mn-20220331false2022Q1000152422312/3197.82.20.10.100015242232022-01-012022-03-3100015242232022-05-05xbrli:shares00015242232022-03-31iso4217:USD00015242232021-12-31iso4217:USDxbrli:shares0001524223mn:InvestmentManagementFeesMember2022-01-012022-03-310001524223mn:InvestmentManagementFeesMember2021-01-012021-03-310001524223mn:DistributionAndshareholderServicingMember2022-01-012022-03-310001524223mn:DistributionAndshareholderServicingMember2021-01-012021-03-310001524223mn:CustodialServicesMember2022-01-012022-03-310001524223mn:CustodialServicesMember2021-01-012021-03-310001524223mn:ServicesOtherMember2022-01-012022-03-310001524223mn:ServicesOtherMember2021-01-012021-03-3100015242232021-01-012021-03-310001524223us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001524223us-gaap:TreasuryStockMember2021-12-310001524223us-gaap:AdditionalPaidInCapitalMember2021-12-310001524223us-gaap:RetainedEarningsMember2021-12-310001524223us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001524223us-gaap:NoncontrollingInterestMember2021-12-310001524223us-gaap:RetainedEarningsMember2022-01-012022-03-310001524223us-gaap:NoncontrollingInterestMember2022-01-012022-03-310001524223us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001524223us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-03-310001524223us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001524223us-gaap:CommonClassAMember2022-01-012022-03-310001524223us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-03-310001524223us-gaap:TreasuryStockMember2022-03-310001524223us-gaap:AdditionalPaidInCapitalMember2022-03-310001524223us-gaap:RetainedEarningsMember2022-03-310001524223us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001524223us-gaap:NoncontrollingInterestMember2022-03-310001524223us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001524223us-gaap:TreasuryStockMember2020-12-310001524223us-gaap:AdditionalPaidInCapitalMember2020-12-310001524223us-gaap:RetainedEarningsMember2020-12-310001524223us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001524223us-gaap:NoncontrollingInterestMember2020-12-3100015242232020-12-310001524223us-gaap:RetainedEarningsMember2021-01-012021-03-310001524223us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001524223us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001524223us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-03-310001524223us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001524223us-gaap:TreasuryStockMemberus-gaap:TreasuryStockMember2021-01-012021-03-310001524223us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-03-310001524223us-gaap:TreasuryStockMember2021-03-310001524223us-gaap:AdditionalPaidInCapitalMember2021-03-310001524223us-gaap:RetainedEarningsMember2021-03-310001524223us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001524223us-gaap:NoncontrollingInterestMember2021-03-3100015242232021-03-310001524223mn:CallodineMemberus-gaap:SubsequentEventMember2022-09-300001524223mn:ManningNapierInc.Member2022-01-012022-03-31xbrli:pure0001524223mn:ManningNapierFundMembermn:ManagedMutualFundsandManagedMutualConsolidatedFundsMember2022-03-310001524223mn:ManningNapierFundMembermn:ManagedMutualFundsandManagedMutualConsolidatedFundsMember2021-12-310001524223us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-03-310001524223us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-12-31mn:segment0001524223mn:BlendedAssetMembermn:WealthManagementMember2022-01-012022-03-310001524223mn:BlendedAssetMembermn:InstitutionalAndIntermediaryMember2022-01-012022-03-310001524223mn:BlendedAssetMembermn:ManagementFeesMember2022-01-012022-03-310001524223mn:BlendedAssetMembermn:WealthManagementMember2021-01-012021-03-310001524223mn:BlendedAssetMembermn:InstitutionalAndIntermediaryMember2021-01-012021-03-310001524223mn:BlendedAssetMembermn:ManagementFeesMember2021-01-012021-03-310001524223us-gaap:EquityFundsMembermn:WealthManagementMember2022-01-012022-03-310001524223mn:InstitutionalAndIntermediaryMemberus-gaap:EquityFundsMember2022-01-012022-03-310001524223mn:ManagementFeesMemberus-gaap:EquityFundsMember2022-01-012022-03-310001524223us-gaap:EquityFundsMembermn:WealthManagementMember2021-01-012021-03-310001524223mn:InstitutionalAndIntermediaryMemberus-gaap:EquityFundsMember2021-01-012021-03-310001524223mn:ManagementFeesMemberus-gaap:EquityFundsMember2021-01-012021-03-310001524223us-gaap:FixedIncomeInvestmentsMembermn:WealthManagementMember2022-01-012022-03-310001524223us-gaap:FixedIncomeInvestmentsMembermn:InstitutionalAndIntermediaryMember2022-01-012022-03-310001524223us-gaap:FixedIncomeInvestmentsMembermn:ManagementFeesMember2022-01-012022-03-310001524223us-gaap:FixedIncomeInvestmentsMembermn:WealthManagementMember2021-01-012021-03-310001524223us-gaap:FixedIncomeInvestmentsMembermn:InstitutionalAndIntermediaryMember2021-01-012021-03-310001524223us-gaap:FixedIncomeInvestmentsMembermn:ManagementFeesMember2021-01-012021-03-310001524223mn:WealthManagementMember2022-01-012022-03-310001524223mn:InstitutionalAndIntermediaryMember2022-01-012022-03-310001524223mn:ManagementFeesMember2022-01-012022-03-310001524223mn:WealthManagementMember2021-01-012021-03-310001524223mn:InstitutionalAndIntermediaryMember2021-01-012021-03-310001524223mn:ManagementFeesMember2021-01-012021-03-310001524223mn:ThirdPartiesMember2022-03-310001524223mn:ThirdPartiesMember2021-12-310001524223mn:AffiliatedMutualFundsandCollectiveTrustsMember2022-03-310001524223mn:AffiliatedMutualFundsandCollectiveTrustsMember2021-12-310001524223mn:AdvisoryRelatedServicesMember2022-01-012022-03-310001524223mn:AdvisoryRelatedServicesMember2021-01-012021-03-310001524223mn:AdvisoryRelatedServicesMembersrt:MinimumMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-03-310001524223mn:AdvisoryRelatedServicesMembersrt:MinimumMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-03-310001524223mn:AffiliatedMutualFundsMember2022-03-310001524223mn:AffiliatedMutualFundsMember2021-12-310001524223mn:AffiliatedCollectiveInvestmentTrustsMember2022-03-310001524223mn:AffiliatedCollectiveInvestmentTrustsMember2021-12-310001524223srt:MinimumMembermn:WealthManagementMember2022-01-012022-03-310001524223srt:MaximumMembermn:WealthManagementMember2022-01-012022-03-310001524223srt:MaximumMember2022-01-012022-03-310001524223srt:MaximumMember2021-01-012021-03-310001524223mn:ManningAndNapierGroupHoldingLlcMember2022-03-310001524223mn:ClassAUnitsMembermn:ManningAndNapierGroupLlcMember2022-03-310001524223mn:ClassAUnitsMembermn:ManningAndNapierGroupLlcMember2021-12-310001524223mn:ManningNapierInc.Membermn:ClassAUnitsMember2021-12-310001524223mn:ClassAUnitsMembermn:ManningAndNapierGroupLlcMember2022-01-012022-03-310001524223mn:ManningNapierInc.Membermn:ClassAUnitsMember2022-01-012022-03-310001524223mn:ManningNapierInc.Membermn:ClassAUnitsMember2022-03-310001524223mn:AccruedExpensesAndOtherLiabilitiesMember2022-03-310001524223us-gaap:USTreasuryNotesSecuritiesMember2022-03-310001524223us-gaap:FixedIncomeSecuritiesMember2022-03-310001524223us-gaap:EquitySecuritiesMember2022-03-310001524223mn:ManningNapierFundMembermn:ManagedMutualFundsMember2022-03-310001524223us-gaap:USTreasuryNotesSecuritiesMember2021-12-310001524223us-gaap:FixedIncomeSecuritiesMember2021-12-310001524223us-gaap:EquitySecuritiesMember2021-12-310001524223mn:ManningNapierFundMembermn:ManagedMutualFundsMember2021-12-310001524223us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2022-03-310001524223us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-03-310001524223us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2022-03-310001524223us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-03-310001524223us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-03-310001524223us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2022-03-310001524223us-gaap:FairValueInputsLevel1Membermn:ManagedMutualFundsMember2022-03-310001524223mn:ManagedMutualFundsMemberus-gaap:FairValueInputsLevel2Member2022-03-310001524223us-gaap:FairValueInputsLevel3Membermn:ManagedMutualFundsMember2022-03-310001524223mn:ManagedMutualFundsMember2022-03-310001524223us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryNotesSecuritiesMember2022-03-310001524223us-gaap:USTreasuryNotesSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-03-310001524223us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryNotesSecuritiesMember2022-03-310001524223us-gaap:FairValueInputsLevel1Member2022-03-310001524223us-gaap:FairValueInputsLevel2Member2022-03-310001524223us-gaap:FairValueInputsLevel3Member2022-03-310001524223us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2021-12-310001524223us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001524223us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2021-12-310001524223us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001524223us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001524223us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2021-12-310001524223us-gaap:FairValueInputsLevel1Membermn:ManagedMutualFundsMember2021-12-310001524223mn:ManagedMutualFundsMemberus-gaap:FairValueInputsLevel2Member2021-12-310001524223us-gaap:FairValueInputsLevel3Membermn:ManagedMutualFundsMember2021-12-310001524223mn:ManagedMutualFundsMember2021-12-310001524223us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryNotesSecuritiesMember2021-12-310001524223us-gaap:USTreasuryNotesSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-12-310001524223us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryNotesSecuritiesMember2021-12-310001524223us-gaap:FairValueInputsLevel1Member2021-12-310001524223us-gaap:FairValueInputsLevel2Member2021-12-310001524223us-gaap:FairValueInputsLevel3Member2021-12-310001524223mn:CallodineMember2022-01-012022-03-310001524223us-gaap:EmployeeStockOptionMember2021-01-012021-03-310001524223mn:ClassAUnitsMember2022-03-310001524223mn:ClassAUnitsMember2021-03-310001524223mn:EquityCompensationPlan2011Member2022-03-310001524223mn:EquityCompensationPlan2011Member2022-01-012022-03-310001524223mn:EquityCompensationPlan2011Member2021-01-012021-03-310001524223us-gaap:EmployeeStockOptionMember2021-01-012021-03-310001524223us-gaap:EmployeeStockOptionMember2022-01-012022-03-310001524223srt:ExecutiveOfficerMember2021-01-012021-03-310001524223srt:ExecutiveOfficerMember2022-01-012022-03-310001524223srt:AffiliatedEntityMemberus-gaap:AdministrativeServiceMembermn:AffiliatedMutualFundsandCollectiveTrustsMember2022-01-012022-03-310001524223srt:AffiliatedEntityMemberus-gaap:AdministrativeServiceMembermn:AffiliatedMutualFundsandCollectiveTrustsMember2021-01-012021-03-310001524223mn:AffiliatedCollectiveInvestmentTrustsMember2022-01-012022-03-310001524223mn:AffiliatedCollectiveInvestmentTrustsMember2021-01-012021-03-310001524223us-gaap:SubsequentEventMembersrt:MaximumMembermn:ManningAndNapierGroupLlcMember2022-04-200001524223us-gaap:SubsequentEventMember2022-04-202022-04-200001524223us-gaap:SubsequentEventMembermn:ClassAUnitsMember2022-04-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

FORM 10-Q

_____________________________________________________________

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2022

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35355

_____________________________________________________________

MANNING & NAPIER, INC.

(Exact name of registrant as specified in its charter)

_____________________________________________________________

| | | | | | | | | | | |

| Delaware | | 45-2609100 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| |

| 290 Woodcliff Drive | | |

| Fairport, | New York | | 14450 |

| (Address of principal executive offices) | | (Zip Code) |

(585) 325-6880

(Registrant’s telephone number, including area code)

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.01 par value per share | MN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ¨ | | Accelerated Filer | | x |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | x |

| | | | | | |

| | | | Emerging growth company | | ¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at May 5, 2022 |

| Class A common stock, $0.01 par value per share | | 19,124,332 |

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| Part I | | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II | | |

| Item 1A. | | |

| Item 6. | | |

| | |

| In this Quarterly Report on Form 10-Q, “we”, “our”, “us”, the “Company”, “Manning & Napier” and the “Registrant” refers to Manning & Napier, Inc. and, unless the context otherwise requires, its consolidated direct and indirect subsidiaries and predecessors. | |

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

Manning & Napier, Inc.

Consolidated Statements of Financial Condition

(U.S. dollars in thousands, except share data)

| | | | | | | | | | | | | | |

| | March 31, 2022 | | December 31, 2021 |

| | | (unaudited) | | |

| Assets | | | | |

| Cash and cash equivalents | | $ | 51,738 | | | $ | 73,489 | |

| Accounts receivable | | 11,140 | | | 13,851 | |

| Investment securities | | 37,020 | | | 24,608 | |

| Prepaid expenses and other assets | | 17,791 | | | 17,147 | |

| Total current assets | | 117,689 | | | 129,095 | |

| Property and equipment, net | | 2,177 | | | 2,109 | |

| Operating lease right-of-use assets | | 12,999 | | | 14,457 | |

| Net deferred tax assets, non-current | | 17,875 | | | 17,859 | |

| Goodwill | | 4,829 | | | 4,829 | |

| Other long-term assets | | 2,999 | | | 3,074 | |

| Total assets | | $ | 158,568 | | | $ | 171,423 | |

| | | | |

| Liabilities | | | | |

| Accounts payable | | $ | 1,909 | | | $ | 1,791 | |

| Accrued expenses and other liabilities | | 25,988 | | | 36,388 | |

| Deferred revenue | | 12,945 | | | 12,963 | |

| Total current liabilities | | 40,842 | | | 51,142 | |

| Operating lease liabilities, non-current | | 12,708 | | | 14,226 | |

| Amounts payable under tax receivable agreement, non-current | | 13,499 | | | 13,499 | |

| Other long-term liabilities | | 148 | | | 155 | |

| Total liabilities | | 67,197 | | | 79,022 | |

| Commitments and contingencies (Note 9) | | | | |

| Shareholders’ equity | | | | |

Class A common stock, $0.01 par value; 300,000,000 shares authorized; 19,873,337 and 19,124,332 shares issued and outstanding at March 31, 2022, 19,503,085 and 18,754,080 shares issued and outstanding at December 31, 2021 | | 199 | | | 195 | |

Treasury stock, at cost, 749,005 shares at March 31, 2022 and December 31, 2021 | | (5,666) | | | (5,666) | |

| Additional paid-in capital | | 103,567 | | | 104,740 | |

| Retained deficit | | (5,339) | | | (5,569) | |

| Accumulated other comprehensive loss | | (428) | | | (337) | |

| Total shareholders’ equity | | 92,333 | | | 93,363 | |

| Noncontrolling interests | | (962) | | | (962) | |

| Total shareholders’ equity and noncontrolling interests | | 91,371 | | | 92,401 | |

| Total liabilities, shareholders’ equity and noncontrolling interests | | $ | 158,568 | | | $ | 171,423 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Operations

(U.S. dollars in thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | Three months ended March 31, |

| | | | | | 2022 | | 2021 |

| Revenues | | | | | | | | |

| Investment management fees | | | | | | $ | 30,827 | | | $ | 29,676 | |

| Distribution and shareholder servicing | | | | | | 2,082 | | | 2,153 | |

| Custodial services | | | | | | 1,677 | | | 1,645 | |

| Other revenue | | | | | | 963 | | | 677 | |

| Total revenue | | | | | | 35,549 | | | 34,151 | |

| Expenses | | | | | | | | |

| Compensation and related costs | | | | | | 20,707 | | | 18,874 | |

| Distribution, servicing and custody expenses | | | | | | 2,280 | | | 2,358 | |

| Other operating costs | | | | | | 11,477 | | | 6,710 | |

| Total operating expenses | | | | | | 34,464 | | | 27,942 | |

| Operating income | | | | | | 1,085 | | | 6,209 | |

| Non-operating income (loss) | | | | | | | | |

| Interest expense | | | | | | (1) | | | (2) | |

| Interest and dividend income | | | | | | 40 | | | 123 | |

| | | | | | | | |

| Net gains (losses) on investments | | | | | | (646) | | | 337 | |

| Total non-operating income (loss) | | | | | | (607) | | | 458 | |

Income before provision for (benefit from) income taxes | | | | | | 478 | | | 6,667 | |

| Provision for (benefit from) income taxes | | | | | | (746) | | | 703 | |

Net income attributable to controlling and noncontrolling interests | | | | | | 1,224 | | | 5,964 | |

Less: net income attributable to noncontrolling interests | | | | | | 38 | | | 724 | |

| Net income attributable to Manning & Napier, Inc. | | | | | | $ | 1,186 | | | $ | 5,240 | |

| | | | | | | | |

Net income per share available to Class A common stock | | | | | | | | |

| Basic | | | | | | $ | 0.06 | | | $ | 0.31 | |

| Diluted | | | | | | $ | 0.06 | | | $ | 0.26 | |

Weighted average shares of Class A common stock outstanding | | | | | | | | |

| Basic | | | | | | 18,988,573 | | | 17,026,500 | |

| Diluted | | | | | | 21,551,937 | | | 20,273,343 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Comprehensive Income

(U.S. dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | Three months ended March 31, |

| | | | | | 2022 | | 2021 |

Net income attributable to controlling and noncontrolling interests | | | | | | $ | 1,224 | | | $ | 5,964 | |

Net unrealized holding gains (losses) on investment securities, net of tax | | | | | | (93) | | | 8 | |

Reclassification adjustment for net realized losses on investment securities included in net income | | | | | | 9 | | | 97 | |

| Comprehensive income | | | | | | $ | 1,140 | | | $ | 6,069 | |

Less: Comprehensive income attributable to noncontrolling interests | | | | | | 45 | | | 822 | |

Comprehensive income attributable to Manning & Napier, Inc. | | | | | | $ | 1,095 | | | $ | 5,247 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Shareholders’ Equity

(U.S. dollars in thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | Common Stock – Class A | | Treasury Stock | | Additional

Paid in Capital | | Retained

Deficit | | Accumulated

Other

Comprehensive Income (Loss) | | Non

Controlling

Interests | | |

| Shares | | Amount | | Shares | | Amount | | | | | | Total |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2022 | | | | | | | | | | | | | | | | | |

| Balance—December 31, 2021 | 18,754,080 | | | $ | 195 | | | 749,005 | | | $ | (5,666) | | | $ | 104,740 | | | $ | (5,569) | | | $ | (337) | | | $ | (962) | | | $ | 92,401 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 1,186 | | | — | | | 38 | | | 1,224 | |

Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (45) | | | (45) | |

Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | (91) | | | (2) | | | (93) | |

Common stock issued under equity compensation plan, net of forfeitures | 370,252 | | | 4 | | | — | | | — | | | (4) | | | — | | | — | | | — | | | — | |

Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (1,640) | | | — | | | — | | | (38) | | | (1,678) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 506 | | | — | | | — | | | 12 | | | 518 | |

Dividends declared on Class A common stock - $0.05 per share | — | | | — | | | — | | | — | | | — | | | (956) | | | — | | | — | | | (956) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Impact of changes in ownership of Manning & Napier Group, LLC (Note 4) | — | | | — | | | — | | | — | | | (35) | | | — | | | — | | | 35 | | | — | |

| | | | | | | | | | | | | | | | | |

| Balance—March 31, 2022 | 19,124,332 | | | $ | 199 | | | 749,005 | | | $ | (5,666) | | | $ | 103,567 | | | $ | (5,339) | | | $ | (428) | | | $ | (962) | | | $ | 91,371 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock – Class A | | Treasury Stock | Additional

Paid in Capital | | Retained

Deficit | | Accumulated

Other

Comprehensive Income (Loss) | | Non

Controlling

Interests | | |

| Shares | | Amount | | Shares | | Amount | | | | | | Total |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2021 | | | | | | | | | | | | | | | | | |

| Balance—December 31, 2020 | 16,989,943 | | | $ | 170 | | | $ | — | | | $ | — | | | $ | 111,848 | | | $ | (28,826) | | | $ | (235) | | | $ | (7,200) | | | $ | 75,757 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 5,240 | | | — | | | 724 | | | 5,964 | |

Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (295) | | | (295) | |

Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | 7 | | | 1 | | | 8 | |

Common stock issued under equity compensation plan, net of forfeitures | 433,259 | | | 4 | | | — | | | — | | | (4) | | | — | | | — | | | — | | | — | |

Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (2,582) | | | — | | | — | | | (322) | | | (2,904) | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 1,091 | | | — | | | — | | | 136 | | | 1,227 | |

| | | | | | | | | | | | | | | | | |

| Purchases of treasury stock | (412,405) | | | — | | | 412,405 | | | (2,987) | | | — | | | — | | | — | | | — | | | (2,987) | |

Impact of changes in ownership of Manning & Napier Group, LLC | — | | | — | | | — | | | — | | | (171) | | | — | | | — | | | 171 | | | — | |

| | | | | | | | | | | | | | | | | |

| Balance—March 31, 2021 | 17,010,797 | | | $ | 174 | | | 412,405 | | | $ | (2,987) | | | $ | 110,182 | | | $ | (23,586) | | | $ | (228) | | | $ | (6,785) | | | $ | 76,770 | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Cash Flows

(U.S. dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| | 2022 | | 2021 |

| Cash flows from operating activities: | | | | |

| Net income attributable to controlling and noncontrolling interests | | $ | 1,224 | | | $ | 5,964 | |

| Adjustment to reconcile net income to net cash provided by operating activities: | | | | |

| Equity-based compensation | | 518 | | | 1,227 | |

| Depreciation and amortization | | 2,620 | | | 436 | |

| | | | |

| Impairment of long-lived assets | | 430 | | | — | |

| | | | |

| | | | |

| | | | |

| Net losses (gains) on investment securities | | 646 | | | (337) | |

| Deferred income taxes | | (16) | | | 756 | |

(Increase) decrease in operating assets and increase (decrease) in operating liabilities: | | | | |

| Accounts receivable | | 2,712 | | | 1,139 | |

| Prepaid expenses and other assets | | (2,992) | | | (2,089) | |

| Other long-term assets | | 565 | | | 627 | |

| Accounts payable | | 118 | | | 484 | |

| Accrued expenses and other liabilities | | (10,455) | | | (13,868) | |

| Deferred revenue | | (18) | | | 640 | |

| Other long-term liabilities | | (941) | | | (706) | |

| Net cash used in operating activities | | (5,589) | | | (5,727) | |

| Cash flows from investing activities: | | | | |

| Purchase of property and equipment | | (313) | | | (2) | |

| Sale of investments | | 6,373 | | | 4,001 | |

| Purchase of investments | | (20,240) | | | (4,063) | |

| | | | |

| | | | |

| | | | |

| Proceeds from maturity of investments | | 715 | | | — | |

| | | | |

| Net cash used in investing activities | | (13,465) | | | (64) | |

| Cash flows from financing activities: | | | | |

| Distributions to noncontrolling interests | | (45) | | | (295) | |

| Dividends paid on Class A common stock | | (956) | | | — | |

| Payment of shares withheld to satisfy withholding requirements | | (1,678) | | | (3,349) | |

| Purchases of treasury stock | | — | | | (2,987) | |

| Payment of capital lease obligations | | (18) | | | (18) | |

| | | | |

| | | | |

| | | | |

| Net cash used in financing activities | | (2,697) | | | (6,649) | |

| | | | |

| | | | |

| Net decrease in cash and cash equivalents | | (21,751) | | | (12,440) | |

| Cash and cash equivalents: | | | | |

| Beginning of period | | 73,489 | | | 57,635 | |

| End of period | | $ | 51,738 | | | $ | 45,195 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements

Note 1—Organization and Nature of the Business

Manning & Napier, Inc. ("Manning & Napier" or the "Company") is an independent investment management firm that provides our clients with a broad range of financial solutions and investment strategies. Founded in 1970 and headquartered in Fairport, NY, the Company serves a diversified client base of high-net-worth individuals and institutions, including 401(k) plans, pension plans, Taft-Hartley plans, endowments and foundations. The Company's investment strategies offer equity, fixed income and a range of blended asset portfolios, including life cycle funds.

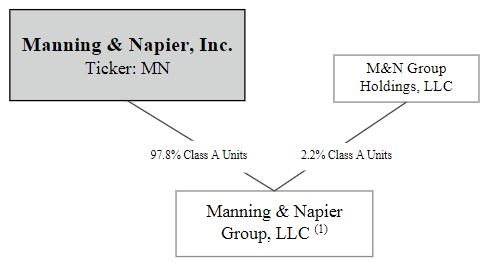

The Company was incorporated in 2011 as a Delaware corporation, and is the sole managing member of Manning & Napier Group, LLC and its subsidiaries (“Manning & Napier Group”), a holding company for the investment management businesses conducted by its operating subsidiaries. The diagram below depicts the Company's organizational structure as of March 31, 2022.

(1)The consolidated operating subsidiaries of Manning & Napier Group include Manning & Napier Advisors, LLC ("MNA"), Manning & Napier Investor Services, Inc., Exeter Trust Company and Rainier Investment Management, LLC ("Rainier").

Plan of Acquisition by Callodine Group, LLC.

On March 31, 2022, the Company entered into an agreement (the "Merger Agreement") under which the Company will go private and be acquired by Callodine Group, LLC ("Callodine"), with the Company continuing as the surviving corporation (the "Merger").

Pursuant to the Merger Agreement, each outstanding share of common stock of the Company and Manning & Napier Group Holdings outstanding units will be converted into the right to receive from Callodine $12.85 in cash. The proposed acquisition is expected to close in the third quarter of 2022, contingent upon shareholder approval and other customary closing conditions.

Note 2—Summary of Significant Accounting Policies

Critical Accounting Policies

The Company's critical accounting policies and estimates are disclosed in its Annual Report on Form 10-K for the year ended December 31, 2021. The Company believes that the disclosures herein are adequate so that the information presented is not misleading; however, these financial statements should be read in conjunction with the financial statements and the notes thereto in the Company's Annual Report on Form 10-K for the year ended December 31, 2021. The financial data for the interim periods may not necessarily be indicative of results for future interim periods or for the full year.

Basis of Presentation

The accompanying unaudited consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and related rules and regulations of the U.S. Securities and

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Exchange Commission (“SEC”) for interim financial reporting and include all adjustments, consisting only of normal recurring adjustments which are, in the opinion of management, necessary for a fair statement of the results for the interim period.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates or assumptions that affect the reported amounts and disclosures in the consolidated financial statements. Actual results could differ from these estimates or assumptions.

Principles of Consolidation

The Company consolidates all majority-owned subsidiaries. As of March 31, 2022, Manning & Napier holds an economic interest of approximately 97.8% in Manning & Napier Group and, as managing member, controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statements of financial condition with respect to the remaining economic interest in Manning & Napier Group held by M&N Group Holdings.

All material intercompany transactions have been eliminated in consolidation.

In accordance with Accounting Standards Update ("ASU") 2015-02, Consolidation (Topic 810) – Amendments to the Consolidation Analysis, the determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design, a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance, and whether a company is obligated to absorb losses or receive benefits that could potentially be significant to the entity. The standard also requires ongoing assessments of whether a company is the primary beneficiary of a variable interest entity (“VIE”). When utilizing the voting interest entity ("VOE") model, controlling financial interest is generally defined as majority ownership of voting interests.

The Company provides seed capital to its investment teams to develop new strategies and services for its clients. The original seed investment may be held in a separately managed account, comprised solely of the Company's investments or within a mutual fund, where the Company's investments may represent all or only a portion of the total equity investment in the mutual fund. Pursuant to U.S. GAAP, the Company evaluates its investments in mutual funds on a regular basis and consolidates such mutual funds for which it holds a controlling financial interest. When no longer deemed to hold a controlling financial interest, the Company would deconsolidate the fund and classify the remaining investment as either an equity method investment, equity investments, at fair value, or as trading securities, as applicable. As of March 31, 2022 and December 31, 2021, the Company did not have investments classified as an equity method investment.

The Company serves as the investment adviser for Manning & Napier Fund, Inc. series of mutual funds (the “Fund”), Exeter Trust Company Collective Investment Trusts (“CIT”) and Rainier Multiple Investment Trust. The Fund, CIT and Rainier Multiple Investment Trust are legal entities, the business and affairs of which are managed by their respective boards of directors. As a result, each of these entities is a VOE. The Company holds, in limited cases, direct investments in a mutual fund (which are made on the same terms as are available to other investors) and consolidates each of these entities where it has a controlling financial interest or a majority voting interest. The Company's investments in the Fund amounted to approximately $14.9 million as of March 31, 2022 and $1.1 million as of December 31, 2021. As of March 31, 2022 and December 31, 2021, the Company did not have a controlling financial interest in any mutual fund.

Revenue

Investment Management: Investment management fees are computed as a percentage of assets under management ("AUM"). The Company's performance obligation is a series of services that form part of a single performance obligation satisfied over time.

Separately managed accounts are paid in advance, typically for a semi-annual or quarterly period, or in arrears, typically for a monthly or quarterly period. When investment management fees are paid in advance, the Company defers the revenue as a contract liability and recognizes it over the applicable period. When investment management fees are paid in arrears, the Company estimates revenue and records a contract asset (accrued accounts receivable) based on AUM as of the most recent month end date.

Mutual funds and collective investment trust investment management revenue is calculated and earned daily based on AUM. Revenue is presented net of cash rebates and fees waived pursuant to contractual expense limitations of the funds. The Company also has agreements with third parties who provide recordkeeping and administrative services for employee benefit plans participating in the collective investment trusts. The Company is acting as an agent on behalf of the employee benefit plan sponsors, therefore, investment management revenue is recorded net of fees paid to third party service providers.

Distribution and shareholder servicing: The Company receives distribution and servicing fees for providing services to its affiliated mutual funds. Revenue is computed and earned daily based on a percentage of AUM. The performance obligation is a series of services that form part of a single performance obligation satisfied over time. The Company has agreements with third parties who provide distribution and administrative services for its mutual funds. The agreements are evaluated to determine

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

whether revenue should be reported gross or net of payments to third-party service providers. The Company controls the services provided and acts as a principal in the relationship. Therefore, distribution and shareholder servicing revenue is recorded gross of fees paid to third parties.

Custodial services: Custodial service fees are calculated as a percentage of the client’s market value with additional fees charged for certain transactions. For the safeguarding and administrative services that are subject to a percentage of market value fee, the Company's performance obligation is a series of services that form part of a single performance obligation satisfied over time. Revenue for transactions assigned a stand-alone selling price is recognized in the period in which the transaction is executed. Custodial service fees are billed monthly in arrears. The Company has agreements with third parties who provide safeguarding, recordkeeping and administrative services for their clients. The Company controls the services provided and acts as a principal in the relationship. Therefore, custodial service revenue is recorded gross of fees paid to third parties.

Cash and Cash Equivalents

The Company generally considers all highly liquid investments with original maturities of three months or less to be cash equivalents. Cash and cash equivalents are primarily held in operating accounts at major financial institutions and also in money market securities. Cash equivalents are stated at cost, which approximates market value due to the short-term maturity of these investments. The fair value of cash equivalents has been classified as Level 1 in accordance with the fair value hierarchy.

Investment Securities

Investment securities are classified as either equity investments, trading, equity method investments or available-for-sale and are carried at fair value. Fair value is determined based on quoted market prices in active markets for identical or similar instruments.

Investment securities classified as equity investments, at fair value consist of equity securities and investments in mutual funds for which the Company provides advisory services. Realized and unrealized gains and losses on equity investments, at fair value or trading securities, as applicable, are recorded in net gains (losses) on investments in the consolidated statements of operations.

Investment securities classified as available-for-sale consist of U.S. Treasury securities and corporate bonds. Unrealized gains and losses on available-for-sale securities are excluded from earnings and are reported, net of deferred income tax, as a separate component of accumulated other comprehensive income in shareholders’ equity until realized. The Company periodically reviews each individual security position that has an unrealized loss, or impairment, to determine if that impairment is other-than-temporary. If impairment is determined to be other-than-temporary, the carrying value of the security will be written down to fair value and the loss will be recognized in earnings. Realized gains and losses on sales of available-for-sale securities are computed on a specific identification basis and are recorded in net gains (losses) on investments in the consolidated statements of operations.

Property, Equipment, Software and Depreciation

Property and equipment is presented net of accumulated depreciation of approximately $8.7 million and $8.6 million as of March 31, 2022 and December 31, 2021, respectively.

Capitalized implementation costs for hosting arrangements are included within prepaid expenses and other assets on the Company's statements of financial condition and totaled approximately $5.1 million and $7.0 million, net of accumulated amortization, as of March 31, 2022 and December 31, 2021, respectively.

During the three months ended March 31, 2022 , the Company recognized a $1.9 million charge for the impairment of certain internal and external costs capitalized in connection with hosted software arrangements, which is reflected within other operating costs in the statements of operations. This impairment charge was recorded subsequent to the Company's determination that portions of a software license agreement with a third-party service provider would be terminated. As such, the Company concluded that capitalized costs associated with the terminated services would not ultimately be completed and placed into service. The Company does not expect to incur future cash expenditures in connection with terminating these services.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Goodwill and Intangible Assets

Goodwill represents the excess cost over the fair value of the identifiable net assets of acquired companies. Identifiable intangible assets generally represent the cost of client relationships and investment management agreements acquired as well as trademarks. Goodwill and indefinite-lived assets are tested for impairment annually or more frequently if events or circumstances indicate that the carrying value may not be recoverable. Intangible assets subject to amortization are tested for impairment whenever events or circumstances indicate that the carrying value may not be recoverable. Goodwill and intangible assets require significant management estimate and judgment, including the valuation and expected life determination in connection with the initial purchase price allocation and the ongoing evaluation for impairment.

Leases

The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use ("ROU") assets, accrued expenses and other liabilities and operating lease liabilities, non-current on its consolidated statements of financial condition. Finance leases are included in other long-term assets, accrued expenses and other liabilities, and other long-term liabilities on its consolidated statements of financial condition.

ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. Operating lease ROU assets and lease liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As the Company's leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The incremental borrowing rate, for each identified lease, is the rate of interest that the Company would have to pay to borrow on a collateralized basis over a similar term. The operating lease ROU asset is reduced for any lease incentives. The Company's lease terms may include options to extend or terminate the lease when it is reasonably certain that it will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

The Company has lease agreements with lease and non-lease components, which are combined for all classes of underlying assets.

Impairment of Long-Lived Assets

The Company reviews the carrying value of its long-lived assets annually or whenever events or changes in circumstances indicate that the historical cost carrying value of an asset may no longer be appropriate.

During the three months ended March 31, 2022, the Company entered into a sublease agreement for a portion of the Company's currently occupied office space, triggering a change in the way the leased asset is utilized by the Company. The subleased space was determined to be a separate asset group from the remaining office space leased by the Company, and as such represents a distinct ROU asset and lease liability. The Company assessed recoverability of the asset group by comparing the undiscounted future net cash flows expected to result from the asset group to its carrying value. The carrying value exceeded the undiscounted future net cash flows of the asset, and an impairment loss of approximately $0.5 million was recognized during the three months ended March 31, 2022 as the difference between the net book value and the fair value of the asset group.

Treasury Stock

Treasury stock is accounted for under the cost method and is included as a deduction from equity in the Shareholders' Equity section of the consolidated statements of financial condition. Upon any subsequent retirement or resale, the treasury stock account is reduced by the cost of such stock.

Operating Segments

The Company operates in one segment, the investment management industry.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 3—Revenue

Disaggregated Revenue

The following table represents the Company’s wealth management and institutional and intermediary investment management revenue by investment portfolio during the three months ended March 31, 2022 and 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | |

| | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Three months ended March 31, 2022 | | Three months ended March 31, 2021 |

| | Wealth Management | | Institutional and Intermediary | | Total | | Wealth Management | | Institutional and Intermediary | | Total |

| | | (in thousands) |

| Blended Asset | | $ | 14,669 | | | $ | 8,297 | | | $ | 22,966 | | | $ | 13,634 | | | $ | 8,068 | | | $ | 21,702 | |

| Equity | | 1,361 | | | 5,921 | | | 7,282 | | | 1,608 | | | 5,865 | | | 7,473 | |

| Fixed Income | | 110 | | | 469 | | | 579 | | | 106 | | | 395 | | | 501 | |

| Total | | $ | 16,140 | | | $ | 14,687 | | | $ | 30,827 | | | $ | 15,348 | | | $ | 14,328 | | | $ | 29,676 | |

Accounts Receivable

Accounts receivable as of March 31, 2022 and December 31, 2021 consisted of the following:

| | | | | | | | | | | | | | |

| | | March 31, 2022 | | December 31, 2021 |

| | | (in thousands) |

| Accounts receivable - third parties | | $ | 5,931 | | | $ | 8,119 | |

| Accounts receivable - affiliated mutual funds and collective investment trusts | | 5,209 | | | 5,732 | |

| Total accounts receivable | | $ | 11,140 | | | $ | 13,851 | |

Accounts receivable represents the Company's unconditional rights to consideration arising from its performance under separately managed account, mutual fund and collective investment trust, distribution and shareholder servicing, and custodial service contracts. Accounts receivable balances do not include an allowance for doubtful accounts nor has any significant bad debt expense attributable to accounts receivable been recorded during the three months ended March 31, 2022 or 2021.

Advisory and Distribution Agreements

The Company earns investment advisory fees, distribution fees and administrative service fees under agreements with affiliated mutual funds and collective investment trusts. Fees earned for advisory and distribution services provided were approximately $10.1 million for the three months ended March 31, 2022 and approximately $9.9 million for the three months ended March 31, 2021, which represents greater than 25% of revenue in each period. The following provides amounts due from affiliated mutual funds and collective investment trusts reported within accounts receivable in the consolidated statements of financial condition as of March 31, 2022 and December 31, 2021:

| | | | | | | | | | | | | | |

| | | March 31, 2022 | | December 31, 2021 |

| | | (in thousands) |

| Affiliated mutual funds | | $ | 3,928 | | | $ | 4,309 | |

| Affiliated collective investment trusts | | 1,281 | | | 1,423 | |

| Accounts receivable - affiliated mutual funds and collective investment trusts | | $ | 5,209 | | | $ | 5,732 | |

Contract assets and liabilities

Accrued accounts receivable: Accrued accounts receivable represents the Company's contract asset for revenue that has been recognized in advance of billing separately managed account contracts. Consideration for the period billed in arrears is dependent on the client’s AUM on a future billing date and therefore conditional as of the reporting period end. During the three months ended March 31, 2022, revenue was decreased by less than $0.1 million for changes in transaction price. Accrued accounts receivable of approximately $0.3 million is reported within prepaid expenses and other assets in the consolidated statements of financial condition for both March 31, 2022 and December 31, 2021.

Deferred revenue: Deferred revenue is recorded when consideration is received or unconditionally due in advance of providing services to the Company's customer. Revenue recognized during the three months ended March 31, 2022 that was included in deferred revenue at the beginning of the period was approximately $9.9 million.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Costs to obtain a contract: Under compensation plans in effect for periods prior to January 1, 2020, certain incremental first year commissions directly associated with new customer contracts were capitalized and amortized on a straight-line basis over an estimated customer contract period of 3 to 7 years. The total net asset as of March 31, 2022 and December 31, 2021 was approximately $0.4 million and $0.5 million, respectively. The related amortization expense, which is included in compensation and related costs, totaled less than $0.1 million for the three months ended March 31, 2022 and less than $0.1 million for the three months ended March 31, 2021. An impairment loss is recorded for contract acquisition costs related to client contracts that cancel during the period. These impairment losses totaled less than $0.1 million for the three months ended March 31, 2022 and were zero for the three months ended March 31, 2021.

Note 4—Noncontrolling Interests

Manning & Napier holds an economic interest of approximately 97.8% in Manning & Napier Group, and as managing member controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statements of financial condition with respect to the remaining approximately 2.2% economic interest in Manning & Napier Group held by M&N Group Holdings. Net income attributable to noncontrolling interests on the statements of operations represents the portion of earnings attributable to the economic interest in Manning & Napier Group held by the noncontrolling interests.

The following table provides a reconciliation from “Income before provision for (benefit from) income taxes” to “Net income attributable to Manning & Napier, Inc.”:

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended March 31, |

| | | | | | 2022 | | 2021 |

| | | | | | | (in thousands) |

Income before provision for (benefit from) income taxes | | | | | | $ | 478 | | | $ | 6,667 | |

Less: income (loss) before provision for (benefit from) income taxes of Manning & Napier, Inc. (1) | | | | | | (1,320) | | | 7 | |

Income before provision for income taxes, as adjusted | | | | | | 1,798 | | | 6,660 | |

Controlling interest percentage (2) | | | | | | 97.8 | % | | 88.9 | % |

| Income before provision for income taxes attributable to controlling interest | | | | | | 1,758 | | | 5,921 | |

Plus: income (loss) before provision for (benefit from) income taxes of Manning & Napier, Inc. (1) | | | | | | (1,320) | | | 7 | |

Income before provision for income taxes attributable to Manning & Napier, Inc. | | | | | | 438 | | | 5,928 | |

Less: provision for (benefit from) income taxes of Manning & Napier, Inc.(3) | | | | | | (748) | | | 688 | |

| Net income attributable to Manning & Napier, Inc. | | | | | | $ | 1,186 | | | $ | 5,240 | |

_______________________(1)Manning & Napier, Inc. incurs certain income or expenses that are only attributable to it and are therefore excluded from the net income attributable to noncontrolling interests.

(2)Income before provision for (benefit from) income taxes is allocated to the controlling interest based on the percentage of units of Manning & Napier Group held by Manning & Napier, Inc. The amount represents the Company's weighted ownership of Manning & Napier Group's income for the respective periods.

(3)The consolidated provision for (benefit from) income taxes is equal to the sum of (i) the provision for (benefit from) income taxes for entities other than Manning & Napier, Inc. and (ii) the provision for (benefit from) income taxes of Manning & Napier, Inc. which includes all U.S. federal and state income taxes. The consolidated provision for (benefit from) income taxes was a benefit of $0.7 million and provision of $0.7 million for the three months ended March 31, 2022 and 2021, respectively.

As of March 31, 2022, a total of 428,812 units of Manning & Napier Group were held by the noncontrolling interests. Pursuant to the terms of the exchange agreement entered into at the time of the Company's initial public offering ("Exchange Agreement"), such units may be tendered for exchange or redemption. For any units exchanged, the Company may (i) pay an amount of cash equal to the number of tendered units multiplied by the value of one share of the Company's Class A common stock less a market discount and expected expenses, or, at the Company's election, (ii) issue shares of the Company's Class A common stock on a one-for-one basis, subject to customary adjustments. As the Company receives units of Manning & Napier Group that are exchanged, the Company's ownership of Manning & Napier Group will increase.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

During the three months ended March 31, 2022, Class A common stock was issued under the Company's 2011 Equity Compensation Plan (the "Equity Plan") for which Manning & Napier, Inc. acquired an equivalent number of Class A units of Manning & Napier Group.

The following is the impact to the Company's equity ownership interest in Manning & Napier Group for the three months ended March 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Manning & Napier Group Class A Units Held | | |

| |

Manning & Napier | |

Noncontrolling Interests | | Total | | Manning & Napier Ownership % |

As of December 31, 2021 | 18,296,780 | | | 428,812 | | | 18,725,592 | | | 97.7% |

| Class A Units issued | 370,252 | | | — | | | 370,252 | | | 0.1% |

| | | | | | | |

| As of March 31, 2022 | 18,667,032 | | | 428,812 | | | 19,095,844 | | | 97.8% |

Manning & Napier Inc., as managing member, controls all of the business and affairs of Manning & Napier Group. Since the Company continues to have a controlling interest in Manning & Napier Group, the aforementioned changes in ownership of Manning & Napier Group were accounted for as equity transactions under ASC Topic 810, Consolidation. Additional paid-in capital and noncontrolling interests in the consolidated statements of financial position are adjusted to reallocate the Company's historical equity to reflect the change in ownership of Manning & Napier Group.

Manning & Napier and the holders of Manning & Napier Group are party to a tax receivable agreement ("TRA"), pursuant to which Manning & Napier is required to pay to such holders 85% of the applicable cash savings, if any, in U.S. federal, state, local and foreign income tax that Manning & Napier actually realizes, or is deemed to realize in certain circumstances, as a result of (i) certain tax attributes of their units sold to Manning & Napier or exchanged (for shares of Class A common stock) and that are created as a result of the sales or exchanges and payments under the TRA and (ii) tax benefits related to imputed interest.

At both March 31, 2022 and December 31, 2021, the Company had recorded a liability of $17.8 million, representing the estimated payments due to the selling unit holders under the TRA entered into between Manning & Napier and the other holders of Class A Units of Manning & Napier Group. Of these amounts, approximately $4.3 million were included in accrued expenses and other liabilities at both March 31, 2022 and December 31, 2021. The Company made no payments pursuant to the TRA during either of the three months ended March 31, 2022 and 2021.

Obligations pursuant to the TRA are obligations of Manning & Napier. They do not impact the noncontrolling interests. These obligations are not income tax obligations. Furthermore, the TRA has no impact on the allocation of the provision for income taxes to the Company’s net income.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 5—Investment Securities

The following represents the Company’s investment securities holdings as of March 31, 2022 and December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2022 |

| | Cost | | Unrealized

Gains | | Unrealized

Losses | | Fair

Value |

| | | (in thousands) |

| Available-for-sale securities | | | | | | | | |

| U.S. Treasury securities | | $ | 9,455 | | | $ | — | | | $ | (191) | | | $ | 9,264 | |

| Fixed income securities | | 6,219 | | | — | | | (204) | | | 6,015 | |

| | | | | | | | |

| | | | | | | | 15,279 | |

| Equity investments, at fair value | | | | | | | | |

| Equity securities | | | | | | | | 6,796 | |

| Mutual funds | | | | | | | | 14,945 | |

| | | | | | | | 21,741 | |

| Total investment securities | | | | | | | | $ | 37,020 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2021 |

| | Cost | | Unrealized

Gains | | Unrealized

Losses | | Fair

Value |

| | | (in thousands) |

| Available-for-sale securities | | | | | | | | |

| U.S. Treasury securities | | $ | 10,442 | | | $ | — | | | $ | (135) | | | $ | 10,307 | |

| Fixed income securities | | 7,015 | | | — | | | (156) | | | 6,859 | |

| | | | | | | | |

| | | | | | | | 17,166 | |

| Equity investments, at fair value | | | | | | | | |

| Equity securities | | | | | | | | 6,377 | |

| Mutual funds | | | | | | | | 1,065 | |

| | | | | | | | 7,442 | |

| Total investment securities | | | | | | | | $ | 24,608 | |

Investment securities are classified as either equity investments or available-for-sale and are carried at fair value. Fair value is determined based on quoted market prices in active markets for identical or similar instruments.

Investment securities classified as equity investments, at fair value consist of equity securities and investments in mutual funds for which the Company provides advisory services. At March 31, 2022 and December 31, 2021, equity investments, at fair value consist of investments held by the Company to provide initial cash seeding for product development purposes and investments in mutual funds to hedge economic exposure to market movements on its deferred compensation plan. The Company recognized approximately $0.5 million of net unrealized losses and $0.3 million of net unrealized gains related to investments classified as equity investments, at fair value during the three months ended March 31, 2022 and 2021, respectively.

Investment securities classified as available-for-sale consist of U.S. Treasury securities and corporate bonds to optimize cash management opportunities and for compliance with certain regulatory requirements. As of March 31, 2022 and December 31, 2021, approximately $0.6 million of these securities was considered restricted. The Company periodically reviews each individual security position that has an unrealized loss, or impairment, to determine if that impairment is other-than-temporary. No other-than-temporary impairment charges have been recognized by the Company during the three months ended March 31, 2022 and 2021.

Note 6—Fair Value Measurements

Fair value is defined as the price that the Company would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. A fair value hierarchy is applied that gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following three-tier fair value hierarchy prioritizes the inputs used in measuring fair value:

•Level 1—observable inputs such as quoted prices in active markets for identical securities;

•Level 2—other significant observable inputs (including but not limited to quoted prices for similar securities, interest rates, prepayment rates, credit risk, etc.); and

•Level 3—significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments).

The following table summarizes the hierarchy of inputs used to derive the fair value of the Company’s assets as of March 31, 2022 and December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2022 |

| | Level 1 | | Level 2 | | Level 3 | | Totals |

| | | (in thousands) |

| Equity securities | | $ | 6,796 | | | $ | — | | | $ | — | | | $ | 6,796 | |

| Fixed income securities | | — | | | 6,015 | | | — | | | 6,015 | |

| Mutual funds | | 14,945 | | | — | | | — | | | 14,945 | |

| | | | | | | | |

| U.S. Treasury securities | | — | | | 9,264 | | | — | | | 9,264 | |

| | | | | | | | |

| Total assets at fair value | | $ | 21,741 | | | $ | 15,279 | | | $ | — | | | $ | 37,020 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2021 |

| | Level 1 | | Level 2 | | Level 3 | | Totals |

| | | (in thousands) |

| Equity securities | | $ | 6,377 | | | $ | — | | | $ | — | | | $ | 6,377 | |

| Fixed income securities | | — | | | 6,859 | | | — | | | 6,859 | |

| Mutual funds | | 1,065 | | | — | | | — | | | 1,065 | |

| U.S. Treasury securities | | — | | | 10,307 | | | — | | | 10,307 | |

| | | | | | | | |

| Total assets at fair value | | $ | 7,442 | | | $ | 17,166 | | | $ | — | | | $ | 24,608 | |

Valuations of investments in fixed income securities and U.S. Treasury securities can generally be obtained through independent pricing services. For most bond types, the pricing service utilizes matrix pricing, which considers one or more of the following factors: yield or price of bonds of comparable quality, coupon, maturity, current cash flows, type and current day trade information, as well as dealer supplied prices. These valuations are categorized as Level 2 in the hierarchy.

The Company’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between valuation levels during the three months ended March 31, 2022.

Note 7—Accrued Expenses and Other Liabilities

Accrued expenses and other liabilities as of March 31, 2022 and December 31, 2021 consisted of the following:

| | | | | | | | | | | | | | |

| | March 31, 2022 | | December 31, 2021 |

| | | (in thousands) |

| Accrued bonus and sales commissions | | $ | 11,182 | | | $ | 22,144 | |

| Accrued payroll and benefits | | 2,953 | | | 4,548 | |

| Accrued sub-transfer agent fees | | 472 | | | 482 | |

| | | | |

| Amounts payable under tax receivable agreement | | 4,273 | | | 4,273 | |

Short-term operating lease liabilities | | 2,788 | | | 2,728 | |

| Other accruals and liabilities | | 4,320 | | | 2,213 | |

| Total accrued expenses and other liabilities | | $ | 25,988 | | | $ | 36,388 | |

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 8—Leases

The Company has operating and finance leases for office space and certain equipment. For these leases, the office space or equipment is an explicitly identified asset within the contract. The Company has determined that it has obtained substantially all of the economic benefits from the use of the underlying asset and directs how and for what purpose the asset is used during the term of the contract.

Certain of the Company's operating leases have been subleased for which the Company will receive cash totaling approximately $4.1 million over the remaining term of such leases. The lease terms for the five subleased operating leases end ranging from 2025 to 2028.

The components of lease expense for the three months ended March 31, 2022 and 2021 were as follows:

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended March 31, |

| | | | | | 2022 | | 2021 |

| | | | | | (in thousands) |

| Finance lease expense | | | | | | | | |

| Amortization of right-of-use assets | | | | | | $ | 13 | | | $ | 24 | |

| Interest on lease liabilities | | | | | | 1 | | | 2 | |

| Operating lease expense | | | | | | 1,183 | | | 826 | |

| Short-term lease expense | | | | | | — | | | — | |

| Variable lease expense | | | | | | 77 | | | 41 | |

| Sublease income | | | | | | (186) | | | (165) | |

| Total lease expense | | | | | | $ | 1,088 | | | $ | 728 | |

Supplemental cash flow information related to leases for the three months ended March 31, 2022 and 2021 were as follows:

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended March 31, |

| | | | | | 2022 | | 2021 |

| | | | | | (in thousands) |

Cash paid for amounts included in the measurement of lease liabilities: | | | | | | | | |

| Operating cash flows from finance leases | | | | | | $ | 1 | | | $ | 2 | |

| Finance cash flows from finance leases | | | | | | $ | 17 | | | $ | 16 | |

| Operating cash flows from operating leases | | | | | | $ | 1,189 | | | $ | 946 | |

| | | | | | | | |

Right-of-use assets obtained in exchange for new lease obligations: | | | | | | | | |

| Finance leases | | | | | | $ | — | | | $ | — | |

| Operating leases | | | | | | $ | (513) | | | $ | 38 | |

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Supplemental balance sheet information related to leases as of March 31, 2022 was as follows:

| | | | | | | | |

| (in thousands, except lease term and discount rate) | | March 31, 2022 |

| Finance Leases | | |

Finance lease right-of-use assets (1) | | $ | 67 | |

| | |

| Accrued expenses and other liabilities | | $ | 44 | |

| Other long-term liabilities | | 28 | |

| Total finance lease liabilities | | $ | 72 | |

| | |

| Operating Leases | | |

| Operating lease right-of-use assets | | $ | 12,999 | |

| | |

| Accrued expenses and other liabilities | | $ | 2,788 | |

| Operating lease liabilities, non-current | | 12,708 | |

| Total operating lease liabilities | | $ | 15,496 | |

| | |

| Weighted average remaining lease term | | |

| Finance leases | | 1.56 years |

| Operating leases | | 5.45 years |

| Weighted average discount rate | | |

| Finance leases | | 4.29 | % |

| Operating leases | | 4.95 | % |

_______________________(1)Amounts included in other long-term assets within the consolidated statements of financial condition.

Maturities of lease liabilities were as follows:

| | | | | | | | | | | | | | |

| Twelve month period ending March 31, | | Finance Leases | | Operating Leases |

| | (in thousands) |

| 2023 | | $ | 47 | | | $ | 3,524 | |

| 2024 | | 27 | | | 3,292 | |

| 2025 | | — | | | 3,171 | |

| 2026 | | — | | | 2,906 | |

| 2027 | | — | | | 2,871 | |

| Thereafter | | — | | | 1,924 | |

| Total lease payments | | 74 | | | 17,688 | |

| Less imputed interest | | (2) | | | (2,192) | |

| Total lease liabilities | | $ | 72 | | | $ | 15,496 | |

Note 9—Commitments and Contingencies

The Company may from time to time enter into agreements that contain certain representations and warranties and which provide general indemnifications. The Company may also serve as a guarantor of such obligations. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred. The Company expects any risk of liability associated with such guarantees to be remote.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Regulation

As an investment adviser to a variety of investment products, the Company and its affiliated broker-dealer are subject to routine reviews and inspections by the SEC and the Financial Industry Regulatory Authority, Inc. From time to time the Company may also be subject to claims, or be involved in various legal proceedings, arising in the ordinary course of its business and other contingencies. The Company does not believe that the outcome of any of these reviews, inspections or other legal proceedings will have a material impact on its consolidated financial statements; however, litigation is subject to many uncertainties, and the outcome of individual litigated matters is difficult to predict. The Company will establish accruals for matters that are probable, can be reasonably estimated, and may take into account any related insurance recoveries to the extent of such recoveries. As of March 31, 2022 and December 31, 2021, the Company has not accrued for any such claims, legal proceedings, or other contingencies.

Merger Agreement

The Company has made customary representations and warranties in the Merger Agreement with Callodine (Note 1). The Merger Agreement also contains customary covenants and agreements, including covenants and agreements relating to the conduct of the Company’s business between the date of the signing of the Merger Agreement and the closing of the transactions contemplated under the Merger Agreement.

The Merger Agreement contains certain termination rights for the Company and Callodine, including the right of the Company to terminate the Merger Agreement to accept a superior proposal, subject to specified limitations, and provides that, upon termination of the Merger Agreement by the Company, the Company will be required to pay Callodine a termination fee of $8,790,000 or upon termination of the Merger Agreement by Callodine, Callodine will be required to pay the Company a termination fee of $15,070,000 in each case under circumstances.

In addition to the foregoing termination rights, and subject to certain limitations, either party may terminate the Merger Agreement if the Merger is not consummated by October 1, 2022.

Note 10—Earnings per Common Share

Basic earnings per share (“basic EPS”) is computed by dividing net income by the weighted average number of shares outstanding for the reporting period. Diluted earnings per share (“diluted EPS”) gives effect during the reporting period to other potentially dilutive shares outstanding.

Net income attributable to noncontrolling interests on the statements of operations represents the portion of earnings attributable to the economic interest of Manning & Napier Group held by the noncontrolling interests (Note 4). For periods in which the outstanding Class A Units of Manning & Napier Group are dilutive to the Company's earnings per share, the calculation of diluted earnings per share also takes into account the incremental net income that would be available to Class A common stock upon the conversion of Class A Units into Class A common stock.

Weighted average shares outstanding for periods prior to January 1, 2022 reflect the impact of the Company's restricted Class A common shares that had been granted under a prior equity plan. These awards had non-forfeitable dividend rights during their vesting period and were therefore considered participating securities under the two-class method for purposes of computing both basic and diluted earnings per share in those periods.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following is a reconciliation of the income and share data used in the basic and diluted EPS computations for the three months ended March 31, 2022 and 2021:

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended March 31, |

| | | | | | 2022 | | 2021 |

| | | | | | | (in thousands, except share data) |

Numerator: | | | | | | | | |

Net income attributable to controlling and noncontrolling interests | | | | | | $ | 1,224 | | | $ | 5,964 | |

| Less: net income attributable to noncontrolling interests | | | | | | 38 | | | 724 | |

| Net income attributable to Manning & Napier, Inc. | | | | | | $ | 1,186 | | | $ | 5,240 | |

| Less: allocation to participating securities | | | | | | — | | | 38 | |

Net income available to Class A common stock for basic EPS | | | | | | $ | 1,186 | | | $ | 5,202 | |

Plus: reallocation of net income attributable to participating securities | | | | | | — | | | 5 | |

| | | | | | | | |

Net income available to Class A common stock for diluted EPS | | | | | | $ | 1,186 | | | $ | 5,207 | |

| | | | | | | | |

Denominator: | | | | | | | | |

Weighted average shares of Class A common stock outstanding - basic | | | | | | 18,988,573 | | | 17,026,500 | |

Dilutive effect of outstanding equity awards | | | | | | 2,563,364 | | | 3,246,843 | |

| | | | | | | | |

Weighted average shares of Class A common stock outstanding - diluted | | | | | | 21,551,937 | | | 20,273,343 | |

Net income available to Class A common stock per share - basic | | | | | | $ | 0.06 | | | $ | 0.31 | |

Net income available to Class A common stock per share - diluted | | | | | | $ | 0.06 | | | $ | 0.26 | |

Performance-based stock options are excluded from the calculation of diluted EPS for periods in which the associated market condition has not yet been achieved. As such, for the three months ended March 31, 2021, 288,000 unvested performance-based stock options were excluded from the calculation of diluted EPS.

For the three months ended March 31, 2021, 232,216 unvested equity awards were excluded from the calculation of diluted EPS because the effect would have been anti-dilutive.

At March 31, 2022, and 2021 there were 428,812 and 2,021,781 Class A Units of Manning & Napier Group outstanding, respectively, which, subject to certain restrictions, may be exchangeable for up to an equivalent number of shares of the Company's Class A common stock. These units were not included in the calculation of diluted earnings per common share for the three months ended March 31, 2022 or for the three months ended March 31, 2021 because the effect would have been anti-dilutive.

Note 11—Equity-Based Compensation

The Equity Plan was adopted by the Company's board of directors and approved by shareholders prior to the consummation of the Company's 2011 initial public offering. A total of 13,142,813 equity interests were authorized for issuance, eligible to be issued in the form of Class A common stock, restricted stock units, stock options, units of Manning & Napier Group, or certain classes of membership interests in the Company which may convert into units of Manning & Napier Group. The Equity Plan expired in November 2021. As such, at March 31, 2022, there were no awards available for issuance pursuant to the Equity Plan.The following table summarizes activity related to awards of restricted stock and restricted stock units (collectively, "stock awards") under the Equity Plan for the three months ended March 31, 2022:

| | | | | | | | | | | | | | |

| | Stock Awards | | Weighted Average Grant Date Fair Value |

| Outstanding at January 1, 2022 | | 3,421,611 | | | $ | 2.90 | |