Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on March 29, 2012

Registration No. 333-175803

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

Morgan Properties Trust

(Exact Name of Registrant as Specified in its Governing Instruments)

160 Clubhouse Road, King of Prussia, Pennsylvania 19406

(610) 265-2800

(Address, Including Zip Code, and Telephone Number, including Area Code,

of Registrant's Principal Executive Offices)

J. Patrick O'Grady

Executive Vice President and Chief Financial Officer

Morgan Properties Trust

160 Clubhouse Road, King of Prussia, Pennsylvania 19406

(610) 265-2800

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Gilbert G. Menna Goodwin Procter LLP The New York Times Building 620 Eighth Avenue New York, New York 10018 (212) 813-8800 |

David J. Goldschmidt Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale of such securities is not permitted.

Subject to Completion

Preliminary Prospectus dated March 29, 2012

PROSPECTUS

Shares

Morgan Properties Trust

Common Shares of Beneficial Interest

This is the initial public offering of Morgan Properties Trust. We are offering common shares of beneficial interest.

We expect the initial public offering price to be between $ and $ per common share. Currently, no public market exists for our common shares. After pricing of the offering, we expect that the common shares will trade on the New York Stock Exchange under the symbol "MPT."

We intend to elect to be taxed and to operate in a manner that will allow us to qualify as a real estate investment trust for federal income tax purposes commencing with our taxable year ending December 31, 2012. To assist us in qualifying as a REIT, our declaration of trust contains certain restrictions on the ownership and transfer of our common shares. See "Description of Shares of Beneficial Interest" beginning on page 161 of this prospectus.

Investing in our common shares involves risks. You should read the section entitled "Risk Factors" beginning on page 25 of this prospectus for a discussion of certain risk factors that you should consider before investing in our common shares.

| |

Per Share

|

Total

|

||

|---|---|---|---|---|

Public offering price |

$ | $ | ||

Underwriting discount |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ |

The underwriters may also exercise their option to purchase up to an additional common shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The common shares will be ready for delivery on or about , 2012.

| BofA Merrill Lynch | Goldman, Sachs & Co. | J.P. Morgan | Morgan Stanley |

The date of this prospectus is , 2012.

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by us or information to which we have referred you. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any free writing prospectus prepared by us is accurate only as of their respective dates or on the date or dates which are specified in those documents. Our business, financial condition, results of operations and prospects may have changed since those dates. We will update this prospectus as required by law.

We use market data, demographic data, industry forecasts and projections throughout this prospectus. Unless otherwise indicated, we derived such information from the market study prepared for us by Rosen Consulting Group, or RCG, a nationally recognized real estate consulting firm. We have paid RCG a fee for such services. In addition, we have obtained certain market and industry data from publicly available industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness

i

of the information are not guaranteed. The forecasts and projections are based on historical market data and the preparers' experience in the industry, and there is no assurance that any of the projected amounts will be achieved. We believe that the market and industry research others have performed are reliable, but we have not independently verified this information. Any forecasts prepared by RCG are based on data (including third-party data), models and experience of various professionals, and are based on various assumptions, all of which are subject to change.

The term our "predecessor" means the combination of (i) the property-owning entities or interests in entities together with the entities which own the distressed debt joint venture investment, all of which are currently controlled by Mitchell L. Morgan and his affiliates and such entities we refer to as the "existing entities," (ii) Mitchell L. Morgan Management, Inc., which we refer to as our "management company" and (iii) Morgan Properties Payroll Services, Inc., which we refer to as our "payroll company."

Unless the context otherwise requires, the terms "portfolio" and "properties" includes 100 properties, consisting of our 94 consolidated properties, which includes 91 wholly-owned properties and three properties in which an outside limited partner owns a de minimis equity interest, as well as six properties owned through joint ventures, which we refer to in this prospectus as our "joint venture properties". The terms "portfolio" and "properties" do not include our recent purchase, through a joint venture, of a certain distressed debt secured by a mortgage on a 1,026 unit multifamily property located in suburban Philadelphia which is currently in default (we refer to this investment as our "distressed debt joint venture investment"). We began foreclosure proceedings against the property in January 2012.

The term "Morgan trusts" means collectively the Agreement of Trust of Mitchell L. Morgan dated May 1, 1996, and the 2007 Morgan Family Trust. When used in the context of describing the tax protection agreements, Mr. Morgan and his affiliates include Mr. Morgan's spouse. The term "affiliates" means, following the completion of this offering, the Morgan trusts, Mr. Morgan's spouse, and ten entities controlled by Mr. Morgan and the Morgan trusts. The ten entities are: Huntley Glen Associates, LLC, MLM Carlyle Investors, LLC, MLM-Montpelier Investors LP, MLM Partners, L.P., FMP/MLM Associates IV, L.P., MLM V Associates, L.P., MLM Towson Investors LLC, MLM Oak Grove Apartment Investors LLC, MLM Forest Hills Investors LLC and MLM Silver Hill Investors LLC. Certain key employees, officers, former employees and former officers own interests in these ten entities.

Interests in our operating partnership are denominated in units, which we call "operating partnership units." Operating partnership units are redeemable for cash or, at our election, for common shares on a one-for-one basis. As used herein, when we refer to our ownership interest in our operating partnership, we mean the percentage of all operating partnership units that will be held by us following the formation transactions described in this prospectus and the completion of this offering.

The term "public multifamily REITs" consists of the following publicly-traded multifamily real estate investment trusts: Apartment Investment & Management Co., Associated Estates Realty Corp., AvalonBay Communities Inc., BRE Properties, Inc., Camden Property Trust, Colonial Properties Trust, Equity Residential, Essex Property Trust Inc., Home Properties Inc., Mid America Apartment Communities Inc., Post Properties Inc., and UDR, Inc.

The term "fully diluted basis" means all of our common shares outstanding at such time plus all outstanding restricted shares, if any, and common shares issuable upon the exchange of operating partnership units for our common shares on a one-for-one basis, which is not the same as the meaning of "fully diluted" under generally accepted accounting principles in the United States of America, or GAAP.

ii

The term "same store" means the portion of our 94 consolidated properties which we owned or managed for each of the entire fiscal years for the period being compared.

The term "our core markets" means the suburban Philadelphia, suburban New York-New Jersey and suburban Baltimore-Washington, D.C. metropolitan areas. We define these metropolitan areas with reference to combined statistical areas, or CSAs, as defined by the United States Office of Management and Budget.

The term "high barrier markets" refers to the following metropolitan areas characterized by RCG in its market study report as high barrier markets: Baltimore, Boston, Central New Jersey, Chicago, Fort Lauderdale, Hartford, Honolulu, Los Angeles, Miami, Nassau-Suffolk Counties, New York City, Northern New Jersey, Oakland, Orange County, Philadelphia, Portland, San Diego, San Francisco, San Jose, Santa Barbara, Seattle, Stamford, Tacoma, Ventura and Washington, D.C.

The term "low barrier markets" refers to the following metropolitan areas characterized by RCG in its report as low barrier markets: Albuquerque, Atlanta, Austin, Bakersfield, Birmingham, Boise, Charlotte, Cincinnati, Cleveland, Colorado Springs, Columbus, Dallas, Denver, Detroit, El Paso, Fort Worth, Fresno, Greensboro/Winston-Salem, Houston, Indianapolis, Inland Empire, Jacksonville, Kansas City, Las Vegas, Louisville, Memphis, Milwaukee, Minneapolis, Modesto, Nashville, Norfolk, Orlando, Phoenix, Pittsburgh, Raleigh-Durham, Richmond, Rochester, Sacramento, Salinas, Salt Lake City, San Antonio, Santa Rosa, Spokane, St. Louis, Stockton, Tampa, Tucson, Tulsa, Vallejo and West Palm Beach.

The term "housing affordability" means the percentage of households with sufficient income to afford monthly mortgage payments on a median-priced existing home utilizing a conventional 30-year fixed mortgage at the prevailing mortgage rate.

The term "CPI rent growth" refers to the growth in the component of the consumer price index that represents multifamily rent.

The term "vacancy expense" refers to the result of multiplying the number of vacant units (i.e., units not subject to a current lease) by the rent that we are able to charge for similar units (which we refer to as the applicable market rent).

iii

This summary highlights some of the information in this prospectus. It does not contain all of the information that you should consider before investing in our common shares. You should read carefully the more detailed information set forth under the heading "Risk Factors" and the other information included in this prospectus. Except where the context suggests otherwise, the terms "our company," "we," "us" and "our" refer to Morgan Properties Trust, a Maryland real estate investment trust, together with its consolidated subsidiaries, including Morgan Properties Operating Partnership, L.P., a Delaware limited partnership, of which we are the sole general partner and including, under certain circumstances, our predecessor as described and presented in the financial statements included in this prospectus. We refer to Morgan Properties Operating Partnership, L.P. as our "operating partnership." Mitchell L. Morgan, our Chairman and Chief Executive Officer, is our promoter. Unless otherwise indicated, the information contained in this prospectus is provided as of , 2012 and assumes that: (1) the underwriters' overallotment option is not exercised, (2) the formation transactions described in this prospectus under the caption "Structure and Formation of our Company" are consummated, (3) the common shares to be sold in this offering are sold at $ per share, which is the midpoint of the estimated per share price range set forth on the cover page of this prospectus, and (4) the operating partnership units to be issued in the formation transactions are valued at $ per unit. Each operating partnership unit is redeemable for cash equal to the then current market value of one of our common shares or, at our option and subject to adjustment under certain circumstances, one of our common shares, commencing 12 months following the completion of this offering.

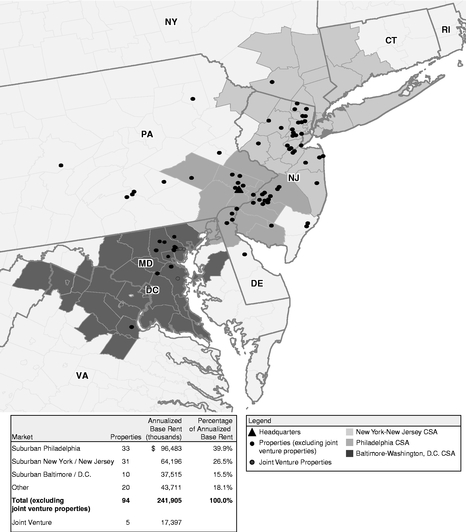

We are a fully integrated real estate investment trust, or REIT, specializing in the acquisition, ownership, management and repositioning of well-located multifamily properties in high-barrier-to-entry markets. We are headquartered in King of Prussia, Pennsylvania. We were formed to succeed Mitchell L. Morgan's multifamily real estate business founded in 1985 and, as such, we have significant experience, longstanding relationships and substantial knowledge of our core markets. Our strategy is to acquire, reposition and professionally manage well-located multifamily properties in supply constrained markets in the suburban Philadelphia, New York-New Jersey and Baltimore-Washington, D.C. metropolitan areas, which we consider our core markets. We place great significance on providing a superior offering of apartment services and features closely matched to our residents' needs. In addition, we take a proactive long-term approach to asset preservation that allows us to cost-effectively maximize the life of our properties. Both are key elements of our business strategy, which, together with our geographic focus, we believe differentiates us from our competitors.

We own a portfolio of 94 properties, consisting of approximately 21,518 apartment homes, and we own equity interests in six additional properties that we also manage, consisting of approximately 1,765 apartment homes, through joint ventures as well as our distressed debt joint venture investment. Our properties are primarily located in established middle income areas of the suburban Philadelphia, New York-New Jersey and Baltimore-Washington, D.C. metropolitan areas and had an average occupancy of 94.5% for the year ended December 31, 2011. Based on applications we received for apartment homes for the year ended December 31, 2011, the average household income of our residents was approximately $[ ] and the average monthly base rent per occupied apartment home at our properties was approximately $990 for the year ended December 31, 2011. We believe our portfolio's extensive footprint in high barrier markets, coupled with our experienced management team and proactive management style positions us to maximize the value of our portfolio over time. Our five-year average same-store revenue growth for the period ended December 31, 2011 of approximately 2.9% has generally outperformed the revenue growth of public multifamily REITs over the same period. A summary of certain information regarding our portfolio of 94 properties is set forth below.

1

- •

- Suburban Philadelphia portfolio: 33 properties comprising

8,479 apartment homes (excluding our interest in one property owned pursuant to a joint venture), which generated approximately 40% of our total annual revenue for the year ended December 31,

2011, reflecting a 0.6% increase over the prior year. Our suburban Philadelphia portfolio had an average occupancy of 94.4% for the year ended December 31, 2011.

- •

- Suburban New York-New Jersey portfolio: 31

properties comprising 4,503 apartment homes, which generated approximately 25.6% of our total annual revenue for the year ended December 31, 2011, reflecting a 3.9% increase over the prior

year. Our suburban New York-New Jersey portfolio had an average occupancy of 94.6% for the year ended December 31, 2011.

- •

- Suburban Baltimore-Washington, D.C. portfolio: ten

properties comprising 3,422 apartment homes (excluding our interests in five properties owned pursuant to joint ventures), which generated approximately 15.9% of our total annual revenue for the year

ended December 31, 2011, reflecting a 1.7% increase over the prior year. Our suburban Baltimore-Washington, D.C. portfolio had an average occupancy of 94.4% for the year ended December, 2011.

- •

- Remaining portfolio: 20 properties comprising 5,114 apartment homes, which generated approximately 18.5% of our total annual revenue for the year ended December 31, 2011, reflecting a 2.2% increase over the prior year. Our remaining portfolio had an average occupancy of 94.6% for the year ended December 31, 2011.

According to RCG, our core markets are characterized as having high-barriers-to-entry for new multifamily real estate construction, in addition to having strong demographics and dynamic, diversified economies that will continue to generate jobs and drive rent growth in our core markets. The properties that we will seek to acquire will typically target middle income residents, which we believe constitute a much larger segment of the population of renters than high income residents in our markets. We believe that we will face less competition from single-family housing than operators of high-end luxury multifamily properties will. We expect that a shift in consumer preferences away from homeownership and towards rentership will further strengthen demand for our apartments.

Mitchell L. Morgan, our founder, Chairman, Chief Executive Officer, President and our largest shareholder, brings a wealth of multifamily expertise developed through more than 30 years of experience in the multifamily real estate industry. Our senior management team, which has an average of 23 years of commercial real estate experience and has worked at our predecessor for an average of approximately 12 years, brings focused expertise in the areas of multifamily leasing, management, marketing, acquisitions, repositioning and financing. Upon completion of this offering, Mr. Morgan and our senior management team, together with affiliates of Mr. Morgan, will own approximately % of our company on a fully diluted basis.

- •

- Irreplaceable portfolio of multifamily properties in high-barrier-to-entry infill markets. During our more than 25 year history, we have aggregated a portfolio of multifamily properties in high-barrier-to-entry markets located in the suburban Philadelphia, New York-New Jersey and Baltimore-Washington, D.C. metropolitan areas. The majority of our properties are located in infill locations where developable land is scarce. Based on our extensive experience, buying, selling, owning and operating properties within our core markets, we believe that the ownership of multifamily properties is highly fragmented in our core markets, and that it would be difficult for our competitors to accumulate a portfolio of similar scale to our portfolio. In addition, we believe that current levels of construction costs restrict the ability to build new moderately priced multifamily housing in our core markets.

2

- •

- Superior product offering tailored to residents'

needs. We tailor our product offering property-by-property and use desirable value features such as

in-unit washer/dryers, renovated bathrooms, and renovated kitchens with dishwashers and built-in microwaves to differentiate our properties from the competition. Furthermore,

we endeavor to provide excellent services to our residents, including 24-hour turn-around time for maintenance requests, popular online rent payment features, online

communication options for service requests and resident feedback, resident events, and opportunities for residents to connect via property-specific online communities on Facebook and Twitter. We

believe these features and our resident services allow us to maintain a lower resident turnover ratio and to charge incrementally higher rents than our competitors, whose properties are not typically

professionally managed.

- •

- Experienced management team with significant ownership

stake. Our senior management team is led by Mitchell L. Morgan, our founder, Chairman, Chief Executive Officer and President, who brings

more than 30 years of experience in the multifamily real estate industry. Mr. Morgan's experience includes overseeing the acquisition by our predecessor and its affiliates of multifamily

properties from third parties consisting of approximately 38,000 apartment homes, and the disposition of multifamily properties to third parties consisting of approximately 14,800 apartment homes. Our

senior management team has an average of 23 years of experience in the real estate industry and have worked at our predecessor for an average of 12 years. Upon completion of this

offering, our senior management team, together with affiliates of Mr. Morgan, will own approximately % of our company on a fully diluted basis.

- •

- Extensive market knowledge and long-standing relationships

facilitate access to a robust pipeline of acquisition opportunities. We believe that our in-depth market knowledge and

extensive network of long-standing relationships with real estate owners, developers, brokers and other market participants will provide us access to an ongoing pipeline of attractive

acquisition opportunities in our core markets. The acquisitions we pursue are typically from smaller, less experienced and/or undercapitalized operators, such as first-generation family owners. We

seek to acquire and transform these well-located, but under-marketed and under-maintained assets into professionally managed communities with distinct marketing advantages over our

competitors.

- •

- Strong balance sheet and access to capital. We believe that our capital structure following completion of this offering will provide us with an advantage over competitors in our core markets because we will have the liquidity required to execute our growth strategies. We expect our pro forma debt to total market capitalization will be % and our pro forma debt to annualized EBITDA will be at the completion of this offering.

Our Business and Growth Strategies

Our primary business goals are to maximize operating cash flow, generate long-term growth and increase shareholder value. We intend to achieve these goals by executing the following business and growth strategies:

- •

- Capitalize on attractive acquisition opportunities in high-barrier-to-entry markets. We intend to expand our portfolio through strategic acquisitions of well-located properties in established, suburban, middle income areas within our high-barrier-to-entry core markets. We view these properties as well located if they are located within a reasonable commute of major employers and near amenities such as grocery and other retail stores as well as entertainment and recreational venues, in neighborhoods with strong rental demographics. In addition, we place a premium on properties located near major highways or mass-transit.

3

- •

- Drive internal growth through focused upgrades, renovations and product

differentiation. We intend to continue to increase rental revenues in our communities through focused, opportunistic unit renovations,

thereby increasing our property values. We typically achieve optimal product differentiation through upgrading kitchens and bathrooms, and installing, where possible, in-unit

washer/dryers, which has historically enabled us to increase rental income. We typically target a cash-on-cash return of 12% for revenue enhancing capital expenditures. In

addition, we intend to continue to generate cost savings through proactive implementation of energy efficiency upgrades, which seek to optimize building systems in order to reduce utility and

maintenance expenses.

- •

- Proactive property management to optimize

returns. We intend to continue to actively manage our properties, employ leading leasing and property management strategies, and

leverage our training platform to improve employee performance. We maximize our revenue by utilizing a third-party revenue management system and service provider call center that enables

24/7 leasing to maximize profitability. We have also developed a training program known as "Morgan University" through which our approximately 625 on-site employees, as of

March 1, 2012, have learned our standards of operational excellence through in-person coaching and online classes. We believe that our proactive utilization of innovative industry

practices will provide us with a competitive advantage over our competitors.

- •

- Cost-effectively maximize physical asset longevity. We believe that our experience in cost-effectively maintaining older assets provides us with a strong competitive advantage in our core markets. We take a proactive long-term approach to asset preservation and employ strategies that include robust preventative maintenance, in addition to architectural and engineering solutions to reduce the cost of maintaining our properties. We manage our capital expenditures on long-term maintenance projects, such as roof, siding, or window replacements, by maintaining an optimal balance between repair and replacement options for various building elements and systems as well as by implementing major replacements in phases.

The ownership of these types of properties is highly fragmented. Our in-depth market knowledge and extensive network of long-standing relationships in our core markets will provide us with access to an ongoing pipeline of acquisition opportunities. We believe that we are well positioned to compete for individual properties as well as portfolios of multifamily properties due to our scale, access to capital and experience in acquiring and repositioning such properties.

4

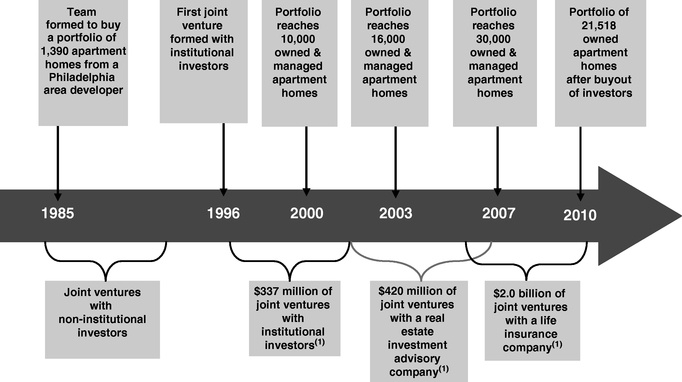

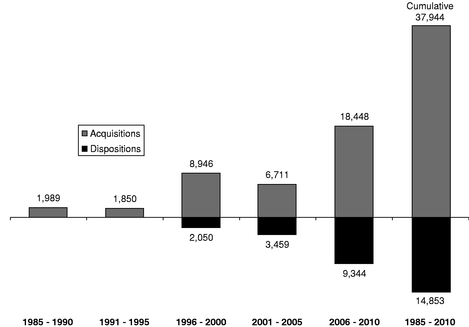

We were formed as the successor to Mitchell L. Morgan's multifamily real estate business that was established in 1985. In 1985, Mr. Morgan initially purchased a portfolio of 1,390 apartment homes from a Philadelphia area developer. Since 1985, Mr. Morgan has overseen the acquisition of approximately 38,000 apartment homes, and the disposition, to third-parties, of approximately 14,800 apartment homes. As illustrated in the timeline below, our growth has been marked by a series of significant milestones based on strategic real estate acquisitions and dispositions within our core markets. We believe we are well-positioned to grow through our extensive network of long-standing relationships within our core markets with real estate owners, developers, brokers and other market participants.

- (1)

- Represents the total purchase price for the acquired assets.

Since January 1, 2008, Mr. Morgan and his affiliates have made investments of approximately $128.6 million in connection with the buyout of the joint venture partners of Mr. Morgan and his affiliates and the acquisition of certain properties and the distressed debt joint venture investment. These investments relate to 89 properties consisting of approximately 20,200 apartment homes and the distressed debt joint venture investment. The $128.6 million includes approximately $80.1 million of direct equity investments and approximately $48.5 million in loans. We will use a portion of the net proceeds from this offering to repay Mr. Morgan and his affiliates approximately $[ ] million of this invested amount. See "Use of Proceeds."

5

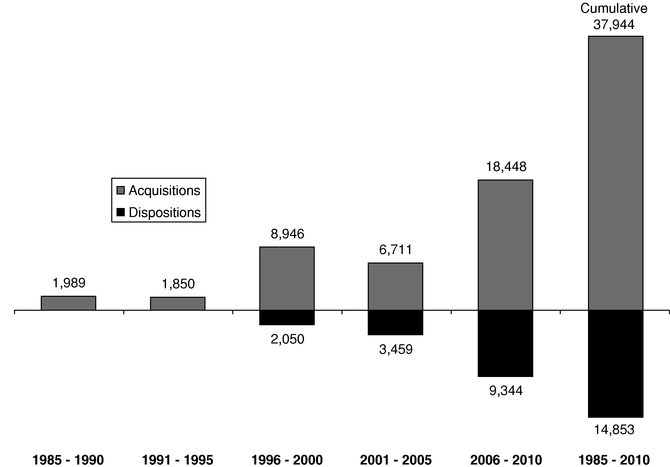

The following bar graph illustrates the acquisitions and dispositions by number of apartment homes of our predecessor and its affiliates over five-year intervals since 1985 as well as cumulative acquisitions and dispositions since 1985.

Note: The number of acquisitions and dispositions of apartment homes includes our joint venture properties but does not include the buyout of the joint venture partners of Mr. Morgan and his affiliates.

On December 23, 2011, we, together with a joint venture partner, purchased a loan secured by a mortgage on a 1,026 unit multifamily property located in suburban Philadelphia. The loan has been in payment default since 2010 and, in January 2012, we began foreclosure proceedings. Our joint venture partner is a large private hedge fund which specializes in investing in distressed debt. We expect the joint venture will own fee simple title to this multifamily property upon completion of the foreclosure proceedings.

On February 22, 2012, we, together with a joint venture partner, purchased a 192 garden-style apartment community called Abrams Run which is located in King of Prussia, a suburb of Philadelphia. The property is well maintained, built in 1996, and, as of the February 22, 2012, was 95% occupied with an average monthly rent of $1,289.

6

An investment in our common shares involves various risks, and prospective investors are urged to carefully consider the matters discussed under "Risk Factors" prior to making an investment in our common shares. Such risks include, but are not limited to:

- •

- Risks associated with the ownership of real property, or changes in economic, demographic or real estate market

conditions, may adversely affect our financial condition, results of operations, cash flows, the market price of our common shares, and our ability to pay distributions to our shareholders.

- •

- Our multifamily properties are primarily concentrated in suburban submarkets of the Philadelphia, New York-New

Jersey and Baltimore-Washington, D.C. metropolitan areas, which makes us more susceptible to adverse developments in those markets.

- •

- Our success depends in part on key personnel, including Mr. Morgan, our Chairman, Chief Executive Officer and

President, whose continued service is not guaranteed, and the loss of one or more of our key personnel could adversely affect our ability to manage our business and to implement our growth strategies.

- •

- We depend on residents for revenue, and vacancies, resident defaults, lease terminations or capital improvements may

adversely affect our operations and cause the value of your investment to decline.

- •

- The average age of our multifamily properties is approximately 40 years and if we are not able to cost effectively

maximize physical asset longevity we may incur greater than anticipated capital expenditure costs, which may adversely affect our ability to pay distributions on our common shares.

- •

- We may be unable to identify and complete acquisitions to expand our business on advantageous terms and successfully

operate acquired properties, which may materially adversely affect our financial condition, results of operations, cash flows, ability to pay distributions, and the market price of our common shares.

- •

- We could be negatively impacted by the condition of the Federal National Mortgage Association, which we refer to as Fannie

Mae, or the Federal Home Loan Mortgage Corporation, which we refer to as Freddie Mac.

- •

- The price we will pay for the existing entities to be acquired by us in the formation transactions may exceed their

aggregate fair market value.

- •

- We have a material weakness in our internal control over financial reporting, which could impact our ability to maintain

an effective control environment over the recording of complex or non-standard transactions.

- •

- We have no experience operating as a public company or as a real estate investment trust, or REIT, for federal income tax

purposes. Our failure to qualify as a REIT would have significant adverse consequences to us and the value of our common shares.

- •

- The extent of our indemnification obligations with respect to certain limited partners upon the sale or other taxable

disposition of certain properties pursuant to tax protection agreements may be such that they prevent us from effectuating such transactions even if they are otherwise in the best interests of

shareholders.

- •

- We are assuming liabilities in connection with the formation transactions, including unknown liabilities and potential tax liabilities.

7

- •

- Conflicts of interest may exist or could arise in the future between the interests of our shareholders and the interests

of holders of operating partnership units.

- •

- We did not conduct arm's-length negotiations with Mr. Morgan, our Chairman, Chief Executive Officer and President,

regarding the terms of the formation transactions, such as the value of the properties to be acquired, and Mr. Morgan exercised significant influence with respect to the terms of the formation

transactions.

- •

- Upon completion of this offering and the formation transactions, Mr. Morgan and his affiliates, directly or

indirectly, will own a substantial beneficial interest in our company on a fully diluted basis and will have the ability to exercise significant influence on our company and our operating partnership.

- •

- Our declaration of trust and bylaws, the amended and restated partnership agreement of our operating partnership and

Maryland law contain provisions that may delay, defer or prevent a change of control transaction.

- •

- Our board of trustees may change our policies without shareholder approval.

- •

- While we anticipate that our estimated cash available for distribution will exceed the amount required to be distributed

pursuant to the annual distribution requirements applicable to REITs, it is possible that under certain circumstances, we may be required to pay distributions in excess of our cash available for

distributions. If we do not have sufficient cash on hand to make distributions, we may consider borrowing money, selling certain assets or using a portion of the net proceeds from this offering or a

future offering in order to fund such distributions.

- •

- The timing and amount of our cash distributions, if any, may fluctuate over time, and a portion of our distributions to

investors in this offering may represent a return of capital.

- •

- Upon completion of this offering, we will use a portion of the proceeds of this offering to pay approximately

$ million of our outstanding loan indebtedness, resulting in a pro forma total consolidated indebtedness of approximately

$ million. However, in the future,

we may incur significant additional debt to finance future acquisitions and repositioning activities. If we incur significant additional debt, debt service payments may leave us with insufficient cash

resources.

- •

- Neither our declaration of trust nor our investment policies impose any limitations on the amount of debt that we can

borrow either in the aggregate or with respect to any given property. In the event that we incur too much debt, after we pay debt service we may be left with insufficient cash flow to carry out our

business plans or pay distributions to our shareholders.

- •

- Payments on our debt will reduce cash available for distribution, including cash available to pay distributions to our

shareholders, and may expose us to the risk of default under our debt obligations.

- •

- Existing loan agreements contain, and future financing arrangements, including our new credit facility, will contain

restrictive covenants relating to our operations, which could limit our ability to make distributions to our shareholders.

- •

- If you invest in this offering, you will experience immediate and substantial dilution.

- •

- Increases in interest rates would increase our expenses, make it more difficult for us to make attractive investments and could limit our ability to pay distributions to our shareholders.

8

Industry Background and Market Opportunity

Unless otherwise indicated, all information contained in this Industry Background and Market Opportunity section is derived from the market study prepared by Rosen Consulting Group, which we refer to as RCG, dated July 22, 2011.

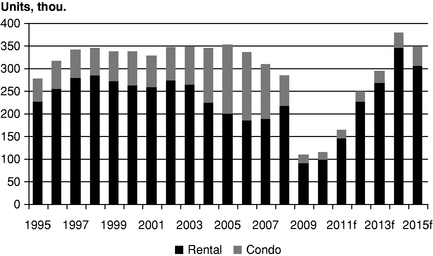

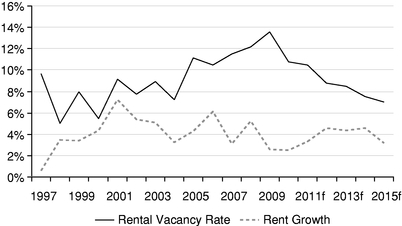

Drivers of Multifamily Demand

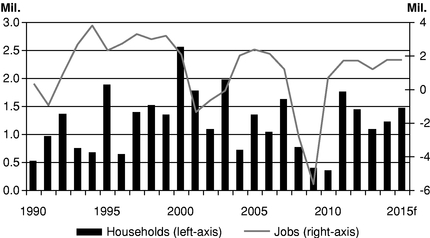

RCG expects that the multifamily housing market is well-positioned to lead the commercial real estate recovery in the United States. Over the next few years the combination of job growth, limited new supply, stringent requirements for new single-family mortgage loans, and the decoupling of currently shared households should translate directly into robust demand for existing multifamily housing. In addition, new household formation, the maturation of the echo-boom generation, and immigration should sustain multifamily demand over the long-term. Our core markets of suburban Philadelphia, New York-New Jersey, and Baltimore-Washington, D.C. have some of the most favorable supply-demand characteristics in the United States. As of December 31, 2011, approximately 81.9% of our annualized base rent was generated in our core markets. Our core markets have high barriers to entry for multifamily product which limit new supply, thus compounding demand for existing multifamily housing.

Short term drivers of demand

- •

- U.S. job growth during the recovery and low unemployment in our core markets.

- •

- Limited expected new multifamily supply in our core markets.

- •

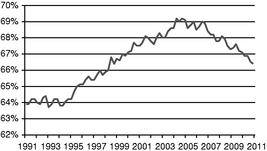

- Strict mortgage lending standards outweigh improved housing affordability and have contributed to a decreased

homeownership rate.

- •

- Shared households will begin to decouple and create new renters.

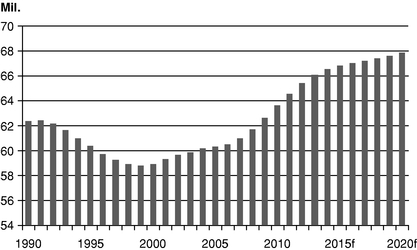

Long term drivers of demand

- •

- Strong expected U.S. population growth and new household formation through 2015 and thereafter.

- •

- Significant growth through 2020 of the U.S. population under age 35.

- •

- Continued inflow of foreign-born persons, the majority of whom rent homes, to the U.S. in particular.

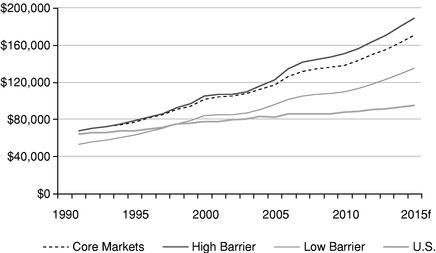

High barrier markets versus low barrier markets

In addition to underlying demographic and economic trends, the local regulatory environment can become an important indicator of relative market performance. Apartment markets with well-established supply constraints often outperform the average market as the risk of oversupply over the long-term is lessened. These constraints can include development regulations, geographic barriers, affordable housing requirements and many other measures that create barriers to market entry, which have the following effects.

- •

- Market barriers constrain new supply, and over the long term significantly more multifamily units are constructed in low

barrier markets than in high barrier markets.

- •

- Constrained supply leads to above-average rent growth.

- •

- High barrier markets typically exhibit low housing affordability, which leads to an increased renter

base.

- •

- Urban centers with market barriers support higher household income levels.

9

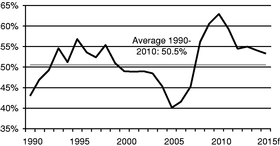

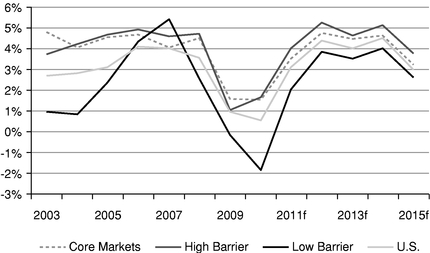

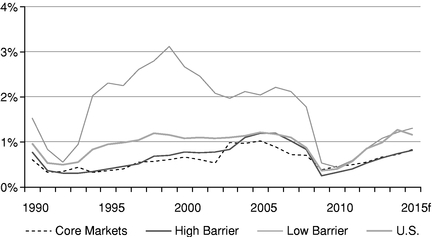

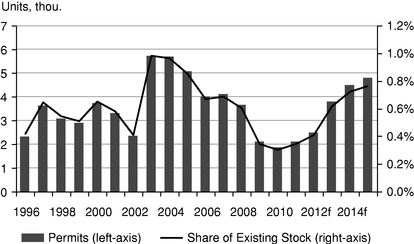

The table below compares our core markets with other high barrier markets, low barrier markets and the national average on a number of important economic metrics including multifamily permits as a percentage of multifamily stock, unemployment rate, CPI rent growth, and housing affordability.

| |

Average Over 2003 – 2010 Historical Period |

2010 | Average Over 2011 – 2015 Projected Period |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Multifamily Permits as a Percentage of Multifamily Stock |

||||||||||

Our Core Markets |

0.8 | % | 0.3 | % | 0.6 | % | ||||

U.S. Average |

0.9 | % | 0.4 | % | 1.0 | % | ||||

High Barrier Markets |

0.8 | % | 0.3 | % | 0.6 | % | ||||

Low Barrier Markets |

1.2 | % | 0.4 | % | 0.8 | % | ||||

Unemployment Rate |

||||||||||

Our Core Markets |

5.8 | % | 8.1 | % | 6.4 | % | ||||

U.S. Average |

6.5 | % | 9.6 | % | 8.0 | % | ||||

High Barrier Markets |

6.4 | % | 9.4 | % | 7.7 | % | ||||

Low Barrier Markets |

6.6 | % | 9.9 | % | 8.1 | % | ||||

CPI Rent Growth |

||||||||||

Our Core Markets |

4.1 | % | 2.5 | % | 4.7 | % | ||||

U.S. Average |

2.7 | % | 0.6 | % | 3.8 | % | ||||

High Barrier Markets |

3.6 | % | 1.4 | % | 4.3 | % | ||||

Low Barrier Markets |

2.0 | % | (0.2 | )% | 3.1 | % | ||||

Housing Affordability |

||||||||||

Our Core Markets |

39.9 | % | 49.3 | % | 40.3 | % | ||||

U.S. Average |

50.0 | % | 62.9 | % | 55.2 | % | ||||

High Barrier Markets |

40.7 | % | 55.4 | % | 45.4 | % | ||||

Low Barrier Markets |

61.6 | % | 73.9 | % | 67.2 | % | ||||

Note: Forecasts by RCG. Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, Census Bureau and RCG.

Our core markets

Our core markets of suburban Philadelphia, New York-New Jersey, and Baltimore-Washington, D.C. have some of the most favorable supply-demand characteristics in the United States. As of December 31, 2011, approximately 81.9% of our annualized base rent was generated by our 94 consolidated properties in our core markets. Our core markets have high barriers to entry for multifamily product which limit new supply, thus compounding demand for existing multifamily housing.

Suburban Philadelphia

The suburban Philadelphia area has a total population of approximately 6.0 million, or 1.9% of the United States population. It has one of the highest mean household income levels in the United States at $128,329 and a current unemployment rate of 8.4%. The pharmaceutical, life sciences, healthcare and higher education industries, in particular, have fueled job gains and income growth during the past decade and continue to sustain the local economy. The University of Pennsylvania and its affiliate, Penn Medicine, are two of the largest private sector employers in the region. Furthermore, the Philadelphia economy has diversified, with services-driven industries generally replacing an outdated manufacturing base over time.

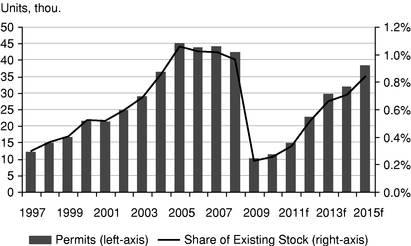

New multifamily construction in the Philadelphia metropolitan area is constrained, resulting in a favorable environment for existing multifamily owners. New multifamily construction permits have

10

averaged 0.6% of total stock versus the national average of 1.0% since 1996. New projects face high barriers to entry due to the extended zoning and approval process, land assembly difficulties and heavily unionized labor. Since 2009, the city of Philadelphia has worked to revise its zoning code and development process. Although these efforts should result in a streamlined development process in the future, it is likely that development approvals will continue to be challenging to obtain, the development timelines will be lengthy and the necessary zoning and environmental approvals will be costly. These challenges, together with strict lending standards will constrain new multifamily development, allowing existing multifamily property owners to take advantage of the vacancy rate drop and CPI rent growth RCG expects to occur through 2015.

A healthy job market, low relative unemployment, high relative household income, and limited new supply have contributed to positive multifamily CPI rent growth in suburban Philadelphia. Average annual CPI rent growth in suburban Philadelphia was 3.0% from 2003 through 2010 versus a national average of 2.7%. RCG expects CPI rent growth in suburban Philadelphia to average 4.0% through 2015 versus the expected national average of 3.8% over the same period.

Suburban New York-New Jersey

The suburban New York-New Jersey area has a total population of approximately 16.3 million, or 5.3% of the United States population. It has one of the highest mean household income levels in the United States at $153,600 and an unemployment rate of 8.8%. This metropolitan area is one of the most densely populated in the United States, and has one of the largest renter pools at 48.4% of households, versus the national average of 33.1%. Many are long-term renters due to the low housing affordability ratio of 37.0%, versus the national average of 62.9%. This area's role as a global business hub, in addition to its plentiful cultural resources, makes it a desirable location for both businesses and residents. The local economy is highly diverse. In addition to financial services, other major industries throughout the New York-New Jersey metropolitan area include business services, education, health care, media and publishing, pharmaceuticals, life sciences and shipping.

The New York-New Jersey metropolitan region is a gateway through which immigrants enter the United States. The ethnically diverse population fuels demand for a variety of goods and services. Importantly, high immigrant populations generally translate into strong apartment demand because new residents tend to inhabit rental housing based on preference and greater difficulty obtaining mortgage credit due to recent immigration. Approximately 32.9% of the New York-New Jersey metropolitan area residents were born outside the United States, compared with 13.9% at the national level.

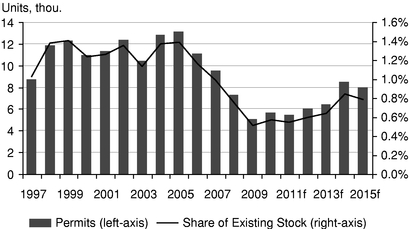

The apartment market in the New York-New Jersey metropolitan area has high barriers to entry for new construction. New multifamily construction permits have averaged 0.6% of total stock versus the national average of 1.0% since 1996, and the area has one of the lowest multifamily vacancy rates in the United States of 7.1%. Often prohibitively high costs associated with new building projects are due to high tax rates, complex land ownership agreements and heavily unionized labor, among other factors. In addition, assembling the necessary parcels of land, complying with building codes and zoning regulations and conducting environmental reviews add time and extra cost to construction projects. As one of the most densely populated metropolitan areas in the United States, there are few opportunities remaining for new development in desirable locations along transportation corridors such as highways and rail lines.

A healthy job market, dense population, low relative unemployment, high relative household income, and limited new supply have contributed to positive multifamily CPI rent growth in suburban New York-New Jersey. Average annual CPI rent growth in suburban New York-New Jersey was 4.3% from 2003 through 2010 versus a national average of 2.7%. RCG expects CPI rent growth in suburban New York-New Jersey to average 4.9% through 2015 versus the expected national average of 3.8% over the same period.

11

Suburban Baltimore-Washington, D.C.

The suburban Baltimore-Washington, D.C. area has a total population of approximately 8.3 million, or 2.7% of the United States population. It has one of the highest average household income levels in the United States at $152,310 and one of the lowest current unemployment rates of 6.3%.

The Baltimore-Washington, D.C. metropolitan area's performance through the recession has been strong, with the presence of the federal government and the private contractors who work for it supporting job growth. The region's numerous colleges and universities also help drive the educational and health services sector, one of Baltimore-Washington, D.C.'s largest job sectors. The area's healthy job market and corresponding high wages are attractions for both young professionals and working families, leading to positive net migration and population growth. Importantly, the Baltimore metropolitan and surrounding area's economy is expected to improve throughout 2011 when the federally mandated Base Realignment and Closure program, which we refer to as BRAC, accelerates. Under this program, 15,000 defense sector jobs are being relocated to bases in Harford and Anne Arundel counties. There is currently more than $100 million of federal funding earmarked for BRAC, and the effort is expected to bring more than 25,000 new jobs to the Baltimore metropolitan and surrounding area through 2015.

The apartment market in the suburban Baltimore-Washington, D.C. area has high barriers to entry for new construction. In 2009, the city of Baltimore established an extensive sustainability plan focused on evaluating development proposals that are brought before Baltimore's Planning Department & Planning Commission. While these initiatives are a benefit to the city's environmental and economic future, they are often associated with prohibitively high initial costs to developers. Density is limited because of the restraints imposed on building vertically, which has caused development to sprawl horizontally. New developments are forced to locate further away from public transit hubs and are often less attractive commuting options. In addition, the Baltimore-Washington, D.C. metropolitan area is subject to affordable housing laws, which apply added pressure on developers, further reducing the number of market value units made available. Average annual CPI rent growth in suburban Baltimore-Washington, D.C. was 4.0% for 2003 through 2010 versus a national average of 2.7%. RCG expects CPI rent growth in suburban Baltimore-Washington, D.C. to average 4.5% through 2015 versus the expected national average of 3.8% over the same period.

12

We own a portfolio of 94 properties, consisting of approximately 21,518 apartment homes, and we own equity interests in six additional properties, consisting of approximately 1,765 apartment homes, through joint ventures. We also recently purchased, through a joint venture, a loan secured by a mortgage on a 1,026 unit multifamily property that is currently in default where we have begun foreclosure proceedings.

Our properties are located in established high barrier markets and are well-maintained and located in areas with close proximity to schools, local businesses and public transportation systems. Our properties are generally two or three story garden-style communities comprised of brick on block and wood frame construction with mature and professionally managed landscaping. Many of our properties offer resident amenities ranging from swimming pools and tennis courts to business centers, fitness centers, playgrounds and pet play areas. Individual apartment homes include personal amenities such as in-unit washer/dryers, renovated kitchens and modernized bathrooms. Management believes that its focus on acquiring quality properties and then enhancing them through active management focusing on enhancing curb appeal, providing resident conveniences and delivering high quality customer service to all residents results in low turnover by industry standards.

The following table presents an overview of our portfolio of multifamily properties based on information as of December 31, 2011. The table does not include the suburban Philadephia joint venture property we acquired in February 2012 or our distressed debt joint venture investment. No single property accounted for more than 10% of our total assets or gross revenue for the year ended December 31, 2011.

| |

Number of Properties |

Number of Apartment Homes(1) |

Average Occupancy(2) |

Annualized Base Rent(3) |

Average Monthly Base Rent Per Occupied Apartment Home(4) |

Percentage of Annualized Base Rent(5) |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

(thousands) |

|

|

|||||||||||||

Core Markets |

|||||||||||||||||||

Suburban Philadelphia |

33 | 8,479 | 94.4 | % | $ | 96,483 | $ | 1,005 | 39.9 | % | |||||||||

Suburban New York-New Jersey |

31 | 4,503 | 94.6 | % | 64,196 | 1,256 | 26.5 | % | |||||||||||

Suburban Baltimore-Washington, D.C. |

10 | 3,422 | 94.4 | % | 37,515 | 968 | 15.5 | % | |||||||||||

Subtotal Core Markets |

74 | 16,404 | 94.4 | % | 198,194 | 1,066 | 81.9 | % | |||||||||||

Other Markets |

20 | 5,114 | 94.6 | % | 43,711 | 753 | 18.1 | % | |||||||||||

Subtotal Core and Other Markets |

94 | 21,518 | 94.5 | % | 241,905 | 992 | 100.0 | % | |||||||||||

Joint Venture Properties |

5 | 1,573 | 94.8 | % | 17,397 | (6) | 973 | ||||||||||||

Total Properties |

99 | 23,091 | 94.4 | % | $ | 259,302 | $ | 990 | |||||||||||

Note: Figures may not add up due to rounding differences.

- (1)

- Excludes

85,530 square feet of commercial space, including our corporate headquarters, located at nine of our residential communities as of

December 31, 2011.

- (2)

- Average

Occupancy is defined as total possible residential rental income, net of vacancy expense, as a percentage of total possible residential rental

income for the year ended December 31, 2011. Vacancy expense is determined by multiplying the number of vacant units (i.e., units not subject to a

current lease) by the rent that we are able to charge for similar units (which we refer to as the applicable market rent).

- (3)

- Annualized Base Rent is defined as total possible residential rental income, net of vacancy expense for the year ended December 31, 2011. Vacancy expense is determined by multiplying the number of vacant units (i.e., units not subject to a current lease) by the rent that we are able to charge for similar units (which we refer to as the applicable market rent).

13

- (4)

- Average

Monthly Base Rent represents Annualized Base Rent divided by the product of the number of apartment homes and Average Occupancy, divided by 12.

Vacancy expense is determined by multiplying the number of vacant units (i.e., units not subject to a current lease) by the rent that we are able to

charge for similar units (which we refer to as the applicable market rent).

- (5)

- Shown

as a percentage of our portfolio of 94 properties.

- (6)

- Amount of annualized base rent for our joint venture properties is shown on a fully consolidated basis, our pro rata share of the annualized base rent for the year ended December 31, 2011 was approximately $1.8 million.

We are currently negotiating the terms of a credit facility with affiliates of certain of the underwriters of this offering. We expect to enter into the facility concurrently with, or shortly following, the completion of this offering. We intend to use this facility for, among other things, acquisitions of additional properties, capital expenditures related to repositioning activities such as product differentiation through upgrading kitchens and bathrooms and installing, where possible, in-unit washer/dryers as well as energy efficiency upgrades, and general business and working capital purposes. There can be no assurance that we will be able to obtain such financing on favorable terms or at all.

We expect to have approximately $[ ] of total consolidated indebtedness outstanding upon completion of this offering and the formation transactions. As of [ ], our indebtedness will have staggered maturities with a weighted average debt maturity of approximately [ ]years and a weighted average interest rate of [ ]% per annum, and consist of approximately [ ]% fixed rate debt. Our overall leverage will depend on how we choose to finance our portfolio, including future acquisitions, and the cost of leverage. Neither our declaration of trust nor our investment policies restrict the amount of leverage that we may incur.

Structure and Formation of Our Company

Our Structure

Morgan Properties Trust was formed on June 24, 2011, as a Maryland real estate investment trust. We are the sole general partner of our operating partnership, Morgan Properties Operating Partnership, L.P., a Delaware limited partnership, which was initially formed on June 2, 2010. We will conduct our business through a traditional UPREIT structure, in which substantially all of our properties are directly or indirectly owned by our operating partnership. We will contribute the net proceeds from this offering to our operating partnership in exchange for operating partnership units.

Formation Transactions

Following completion of the formation transactions and this offering, we will own and control, through our operating partnership, the 94 properties in our portfolio and we will own the equity interests in our six joint venture properties and our distressed debt joint venture investment.

Currently, each of the 94 properties in our portfolio is owned, directly or indirectly, by various entities predominantly owned by Mr. Morgan, our Chairman, Chief Executive Officer and President, and his affiliates, including the Morgan trusts; certain current or former employees own vested interests (which range from 0% to 10.4% of the equity in the individual properties) in the entities that own certain of our properties and a third party owns 1% of one partnership that owns three properties. In the aggregate, Mr. Morgan and his affiliates, including the Morgan trusts own in excess of 95% of the equity in the 94 properties. We refer to the entities that directly or indirectly own our properties collectively as the "ownership entities" and the current owners of the ownership entities as the "continuing investors." Mr. Morgan and his affiliates also currently own non-controlling equity interests in our six joint venture properties and our distressed debt joint venture investment.

In connection with the formation transactions, our operating partnership will acquire ownership and control over all 94 properties in our portfolio and the equity interests in our six joint venture

14

properties and our distressed debt joint venture investment. Currently, our operating partnership indirectly wholly owns 55 properties. Pursuant to our formation agreements, our operating partnership will exchange operating partnership units for equity interests in each of the existing entities that directly or indirectly own 39 owned properties in our portfolio (or, in some cases, for the fee simple interest in such properties) and for the equity interests in our six joint ventures and our distressed debt joint venture investment. In addition, in connection with the formation transactions, we will acquire the assets of our management company and payroll company, which are wholly-owned by Mr. Morgan. We refer to this transaction as the "management company acquisition." As a result of the management company acquisition, we will succeed to the property management business of our management company and payroll company, which we refer to as the "property management business." The formation transactions are subject to customary closing conditions, including obtaining required third-party consents and approvals and the completion of this offering.

Prior to or concurrently with the completion of this offering, we will engage in certain formation transactions, which are designed to:

- •

- consolidate the ownership of our portfolio under our operating partnership;

- •

- cause us to succeed to the property management business of our management company;

- •

- facilitate this offering;

- •

- enable us to repay existing indebtedness related to certain properties in our portfolio;

- •

- enable us to qualify as a REIT for federal income tax purposes commencing with the taxable year ending December 31,

2012;

- •

- enable certain investors in our predecessor, whom we refer to as continuing investors, to obtain liquidity for their

investments; and

- •

- defer the recognition of taxable gain by certain continuing investors.

Following the completion of our formation transactions, Mr. Morgan and his affiliates, including the Morgan trusts, and our other executive officers and senior employees will own an aggregate of operating partnership units and common shares. The following chart shows the number of operating partnership units and common shares, to be owned either directly or indirectly, by Mr. Morgan and his affiliates, including the Morgan trusts and our other executive officers and senior employees.

Name

|

# Operating Partnership Units |

# of Common Shares |

|||||

|---|---|---|---|---|---|---|---|

Mitchell L. Morgan |

|||||||

Morgan trusts |

|||||||

J. Patrick O'Grady |

|||||||

Rimas Petrulis |

|||||||

Karen V. McAlonen |

|||||||

Stephen J. Waters |

|||||||

Total |

|||||||

In addition, Mr. Morgan and certain entities owned by him are currently the guarantors on $ million of indebtedness. We intend to either replace Mr. Morgan as guarantor, repay such indebtedness or provide Mr. Morgan with a back-up guarantee on such indebtedness. Finally, we will repay Mr. Morgan and his affiliates approximately $ million for a portion of their cash advances and equity investments made in connection with our purchase of certain properties in our portfolio since 2008 and repay $ million of debt owed to Mr. Morgan and his affiliates.

15

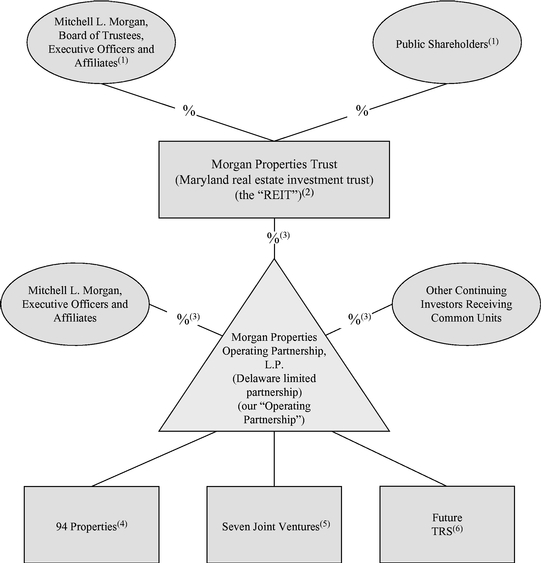

Our Organization and Ownership Structure

The following diagram depicts our organization and ownership structure upon completion of this offering and the formation transactions. Our operating partnership will own the various properties in our portfolio directly or indirectly, and in some cases through special purpose entities that were created in connection with various financings and the formation transactions. The ownership percentages below will vary depending on whether and to the extent the underwriters exercise their overallotment option.

- (1)

- On

a fully diluted basis, our public shareholders will own approximately % of our outstanding common shares, Mr. Morgan and his

affiliates will own approximately % of our outstanding common shares, and our trustees and executive officers, other than Mr. Morgan and his affiliates, will own approximately

% of our outstanding common shares.

- (2)

- Morgan

Properties Trust serves as the general partner of Morgan Properties Operating Partnership, L.P.

- (3)

- Represents

limited partnership interests in our operating partnership.

- (4)

- Consists

of 91 wholly-owned properties and three properties in which an outside limited partner owns a de minimis equity interest.

- (5)

- Represents

an approximately 12% economic interest in one multifamily property, an approximately 10% economic interest in four multifamily properties, a 25%

interest in one multifamily property and a 20% interest in our distressed debt joint venture investment.

- (6)

- In the future, we may utilize one or more taxable REIT subsidiaries, or TRSs.

16

In connection with this offering and the formation transactions, Mr. Morgan, our Chairman, Chief Executive Officer and President, and certain of our trustees and executive officers will receive material financial and other benefits described in "Certain Relationships and Related Party Transactions," including the following. All amounts are based on the midpoint of the per share price range set forth on the cover page of this prospectus. The value of the common shares and operating partnership units to be received as described below will increase or decrease if our common shares are priced above or below on the midpoint of the per share price range set forth on the cover page of this prospectus.

- •

- Mr. Morgan and his affiliates, including the Morgan trusts, will

receive common shares and

operating partnership units in

connection with the formation transactions, with an aggregate value of approximately $ million.

- •

- Our executive officers, other than Mr. Morgan and his affiliates, will

receive operating

partnership units in connection with the formation transactions, with an aggregate value of approximately $ million,

and restricted shares in exchange for their

interests in our management company, with an aggregate value of approximately $ million.

- •

- We will repay third-party debt of approximately $ million (including debt of approximately

$ million guaranteed by Mr. Morgan and his affiliates) encumbering certain properties acquired from Mr. Morgan and his affiliates as part of the formation

transactions.

- •

- We expect to enter into agreements that provide for the release of all the personal debt guarantees provided by

Mr. Morgan and his affiliates with respect to indebtedness that we assume in connection with the formation transactions.

- •

- We will repay Mr. Morgan and his affiliates approximately $ million for a portion of their

cash advances and equity investments made in connection with our purchase of certain properties in our portfolio since 2008.

- •

- We will repay debt owed to Mr. Morgan and his affiliates of approximately $ million made in

connection with our purchase of certain properties in our portfolio since 2008.

- •

- We will enter into tax protection agreements with Mr. Morgan and his affiliates.

- •

- We intend to enter into severance agreements with Mr. Morgan, our Chairman, Chief Executive Officer and President,

and Mr. O'Grady, our Executive Vice President and Chief Financial Officer that will become effective as of the completion of this offering.

- •

- We will enter into a registration rights agreement with the various persons receiving common shares and/or operating

partnership units in the formation transactions, including Mr. Morgan and his affiliates, the Morgan trusts, and our executive officers.

- •

- We intend to adopt our 2012 Equity Incentive Award Plan under which we may grant cash and equity-based incentive awards to our trustees, officers, employees and consultants. See "Management—2012 Equity Incentive Plan."

Under the partnership agreement, holders of operating partnership units do not have redemption or exchange rights for a period of 12 months after first acquiring operating partnership units and, except under limited circumstances, may not otherwise transfer their operating partnership units during such period without our consent. In addition, our executive officers and trustees have

17

agreed with the underwriters not to sell or otherwise transfer or encumber any of our common shares or securities convertible into or exchangeable for our common shares (including operating partnership units) owned by them at the completion of this offering or thereafter acquired by them for a period of 180 days after the completion of this offering without the consent of Merrill Lynch, Pierce, Fenner & Smith Incorporated, Goldman, Sachs & Co., J.P. Morgan Securities LLC and Morgan Stanley & Co. LLC.

Restrictions on Ownership of our Common Shares

The Internal Revenue Code of 1986, as amended, or the Code, imposes limitations on the concentration of ownership of REIT shares. Our declaration of trust generally prohibits (i) any person from beneficially or constructively owning more than 9.8%, in value or in number of shares, whichever is more restrictive, of our outstanding common shares or (ii) 9.8% in value of the aggregate of our outstanding shares. Our declaration of trust also generally prohibits any individual (as defined under the Code to include certain entities such as private foundations) from beneficially owning (i) more than %, in value or in number of shares, whichever is more restrictive, of our outstanding common shares or (ii) % in value of the aggregate of our outstanding shares. We refer to these restrictions as the ownership limits. These restrictions generally do not apply, however, to Mr. Morgan, his family and certain affiliates, who may collectively own up to % by value of the aggregate of our outstanding shares, as described under "Description of Shares of Beneficial Interest—Restrictions on Ownership and Transfer." Our declaration of trust permits our board of trustees in its sole and absolute discretion to increase the ownership limitation applicable to Mr. Morgan, his family and his affiliates and grant additional exemptions from any or all of the ownership limits if, among other limitations, such increase or exemptions will not cause us to fail to qualify as a REIT.

Following the completion of this offering and the formation transactions, conflicts of interest may arise with respect to certain transactions between the holders of operating partnership units and our shareholders. In particular, the completion of certain business combinations, the taxable sale of any properties (especially those contributed in exchange for operating partnership units or held by the operating partnership prior to the closing of the initial public offering) or a reduction of indebtedness could have adverse tax consequences to holders of operating partnership units, which would make those transactions less desirable to certain holders of such operating partnership units. Mr. Morgan will hold both operating partnership units and common shares upon completion of this offering and the formation transactions.

Mr. Morgan and his affiliates own interests, directly or indirectly, in the existing entities that own the properties that are included in our portfolio and that we will acquire in the formation transactions and as such are parties to, or have interests in, contribution or other acquisition agreements with us. In addition, certain of our executive officers may become parties to severance agreements with us. We may choose not to enforce, or to enforce less vigorously, our rights under these agreements because of our desire to maintain our ongoing relationships with members of our senior management or our board of trustees and their affiliates, with possible negative impact on shareholders.

We did not conduct arm's-length negotiations with Mr. Morgan with respect to the terms of the formation transactions. In the course of structuring the formation transactions, Mr. Morgan had the ability to influence the type and level of benefits that he will receive from us. In addition, we have not obtained any third-party appraisals of the properties and other assets to be acquired by us from the continuing investors, including Mr. Morgan and his affiliates, in connection with the formation transactions. As a result, the price to be paid by us to our continuing investors, including Mr. Morgan and his affiliates, for the acquisition of the assets in the formation transactions may exceed the fair market value of those assets.

18

In addition, we have agreed pursuant to tax protection agreements to indemnify Mr. Morgan and his affiliates, whom we refer to as the protected parties, against the taxes incurred by them upon a sale, exchange or other disposition of 35 of our properties in our core markets (or 37% of our 94 consolidated properties) in a taxable transaction until ten years following the closing of this offering, which we refer to as the restricted period. We refer to these 35 properties as the tax protected properties. We will also be required to indemnify the protected parties if we engage in other transactions, such as a taxable merger, that trigger their tax gain with respect to the tax protected properties during the restricted period. We also have agreed to maintain sufficient qualified nonrecourse financing during the restricted period on our properties so that at least $250 million of such indebtedness is allocated to Mr. Morgan and his affiliates for federal income tax purposes. In addition, we have agreed to maintain at least $120 million of certain additional indebtedness in order to permit the protected parties to guarantee or otherwise become at risk for such amount at their election in order to facilitate additional deferral of taxable income with respect to their operating partnership units. If we trigger these tax protection provisions, we must indemnify the protected parties for the entire amount of the resulting tax liabilities (without regard to any deductions or offsets available to them from other sources), plus an additional amount equal to the taxes incurred by them as a result of indemnification payments. The amount of the indemnity under the tax protection agreements is not subject to a cap or similar limitation.The tax indemnities granted to the protected parties under the tax protection agreements may affect the way in which we conduct our business, including when and under what circumstances we sell properties or interests therein during the restricted period. See "Certain Relationships and Related Party Transactions—Tax Protection Agreements."

We intend to adopt policies that are designed to eliminate or minimize certain potential conflicts of interests. See "Policies with Respect to Certain Activities—Conflict of Interest Policies" and "Description of the Partnership Agreement of Morgan Properties Operating Partnership, L.P."

We intend to pay cash dividends to holders of our common shares. We intend to pay a pro rata dividend with respect to the period commencing on the completion of this offering and ending on December 31, 2012 based on a dividend payment of $ per share for a full quarter. On an annualized basis, this would equal $ per share, or an annual distribution rate of approximately %, based on the midpoint of the per share price range set forth on the cover page of this prospectus. Dividends and other distributions made by us will be authorized by our board of trustees and declared by us out of funds legally available therefor and will be dependent upon a number of factors, including restrictions under applicable law and the distribution requirements for our qualification as a REIT for federal income tax purposes. See "Distribution Policy." We do not intend to reduce the expected dividend per share if the underwriters' overallotment option is exercised.

We intend to elect to be taxed and to operate in a manner that will allow us to qualify as a REIT for federal income tax purposes commencing with our taxable year ending December 31, 2012. We believe that our organization and proposed method of operation will enable us to meet the requirements for qualification and taxation as a REIT. To maintain REIT status, we must meet a number of organizational and operational requirements, including a requirement that we annually distribute at least 90% of our REIT taxable income to our shareholders, determined without regard to the dividends paid deduction and excluding net capital gains. As a REIT, we generally will not be subject to federal income tax on REIT taxable income that we distribute to our shareholders during the year in which we earn the income. If we fail to qualify as a REIT in any taxable year, and the statutory relief provisions of the Code do not apply, we will be subject to federal income tax on all of our

19

taxable income at regular corporate rates. Even if we qualify for taxation as a REIT, we may be subject to certain federal, state and local taxes on our income or property. In addition, the income of any taxable REIT subsidiary, or TRS, that we own will be subject to taxation at regular corporate rates. See "Material U.S. Federal Income Tax Considerations."