Filed pursuant to Rule 424(b)(3)

File No. 333-230251

Maximum Offering of $300,000,000 of Common Stock

Prospect Flexible Income Fund, Inc.

Prospect Flexible Income Fund, Inc. (“we,” “us,” “our,” “FLEX” or the “Company”) is an externally managed, non-diversified, closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended (the “Company Act”). We have elected and intend to qualify annually to be taxed for U.S. federal income tax purposes as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”).

Our investment objective is to generate current income and, as a secondary objective, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns. We intend to meet our investment objective by primarily lending to and investing in the debt of privately-owned U.S. middle market companies, which we define as companies with annual revenue between $50 million and $2.5 billion. We expect that at least 70% of our portfolio of investments will consist primarily of syndicated senior secured first lien loans, syndicated senior secured second lien loans, and to a lesser extent, subordinated debt. Syndicated secured loans refer to commercial loans provided by a group of lenders that are structured, arranged, and administered by one or several commercial or investment banks, known as arrangers. These loans are then sold (or syndicated) to other banks or institutional investors. Syndicated secured loans may have a first priority lien on a borrower’s assets (i.e., senior secured first lien loans), a second priority lien on a borrower’s assets (i.e., senior secured second lien loans), or a lower lien or unsecured position on the borrower’s assets (i.e., subordinated debt). We expect that up to 30% of our portfolio of investments will consist of other securities, including private equity (both common and preferred), dividend-paying equity, royalties, and the equity and junior debt tranches of a type of pools of broadly syndicated loans known as collateralized loan obligations, or CLOs, which we referred to as “Subordinated Structured Notes” or “SSNs”. The senior secured loans underlying our SSN investments are expected typically to be BB or B rated (non-investment grade, which is often referred to as “high yield” or “junk”) and in limited circumstances, unrated, senior secured loans. Our investment portfolio is expected to consist primarily of debt securities. Our target credit investments are expected to typically have initial maturities between three and ten years and generally range in size between $1 million and $100 million, although the investment size may vary with the size of our capital base.

On March 31, 2019, Pathway Capital Opportunity Fund, Inc. (“PWAY”) merged with and into us (the “Merger”). As the combined surviving company, we were renamed as TP Flexible Income Fund, Inc. (we were formerly known as Triton Pacific Investment Corporation, Inc.). In connection with the Merger, Prospect Flexible Income Management, LLC (the “Adviser”), an affiliate of PWAY, became our investment adviser, and Prospect Administration LLC, an affiliate of the Adviser, became our administrator. Effective August 5, 2020, we changed our name to Prospect Flexible Income Fund, Inc.

We have engaged Triton Pacific Securities, LLC to serve as the dealer manager for our offering. The dealer manager is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered.

Through our dealer manager, we are conducting a continuous public offering of shares of our common stock on a best efforts basis. Currently, we are only offering Class A Shares at a current public offering price of $9.33 per share. Any sales load will be deducted from the public offering price per share. The maximum upfront sales load is 9% of the amount invested for Class A Shares. To the extent our net asset value per share increases, we will sell at a price necessary to ensure that shares are not sold at a price per share, after deduction of selling commissions and dealer manager fees, that is below our net asset value per share. Persons who subscribe for shares in this offering must submit subscriptions for a certain dollar amount rather than a number of shares and, as a

result, may receive fractional shares of our common stock. The minimum investment in shares of our common stock is $5,000. We intend to file post-effective amendments to the registration statement, of which this prospectus is a part, which will be subject to review by the Securities and Exchange Commission, or SEC, to allow us to continue this offering for up to three years from the date of initial effectiveness of such registration statement. Such post-effective amendments will also be subject to review by the state regulators in the states in which our offering is registered. As of August 25, 2020, we have sold a total of 1,875,858 shares of common stock, including 198,792 shares issued pursuant to our distribution reinvestment plan, for gross proceeds of approximately $26.3 million.

An investment in our common stock is highly speculative and involves a high degree of risk, including the risk of a substantial or entire loss of investment. In addition, we and the companies in which we will invest are subject to special risks. See “Risk Factors” beginning on page 38 to read about the risks you should consider before buying shares of our common stock, including the risk of leverage. We intend to continue to issue shares in this offering and, as a result, your ownership in us is subject to dilution. See “Risk Factors—Risks Relating to this Offering and Our Common Stock.”

| ● | You should not expect to be able to resell your shares. |

| ● | We do not intend to list our shares on any securities exchange during or for what may be a significant time after the offering period, if ever, and we do not expect a secondary market in the shares to develop. We define the term “offering period” as the time during which we conduct this offering, as approved and extended by our board of directors. The offering period currently extends to a date that is three years from the initial effective date of the registration statement of which this prospectus is a part, which we expect to be approximately September 26, 2022. We may, in our discretion, extend the term of the offering indefinitely. |

| ● | We intend to seek to complete a liquidity event (as defined herein) within five to seven years following the completion of our offering period; however, there can be no assurance that we will be able to complete a liquidity event. |

| ● | We have not identified any specific investments that we will make with the proceeds of this offering and you will not have the opportunity to evaluate our future investments prior to purchasing shares of our common stock. As a result, our offering may be considered a “blind pool” offering. |

| ● | There can be no assurance that we will be able to complete a liquidity event within the time frame anticipated by us. Should we not be able to do so within seven years following the completion of this offering, subject to the authority of our independent directors or the rights of the stockholders to postpone liquidation, we may cease to make investments in new portfolio companies and could begin the orderly liquidation of our assets. |

| ● | An investment in our shares is not suitable for all investors, particularly investors who require short or medium term liquidity. See “Suitability Standards” beginning on page ii, “Share Repurchase Program” and “Liquidity Strategy.” |

| ● | We have implemented a share repurchase program, but only a limited number of shares, if any, will be eligible for repurchase. In addition, any such repurchases will be at the net offering price in effect for the applicable class on the date of repurchase, which may be lower than the price you paid for your shares in our offering. Our board of directors may amend, suspend or terminate the share repurchase program at any time and there can be no assurance that any shares will be repurchased under the share repurchase program. For more information regarding the limitations in respect of the proposed share repurchase program, see “Share Repurchase Program.” |

| ● | For a significant time after the commencement of our offering, a substantial portion of our distributions, if any, will result from expense waivers from our Adviser, which are subject to repayment by us, and may also consist, in whole or in part, of a return of capital. In addition, we may fund our cash distributions to stockholders from any sources of funds legally available to us, including offering proceeds and borrowings. If we borrow money to fund cash distributions, the costs of such borrowings will be borne by us and, indirectly, by our stockholders. You should understand that any such distributions are not based on our investment performance, and can only be sustained if we achieve positive investment performance in future periods and/or our Adviser continues to make such expense waivers. You should also understand that our future repayments may reduce the distributions that you would otherwise receive. Prior to the merger, a most of our distributions resulted from expense reimbursements from our former investment adviser and the return of capital. |

| ● | The credit facility entered into by our wholly-owned financing subsidiary exposes us to certain risks, including market risk, liquidity risk and other risks similar to those associated with the use of leverage. |

This prospectus contains important information that a prospective investor should know. Please read this prospectus before investing and keep it for future reference. We file annual, quarterly and current reports, proxy statements and other information about us with the SEC, as required. This information will be available free of charge by contacting us at 10 East 40th Street, 42nd Floor, New York, New York 10016 or by telephone at (212) 448-0702 or on our website at www.flexbdc.com before investing in our common stock. The SEC also maintains a website at www.sec.gov that contains such information. Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Except as specifically required by the Company Act, and the rules and regulations thereunder, the use of forecasts is prohibited and any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence which may flow from an investment in our common stock is not permitted.

| Maximum Aggregate Price to Public(1) |

Maximum Sales Load(2)(3) |

Net Proceeds (Before Expenses)(4) |

||||||||||

| Maximum Offering | $ | 300,000,000 | 9% | $ | 273,000,000 | |||||||

| Per Class A Share | $ | 9.33 | 9% | $ | 8.49 | |||||||

| (1) | Assumes all shares are sold at the current public offering price of $9.33 per Class A Share. |

| (2) | Investors will pay a maximum upfront sales load of up to 9.0% of the price per share for combined upfront selling commissions and dealer manager fees. The upfront selling commissions and dealer manager fees will not be paid by you for shares issued under our distribution reinvestment plan. The “dealer manager fee” refers to the portion of the sales load available to our dealer manager and participating broker-dealers for assistance in selling and marketing our shares. In addition to the upfront selling commissions and dealer manager fees, our Adviser may pay our dealer manager a fee equal to no more than 1.0% of the net asset value per share per year. Our dealer manager may reallow all or a portion of such amounts to participating broker-dealers. Such amounts will not be paid by our shareholders. See “Plan of Distribution—Compensation of the Dealer Manager and Selected Broker-Dealers.” |

| (3) | In determining the maximum upfront sales load, we have assumed all shares sold were Class A Shares at the current public offering price of $9.33 per share. |

| (4) | In addition to the upfront sales load, we estimate that our total organization and offering costs for this offering will be approximately 2% of our total gross proceeds. See “Estimated Use of Proceeds.” |

Because you will pay an upfront sales load of up to 9% and offering expenses of up to 2%, if you invest $100 in our Class A Shares and pay the full upfront sales load, approximately $89 will actually be used by us for investments. As a result, based on the current public offering price, you would have to experience a total return on your investment of approximately 12.4% in order to recover these expenses.

The date of this prospectus is August 26, 2020.

Triton Pacific Securities, LLC

This prospectus is part of a registration statement we have filed with the SEC, in connection with a continuous offering process, to raise capital for us. As we have material developments, we will periodically provide prospectus supplements or may amend this prospectus to add, update or change information contained in this prospectus.

Shares will be offered at an offering price of $9.33 per share. We will seek to avoid interruptions in the continuous offering of shares of our common stock; we may, however, to the extent permitted or required under the rules and regulations of the SEC, supplement this prospectus or file an amendment to the registration statement with the SEC if our net asset value per share: (i) declines more than 10% from the net asset value per share as of the effective date of this registration statement or (ii) increases to an amount that is greater than the net proceeds per share as stated in this prospectus. We will supplement this prospectus in the event that we need to change the public offering price. There can be no assurance that our continuous offering will not be interrupted during the SEC’s review of any such registration statement amendment.

Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in a subsequent prospectus supplement. The registration statement we have filed with the SEC includes exhibits that provide more detailed descriptions of certain matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any prospectus supplement, together with additional information described below under “Available Information.” In this prospectus, we use the term “day” to refer to a calendar day, and we use the term “business day” to refer to any day other than Saturday, Sunday, a legal holiday or a day on which banks in New York City are authorized or required to close.

You should rely only on the information contained in this prospectus. We have not, and our dealer manager has not authorized any other person to provide you with information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus is complete and accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We will update this prospectus to reflect material changes only as and when required by law.

We and our dealer manager are not making an offer to sell our common stock in any jurisdiction where the offer or sale is not permitted.

For information on the suitability standards that investors must meet in order to purchase shares of our common stock in this offering, see “Suitability Standards.”

I

The following are our suitability standards for investors which are required by the Omnibus Guidelines published by the North American Securities Administrators Association in connection with our continuous offering of common shares under this registration statement.

Pursuant to applicable state securities laws, shares of common stock offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means who have no need for liquidity in this investment. Initially, there is not expected to be any public market for the shares, which means that it may be difficult to sell shares. As a result, we have established suitability standards which require investors to have either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, furnishings, and personal automobiles) of at least $250,000. Our suitability standards also require that a potential investor (1) can reasonably benefit from an investment in us based on such investor’s overall investment objectives and portfolio structuring; (2) is able to bear the economic risk of the investment based on the prospective stockholder’s overall financial situation; and (3) has apparent understanding of (a) incremental risks of the investment, (b) the risk that such investor may lose his or her entire investment, (c) the lack of liquidity of the shares, (d) the background and qualifications of our Adviser, and (e) the tax consequences of the investment.

In addition, we will not sell shares to investors in the states named below unless they meet special suitability standards.

Alabama — In addition to the general suitability requirements, investors must have a liquid net worth of at least 10 times their investment in us and our affiliates.

Arizona — The term of this offering shall be effective for a period of one year with the ability to renew for additional periods of one year.

California — Investors who reside in the state of California must have either (i) a liquid net worth of $75,000 and annual gross income of $150,000 or (ii) a liquid net worth of at least $350,000. Additionally, a California investor’s total investment in us may not exceed 10% of his or her net worth.

Idaho — Investors who reside in the state of Idaho must have either (i) a liquid net worth of $85,000 and annual gross income of $85,000 or (ii) a liquid net worth of $300,000. Additionally, an Idaho investor’s total investment shall not exceed 10% of his or her liquid net worth. (The calculation of liquid net worth shall include only cash plus cash equivalents. Cash equivalents include assets which may be convertible to cash within one year.)

Iowa — Investors who reside in the state of Iowa must have either (i) a liquid net worth of $85,000 and annual gross income of $85,000 or (ii) a liquid net worth of $300,000. Additionally, an Iowa investor’s total investment in us shall not exceed 10% of his or her net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

Kansas — The Office of the Kansas Securities Commissioner recommends that you should limit your aggregate investment in our shares and other non-traded business development companies to not more than 10% of your liquid net worth. Liquid net worth is that portion of your total net worth (assets minus liabilities) that is comprised of cash, cash equivalents and readily marketable securities.

Kentucky — Investors who reside in the state of Kentucky must have either (i) a liquid net worth of $70,000 and annual gross income of $70,000 or (ii) a liquid net worth of $250,000. Additionally, a Kentucky investor’s total investment in us and any business development companies affiliated with is, shall not exceed 10% of his or her liquid net worth. For this purpose, “liquid net worth” is defined as that portion of a person’s total assets (exclusive of home, home furnishings and automobiles) minus total liabilities) that consists of cash, cash equivalents and readily marketable securities.

Maine — The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

Massachusetts — In addition to the suitability standards above, the state of Massachusetts requires that each Massachusetts investor will limit his or her investment in our common stock together with investments in other business development companies and direct participation investments to a maximum of 10% of his or her liquid net worth.

Michigan — In addition to the suitability standards above, the state of Michigan requires that each Michigan investor will limit his or her investment in our common stock to a maximum of 10% of his or her net worth.

II

Missouri — In addition to the suitability standards above, the state of Missouri requires that each Missouri investor will limit his or her investment in our common stock to a maximum of 10% of his or her liquid net worth.

Nebraska —Nebraska investors must have (i) either (a) an annual gross income of at least $100,000 and a net worth of at least $250,000, or (b) a net worth of at least $350,000; and (ii) Nebraska investors must limit their aggregate investment in this offering and in the securities of other non-publicly traded business development companies (BDCs) to 10% of such investor’s net worth. (Net worth in each case should be determined exclusive of home, home furnishings, and automobiles.) Investors who are accredited investors as defined in Regulation D under the Securities Act of 1933, as amended, are not subject to the foregoing investment concentration limit.

New Jersey — Investors who reside in the state of New Jersey must have either (i) a minimum liquid net worth of at least $100,000 and minimum annual gross income of at least $100,000, or (ii) a minimum liquid net worth of $350,000. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings and automobiles, minus total liabilities) that consists of cash, cash equivalents and readily marketable securities. Additionally, a New Jersey investor’s total investment in our shares, the shares of any of our affiliates and other direct participation investments (including real estate investment trusts, business development companies, oil and gas programs, equipment leasing programs and commodity pools, but excluding unregistered, federally and state exempt private offerings) shall not exceed 10% of such investor’s liquid net worth.

New Mexico — In addition to the suitability standards above, the state of New Mexico provides that it shall be unsuitable for a New Mexico investor’s aggregate investment in our shares, shares of any of our affiliates, and in other non-traded business development companies to exceed ten percent (10%) of his, her, or its liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of primary residence, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities.

North Dakota — Our shares will only be sold to residents of North Dakota representing that their investment will not exceed 10% of his or her net worth and that they meet one of the established suitability standards.

Ohio — In addition to the suitability standards above, the state of Ohio provides that it shall be unsuitable for an Ohio investor’s aggregate investment in our shares, shares of any of our affiliates, and in other non-traded business development companies to exceed ten percent (10%) of his, her, or its liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of primary residence, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities.

Oklahoma — Investors who reside in the state of Oklahoma must have either (i) a minimum annual gross income of $100,000 and a minimum net worth of $100,000, or (ii) a minimum net worth of $250,000, exclusive of home, home furnishings and automobile, irrespective of gross annual income. In addition, Oklahoma residents’ total investment in our shares must not exceed 10% of their liquid net worth, exclusive of home, home furnishings and automobile.

Oregon — In addition to the suitability standards above, the state of Oregon requires that each Oregon investor will limit his or her investment in our common stock to a maximum of 10% of his or her net worth.

Tennessee — In addition to the general suitability standards above, Tennessee investors may not invest more than ten percent (10%) of their liquid net worth (exclusive of home, home furnishings, and automobiles) in this offering.

Texas — Investors who reside in the state of Texas must have either (i) a minimum annual gross income of $100,000 and a minimum net worth of $100,000, or (ii) a minimum net worth of $250,000, exclusive of home, home furnishings and automobile, irrespective of gross annual income. In addition, a Texas resident’s total investment in our shares must not exceed 10% of their net worth.

Vermont – Accredited investors in Vermont, as defined i n 17 C.F.R. § 230.50 1, may invest freely in this offering. In addition to the suitability standards described above, non-accredited investors in Vermont may not purchase an amount i n this offering that exceeds 10% of the investor’s liquid net worth. For these purposes, “liquid net worth” is defined as an investor’s total assets (not including home, home furnishing or automobiles) minus total liabilities.

The minimum purchase amount is $5,000 in shares of our common stock. To satisfy the minimum purchase requirements for retirement plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate individual retirement accounts, or IRAs, provided that each such contribution is made in increments of $500. You should note that an investment in shares of our common stock will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Code.

III

If you have satisfied the applicable minimum purchase requirement, any additional purchase must be in amounts of at least $500. The investment minimum for subsequent purchases does not apply to shares purchased pursuant to our distribution reinvestment plan.

In the case of sales to fiduciary accounts, these suitability standards must be met by the person who directly or indirectly supplied the funds for the purchase of the shares of our stock or by the beneficiary of the account.

These suitability standards are intended to help ensure that, given the long-term nature of an investment in shares of our stock, our investment objectives and the relative illiquidity of our stock, shares of our stock are an appropriate investment for those of you who become stockholders. We, in conjunction with our Adviser and those selling shares on our behalf, will make every reasonable effort to determine that the purchase of shares of our stock is a suitable and appropriate investment for each stockholder’s financial situation and investment objectives based on information provided by the stockholder in the subscription agreement. As such, it is essential that all the information provided by the stockholder is complete and accurate in order for us, the Adviser and those selling shares on our behalf, to make such a determination. We, along with each participating broker-dealer, are required to maintain for six years records of the information used to determine that an investment in shares of our stock is suitable and appropriate for a stockholder.

In purchasing shares, custodians or trustees of employee pension benefit plans or IRAs may be subject to the fiduciary duties imposed by the Employee Retirement Income Security Act of 1974, or ERISA, or other applicable laws and to the prohibited transaction rules prescribed by ERISA and related provisions of the Code. In addition, prior to purchasing shares, the trustee or custodian of an employee pension benefit plan or an IRA should determine that such an investment would be permissible under the governing instruments of such plan or account and applicable law.

Effective June 30, 2020, the registered

broker-dealers who offer and sell our shares in this offering are required to comply with the Regulation Best Interest rule included

in Rule 15l-1under the Exchange Act. The Regulation Best Interest (or Regulation BI) rule requires that our selling broker-dealers,

among other things, act in the best interest of the retail customer, without placing the financial or other interest of the broker-dealer

ahead of the interests of the retail customer; and address conflicts of interest by establishing, maintaining, and enforcing policies

and procedures reasonably designed to identify and fully and fairly disclose material facts about conflicts of interest, and in

instances where disclosure is insufficient, to reasonably address the conflict, to mitigate or, in certain instances, eliminate

the conflict. Our dealer manager has revised its compliance procedures to ensure its compliance with Regulation BI and will continue

to monitor its compliance with Regulation BI on an annual or as needed basis.

IV

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS | 146 |

| REGULATION | 155 |

| PLAN OF DISTRIBUTION | 159 |

V

VI

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider. To understand this offering fully, you should read the entire prospectus carefully, including the section entitled “Risk Factors” before making a decision to invest in our common stock.

Unless otherwise noted, the terms “we,” “us,” “our,” the “Company” and “FLEX” refer to Prospect Flexible Income Fund, Inc., a Maryland corporation. Certain other entities having a role in our offering or in our management are referred to as follows and are further described in this prospectus:

“Adviser” or “Investment Adviser” refers to Prospect Flexible Income Management, LLC, a Delaware limited liability company and our investment adviser.

“Dealer Manager” refers to Triton Pacific Securities, LLC, a Delaware limited liability company and the dealer manager for this offering.

“Administrator” or “Prospect Administration” refers to Prospect Administration LLC, a Delaware limited liability company and our administrator.

“Prospect Capital Management” refers to Prospect Capital Management L.P., a Delaware limited partnership and a private equity investment management firm.

Also, the terms “Company Act” and “Advisers Act” refer to the Investment Company Act of 1940, as amended, and the Investment Advisers Act of 1940, as amended, respectively, and the term “Code” refers to the Internal Revenue Code of 1986, as amended.

Who We Are

We were formed as a Maryland corporation on April 29, 2011. We are an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company, or BDC, under the Company Act. We are therefore required to comply with certain regulatory requirements. We have elected to be taxed for U.S. federal income tax purposes, and intend to qualify annually as a regulated investment company, or RIC, under Subchapter M of the Code. Our Adviser is registered as an investment adviser with the Securities and Exchange Commission, or SEC, under the Advisers Act. Our Adviser manages our portfolio and makes all investment decisions for us, subject to supervision by our board of directors. On June 25, 2014, we satisfied our minimum offering requirement of selling at least $2.5 million in common stock and on October 1, 2014, we commenced our investment operations.

Our investment objective is to generate current income and, as a secondary objective, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns. We intend to meet our investment objective by primarily lending to and investing in the debt of privately-owned U.S. middle market companies, which we define as companies with annual revenue between $50 million and $2.5 billion. We may on occasion invest in smaller or larger companies if an attractive opportunity presents itself, especially when there are dislocations in the capital markets. We expect to focus primarily on making investments in syndicated senior secured first lien loans, syndicated senior secured second lien loans, and to a lesser extent, subordinated debt, of middle market companies in a broad range of industries. Syndicated secured loans refer to commercial loans provided by a group of lenders that are structured, arranged, and administered by one or several commercial or investment banks, known as arrangers. These loans are then sold (or syndicated) to other banks or institutional investors. Syndicated secured loans may have a first priority lien on a borrower’s assets (i.e., senior secured first lien loans), a second priority lien on a borrower’s assets (i.e., senior secured second lien loans), or a lower lien or unsecured position on the borrower’s assets (i.e., subordinated debt). Our target credit investments are expected to typically have initial maturities between three and ten years and generally range in size between $1 million and $100 million, although the investment size may vary with the size of our capital base. We expect that the majority of our debt investments will bear interest at floating interest rates, but our portfolio may also include fixed-rate investments.

We expect to make our investments directly through the primary issuance by the borrower or in the secondary market. We expect that at least 70% of our portfolio of investments will consist primarily of syndicated senior secured first lien loans, syndicated senior secured second lien loans, and to a lesser extent, subordinated debt, and up to 30% of our portfolio of investments will consist of other securities, including private equity (both common and preferred), dividend-paying equity, royalties, and the equity and junior debt tranches of a type of pools of broadly syndicated loans known as collateralized loan obligations, or CLOs, which we referred to as “Subordinated Structured Notes” or “SSNs”. The senior secured loans underlying our SSN investments are expected typically to be BB or B rated (non-investment grade, which is often referred to as “high yield” or “junk”) and in limited circumstances, unrated, senior secured loans. The SSN investments are entitled to recurring distributions which are generally equal to the excess cash flow

2

generated from the underlying investments after payment of the contractual payments to debt holders and fund expenses. The current estimated yield, calculated using amortized cost, is based on the current projections of this excess cash flow taking into account assumptions which have been made regarding expected prepayments, losses and future reinvestment rates. These assumptions are periodically reviewed and adjusted. Ultimately, the actual yield may be higher or lower than the estimated yield if actual results differ from those used for the assumptions.

The use of the term “flexible” in our name refers to our anticipated investment strategy. As part of our strategy, we intend to dynamically allocate our assets in varying types of investments based on our analysis of the credit markets. These investments include senior secured first lien loans, senior secured second lien loans, subordinated debt, equity and equity-related securities, non-U.S. securities, subordinated structured notes and other securities. The use of the term “flexible:” in our name is intended to indicate that we intend to invest across a variety of economic sectors and in multiple types of securities in order to try and provide the optimal return for our investors.

We intend to seek to engage in a “liquidity event,” within five to seven years following the completion of our offering period, whereby we will seek to provide liquidity to our investors, such as (i) a listing of our shares on a national securities exchange, (ii) the sale of all or substantially all of our assets followed by a liquidation, or (iii) a merger or other transaction approved by our board of directors in which our stockholders will receive cash or shares of another company. However, there can be no assurance that we will be able to complete a liquidity event within such time frame. We define the term “offering period” as the time during which we conduct this offering, as approved and extended by our board of directors. The offering period currently extends to a date that is three years from the initial effective date of the registration statement of which this prospectus is a part, which we expect to be approximately September 26, 2022. We may, in our discretion, extend the term of the offering indefinitely.

Merger and Accounting Survivor

On March 31, 2019, Pathway Capital Opportunity Fund, Inc. (“PWAY”) merged with and into us (the “Merger”). As the combined surviving company, we were renamed as TP Flexible Income Fund, Inc. (we were formerly known as Triton Pacific Investment Corporation, Inc. (“TPIC”)). In connection with the Merger, Prospect Flexible Income Management, LLC, an affiliate of PWAY, became our investment adviser, and Prospect Administration LLC, an affiliate of the Adviser, became our administrator. Effective August 5, 2020, we changed our name to Prospect Flexible Income Fund, Inc.

Although PWAY merged with and into us, PWAY is considered the accounting survivor of the Merger and its historical financial statements are included and discussed in this prospectus and in the reports that we file with the Securities and Exchange Commission (the “SEC”).

Status of Our Ongoing Public Offering

As of August 25, 2020, we have sold a total of 1,875,858 shares of common stock, including 198,792 shares issued pursuant to our distribution reinvestment plan, for gross proceeds of approximately $ 26.3 million.

Below is a summary of the ongoing public offering of shares of our common stock during the calendar years ended December 31, 2019, 2018 and 2017:

| Year Ended December 31, | |||||||||||||||||||||||||

| 2019(1) | 2018(2) | 2017(2) | |||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | ||||||||||||||||||||

| Gross proceeds from Offering | 26,308 | 307,034 | 158,267 | 2,080,405 | 440,963 | 6,385,593 | |||||||||||||||||||

| Reinvestment of Distributions | 61,774 | 666,735 | 29,466 | 346,702 | 22,461 | 291,697 | |||||||||||||||||||

| Commissions and Dealer Manager Fees | (15,088 | ) | (199,991 | ) | (606,188 | ) | |||||||||||||||||||

| Net Proceeds to Company from Share Transactions | 88,082 | 958,681 | 187,733 | 2,227,116 | 463,424 | 6,071,102 | |||||||||||||||||||

| (1) | Reflects ongoing public offering of shares of the Company in the capacity as TPIC (from January 1, 2019 through March 31, 2019) and in the capacity as FLEX (from April 1, 2019 through December 31, 2019). |

| (2) | Reflects ongoing public offering of shares of the Company in the capacity as TPIC. |

During the calendar years ended December 31, 2019, 2018 and 2017, 26,308.29, 158,266.54, and 440,963.13 shares of common stock were sold, respectively, for gross proceeds of approximately $307,034, $2,080,405 and $6,385,593, respectively, at an average price per share of $11.67, $13.14, and $14.48, respectively. The increase in capital in excess of par value during the calendar years ended December 31, 2019, 2018 and 2017 also includes reinvested stockholder distributions of $666,735, $346,702, and $291,697, respectively, for which 61,774, 29,466.05, and 22,461.05, shares of common stock were issued, respectively.

3

Prior to the Merger, selling commissions and dealer manager fees included selling commissions of up to 7.0% of the gross offering proceeds of Class A Shares sold and a dealer manager fee of up to 3.0% of the gross offering proceeds of Class A Shares sold. Following the Merger, selling commissions were reduced to up to 3.0% of the gross offering proceeds of Class A Shares sold in this offering and the dealer manager fee remained at up to 3.0% of the gross offering proceeds of Class A Shares sold in this offering. All or a portion of the selling commissions and dealer manager fees, as applicable, may be paid to selected participating broker-dealers and financial representatives. Such selling commissions and dealer manager fees may be reduced or waived in connection with certain categories of sales, such as sales for which a volume discount applies, sales through investment advisers or banks acting as trustees or fiduciaries and sales to our affiliates. See “Compensation of Our Dealer Manager and Investment Adviser” and “Plan of Distribution” for additional information.

About Our Adviser

Prospect Flexible Income Management, LLC serves as our investment adviser. Our Adviser is registered as an investment adviser under the Advisers Act and provides services to us pursuant to the terms of an investment advisory agreement between us and our Adviser, or the Investment Advisory Agreement. Our Adviser’s investment activities are led by a team of investment professionals from the investment and operations team of Prospect Capital Management. Our Adviser’s investment professionals have significant experience and an extensive track record of investing in companies, managing high-yielding debt and equity investments in infrastructure companies and have developed an expertise in using all levels of a firm’s capital structure to produce income-generating investments, while focusing on risk management. Such parties also have extensive knowledge of the managerial, operational and regulatory requirements of publicly traded investment companies. Most of the finance professionals of our Adviser were closely involved with the operation of PWAY prior to the Merger. In addition, most of our finance professionals are also involved in the operation, management and regulatory compliance of two affiliated funds, Prospect Capital Corporation, a BDC that is listed for trading on the Nasdaq Stock Market that had total assets of approximately $5.2 billion as of March 31, 2020, and Priority Income Fund, Inc., an externally managed, non-diversified, closed-end management investment company that invests primarily in senior secured loans, including via SSN investments, of companies whose debt is rated below investment grade or, in limited circumstances, unrated.

Our Adviser does not currently have employees, but has access to certain investment, finance, accounting, legal and administrative personnel of Prospect Capital Management and Prospect Administration and may retain additional personnel as our activities expand. In particular, certain personnel of Prospect Capital Management will be made available to our Adviser to assist it in managing our portfolio and operations, provided that they are supervised at all times by our Adviser’s management team.

M. Grier Eliasek, the President and Chief Operating Officer of our Adviser, also serves as our Chairman, Chief Executive Officer and President. Mr. Eliasek has substantial investment and portfolio management experience. Mr. Eliasek served as the Chairman, Chief Executive Officer and President of PWAY until the Merger and is the President, Co-Founder and Chief Operating Officer of Prospect Capital Corporation. Mr. Eliasek is also the Chief Executive Officer and President of Priority Income Fund, Inc., an externally managed, non-diversified, closed-end management investment company that invests primarily in senior secured loans, including via SSN investments, of companies whose debt is rated below investment grade or, in limited circumstances, unrated.

Our board of directors includes a majority of independent directors and oversees and monitors the activities of our Adviser as well as our investment portfolio and performance, and annually reviews the compensation paid to our Adviser. See “Investment Advisory Agreement” below. In addition to managing our portfolio, our Adviser provides on our behalf managerial assistance to those of our portfolio companies to which we are required to provide such assistance. We have the right to terminate the Investment Advisory Agreement upon 60 days’ written notice to our Adviser, and our Adviser has the right to terminate the Investment Advisory Agreement upon 120 days’ written notice to us.

Wuhan Virus

On March 11, 2020, the World Health Organization declared the coronavirus (“Wuhan Virus”) as a global pandemic and recommended containment and mitigation measures worldwide. As of the three months ended March 31, 2020, and subsequent to March 31, 2020, the Wuhan Virus pandemic has had a significant impact on the U.S. and global economy and on us. We have experienced an increase in unrealized depreciation of our investment portfolio due to decreases in fair value of its investments attributable to the impact of the Wuhan Virus pandemic on the markets.

The extent of the impact of the Wuhan Virus pandemic on the financial performance of our current and future investments will depend on future developments, including the duration and spread of the virus, related advisories and restrictions, and the health of the financial markets and economy, all of which are highly uncertain and cannot be predicted. To the extent our portfolio companies are adversely impacted by the effects of the Wuhan Virus pandemic, it may have a material adverse impact on its future net investment

4

income, the fair value of its portfolio investments, its financial condition and the results of operations and financial condition of our portfolio companies. See “Risk Factors.”

Risk Factors

An investment in our common stock involves a high degree of risk and may be considered speculative. You should carefully consider the information found in “Risk Factors” before deciding whether to invest in shares of our common stock. The following are some of the risks an investment in us involves:

| ● | Disruptions or instability in capital markets, including those caused by the ongoing Wuhan Virus pandemic, could negatively impact our ability to raise capital and could have a material adverse effect on our business, financial condition and results of operations. |

| ● | Economic, political and market conditions, including as a result of the Wuhan Virus pandemic, may adversely affect our portfolio companies and our business, results of operations and financial condition, including our revenue growth and profitability. |

| ● | We do not intend to list our shares on any securities exchange during this offering and for a substantial period thereafter and we do not expect a public market for our shares to develop in the foreseeable future, if ever. Therefore, you should not expect to be able to sell your shares. No stockholder will have the right to require us to repurchase any of his or her shares. |

| ● | The amount of distributions, if any, we may make is uncertain. In particular, if the current period of market disruption and instability caused by the Wuhan Virus pandemic continues for an extended period of time, our ability to declare and pay distributions on our shares may be adversely impacted. Our distributions may exceed our earnings, particularly during the period before we have substantially invested the net proceeds from this offering. In addition, we may fund our cash distributions to stockholders from any sources of funds legally available to us, including offering proceeds and borrowings. If we borrow money to fund cash distributions, the costs of such borrowings will be borne by us and, indirectly, by our stockholders. Therefore, portions of the distributions that we make may represent a return of capital to you and reduce the amount of capital available to us for any investments. Any capital returned to you through distributions will be distributed after payment of fees and expenses. Moreover, a return of capital will generally not be taxable but will reduce each stockholder’s cost basis in our common stock, and will result in a higher reported capital gain or lower reported capital loss when such common stock is sold. |

| ● | We have qualified and intend to annually qualify as a RIC for U.S. federal income tax purposes, but may fail to do so. Such failure would subject us to corporate-level U.S. federal income tax on all of our income, which would have a material adverse effect on our financial performance. |

| ● | As a result of the annual distribution requirement to qualify as a RIC, in order to fund new investments we will likely need to continually raise cash or make borrowings. At times, these sources of funding may not be available to us on acceptable terms, if at all. |

| ● | We are subject to financial market risks, including changes in interest rates, which may have a substantial negative effect on our investments. |

| ● | Because our portfolio companies will typically not be publicly-traded, a significant portion of our portfolio will be recorded at fair value as determined in good faith by our board of directors. As a result, there could be uncertainty as to the actual market value of our portfolio investments. |

| ● | Investing in small and mid-sized private companies involves a number of significant risks related to their size, limited experience, limited financial resources, and greater dependence on the management talents and efforts of a smaller group of persons, and less predictable operating results. Such risks may lead to increased risk of loss of private equity investments and greater risk of default on debt investments. In addition, evaluating such companies for investment may be more difficult due to the lack of publicly available information and often to accounting policies that are less sophisticated than those used by larger companies. |

| ● | We may make debt investments or finance transactions with debt instruments which may issue warrants attached to such debt instruments or make payments in kind, or PIK, interest payments that are capitalized for some portion or over the life of the loan. PIK loans generally represent a significantly higher credit risk than coupon loans. PIK loans have unreliable valuations because their continuing accruals require judgments about the collectability of the deferred payments and the value of any collateral. |

5

| ● | SSNs typically will have no significant assets other than their underlying senior secured loans; payments on SSN investments are and will be payable solely from the cash flows from such senior secured loans. |

| ● | Our CLO investments will be exposed to leveraged credit risks. |

| ● | There is the potential for interruption and deferral of cash flow from CLO investments. |

| ● | The payment of underlying portfolio manager fees and other charges on CLO investments could adversely impact our return on our CLO investments. |

| ● | The inability of an CLO collateral manager to reinvest the proceeds of the prepayment of senior secured loans may adversely affect us. |

| ● | Our CLO investments are subject to prepayments and calls, increasing re-investment risk. |

| ● | We will have limited control of the administration and amendment of senior secured loans owned by the CLOs in which it invests. |

| ● | We have limited control of the administration and amendment of any CLO in which we invest. |

| ● | Our financial results may be affected adversely if one or more of our significant equity or junior debt investments in an CLO vehicle defaults on our payment obligations or fails to perform as we expect. |

| ● | Non-investment grade debt (which is often referred to as “high yield” or “junk”) involves a greater risk of default and higher price volatility than investment grade debt. |

| ● | We will have no influence on management of underlying investments managed by non-affiliated third party CLO collateral managers. |

| ● | The application of the risk retention rules under Section 941 of the Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) to CLOs may have broader effects on the CLO and loan markets in general, potentially resulting in fewer or less desirable investment opportunities for us. |

| ● | We have not identified specific investments that we will make with the proceeds of this offering. Therefore, at the time of your investment, you will not have opportunity to evaluate our future investments prior to purchasing shares of our common stock. |

| ● | Significant delays may occur in the deployment of the capital raised from this offering. These delays can be caused by a number of factors, including market conditions, the relative lack of suitable investment candidates or the time needed for transaction due diligence and execution. Any delays in the deployment of capital may make it more difficult for us to achieve our investment objectives and our returns may be adversely affected. |

| ● | There is a highly competitive market for attractive investment opportunities. If we, through our Adviser, are unable to find suitable investments in a timely manner, we may not be able to obtain our objectives or pay distributions. |

| ● | We intend to invest primarily in syndicated senior secured first lien loans, syndicated senior secured second lien loans, senior secured bonds, subordinated debt and equity of private U.S. companies, including middle market companies. Investments in such companies have particular risks. Equity investments are the least secured investments within a company’s capital structure and, accordingly, pose a risk of loss of the entire investment. For our senior secured first lien and senior secured second lien debt investments, the collateral securing these investments may decrease in value or lose its entire value over time or may fluctuate based on the performance of the portfolio company, all of which may lead to the impairment or loss of principal. |

| ● | An investment strategy focused primarily on privately-held companies presents certain challenges, including the lack of available information about these companies, an illiquid market which may affect our ability to exit investments, and more limited access to capital, which could add financial stress to such companies. |

| ● | As a non-diversified fund, we may focus our investments in companies in a particular industry or industries, which could magnify the impact of any adverse events on our operating results due to such industry or industries. |

6

| ● | We have entered into a credit facility that we intend to use to make investments. See “—Credit Facility.” As a result, we will be exposed to the risks of borrowing, also known as leverage, which may be considered a speculative investment technique. Leverage increases the volatility of investments by magnifying the potential for gain and loss on amounts invested, therefore increasing the risks associated with investing in our shares. Moreover, any assets we may acquire with leverage will be subject to base management fees payable to our Adviser and, accordingly, such fees will be higher than if we did not use leverage, whether or not the leveraged investments are ultimately successful. |

| ● | In connection with our credit facility, a significant portion of our assets have been pledged as collateral under such credit facility. In the event that we default under such a credit facility or any other future borrowing facility, our business could be adversely affected as we may be forced to sell all or a portion of our investments quickly and prematurely at what may be disadvantageous prices to us in order to meet our outstanding payment obligations and/or support covenants and working capital requirements under any credit or borrowing facility, any of which would have a material adverse effect on our business, financial condition, results of operations and cash flows. |

| ● | We may issue preferred stock with rights and preferences that would adversely affect the holders of common stock, including preferences as to cash distributions and preferences upon the liquidation or dissolution of the Company. In addition, preferred stock will subject us to additional legal requirements under the Company Act. We currently do not intend to issue any preferred stock during the first year following the date of this prospectus. |

| ● | Market conditions could have an adverse effect on the capital markets and reduce the availability of equity and debt capital for the market as a whole and financial firms in particular. These conditions would make it more difficult for us to achieve our investment objectives. |

| ● | Events outside of our control, including public health crises (such as the Wuhan Virus pandemic), may negatively affect our results of operations and financial performance. |

| ● | We may pursue growth through acquisitions of other BDCs or registered investment companies, acquisitions of critical business partners or other strategic initiatives. Attempts to expand our business involve a number of special risks, including some or all of the following: (1) the required investment of capital and other resources, (2) the assumption of liabilities in any acquired business, (3) the disruption of our ongoing business and (4) increasing demands on our operational and management systems and controls. |

| ● | If we are unable to consummate or successfully integrate development opportunities, acquisitions or joint ventures, we may not be able to implement our growth strategy successfully. |

| ● | Our Adviser may have an incentive to increase portfolio leverage in order to earn higher base management fees. In addition, the Adviser may be incentivized to enter into investments that are riskier or more speculative than would otherwise be the case for the potential for greater incentive based fees under the Investment Advisory Agreement. |

| ● | This is a “best efforts” offering and if we are unable to raise substantial funds then we will be more limited in the number and type of investments we may make, and the value of your investment in us may be reduced in the event our assets underperform. |

| ● | Our Adviser and its affiliates face conflicts of interest as a result of compensation arrangements, time constraints and competition for investments, which they will attempt to resolve in a fair and equitable manner but which may result in actions that are not in your best interests. |

| ● | We established the offering price for our shares of common stock on an arbitrary basis, and the offering price may not accurately reflect the value of our assets. |

| ● | The purchase price at which you purchase shares will be determined at each closing date. As a result, your purchase price may be higher than the prior closing price per share, and therefore you may receive a smaller number of shares than if you had subscribed at the prior closing price. |

| ● | Our portfolio investments, especially until we raise significant capital from this offering, may consist of a limited number of investments, which would magnify the effect of any losses suffered in a few of these investments. |

| ● | One of our potential exit strategies is to list our shares for trading on a national exchange, although there can be no assurance that we ever list our shares on a national exchange. Shares of publicly-traded, closed-end investment companies frequently trade at a discount to their net asset value per share. In such case, we would not be able to predict whether our common stock would trade above, at or below net asset value per share. This risk is separate and distinct from the risk that our net asset |

7

| value per share may decline. |

Prospective investors should realize that factors other than those set forth in this prospectus may ultimately affect the investment offered pursuant to this prospectus in a manner and to a degree which cannot be foreseen at this time.

Credit Facility

On May 16, 2019, we established a $50 million senior secured revolving credit facility (the “Credit Facility”) with Royal Bank of Canada, a Canadian chartered bank (“RBC”), acting as administrative agent. In connection with the Credit Facility, our wholly owned financing subsidiary, Prospect Flexible Funding, LLC (formerly known as TP Flexible Funding, LLC) (the “SPV”), as borrower, and each of the other parties thereto, entered into a Revolving Loan Agreement, dated as of May 16, 2019 (the “Loan Agreement”). The SPV is a wholly-owned subsidiary of the Company that was formed to facilitate the transactions under the Credit Facility. Under the terms of the Credit Facility, the SPV holds certain of the securities that would otherwise be owned by the Company to be used as the borrowing base and collateral under the Credit Facility. Income paid on these investments is distributed to the Company pursuant to a waterfall after taxes, fees, expenses, and debt service. The lenders under the Credit Facility have a security interest in the investments held by the SPV. Although these investments are owned by the SPV, because the SPV is a wholly-owned subsidiary of the Company, the Company is subject to all of the benefits and risks associated with the Credit Facility and the investments held by the SPV.

The Credit Facility matures on May 21, 2029 and generally bears interest at a rate of three-month LIBOR plus 1.55%. However, on May 11, 2020, the Company agreed to an increased interest rate of three-month LIBOR plus 2.20% on the Credit Facility for the period between May 16, 2020 to November 15, 2020. The Credit Facility is secured by substantially all of the SPV’s properties and assets. Under the Loan Agreement, the SPV has made certain customary representations and warranties and is required to comply with various covenants, including reporting requirements and other customary requirements for similar credit facilities. The Loan Agreement includes usual and customary events of default for credit facilities of this nature.

Potential Market Opportunity

We believe that there are and will continue to be significant investment opportunities in the senior secured first lien loan and senior secured second lien loan asset classes, as well as investments in debt and equity securities of middle market companies.

Potential Opportunity in Middle Market Private Companies

We believe the middle market lending environment provides opportunities for us to meet our objective of making investments that generate attractive risk-adjusted returns as a result of a combination of the following factors:

Large Addressable Market. According to Leveraged Commentary & Data, institutional leveraged loan issuance (senior secured loans and second lien secured loans) remained strong in 2019 at approximately $490 billion. We believe that there exists a large number of prospective lending opportunities for lenders, which should allow us to generate substantial investment opportunities and build an attractive portfolio of investments.

Strong Demand for Debt Capital. We expect that private equity firms will continue to be active investors in middle market companies. These private equity funds generally seek to leverage their investments by combining their capital with loans provided by other sources, and we believe that our investment strategy positions us well to invest alongside such private equity investors. In addition, we believe the large amount of uninvested capital held by funds of private equity firms, estimated by Preqin Ltd., an alternative assets industry data and research company, to be $1.45 trillion as of December 2019, will continue to drive deal activity.

Attractive Market Segment. We believe that the underserved nature of such a large segment of the market can at times create a significant opportunity for investment. In many environments, we believe that middle market companies are more likely to offer attractive economics in terms of transaction pricing, up-front and ongoing fees, prepayment penalties and security features in the form of stricter covenants and quality collateral than loans to larger companies. In addition, as compared to larger companies, middle market companies often have simpler capital structures and carry less leverage, thus aiding the structuring and negotiation process and allowing us greater flexibility in structuring favorable transactions.

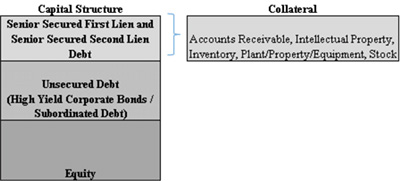

Attractive Deal Structure and Terms

We believe senior secured debt provides strong defensive characteristics. Because this debt has priority in payment among an issuer’s security holders (i.e., holders are due to receive payment before junior creditors and equityholders), they carry less potential risk than other investments in the issuer’s capital structure. Further, these investments are secured by the issuer’s assets, which may be seized in the event of a default, if necessary. They generally also carry restrictive covenants aimed at ensuring repayment before junior

8

creditors, such as most types of unsecured bondholders, and other security holders and preserving collateral to protect against credit deterioration.

The chart below illustrates examples of the collateral used to secure senior secured first lien debt and senior secured second lien debt.

Investments in Floating Rate Debt

A large portion of the investments we expect to make in middle market companies are expected to be in the form of floating rate debt instruments. These floating rate debt instruments are expected to be below investment grade rated (which are often referred to as “high yield” or “junk”). Floating rate loans have a base rate that adjusts periodically plus a spread over the base rate. The base rate is typically the three-month London Interbank Offered Rate (“LIBOR”), and resets every 30-90 days. As LIBOR increases, the income stream from these floating rate instruments will also increase. Syndicated floating rate debt offers certain benefits:

Adjustable coupon payment. Floating rate loans are structured so that interest rates reset on a predetermined schedule. As a result, when interest rates rise, coupon payments increase, and vice versa, with little lag time (typically 90 days or less). This feature greatly reduces the interest rate risk, or duration risk, inherent in high yield bonds, as the value of high yields bonds may decline in an increasing interest rate environment because their interest rates do not reset. For example, as short-term rates rise, the value of a high yield bond typically will decline while the value of a floating rate loan typically will remain stable because its interest rate will reset.

Priority in event of default. In the event of a default, floating rate loans typically have a higher position in a company’s capital structure, have first claim to assets and greater covenant protection than high yield bonds. As a result, floating rate loans have generally recovered a greater percentage of value than high yield bonds. Also, the default rate for floating rate loans has historically been lower than defaults of high yield bonds.

Reduced volatility. The return of floating rate loans has historically had a low correlation to most asset classes and a negative correlation with some asset classes. Therefore, adding floating rate loans to a portfolio should reduce volatility and risk.

Investment Objectives and Strategy

Our investment objective is to generate current income and, as a secondary objective, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns. We intend to meet our investment objective by primarily lending to and investing in the debt of privately-owned U.S. middle market companies, which we define as companies with annual revenue between $50 million and $2.5 billion. We may on occasion invest in smaller or larger companies if an attractive opportunity presents itself, especially when there are dislocations in the capital markets. We expect to focus primarily on making investments in syndicated senior secured first lien loans, syndicated senior secured second lien loans, and to a lesser extent, subordinated debt, of middle market companies in a broad range of industries. Our target credit investments are expected to typically have initial maturities between three and ten years and generally range in size between $1 million and $100 million, although the investment size may vary with the size of our capital base. We expect that the majority of our debt investments will bear interest at floating interest rates, but our portfolio may also include fixed-rate investments. We expect to make our investments directly through the primary issuance by the borrower or in the secondary market.

As part of our investment objective to generate current income, we expect that at least 70% of our portfolio of investments will consist primarily of syndicated senior secured first lien loans, syndicated senior secured second lien loans, and to a lesser extent, subordinated debt, and up to 30% of our portfolio of investments will consist of other securities, including private equity (both common and preferred), dividend-paying equity, royalties, and the equity and junior debt tranches of SSNs. The senior secured loans underlying our SSN investments are expected typically to be BB or B rated (non-investment grade, which is often referred to as “high yield” or

9

“junk”) and in limited circumstances, unrated, senior secured loans. Our investment portfolio is expected to consist primarily of debt securities.

When identifying prospective portfolio companies, we expect to focus primarily on the attributes set forth below, which we believe should help us generate attractive total returns with an acceptable level of risk. While these criteria provide general guidelines for our investment decisions, we caution investors that, if we believe the benefits of investing are sufficiently strong, not all of these criteria necessarily will be met by each prospective portfolio company in which we chooses to invest. These attributes are:

| ● | Defensible market positions. We seek to invest in companies that have developed strong positions within their respective markets and exhibit the potential to maintain sufficient cash flows and profitability to service our debt in a range of economic environments. We seek companies that can protect their competitive advantages through scale, scope, customer loyalty, product pricing or product quality versus their competitors, thereby minimizing business risk and protecting profitability. |

| ● | Proven management teams. We expect to focus on companies that have experienced management teams with an established track record of success. |

| ● | Allocation among various issuers and industries. We seek to allocate our portfolio broadly among issuers and industries, thereby attempting to reduce the risk of a downturn in any one company or industry having a disproportionate adverse impact on the value of our portfolio. |

| ● | Viable exit strategy. We will attempt to invest a majority of our assets in securities that may be sold in a privately negotiated over-the-counter market or public market, providing us a means by which we may exit our positions. We expect that a large portion of our portfolio may be sold on this secondary market for the foreseeable future, depending on market conditions. For investments that are not able to be sold within this market, we intend to focus primarily on investing in companies whose business models and growth prospects offer attractive exit possibilities, including repayment of our investments, an initial public offering of equity securities, a merger, a sale or a recapitalization, in each case with the potential for capital gains. |

| ● | Investing in stable companies with positive cash flow. We seek to invest in established, stable companies with strong profitability and cash flows. Such companies, we believe, are well-positioned to maintain consistent cash flow to service and repay our loans and maintain growth in their businesses or market share. We do not intend to invest to any significant degree in start-up companies, turnaround situations or companies with speculative business plans. |

| ● | Private equity sponsorship. Often, we will seek to participate in transactions sponsored by what we believe to be sophisticated and seasoned private equity firms. Our Adviser’s management team believes that a private equity sponsor’s willingness to invest significant sums of equity capital into a company is an endorsement of the quality of the investment. Further, by co-investing with such experienced private equity firms which commit significant sums of equity capital ranking junior in priority of payment to our debt investments, we may benefit from the due diligence review performed by the private equity firm, in addition to our own due diligence review. Further, strong private equity sponsors with significant investments at risk have the ability and a strong incentive to contribute additional capital in difficult economic times should operational or financial issues arise, which could provide additional protections for our investments. |

We will be subject to certain regulatory restrictions in making our investments. On January 13, 2020, we received a co-investment exemptive order from the SEC (the “Order”) granting us the ability to negotiate terms other than price and quantity of co-investment transactions with other funds managed or owned by our Adviser or certain affiliates, including Prospect Capital Corporation and Priority Income Fund, Inc., where co-investing would otherwise be prohibited under the Company Act, subject to the conditions included therein. Under the terms of the Order, a majority of our independent directors who have no financial interest in the transaction must make certain conclusions in connection with a co-investment transaction, including that (1) the terms of the proposed transaction, including the consideration to be paid, are reasonable and fair to us and our stockholders and do not involve overreaching of us or our stockholders on the part of any person concerned and (2) the transaction is consistent with the interests of our stockholders and is consistent with our investment objective and strategies. The Order also imposes reporting and record keeping requirements and limitations on transactional fees. We may only co-invest with other funds managed or owned by our Adviser or certain affiliates in accordance with such Order and existing regulatory guidance. See “Additional Relationships and Related Party Transactions—Allocation of Investments.” These co-investment transactions may give rise to conflicts of interest or perceived conflicts of interest among us and the other participating accounts. To mitigate these conflicts, our Adviser and its affiliates will seek to allocate portfolio transactions for all of the participating investment accounts, including us, on a fair and equitable basis, taking into account such factors as the relative amounts of capital available for new investments, the applicable investment programs and portfolio positions, the clients for which participation is appropriate and any other factors deemed appropriate. We intend to make all of our investments in compliance with the Company Act and in a manner that will not jeopardize our status as a BDC or RIC.

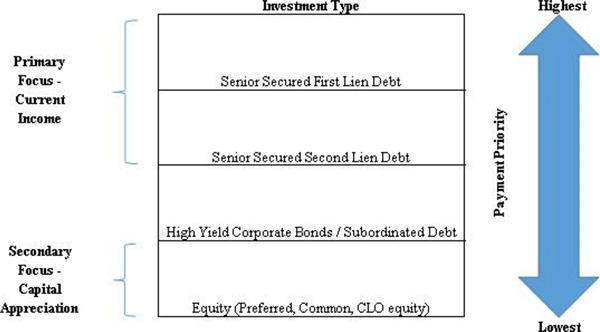

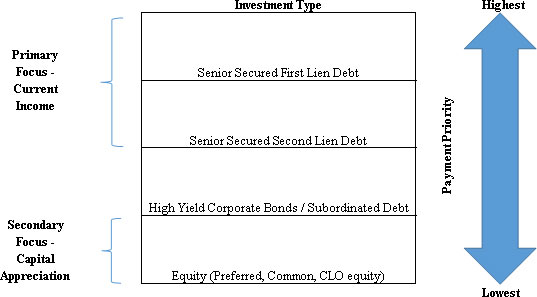

Our portfolio is expected to be comprised primarily of investments in syndicated senior secured first lien loans, syndicated senior secured second lien loans, and to a lesser extent, subordinated debt of private middle market U.S. companies. In addition, a portion of our portfolio may be comprised of other securities, including private equity (both common and preferred), dividend-paying equity, royalties, and the equity and junior debt tranches of SSNs. Our Adviser will seek to tailor our investment focus as market conditions evolve. Depending on market conditions, we may increase or decrease our exposure to less senior portions of the capital structure, where returns tend to be stronger in a more stable or growing economy, but less secure in weak economic environments. Below is a

10

diagram illustrating where these investments lie in a typical portfolio company’s capital structure. Senior secured first lien debt is situated at the top of the capital structure and typically has the first claim on the assets and cash flows of the company, followed by senior secured second lien debt, subordinated debt, preferred equity and, finally, common equity. Due to this priority of cash flows, an investment’s risk increases as it moves further down the capital structure. Investors are usually compensated for this risk associated with junior status in the form of higher returns, either through higher interest payments or potentially higher capital appreciation. We will rely on our Adviser’s experience to structure investments, possibly using all levels of the capital structure, which we believe will perform in a broad range of economic environments.

Typical Leveraged Capital Structure Diagram

As a BDC, we are permitted under the Company Act to borrow funds to finance portfolio investments. To enhance our opportunity for gain, we intend to employ leverage as market conditions permit. At the annual meeting of stockholders held on March 15, 2019 (the “2019 Annual Meeting”), TPIC’s stockholders approved a proposal allowing us to modify our asset coverage ratio requirement from 200% to 150%. As a result, we are allowed to increase our leverage capacity effective as of March 16, 2019. The use of leverage, although it may increase returns, may also increase the risk of loss to our investors, particularly if the level of our leverage is high and the value of our investments declines. For a discussion of the risks of leverage, see “Risk Factors – Risks Relating to Our Business and Structure.”

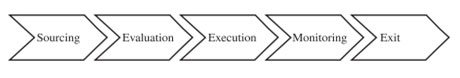

Investment Process

The investment professionals utilized by our Adviser have spent their careers developing the resources necessary to invest in private companies. Our transaction process is highlighted below.

Our Transaction Process

Sourcing