united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22572

Destra Multi-Alternative Fund

(Exact name of registrant as specified in charter)

444 West Lake Street, Suite 1700, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

The Corporation Trust Company – Corporation Trust Center

1209 Orange Street, Wilmington, Deleware 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 2/28

Date of reporting period: 2/28/19

Item 1. Reports to Stockholders.

|

| Destra Multi-Alternative Fund |

| Annual Report |

| February 28, 2019 |

INVESTOR INFORMATION: 1-855-601-3841

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an of fer of sale or solicitation of an offer to buy shares of the Destra Multi-Alternative Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by Destra Capital Investments, LLC Member

FINRA

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website www.destracapital.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

1

Dear Shareholders,

Thank you for your investment in the Destra Multi-Alternative Fund, formerly the Multi-Strategy Growth & Income Fund. On December 1st of 2018, Destra Capital Advisors LLC (“Destra”) became the advisor of the Fund. Pinhook Capital, LLC (“Pinhook”) (formerly known as LCM Investment Management LLC) has stayed on as the Fund’s manager and sub-advisor. Destra is proud to be partnered with Pinhook on the newly renamed Destra Multi-Alternative Fund.

When we first met the investment team at Pinhook in 2017, we were impressed with the sophistication and detailed process they had to managing investments across the alternative landscape. As we worked with them through 2018 on adopting the Fund to Destra’s business platform, we had the opportunity to observe first hand Pinhook’s capabilities in sourcing, analyzing, negotiating and navigating alternative investments. Based on these experiences, we are encouraged to be working with Pinhook and believe the future for the Destra Multi-Alternative Fund, now sub-advised by Pinhook, is a bright one.

The fiscal year for the Fund, which ended on February 28, 2019, was a turbulent one in the markets. The start of the fiscal year saw significant equity volatility return to the US market on a magnitude not seen for several years. In the summer and early fall of 2018 the markets turned eerily tranquil for both US equity and debt. By the fall of last year however, the markets had gone into near free-fall, with almost every equity, debt and even alternative asset class losing value through the 4th quarter of 2018 and most ending the year negative for the calendar year. As if to confound those looking for clear trends, the markets then returned to positive results in the last two months of the Fund’s fiscal year (January & February 2019) leaving the Fund essentially flat at -0.05% for the entire fiscal period and up 3.99% for the first two months of the new calendar year.

In the report that follows, you will find performance for your Fund through the end of the fiscal year, as well as a detailed commentary from the portfolio management team at Pinhook. This commentary describes in great detail the performance of the Fund, Pinhook’s continued efforts and progress in streamlining the legacy portfolio investments, and their outlook for the remainder of 2019 . We encourage you to read this document carefully, as it is the most detailed assessment of your investment each year and holds important information for you.

As noted at the beginning of this Shareholder Letter, those of us at Destra are excited to be a part of the Destra Multi-Alternative Fund and we look forward to communicating with you again soon.

Sincerely,

Robert A. Watson, CFP®

President of Destra Capital Advisors LLC

2

Pinhook Capital Manager Discussion & Analysis

Investment Environment

The Destra Multi-Alternative Fund (the “Fund”) seeks returns from capital appreciation and income with an emphasis on income generation. The interval fund structure allows the Fund to invest a substantial amount of its capital in institutional-quality, less liquid, longer-horizon individual investments, thereby capturing the illiquidity premiums embedded in these instruments as they mature, for the benefit of the Fund’s shareholders. This structure also fits well with Pinhook Capital LLC’s multi-step, multi-phase proprietary sourcing, research and due diligence process that can stretch over months or even years.

Fiscal 2019 (March 1, 2018 – February 28, 2019) was largely a tale of two periods – the first 10 months of the Fiscal Year characterized by a tightening Federal Reserve (“Fed”), rising interest rates and fundamental headwinds for many income-oriented alternative investments. And, the final two months (2019 YTD) characterized by a neutral Fed, stable-to-falling interest rates and fundamental tailwinds for income oriented alternative investments. Periods of intermittent heightened volatility in the fixed income and equity markets added stress to the environment. In our view, the markets were in part “adjusting” to both tighter monetary policy in the U.S. and the potential for other countries to follow suit. Additionally, as the year progressed, skirmishes over trade and tariffs put a damper on global growth expectations, at least some of which were evident in the economic data. This created further uncertainty which led to significant drawdowns in nearly all asset classes at various points during the period (most notably in February, October and December of 2018). Towards year-end 2018, as the markets melted down, the Fed reversed course and indicated that it was “done” raising rates for now (maybe for the foreseeable future). In fact, the US 10-Year yield started the 2018 fiscal year at 2.86% and finished at 2.72%; however, at its intra-year peak it reached as high as 3.24%.

The relatively wide variance in interest rates caused a significant disparity amongst alternative asset classes, particularly yield-oriented ones. Public REIT and BDC markets significantly outperformed broad equities, but bonds, MLPs, preferred securities, and most commodities did not. Interestingly, BDCs are generally considered to have low duration risk due to their mainly floating rate portfolios, while REITs often have high intrinsic durations (especially those with longer lease terms), yet both areas outperformed similarly over the fiscal year. Historically, higher volatility has generally been a positive for hedge funds, so their underperformance was also somewhat surprising.

Performance Discussion

For the fiscal year ended February 28, 2019, the Fund returned -0.05% on a total return basis. We are nearing completion of the multi-year plan that was put in place several years ago to position the portfolio for long-term success, which has included rationalizing and restructuring large portions of the portfolio. You will often hear us refer to the asset dichotomy within that restructuring as “institutional” versus “legacy” (mainly public non-traded REITs and BDCs) investments.

As part of this process, from time to time, we have made decisions that have led to a short-term impact on performance in the interest of meeting the Fund’s long-term objectives. Fiscal year ended February 28, 2019 featured a deliberate and sometimes opportunistic acceleration of certain dispositions and write-downs. Please keep in mind, the largest impairments were generally one-time events that resulted in the Fund’s permanent exit from those securities (meaning they are no longer ongoing concerns). As a

3

result, we feel strongly that the process has resulted in a higher quality, more sustainable portfolio going forward. Without these efforts, the Fund would likely have faced more significant negative impacts in the future. Although such events largely offset the continuing outperformance of the best institutional investments in the Fund during the fiscal year, we believe we have reached a significant inflection point in terms of expected relative contributions to performance going forward, driven by the absolute increase and the maturing stages of new and existing institutional investment allocations.

Due to the more unique multi-asset nature of the Fund, there are limited comparable indices from which to compare performance; however, we believe that the Morningstar Diversified Alternative Total Return Index (MDATR) and Morningstar US Closed-End Multialternative Category (MUCEM) are the most relevant at this time. During the fiscal year ended February 28, 2019, the MDATR Index returned 0.70%, and the MUCEM Category was up 1.12%. While the Fund slightly underperformed both the Index and category during the Fiscal year, during longer-term periods the Fund has considerably outperformed both the MDATR index and the MUCEM category.

It is worth noting that as with most alternative investment strategies, a major objective of the Fund is to reduce volatility relative to traditional asset classes; therefore, we believe valid performance comparisons must include risk-adjusted performance metrics and not just absolute and relative returns.

Portfolio Activity

As was noted previously, milestone progress was made during the fiscal year regarding our long-term concerted but disciplined efforts to streamline the original retail-oriented portfolio, while increasing the Fund’s allocations to superior institutional investments. Through that process of active management of the portfolio within this context alone, such decisions have had a meaningful impact on portfolio quality and a measurable positive impact on performance. We have had to manage this process carefully -- we are not interested in liquidity at any price and we painstakingly assess a wide variety of potential exit strategies to increase the probability of better outcomes. As this process has largely been executed, the portfolio of legacy positions has been substantially de-risked.

During Fiscal 2019, legacy assets exposure decreased from 34.3% to 16.7% of the Fund, while institutional investments increased from 45.8% to 64.3% of the Fund. As an example, within that data we trimmed off nearly all the Fund’s remaining non-traded BDC exposure, taking it from more than $15 million to less than $2.5 million, and did so at a discount to net asset value of less than 8%. Additionally, we have been able to place these proceeds in new accretive and attractive opportunities. The increasing effects of this can already be seen in the positive performance of the Fund during the first two months of calendar year 2019.

Four new illiquid institutional investments were approved and allocated to during the fiscal year, in addition to a variety of new liquid investments. These four illiquid investments include:

| ● | An allocation to a heavily oversubscribed and institutionally renowned private equity co-investment fund, as well as potential co-investment opportunities down the road. |

| ● | Seeding a newly launched asset-backed debt fund with meaningfully negotiated preferred terms, including no management or back-end fees of any kind and an equity interest in the Fund’s general partner. |

| ● | An allocation to a highly regarded institutional credit manager’s private CLO fund. |

4

| ● | Participating significantly in the private IPO of a new REIT seeded with a portfolio of properties at or below cost, fully occupied with long-term leases and annual escalators, with greater than 11% cap rates and in a unique niche arena where there are very few competitors. |

For both shared and idiosyncratic reasons, we are extremely excited about each of these new investments. We expect all four to increase in size during 2019 and beyond through capital calls, discretionary add-on investments, and certain predefined risk-mitigating hurdles being met by the managers.

Perspective & Outlook

By many measures, economic conditions and liquidity in the US remains favorable, although most expect the U.S. economy to slow from 2.9% growth in 2018 to 2.0-2.5% in 2019. We expect that some of the slowing we will see in the first half of 2019 relates to the transitory effects of the government shutdown and spending delays related to the uncertainties surrounding global trade. In short, with the Fed on the sidelines for now, we expect economic activity to accelerate in the second half of the year, but for that growth to remain slower than what was witnessed during the prior year. Sporadic heightened volatility, particularly surrounding headline news, should persist.

Going forward, the Fed’s new stance should serve to dampen volatility overall and keep interest rates low. In our opinion, this is a generally favorable environment for higher-yielding, asset-based investment classes in general. However, we believe that sector-specificity and being able to differentiate between upper- and lower-end performers will become increasingly important. In this light, identifying outsized return potentials will become increasingly difficult in the latter stages of the economic cycle. As such, we will continue to seek out niche opportunities via best-in-class managers focused on environments with lower correlations to the domestic economy, as well as situations where we can directly negotiate substantially preferred economic terms for the Fund and further develop our co-investment sourcing network.

5

| Destra Multi-Alternative Fund |

| PORTFOLIO REVIEW (Unaudited) |

| February 28, 2019 |

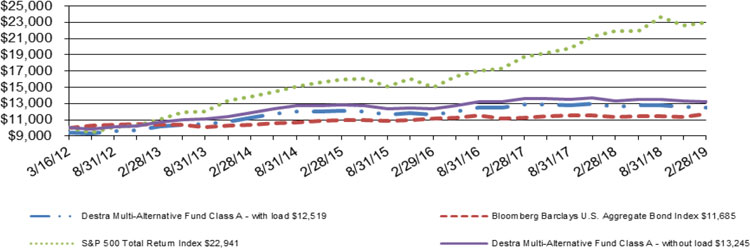

Composition of the Change in Value of a $10,000 Investment (since inception through February 28, 2019):

The Fund’s performance figures for the periods ended February 28, 2019, compared to its benchmarks:

| Annualized Since | |||||

| One | Annualized | Annualized | Annualized Since | Inception Class C, | |

| Total Returns as of February 28, 2019 | Year | Three Year | Five Year | Inception Class A* | Class I and Class L ** |

| Destra Mutli-Alternative Fund | |||||

| Class A: | |||||

| Without Load | (0.05)% | 2.34% | 2.12% | 4.11% | — |

| With Load | (5.79)% | 0.33% | 0.97% | 3.27% | — |

| Class C | (0.80)% | 1.58% | — | — | 0.51% |

| Class I | 0.17% | 2.77% | — | — | 1.54% |

| Class L: | |||||

| Without Load | (0.46)% | 1.83% | — | — | 0.77% |

| With Load | (2.45)% | 0.54% | — | — | (0.05)% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 3.17% | 1.69% | 2.32% | 2.26% | 2.19% |

| S&P 500 Total Return Index | 4.68% | 15.28% | 10.67% | 12.68% | 9.90% |

| * | Class A commenced operations on March 16, 2012. |

| ** | Class C, Class I and Class L commenced operations on July 2, 2014. |

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. The Fund’s total gross annual operating expenses, per its prospectus (“Prospectus”) dated December 7, 2018 including underlying funds, are 3.20%, 3.96%, 3.00%, and 3.67% for Class A, Class C, Class I and Class L shares, respectively. The Fund’s total net annual operating expenses, after fee waivers and/or expense reimbursements, are 2.92%, 3.66%, 2.66%, and 3.41% for Class A, Class C, Class I and Class L shares, respectively, per the Prospectus. Class A and Class L shares of the Fund are subject to a maximum sales load imposed on purchases of 5.75% and 2.00%, respectively. Class C and Class I are not subject to a sales load. The chart does not reflect the deduction of taxes that a shareholder may have to pay on Fund distributions or the redemption of the Fund shares. For performance data current to the most recent month-end, please call 1-855-601-3841.

6

| Destra Multi-Alternative Fund |

| PORTFOLIO OF INVESTMENTS |

| February 28, 2019 |

| Shares | Security | Value | ||||||

| COMMON STOCKS - 5.50% | ||||||||

| ENTERTAINMENT - 0.38% | ||||||||

| 10,988 | Cedar Fair LP | $ | 582,364 | |||||

| LISTED BUSINESS DEVELOPMENT COMPANIES - 2.35% | ||||||||

| 25,194 | Ares Capital Corp. | 436,360 | ||||||

| 51,792 | BlackRock Capital Investment Corp. | 323,182 | ||||||

| 30,782 | FS Investment Corp. | 199,775 | ||||||

| 33,990 | Garrison Capital, Inc. | 254,245 | ||||||

| 24,505 | Golub Capital BDC, Inc. | 452,117 | ||||||

| 17,971 | New Mountain Finance Corp. | 248,898 | ||||||

| 27,634 | PennantPark Floating Rate Capital Ltd. | 362,006 | ||||||

| 27,852 | TPG Specialty Lending, Inc. | 560,939 | ||||||

| 27,527 | TriplePoint Venture Growth BDC Corp. | 350,143 | ||||||

| 32,516 | WhiteHorse Finance, Inc. | 438,966 | ||||||

| 3,626,631 | ||||||||

| PIPELINES - 0.28% | ||||||||

| 4,585 | Buckeye Partners LP | 144,336 | ||||||

| 19,618 | Enable Midstream Partners LP | 291,720 | ||||||

| 436,056 | ||||||||

| PRIVATE EQUITY - 1.34% | ||||||||

| 30,249 | Hercules Capital, Inc. | 423,486 | ||||||

| 14,289 | Icahn Enterprises LP | 1,061,530 | ||||||

| 32,700 | The Carlyle Group LP | 579,117 | ||||||

| 2,064,133 | ||||||||

| SEMICONDUCTORS - 1.15% | ||||||||

| 19,400 | NXP Semiconductors NV | 1,771,608 | ||||||

| TOTAL COMMON STOCKS | 8,480,792 | |||||||

| (Cost - $9,212,150) | ||||||||

| EXCHANGE TRADED FUND - 0.38% | ||||||||

| 12,500 | KraneShares CSI China Internet ETF | 585,500 | ||||||

| TOTAL EXCHANGE TRADED FUND | ||||||||

| (Cost - $510,730) | ||||||||

| EXCHANGE TRADED NOTE - 0.57% | ||||||||

| 100,000 | Credit Suisse X-Links Gold Shares Covered Call ETN | 874,000 | ||||||

| TOTAL EXCHANGE TRADED NOTE | ||||||||

| (Cost - $929,130) | ||||||||

| REAL ESTATE INVESTMENT TRUSTS - 45.33% | ||||||||

| LISTED REAL ESTATE INVESTMENT TRUSTS - 5.56% | ||||||||

| 40,800 | American Campus Communities, Inc. | 1,838,448 | ||||||

| 175,103 | American Finance Trust | 1,892,863 | ||||||

| 125,685 | Colony Credit Real Estate, Inc. | 2,190,690 | ||||||

| 20,000 | CoreCivic, Inc. | 423,600 | ||||||

| 19,440 | CyrusOne, Inc. | 968,890 | ||||||

| 45,000 | Granite Point Mortgage Trust, Inc. | 855,900 | ||||||

| 17,450 | The GEO Group, Inc. | 396,464 | ||||||

| TOTAL LISTED REAL ESTATE INVESTMENT TRUSTS | 8,566,855 | |||||||

| NON-LISTED REAL ESTATE INVESTMENT TRUSTS - 17.76% | ||||||||

| 228,122 | Carey Watermark Investors, Inc. # | 2,354,093 | ||||||

| 290,378 | Healthcare Trust, Inc. # | 6,132,652 | ||||||

| 456,540 | Hospitality Investor Trust, Inc. # * | 6,277,128 | ||||||

| 1,081,081 | NorthStar Health Care Income, Inc. # | 8,029,589 | ||||||

| 764,346 | N1 Liquidating Trust # | 557,973 | ||||||

| 388,931 | Steadfast Income REIT, Inc. # | 4,009,301 | ||||||

| TOTAL NON-LISTED REAL ESTATE INVESTMENT TRUSTS | 27,360,736 | |||||||

See accompanying notes to financial statements.

7

| Destra Multi-Alternative Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| February 28, 2019 |

| Shares | Security | Value | ||||||

| PRIVATE REAL ESTATE INVESTMENT TRUSTS - 22.01% | ||||||||

| 7,354 | Clarion Lion Industrial Trust # | $ | 14,000,181 | |||||

| 661,928 | Cottonwood Residential, Inc. # | 12,411,150 | ||||||

| 375,000 | Treehouse Real Estate Investment Trust, Inc. # | 7,500,000 | ||||||

| TOTAL PRIVATE REAL ESTATE INVESTMENT TRUSTS | 33,911,331 | |||||||

| TOTAL REAL ESTATE INVESTMENT TRUSTS | 69,838,922 | |||||||

| (Cost - $58,327,086) | ||||||||

| NON-LISTED BUSINESS DEVELOPMENT COMPANIES - 1.58% | ||||||||

| 278,101 | Cion Investment Corp. # (Cost - $2,682,559) | 2,430,600 | ||||||

| PRIVATE BUSINESS DEVELOPMENT COMPANIES - 5.23% | ||||||||

| 534,081 | Owl Rock Capital Corp. # (Cost - $8,187,532) | 8,064,627 | ||||||

| PRIVATE INVESTMENT FUNDS - 29.10% | ||||||||

| 15 | AIM Infrastructure MLP Fund II LP # | 4,206,678 | ||||||

| 250 | Arboretum Core Asset Fund, L.P. # | 2,490,517 | ||||||

| 9,910 | Clarion Lion Properties Fund # | 14,890,765 | ||||||

| 2 | Levine Leichtman Capital Partners VI, LP # | 2,627,344 | ||||||

| 9,076 | Mosaic Real Estate Credit, LLC # | 10,147,147 | ||||||

| 3 | Ovation Alternative Income Fund # | 7,787,072 | ||||||

| 1 | Stepstone Capital Partners IV, L.P. # | 2,695,688 | ||||||

| TOTAL PRIVATE INVESTMENT FUNDS | 44,845,211 | |||||||

| (Cost - $43,736,124) | ||||||||

| CLOSED-END FUNDS - 9.54% | ||||||||

| 12,000 | Altaba, Inc. * | 895,080 | ||||||

| 92,641 | Apollo Tactical Income Fund, Inc. | 1,365,528 | ||||||

| 125,086 | BlackRock Debt Strategies Fund, Inc. | 1,348,427 | ||||||

| 114,153 | BlackRock Multi-Sector Income Trust | 1,912,063 | ||||||

| 58,623 | Blackstone/GSO Long-Short Credit Income Fund | 916,864 | ||||||

| 53,000 | Brookfield Real Assets Income Fund, Inc. | 1,131,550 | ||||||

| 98,042 | DoubleLine Income Solutions Fund | 1,937,310 | ||||||

| 40,000 | First Trust Energy Income and Growth Fund | 808,400 | ||||||

| 65,009 | Flaherty & Crumrine Dynamic Preferred and Income | 1,519,260 | ||||||

| 71,536 | John Hancock Premium Dividend Fund | 1,162,460 | ||||||

| 26,800 | Morgan Stanley China A Share Fund, Inc. | 610,504 | ||||||

| 78,964 | Western Asset Emerging Markets Debt Fund, Inc. | 1,097,600 | ||||||

| TOTAL CLOSED-END FUNDS | 14,705,046 | |||||||

| (Cost - $15,231,403) | ||||||||

| HEDGE FUND - 17.71% | ||||||||

| 24,744 | Collins Master Access Fund Ltd. # * | 27,294,495 | ||||||

| TOTAL HEDGE FUNDS | ||||||||

| (Cost - $25,002,167) | ||||||||

See accompanying notes to financial statements.

8

| Destra Multi-Alternative Fund |

| PORTFOLIO OF INVESTMENTS (Continued) |

| February 28, 2019 |

| Shares | Security | Value | ||||||

| SHORT-TERM INVESTMENT - 0.42% | ||||||||

| MONEY MARKET FUND - 0.42% | ||||||||

| 639,801 | Fidelity Investments Money Market Funds - Treasury Portfolio, Class I, 2.07% + | $ | 639,801 | |||||

| TOTAL SHORT-TERM INVESTMENT | ||||||||

| (Cost - $639,801) | ||||||||

| TOTAL INVESTMENTS - 115.36% | ||||||||

| (Cost - $164,458,682) | $ | 177,758,994 | ||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (15.36)% | (23,662,675 | ) | ||||||

| NET ASSETS - 100.00 % | $ | 154,096,319 | ||||||

LLC - Limited Liability Company

LP - Limited Partnership

NV - Naamloze Vennootschap

REIT - Real Estate Investment Trust

| * | Non-income producing security. |

| # | Fair Value estimated using Fair Valuation Procedures adopted by the Board of Trustees. Total value of such securities is $143,907,000 or 93.40% of net assets. |

| + | Money market fund; interest rate reflects the seven-day effective yield on February 28, 2019. |

| Portfolio Composition as of February 28, 2019 | ||||

| Percent of Net Assets | ||||

| Private Investment Funds | 29.10 | % | ||

| Real Estate Investment Trusts | ||||

| Private Real Estate Investment Trusts | 22.01 | % | ||

| Non-Listed Real Estate Investment Trusts | 17.76 | % | ||

| Listed Real Estate Investment Trusts | 5.56 | % | ||

| Hedge Fund | 17.71 | % | ||

| Closed End Funds | 9.54 | % | ||

| Private Business Development Companies | 5.23 | % | ||

| Listed Business Development Companies | 2.35 | % | ||

| Non-Listed Business Development Companies | 1.58 | % | ||

| Private Equity | 1.34 | % | ||

| Semiconductors | 1.15 | % | ||

| Exchange Traded Note | 0.57 | % | ||

| Short-term Investment | 0.42 | % | ||

| Exchange Traded Fund | 0.38 | % | ||

| Entertainment | 0.38 | % | ||

| Pipelines | 0.28 | % | ||

| Liabilities In Excess Of Other Assets | (15.36 | )% | ||

| Net Assets | 100.00 | % | ||

See accompanying notes to financial statements.

9

| Destra Multi-Alternative Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| February 28, 2019 |

| Assets: | ||||

| Investments in Securities, at Value (identified cost $164,458,682) | $ | 177,758,994 | ||

| Dividends and Interest Receivable | 489,093 | |||

| Receivable for Fund Shares Sold | 20,509 | |||

| Prepaid Expenses and Other Assets | 42,230 | |||

| Total Assets | 178,310,826 | |||

| Liabilities: | ||||

| Line of Credit Payable | 23,800,000 | |||

| Interest Payable | 159,619 | |||

| Accrued Advisory Fees (1) | 138,266 | |||

| Distribution Fee Payable | 11,752 | |||

| Payable to Related Parties (1) | 28,340 | |||

| Shareholder Servicing Fees Payable | 26,150 | |||

| Other Accrued Expenses | 50,380 | |||

| Total Liabilities | 24,214,507 | |||

| Net Assets | $ | 154,096,319 | ||

| Composition of Net Assets: | ||||

| At February 28, 2019, Net Assets consisted of: | ||||

| Paid-in-Capital | $ | 148,992,974 | ||

| Accumulated earnings | 5,103,345 | |||

| Net Assets | $ | 154,096,319 |

| (1) | See Note 3. |

See accompanying notes to financial statements.

10

| Destra Multi-Alternative Fund |

| STATEMENT OF ASSETS AND LIABILITIES (Continued) |

| February 28, 2019 |

| Class A Shares: | ||||

| Net Assets | $ | 113,920,981 | ||

| Shares Outstanding (no par value; unlimited number of shares authorized) | 8,377,714 | |||

| Net Asset Value and Redemption Price Per Share * | $ | 13.60 | ||

| Offering Price Per Share ($13.60/0.9425) | $ | 14.43 | ||

| Class C Shares: | ||||

| Net Assets | $ | 16,451,492 | ||

| Shares Outstanding (no par value; unlimited number of shares authorized) | 1,248,431 | |||

| Net Asset Value, Offering Price and Redemption Price Per Share * | $ | 13.18 | ||

| Class I Shares: | ||||

| Net Assets | $ | 18,878,520 | ||

| Shares Outstanding (no par value; unlimited number of shares authorized) | 1,366,652 | |||

| Net Asset Value, Offering Price and Redemption Price Per Share * | $ | 13.81 | ||

| Class L Shares: | ||||

| Net Assets | $ | 4,845,326 | ||

| Shares Outstanding (no par value; unlimited number of shares authorized) | 363,832 | |||

| Net Asset Value and Redemption Price Per Share * | $ | 13.32 | ||

| Offering Price Per Share ($13.32/0.98) | $ | 13.59 | ||

| * | The Net Asset Value for each class will differ due primarily to the allocation of class specific expenses, such as distribution fees and shareholder servicing fees. |

See accompanying notes to financial statements.

11

| Destra Multi-Alternative Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended February 28, 2019 |

| Investment Income: | ||||

| Dividend Income | $ | 7,752,889 | ||

| Interest Income | 42,676 | |||

| Total Investment Income | 7,795,565 | |||

| Expenses: | ||||

| Investment Advisory Fees | 2,310,044 | |||

| Shareholder Servicing Fees: | ||||

| Class A | 335,384 | |||

| Class C | 53,337 | |||

| Class L | 14,323 | |||

| Distribution Fees: | ||||

| Class C | 160,011 | |||

| Class L | 28,646 | |||

| Interest Expense | 720,665 | |||

| Trustees’ Fees and Expenses | 163,947 | |||

| Administration Fees | 148,915 | |||

| Transfer Agent Fees | 136,076 | |||

| Legal Fees | 96,003 | |||

| Audit Fees | 80,131 | |||

| Printing Expense | 73,233 | |||

| Registration & Filing Fees | 67,126 | |||

| Fund Accounting Fees | 59,096 | |||

| Compliance Fees | 39,472 | |||

| Non 12b-1 Shareholder Servicing | 32,103 | |||

| Custody Fees | 13,669 | |||

| Insurance Expense | 11,603 | |||

| Miscellaneous Expenses | 1,784 | |||

| Total Expenses | 4,545,568 | |||

| Less: Fees Waived by Advisor | (327,457 | ) | ||

| Net Expenses | 4,218,111 | |||

| Net Investment Income | 3,577,454 | |||

| Net Realized and Unrealized Gain (Loss) on Investments: | ||||

| Net Realized Gain (Loss) on: | ||||

| Investments | (6,664,232 | ) | ||

| Distributions of realized gain from underlying investments | 88,473 | |||

| Total Net Realized Loss | (6,575,759 | ) | ||

| Net Change in Unrealized Appreciation on: | ||||

| Investments | 2,920,497 | |||

| Total Net Change in Unrealized Appreciation | 2,920,497 | |||

| Net Realized and Unrealized Loss on Investments | (3,655,262 | ) | ||

| Net Decrease in Net Assets Resulting From Operations | $ | (77,808 | ) |

See accompanying notes to financial statements.

12

| Destra Multi-Alternative Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the Year | For the Year | |||||||

| Ended | Ended | |||||||

| February 28, 2019 | February 28, 2018 | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 3,577,454 | $ | 2,679,368 | ||||

| Net Realized Gain (Loss) on Investments | (6,664,232 | ) | 3,712,686 | |||||

| Distributions of Realized Gain from | ||||||||

| Underlying Investments | 88,473 | 55,588 | ||||||

| Net Change in Unrealized Appreciation | ||||||||

| (Depreciation) on Investments | 2,920,497 | (10,476,098 | ) | |||||

| Net Decrease in Net Assets | ||||||||

| Resulting From Operations | (77,808 | ) | (4,028,456 | ) | ||||

| Distributions to Shareholders From: | ||||||||

| Total distributions paid * | ||||||||

| Class A | (534,638 | ) | — | |||||

| Class C | (90,458 | ) | — | |||||

| Class I | (20,369 | ) | — | |||||

| Class L | (23,785 | ) | — | |||||

| (669,250 | ) | — | ||||||

| Net Investment Income | ||||||||

| Class A | — | (2,478,355 | ) | |||||

| Class C | — | (374,832 | ) | |||||

| Class I | — | (58,872 | ) | |||||

| Class L | — | (133,920 | ) | |||||

| Total from Net Investment Income | — | (3,045,979 | ) | |||||

| Return of Capital | ||||||||

| Class A | (7,383,979 | ) | (7,422,228 | ) | ||||

| Class C | (1,162,373 | ) | (1,192,608 | ) | ||||

| Class I | (608,511 | ) | (214,883 | ) | ||||

| Class L | (313,618 | ) | (352,090 | ) | ||||

| Total from Return of Capital | (9,468,481 | ) | (9,181,809 | ) | ||||

| Total Distributions to Shareholders | $ | (10,137,731 | ) | $ | (12,227,788 | ) | ||

| * | Distributions from net investment income and net realized capital gains are combined for the year ended February 28, 2019. See “New Accounting Pronouncements” in the Notes to Financial Statements for more information. The dividends and distributiions to shareholders for the year ended February 28, 2018 have not been reclassified to conform to the current year presentation. |

See accompanying notes to financial statements.

13

| Destra Multi-Alternative Fund |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| For the Year | For the Year | |||||||

| Ended | Ended | |||||||

| February 28, 2019 | February 28, 2018 | |||||||

| From Shares of Beneficial Interest: | ||||||||

| Class A Shares: | ||||||||

| Proceeds from Shares Issued (278,673 and 741,421 shares, respectively) | $ | 3,962,542 | $ | 11,450,602 | ||||

| Distributions Reinvested (293,832 and 375,221 shares, respectively) | 4,140,233 | 5,720,058 | ||||||

| Cost of Shares Redeemed (1,989,225 and 1,375,715 shares, respectively) | (28,125,531 | ) | (21,100,354 | ) | ||||

| Proceeds from Shares Transferred (536 and 1,364 shares, respectively) | 7,578 | 21,262 | ||||||

| Cost of Shares Transferred (619,661 and 61,827 shares, respectively) | (8,704,497 | ) | (910,352 | ) | ||||

| Total From Capital Transactions: Class A | (28,719,675 | ) | (4,818,784 | ) | ||||

| Class C Shares: | ||||||||

| Proceeds from Shares Issued (93,295 and 314,032 shares, respectively) | 1,307,718 | 4,749,354 | ||||||

| Distributions Reinvested (51,938 and 59,771 shares, respectively) | 711,966 | 892,131 | ||||||

| Cost of Shares Redeemed (360,011 and 206,054 shares, respectively) | (4,972,544 | ) | (3,086,017 | ) | ||||

| Cost of Shares Transferred (278,310 and 20,835 shares, respectively) | (3,765,310 | ) | (310,920 | ) | ||||

| Total From Capital Transactions: Class C | (6,718,170 | ) | 2,244,548 | |||||

| Class I Shares: | ||||||||

| Proceeds from Shares Issued (282,440 and 181,501 shares, respectively) | 4,022,642 | 2,814,493 | ||||||

| Distributions Reinvested (17,804 and 6,832 shares, respectively) | 250,790 | 104,979 | ||||||

| Cost of Shares Redeemed (197,947 and 140,629 shares, respectively) | (2,854,486 | ) | (2,174,192 | ) | ||||

| Proceeds from Shares Transferred (895,872 and 79,844 shares, respectively) | 12,734,148 | 1,200,010 | ||||||

| Total From Capital Transactions: Class I | 14,153,094 | 1,945,290 | ||||||

| Class L Shares: | ||||||||

| Proceeds from Shares Issued (9,752 and 20,138 shares, respectively) | 134,721 | 308,409 | ||||||

| Distributions Reinvested (12,798 and 19,046 shares, respectively) | 177,046 | 286,942 | ||||||

| Cost of Shares Redeemed (100,927 and 169,591 shares, respectively) | (1,411,323 | ) | (2,571,832 | ) | ||||

| Cost of Shares Transferred (20,225 and 0 shares, respectively) | (271,919 | ) | — | |||||

| Total From Capital Transactions: Class L | (1,371,475 | ) | (1,976,481 | ) | ||||

| Total Decrease in Net Assets from Shares of Beneficial Interest: | (22,656,226 | ) | (2,605,427 | ) | ||||

| Total Decrease in Net Assets | (32,871,765 | ) | (18,861,671 | ) | ||||

| Net Assets: | ||||||||

| Beginning of Year | 186,968,084 | 205,829,755 | ||||||

| End of Year ** | $ | 154,096,319 | $ | 186,968,084 | ||||

| ** | Net Assets - End of Year includes accumulated net investment income of $1,307,764 as of February 28, 2018. |

See accompanying notes to financial statements.

14

| Destra Multi-Alternative Fund |

| STATEMENT OF CASH FLOWS |

| For the Year Ended February 28, 2019 |

| Cash flows from operating activities: | ||||

| Net decrease in net assets resulting from operations | $ | (77,808 | ) | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | ||||

| Purchases of investments | (36,067,105 | ) | ||

| Proceeds from sales | 51,164,049 | |||

| Purchases of short term investments, net | 69,318 | |||

| Return of capital from investments | 2,833,058 | |||

| Net realized loss from investments | 6,664,232 | |||

| Net change in unrealized appreciation from investments | (2,920,497 | ) | ||

| Changes in assets and liabilities (Increase)/Decrease in assets: | ||||

| Dividends and Interest Receivable | 2,416,826 | |||

| Receivable for Securities Sold | 304,404 | |||

| Receivable for Fund Shares Sold | 61,408 | |||

| Prepaid Expenses and Other Assets | (3,498 | ) | ||

| Increase/(Decrease) in liabilities: | ||||

| Accrued Advisory Fees | 59,895 | |||

| Interest Payable | 110,464 | |||

| Shareholder Servicing Fee | (9,112 | ) | ||

| Payable to Related Parties | (4,318 | ) | ||

| Distribution Fee Payable | (16,015 | ) | ||

| Other Accrued Expenses Payable | (91,344 | ) | ||

| Net cash provided by operating activities | 24,493,957 | |||

| Cash flows from financing activities: | ||||

| Gross additions to line of credit | 36,000,000 | |||

| Gross payments of principal to line of credit | (27,700,000 | ) | ||

| Proceeds from shares sold | 9,427,623 | |||

| Payment on shares redeemed | (37,363,884 | ) | ||

| Cash distributions paid | (4,857,696 | ) | ||

| Net cash used in financing activities | (24,493,957 | ) | ||

| Net increase in cash | — | |||

| Cash at beginning of year | — | |||

| Cash at end of year | $ | — | ||

| Supplemental disclosure of non-cash activity: | ||||

| Noncash financing activities not including herein consists of: | ||||

| Reinvestment of dividends | $ | 5,280,035 | ||

| Interest Paid | $ | 610,201 |

See accompanying notes to financial statements.

15

| Destra Multi-Alternative Fund - Class A |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each year presented.

| For the Year | For the Year | For the Year | For the Year | For the Year | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| February 28, 2019 | February 28, 2018 | February 28, 2017 | February 29, 2016 | February 28, 2015 | ||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 14.45 | $ | 15.67 | $ | 15.20 | $ | 16.74 | $ | 16.51 | ||||||||||

| From Operations: | ||||||||||||||||||||

| Net investment income (a) | 0.32 | 0.22 | 0.35 | 0.46 | 0.41 | |||||||||||||||

| Net gain (loss) on investments (both realized and unrealized) | (0.32 | ) | (0.52 | ) | 1.06 | (1.04 | ) | 0.80 | ||||||||||||

| Total from Operations | — | (0.30 | ) | 1.41 | (0.58 | ) | 1.21 | |||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.05 | ) | (0.23 | ) | (0.29 | ) | (0.40 | ) | (0.40 | ) | ||||||||||

| From net realized gains on investments | — | — | — | — | (0.37 | ) | ||||||||||||||

| From paid in capital | (0.80 | ) | (0.69 | ) | (0.65 | ) | (0.56 | ) | (0.21 | ) | ||||||||||

| Total Distributions | (0.85 | ) | (0.92 | ) | (0.94 | ) | (0.96 | ) | (0.98 | ) | ||||||||||

| Net Asset Value, End of Year | $ | 13.60 | $ | 14.45 | $ | 15.67 | $ | 15.20 | $ | 16.74 | ||||||||||

| Total Return (b) | (0.05 | )% | (2.56 | )% | 9.48 | % (h) | (3.57 | )% (h) | 7.46 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (in 000’s) | $ | 113,921 | $ | 150,428 | $ | 168,232 | $ | 157,986 | $ | 178,502 | ||||||||||

| Ratio to average net assets: | ||||||||||||||||||||

| Expenses, Gross (c)(f) | 2.56 | % | 1.99 | % | 1.66 | % | 1.58 | % | 1.55 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(f) | 2.37 | % | 1.80 | % | 1.66 | % | 1.58 | % | 1.61 | % (e) | ||||||||||

| Net investment income, Net of Reimbursement/Recapture (c)(g) | 2.25 | % | 1.42 | % | 2.25 | % | 2.87 | % | 2.43 | % | ||||||||||

| Ratio to average net assets (excluding interest expense): | ||||||||||||||||||||

| Expenses, Gross (c)(f) | 2.14 | % | 1.96 | % | 1.57 | % | 1.49 | % | 1.55 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(f) | 1.95 | % | 1.77 | % | 1.57 | % | 1.49 | % | 1.61 | % (e) | ||||||||||

| Portfolio turnover rate | 19 | % | 27 | % | 13 | % | 21 | % | 49 | % | ||||||||||

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any and exclude the effects of sales loads. Total returns for periods less than one year are not annualized. |

| (c) | Annualized for periods less than one year. |

| (d) | Not annualized. |

| (e) | Such ratio includes the Advisor’s recapture of waived/reimbursed fees from prior periods. |

| (f) | Does not include the expenses of the investment companies in which the Fund invests. |

| (g) | The recognition of investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (h) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

16

| Destra Multi-Alternative Fund - Class C |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented.

| For the Year | For the Year | For the Year | For the Year | For the Period | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| February 28, 2019 | February 28, 2018 | February 28, 2017 | February 29, 2016 | February 28, 2015 * | ||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 14.11 | $ | 15.42 | $ | 15.06 | $ | 16.71 | $ | 17.02 | ||||||||||

| From Operations: | ||||||||||||||||||||

| Net investment income (a) | 0.22 | 0.10 | 0.23 | 0.33 | 0.18 | |||||||||||||||

| Net gain (loss) on investments (both realized and unrealized) | (0.33 | ) | (0.51 | ) | 1.06 | (1.03 | ) | 0.16 | ||||||||||||

| Total from Operations | (0.11 | ) | (0.41 | ) | 1.29 | (0.70 | ) | 0.34 | ||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.05 | ) | (0.22 | ) | (0.28 | ) | (0.39 | ) | (0.12 | ) | ||||||||||

| From net realized gains on investments | — | — | — | — | (0.35 | ) | ||||||||||||||

| From return of capital | (0.77 | ) | (0.68 | ) | (0.65 | ) | (0.56 | ) | (0.18 | ) | ||||||||||

| Total Distributions | (0.82 | ) | (0.90 | ) | (0.93 | ) | (0.95 | ) | (0.65 | ) | ||||||||||

| Net Asset Value, End of Period | $ | 13.18 | $ | 14.11 | $ | 15.42 | $ | 15.06 | $ | 16.71 | ||||||||||

| Total Return (b) | (0.80 | )% | (3.32 | )% | 8.73 | % (g) | (4.28 | )% (g) | 2.04 | % (d) | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 16,451 | $ | 24,575 | $ | 24,585 | $ | 19,046 | $ | 10,926 | ||||||||||

| Ratio to average net assets: | ||||||||||||||||||||

| Expenses, Gross (c)(e) | 3.31 | % | 2.75 | % | 2.40 | % | 2.33 | % | 2.30 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(e) | 3.12 | % | 2.55 | % | 2.40 | % | 2.33 | % | 2.30 | % | ||||||||||

| Net investment income (c)(f) | 1.58 | % | 0.68 | % | 1.48 | % | 2.12 | % | 1.76 | % | ||||||||||

| Ratio to average net assets (excluding interest expense) | ||||||||||||||||||||

| Expenses, Gross (c)(e) | 2.89 | % | 2.72 | % | 2.33 | % | 2.24 | % | 2.30 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(e) | 2.70 | % | 2.53 | % | 2.33 | % | 2.24 | % | 2.30 | % | ||||||||||

| Portfolio turnover rate | 19 | % | 27 | % | 13 | % | 21 | % | 49 | % (d) | ||||||||||

| * | Class C commenced operations on July 2, 2014. |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Total returns for periods less than one year are not annualized. |

| (c) | Annualized for periods less than one year. |

| (d) | Not annualized. |

| (e) | Does not include the expenses of the investment companies in which the Fund invests. |

| (f) | The recognition of investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

17

| Destra Multi-Alternative Fund - Class I |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented.

| For the Year | For the Year | For the Year | For the Year | For the Period | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| February 28, 2019 | February 28, 2018 | February 28, 2017 | February 29, 2016 | February 28, 2015 * | ||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 14.64 | $ | 15.86 | $ | 15.24 | $ | 16.75 | $ | 17.02 | ||||||||||

| From Operations: | ||||||||||||||||||||

| Net investment income (a) | 0.18 | 0.25 | 0.42 | 0.48 | 0.30 | |||||||||||||||

| Net gain (loss) on investments (both realized and unrealized) | (0.15 | ) | (0.54 | ) | 1.15 | (1.03 | ) | 0.09 | ||||||||||||

| Total from Operations | 0.03 | (0.29 | ) | 1.57 | (0.55 | ) | 0.39 | |||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.05 | ) | (0.23 | ) | (0.30 | ) | (0.40 | ) | (0.06 | ) | ||||||||||

| From net realized gains on investments | — | — | — | — | (0.37 | ) | ||||||||||||||

| From return of capital | (0.81 | ) | (0.70 | ) | (0.65 | ) | (0.56 | ) | (0.23 | ) | ||||||||||

| Total Distributions | (0.86 | ) | (0.93 | ) | (0.95 | ) | (0.96 | ) | (0.66 | ) | ||||||||||

| Net Asset Value, End of Period | $ | 13.81 | $ | 14.64 | $ | 15.86 | $ | 15.24 | $ | 16.75 | ||||||||||

| Total Return (b) | 0.17 | % | (2.39 | )% | 10.52 | % (g) | (3.37 | )% (g) | 2.37 | % (d) | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 18,879 | $ | 5,395 | $ | 3,820 | $ | 7,806 | $ | 1,185 | ||||||||||

| Ratio to average net assets: | ||||||||||||||||||||

| Expenses, Gross (c)(e) | 2.37 | % | 1.79 | % | 1.39 | % | 1.33 | % | 1.30 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(e) | 2.18 | % | 1.57 | % | 1.39 | % | 1.33 | % | 1.30 | % | ||||||||||

| Net investment income (c)(f) | 1.25 | % | 1.64 | % | 2.67 | % | 3.09 | % | 2.80 | % | ||||||||||

| Ratio to average net assets (excluding interest expense) | ||||||||||||||||||||

| Expenses, Gross (c)(e) | 1.89 | % | 1.76 | % | 1.29 | % | 1.24 | % | 1.30 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(e) | 1.70 | % | 1.55 | % | 1.29 | % | 1.24 | % | 1.30 | % | ||||||||||

| Portfolio turnover rate | 19 | % | 27 | % | 13 | % | 21 | % | 49 | % (d) | ||||||||||

| * | Class I commenced operations on July 2, 2014. |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Total returns for periods less than one year are not annualized. |

| (c) | Annualized for periods less than one year. |

| (d) | Not annualized. |

| (e) | Does not include the expenses of the investment companies in which the Fund invests. |

| (f) | The recognition of investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

18

| Destra Multi-Alternative Fund - Class L |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented.

| For the Year | For the Year | For the Year | For the Year | For the Period | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| February 28, 2019 | February 28, 2018 | February 28, 2017 | February 29, 2016 | February 28, 2015 * | ||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 14.21 | $ | 15.51 | $ | 15.11 | $ | 16.72 | $ | 17.02 | ||||||||||

| From Operations: | ||||||||||||||||||||

| Net investment income (a) | 0.25 | 0.14 | 0.27 | 0.37 | 0.20 | |||||||||||||||

| Net gain (loss) on investments (both realized and unrealized) | (0.31 | ) | (0.53 | ) | 1.06 | (1.03 | ) | 0.17 | ||||||||||||

| Total from Operations | (0.06 | ) | (0.39 | ) | 1.33 | (0.66 | ) | 0.37 | ||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.05 | ) | (0.23 | ) | (0.28 | ) | (0.39 | ) | (0.13 | ) | ||||||||||

| From net realized gains on investments | — | — | — | — | (0.35 | ) | ||||||||||||||

| From return of capital | (0.78 | ) | (0.68 | ) | (0.65 | ) | (0.56 | ) | (0.19 | ) | ||||||||||

| Total Distributions | (0.83 | ) | (0.91 | ) | (0.93 | ) | (0.95 | ) | (0.67 | ) | ||||||||||

| Net Asset Value, End of Period | $ | 13.32 | $ | 14.21 | $ | 15.51 | $ | 15.11 | $ | 16.72 | ||||||||||

| Total Return (b) | (0.46 | )% | (3.13 | )% | 9.01 | % (g) | (4.03 | )% (g) | 2.25 | % (d) | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of period (in 000’s) | $ | 4,845 | $ | 6,570 | $ | 9,192 | $ | 9,143 | $ | 8,356 | ||||||||||

| Ratio to average net assets: | ||||||||||||||||||||

| Expenses, Gross (c)(e) | 3.06 | % | 2.46 | % | 2.16 | % | 2.08 | % | 2.05 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(e) | 2.87 | % | 2.28 | % | 2.16 | % | 2.08 | % | 2.05 | % | ||||||||||

| Net investment income (c)(f) | 1.78 | % | 0.90 | % | 1.77 | % | 2.37 | % | 2.00 | % | ||||||||||

| Ratio to average net assets (excluding interest expense) | ||||||||||||||||||||

| Expenses, Gross (c)(e) | 2.64 | % | 2.43 | % | 2.07 | % | 1.99 | % | 2.05 | % | ||||||||||

| Expenses, Net of Reimbursement/Recapture (c)(e) | 2.45 | % | 2.26 | % | 2.07 | % | 1.99 | % | 2.05 | % | ||||||||||

| Portfolio turnover rate | 19 | % | 27 | % | 13 | % | 21 | % | 49 | % (d) | ||||||||||

| * | Class L commenced operations on July 2, 2014. |

| (a) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any and exclude the effects of sales loads. Total returns for periods less than one year are not annualized. |

| (c) | Annualized for periods less than one year. |

| (d) | Not annualized. |

| (e) | Does not include the expenses of the investment companies in which the Fund invests. |

| (f) | The recognition of investment income is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

See accompanying notes to financial statements.

19

| Destra Multi-Alternative Fund |

| NOTES TO FINANCIAL STATEMENTS |

| February 28, 2019 |

| 1. | ORGANIZATION |

Destra Multi-Alternative Fund (“the Fund”), formerly known as Multi-Strategy Growth & Income Fund, was organized as a Delaware statutory trust on June 3, 2011, is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), and is a non-diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The investment objective of the Fund is to seek returns from capital appreciation and income with an emphasis on income generation. The Fund pursues its investment objective by investing primarily in the income-producing securities of real estate investment trusts (“REITs”) and alternative investment funds, as well as common stocks and structured notes, notes, bonds and asset-backed securities.

The Fund currently offers Class A, Class C, Class I and Class L shares. Class A shares commenced operations on March 16, 2012; Class C, Class I and Class L shares commenced operations on July 2, 2014. Class A and Class L shares are offered at net asset value (“NAV”) plus a maximum sales charge of 5.75% and 2.00%, respectively. Class C and Class I shares are offered at net asset value. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class-specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standard Update “ASU” 2013-08.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale, such securities shall be valued at the mean of the closing bid and asked prices on the day of valuation. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Advisor (defined below), those securities will be valued at “fair value” as determined in good faith by the Fair Valuation Committee using procedures adopted by and under the supervision of the Fund’s Board of Trustees (the “Board”). There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV.

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a

20

| Destra Multi-Alternative Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| February 28, 2019 |

substantial period, or (4) the Advisor determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but would not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality. Calls with the management teams of these securities are completed to gain further insight that might not be as evident through the reading of published reports or filings.

Often, significant back-testing or historical data analysis is employed to gain increased, tangible perspective into ways to enhance the accuracy of either existing, or potentially new fair valuation approaches. This also ensures that recent enhancements or additional methodologies are leading to more accurate valuations.

Ongoing “logic checks” and evaluations of underlying portfolios are used to identify potential disconnects between current methodologies and expected results.

The values assigned to fair valued investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Changes in the fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material.

The Fund invests in some securities which are not traded and the Board’s Valuation Committee has established a methodology for the fair valuation of each type of security. Non-listed REITs that are in the public offering period (or start-up phase) are valued at cost according to management’s fair valuation methodology unless the REIT issues an updated valuation. The Fund generally purchases REITs at NAV or without a commission. However, startup REITs amortize a significant portion of their start-up costs and therefore, potentially carry additional risks that may impact valuation should the REIT be unable to raise sufficient capital and execute their business plan. As such, start-up REITs pose a greater risk than seasoned REITs because if they encounter going concern issues, they may see significant deviation in value from the fair value, cost basis approach as represented. Management is not aware of any information which would cause a change in cost basis valuation methodology currently being utilized for non-traded REITs in their offering period. Non-traded REITs that are in their offering period are generally categorized as Level 3 in the fair value hierarchy. Once a REIT closes to new investors, the Fund values the security based on the movement of an appropriate market index or a similar security that is publicly traded until the REIT issues an updated market valuation. Non-traded REITs that have closed to new investors are generally categorized in Level 2 of the fair value hierarchy, due to the significance of the effect of the application of the movement of the market index on the overall fair valuation of the REIT. Other non-traded private investments are monitored for any independent audits of the investment or impairments reported on the potential value of the investment. For non-traded private investments, including private real estate investment trusts and non-traded partnership funds, that are themselves treated as investment companies under GAAP, the Fund follows the guidance in GAAP that allows, as practical expedient, the Fund to value such investments at their reported NAV per share (or if not unitized, at an equivalent percentage of the capital of the investee entity). Such investments typically provide an updated NAV or its equivalent on a quarterly basis. The Valuation Committee meets frequently to discuss the valuation methodology and will adjust the value of a security if there is a public update to such valuation.

21

| Destra Multi-Alternative Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| February 28, 2019 |

Non-listed business development companies provide quarterly fair value pricing which is used as an indicator of the valuation for the Fund. If the value significantly fluctuates, the Advisor will provide an updated price. If a significant event occurs that causes a large change in price, the Fair Valuation Committee will call a meeting to evaluate the fair value. Non-traded business development companies are categorized as Level 2 in the fair value hierarchy. Hedge funds provide monthly fair value pricing which is used as an indicator of the valuation for the Fund. The Fund values the security based on the movement of an appropriate market index or a similar security that is publicly traded until the hedge fund issues an updated market valuation.

Valuation of Fund of Funds - The Fund may invest in funds of open-end or closed-end investment companies (the “Underlying Funds”). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value using the methods established by the board of directors of the Underlying Funds. Open-end funds are valued at their NAV per share and closed-end fund that trade on an exchange are valued as described under security valuation.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value of a security may fall into different levels (Level 1, Level 2 or Level 3) of the fair value hierarchy. In such cases, for disclosure purposes, the level within which the fair value measurement falls, in its entirety, is determined based on the lowest level input that is significant in its entirety to the fair value measurement.

22

| Destra Multi-Alternative Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| February 28, 2019 |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of February 28, 2019 for the Fund’s assets and liabilities measured at fair value:

| Assets* | ||||||||||||||||||||

| Investments: | Practical Expedient (1) | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||

| Common Stocks | $ | — | $ | 8,480,792 | $ | — | $ | — | $ | 8,480,792 | ||||||||||

| Exchange Traded Fund | — | 585,500 | — | — | 585,500 | |||||||||||||||

| Exchange Traded Notes | — | 874,000 | — | — | 874,000 | |||||||||||||||

| Real Estate Investment Trusts | 21,500,181 | 8,566,855 | 39,771,886 | — | 69,838,922 | |||||||||||||||

| Non-Listed Business Development Companies | 2,430,600 | — | — | — | 2,430,600 | |||||||||||||||

| Private Business Development Companies | 8,064,627 | — | — | — | 8,064,627 | |||||||||||||||

| Private Investment Funds | 44,845,211 | — | — | — | 44,845,211 | |||||||||||||||

| Closed-End Funds | — | 14,705,046 | — | — | 14,705,046 | |||||||||||||||

| Hedge Fund | 27,294,495 | — | — | — | 27,294,495 | |||||||||||||||

| Short-Term Investment | — | 639,801 | — | — | 639,801 | |||||||||||||||

| Total Investments | $ | 104,135,114 | $ | 33,851,994 | $ | 39,771,886 | $ | — | $ | 177,758,994 | ||||||||||

| (1) | Certain investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the portfolio of investments. |

| * | Refer to the Portfolio of Investments for industry classifications. |

There was a change in fair valuation measurement inputs from Level 3 to practical expedient. Practical expedient became available based on the Fund receiving NAVs quarterly via investor letters and/or statements from the Sponsor of the investment.

The following is the fair value measurement of investments that are measured at NAV per Share (or its equivalent) as a practical expedient:

| Acquisition | % of Net | Unfunded | ||||||||||||||||||||

| Security Description | Industry | Date | Cost | Value | Assets | Commitments | Redemption Frequency | Redemption Notice Period | ||||||||||||||

| AIM Infrastructure MLP Fund II | Private Investment Company | 3/12/2014 | $ | 6,108,750 | $ | 4,206,678 | 2.7% | $ | 1,391,250 | Quarterly | 30-60 Days | |||||||||||

| Arboretum Core Asset Fund, L.P. | Private Investment Company | 8/2/2018 | 2,500,000 | 2,490,517 | 1.6% | 7,500,000 | Annually | 30 Days | ||||||||||||||

| Canyon CLO Fund II LP | Private Investment Company | 2/25/2019 | 10,000,000 | Subject to advisor approval | n/a | |||||||||||||||||

| Cion Investment Corp. | Non-Listed BDC | 4/21/2014 | 2,682,559 | 2,430,600 | 1.6% | — | Quarterly | 30 Days | ||||||||||||||

| Clarion Lion Industrial Trust | REIT | 6/29/2015 | 9,902,914 | 14,000,181 | 9.1% | — | Quarterly | 90 Days | ||||||||||||||

| Clarion Lion Properties Fund | Private Investment Company | 4/1/2014 | 11,000,000 | 14,890,765 | 9.7% | — | Quarterly | 90 Days | ||||||||||||||

| Collins Masters Access Fund, Ltd. | Hedge Fund | 6/2/2015 | 25,002,167 | 27,294,495 | 17.7% | — | Subject to advisor approval | 30-60 Days | ||||||||||||||

| Levine Leichtman Capital Partners VI, LP | Private Investment Company | 11/22/2017 | 3,830,759 | 2,627,344 | 1.7% | 7,303,288 | Subject to advisor approval | n/a | ||||||||||||||

| Mosaic Real Estate Credit, LLC | Private Investment Company | 7/6/2017 | 9,999,997 | 10,147,147 | 6.6% | — | Subject to advisor approval | 2 year lock up, then annual with 90 Days notice | ||||||||||||||

| Ovation Alternative Income Fund, LP | Private Investment Company | 7/25/2014 | 7,500,000 | 7,787,072 | 5.1% | — | Quarterly | 180 Days | ||||||||||||||

| Owl Rock Capital Corp. | Private BDC | 9/6/2017 | 8,187,532 | 8,064,627 | 5.2% | 4,126,442 | Quarterly | 90 Days | ||||||||||||||

| Stepstone Capital Partners IV, L.P. | Private Investment Company | 7/30/2018 | 2,796,618 | 2,695,688 | 1.7% | 7,203,382 | Subject to advisor approval | n/a | ||||||||||||||

| Treehouse Real Estate Investment Trust, Inc. | Private Investment Company | 12/31/2018 | 7,500,000 | 7,500,000 | 4.9% | — | Subject to advisor approval | n/a | ||||||||||||||

| $ | 97,011,297 | $ | 104,135,114 | $ | 37,524,362 | |||||||||||||||||

Exchange Traded Funds – The Fund may invest in exchange traded funds (“ETFs”). Most ETFs are a type of index fund bought and sold on a securities exchange. An ETF trades like common stock and represents a fixed (or managed) portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. The Fund may purchase an ETF to gain exposure to a portion of the U.S. or a foreign market. The risks of owning an ETF generally reflect the risks of owning the underlying securities it is designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest

23

| Destra Multi-Alternative Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| February 28, 2019 |

income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal Income Taxes – The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute all of its taxable income, if any to shareholders. Accordingly, no provision for Federal income taxes is required in the financial statements.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended February 29, 2016 to February 28, 2018, or expected to be taken in the Fund’s February 28, 2019 year-end tax return. The Fund identifies its major tax jurisdiction as U.S. Federal. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended February 28, 2019, the Fund did not incur any interest or penalties.

Distributions to Shareholders – Distributions from investment income are declared and paid monthly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Indemnification – The Fund indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

| 3. | RECENT ACCOUNTING PRONOUNCEMENTS AND REPORTING UPDATES |

In August 2018, the FASB issued Accounting Standards Update (“ASU”) No. 2018-13, which changes certain fair value measurement disclosure requirements. The new ASU, in addition to other modifications and additions, removes the requirement to disclose the amount and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, and the policy for the timing of transfers between levels. For investment companies, the amendments are effective for financial statements issued for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. The Fund has adopted early.

In August 2018, the Securities and Exchange Commission adopted amendments to certain disclosure requirements under Regulation S-X to conform to US GAAP, including: (i) an amendment to require presentation of the total, rather than the components, of distributable earnings on the Statement of Assets and Liabilities; and (ii) an amendment to require presentation of the total, rather than the components, of distributions to shareholders, except for tax return of capital distributions, on the Statement of Changes in Net Assets. The amendments also removed the requirement for parenthetical disclosure of undistributed net investment income on the Statement of Changes in Net Assets. These amendments have been adopted with these financial statements.

24

| Destra Multi-Alternative Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| February 28, 2019 |

| 4. | INVESTMENT MANAGEMENT AND OTHER AGREEMENTS |

Advisory Agreement – Pursuant to an investment advisory agreement with the Fund, (the “Advisory Agreement”), investment advisory services are provided to the Fund by Destra Capital Advisors LLC (the “Advisor”), effective November 30, 2018. Under the terms of the Advisory Agreement, the Advisor receives monthly fees calculated at an annual rate of 1.35% of the average daily net assets of the Fund. Prior to November 30, 2018, Pinhook Capital, LLC (f/k/a LCM Invesment Management, LLC) (“Pinhook”) was the investment adviser to the Fund. For the period from February 28, 2018 to November 30, 2018, Pinhook earned advisory fees of $1,831,869. For the period from December 1, 2018 to February 28, 2019, the Advisor earned advisory fees of $478,175. For the year ended February 28, 2019, the Advisor was owed $138,266 in advisory fees.

Pursuant to a written contract (the “Expense Limitation Agreement”), the Advisor has agreed, at least until November 30, 2020, to waive a portion of its advisory fee and has agreed to reimburse the Fund for other expenses to the extent necessary so that the total expenses incurred by the Fund (excluding front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expenses on securities sold short), fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including, for example, option and swap fees and expenses), taxes or extraordinary expenses, such as litigation expenses), do not exceed the following amounts per annum of the average daily net assets of each class of shares:

| Class A | Class C | Class I | Class L | ||||||||

| 1.95% | 2.70% | 1.70% | 2.45% |

These amounts will herein be referred to as the “expense limitations.”

Any waiver or reimbursement by the Advisor under the Expense Limitation Agreement is subject to repayment by the Fund within three years from the date the Advisor waived any payment or reimbursed any expense, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of waiver or the current expense limitation and the repayment is approved by the Board. The Adviser may not terminate the Expense Limitation Agreement during the initial term. After the initial term, either the Board or the adviser may terminate the expense reimbursement arrangement upon 60 days’ written notice. For the fiscal year ended February 28, 2019, the Advisor waived fees/reimbursed expenses of $327,457.