As filed with the Securities and Exchange Commission on May 13, 2011

File No. xxx-xxxxxx

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Registration Statement on Form F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

FLINT INT’L SERVICES, INC.

(Exact name of registrant as specified in its charter)

|

The British Virgin Islands

|

|

8331

|

|

Applied For

|

|

(State or jurisdiction of incorporation or organization)

|

|

(Primary Industrial Classification Code No.)

|

|

I.R.S. Employer Identification No.

|

5732 HWY 7 West, Unit 15, Vaughn, ON, L4L 3A2, Canada (877) 439-3001

(Address, including the ZIP code & telephone number, including area code of Registrant's principal executive office)

5732 HWY 7 West, Unit 15, Vaughn, ON, L4L 3A2, Canada (877) 439-3001

(Address of principal place of business or intended principal place of business)

5732 HWY 7 West, Unit 15, Vaughn, ON, L4L 3A2, Canada (877) 439-3001

(Name, address, including zip code, and telephone number, including area code of agent for service)

| |

Copies to:

|

|

|

Jose Santos

|

|

The McCall Law Firm, PC

|

|

Forbes Hare

|

|

3201 Maple Ave.

|

|

P.O. Box 4649

|

|

Suite 400

|

|

Road Town, Tortola

|

|

Dallas, TX 75201

|

|

British Virgin Islands

|

|

(972) 665 9600 Tel

|

|

(284) 494 1890

|

|

(817) 533 5330 Fax

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

We have not made any arrangements to place the funds in an escrow, trust, or similar account. Please see the Plan of Distribution section of the F-1 for more information.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the securities Act registration number of the earlier effective registration statement for the same offering. |_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

|

(Do not check if a smaller reporting company)

|

|

|

|

_______________________

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the securities Act registration number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the securities Act registration number of the earlier effective registration statement for the same offering. |_|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. |_|

_________________

No dealer, salesman or any other person has been authorized to give any quotation or to make any representations in connection with the offering described herein, other than those contained in this Prospectus. If given or made, such other information or representation'; must not he relied upon as having been authorized by the Company or by any Underwriter. This Prospectus does not constitute an offer to sell, or a solicitation of an otter to buy any securities offered hereby in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction.

TABLE OF CONTENTS

|

Prospectus Summary

|

2

|

|

Corporate Information

|

2

|

|

Summary Financial Data

|

3

|

|

Risk Factors

|

4

|

|

Forward Looking Statements

|

7

|

|

Dilution

|

7

|

|

Plan of Distribution

|

8

|

|

Use of Proceeds

|

10

|

|

Description of Business

|

11

|

|

Description of Property

|

13

|

|

Legal Proceedings

|

13

|

|

Securities Being Offered

|

13

|

|

Taxation

|

14

|

|

Management’s Discussion and Plan of Operations

|

18

|

|

Director’s, Executive Officers and Significant Employees

|

19

|

|

Remuneration of Officers and Directors

|

20

|

|

Interest of Management and Others in Certain Transactions

|

20

|

|

Principal Shareholders

|

21

|

|

Significant Parties

|

21

|

|

Relationship with Issuer of Experts Named in Registration Statement

|

21

|

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

21

|

|

Disclosure of Commission Position of Indemnification for Securities Act Liabilities

|

22

|

|

Legal Matters

|

22

|

|

Experts

|

22

|

|

Dividend Policy

|

22

|

|

Capitalization

|

23

|

|

Transfer Agent

|

23

|

|

Financial Statements

|

F-1

|

Until the 90th day after the later of (1) the effective date of the registration statement or (2) the first date on which the securities are offered publicly), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

CALCULATION OF REGISTRATION FEE

|

Title of Each

Class of Securities

to be Registered

|

|

Amount

to be

Registered

|

|

Proposed

Offering Price

Per Share(1)

|

|

Minimum/Maximum

Proposed Aggregate

Offering(1)

|

|

Amount of

Registration

Fee

|

|

Ordinary shares,

$0.001 par value

Minimum

Maximum

|

|

70,000

500,000

|

|

$1.00

$1.00

|

|

$ 70,000

$500,000

|

|

$ 10

$ 64

|

|

Total maximum

|

|

500,000

|

|

$1.00

|

|

$500,000

|

|

$ 64

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that the registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933. |X|

(1) Estimated solely for the purpose of calculating the registration fee.

Initial public offering prospectus

Flint Int’l Services, Inc.

Minimum of 70,000 shares of ordinary shares, and a

Maximum of 500,000 shares of ordinary shares

$1.00 per share

We are making a best efforts offering to sell ordinary shares in the capital of our company. The ordinary shares will be sold by our officer and director, Russell Hiebert after the effective date of this registration statement. The offering price was determined arbitrarily and we will raise a minimum of $70,000 and a maximum of $500,000. The money we raise in this offering before the minimum amount, $70,000, is sold will be deposited in a separate non-interest bearing bank account where the funds will be held for the benefit of those subscribing for our shares, until the minimum amount is raised at which time we will deposit them in our bank account and retain the transfer agent who will then issue the shares. The offering will end on November 15, 2011 and if the minimum subscription is not raised by the end of the offering period, all funds will be refunded promptly to those who subscribed for our shares, without interest. There is no minimum purchase requirement for subscribers. After the offering, our officer and director, Russell Heibert will continue to own sufficient shares to control the company.

|

The Offering:

|

|

|

|

|

|

|

|

|

| |

70,000 shares

|

|

500,000 shares

|

|

| |

Minimum offering

|

|

Maximum offering

|

|

| |

Per Share

|

|

Amount

|

|

Per Share

|

|

Amount

|

|

| |

|

|

|

|

|

|

|

|

|

Public Offering Price

|

$1.00

|

|

$70,000

|

|

$1.00

|

|

$500,000

|

|

Offering expenses are estimated to be $16,769 if the minimum number of shares are sold, which equates to $0.002 per share, and $33,769 if the maximum number of shares are sold, which equates to $0.004 per share.

There is currently no market for our shares. We intend to work with a market maker who would then apply to have our securities quoted on the over-the-counter bulletin Board or on an exchange as soon as practicable after our offering. We will close our offering on November 15, 2011. However, it is possible that we do not get trading on the over-the-counter bulletin Board, and if we do get quoted on the bulletin board, we may not satisfy the listing requirements for an exchange, which are greater than that of the bulletin board.

____________________________

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on Page 3.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

This Prospectus is dated __________________________

PROSPECTUS SUMMARY

OUR COMPANY

Flint Int'l Services, Inc. was incorporated on December 29, 2010 under the laws of the Cayman Islands in order to purchase 100% of the outstanding interests of Flint Management, LLC, a Canadian corporation. In May 2011, we completed a merger/redomestication into our wholly owned subsidiary based in the British Virgin Islands, also named Flint Int'l Services, Inc., which was formed as a business company with limited liability (meaning the liability of shareholders is limited to the price paid for their shares). The British Virgin Islands corporation became the surviving entity along with its Memorandum and Articles.

Flint Management, LLC (“Flint LLC”) is a wholly owned subsidiary of Flint Int’l Services, Inc. (“FLINT” or “the Company” or “we”) and was formed in January 2004 as an Ontario, Canada Corporation. Flint LLC, is an education corporation that tailor-makes courses designed to cover a specific topic or range of topics in a concise, easy to understand, computer-based format.

In Note 6 to the Company’s consolidated financial statements, the Company discusses a substantial doubt that we can continue as a going concern. We expect that the proceeds of this offering will reduce that risk.

THE OFFERING

The Company’s officer and director will be selling the offering:

| |

|

Minimum

|

|

|

Midpoint

|

|

|

Maximum

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares outstanding before this offering

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shares outstanding after this offering

|

|

|

|

|

|

|

|

|

|

|

|

|

Officers, directors and their affiliates will not be able to purchase shares in this offering.

SUMMARY FINANCIAL DATA

The following table sets forth certain of our summary financial information. This information should be read in conjunction with the financial statements and notes thereto appearing elsewhere in this prospectus.

| Balance Sheet |

|

AUDITED

December 31,

2010

|

|

|

AUDITED

31, 2009

December 31, 2009

|

|

| Working Capital |

|

$ |

7,462 |

|

|

$ |

14,044 |

|

| Total Assets |

|

$ |

150,951 |

|

|

$ |

142,639 |

|

| Total Liabilities |

|

$ |

124,015 |

|

|

$ |

116,752 |

|

| Shareholder's Equity |

|

$ |

26,936 |

|

|

$ |

25,887 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Statement of Operations |

|

AUDITED

December 31,

2010

|

|

|

AUDITED

December

31, 2009

|

|

| Revenue |

|

$ |

438,278 |

|

|

$ |

367,989 |

|

| Cost of Sales |

|

$ |

324,120 |

|

|

$ |

243,251 |

|

| Operating Expenses |

|

$ |

114,038 |

|

|

$ |

82,208 |

|

| Other Expense |

|

$ |

- |

|

|

$ |

- |

|

| Income Tax Provision |

|

$ |

(1,370 |

) |

|

$ |

(6,726 |

) |

| Net Income (Loss) |

|

$ |

(1,250 |

) |

|

$ |

(35,804 |

) |

| Earnings (Loss) per share: Basic & Diluted |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

| Weighted Average Number of Shares Outstanding |

|

|

7,500,000 |

|

|

|

7,500,000 |

|

RISK FACTORS

The investor should carefully consider the risks described below and all other information contained in this prospectus before making an investment decision. We have identified all material risks known to, and anticipated by, us as of the filing of this registration statement.

We have a limited operating history, with minimal retained earnings, which, if losses occur, could cause us to run out of money and close our business.

We have minimal retained earnings from operations. There is not sufficient gross revenue and profit to finance our planned growth and, without additional financing as outlined in this prospectus, we could continue to experience losses in the future. Our accumulated deficit as of December 31, 2010 was $2,238. We may incur significant expenses in promoting our business, and as a result, will need to generate significant revenues over and above our current revenue to achieve consistent profitability. If we are unable to achieve that profitability, your investment in our ordinary shares may decline or become worthless.

We rely on our sole officer for decisions and he may make decisions that are not in the best interest of all shareholders.

We rely on our officer, Russell Hiebert, to direct the affairs of the company and rely upon them to competently operate the business. We do not have key man insurance on him and have no employment agreements with him. Should something happen to them, this reliance on one person could have a material detrimental impact on our business and could cause the business to lose its place in the market, or even fail. Such events could cause the value of our shares to decline or become worthless.

Our sole officer will retain control over our business after the offering and may make decisions that are not in the best interest of all shareholders.

Upon completion of this offering, our officer, Russell Hiebert, will, in the aggregate, beneficially own approximately 92.47% (or 87.50% if maximum is sold) of the outstanding ordinary shares. As a result, our sole officer will have the ability to control all the matters submitted to our shareholders for approval, including the election and removal of directors and any merger, consolidation or sale of all of our assets. He will also control our management and affairs. Accordingly, this concentration of ownership may have the effect of delaying, deferring or preventing a change in control of us, impeding a merger, consolidation, takeover or other business combination involving us or discouraging a potential acquirer from making a tender offer or otherwise attempting to take control of us, even if the transaction would be beneficial to other shareholders. This in turn could cause the value of our shares to decline or become worthless.

Although we believe the funds we raise in this offering will allow us to generate sufficient funds from operations, if that is not the case, we may have to raise additional capital which may not be available or may be too costly, which, if we cannot obtain, could cause us to have to cease our operations.

We expect that the funds we raise in this offering will take us to the point of a positive cash flow. However, if that does not turn out to be the case, our capital requirements could be more than our operating income. As of December 31, 2010, our cash balance was $25,975. We do not have sufficient cash to indefinitely sustain operating losses, but believe we can continue to generate positive cash flow within twelve months from the funds raised in this offering. Our potential profitability depends on our ability to generate and sustain substantially higher net sales with reasonable expense levels. We may not operate on a profitable basis or that cash flow from operations will be sufficient to pay our operating costs. We anticipate that the funds raised in this offering will be sufficient to fund our planned growth for the year after we close on the offering assuming we raise the minimum amount in this offering. Thereafter, if we do not achieve profitability, we will need to raise additional capital to finance our operations. We have no current or proposed financing plans or arrangements other than this offering. We could seek additional financing through debt or equity offerings. Additional financing may not be available to us, or, if available, may be on terms unacceptable or unfavorable to us. If we need and cannot raise additional funds, further development of our business, upgrades in our technology, additions to our product lines may be delayed or postponed indefinitely; if this happens, the value of your investment could decline or become worthless.

No public market for our ordinary shares currently exists and an active trading market may never materialize, and an investor may not be able to sell their shares.

Prior to this offering, there has been no public market for our ordinary shares. We plan work with a market maker who would then apply to have our securities quoted on the OTC Bulletin Board (“OTCBB”). In order to be quoted on the OTCBB, we must be sponsored by a participating market maker who would make the application on our behalf; at this time, we are not aware of a market maker who intends to sponsor our securities and make a market in our shares. Assuming we become quoted, an active trading market still may not develop and if an active market does not develop, the market value could decline to a value below the offering price in this prospectus. Additionally, if the market is not active or illiquid, investors may not be able to sell their securities.

If a public trading market for our ordinary shares materializes, we will be classified as a ‘penny stock’ which has additional requirements in trading the shares, which could cause an investor not to be able to sell their shares.

The U.S. Securities and Exchange Commission treats shares of certain companies as a ‘penny stock’. We are not aware of a market maker who intends to make a market in our shares, but should we be cleared to trade, we would be classified as a ‘penny stock’ which makes it harder to trade even if it is traded on an electronic exchange like the over-the-counter bulletin board. These requirements include (i) broker-dealers who sell to customers must have the buyer fill out a questionnaire, and (ii) broker-dealers may decide upon the information given by a prospective buyer whether or not the broker-dealer determines the shares are suitable for their financial position. These rules may adversely affect the ability of both the selling broker-dealer and the buying broker-dealer to trade the securities as well as the purchasers of investors’ securities to sell them in the secondary market. These requirements may cause potential buyers to be eliminated and the market for the ordinary shares investors purchase in this offering could have no effective market to sell into, thereby causing investors’ investment to be worthless.

Investing in a penny stock has inherent risks, affecting brokers, buyers and sellers, which could cause the marketability of your shares to be lesser than if there were not those requirements.

When a seller of a ‘penny stock’ desires to sell, they must execute that trade through a broker. Many brokers do not deal in penny stocks, so a seller’s ability to market/sell their shares is reduced because of the number of brokers who engage in trading such shares. Additionally, if a broker does engage in trading penny stocks, and the broker has a client who wishes to buy the shares, they must have the client fill out a number of pages of paperwork before they can execute the trade. These requirements cause a burden to some who may decide not to buy because of the additional paperwork. Thus, the marketability of the shares is less as a penny stock than as a stock listed on an exchange. This could cause the investment to be less liquid and investors may not be able to market their shares effectively.

Shareholders purchasing shares in this offering will experience immediate and substantial dilution, causing their investment to immediately be worth less than their purchase price.

If ordinary shares is purchased in this offering, the shares will experience an immediate and substantial dilution in the projected book value of the ordinary shares from the price paid in this initial offering. Thus, shares purchased in this offering at $1.00 per share, will be substantially higher in cost than the cost to our current shareholders. The following represents your dilution: (a) if the minimum of 70,000 shares are sold, an immediate decrease in book value to our new shareholders from $1.00 to $0.01 per share and an immediate dilution to the new shareholders of $0.99 per ordinary share; (b) if the midpoint of 285,000 shares are sold, an immediate decrease in book value to our new shareholders from $1.00 to $0.04 per share and an immediate dilution to the new shareholders of $0.96 per ordinary share. and (c) if the maximum of 500,000 shares are sold, an immediate decrease in book value to our new shareholders from $1.00 to $0.06 per share and an immediate dilution to the new shareholders of $0.94 per ordinary share.

Investors are not able to cancel their subscription agreements they sign, therefore losing any chance to change their minds.

Once the Company receives an investors subscription, the investor will not be able to cancel their subscription and will therefore lose any right or opportunity to change their decision to subscribe.

Our offering price of $1.00 was determined arbitrarily by our Sole Office and Director. Your investment may not be worth as much as the offering price because of the method of its determination.

The Sole Office and Director arbitrarily determined the price for the offering of $1.00 per share. As the offering price is not based on a specific calculation or metric the price has inherent risks and therefore your investment could be worth less than the offering price.

Our audit report dated April 14, 2011, from our auditors discloses in Note 6 to the financial statements that there is substantial doubt as to our ability to continue as a going concern, which, if true, could result in your investment becoming worth significantly less than the offering price, or possibly even causing it to become worthless.

As discussed in Note 5 to our financial statements there is a substantial doubt that we can continue as a going concern. If we are unable to continue as a going concern, we will have to close our doors or recapitalize, both of which would cause a loss of value, either through dilution or becoming worthless if we close down altogether.

The money we raise in this offering before the minimum amount is met will be held uncashed in a company safe, and could be within reach of creditors, which if accessed, such action could cause your investment to lose value or become worthless.

The money we raise in this offering before the minimum amount of $70,000 is sold, will be held uncashed in a company safe. Although we believe that creditors would not have access to it, there is a possibility they could gain access to the funds to satisfy liabilities of the Company. If such access occurred, there is a possibility that the Company would not have them to refund to the investors if the minimum offering is not raised, which could cause the investment to lose value or become worthless.

FORWARD LOOKING STATEMENTS

This prospectus contains forward looking statements. These forward looking statements are not historical facts but rather are based our current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as "anticipates", "expects", "intends", "plans", "believes", "seeks" and "estimates", and variations of these words and similar expressions, are intended to identify forward looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed, implied or forecasted in the forward looking statements. In addition, the forward looking events discussed in this prospectus might not occur. These risks and uncertainties include, among others, those described in "Risk Factors" and elsewhere in this prospectus. Readers are cautioned not to place undue reliance on these forward looking statements, which reflect our management's view only as of the date of this prospectus.

DILUTION

If ordinary shares are purchased in this offering, the shares will experience an immediate and substantial dilution in the projected book value of the ordinary shares from the price paid in this initial offering.

The book value of our ordinary shares as at December 31, 2010 was $26,935 or $0.00 per share. Projected book value per share is equal to our total assets, less total liabilities, divided by the number of ordinary shares outstanding.

After giving effect to the sale of ordinary shares offered by us in this offering, and the receipt and application of the estimated net proceeds (at an initial public offering price of $1.00 per share, after deducting estimated offering expenses), our projected book value as December 31, 2010 would be:

Positive $80,256 or $0.01 per share, if the minimum is sold, $286,166 or $0.04 per share, if the midpoint amount is sold, and $493,166 or $0.06 per share, if the maximum is sold.

This means that if you buy shares in this offering at $1.00 per share, you will pay substantially more than our current shareholders. The following represents your dilution:

|

●

|

if the minimum of 70,000 shares are sold, an immediate decrease in book value to our new shareholders from $1.00 to $0.01 per share and an immediate dilution to the new shareholders of $0.99 per ordinary share.

|

| |

|

|

●

|

if the midpoint amount of 285,000 shares are sold, an immediate decrease in book value to our new shareholders from $1.00 to $0.04 per share and an immediate dilution to the new shareholders of $0.96 per ordinary share.

|

| |

|

|

●

|

if the maximum of 500,000 shares are sold, an immediate decrease in book value to our new shareholders from $1.00 to $0.06 per share and an immediate dilution to the new shareholders of $0.94 per ordinary share.

|

The following table illustrates this per share dilution:

| |

|

Minimum

|

|

|

Midpoint

|

|

|

Maximum

|

|

Assumed initial public offering price

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value as of December 31, 2010

|

|

|

|

|

|

|

|

|

|

|

|

|

Projected book value after this offering

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Increase attributable to new shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Projected book value as of

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2010 after this offering

|

|

|

|

|

|

|

|

|

|

|

|

|

Decrease to new shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage dilution to new shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table summarizes and shows on a projected basis as of December 31, 2010, the differences between the number of ordinary shares purchased, the total consideration paid and the total average price per share paid by the existing shareholders and the new investors purchasing ordinary shares in this offering:

|

Minimum offering

|

|

Number of

shares owned

|

|

|

Percent of

shares owned

|

|

|

Amount paid

|

|

|

Average price

per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLAN OF DISTRIBUTION

The ordinary shares are being sold on our behalf by our sole officer and director, who will receive no commission on such sales. All sales will be made by personal contact by our officer and director, Russell Hiebert. We will not be mailing our prospectus to anyone or soliciting anyone who is not personally known by him, or introduced or referred to him. We have no agreements, understandings or commitments, whether written or oral, to offer or sell the securities to any individual or entity, or with any person, including our attorney, or group for referrals and if there are any referrals, we will not pay finder’s fees.

The officer will be selling the ordinary shares in this offering relying on the safe harbor from broker registration under the Rule 3a4-1(a) of the Securities Exchange Act of 1934. The officer qualifies under this safe harbor because they (a) are not subject to a statutory disqualification, (b) will not be compensated in connection with his participation by the payment or other remuneration based either directly or indirectly on transactions in the securities, (c) are not an associated person of a broker dealer, and have not been an associated person of a broker dealer within the preceding twelve months, and (d) primarily performs, and will perform, after this offering, substantial duties for the issuer other than in connection with the proposed sale of securities in this offering, and he is not a broker dealer, or an associated person of a broker dealer, within the preceding 12 months, and they have not participated in selling securities for any issuer in the past 12 months and shall not sell for another issuer in the twelve months following the last sale in this offering.

Additionally, he will be contacting relatives, friends and business associates to invest in this offering and provide them with a printed copy of the prospectus and subscription agreement. No printed advertising materials will be used for solicitation, no internet solicitation and no cold calling people to solicit interest for investment. Officers, directors and affiliates will not be able to purchase shares in this offering.

The money we raise in this offering before the minimum amount is sold will be held uncashed, in a company safe where the funds will be held for the benefit of those subscribing for our shares, until the minimum amount is raised, at which time we will deposit the funds in our bank account and retain the transfer agent who will then issue the shares. We do not have an escrow agreement or any other agreement regarding the custody of the funds we raise. The offering will end on November 15, 2011 and if the minimum subscription is not raised by the end of the offering period, all funds will be refunded by the end of the next business day to those who subscribed for our shares, without interest. The offering will close on November 15, 2011, if not terminated sooner.

The subscription agreement will provide investors the opportunity to purchase shares at $1.00 per share by purchasing directly from the Company. The agreement also provides that investors are not entitled to cancel, terminate or revoke the agreement. In addition, if the minimum subscription is not raised by November 15, 2011, the subscription agreement will be terminated and any funds received will be promptly returned to the investors. Changes in the material terms of this offering and the effective date of this registration statement will terminate the original offer and subscribers would then be entitled to a refund. Material changes include but are not limited to a) extension of the offering period beyond November 15, 2011, b) a change in the offering price, c) a change in the minimum purchase required by investors, d) a change in the amount of proceeds necessary to release proceeds to the company, and e) a change in the application of proceeds from the offering. With the exception of the extension of the offering period beyond November 15, 2011, any modifications to the terms of the offering will require the Company to return all proceeds of the offering to investors and institute a new offer by means of a post-effective amendment or other filing. If the offering period is extended past November 15, 2011, the Company will file a post-effective amendment informing purchasers that their investment will be refunded pursuant to the terms described in the prospectus. If purchasers wish to subscribe to the extended offer, they must make an affirmative statement declaring their wish to do so.

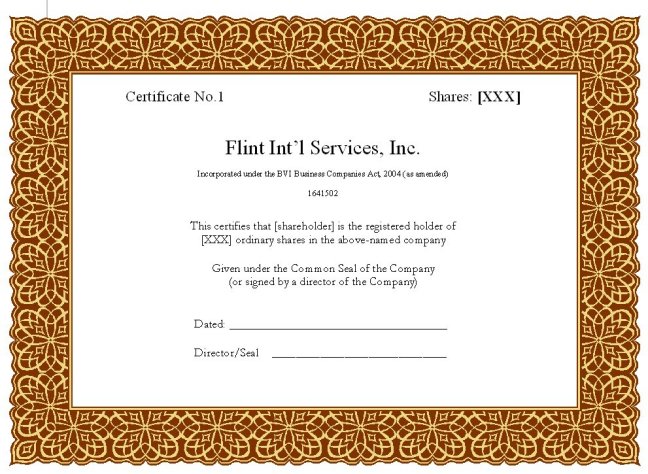

Certificates for ordinary shares sold in this offering will be delivered to the purchasers by Signature Stock Transfer, Inc., the stock transfer company chosen by the company within 30 days of the minimum subscription amount being raised. The transfer agent will only be engaged in the event that we obtain at least the minimum subscription amount in this offering.

USE OF PROCEEDS

The total cost of the minimum offering is estimated to be $16,769, or $33,769 if the maximum is sold consisting primarily of legal, accounting and blue sky fees (the fees charged by regulatory agencies or states with regard to this offering).

The following table sets forth how we anticipate using the proceeds from selling ordinary shares in this offering, reflecting the minimum and maximum subscription amounts:

| |

|

$70,000

Minimum

|

|

|

$285,000

Midpoint

|

|

|

$500,000

Maximum

|

|

Legal, Accounting & Printing Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following describe each of the expense categories:

|

·

|

Legal, accounting and printing expense is the estimated costs associated with this offering. As more shares are sold, we anticipate legal fees to increase due to the likelihood of investors being from other states which could result in state blue sky securities filings. Although our legal fees are not contingent on the number of shares sold, it is likely that the legal fees will increase as our attorney will charge us for these filings. Also, as more shares are sold, our printing expenses will increase.

|

|

·

|

Other offering expenses include SEC registration fee, blue sky fees and miscellaneous expenses with regards to this offering. The blue sky fees are fees charged by the States to pay for registering in various states, which vary by state, as well as additional legal fees.

|

The following table sets forth how we anticipate using the net proceeds to the company:

| |

|

$70,000

Minimum

|

|

|

$285,000

Midpoint

|

|

|

$500,000

Maximum

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Corporate Overhead (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) General Corporate overhead includes office rent, office supplies, utilities, taxes, and any other expense incurred in the normal course of business.

We do not plan to use any of the proceeds to pay off debts owed by the Company. Additionally, all amounts allocated for salaries/commissions will be for new hires and not for officers or directors of the company. For a more detailed discussion of the use of proceeds, reader is referred to the Management’s Discussion and Plan of Operation section of this offering.

Advertising: We plan to utilize traditional advertising mediums (newspaper, industry magazines, etc.).

DESCRIPTION OF BUSINESS

Flint Management, LLC (“Flint LLC”) is a wholly owned subsidiary of Flint Int’l Services, Inc. (“FLINT” or “the Company” or “we” or "our") and was formed in January 2004 as an Ontario, Canada Corporation. Flint LLC, is an education technology company [corporation?] that tailor-makes electronic lessons and courses in an easily accessible, interactive bundle.

We believe in the potential of people. Effective communication holds the key to tapping this potential. But communication requires translation. Not just between languages but also between styles, entrenched opinions and beliefs. Today we communicate more but we listen less. We erect barriers to communication to cope with the barrage of information and to avoid the risk of being misled. These barriers exist between cultures, company departments, partners and project stakeholders.

At FLINT we believe these barriers suppress the potential of professionals more than any other single factor within an organization. As a company our goal is to patiently and persistently dismantle these barriers.

Our mission is to engage the potential of professionals through electronic learning mediums. We achieve this by understanding the barriers and enablers to change, by developing creative and engaging learning solutions, and by demonstrating authenticity, honesty and respect in all our business dealings. As a result, we provide custom eLearning solutions.

Our solutions include comprehensive consulting, project management, instructional design, and eLearning course development services. With over 50 years of collective experience in communications, change management and interactive media development we build eLearning solutions that work. We make companies work better by helping people work smarter.

Our competitive advantage is based on three central platforms:

1. Content Development - We conduct in-depth research on a wide range of corporate subjects. We then develop content that is engaging and messages that are accurate and succinct.

2. Design - Our custom eLearning designs engage learners. We apply adult learning principles and a full range of multi-media techniques to appeal to all learning styles.

3. Retention Strategies - Our learning solutions are developed to produce sustainable change. To achieve this we supplement our leaning modules with self-help tools that learners integrate into their everyday lives. These tools both reinforce learning and simplify tasks.

Our customers are varied and include institutions in both the public and private sectors. We have developed programs on a wide range of corporate subjects. We are a Vendor of Record with the Ontario Provincial Government in Canada. Our custom designs have won awards in both the public and private sector. Our customers engage us for two key reasons:

1. To make the complex simple: Apply adult learning techniques to present complex subjects in a way that engages learners to produce measurable and sustainable change.

2. Identify current and desired behaviors: We develop a learning experience to close the gap, measure and continuously improve the learning experience.

eLearning offers a number of unique benefits such as:

1. Reduced cost: There are no instructor salaries, meeting room rental fees, student travel or lodging costs with eLearning. eLearning also considerably minimizes the time spent away from the job.

2. Increased retention: A user-driven, interactive experience combined with built in retention tools can increase retention by greater than 25% over classroom training.

3. Improved Convenience: eLearning offers an on-demand, portable learning experience. Learners can access training anytime, anywhere for refreshers or reference, resulting in an environmentally conscious process as there is no paper involved.

eLearning is a powerful communication medium that can be applied in both traditional and non-traditional learning applications. We have proven eLearning can help to facilitate change, collaboration, compliance. eLearning can be supplemented with self-service and decision support tools to operationalize learning.

Following are examples of eLearning projects FLINT has created:

|

|

·

|

Web-based multimedia training for the Toronto Financial Services Association

|

|

|

-

|

Conversion of 60 hours of classroom material into an interactive online experience for the Ontario Native Welfare Administrators Association

|

|

|

-

|

Multi-module project designed to provide broad teaching to 100-level students. It consists of 5 eLearning modules running a total length of 9 hours. Designed for Healthcare Supply Chain Network

|

|

|

-

|

A single repository, or tool box, for thousands of public sector Project Management and IT Architecture professionals seeking learning, templates and links related to the subject matter. A classroom training course was offered in addition to the eLearning module.

|

|

|

For reference purposes the reader is referred to our web site at flinttc.com to read more about prior customers, our services, and our products.

|

MARKETING ACTIVITIES

Marketing activities have been restricted by lack of available cash flow and as such have been limited to networking within the industry and mailing out targeted collateral pieces. Through the proceeds of this offering, the company intends to increase marketing activities through printed circulars, newspapers, trade magazines and internet advertising.

DEPENDENCE ON ONE OR A FEW MAJOR CUSTOMERS

Our revenue from continuing operations during the past three years was derived from the sale of services to the energy industry. During 2010 and 2009, respectively, the Company generated 98% and 83.6% of their revenue from their three largest customers. The customers, in order of sales revenue for both 2009 and 2008 are: The FRAC Head Corporation (related party), Range Resources, and J-W Operating Company. In 2008 the customers in order of sales revenue were The FRAC Head Corporation (related party), Range Resources and Wynn-Crosby Corp.

GOVERNMENT REGULATION

The Companies business and services are not subject to any material governmental regulation. At the present time we are unaware of any governmental regulations that are in effect that would impact our business operations.

OUR QUALIFICATIONS

Our qualifications are our proprietary product offerings, our reputation, and our experience in the e-learning industry.

INDUSTRY AND COMPETITORS

We continue to believe in the strength of the long-term fundamentals of our business. Since our customers are typically signed on for a single project, our business depends on a consistent ability to find new clients and provide a quality product for them. Since there is a low barrier to entry into a technological, web-based company like FLINT, new clients choose the Company because of our past performance and our experience.

Our services are provided in highly competitive domestic markets. Competitive factors impacting sales of our services include:

| |

-

|

price;

|

| |

-

|

service delivery (including the ability to deliver services on an “as needed, where needed” basis);

|

| |

-

|

quality;

|

| |

-

|

value

|

SOURCES AND THE AVAILABILITY OF RESOURCES

Resources essential to our business, including computers and bandwidth, are normally readily available. We are always seeking ways to ensure the availability of resources, as well as manage their costs.

SEASONALITY

On an overall basis, our operations are not generally affected by seasonality. Weather and natural phenomena can temporarily affect the performance of our services through power outages and unexpected bandwidth interruption.

FUTURE PRODUCTS AND SERVICES

The nature of our business is that each product we create is uniquely tailored to the client’s needs. We do not have any plans to expand our current scope of product development, but this is largely dependent on the client.

NUMBER OF EMPLOYEES

The Company presently has 2 employees, the Sole Office and Director and an administrative assistant. All other workers are subcontractors hired on a job by job basis.

SUBSIDIARIES

The Company has one subsidiary, Flint Management, LLC.

COSTS AND EFFECTS OF COMPLIANCE WITH ENVIRONMENTAL LAWS

We are not aware of nor do we anticipate any environmental laws with which we will have to comply.

MERGERS & ACQUISITIONS

The Company has one subsidiary, Flint Management, LLC, which it acquired through a reverse merger in 2010. Otherwise, the Company has not made nor is it subject to any additional mergers or acquisitions.

FUTURE INDEBTEDNESS & FINANCING

With the approval of this registration statement the Company does not anticipate having cash flow and liquidity problems within the next twelve months. The Company is not in violation of any note, loan, lease or other indebtedness or financing arrangement requiring the Company to make payments.

Our working capital at December 31, 2010 was $7,462. We believe that by raising the minimum amount of funds in this offering, coupled with the impact of increased revenue related to raised funds expensed on sales generation, we will have sufficient funds to cash flow our growth plans for a minimum of twelve. We are of this belief as we generated a small negative cash flow ($5,798) in 2010 and positive cash flow in 2009, $18,637, and that we plan to spend $28,000 of the offering funds directly on raising revenues.

PUBLIC INFORMATION

We do not have any information that has been made public or that will require an investment or material asset of ours.

Additional information:

We have made no public announcements to date and have no additional or new products or services. In addition, we don’t intend to spend funds in the field of research and development; no money has been spent or is contemplated to be spent on customer sponsored research activities relating to the development of new products, services or techniques; and we do not anticipate spending funds on improvement of existing products, services or techniques.

DESCRIPTION OF PROPERTY

Our corporate facilities are located in a 800 sf office space in Vaughn, ON, Canada . We pay $850 Canadian per month, on a lease that expires on January 31, 2012.

LEGAL PROCEEDINGS

We are not involved in any legal proceedings at this time.

SECURITIES BEING OFFERED

We are offering for sale ordinary shares in the capital of our Company at a price of $1.00 per share. We are offering a minimum of 70,000 shares and a maximum of 500,000 shares. The authorized capital in our Company consists of 50,000,000 ordinary shares having a nominal or par value of $0.001 per share and 20,000,000 preferred shares having a nominal or par value of $0.001 per share. As December 31, 2010, we had 7,500,000 ordinary shares issued and outstanding and no preferred shares outstanding.

Every investor who purchases our ordinary shares is entitled to one vote at meetings of our shareholders and to participate equally and ratably in any dividends declared by us and in any property or assets that may be distributed by us to the holders of ordinary shares in the event of a voluntary or involuntary liquidation, dissolution or winding up of the Company.

The existing shareholders and all who subscribe to ordinary shares in this offering do not have a preemptive right to purchase ordinary shares offered for sale by us, and no right to cumulative voting in the election of our directors. These provisions apply to all holders of our ordinary shares.

The following summary of the material British Virgin Islands and United States federal income tax consequences of an investment in our Ordinary Shares is based upon laws and relevant interpretations thereof in effect as of the date of this registration statement, all of which are subject to change. This summary does not deal with all possible tax consequences relating to an investment in our Ordinary Share, such as the tax consequences under state, local and other tax laws. To the extent that the discussion relates to matters of British Virgin Islands tax law, it is the opinion of Forbes Hare, our special British Virgin Islands counsel.

British Virgin Islands Taxation

The Government of the British Virgin Islands, will not, under existing legislation, impose any income, corporate or capital gains tax, estate duty, inheritance tax, gift tax or withholding tax upon the company or its shareholders. The British Virgin Islands are not party to any double taxation treaties.

The company and all distributions, interest and other amounts paid by the company to persons who are not persons resident in the British Virgin Islands are exempt from the provisions of the Income Tax Act in the British Virgin Islands and any capital gains realized with respect to any shares, debt obligations or other securities of the company by persons who are not resident in the British Virgin Islands are exempt from all forms of taxation in the British Virgin Islands. As of January 1, 2007, the Payroll Taxes Act, 2004 came into force. It will not apply to the company except to the extent the company has employees (and deemed employees) rendering services to the company wholly or mainly in the British Virgin Islands. The company at present has no employees in the British Virgin Islands and has no intention of having any employees in the British Virgin Islands.

No estate, inheritance, succession or gift tax, rate, duty, levy or other charge is payable by persons who are not persons resident in the British Virgin Islands with respect to any shares, debt obligations or other securities of the company.

All instruments relating to transactions in respect of the shares, debt obligations or other securities of the company and all instruments relating to other transactions relating to the business of the company are exempt from the payment of stamp duty in the British Virgin Islands.

There are currently no withholding taxes or exchange control regulations in the British Virgin Islands applicable to the company or its shareholders.

Material United States Federal Income Tax Considerations

The following is a summary of the material United States federal income tax consequences of the ownership and disposition of our Ordinary Shares by a U.S. Holder, as defined below, that acquires our Ordinary Shares in the offering and holds our Ordinary Shares as “capital assets” (generally, property held for investment) under the United States Internal Revenue Code. This summary is based upon existing United States federal tax law, which is subject to differing interpretations or change, possibly with retroactive effect. No ruling has been sought from the Internal Revenue Service (the “IRS”) with respect to any United States federal income tax consequences described below, and there can be no assurance that the IRS or a court will not take a contrary position. This summary does not discuss all aspects of United States federal income taxation that may be important to particular investors in light of their individual investment circumstances, including investors subject to special tax rules (for example, certain financial institutions, insurance companies, regulated investment companies, real estate investment trusts, broker-dealers, traders in securities that elect mark-to-market treatment, partnerships and their partners, and tax-exempt organizations (including private foundations)), investors who are not U.S. Holders, investors who own (directly, indirectly, or constructively) 10% or more of our voting stock, investors that hold their Ordinary Shares as part of a straddle, hedge, conversion, constructive sale or other integrated transaction for United States federal income tax purposes, or investors that have a functional currency other than the United States dollar, all of whom may be subject to tax rules that differ significantly from those summarized below. In addition, this summary does not discuss any state, local, or non-United States tax considerations. Each potential investor is urged to consult its tax advisor regarding the United States federal, state, local and non-United States income and other tax considerations of an investment in our Ordinary Shares.

General

For purposes of this summary, a “U.S. Holder” is a beneficial owner of our Ordinary Shares that is, for United States federal income tax purposes, (i) an individual who is a citizen or resident of the United States, (ii) a corporation (or other entity treated as a corporation for United States federal income tax purposes) created in, or organized under the law of, the United States or any state thereof or the District of Columbia, (iii) an estate the income of which is includible in gross income for United States federal income tax purposes regardless of its source, or (iv) a trust (A) the administration of which is subject to the primary supervision of a United States court and which has one or more United States persons who have the authority to control all substantial decisions of the trust or (B) that has otherwise elected to be treated as a United States person under the United States Internal Revenue Code.

If a partnership (or other entity treated as a partnership for United States federal income tax purposes) is a beneficial owner of our Ordinary Shares, the tax treatment of a partner in the partnership will generally depend upon the status of the partner and the activities of the partnership. Partnerships and partners of a partnership holding our Ordinary Shares are urged to consult their tax advisors regarding an investment in our Ordinary Shares.

Passive Foreign Investment Company Considerations

A non-United States corporation, such as our company, will be a “passive foreign investment company,” or PFIC, for United States federal income tax purposes for any taxable year, if either (i) 75% or more of its gross income for such year consists of certain types of “passive” income or (ii) 50% or more of the value of its assets (determined on the basis of a quarterly average) during such year produce or are held for the production of passive income (the “asset test”). Passive income generally includes dividends, interest, royalties, rents, annuities, net gains from the sale or exchange of property producing such income and net foreign currency gains. For this purpose, cash and assets readily convertible into cash are categorized as passive assets and the company’s unbooked intangibles are taken into account for determining the value of its assets. We will be treated as owning a proportionate share of the assets and earning a proportionate share of the income of any other corporation in which we own, directly or indirectly, more than 25% (by value) of the stock.

Although the law in this regard is not entirely clear, we treat Flint Management LLC as being owned by us for United States federal income tax purposes, because we control their management decisions and are entitled to substantially all of the economic benefits associated with these entities, and, as a result, we consolidate these entities’ results of operations in our consolidated U.S. GAAP financial statements. If it were determined, however, that we are not the owner of Flint Management LLC for United States federal income tax purposes, we would likely be treated as a PFIC for our current taxable year and any subsequent taxable year.

Assuming that we are the owner of Flint Management LLC for United States federal income tax purposes, we believe that we primarily operate as an education technology corporation in Canada. Based on our current income and assets and projections as to the value of our assets based, in part, on the expected market value of our Ordinary Shares and outstanding Class A ordinary shares following this offering, we do not expect to be a PFIC for the current taxable year or in the foreseeable future. While we do not anticipate being a PFIC, because the value of the assets for purpose of the asset test may be determined by reference to the market price of our Ordinary Shares, fluctuations in the market price of our Ordinary Shares may cause us to become a PFIC for the current or subsequent taxable year.

The composition of our income and our assets will also be affected by how, and how quickly, we spend our liquid assets and the cash raised in this offering. Under circumstances where revenues from activities that produce passive income significantly increase relative to our revenues from activities that produce nonpassive income, or where we determine not to deploy significant amounts of cash for active purposes, our risk of becoming classified as a PFIC may substantially increase.

Furthermore, because there are uncertainties in the application of the relevant rules, it is possible that the IRS may challenge our classification of certain income and assets as non-passive or our valuation of our tangible and intangible assets, each of which may result in our becoming a PFIC for the current or subsequent taxable years. Because PFIC status is a fact-intensive determination made on an annual basis and will depend upon the composition of our assets and income and the value of our tangible and intangible assets from time to time, no assurance can be given that we are not or will not become a PFIC. In particular, if we are a PFIC for any year during which a U.S. Holder holds our Ordinary Shares, we generally will continue to be treated as a PFIC as to such U.S. Holder for all succeeding years during which such U.S. Holder holds our Ordinary Shares unless we cease to be a PFIC and the U.S. Holder makes a “deemed sale” election with respect to the Ordinary Shares.

The discussion below under “Dividends” and “Sale or Other Disposition of Ordinary Shares” assumes that we will not be a PFIC for United States federal income tax purposes. The U.S. federal income tax rules that apply if we are a PFIC for the current or any subsequent taxable year are generally discussed below under “Passive Foreign Investment Company Rules.”

Dividends

Any cash distributions (including the amount of any PRC tax withheld) paid on our Ordinary Shares out of our current or accumulated earnings and profits, as determined under United States federal income tax principles, will generally be includible in the gross income of a U.S. Holder as dividend income on the day actually or constructively received by the U.S. Holder, in the case of Class A ordinary shares, or by the depositary bank, in the case of Ordinary Shares. Because we do not intend to determine our earnings and profits on the basis of United States federal income tax principles, any distribution paid will generally be treated as a “dividend” for United States federal income tax purposes. Subject to the discussion above regarding concerns expressed by the U.S. Treasury, for taxable years beginning before January 1, 2013, a non-corporate recipient of dividend income generally will be subject to tax on dividend income from a “qualified foreign corporation” at a lower applicable capital gains rate rather than the marginal tax rates generally applicable to ordinary income provided that certain holding period and other requirements are met. We will be considered to be a qualified foreign corporation (i) with respect to any dividend we pay on our Ordinary Shares that are readily tradable on an established securities market in the United States, or (ii) if we are eligible for the benefits of a comprehensive tax treaty with the United States that the Secretary of Treasury of the United States determines is satisfactory for this purpose and includes an exchange of information program. We anticipate applying to list the Ordinary Shares on the NASDAQ Bulletin Board. Provided the listing is approved, we believe that the Ordinary Shares will be readily tradable on an established securities market in the United States and that we will be a qualified foreign corporation with respect to dividends paid on the Ordinary Shares. U.S. Holders should consult their tax advisors regarding the availability of the reduced tax rate on dividends in their particular circumstances. Dividends received on our Ordinary Shares will not be eligible for the dividends received deduction allowed to corporations.

Dividends paid on our Ordinary Shares generally will be treated as income from foreign sources for United States foreign tax credit purposes and generally will constitute passive category income. There may be an event which causes withholding taxes on dividends paid, if any, on our Ordinary Shares. A U.S. Holder may be eligible, subject to a number of complex limitations, to claim a foreign tax credit in respect of any foreign withholding taxes imposed on dividends received on our Ordinary Shares. A U.S. Holder who does not elect to claim a foreign tax credit for foreign tax withheld may instead claim a deduction for United States federal income tax purposes in respect of such withholding, but only for a year in which such holder elects to do so for all creditable foreign income taxes. The rules governing the foreign tax credit are complex. U.S. Holders are urged to consult their tax advisors regarding the availability of the foreign tax credit under their particular circumstances.

Sale or Other Disposition of Ordinary Shares

A U.S. Holder will generally recognize capital gain or loss upon the sale or other disposition of Ordinary Shares in an amount equal to the difference between the amount realized upon the disposition and the holder’s adjusted tax basis in such Ordinary Shares. Any capital gain or loss will be long-term if the Ordinary Shares have been held for more than one year and will generally be United States source gain or loss for United States foreign tax credit purposes.

Passive Foreign Investment Company Rules

If we are a PFIC for any taxable year during which a U.S. Holder holds our Ordinary Shares, unless the U.S. Holder makes a mark-to-market election (as described below), the U.S. Holder will generally be subject to special tax rules that have a penalizing effect, regardless of whether we remain a PFIC, on (i) any excess distribution that we make to the U.S. Holder (which generally means any distribution paid during a taxable year to a U.S. Holder that is greater than 125% of the average annual distributions paid in the three preceding taxable years or, if shorter, the U.S. Holder’s holding period for the Ordinary Shares), and (ii) any gain realized on the sale or other disposition, including, under certain circumstances, a pledge, of Ordinary Shares. Under the PFIC rules:

| |

•

|

|

the excess distribution and/or gain will be allocated ratably over the U.S. Holder’s holding period for the Ordinary Shares;

|

| |

•

|

|

the amount allocated to the current taxable year and any taxable years in the U.S. Holder’s holding period prior to the first taxable year in which we are a PFIC, or pre-PFIC year, will be taxable as ordinary income;

|

| |

•

|

|

the amount allocated to each prior taxable year, other than the current taxable year or a pre-PFIC year, will be subject to tax at the highest tax rate in effect applicable to individuals or corporations as appropriate for that year; and

|

| |

•

|

|

the interest charge generally applicable to underpayments of tax will be imposed on the tax attributable to each prior taxable year, other than a pre-PFIC year.

|

If we are a PFIC for any taxable year during which a U.S. Holder holds our Ordinary Shares and any of our non-United States subsidiaries is also a PFIC, such U.S. Holder would be treated as owning a proportionate amount (by value) of the shares of the lower-tier PFIC and would be subject to the rules described above on certain distributions by a lower-tier PFIC and a disposition of shares of a lower-tier PFIC even though such U.S. holder would not receive the proceeds of those distributions or dispositions. U.S. Holders should consult their tax advisors regarding the application of the PFIC rules to any of our subsidiaries.

As an alternative to the foregoing rules, if we are a PFIC, a U.S. Holder of “marketable stock” may make a mark-to-market election with respect to our Ordinary Shares, but not our Class A ordinary shares, provided that the Ordinary Shares are, as expected, listed on the NASDAQ Global Market and that the Ordinary Shares are regularly traded. We anticipate that our Ordinary Shares should qualify as being regularly traded, but no assurances may be given in this regard. If a U.S. Holder makes this election, the holder will generally (i) include as ordinary income for each taxable year that we are a PFIC the excess, if any, of the fair market value of Ordinary Shares held at the end of the taxable year over the adjusted tax basis of such Ordinary Shares and (ii) deduct as an ordinary loss the excess, if any, of the adjusted tax basis of the Ordinary Shares over the fair market value of such Ordinary Shares held at the end of the taxable year, but such deduction will only be allowed to the extent of the net amount previously included in income as a result of the mark-to-market election. The U.S. Holder’s adjusted tax basis in the Ordinary Shares would be adjusted to reflect any income or loss resulting from the mark-to-market election. If a U.S. Holder makes a mark-to-market election and we cease to be a PFIC, the holder will not be required to take into account the mark-to-market gain or loss described above during any period that we are not a PFIC. If a U.S. Holder makes a mark-to-market election, any gain such U.S. Holder recognizes upon the sale or other disposition of our Ordinary Shares in a year when we are a PFIC will be treated as ordinary income and any loss will be treated as ordinary loss, but such loss will only be treated as ordinary loss to the extent of the net amount previously included in income as a result of the mark-to-market election. In the case of a U.S. Holder who has held Ordinary Shares during any taxable year in respect of which we were classified as a PFIC and continues to hold such Ordinary Shares (or any portion thereof) and has not previously determined to make a mark-to-market election, and who is now considering making a mark-to-market election, special tax rules may apply relating to purging the PFIC taint of such Ordinary Shares.

Because a mark-to-market election cannot be made for any lower-tier PFICs that we may own, a U.S. Holder may continue to be subject to the PFIC rules with respect to such U.S. Holder’s indirect interest in any investments held by us that are treated as an equity interest in a PFIC for United States federal income tax purposes.

We do not intend to provide information necessary for U.S. Holders to make qualified electing fund elections, which, if available, would result in tax treatment different from the general tax treatment for PFICs described above.

If a U.S. Holder owns our Ordinary Shares during any taxable year that we are a PFIC, the holder must file an annual report with the U.S. Internal Revenue Service. Each U.S. Holder is urged to consult its tax advisor concerning the United States federal income tax consequences of purchasing, holding, and disposing Ordinary Shares if we are or become a PFIC, including the possibility of making a mark-to-market election.

Information Reporting and Backup Withholding

Pursuant to the Hiring Incentives to Restore Employment Act enacted on March 18, 2010, in tax years beginning after the date of enactment, an individual U.S. Holder and certain entities may be required to submit to the Internal Revenue Service certain information with respect to his or her beneficial ownership of the Ordinary Shares, if such Ordinary Shares are not held on his or her behalf by a U.S. financial institution. This new law also imposes penalties if an individual U.S. Holder is required to submit such information to the Internal Revenue Service and fails to do so.

In addition, dividend payments with respect to the Ordinary Shares and proceeds from the sale, exchange or redemption of the Ordinary Shares may be subject to information reporting to the IRS and United States backup withholding. Backup withholding will not apply, however, to a U.S. Holder who furnishes a correct taxpayer identification number and makes any other required certification, or who is otherwise exempt from backup withholding. U.S. Holders should consult their tax advisors regarding the application of the United States information reporting and backup withholding rules. Backup withholding is not an additional tax. Amounts withheld as backup withholding may be credited against a U.S. Holder’s United States federal income tax liability, and a U.S. Holder generally may obtain a refund of any excess amounts withheld under the backup withholding rules by filing the appropriate claim for refund with the Internal Revenue Service and furnishing any required information.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Liquidity

The Company is filing this Form F-1 registration statement with the U.S. Securities & Exchange Commission (“SEC”) in order to raise funds to expand its business and execute its business plan.

Trends, events or uncertainties impact on liquidity:

The Company knows of no trends, additional events or uncertainties that would impact liquidity within its business or the market place.

In addition to the preceding, the Company is planning for liquidity needs on a short term and long term basis as follows:

Short Term Liquidity:

The Company has a small accumulated deficit of $2,238 as of December 31, 2010. The Company relies on positive operating cash flow to fund short term working capital. This Form F-1 registration, if the minimum amount is raised, will assist in meeting the Company’s liquidity needs for the next twelve months.

Long Term Liquidity:

The long term liquidity needs of the Company, provided this F-1 Registration Statement is approved, are projected to be met primarily through the cash flow provided by operations. Cash flow from Operating Activities is expected to become positive due to revenue increases 2011-2012.

Capital Resources

As of December 31, 2010, the Company did not have any capital commitments. As of the date of this filing the Company had no other commitments. If this filing is approved we plan to significantly invest in capital and personnel (please see ‘Use of Proceeds’). Planned purchases consist of technology (computers) and improved web interfaces.

Trends, Events or Uncertainties

The Company, since its inception in 2004, has not experienced noticeable sales trends. Sales revenue follows the awarding of a service contract..

Material Changes in Financial Condition

WORKING CAPITAL: Working Capital as of December 31, 2010 was $7,462. This is a decrease of $6,582 versus December 31, 2009 of $14,044. The decrease is mainly due to a decrease in cash of $5,797, a decrease in accounts receivable of $15,243 and partially off-set by an decrease in accounts payable and accrued expenses of $14,458.

SHAREHOLDER’S EQUITY/(DEFICIT): Shareholder’s Equity at December 31, 2010 was negative $26,936 decreasing from December 31, 2009 by the net amount of the year-to-date net loss of $2,238 and the currency translation effect of $2,299.