Table of Contents

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-190825

PROSPECTUS SUPPLEMENT

(to Prospectus dated September 6, 2013)

2,512,121 Shares

Common Stock

Lumos Networks Corp.

Common Stock

The selling stockholders identified in this prospectus supplement are offering 2,512,121 shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders.

Our common stock is quoted on The Nasdaq Global Market under the symbol “LMOS.” The last reported sale price of our common stock on The Nasdaq Global Market on November 12, 2013 was $21.90 per share.

You should carefully read this prospectus supplement and the accompanying prospectus, together with the documents we incorporate by reference, before you invest in our common stock.

Investing in our common stock involves risks. See “Risk Factors” beginning on page S-10 of this prospectus supplement concerning factors you should consider before investing in our securities.

| Per Share |

Total | |||||||

| Initial price to public |

$ | 20.00 | $ | 50,242,420 | ||||

| Underwriting discounts and commissions(1) |

$ | 1.10 | $ | 2,763,333 | ||||

| Proceeds, before expenses, to the selling stockholders |

$ | 18.90 | $ | 47,479,087 | ||||

| (1) | See “Underwriting” beginning on page S-17 of this prospectus supplement for additional information regarding underwriting compensation. |

To the extent that the underwriters sell more than 2,512,121 shares of common stock, the underwriters have the option to purchase up to an additional 376,818 shares of common stock from the selling stockholders at the public offering price less the underwriting discount.

None of the Securities and Exchange Commission, any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares or about November 20, 2013.

| Wells Fargo Securities | Cowen and Company |

| D.A. Davidson & Co. | Canaccord Genuity | Drexel Hamilton |

Prospectus Supplement dated November 14, 2013.

Table of Contents

| Page | ||||

| S-ii | ||||

| S-iii | ||||

| S-iv | ||||

| S-1 | ||||

| S-10 | ||||

| S-12 | ||||

| S-13 | ||||

| S-14 | ||||

| S-15 | ||||

| S-17 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders |

S-22 | |||

| S-26 | ||||

| S-26 | ||||

| S-26 | ||||

| S-27 | ||||

You may rely on the information contained in this prospectus supplement and the accompanying prospectus. Neither we, the selling stockholders nor any of the underwriters have authorized anyone to provide information different from that contained in this prospectus supplement and the accompanying prospectus. When you make a decision about whether to invest in our common stock, you should not rely upon any information other than the information in this prospectus supplement and the accompanying prospectus. Neither the delivery of this prospectus supplement nor sale of common stock means that information contained in this prospectus supplement is correct after the date of this prospectus supplement. This prospectus supplement is not an offer to sell or solicitation of an offer to buy these shares of common stock in any circumstances under which the offer or solicitation is unlawful.

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document has two parts, a prospectus supplement and an accompanying prospectus dated September 6, 2013. This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a shelf registration process. Under this shelf registration process, the selling stockholders described in the prospectus may offer and sell in one or more offerings, up to an aggregate of 5,680,837 shares of common stock. The accompanying prospectus describes the general manner in which the shares may be offered and sold by the selling stockholders. This prospectus supplement adds to and updates information contained or incorporated by reference in the accompanying prospectus. You should read both this prospectus supplement and the accompanying prospectus together with additional information described in the section entitled “Where You Can Find More Information” in this prospectus supplement.

The rules of the SEC allow us to incorporate by reference information into this prospectus supplement. This information incorporated by reference is considered to be a part of this prospectus supplement, and information that we file later with the SEC, to the extent incorporated by reference, will automatically update and supersede this information. See the section entitled “Incorporation by Reference.” Any statement that we make in the accompanying prospectus will be modified or superseded by any inconsistent statement made by us in this prospectus supplement. You should read both this prospectus supplement and the accompanying prospectus together with additional information described in the section entitled “Where You Can Find More Information” before investing in our common stock.

We, the underwriters and the selling stockholders have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered common stock to which they relate, nor do this prospectus supplement and the accompanying prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus or any free writing prospectus prepared by us is accurate on any date subsequent to the date set forth on the front of the document or that any information incorporated therein by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus supplement and the accompanying prospectus is delivered or common stock is sold on a later date.

Unless the context otherwise requires or as otherwise expressly stated, references in this prospectus to “Lumos Networks,” “we,” “us,” “our,” and similar terms refer to Lumos Networks Corp. and its consolidated subsidiaries.

Quadrangle Capital Partners LP, Quadrangle Select Partners LP and Quadrangle Capital Partners-A LP are referred to in this prospectus supplement as the “selling stockholders.”

S-ii

Table of Contents

Any statements contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as such. The words “anticipates,” “believes,” “expects,” “intends,” “plans,” “estimates,” “targets,” “projects,” “should,” “may,” “will” and similar words and expressions are intended to identify forward-looking statements. These forward-looking statements are contained throughout this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, for example in the section entitled “Risk Factors.” Such forward-looking statements reflect, among other things, our current expectations, plans and strategies, and anticipated financial results, all of which are subject to known and unknown risks, uncertainties and factors that may cause our actual results to differ materially from those expressed or implied by these forward-looking statements. Many of these risks are beyond our ability to control or predict. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. Because of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. These risks and other factors are the “Risk Factors” identified in this prospectus supplement and the accompanying prospectus or in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. Furthermore, forward-looking statements speak only as of the date they are made. We do not undertake any obligation to update or review any forward-looking information, whether as a result of new information, future events or otherwise.

S-iii

Table of Contents

We obtained the industry, market and competitive position data used throughout this prospectus supplement from our own internal research and analysis of data from research, surveys and studies conducted by third parties, including Cisco’s 2013 Visual Networking Index (the “Cisco Index”), Equifax Telecom, Stratsoft and Tower Source, and public records databases. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. Forecasts, future estimates and other forward-looking information whether prepared by us or obtained from third parties are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus supplement or incorporated by reference into this prospectus supplement and the accompanying prospectus.

S-iv

Table of Contents

This summary highlights selected information included elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus and does not contain all the information that you should consider before making an investment decision. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the section entitled “Risk Factors” and the financial statements and related notes and other information incorporated by reference, before making an investment decision.

Our Company

We are a fiber-based bandwidth infrastructure provider in the Mid-Atlantic region. We provide services to over 1,500 customers, including carriers, healthcare providers, local government agencies, financial institutions, educational institutions, and other enterprises over our advanced fiber network. Our principal products and services include Multiprotocol Label Switching (“MPLS”) and Ethernet / Metro E, Fiber to the Cell (“FTTC”) wireless backhaul and fiber transport services, data center wavelength transport services and IP services.

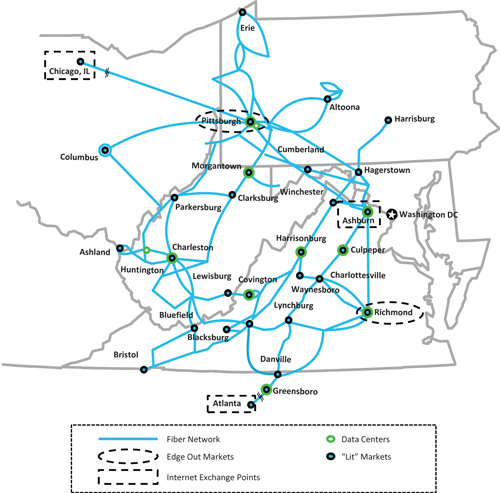

The following map identifies the features of our fiber network:

S-1

Table of Contents

Our industry continues to experience significant increases in global data traffic. The proliferation of smartphones and other network connected devices, the increase in rich media applications, the rise of cloud computing, the deployment of 4G LTE mobile broadband, and the trend towards outsourced enterprise IT and storage services are driving demand for increased connectivity and speed. According to the Cisco Index, global tablet, mobile phone, and machine-to-machine IP traffic is anticipated to grow 104%, 79%, and 82%, respectively, from 2012 through 2017. The Cisco Index estimates that U.S. mobile IP traffic is forecasted to grow approximately nine times from 2012 through 2017, while business IP traffic is expected to nearly triple over the same period. We believe that fiber represents the only transport medium currently capable of supporting these increasing bandwidth demands.

We leverage our fiber assets to capture the continued rapid growth in demand for data and mobility services in the second- and third-tier markets we primarily serve. Compared to first-tier cities, the majority of our markets have a favorable competitive landscape, as there are currently fewer other competitors present. We believe this landscape, combined with our unique network and the strength of our customer relationships, provides us with a sustainable competitive advantage in many of our markets.

As of September 30, 2013, our fiber network spanned approximately 5,800 long-haul fiber route miles. We currently connect to 540 cell towers, approximately 1,300 buildings and 12 data center locations. Based on internal estimates, there are approximately 4,000 cell sites within five miles of our network, over 20,000 buildings within one mile of our network and approximately 80 data centers within our markets. We believe there is a significant opportunity for us to leverage our existing fiber footprint to compete for these opportunities within our markets. To assist us in capturing this opportunity, we have strengthened our management team with recent hires over the last 18 months and intend to drive growth by focusing on leveraging our strategic fiber assets to deliver next-generation communications services.

Our Segments and Services

Beginning in the first quarter of 2013, we restructured our operating segments to more closely align with our product and service offerings, which coincides with the way that we measure performance and allocate resources. We have three reportable operating segments—strategic data, legacy voice and access.

Strategic Data

Our strategic data segment includes our carrier data, enterprise data and IP services product groups and represents the focal point of our growth strategy. We market and sell these services primarily to carrier and enterprise clients, including healthcare providers, local government agencies, financial institutions, educational institutions, and data centers. Given our focus on on-net customers, our strategic data services typically carry higher gross margins than many of our other product lines. A significant majority of our capital expenditures and sales force are dedicated to increasing revenue and profits from our strategic data segment.

We believe that a balanced split between carrier and enterprise revenue results in the most effective capital allocation and resulting profitability. For example, adding a new on-net building brings us closer to nearby cell sites, thus providing an opportunity for FTTC growth, and adding a new cell site brings us closer to nearby on-net buildings and provides an opportunity for enterprise growth. Our ability to sustain revenue growth in our strategic data segment depends on our effectively deploying capital and implementing our FTTC and edge-out plans in a timely and disciplined manner, attracting new customers and upselling existing customers.

We generate growth within our strategic data segment through increased bandwidth demand, particularly for long-term FTTC contracts from wireless carriers deploying 4G LTE services, improving enterprise penetration

S-2

Table of Contents

within our existing markets and selling into the edge-out markets. We have added 279 FTTC sites over the last 12 months, representing a year over year increase of over 100%, and 153 on-net buildings, representing an increase of 13% over the last 12 months. Our sales force is focused on capitalizing on these sources of growth as we are organized into carrier and enterprise teams to effectively pursue the opportunity.

Legacy Voice and Access

Our legacy voice segment includes our local lines, primary rate interface (“PRI”), long distance, toll and directory advertising and other voice services, excluding voice over IP (“VoIP”) which is typically provided to enterprise customers and is included in our strategic data segment. These products are sold to enterprise and residential customers on our network.

Our access segment provides carrier customers access to our network within our footprint and primarily includes switched access and reciprocal compensation products.

These legacy businesses, in the aggregate, require limited incremental capital and personnel investment to maintain the underlying assets and deliver reasonably predictable cash flows. We currently expect aggregate revenue from these businesses will continue to decline at an annual rate of approximately 15%. Despite the declining revenues, we expect the cash flows from these businesses to continue to significantly contribute to funding the capital expenditures for our growing strategic data segment.

Our Network and Platform

We have developed a robust, dense network of long-haul fiber, metro Ethernet and Ethernet rings located primarily in Virginia and West Virginia, and portions of Pennsylvania, Maryland, Ohio and Kentucky. As of September 30, 2013, our fiber network spanned approximately 5,800 long-haul fiber route miles. To support the continued surge in network traffic, in July 2013, we launched 100 Gbps wavelength services across our entire Mid-Atlantic footprint. We believe our 100 Gbps capability, which provides greater throughput and superior latency performance, is attractive to carrier and enterprise customers.

Our integrated fiber transport network allows us to offer a suite of advanced next generation communications services, including, but not limited to, multi-site networking, dedicated Internet and Metro Ethernet Forum (“MEF”) 2.0 certified Ethernet solutions, high-speed Internet and VoIP services. We use a multi-vendor approach, including Cisco and Ciena, among others, to deliver high speed wavelength services directly to end customers or as infrastructure for the MPLS Ethernet and high-speed Internet backbone. Network-to-network interconnection points allow us to engage carrier partners to provide end to end service for carrier and enterprise customers. We continue to invest in our fiber network to support the deployment of next-generation products and services, expand our addressable market and bring new customers on-net.

Our local networks consist of central office digital switches, routers, loop carriers and virtual and physical colocations interconnected primarily with fiber facilities. A mix of fiber optic and copper facilities connect our customers with the core network. Our network operations center provides technical surveillance of our network using IBM-based network management systems.

In June 2013, we launched an upgrade of our internal business processes and systems including provisioning, billing and customer care, which will allow us to scale our back office systems as our business continues to grow. We expect to begin realizing the benefits of this initiative in 2014, including operating efficiencies, improved customer facing capabilities and streamlined business processes.

S-3

Table of Contents

Our Competitive Strengths

We believe the following competitive strengths will help us successfully execute our business strategy:

| • | our advanced fiber network, which allows us to provide next generation communication solutions and tailored services to our customers; |

| • | our footprint, including greenfield contiguous markets, which we believe provides significant opportunities for growth with a favorable competitive environment relative to first-tier markets; |

| • | our robust and expanding products and services, including FTTC and Metro Ethernet, and increasing customer bandwidth demands, both of which drive our growth; |

| • | our disciplined, success-based capital investment strategy aimed at maximizing our capital efficiency and delivering attractive returns; |

| • | our diverse customer base, which we believe affords us significant opportunities to upsell additional advanced data products and solutions; |

| • | our strong liquidity position and cash flow visibility from our legacy voice and access segments, which we believe will allow us to fund our growth plan; and |

| • | our experienced management team, with deep industry experience and a strong track record of operating and scaling bandwidth infrastructure assets. |

Operating Strategy

Our overall strategy is to:

| • | monetize our fiber optic network by selling bandwidth infrastructure services to new and existing carrier and enterprise customers while maintaining approximately 70 – 80% of our strategic data revenue from on-net traffic; |

| • | leverage our balanced mix of carrier and enterprise customers to increase the density of our network in our existing markets; |

| • | provide competitive value proposition and high quality customer service with in-market relationships and support; |

| • | use our edge-out strategy to expand into new adjacent geographic markets to expand our addressable market; and |

| • | execute our success-based investment strategy to improve capital efficiency and expand margins. |

The core tenets of our growth strategy include:

Continue to Scale Our FTTC Revenue Stream

As demand continues to increase for 4G LTE services, wireless carriers are upgrading their backhaul networks from legacy copper based T1s and even Ethernet over SONET connections to native Ethernet in order to handle the exponential need for capacity. To meet this need, we provide FTTC backhaul solutions and transport services to multiple large telecommunications providers who operate in our markets, where our wireless carrier customers are upgrading to 4G LTE services. As of September 30, 2013, we provided FTTC backhaul solutions to 540 sites. We are targeting having FTTC connectivity to 1,500 of the approximately 4,000 cell sites within five miles of our network over the next several years to capitalize on the growth opportunity in our footprint. Based on wireless carrier plans to upgrade to 4G LTE and associated bandwidth growth, together with our knowledge of and experience in the markets we serve, we anticipate long-term growth in tenants, bandwidth and monthly revenue per FTTC site across our addressable market.

S-4

Table of Contents

Drive Incremental On-Net Data Traffic

Our on-net strategy focuses on driving traffic through our network, thereby providing economies of scale and increasing profitability. As bandwidth demand grows, we are able to drive incremental revenue through our existing network with minimal increase in operating expenses or capital expenditures. We evaluate this on-net approach and the associated capital expenditure against the revenue opportunity and have determined that maintaining approximately 70 – 80% of our strategic data revenue from on-net traffic is the most effective use of capital.

Edge-Out into Key Markets Adjacent to Our Existing Network Footprint

Our edge-out strategy expands our fiber network into new contiguous markets based on demand from existing customers and by leveraging existing assets. We also employ experienced in-market sales teams to drive growth. Our current edge-out markets include Richmond, VA and Western PA, which meaningfully increase our addressable market. We had an existing customer which needed alternative solutions in Richmond, VA, and signed a multi-year contract for our services, thus providing us with an anchor to support our expansion into this market. We recently completed the build out of our 110 metro-mile fiber network in Richmond, VA and lit up the network, with anchor enterprise and carrier customers already under contract. In Western PA, we own fiber assets and can leverage these assets to build out metro Ethernet and Ethernet rings. As we edge-out into new markets, we are able to bring new carrier customers, cell sites and enterprise customers onto our fiber networks, thus significantly increasing our addressable market.

Disciplined Success-Based Capital Investment Strategy

We seek to maximize our capital expenditure efficiency by requiring that a significant percentage of our capital investment be tied to specific revenue generating projects based on customer commitments, which we refer to as “success-based projects”. We also maximize our capital expenditure efficiency by pursuing on-net and near-net customer opportunities and maintaining a balanced mix of carrier and enterprise business. Our capital investment strategy targets a 15% – 20% return on investment and a less than 4-year payback. During the nine months ended September 30, 2013, 77% of our funds committed to capital projects were for success-based projects. Since the beginning of 2012, we have invested approximately $88 million of capital within our strategic data segment, the vast majority of which was allocated to success-based projects. Our goal is to continue to achieve a similar ratio of success-based projects to total capital expenditures.

Corporate Information

Our principal executive offices are located at One Lumos Plaza, Waynesboro, Virginia 22980. The telephone number at that address is (540) 946-2000.

S-5

Table of Contents

The Offering

| Common stock offered by the selling stockholders |

2,512,121 shares (or 2,888,939 shares if the underwriters fully exercise their option to purchase additional shares). |

| Total common stock outstanding before and after this offering |

22,022,899 shares.(1) |

| Selling stockholders |

See the section entitled “Selling Stockholders” in this prospectus supplement and “Selling Stockholders” in the accompanying prospectus for information on the selling stockholders in this offering. |

| Options to purchase additional shares |

The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 376,818 shares of common stock from the selling stockholders at the public offering price less the underwriting discounts and commissions. |

| Use of proceeds |

We will not receive any proceeds from the sale of shares of our common stock in this offering by the selling stockholders. |

| The Nasdaq Global Market symbol |

“LMOS.” |

| Risk factors |

See the section entitled “Risk Factors” and other information included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus as they may be amended, updated or modified periodically in our reports filed with the SEC for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Lock-up |

We, all of our directors and executive officers, the selling stockholders and their affiliates have agreed that, subject to certain exceptions, without the prior consent of Wells Fargo Securities, LLC and Cowen and Company, LLC, we and they will not directly or indirectly offer for sale, sell, pledge, or otherwise dispose of any shares of our common stock for period of 90 days after the date of this prospectus supplement. See “Underwriting.” |

| (1) | Except as otherwise noted, the number of shares of our common stock to be outstanding before and after this offering is based on 22,022,899 shares of our common stock outstanding as of October 28, 2013 and excludes shares reserved for future issuance under our equity and cash incentive plan and our employee stock purchase plan. |

S-6

Table of Contents

Summary Historical Consolidated Financial Data

The summary historical consolidated financial data as of December 31, 2012 and 2011 and for the years ended December 31, 2012, 2011 and 2010 have been derived from our audited consolidated financial statements and related notes thereto included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012, as revised by our Current Report on Form 8-K filed with the SEC on August 26, 2013, and are incorporated by reference in this prospectus supplement and the accompanying prospectus. The summary historical consolidated financial data as of September 30, 2013 and for the nine months ended September 30, 2013 and 2012 have been derived from our unaudited consolidated financial statements and related notes thereto included in our Quarterly Report on Form 10-Q for the nine months ended September 30, 2013 and are incorporated by reference in this prospectus supplement and the accompanying prospectus.

You should read the following information in conjunction with our consolidated financial statements, including the accompanying notes. Certain reclassifications have been made to prior annual periods to conform to the current year presentation.

| For the nine months ended September 30, |

For the year ended December 31, |

|||||||||||||||||||

| 2013 | 2012 | 2012 | 2011 | 2010 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| Consolidated Statement of Income Data: |

||||||||||||||||||||

| Operating revenues |

$ | 156,472 | $ | 154,192 | $ | 206,871 | $ | 207,414 | $ | 145,964 | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Network access costs |

31,997 | 35,471 | 46,845 | 47,715 | 24,381 | |||||||||||||||

| Selling, general and administrative(1) |

58,647 | 59,341 | 79,176 | 66,571 | 49,078 | |||||||||||||||

| Depreciation and amortization |

31,528 | 27,673 | 38,884 | 43,090 | 31,365 | |||||||||||||||

| Asset impairment charge |

— | — | — | 86,295 | — | |||||||||||||||

| Accretion of asset retirement obligations |

95 | 93 | 124 | 116 | 11 | |||||||||||||||

| Gain on settlements, net(2) |

— | (2,335 | ) | (2,335 | ) | — | — | |||||||||||||

| Restructuring charges(3) |

50 | — | 2,981 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

34,155 | 33,949 | 41,196 | (36,373 | ) | 41,129 | ||||||||||||||

| Interest expense |

(10,375 | ) | (8,980 | ) | (11,921 | ) | (11,993 | ) | (5,752 | ) | ||||||||||

| Loss on interest rate derivatives |

(110 | ) | (555 | ) | (1,898 | ) | — | — | ||||||||||||

| Other income (expense), net |

(804 | ) | 55 | 81 | 105 | 43 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income tax expense |

22,866 | 24,469 | 27,458 | (48,261 | ) | 35,420 | ||||||||||||||

| Income tax expense (benefit) |

9,037 | 9,985 | 11,010 | (4,383 | ) | 14,477 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

13,829 | 14,484 | 16,448 | (43,878 | ) | 20,943 | ||||||||||||||

| Net income attributable to noncontrolling interests |

(121 | ) | (80 | ) | (108 | ) | (52 | ) | (119 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to Lumos Networks Corp. |

$ | 13,708 | $ | 14,404 | $ | 16,340 | $ | (43,930 | ) | $ | 20,824 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (loss) per common share: |

||||||||||||||||||||

| Basic |

$ | 0.63 | $ | 0.69 | $ | 0.78 | $ | (2.11 | ) | |||||||||||

| Diluted |

$ | 0.62 | $ | 0.67 | $ | 0.76 | $ | (2.11 | ) | |||||||||||

| Cash dividends declared per common share |

$ | 0.42 | $ | 0.42 | $ | 0.56 | $ | 0.14 | ||||||||||||

| Other Consolidated Financial Data: |

||||||||||||||||||||

| Cash flows from operating activities |

$ | 54,295 | $ | 54,202 | $ | 72,215 | $ | 82,908 | $ | 58,977 | ||||||||||

| Capital expenditures |

45,721 | 43,925 | 59,881 | 61,536 | 40,254 | |||||||||||||||

| Adjusted EBITDA(4) |

$ | 72,292 | $ | 65,678 | $ | 88,889 | $ | 96,940 | $ | 77,054 | ||||||||||

S-7

Table of Contents

| For the nine months ended September 30, |

For the year ended December 31, |

|||||||||||||||

| 2013 | 2012 | 2012 | 2011 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Operating Segments Data: |

||||||||||||||||

| Strategic Data: |

||||||||||||||||

| Operating revenues |

$ | 90,000 | $ | 79,754 | $ | 108,753 | $ | 93,549 | ||||||||

| Network access costs |

16,309 | 15,710 | 21,192 | 18,042 | ||||||||||||

| Network operating costs |

22,567 | 17,343 | 24,222 | 20,981 | ||||||||||||

| Selling, general and administrative expenses |

11,508 | 9,695 | 12,704 | 7,308 | ||||||||||||

| Adjusted EBITDA(4) |

39,617 | 37,008 | 50,637 | 47,218 | ||||||||||||

| Capital expenditures |

36,620 | 38,058 | 51,225 | 44,886 | ||||||||||||

| Legacy Voice: |

||||||||||||||||

| Operating revenues |

$ | 43,276 | $ | 49,004 | $ | 64,403 | $ | 75,648 | ||||||||

| Network access costs |

14,738 | 18,684 | 24,228 | 28,074 | ||||||||||||

| Network operating costs |

7,690 | 13,010 | 17,156 | 20,380 | ||||||||||||

| Selling, general and administrative expenses |

5,519 | 6,038 | 7,912 | 5,906 | ||||||||||||

| Adjusted EBITDA(4) |

15,328 | 11,272 | 15,107 | 21,288 | ||||||||||||

| Capital expenditures |

1,103 | 406 | 469 | 5,377 | ||||||||||||

| Access: |

||||||||||||||||

| Operating revenues |

$ | 23,196 | $ | 25,434 | $ | 33,715 | $ | 38,217 | ||||||||

| Network access costs |

950 | 1,077 | 1,425 | 1,599 | ||||||||||||

| Network operating costs |

1,947 | 3,338 | 4,401 | 5,203 | ||||||||||||

| Selling, general and administrative expenses |

2,952 | 3,619 | 4,742 | 2,981 | ||||||||||||

| Adjusted EBITDA(4) |

17,347 | 17,398 | 23,145 | 28,434 | ||||||||||||

| Capital expenditures |

1,403 | 531 | 597 | 6,634 | ||||||||||||

| Corporate (unallocated): |

||||||||||||||||

| Selling, general and administrative expenses |

$ | 6,464 | $ | 6,298 | $ | 8,039 | $ | 3,812 | ||||||||

| Capital expenditures |

6,595 | 4,930 | 7,590 | 4,639 | ||||||||||||

| As of September 30, | As of December 31, | |||||||||||||||

| 2013 | 2012 | 2012 | 2011 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||

| Cash |

$ | 58,072 | $ | 2 | $ | 2 | $ | 10,547 | ||||||||

| Restricted cash(5) |

4,324 | 6,750 | 5,303 | 7,554 | ||||||||||||

| Property, plant and equipment, net |

362,527 | 325,098 | 336,589 | 299,958 | ||||||||||||

| Total assets |

594,514 | 504,436 | 513,162 | 498,600 | ||||||||||||

| Current portion of long-term debt |

5,422 | 6,781 | 7,900 | 2,679 | ||||||||||||

| Long-term debt |

375,288 | 307,597 | 304,325 | 323,897 | ||||||||||||

| Total equity |

$ | 75,795 | $ | 62,274 | $ | 64,602 | $ | 52,827 | ||||||||

| Common stock outstanding, in shares at end of period |

22,017 | 21,482 | 21,498 | 21,170 | ||||||||||||

| (1) | Includes equity-based compensation charges related to all of our share-based awards and our 401(k) matching contributions of $5.5 million and $2.9 million for the nine months ended September 30, 2013 and 2012, respectively, and $3.9 million, $2.4 million and $1.5 million for the years ended December 31, 2012, 2011 and 2010, respectively. |

| (2) | We recognized a net pre-tax gain of approximately $2.3 million in the third quarter of 2012 in connection with the settlement of outstanding matters related to a prior acquisition and the settlement of an outstanding lawsuit. |

S-8

Table of Contents

| (3) | In December 2012, we completed a cost reduction plan involving an employee reduction-in-force, consolidation of certain facilities and freezing the accumulation of benefits under certain postretirement plans. Restructuring charges of $3.0 million were recognized in the fourth quarter of 2012 in connection with this plan, $2.4 million of which related to employee severance and termination benefits and $0.6 million of which related to lease termination costs. |

| (4) | We evaluate our performance based upon Adjusted EBITDA (a measure that is not determined in accordance with U.S. generally accepted accounting principles (“GAAP”)), defined by us as net income or loss attributable to us before interest, income taxes, depreciation and amortization, accretion of asset retirement obligations, net income or loss attributable to noncontrolling interests, other income or expenses, equity-based compensation charges, acquisition-related charges, amortization of actuarial losses on retirement plans, employee separation charges, restructuring-related charges, gain or loss on settlements and gain or loss on interest rate derivatives. The following table provides a reconciliation of our operating income (a GAAP financial measure) to our Adjusted EBITDA (a non-GAAP financial measure) for the indicated periods: |

| For the nine months ended September 30, |

For the year ended December 31, |

|||||||||||||||||||

| 2013 | 2012 | 2012 | 2011 | 2010 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Operating income (loss) |

$ | 34,155 | $ | 33,949 | $ | 41,196 | $ | (36,373 | ) | $ | 41,129 | |||||||||

| Depreciation and amortization |

31,528 | 27,673 | 38,884 | 43,090 | 31,365 | |||||||||||||||

| Accretion of asset retirement obligations |

95 | 93 | 124 | 116 | 11 | |||||||||||||||

| Asset impairment charges |

— | — | — | 86,295 | — | |||||||||||||||

| Amortization of actuarial losses |

928 | 1,336 | 1,781 | — | — | |||||||||||||||

| Equity-based compensation |

5,536 | 2,887 | 3,912 | 2,383 | 1,529 | |||||||||||||||

| Restructuring charges |

50 | — | 2,981 | — | — | |||||||||||||||

| Employee separation charges |

— | 2,075 | 2,346 | — | — | |||||||||||||||

| Gain on settlements, net |

— | (2,335 | ) | (2,335 | ) | — | — | |||||||||||||

| Business separation and acquisition-related charges |

— | — | — | 1,429 | 3,020 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 72,292 | $ | 65,678 | $ | 88,889 | $ | 96,940 | $ | 77,054 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Adjusted EBITDA is a non-GAAP financial performance measure. It should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with GAAP. We believe that Adjusted EBITDA is a standard measure of operating performance and liquidity that is commonly reported in the telecommunications and high speed data transport industry and provides relevant and useful information to investors for comparing performance period to period and for comparing financial performance of similar companies. However, our calculation of Adjusted EBITDA may not be comparable to other similarly-titled measures of other companies and should not be considered in isolation or as a substitute for analysis of our operating results as reported under GAAP. We utilize Adjusted EBITDA internally to assess our ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, and to fund continued growth. We also use Adjusted EBITDA to evaluate the performance of our business for budget planning purposes and as factors in our employee compensation programs.

| (5) | During 2010, we received a Federal stimulus award providing 50% funding to bring broadband services and infrastructure to Alleghany County, Virginia. We were required to deposit 100% of our grant ($8.1 million) into pledged accounts in advance of any reimbursements, to be drawn down ratably following reimbursement approvals. |

S-9

Table of Contents

An investment in our common stock involves risks. You should carefully consider the specific risks set forth in this prospectus supplement and the accompanying prospectus and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2012 and our Quarterly Reports on Form 10-Q for the six months ended June 30, 2013 and the nine months ended September 30, 2013, which are incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. You should also consider similar information contained in any Annual Report on Form 10-K, Quarterly Report on Form 10-Q or other document filed by us with the SEC after the date of this prospectus supplement before deciding to invest in our common stock. The occurrence of any such risks might cause you to lose all or part of your investment in our common stock. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations and financial condition.

Risks Relating to this Offering and our Common Stock

The Quadrangle Entities will continue to have significant influence over our business after this offering and could delay, deter or prevent a change of control, change in management or business combination that may be beneficial to our stockholders, and as a result, may depress the market price of our common stock.

Upon completion of this offering, the Quadrangle Entities (as defined in the section entitled “Selling Stockholders”) will beneficially own 3,168,716 shares of our common stock, or approximately 14.4% of our outstanding common stock. If the underwriters’ option to purchase 376,818 additional shares is exercised in full, the Quadrangle Entities will beneficially own 2,791,898 shares of our common stock, or approximately 12.7% of our outstanding common stock. In addition, two of the eight directors who serve on our board of directors will be representatives or designees of the Quadrangle Entities. Pursuant to the terms of the Stockholders Agreement (as defined in the section entitled “Selling Stockholders”), the Quadrangle Entities currently have the right to nominate three directors. One of the three directors designated by the Quadrangle Entities currently must be “independent” as defined by the rules of The NASDAQ Stock Market. Pursuant to the Stockholders Agreement, the Quadrangle Entities may designate only two directors, who do not need to be “independent,” if their ownership falls below 20% of the voting power of our common stock, one director, who does not need to be “independent,” if their ownership falls below 10% and no directors if their ownership falls below 5%. The Stockholders Agreement also provides that one director will be our Chief Executive Officer for so long as he or she is employed by us. Upon completion of this offering, the Quadrangle Entities’ ownership of our common stock will fall below 20% of the voting power of our common stock, and, as result, they may continue to designate two directors who do not need to be “independent.”

By virtue of the Stockholder’s Agreement and such stock ownership and representation on the board of directors, the Quadrangle Entities will continue to have a significant influence over day-to-day corporate and management policies and all matters submitted to our stockholders, including the election of the directors, and to exercise significant control over our business, policies and affairs. Such concentration of voting power could have the effect of delaying, deterring or preventing a change of control, a change in management or a business combination that might otherwise be beneficial to our stockholders and as a result, may depress the market price of our common stock.

The interests of the Quadrangle Entities may not coincide with the interests of a holder of our common stock and because the Quadrangle Entities will continue to have significant influence over our business, they could cause us to enter into transactions or agreements adverse to the interests of our other stockholders.

The interests of the Quadrangle Entities may not always coincide with the interests of our other stockholders. Accordingly, because the Quadrangle Entities will continue to have significant influence over our business after the closing of this offering, they could cause us to enter into transactions or agreements adverse to the interests of our other stockholders.

S-10

Table of Contents

In addition, the Quadrangle Entities are in the business of making investments in companies and may, from time to time, acquire and hold interests in businesses that compete directly or indirectly with us. The Quadrangle Entities may also pursue, for their own account, acquisition opportunities that may be complementary to our business, and as a result, those acquisition opportunities may not be available to us. Additionally, we have specifically renounced in the Shareholders Agreement (as defined in the section entitled “Selling Stockholders”) any interest or expectancy that the Quadrangle Entities will offer to us any investment or business opportunity of which they are aware.

The shares of our common stock being sold in this offering by the selling stockholders were not freely tradable on The Nasdaq Global Market prior to the completion of this offering, and the sale by the selling stockholders of the shares of our common stock in this offering will increase the number of shares of our common stock eligible to be freely traded on The Nasdaq Global Market, which could depress the market price of our common stock.

Of the 22,022,899 shares of our common stock issued and outstanding as of October 28, 2013, approximately 25.8% was held by the selling stockholders. The remainder of our shares of issued and outstanding common stock are freely tradable on The Nasdaq Global Market without restriction or further registration under the Securities Act of 1933, as amended (the “Securities Act”), unless such shares constitute “restricted securities” within the meaning of Rule 144 under the Securities Act or are purchased by our “affiliates” as that term is defined in Rule 144 under the Securities Act. The shares of common stock being sold in this offering were not freely tradable on The Nasdaq Global Market prior to the completion of this offering and the sale by the selling stockholders of the shares of common stock in this offering will increase the number of shares of our common stock eligible to be freely traded on The Nasdaq Global Market, which could depress the market price of our common stock.

S-11

Table of Contents

We will not receive any proceeds from the sale of shares of our common stock in this offering by the selling stockholders.

S-12

Table of Contents

PRICE RANGE OF COMMON STOCK AND DIVIDENDS

We became an independent, publicly traded company on October 31, 2011, as a result of our spin-off from NTELOS Holdings Corp. Our common stock has been publicly traded on The Nasdaq Global Market under the symbol “LMOS” since November 1, 2011. The following table sets forth, for the periods indicated, the range of high and low sale prices for our common stock, as reported by The Nasdaq Global Market and the cash dividends declared on the common stock for the periods indicated:

| Price Range |

High | Low | Dividends | |||||||||

| 2011 |

||||||||||||

| Fourth Quarter (from November 1, 2011) |

$ | 17.99 | $ | 11.70 | $ | 0.14 | ||||||

| 2012 |

||||||||||||

| First Quarter |

$ | 18.18 | $ | 10.13 | $ | 0.14 | ||||||

| Second Quarter |

10.76 | 7.65 | 0.14 | |||||||||

| Third Quarter |

9.86 | 7.50 | 0.14 | |||||||||

| Fourth Quarter |

10.54 | 7.61 | 0.14 | |||||||||

| 2013 |

||||||||||||

| First Quarter |

$ | 13.57 | $ | 8.82 | $ | 0.14 | ||||||

| Second Quarter |

17.72 | 12.27 | 0.14 | |||||||||

| Third Quarter |

22.25 | 15.015 | 0.14 | |||||||||

| Fourth Quarter (through November 12, 2013) |

24.72 | 18.83 | 0.14 | |||||||||

On November 12, 2013 the last reported sale price for our common stock was $21.90 per share.

On October 30, 2013, our board of directors declared a quarterly dividend on our common stock in the amount of $0.14 per share to be paid on January 9, 2014 to stockholders of record on December 12, 2013. We currently intend to continue to pay regular quarterly dividends on our common stock at a rate of $0.14 per share. All decisions to declare future dividends will be made at the discretion of the board of directors and will depend on, among other things, our results of operations, cash requirements, investment opportunities, financial condition, credit agreement and contractual restrictions and other factors that the board of directors may deem relevant. We are a holding company that does not operate any business of our own. As a result, we are dependent on cash dividends and distributions and other transfers from our subsidiaries to make dividend payments or other distributions to our stockholders. Amounts that can be made available to us to pay cash dividends will be permitted by our credit agreement within the parameters of a restricted payment basket.

As of March 1, 2013, there were approximately 3,300 record holders of our common stock.

S-13

Table of Contents

The table below shows our unaudited capitalization on a consolidated basis as of September 30, 2013.

You should read this table together with our consolidated financial statements, including the accompanying notes, contained in our Annual Report on Form 10-K for the year ended December 31, 2012, as revised by our Current Report on Form 8-K filed with the SEC on August 26, 2013, as well as the unaudited information presented in our most recent Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2013.

| As of September 30, 2013 |

||||

| (in thousands) | ||||

| Cash and cash equivalents |

$ | 58,072 | ||

|

|

|

|||

| Current portion of long-term debt |

$ | 5,422 | ||

| Long-term debt |

375,288 | |||

|

|

|

|||

| Total debt(1) |

$ | 380,710 | ||

|

|

|

|||

| Stockholders’ equity: |

||||

| Preferred stock ($0.01 par value, authorized 100,000 shares, none issued) |

— | |||

| Common stock ($0.01 par value, authorized 55,000,000 shares; issued 22,073,000 shares; and outstanding 22,017,000 shares) |

221 | |||

| Additional paid-in capital |

135,913 | |||

| Treasury stock (56,000 shares at cost) |

(351 | ) | ||

| Accumulated deficit |

(48,552 | ) | ||

| Accumulated other comprehensive loss |

(12,109 | ) | ||

|

|

|

|||

| Total Lumos Networks Corp. stockholders’ equity |

$ | 75,122 | ||

|

|

|

|||

| Total capitalization |

$ | 455,832 | ||

|

|

|

|||

| (1) | Includes $6.4 million of capital lease obligations. |

S-14

Table of Contents

We are party to a Shareholders Agreement, dated as of October 31, 2011, among us, Quadrangle Capital Partners LP, Quadrangle Select Partners LP, Quadrangle Capital Partners-A LP, Quadrangle NTELOS Holdings II LP (together with Quadrangle Capital Partners LP, Quadrangle Select Partners LP and Quadrangle Capital Partners-A LP, the “Quadrangle Entities”) and the management shareholders named therein (the “Shareholders Agreement”). Pursuant to our Shareholders Agreement, we agreed to register shares of our common stock held by the Quadrangle Entities. The Quadrangle Entities previously requested that we register all of their shares under the Securities Act. Upon this request from the Quadrangle Entities, we were obligated to prepare and file a registration statement covering the shares held by them. On August 26, 2013, to comply with these registration obligations, we filed a registration statement. This prospectus supplement and the accompanying prospectus form a part of the registration statement.

Stock Ownership of Selling Stockholders

The following table sets forth information known to us with respect to the beneficial ownership of our common stock as of November 12, 2013 by the selling stockholders.

We have determined the number and percentage of shares beneficially owned in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and this information does not necessarily indicate beneficial ownership for any other purpose. In determining the number of shares beneficially owned by the selling stockholders and the percentage ownership of the selling stockholders, we included any shares as to which the selling stockholders has sole or shared voting power or investment power. Under the rules of the SEC more than one person may be deemed a beneficial owner of the same securities. Percentage of shares beneficially owned is based on 22,022,899 shares of our common stock outstanding as of October 28, 2013. The address of Quadrangle Capital Partners LP is 1065 Avenue of the Americas, New York, NY 10018.

| Selling Stockholder |

Common Stock Beneficially Owned Prior to this Offering(1) |

Number of Shares of Common Stock to be Sold under the Offering |

Number of Shares of Common

Stock Beneficially Owned after the Offering |

|||||||||||||||||||||||||

| Excluding Exercise of Option(2) |

Including Exercise of Option(3) |

Excluding Exercise of Option |

Including Exercise of Option |

|||||||||||||||||||||||||

| Number | Percentage | Number | Percentage | |||||||||||||||||||||||||

| Quadrangle Capital Partners LP. |

5,680,837 | 2,512,121 | 2,888,939 | 3,168,716 | 14.4 | % | 2,791,898 | 12.7 | % | |||||||||||||||||||

| (1) | Includes 2,011,848 shares of common stock owned by Quadrangle Capital Partners LP, 109,928 shares of common stock owned by Quadrangle Select Partners LP, 767,163 shares of common stock owned by Quadrangle Capital Partners-A LP and 2,791,898 shares of common stock owned by Quadrangle NTELOS Holdings II LP. Quadrangle NTELOS Holdings II LP has pledged its interest in 2,791,898 shares of common stock to secure repayment of a loan made to it by the Bank of Montreal. Quadrangle GP Investors LLC, Quadrangle GP Investors LP, Quadrangle Capital Partners LP, Quadrangle Select Partners LP, Quadrangle Capital Partners-A LP, QCP GP Investors II LLC, Quadrangle GP Investors II LP, Quadrangle (AIV2) Capital Partners II LP, Quadrangle Select Partners II LP, Quadrangle Capital Partners II-A LP, Quadrangle NTELOS GP LLC and Quadrangle NTELOS Holdings II LP may be deemed to beneficially own the shares of the Quadrangle Entities. Quadrangle GP Investors LLC is the general partner of Quadrangle GP Investors LP, which is the general partner of each of Quadrangle Capital Partners LP, Quadrangle Select Partners LP and Quadrangle Capital Partners-A LP. QCP GP Investors II LLC is the general partner of Quadrangle GP Investors II LP, which is the general partner of each of Quadrangle (AIV2) Capital Partners II LP, Quadrangle Select Partners II LP and Quadrangle Capital Partners II-A LP (collectively, the “QCP II Funds”). The QCP II Funds |

S-15

Table of Contents

| are managing members of Quadrangle NTELOS GP LLC, which is the general partner of Quadrangle NTELOS Holdings II LP. Quadrangle Holdings LLC is the managing member of QCP GP Investors II LLC. |

| (2) | Includes 1,748,436 shares of common stock owned by Quadrangle Capital Partners LP, 95,461 shares of common stock owned by Quadrangle Select Partners LP and 668,224 shares of common stock owned by Quadrangle Capital Partners-A LP. |

| (3) | Includes 2,011,848 shares of common stock owned by Quadrangle Capital Partners LP, 109,928 shares of common stock owned by Quadrangle Select Partners LP and 767,163 shares of common stock owned by Quadrangle Capital Partners-A LP. |

Certain Relationships and Transactions

Our board of directors currently consists of eight members. Pursuant to the terms of the Shareholders Agreement, the Quadrangle Entities currently have the right to nominate three directors. One of the three directors designated by the Quadrangle Entities currently must be “independent” as defined by the rules of The NASDAQ Stock Market. Pursuant to the Shareholders Agreement, the Quadrangle Entities may designate only two directors, who do not need to be “independent,” if their ownership falls below 20% of the voting power of our common stock, one director, who does not need to be “independent,” if their ownership falls below 10% and no directors if their ownership falls below 5%. The Shareholders Agreement also provides that one director will be our Chief Executive Officer for so long as he or she is employed by us. Upon completion of this offering, the Quadrangle Entities’ ownership of our common stock will fall below 20% of the voting power of our common stock, and, as result, they may designate two directors who do not need to be “independent.”

S-16

Table of Contents

Subject to the terms and conditions stated in the underwriting agreement, the selling stockholders have agreed to sell to the underwriters named below, and the underwriters, for whom Wells Fargo Securities, LLC and Cowen and Company, LLC are acting as joint book-running managers and representatives, have, severally and not jointly, agreed to purchase from the selling stockholders, the respective number of shares of common stock appearing opposite their names below.

| Underwriters |

Number of Shares of Common Stock |

|||

| Wells Fargo Securities, LLC |

1,165,624 | |||

| Cowen and Company, LLC |

906,876 | |||

| D.A. Davidson & Co. |

188,409 | |||

| Canaccord Genuity Inc. |

125,606 | |||

| Drexel Hamilton, LLC |

125,606 | |||

|

|

|

|||

| Total |

2,512,121 | |||

|

|

|

|||

The underwriting agreement provides that the obligations of the several underwriters are subject to various conditions, including approval of legal matters by counsel. The underwriters are obligated, severally and not jointly, to purchase all of the common stock (other than those covered by the option to purchase additional shares of common stock described below) if they purchase any of the common stock. If an underwriter defaults, the underwriting agreement provides that the purchase commitments of the non-defaulting underwriters may be increased or, under certain limited circumstances, the underwriting agreement may be terminated.

Option to Purchase Additional Common Stock

The selling stockholders have granted the underwriters a 30-day option, exercisable from the date of this prospectus supplement, to purchase up to an additional 376,818 shares of common stock from the selling stockholders at the public offering price less the underwriting discounts and commissions. To the extent the option is exercised, each underwriter must, subject to the terms and conditions contained in the underwriting agreement, purchase a number of additional shares of common stock approximately proportionate to that underwriters’ initial purchase commitment.

Underwriting Discounts and Expenses

The underwriters propose to offer some of the shares of common stock directly to the public at the public offering price set forth on the cover page of this prospectus supplement and some of the shares of common stock to dealers at the public offering price less a concession not to exceed $0.60 per share of common stock. After the offering, the underwriters may change the public offering price and the other selling terms. The offering of the shares of common stock by the underwriters is subject to receipt and acceptance and subject to the underwriters’ right to reject any order in whole or in part.

The following table summarizes the underwriting discounts and commissions and the proceeds, before expenses, payable to the selling stockholders, both on a per share basis and in total, assuming either no exercise or full exercise by the underwriters of their option to purchase additional common stock from the selling stockholders.

| Per Share | Total | |||||||||||

| No Exercise | Full Exercise | |||||||||||

| Public offering price |

$ | 20.00 | $ | 50,242,420 | $ | 57,778,780 | ||||||

| Underwriting discounts and commissions paid by the selling stockholders per share of common stock |

$ | 1.10 | $ | 2,763,333 | $ | 3,177,833 | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | 18.90 | $ | 47,479,087 | $ | 54,600,947 | ||||||

S-17

Table of Contents

We estimate that our total expenses of this offering, other than underwriting discounts and commissions, will be approximately $700,000 and are payable by us. We have also agreed to reimburse the underwriters for certain of their expenses relating to required reviews by FINRA in an amount up to $10,000.

Lock-Up Agreements

We, all of our directors and executive officers, the selling stockholders and their affiliates have agreed that, subject to certain exceptions (including in connection with change of control transactions, to us to satisfy tax withholding obligations and up to 5% of our issued and outstanding common stock by us in connection with strategic transactions), without the prior written consent of Wells Fargo Securities, LLC and Cowen and Company, LLC, we and they will not directly or indirectly (1) offer for sale, sell, pledge, or otherwise dispose of (or enter into any transaction or device that is designed to, or could be expected to, result in the disposition by any person at any time in the future of) any shares of common stock (including, without limitation, shares of common stock that may be deemed to be beneficially owned by us or them in accordance with the rules and regulations of the SEC and shares of common stock that may be issued upon exercise of any options or warrants) or securities convertible into or exercisable or exchangeable for common stock (other than the shares of common stock offered for sale by the selling stockholders as described in this prospectus supplement), (2) enter into any swap or other derivatives transaction that transfers to another, in whole or in part, any of the economic benefits or risks of ownership of the common stock, (3) cause to be filed a registration statement with respect to any shares of common stock or securities convertible, exercisable or exchangeable into common stock or any of our other securities, or (4) publicly disclose the intention to do any of the foregoing for a period of 90 days after the date of this prospectus supplement.

To the extent any of the underwriters in this offering are unable to publish research reports on us under Rule 139 of the Securities Act and/or pursuant to NASD Rule 2711 of the rules and regulations of the Financial Industry Regulatory Authority, the 90-day restricted period described in the preceding paragraph will be extended if:

| • | during the last 17 days of the 90-day restricted period we issue an earnings release or material news or a material event relating to us occurs; or |

| • | prior to the expiration of the 90-day restricted period, we announce that we will release earnings results during the 16-day period beginning on the last day of the 90-day period; |

in which case the restrictions described in the preceding paragraph will continue to apply until the expiration of the 18-day period beginning on the date of issuance of the earnings release or the announcement of the material news or material event, unless such extension is waived in writing by each of Wells Fargo Securities, LLC and Cowen and Company, LLC.

Listing on The NASDAQ Global Market

Our shares of common stock are listed on The Nasdaq Global Market under the symbol “LMOS.”

Price Stabilization, Short Positions and Penalty Bids

In connection with the offering, the underwriters may purchase and sell common stock in the open market. These transactions may include short sales, covering transactions and stabilizing transactions. Short sales involve sales of common stock in excess of the number of common stock to be purchased by the underwriters in the offering, which creates a short position. “Covered” short sales are sales of common stock made in an amount up to the number of common stock represented by the underwriters’ option to purchase additional shares. In determining the source of common stock to close out the covered short position, the underwriters will consider, among other things, the price of common stock available for purchase in the open market as compared to the price at which they may purchase shares of common stock through the option to purchase additional shares. Transactions to close out the covered short position involve either purchases of the common stock in the open market after the distribution has been completed or the exercise of the option to purchase additional shares. The underwriters may also make “naked” short sales of common stock in excess of the option to purchase additional

S-18

Table of Contents

shares. The underwriters must close out any naked short position by purchasing common stock in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the common stock in the open market after pricing that could adversely affect investors who purchase in the offering. Stabilizing transactions consist of bids for or purchases of common stock in the open market while the offering is in progress.

The underwriters also may impose a penalty bid. Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when it repurchases common stock originally sold by that syndicate member in order to cover syndicate short positions or make stabilizing purchases.

Any of these activities may have the effect of preventing or retarding a decline in the market price of the common stock. They may also cause the price of the common stock to be higher than the price that would otherwise exist in the open market in the absence of these transactions. The underwriters may conduct these transactions on The NASDAQ Global Market or in the over-the-counter market, or otherwise. If the underwriters commence any of these transactions, they may discontinue them at any time. Neither we nor the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of the common stock.

Certain Relationships

The underwriters and their affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriters and their related entities have performed and may perform investment and commercial banking and advisory services for us and our affiliates from time to time, for which they have received and may receive customary fees and expense reimbursement. The underwriters and their affiliates may, from time to time, engage in transactions with and perform services for us in the ordinary course of their business.

In addition, in the ordinary course of their various business activities, the underwriters and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investment and securities activities may involve securities and instruments of the issuer. The underwriters and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Electronic Distribution

This prospectus supplement in electronic format may be made available on the websites maintained by the underwriters. The underwriters may agree to allocate a number of shares of common stock for sale to their online brokerage account holders. The common stock will be allocated to the underwriters, which may make Internet distributions on the same basis as other allocations. In addition, shares of common stock may be sold by the underwriters to securities dealers who resell shares of common stock to online brokerage account holders.

Other than this prospectus supplement in electronic format, information contained in any websites maintained by the underwriters is not part of this prospectus supplement or registration statement of which this prospectus supplement forms a part, has not been endorsed by us and should not be relied on by investors in deciding whether to purchase common stock. The underwriters are not responsible for information contained in websites that they do not maintain.

S-19

Table of Contents

Indemnification

We, and the selling stockholders, have agreed, joint and severally, to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute to payments the underwriters may be required to make because of any of those liabilities.

Sales Outside the United States

No action has been taken in any jurisdiction (except in the United States) that would permit a public offering of the common stock or the possession, circulation or distribution of this prospectus supplement or any other material relating to us or the common stock in any jurisdiction where action for that purpose is required. Accordingly, the common stock may not be offered or sold, directly or indirectly, and neither this prospectus supplement nor any other offering material or advertisements in connection with the common stock may be distributed or published, in or from any country or jurisdiction, except in compliance with any applicable rules and regulations of any such country or jurisdiction.

The underwriters may arrange to sell common stock offered hereby in certain jurisdictions outside the United States, either directly or through affiliates, where it is permitted to do so.

Notice to Prospective Investors in the European Economic Area

In relation to each member state of the European Economic Area that has implemented the Prospectus Directive (as defined below) (each, a relevant member state), with effect from and including the date on which the Prospectus Directive is implemented in that relevant member state (the relevant implementation date), an offer of securities described in this prospectus supplement may not be made to the public in that relevant member state other than:

| • | to any legal entity which is a qualified investor as defined in the Prospectus Directive; |

| • | to fewer than 100 or, if the relevant member state has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the relevant dealer or dealers nominated by the issuer for any such offer; or |

| • | in any other circumstances falling within Article 3(2) of the Prospectus Directive, |

provided that no such offer of securities shall require us or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement to a prospectus pursuant to Article 16 of the Prospectus Directive.

The issue and distribution of this prospectus supplement is restricted by law. This prospectus supplement is not being distributed by, nor has it been approved for the purposes of section 21 of the Financial Services and Markets Act 2000 by, a person authorized under the Financial Services and Markets Act 2000. In the United Kingdom, this prospectus supplement is for distribution only to persons who (i) have professional experience in matters relating to investments (being investment professionals falling within Article 19(5) of the Financial Promotion Order; (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”) of the Financial Promotion Order; (iii) are outside the United Kingdom; or (iv) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, (1) in the United Kingdom, relevant persons and (2) in any member state of the EEA other than the United Kingdom, “qualified investors” (“Qualified Investors”) within the meaning of Article 2(1)(e) of the Prospectus Directive. This prospectus

S-20

Table of Contents

supplement and its contents should not be acted upon or relied upon (1) in the United Kingdom, by persons who are not relevant persons or (2) in any member state of the EEA other than the United Kingdom, by persons who are not Qualified Investors. No part of this prospectus supplement should be published, reproduced, distributed or otherwise made available in whole or in part to any other person without the prior written consent of the issuer.

Securities may not be offered into the Netherlands unless such offer is made exclusively to legal entities, which are qualified investors (as defined in the Prospectus Directive) and to authorized discretionary asset managers acting for the account of retail investors under a discretionary investment management contract.

For purposes of this provision, the expression an “offer of securities to the public’’ in any relevant member state means the communication in any form and by any means of sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide to purchase or subscribe for the securities, as the expression may be varied in that member state by any measure implementing the Prospectus Directive in that member state, and the expression “Prospectus Directive’’ means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the relevant member state) and includes any relevant implementing measure in each relevant member state. The expression “2010 PD Amending Directive’’ means Directive 2010/73/EU.

We have not authorized and do not authorize the making of any offer of securities through any financial intermediary on their behalf, other than offers made by the underwriters with a view to the final placement of the securities as contemplated in this prospectus supplement. Accordingly, no purchaser of the securities, other than any of the underwriters, is authorized to make any further offer of the securities on behalf of us or the underwriters.

Notice to Prospective Investors in Switzerland

This prospectus supplement is being communicated in Switzerland to a small number of selected investors only. Each copy of this prospectus supplement is addressed to a specifically named recipient and may not be copied, reproduced, distributed or passed on to third parties. Our common stock is not being offered to the public in Switzerland, and neither this prospectus supplement, nor any other offering materials relating to our common stock may be distributed in connection with any such public offering.

We have not been registered with the Swiss Financial Market Supervisory Authority FINMA as a foreign collective investment scheme pursuant to Article 120 of the Collective Investment Schemes Act of June 23, 2006 (“CISA”). Accordingly, our common stock may not be offered to the public in or from Switzerland, and neither this prospectus supplement, nor any other offering materials relating to our common stock may be made available through a public offering in or from Switzerland. Our common stock may only be offered and this prospectus supplement may only be distributed in or from Switzerland by way of private placement exclusively to qualified investors (as this term is defined in the CISA and its implementing ordinance).

S-21

Table of Contents

MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS