Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

ACADIA HEALTHCARE COMPANY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date filed:

| |||

Table of Contents

6100 TOWER CIRCLE, SUITE 1000

FRANKLIN, TENNESSEE 37067

March 21, 2019

TO OUR STOCKHOLDERS:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of Acadia Healthcare Company, Inc., to be held on Thursday, May 2, 2019, at 9:30 a.m. (Central Time), at our executive offices located at 6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067. The matters to be acted upon at the Annual Meeting are more fully described in the accompanying Proxy Statement and related materials.

In accordance with rules adopted by the Securities and Exchange Commission, we are mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials instead of a paper copy of the Proxy Statement and our 2018 Annual Report to Stockholders. The Notice of Internet Availability of Proxy Materials contains instructions on how stockholders can access the proxy documents over the internet as well as how stockholders can receive a paper copy of our proxy materials, including the Proxy Statement, the 2018 Annual Report to Stockholders and a form of proxy card.

It is important that your shares be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote by proxy as soon as possible by following the instructions located in the Notice of Internet Availability of Proxy Materials sent to you or in the Proxy Statement. If you attend the Annual Meeting, you may withdraw your proxy and vote your shares personally.

We look forward to seeing you at the Annual Meeting.

| Sincerely, |

|

| Debra K. Osteen |

| Chief Executive Officer and Director |

YOUR VOTE IS IMPORTANT.

PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD

AS PROMPTLY AS POSSIBLE.

Table of Contents

6100 TOWER CIRCLE, SUITE 1000

FRANKLIN, TENNESSEE 37067

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 2, 2019

TO OUR STOCKHOLDERS:

The 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of Acadia Healthcare Company, Inc. will be held on Thursday, May 2, 2019, at 9:30 a.m. (Central Time), at our executive offices located at 6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067, for the following purposes:

| (1) | To elect two nominees as Class II directors; |

| (2) | To approve, on a non-binding advisory basis, the compensation of our named executive officers; |

| (3) | To approve, on a non-binding advisory basis, the frequency of a non-binding advisory vote on the compensation of our named executive officers; |

| (4) | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; |

| (5) | To transact any other business that properly comes before the Annual Meeting or any adjournments or postponements thereof. |

The matters to be acted upon at the Annual Meeting are more fully described in the Proxy Statement and related materials. Please read the materials carefully.

The Board of Directors has fixed the close of business on March 11, 2019 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof.

| Dated: March 21, 2019 | By order of the Board of Directors, | |||||

| ||||||

| Debra K. Osteen | ||||||

| Chief Executive Officer and Director | ||||||

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, TO ASSURE THE PRESENCE OF A QUORUM, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE. IF YOU ATTEND THE MEETING AND WISH TO VOTE YOUR SHARES PERSONALLY, YOU MAY DO SO AT ANY TIME BEFORE THE PROXY IS EXERCISED.

Table of Contents

Table of Contents

6100 TOWER CIRCLE, SUITE 1000

FRANKLIN, TENNESSEE 37067

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board” or “Board of Directors”) of Acadia Healthcare Company, Inc. (the “Company”) of proxies to be voted at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”), to be held at our executive offices located at 6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067, on Thursday, May 2, 2019, at 9:30 a.m. (Central Time), for the purposes set forth in the accompanying notice, and at any adjournments or postponements thereof. This Proxy Statement and the accompanying proxy are first being mailed or made available to stockholders on or about March 21, 2019.

INFORMATION CONCERNING SOLICITATION AND VOTING

Record Date

The close of business on March 11, 2019 has been fixed as the record date for the determination of stockholders entitled to vote at the Annual Meeting. As of such date, we had 180,000,000 authorized shares of common stock, $0.01 par value per share (“Common Stock”), of which 88,446,348 shares were outstanding and entitled to vote, and 10,000,000 authorized shares of preferred stock, $0.01 par value per share, of which no shares were outstanding. Common Stock is our only outstanding class of voting stock. Each share of Common Stock will have one vote on each matter to be voted upon at the Annual Meeting.

Quorum Requirements

A majority of the shares of Common Stock entitled to vote, represented in person or by proxy, is required to constitute a quorum. Abstentions and broker non-votes will be counted for purposes of determining the presence of a quorum at the Annual Meeting. If a quorum is not present at the time of the Annual Meeting, the stockholders entitled to vote, present in person or represented by proxy, shall have the power to adjourn the Annual Meeting until a quorum shall be present or represented by proxy. The Annual Meeting may be adjourned from time to time, whether or not a quorum is present, by the affirmative vote of a majority of the votes present and entitled to be cast at the Annual Meeting.

Voting Procedures

Whether you hold shares directly as the stockholder of record or through a broker, trustee or other nominee, as the beneficial owner, you may direct how your shares are voted without attending the Annual Meeting. If you hold shares in street name, you must vote by giving instructions to your broker or nominee. You should follow the voting instructions on any form that you receive from your broker or nominee. The availability of telephone and Internet voting for shares held in street name will depend on your broker’s or nominee’s voting process. Please refer to the instructions in the materials provided in the Notice of Internet Availability of Proxy Materials or proxy card provided to you for information on the available voting methods.

If a proxy is properly given prior to or at the Annual Meeting and not properly revoked, it will be voted in accordance with the instructions, if any, given by the stockholder. Subject to the requirements described below, if no instructions are given, each proxy will be voted:

| • | FOR the election as directors of the nominees described in this Proxy Statement; |

1

Table of Contents

| • | FOR the approval, on a non-binding advisory basis, of the compensation of our executive officers named in the section below entitled “EXECUTIVE COMPENSATION – Summary Compensation Table” (the “Named Executive Officers”); |

| • | For a frequency of every year for future non-binding advisory votes on the compensation of our Named Executive Officers; |

| • | FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; and |

| • | In accordance with the recommendation of the Board on any other proposal that may properly come before the Annual Meeting or any adjournment thereof. |

The persons named as proxies were selected by our Board of Directors.

Without your instructions, your broker or nominee is permitted to use its own discretion and vote your shares on certain routine matters (such as Proposal 4), but is not permitted to use its discretion and vote your shares on non-routine matters (such as Proposals 1, 2 and 3). We urge you to give voting instructions to your broker or nominee on all proposals. Shares that are not permitted to be voted by your broker or nominee are called “broker non-votes.” Broker non-votes are not considered votes for or against a proposal and, therefore, will have no direct impact on any proposal. If you abstain from voting on Proposal 1, your abstention will have no effect on the outcome of the election. If you abstain from voting on Proposals 2, 3 or 4, your abstention will have the same legal effect as a vote against these proposals.

Stockholders who give proxies have the right to revoke them at any time before they are voted by delivering a written request to Christopher L. Howard, Esq., Executive Vice President, General Counsel and Secretary, at 6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067, prior to the Annual Meeting or by submitting another proxy at a later date. The giving of the proxy will not affect the right of a stockholder to attend the Annual Meeting and vote in person.

Miscellaneous

We will bear the cost of printing, mailing and other expenses in connection with this solicitation of proxies and will also reimburse brokers and other persons holding shares of Common Stock in their names or in the names of nominees for their expenses in forwarding the proxy materials to the beneficial owners of such shares. Certain of our directors, officers and employees may, without any additional compensation, solicit proxies in person or by telephone.

Our management is not aware of any matters other than those described in this Proxy Statement that may be presented for action at the Annual Meeting. If any other matters properly come before the Annual Meeting, it is intended that the proxies will be voted with respect thereto in accordance with the judgment of the person or persons voting such proxies subject to the direction of our Board of Directors.

2

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Introduction

Our Amended and Restated Certificate of Incorporation, as amended (“Certificate of Incorporation”), provides that our Board of Directors shall be divided into three classes. All classes of directors have three-year terms. The terms of our Class II directors expire at the Annual Meeting.

Our Board of Directors has nominated the individuals named below under the caption “Class II Nominees” for election as directors to serve until the annual meeting of stockholders in 2022 and their successors have been elected and take office or until their earlier death, resignation or removal. Each nominee has consented to be a candidate and to serve if elected. Proxies cannot be voted for a greater number of persons than the nominees named. In connection with the expiration of the current term of the Class II directors, we plan to reduce the size of the Board from nine to eight members effective at the Annual Meeting.

Qualification of Directors

As described below, our Board of Directors is composed of individuals from differing backgrounds and experiences. We believe that each of our directors possesses unique qualifications, skills and attributes that complement the performance of the full Board. The experience that each has obtained from his or her professional background, as set forth below, has qualified him or her to serve on our Board of Directors.

Class II Nominees

The following table shows the names, ages and principal occupations of each of the nominees designated by our Board of Directors to become directors and the year in which each nominee was first appointed or elected to the Board of Directors:

| Name |

Age | Principal Occupation/Other Directorships |

Director Since | |||

| William F. Grieco | 65 | Since March 2018, Mr. Grieco has served as Vice President and Chief Compliance Officer of NX Development Corporation, the U.S. life sciences affiliate of Tokyo-based SBI Holdings, Inc. Also, since 2008, Mr. Grieco has served as the Managing Director of Arcadia Strategies, LLC, a legal and business consulting organization servicing healthcare, science and technology companies. From 2003 to 2008, he served as Senior Vice President and General Counsel of American Science and Engineering, Inc., an x-ray inspection technology company. From 2001 to 2002, he served as Senior Vice President and General Counsel of IDX Systems Corporation, a healthcare information technology company. Previously, from 1995 to 1999, he was Senior Vice President and General Counsel for Fresenius Medical Care North America, a dialysis service and products company. Prior to that, Mr. Grieco was a partner in the Healthcare Department at Choate, Hall & Stewart, a general service law firm. Mr. Grieco previously served on the board of directors of PHC, Inc. Our Board believes that Mr. Grieco is qualified to serve as a director because of, among other things, his extensive knowledge of and experience in the healthcare industry and his general business and financial acumen. | 2011 | |||

| Reeve B. Waud | 55 | Since December 16, 2018, Mr. Waud has served as the Chairman of our Board. Mr. Waud previously served as the Lead Director of the Board from April 2012 to December 2018. Mr. Waud formed Waud Capital Partners, L.L.C. (“WCP”) in 1993 and has served as the Managing Partner of WCP since that time. Prior to | 2005 | |||

3

Table of Contents

| Name |

Age | Principal Occupation/Other Directorships |

Director Since | |||

| founding WCP, Mr. Waud was an investment professional at Golder, Thoma, Cressey, Rauner, Inc. (“GTCR”), a private equity investment group based in Chicago, Illinois. Before joining GTCR, Mr. Waud was in the Corporate Finance Group of Salomon Brothers Inc and was a founding member of its Venture Capital Group. Mr. Waud is a trustee of St. Paul’s School in Concord, New Hampshire and is a member of the executive committee and chairman of the audit and finance committee of the John G. Shedd Aquarium. He is a member of the Northwestern Memorial HealthCare finance committee, a trustee of the Art Institute of Chicago and serves on the board of directors of The Economic Club of Chicago. In addition, Mr. Waud is a member of the Illinois State Police Merit Board which has oversight responsibility for the Illinois State Police. Our Board believes that Mr. Waud is qualified to serve as a director because of, among other things, his extensive knowledge of and experience in the healthcare industry and his general business and financial acumen. Mr. Waud was originally designated as a director by WCP. |

Required Vote

Our Certificate of Incorporation provides that, in an uncontested election, a nominee is elected if a majority of the votes cast by the holders of the shares of Common Stock entitled to vote in the election at a meeting at which a quorum is present are cast in favor of such nominee’s election. In contested elections, directors are elected by a plurality of the votes cast. Our Certificate of Incorporation does not provide for cumulative voting, and, accordingly, the stockholders do not have cumulative voting rights with respect to the election of directors. Consequently, each stockholder may cast one vote per share of Common Stock held of record for each nominee. Abstentions and broker non-votes will have no effect on the outcome of the election. If a nominee becomes unavailable for election, shares covered by a proxy will be voted for a substitute nominee selected by our Board of Directors.

The Board of Directors recommends that the stockholders vote FOR each of the Class II nominees.

Continuing Directors

Each of the persons named below will continue to serve as a director until the annual meeting of stockholders in the year indicated and a successor is elected and takes office or until his or her earlier death, resignation or removal. Stockholders are not voting on the election of the Class I directors or Class III directors. The following table shows the names, ages, principal occupations and other directorships of each continuing director and the year in which each was first appointed or elected to our Board or that of our predecessor, Acadia Healthcare Company, LLC:

| Name |

Age | Principal Occupation/Other Directorships |

Director Since | |||||

| Class III Term Expiring in 2020

|

||||||||

| Christopher R. Gordon | 46 | Mr. Gordon has been a Managing Director of Bain Capital Private Equity, LP (“BCPE”) since 2009. Prior to joining BCPE, Mr. Gordon was a consultant at Bain & Company, Inc. Mr. Gordon currently serves as a director of Aveanna Healthcare, LLC, Beacon Health Options, Cereval Therapeutics, Grupo Notre Dame Intermedica, Kestra Medical Technologies, Inc. and Waystar. Mr. | 2015 | |||||

4

Table of Contents

| Name |

Age | Principal Occupation/Other Directorships |

Director Since | |||

| Gordon also serves on the board of directors for Year Up – Boston, the Boston Medical Center Foundation Board, and the Boston Medical Center Health Plan Board and serves as a Trustee of the Dana Farber Cancer Center. Our Board believes that Mr. Gordon is qualified to serve as a director because of, among other things, his experience in the healthcare industry and his general business and financial acumen. Mr. Gordon provided notice of his intention to resign from our Board effective May 28, 2019. | ||||||

| Wade D. Miquelon | 54 | Mr. Miquelon is the Chief Executive Officer and President of Jo-Ann Stores, LLC (“Jo-Ann”), the nation’s leading fabric and craft specialty retailer. Prior to that, he served as the Chief Financial Officer and Executive Vice President of Jo-Ann. Prior to joining Jo-Ann, he served as Chief Financial Officer, Executive Vice President and President International for Walgreen Co. from June 2008 to August of 2014. From 2006 to 2008, he was Executive Vice President and Chief Financial Officer at Tyson Foods, Inc. Prior to that, Mr. Miquelon served Procter and Gamble in a number of positions of increasing responsibility. Our Board believes that Mr. Miquelon is qualified to serve as a director because of, among other things, his extensive knowledge and background in public accounting and finance. | 2012 | |||

| William M. Petrie, M.D. | 72 | Dr. Petrie is Professor of Clinical Psychiatry in the Department of Psychiatry at the Vanderbilt University School of Medicine, where he has served for more than 20 years. He is also Director, Vanderbilt Senior Assessment Clinic in the Department of Psychiatry at the Vanderbilt University School of Medicine. Previously, Dr. Petrie served as President and Co-Director of Research at Psychiatric Consultants, P.C., a leading psychiatry practice in Nashville, Tennessee, and Chairman, Department of Psychiatry, Parthenon Pavilion at Centennial Medical Center. Dr. Petrie served as a director for Psychiatric Solutions, Inc. (“PSI”), from September 2004 until November 2010. Our Board believes that Dr. Petrie is qualified to serve as a director because of, among other things, his extensive healthcare experience, particularly in the psychiatric and behavioral healthcare fields. | 2012 | |||

| Class I Term Expiring in 2021 |

||||||

| E. Perot Bissell | 59 | Since 2016, Mr. Bissell has been a Managing Partner of Egis Capital Partners, LLC, a private equity firm that invests in the security and protection industries. Mr. Bissell served as the Chairman and Chief Executive Officer of Next Generation Energy Logistics, LLC, an energy logistics development company, from 2013 to 2015. Before that, Mr. Bissell served as the Vice Chairman of Pilot Logistics Services, a provider of drilling and exploration support services, from September 2012 until July 2013. From 2006 to 2012, he served as Chief Executive Officer for Maxum Petroleum, Inc., an independent energy logistics company. Prior to that, Mr. Bissell was a Partner of Northwest Capital Appreciation, Inc., a merchant banking and private equity firm, and before that, the Co-Managing Partner and Chief Financial Officer of SLP Capital, a specialty finance company. Mr. Bissell also serves on the board of directors of Cactus Energy, LLC and has served on a number of charitable boards. Our Board believes that Mr. Bissell is qualified to serve as a director because of, among other things, his extensive corporate finance background and his general business and financial acumen. | 2013 | |||

5

Table of Contents

| Name |

Age | Principal Occupation/Other Directorships |

Director Since | |||

| Vicky B. Gregg | 64 | Since November 2014, Ms. Gregg has served as Co-Founder and Partner of Guidon Partners, an investor and consultant for an array of privately held healthcare companies. She served as Chief Executive Officer of BlueCross BlueShield of Tennessee from January 2003 through the end of 2012. Ms. Gregg currently serves on the board of directors of Quest Diagnostics Incorporated and Elara Caring, LLC. Our Board believes that Ms. Gregg is qualified to serve as a director because of, among other things, her extensive healthcare background and her general business and financial acumen. | 2016 | |||

| Debra K. Osteen | 63 | Since December 16, 2018, Ms. Osteen has served as our Chief Executive Officer. Ms. Osteen has extensive experience in the behavioral health industry. Prior to joining the Company in 2018, she served as Senior Vice President of United Health Services, Inc. (NYSE: UHS) since 2005 and President, Behavioral Health Division since 1999. Our Board believes that Ms. Osteen is qualified to serve as a director because of, among other things, her 35 years of experience in the healthcare industry and her general business and financial acumen. | 2018 | |||

6

Table of Contents

PROPOSAL 2: NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our stockholders to vote to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers as described below in the sections entitled “COMPENSATION DISCUSSION AND ANALYSIS” and “EXECUTIVE COMPENSATION.” Because your vote is advisory, it will not be binding on the Board of Directors or the Compensation Committee, override any decision made by the Board of Directors or the Compensation Committee or create or imply any additional fiduciary duty of the Board of Directors or the Compensation Committee. The Compensation Committee will, however, review the voting results and take them into consideration when making future decisions regarding executive compensation.

Our executive compensation program is vital to our ability to attract, motivate and retain a highly experienced team of executives. We believe that the program is structured in a manner that supports our company and our business objectives.

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended, we are asking our stockholders to indicate their support for the compensation of our Named Executive Officers disclosed in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on the compensation of our Named Executive Officers. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we ask our stockholders to vote FOR the following resolution at the Annual Meeting:

RESOLVED, that the Company’s stockholders approve, on a non-binding advisory basis, the compensation of the Named Executive Officers as disclosed in the Company’s Proxy Statement for the 2019 annual meeting of stockholders pursuant to Item 402 of Regulation S-K, including the sections entitled “COMPENSATION DISCUSSION AND ANALYSIS” and “EXECUTIVE COMPENSATION.”

Although the results of this advisory vote are not binding on the Board of Directors or the Compensation Committee, the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation.

The Board of Directors recommends that stockholders vote FOR the resolution to approve, on a

non-binding advisory basis, the compensation of our Named Executive Officers.

7

Table of Contents

PROPOSAL 3: NON-BINDING ADVISORY VOTE ON THE FREQUENCY

OF THE VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Act requires us to include, at least once every six years, a non-binding advisory vote regarding the frequency of the non-binding advisory vote on executive compensation. In casting their advisory vote, stockholders may choose among four options:

| • | A vote every year; |

| • | A vote every two years; |

| • | A vote every three years; or |

| • | To abstain from voting. |

The last time the Company’s stockholders cast a frequency vote was at the 2013 annual meeting of stockholders. The stockholders voted in favor of a frequency of every year. Based on these results and the reasons described below, the Board of Directors has determined that a non-binding advisory vote on executive compensation that occurs every year is the most appropriate alternative for us at this time. The Board of Directors believes that an advisory vote every year will be the most effective timeframe for us to respond to stockholders’ feedback and provide us with sufficient time to engage with stockholders to understand and respond to the vote results. Setting a one-year period will enhance stockholder communication by providing a clear, simple means for us to obtain information on investor sentiment about our executive compensation philosophy.

Although this advisory vote is non-binding, the Board of Directors and the Compensation Committee will review the voting results and will respect the expressed desire of the Company’s stockholders by implementing the option, if any, that receives an affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter. If no option receives a majority, the Board will select the annual option to be in effect until the next vote on the frequency of the vote on executive compensation.

The Board of Directors recommends that stockholders vote for a frequency of every year for future non-binding

stockholder advisory votes on the compensation of our Named Executive Officers.

8

Table of Contents

PROPOSAL 4: RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions. Although ratification is not required by our Amended and Restated Bylaws, as amended (“Bylaws”), or otherwise, our Board of Directors is submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice.

Fees

The following table presents fees for professional services rendered by Ernst & Young LLP for the audit of our annual financial statements for the years ended December 31, 2018 and 2017, and fees incurred for other services rendered by Ernst & Young LLP for such years:

| 2018 | 2017 | |||||||

| Audit Fees(1) |

$ | 4,238,924 | $ | 4,247,839 | ||||

| Audit-Related Fees |

— | — | ||||||

| Tax Fees(2) |

870,843 | 2,749,039 | ||||||

| All Other Fees |

— | — | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 5,109,767 | $ | 6,996,878 | ||||

|

|

|

|

|

|||||

| (1) | Primarily for the audit of our annual financial statements and the review of our quarterly financial statements, and services provided in connection with acquisition due diligence. |

| (2) | Primarily for tax compliance services and other tax planning and tax advice services. |

Pre-approval of Auditor Services

The charter of the Audit Committee provides that the Audit Committee must pre-approve all auditing and non-auditing services to be provided by our auditor. In addition, the Audit Committee shall have the sole authority to approve any compensation to our auditor for any approved audit or non-audit services. For 2018, all services provided by Ernst & Young LLP were pre-approved by the Audit Committee. All non-audit services were reviewed by the Audit Committee, and the Audit Committee concluded that the provision of such services by Ernst & Young LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

Required Vote

The affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter is needed to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. Under Delaware law, an abstention will have the same legal effect as a vote against the ratification of Ernst & Young LLP, and broker non-votes will have no effect on the outcome of the ratification of the independent registered public accounting firm. If the appointment is not ratified, the matter will be referred to the Audit Committee for further review.

The Audit Committee and the Board of Directors recommend that the stockholders vote FOR ratification

of the appointment of Ernst & Young LLP as our independent registered public

accounting firm for the fiscal year ending December 31, 2019.

9

Table of Contents

Independence of the Board of Directors

Our Board annually reviews the independence of all of our directors and affirmatively makes a determination as to the independence of each director based on whether such director satisfies the definition of “independent director” as set forth in the applicable rules of The NASDAQ Stock Market. Our Board has determined that all of our directors are independent directors other than Ms. Osteen and Mr. Jacobs.

Code of Conduct and Code of Ethics for Senior Financial Officers

Our Board of Directors has adopted a Code of Conduct which is applicable to all of our officers, employees and directors, including our Chief Executive Officer, Chief Financial Officer, the principal accounting officer or controller and all persons performing similar functions (together, the “Senior Financial Officers”). In addition, our Board has adopted a Code of Ethics that applies to the Senior Financial Officers. Both the Code of Conduct and the Code of Ethics are available on our website at www.acadiahealthcare.com under the webpage “Investors – Corporate Governance.”

Committees of the Board of Directors

Our Board of Directors has established three standing committees – a Compensation Committee, an Audit Committee and a Nominating and Governance Committee, each of which is described below.

Compensation Committee

Our Board of Directors has appointed a Compensation Committee to assist it with executive compensation matters. The primary responsibilities and duties of the Compensation Committee are:

| • | Reviewing and approving for the Chief Executive Officer and other executive officers (a) the annual base salary level, (b) bonus and other annual incentives, (c) equity compensation, (d) employment agreements, severance arrangements and change in control arrangements, and (e) any other benefits, compensation, compensation policies or arrangements; |

| • | Reviewing and making recommendations to the Board regarding the compensation policy for such other officers as directed by the Board; |

| • | Preparing a report to be included in the annual report or proxy statement that describes: (a) the criteria on which compensation paid to the Chief Executive Officer for the last completed fiscal year is based; (b) the relationship of such compensation to our performance; and (c) the Compensation Committee’s executive compensation policies applicable to executive officers; and |

| • | Overseeing the administration and approval of our current equity-based compensation plans and making recommendations to our Board of Directors with respect to amendments to the plans, changes in the number of shares reserved for issuance thereunder and other equity-based compensation plans proposed for adoption. |

The Compensation Committee is currently composed of Ms. Gregg, Messrs. Gordon and Miquelon and Dr. Petrie, with Mr. Miquelon serving as Chairman. During 2018, the Compensation Committee held five meetings and took action by written consent two times. The Compensation Committee has a written charter that is available on our website at www.acadiahealthcare.com under the webpage “Investors – Corporate Governance.”

10

Table of Contents

Audit Committee

Our Board of Directors has appointed an Audit Committee to assist it in fulfilling its oversight responsibilities for our financial reports, systems of internal control over financial reporting and accounting policies, procedures and practices. The primary responsibilities and duties of the Audit Committee are:

| • | Appointing, retaining, evaluating and, when appropriate, replacing our independent registered public accounting firm, whose duty it is to audit our financial statements and our internal control over financial reporting for the fiscal year in which it is appointed; |

| • | Determining the compensation to be paid to our independent registered public accounting firm (subject to ratification by our stockholders) and, in its sole discretion, approving all audit and engagement fees and terms and pre-approve all auditing and non-auditing services of our independent registered public accounting firm; |

| • | Reviewing and discussing our system of internal control over financial reporting, audit procedures and the adequacy and effectiveness of our disclosure controls and procedures with management, our independent registered public accounting firm and our internal auditors; |

| • | Reviewing the internal audit function of the Company, including the independence of its reporting obligations and the adequacy of the internal audit budget and staffing; |

| • | Reviewing and discussing with management and our independent registered public accounting firm the audited financial statements to be included in our Annual Report on Form 10-K, the quarterly financial statements to be included in our Quarterly Reports on Form 10-Q, our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the selection, application and disclosure of critical accounting policies used in our financial statements; |

| • | Reviewing and discussing with management the Company’s major risk exposures with respect to the Company’s accounting and financial reporting policies and procedures; |

| • | Reviewing and discussing with management all existing related-party transactions and approving any proposed related-party transactions to ensure that they are in our best interest; |

| • | Reviewing and discussing with management the quarterly earnings press releases and financial information and earnings guidance provided to analysts and rating agencies; |

| • | Establishing and overseeing procedures for receiving, retaining and treating complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and |

| • | Reviewing and reassessing the performance of the Audit Committee and the adequacy of the Audit Committee charter adopted by our Board of Directors and recommending proposed changes to the Board. |

The Audit Committee is currently composed of Messrs. Bissell, Gordon and Grieco, with Mr. Grieco serving as Chairman. Our Board of Directors has determined that each of Messrs. Bissell, Gordon and Grieco is an “audit committee financial expert” as defined in rules promulgated by the SEC under the Exchange Act, and that each member of the Audit Committee meets the financial literacy requirements under the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and rules and regulations of NASDAQ and the SEC. Our Board has determined that each of Messrs. Bissell, Gordon and Grieco satisfies the independence requirements for audit committee members set forth in the applicable rules of The NASDAQ Stock Market. The Audit Committee held four meetings during 2018. The Audit Committee has a written charter available on our website, www.acadiahealthcare.com under the webpage “Investors – Corporate Governance.”

11

Table of Contents

Nominating and Governance Committee

Our Board of Directors has appointed a Nominating and Governance Committee (the “Nominating Committee”) to assist it with director nominations matters. The primary responsibilities and duties of the Nominating Committee are:

| • | Identifying, recruiting and recommending individuals qualified to serve on the Board; |

| • | Reviewing the qualifications and performance of incumbent directors to determine whether to recommend them as nominees for re-election; |

| • | Reviewing and considering candidates who may be properly suggested by any director or executive office of the Company, or by any stockholder of the Company; |

| • | Periodically reviewing the composition of the Board, including size of the Board and the minimum qualifications for director nominees; |

| • | Reviewing the performance of members of the Board; and |

| • | Carrying out such other responsibilities delegated by the Board relating to the director nominations process and procedures. |

The Nominating Committee is currently composed of Ms. Gregg, Messrs. Bissell and Grieco and Dr. Petrie, with Mr. Bissell serving as Chairman. During 2018, the Nominating Committee held two meetings. The Nominating Committee has a written charter available on our website, www.acadiahealthcare.com under the webpage “Investors – Corporate Governance.”

Meetings of our Board of Directors and Committees

During 2018, our Board of Directors held a total of sixteen meetings and took action by written consent one time. Each director attended 75% or more of the meetings of our Board and the committees of our Board of Directors on which such director served.

Nomination of Directors

Nominations By the Nominating Committee

Directors may be nominated by our Nominating Committee, Board, executive officers or by our stockholders in accordance with our Bylaws, Certificate of Incorporation, applicable laws and any guidelines developed by Nominating Committee or the Board. The Nominating Committee is responsible for identifying individuals qualified to become members of the Board and its committees, and recommending candidates for the Board’s selection as director nominees for election at the annual or other properly convened meeting of the stockholders in accordance with our Bylaws and applicable laws and regulations. The Nominating Committee meets to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board. The Nominating Committee considers each identified candidate’s qualifications, which include the nominee’s experience, business acumen, education, integrity, character, commitment, diligence, conflicts of interest and ability to exercise sound business judgment. While we have not established diversity standards for nominees, as a matter of practice, we generally seek nominees with a broad diversity of experience, professions, skills and backgrounds. We do not currently pay a fee to any third party to identify or assist in identifying or evaluating potential nominees.

12

Table of Contents

Nominations By Our Stockholders

Our Bylaws govern stockholder nominations of directors. To make a director nomination at the 2020 annual meeting, a stockholder of record entitled to vote at the annual meeting must deliver a written notice (containing certain information specified in our Bylaws as discussed below) to Christopher L. Howard, Esq., Executive Vice President, General Counsel and Secretary, at Acadia Healthcare Company, Inc., 6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067 between the close of business on January 3, 2020 and the close of business on February 2, 2020. If the date of the 2020 annual meeting is more than 30 days before or more than 70 days after May 2, 2020, the stockholder’s notice must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made by the Company. To make a director nomination to be voted on at a special meeting of stockholders called for the purpose of electing directors, a stockholder of record entitled to vote in such election must deliver written notice to our secretary at the address above no earlier than the close of business on the 120th day prior to such special meeting and no later than the close of business on the later of the 90th day prior to such special meeting or the tenth day following the day on which we first publicly announce the date of the special meeting and the nominees proposed by the Board to be elected at such meeting.

For a stockholder nomination to be deemed proper, the notice must contain certain information specified in our Bylaws, including information as to the director nominee(s) proposed by the stockholder, the name and address of the stockholder, the class and number of shares of our capital stock beneficially owned by the stockholder, a description of all arrangements or understandings between the stockholder and any other persons (including each proposed nominee(s) if applicable) in connection with the proposed nominations, and a representation that such stockholder intends to appear in person or by proxy at the meeting to bring such business or nominate the person(s) named in the notice.

Majority Voting for Uncontested Director Elections; Director Resignation Policy

In May 2017, amendments to our Certificate of Incorporation and Bylaws became effective that adopted a majority voting standard for uncontested director elections. In contested elections, directors will continue to be elected by a plurality of the votes cast. The Board also adopted a Director Resignation Policy requiring a nominee for director to submit a written offer of resignation to the Board in the event such nominee does not receive a majority of the votes cast in an uncontested election of directors. The Director Resignation Policy addresses the continuation in office of a “holdover” director, so that an incumbent director who does not receive the requisite affirmative majority of the votes cast for his or her re-election must tender his or her resignation to the Board. In the event a nominee submits a written officer of resignation to the Board, the Nominating and Governance Committee will promptly consider the director’s offer of resignation and recommend to the Board whether to accept the resignation or reject it. The Board will act on such recommendation within 90 days following receipt of the recommendation.

Communicating with the Board

All stockholder communications with our Board of Directors should be directed to Christopher L. Howard, Esq., Executive Vice President, General Counsel and Secretary, at Acadia Healthcare Company, Inc., 6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067, and should prominently indicate on the outside of the envelope that it is intended for our Board of Directors or for an individual director. Each communication intended for our Board of Directors and received by Mr. Howard will not be opened, but will be promptly forwarded unopened to the Chairman of the Audit Committee following its clearance through normal security procedures.

Attendance by Members of the Board of Directors at the Annual Meeting of Stockholders

We encourage each member of our Board of Directors to attend the annual meeting of stockholders. For the 2018 annual meeting of stockholders, each director attended in person or participated by phone.

Board Leadership Structure

The Board of Directors does not have a formal policy on whether the roles of Chief Executive Officer and Chairman of the Board of Directors should be separate. While historically these roles have been combined, the Company currently has separate individuals serve in those positions. Reeve B. Waud serves as the Chairman of the

13

Table of Contents

Board and Debra K. Osteen serves as our Chief Executive Officer. Ms. Osteen is also a member of the Board. The Board of Directors has carefully considered its leadership structure and believes at this time that the Company and its stockholders are best served by having the positions of Chairman of the Board and Chief Executive Officer filled by different individuals. This allows the Chief Executive Officer to, among other things, focus on the Company’s day-to-day business, while allowing the Chairman to lead the Board of Directors in its fundamental role of providing advice and oversight of management. In addition, our independent directors bring experience, oversight and expertise from outside our Company and industry, while the Chief Executive Officer brings Company-specific experience and expertise. The Board of Directors recognizes that depending on future circumstances, other leadership models may become more appropriate. Accordingly, the Board of Directors will continue to periodically review its leadership structure.

Risk Oversight

Our Board is responsible for overseeing our risk management process. The Board fulfills its responsibility by delegating many of these functions to its committees. Under its charter, the Audit Committee is responsible for meeting periodically with management to review our major financial risks and the steps management has taken to monitor and control such risks. The Audit Committee also oversees our financial reporting and internal controls and compliance programs.

The Board receives reports on risk management from our senior officers and from the Chairman of the Audit Committee. Also, our Executive Vice President, General Counsel and Secretary provides a summary of our outstanding litigation and any governmental investigations to our Board at each Board meeting. Additionally, our Board regularly engages in discussions of the most significant risks that we are facing and how these risks are being managed. Our Board of Directors believes that the work undertaken by the Audit Committee, together with the oversight provided by the full Board of Directors, enables the Board to oversee our risk management function effectively.

Non-Management Executive Sessions

We had seven independent directors in 2018. During 2018, there were seven executive sessions of the independent directors.

Compensation Committee Interlocks and Insider Participation

Since May 19, 2016, the Compensation Committee has consisted of Ms. Gregg, Messrs. Gordon and Miquelon and Dr. Petrie, none of whom has at any time been one of our officers or employees. None of our executive officers serves, or in the past year served, as a member of the board of directors or compensation committee of any entity that has or had one or more of its executive officers serving on our Board or Compensation Committee.

Policy on Reporting of Concerns Regarding Accounting Matters

The Audit Committee has adopted a policy on the reporting of concerns regarding accounting, internal accounting controls or auditing matters. We have established a compliance hotline called ValuesLine (800-500-0333), which is administered by a third party, as a hotline for the receipt, retention and treatment of complaints from employees or others regarding accounting, internal accounting controls and auditing matters. Information received through the hotline is conveyed directly to our Chief Compliance Officer. Complaints relating to accounting, internal accounting controls or auditing matters will then be directed to the Chairman of the Audit Committee. Any complaint may be made anonymously if the claimant so desires, and all claimants will be provided confidentiality in the handling of the complaint.

14

Table of Contents

Procedure for Approval of Transactions with Related Persons

We have established policies and other procedures regarding approval of transactions between the Company and any employee, officer, director, and certain of their family members and other related persons, including those required to be reported under Item 404 of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”). These policies and procedures are generally not in writing, but are evidenced by principles set forth in our Code of Conduct or adhered to by our Board. As set forth in the Audit Committee Charter, the Audit Committee reviews and approves all related person transactions after reviewing such transaction for potential conflicts of interests and improprieties. Accordingly, all such related person transactions are submitted to the Audit Committee for ongoing review and oversight. Generally speaking, we enter into related person transactions only on terms that we believe are at least as favorable to the Company as those that we could obtain from an unrelated third party. See the section below entitled “CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS” for additional information.

15

Table of Contents

Executive Officers

Below are the names and ages (as of March 1, 2019) of our executive officers and a brief account of the business experience of the executive officers who are not members of our Board.

| Name |

Age | Title | ||

| Debra K. Osteen |

63 | Chief Executive Officer | ||

| Ronald M. Fincher |

65 | Chief Operating Officer | ||

| Brent Turner |

53 | President | ||

| Christopher L. Howard |

52 | Executive Vice President, General Counsel and Secretary | ||

| David M. Duckworth |

39 | Chief Financial Officer |

The term of each executive officer runs until his or her successor is appointed and qualified, or until his or her earlier death, resignation or removal.

Ronald M. Fincher joined the Company in February 2011 and has served as our Chief Operating Officer since that time. Previously, Mr. Fincher served as PSI’s Chief Operating Officer from October 2008 to November 2010. As Chief Operating Officer of PSI, Mr. Fincher oversaw hospital operations for 95 facilities. Mr. Fincher served as PSI’s Division President from April 2003 to October 2008. As a Division President, Mr. Fincher was responsible for managing the operations of multiple inpatient behavioral healthcare facilities owned by PSI. Prior to joining PSI, Mr. Fincher served as a Regional Vice President of Universal Health Services, Inc. from 2000 until 2003.

Brent Turner joined the Company in February 2011 and served as Co-President from that time until April 2012, when he was named President. Previously, Mr. Turner served as the Executive Vice President, Finance and Administration of PSI from August 2005 to November 2010 and as the Vice President, Treasurer and Investor Relations of PSI from February 2003 to August 2005. From 2008 through 2010, Mr. Turner also served as a Division President of PSI overseeing facilities in Texas, Illinois and Minnesota. From 1996 until January 2001, Mr. Turner was employed by Corrections Corporation of America, a prison operator, serving as Treasurer from 1998 to 2001. Mr. Turner serves on the board of directors of LHC Group, Inc. (NASDAQ: LHCG), Surgery Partners, Inc. (NASDAQ: SRGY), and the National Association of Behavioral Health (NABH), where he served as Chairman in 2018 and 2009.

Christopher L. Howard joined the Company in February 2011 and has served as our Executive Vice President, General Counsel and Secretary since that time. Before joining the Company, Mr. Howard served as PSI’s Executive Vice President, General Counsel and Secretary from September 2005 to November 2010. Prior to joining PSI, Mr. Howard was a partner at Waller Lansden Dortch & Davis, LLP, a law firm based in Nashville, Tennessee.

David M. Duckworth joined the Company as our Controller in April 2011 and became Chief Accounting Officer in January 2012 and Chief Financial Officer in July 2012. From May 2010 to April 2011, Mr. Duckworth served as Director of Finance at Emdeon Inc., a leading provider of revenue and payment cycle management and clinical information exchange solutions. Prior to joining Emdeon, Mr. Duckworth was a Manager with Ernst & Young LLP, which he joined in 2002.

16

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth information with respect to ownership of our Common Stock as of March 11, 2019, by:

| • | Each person who we know to be the beneficial owner of more than 5% of the outstanding shares of Common Stock; |

| • | Each of our directors and nominees; |

| • | Each of our Named Executive Officers; and |

| • | All of our directors and executive officers as a group. |

To our knowledge, unless otherwise indicated, each stockholder listed below has sole voting and investment power with respect to the shares beneficially owned. All computations are based on 88,446,348 shares of Common Stock outstanding on March 11, 2019, unless otherwise indicated.

| Name of Beneficial Owner(1) |

Amount and Nature of Beneficial Ownership(2) |

Percent of Class |

||||||

| T. Rowe Price Associates, Inc.(3) |

13,066,400 | 14.8 | % | |||||

| Wellington Management Group LLC(4) |

10,035,793 | 11.3 | % | |||||

| BlackRock, Inc.(5) |

8,016,872 | 9.1 | % | |||||

| The Vanguard Group(6) |

7,942,610 | 9.0 | % | |||||

| Aristotle Capital Management, LLC(7) |

7,078,871 | 8.0 | % | |||||

| Dimensional Fund Advisors LP(8) |

5,591,881 | 6.3 | % | |||||

| JPMorgan Chase & Co.(9) |

4,624,655 | 5.2 | % | |||||

| Debra K. Osteen(10) |

240,942 | * | ||||||

| Brent Turner(11) |

127,258 | * | ||||||

| Ronald M. Fincher(12) |

94,407 | * | ||||||

| Christopher L. Howard(13) |

184,442 | * | ||||||

| David M. Duckworth(14) |

57,799 | * | ||||||

| Reeve B. Waud(15) |

807,841 | * | ||||||

| Joey A. Jacobs(16) |

593,831 | * | ||||||

| E. Perot Bissell(17) |

17,575 | * | ||||||

| Christopher R. Gordon(17) |

12,328 | * | ||||||

| Vicky B. Gregg(17) |

10,717 | * | ||||||

| William F. Grieco(18) |

66,406 | * | ||||||

| Wade D. Miquelon(17) |

29,643 | * | ||||||

| William M. Petrie, M.D.(17) |

21,364 | * | ||||||

| All directors and executive officers as a group (13 persons)(19) |

2,264,553 | 2.6 | % | |||||

| * | Less than 1% |

| (1) | Unless otherwise indicated, the address of each beneficial owner is c/o Acadia Healthcare Company, Inc., 6100 Tower Circle, Suite 1000, Franklin, Tennessee 37067. |

| (2) | Under SEC rules, the number of shares shown as beneficially owned includes shares of Common Stock subject to options that currently are exercisable or will be exercisable within 60 days of March 11, 2019. Such shares are deemed to be outstanding for the purpose of computing the “percent of class” for that individual, but are not deemed outstanding for the purpose of computing the percentage of any other person. |

| (3) | Information is based solely on the Schedule 13G/A filed by T. Rowe Price Associates, Inc. (“Price Associates”) with the SEC on February 14, 2019. Price Associates reported that it possesses (i) sole voting power with respect to 3,607,485 shares, and (ii) sole dispositive power with respect to all of the shares. These securities are owned by various individual and institutional investors for which Price Associates serves as an investment adviser with power to direct investments and/or sole power to vote the securities. For the purposes of the reporting requirements of the Exchange Act, Price Associates is deemed to be the beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. The address for Price Associates is 100 E. Pratt Street, Baltimore, Maryland 21202. |

17

Table of Contents

| (4) | Information is based solely on the Schedule 13G/A filed by Wellington Management Group LLP (“Wellington”) with the SEC on February 12, 2010. Wellington reported that it possessed shared dispositive power with respect to all of the shares. The address for Wellington is 280 Congress Street, Boston, Massachusetts 02210. |

| (5) | Information is based solely on the Schedule 13G/A filed by BlackRock, Inc. (“BlackRock”) with the SEC on February 4, 2018. BlackRock reported that it possessed (i) sole voting power with respect to 7,671,917 shares and (ii) sole dispositive power with respect to all of the shares. The address for BlackRock is 55 East 52nd Street, New York, New York 10055. |

| (6) | Information is based solely on the Schedule 13G/A filed by The Vanguard Group (“Vanguard”) with the SEC on February 11, 2019. Vanguard reported that it possessed (i) sole voting power with respect to 42,298 shares, (ii) sole dispositive power with respect to 7,900,449 shares, and (iii) shared dispositive power with respect to 42,161 shares. The address for Vanguard is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (7) | Information is based solely on the Schedule 13G filed by Aristotle Capital Management, LLC (“Aristotle”) with the SEC on February 4, 2019. Aristotle reported that it possessed (i) sole voting power with respect to 3,480,504 shares and (ii) sole dispositive power with respect to all of the shares. The address for Aristotle is 11100 Santa Monica Blvd., Suite 1700, Los Angeles, California 90025. |

| (8) | Information is based solely on the Schedule 13G/A filed by Dimensional Fund Advisors LP (“Dimensional”) with the SEC on February 8, 2019. Dimensional reported that it possessed (i) sole voting power with respect to 5,434,730 shares and (ii) sole dispositive power with respect to all of the shares. The address for Dimensional is Building One, 6300 Bee Cave Road, Austin, Texas 78746. |

| (9) | Information is based solely on the Schedule 13G/A filed by JPMorgan Chase & Co. (“JPMorgan”) with the SEC on January 16, 2019. JPMorgan reported that it possessed (i) sole voting power with respect to 4,230,061 shares, (ii) sole dispositive power with respect to 4,622,391 shares, and (iii) shared dispositive power with respect to 964 shares. The address for JPMorgan is 270 Park Avenue, New York, New York 10017. |

| (10) | Includes 240,942 shares of restricted stock. The shares of restricted stock held by Ms. Osteen will be reduced by a number of shares (valued at the effective date of her employment) equal to any amounts received by Ms. Osteen in respect of stock options issued by her former employer and held by her on December 12, 2018. |

| (11) | Includes 14,549 shares of restricted stock and options to purchase 30,032 shares of Common Stock. |

| (12) | Includes 3,712 shares held by the Ras W. Fincher II Trust u/a/d 9/13/11, 3,711 shares held by the Morgan M. Fincher Trust u/a/d 9/13/11, 3,712 shares held by the Cody C. Fincher Trust u/a/d 9/13/11, 15,761 shares of restricted stock and options to purchase 7,159 shares of Common Stock. |

| (13) | Includes 51,578 shares held by the Christopher L. Howard Family 2017 Grantor Retained Annuity Trust, 51,578 shares held by the Angie Parrott Howard Family 2017 Grantor Retained Annuity Trust, 8,422 shares held by Mr. Howard’s wife, 12,554 shares of restricted stock and options to purchase 22,103 shares of Common Stock. |

| (14) | Includes 10,764 shares of restricted stock and options to purchase 22,677 shares of Common Stock. |

| (15) | Includes 7,575 shares of restricted stock. The 807,841 shares of Common Stock are owned of record as follows: (i) 355,912 shares by the Halcyon Exempt Family Trust (the “Halcyon Trust”); (ii) 33,333 shares by Melissa W. Waud, Mr. Waud’s wife; (iii) 37,493 shares by Waud Capital Partners, L.L.C; (iv) 183,445 shares by the Reeve B. Waud Jr. 2012 Family Trust (the “2012 RBW Jr Family Trust”); (v) 183,445 shares by the Cecily R.M. Waud 2012 Family Trust (the “2012 CRMW Family Trust”) and (vi) 14,213 shares directly held by Mr. Waud. |

18

Table of Contents

Mr. Waud may be deemed to beneficially own the shares of Common Stock reported herein by virtue of (A) his being the investment advisor of the Halcyon Trust of which Mr. Waud’s children are beneficiaries, (B) his being married to Ms. Waud, (C) his being the sole manager of WCP LLC, and (D) his being the investment advisor of the 2012 RBW Jr Family Trust and the 2012 CRMW Family Trust of which Mr. Waud’s grandchildren are beneficiaries.

| (16) | Includes 133,825 shares held by the Jeremy Brent Jacobs GST Non-Exempt Trust u/a/d 04/26/2011, 133,824 shares held by the Scott Douglas Jacobs GST Non-Exempt Trust u/a/d 04/26/2011, 69,001 shares of restricted stock and options to purchase 59,794 shares of Common Stock. |

| (17) | Includes 7,575 shares of restricted stock. |

| (18) | Includes 7,575 shares of restricted stock and options to purchase 10,000 shares of Common Stock. |

| (19) | Includes 418,954 shares of restricted stock and options to purchase 151,765 shares of Common Stock. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who beneficially own more than 10% of our Common Stock to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Stock. These officers, directors and greater than 10% stockholders are required by SEC rules to furnish us with copies of all Section 16(a) reports they file. There are specific due dates for these reports and we are required to report in this Proxy Statement any failure to file reports in a timely manner as required during 2018. Based upon a review of these filings and written representations from our directors and executive officers, we believe that all reports required to be filed with the SEC pursuant to Section 16(a) during 2018 were filed in a timely manner except:

| • | Each of Joey A. Jacobs, Brent Turner, Ronald M. Fincher, David M. Duckworth and Christopher L. Howard filed a report on Form 4 on March 7, 2018 with respect to an award of restricted stock on March 2, 2018; and |

| • | Joey A. Jacobs filed a Form 5 report on February 13, 2019 with respect to the disposition of Common Stock on December 16, 2018. |

19

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides a detailed description of our executive compensation philosophy and programs, the compensation arrangements that we have with our Named Executive Officers, and the alignment of our executive compensation programs with Company performance.

Table of Contents

| 20 | ||||

| 20 | ||||

| 23 | ||||

| 24 | ||||

| 27 | ||||

| 27 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| Stock Ownership Guidelines, Insider Trading Policy, Hedging and Pledging |

38 | |||

| 39 |

Our Named Executive Officers for 2018 were:

| Name |

Title | |

| Debra K. Osteen |

Chief Executive Officer and Director | |

| Ronald M. Fincher |

Chief Operating Officer | |

| Brent Turner |

President | |

| Christopher L. Howard |

Executive Vice President, General Counsel and Secretary | |

| David M. Duckworth |

Chief Financial Officer | |

| Joey A. Jacobs | Director (Former Chief Executive Officer and Chairman of the Board) |

Acadia is the leading publicly traded pure-play provider of behavioral healthcare services, with operations in the United States and the United Kingdom. Our business strategy is to acquire and develop behavioral healthcare facilities and improve our operating results within our facilities and our other behavioral healthcare operations. We strive to improve the operating results of our facilities by providing quality patient care, expanding referral networks and marketing initiatives while meeting the increased demand for behavioral healthcare services through expansion of our current locations as well as developing new services within existing locations. The Company grew rapidly between becoming a publicly-traded company in late 2011 and 2016, completing several significant acquisitions during that period. Since acquiring Priory Group No. 1 Limited in early 2016, acquisition activity has slowed considerably compared to prior years, while organic growth through bed additions and development has continued. The Company experienced various business challenges beginning in 2017 and continuing through 2018, including challenges with its United Kingdom operations relating to, among other things, a lower census than expected and higher labor expense resulting from staffing shortages

Acadia has a history of motivating leaders through the use of performance-based pay with challenging annual and long-term incentives and a record of good alignment with stockholders’ interests as a result of incentive designs and executive equity ownership. As described in greater detail below, our executive compensation program seeks to:

| (i) | attract and retain superior executives by providing the opportunity to earn competitive compensation packages, |

| (ii) | align the pay of our executive officers with Company performance, and |

20

Table of Contents

| (iii) | recognize and reward senior management’s individual and collective efforts relating to the financial performance of the Company and creation of stockholder value. |

Despite various challenges and external headwinds, the Company produced solid operating results in 2018 as described below. Nonetheless, the Company’s performance fell short of target goals set for management in early 2018 and, accordingly, executives did not realize the full potential of the Company’s annual and long-term incentive compensation opportunities for 2018. Further, the realizable value (as defined below) of outstanding equity awards held by our executives decreased consistent with the decline in our stock price. We believe that the compensation of our executive officers was well aligned with our financial and operating performance, and the returns experienced by our stockholders, and reflected the challenging year. We remain committed to providing quality patient care at our facilities and supporting our long-term strategic objectives. We believe that the Company is well positioned to address the challenges facing it and to grow through future acquisitions and same-facility growth, both of which will contribute to additional stockholder value creation in the future.

Following the say-on-pay vote at our 2017 Annual Meeting of Stockholders and extensive review and discussions with our independent compensation consultant, Pay Governance LLC (“Pay Governance”), about our executive compensation program and that of our peer companies, we initiated several changes to our executive compensation program aimed at further aligning our executive compensation program with long-term stockholder interests. Those changes are reflected in the executive compensation programs implemented in 2018 as described below.

On December 16, 2018, the Company announced a leadership transition whereby Debra K. Osteen became the Company’s Chief Executive Officer and a member of the Board, and Reeve B. Waud became the Chairman of the Board, separating the roles of Chief Executive Officer and Chairman of the Board. Joey A. Jacobs was removed from his positions as the Chief Executive Officer and Chairman of the Board. In connection with this transition, Ms. Osteen received a compensation package as described below in “Chief Executive Officer Transition - Ms. Osteen’s Compensation Arrangements” and Mr. Jacobs received the compensation described below in “Chief Executive Officer Transition - Mr. Jacobs’ Payments Upon Termination.”

Summary of 2018 Company Performance

Results for 2018 include:

| • | Revenue for 2018 remained strong at $3,012.4 million. For purposes of our 2018 equity and non-equity incentive awards, our target level revenue was $3,060.0 million. |

| • | Adjusted EPS (as defined below) for purposes of our compensation plans was $2.39 for 2018 compared with $2.41 for 2017, on a 0.4% increase in weighted average basic shares outstanding. For purposes of our 2018 equity and non-equity incentive awards, our target level Adjusted EPS was $2.45. |

| • | Adjusted EBITDA (as defined below) for purposes of our compensation plans was approximately $597.2 million for 2018 compared with approximately $602.1 million for 2017. For purposes of our 2018 equity and non-equity incentive awards, our target level Adjusted EBITDA was $640.5 million. |

| • | We added over 650 beds to our operations through organic growth, including approximately 500 beds added at existing facilities during 2018 (and over 150 beds at two de novo facilities), ending the year with over 18,100 beds in 583 facilities in 40 states, the United Kingdom and Puerto Rico. |

| • | Our one-year total stockholder return (“TSR”) for 2018 was approximately (21)%. Our five-year TSR for 2014 through 2018 was approximately (46)%. However, our TSR year-to-date through March 1, 2019 has increased to approximately 18%. |

A reconciliation of non-GAAP financial measures can be found beginning on page 59 of this Proxy Statement.

21

Table of Contents

Pay for Performance

Compensation paid to executive officers for 2018 reflects the alignment of pay with the Company’s performance, as more fully described in this Compensation Discussion and Analysis:

| • | Below Target Payment of 2018 Non-Equity Incentive Compensation. The Adjusted EBITDA, Adjusted EPS and revenue measures set forth in our non-equity incentive compensation plan for 2018 were achieved at 93.2%, 97.6% and 98.4% of target, respectively, resulting in the payment of below-target cash bonuses to our Named Executive Officers as described below in the section entitled “Components of Executive Compensation – Annual Non-Equity Incentive Compensation.” |

| • | Below Target Vesting of 2018 Equity Awards. Based on actual 2018 Adjusted EPS performance in relation to targets, the first tranche of the performance vesting restricted stock units granted in 2018 were earned below target levels. As further described in the section below entitled “Components of Executive Compensation – Equity-Based Compensation,” approximately 83.8% of the first tranche of both the 2018 restricted stock unit annual award and 2018 restricted stock unit transition award was earned, subject to the three-year TSR modifier, and performance vesting restricted stock units issued in 2017 and 2016 did not vest and were forfeited. |

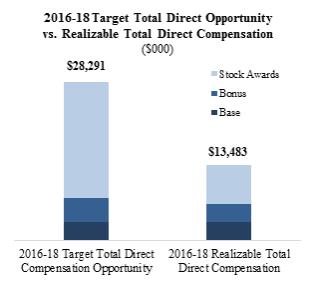

| • | Reduction in Realizable Value of Outstanding Equity Awards. Given the trading price of our common stock, the realizable value of prior-year equity awards was significantly below the granted opportunity as of the end of 2018. For example, realizable value as of December 31, 2018 of equity awards granted to our Chief Executive Officer (Mr. Jacobs for purposes of this analysis) during the past three fiscal years represents approximately 34% of the originally granted target opportunity. See the section below entitled “– Assessment of Realizable Pay and Performance.” |

Stockholder Approval of Executive Compensation on an Advisory Basis

At our 2018 Annual Meeting of Stockholders in May 2018, we held an advisory vote to approve the compensation of our Named Executive Officers as disclosed in our Proxy Statement dated March 23, 2018 related to the annual meeting. Stockholders of the Company expressed strong support for the compensation of our Named Executive Officers, with approximately 97% of the votes cast supporting the Company’s executive compensation. Given the strong support of the stockholders and the significant changes implemented in the 2018, the Compensation Committee’s approach to compensation programs for 2019 has remained relatively consistent with 2018.

Executive Compensation Highlights

Following the say-on-pay vote at our 2017 Annual Meeting of Stockholders and extensive review and discussions with our independent compensation consultant, Pay Governance LLC (“Pay Governance”), about our executive compensation program and that of our peer companies, our executive compensation program included the following features for 2018:

| • | No Salary Increase for our Chief Executive Officer — Modest 2% raises to the base salary of each of our applicable Named Executive Officers for 2018, except for Mr. Jacobs whose base salary did not increase for 2018; |

| • | Re-affirm our Approach of Allocating the Majority of Equity Value to Performance-Based Awards — 75% of overall long-term incentive value for each Named Executive Officer is delivered as performance vesting restricted stock units and 25% as time-vesting restricted stock awards. |

| • | Introduction of Relative TSR to Performance-Based Equity Incentive Awards — Adopted an additional performance metric under performance vesting restricted stock unit awards, in the form of a modifier based on our three-year TSR relative to the companies listed in the S&P Composite 1500 Index within the GICS Healthcare Providers and Services Industry Group, plus Brookdale Senior Living Inc. and Civitas Solutions, Inc. (collectively, the “TSR Peer Group”); |

22

Table of Contents

| • | Three-Year Performance Period for Restricted Stock Units — The performance-based restricted stock units will vest only after the three-year performance period and only if the Company meets or exceeds established Adjusted EPS goals, with shares earned based on Adjusted EPS performance to be adjusted up or down based on our three-year TSR relative to the TSR Peer Group. |

| • | Introduction of Revenue as Component of Annual Non-Equity Incentive Awards — Revenue added as a financial measure for determining annual cash incentive awards, strengthening our focus on continued strong growth and reducing the weight of Adjusted EPS in the calculation. The Compensation Committee reviewed the relationship between performance in each of our three primary incentive plan metrics (revenue, Adjusted EPS and Adjusted EBITDA) and long-term stockholder value creation and found each to be strongly correlated to long-term stockholder value. |

| • | Reductions in our Chief Executive Officer’s 2018 Long-Term Incentive Opportunity — In addition to the performance award design changes described above, we reduced Mr. Jacobs’ 2018 target long-term incentive award value by $500,000, or 7%, when compared to his 2017 target award. |

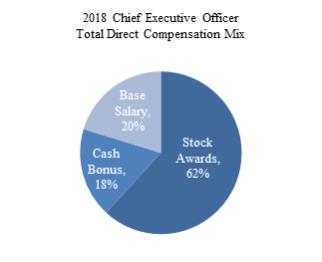

The Compensation Committee approved the following annual compensation package for Ms. Osteen for 2019, separate from her initial stock grant in February 2019 and any retention bonus to be paid in 2019:

| (i) | base salary of $900,000, |

| (ii) | non-equity incentive award with threshold, target and maximum award levels at 50%, 100% and 200%, respectively, |

| (iii) | equity incentive awards consisting of a grant of performance vesting restricted stock units and shares of time vesting restricted stock, with a target value of at least $3.2 million, and |

| (iv) | insurance, health and welfare benefits generally applicable to our Named Executive Officers. |