UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22572

———————

Destra Multi-Alternative Fund

———————————

(Exact name of registrant as specified in charter)

444 West Lake Street, Suite 1700

Chicago, IL 60606

———————————

(Address of principal executive offices) (Zip code)

Robert A. Watson

C/O Destra Capital Advisors LLC

444 West Lake Street, Suite 1700

Chicago, IL 60606

———————————

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 843-6161

———————

Date of fiscal year end: February 29

———————

Date of reporting period: February 29, 2020

———————

Item 1. Reports to Stockholders.

Destra Multi-Alternative Fund

Annual Report

February 29, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at www.destracapital.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank), through the Fund’s transfer agent by calling the Fund toll-free at 844-9DESTRA (933-7872), or if you are a direct investor, by enrolling at www.destracapital.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call toll-free at 844-9DESTRA (933-7872) to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the Destra Fund Complex if you invest directly with the Fund.

Table of Contents

|

3 |

||

|

4 |

||

|

6 |

||

|

7 |

||

|

9 |

||

|

10 |

||

|

11 |

||

|

12 |

||

|

14 |

||

|

15 |

||

|

17 |

||

|

28 |

||

|

29 |

||

|

31 |

||

|

33 |

2

Thank you for your investment in the Destra Multi-Alternative Fund.

This Annual Report covers the period from March 1, 2019 to February 29, 2020 (a Leap Year), which is the Fiscal Year for your Fund. The Fiscal Year started March 1, 2019 and was characterized by a strong market for traditional stocks and bonds for the remainder of calendar 2019. 2020 started with very encouraging economic numbers and a market that appeared to be continuing higher. But the end of the Fiscal Year for your Fund ended with markets in free-fall during the last week and half of February, as the unprecedented events surrounding the COVID-19 pandemic originating out of Wuhan, China brought one of the longest economic expansions and concurrent bull markets in history to a crashing halt. This put a disappointing end on what otherwise, was a very positive Fiscal Year period for the Fund.

For the Fiscal Year period your Fund’s Total Return was 1.90% (Class I Shares), which compares favorably to key Alternative benchmarks and industry Peer Groups. In the table below, we show the return of the Fund over the Fiscal Year compared to a range of Alternative Indexes and a representative Peer Group for the Fund.

|

Returns as of 2/29/2020 |

||||

|

Asset Class |

Index |

1 Year |

||

|

Destra Fund |

|

|

||

|

MSFIX |

Destra Multi-Alternative Fund (Class I) |

1.90% |

||

|

Non-Traditional |

|

|

||

|

Multi-Asset Class |

Morningstar Diversified Alternatives TR USD |

0.62% |

||

|

Multi-Asset Class |

Morningstar US Fund Multialternative Category |

1.30% |

||

|

REITs |

FTSE NAREIT All Equity REITs |

7.98% |

||

|

Mortgage REITs |

FTSE NAREIT Mortgage REITs |

6.56% |

||

|

BDCs |

Wells Fargo BDC |

-0.60% |

||

|

MLPs |

Alerian MLP |

-23.46% |

||

|

Hedge Funds |

UBS ETF HFRX Global HF |

4.69% |

||

|

Commodities |

Bloomberg Commodity Index |

-11.05% |

||

While we are disappointed with the COVID-19 triggered sell off in the last two weeks of the Fiscal Year, we are encouraged by the overall results of the Fund in the reporting period, as it showcases the logic to the Fund’s investment approach and highlights the ability of the Fund to play an important diversification role in a well-designed portfolio.

In the report that follows, you will receive detailed commentary from the portfolio management team at Pinhook (the Fund’s Sub-Adviser) for the Fiscal Year period which will discuss performance, their continued effort to manage and best position the portfolio, as well as their outlook for the rest of calendar 2020 and beyond. We encourage you to read this document carefully, as it is the most detailed assessment of your investment each year and holds important information for you about the organization, management and financial position of your Fund.

Thank you again for your investment in the Fund. We look forward to reporting to you again in the future and hope that you and your family are safe and stay healthy in this extraordinary time.

Sincerely,

Robert A. Watson, CFP®

President

Destra Capital Advisors LLC

3

Pinhook Capital Manager Discussion & Analysis

Investment Environment

Last year we noted that Fiscal 2019 was very much a tale of two periods, with the first 10 months featuring macro and monetary headwinds, and the latter two months characterized by strong risk-on and income-oriented tailwinds. For Fiscal 2020 (March 1, 2019 – February 29, 2020), the tale of two periods was reversed, and extreme. For the vast majority of Fiscal 2020, an accommodative Fed, loose global monetary policy, and expectations of an imminent return to economic growth spurred most asset classes upward. Trade war rhetoric sporadically moved markets, and other occasional idiosyncratic or geopolitical tensions caused interim spells of noise that rarely lasted long before markets drove upwards yet again. The net result was a collective head shrugging of sorts and a general rise upward to rich valuations with a widely held view that the positives would far outweigh the negatives, which were seen as manageable and largely in the rear-view mirror. Even early news around the coronavirus (COVID-19) contagion were largely dismissed. It was only in the last days of February 2020 that concerns over a possible global pandemic causing a substantial global economic downturn became more “real” and caused the beginning of a precipitous market and risk-asset selloff that we are still in the grips of as we write this today.

Perhaps the most significant changes during the period were in the fixed income markets. Over our Fiscal 2020, rates across the yield curve plummeted, due to a combination of market expectations of loose monetary policy and lower (or negative) rates overseas. The 3-month declined by 48.2%, the 2-year by 65.9%, and the 10-year by 58.6%. We had three separate bouts of an inverted yield curve, historically a foreboding indicator of a future recession, there has been great debate over whether the recent intensive monetary stimulus and low global rates has caused this data point to be less accurate of a prognosticator in today’s environment. Most importantly, there were significant periods of complete dislocation in public pricing that were caused by forced liquidations (almost at any price) both from adjustments to risk models and from ETFs and hedge funds that were shutting down.

The volatility and steep declines in rates caused a great deal of interim noise amongst alternative asset classes, particularly yield-oriented ones. However, it was the late-period selloff that diminished strong performance in several categories, and exacerbated disparity amongst others. Public REITs nearly kept up with equity markets, but it was very much a secular story of the have’s and have not’s. Hedge Funds and diversified alternatives generally finished slightly positive. While lower rates were an important tailwind for BDCs and other high yield debt securities, recent concerns over leverage and liquidity in pared much or all of their previously significant gains, as BDCs finished slightly negative for the period. MLPs and other energy-related securities were a consistent underperformer across the year, a fact only worsened by an extreme selloff in energy markets during 2020 as an oil price war took hold. Given that higher volatility has historically been a positive for hedge funds, yet forced deleveraging has handcuffed many, it will be interesting to see how they perform going forward.

Performance Discussion

For the fiscal year ended February 29, 2020, the Fund returned 1.90% on a total return basis. For context as it relates to late-period volatility — this performance number was more than 5.29% for the 10-month period through December 31, 2019 (and just above 9.61% for calendar 2019).

We continued to make substantial progress positioning the Fund portfolio for long-term success. Last year featured milestone progress in our disciplined efforts to streamline while increasing the Fund’s allocations to superior institutional investments. Perhaps more importantly, we also saw more significant positive impact from this transition on overall Fund performance. With the high-end illiquid institutional investments now representing the majority of the Fund’s illiquid portfolio, the accretive nature of those return streams tangibly outweighed a few remaining legacy investment declines. We believe the efforts we have made, and continue to make, on this front will continue to meaningfully benefit performance going forward.

Due to the unique multi-asset nature of the Fund, there are limited comparable indices from which to compare performance; however, we believe that the Morningstar Diversified Alternative Total Return Index (MDATR) and Morningstar US Multialternative Category (MUMAC) are the most relevant at this time. During the fiscal year ended February 29, 2020, the MDATR Index returned 0.62%, and the MUMAC Category was up 1.30%. The Fund slightly outperformed both the Index and category during the Fiscal year, and during longer-term periods the Fund has considerably outperformed both the MDATR index and the MUMAC category.

It is worth noting that as with most alternative investment strategies, a major objective of the Fund is to reduce volatility relative to traditional asset classes; therefore, we believe performance comparisons must include risk-adjusted performance metrics and not just absolute and relative returns. From a risk-adjusted basis using metrics such as the Sharpe and Sortino Ratios, the Fund has outperformed both MDATR and MUMAC by even more significant extents on both a near-term and long-term basis.

4

|

Destra Multi-Alternative Fund |

|

Manager’s Commentary (unaudited) (continued) |

|

|

Portfolio Activity

We have previously spoken in depth about the transition of assets towards institutional products, resulting in a higher quality, more sustainable portfolio going forward. This year, there was another important theme underlying many of the allocation decisions and changes we have been making: that of recession resistance and inefficient or niche opportunity discovery.

We spend a great deal of time understanding what arenas we expect to have the highest likelihood of success over the next 5+ years, as this is an essential part of ensuring long-term outperformance when investing in illiquid securities. Certain market trends and expectations specifically caught our attention within the aging economic cycle. There were two particular theses that we focused on within this theme. The first was turning the portfolio away from arenas where there was minimal future upside and less defensibility in a stagnant or down-turning economy. The second was then defining and targeting areas where market inefficiencies still existed, allowing for outsized return generation going forward and/or less vulnerability to possible economic environments.

Specifically, this involved trimming certain real estate sector exposures where stabilized core assets were trading at historically low cap rates with little room for significant upside from here. We repurposed this capital towards sectors that should act more defensively without sacrificing return potential. An example of this would be the multifamily residential sector, and notably low-income housing within that. This is a highly defensive sub-sector, with a strong perpetual demand story due to unbalanced supply and demand, that should see far less detrimental effects from economic stagnancy or downturn on a relative basis. Through thoughtful exploration of this niche space, we were able to identify inefficient pricing and implement exposure at extremely attractive levels via an investment in Preservation REIT. We also continued to increase our exposure in the cannabis-related real estate arena, increasing the Treehouse REIT allocation and expanding into a new more industrial-focused opportunity in GreenAcreage REIT. It is important to note that our investments are not “cannabis investments” per se — they merely own and rent the hard-asset real estate to tenants. This is another niche real estate category where substantial inefficiencies exist due to the immaturity of the industry, allowing for extraordinary asset acquisition terms, where demand should remain relatively insensitive to an economic downturn.

Another example of where changing market conditions caused us to tweak how we allocated new capital was in the private equity space where the Fund was already underweight. Due to the rapidly increasing amount of capital being targeted towards private equity assets over the last several years, as well as the expanding valuation levels for both public and private equities, competition for deal flow had pushed up acquisition multiples and, in our opinion, were likely to push down future returns. Instead of adding to such an already crowded space, we focused specifically on early and seed stage venture capital opportunities. The smaller, niche opportunity sets featured less institutional crowding, and significant competitive advantages via deal flow, access, and sourcing. Longley Ventures provided a uniquely attractive entry point, focusing primarily on the Southern California early-stage startup community that had largely been ignored by the larger capital providers and where local relationships create a sustainable competitive advantage.

These incremental moves along with continued capital calls from existing institutional investments should position the Fund to best perform in the years to come with reduced exposure to an economic downturn over time. While much of these developments are inherently long-term in nature and could take multiple quarters or even years to have a meaningful impact, we have also been pleased that some investments also added to performance almost immediately. The Treehouse REIT and Preservation REIT investments noted above have already been performing above expectations, and were actually the top two individual contributors during the fiscal year from a dollar attribution basis — a major accomplishment given our investment horizon for these investments.

Perspective & Outlook

As we head into the last 3 quarters of calendar 2020, we are faced with an environment clouded by unknowns. The COVID-19 pandemic has caused tumult in nearly all markets, with frenetic selling pressure gripping fixed income and alternative investments as well. This has caused significant dislocations between pricing and valuations. The extent of future changes to valuations, as well as the depth or continuation of such pricing dislocations, is wholly contingent on the overall effect of this pandemic on the future of the global economy. In fact, the odds are that in the time between the crafting and the actual publication of this letter, there will be “new news” that may impact alternative investments and their outlook.

While we will not pretend to know what the future holds in that regard (nor can anyone), what we can assure you is that we intend to continue to manage the Fund in the same fashion that we have been — with a focus on risk management and disciplined investing. The active management decisions we have been making for some time in anticipation of an economic downturn will prove their value, with some already meaningfully doing so. We will continue to adjust and enhance the portfolio as necessary to best weather future economic turbulence, as well as position it to meaningfully take advantage of the attractive opportunities that we expect will inevitably present themselves in the days to come.

5

|

Average Annual Total Return for the period ended February 29, 2020 |

|||||||||||||||

|

Inception Date: |

Inception Date: |

||||||||||||||

|

Share Class |

1 Year |

3 year |

5 year |

Since Inception |

Since Inception |

||||||||||

|

Class A at NAV |

1.59 |

% |

-0.18 |

% |

0.98 |

% |

3.79 |

% |

— |

|

|||||

|

Class A with Load |

-4.25 |

% |

-2.14 |

% |

-0.21 |

% |

3.06 |

% |

— |

|

|||||

|

Class C |

0.88 |

% |

-0.92 |

% |

0.24 |

% |

— |

|

0.57 |

% |

|||||

|

Class I |

1.90 |

% |

0.02 |

% |

1.34 |

% |

— |

|

1.60 |

% |

|||||

|

Class T at NAV |

1.10 |

% |

-0.70 |

% |

0.49 |

% |

— |

|

0.83 |

% |

|||||

|

Class T with Load |

-0.91 |

% |

-1.37 |

% |

-0.28 |

% |

— |

|

0.15 |

% |

|||||

|

Bloomberg Barclays U.S. Aggregate Bond Index |

11.68 |

% |

5.01 |

% |

3.58 |

% |

3.40 |

% |

3.81 |

% |

|||||

|

S&P 500 Total Return Index |

8.19 |

% |

9.87 |

% |

9.23 |

% |

12.10 |

% |

9.59 |

% |

|||||

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Please read the Fund’s Prospectus, including the description of the Fund’s repurchase policy carefully before investing. For performance information current to the most recent month-end, please call the Fund at 1-844-9DESTRA (933-7873). Class A and Class T shares of the Fund have a maximum sales charge of 5.75% and 3.00%, respectively. Cass C and Class I are not subject to a sales load.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

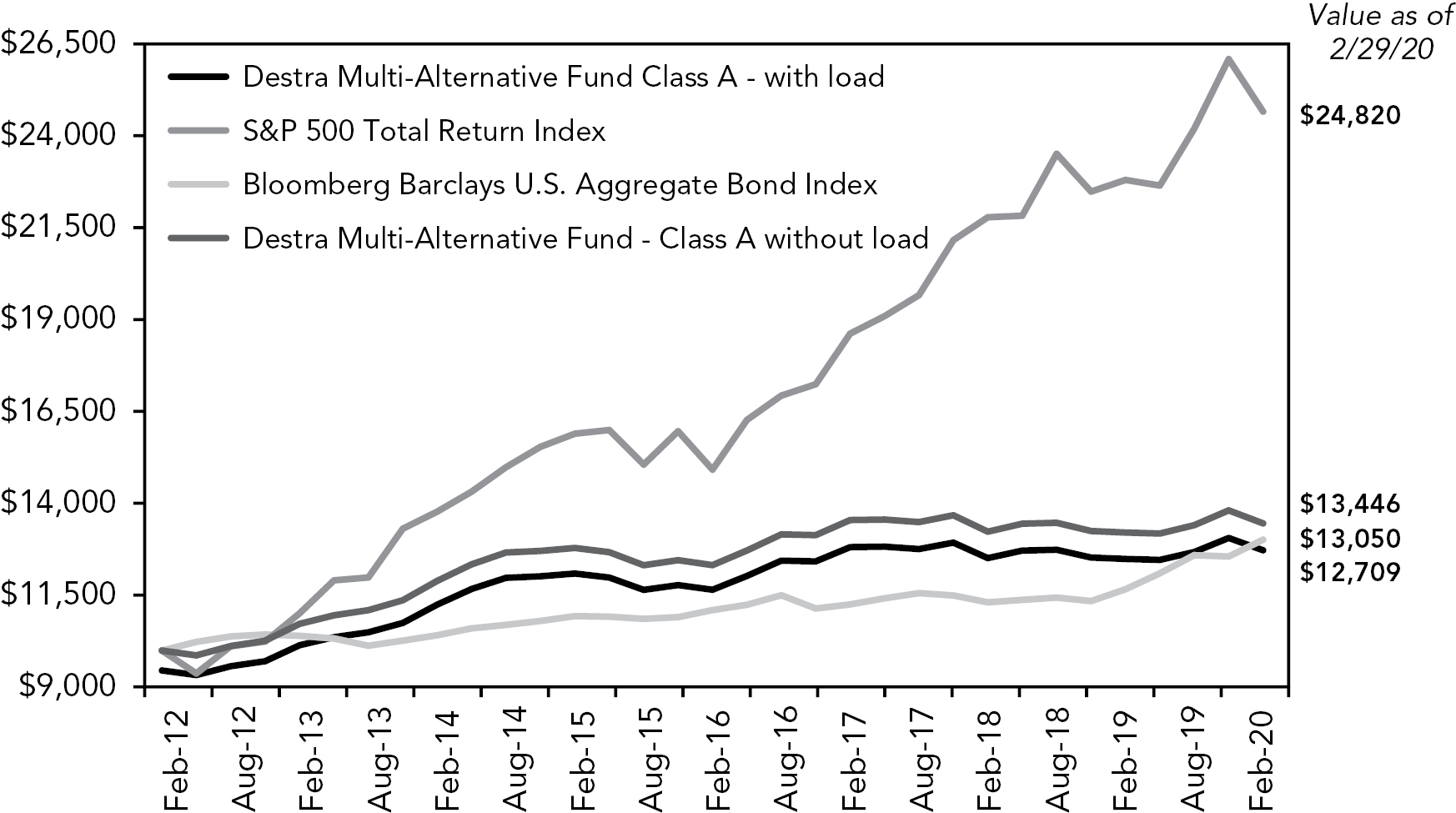

Growth of an Assumed $10,000 Investment

This graph illustrates the hypothetical investment of $10,000 in the Fund, Class A, from March 16, 2012 to February 29, 2020. The Average Annual and Cumulative Total Return table and Growth of Assumed $10,000 Investment graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

6

|

Shares |

Security |

Value |

|||

|

COMMON STOCKS – 10.8% |

|

||||

|

LISTED BUSINESS DEVELOPMENT COMPANIES – 9.1% |

|

||||

|

40,000 |

Ares Capital Corp. |

$ |

687,600 |

||

|

24,505 |

Golub Capital BDC, Inc. |

|

408,253 |

||

|

81,142 |

Hercules Capital, Inc.(1) |

|

1,071,074 |

||

|

595,655 |

Owl Rock Capital Corp.(2) |

|

9,071,826 |

||

|

50,000 |

WhiteHorse Finance, Inc. |

|

628,500 |

||

|

|

11,867,253 |

||||

|

|

|||||

|

PIPELINES – 1.4% |

|

||||

|

34,363 |

CrossAmerica Partners LP |

|

579,360 |

||

|

33,500 |

Delek Logistics Partners LP |

|

719,915 |

||

|

110,000 |

Golar LNG Partners LP |

|

467,500 |

||

|

|

1,766,775 |

||||

|

|

|||||

|

PRIVATE EQUITY – 0.3% |

|

||||

|

7,000 |

Icahn Enterprises LP |

|

439,110 |

||

|

TOTAL COMMON STOCKS |

|

14,073,138 |

|||

|

|

|||||

|

RIGHTS – 0.4% |

|

||||

|

PHARMACEUTICALS – 0.4% |

|

||||

|

145,000 |

Bristol-Myers Squibb Co. CVR(3) |

|

485,750 |

||

|

TOTAL RIGHTS |

|

485,750 |

|||

|

|

|||||

|

REAL ESTATE INVESTMENT TRUSTS – 49.4% |

|

||||

|

LISTED REAL ESTATE INVESTMENT TRUSTS – 2.9% |

|

||||

|

40,800 |

American Campus Communities, Inc.(1) |

|

1,772,352 |

||

|

44,100 |

Granite Point Mortgage Trust, Inc. |

|

724,122 |

||

|

23,000 |

QTS Realty Trust, Inc. |

|

1,291,910 |

||

|

TOTAL LISTED REAL ESTATE INVESTMENT TRUSTS |

|

3,788,384 |

|||

|

|

|||||

|

NON-LISTED REAL ESTATE INVESTMENT TRUSTS – 14.1% |

|

||||

|

290,378 |

Healthcare Trust, Inc.(2) |

|

4,478,059 |

||

|

456,540 |

Hospitality Investor Trust, Inc.(2)(3) |

|

3,447,843 |

||

|

764,346 |

N1 Liquidating Trust(2)(3) |

|

183,443 |

||

|

1,081,081 |

NorthStar Healthcare Income, Inc.(2)(3) |

|

6,672,169 |

||

|

383,031 |

Steadfast Income REIT, Inc.(2) |

|

3,525,325 |

||

|

TOTAL NON-LISTED REAL ESTATE INVESTMENT TRUSTS |

|

18,306,839 |

|||

|

|

|||||

|

PRIVATE REAL ESTATE INVESTMENT TRUSTS – 32.4% |

|

||||

|

5,924 |

Clarion Lion Industrial Trust(2) |

|

12,610,111 |

||

|

275,000 |

GreenAcreage Real Estate Corp.(2)(3) |

|

5,500,000 |

||

|

159 |

Preservation REIT 1, Inc.(2) |

|

6,868,058 |

||

|

Shares |

Security |

Value |

|||

|

REAL ESTATE INVESTMENT TRUSTS (continued) |

|

||||

|

PRIVATE REAL ESTATE INVESTMENT TRUSTS (continued) |

|

||||

|

715,000 |

Treehouse Real Estate Investment Trust, Inc.(2) |

$ |

17,160,000 |

||

|

TOTAL PRIVATE REAL ESTATE INVESTMENT TRUSTS |

|

42,138,169 |

|||

|

|

|||||

|

TOTAL REAL ESTATE INVESTMENT TRUSTS |

|

64,233,392 |

|||

|

|

|||||

|

NON-LISTED BUSINESS DEVELOPMENT COMPANIES – 0.7% |

|

||||

|

116,300 |

Cion Investment Corp.(2) |

|

955,984 |

||

|

TOTAL NON-LISTED BUSINESS DEVELOPMENT COMPANIES |

|

955,984 |

|||

|

|

|||||

|

PRIVATE INVESTMENT |

|

||||

|

AIM Infrastructure MLP Fund II, LP.(2) |

|

4,791,109 |

|||

|

Arboretum Core Asset Fund, L.P.(2) |

|

2,553,010 |

|||

|

Canyon CLO Fund II L.P.(2)(3) |

|

3,714,352 |

|||

|

Clarion Lion Properties Fund(2) |

|

6,936,161 |

|||

|

Levine Leichtman Capital Partners VI, LP(2) |

|

3,493,152 |

|||

|

Longley Partners Ventures, L.P.(2)(3) |

|

4,692,178 |

|||

|

Mosaic Real Estate Credit, LLC(2) |

|

10,321,032 |

|||

|

Ovation Alternative Income Fund(2) |

|

7,466,888 |

|||

|

Stepstone Capital Partners IV, L.P.(2)(3) |

|

6,004,149 |

|||

|

TOTAL PRIVATE INVESTMENT FUNDS |

|

49,972,031 |

|||

|

|

|||||

|

CLOSED-END FUNDS – 8.6% |

|

||||

|

92,641 |

Apollo Tactical Income Fund, Inc. |

|

1,347,926 |

||

|

109,949 |

BlackRock Debt Strategies Fund, Inc.(1) |

|

1,162,161 |

||

|

114,153 |

BlackRock Multi-Sector Income Trust |

|

1,773,938 |

||

|

58,623 |

Blackstone/GSO Long-Short Credit Income Fund |

|

855,310 |

||

|

88,000 |

Brookfield Real Assets Income Fund, Inc.(1) |

|

1,772,320 |

||

|

98,042 |

DoubleLine Income Solutions Fund |

|

1,828,483 |

||

|

37,800 |

First Trust Intermediate Duration Preferred & Income Fund(1) |

|

850,500 |

||

|

30,274 |

John Hancock Premium Dividend Fund |

|

451,688 |

||

|

78,964 |

Western Asset Emerging Markets Debt Fund, Inc.(1) |

|

1,086,545 |

||

|

TOTAL CLOSED-END FUNDS |

|

11,128,871 |

|||

See accompanying Notes to Financial Statements.

7

|

Destra Multi-Alternative Fund |

|

Schedule of Investments (continued) |

|

As of February 29, 2020 |

|

Shares |

Security |

Value |

||||

|

HEDGE FUND – 16.9% |

|

|

||||

|

Collins Master Access Fund, LLC(2)(3) |

$ |

22,009,984 |

|

|||

|

TOTAL HEDGE FUNDS |

|

22,009,984 |

|

|||

|

|

|

|||||

|

SHORT-TERM INVESTMENTS – 1.4% |

|

|

||||

|

MONEY MARKET FUND – 1.4% |

|

|

||||

|

1,762,977 |

Fidelity Investments Money Market Funds – Government Portfolio, |

|

1,762,977 |

|

||

|

TOTAL SHORT-TERM INVESTMENTS |

|

1,762,977 |

|

|||

|

|

|

|||||

|

TOTAL INVESTMENTS – 126.7% |

|

164,622,127 |

|

|||

|

Liabilities in Excess of Other Assets – (26.7)% |

|

(34,724,345 |

) |

|||

|

TOTAL NET ASSETS – 100.0% |

$ |

129,897,782 |

|

|||

|

|

|

|||||

|

COMMON STOCKS SOLD SHORT – (2.1)% |

|

|

||||

|

LEISURE TIME – (1.4)% |

|

|

||||

|

(69,000) |

Peloton Interactive, Inc., Class A |

|

(1,841,610 |

) |

||

|

SEMICONDUCTORS – (0.7)% |

|

|

||||

|

(16,000) |

Applied Materials, Inc. |

|

(929,920 |

) |

||

|

TOTAL COMMON STOCKS SOLD SHORT |

|

(2,771,530 |

) |

|||

|

|

|

|||||

|

EXCHANGE-TRADED FUNDS SOLD SHORT – (0.4)% |

|

|

||||

|

(6,500) |

ProShares UltraPro QQQ |

|

(500,500 |

) |

||

|

TOTAL EXCHANGE-TRADED FUNDS SOLD SHORT |

|

(500,500 |

) |

|||

|

TOTAL SECURITIES SOLD SHORT |

$ |

(3,272,030 |

) |

|||

1 All or a portion of this security is segregated as collateral for securities sold short.

2 Restricted investments as to resale.

3 Non-income producing security.

4 The rate is the annualized seven-day yield as of February 29, 2020.

BDC — Business Development Company

LP — Limited Partnership

CVR — Contingent Value Right

REIT — Real Estate Investment Trusts

LLC — Limited Liability Company

See accompanying Notes to Financial Statements.

8

|

Percent of |

|||

|

Real Estate Investment Trusts |

|

||

|

Private Real Estate Investment Trusts |

32.4 |

% |

|

|

Non-Listed Real Estate Investment Trusts |

14.1 |

% |

|

|

Listed Real Estate Investment Trusts |

2.9 |

% |

|

|

Private Investment Funds |

38.5 |

% |

|

|

Hedge Fund |

16.9 |

% |

|

|

Common Stocks |

|

||

|

Listed Business Development Companies |

9.1 |

% |

|

|

Pipelines |

1.4 |

% |

|

|

Private Equity |

0.3 |

% |

|

|

Closed-End Funds |

8.6 |

% |

|

|

Short-Term Investments |

1.4 |

% |

|

|

Non-Listed Business Development Companies |

0.7 |

% |

|

|

Rights |

|

||

|

Pharmaceuticals |

0.4 |

% |

|

|

Liabilities in Excess of Other Assets |

(26.7 |

)% |

|

|

Net Assets |

100.0 |

% |

|

|

Exchange-Traded Funds Sold Short |

(0.4 |

)% |

|

|

Common Stocks Sold Short |

|

||

|

Semiconductors |

(0.7 |

)% |

|

|

Leisure Time |

(1.4 |

)% |

|

See accompanying Notes to Financial Statements.

9

|

Assets: |

|

||

|

Investments, at value (cost $157,609,308) |

$ |

164,622,127 |

|

|

Receivables: |

|

||

|

Dividends |

|

376,953 |

|

|

Investments sold |

|

106,172 |

|

|

Fund shares sold |

|

1,329 |

|

|

Prepaid expenses |

|

44,013 |

|

|

Other assets |

|

628 |

|

|

Total assets |

|

165,151,222 |

|

|

Liabilities: |

|

||

|

Securities sold short, at value (proceeds $3,192,896) |

|

3,272,030 |

|

|

Credit facility (see note 8) |

|

29,300,000 |

|

|

Due to custodian |

|

1,223,526 |

|

|

Payables: |

|

||

|

Investment purchased |

|

1,151,725 |

|

|

Interest payable |

|

100,124 |

|

|

Management fees payable (see note 3) |

|

75,241 |

|

|

Transfer agent fees and expenses |

|

48,133 |

|

|

Accounting and administrative fees |

|

20,803 |

|

|

Shareholder servicing fees |

|

19,503 |

|

|

Trustee fees |

|

12,019 |

|

|

Distribution fees |

|

9,016 |

|

|

Professional fees |

|

6,972 |

|

|

Custody fees |

|

4,580 |

|

|

Chief compliance officer fees |

|

2,083 |

|

|

Accrued other expenses |

|

7,685 |

|

|

Total liabilities |

|

35,253,440 |

|

|

Net assets |

$ |

129,897,782 |

|

|

Net assets consist of: |

|

||

|

Paid-in capital (unlimited shares authorized at $0.001 par value common stock) |

$ |

122,704,132 |

|

|

Total distributable earnings |

|

7,193,650 |

|

|

Net assets |

$ |

129,897,782 |

|

|

Net assets: |

|

||

|

Class I |

$ |

35,208,375 |

|

|

Class A |

|

78,758,216 |

|

|

Class C |

|

11,965,574 |

|

|

Class T# |

|

3,965,617 |

|

|

Shares outstanding: |

|

||

|

Class I |

|

2,657,031 |

|

|

Class A |

|

6,052,949 |

|

|

Class C |

|

956,050 |

|

|

Class T# |

|

312,746 |

|

Net asset value per share:* |

|

||

|

Class I |

$ |

13.25 |

|

|

Class A |

|

13.01 |

|

|

Maximum offering price per share(1) |

|

13.80 |

|

|

Class C |

|

12.52 |

|

|

Class T# |

|

12.68 |

|

|

Maximum offering price per share(2) |

|

13.07 |

* The Net Asset Value for each class will differ due primarily to the allocation of class specific expenses, such as distribution fees and shareholder servicing fees.

# As of July 1, 2019, the Fund redesignated its issued and outstanding Class L Shares as Class T Shares.

1 Include a sales charge of 5.75%.

2 Include a sales charge of 3.00%.

See accompanying Notes to Financial Statements.

10

|

Investment income: |

|

|

||

|

Dividend income(1) |

$ |

6,292,525 |

|

|

|

Interest income |

|

85,079 |

|

|

|

Total investment income |

|

6,377,604 |

|

|

|

Expenses: |

|

|

||

|

Management fees (see note 3) |

|

1,953,381 |

|

|

|

Interest expense |

|

1,258,110 |

|

|

|

Professional fees |

|

311,746 |

|

|

|

Accounting and administrative fees |

|

222,415 |

|

|

|

Transfer agent fees and expenses |

|

188,071 |

|

|

|

Shareholder reporting fees |

|

112,118 |

|

|

|

Trustee fees |

|

54,687 |

|

|

|

Registration fees |

|

54,414 |

|

|

|

Chief financial officer fees |

|

48,000 |

|

|

|

Chief compliance officer fees |

|

40,374 |

|

|

|

Custody fees |

|

28,416 |

|

|

|

Insurance expense |

|

15,839 |

|

|

|

Distribution fees Class C (see note 3) |

|

107,404 |

|

|

|

Distribution fees Class T# (see note 3) |

|

22,823 |

|

|

|

Shareholder servicing fees Class C (see note 3) |

|

35,801 |

|

|

|

Shareholder servicing fees Class A (see note 3) |

|

243,472 |

|

|

|

Shareholder servicing fees Class T# (see note 3) |

|

11,412 |

|

|

|

Other expenses |

|

22,008 |

|

|

|

Total expenses: |

|

4,730,491 |

|

|

|

Expenses waived from adviser (see note 3) |

|

(592,247 |

) |

|

|

Net expenses |

|

4,138,244 |

|

|

|

Net investment income |

|

2,239,360 |

|

|

|

Net realized and unrealized gain (loss): |

|

|

||

|

Net realized gain (loss) on: |

|

|

||

|

Investments |

|

8,773,384 |

|

|

|

Capital gains distributions |

|

1,030 |

|

|

|

Purchased options |

|

(157,136 |

) |

|

|

Securities sold short |

|

(593,148 |

) |

|

|

Total net realized gain |

|

8,024,130 |

|

|

|

Net change in unrealized depreciation on: |

|

|

||

|

Investments |

|

(7,441,773 |

) |

|

|

Securities sold short |

|

(79,134 |

) |

|

|

Total net change in unrealized depreciation |

|

(7,520,907 |

) |

|

|

Net realized and unrealized gain |

|

503,223 |

|

|

|

Net increase in net assets resulting from operations |

$ |

2,742,583 |

|

# As of July 1, 2019, the Fund redesignated its issued and outstanding Class L Shares as Class T Shares.

1 Net of foreign withholding taxes of $1,491.

See accompanying Notes to Financial Statements.

11

|

Year Ended |

Year Ended |

|||||||

|

Increase (decrease) in net assets resulting from operations |

|

|

|

|

||||

|

Net investment income |

$ |

2,239,360 |

|

$ |

3,577,454 |

|

||

|

Net realized gain (loss) |

|

8,024,130 |

|

|

(6,575,759 |

) |

||

|

Net change in unrealized appreciation (depreciation) |

|

(7,520,907 |

) |

|

2,920,497 |

|

||

|

Net increase (decrease) in net assets resulting from operations |

|

2,742,583 |

|

|

(77,808 |

) |

||

|

Distributions to shareholders: |

|

|

|

|

||||

|

Class I |

|

(161,276 |

) |

|

(20,369 |

) |

||

|

Class A |

|

(529,118 |

) |

|

(534,638 |

) |

||

|

Class C |

|

(78,054 |

) |

|

(90,458 |

) |

||

|

Class T# |

|

(25,046 |

) |

|

(23,785 |

) |

||

|

Total distributions to shareholders |

|

(793,494 |

) |

|

(669,250 |

) |

||

|

Return of capital to shareholders |

|

|

|

|

||||

|

Class I |

|

(1,585,742 |

) |

|

(608,511 |

) |

||

|

Class A |

|

(5,202,526 |

) |

|

(7,383,979 |

) |

||

|

Class C |

|

(767,468 |

) |

|

(1,162,373 |

) |

||

|

Class T# |

|

(246,265 |

) |

|

(313,618 |

) |

||

|

Total return of capital to shareholders |

|

(7,802,001 |

) |

|

(9,468,481 |

) |

||

|

Capital transactions: |

|

|

|

|

||||

|

Proceeds from shares sold: |

|

|

|

|

||||

|

Class I |

|

19,415,616 |

|

|

16,756,790 |

|

||

|

Class A |

|

953,970 |

|

|

3,970,120 |

|

||

|

Class C |

|

1,180,343 |

|

|

1,307,718 |

|

||

|

Class T# |

|

94,193 |

|

|

134,721 |

|

||

|

Reinvestment of distributions: |

|

|

|

|

||||

|

Class I |

|

710,046 |

|

|

250,790 |

|

||

|

Class A |

|

2,835,820 |

|

|

4,140,233 |

|

||

|

Class C |

|

467,570 |

|

|

711,966 |

|

||

|

Class T# |

|

131,391 |

|

|

177,046 |

|

||

|

Cost of shares repurchased: |

|

|

|

|

||||

|

Class I |

|

(2,332,574 |

) |

|

(2,854,486 |

) |

||

|

Class A |

|

(35,417,751 |

) |

|

(36,830,028 |

) |

||

|

Class C |

|

(5,481,057 |

) |

|

(8,737,854 |

) |

||

|

Class T# |

|

(903,192 |

) |

|

(1,683,242 |

) |

||

|

Net decrease in net assets from capital transactions |

|

(18,345,625 |

) |

|

(22,656,226 |

) |

||

|

Total decrease in net assets |

|

(24,198,537 |

) |

|

(32,871,765 |

) |

||

|

Net assets: |

|

|

|

|

||||

|

Beginning of year |

|

154,096,319 |

|

|

186,968,084 |

|

||

|

End of year |

$ |

129,897,782 |

|

$ |

154,096,319 |

|

||

See accompanying Notes to Financial Statements.

12

|

Destra Multi-Alternative Fund |

|

Statements of Changes in Net Assets (continued) |

|

|

|

Year Ended |

Year Ended |

|||||

|

Capital share transactions: |

|

|

||||

|

Shares sold: |

|

|

||||

|

Class I |

1,407,072 |

|

1,178,312 |

|

||

|

Class A |

70,396 |

|

279,209 |

|

||

|

Class C |

89,952 |

|

93,295 |

|

||

|

Class T# |

7,057 |

|

9,752 |

|

||

|

Shares reinvested: |

|

|

||||

|

Class I |

51,739 |

|

17,804 |

|

||

|

Class A |

209,996 |

|

293,832 |

|

||

|

Class C |

35,871 |

|

51,938 |

|

||

|

Class T# |

9,960 |

|

12,798 |

|

||

|

Shares repurchased: |

|

|

||||

|

Class I |

(168,431 |

) |

(197,947 |

) |

||

|

Class A |

(2,605,157 |

) |

(2,608,886 |

) |

||

|

Class C |

(418,204 |

) |

(638,321 |

) |

||

|

Class T# |

(68,103 |

) |

(121,152 |

) |

||

|

Net decrease from capital share transactions |

(1,377,852 |

) |

(1,629,366 |

) |

||

# As of July 1, 2019, the Fund redesignated its issued and outstanding Class L Shares as Class T Shares.

See accompanying Notes to Financial Statements.

13

|

Cash flows from operating activities: |

|

|

||

|

Net increase in net assets from operations |

$ |

2,742,583 |

|

|

|

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: |

|

|

||

|

Purchases of investments |

|

(157,742,146 |

) |

|

|

Proceeds from redemptions, sales, or other dispositions of investments(1) |

|

174,654,266 |

|

|

|

Net realized (gain) loss on: |

|

|

||

|

Investments |

|

(8,773,384 |

) |

|

|

Capital gains distributions |

|

(1,030 |

) |

|

|

Purchased options |

|

157,136 |

|

|

|

Securities sold short |

|

593,148 |

|

|

|

Net change in unrealized (appreciation) depreciation on: |

|

|

||

|

Investments |

|

7,441,773 |

|

|

|

Securities sold short |

|

79,134 |

|

|

|

Change in operating assets and liabilities: |

|

|

||

|

Receivables: |

|

|

||

|

Investments sold |

|

(106,172 |

) |

|

|

Interest |

|

1,691 |

|

|

|

Dividends |

|

109,821 |

|

|

|

Prepaid expenses |

|

(1,783 |

) |

|

|

Payables: |

|

|

||

|

Investments purchased |

|

1,151,725 |

|

|

|

Management fees payable |

|

(63,025 |

) |

|

|

Custody fees |

|

2,952 |

|

|

|

Accounting and administration fees |

|

1,797 |

|

|

|

Professional fees |

|

6,972 |

|

|

|

Transfer agent fees and expenses |

|

48,133 |

|

|

|

Trustee Fees |

|

12,019 |

|

|

|

Chief compliance officer fees |

|

2,083 |

|

|

|

Distribution fees |

|

(2,736 |

) |

|

|

Shareholder servicing fees |

|

(6,647 |

) |

|

|

Interest payable |

|

(59,495 |

) |

|

|

Accrued other expenses |

|

(50,401 |

) |

|

|

Net cash provided by operating activities |

|

20,198,414 |

|

|

|

Cash flows from financing activities: |

|

|

||

|

Advances from credit facility |

|

41,000,000 |

|

|

|

Repayments on credit facility |

|

(35,500,000 |

) |

|

|

Proceeds from shares sold |

|

21,663,302 |

|

|

|

Payments for shares repurchased |

|

(44,134,574 |

) |

|

|

Cash distributions paid, net of reinvestments |

|

(4,450,668 |

) |

|

|

Net cash used in financing activities |

|

(21,421,940 |

) |

|

|

Net change in cash and cash equivalents |

|

(1,223,526 |

) |

|

|

Cash and cash equivalents at beginning of year |

|

— |

|

|

|

Cash and cash equivalents at end of year |

$ |

(1,223,526 |

) |

|

|

Supplemental schedule of cash activity: |

|

|

||

|

Interest expense on borrowings |

$ |

1,258,110 |

|

|

|

Supplemental schedule of non-cash activity: |

|

|

||

|

Reinvestment of distributions |

$ |

4,144,827 |

|

1 Inclusive of securities sold short.

See accompanying Notes to Financial Statements.

14

|

Financial Highlights |

|

For a share of common stock outstanding throughout the periods indicated |

|

Period ending |

Net asset |

Net |

Net |

Total from |

Distributions |

Distributions |

Distributions |

Total |

Net asset |

Total |

Gross |

Net |

Net |

Net assets, |

Portfolio |

|||||||||||||||||||||||||||||||||||

|

Class I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

2020 |

$ |

13.81 |

$ |

0.25 |

$ |

0.02 |

|

$ |

0.27 |

|

$ |

(0.08 |

) |

$ |

— |

$ |

(0.75 |

) |

$ |

(0.83 |

) |

$ |

13.25 |

1.90 |

% |

2.98 |

% |

2.57 |

% |

1.78 |

% |

$ |

35,208 |

42 |

% |

|||||||||||||||

|

2019 |

|

14.64 |

|

0.18 |

|

(0.15 |

) |

|

0.03 |

|

|

(0.05 |

) |

|

— |

|

(0.81 |

) |

|

(0.86 |

) |

|

13.81 |

0.17 |

|

2.37 |

|

2.18 |

|

1.25 |

|

|

18,879 |

19 |

|

|||||||||||||||

|

2018 |

|

15.86 |

|

0.25 |

|

(0.54 |

) |

|

(0.29 |

) |

|

(0.23 |

) |

|

— |

|

(0.70 |

) |

|

(0.93 |

) |

|

14.64 |

(2.39 |

) |

1.79 |

|

1.57 |

|

1.64 |

|

|

5,395 |

27 |

|

|||||||||||||||

|

2017 |

|

15.24 |

|

0.42 |

|

1.15 |

|

|

1.57 |

|

|

(0.30 |

) |

|

— |

|

(0.65 |

) |

|

(0.95 |

) |

|

15.86 |

10.52 |

|

1.39 |

|

1.39 |

|

2.67 |

|

|

3,820 |

13 |

|

|||||||||||||||

|

2016 |

|

16.75 |

|

0.48 |

|

(1.03 |

) |

|

(0.55 |

) |

|

(0.40 |

) |

|

— |

|

(0.56 |

) |

|

(0.96 |

) |

|

15.24 |

(3.37 |

) |

1.33 |

|

1.33 |

|

3.09 |

|

|

7,806 |

21 |

|

|||||||||||||||

|

Class A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

2020 |

|

13.60 |

|

0.22 |

|

0.01 |

|

|

0.23 |

|

|

(0.08 |

) |

|

— |

|

(0.74 |

) |

|

(0.82 |

) |

|

13.01 |

1.59 |

|

3.23 |

|

2.82 |

|

1.60 |

|

|

78,758 |

42 |

|

|||||||||||||||

|

2019 |

|

14.45 |

|

0.32 |

|

(0.32 |

) |

|

— |

|

|

(0.05 |

) |

|

— |

|

(0.80 |

) |

|

(0.85 |

) |

|

13.60 |

(0.05 |

) |

2.56 |

|

2.37 |

|

2.25 |

|

|

113,921 |

19 |

|

|||||||||||||||

|

2018 |

|

15.67 |

|

0.22 |

|

(0.52 |

) |

|

(0.30 |

) |

|

(0.23 |

) |

|

— |

|

(0.69 |

) |

|

(0.92 |

) |

|

14.45 |

(2.56 |

) |

1.99 |

|

1.80 |

|

1.42 |

|

|

150,428 |

27 |

|

|||||||||||||||

|

2017 |

|

15.20 |

|

0.35 |

|

1.06 |

|

|

1.41 |

|

|

(0.29 |

) |

|

— |

|

(0.65 |

) |

|

(0.94 |

) |

|

15.67 |

9.48 |

|

1.66 |

|

1.66 |

|

2.25 |

|

|

168,232 |

13 |

|

|||||||||||||||

|

2016 |

|

16.74 |

|

0.46 |

|

(1.04 |

) |

|

(0.58 |

) |

|

(0.40 |

) |

|

— |

|

(0.56 |

) |

|

(0.96 |

) |

|

15.20 |

(3.57 |

) |

1.58 |

|

1.58 |

|

2.87 |

|

|

157,986 |

21 |

|

|||||||||||||||

|

Class C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

2020 |

|

13.18 |

|

0.11 |

|

0.01 |

|

|

0.12 |

|

|

(0.07 |

) |

|

— |

|

(0.71 |

) |

|

(0.78 |

) |

|

12.52 |

0.88 |

|

3.98 |

|

3.57 |

|

0.85 |

|

|

11,966 |

42 |

|

|||||||||||||||

|

2019 |

|

14.11 |

|

0.22 |

|

(0.33 |

) |

|

(0.11 |

) |

|

(0.05 |

) |

|

— |

|

(0.77 |

) |

|

(0.82 |

) |

|

13.18 |

(0.80 |

) |

3.31 |

|

3.12 |

|

1.58 |

|

|

16,451 |

19 |

|

|||||||||||||||

|

2018 |

|

15.42 |

|

0.10 |

|

(0.51 |

) |

|

(0.41 |

) |

|

(0.22 |

) |

|

— |

|

(0.68 |

) |

|

(0.90 |

) |

|

14.11 |

(3.32 |

) |

2.75 |

|

2.55 |

|

0.68 |

|

|

24,575 |

27 |

|

|||||||||||||||

|

2017 |

|

15.06 |

|

0.23 |

|

1.06 |

|

|

1.29 |

|

|

(0.28 |

) |

|

— |

|

(0.65 |

) |

|

(0.93 |

) |

|

15.42 |

8.73 |

|

2.40 |

|

2.40 |

|

1.48 |

|

|

24,585 |

13 |

|

|||||||||||||||

|

2016 |

|

16.71 |

|

0.33 |

|

(1.03 |

) |

|

(0.70 |

) |

|

(0.39 |

) |

|

— |

|

(0.56 |

) |

|

(0.95 |

) |

|

15.06 |

(4.28 |

) |

2.33 |

|

2.33 |

|

2.12 |

|

|

19,046 |

21 |

|

|||||||||||||||

|

Class T# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

2020 |

|

13.32 |

|

0.14 |

|

0.01 |

|

|

0.15 |

|

|

(0.07 |

) |

|

— |

|

(0.72 |

) |

|

(0.79 |

) |

|

12.68 |

1.10 |

|

3.73 |

|

3.32 |

|

1.09 |

|

|

3,966 |

42 |

|

|||||||||||||||

|

2019 |

|

14.21 |

|

0.25 |

|

(0.31 |

) |

|

(0.06 |

) |

|

(0.05 |

) |

|

— |

|

(0.78 |

) |

|

(0.83 |

) |

|

13.32 |

(0.46 |

) |

3.06 |

|

2.87 |

|

1.78 |

|

|

4,845 |

19 |

|

|||||||||||||||

|

2018 |

|

15.51 |

|

0.14 |

|

(0.53 |

) |

|

(0.39 |

) |

|

(0.23 |

) |

|

— |

|

(0.68 |

) |

|

(0.91 |

) |

|

14.21 |

(3.13 |

) |

2.46 |

|

2.28 |

|

0.90 |

|

|

6,570 |

27 |

|

|||||||||||||||

|

2017 |

|

15.11 |

|

0.27 |

|

1.06 |

|

|

1.33 |

|

|

(0.28 |

) |

|

— |

|

(0.65 |

) |

|

(0.93 |

) |

|

15.51 |

9.01 |

|

2.16 |

|

2.16 |

|

1.77 |

|

|

9,192 |

13 |

|

|||||||||||||||

|

2016 |

|

16.72 |

|

0.37 |

|

(1.03 |

) |

|

(0.66 |

) |

|

(0.39 |

) |

|

— |

|

(0.56 |

) |

|

(0.95 |

) |

|

15.11 |

(4.03 |

) |

2.08 |

|

2.08 |

|

2.37 |

|

|

9,143 |

21 |

|

|||||||||||||||

# As of July 1, 2019, the Fund redesignated its issued and outstanding Class L Shares as Class T Shares.

1 Based on average shares outstanding during the period.

2 Based on the net asset value as of period end. Assumes an investment at net asset value at the beginning of the period, reinvestment of all distributions during the period and does not include payment of the maximum sales charge. The return would have been lower if certain expenses had not been waived or reimbursed by the investment adviser.

See accompanying Notes to Financial Statements.

15

|

Destra Multi-Alternative Fund |

|

Financial Highlights (continued) |

|

For a share of common stock outstanding throughout the periods indicated |

3 Percentages shown include interest expense. Gross and net expense ratios, respectively, excluding interest expense are as follows:

|

Gross |

Net |

|||||||||

|

Class I |

|

|

||||||||

|

2020 |

2.11 |

% |

1.70 |

% |

||||||

|

2019 |

1.89 |

|

1.70 |

|

||||||

|

2018 |

1.76 |

|

1.55 |

|

||||||

|

2017 |

1.29 |

|

1.29 |

|

||||||

|

2016 |

1.24 |

|

1.24 |

|

||||||

|

Class A |

|

|

||||||||

|

2020 |

2.36 |

|

1.95 |

|

||||||

|

2019 |

2.14 |

|

1.95 |

|

||||||

|

2018 |

1.96 |

|

1.77 |

|

||||||

|

2017 |

1.57 |

|

1.57 |

|

||||||

|

2016 |

1.49 |

|

1.49 |

|

||||||

|

Class C |

|

|

||||||||

|

2020 |

3.11 |

|

2.70 |

|

||||||

|

2019 |

2.89 |

|

2.70 |

|

||||||

|

2018 |

2.72 |

|

2.53 |

|

||||||

|

2017 |

2.33 |

|

2.33 |

|

||||||

|

2016 |

2.24 |

|

2.24 |

|

||||||

|

Class T# |

|

|

||||||||

|

2020 |

2.86 |

|

2.45 |

|

||||||

|

2019 |

2.64 |

|

2.45 |

|

||||||

|

2018 |

2.43 |

|

2.26 |

|

||||||

|

2017 |

2.07 |

|

2.07 |

|

||||||

|

2016 |

1.99 |

|

1.99 |

|

||||||

4 The contractual fee and expense waiver is reflected in both the net expense and net investment income (loss) ratios (see Note 3)

See accompanying Notes to Financial Statements.

16

1. Organization

Destra Multi-Alternative Fund (“the Fund”), formerly known as Multi-Strategy Growth & Income Fund, was organized as a Delaware statutory trust on June 3, 2011, is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), and is a non-diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares.

The Fund currently offers Class A, Class C, Class I and Class T shares. As of July 1, 2019, the Fund redesignated its issued and outstanding Class L Shares as Class T Shares. Class A shares commenced operations on March 16, 2012; Class C, Class I and Class T shares commenced operations on July 2, 2014. Class A and Class T shares are offered at net asset value (“NAV”) plus a maximum sales charge of 5.75% and 3.00%, respectively. Class C and Class I shares are offered at NAV. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class-specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

The Fund’s investment adviser is Destra Capital Advisors LLC (the “Adviser”), the Fund’s sub-adviser is Pinhook Capital, LLC (f/k/a LCM Investment Management, LLC) (the “Sub-Adviser” and together with the Adviser are referred to herein as the “Advisers”).

The investment objective of the Fund is to seek returns from capital appreciation and income with an emphasis on income generation. The Fund pursues its investment objective by investing primarily in the income-producing securities of real estate investment trusts (“REITs”) and alternative investment funds, as well as common stocks and structured notes, notes, bonds and asset-backed securities.

2. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services — Investment Companies” including FASB Accounting Standard Update “ASU” 2013-08.

Security Valuation — Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale, such securities shall be valued at the mean of the closing bid and asked prices on the day of valuation. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at “fair value” as determined in good faith by the Fair Valuation Committee using procedures adopted by and under the supervision of the Fund’s Board of Trustees (the “Board”). There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV.

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but would not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality. Calls with the management teams of these securities are completed to gain further insight that might not be as evident through the reading of published reports or filings.

17

|

Destra Multi-Alternative Fund |

|

Notes to Financial Statements |

|

February 29, 2020 (continued) |

Often, significant back-testing or historical data analysis is employed to gain increased, tangible perspective into ways to enhance the accuracy of either existing, or potentially new fair valuation approaches. This also ensures that recent enhancements or additional methodologies are leading to more accurate valuations.

Ongoing “logic checks” and evaluations of underlying portfolios are used to identify potential disconnects between current methodologies and expected results.

The values assigned to fair valued investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Changes in the fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material.

The Fund invests in some securities which are not traded and the Fair Valuation Committee has established a methodology for the fair valuation of each type of security. Non-listed REITs that are in the public offering period (or start-up phase) are valued at cost according to the Fair Valuation Committee’s fair valuation methodology unless the REIT issues an updated valuation. The Fund generally purchases REITs at NAV or without a commission. However, startup REITs amortize a significant portion of their start-up costs and therefore, potentially carry additional risks that may impact valuation should the REIT be unable to raise sufficient capital and execute their business plan. As such, start-up REITs pose a greater risk than seasoned REITs because if they encounter going concern issues, they may see significant deviation in value from the fair value, cost basis approach as represented. Management is not aware of any information which would cause a change in cost basis valuation methodology currently being utilized for non-traded REITs in their offering period. Non-traded REITs that are in their offering period are generally categorized as Level 3 in the fair value hierarchy. Once a REIT closes to new investors, the Fund values the security based on the movement of an appropriate market index or a similar security that is publicly traded until the REIT issues an updated market valuation. Non-traded REITs that have closed to new investors are generally categorized in Level 2 of the fair value hierarchy, due to the significance of the effect of the application of the movement of the market index on the overall fair valuation of the REIT. Other non-traded private investments are monitored for any independent audits of the investment or impairments reported on the potential value of the investment.

Valuation of Fund of Funds — The Fund may invest in funds of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value using the methods established by the board of directors of the Underlying Funds. Open-end funds are valued at their NAV per share and closed-end funds that trade on an exchange are valued as described under security valuation.

For non-traded private investments, including private real estate investment trusts, non-traded partnership funds, non-listed business development companies and hedge funds, that are themselves treated as investment companies under GAAP, the Fund follows the guidance in GAAP that allows, as practical expedient, the Fund to value such investments at their reported NAV per share (or if not unitized, at an equivalent percentage of the capital of the investee entity). Such investments typically provide an updated NAV or its equivalent on a quarterly basis. The Fair Valuation Committee meets frequently to discuss the fair valuation methodology and will adjust the value of a security if there is a public update to such valuation.

Non-listed business development companies provide quarterly fair value pricing which is used as an indicator of the valuation for the Fund. If the value significantly fluctuates, the Adviser will provide an updated price. If a significant event occurs that causes a large change in price, the Fair Valuation Committee will call a meeting to evaluate the fair value.

Hedge funds provide monthly fair value pricing which is used as an indicator of the valuation for the Fund. The Fund values the security based on the movement of an appropriate market index or a similar security that is publicly traded until the hedge fund issues an updated market valuation.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

• Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

• Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

18

|

Destra Multi-Alternative Fund |

|

Notes to Financial Statements |

|

February 29, 2020 (continued) |

• Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value of a security may fall into different levels (Level 1, Level 2 or Level 3) of the fair value hierarchy. In such cases, for disclosure purposes, the level within which the fair value measurement falls, in its entirety, is determined based on the lowest level input that is significant in its entirety to the fair value measurement.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of February 29, 2020 for the Fund’s assets and liabilities measured at fair value:

|

Assets* |

|||||||||||||||

|

Investments: |

Practical |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||

|

Common Stocks |

$ |

— |

$ |

14,073,138 |

$ |

— |

$ |

— |

$ |

14,073,138 |

|||||

|

Rights |

|

|

485,750 |

|

|

|

485,750 |

||||||||

|

Real Estate Investment Trusts |

|

19,478,169 |

|

3,788,384 |

|

40,966,839 |

|

— |

|

64,233,392 |

|||||

|

Non-Listed Business Development Companies |

|

955,984 |

|

— |

|

— |

|

— |

|

955,984 |

|||||

|

Private Investment Funds |

|

49,972,031 |

|

— |

|

— |

|

— |

|

49,972,031 |

|||||

|

Closed-End Funds |

|

— |

|

11,128,871 |

|

— |

|

— |

|

11,128,871 |

|||||

|

Hedge Fund |

|

22,009,984 |

|

— |

|

— |

|

— |

|

22,009,984 |

|||||

|

Short-Term Investment |

|

— |

|

1,762,977 |

|

— |

|

— |

|

1,762,977 |

|||||

|

Total Investments |

$ |

92,416,168 |

$ |

31,239,120 |

$ |

40,966,839 |

$ |

— |

$ |

164,622,127 |

|||||

|

Liabilities* |

|||||||||||||||||

|

Investments: |

Practical |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

|

Exchange Traded Fund Sold Short |

$ |

— |

$ |

(500,500 |

) |

$ |

— |

$ |

— |

$ |

(500,500 |

) |

|||||

|

Common Stocks |

|

— |

|

(2,771,530 |

) |

|

— |

|

— |

|

(2,771,530 |

) |

|||||

|

Total Investments |

$ |

— |

$ |

(3,272,030 |

) |

$ |

— |

$ |

— |

$ |

(3,272,030 |

) |

|||||