Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

FORM 10-Q

_____________________________________________________________

(Mark One)

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2019

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35355

_____________________________________________________________

MANNING & NAPIER, INC.

(Exact name of registrant as specified in its charter)

_____________________________________________________________

|

| | |

Delaware | | 45-2609100 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

290 Woodcliff Drive Fairport, New York | | 14450 |

(Address of principal executive offices) | | (Zip Code) |

(585) 325-6880

Registrant’s telephone number, including area code

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A common stock, $0.01 par value per share | MN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | ¨

|

| | | |

Non-accelerated filer | | x | | Smaller reporting company | | x |

| | | | | | |

| | | | Emerging growth company | | ¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

| | |

Class | | Outstanding at August 6, 2019 |

Class A common stock, $0.01 par value per share | | 15,620,595 |

TABLE OF CONTENTS

|

| | |

| | Page |

Part I | | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

Part II | | |

Item 1A. | | |

Item 6. | | |

| | |

| In this Quarterly Report on Form 10-Q, “we”, “our”, “us”, the “Company”, “Manning & Napier” and the “Registrant” refers to Manning & Napier, Inc. and, unless the context otherwise requires, its consolidated direct and indirect subsidiaries and predecessors. | |

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

Manning & Napier, Inc.

Consolidated Statements of Financial Condition

(U.S. dollars in thousands, except share data)

|

| | | | | | | | |

| | June 30, 2019 | | December 31, 2018 |

| | (unaudited) | | |

Assets | | | | |

Cash and cash equivalents | | $ | 57,169 |

| | $ | 59,586 |

|

Accounts receivable | | 12,231 |

| | 11,447 |

|

Investment securities | | 89,619 |

| | 91,190 |

|

Prepaid expenses and other assets | | 5,849 |

| | 5,221 |

|

Current assets, held for sale | | 237 |

| | — |

|

Total current assets | | 165,105 |

| | 167,444 |

|

Property and equipment, net | | 5,961 |

| | 5,649 |

|

Operating lease right-of-use assets | | 20,067 |

| | — |

|

Net deferred tax assets, non-current | | 20,460 |

| | 20,795 |

|

Goodwill | | 4,829 |

| | 4,829 |

|

Other long-term assets | | 4,138 |

| | 3,842 |

|

Total assets | | $ | 220,560 |

| | $ | 202,559 |

|

| | | | |

Liabilities | | | | |

Accounts payable | | $ | 1,712 |

| | $ | 1,845 |

|

Accrued expenses and other liabilities | | 21,863 |

| | 25,126 |

|

Deferred revenue | | 10,503 |

| | 9,305 |

|

Current liabilities, held for sale | | 48 |

| | — |

|

Total current liabilities | | 34,126 |

| | 36,276 |

|

Operating lease liabilities, non-current | | 19,939 |

| | — |

|

Amounts payable under tax receivable agreement, non-current | | 17,154 |

| | 17,349 |

|

Other long-term liabilities | | 611 |

| | 2,691 |

|

Total liabilities | | 71,830 |

| | 56,316 |

|

Commitments and contingencies (Note 9) | |

|

| |

|

|

Shareholders’ equity | | | | |

Class A common stock, $0.01 par value; 300,000,000 shares authorized; and 15,620,595 and 15,310,958 shares issued and outstanding at June 30, 2019 and December 31, 2018, respectively | | 156 |

| | 153 |

|

Additional paid-in capital | | 198,304 |

| | 198,604 |

|

Retained deficit | | (38,372 | ) | | (38,865 | ) |

Accumulated other comprehensive income | | (34 | ) | | (77 | ) |

Total shareholders’ equity | | 160,054 |

| | 159,815 |

|

Noncontrolling interests | | (11,324 | ) | | (13,572 | ) |

Total shareholders’ equity and noncontrolling interests | | 148,730 |

| | 146,243 |

|

Total liabilities, shareholders’ equity and noncontrolling interests | | $ | 220,560 |

| | $ | 202,559 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Operations

(U.S. dollars in thousands, except share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

Revenues | | | | | | | | |

Management Fees | | | | | | | | |

Separately managed accounts | | $ | 21,738 |

| | $ | 24,483 |

| | $ | 43,213 |

| | $ | 49,838 |

|

Mutual funds and collective investment trusts | | 7,403 |

| | 11,030 |

| | 15,631 |

| | 22,010 |

|

Distribution and shareholder servicing | | 2,566 |

| | 3,033 |

| | 5,190 |

| | 6,211 |

|

Custodial services | | 1,750 |

| | 1,895 |

| | 3,495 |

| | 3,817 |

|

Other revenue | | 837 |

| | 679 |

| | 1,562 |

| | 1,468 |

|

Total revenue | | 34,294 |

| | 41,120 |

| | 69,091 |

| | 83,344 |

|

Expenses | | | | | | | | |

Compensation and related costs | | 20,161 |

| | 21,689 |

| | 41,609 |

| | 45,462 |

|

Distribution, servicing and custody expenses | | 3,019 |

| | 4,502 |

| | 6,777 |

| | 9,283 |

|

Other operating costs | | 8,639 |

| | 8,579 |

| | 16,946 |

| | 15,033 |

|

Total operating expenses | | 31,819 |

| | 34,770 |

| | 65,332 |

| | 69,778 |

|

Operating income | | 2,475 |

| | 6,350 |

| | 3,759 |

| | 13,566 |

|

Non-operating income (loss) | | | | | | | | |

Interest expense | | (10 | ) | | (21 | ) | | (13 | ) | | (30 | ) |

Interest and dividend income | | 837 |

| | 374 |

| | 1,646 |

| | 876 |

|

Change in liability under tax receivable agreement | | — |

| | — |

| | 195 |

| | 291 |

|

Net gains (losses) on investments | | 248 |

| | (21 | ) | | 1,122 |

| | (270 | ) |

Total non-operating income | | 1,075 |

| | 332 |

| | 2,950 |

| | 867 |

|

Income before provision for income taxes | | 3,550 |

| | 6,682 |

| | 6,709 |

| | 14,433 |

|

Provision for income taxes | | 331 |

| | 492 |

| | 573 |

| | 970 |

|

Net income attributable to controlling and noncontrolling interests | | 3,219 |

| | 6,190 |

| | 6,136 |

| | 13,463 |

|

Less: net income attributable to noncontrolling interests | | 2,805 |

| | 5,424 |

| | 5,161 |

| | 11,483 |

|

Net income attributable to Manning & Napier, Inc. | | $ | 414 |

| | $ | 766 |

| | $ | 975 |

| | $ | 1,980 |

|

| | | | | | | | |

Net income per share available to Class A common stock | | | | | | | | |

Basic | | $ | 0.03 |

| | $ | 0.05 |

| | $ | 0.07 |

| | $ | 0.13 |

|

Diluted | | $ | 0.03 |

| | $ | 0.05 |

| | $ | 0.06 |

| | $ | 0.13 |

|

Weighted average shares of Class A common stock outstanding | | | | | | | | |

Basic | | 15,267,762 |

| | 14,691,928 |

| | 15,098,454 |

| | 14,503,784 |

|

Diluted | | 15,613,939 |

| | 14,709,403 |

| | 78,317,986 |

| | 14,530,398 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Comprehensive Income

(U.S. dollars in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

Net income attributable to controlling and noncontrolling interests | | $ | 3,219 |

| | $ | 6,190 |

| | $ | 6,136 |

| | $ | 13,463 |

|

Net unrealized holding gains (losses) on investment securities, net of tax | | 116 |

| | — |

| | 232 |

| | (147 | ) |

Reclassification adjustment for realized (gains) losses on investment securities included in net income | | 8 |

| | — |

| | (6 | ) | | — |

|

Comprehensive income | | $ | 3,343 |

| | $ | 6,190 |

| | $ | 6,362 |

| | $ | 13,316 |

|

Less: Comprehensive income attributable to noncontrolling interests | | 2,907 |

| | 5,424 |

| | 5,344 |

| | 11,363 |

|

Comprehensive income attributable to Manning & Napier, Inc. | | $ | 436 |

| | $ | 766 |

| | $ | 1,018 |

| | $ | 1,953 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Shareholders’ Equity

(U.S. dollars in thousands, except share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Common Stock – Class A | | Additional Paid in Capital | | Retained Deficit | | Accumulated Other Comprehensive Income (Loss) | | Non Controlling Interests | | |

| Shares | | Amount | | | | | | Total |

Three months ended June 30, 2019 | | | | | | | | | | | | | |

Balance—March 31, 2019 | 15,684,573 |

| | $ | 157 |

| | $ | 198,811 |

| | $ | (38,516 | ) | | $ | (56 | ) | | $ | (11,488 | ) | | $ | 148,908 |

|

Net income | — |

| | — |

| | — |

| | 414 |

| | — |

| | 2,805 |

| | 3,219 |

|

Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | (798 | ) | | (798 | ) |

Net changes in unrealized investment securities gains or losses | — |

| | — |

| | — |

| | — |

| | 22 |

| | 94 |

| | 116 |

|

Common stock issued under equity compensation plan, net of forfeitures | (63,978 | ) | | (1 | ) | | 1 |

| | — |

| | — |

| | — |

| | — |

|

Shares withheld to satisfy tax withholding requirements related to equity awards vested | — |

| | — |

| | (15 | ) | | — |

| | — |

| | (63 | ) | | (78 | ) |

Equity-based compensation | — |

| | — |

| | 130 |

| | — |

| | — |

| | 555 |

| | 685 |

|

Dividends declared on Class A common stock - $0.02 per share | — |

| | — |

| | — |

| | (270 | ) | | — |

| | — |

| | (270 | ) |

Impact of changes in ownership of Manning & Napier Group, LLC (Note 4) | — |

| | — |

| | (623 | ) | | — |

| | — |

| | (2,429 | ) | | (3,052 | ) |

Balance—June 30, 2019 | 15,620,595 |

| | $ | 156 |

| | $ | 198,304 |

| | $ | (38,372 | ) | | $ | (34 | ) | | $ | (11,324 | ) | | $ | 148,730 |

|

| | | | | | | | | | | | | |

Six months ended June 30, 2019 | | | | | | | | | | | | | |

Balance—December 31, 2018 | 15,310,958 |

| | $ | 153 |

| | $ | 198,604 |

| | $ | (38,865 | ) | | $ | (77 | ) | | $ | (13,572 | ) | | $ | 146,243 |

|

Net income | — |

| | — |

| | — |

| | 975 |

| | — |

| | 5,161 |

| | 6,136 |

|

Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | (2,419 | ) | | (2,419 | ) |

Net changes in unrealized investment securities gains or losses | — |

| | — |

| | — |

| | — |

| | 43 |

| | 189 |

| | 232 |

|

Common stock issued under equity compensation plan, net of forfeitures | 309,637 |

| | 3 |

| | (3 | ) | | — |

| | — |

| | — |

| | — |

|

Shares withheld to satisfy tax withholding requirements related to equity awards vested | — |

| | — |

| | (15 | ) | | — |

| | — |

| | (63 | ) | | (78 | ) |

Equity-based compensation | — |

| | — |

| | 402 |

| | — |

| | — |

| | 1,748 |

| | 2,150 |

|

Dividends declared on Class A common stock - $0.04 per share | — |

| | — |

| | — |

| | (558 | ) | | — |

| | — |

| | (558 | ) |

Cumulative effect of change in accounting principle, net of taxes (Note 8) | — |

| | — |

| | — |

| | 76 |

| | — |

| | — |

| | 76 |

|

Impact of changes in ownership of Manning & Napier Group, LLC (Note 4) | — |

| | — |

| | (684 | ) | | — |

| | — |

| | (2,368 | ) | | (3,052 | ) |

Balance—June 30, 2019 | 15,620,595 |

| | $ | 156 |

| | $ | 198,304 |

| | $ | (38,372 | ) | | $ | (34 | ) | | $ | (11,324 | ) | | $ | 148,730 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Common Stock – Class A | | Additional Paid in Capital | | Retained Deficit | | Accumulated Other Comprehensive Income (Loss) | | Non Controlling Interests | | |

| Shares | | Amount | | | | | | Total |

Three months ended June 30, 2018 | | | | | | | | | | | | | |

Balance—March 31, 2018 | 15,263,565 |

| | $ | 153 |

| | $ | 198,407 |

| | $ | (38,165 | ) | | $ | (113 | ) | | $ | (20,200 | ) | | $ | 140,082 |

|

Net income | — |

| | — |

| | — |

| | 766 |

| | — |

| | 5,424 |

| | 6,190 |

|

Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | (3,273 | ) | | (3,273 | ) |

Common stock issued under equity compensation plan, net of forfeitures | 69,476 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Equity-based compensation | — |

| | — |

| | 89 |

| | — |

| | — |

| | 397 |

| | 486 |

|

Dividends declared on Class A common stock - $0.08 per share | — |

| | — |

| | — |

| | (1,227 | ) | | — |

| | — |

| | (1,227 | ) |

Cumulative effect of change in accounting principle, net of taxes | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Impact of changes in ownership of Manning & Napier Group, LLC | — |

| | — |

| | (8 | ) | | — |

| | — |

| | 8 |

| | — |

|

Balance—June 30, 2018 | 15,333,041 |

| | $ | 153 |

| | $ | 198,488 |

| | $ | (38,626 | ) | | $ | (113 | ) | | $ | (17,644 | ) | | $ | 142,258 |

|

| | | | | | | | | | | | | |

Six months ended June 30, 2018 | | | | | | | | | | | | | |

Balance—December 31, 2017 | 15,039,347 |

| | $ | 150 |

| | $ | 198,641 |

| | $ | (38,424 | ) | | $ | (86 | ) | | $ | (21,921 | ) | | $ | 138,360 |

|

Net income | — |

| | — |

| | — |

| | 1,980 |

| | — |

| | 11,483 |

| | 13,463 |

|

Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | (8,181 | ) | | (8,181 | ) |

Net changes in unrealized investment securities gains or losses | — |

| | — |

| | — |

| | — |

| | (27 | ) | | (120 | ) | | (147 | ) |

Common stock issued under equity compensation plan, net of forfeitures | 293,694 |

| | 3 |

| | (3 | ) | | — |

| | — |

| | — |

| | — |

|

Equity-based compensation | — |

| | — |

| | 297 |

| | — |

| | — |

| | 1,342 |

| | 1,639 |

|

Dividends declared on Class A common stock - $0.16 per share | — |

| | — |

| | — |

| | (2,448 | ) | | — |

| | — |

| | (2,448 | ) |

Cumulative effect of change in accounting principle, net of taxes | — |

| | — |

| | — |

| | 266 |

| | — |

| | 1,224 |

| | 1,490 |

|

Impact of changes in ownership of Manning & Napier Group, LLC | — |

| | — |

| | (447 | ) | | — |

| | — |

| | (1,471 | ) | | (1,918 | ) |

Balance—June 30, 2018 | 15,333,041 |

| | $ | 153 |

| | $ | 198,488 |

| | $ | (38,626 | ) | | $ | (113 | ) | | $ | (17,644 | ) | | $ | 142,258 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Cash Flows

(U.S. dollars in thousands)

(Unaudited)

|

| | | | | | | | |

| | Six months ended June 30, |

| | 2019 | | 2018 |

Cash flows from operating activities: | | | | |

Net income attributable to controlling and noncontrolling interests | | $ | 6,136 |

| | $ | 13,463 |

|

Adjustment to reconcile net income to net cash provided by operating activities: | | | | |

Equity-based compensation | | 2,150 |

| | 1,639 |

|

Depreciation and amortization | | 796 |

| | 957 |

|

Change in amounts payable under tax receivable agreement | | (195 | ) | | (291 | ) |

Gain on sale of intangible assets | | (116 | ) |

| (2,509 | ) |

Net (gains) losses on investment securities | | (1,122 | ) | | 270 |

|

Deferred income taxes | | 410 |

| | 721 |

|

(Increase) decrease in operating assets and increase (decrease) in operating liabilities: | | | | |

Accounts receivable | | (788 | ) | | 2,474 |

|

Prepaid expenses and other assets | | (645 | ) | | 197 |

|

Long-term assets | | 1,211 |

|

| (617 | ) |

Accounts payable | | (121 | ) | | 755 |

|

Accrued expenses and other liabilities | | (5,535 | ) | | (6,714 | ) |

Deferred revenue | | 1,198 |

| | (327 | ) |

Long-term liabilities | | (1,327 | ) | | (348 | ) |

Net cash provided by operating activities | | 2,052 |

| | 9,670 |

|

Cash flows from investing activities: | | | | |

Purchase of property and equipment | | (1,084 | ) | | (1,265 | ) |

Sale of investments | | 4,734 |

| | 1,615 |

|

Purchase of investments | | (55,863 | ) | | (25,967 | ) |

Sale of intangible assets | | 116 |

|

| 2,509 |

|

Proceeds from maturity of investments | | 54,054 |

| | 24,963 |

|

Net cash provided by investing activities | | 1,957 |

| | 1,855 |

|

Cash flows from financing activities: | | | | |

Distributions to noncontrolling interests | | (2,419 | ) | | (8,181 | ) |

Dividends paid on Class A common stock | | (620 | ) | | (2,424 | ) |

Payment of shares withheld to satisfy withholding requirements | | (78 | ) | | — |

|

Payment of capital lease obligations | | (61 | ) | | (66 | ) |

Purchase of Class A units of Manning & Napier Group, LLC | | (3,052 | ) | | (1,918 | ) |

Net cash used in financing activities | | (6,230 | ) | | (12,589 | ) |

Net decrease in cash and cash equivalents, including cash classified within current assets held for sale (Note 2) | | (2,221 | ) | | (1,064 | ) |

Less: increase in cash classified within current assets held for sale | | 196 |

| | — |

|

Net decrease in cash and cash equivalents | | (2,417 | ) | | (1,064 | ) |

Cash and cash equivalents: | | | | |

Beginning of period | | 59,586 |

| | 78,262 |

|

End of period | | $ | 57,169 |

| | $ | 77,198 |

|

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements

Note 1—Organization and Nature of the Business

Manning & Napier, Inc. ("Manning & Napier" or the "Company") provides a broad range of investment solutions through separately managed accounts, mutual funds, and collective investment trust funds, as well as a variety of consultative services that complement its investment process. Founded in 1970, the Company offers equity, fixed income and alternative strategies, as well as a range of blended asset portfolios, including life cycle funds. Headquartered in Fairport, New York, the Company serves a diversified client base of high-net-worth individuals and institutions, including 401(k) plans, pension plans, Taft-Hartley plans, platforms, endowments and foundations.

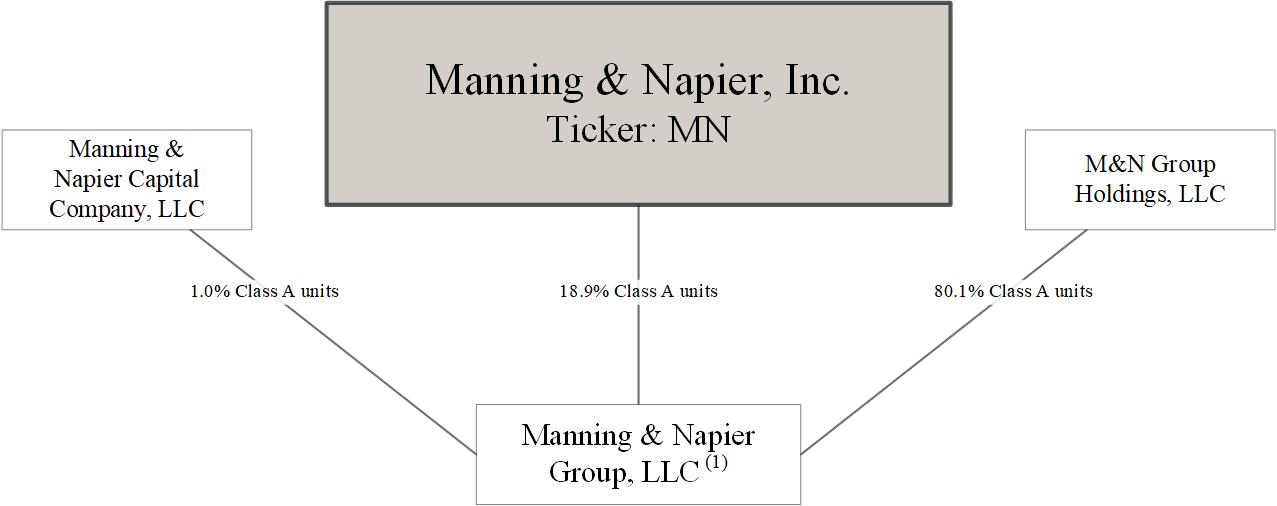

The Company was incorporated in 2011 as a Delaware corporation, and is the sole managing member of Manning & Napier Group, LLC and its subsidiaries (“Manning & Napier Group”), a holding company for the investment management businesses conducted by its operating subsidiaries. The diagram below depicts the Company's organizational structure as of June 30, 2019.

| |

(1) | The consolidated operating subsidiaries of Manning & Napier Group include Manning & Napier Advisors, LLC ("MNA"), Perspective Partners LLC, Manning & Napier Information Services, LLC, Manning & Napier Investor Services, Inc., Exeter Trust Company and Rainier Investment Management, LLC ("Rainier"). |

Note 2—Summary of Significant Accounting Policies

Critical Accounting Policies

The Company's critical accounting policies and estimates are disclosed in its Annual Report on Form 10-K for the year ended December 31, 2018. The Company believes that the disclosures herein are adequate so that the information presented is not misleading; however, these financial statements should be read in conjunction with the financial statements and the notes thereto in the Company's Annual Report on Form 10-K for the year ended December 31, 2018. The financial data for the interim periods may not necessarily be indicative of results for future interim periods or for the full year.

Changes to the Company's accounting policies as a result of adoption ASU 2016-02, Leases (Topic 842) are discussed under "Leases" below and in Note 8.

Basis of Presentation

The accompanying unaudited consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and related rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) for interim financial reporting and include all adjustments, consisting only of normal recurring adjustments which are, in the opinion of management, necessary for a fair statement of the results for the interim period.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates or assumptions that affect the reported amounts and disclosures in the consolidated financial statements. Actual results could differ from these estimates or assumptions.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Assets and Liabilities Held for Sale

On June 28, 2019, the Company entered into an agreement (the "Agreement") to sell all of the equity interests in its wholly-owned subsidiary, Perspective Partners, LLC ("PPI") to Manning Partners, LLC (Note 13). Manning Partners, LLC is wholly owned by the Chairman of the Company's Board of Directors. Closing of the sale pursuant to the Agreement is subject to customary closing conditions. This transaction does not meet the U.S. GAAP criteria to be reported as a discontinued operation, as it does not represent a strategic shift. The assets and liabilities of PPI are classified as held for sale as of June 30, 2019 and have been reported as such on the consolidated statements of financial condition. Assets held for sale as of June 30, 2019 consist of approximately $0.2 million of cash.

Principles of Consolidation

The Company consolidates all majority-owned subsidiaries. In addition, as of June 30, 2019, Manning & Napier holds an economic interest of approximately 18.9% in Manning & Napier Group but, as managing member, controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statements of financial condition with respect to the remaining economic interest in Manning & Napier Group held by Manning & Napier Group Holdings, LLC (“M&N Group Holdings”) and Manning & Napier Capital Company, LLC (“MNCC”).

All material intercompany transactions have been eliminated in consolidation.

In accordance with Accounting Standards Update ("ASU") 2015-02, Consolidation (Topic 810) – Amendments to the Consolidation Analysis, the determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design, a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance, and whether a company is obligated to absorb losses or receive benefits that could potentially be significant to the entity. The standard also requires ongoing assessments of whether a company is the primary beneficiary of a variable interest entity (“VIE”). When utilizing the voting interest entity ("VOE") model, controlling financial interest is generally defined as majority ownership of voting interests.

The Company provides seed capital to its investment teams to develop new strategies and services for its clients. The original seed investment may be held in a separately managed account, comprised solely of the Company's investments or within a mutual fund, where the Company's investments may represent all or only a portion of the total equity investment in the mutual fund. Pursuant to U.S. GAAP, the Company evaluates its investments in mutual funds on a regular basis and consolidates such mutual funds for which it holds a controlling financial interest. When no longer deemed to hold a controlling financial interest, the Company would deconsolidate the fund and classify the remaining investment as either an equity method investment or as trading securities, as applicable. As of June 30, 2019 and December 31, 2018, the Company did not have investments classified as an equity method investment.

The Company serves as the investment adviser for Manning & Napier Fund, Inc. series of mutual funds (the “Fund”), Exeter Trust Company Collective Investment Trusts (“CIT”) and Rainier Multiple Investment Trust. The Fund, CIT and Rainier Multiple Investment Trust are legal entities, the business and affairs of which are managed by their respective boards of directors. As a result, each of these entities is a VOE. The Company holds, in limited cases, direct investments in a mutual fund (which are made on the same terms as are available to other investors) and consolidates each of these entities where it has a controlling financial interest or a majority voting interest. The Company's investments in the Fund amounted to approximately $4.0 million as of June 30, 2019 and $3.6 million as of December 31, 2018. As of June 30, 2019 and December 31, 2018, the Company did not have a controlling financial interest in any mutual fund.

Revenue

Investment Management: Investment management fees are computed as a percentage of assets under management ("AUM"). The Company's performance obligation is a series of services that form part of a single performance obligation satisfied over time.

Separately managed accounts are paid in advance, typically for a semi-annual or quarterly period, or in arrears, typically for a monthly or quarterly period. When investment management fees are paid in advance, the Company defers the revenue as a contract liability and recognizes it over the applicable period. When investment management fees are paid in arrears, the Company estimates revenue and records a contract asset (accrued accounts receivable) based on AUM as of the most recent month end date.

Mutual funds and collective investment trust investment management revenue is calculated and earned daily based on AUM. Revenue is presented net of cash rebates and fees waived pursuant to contractual expense limitations of the funds. The Company also has agreements with third parties who provide recordkeeping and administrative services for employee benefit plans participating in the collective investment trusts. The Company is acting as an agent on behalf of the employee benefit plan sponsors, therefore, investment management revenue is recorded net of fees paid to third party service providers.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Distribution and shareholder servicing: The Company receives distribution and servicing fees for providing services to its affiliated mutual funds. Revenue is computed and earned daily based on a percentage of AUM. The performance obligation is a series of services that form part of a single performance obligation satisfied over time. The Company has agreements with third parties who provide distribution and administrative services for its mutual funds. The agreements are evaluated to determine whether revenue should be reported gross or net of payments to third-party service providers. The Company controls the services provided and acts as a principal in the relationship. Therefore, distribution and shareholder servicing revenue is recorded gross of fees paid to third parties.

Custodial services: Custodial service fees are calculated as a percentage of the client’s market value with additional fees charged for certain transactions. For the safeguarding and administrative services that are subject to a percentage of market value fee, the Company's performance obligation is a series of services that form part of a single performance obligation satisfied over time. Revenue for transactions assigned a stand-alone selling price is recognized in the period which the transaction is executed. Custodial service fees are billed monthly in arrears. The Company has agreements with third parties who provide safeguarding, recordkeeping and administrative services for their clients. The Company controls the services provided and acts as a principal in the relationship. Therefore, custodial service revenue is recorded gross of fees paid to third parties.

Costs to Obtain a Contract

Incremental first year commissions directly associated with new separate account and collective investment trust contracts are capitalized and amortized on a straight-line basis over the estimated customer contract period of 7 years for separate accounts and 3 years for collective investment trust contracts. Refer to Note 3 for further discussion.

Cash and Cash Equivalents

The Company generally considers all highly liquid investments with original maturities of three months or less to be cash equivalents. Cash and cash equivalents are primarily held in operating accounts at major financial institutions and also in money market securities. Cash equivalents are stated at cost, which approximates market value due to the short-term maturity of these investments. The fair value of cash equivalents has been classified as Level 1 in accordance with the fair value hierarchy.

Investment Securities

Investment securities are classified as either trading, equity method investments or available-for-sale and are carried at fair value. Fair value is determined based on quoted market prices in active markets for identical or similar instruments.

Investment securities classified as trading consist of equity securities, fixed income securities, and investments in mutual funds for which the Company provides advisory services. Realized and unrealized gains and losses on trading securities are recorded in net gains (losses) on investments in the consolidated statements of operations. At June 30, 2019, trading securities consist of investments held by the Company to provide initial cash seeding for product development purposes and investments to hedge economic exposure to market movements on its deferred compensation plan.

Investments classified as equity method investments represent seed investments in which the Company owns between 20-50% of the outstanding voting interests in the affiliated fund or when it is determined that the Company is able to exercise significant influence but not control over the investments. If the seed investment results in significant influence, but not control, the investment will be accounted for as an equity method investment. When using the equity method, the Company recognizes its share of the investee's net income or loss for the period which is recorded in net gains (losses) on investments in the consolidated statements of operations.

Investment securities classified as available-for-sale consist of U.S. Treasury notes and other short-term investments. Unrealized gains and losses on available-for-sale securities are excluded from earnings and are reported, net of deferred income tax, as a separate component of accumulated other comprehensive income in shareholders’ equity until realized. The Company periodically reviews each individual security position that has an unrealized loss, or impairment, to determine if that impairment is other-than-temporary. If impairment is determined to be other-than-temporary, the carrying value of the security will be written down to fair value and the loss will be recognized in earnings. Realized gains and losses on sales of available-for-sale securities are computed on a specific identification basis and are recorded in net gains (losses) on investments in the consolidated statements of operations.

Property and Equipment

Property and equipment is presented net of accumulated depreciation of approximately $10.9 million and $11.3 million as of June 30, 2019 and December 31, 2018, respectively.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Goodwill and Intangible Assets

Goodwill represents the excess cost over the fair value of the identifiable net assets of acquired companies. Identifiable intangible assets generally represent the cost of client relationships and investment management agreements acquired as well as trademarks. Goodwill and indefinite-lived assets are tested for impairment annually or more frequently if events or circumstances indicate that the carrying value may not be recoverable. Intangible assets subject to amortization are tested for impairment whenever events or circumstances indicate that the carrying value may not be recoverable. Goodwill and intangible assets require significant management estimate and judgment, including the valuation and expected life determination in connection with the initial purchase price allocation and the ongoing evaluation for impairment.

Leases

The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use ("ROU") assets, accrued expenses and other liabilities and operating lease liabilities, non-current on its consolidated statements of financial condition. Finance leases are included in other long-term assets, accrued expenses and other liabilities, and other long-term liabilities on its consolidated statements of financial condition.

ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. Operating lease ROU assets and lease liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As the Company's leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The incremental borrowing rate, for each identified lease, is the rate of interest that the Company would have to pay to borrow on a collateralized basis over a similar term. The operating lease ROU asset is reduced for any lease incentives. The Company's lease terms may include options to extend or terminate the lease when it is reasonably certain that it will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

The Company has lease agreements with lease and non-lease components, which are combined for all classes of underlying assets.

Operating Segments

The Company operates in one segment, the investment management industry.

Recently Adopted Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board ("FASB") issued ASU 2016-02, Leases (Topic 842), which is intended to increase transparency and comparability among organizations by recognizing all lease transactions (with terms in excess of 12 months) on the balance sheet as a lease liability and a right-of-use asset (as defined). In July 2018, the FASB issued ASU 2018-11, Leases - Targeted Improvements, which provides an optional transition method related to implementing the new lease standard. The Company adopted the new standard on its effective date of January 1, 2019. Refer to Note 8 for further discussion regarding the impact of adoption.

In February 2018, the FASB issued ASU No. 2018-02, Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. The ASU requires a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the newly enacted federal corporate income tax rate as a result of the Tax Cuts and Jobs Act. The amount of the reclassification is the difference between the historical corporate income tax rate and the newly enacted 21% corporate income tax rate. The ASU will be effective for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company's adoption of ASU 2018-02 on January 1, 2019 did not have a material impact on its consolidated financial statements.

Recent Accounting Pronouncements Not Yet Adopted

In January 2017, the FASB issued ASU 2017-04, Intangibles - Goodwill and Other (Topic 350), Simplifying the Test for Goodwill Impairment, which simplifies the accounting for goodwill impairments by eliminating step two from the goodwill impairment test. The ASU requires goodwill impairments to be measured on the basis of the fair value of the reporting unit relative to the reporting unit's carrying amount rather than on the basis of the implied amount of goodwill relative to the goodwill balance of the reporting unit. The ASU is effective for annual and interim impairment tests for periods beginning after December 15, 2019. Early adoption is allowed for annual and interim impairment tests occurring after January 1, 2017. The Company is evaluating the effect of adopting this new accounting standard.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 3—Revenue

Disaggregated Revenue

The following tables represent the Company’s separately managed account and mutual fund and collective investment trust investment management revenue by investment portfolio during the three and six months ended June 30, 2019 and June 30, 2018:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, 2019 | | Three months ended June 30, 2018 |

| | Separately managed accounts | | Mutual funds and collective investment trusts | | Total | | Separately managed accounts | | Mutual funds and collective investment trusts | | Total |

| | (in thousands) |

Blended Asset | | $ | 16,370 |

| | $ | 4,423 |

| | $ | 20,793 |

| | $ | 18,010 |

| | $ | 6,699 |

| | $ | 24,709 |

|

Equity | | 4,767 |

| | 2,946 |

| | 7,713 |

| | 5,831 |

| | 4,222 |

| | 10,053 |

|

Fixed Income | | 601 |

| | 34 |

| | 635 |

| | 642 |

| | 109 |

| | 751 |

|

Total | | $ | 21,738 |

| | $ | 7,403 |

| | $ | 29,141 |

| | $ | 24,483 |

| | $ | 11,030 |

| | $ | 35,513 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six months ended June 30, 2019 | | Six months ended June 30, 2018 |

| | Separately managed accounts | | Mutual funds and collective investment trusts | | Total | | Separately managed accounts | | Mutual funds and collective investment trusts | | Total |

| | (in thousands) |

Blended Asset | | $ | 32,641 |

| | $ | 9,478 |

| | $ | 42,119 |

| | $ | 36,319 |

| | $ | 13,151 |

| | $ | 49,470 |

|

Equity | | 9,379 |

| | 6,052 |

| | 15,431 |

| | 12,187 |

| | 8,710 |

| | 20,897 |

|

Fixed Income | | 1,193 |

| | 101 |

| | 1,294 |

| | 1,332 |

| | 149 |

| | 1,481 |

|

Total | | $ | 43,213 |

| | $ | 15,631 |

| | $ | 58,844 |

| | $ | 49,838 |

| | $ | 22,010 |

| | $ | 71,848 |

|

Accounts Receivable

Accounts receivable as of June 30, 2019 and December 31, 2018 consisted of the following:

|

| | | | | | | | |

| | June 30, 2019 | | December 31, 2018 |

| | (in thousands) |

Accounts receivable - third parties | | $ | 7,799 |

| | $ | 5,342 |

|

Accounts receivable - affiliated mutual funds and collective investment trusts | | 4,432 |

| | 6,105 |

|

Accounts receivable - current assets held for sale (Note 2) | | 4 |

| | — |

|

Total accounts receivable | | $ | 12,235 |

| | $ | 11,447 |

|

Accounts receivable represents the Company's unconditional rights to consideration arising from its performance under separately managed account, mutual fund and collective investment trust, distribution and shareholder servicing, and custodial service contracts. Accounts receivable balances do not include an allowance for doubtful accounts nor has any significant bad debt expense attributable to accounts receivable been recorded during the three or six months ended June 30, 2019 or 2018.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Advisory and Distribution Agreements

The Company earns investment advisory fees, distribution fees and administrative service fees under agreements with affiliated mutual funds and collective investment trusts. Fees earned for advisory and distribution services provided were approximately $10.2 million and $21.3 million for the three and six months ended June 30, 2019, respectively, and approximately $14.3 million and $28.8 million for the three and six months ended June 30, 2018, respectively, which represents greater than 25% of revenue in each period. The following provides amounts due from affiliated mutual funds and collective investment trusts reported within accounts receivable in the consolidated statements of financial condition as of June 30, 2019 and December 31, 2018:

|

| | | | | | | | |

| | June 30, 2019 | | December 31, 2018 |

| | (in thousands) |

Affiliated mutual funds | | $ | 3,056 |

| | $ | 4,802 |

|

Affiliated collective investment trusts | | 1,376 |

| | 1,303 |

|

Accounts receivable - affiliated mutual funds and collective investment trusts | | $ | 4,432 |

| | $ | 6,105 |

|

Contract assets and liabilities

Accrued accounts receivable: Accrued accounts receivable represents the Company's contract asset for revenue that has been recognized in advance of billing separately managed account contracts. Consideration for the period billed in arrears is dependent on the client’s AUM on a future billing date and therefore conditional as of the reporting period end. During the six months ended June 30, 2019, revenue was increased by less than $0.1 million for changes in transaction price. Accrued accounts receivable of approximately $0.3 million and $0.2 million is reported within prepaid expenses and other assets in the consolidated statements of financial condition as of June 30, 2019 and December 31, 2018, respectively.

Deferred revenue: Deferred revenue is recorded when consideration is received or unconditionally due in advance of providing services to the Company's customer. Revenue recognized during the six months ended June 30, 2019 that was included in deferred revenue at the beginning of the period was approximately $8.8 million.

Costs to obtain a contract: Incremental first year commissions directly associated with new separate account and collective investment trust contracts are capitalized and amortized straight-line over an estimated customer contract period of 7 years for separate accounts and 3 years for collective investment trust contracts. The total net asset as of both June 30, 2019 and December 31, 2018 was approximately $1.2 million. Amortization expense included in compensation and related costs totaled approximately $0.1 million and $0.2 million for the three and six months ended June 30, 2019 and 2018, respectively. An impairment loss of less than $0.1 million was recognized during the three and six months ended June 30, 2019 and 2018, respectively, related to contract acquisition costs for client contracts that canceled during the respective periods.

Note 4—Noncontrolling Interests

Manning & Napier holds an economic interest of approximately 18.9% in Manning & Napier Group, but as managing member controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statements of financial condition with respect to the remaining approximately 81.1% economic interest in Manning & Napier Group held by M&N Group Holdings and MNCC. Net income attributable to noncontrolling interests on the statements of operations represents the portion of earnings attributable to the economic interest in Manning & Napier Group held by the noncontrolling interests.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following provides a reconciliation from “Income before provision for income taxes” to “Net income attributable to Manning & Napier, Inc.”:

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| | (in thousands) |

Income before provision for income taxes | | $ | 3,550 |

| | $ | 6,682 |

| | $ | 6,709 |

| | $ | 14,433 |

|

Less: income (loss) before provision for income taxes of Manning & Napier, Inc. (1) | | (10 | ) | | (12 | ) | | 181 |

| | 259 |

|

Income before provision for income taxes, as adjusted | | 3,560 |

| | 6,694 |

| | 6,528 |

| | 14,174 |

|

Controlling interest percentage (2) | | 18.8 | % | | 18.2 | % | | 18.7 | % | | 18.2 | % |

Net income attributable to controlling interest | | 669 |

| | 1,221 |

| | 1,221 |

| | 2,573 |

|

Plus: income (loss) before provision for income taxes of Manning & Napier, Inc. (1) | | (10 | ) | | (12 | ) | | 181 |

| | 259 |

|

Income before income taxes attributable to Manning & Napier, Inc. | | 659 |

| | 1,209 |

| | 1,402 |

| | 2,832 |

|

Less: provision for income taxes of Manning & Napier, Inc.(3) | | 245 |

| | 443 |

| | 427 |

| | 852 |

|

Net income attributable to Manning & Napier, Inc. | | $ | 414 |

| | $ | 766 |

| | $ | 975 |

| | $ | 1,980 |

|

| |

(1) | Manning & Napier, Inc. incurs certain income or expenses that are only attributable to it and are therefore excluded from the net income attributable to noncontrolling interests. |

| |

(2) | Income before provision for income taxes is allocated to the controlling interest based on the percentage of units of Manning & Napier Group held by Manning & Napier, Inc. The amount represents the Company's weighted ownership of Manning & Napier Group for the respective periods. |

| |

(3) | The consolidated provision for income taxes is equal to the sum of (i) the provision for income taxes for entities other than Manning & Napier, Inc. and (ii) the provision for income taxes of Manning & Napier, Inc. which includes all U.S. federal and state income taxes. The consolidated provision for income taxes was $0.3 million and $0.6 million for the three and six months ended June 30, 2019, respectively, and $0.5 million and $1.0 million for the three and six months ended June 30, 2018, respectively. |

As of June 30, 2019, a total of 62,034,200 units of Manning & Napier Group were held by the noncontrolling interests. Pursuant to the terms of the exchange agreement entered into at the time of the Company's initial public offering ("Exchange Agreement"), such units may be exchangeable for shares of the Company's Class A common stock. For any units exchanged, the Company will (i) pay an amount of cash equal to the number of units exchanged multiplied by the value of one share of the Company's Class A common stock less a market discount and expected expenses, or, at the Company's election, (ii) issue shares of the Company's Class A common stock on a one-for-one basis, subject to customary adjustments. As the Company receives units of Manning & Napier Group that are exchanged, the Company's ownership of Manning & Napier Group will increase.

During the six months ended June 30, 2019, M&N Group Holdings and MNCC exchanged a total of 1,315,521 Class A units of Manning & Napier Group for approximately $3.1 million in cash. Subsequent to the exchange the Class A units were retired, resulting in an increase in Manning & Napier's ownership in Manning & Napier Group. In addition, during the six months ended June 30, 2019, Class A common stock was issued under the Company's 2011 Equity Compensation Plan (the "Equity Plan") for which Manning & Napier, Inc. acquired an equivalent number of Class A units of Manning & Napier Group, net of forfeitures of unvested restricted stock awards.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following is the impact to the Company's equity ownership interest in Manning & Napier Group for the six months ended June 30, 2019:

|

| | | | | | | | | | |

| Manning & Napier Group Class A Units Held | | |

|

Manning & Napier | |

Noncontrolling Interests | | Total | | Manning & Napier Ownership % |

As of December 31, 2018 | 14,126,736 |

| | 63,349,721 |

| | 77,476,457 |

| | 18.2% |

Class A Units issued | 351,532 |

| | — |

| | 351,532 |

| | 0.4% |

Class A Units exchanged | — |

| | (1,315,521 | ) | | (1,315,521 | ) | | 0.3% |

As of June 30, 2019 | 14,478,268 |

| | 62,034,200 |

| | 76,512,468 |

| | 18.9% |

Since the Company continues to have a controlling interest in Manning & Napier Group, the aforementioned changes in ownership of Manning & Napier Group were accounted for as equity transactions under ASC 810, Consolidation. Additional paid-in capital and noncontrolling interests in the Consolidated Statements of Financial Position are adjusted to reallocate the Company's historical equity to reflect the change in ownership of Manning & Napier Group.

At June 30, 2019 and December 31, 2018, the Company had recorded a liability of $17.8 million and $18.0 million, respectively, representing the estimated payments due to the selling unit holders under the tax receivable agreement ("TRA") entered into between Manning & Napier and the other holders of Class A Units of Manning & Napier Group. Of these amounts, $0.7 million were included in accrued expenses and other liabilities at both June 30, 2019 and December 31, 2018. The Company made no payments pursuant to the TRA during the six months ended June 30, 2019 and 2018.

Obligations pursuant to the TRA are obligations of Manning & Napier. They do not impact the noncontrolling interests. These obligations are not income tax obligations. Furthermore, the TRA has no impact on the allocation of the provision for income taxes to the Company’s net income.

Note 5—Investment Securities

The following represents the Company’s investment securities holdings as of June 30, 2019 and December 31, 2018: |

| | | | | | | | | | | | | | | | |

| | June 30, 2019 |

| | Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| | (in thousands) |

Available-for-sale securities | | | | | | | | |

U.S. Treasury notes | | $ | 15,459 |

| | $ | 175 |

| | $ | — |

| | $ | 15,634 |

|

Fixed income securities | | 22,173 |

| | 18 |

| | — |

| | 22,191 |

|

Short-term investments | | 42,386 |

| | — |

| | — |

| | 42,386 |

|

| | | | | | | | 80,211 |

|

Trading securities | | | | | | | | |

Equity securities | | | | | | | | 5,442 |

|

Mutual funds | | | | | | | | 3,966 |

|

| | | | | | | | 9,408 |

|

Total investment securities | | | | | | | | $ | 89,619 |

|

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

|

| | | | | | | | | | | | | | | | |

| | December 31, 2018 |

| | Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| | (in thousands) |

Available-for-sale securities | | | | | | | | |

U.S. Treasury notes | | $ | 21,613 |

| | $ | 36 |

| | $ | — |

| | $ | 21,649 |

|

Fixed income securities | | 15,488 |

| | — |

| | (75 | ) | | 15,413 |

|

Short-term investments | | 45,879 |

| | — |

| | — |

| | 45,879 |

|

| | | | | | | | 82,941 |

|

Trading securities | | | | | | | | |

Equity securities | | | | | | | | 4,683 |

|

Mutual funds | | | | | | | | 3,566 |

|

| | | | | | | | 8,249 |

|

Total investment securities | | | | | | | | $ | 91,190 |

|

Investment securities are classified as either trading or available-for-sale and are carried at fair value. Fair value is determined based on quoted market prices in active markets for identical or similar instruments.

Investment securities classified as trading consist of equity securities, fixed income securities and investments in mutual funds for which the Company provides advisory services. At June 30, 2019 and December 31, 2018, trading securities consist of investments held by the Company to provide initial cash seeding for product development purposes and investments in mutual funds to hedge economic exposure to market movements on its deferred compensation plan. The Company recognized approximately $1.1 million of net unrealized gains and $0.3 million of net unrealized losses related to investments classified as trading during the six months ended June 30, 2019 and 2018, respectively.

Investment securities classified as available-for-sale consist of U.S. Treasury notes, corporate bonds and other short-term investments to optimize cash management opportunities and for compliance with certain regulatory requirements. As of June 30, 2019 and December 31, 2018, approximately $0.6 million of these securities was considered restricted. The Company periodically reviews each individual security position that has an unrealized loss, or impairment, to determine if that impairment is other-than-temporary. No other-than-temporary impairment charges have been recognized by the Company during the six months ended June 30, 2019 and 2018.

Note 6—Fair Value Measurements

Fair value is defined as the price that the Company would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. A fair value hierarchy is provided that gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The following three-tier fair value hierarchy prioritizes the inputs used in measuring fair value:

•Level 1—observable inputs such as quoted prices in active markets for identical securities;

| |

• | Level 2—other significant observable inputs (including but not limited to quoted prices for similar securities, interest rates, prepayment rates, credit risk, etc.); and |

| |

• | Level 3—significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments). |

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following provides the hierarchy of inputs used to derive the fair value of the Company’s assets as of June 30, 2019 and December 31, 2018:

|

| | | | | | | | | | | | | | | | |

| | June 30, 2019 |

| | Level 1 | | Level 2 | | Level 3 | | Totals |

| | (in thousands) |

Equity securities | | $ | 5,442 |

| | $ | — |

| | $ | — |

| | $ | 5,442 |

|

Fixed income securities | | — |

| | 22,191 |

| | — |

| | 22,191 |

|

Mutual funds | | 3,966 |

| | — |

| | — |

| | 3,966 |

|

U.S. Treasury notes | | — |

| | 15,634 |

| | — |

| | 15,634 |

|

Short-term investments | | 32,950 |

| | 9,436 |

| | — |

| | 42,386 |

|

Total assets at fair value | | $ | 42,358 |

| | $ | 47,261 |

| | $ | — |

| | $ | 89,619 |

|

| | | | | | | | |

Contingent consideration liability | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Total liabilities at fair value | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

|

| | | | | | | | | | | | | | | | |

| | December 31, 2018 |

| | Level 1 | | Level 2 | | Level 3 | | Totals |

| | (in thousands) |

Equity securities | | $ | 4,683 |

| | $ | — |

| | $ | — |

| | $ | 4,683 |

|

Fixed income securities | | — |

| | 15,413 |

| | — |

| | 15,413 |

|

Mutual funds | | 3,566 |

| | — |

| | — |

| | 3,566 |

|

U.S. Treasury notes | | — |

| | 21,649 |

| | — |

| | 21,649 |

|

Short-term investments | | 43,914 |

| | 1,965 |

| | — |

| | 45,879 |

|

Total assets at fair value | | $ | 52,163 |

| | $ | 39,027 |

| | $ | — |

| | $ | 91,190 |

|

| | | | | | | | |

Contingent consideration liability | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Total liabilities at fair value | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Short-term investments consists of certificate of deposits that are stated at cost, which approximate fair value due to the short maturity of the investments and U.S. Treasury bills.

Valuations of investments in fixed income securities, U.S. Treasury notes and U.S. Treasury bills can generally be obtained through independent pricing services. For most bond types, the pricing service utilizes matrix pricing, which considers one or more of the following factors: yield or price of bonds of comparable quality, coupon, maturity, current cash flows, type and current day trade information, as well as dealer supplied prices. These valuations are categorized as Level 2 in the hierarchy.

Contingent consideration was a component of the purchase price of Rainier in 2016 of additional cash payments of up to $32.5 million over the period ending December 31, 2019, contingent upon Rainier's achievement of certain financial targets. The fair value of the contingent consideration is calculated on a quarterly basis by forecasting Rainier’s adjusted earnings before interest, taxes and amortization over the contingency period. There were no changes in contingent consideration liability measured at fair value using significant unobservable inputs (Level 3) for the six months ended June 30, 2019.

The Company’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between valuation levels during the six months ended June 30, 2019.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 7—Accrued Expenses and Other Liabilities

Accrued expenses and other liabilities as of June 30, 2019 and December 31, 2018 consisted of the following:

|

| | | | | | | | |

| | June 30, 2019 | | December 31, 2018 |

| | (in thousands) |

Accrued bonus and sales commissions | | $ | 12,518 |

| | $ | 16,121 |

|

Accrued payroll and benefits | | 2,366 |

| | 4,087 |

|

Accrued sub-transfer agent fees | | 555 |

| | 1,451 |

|

Dividends payable | | 313 |

| | 306 |

|

Amounts payable under tax receivable agreement | | 674 |

| | 674 |

|

Short-term operating lease liabilities | | 2,791 |

| | — |

|

Other accruals and liabilities | | 2,646 |

| | 2,487 |

|

Total accrued expenses and other liabilities | | $ | 21,863 |

| | $ | 25,126 |

|

During the year ended December 31, 2018, the Company commenced a voluntary employee retirement offering (the "offering"), available to employees meeting certain age and length-of-service requirements as well as business function criteria. Employees electing to participate in the offering were subject to approval by the Company, and received enhanced separation benefits. These employees are required to render service until their agreed upon termination date (which varies from person to person) in order to receive the benefits and as such, the liability will be recognized ratably over the applicable service period.

The Company estimates the total employee severance costs under the offering to be approximately $2.6 million, of which approximately $2.2 million was recognized during the year ended December 31, 2018. During the six months ended June 30, 2019, the Company recognized approximately $0.2 million of severance costs under the offering and approximately $0.8 million as a result of involuntary workforce reductions. Employee severance costs recognized are included in compensation and related costs in the consolidated statements of operations.

The following table summarizes the changes in accrued employee severance costs recognized by the Company during the six months ended June 30, 2019, as included in accrued expenses and other liabilities in the consolidated statements of financial condition:

|

| | | | |

| | Six months ended June 30, 2019 |

| | (in thousands) |

Accrued employee severance costs as of December 31, 2018 | | $ | 1,642 |

|

Employee severance costs recognized | | 1,011 |

|

Payment of employee severance costs | | (2,068 | ) |

Accrued employee severance costs as of June 30, 2019 | | $ | 585 |

|

Note 8—Leases

Adoption of ASU 2016-02, Leases (Topic 842)

On January 1, 2019, the Company adopted Topic 842 using the optional transition method. Consequently, financial information and disclosures for the reporting periods beginning after January 1, 2019 are presented under Topic 842, while prior period amounts are not adjusted and continue to be reported in accordance with the Company's historic accounting policies under Topic 840.

Topic 842 provides a number of optional practical expedients as part of the transition from Topic 840. The Company elected the ‘package of practical expedients’, which permits it to not reassess, under Topic 842, its prior conclusions about lease identification, lease classification and initial direct costs.

Topic 842 also provides practical expedients for an entity’s ongoing accounting under Topic 842. The Company elected the short-term lease recognition exemption for all leases that qualify, and elected the practical expedient to combine lease and non-lease components as a single combined lease component for all of its leases.

On adoption, the Company recognized lease liabilities of approximately $23.2 million and right-of-use assets for approximately $20.6 million, based on the present value of the remaining minimum rental payments under Topic 840 for operating leases that existed as of the date of adoption. In addition, the Company wrote-down approximately $2.6 million of unamortized deferred lease costs and tenant incentives previously recorded as deferred rent liability in the consolidated

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

statements of financial condition as of December 31, 2018. The Company recognized an increase to opening shareholders' equity and noncontrolling interest of approximately $0.1 million, as of January 1, 2019, related to the deferred tax impacts of adopting Topic 842.

Leases

The Company has operating and finance leases for office space and certain equipment. For these leases, the office space or equipment is an explicitly identified asset within the contract. The Company has determined that it has obtained substantially all of the economic benefits from the use of the underlying asset and directs how and for what purpose the asset is used during the term of the contract.

The Company's leases have remaining lease terms ranging between approximately 1 year and 9 years. The Company's lease term on certain of its multi-year office space leases, including its headquarters, include options for the Company to extend those leases for periods ranging from an additional five to ten years. In addition, the Company has the option to reduce a portion of its square footage at certain times throughout the term of the lease for its headquarters. The Company determined it is not reasonably certain at this time it will exercise the options to extend these leases or will exercise the options to reduce its square footage; therefore, the payment amounts related to these lease term extensions and contraction options have been excluded from determining its right-of-use asset and lease liability.

Certain of the Company's operating leases for office space include variable lease payments, including non-lease components (such as utilities and operating expenses) that vary based on actual expenses and are adjusted on an annual basis. The Company concluded that these variable lease payments are in substance fixed payments and included the estimated variable payments in its determination of right-of-use assets and lease liabilities.

Changes in the lease terms, including renewal options and options to reduce its square footage, incremental borrowing rates, and/or variable lease payments, and the corresponding impact to the right-of-use assets and lease liabilities, are recognized in the period incurred.

Certain of the Company's operating leases have been subleased for which the Company will receive cash totaling approximately $3.4 million over the term of such leases. The lease terms for the three subleased operating leases end in 2019, 2021 and 2027.

The components of lease expense for the three and six months ended June 30, 2019 were as follows: |

| | | | | | | | |

| | Three months ended June 30, 2019 | | Six months ended June 30, 2019 |

| | (in thousands) |

Finance lease expense | | | | |

Amortization of right-of-use assets | | $ | 30 |

| | $ | 59 |

|

Interest on lease liabilities | | 2 |

| | 5 |

|

Operating lease expense | | 934 |

| | 1,857 |

|

Short-term lease expense | | 4 |

| | 8 |

|

Variable lease expense | | 65 |

| | 111 |

|

Sublease income | | (174 | ) | | (297 | ) |

Total | | $ | 861 |

| | $ | 1,743 |

|

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Supplemental cash flow information related to leases for the three and six months ended June 30, 2019 were as follows:

|

| | | | | | | | |

| | Three months ended June 30, 2019 | | Six months ended June 30, 2019 |

| | (in thousands) |

Cash paid for amounts included in the measurement of lease liabilities: | | | | |

Operating cash flows from finance leases | | $ | 3 |

| | $ | 5 |

|

Finance cash flows from finance leases | | $ | 33 |

| | $ | 61 |

|

Operating cash flows from operating leases | | $ | 1,159 |

| | $ | 1,953 |

|

| | | | |

Right-of-use assets obtained in exchange for new lease obligations: | | | | |

Finance leases | | $ | 15 |

| | $ | 175 |

|

Operating leases | | $ | 862 |

| | $ | 862 |

|

Supplemental balance sheet information related to leases as of June 30, 2019 was as follows:

|

| | | | |

(in thousands, except lease term and discount rate) | | June 30, 2019 |

Finance Leases | | |

Finance lease right-of-use assets (1) | | $ | 268 |

|

| | |

Accrued expenses and other liabilities | | $ | 120 |

|

Other long-term liabilities | | 162 |

|

Total finance lease liabilities | | $ | 282 |

|

| | |

Operating Leases | | |

Operating lease right-of-use assets | | $ | 20,067 |

|

| | |

Accrued expenses and other liabilities | | $ | 2,791 |

|

Operating lease liabilities, non-current | | 19,939 |

|

Total operating lease liabilities | | $ | 22,730 |

|

| | |

Weighted average remaining lease term | | |

Finance leases | | 2.98 years |

|

Operating leases | | 7.76 years |

|

Weighted average discount rate | | |

Finance leases | | 4.41 | % |

Operating leases | | 5.14 | % |

| |

(1) | Amounts included in other long-term assets within the consolidated statements of financial condition. |

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Maturities of lease liabilities were as follows:

|

| | | | | | | | |

Twelve month period ending June 30, | | Finance Leases | | Operating Leases |

| | (in thousands) |

2020 | | $ | 131 |

| | $ | 3,889 |

|

2021 | | 75 |

| | 3,887 |

|

2022 | | 55 |

| | 3,558 |

|

2023 | | 28 |

| | 3,272 |

|

2024 | | 14 |

| | 3,132 |

|

Thereafter | | — |

| | 9,895 |

|

Total lease payments | | 303 |

| | 27,633 |

|

Less imputed interest | | (21 | ) | | (4,903 | ) |

Total lease liabilities | | $ | 282 |

| | $ | 22,730 |

|

As of December 31, 2018, minimum rent payments relating to the office leases for each of the following five years and thereafter were as follows:

|

| | | | |

Year Ending December 31, | | Minimum Payments |

| | (in thousands) |

2019 | | $ | 3,748 |

|

2020 | | 3,780 |

|

2021 | | 3,712 |

|

2022 | | 3,668 |

|

2023 | | 3,369 |

|

Thereafter | | 13,397 |

|

Total undiscounted lease payments | | $ | 31,674 |

|

Note 9—Commitments and Contingencies

The Company may from time to time enter into agreements that contain certain representations and warranties and which provide general indemnifications. The Company may also serve as a guarantor of such obligations. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred. The Company expects any risk of liability associated with such guarantees to be remote.

Regulation

As an investment adviser to a variety of investment products, the Company and its affiliated broker-dealer are subject to routine reviews and inspections by the SEC and the Financial Industry Regulatory Authority, Inc. Additionally, the Company could be subject to non-routine reviews and inspections by the National Futures Association and U.S. Commodity Futures Trading Commission in regards to the Company’s de minimis exposure to commodity interest investments in the mutual funds and collective investment trust vehicles it operates. From time to time the Company may also be subject to claims, or be involved in various legal proceedings, arising in the ordinary course of its business and other contingencies. The Company does not believe that the outcome of any of these reviews, inspections or other legal proceedings will have a material impact on its consolidated financial statements; however, litigation is subject to many uncertainties, and the outcome of individual litigated matters is difficult to predict. The Company will establish accruals for matters that are probable, can be reasonably estimated, and may take into account any related insurance recoveries to the extent of such recoveries. As of June 30, 2019 and December 31, 2018, the Company has not accrued for any such claims, legal proceedings, or other contingencies.

Note 10—Earnings per Common Share

Basic earnings per share (“basic EPS”) is computed using the two-class method to determine net income available to Class A common stock. The two-class method includes an earnings allocation formula that determines earnings per share for each participating security according to dividends declared and undistributed earnings for the period. The Company's restricted Class A common shares granted under the Equity Plan have non-forfeitable dividend rights during their vesting period and are therefore considered participating securities under the two-class method. Under the two-class method, the Company's net income available to Class A common stock is reduced by the amount allocated to the unvested restricted Class A common

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

stock. Basic EPS is calculated by dividing net income available to Class A common stock by the weighted average number of common shares outstanding during the period.

Diluted earnings per share (“diluted EPS”) is computed under the more dilutive of either the treasury method or the two-class method. For the diluted calculation, the weighted average number of common shares outstanding during the period is increased by the assumed conversion into Class A common stock of the unvested equity awards and the exchangeable Class A units of Manning & Napier Group, to the extent that such conversion would dilute earnings per share.

The following is a reconciliation of the income and share data used in the basic and diluted EPS computations for the three and six months ended June 30, 2019 and 2018 under the two-class method:

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| | (in thousands, except share data) | | | | |

Net income attributable to controlling and noncontrolling interests | | $ | 3,219 |

| | $ | 6,190 |

| | $ | 6,136 |

| | $ | 13,463 |

|

Less: net income attributable to noncontrolling interests | | 2,805 |

| | 5,424 |

| | 5,161 |

| | 11,483 |

|

Net income attributable to Manning & Napier, Inc. | | $ | 414 |

| | $ | 766 |

| | $ | 975 |

| | $ | 1,980 |

|