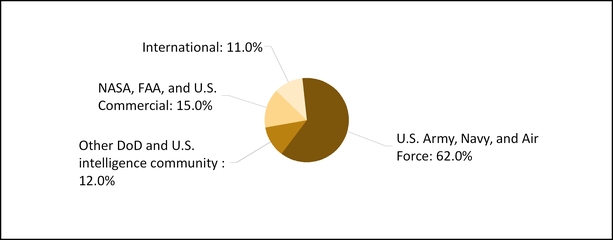

enduring demand such as air traffic management, electronic warfare, data analytics, advanced imaging and sensor systems, precision timing and navigation, information networks, and composite structures. As set forth in the chart below, our revenue from end-user customers other than the U.S. Army, Navy, and Air Force was approximately 38% of total revenue for the year ended December 31, 2013.

2013 Revenue by End User

While we protect and expand our core positions as a diversified aerospace, defense, information and services solutions provider, we will continue to evaluate potential strategic acquisitions, spin-offs or divestitures that will sharpen our focus and enhance our ability to deliver greater value to our shareholders. Over the last several years, we have successfully completed and integrated several acquisitions, broadening our product and technology portfolio and expanding our customer base.

We are both a prime contractor and a supplier of first-tier systems, subsystems, and components, with approximately 78% of our revenue coming from contracts where we are the prime contractor.

Innovative technologies and solutions

We focus on investing in differentiating technologies and solutions that address our customers' greatest priorities through:

| |

• | Advanced technologies in integrated electronic warfare, networked information and communications, sensors and surveillance, precision navigation and timing, image processing, air traffic management, night vision, and composite aerostructures. |

| |

• | Creative approaches to rapidly fielding affordable solutions for critical customer needs, such as our Global Network On the Move Active Distribution (GNOMAD) solution for affordable vehicle-mounted tactical satellite communications, our handheld Netted Iridium radios for secure, 24/7 beyond-line-of-sight voice and data communications, and our Knight Owl compact imaging systems mounted on Unmanned Aerial Vehicles (UAVs) to perform persistent surveillance missions over wide geographical areas. |

| |

• | Advanced technical services focused on critical customer missions including designing, building, operating and sustaining large, specialized and secure communications networks. |

| |

• | Collaboration internally across our businesses and externally with partners to deliver offerings and solutions on new business opportunities. Examples include our winning solution as the prime contractor for the FAA’s ADS-B system, where we are providing GPS-based positioning data for aircraft throughout the United States, and our role as a major subcontractor on the next generation Global Positioning System Operational Control System (GPS OCX) project for the U.S. Air Force, where we are providing key components for navigation and system security. |

Organic and geographic growth, while broadening our customer base

We aim to grow market share, expand into adjacent markets and penetrate non-DoD customers. Our strong incumbent positions and large fielded base of night vision devices, radios, jammers, radars and other electronic equipment are expected to remain in operation for decades, providing opportunities for future upgrades, modernization and sustainment contracts as the military services seek affordable alternatives to costly and unproven replacement programs. We are also growing our international sales, with focus on allied countries with enduring defense and security needs as well as countries that seek modernization of their air traffic management infrastructures and other critical networks. For the year ended December 31, 2013, international sales were $545, approximately 11% of our total revenue. We are also pursuing extensions of existing technologies in commercial markets, such as air traffic management data for commercial air carriers and composite solutions for commercial, fixed and rotary-wing aircraft.

Business Segments

We operate in two segments: C4ISR Electronics and Systems, and Information and Technical Services.

C4ISR Electronics and Systems

Our C4ISR Electronics and Systems segment had revenues of $2.1 billion, $2.5 billion and $2.8 billion and operating income of $218, $350 and $385 for the years ended December 31, 2013, 2012 and 2011, respectively, and accounted for 44%, 45%, and 48%, respectively, of our total revenues. This segment consists of the following major product lines:

Intelligence, Surveillance and Reconnaissance Systems

Our Intelligence, Surveillance and Reconnaissance (ISR) Systems business serves an array of government, civil, commercial, and international customers with integrated real-time, autonomous geospatial analytics solutions, extending from image collection through processing, exploitation and dissemination of actionable intelligence. Our offerings enhance information superiority, contribute to national security, provide environmental data, and protect property and human life. Our specialized capabilities include high reliability remote sensing payloads for ground, air and space, offering active and motion imaging; anti-jam signal generation; data encryption; information processing; real-time forensic and predictive analytics; and system performance modeling and simulation. We also provide solutions that map and monitor the earth for a variety of commercial and government users. Our imaging payloads or sensor systems have been at the heart of nearly every U.S. commercial remote sensing satellite system. Our sensors currently provide all of the commercial high resolution space-based imagery in the United States, and we are expanding this expertise to pursue several international opportunities. Our environmental systems monitor and evaluate our global environment with ground-based and space-based remote sensing, change detection, and data processing. The capabilities of our ISR Systems business are at the heart of the ISR & Analytics SGP and serve enduring ISR and environmental missions for U.S. and international customers.

Integrated Electronic Warfare Systems

Integrated Electronic Warfare Systems (IEWS) is a leader in the design and manufacture of Electronic Warfare solution products with a history spanning more than 50 years. Having fielded more than 20,000 state-of-the-art counter-improvised explosive devices (IEDs) during recent conflicts, IEWS has been at the forefront of ground electronic warfare technologies that protect forces in asymmetrical threat environments. IEWS develops, produces and sells electronic warfare solutions to most U.S. military service branches and to classified customers and allied nations, and is a leading producer of electronic warfare countermeasures (ECM) solutions for tactical and strategic aircraft. IEWS is a key player on airborne platforms such as the U.S. Navy's F/A-18, and U.S. special operations forces (SOF) MH-60s and MH-47s helicopters. IEWS's experience and capabilities are the cornerstone for our electronic warfare SGP.

Electronic Attack and Release Systems

Electronic Attack and Release Systems (EARS) is a leading designer and producer of aircraft-armament suspension and release equipment, weapons interface systems for fighter jets, surveillance aircraft and unmanned aerial vehicles for the U.S. military and allied forces. EARS has built a strong leadership position and worldwide recognition in the weapons carriage and release area, having produced well over 22,000 systems during the past 45 years. This strength comes from our sole source position on many of the major airframes utilized by U.S. and international militaries,

including the F-15, F-22, F-35, F-16, F/A-18, P-8, AV-8B and MQ-9. EARS products also include advanced antenna technologies which provide communication, navigation, direction-finding and electronic warfare capabilities for military and commercial aircraft, with antennas on all Boeing 7-Series planes.

Radar, Reconnaissance and Undersea Systems

Radar, Reconnaissance and Undersea Systems (RRUS) designs and manufactures high performance, high quality radio frequency (RF) and acoustic surveillance sensors, integrated radar and precision air traffic control surveillance systems for both domestic and international customers, with a broad portfolio of defense products. RRUS’s core capabilities include defense surveillance radars, air traffic control radars, command and control, towed and hull mount sonars, tactical data links and airborne multifunction radars. The RRUS business also provides electronic warfare and signals intelligence systems for reconnaissance and surveillance, with monitoring and signal processing systems and equipment for electronic intelligence (ELINT), electronic support measures (ESM), electronic counter measures (ECM) and signals intelligence (SIGINT) applications. We have provided more than 1,500 ESM /ELINT systems to customers in more than 30 countries during the past 30 years. Capitalizing on its capability to produce highly engineered piezoelectric devices, RRUS has also developed innovative applications of this technology to address the geophysical and healthcare markets. RRUS is currently the largest U.S. manufacturer of mine sweeping systems and has been the trusted provider of mine defense solutions to the U.S. Navy since 1973, through our landmark MK-105 Airborne Mine Countermeasures (AMCM) magnetic mine sweeping system.

Communications Solutions

Communication Solutions (CS) is a globally recognized leader in the design and manufacture of RF-based systems. CS specializes in tactical communications systems; mobile satellite communications systems; wireless communications systems; special mission communications systems; global positioning systems (GPS); mobile ad hoc networking (MANET) solutions; and integrated command, control, and communications (C3) solutions for U.S. and allied forces, as well as many government agencies. CS's key products include the Single Channel Ground and Airborne Radio System (SINCGARS), the most widely deployed military tactical radio program in the world with more than 650,000 units in use in more than 35 countries, and the Soldier Radio Waveform (SRW), one of the key networking enablers for Joint Tactical Radio System (JTRS) programs. We also develop advanced technology at lower size, weight, power and cost (SWAP-C), and remain a strong competitor for global tactical radio programs.

Night Vision

Our Night Vision business is a leader in image intensification and sensor fusion technology. We are the world’s leading developer, producer, and supplier of Generation 3 image intensification technology for U.S. and allied military and security forces, and we are the largest producer of high performance night vision products in the world. We provide AN/PVS-14 and AN/PVS-7 ground night vision goggles and spare image intensifier tubes to the U.S. and allied militaries, via foreign military sales, and we are the primary supplier to the U.S. military for the AN/AVS-6 and AN/AVS-9 aviation night vision goggles, which provides rotary- and fixed-wing aircraft pilots the ability to operate in extreme low-light situations. We also developed the Enhanced Night Vision Goggle Optical (ENVG(O)) system, which was the first production goggle to optically overlay traditional night vision imagery with long wave thermal infrared imagery. The ENVG(O) system enables users to effectively operate in extreme low light and obscured battlefield conditions.

Positioning, Navigation and Timing

Our Positioning, Navigation and Timing (PNT) business is a total GPS navigation systems supplier providing high-performance, reliable, cost-effective GPS payload, receiver and control solutions. We have developed more than 50 GPS satellite payloads that have been on every U.S. Government GPS satellite ever launched, and our equipment has accumulated over 500 years of combined on-orbit life without a mission-related failure due to our equipment. Today, new GPS technologies are being developed that will dramatically improve the accuracy and reliability of this global utility under the GPS III program. The next generation Global Positioning System Operational Control System (GPS OCX) will provide command, control and mission support for all current and future GPS satellites based on a modern, service-oriented architecture that will integrate a government and industry open system standard. We are providing the key navigation processing elements and precision monitor station receivers during the current phase of the GPS OCX program that includes advanced anti-jam capabilities, and improved system security, accuracy and reliability. We are further leveraging our patented PNT technologies to develop a proprietary product, known as Signal Sentry,

that detects and geo-locates GPS interference sources in real time providing actionable intelligence to protect critical infrastructures that depend upon GPS availability. Our PNT business is another key driver of our ISR & Analytics SGP.

Aerostructures

Our Aerostructures business is a technically advanced designer and manufacturer of lightweight composite aerospace assembly structures, sub-assemblies and components. For more than 40 years, we have innovated advanced composite solutions for defense and commercial industries in applications from large commercial transport aircraft to fighter jets and commercial and military rotorcraft. We supply composites to most major aerospace prime contractors, including Boeing, Airbus, Lockheed Martin, Sikorsky and BAE Systems. Our composite design and fabrication expertise can be found on many commercial platforms such as Boeing’s 7-series family, Airbus's A380 aircraft, General Electric's GEnx engine, as well as Sikorsky's S-76 helicopter. For defense programs, we provide a wide range of products including complete structural assemblies, flight critical components, primary and secondary structural elements for platforms such as the F-35 Lightning II, the CH-53K Heavy Lift Helicopter, the C-17 Globemaster III and the Joint Air-to-Surface Standoff Missile (JASSM). Our aerostructures capabilities are the foundation for the Composite Aerostructures SGP.

Specialty Applications

Specialty Applications (SA) develops advanced, custom solutions which provide our government and commercial customers with self-protection, data protection, enhanced communications, and situational awareness. SA specializes in satellite based communications systems, ground electronic warfare systems, commercial wireless technologies, tagging, tracking and locating, and information assurance. To combat the anti-access/area denial (A2/AD) threat, SA leverages an adaptive multi-platform approach to ensure that users can connect and share data globally without being constrained by terrain or distance. We integrate data devices into A2/AD-resilient architectures which provide a secure global backbone for C4ISR capabilities against sophisticated adversaries.

Information and Technical Services

Our Information and Technical Services segment had revenues of $2.7 billion, $3.0 billion and $3.0 billion and operating income of $258, $211 and $150 for the years ended December 31, 2013, 2012 and 2011, respectively, and accounted for 56%, 55% and 52%, respectively, of our total revenues. This segment consists of the following major program areas:

Advanced Information Solutions

Our Advanced Information Solutions (AIS) business serves a broad range of federal customers in defense, intelligence and homeland security. AIS consists of a comprehensive portfolio that includes enduring mission support, advanced research and development support, and enterprise information support to enable it to deliver affordable, essential mission solutions in the critical networks and ISR & analytics market spaces. AIS serves enduring missions in military and national intelligence, strategic deterrence, and defense against chemical, biological, radiological nuclear and explosive threats, and other core defense programs. We combine deep customer knowledge, subject matter expertise, engineering science and technical skills, and multiple technology partnerships to provide our customers with innovative solutions for ever-changing needs. Our key roles in support of the U.S. Army, Air Force, and Navy research laboratories generate early insights into emerging inflection points with respect to technology readiness and customer needs. AIS develops information-enabled solutions for U.S. Government customers that rely on our expertise to securely access, integrate and share sensitive data. These solutions integrate key capabilities in cyber defense, cross-domain information sharing, broad enterprise applications of information technology, and the implementation of leading edge network and systems architectures. We are the prime contractor for the U.S. Joint Spectrum Center’s (JSC) Electromagnetic Spectrum Engineering Services contract, where we provide engineering systems support, technical analysis, test support, and long-term strategic planning as JSC meets national security and military objectives related to the use of the electromagnetic spectrum.

Civil and Aerospace Systems

Our Civil and Aerospace Systems business has a 30-year history as a trusted provider of air traffic control navigation, communication and surveillance solutions as well as space and ground communications networks. Civil and Aerospace Systems provides the FAA with engineering expertise and full system solutions in the development and

implementation of a modernized air traffic system. Our core program is the Automated Dependent Surveillance-Broadcast (ADS-B) system, the cornerstone program of the FAA’s Next Generation Air Transportation System (NextGen) initiative to modernize from a ground-based system of air traffic control to a satellite-based system of air traffic management. As the prime contractor on the ADS-B contract, we are designing, building and operating a nationwide system of radio communications, telecommunications networks, information technology and software to deliver highly accurate, networked, real-time surveillance data to the automated systems of the FAA. We have extended our integrated network systems capabilities to the commercial aviation market with a comprehensive, web-based application suite called Symphony, which enables key business functions for airports and airlines to improve efficiencies in their operations. This real-time, comprehensive flight tracking data is essential to improving airport stakeholders’ operations, including flight information display systems, billing, auditing, resource allocation and situational awareness. We have supported NASA for more than 25 years as a leading provider of advanced engineering services for its space and ground communications networks. We are the prime contractor on NASA’s Space Communications Network Services (SCNS) contract for the Goddard Space Flight Center, which provides most of the communications and tracking services for a wide range of Earth-orbiting spacecraft, such as the International Space Stations and the space shuttle. Also, we provide operations, maintenance and engineering support to NASA under the Deep Space Network (DSN) contract. The DSN provides the link between earth and scores of NASA spacecraft roaming the solar system on a variety of important interplanetary missions.

Command, Control and Communications Systems

Our Command, Control and Communications Systems (C3S) business provides a full spectrum of technical services supporting mission critical network systems. These services include systems engineering, lifecycle sustainment, logistic support, modernization, and operations and maintenance for U.S. military launch, test and training ranges, including; DoD's SATCOM systems, NASA’s ground communications networks and launch ranges and other high-priority U.S. Government assets throughout the world. C3S supports complex mission requirements that cover a broad spectrum of support, from facilities maintenance to reverse engineering of legacy systems. Key areas of support include system engineering, sustainment, logistics, depot maintenance, software and hardware engineering and configuration management for range instrumentation such as tracking, telemetry, optical, weather, communications, and command & control networks and systems. C3S also provides payload processing and launch services for numerous government agencies. These key systems and assets are critical to the launch range and space communications network infrastructures, including the world’s largest air, land and sea training range for the U.S. Navy and the U.S. Air Force space launch ranges on the U.S. East and West Coasts. Under our Spacelift Range System (SLRS) contract, we engineer, modernize and sustain large networks and range support infrastructure for the western ranges based in Vandenburg Air Force Base in California and the eastern ranges based in Patrick Air Force Base in Florida. We also provide engineering support and sustainment for the U.S. Air Force's early warning system under our System Engineering and Sustainment Integrator (SENSOR) contract. C3S is also responsible for sustaining, maintaining and modernizing large radar installations globally. Together, our AIS, Civil and Aerospace Systems, and C3S businesses are the foundation of our Critical Networks SGP.

Infrastructure Asset Management

Our Infrastructure Asset Management business supports the U.S. Army, Air Force and Navy with enduring technical services. Core capabilities include: infrastructure operations and maintenance; security; warehouse management and distribution; ammunition management; air base maintenance and operations; communications; emergency services; transportation; and life support activities. Our primary contracts include: the Kuwait Base Operating Support, Services and Security (K-BOSSS) contract for Camp Arifjan, Kuwait, one of the largest logistics bases in the U.S. military, which provides services ranging from medical, postal, and maintenance services, to public works, transportation, and emergency services; our Maxwell Base Operations Support contract which operates and maintains key facilities at the U.S. Air Force Air University, and performs facility maintenance and air base equipment maintenance; our Kaiserslautern Facilities Engineering contract which provides facility engineering services for the Kaiserslautern Military Community, including maintenance and repair of installed building equipment, utility services, construction, and a number of ancillary support functions. Infrastructure Asset Management contracts in Afghanistan consist of two contracts with the U.S. Army Corps of Engineers to provide facilities operations, maintenance and training services for the Afghan National Security Forces (ANSF) and the Combined Security Transition Command in both Northern and Southern Afghanistan (ANSF Facilities Support programs) contracts and the Logistics Civilian Augmentation

Program (LOGCAP) contract, which provides logistics and supply operations, airfield operations and transportation support to the U.S. warfighter and to the Afghanistan National Security Forces.

Logistics and Supply Chain Management

Our Logistics and Supply Chain Management business core capabilities include equipment maintenance, repair and services; care of supplies in storage; warehouse management and distribution; supply point distribution; and transportation support. As part of our offerings, we also warehouse, inspect, service and maintain large equipment sets in storage; maintain, issue and ship military supplies for contingency and humanitarian missions; provide maintenance, storage and issuance of ammunition; provide retail fuel distribution support for unit movements; move and ship containerized equipment, supplies, and personal property; and administer motor pool operations. Our major contracts include: the Kuwait based Army Preposition Stock-5 (APS-5 Kuwait) contract, which supports the U.S. Army's largest pre-positioned stocks stored and maintained in Kuwait; Fort Rucker Logistics Support Services contract, which provides multifaceted logistics services in support of the Logistics Readiness Center (LRC) for all ground equipment and soldiers at Fort Rucker and Eglin AFB; and the Marine Corps Logistics Support Services contract, which provides support to the Marine Corps in the areas of distribution, supply chain, and storage services in support of Marine Corps and Navy operations in the Middle East, throughout the United States and in the Pacific Rim.

Information Technology and Network Communication Services

Our Information Technology and Network Communication Services business has over a 50-year history of providing information technology support and services for worldwide communications and network systems. Operations and maintenance support ranges from legacy World War II era communications systems in Europe to dynamic state-of-the-art communications systems in remote and hostile locations in Iraq and Afghanistan. We have demonstrated our capacity to effectively operate, maintain, supply, staff, sustain, and modernize communications systems. Our work is performed in Germany, Italy, Great Britain, Turkey, Kosovo, Kuwait, Afghanistan, Japan, Korea, Qatar, Oman, Bahrain, California, Colorado, Hawaii, Virginia and at sea. Our services capabilities consist of: communications; management and service support; network security; systems installation and activation; and quality control. The largest contracts within our Information Technology and Network Communication Services business include the Operations, Maintenance and Defense of Army Communications Southwest Asia, Central Asia and Africa (OMDAC-SWACAA) contract (formerly the Total Army Communications for Southwest Asia, Central Asia and Africa (TACSWACAA) contract), where we operate and maintain the U.S. Army’s largest communications network from locations in the Middle East, and the Fleet Systems Engineering Team (FSET) contract where, we provide on-site technical and end-to-end systems engineering support for Command, Control, Communications, Computer, Intelligence (C4I) systems for the U.S. Navy.

Industry Background

The federal government remains the largest consumer of services and solutions in the United States. The DoD is the largest purchaser of services and solutions in the federal government and is our largest customer. In addition to the DoD, we do substantial business with the U.S. intelligence community, NASA, FAA and allied international customers.

U.S. federal government spending is affected by the state of the U.S. economy and by measures taken to deal with persistent fiscal deficits. However, DoD spending is also driven by our nation’s security posture and the perceived threat environment. Deficit reduction measures will continue to put pressure on all areas of federal government spending, including defense, and we believe there is significant risk of further DoD and intelligence spending reductions going forward. Approval of the Bipartisan Budget Act of 2013 and the Consolidated Appropriations Act for fiscal year 2014 has provided some clarity on federal spending levels for fiscal years 2014 and 2015. However, longer term federal spending levels remain unclear. Within the defense, intelligence and homeland security budgets, we anticipate that there will be pockets of priority spending, driven by growing needs for sophisticated intelligence gathering, secure information sharing, capabilities that counter anti-access and area-denial intentions, and affordable versus “exquisite” solutions to modernize aged, outmoded, or war-torn equipment. Thus, we foresee sustained levels of funding in the areas of integrated electronic warfare, networked communications, intelligence and information analysis, cyber-security and cyber warfare, unmanned systems, submarines, sustainment, and affordable upgrades to fielded equipment.

Within the NASA budgets, we anticipate funding for earth science and space communications network programs, in which we participate, to persist. Reliance on timely and accurate weather data, environmental monitoring and reliable communications will continue to be priorities in an increasingly mobile, connected, and environmentally responsible society.

Within the FAA, in spite of overall fiscal pressures, we expect continued budget priority to be placed on deployment of next generation air traffic management systems. We expect the U.S. Congress to continue to fund these critically important programs, driven by increased volumes of air traffic; safety, cost and environmental benefits; the need to better manage congestion around major airports; and the urgent need to replace outdated technology and infrastructure.

Internationally, austerity measures are affecting defense spending among Western European allies, but we project continued strong spending in allied countries that face regional security threats and volatility in the Middle East, Latin America and Asia-Pacific regions.

Customers

Our largest customer is the DoD, primarily the U.S. Army, Navy and Air Force. In addition, we do substantial business with NASA, the FAA and the U.S. intelligence community. Our sources of revenue were as follows:

|

| | | | | | | | | |

| Year Ended December 31, |

| 2013 | 2012 | 2011 |

Domestic | | | |

U.S. Army, Navy, and Air Force | $ | 2,964 |

| $ | 3,623 |

| $ | 3,985 |

|

NASA, FAA, and U.S. Commercial | 704 |

| 741 |

| 682 |

|

Other DoD and Intelligence Community | 603 |

| 612 |

| 638 |

|

International | 545 |

| 546 |

| 534 |

|

Total revenue | $ | 4,816 |

| $ | 5,522 |

| $ | 5,839 |

|

International Sales

Our sales to customers outside the United States were $545, $546 and $534 or 11%, 10% and 9% of total revenue in 2013, 2012 and 2011, respectively. Included in sales to customers outside the United States were foreign military sales through the U.S. Government. Revenue and income from international operations and investments are subject to U.S. Government laws, regulations and policies, including the International Traffic in Arms Regulations (ITAR), the Foreign Corrupt Practices Act (FCPA) and the export laws and regulations described below, as well as foreign government laws, regulations and procurement policies and practices, which may differ from U.S. Government regulations. In addition, embargoes, international hostilities and changes in currency values can also impact our international sales.

Regulatory Matters

We act as a prime contractor or major subcontractor for numerous U.S. Government programs. As a result, we are subject to the extensive regulations and requirements of the U.S. Government agencies and entities which govern these programs, including with respect to the award, administration and performance of contracts under such programs. We are also subject to certain specific business risks associated with U.S. Government program funding and appropriations and U.S. Government contracts, and with supplying technologically advanced, cutting-edge defense-related products and services to the U.S. Government.

U.S. Government contracts generally are subject to the Federal Acquisition Regulation (FAR), which sets forth policies, procedures and requirements for the acquisition of goods and services by the U.S. Government, agency-specific regulations that implement or supplement FAR, such as the DoD’s Defense Federal Acquisition Regulation Supplement (DFARS) and other applicable laws and regulations. These regulations impose a broad range of requirements, many of which are unique to government contracting, including various procurement, import and export, security, contract termination and adjustment, and audit requirements. In addition, these regulations govern contract pricing and cost

by, among other things, defining allowable and unallowable costs, requiring certification and disclosure of all cost and pricing data in connection with certain contract negotiations, and otherwise governing the right to reimbursement under various U.S. Government contracts. These laws and regulations impose specific cost accounting practices that may differ from accounting principles generally accepted in the United States of America (GAAP). These regulations also impose restrictions on the use and dissemination of classified information for national security purposes and the exportation of certain products and technical data. We also cannot compete for or divest of work if an organizational conflict of interest related to such work exists and/or cannot be appropriately mitigated. A contractor’s failure to comply with these regulations and requirements could result in reductions to the value of contracts, contract modifications or termination, the assessment of penalties and fines, and lead to suspension or debarment, for cause, from government contracting or subcontracting for a period of time.

In addition, government contractors are also subject to routine audits and investigations by U.S. Government agencies such as the Defense Contract Audit Agency (DCAA). These agencies review a contractor’s performance on its U.S. Government contracts, including indirect rates and pricing practices and compliance with applicable contracting and procurement laws, regulations and standards. The DCAA also reviews the adequacy of a contractor’s compliance with U.S. Government standards for accounting and management internal control systems, including control environment and accounting systems, general information technology systems, budget and planning systems, purchasing systems, material management and accounting systems, compensation systems, labor systems, indirect and other direct costs systems, billing systems and estimating systems.

U.S. Government programs generally are implemented by the award of individual contracts and subcontracts. Congress generally appropriates funds on a fiscal year basis even though a program may extend across several fiscal years. Consequently, programs are often only partially funded initially and additional funds are committed only as Congress makes further appropriations. The contracts and subcontracts under a program generally are subject to termination for convenience or adjustment if appropriations for such programs are not available or change. The U.S. Government is required to equitably adjust a contract price for additions or reductions in scope or other changes ordered by it.

We are also involved in U.S. Government programs which are classified by the U.S. Government and cannot be specifically described in this Annual Report on Form 10-K. The operating results of these classified programs are included in our financial statements. The business risks and considerations associated with these classified programs generally do not differ materially from those of our other U.S. Government programs and products, and are subject to the same oversight and internal controls as other U.S. Government programs.

The export from the United States of many of our products may require the issuance of a license by either the U.S. Department of State under the Arms Export Control Act of 1976 and its implementing regulations under the ITAR, the U.S. Department of Commerce under the Export Administration Act and its implementing regulations as kept in force by the International Emergency Economic Powers Act of 1977 (IEEPA), and/or the U.S. Department of the Treasury under IEEPA or the Trading with the Enemy Act of 1917. Such licenses may be denied for reasons of U.S. national security or foreign policy. In the case of certain exports of defense equipment and services, the Department of State must notify Congress at least 15 to 60 days (depending on the identity of the importing country that will utilize the equipment and services) prior to authorizing such exports. During that time, Congress may take action to block or delay a proposed export by joint resolution which is subject to Presidential veto.

We are also subject to additional U.S. Government and foreign government regulations and contract requirements with respect to our sales to non-U.S. customers. Revenue and income from international operations and investments are subject to U.S. Government laws, regulations and policies, including the ITAR and the FCPA and export laws and regulations, as well as foreign government laws, regulations and procurement policies and practices, which may differ from U.S. Government regulation, including import-export control, investments, exchange controls, repatriation of earnings and requirements to expend a portion of program funds in-country.

The U.S. Government may revise its procurement practices or adopt new or revised contract rules and regulations at any time. In order to help ensure compliance with these complex laws and regulations, all of our employees are required to complete ethics training and other compliance training relevant to their respective positions.

Competition

We compete against many companies in the aerospace, defense, information and services markets, but primarily against Lockheed Martin Corporation, The Boeing Company, Raytheon Company, General Dynamics Corporation, L-3 Communications Corporation, SAIC Inc., Northrop Grumman Corporation, Harris Corporation and BAE Systems, Inc. Internationally, we also compete against these same companies as well as Thales Group, EADS N.V., Finmeccanica S.p.A. and many others. Intense competition and long procurement and operating cycles are both key characteristics of our business and the overall aerospace and defense industries. It is common in these industries for work on major programs to be shared among a number of companies and a company competing as a prime contractor may, upon ultimate award of the contract to another party, serve as a subcontractor for the ultimate prime contracting party. It is not uncommon to compete for a contract award with a peer company and, simultaneously, perform as a supplier to, or a customer of, such competitor on other contracts. The nature of major aerospace and defense programs, conducted under binding contracts, allows companies that perform well to benefit from a level of program continuity not common in many other industries.

Our success in such competitive industries depends upon our ability to develop and market our products and services, as well as our ability to provide the people, technologies, facilities, equipment and financial capacity needed to deliver those products and services with maximum efficiency. We must continue to maintain reliable and trusted sources for raw materials, fabricated parts, electronic components and major subassemblies. In this manufacturing and systems integration environment, effective oversight of subcontractors and suppliers is as vital to success as managing internal operations.

Similarly, there is intense competition among many companies in the more labor intensive information and services markets. Major competitors in these markets include DynCorp International Inc., KBR Inc., and Fluor Corporation, as well as several of the other defense and government services companies mentioned above, and many other large and small entities with expertise in specialized areas. Our ability to successfully compete in these markets depends on a number of factors, the most important of which is the capability to deploy skilled professionals, many requiring security clearances, at competitive prices across the diverse spectrum of customer requirements. We consider the quality and dedication of our employees to be a key differentiator for Exelis and we have implemented a range of initiatives to ensure our success in attracting, developing and retaining our workforce in order to maintain or improve our competitive position within these markets.

Intellectual Property

We own an intellectual property portfolio of U.S. and foreign patents, and unpatented know-how, data, software, trademarks and copyrights, all of which contribute to the preservation of our competitive position in the marketplace. Although our intellectual property rights in the aggregate are important to the operation of our business, we do not believe that any existing patent, license or other intellectual property right is of such importance that its loss or termination would have a material adverse effect on our business, taken as a whole.

In addition to our patent portfolio, we are licensed to use certain patents, technology, and other intellectual property rights owned and controlled by others, and, the U.S. Government and/or other entities are licensed to use certain patents, technology, and other intellectual property rights owned and controlled by us, under U.S. Government contracts or otherwise. We believe that our business, taken as a whole, is not materially dependent on any one license agreement or related group of license agreements.

Research and Development

We conduct research and development activities to continually enhance our existing products and services, develop new products and services to meet our customers’ changing needs and requirements and address new market opportunities. During 2013, we invested $54 on research and development efforts compared to $67 in 2012 and $99 in 2011. These expenditures principally have been for product development for the U.S. Government. In addition, we also conduct funded research and development activities under U.S. Government contracts which are included in total revenue.

Employees

Respect, responsibility and integrity are our core values. We intend to continue our rigorous corporate responsibility programs which ensure a safe and secure work environment, compliance with government regulations, and allow our employees to voice any concerns while knowing these concerns will be appropriately addressed. Our Company is comprised of diverse people and we believe that our diversity enhances our creativity and enriches our work culture. We are committed to good corporate citizenship and intend to always maintain the trust and support of the communities in which our employees work and live.

As of December 31, 2013, we had approximately 17,200 employees, approximately 2,800 of whom were working under collective bargaining agreements with labor unions and worker representatives. These collective bargaining agreements, which cover approximately 16% of our employees, will be renegotiated at various times over the next 3 years as they expire. We have historically renegotiated these agreements without any significant disruption to our operating activities.

Raw Materials, Suppliers and Seasonality

We depend on our extended supply chain for many of the raw materials, components and supplies used in our product and service offerings. We recognize that all supply networks can experience price fluctuations and capacity constraints that put pressure on pricing and lead times. Through our comprehensive supply chain management practices we evaluate our value chain for competitiveness, viability, and overall performance, which is an important and integral element of our overarching integrated management system. Our ability to maintain multiple sources of supply for many of the items we acquire reduces the risk of potential disruption to our operations. In those instances where we rely on single sources or are engaged in commodity markets with a limited number of suppliers, we attempt to mitigate those perceived risks through long-term agreements and additional supplier oversight. To date, we have not experienced, and do not foresee, significant difficulties in obtaining the materials, components or supplies necessary for our business operations.

We do not consider any material portion of our business to be seasonal. However, various factors can affect the distribution of our revenue between accounting periods, including the timing of contact awards, the availability of customer funding, product deliveries and customer acceptance.

Backlog

At December 31, 2013, total backlog was $9.4 billion compared to $9.5 billion at the end of 2012. Approximately 40% of total backlog at December 31, 2013 is expected to be converted into revenue in 2014. Total backlog included $3.4 billion of funded backlog and $6.0 billion of unfunded backlog at December 31, 2013.

Total backlog includes both funded backlog (firm orders for which funding is contractually obligated by the customer) and unfunded backlog (firm orders for which funding is not currently contractually obligated by the customer). Unfunded backlog represents firm orders, potential options on multi-year contracts and multi-year commercial contracts when demand is supported by customer backlog, and excludes potential orders under indefinite delivery / indefinite quantity (IDIQ) contracts. Backlog is converted into revenue as work is performed or deliveries are made.

Contracts

Generally, the sales price arrangements for our contracts are either fixed-price, cost-plus or time-and-material. A fixed-price contract typically offers higher profit margin potential than a cost-plus or time-and-material contract, which is commensurate with the greater levels of risk we assume on a fixed-price contract.

On a fixed-price contract, we agree to perform the contractual statement of work for a predetermined sales price. Although a fixed-price contract generally permits us to retain profits if the total actual contract costs are less than the estimated contract costs, we bear the risk that increased or unexpected costs may reduce our profit or cause us to sustain losses on the contract.

On a cost-plus contract, we are paid our allowable incurred costs plus a profit which can be fixed or variable depending on the contract’s fee arrangement up to predetermined funding levels determined by our customers. Cost-plus contracts with award and incentive fee provisions are our primary variable contract fee arrangements. Award fees provide for a fee based on actual performance relative to contractually specified performance criteria. Incentive fees generally provide for a fee based on the relationship which total allowable costs bear to target cost.

On a time-and-material contract, we are paid on the basis of direct labor hours expended at specified fixed-price hourly rates (that include wages, overhead, allowable general and administrative expenses and profit) and materials at cost. Therefore, on cost-plus and time-and-material contracts we generally do not bear the risks of unexpected cost overruns, provided that we do not incur costs that exceed the predetermined funded amounts.

We believe we have a balanced mix of fixed-price, cost-plus and time-and-material contracts and a diversified business base with limited reliance on any single contract.

The table below presents the percentage of our total revenue generated from each contract type for the years ended December 31, 2013, 2012, and 2011.

|

| | | | | | |

| Year Ended December 31, |

Contract type | 2013 | 2012 | 2011 |

Fixed price | 43 | % | 43 | % | 45 | % |

Cost plus and time-and-material | 57 | % | 57 | % | 55 | % |

Total revenue | 100 | % | 100 | % | 100 | % |

Environmental

We are subject to stringent federal, state, local and foreign environmental laws and regulations. These environmental laws and regulations are subject to change, which can be difficult to predict reliably and the timing of potential changes is uncertain. Environmental requirements significantly affect our operations, and we have established an internal program to address our compliance with these requirements.

We are responsible, or are alleged to be responsible, for ongoing environmental investigation and remediation of multiple sites. These sites are in various stages of investigation and/or remediation and in many of these proceedings our liability is considered de minimis. We have received notification from the U.S. Environmental Protection Agency (EPA), and from similar agencies, that a number of sites formerly or currently owned and/or operated by Exelis, and other properties or water supplies that may be or have been impacted by those operations, contain disposed or recycled materials or wastes and require environmental investigation and/or remediation. These sites include instances where we have been identified as a potentially responsible party under federal and state environmental laws and regulations. Our accruals for environmental matters are recorded on a site-by-site basis when it is probable that a liability has been incurred and the amount of the liability can be reasonably estimated, based on current law and existing technologies available to us.

It is difficult to estimate the final costs of investigation and remediation due to various factors, including incomplete information regarding particular sites and other potentially responsible parties, uncertainty regarding the extent of investigation or remediation and our share, if any, of liability for such conditions, the selection of alternative remedial approaches, and changes in environmental standards and regulatory requirements. We have estimated and accrued $26 and $27 as of December 31, 2013 and 2012, respectively, for environmental matters. We believe the total amount accrued is appropriate based on existing facts and circumstances.

Cautionary Statement Concerning Forward-looking Statements

Some of the information included herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995 (the “Act”). Whenever used, words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “may,” “could,” “outlook” and other terms of similar meaning are intended to identify such forward-looking statements. Forward-looking statements are uncertain and to some extent unpredictable, and involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in, or implied

from, such forward-looking statements. The Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described in Item 1A, “Risk Factors,” and elsewhere in this report, and those described from time to time in our future reports filed with the Securities and Exchange Commission.

Available Information, Internet Address and Internet Access to Current and Periodic Reports

Our website address is www.exelisinc.com. Exelis makes available free of charge on or through this website under “SEC Filings,” our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (SEC). Information contained on our website is not incorporated by reference unless specifically stated herein. As noted, we file the above reports electronically with the SEC, and they are available on the SEC’s web site (www.sec.gov). In addition, all reports filed by Exelis with the SEC may be read and copied at the SEC’s Public Reference Room located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Item 1A. RISK FACTORS

You should carefully consider each of the following risks, which we believe are the principal risks that we face and of which we are currently aware, and all of the other information in this report. Should any of the following risks and uncertainties develop into actual events, our business, financial condition or results of operations could be materially and adversely affected, the trading price of our common stock could decline, and you could lose all or part of your investment in the Company.

Risks Relating to Our Business

We face the following risks in connection with the general conditions and trends of the industry in which we operate:

We are dependent on the U.S. Government for a substantial portion of our business, and the outlook for U.S. Government spending is uncertain.

Approximately 85% of our 2013 revenues were derived from products and services ultimately sold to the U.S. Government, including the Department of Defense (DoD). These sales are affected by the federal budget and related federal spending levels.

Federal spending is affected by the state of the U.S. economy and by measures taken to deal with persistent fiscal deficits. The Company’s future results could be affected by budgetary actions taken by Congress to reduce federal spending. However, national security spending is also driven by our nation’s national security posture and the perceived threat environment. U.S. Government funding in Afghanistan is expected to continue to decrease as the U.S. military continues to draw down U.S. troop levels in 2014. Such factors have direct bearing on our ability to win new business and deliver on existing contracts, and may affect the timing and volume of our business.

Overall, we expect that top-line defense spending will decline over the next several years and that such spending reductions will likely have an impact across the DoD budget, including reductions in operations and maintenance, procurement and research, development, test and evaluation spending. Such reductions in U.S. Government spending could have a material impact on our business. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties.”

The termination of government contracts may adversely affect our business.

Our financial performance is dependent on our performance under our U.S. Government contracts. The U.S. Government, and other governments, may terminate any of our government contracts, in whole or in part, without prior notice, at their convenience, as well as for default based on our failure to meet specified performance measurements. If any of our government contracts were to be terminated for convenience, we generally would be entitled to receive payment for work completed and allowable termination or cancellation costs. If any of our government contracts were to be terminated for default, generally the U.S. Government would pay only for the work

that has been accepted and can require us to pay the difference between the original contract price and the cost to re-procure the contract items, net of the work accepted from the original contract. The U.S. Government can also hold us liable for damages resulting from the default. The termination of any of our government contracts, whether for convenience or default, may adversely affect our current programs and may reduce our revenue, earnings or cash flows.

As a U.S. Government contractor, we are subject to a number of procurement regulations and could be adversely affected by changes in regulations or any negative findings from a U.S. Government audit or investigation.

U.S. Government contractors must comply with many significant procurement regulations and other requirements. These regulations and requirements, although customary in government contracts, increase our performance and compliance costs. If any such regulations or procurement requirements change, our costs of complying with them could increase and therefore reduce our margins.

We operate in a highly regulated environment and are routinely audited and reviewed by the U.S. Government and its agencies such as the Defense Contract Audit Agency (DCAA) and Defense Contract Management Agency (DCMA). These agencies review our performance under our contracts, our cost structure and our compliance with applicable laws, regulations and standards, as well as the adequacy of, and our compliance with, our internal control systems and policies. Systems that are subject to review include, but are not limited to, our accounting systems, purchasing systems, billing systems, property management and control systems, cost estimating systems, compensation systems and management information systems. Any costs found to be unallowable or improperly allocated to a specific contract will not be reimbursed or must be refunded if already reimbursed. If an audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, which may include termination of contracts, forfeiture of profits, suspension of payments, fines and suspension, or prohibition from doing business with the U.S. Government. Whether or not illegal activities are alleged, the U.S. Government also has the ability to decrease or withhold certain payments when it deems systems subject to its review to be inadequate or if it believes it is in the government’s best interests during a dispute. In addition, we could suffer serious reputational harm if allegations of impropriety were made against us.

The U.S. Government, from time to time, may require its contractors to reduce certain contract prices, or may disallow costs allocated to certain contracts. These adjustments can involve substantial amounts. In the past, as a result of such audits and other investigations and inquiries, we have on occasion made adjustments to our contract prices and the costs allocated to our government contracts.

We are also, from time to time, subject to U.S. Government investigations relating to our operations, and we are subject to or expected to perform in compliance with a vast array of federal laws, including but not limited to the Truth in Negotiations Act, the False Claims Act, the Procurement Integrity Act, Cost Accounting Standards, the International Traffic in Arms Regulations promulgated under the Arms Export Control Act, the Close the Contractor Fraud Loophole Act and the Foreign Corrupt Practices Act. If we are convicted or otherwise found to have violated the law, or are found not to have acted responsibly as defined by the law, we may be subject to reductions of the value of contracts, contract modifications or termination and the assessment of penalties and fines, compensatory or treble damages, which could have a material adverse effect on our financial position, results of operations, or cash flows. Such findings or convictions could also result in suspension or debarment from government contracting. Given our dependence on government contracting, suspension or debarment could have a material adverse effect on our financial position, results of operations, or cash flows.

Competition within our markets may reduce our revenue and market share.

We operate in highly competitive markets, and our competitors may have more extensive or more specialized engineering, manufacturing and marketing capabilities than we do in some areas. We anticipate higher competition in some of our core markets as a result of the reduction in budgets for many U.S. Government agencies and fewer new program starts. In addition, as discussed above, projected U.S. defense spending levels for periods beyond the near-term are uncertain and difficult to predict. Changes in U.S. defense spending may limit certain future market opportunities. We are also facing increasing competition in our domestic and international markets from foreign and multinational firms. Additionally, some customers, including the DoD, may turn to commercial contractors, rather than traditional defense contractors, for information technology and other support work. If we are unable to continue

to compete successfully against our current or future competitors, we may experience declines in revenue and market share which could negatively impact our financial position, results of operations, or cash flows. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Known Trends and Uncertainties.”

Our international business exposes us to additional risks.

Our international business constituted approximately 11% of total revenue for the year ended December 31, 2013. We are subject to numerous U.S. and foreign laws and regulations, including, without limitation, regulations relating to import-export control, technology transfer restrictions, repatriation of earnings, exchange controls, the Foreign Corrupt Practices Act and the anti-boycott provisions of the U.S. Export Administration Act. Failure by us or our sales representatives or consultants to comply with these laws and regulations could result in administrative, civil, or criminal liabilities and could, in the extreme case, result in suspension or debarment from government contracts or suspension of our export privileges, which could have a material adverse effect on us. Changes in regulation or political environment may affect our ability to conduct business in foreign markets, including investment, procurement and repatriation of earnings.

The services and products we provide internationally, including through the use of subcontractors, are sometimes in countries with unstable governments, in areas of military conflict or at military installations. This increases the risk of an incident resulting in damage or destruction to our products or resulting in injury or loss of life to our employees, subcontractors or other third parties. We maintain insurance to mitigate risk and potential liabilities related to our international operations, but our insurance coverage may not be adequate to cover these claims and liabilities and we may bear substantial costs arising from those claims. The impact of these factors is difficult to predict, but any one or more of them could adversely affect our financial position, results of operations, or cash flows.

Our future success depends, in part, on our ability to develop new products and new technologies and maintain technologies, facilities, equipment and a qualified workforce to meet the needs of current and future customers.

The markets in which we operate are characterized by changing technologies. The product, program and service needs of our customers change and evolve regularly. Accordingly, our success in the competitive defense industry depends upon our ability to develop and market our products and services. If we fail to maintain our competitive position, we could lose a significant amount of future business to our competitors, which would have a material adverse effect on our ability to generate favorable financial results and maintain market share.

Our operating results are heavily dependent upon our ability to attract and retain sufficient personnel with requisite skills and/or security clearances. If qualified personnel become scarce, we could experience higher labor, recruiting or training costs in order to attract and retain such employees or could experience difficulty in performing under our contracts if the needs for such employees are unmet.

Many of our contracts contain performance obligations that require innovative design capabilities, are technologically complex, require state-of-the-art manufacturing expertise or are dependent upon factors not wholly within our control. Failure to meet these obligations could adversely affect our profitability and future prospects.

We design, develop and manufacture technologically advanced and innovative products and services applied by our customers in a variety of environments. Problems and delays in development or delivery as a result of issues with respect to design, technology, licensing and patent rights, labor, learning curve assumptions or materials and components could prevent us from achieving contractual requirements.

In addition, our products cannot be tested and proven in all situations and are otherwise subject to unforeseen problems. Examples of unforeseen problems that could negatively affect revenue and profitability include loss on launch of spacecraft, premature failure of products that cannot be accessed for repair or replacement, problems with quality and workmanship, country of origin, delivery of subcontractor components or services and unplanned degradation of product performance. These failures could result, either directly or indirectly, in loss of life or property. Among the factors that may affect revenue and profits could be unforeseen costs and expenses not covered by insurance or indemnification from the customer, loss of follow-on work, and, in the case of certain contracts, liquidated damages, penalties and repayment to the customer of contract cost and fee payments we previously received.

Misconduct of our employees, subcontractors, agents and business partners could cause us to lose customers or our ability to obtain new contracts.