As filed with the Securities and Exchange Commission on December 15, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACADIA HEALTHCARE COMPANY, INC.*

(Exact Name of Each Registrant as Specified in Its Charter)

| Delaware | 8093 | 45-2492228 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

830 Crescent Centre Drive, Suite 610

Franklin, Tennessee 37067

(615) 861-6000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Christopher L. Howard

Executive Vice President, General Counsel and Secretary

Acadia Healthcare Company, Inc.

830 Crescent Centre Drive, Suite 610

Franklin, Tennessee 37067

(615) 861-6000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Richard W. Porter, P.C.

Elisabeth M. Martin

Kirkland & Ellis LLP

300 North LaSalle Street

Chicago, Illinois 60654

(312) 862-2000

* The co-registrants listed on the next page are also included in this Form S-4 registration statement as additional registrants.

Approximate Date of Commencement of Proposed Sale to the Public: As soon as reasonably practicable after this registration statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the “Securities Act”), check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934 (Check One):

| Large accelerated filer: ¨ | Accelerated filer: | ¨ | ||||||||

| Non-accelerated filer (Do not check if a smaller reporting company): ¨ | Smaller reporting company: | x | ||||||||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer): ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer): ¨

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to Be Registered(1) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||

| 12.875% Senior Notes due 2018 |

$150,000,000 | $17,190 | ||

| Guarantees related to the 12.875% Senior Notes due 2018(2) |

N/A | N/A | ||

| Total |

$150,000,000 | $17,190 | ||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) promulgated under the Securities Act. |

| (2) | No separate consideration will be received for the guarantees, and no separate fee is payable, pursuant to Rule 457(n) under the Securities Act. |

THE REGISTRANTS HEREBY AMEND THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANTS SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

TABLE OF ADDITIONAL REGISTRANTS

| Name of Additional Registrants* |

State or Other Jurisdiction of Incorporation or Formation |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. | |||

| Acadia Abilene, LLC |

DE | 8093 | 20-8041863 | |||

| Acadia Hospital of Lafayette, LLC |

DE | 8093 | 20-4765040 | |||

| Acadia Hospital of Longview, LLC |

DE | 8093 | 20-4764998 | |||

| Acadia Louisiana, LLC |

DE | 8093 | 26-4178782 | |||

| Acadia Management Company, Inc. |

DE | 8093 | 20-3879717 | |||

| Acadia Merger Sub, LLC |

DE | 8093 | 45-2352463 | |||

| Acadia RiverWoods, LLC |

DE | 8093 | 26-2700697 | |||

| Acadia Village, LLC |

DE | 8093 | 27-0788813 | |||

| Acadia - YFCS Holdings, Inc. |

DE | 8093 | 27-5289083 | |||

| Ascent Acquisition Corporation |

AR | 8093 | 20-5189115 | |||

| Ascent Acquisition Corporation - CYPDC |

AR | 8093 | 20-5099744 | |||

| Ascent Acquisition Corporation - PSC |

AR | 8093 | 20-5099728 | |||

| Behavioral Health Online, Inc. |

MA | 8093 | 04-3456003 | |||

| Child & Youth Pediatric Day Clinics, Inc. |

AR | 8093 | 62-1696477 | |||

| Childrens Medical Transportation Services, LLC |

AR | 8093 | 40-0002231 | |||

| Detroit Behavioral Institute, Inc. |

MA | 8093 | 13-4265013 | |||

| Habilitation Center, Inc. |

AR | 8093 | 74-2474097 | |||

| Kids Behavioral Health of Montana, Inc. |

MT | 8093 | 62-1681724 | |||

| Lakeland Hospital Acquisition Corporation |

GA | 8093 | 58-2291915 | |||

| Lakeview Behavioral Health System LLC |

DE | 8093 | 27-3047619 | |||

| Med Properties, Inc. |

AR | 8093 | 71-0773279 | |||

| Meducare Transport, L.L.C. |

AR | 8093 | 71-0820296 | |||

| Memorial Hospital Acquisition Corporation |

NM | 8093 | 03-0439201 | |||

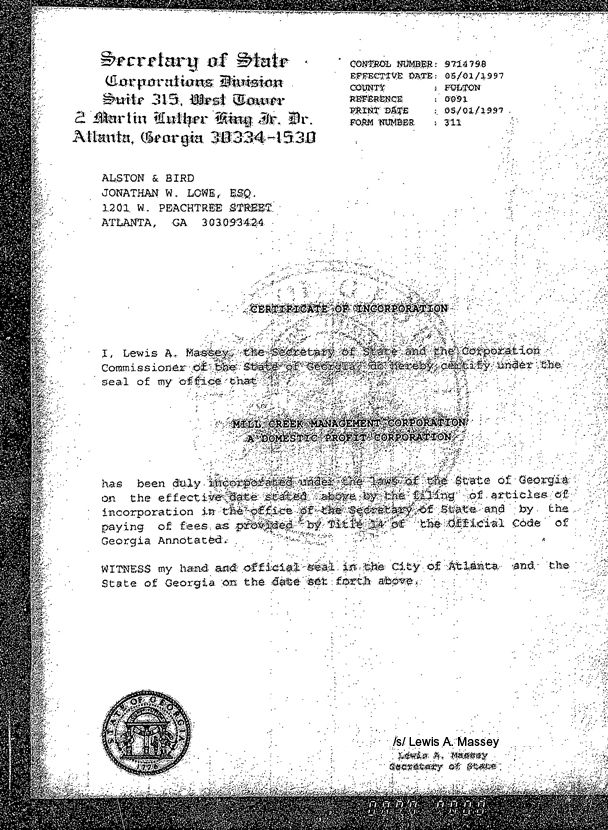

| Millcreek Management Corporation |

GA | 8093 | 58-2313790 | |||

| Millcreek School of Arkansas, Inc. |

AR | 8093 | 74-2474098 | |||

| Millcreek Schools Inc. |

MS | 8093 | 64-0653443 | |||

| North Point - Pioneer, Inc. |

MA | 8093 | 04-3317934 | |||

| Options Community Based Services, Inc. |

IN | 8093 | 26-0509223 | |||

| Options Treatment Center Acquisition Corporation |

IN | 8093 | 03-0512678 | |||

| Pediatric Specialty Care Properties, LLC |

AR | 8093 | 71-0830663 | |||

| Pediatric Specialty Care, Inc. |

AR | 8093 | 71-0773280 | |||

| PHC MeadowWood, Inc. |

DE | 8093 | 45-1343206 | |||

| PHC of Michigan, Inc. |

MA | 8093 | 04-3232990 | |||

| PHC of Nevada, Inc. |

MA | 8093 | 04-3290453 | |||

| PHC of Utah, Inc. |

MA | 8093 | 87-0401574 | |||

| PHC of Virginia, Inc. |

MA | 8093 | 04-2901824 | |||

| Psychiatric Resource Partners, Inc. |

DE | 8093 | 37-1647527 | |||

| PsychSolutions Acquisition Corporation |

FL | 8093 | 01-0857190 | |||

| PsychSolutions, Inc. |

FL | 8093 | 65-0428340 | |||

| Rebound Behavioral Health, LLC |

SC | 8093 | 30-0701952 | |||

| Rehabilitation Centers, Inc. |

MS | 8093 | 64-0568382 | |||

| Renaissance Recovery, Inc. |

MA | 8093 | 27-3350807 | |||

| Resolute Acquisition Corporation |

IN | 8093 | 03-0512672 | |||

| Resource Community Based Services, Inc. |

IN | 8093 | 26-0508652 | |||

| RTC Resource Acquisition Corporation |

IN | 8093 | 03-0512675 | |||

| Seven Hills Hospital, Inc. |

DE | 8093 | 51-0578850 | |||

| Southwestern Children’s Health Services, Inc. |

AZ | 8093 | 86-0768811 | |||

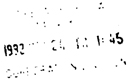

| Southwood Psychiatric Hospital, Inc. |

PA | 8093 | 25-1414990 | |||

| Success Acquisition Corporation |

IN | 8093 | 03-0512680 | |||

| Suncoast Behavioral, LLC |

DE | 8093 | 80-0731400 | |||

| Wellplace, Inc. |

MA | 8093 | 13-4265014 | |||

| YFCS Holdings - Georgia, Inc. |

GA | 8093 | 52-2052380 | |||

| YFCS Management, Inc. |

GA | 8093 | 58-2281069 | |||

| Youth and Family Centered Services of Florida, Inc. |

FL | 8093 | 52-1955335 | |||

| Youth and Family Centered Services of New Mexico, Inc. |

NM | 8093 | 74-2753620 | |||

| Youth and Family Centered Services, Inc. |

GA | 8093 | 58-2281089 |

| * | Address and telephone numbers of principal executive offices are the same as those of Acadia Healthcare Company, Inc. |

The information in this preliminary prospectus is not complete and may be changed. This preliminary prospectus is not an offer to sell these securities and it is not a solicitation of an offer to buy these securities in any jurisdiction where the offering is not permitted.

Subject to Completion, dated December 15, 2011

Preliminary Prospectus

$150,000,000

Acadia Healthcare Company, Inc.

Exchange Offer for

12.875% Senior Notes due 2018

Offer (which we refer to as the “Exchange Offer”) for outstanding 12.875% Senior Notes due 2018, in the aggregate principal amount of $150,000,000 (which we refer to as the “Outstanding Notes”), in exchange for up to $150,000,000 in aggregate principal amount of 12.875% Senior Notes due 2018 which have been registered under the Securities Act of 1933, as amended (which we refer to as the “Exchange Notes” and, together with the Outstanding Notes, the “notes”).

Material Terms of the Exchange Offer:

| • | Expires 5:00 p.m., New York City time, , 2012, unless extended. |

| • | You may withdraw tendered Outstanding Notes any time before the expiration of the Exchange Offer. |

| • | Not subject to any condition other than that the Exchange Offer does not violate applicable law or any interpretation of the staff of the United States Securities and Exchange Commission (the “SEC”). |

| • | We can amend or terminate the Exchange Offer. |

| • | We will not receive any proceeds from the Exchange Offer. |

| • | The exchange of Outstanding Notes for the Exchange Notes should not be a taxable exchange for United States federal income tax purposes. See “Certain Material United States Federal Income Tax Considerations.” |

Terms of the Exchange Notes:

| • | The terms of the Exchange Notes are substantially identical to those of the Outstanding Notes, except the transfer restrictions, registration rights and additional interest provisions relating to the Outstanding Notes do not apply to the Exchange Notes. |

| • | The Exchange Notes and the related guarantees will be our and the guarantors’ general unsecured senior obligations, will rank senior in right of payment to all existing and future senior subordinated indebtedness and equal in right of payment with all other existing and future senior indebtedness, including borrowings under our senior secured credit facility (the “Senior Secured Credit Facility”). The Exchange Notes and the related guarantees will be effectively subordinated to our and the guarantors’ existing and future secured indebtedness, to the extent of the value of the assets securing such indebtedness. |

| • | The Exchange Notes will mature on November 1, 2018. The Exchange Notes will bear interest semi-annually in cash in arrears on November 1 and May 1 of each year. No interest will be paid on either the Exchange Notes or the Outstanding Notes at the time of the exchange. The Exchange Notes will accrue interest from and including the last interest payment date on which interest has been paid on the Outstanding Notes. |

| • | We may redeem the Exchange Notes in whole or in part from time to time. See “Description of the Exchange Notes.” |

| • | Upon the occurrence of specific kinds of changes of control, we must offer to repurchase all of the Exchange Notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. |

For a discussion of the specific risks that you should consider before tendering your Outstanding Notes in the Exchange Offer, see “Risk Factors” beginning on page 19 of this prospectus.

There is no established trading market for the Outstanding Notes or the Exchange Notes.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the Exchange Offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. A broker dealer who acquired Outstanding Notes as a result of market making or other trading activities may use this Exchange Offer prospectus, as supplemented or amended from time to time, in connection with any resales of the Exchange Notes.

Neither the SEC nor any state securities commission has approved or disapproved of the Exchange Notes or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011

TABLE OF CONTENTS

| 1 | ||||

| 19 | ||||

| 37 | ||||

| 39 | ||||

| 49 | ||||

| 50 | ||||

| Unaudited Pro Forma Condensed Combined Financial Information |

51 | |||

| 64 | ||||

| Acadia Management’s Discussion and Analysis of Financial Condition and Results of Operations |

68 | |||

| PHC Management’s Discussion and Analysis of Financial Condition and Results of Operations |

83 | |||

| 92 | ||||

| 93 | ||||

| 107 | ||||

| 111 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

124 | |||

| 126 | ||||

| 133 | ||||

| 136 | ||||

| 192 | ||||

| Certain Material United States Federal Income Tax Considerations |

194 | |||

| 195 | ||||

| 197 | ||||

| 199 | ||||

| 199 | ||||

| 199 | ||||

| F-1 |

Each broker-dealer that receives Exchange Notes for its own account in exchange for Outstanding Notes that were acquired as a result of market-making activities or other trading activities must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). A broker dealer who acquired Outstanding Notes as a result of market making or other trading activities may use this prospectus, as supplemented or amended from time to time, in connection with any resales of the Exchange Notes. We have agreed that, for a period of up to 180 days after the closing of the Exchange Offer, we will make this prospectus available for use in connection with any such resale. See “Plan of Distribution”.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with information different from that contained in this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities other than those specifically offered hereby or an offer to sell any securities offered hereby in any jurisdiction where, or to any person whom, it is unlawful to make such an offer or solicitation. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our 12.875% Senior Notes due 2018.

i

COMPANY BACKGROUND

Acadia Healthcare Company, Inc. is a Delaware corporation doing business as Pioneer Behavioral Health. Our predecessor, Acadia Healthcare Company, LLC, was organized in 2005 and converted to a corporation in May 2011.

At the beginning of 2011, we operated through six psychiatric and behavioral health facilities. In April 2011, we acquired Youth and Family Centered Services, Inc. (“YFCS”). YFCS operates 13 inpatient and outpatient facilities, psychiatric and behavioral health facilities.

In November 2011, we completed the acquisition of PHC, Inc., which we refer to as “PHC.” PHC operates 15 substance abuse treatment centers and psychiatric facilities and provides related services. In July 2011, PHC had acquired all of the assets of HHC Delaware, Inc. (collectively with its subsidiary, “HHC”), consisting principally of the MeadowWood Behavioral Health System, an acute care psychiatric hospital (“MeadowWood”). We acquired MeadowWood when we acquired PHC. Upon completion of the acquisition of PHC, our common stock began trading on The NASDAQ Global Market under the symbol “ACHC.”

In this prospectus, unless the context requires otherwise, references to “Acadia,” the “Company,” “we,” “us” or “our” refer to Acadia Healthcare Company, Inc. and its predecessor, Acadia Healthcare Company, LLC. Current references include the acquired operations mentioned above; historical references include those operations form and after their date of acquisition. When we refer to our operations or results “on a pro forma basis” or “on a pro forma basis giving effect to the Merger,” we mean the statement is made as if each of the acquisitions mentioned above had been completed as of the date stated or as of the beginning of the period referenced.

NON-GAAP FINANCIAL MEASURES

We have included certain financial measures in this prospectus, including Pro Forma EBITDA and Pro Forma Adjusted EBITDA, which are “non-GAAP financial measures” as defined under the rules and regulations promulgated by the SEC. We define Pro Forma EBITDA as pro forma net income (loss) adjusted for (loss) income from discontinued operations, net interest expense, income tax provision (benefit) and depreciation and amortization. We define Pro Forma Adjusted EBITDA as Pro Forma EBITDA adjusted for equity-based compensation expense, transaction-related expenses, management fees, impairment charges, legal settlement, and integration and closing costs. For the nine-month periods ended September 30, 2010 and 2011 and the twelve-month period ended December 31, 2010, Pro Forma Adjusted EBITDA also includes adjustments relating to a rate increase on one of PHC’s contracts, anticipated future operating income at the Seven Hills Behavioral Center, the elimination of rent expense associated with PHC’s subsidiary, Detroit Behavioral Institute, Inc., and cost savings/synergies in connection with the Merger (as defined herein). For a reconciliation of pro forma net income (loss) to Pro Forma Adjusted EBITDA, see “Prospectus Summary—Summary Historical Condensed Consolidated Financial Data and Unaudited Pro Forma Condensed Combined Financial Data.” We may not achieve all of the expected benefits from synergies, cost savings and recent improvements to our revenue base.

Pro Forma EBITDA and Pro Forma Adjusted EBITDA, as presented in this prospectus, are supplemental measures of our performance and are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). Pro Forma EBITDA and Pro Forma Adjusted EBITDA are not measures of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as measures of our liquidity. Our measurements of Pro Forma EBITDA and Pro Forma Adjusted EBITDA may not be comparable to similarly titled measures of other companies and are not measures of performance calculated in accordance with GAAP. We have included information concerning Pro Forma EBITDA and Pro Forma Adjusted EBITDA in this prospectus because we believe that such information is used by certain investors as measures of a company’s historical performance. We

ii

believe these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of issuers of equity securities, many of which present EBITDA and Adjusted EBITDA when reporting their results. Our presentation of Pro Forma EBITDA and Pro Forma Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items.

MARKET AND INDUSTRY DATA

Market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, reports by market research firms or other published independent sources including, but not limited to, IBISWorld industry reports (“IBISWorld”) and reports prepared by the National Institute of Mental Health published in 2010, and the U.S. Department of Health and Human Services published in 2008. Some data are also based on our good faith estimates, which are derived from management’s review of internal data and information, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information, and we have not ascertained the underlying economic assumptions relied upon therein, and cannot guarantee its accuracy and completeness. Statements as to our market position are based on market data currently available to us and, primarily, on management estimates as information regarding most of our major competitors is not publicly available. Our estimates involve risks and uncertainties, and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

TRADEMARKS AND TRADE NAMES

This prospectus includes our trademarks such as “Pioneer Behavioral Health,” which are protected under applicable intellectual property laws and are the property of Acadia Healthcare Company, Inc. or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

iii

This summary highlights selected information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to participate in the Exchange Offer. You should carefully read the entire prospectus, including the section entitled “Risk Factors” beginning on page 19 and the financial statements and notes thereto included elsewhere in this prospectus.

On November 1, 2011, PHC, Inc., a Massachusetts corporation (“PHC”), merged with and into Acadia Merger Sub, LLC (the “Merger”), a Delaware limited liability company and our wholly-owned subsidiary (“Merger Sub”), with Merger Sub continuing as the surviving company following the Merger (the “Merger”). In this prospectus, unless the context requires otherwise, references to “Acadia,” “the Company,” “we,” “us” or “our” refer to Acadia Healthcare Company, Inc. together with its consolidated subsidiaries and including the assets and operations acquired in the Merger. We recently completed several significant acquisitions and greatly expanded our business. See “Company Background.”

Our Company

Overview. We are the leading publicly traded pure-play provider of inpatient behavioral health care services in the United States based upon number of licensed beds. As of November 1, 2011 we operated 34 behavioral healthcare inpatient and outpatient facilities with approximately 1,950 licensed beds in 18 states. We believe that our primary focus on the provision of behavioral health services allows us to operate more efficiently and provide higher quality care than our competitors. On a pro forma basis for the nine months ended September 30, 2011 and the twelve months ended December 31, 2010, giving effect to the Merger, we would have generated revenue of $252.2 million and $320.3 million, respectively.

Our inpatient facilities offer a wide range of inpatient behavioral health care services for children, adolescents and adults. We offer these services through a combination of acute inpatient behavioral facilities and residential treatment centers (“RTCs”). Our acute inpatient behavioral facilities provide the most intensive level of care, including 24-hour skilled nursing observation and care, daily interventions and oversight by a psychiatrist and intensive, highly coordinated treatment by a physician-led team of mental health professionals. Our RTCs offer longer-term treatment programs primarily for children and adolescents with long-standing chronic behavioral health problems. Our RTCs provide physician-led, multi-disciplinary treatments that address the overall medical, psychiatric, social and academic needs of the patient.

Our outpatient community-based services provide therapeutic treatment to children and adolescents who have a clinically defined emotional, psychiatric or chemical dependency disorder while enabling patients to remain at home and within their community. Many patients who participate in community-based programs have transitioned out of a residential facility or have a disorder that does not require placement in a facility that provides 24-hour care.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors:

Premier operational management team with track record of success. Our management team has approximately 145 combined years of experience in acquiring, integrating and operating a variety of behavioral health facilities. Following the sale of Psychiatric Solutions, Inc. (“PSI”) to Universal Health Services, Inc. in November 2010, certain of PSI’s key former executive officers joined Acadia in February 2011. The combination of the Acadia management team with the operational expertise of the former PSI management team gives us

1

what we believe to be the premier leadership team in the behavioral health care industry. The new management team intends to bring its years of experience operating behavioral health facilities to generate strong cash flow and grow a strong business.

Favorable industry and legislative trends. According to the National Institute of Mental Health, approximately 6% of people in the United States suffer from a seriously debilitating mental illness and over 20% of children, either currently or at some point during their life, have had a seriously debilitating mental disorder. We believe the market for behavioral services will continue to grow due to increased awareness of mental health and substance abuse conditions and treatment options. National expenditures on mental health and substance abuse treatment are expected to reach $239 billion in 2014, up from $121 billion in 2003, representing a compound annual growth rate of approximately 6.4%.

While the growing awareness of mental health and substance abuse conditions is expected to accelerate demand for services, recent healthcare reform is expected to increase access to industry services as more people obtain insurance coverage. A key aspect of reform legislation is the extension of mental health parity protections established into law by the Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (the “MHPAEA”). The MHPAEA provides for equal coverage between psychiatric or mental health services and conventional medical health services and forbids employers and insurers from placing stricter limits on mental health care compared to other health conditions. According to IBISWorld, the MHPAEA is projected to affect more than 113 million individuals.

Leading platform in attractive healthcare niche. We are a leading behavioral healthcare platform in an industry that is undergoing consolidation in an effort to reduce costs and better negotiate with larger payor organizations. In addition, the behavioral health care industry has significant barriers to entry, including (i) significant initial capital outlays required to open new facilities (ii) expertise required to deliver highly specialized services safely and effectively and (iii) high regulatory hurdles that require market entrants to be knowledgeable of state and federal laws and be licensed with local agencies at the facility level.

Diversified revenue and payor bases. We currently operate 34 facilities in 18 states. The Merger increased our payor, patient/client and geographic diversity, which mitigates the potential risk associated with any single facility. On a pro forma basis for the twelve months ended September 30, 2011, we received 66% of our revenue from Medicaid, 21% from commercial payors, 8% from Medicare, and 5% from other payors. As we receive Medicaid payments from 23 states, we do not believe that we are significantly affected by changes in reimbursement policies in any one state. Substantially all of our Medicaid payments relate to the care of children and adolescents. Management believes that children and adolescents are a patient class that is less susceptible to reductions in reimbursement rates. On a pro forma basis, our largest facility would have accounted for less than 12% of total revenue for the twelve months ended September 30, 2011, and no other facility would have accounted for more than 9% of total revenue for the same period. Additionally, on a pro forma basis, no state would have accounted for more than 15% of total revenue for the twelve months ended September 30, 2011. We believe that our increased geographic diversity will mitigate the impact of any financial or budgetary pressure that may arise in a particular state where we operate.

Strong cash flow generation and low capital requirements. We generate strong free cash flow by profitably operating our business and by actively managing our working capital. Moreover, as the behavioral health care business does not typically require the procurement and replacement of expensive medical equipment, our maintenance capital expenditure requirements are generally less than that of other facility-based health care providers. For the year ended December 31, 2010, Acadia’s capital expenditures amounted to approximately 2.3% of our revenue. In addition, our accounts receivable management is less complex than medical/surgical hospital providers because there are fewer billing codes for inpatient behavioral health care facilities.

2

Business Strategy

We are committed to providing the communities we serve with high quality, cost-effective behavioral health services, while growing our business, increasing profitability and creating long-term value for our stockholders. To achieve these objectives, we have aligned our activities around the following growth strategies:

Increase margins by enhancing programs and improving performance at existing facilities. We believe we can improve efficiencies and increase operating margins by utilizing our management’s expertise and experience within existing programs and their expertise in improving performance at underperforming facilities. We believe the efficiencies can be realized by investing in growth in strong markets, addressing capital- constrained facilities that have underperformed and improving management systems. Furthermore, the combination of Acadia, YFCS and PHC provides the combined company an opportunity to develop a national marketing strategy in many markets which should help to increase the geographic footprint from which our existing facilities attract patients and referrals.

Opportunistically pursue acquisitions. We have established a national platform for becoming the leading, dedicated provider of high quality behavioral health care services in the U.S. Our industry is highly fragmented, and we selectively seek opportunities to expand and diversify our base of operations by acquiring additional facilities. We believe there are a number of acquisition candidates available at attractive valuations, and we have a number of potential acquisitions in various stages of development and consideration. We believe our focus on inpatient behavioral health care and history of completing acquisitions provides us with a strategic advantage in sourcing, evaluating and closing acquisitions. We intend to focus our efforts on acquiring additional acute psychiatric facilities, which should increase the percentage of such facilities in our portfolio. The combination of PHC and recently acquired MeadowWood added seven inpatient facilities (four for general psychiatric services and three for substance abuse services) and eight outpatient psychiatric facilities as well as two call centers. We leverage our management team’s expertise to identify and integrate acquisitions based on a disciplined acquisition strategy that focuses on quality of service, return on investment and strategic benefits. We also have a comprehensive post-acquisition strategic plan to facilitate the integration of acquired facilities that includes improving facility operations, retaining and recruiting psychiatrists and expanding the breadth of services offered by the facilities.

Drive organic growth of existing facilities. We seek to increase revenue at our facilities by providing a broader range of services to new and existing patients and clients. The YFCS acquisition presented us with an opportunity to provide a wider array of behavioral health services (including adult services and acute-care services) to patients and clients in the markets YFCS serviced, without increasing the number of our licensed beds. We believe there are similar opportunities to market a broader array of services to the markets served by PHC’s facilities. We also intend to increase licensed bed counts in our existing facilities, with a focus on increasing the number of acute psychiatric beds. For example, since September 1, 2011, we have added 76 beds and expect to add approximately 95 additional beds by March 31, 2012. Additionally, 42 beds have already been converted from residential treatment care beds to acute psychiatric care beds, which have higher reimbursement rates on average. Furthermore, we believe that opportunities exist to leverage out-of-state referrals to increase volume and minimize payor concentration, especially with respect to our youth and adolescent focused services and our substance abuse services.

Recent Developments

On November 1, 2011, PHC merged with and into Merger Sub, with Merger Sub continuing as the surviving company (the “Merger”).

Concurrently with the closing of the Merger, the following events were effected, which together with the Merger, we collectively refer to as the “Transactions”:

| • | our issuance of $150,000,000 in aggregate principal amount of the Outstanding Notes; |

3

| • | the effectiveness of an amendment to the Senior Secured Credit Facility (the “Second Amendment”); |

| • | the payment of a cash dividend to the holders of shares of Acadia’s common stock immediately prior to the Merger of approximately $74.4 million; |

| • | the permanent repayment of all outstanding indebtedness under PHC’s senior credit facility; and |

| • | the payment of approximately $40.9 million of fees and expenses related to the foregoing transactions, including approximately $20.6 million paid to Waud Capital Partners, L.L.C. (“Waud Capital Partners”) to terminate its professional services agreement and approximately $2.4 million of change in control payments paid to certain PHC executives, commitment, placement and other financing fees, financial advisory costs and other transaction costs and professional fees. |

For a description of the Senior Secured Credit Facility and the Second Amendment, see “Acadia Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and “Description of Other Indebtedness.

On December 15, 2011, we announced the pricing of a registered public offering of 8,333,333 shares of our common stock at a public offering price of $7.50 per share. We also granted to the underwriters a 30-day option to purchase up to an additional 1,249,999 shares of our common stock to cover overallotments, if any.

Equity Sponsor

Founded in 1993, Waud Capital Partners is a leading middle-market private equity firm that partners with management teams to create, acquire and grow companies that address significant, inefficient, highly fragmented and underserved industry segments. Waud Capital Partners invests primarily through control-oriented growth equity investments, industry consolidations, buyouts or recapitalizations and seeks companies that generate strong cash flow and can be grown both organically and through add-on acquisitions. Waud Capital Partners’ current and exited portfolio is comprised of companies in the healthcare, business/consumer, logistics/specialty distribution and value-added industrial business segments.

Waud Capital Partners owns a substantial majority of our common stock, currently is entitled to designate a majority of our directors and, so long as it owns at least 17.5% of our outstanding common stock, has consent rights to many corporate actions, such as issuing equity or debt securities, paying dividends, acquiring any interest in another company and materially changing our business activities. This means that we cannot engage in any of those activities without the consent of Waud Capital Partners.

Company Information

Our principal executive offices are located at 830 Crescent Centre Drive, Suite 610, Franklin, Tennessee 37067. Our telephone number is (615) 861-6000. Our website is http://www.acadiahealthcare.com. The information contained on our website is not part of this prospectus and is not incorporated in this prospectus by reference.

4

Summary of the Exchange Offer

The summary below describes the principal terms of the Exchange Offer. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Exchange Offer” section of this prospectus contains a more detailed description of the terms and conditions of the Exchange Offer.

| Initial Offering of Outstanding Notes |

On November 1, 2011, we sold, through a private placement exempt from the registration requirements of the Securities Act, $150,000,000 of our 12.875% Senior Notes due 2018 (the “Outstanding Notes”), all of which are eligible to be exchanged for Exchange Notes. |

| Registration Rights Agreement |

Simultaneously with the private placement, we entered into a registration rights agreement with the initial purchaser of the Outstanding Notes (the “Registration Rights Agreement”). Under the Registration Rights Agreement, we are required to file a registration statement for substantially identical debt securities (and related guarantees), which will be issued in exchange for the Outstanding Notes, with the SEC. You may exchange your Outstanding Notes for Exchange Notes in this Exchange Offer. For further information regarding the Exchange Notes, see the sections entitled “Exchange Offer” and “Description of the Exchange Notes” in this prospectus. |

| Exchange Notes Offered |

$150,000,000 aggregate principal amount of 12.875% Senior Notes due 2018. |

| Exchange Offer |

We are offering to exchange the Outstanding Notes for a like principal amount at maturity of the Exchange Notes. Outstanding Notes may be exchanged only in denominations of $2,000 and integral multiples of $1,000 in excess thereof. The Exchange Offer is being made pursuant to the Registration Rights Agreement which grants the initial purchaser and any subsequent holders of the Outstanding Notes certain exchange and registration rights. This Exchange Offer is intended to satisfy those exchange and registration rights with respect to the Outstanding Notes. After the Exchange Offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your Outstanding Notes. |

| Expiration Date; Withdrawal of Tender |

The Exchange Offer will expire 5:00 p.m., New York City time, on , 2012, or a later time if we choose to extend the Exchange Offer in our sole and absolute discretion. You may withdraw your tender of Outstanding Notes at any time prior to the expiration date. All Outstanding Notes that are validly tendered and not validly withdrawn will be exchanged. Any Outstanding Notes not accepted by us for exchange for any reason will be returned to you at our expense as promptly as possible after the expiration or termination of the Exchange Offer. |

| Broker-Dealer |

Each broker-dealer acquiring Exchange Notes issued for its own account in exchange for Outstanding Notes, which it acquired through market-making activities or other trading activities, must acknowledge that it will deliver a proper prospectus when any |

5

| Exchange Notes issued in the Exchange Offer are transferred. A broker-dealer may use this prospectus for an offer to resell, a resale or other retransfer of the Exchange Notes issued in the Exchange Offer. |

| Prospectus Recipients |

We mailed this prospectus and the related Exchange Offer documents to registered holders of the Outstanding Notes as of , 2011. |

| Conditions to the Exchange Offer |

Our obligation to accept for exchange, or to issue the Exchange Notes in exchange for, any Outstanding Notes is subject to certain customary conditions, including our determination that the Exchange Offer does not violate any law, statute, rule, regulation or interpretation by the staff of the SEC or any regulatory authority or other foreign, federal, state or local government agency or court of competent jurisdiction, some of which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See “Exchange Offer—Conditions to the Exchange Offer.” |

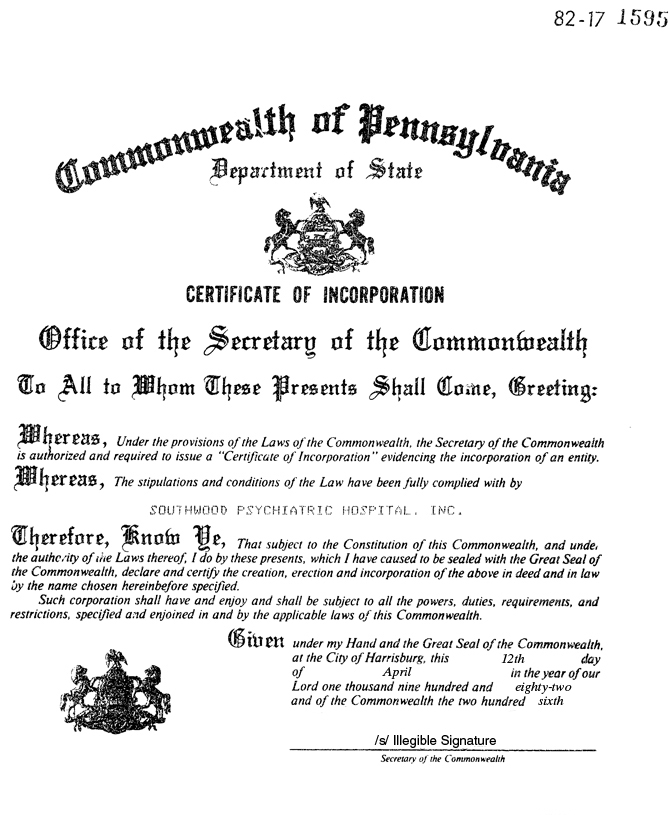

| Procedures for Tendering Outstanding Notes Held in the Form of Book-Entry Interests |

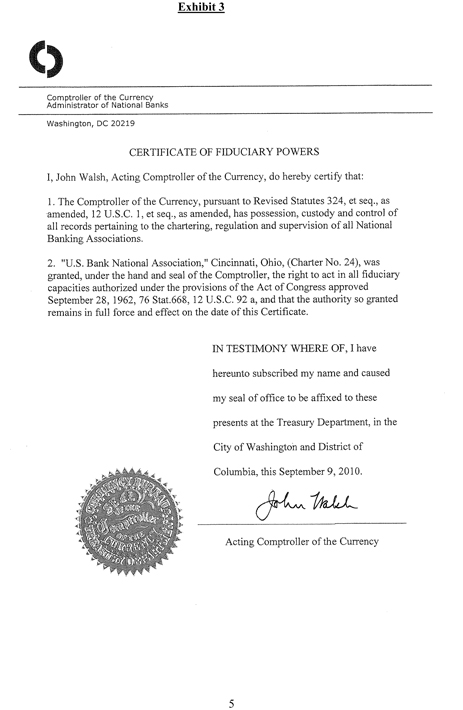

The Outstanding Notes were issued as global securities and were deposited upon issuance with U.S. Bank National Association, as custodian for The Depository Trust Company (“DTC”). |

| Beneficial interests in the Outstanding Notes, which are held by direct or indirect participants in DTC, are shown on, and transfers of the Outstanding Notes can only be made through, records maintained in book-entry form by DTC. |

| You may tender your Outstanding Notes by instructing your broker or bank where you keep the Outstanding Notes to tender them for you. By tendering your Outstanding Notes you will be deemed to have acknowledged and agreed to be bound by the terms set forth under “Exchange Offer” and in the letter of transmittal accompanying this prospectus. Your Outstanding Notes must be tendered in denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| In order for your tender of Outstanding Notes for Exchange Notes in the Exchange Offer to be considered valid, you must transmit to the exchange agent on or before 5:00 p.m., New York City time on the expiration date either: |

| • | an original or facsimile of a properly completed and duly executed copy of the letter of transmittal, which accompanies this prospectus, together with your Outstanding Notes and any other documentation required by the letter of transmittal, at the address provided on the cover page of the letter of transmittal; or |

| • | if the Outstanding Notes you own are held of record by DTC, in book-entry form and you are making delivery by book-entry transfer, a computer-generated message transmitted by means of the Automated Tender Offer Program System of DTC (“ATOP”), |

6

| in which you acknowledge and agree to be bound by the terms of the letter of transmittal and which, when received by the exchange agent, forms a part of a confirmation of book-entry transfer. As part of the book-entry transfer, DTC will facilitate the exchange of your Outstanding Notes and update your account to reflect the issuance of the Exchange Notes to you. ATOP allows you to electronically transmit your acceptance of the Exchange Offer to DTC instead of physically completing and delivering a letter of transmittal to the exchange agent. |

| In addition, if you are making delivery via book-entry transfer, you must deliver, to the exchange agent on or before 5:00 p.m., New York City time on the expiration date, a timely confirmation of book-entry transfer of your Outstanding Notes into the account of the exchange agent at DTC. |

| Special Procedures for Beneficial Owners |

If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of Outstanding Notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or Outstanding Notes in the Exchange Offer, you should contact the person in whose name your book-entry interests or Outstanding Notes are registered promptly and instruct that person to tender on your behalf. |

| United States Federal Income Tax Considerations |

The Exchange Offer should not result in any income, gain or loss to the holders of Outstanding Notes for United States federal income tax purposes. See “Certain Material United States Federal Income Tax Considerations.” |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the Exchange Notes in the Exchange Offer. |

| Exchange Agent |

U.S. Bank National Association is serving as the exchange agent for the Exchange Offer. |

| Shelf Registration Statement |

In limited circumstances, holders of Outstanding Notes may require us to register their Outstanding Notes under a shelf registration statement. See “Exchange Offer—Purpose of Exchange Offer.” |

7

Consequences of Not Exchanging Outstanding Notes

If you do not exchange your Outstanding Notes in the Exchange Offer, your Outstanding Notes will continue to be subject to the restrictions on transfer currently applicable to the Outstanding Notes. In general, you may offer or sell your Outstanding Notes only:

| • | if they are registered under the Securities Act and applicable state securities laws; |

| • | if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

| • | if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

We do not currently intend to register the Outstanding Notes under the Securities Act. Under some circumstances, however, holders of the Outstanding Notes, including holders who are not permitted to participate in the Exchange Offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of Outstanding Notes by these holders. For more information regarding the consequences of not tendering your Outstanding Notes and our obligation to file a shelf registration statement, see “Exchange Offer—Purpose of the Exchange Offer”.

8

Summary of Terms of the Exchange Notes

The summary below describes the principal terms of the Exchange Notes. Certain of the terms described below are subject to important limitations and exceptions. See the section entitled “Description of the Exchange Notes” of this prospectus for a more detailed description of the terms of the Exchange Notes.

| Issuer |

Acadia Healthcare Company, Inc. |

| Securities |

$150,000,000 aggregate principal amount of 12.875% Senior Notes due 2018, which will be registered under the Securities Act. The Exchange Notes will evidence the same debt as the Outstanding Notes. |

| Maturity Date |

November 1, 2018. |

| Interest Rate |

We will pay interest on the Exchange Notes at an annual interest rate of 12.875%. |

| Interest Payment Dates |

Interest payments on the Exchange Notes are payable semi-annually in arrears on each November 1 and May 1. No interest will be paid on either the Exchange Notes or the Outstanding Notes at the time of exchange. The Exchange Notes will accrue interest from and including the last interest payment date on which interest has been paid on the Outstanding Notes and, if no interest has been paid, the Exchange Notes will accrue interest since the issue date of the Outstanding Notes. |

| Accordingly, the holders of Outstanding Notes that are accepted for exchange will not receive accrued but unpaid interest on such Outstanding Notes at the time of tender. Rather, that interest will be payable on the Exchange Notes delivered in exchange for the Outstanding Notes on the first interest payment date following the expiration date of the Exchange Notes. |

| Guarantees |

The Exchange Notes will be guaranteed on a senior unsecured basis by each of our domestic subsidiaries that is a guarantor under the Senior Secured Credit Facility and, subject to certain exceptions, each of our future domestic subsidiaries that guarantees indebtedness under the Senior Secured Credit Facility. See “Description of the Exchange Notes—Additional Note Guarantees.” |

| Ranking |

The Exchange Notes and the guarantees will be our and the guarantors’ senior unsecured obligations and will be: |

| • | senior in right of payment to any of our and the guarantors’ existing and future subordinated indebtedness; |

| • | equal in right of payment with all of our and the guarantors’ existing and future senior indebtedness, including the Senior Secured Credit Facility; |

9

| • | effectively subordinated to our and the guarantors’ existing and future secured indebtedness, including the Senior Secured Credit Facility, to the extent of the value of the assets securing such indebtedness; and |

| • | structurally subordinated to all of the existing and future liabilities (including trade payables) of each of our subsidiaries that do not guarantee the Exchange Notes. |

| As of the date of this prospectus, all of our existing subsidiaries guarantee the Outstanding Notes and the Senior Secured Credit Facility. |

| Optional Redemption |

On or after November 1, 2015, we may redeem some or all of the Exchange Notes at the redemption prices set forth under “Description of the Exchange Notes—Optional Redemption.” |

| Prior to November 1, 2014, we may redeem up to 35% of the aggregate principal amount of the Exchange Notes at the premium set forth under “Description of the Exchange Notes—Optional Redemption,” with certain of the proceeds realized by us from the sale of a qualified equity issuance; provided however, that at least 65% of the original principal amount of the notes are outstanding immediately following the redemption. |

| We may redeem some or all of the Exchange Notes at any time prior to November 1, 2015 by paying a “make whole” premium as described in this prospectus. |

| Change of Control Offer |

If we experience a change of control, the holders of the Exchange Notes will have the right to require us to purchase their Exchange Notes at a price in cash equal to 101% of the principal amount thereof, together with accrued and unpaid interest, if any, to the date of purchase. |

| Asset Sales |

Upon certain asset sales, we may be required to offer to use the net proceeds of the asset sale to purchase some or all of the Exchange Notes at 100% of the principal amount thereof, together with accrued and unpaid interest, if any, to the date of purchase. |

| Certain Covenants |

The indenture under which the Outstanding Notes were issued will govern the Exchange Notes. The indenture contains covenants that, among other things, limit our ability and the ability of the restricted subsidiaries to: |

| • | incur or guarantee additional indebtedness or issue certain preferred stock; |

10

| • | pay dividends on our equity interests or redeem, repurchase or retire our equity interests or subordinated indebtedness; |

| • | transfer or sell assets; |

| • | make certain investments; |

| • | incur certain liens; |

| • | create restrictions on the ability of our subsidiaries to pay dividends or make other payments to us; |

| • | engage in certain transactions with our affiliates; and |

| • | merge or consolidate with other companies or transfer all or substantially all of our assets. |

| These covenants are subject to a number of important limitations and exceptions as described under “Description of the Exchange Notes—Certain Covenants.” |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the Exchange Notes in the Exchange Offer. |

| No Public Market |

The Exchange Notes will be a new issue of securities and will not be listed on any securities exchange or included in any automated quotation system. Accordingly, we cannot assure you that a liquid market for the Exchange Notes will develop or be maintained. |

| Risk Factors |

You should consider carefully all of the information included in this prospectus and, in particular, the information under the heading “Risk Factors” beginning on page 19 prior to deciding to tender your Outstanding Notes in the Exchange Offer. |

11

Summary Historical Condensed Consolidated Financial Data and

Unaudited Pro Forma Condensed Combined Financial Data

Acadia Historical Financial Data

The following table sets forth summary historical condensed consolidated financial data for Acadia and its subsidiaries on a consolidated basis for the periods ended and at the dates indicated and does not give effect to YFCS operating results prior to April 1, 2011 or the consummation of the Transactions. Acadia has derived the historical consolidated financial data as of December 31, 2009 and 2010 and for each of the three years in the period ended December 31, 2010 from Acadia Healthcare Company, LLC’s audited consolidated financial statements included elsewhere in this prospectus. Acadia has derived the summary consolidated financial data as of and for the nine months ended September 30, 2010 and 2011 from Acadia Healthcare Company, Inc.’s unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. Acadia has derived the summary consolidated financial data as of December 31, 2008 from Acadia Healthcare Company, LLC’s audited consolidated financial statements not included in this prospectus. The results for the nine months ended September 30, 2011 are not necessarily indicative of the results that may be expected for the entire fiscal year. The summary consolidated financial data below should be read in conjunction with “Acadia Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information” and Acadia Healthcare Company, LLC’s consolidated financial statements and the notes thereto included elsewhere in this prospectus. On May 13, 2011, Acadia Healthcare Company, LLC elected to convert to a corporation (Acadia Healthcare Company, Inc.) in accordance with Delaware law.

| YEAR ENDED DECEMBER 31, | NINE MONTHS ENDED | |||||||||||||||||||

| 2008 | 2009 | 2010 | SEPTEMBER 30, 2010 |

SEPTEMBER 30, 2011 |

||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Net patient service revenue |

$ | 33,353 | $ | 51,821 | $ | 64,342 | $ | 48,344 | 146,019 | |||||||||||

| Salaries, wages and benefits |

22,342 | 30,752 | 36,333 | 28,980 | 110,750 | |||||||||||||||

| Professional fees |

952 | 1,977 | 3,612 | 1,151 | 5,111 | |||||||||||||||

| Provision for doubtful accounts |

1,804 | 2,424 | 2,239 | 1,803 | 1,664 | |||||||||||||||

| Other operating expenses |

8,328 | 12,116 | 13,286 | 8,792 | 24,344 | |||||||||||||||

| Depreciation and amortization |

740 | 967 | 976 | 728 | 3,114 | |||||||||||||||

| Interest expense, net |

729 | 774 | 738 | 549 | 4,143 | |||||||||||||||

| Sponsor management fees |

— | — | — | 105 | 1,135 | |||||||||||||||

| Transaction related expenses |

— | — | — | 104 | 10,594 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations, before income taxes |

(1,542) | 2,811 | 7,158 | 6,132 | (14,836 | ) | ||||||||||||||

| Income tax provision (benefit) |

20 | 53 | 477 | 459 | 3,382 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations |

(1,562) | 2,758 | 6,681 | 5,673 | (18,218 | ) | ||||||||||||||

| (Loss) income from discontinued operations, net of income taxes |

(156) | 119 | (471) | 13 | (765 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (1,718) | $ | 2,877 | $ | 6,210 | $ | 5,686 | $ | (18,983 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Ratio of earnings to fixed charges (1) |

— | 3.95x | 8.03x | 9.18x | — | |||||||||||||||

| Balance Sheet Data (as of end of period): |

||||||||||||||||||||

| Cash and equivalents |

$ | 45 | $ | 4,489 | $ | 8,614 | $ | 6,479 | $ | 1,254 | ||||||||||

| Total assets |

32,274 | 41,254 | 45,412 | 42,937 | 269,609 | |||||||||||||||

| Total debt |

11,062 | 10,259 | 9,984 | 10,051 | 138,125 | |||||||||||||||

| Total members’ equity |

15,817 | 21,193 | 25,107 | 24,648 | 76,986 | |||||||||||||||

| (1) | For purposes of calculating earnings to fixed charges, earnings consists of income (loss) from continuing operations before income taxes and fixed charges. Fixed charges include interest expense and the estimated interest portion of rent expense. Earnings were insufficient to cover fixed charges by approximately $1.5 million and $14.8 million for the year ended December 31, 2008 and the nine months ended September 30, 2011, respectively. |

12

YFCS Historical Financial Data

The following table sets forth summary historical condensed consolidated financial data for YFCS and its subsidiaries on a consolidated basis for the periods ended and at the dates indicated and does not give effect to Acadia’s acquisition of YFCS or the Transactions. Acadia has derived the historical consolidated financial data as of December 31, 2009 and 2010 and for each of the three years in the period ended December 31, 2010 from YFCS’ audited consolidated financial statements included elsewhere in this prospectus. Acadia has derived the summary consolidated financial data as of and for the three months ended March 31, 2010 and 2011 from YFCS’ unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. Acadia has derived the summary consolidated financial data as of December 31, 2008 from YFCS’ audited consolidated financial statements not included in this prospectus. The results for the three months ended March 31, 2011 are not necessarily indicative of the results that may have been expected for the entire fiscal year. The summary financial data below should be read in conjunction with “Acadia Management’s Discussion and Analysis of Financial Condition and Results of Operations—YFCS Acquisition,” “Unaudited Pro Forma Condensed Combined Financial Information” and YFCS’ consolidated financial statements and the notes thereto included elsewhere in this prospectus.

| YEAR ENDED DECEMBER 31, | THREE MONTHS ENDED | |||||||||||||||||||

| 2008 | 2009 | 2010 | MARCH 31, 2010 |

MARCH 31, 2011 |

||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Revenue |

$ | 180,646 | $ | 186,586 | $ | 184,386 | $ | 45,489 | $ | 45,686 | ||||||||||

| Salaries and benefits |

110,966 | 113,870 | 113,931 | 27,813 | 29,502 | |||||||||||||||

| Other operating expenses |

37,704 | 37,607 | 38,146 | 8,944 | 9,907 | |||||||||||||||

| Provision for bad debts |

1,902 | (309 | ) | 525 | 56 | 208 | ||||||||||||||

| Interest expense |

12,488 | 9,572 | 7,514 | 1,954 | 1,726 | |||||||||||||||

| Depreciation and amortization |

9,419 | 7,052 | 3,456 | 914 | 819 | |||||||||||||||

| Impairment of goodwill |

— | — | 23,528 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations, before income taxes |

8,167 | 18,794 | (2,714 | ) | 5,808 | 3,524 | ||||||||||||||

| Provision for income taxes |

3,132 | 7,133 | 5,032 | 2,267 | 1,404 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from continuing operations |

5,035 | 11,661 | (7,746 | ) | 3,541 | 2,120 | ||||||||||||||

| Income (loss) from discontinued operations, net of income taxes |

964 | (1,443 | ) | (4,060 | ) | (151 | ) | (64 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 5,999 | $ | 10,218 | $ | (11,806 | ) | $ | 3,390 | $ | 2,056 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance Sheet Data (as of end of period): |

||||||||||||||||||||

| Cash and equivalents |

$ | 20,874 | $ | 15,294 | $ | 5,307 | $ | 8,570 | $ | 4,009 | ||||||||||

| Total assets |

271,446 | 254,620 | 217,530 | 249,748 | 216,609 | |||||||||||||||

| Total debt |

138,234 | 112,127 | 86,073 | 98,831 | 84,304 | |||||||||||||||

| Total stockholders’ equity |

102,696 | 113,921 | 102,126 | 117,311 | 104,182 | |||||||||||||||

13

PHC Historical Financial Data

The following table sets forth summary historical condensed consolidated financial data for PHC and its subsidiaries on a consolidated basis for the periods ended and at the dates indicated and does not give effect to the consummation of the Transactions. The consolidated financial statements of PHC and the notes related thereto are included elsewhere in this prospectus. PHC derived the historical consolidated financial data as of June 30, 2010 and 2011 and for each of the two years in the period ended June 30, 2011 from PHC’s audited financial statements included elsewhere in this prospectus. PHC derived the historical consolidated financial data as of and for the three months ended September 30, 2010 and 2011 from PHC’s unaudited interim financial statements included elsewhere in this prospectus. Certain amounts for all periods presented have been reclassified to be consistent with Acadia’s financial information. PHC derived the historical consolidated financial data as of June 30, 2009 and for the year ended June 30, 2009 from PHC’s audited financial statements not included in this prospectus. The summary financial data below should be read in conjunction with the “PHC Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information” and PHC’s consolidated financial statements and the notes thereto included elsewhere in this prospectus.

| YEAR ENDED JUNE 30, | THREE MONTHS ENDED | |||||||||||||||||||

| 2009 | 2010 | 2011 | SEPTEMBER 30, 2010 |

SEPTEMBER 30, 2011 |

||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Revenues |

$ | 46,411 | $ | 53,077 | $ | 62,008 | $ | 15,071 | $ | 20,684 | ||||||||||

| Patient care expenses |

23,835 | 26,307 | 30,236 | 7,024 | 10,466 | |||||||||||||||

| Contract expenses |

3,016 | 2,965 | 3,618 | 708 | 1,070 | |||||||||||||||

| Provision for doubtful accounts |

1,638 | 2,131 | 3,406 | 1,003 | 1,263 | |||||||||||||||

| Administrative expenses |

18,721 | 19,111 | 22,206 | 5,100 | 7,360 | |||||||||||||||

| Legal settlement |

— | — | 446 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

(799) | 2,563 | 2,096 | 1,236 | 525 | |||||||||||||||

| Other income including interest expense, net |

(177) | (37) | (108) | — | (949) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

(976) | 2,526 | 1,988 | 1,236 | (424) | |||||||||||||||

| Provision for (benefit from) income taxes |

65 | 1,106 | 1,408 | (557) | 140 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) from continuing operations |

(1,041) | 1,420 | 580 | 679 | (284) | |||||||||||||||

| Net income (loss) from discontinued operations |

(1,413) | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (2,454) | $ | 1,420 | $ | 580 | $ | 679 | $ | (284) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance Sheet Data (as of end of period): |

||||||||||||||||||||

| Cash and equivalents |

$ | 3,199 | $ | 4,540 | $ | 3,668 | $ | 3,066 | $ | 3,261 | ||||||||||

| Total assets |

22,692 | 25,650 | 28,282 | 25,101 | 51,825 | |||||||||||||||

| Total debt |

2,241 | 2,557 | 2,239 | 2,340 | 26,535 | |||||||||||||||

| Total stockholders’ equity |

16,044 | 17,256 | 17,915 | 17,879 | 17,678 | |||||||||||||||

14

Summary Unaudited Pro Forma Condensed Combined Financial Data

The following summary unaudited pro forma condensed combined financial data gives effect to (1) Acadia’s acquisition of YFCS and the related debt and equity financing transactions on April 1, 2011, (2) PHC’s acquisition of MeadowWood and related debt financing transaction on July 1, 2011 and (3) the Merger and the related issuance of Outstanding Notes on November 1, 2011, as if each had occurred on September 30, 2011 for the unaudited pro forma condensed combined balance sheet and January 1, 2010 for the unaudited pro forma condensed combined statements of operations. Acadia’s condensed consolidated balance sheet as of September 30, 2011 reflects the acquisition of YFCS and related debt and equity transactions and Acadia’s condensed consolidated statement of operations reflects the results of YFCS operations for the period from April 1, 2011 to September 30, 2011. PHC’s condensed consolidated balance sheet as of September 30, 2011 reflects the acquisition of MeadowWood and related debt financing transaction on July 1, 2011.

The fiscal years of Acadia, YFCS and HHC Delaware end December 31 while the fiscal year of PHC ended on June 30. The combined company’s fiscal year ends December 31.

The unaudited pro forma condensed combined balance sheet combines the unaudited consolidated balance sheets of each of Acadia and PHC as of September 30, 2011.

The unaudited pro forma condensed combined statement of operations for the nine months ended September 30, 2010 combines the unaudited condensed consolidated statements of operations of Acadia, YFCS, HHC Delaware and PHC (which was derived from the audited consolidated statement of operations of PHC for the fiscal year ended June 30, 2010 less the unaudited condensed consolidated statement of operations of PHC for the six months ended December 31, 2009 plus the unaudited condensed consolidated statement of operations of PHC for the three months ended September 30, 2010). The unaudited pro forma condensed combined statement of operations for the nine months ended September 30, 2011 combines Acadia’s unaudited condensed consolidated statement of operations for that period with the unaudited condensed consolidated statement of operations of YFCS for the three months ended March 31, 2011, the unaudited condensed consolidated statement of operations of HHC Delaware for the six months ended June 30, 2011 and the unaudited condensed consolidated statement of operations of PHC for the nine months ended September 30, 2011 (which was derived from the audited consolidated statement of operations of PHC for the fiscal year ended June 30, 2011 less the unaudited condensed consolidated statement of operations of PHC for the six months ended December 31, 2010 plus the unaudited condensed consolidated statement of operations of PHC for the three months ended September 30, 2011). The unaudited pro forma condensed combined statement of operations for the year ended December 31, 2010 combines the audited consolidated statement of operations of Acadia, YFCS and HHC Delaware for that period with the unaudited condensed consolidated statement of operations of PHC for that period (which was derived from the audited consolidated statement of operations of PHC for the fiscal year ended June 30, 2010 less the unaudited condensed consolidated statement of operations of PHC for the six months ended December 31, 2009 plus the unaudited condensed consolidated statement of operations of PHC for the six months ended December 31, 2010).

The unaudited pro forma condensed combined financial data has been prepared using the acquisition method of accounting for business combinations under GAAP. The adjustments necessary to fairly present the unaudited pro forma condensed combined financial data have been made based on available information and in the opinion of management are reasonable. Assumptions underlying the pro forma adjustments are described in the accompanying notes, which should be read in conjunction with this unaudited pro forma condensed combined financial data. The pro forma adjustments are preliminary and revisions to the fair value of assets acquired and liabilities assumed and the financing of the Transactions may have a significant impact on the pro forma adjustments. A final valuation of assets acquired and liabilities assumed in the YFCS, MeadowWood and PHC acquisitions has not been completed and the completion of fair value determinations will most likely result in

15

changes in the values assigned to property and equipment and other assets (including intangibles) acquired and liabilities assumed.

The unaudited pro forma condensed combined financial data is for illustrative purposes only and does not purport to represent what our financial position or results of operations actually would have been had the events noted above in fact occurred on the assumed dates or to project our financial position or results of operations for any future date or future period.

| PRO FORMA NINE MONTHS ENDED |

PRO FORMA NINE MONTHS ENDED |

PRO FORMA YEAR ENDED |

||||||||||

| SEPTEMBER 30, 2010 |

SEPTEMBER 30, 2011 |

DECEMBER 31, 2010 |

||||||||||

| (unaudited) (In thousands) |

||||||||||||

| Unaudited Pro Forma Condensed Combined Statement of Operations Data: |

||||||||||||

| Revenue |

$ | 239,718 | $ | 252,235 | $ | 320,298 | ||||||

| Salaries, wages and benefits |

141,550 | 172,838 | 189,000 | |||||||||

| Professional fees |

13,769 | 13,095 | 18,245 | |||||||||

| Supplies |

11,484 | 12,400 | 15,305 | |||||||||

| Rent |

7,508 | 7,800 | 10,046 | |||||||||

| Other operating expenses |

23,051 | 24,988 | 32,723 | |||||||||

| Provision for doubtful accounts |

4,642 | 5,217 | 6,141 | |||||||||

| Depreciation and amortization |

4,781 | 3,717 | 5,977 | |||||||||

| Interest expense, net |

21,269 | 21,289 | 28,264 | |||||||||

| Impairment of goodwill |

— | — | 23,528 | |||||||||

| Sponsor management fees |

105 | 135 | — | |||||||||

| Legal settlement |

— | 446 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total expenses |

228,159 | 261,925 | 329,229 | |||||||||

| Income (loss) from continuing operations before income taxes |

11,559 | (9,690 | ) | (8,931 | ) | |||||||

| Provision for income taxes |

4,901 | 5,934 | 2,700 | |||||||||

|

|

|

|

|

|

|

|||||||

| Income (loss) from continuing operations |

6,658 | (15,624 | ) | (11,631 | ) | |||||||

| (Income) Loss from discontinued operations |

(567 | ) | (829 | ) | 4,531 | |||||||

|

|

|

|

|

|

|

|||||||

| Net income (loss) |

$ | 6,091 | $ | (16,453 | ) | $ | (16,162 | ) | ||||

|

|

|

|

|

|

|

|||||||

| Other Financial Data: |

||||||||||||

| Pro Forma EBITDA (1) |

$ | 37,609 | $ | 15,316 | $ | 25,310 | ||||||

| Pro Forma Adjusted EBITDA (1) |

$ | 43,415 | $ | 40,649 | $ | 56,441 | ||||||

| ACTUAL | PRO FORMA | |||||||

| Unaudited Pro Forma Condensed Combined Balance Sheet Data (as of September 30, 2011): |

||||||||

| Cash and equivalents |

$ | 1,254 | $ | 5,234 | ||||

| Total assets |

269,609 | 359,026 | ||||||

| Total debt |

138,125 | 285,610 | ||||||

| Total stockholders’ equity |

76,986 | 11,029 | ||||||

16

| (1) | Pro Forma EBITDA and Pro Forma Adjusted EBITDA are reconciled to pro forma net income (loss) in the table below. Pro Forma EBITDA and Pro Forma Adjusted EBITDA are financial measures not recognized under GAAP. When presenting non-GAAP financial measures, we are required to reconcile the non-GAAP financial measures with the most directly comparable GAAP financial measure or measures. We define Pro Forma EBITDA as pro forma net income (loss) adjusted for (loss) income from discontinued operations, net interest expense, income tax provision (benefit) and depreciation and amortization. Pro Forma |

Adjusted EBITDA differs from “EBITDA” as that term may be commonly used. We define Pro Forma Adjusted EBITDA, as Pro Forma EBITDA adjusted for equity-based compensation expense, transaction-related expenses, management fees, impairment charges, legal settlement, and integration and closing costs. For the nine-month periods ended September 30, 2011 and 2010 and the twelve-month period ended December 31, 2010, Pro Forma Adjusted EBITDA also includes adjustments relating to a rate increase on one of PHC’s contracts, anticipated future operating income at the Seven Hills Behavioral Center, the elimination of rent expense associated with PHC’s subsidiary, Detroit Behavioral Institute, Inc., and cost savings/synergies in connection with the Merger. See the table and related footnotes below for additional information.

We present Pro Forma Adjusted EBITDA because it is a measure management uses to assess financial performance. We believe that companies in our industry use measures of Pro Forma EBITDA as common performance measurements. We also believe that securities analysts, investors and other interested parties frequently use measures of Pro Forma EBITDA as financial performance measures and as indicators of ability to service debt obligations. While providing useful information, measures of Pro Forma EBITDA, including Pro Forma Adjusted EBITDA, should not be considered in isolation or as a substitute for consolidated statement of operations and cash flows data prepared in accordance with GAAP and should not be construed as an indication of a company’s operating performance or as a measure of liquidity. Pro Forma Adjusted EBITDA may have material limitations as a performance measure because it excludes items that are necessary elements of our costs and operations. In addition, “EBITDA,” “Adjusted EBITDA” or similar measures presented by other companies may not be comparable to our presentation, since each company may define these terms differently. See “Non-GAAP Financial Measures.”

| NINE MONTHS ENDED SEPTEMBER 30, |

YEAR ENDED DECEMBER 30, |

|||||||||||

| 2010 | 2011 | 2010 | ||||||||||

| (In thousands) | ||||||||||||

| Reconciliation of Pro Forma Net Income (Loss) to Pro Forma Adjusted EBITDA: |

||||||||||||

| Net income (loss) (a) |

$ | 6,091 | $ | (16,453 | ) | $ | (16,162 | ) | ||||

| Loss from discontinued operations |

567 | 829 | 4,531 | |||||||||

| Interest expense, net |

21,269 | 21,289 | 28,264 | |||||||||

| Income tax provision |

4,901 | 5,934 | 2,700 | |||||||||

| Depreciation and amortization |

4,781 | 3,717 | 5,977 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pro Forma EBITDA |

37,609 | 15,316 | 25,310 | |||||||||

| Adjustments: |

||||||||||||

| Equity-based compensation expense (b) |

128 | 19,925 | 203 | |||||||||

| Transaction-related expenses (c) |

— | — | 69 | |||||||||

| Management fees (d) |

433 | 361 | 550 | |||||||||

| Impairment charges (e) |

— | — | 23,528 | |||||||||

| Legal settlement (f) |

— | 446 | — | |||||||||

| Integration and closing costs (g) |

— | 947 | — | |||||||||

| Rate increase on a PHC contract (h) |

1,400 | 333 | 1,900 | |||||||||

| Anticipated operating income at the Seven Hills Behavioral Center (i) |

763 | 225 | 767 | |||||||||

| Rent elimination (j) |