Exhibit 99.1

|

|

Exhibit 99.1

2012 FBR Fall Investor Conference

November 27, 2012

Financial data as of September 30, 2012

|

|

Forward Looking Statements

Any statements in this presentation that are not historical or current facts are forward-looking statements. Forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. Forward-looking statements convey Nationstar Mortgage Holdings Inc.’s (“Nationstar”) current expectations or forecasts of future events. When used in this presentation, the words “anticipate,” “appears,” “believe,” “foresee,” “intend,” “should,” “expect,” “estimate,” “target,” “project,” “plan,” “may,” “could,” “will,” “are likely” and similar expressions are intended to identify forward-looking statements These statements involve predictions of our future financial condition, performance, plans and strategies, and are thus dependent on a number of factors including, without limitation, assumptions and data that may be imprecise or incorrect. Specific factors that may impact performance or other predictions of future actions have, in many but not all cases, been identified in connection with specific forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Nationstar’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk Factors” section of Nationstar Mortgage LLC’s Form 10-K for the year ended December 31, 2011, Nationstar Mortgage Holdings Inc.’s Form 10-Q for the quarter ended June 30, 2012, and other reports filed with the SEC, which are available at the SEC’s website at http://www.sec.gov. We caution you not to place undue reliance on these forward-looking statements that speak only as of the date they were made. Unless required by law, Nationstar undertakes no obligation to publicly update or revise any forward-looking statements to reflect circumstances or events after the date of this presentation.

1

|

|

Fee-Based Business Model with Strong Cash Flow

Earn stable contractual fee for servicing residential customers Make money based on volume and effectiveness

Originate or refinance loans – predominantly based on existing relationships

Borrowers

Service +1 million customers Majority are current (85%)

Mortgage Owners

GSEs / Government Financial Institutions Private Investors

$198 billion of UPB(1)

Originations Servicing Adjacent Svcs.

Addressable Market: $10+ trillion in servicing UPB 60 million customers

1) As of September 30, 2012

2

|

|

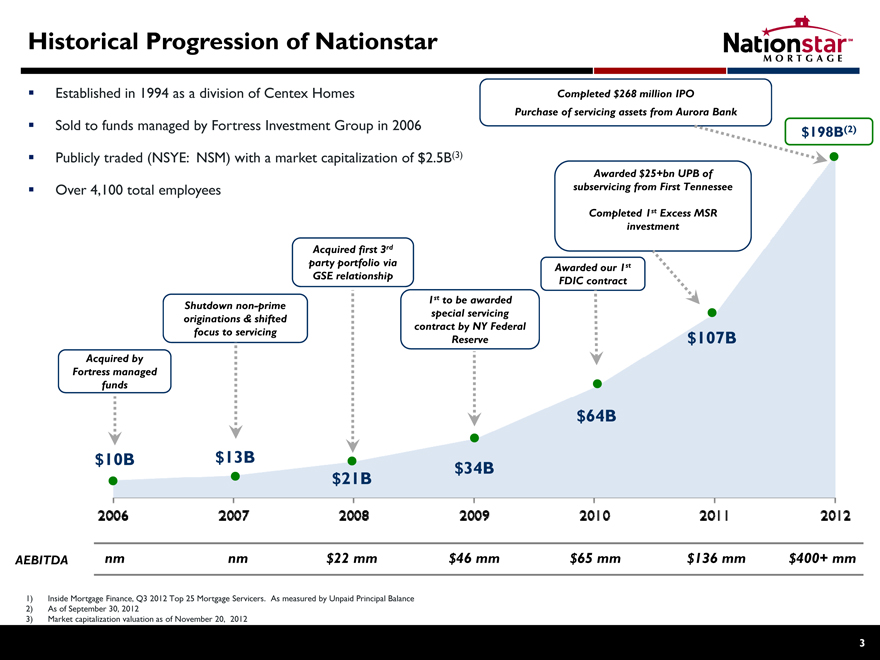

Historical Progression of Nationstar

Established in 1994 as a division of Centex Homes

Sold to funds managed by Fortress Investment Group in 2006 Publicly traded (NSYE: NSM) with a market capitalization of $2.5B(3) Over 4,100 total employees

Completed $268 million IPO

Purchase of servicing assets from Aurora Bank

$198B(2)

Awarded $25+bn UPB of subservicing from First Tennessee

Completed 1st Excess MSR investment

Acquired by Fortress managed funds

Shutdown non-prime originations & shifted focus to servicing

Acquired first 3rd party portfolio via GSE relationship

1st to be awarded special servicing contract by NY Federal Reserve

Awarded our 1st FDIC contract

$10B $13B

$21B

$34B

$64B

$107B

2006 2007 2008 2009 2010 2011 2012

AEBITDA nm nm $22 mm $46 mm $65 mm $136 mm $400+ mm

1) Inside Mortgage Finance, Q3 2012 Top 25 Mortgage Servicers. As measured by Unpaid Principal Balance

2) As of September 30, 2012

3) Market capitalization valuation as of November 20, 2012

3

|

|

2012: Transformative Year

Significant growth in market value, UPB and AEBITDA

Acquisition of $63 billion Aurora portfolio and $45 billion of other UPB

March IPO—$268 million; raised $775 million of growth capital via debt markets

Origination platform more than doubled to $7.3 billion(1)

Strategic initiative to expand origination segment to capitalize on market dislocation

Servicing Growth

($bn of UPB)

225

$198

200

175

150

125 $107

100

75 $64

50 $34

25 $21

0

2008 2009 2010 2011 Q3 2012

AEBITDA Growth(2)

($mm)

450 $400+

400

350

300

250

200

$136

150 $301

100 $65 YTD

$46

50 $22

0

2008 2009 2010 2011 2012

Estimate

1) Annual origination run-rate based on Q3’12 annualized.

2) Please see Appendix for information on AEBITDA and reconciliations.

4

|

|

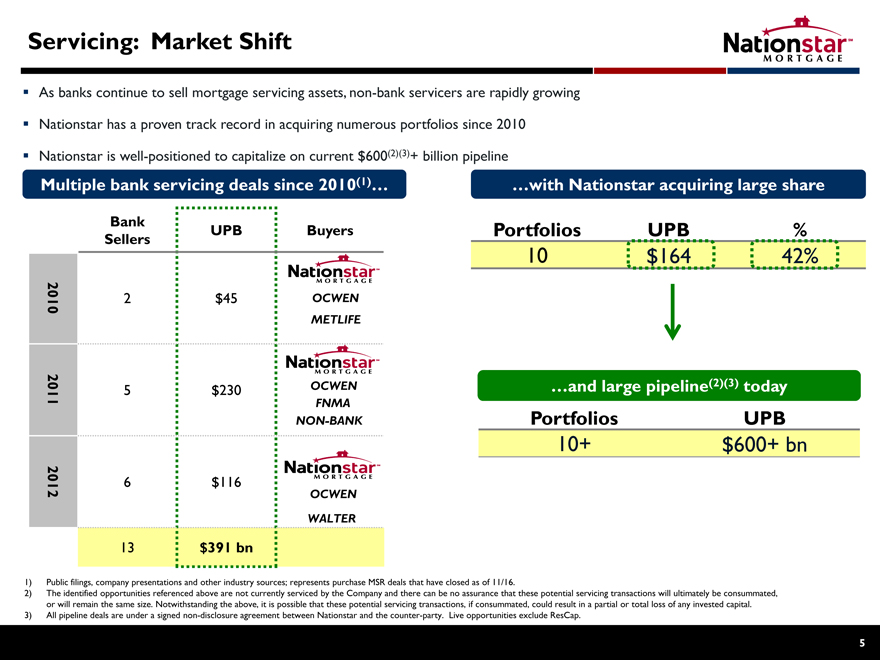

Servicing: Market Shift

As banks continue to sell mortgage servicing assets, non-bank servicers are rapidly growing Nationstar has a proven track record in acquiring numerous portfolios since 2010 Nationstar is well-positioned to capitalize on current $600(2)(3)+ billion pipeline

Multiple bank servicing deals since 2010(1)…

…with Nationstar acquiring large share

Bank UPB Buyers

Sellers

2010 2$45 OCWEN

METLIFE

2011 5 $230 OCWEN

FNMA

NON-BANK

2

012 6 $116 OCWEN

WALTER

13 $391 bn

Portfolios UPB %

10 $164 42%

…and large pipeline(2)(3) today

Portfolios UPB

10+ $600+ bn

1) Public filings, company presentations and other industry sources; represents purchase MSR deals that have closed as of 11/16.

2) The identified opportunities referenced above are not currently serviced by the Company and there can be no assurance that these potential servicing transactions will ultimately be consummated, or will remain the same size. Notwithstanding the above, it is possible that these potential servicing transactions, if consummated, could result in a partial or total loss of any invested capital.

3) All pipeline deals are under a signed non-disclosure agreement between Nationstar and the counter-party. Live opportunities exclude ResCap.

5

|

|

Servicing Pipeline: Future Growth Opportunities(1)

Pipeline of opportunities remains elevated for the foreseeable future

Macro-thesis of secular shift remains intact; legal, regulatory and headline risk for banks persists

Growth of customer base presents opportunity for expansion of ancillary services business via Solutions

Live Opportunities(2)

Prospective

Opportunities

Bulk Servicing Flow Servicing Solutions Banks Under Pressure

MSRs and subservicing Mix aligns with NSM portfolio composition

Multiple lenders Newly-originated loans Delinquent loans

1 Million + consumers in servicing portfolio Data-rich environment Multiple fee-based opportunities

Banks presently dominate servicing market share (85% of UPB)(3) Top 4 banks have 50% share(3) Basel III phase implementation begins in Q1 ‘13

Potential Opportunity Size:

$600 billion+ $25-50 billion annually $198 billion portfolio $2 trillion+

1) The identified opportunities referenced above are not currently serviced by the Company and there can be no assurance that these potential servicing transactions will ultimately be consummated, or will remain the same size. Notwithstanding the above, it is possible that these potential servicing transactions, if consummated, could result in a partial or total loss of any invested capital.

2) All pipeline deals are under a signed non-disclosure agreement between Nationstar and the counter-party. Live opportunities exclude ResCap.

3) Inside Mortgage Finance, as of Q2 2012.

6

|

|

Strategically Positioned Platform

Balanced platform designed to drive fee-based income across the entire economic cycle

Low rate environment Distressed market

Rising rate environment Improving economy

Servicing

Originations

Acquire servicing at attractive multiples Additional revenue streams (mod fees, incentive fees, late fees) Servicing costs are higher due to higher delinquencies

Extended life of servicing cash flows Lower portfolio DQs Lower servicing costs

Recapture drives strong margins with no customer acquisition costs Recapture extends servicing cash flows Profitably create servicing assets

Robust housing market—rising purchase volumes Stronger builder and broker channels drive significant purchase money volume Healthy economy improves employment and credit—larger pool of eligible buyers

Ancillary revenue from Solutions attractive in every environment

7

|

|

Servicing Initiatives: Driver of Earnings Growth

Cost Per Loan(1)

Reduce 20%

Portfolio Delinquency(2)

Reduce 5%

Servicing Advances

Reduce advance ratio 80 bps

Expense management delivers margin improvement

Strategic vendor management Optimize processes Invest in automation

Reduce portfolio delinquency via high-touch servicing and modifications

Homeownership preservation

Identify high risk early

Advanced loss mitigation

technology platform

Reduce advance balances

Advance ratio on primary pool

1.7% of UPB

Lower cost of financing

3.2 bps 2.8 bps 2.0 bps

Targeting 8 bps improvement(3) in profitability through expense reduction by Q3 ‘14

Additional upside from Solutions

1) Illustrative example of a $200 billion servicing portfolio with an average loan value of $150,000. Cost per loan assumes expense ratio of 8/1 (DQ/current) and does not include corporate overhead. Interest expense calculated using weighted average cost of current advance facilities.

2) Additional staffing/expense could be necessary to reduce portfolio delinquency which would potentially reduce expected operating savings.

3) Amounts are pre-tax for servicing segment on an annualized basis

8

|

|

Originations: Enhances Core Servicing Platform

Originate primarily conforming loans – typically sold into the market within 30 days

“Recapture” of refinanced Nationstar loans – cash flow positive and profitable

Significant increase in volume and profit since last year driven by:

Growth in servicing UPB – recapturing from a larger universe

Market dynamics such as low rates, government initiatives and consolidation

Improvement YoY in recapture rate

Origination Volume

($bn of UPB)

10

64% CAGR

8 $7.2

6

4 $3.4 $2.8

2 $1.5

0

2009 2010 2011 Q3 ‘12 Ann.

Q3 2012 Unit Economics

($mm)

Cash – Points, Fees, Gain on Sale $90.4

Pipeline Value(1) 34.7

Subtotal Cash / Near Cash Revenue $125.1

Servicing Asset 13.5

(Cash value realized over time)

Other (3.4)

Total Originations Revenue $135.2

Originations Volume $1,818

Locked Pipeline(2) $4,353

Application Pipeline(2) $5,535

Cash / near cash is 93% of total revenue

1) Includes mark-to-market on loans held for sale and derivative/hedges

2) As of 9-30-12

9

|

|

Solutions

Solutions poised for growth now that Nationstar servicing portfolio has reached critical mass

Expand offering of end-to-end solutions for originations and default services

Develop in-house competencies in-lieu of outsourcing to 3rd party vendors

Expand revenue base by providing services to banks, originators, credit investors

Multiple Avenues of Revenue Opportunities

Products and Services

Loan Status Service Provided

Origination

Appraisal Title Insurance Loan Settlement

Delinquent Loans & REO

Appraisal

Broker Price Opinion Pre-Foreclosure Title Non-Legal Processing Property Inspection Property Preservation Debt Recovery REO Management

As servicing and origination platform grows, Solutions’ opportunities grow

10

|

|

Consolidated Performance

Total GAAP Net Income of $55 million GAAP EPS of $0.61, Pro-forma EPS of $0.64(1) Operating Segment AEBITDA of $123 million(2)

Servicing segment expense includes $4 million of transaction-related expenses and $4 million of interest expense on non-deployed debt proceeds

Q3 ‘12 Q2’12

($ millions except where noted) Servicing Originations Operating Total(3) Total

AEBITDA(2) $42.1 $80.9 $123.0 $121.7 $93.7

margin% 30% 60% 44%

Pre-Tax Income $5.5 $77.1 $82.7 $79.8 $49.1

Income Tax Expense ($24.7) ($12.8)

Net Income—GAAP $55.1 $36.3

Per Share Data:

Pre-Tax Income ($0.05) $0.68 $0.92 $0.89 $0.55

Net Income—GAAP $0.61 $0.41

AEBITDA(2) $0.47 $0.90 $1.37 $1.36 $1.05

Average shares outstanding (mm) 89.8 89.8 89.8 89.8 89.5

Pro forma NI excluding transaction expenses(1) $57.8 $39.3

Per share $0.64 $0.44

1) Please reference Appendix and reconciliation 2) Please see Appendix AEBITDA reconciliations 3) Includes Legacy Segment

11

|

|

Appendix

|

|

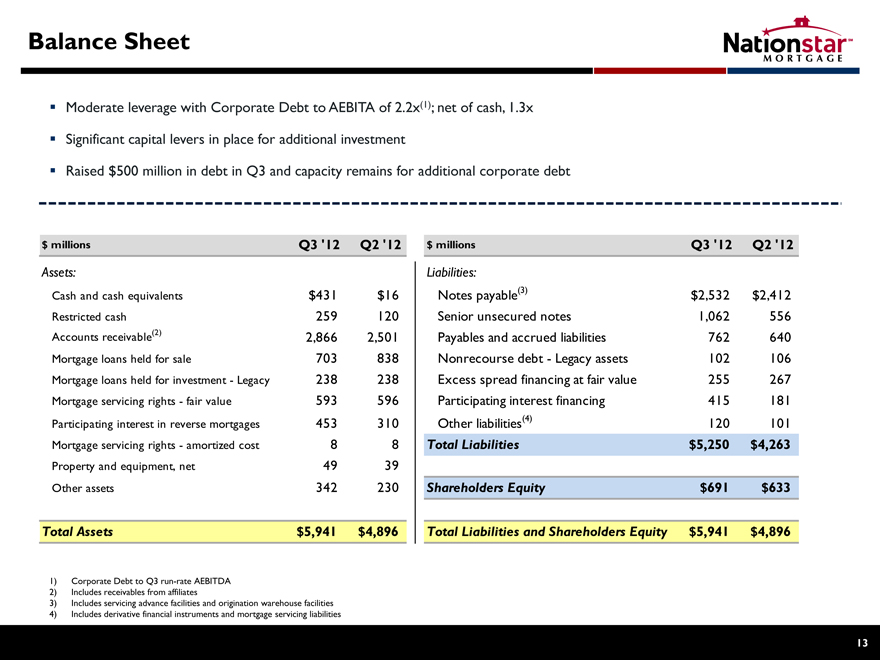

Balance Sheet

Moderate leverage with Corporate Debt to AEBITA of 2.2x(1); net of cash, 1.3x Significant capital levers in place for additional investment Raised $500 million in debt in Q3 and capacity remains for additional corporate debt

$ millions Q3 ‘12 Q2 ‘12

Assets:

Cash and cash equivalents $431 $16

Restricted cash 259 120

Accounts receivable(2) 2,866 2,501

Mortgage loans held for sale 703 838

Mortgage loans held for investment—Legacy 238 238

Mortgage servicing rights—fair value 593 596

Participating interest in reverse mortgages 453 310

Mortgage servicing rights—amortized cost 8 8

Property and equipment, net 49 39

Other assets 342 230

Total Assets $5,941 $4,896

$ millions Q3 ‘12 Q2 ‘12

Liabilities:

Notes payable(3) $2,532 $2,412

Senior unsecured notes 1,062 556

Payables and accrued liabilities 762 640

Nonrecourse debt—Legacy assets 102 106

Excess spread financing at fair value 255 267

Participating interest financing 415 181

Other liabilities(4) 120 101

Total Liabilities $5,250 $4,263

Shareholders Equity $691 $633

Total Liabilities and Shareholders Equity $5,941 $4,896

1) Corporate Debt to Q3 run-rate AEBITDA

2) Includes receivables from affiliates

3) Includes servicing advance facilities and origination warehouse facilities

4) Includes derivative financial instruments and mortgage servicing liabilities

13

|

|

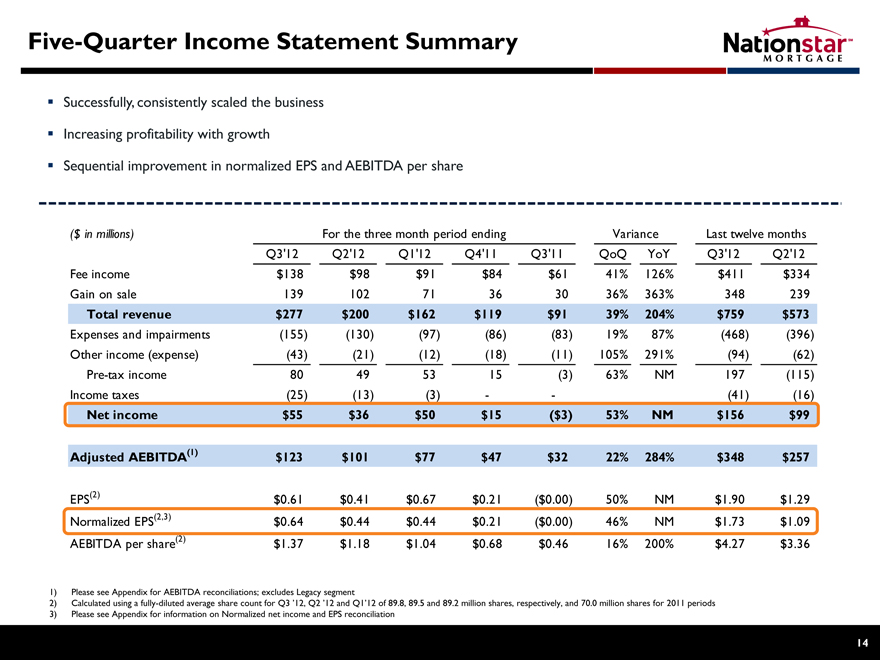

Five-Quarter Income Statement Summary

Successfully, consistently scaled the business

Increasing profitability with growth

Sequential improvement in normalized EPS and AEBITDA per share

($ in millions) For the three month period ending Variance Last twelve months

Q3’12 Q2’12 Q1’12 Q4’11 Q3’11 QoQ YoY Q3’12 Q2’12

Fee income $138 $98 $91 $84 $61 41% 126% $411 $334

Gain on sale 139 102 71 36 30 36% 363% 348 239

Total revenue $277 $200 $162 $119 $91 39% 204% $759 $573

Expenses and impairments (155) (130) (97) (86) (83) 19% 87% (468) (396)

Other income (expense) (43) (21) (12) (18) (11) 105% 291% (94) (62)

Pre-tax income 80 49 53 15 (3) 63% NM 197 (115)

Income taxes (25) (13) (3)—- (41) (16)

Net income $55 $36 $50 $15 ($3) 53% NM $156 $99

Adjusted AEBITDA(1) $123 $101 $77 $47 $32 22% 284% $348 $257

EPS(2) $0.61 $0.41 $0.67 $0.21 ($0.00) 50% NM $1.90 $1.29

Normalized EPS(2,3) $0.64 $0.44 $0.44 $0.21 ($0.00) 46% NM $1.73 $1.09

AEBITDA per share(2) $1.37 $1.18 $1.04 $0.68 $0.46 16% 200% $4.27 $3.36

1) Please see Appendix for AEBITDA reconciliations; excludes Legacy segment

2) Calculated using a fully-diluted average share count for Q3 ‘12, Q2 ‘12 and Q1’12 of 89.8, 89.5 and 89.2 million shares, respectively, and 70.0 million shares for 2011 periods

3) Please see Appendix for information on Normalized net income and EPS reconciliation

14

|

|

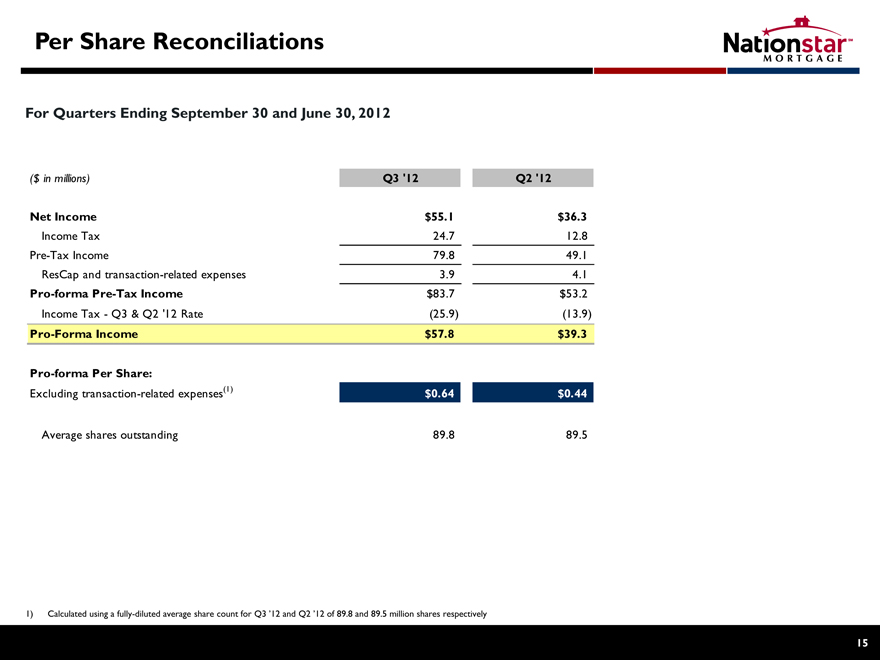

Per Share Reconciliations

For Quarters Ending September 30 and June 30, 2012

($ in millions) Q3 ‘12 Q2 ‘12

Net Income $55.1 $36.3

Income Tax 24.7 12.8

Pre-Tax Income 79.8 49.1

ResCap and transaction-related expenses 3.9 4.1

Pro-forma Pre-Tax Income $83.7 $53.2

Income Tax—Q3 & Q2 ‘12 Rate (25.9) (13.9)

Pro-Forma Income $57.8 $39.3

Pro-forma Per Share:

Excluding transaction-related expenses(1) $0.64 $0.44

Average shares outstanding 89.8 89.5

1) Calculated using a fully-diluted average share count for Q3 ‘12 and Q2 ‘12 of 89.8 and 89.5 million shares respectively

15

|

|

AEBITDA Reconciliation

For Quarter Ended September 30, 2012

($ in millions) Servicing Originations Operating Legacy Total

Adjusted EBITDA $42.1 $80.9 $123.0 ($1.3) $121.7

Interest expense on corporate notes (15.7) (1.9) (17.7)—(17.7)

MSR valuation adjustment (22.4)—(22.4)—(22.4)

Excess spread adjustment 2.2—2.2—2.2

Amortization of mort. serv. obligations 2.7—2.7—2.7

Depreciation & amortization (2.0) (0.8) (2.8) (0.2) (3.0)

Stock-based compensation (1.6) (1.1) (2.6) 0.0 (2.6)

Fair value adjustment for derivatives 0.2—0.2 (1.3) (1.1)

Pre-Tax Income $5.5 $77.1 $82.7 ($2.9) $79.8

Income Tax (24.7)

Net Income $55.1

Earnings per share(1) $0.61

AEBITDA per share(1) $0.47 $0.90 $1.37 ($0.02) $1.36

Pre-Tax Income per share(1) $0.06 $0.86 $0.92 ($0.03) $0.89

1) Calculated using a fully-diluted average share count of 89.8 million shares

16

|

|

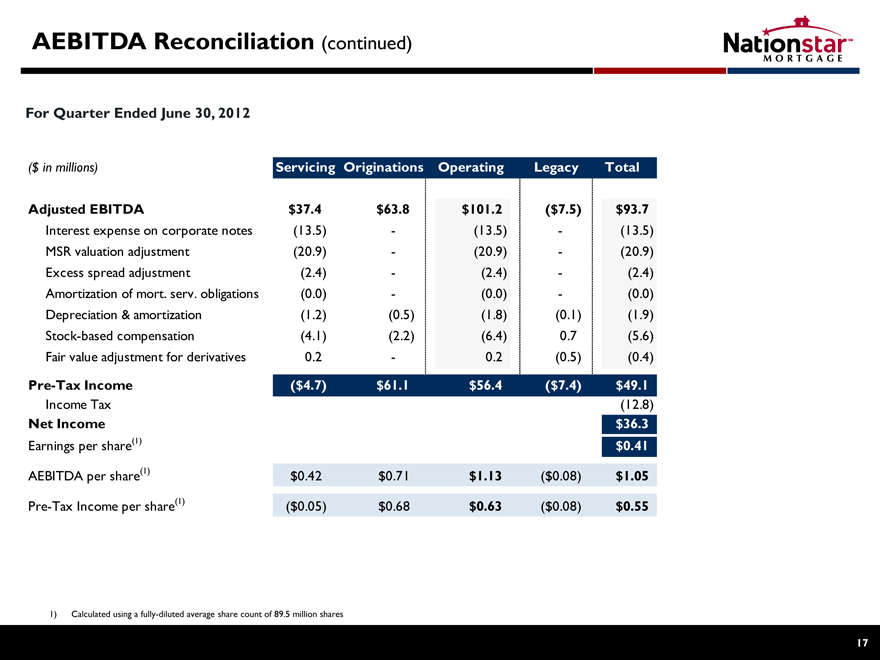

AEBITDA Reconciliation (continued)

For Quarter Ended June 30, 2012

($ in millions) Servicing Originations Operating Legacy Total

Adjusted EBITDA $37.4 $63.8 $101.2 ($7.5) $93.7

Interest expense on corporate notes (13.5)—(13.5)—(13.5)

MSR valuation adjustment (20.9)—(20.9)—(20.9)

Excess spread adjustment (2.4)—(2.4)—(2.4)

Amortization of mort. serv. obligations (0.0)—(0.0)—(0.0)

Depreciation & amortization (1.2) (0.5) (1.8) (0.1) (1.9)

Stock-based compensation (4.1) (2.2) (6.4) 0.7 (5.6)

Fair value adjustment for derivatives 0.2—0.2 (0.5) (0.4)

Pre-Tax Income ($4.7) $61.1 $56.4 ($7.4) $49.1

Income Tax (12.8)

Net Income $36.3

Earnings per share(1) $0.41

AEBITDA per share(1) $0.42 $0.71 $1.13 ($0.08) $1.05

Pre-Tax Income per share(1) ($0.05) $0.68 $0.63 ($0.08) $0.55

1) Calculated using a fully-diluted average share count of 89.5 million shares

17

|

|

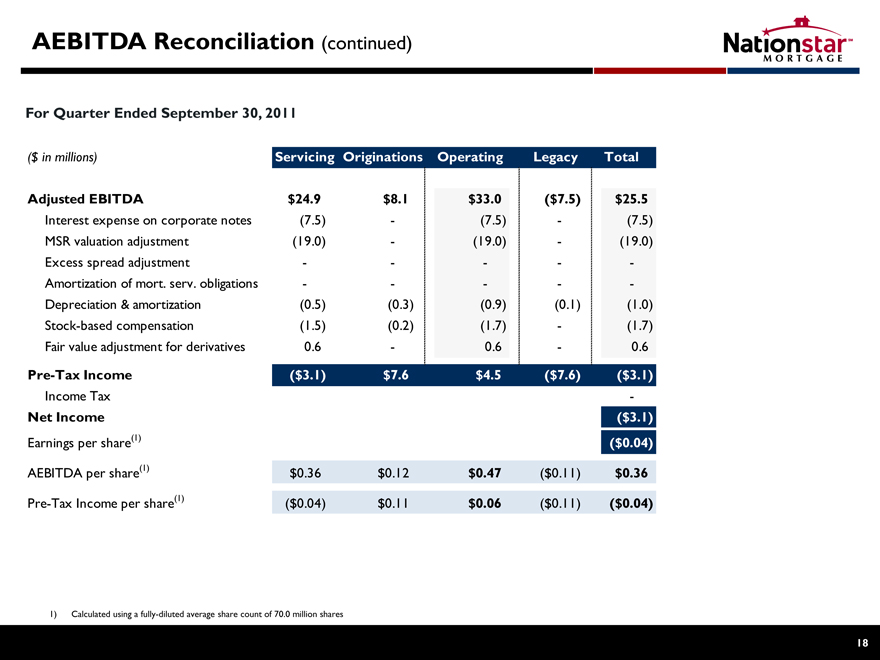

AEBITDA Reconciliation (continued)

For Quarter Ended September 30, 2011

($ in millions) Servicing Originations Operating Legacy Total

Adjusted EBITDA $24.9 $8.1 $33.0 ($7.5) $25.5

Interest expense on corporate notes (7.5)—(7.5)—(7.5)

MSR valuation adjustment (19.0)—(19.0)—(19.0)

Excess spread adjustment———-

Amortization of mort. serv. obligations———-

Depreciation & amortization (0.5) (0.3) (0.9) (0.1) (1.0)

Stock-based compensation (1.5) (0.2) (1.7)—(1.7)

Fair value adjustment for derivatives 0.6—0.6—0.6

Pre-Tax Income ($3.1) $7.6 $4.5 ($7.6) ($3.1)

Income Tax -

Net Income ($3.1)

Earnings per share(1) ($0.04)

AEBITDA per share(1) $0.36 $0.12 $0.47 ($0.11) $0.36

Pre-Tax Income per share(1) ($0.04) $0.11 $0.06 ($0.11) ($0.04)

1) Calculated using a fully-diluted average share count of 70.0 million shares

18

|

|

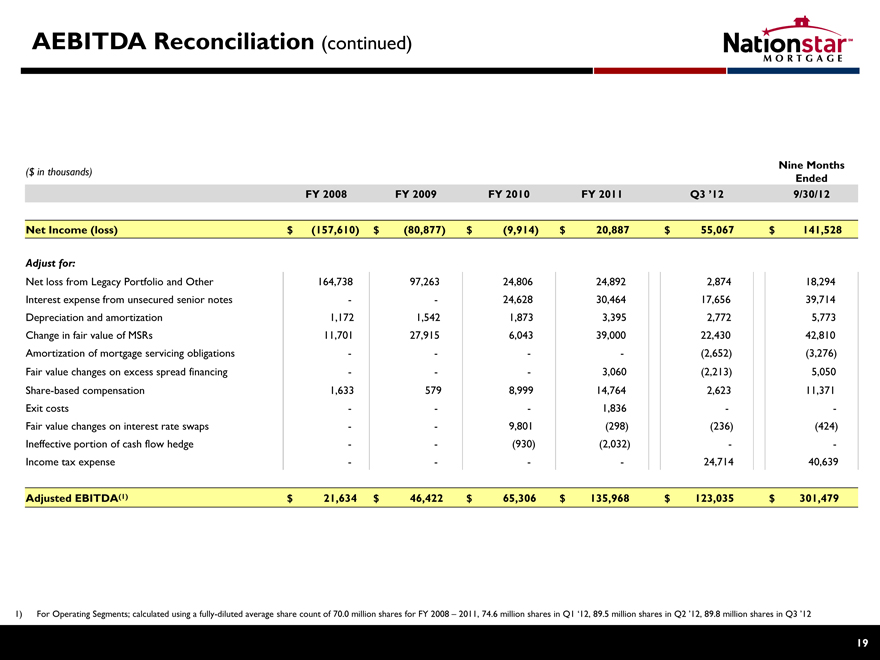

AEBITDA Reconciliation (continued)

($ in thousands) Nine Months

Ended

FY 2008 FY 2009 FY 2010 FY 2011 Q3 ‘12 9/30/12

Net Income (loss) $ (157,610) $ (80,877) $ (9,914) $ 20,887 $ 55,067 $ 141,528

Adjust for:

Net loss from Legacy Portfolio and Other 164,738 97,263 24,806 24,892 2,874 18,294

Interest expense from unsecured senior notes —— 24,628 30,464 17,656 39,714

Depreciation and amortization 1,172 1,542 1,873 3,395 2,772 5,773

Change in fair value of MSRs 11,701 27,915 6,043 39,000 22,430 42,810

Amortization of mortgage servicing obligations ————(2,652) (3,276)

Fair value changes on excess spread financing ——— 3,060 (2,213) 5,050

Share-based compensation 1,633 579 8,999 14,764 2,623 11,371

Exit costs ——— 1,836—-

Fair value changes on interest rate swaps —— 9,801 (298) (236) (424)

Ineffective portion of cash flow hedge —— (930) (2,032)—-

Income tax expense ————24,714 40,639

Adjusted EBITDA(1) $ 21,634 $ 46,422 $ 65,306 $ 135,968 $ 123,035 $ 301,479

For Operating Segments; calculated using a fully-diluted average share count of 70.0 million shares for FY 2008 – 2011, 74.6 million shares in Q1 ‘12, 89.5 million shares in Q2 ‘12, 89.8 million shares in Q3 ‘12

19

|

|

Endnotes

Adjusted EBITDA (“AEBITDA”) This disclaimer applies to every usage of “Adjusted EBITDA” or “AEBITDA” in this presentation. Adjusted EBITDA is a key performance metric used by management in evaluating the performance of our segments. Adjusted EBITDA represents our Operating Segments’ income (loss), and excludes income and expenses that relate to the financing of our senior notes, depreciable (or amortizable) asset base of the business, income taxes (if any), exit costs from our restructuring and certain non-cash items. Adjusted EBITDA also excludes results from our legacy asset portfolio and certain securitization trusts that were consolidated upon adoption of the accounting guidance eliminating the concept of a qualifying special purpose entity (“QSPE”).

2012 Estimate AEBITDA 2012 Estimate AEBITDA is based on our expectations of continued growth, current market conditions and increased operating efficiencies in our business in addition to our financial targets for 2012. Target for all non-GAAP figures excludes the same items as we excluded in our 2011 non-GAAP reconciliation, as follows: income and expenses that relate to the financing of the senior notes, depreciable (or amortizable) asset base and several other relevant items. Our actual AEBITDA for 2012 on an annualized basis may differ from our 2012(E) AEBITDA.

NOTE: 2012 Estimate AEBITDA is forward-looking and subject to significant business, economic, regulatory and competitive uncertainties, many of which are beyond control of Nationstar and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. Nothing in this presentation should be regarded as a representation by any person that this target will be achieved and Nationstar undertakes no duty to update this target.

Expected Annual Aurora AEBITDA Contribution Our expectations regarding the approximate annualized contribution to Adjusted EBITDA and the approximate integration and transition costs are based on a number of assumptions, including, but not limited to, prepayments, delinquencies, ancillary fees, cost to service and recapture rates and margins. The actual annualized contribution to Adjusted EBITDA and the actual integration and transition costs will depend on many factors, some of which are beyond our control, and could differ materially from our estimates. Errors in our financial models or changes in assumptions could result in our estimates and expectations being materially inaccurate which may adversely affect our earnings.

Pro-forma Earnings Per Share (“Pro-forma EPS”) This disclaimer applies to every usage of pro-forma EPS in this presentation. Pro-forma EPS is a metric that is used by management to exclude certain non-recurring items in an attempt to provide a better earnings per share comparison to prior periods. Pro-forma Q3 ‘12 EPS excludes certain expenses related to ResCap and other transactions. These expenses include the advance hiring of servicing staff, recruiting expenses and travel and licensing expenses. Pro-forma Q2 ‘12 EPS excluded certain expenses incurred in advance of the closing of the Aurora transaction.

Pro-forma AEBITDA Per Share This disclaimer applies to every usage of pro-forma AEBITDA per share in this presentation. Pro-forma AEBITDA per share is a metric that is used by management to exclude certain non-recurring items in an attempt to provide a better earnings per share comparison to prior periods. Pro-forma Q3 ‘12 AEBITDA per share excludes certain expenses related to ResCap and other transactions. These expenses include the advance hiring of servicing staff, recruiting expenses and travel and licensing expenses. Pro-forma Q2 ‘12 AEBITDA per share excluded certain expenses incurred in advance of the closing of the Aurora transaction.

20