February 5, 2015 2015 Analyst Day Presentation NYSE: MTDR Exhibit 99.2

1 Disclosure Statements Safe Harbor Statement – This presentation and statements made by representatives of Matador Resources Company (“Matador” or the “Company”) during the course of this presentation include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. “Forward-looking statements” are statements related to future, not past, events. Forward-looking statements are based on current expectations and include any statement that does not directly relate to a current or historical fact. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “could,” “believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “should,” “continue,” “plan,” “predict,” “potential,” “project” and similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Actual results and future events could differ materially from those anticipated in such statements, and such forward-looking statements may not prove to be accurate. These forward-looking statements involve certain risks and uncertainties, including, but not limited to, the following risks related to our financial and operational performance: consummation of the merger with Harvey E. Yates Company and the integration of its assets, employees and operations; general economic conditions; our ability to execute our business plan, including whether our drilling program is successful; changes in oil, natural gas and natural gas liquids prices and the demand for oil, natural gas and natural gas liquids; our ability to replace reserves and efficiently develop our current reserves; our costs of operations, delays and other difficulties related to producing oil, natural gas and natural gas liquids; our ability to make acquisitions on economically acceptable terms; availability of sufficient capital to execute our business plan, including from our future cash flows, increases in our borrowing base and otherwise; weather and environmental conditions; and other important factors which could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. For further discussions of risks and uncertainties, you should refer to Matador’s SEC filings, including the “Risk Factors” section of Matador’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. Matador undertakes no obligation and does not intend to update these forward- looking statements to reflect events or circumstances occurring after the date of this presentation, except as required by law, including the securities laws of the United States and the rules and regulations of the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement. Cautionary Note – The Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves. Potential resources are not proved, probable or possible reserves. The SEC’s guidelines prohibit Matador from including such information in filings with the SEC. Definitions – Proved oil and natural gas reserves are the estimated quantities of oil and natural gas which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. Matador’s production and proved reserves are reported in two streams: oil and natural gas, including both dry and liquids-rich natural gas. Where Matador produces liquids-rich natural gas, the economic value of the natural gas liquids associated with the natural gas is included in the estimated wellhead natural gas price on those properties where the natural gas liquids are extracted and sold. Estimated ultimate recovery (EUR) is a measure that by its nature is more speculative than estimates of proved reserves prepared in accordance with SEC definitions and guidelines and is accordingly less certain.

Welcome and Opening Remarks

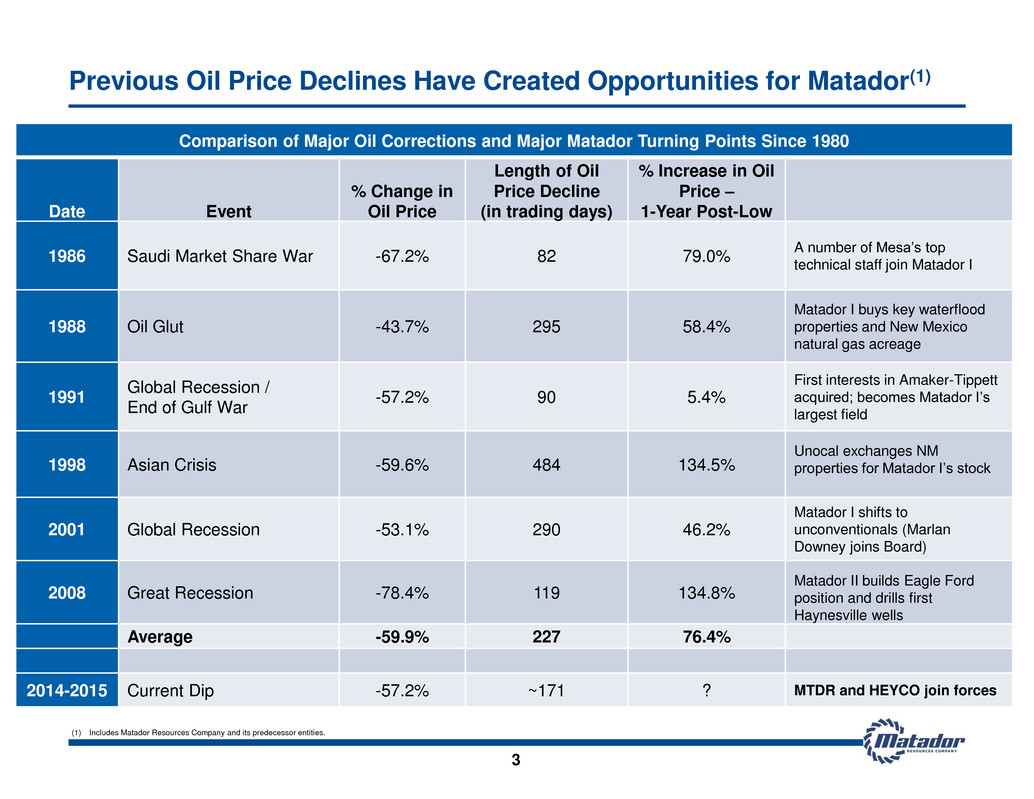

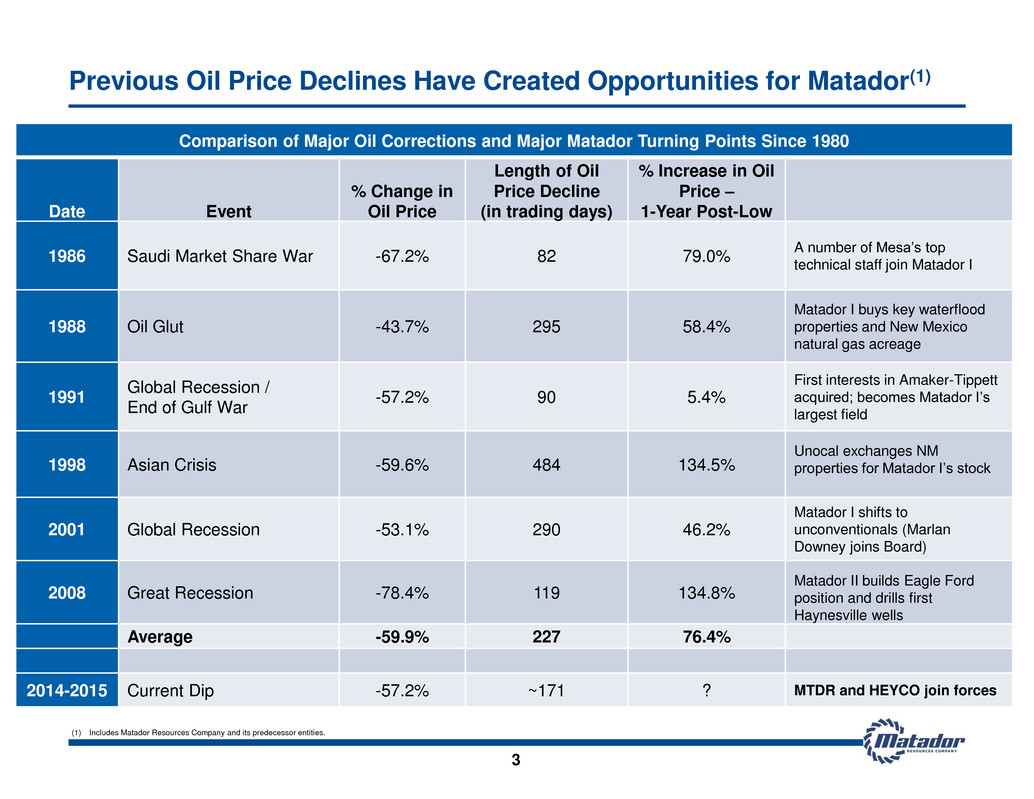

3 Previous Oil Price Declines Have Created Opportunities for Matador(1) Comparison of Major Oil Corrections and Major Matador Turning Points Since 1980 Date Event % Change in Oil Price Length of Oil Price Decline (in trading days) % Increase in Oil Price – 1-Year Post-Low 1986 Saudi Market Share War -67.2% 82 79.0% A number of Mesa’s top technical staff join Matador I 1988 Oil Glut -43.7% 295 58.4% Matador I buys key waterflood properties and New Mexico natural gas acreage 1991 Global Recession / End of Gulf War -57.2% 90 5.4% First interests in Amaker-Tippett acquired; becomes Matador I’s largest field 1998 Asian Crisis -59.6% 484 134.5% Unocal exchanges NM properties for Matador I’s stock 2001 Global Recession -53.1% 290 46.2% Matador I shifts to unconventionals (Marlan Downey joins Board) 2008 Great Recession -78.4% 119 134.8% Matador II builds Eagle Ford position and drills first Haynesville wells Average -59.9% 227 76.4% 2014-2015 Current Dip -57.2% ~171 ? MTDR and HEYCO join forces (1) Includes Matador Resources Company and its predecessor entities.

4 Today’s Agenda Welcome and Opening Remarks Joseph Wm. Foran, Chairman and CEO Special Guests: George M. Yates, CEO, HEYCO Energy Group, Inc.; other HEYCO team members HEYCO Acquisition and Midstream Initiatives Matthew V. Hairford, President 2015 Capital Investment Plan David E. Lancaster, Executive Vice President, COO and CFO Eagle Ford Operations Update Ryan C. London, Executive Vice President and General Manager Permian Operations Update David F. Nicklin, Executive Director of Exploration Ryan C. London, Executive Vice President and General Manager Haynesville Operations Update Bradley M. Robinson, Vice President of Reservoir Engineering and CTO Summary and Closing Remarks/Q&A Joseph Wm. Foran, Chairman and CEO Buffet Lunch Bit Demonstration: Josh Passauer, Senior Drilling Engineer, and Patrick Walsh, Drilling Engineer

Keys to Matador’s Success Over Last 35 Years(1) 5 People We have a strong, committed technical and financial team in place, and we continue to make additions and improvements to our staff, our capabilities and our processes Board and Special Advisor additions have strengthened Board skills and stewardship Properties Matador’s acreage positions and multi-year drilling inventory are significant and located in three of the industry’s best plays – Eagle Ford, Permian and Haynesville Our property mix provides us with a balanced opportunity set for both oil and natural gas Process Continuous improvement in all aspects of our business leading to more efficient operations, improved financial results and increased shareholder value Gaining momentum in being a successful publicly-held company Execution Increase total production by ~40%, with oil production expected to increase to ~4.1 million barrels and natural gas production expected to increase to ~25 Bcf in 2015 Maintain quality acreage positions in the Eagle Ford, Permian and Haynesville – successfully integrate HEYCO acreage in Permian Reduce drilling and completion times and costs – improve operational efficiencies Maintain strong financial position and technical and administrative teams (1) Includes Matador Resources Company and its predecessor entities.

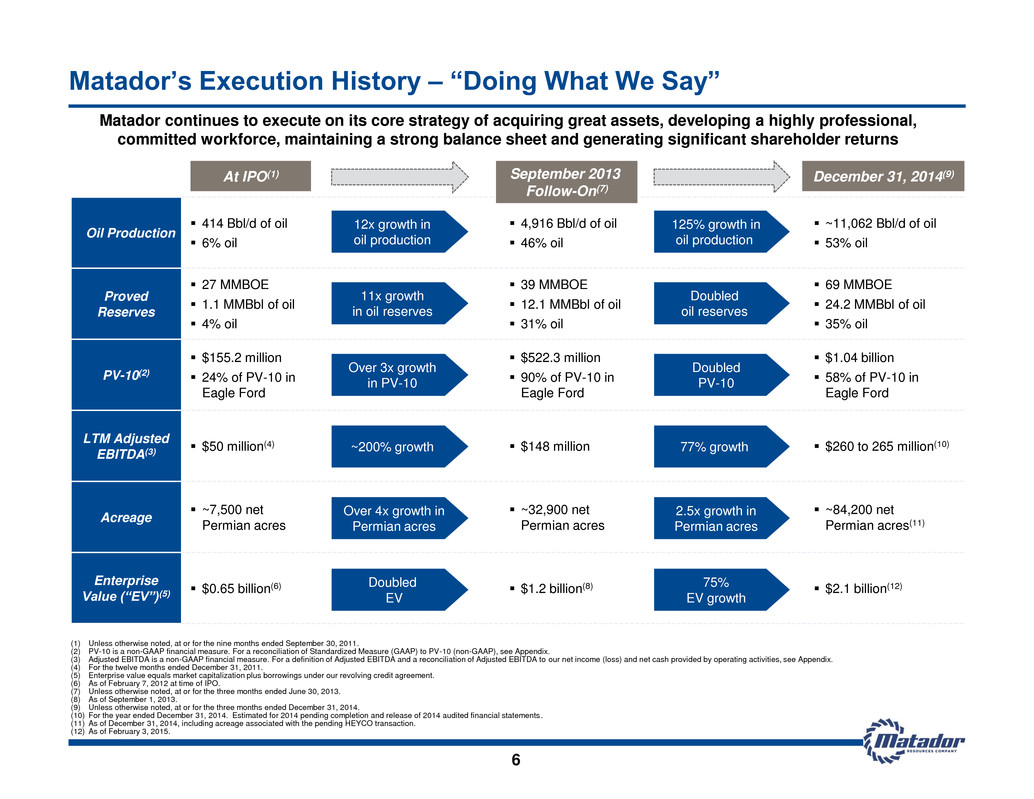

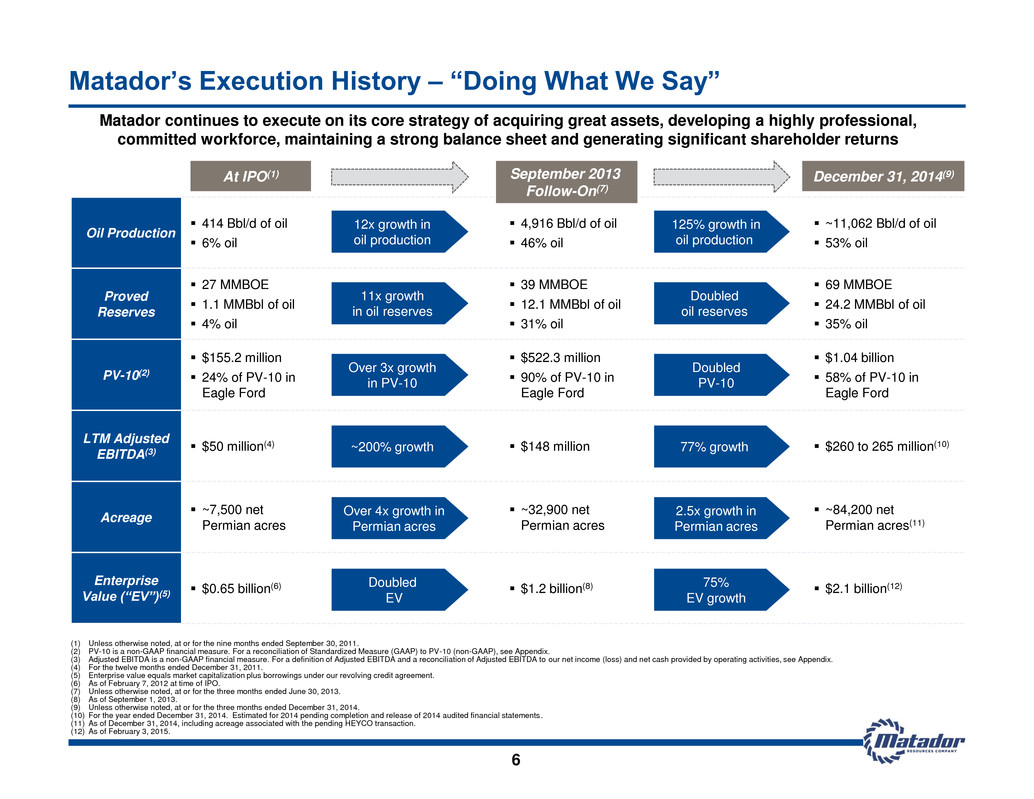

Matador’s Execution History – “Doing What We Say” Oil Production 414 Bbl/d of oil 6% oil 4,916 Bbl/d of oil 46% oil ~11,062 Bbl/d of oil 53% oil Proved Reserves 27 MMBOE 1.1 MMBbl of oil 4% oil 39 MMBOE 12.1 MMBbl of oil 31% oil 69 MMBOE 24.2 MMBbl of oil 35% oil PV-10(2) $155.2 million 24% of PV-10 in Eagle Ford $522.3 million 90% of PV-10 in Eagle Ford $1.04 billion 58% of PV-10 in Eagle Ford LTM Adjusted EBITDA(3) $50 million(4) $148 million $260 to 265 million(10) Acreage ~7,500 net Permian acres ~32,900 net Permian acres ~84,200 net Permian acres(11) Enterprise Value (“EV”)(5) $0.65 billion(6) $1.2 billion(8) $2.1 billion(12) 12x growth in oil production 11x growth in oil reserves ~200% growth Doubled EV Over 4x growth in Permian acres At IPO(1) September 2013 Follow-On(7) Over 3x growth in PV-10 (1) Unless otherwise noted, at or for the nine months ended September 30, 2011. (2) PV-10 is a non-GAAP financial measure. For a reconciliation of Standardized Measure (GAAP) to PV-10 (non-GAAP), see Appendix. (3) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (4) For the twelve months ended December 31, 2011. (5) Enterprise value equals market capitalization plus borrowings under our revolving credit agreement. (6) As of February 7, 2012 at time of IPO. (7) Unless otherwise noted, at or for the three months ended June 30, 2013. (8) As of September 1, 2013. (9) Unless otherwise noted, at or for the three months ended December 31, 2014. (10) For the year ended December 31, 2014. Estimated for 2014 pending completion and release of 2014 audited financial statements. (11) As of December 31, 2014, including acreage associated with the pending HEYCO transaction. (12) As of February 3, 2015. 125% growth in oil production Doubled oil reserves 77% growth 75% EV growth 2.5x growth in Permian acres Doubled PV-10 December 31, 2014(9) Matador continues to execute on its core strategy of acquiring great assets, developing a highly professional, committed workforce, maintaining a strong balance sheet and generating significant shareholder returns 6

2014 Was Another Very Solid Year for Matador 7 Record oil, natural gas and total oil equivalent production Oil production of 3.32 million barrels, up 56% from 2.13 million barrels in 2013 Natural gas production of 15.3 Bcf, up 18% from 12.9 Bcf in 2013 Total oil equivalent production of 5.9 million BOE, up 37% from 4.3 million BOE in 2013 All-time high proved oil and natural gas reserves Proved oil and natural gas reserves of 68.7 million BOE at YE 2014, up 33% from 51.7 million BOE at YE 2013, up 44% including 2014 oil equivalent production of 5.9 million BOE PV-10(1) of proved reserves of $1.04 billion at YE 2014, up 59% from $655 million at YE 2013 Proved oil reserves of 24.2 million barrels at YE 2014, up 48% from 16.4 million barrels at YE 2013, up 68% including 2014 oil production of 3.3 million barrels Estimated Adjusted EBITDA(2) growth of 37% Estimated $260 to $265 million in 2014(3) compared to $191.8 million in 2013 Maintained strong balance sheet and low leverage YE 2014 Debt/Adjusted EBITDA(2)(3) of ~1.3, well below peer average (1) PV-10 is a non-GAAP financial measure. For a reconciliation of Standardized Measure (GAAP) to PV-10 (non-GAAP), see Appendix. (2) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (3) Estimated for 2014 pending completion and release of 2014 audited financial statements.

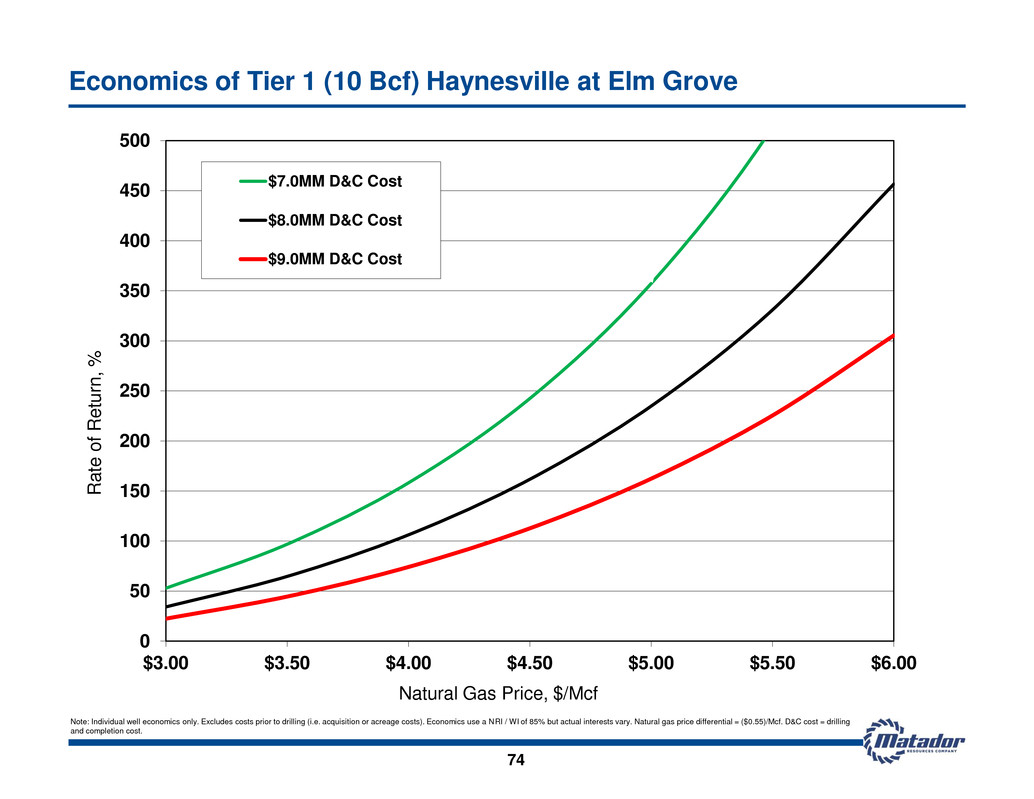

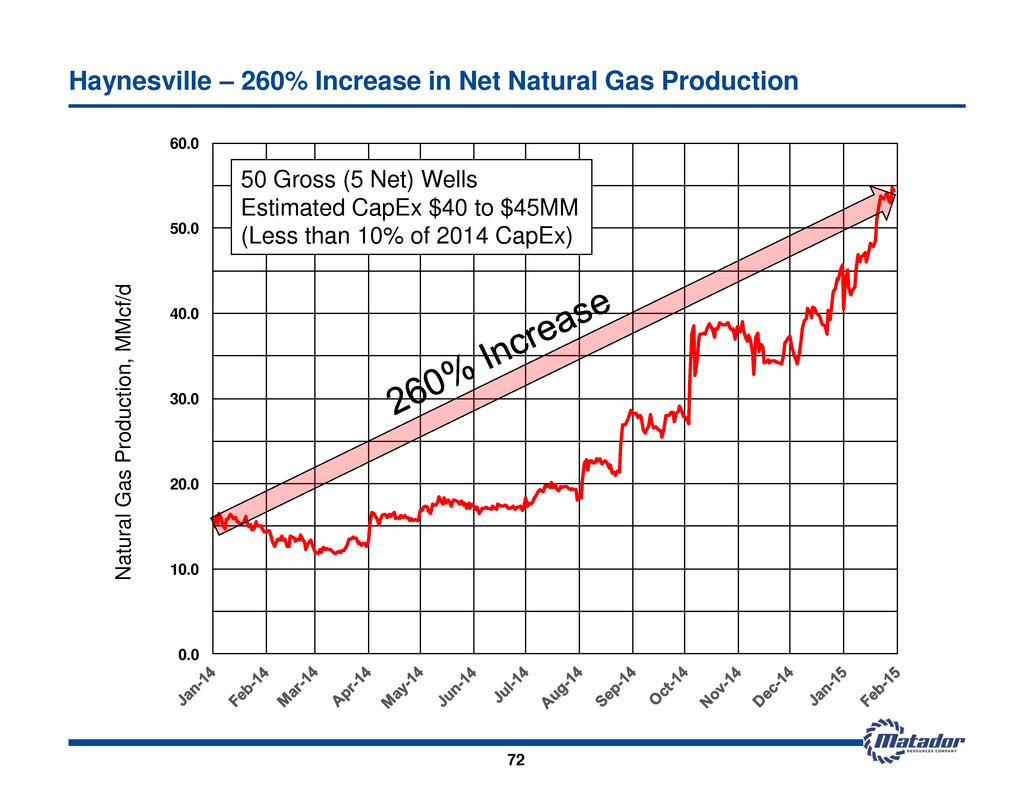

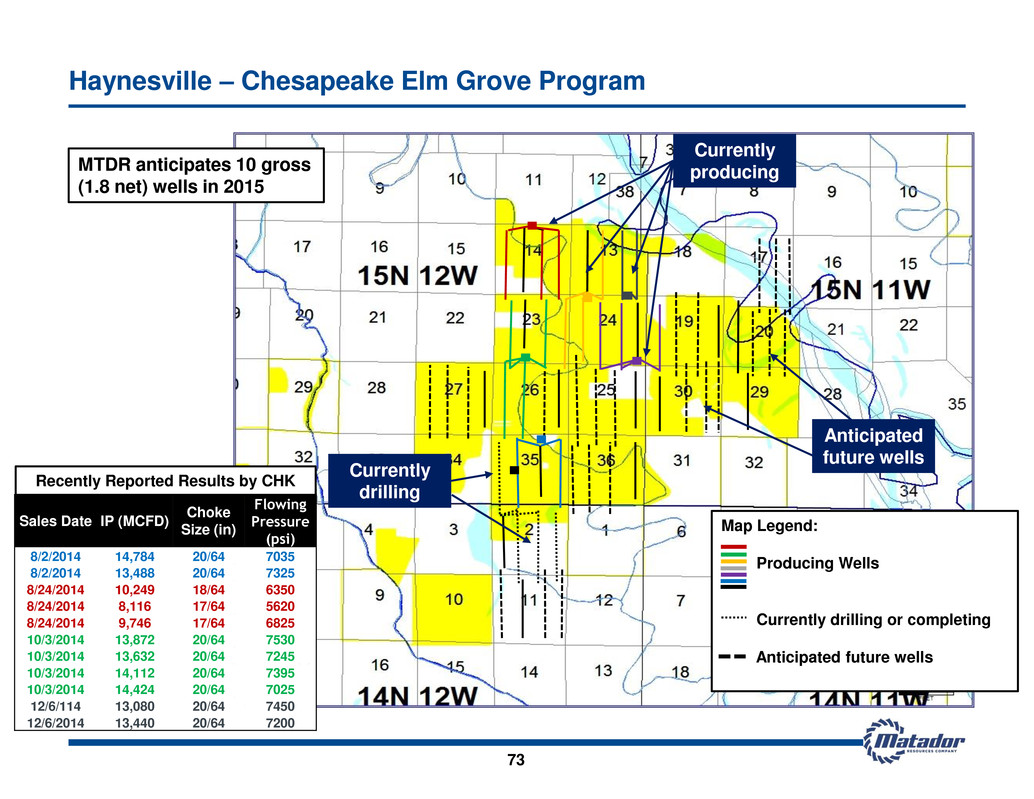

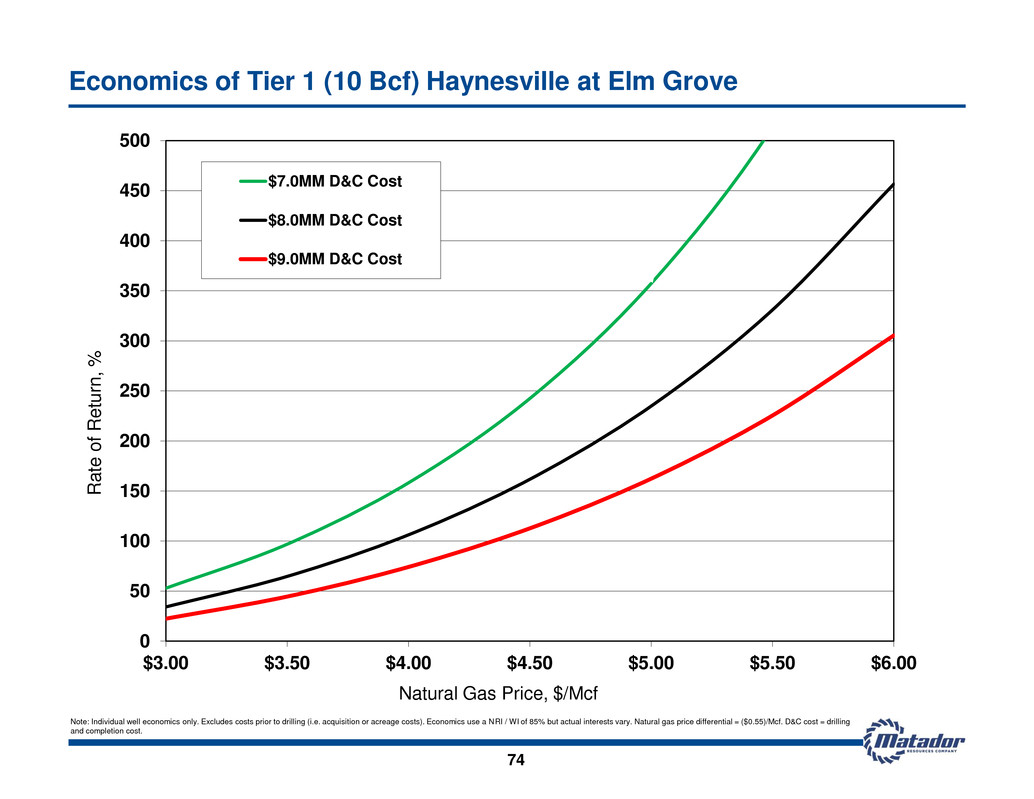

2014 Was Another Very Solid Year for Matador 8 Strong execution in each of our primary operating areas Eagle Ford Eagle Ford average daily oil production up 44% from ~6,400 Bbl/d in Q4 2013 to ~9,100 Bbl/d in Q4 2014 Continued improvement in drilling times, completion and production operations and overall well costs Permian Drilling program off to an excellent start – performance of most initial wells has exceeded expectations Permian average total daily production grew 10-fold from ~260 BOE/d in Q4 2013 to ~2,600 BOE/d in Q4 2014; ~13% of total production in Q4 2014 Acreage position up 47% or ~21,000 net additional acres to ~66,000 net acres at YE 2014 (prior to HEYCO); including pending HEYCO merger, Permian acreage position up 88% to ~84,000 net acres Haynesville Non-op drilling program (primarily by Chesapeake at Elm Grove) very successful - excellent wells for lower-than- projected costs; estimated recoveries of 8 to 12 Bcf (IP rates of 10 to 15 MMcf/d) for costs of $7 to $8 million Haynesville average daily natural gas production up over 3-fold from 11.1 MMcf/d in Q4 2013 to 35.0 MMcf/d in Q4 2014; currently ~55 MMcf/d Significantly enhanced the Matador team Added strong new hires in operations, geoscience, land and legal, accounting and administration providing the foundation for future growth Adding significant Permian Basin experience and expertise through pending merger with HEYCO

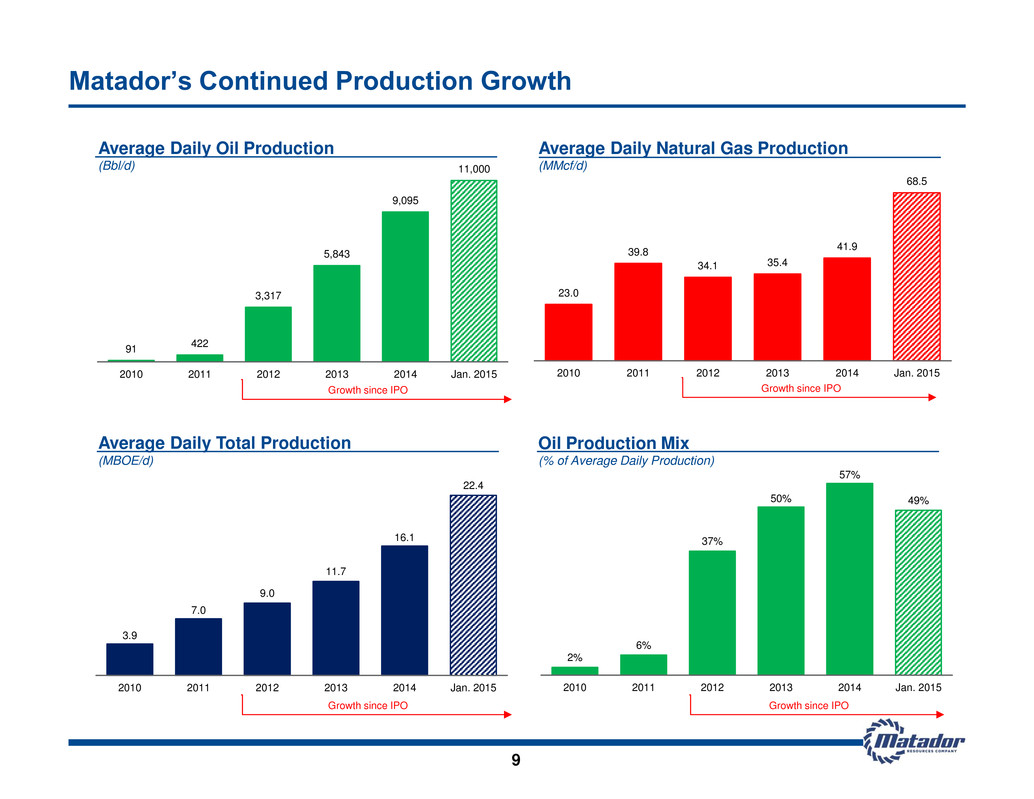

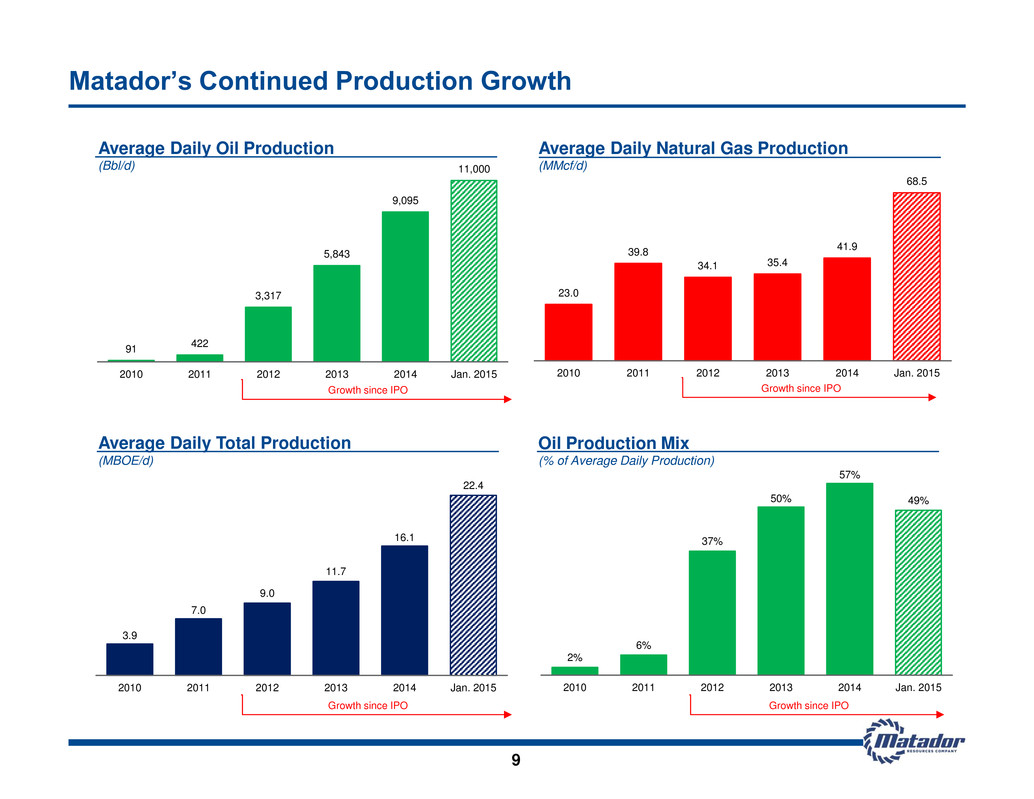

Matador’s Continued Production Growth Average Daily Oil Production (Bbl/d) Average Daily Natural Gas Production (MMcf/d) Average Daily Total Production (MBOE/d) Oil Production Mix (% of Average Daily Production) 9 91 422 3,317 5,843 9,095 11,000 2010 2011 2012 2013 2014 Jan. 2015 Growth since IPO 3.9 7.0 9.0 11.7 16.1 22.4 2010 2011 2012 2013 2014 Jan. 2015 Growth since IPO Growth since IPO 2% 6% 37% 50% 57% 49% 2010 2011 2012 2013 2014 Jan. 2015 23.0 39.8 34.1 35.4 41.9 68.5 2010 2011 2012 2013 2014 Jan. 2015 Growth since IPO

10 Oil and Natural Gas Proved Reserves and PV-10(1) Growth By Area YE 2013 Total proved reserves = 68.7 million BOE PV-10(1): $1,043.4 million $91.48 oil / $4.35 natural gas (1) PV-10 is a non-GAAP financial measure. For a reconciliation of Standardized Measure (GAAP) to PV-10 (non-GAAP), see Appendix. YE 2012 Total proved reserves = 23.8 million BOE PV-10(1): $423.2 million $91.21 oil /$2.76 natural gas Total proved reserves = 51.7 million BOE PV-10(1): $655.2 million $93.42 oil / $3.67 natural gas YE 2014 Eagle Ford $393.6 million, 93% Permian $2.0 million, 1% Haynesville/CV $27.6 million, 6% Eagle Ford $540.4 million, 82% Haynesville/CV $82.9 million, 13% Permian $31.9 million, 5% Eagle Ford $603.8 million, 58% Haynesville/CV $193.4 million, 18% Permian $246.2 million, 24%

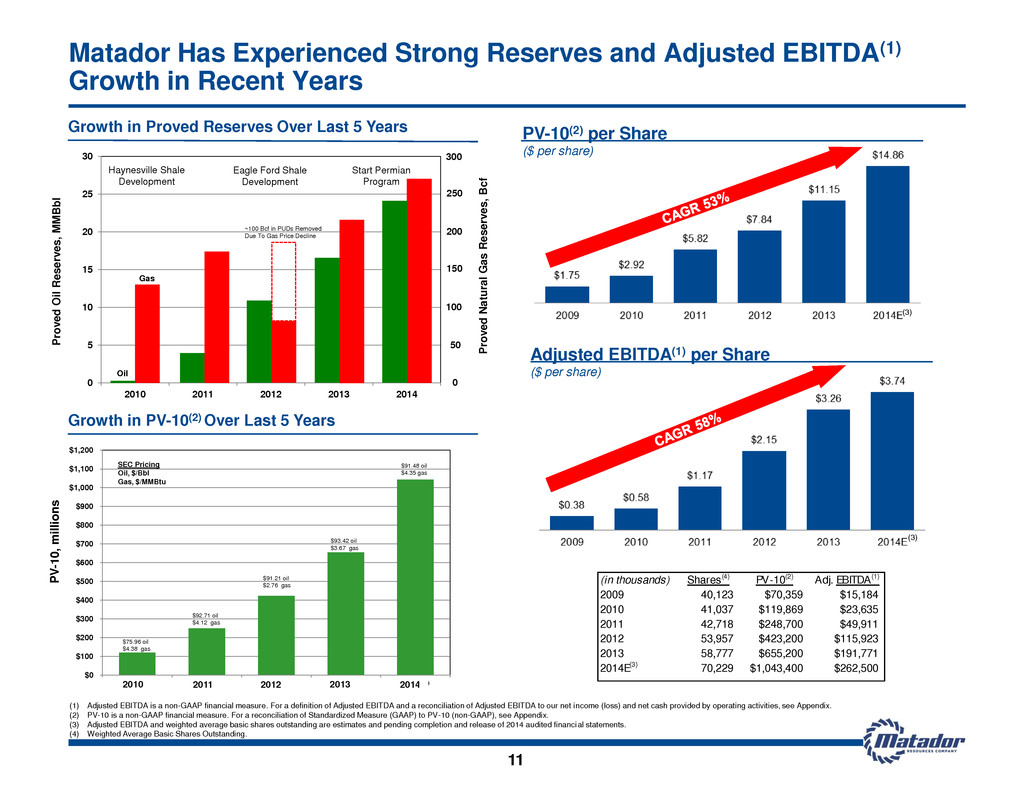

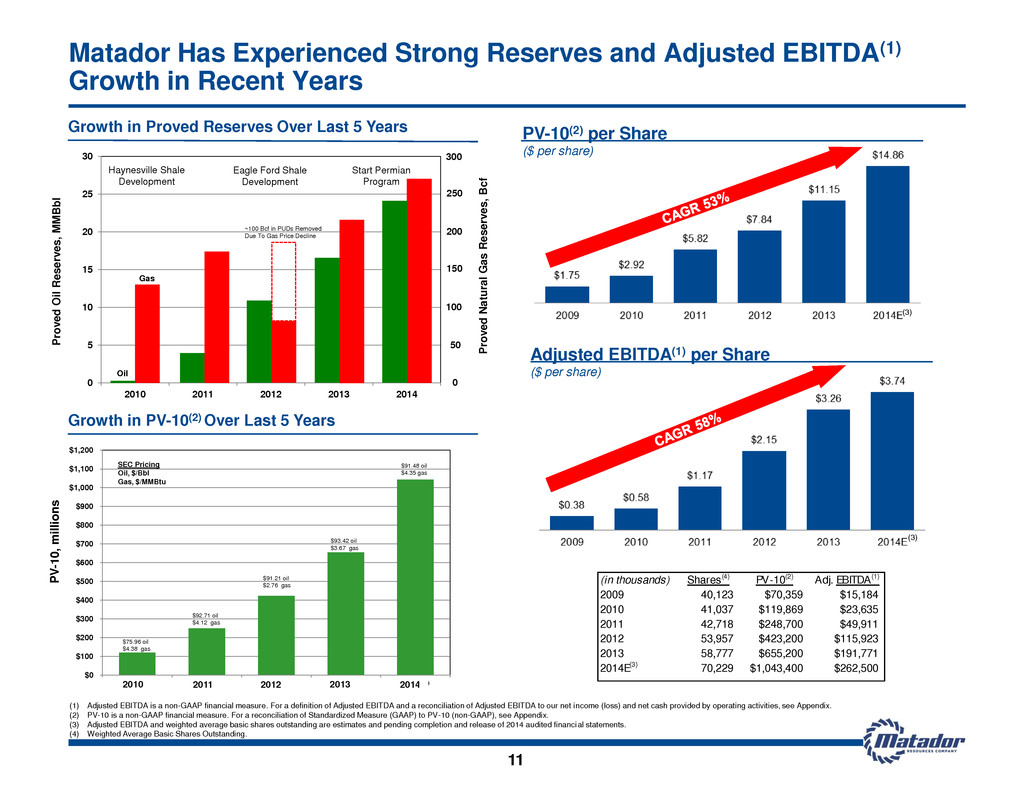

(1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (2) PV-10 is a non-GAAP financial measure. For a reconciliation of Standardized Measure (GAAP) to PV-10 (non-GAAP), see Appendix. (3) Adjusted EBITDA and weighted average basic shares outstanding are estimates and pending completion and release of 2014 audited financial statements. (4) Weighted Average Basic Shares Outstanding. $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 2010 2011 2012 2013 20142014 (1)2010 (1) 201 (1) 2012 (1) PV -1 0, mil lio ns $75.96 oil $4.38 gas $92.71 oil $4.12 gas $91.21 oil $2.76 gas SEC Pricing Oil, $/Bbl Gas, $/MMBtu 2013 (1) $93.42 oil $3.67 gas $91.48 oil $4.35 gas (in thousands) Shares(4) PV-10(2) Adj. EBITDA(1) 2009 40,123 $70,359 $15,184 2010 41,037 $119,869 $23,635 2011 42,718 $248,700 $49,911 2012 53,957 $423,200 $115,923 2013 58,777 $655,200 $191,771 2014E(3) 70,229 $1,043,400 $262,500 0 5 1 15 2 25 30 2010 2011 2012 2013 2014 Pro ve d O il Reser ves, MMB bl Pr ov ed Nat ural G as Reser ves, Bc f Oil Gas ~100 Bcf in PUDs Removed Due To Gas Price Decline Haynesville Shale Development Eagle Ford Shale Development 250 200 150 100 50 0 Start Permian Program 300 Matador Has Experienced Strong Reserves and Adjusted EBITDA(1) Growth in Recent Years 11 Growth in Proved Reserves Over Last 5 Years Growth in PV-10(2) Over Last 5 Years PV-10(2) per Share ($ per share) Adjusted EBITDA(1) per Share ($ per share) (3) (3)

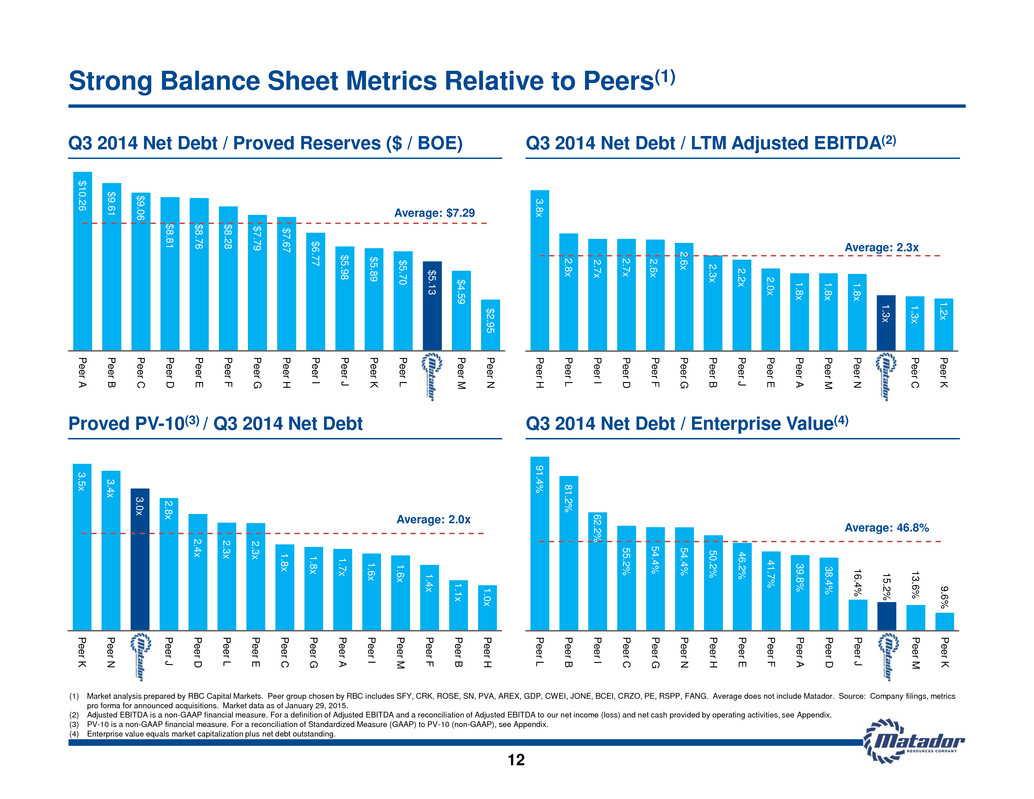

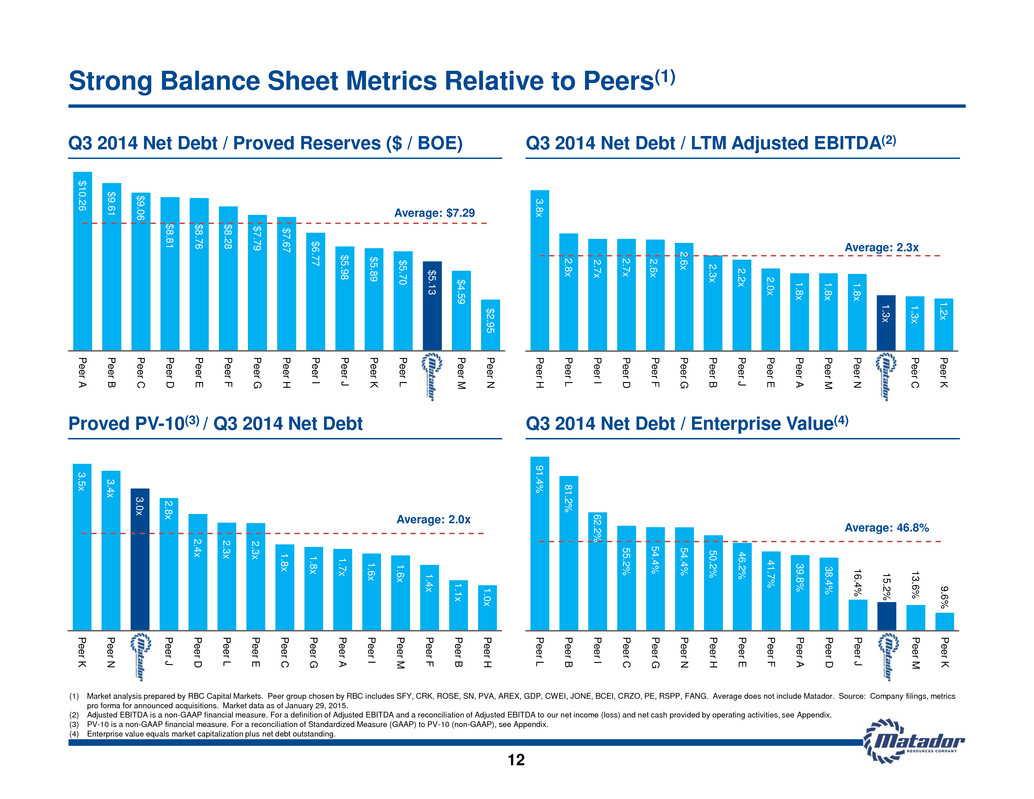

91.4% 81.2% 62.2% 55.2% 54.4% 54.4% 50.2% 46.2% 41.7% 39.8% 38.4% 16.4% 15.2% 13.6% 9.6% Peer L Peer B Peer I Peer C Peer G Peer N Peer H Peer E Peer F Peer A Peer D Peer J 0 Peer M Peer K 3.5x 3.4x 3.0x 2.8x 2.4x 2.3x 2.3x 1.8x 1.8x 1.7x 1.6x 1.6x 1.4x 1.1x 1.0x Peer K Peer N 0 Peer J Peer D Peer L Peer E Peer C Peer G Peer A Peer I Peer M Peer F Peer B Peer H $10.26 $9.61 $9.06 $8.8 1 $8.7 6 $8.2 8 $7.79 $7.67 $6.77 $5.98 $5.89 $5.70 $5.13 $4.59 $2.95 Peer A Peer B Peer C Peer D Peer E Peer F Peer G Peer H Peer I Peer J Peer K Peer L 0 Peer M Peer N 3.8x 2.8x 2.7x 2.7x 2.6x 2.6x 2.3x 2.2x 2.0x 1.8x 1.8x 1.8x 1.3x 1.3x 1.2x Peer H Peer L Peer I Peer D Peer F Peer G Peer B Peer J Peer E Peer A Peer M Peer N 0 Peer C Peer K Strong Balance Sheet Metrics Relative to Peers(1) 12 Q3 2014 Net Debt / Proved Reserves ($ / BOE) Q3 2014 Net Debt / LTM Adjusted EBITDA(2) Proved PV-10(3) / Q3 2014 Net Debt Q3 2014 Net Debt / Enterprise Value(4) Average: $7.29 Average: 2.3x Average: 2.0x Average: 46.8% (1) Market analysis prepared by RBC Capital Markets. Peer group chosen by RBC includes SFY, CRK, ROSE, SN, PVA, AREX, GDP, CWEI, JONE, BCEI, CRZO, PE, RSPP, FANG. Average does not include Matador. Source: Company filings, metrics pro forma for announced acquisitions. Market data as of January 29, 2015. (2) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (3) PV-10 is a non-GAAP financial measure. For a reconciliation of Standardized Measure (GAAP) to PV-10 (non-GAAP), see Appendix. (4) Enterprise value equals market capitalization plus net debt outstanding.

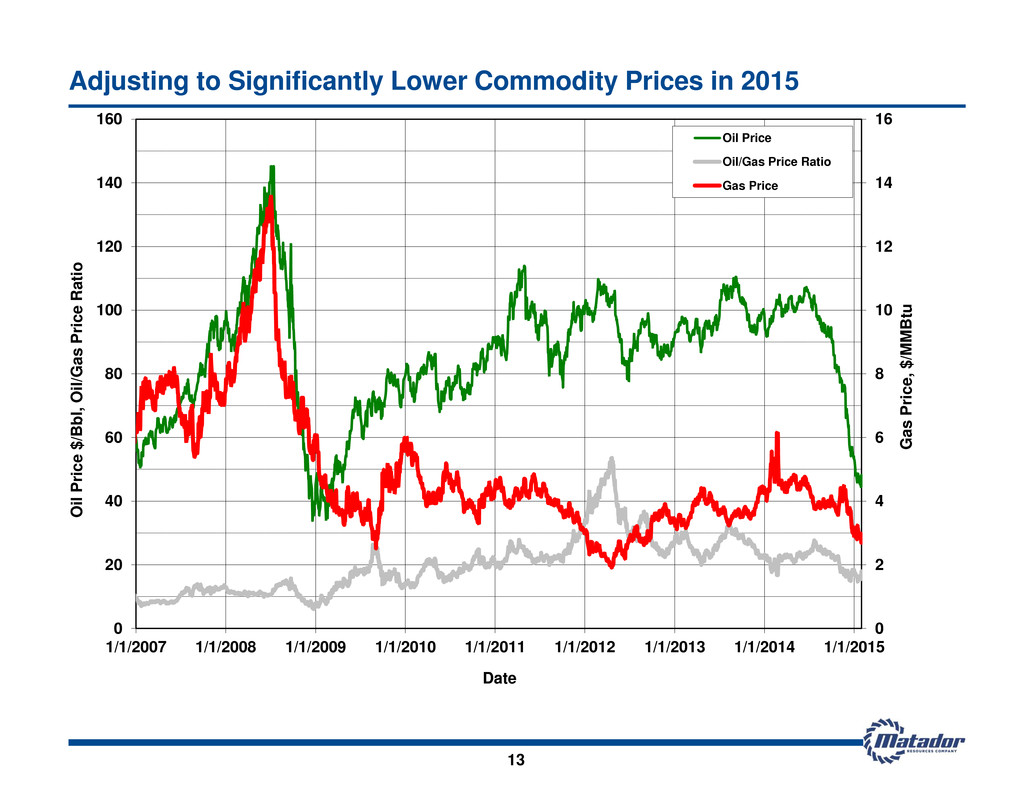

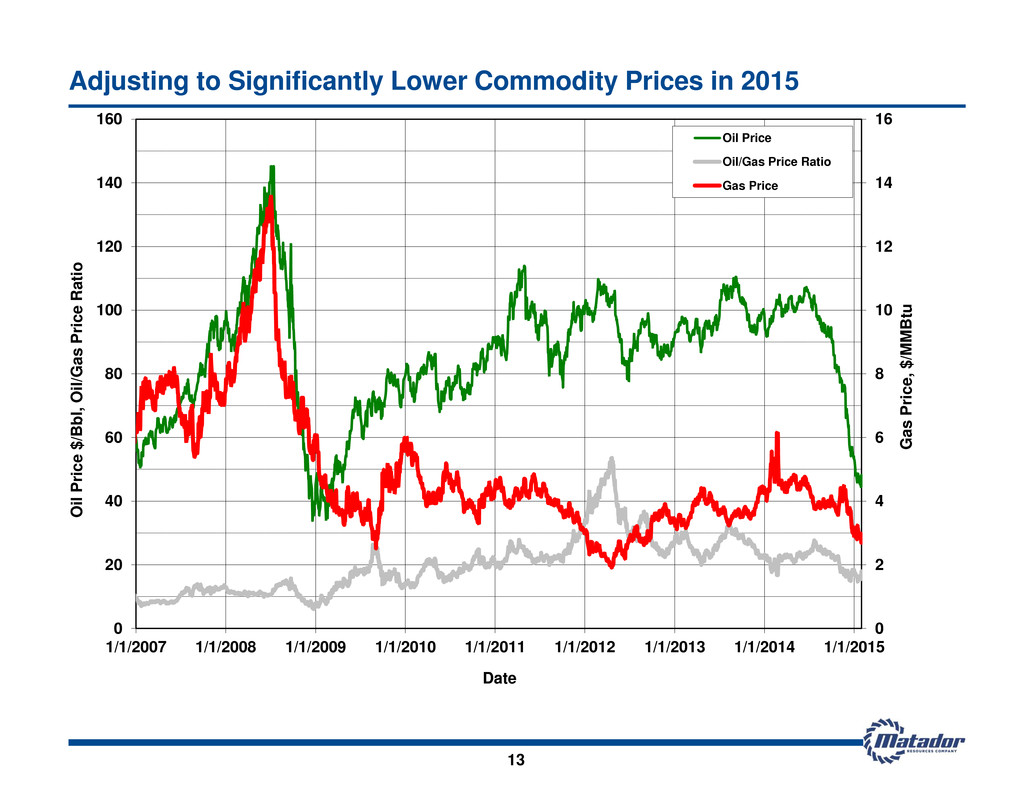

13 Adjusting to Significantly Lower Commodity Prices in 2015 0 2 4 6 8 10 12 14 16 0 20 40 60 80 100 120 140 160 1/1/2007 1/1/2008 1/1/2009 1/1/2010 1/1/2011 1/1/2012 1/1/2013 1/1/2014 1/1/2015 G a s P ri c e , $ /M M B tu O il P ri c e $ /Bbl , O il /G a s P ri c e Ratio _ Date Oil Price Oil/Gas Price Ratio Gas Price

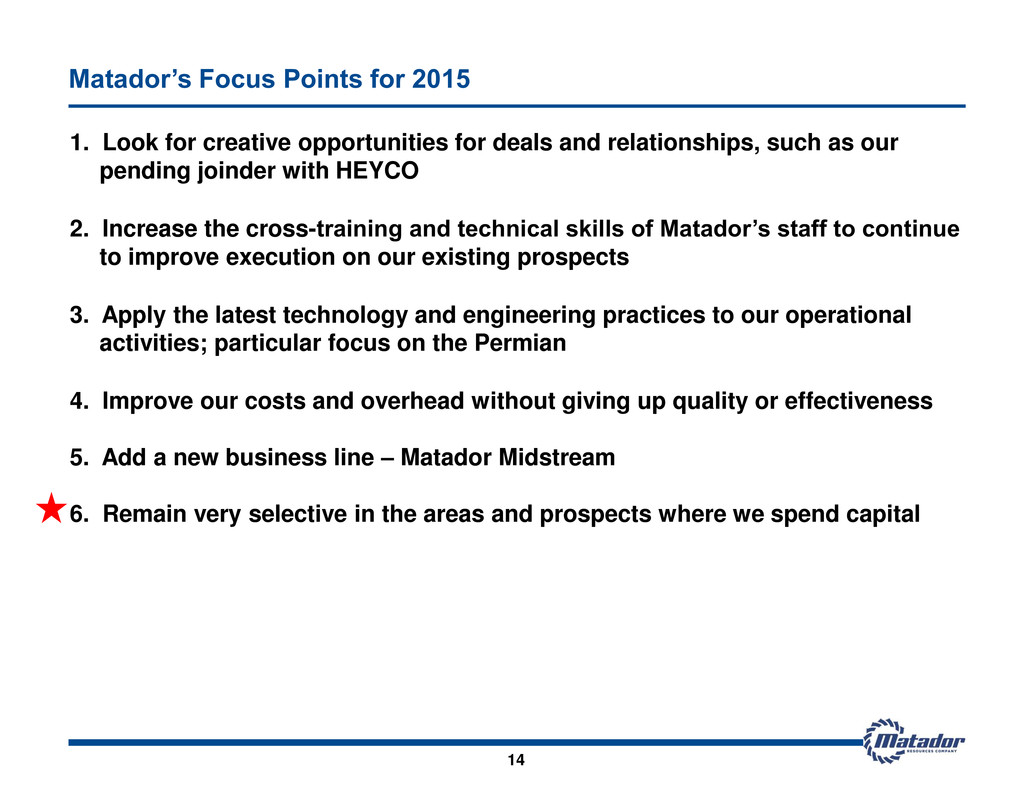

Matador’s Focus Points for 2015 14 1. Look for creative opportunities for deals and relationships, such as our pending joinder with HEYCO 2. Increase the cross-training and technical skills of Matador’s staff to continue to improve execution on our existing prospects 3. Apply the latest technology and engineering practices to our operational activities; particular focus on the Permian 4. Improve our costs and overhead without giving up quality or effectiveness 5. Add a new business line – Matador Midstream 6. Remain very selective in the areas and prospects where we spend capital

HEYCO Combination Overview

Transaction Summary 16 (1) As part of the consideration for the combination, Matador will issue 150,000 shares of Series A Convertible Preferred Stock (the “Series A Preferred Stock”). Each share of Series A Preferred Stock will automatically convert into ten shares of Matador Common Stock, subject to customary anti-dilution adjustments, upon the vote and approval by Matador’s shareholders of an amendment to Matador’s Amended and Restated Certificate of Formation to increase the number of shares of authorized Matador Common Stock. Each share of Series A Preferred Stock is entitled to ten votes on each matter submitted to Matador’s shareholders for vote. Beginning on the date that is six months following the first date of issuance of the Series A Preferred Stock and until such time as the Series A Preferred Stock is converted to Common Stock, the holders will be entitled to a quarterly dividend of $1.80 per share. Neither the issuance of the Series A Preferred Stock nor the Common Stock issued in connection with this combination will be registered under the Securities Act of 1933, as amended, and neither the Series A Preferred Stock nor such Common Stock may be offered or sold in the United States absent such registration or an applicable exemption from registration requirements. As part of this transaction, Matador has agreed to enter into a registration rights agreement with HEYCO Energy Group, Inc. providing certain demand and piggyback registration rights, with demand registration rights exercisable after the first anniversary of the closing of the combination. Matador is combining assets with the Harvey E. Yates Company (“HEYCO”), headquartered in Roswell, New Mexico, a subsidiary of HEYCO Energy Group, Inc., including certain oil and natural gas producing properties and undeveloped acreage located in Lea and Eddy Counties, New Mexico HEYCO is privately owned by members of the Yates family of Southeastern New Mexico, who have been active in the oil and natural gas business in the Delaware Basin since the 1920s Consideration for the combination $37.4 million in cash (including assumed debt obligations) 3,140,960 shares of Matador Common Stock 150,000 shares of newly created Series A Convertible Preferred Stock(1) Subject to customary purchase price adjustments, including adjusting for production, revenues and operating and capital expenditures from September 1, 2014 to closing Upon closing of the transaction, Mr. George M. Yates, CEO of HEYCO Energy Group, Inc., is expected to join Matador’s Board of Directors Upon closing of the transaction, HEYCO Energy Group, Inc. will become one of the largest shareholders in Matador Resources Company, owning approximately 6% of the equity of the combined entity Expected to close February 27, 2015.

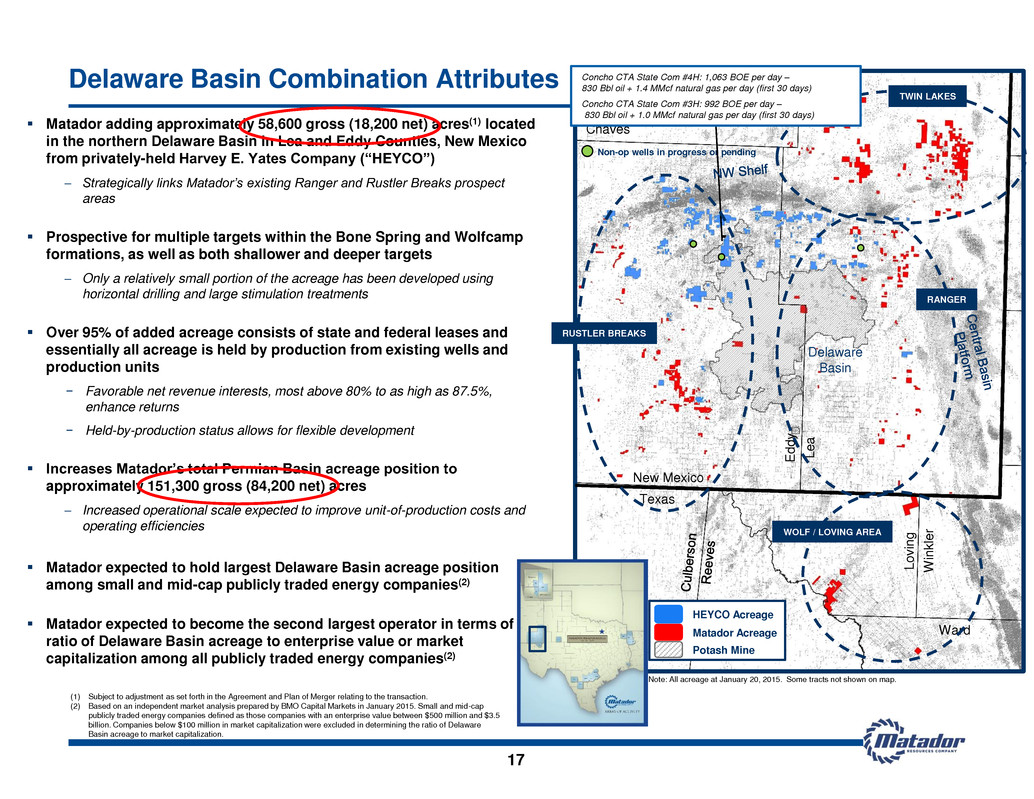

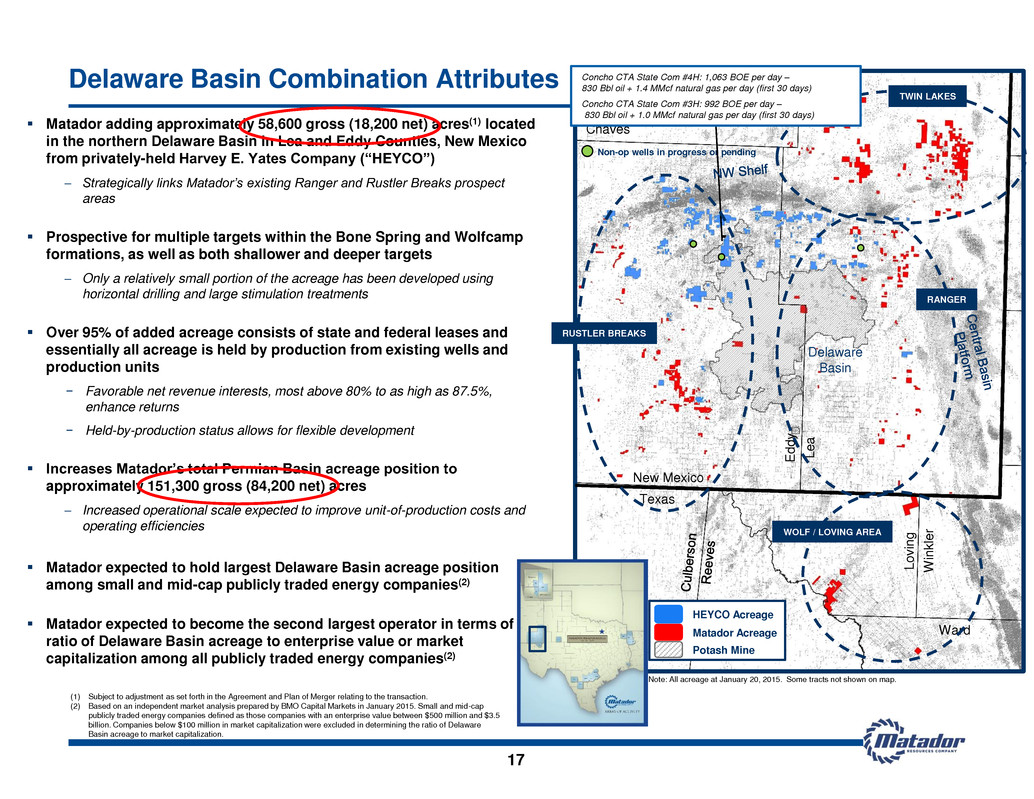

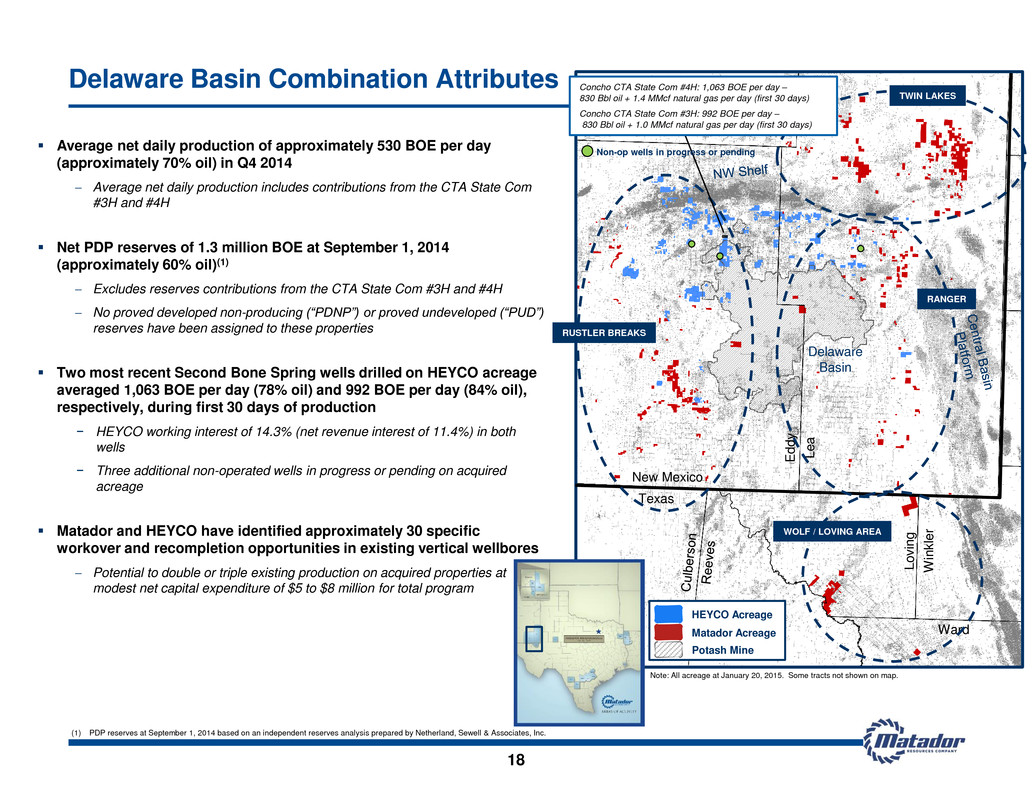

17 Delaware Basin Combination Attributes Matador adding approximately 58,600 gross (18,200 net) acres(1) located in the northern Delaware Basin in Lea and Eddy Counties, New Mexico from privately-held Harvey E. Yates Company (“HEYCO”) Strategically links Matador’s existing Ranger and Rustler Breaks prospect areas Prospective for multiple targets within the Bone Spring and Wolfcamp formations, as well as both shallower and deeper targets Only a relatively small portion of the acreage has been developed using horizontal drilling and large stimulation treatments Over 95% of added acreage consists of state and federal leases and essentially all acreage is held by production from existing wells and production units − Favorable net revenue interests, most above 80% to as high as 87.5%, enhance returns − Held-by-production status allows for flexible development Increases Matador’s total Permian Basin acreage position to approximately 151,300 gross (84,200 net) acres Increased operational scale expected to improve unit-of-production costs and operating efficiencies Matador expected to hold largest Delaware Basin acreage position among small and mid-cap publicly traded energy companies(2) Matador expected to become the second largest operator in terms of the ratio of Delaware Basin acreage to enterprise value or market capitalization among all publicly traded energy companies(2) (1) Subject to adjustment as set forth in the Agreement and Plan of Merger relating to the transaction. (2) Based on an independent market analysis prepared by BMO Capital Markets in January 2015. Small and mid-cap publicly traded energy companies defined as those companies with an enterprise value between $500 million and $3.5 billion. Companies below $100 million in market capitalization were excluded in determining the ratio of Delaware Basin acreage to market capitalization. Note: All acreage at January 20, 2015. Some tracts not shown on map. E d d y L e a L o v in g W in k le r Ward Texas New Mexico Chaves Delaware Basin Non-op wells in progress or pending Matador Acreage HEYCO Acreage Potash Mine WOLF / LOVING AREA RANGER RUSTLER BREAKS TWIN LAKES Concho CTA State Com #4H: 1,063 BOE per day – 830 Bbl oil + 1.4 MMcf natural gas per day (first 30 days) Concho CTA State Com #3H: 992 BOE per day – 830 Bbl oil + 1.0 MMcf natural gas per day (first 30 days)

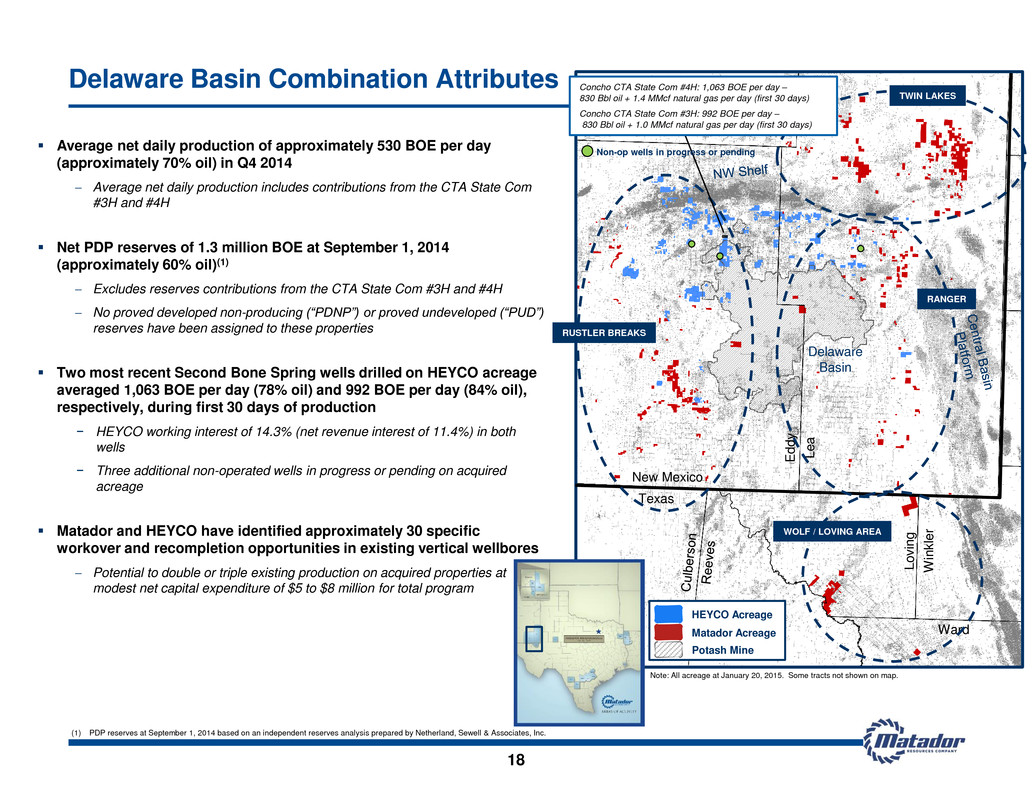

18 Delaware Basin Combination Attributes Average net daily production of approximately 530 BOE per day (approximately 70% oil) in Q4 2014 Average net daily production includes contributions from the CTA State Com #3H and #4H Net PDP reserves of 1.3 million BOE at September 1, 2014 (approximately 60% oil)(1) Excludes reserves contributions from the CTA State Com #3H and #4H No proved developed non-producing (“PDNP”) or proved undeveloped (“PUD”) reserves have been assigned to these properties Two most recent Second Bone Spring wells drilled on HEYCO acreage averaged 1,063 BOE per day (78% oil) and 992 BOE per day (84% oil), respectively, during first 30 days of production − HEYCO working interest of 14.3% (net revenue interest of 11.4%) in both wells − Three additional non-operated wells in progress or pending on acquired acreage Matador and HEYCO have identified approximately 30 specific workover and recompletion opportunities in existing vertical wellbores Potential to double or triple existing production on acquired properties at modest net capital expenditure of $5 to $8 million for total program (1) PDP reserves at September 1, 2014 based on an independent reserves analysis prepared by Netherland, Sewell & Associates, Inc. Note: All acreage at January 20, 2015. Some tracts not shown on map. E d d y L e a L o v in g W in k le r Ward Texas New Mexico Chaves Delaware Basin TWIN LAKES RUSTLER BREAKS RANGER WOLF / LOVING AREA Matador Acreage HEYCO Acreage Potash Mine Concho CTA State Com #4H: 1,063 BOE per day – 830 Bbl oil + 1.4 MMcf natural gas per day (first 30 days) Concho CTA State Com #3H: 992 BOE per day – 830 Bbl oil + 1.0 MMcf natural gas per day (first 30 days) Non-op wells in progress or pending

MIDSTREAM

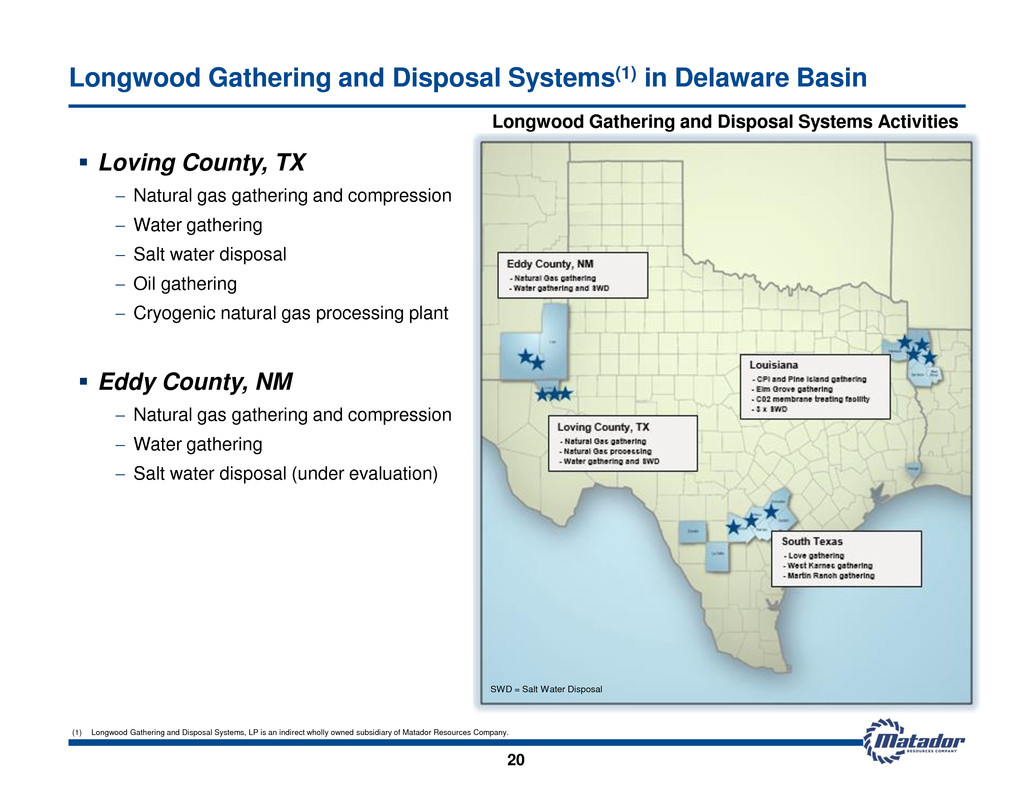

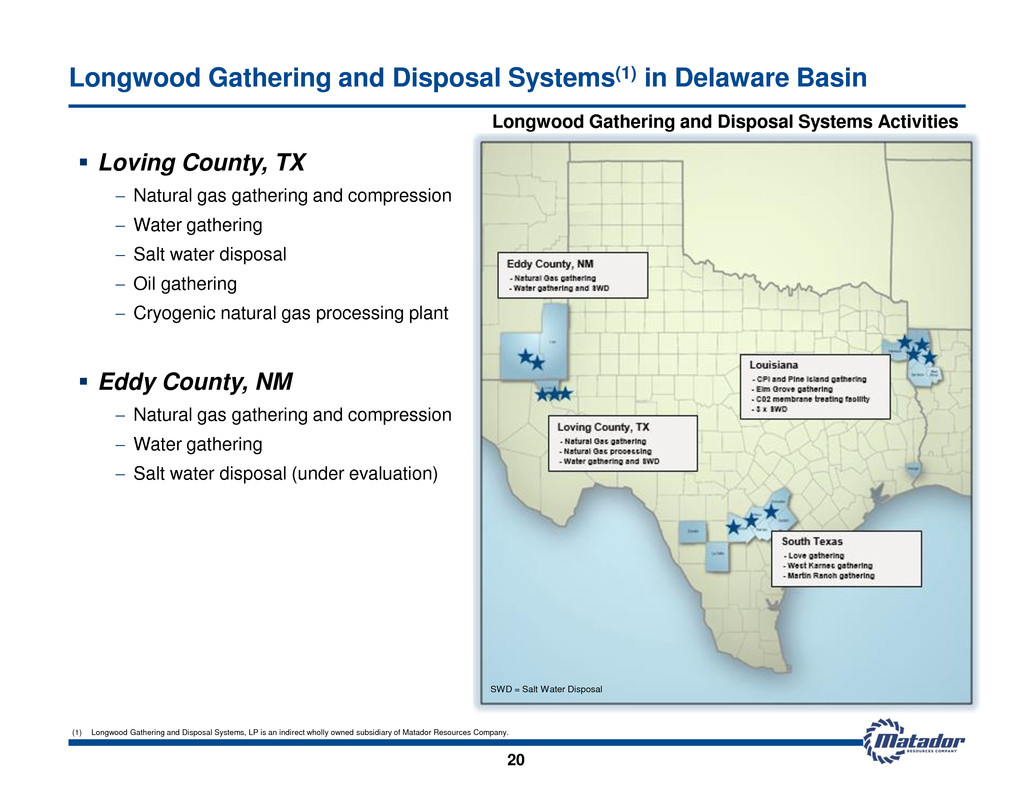

20 Longwood Gathering and Disposal Systems(1) in Delaware Basin Loving County, TX Natural gas gathering and compression Water gathering Salt water disposal Oil gathering Cryogenic natural gas processing plant Eddy County, NM Natural gas gathering and compression Water gathering Salt water disposal (under evaluation) (1) Longwood Gathering and Disposal Systems, LP is an indirect wholly owned subsidiary of Matador Resources Company. SWD = Salt Water Disposal Longwood Gathering and Disposal Systems Activities

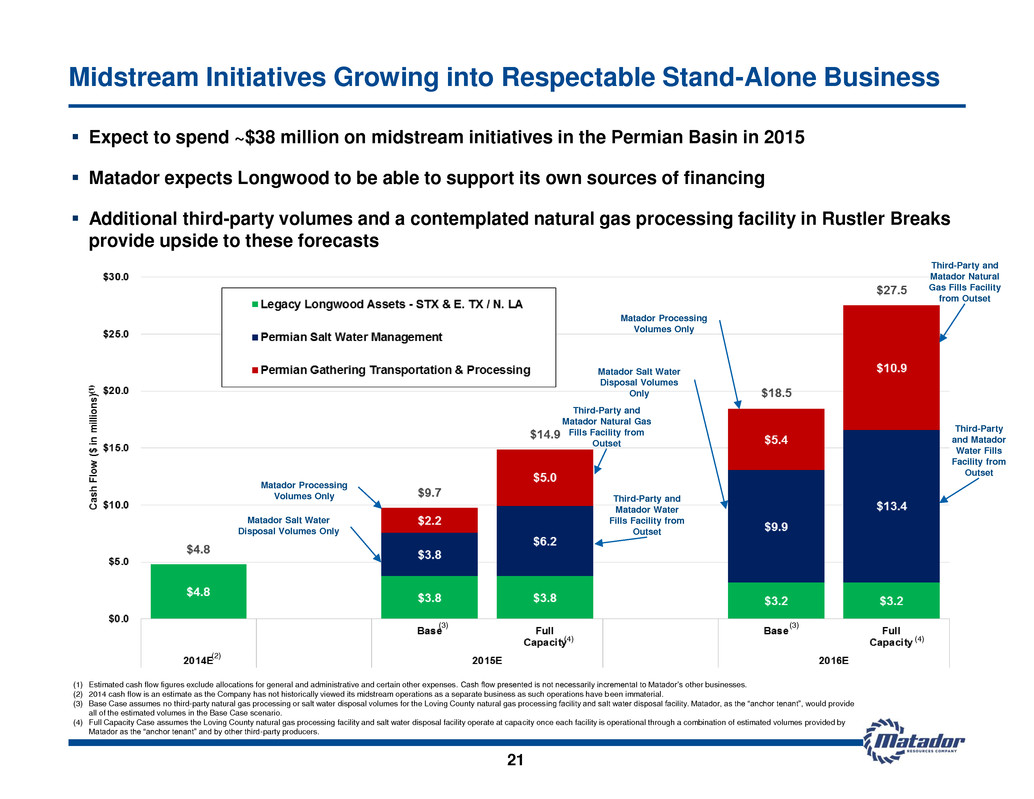

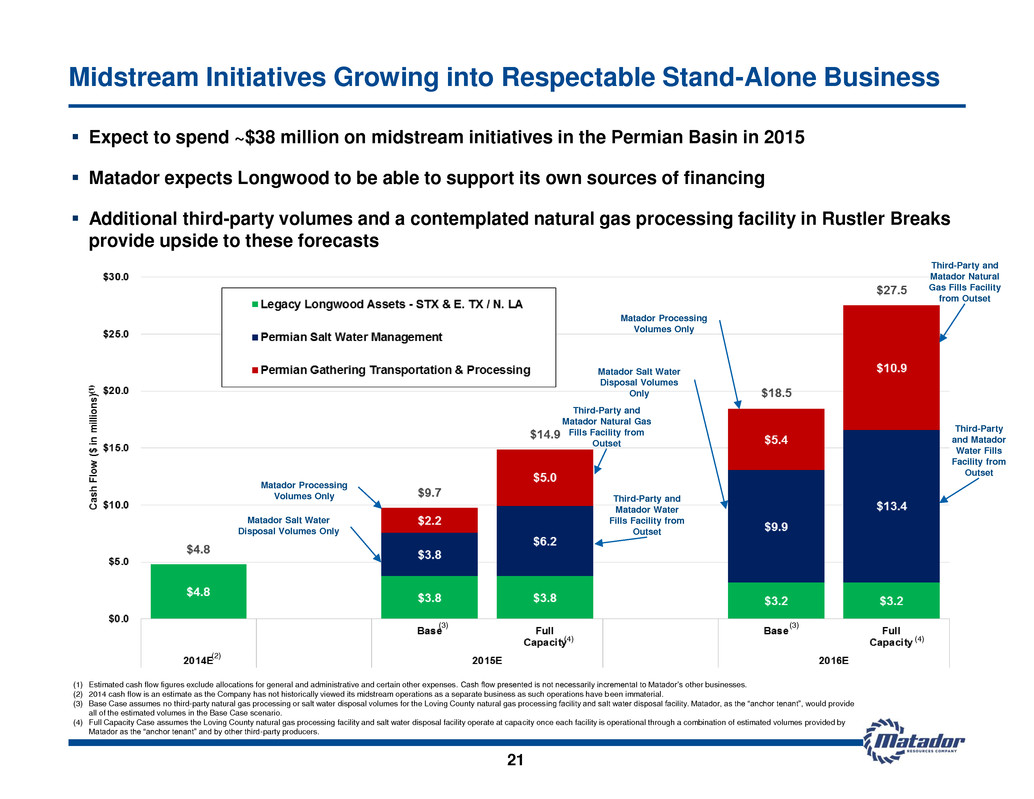

Midstream Initiatives Growing into Respectable Stand-Alone Business 21 Expect to spend ~$38 million on midstream initiatives in the Permian Basin in 2015 Matador expects Longwood to be able to support its own sources of financing Additional third-party volumes and a contemplated natural gas processing facility in Rustler Breaks provide upside to these forecasts (1) Estimated cash flow figures exclude allocations for general and administrative and certain other expenses. Cash flow presented is not necessarily incremental to Matador’s other businesses. (2) 2014 cash flow is an estimate as the Company has not historically viewed its midstream operations as a separate business as such operations have been immaterial. (3) Base Case assumes no third-party natural gas processing or salt water disposal volumes for the Loving County natural gas process ing facility and salt water disposal facility. Matador, as the “anchor tenant”, would provide all of the estimated volumes in the Base Case scenario. (4) Full Capacity Case assumes the Loving County natural gas processing facility and salt water disposal facility operate at capacity once each facility is operational through a combination of estimated volumes provided by Matador as the “anchor tenant” and by other third-party producers. (2) Matador Processing Volumes Only Third-Party and Matador Natural Gas Fills Facility from Outset Matador Salt Water Disposal Volumes Only (3) (4) (3) (4) Third-Party and Matador Water Fills Facility from Outset Matador Processing Volumes Only Third-Party and Matador Natural Gas Fills Facility from Outset Matador Salt Water Disposal Volumes Only Third-Party and Matador Water Fills Facility from Outset

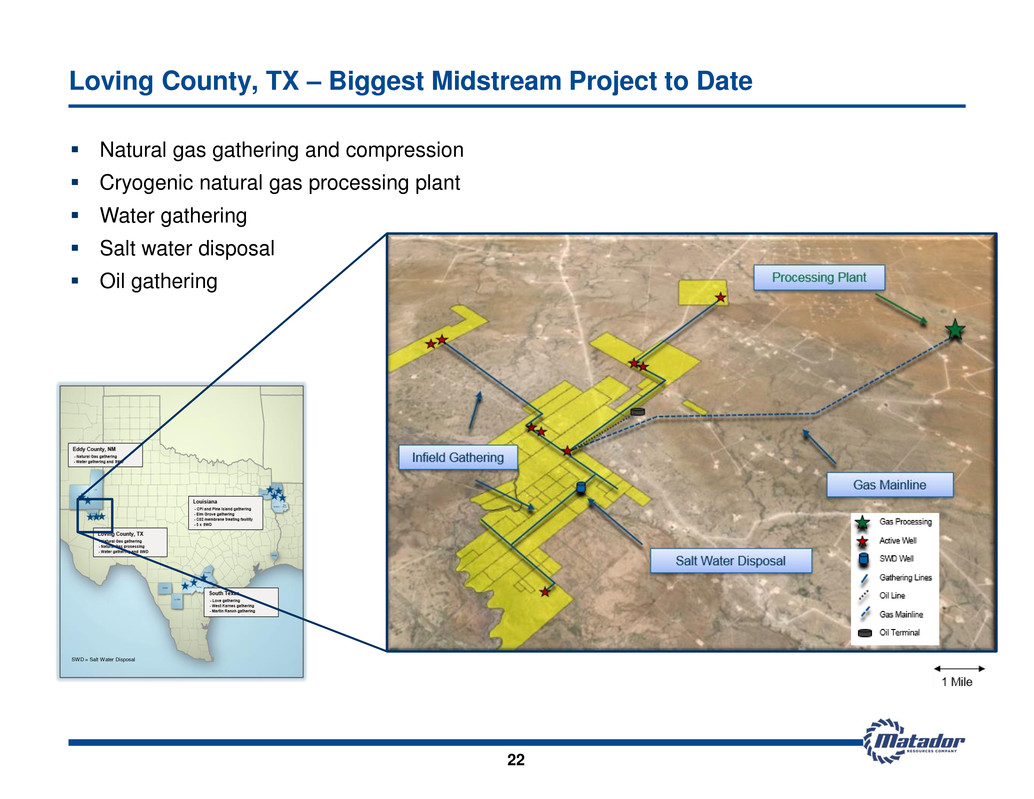

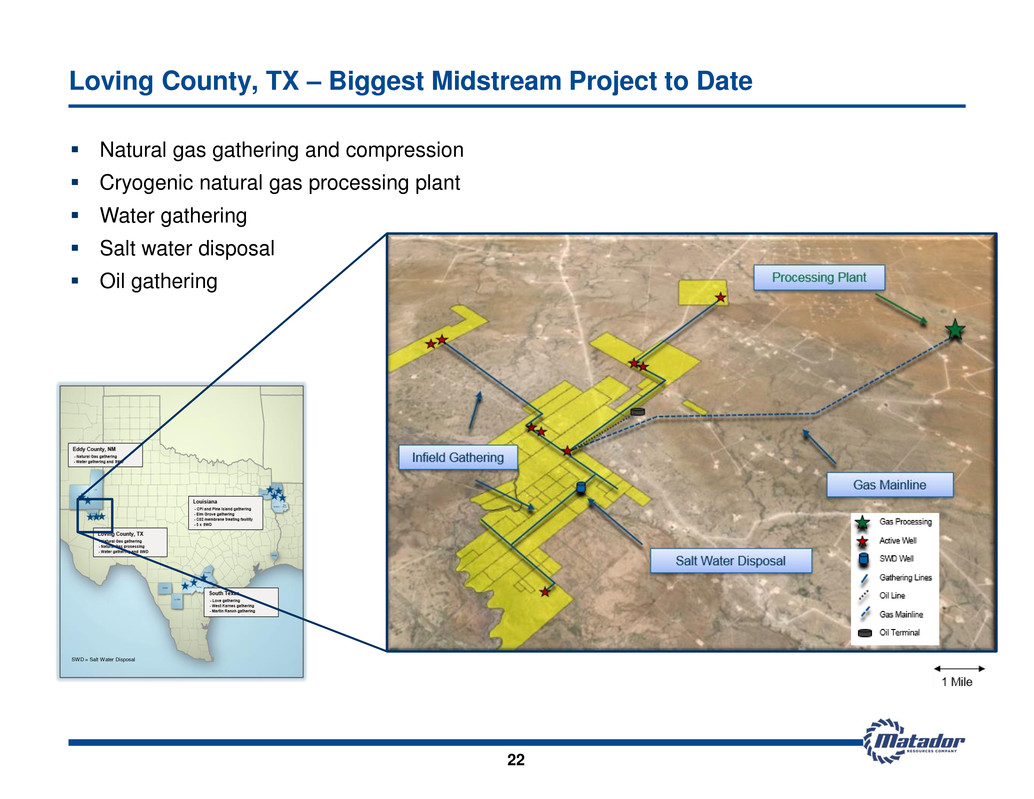

22 Loving County, TX – Biggest Midstream Project to Date Natural gas gathering and compression Cryogenic natural gas processing plant Water gathering Salt water disposal Oil gathering SWD = Salt Water Disposal

2015 Capital Investment Plan

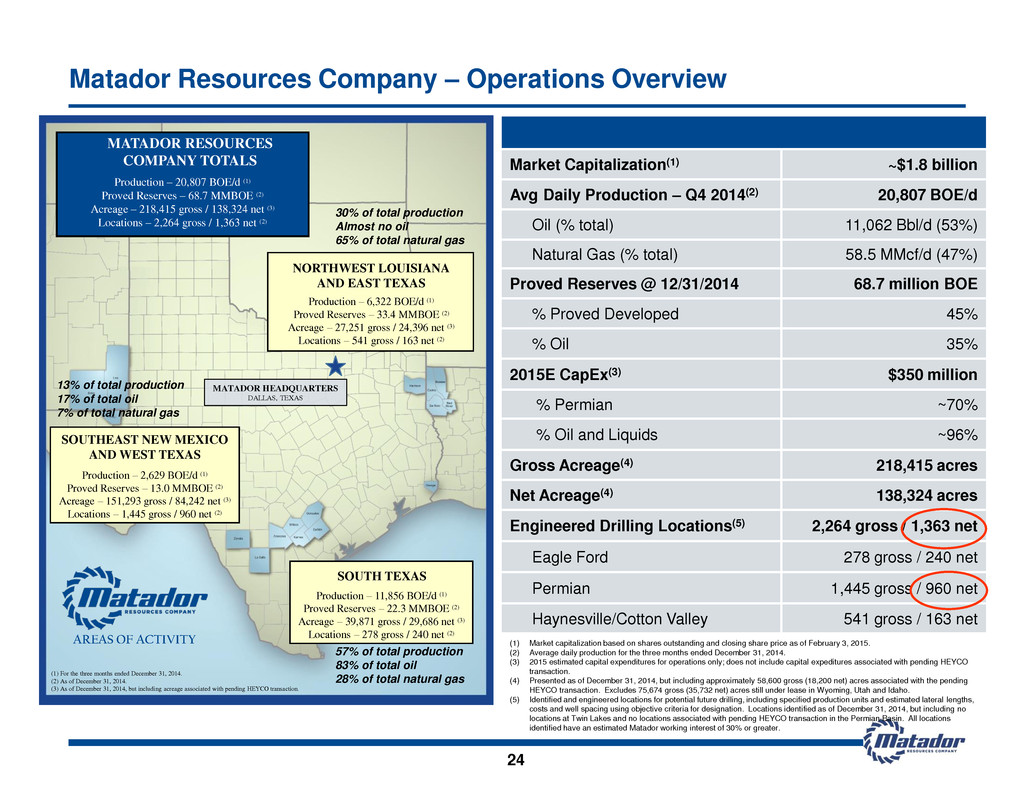

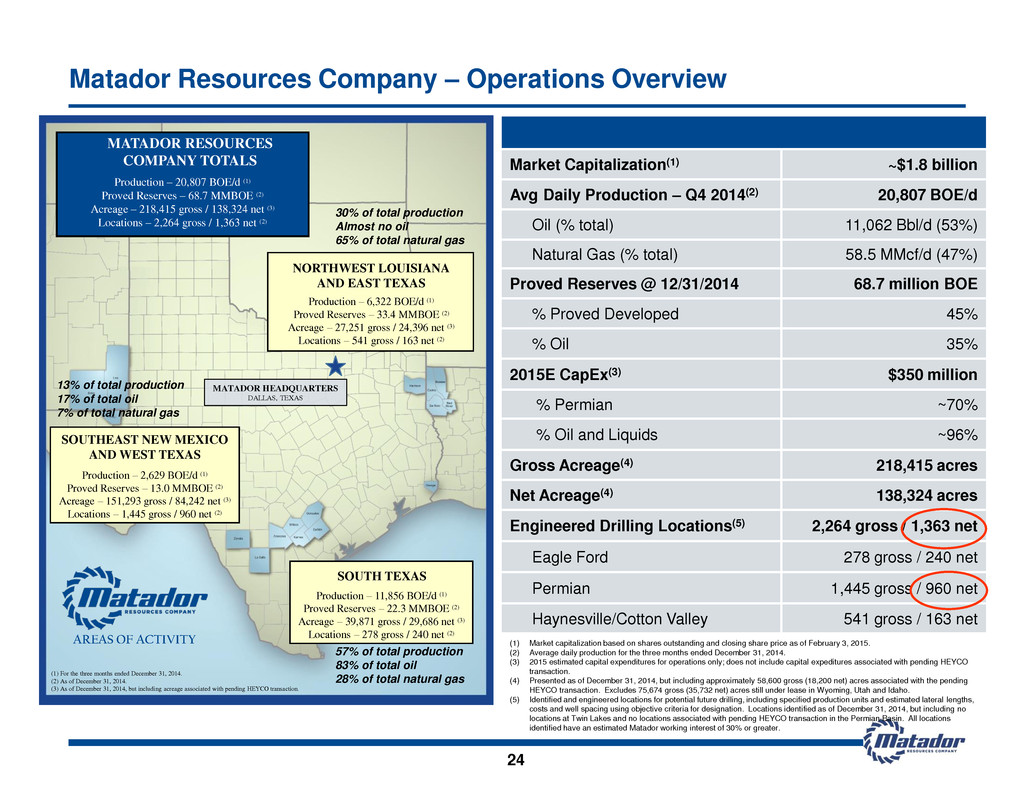

Matador Resources Company – Operations Overview Market Capitalization(1) ~$1.8 billion Avg Daily Production – Q4 2014(2) 20,807 BOE/d Oil (% total) 11,062 Bbl/d (53%) Natural Gas (% total) 58.5 MMcf/d (47%) Proved Reserves @ 12/31/2014 68.7 million BOE % Proved Developed 45% % Oil 35% 2015E CapEx(3) $350 million % Permian ~70% % Oil and Liquids ~96% Gross Acreage(4) 218,415 acres Net Acreage(4) 138,324 acres Engineered Drilling Locations(5) 2,264 gross / 1,363 net Eagle Ford 278 gross / 240 net Permian 1,445 gross / 960 net Haynesville/Cotton Valley 541 gross / 163 net (1) Market capitalization based on shares outstanding and closing share price as of February 3, 2015. (2) Average daily production for the three months ended December 31, 2014. (3) 2015 estimated capital expenditures for operations only; does not include capital expeditures associated with pending HEYCO transaction. (4) Presented as of December 31, 2014, but including approximately 58,600 gross (18,200 net) acres associated with the pending HEYCO transaction. Excludes 75,674 gross (35,732 net) acres still under lease in Wyoming, Utah and Idaho. (5) Identified and engineered locations for potential future drilling, including specified production units and estimated lateral lengths, costs and well spacing using objective criteria for designation. Locations identified as of December 31, 2014, but including no locations at Twin Lakes and no locations associated with pending HEYCO transaction in the Permian Basin. All locations identified have an estimated Matador working interest of 30% or greater. 24 SOUTHEAST NEW MEXICO AND WEST TEXAS Production – 2,629 BOE/d (1) Proved Reserves – 13.0 MMBOE (2) Acreage – 151,293 gross / 84,242 net (3) Locations – 1,445 gross / 960 net (2) NORTHWEST LOUISIANA AND EAST TEXAS Production – 6,322 BOE/d (1) Proved Reserves – 33.4 MMBOE (2) Acreage – 27,251 gross / 24,396 net (3) Locations – 541 gross / 163 net (2) SOUTH TEXAS Production – 11,856 BOE/d (1) Proved Reserves – 22.3 MMBOE (2) Acreage – 39,871 gross / 29,686 net (3) Locations – 278 gross / 240 net (2) MATADOR RESOURCES COMPANY TOTALS Production – 20,807 BOE/d (1) Proved Reserves – 68.7 MMBOE (2) Acreage – 218,415 gross / 138,324 net (3) Locations – 2,264 gross / 1,363 net (2) (1) For the three months e ded December 31, 2014. (2) As of December 31, 2014. (3) As of December 31, 2014, but including acreage associated with pending HEYCO transaction. AREAS OF ACTIVITY MATADOR HEADQUARTERS DALLAS, TEXAS 30% of total production Almost no oil 65% of total natural gas 57% of total production 83% of total oil 28% of total natural gas 13% of total production 17% of total oil 7% of total natural gas

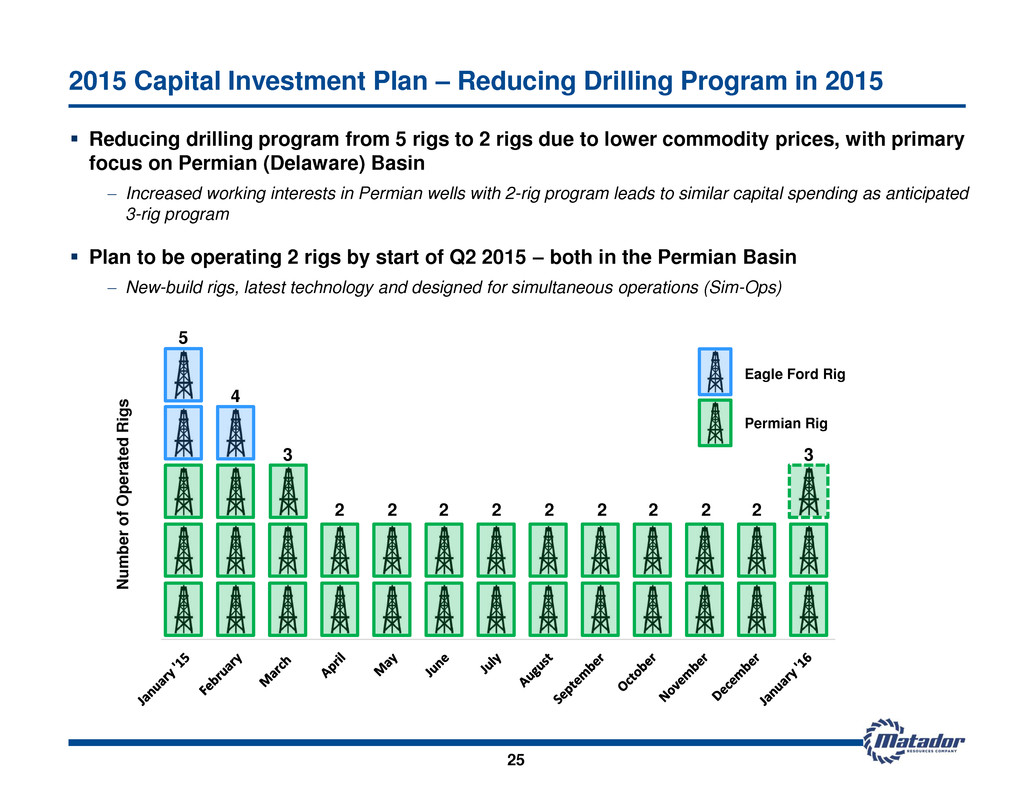

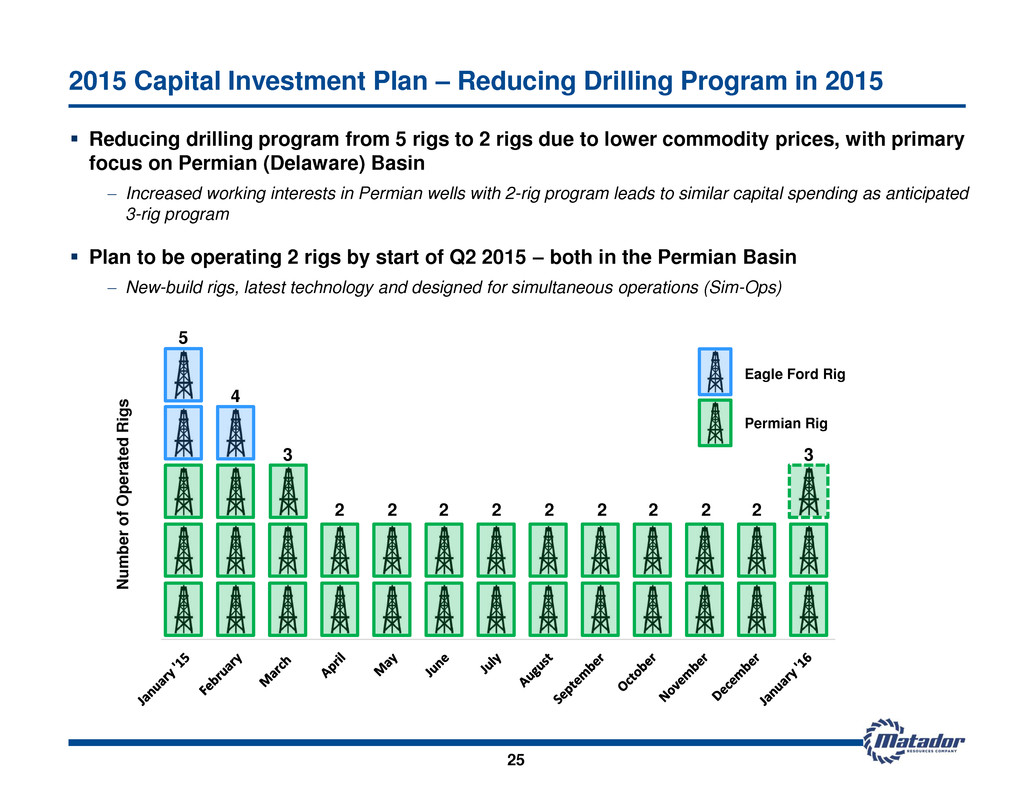

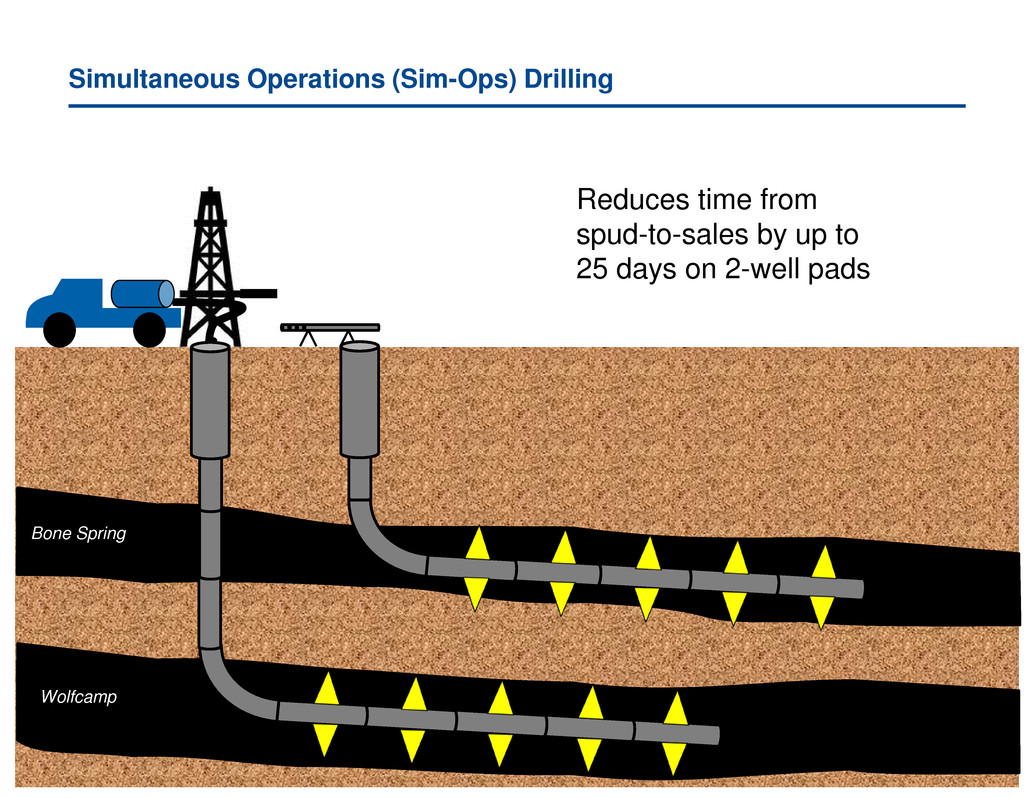

25 2015 Capital Investment Plan – Reducing Drilling Program in 2015 Reducing drilling program from 5 rigs to 2 rigs due to lower commodity prices, with primary focus on Permian (Delaware) Basin Increased working interests in Permian wells with 2-rig program leads to similar capital spending as anticipated 3-rig program Plan to be operating 2 rigs by start of Q2 2015 – both in the Permian Basin New-build rigs, latest technology and designed for simultaneous operations (Sim-Ops) # o f RIg s Eagle Ford Rig Permian Rig 5 4 3 2 2 2 2 2 2 2 2 2 3 N u m b e r o f O per a ted Rig s

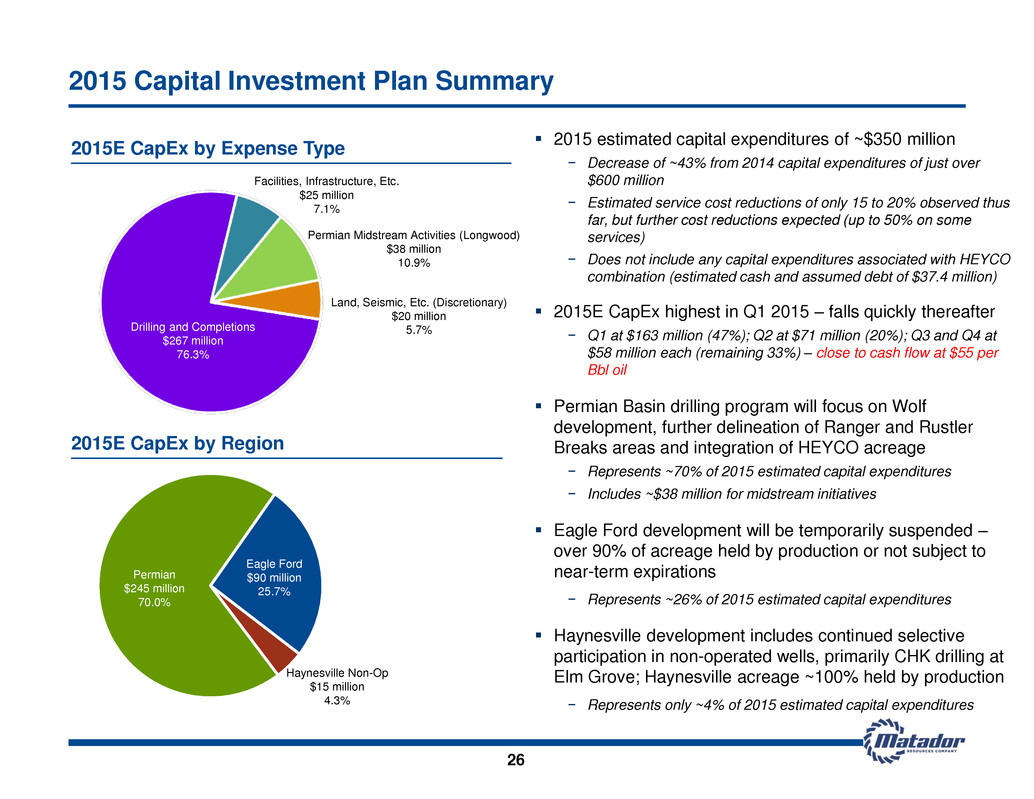

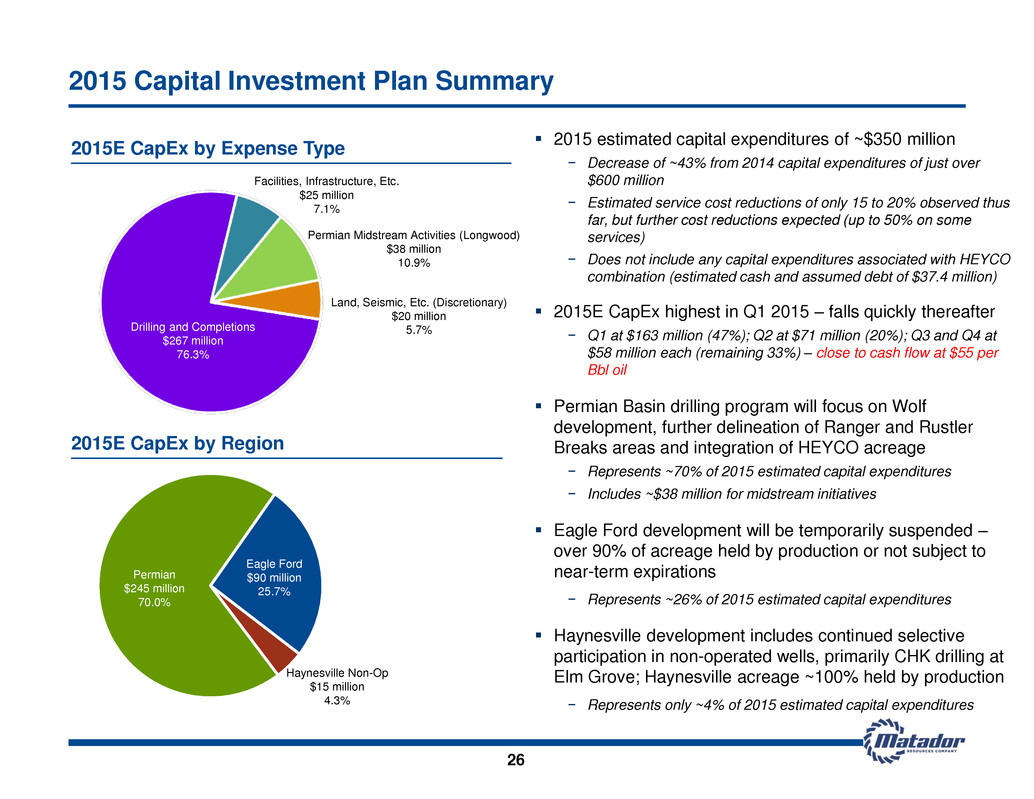

2015 estimated capital expenditures of ~$350 million − Decrease of ~43% from 2014 capital expenditures of just over $600 million − Estimated service cost reductions of only 15 to 20% observed thus far, but further cost reductions expected (up to 50% on some services) − Does not include any capital expenditures associated with HEYCO combination (estimated cash and assumed debt of $37.4 million) 2015E CapEx highest in Q1 2015 – falls quickly thereafter − Q1 at $163 million (47%); Q2 at $71 million (20%); Q3 and Q4 at $58 million each (remaining 33%) – close to cash flow at $55 per Bbl oil Permian Basin drilling program will focus on Wolf development, further delineation of Ranger and Rustler Breaks areas and integration of HEYCO acreage − Represents ~70% of 2015 estimated capital expenditures − Includes ~$38 million for midstream initiatives Eagle Ford development will be temporarily suspended – over 90% of acreage held by production or not subject to near-term expirations − Represents ~26% of 2015 estimated capital expenditures Haynesville development includes continued selective participation in non-operated wells, primarily CHK drilling at Elm Grove; Haynesville acreage ~100% held by production − Represents only ~4% of 2015 estimated capital expenditures 2015 Capital Investment Plan Summary 26 Land, Seismic, Etc. (Discretionary) $20 million 5.7% Facilities, Infrastructure, Etc. $25 million 7.1% Drilling and Completions $267 million 76.3% Permian Midstream Activities (Longwood) $38 million 10.9% 2015E CapEx by Expense Type Permian $230 million 65.7% Eagle Ford $85 million 24.3% 2015E CapEx by Region Haynesville Non-Op $15 million 4.3% Permian $245 million 70.0% Eagle Ford $90 million 25.7%

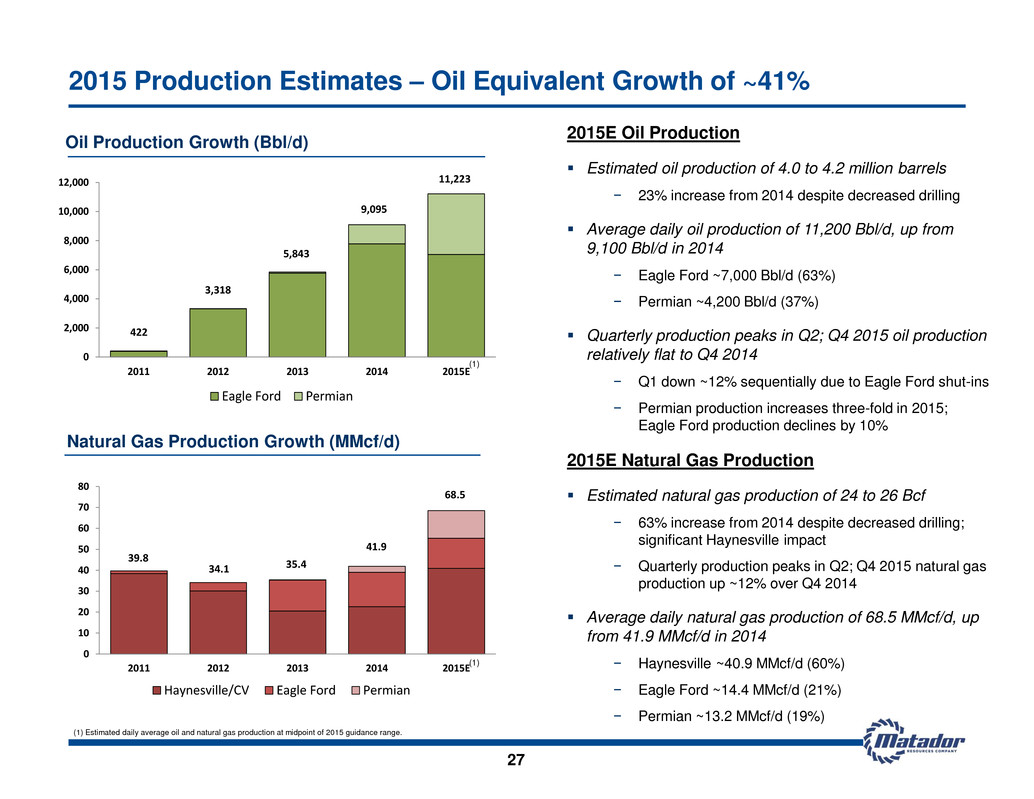

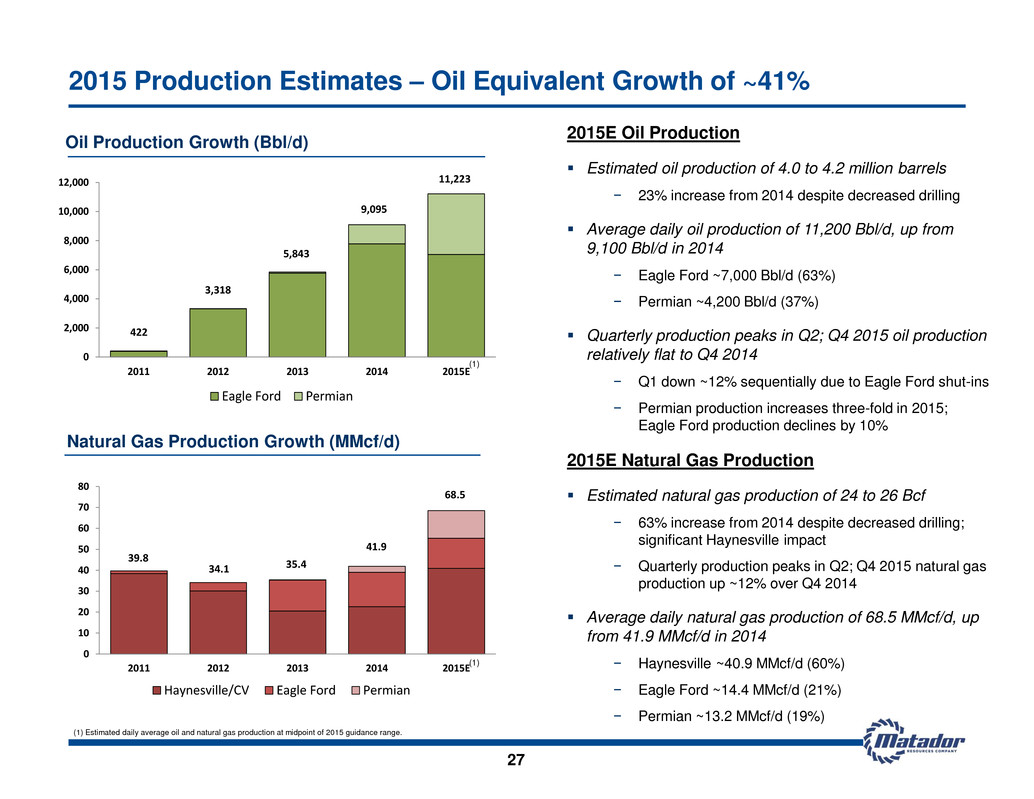

2015E Oil Production Estimated oil production of 4.0 to 4.2 million barrels − 23% increase from 2014 despite decreased drilling Average daily oil production of 11,200 Bbl/d, up from 9,100 Bbl/d in 2014 − Eagle Ford ~7,000 Bbl/d (63%) − Permian ~4,200 Bbl/d (37%) Quarterly production peaks in Q2; Q4 2015 oil production relatively flat to Q4 2014 − Q1 down ~12% sequentially due to Eagle Ford shut-ins − Permian production increases three-fold in 2015; Eagle Ford production declines by 10% 2015E Natural Gas Production Estimated natural gas production of 24 to 26 Bcf − 63% increase from 2014 despite decreased drilling; significant Haynesville impact − Quarterly production peaks in Q2; Q4 2015 natural gas production up ~12% over Q4 2014 Average daily natural gas production of 68.5 MMcf/d, up from 41.9 MMcf/d in 2014 − Haynesville ~40.9 MMcf/d (60%) − Eagle Ford ~14.4 MMcf/d (21%) − Permian ~13.2 MMcf/d (19%) 2015 Production Estimates – Oil Equivalent Growth of ~41% (1) Estimated daily average oil and natural gas production at midpoint of 2015 guidance range. 27 Oil Production Growth (Bbl/d) Natural Gas Production Growth (MMcf/d) 0 10 20 30 40 50 60 70 80 2011 2012 2013 2014 2015E Haynesville/CV Eagle Ford Permian 39.8 34.1 35.4 41.9 68.5 (1) 0 2,00 4,000 6,000 8,000 10,000 12,000 2011 2012 2013 2014 2015E Eagle Ford Permian 422 3,318 5,843 9,095 11,223 (1)

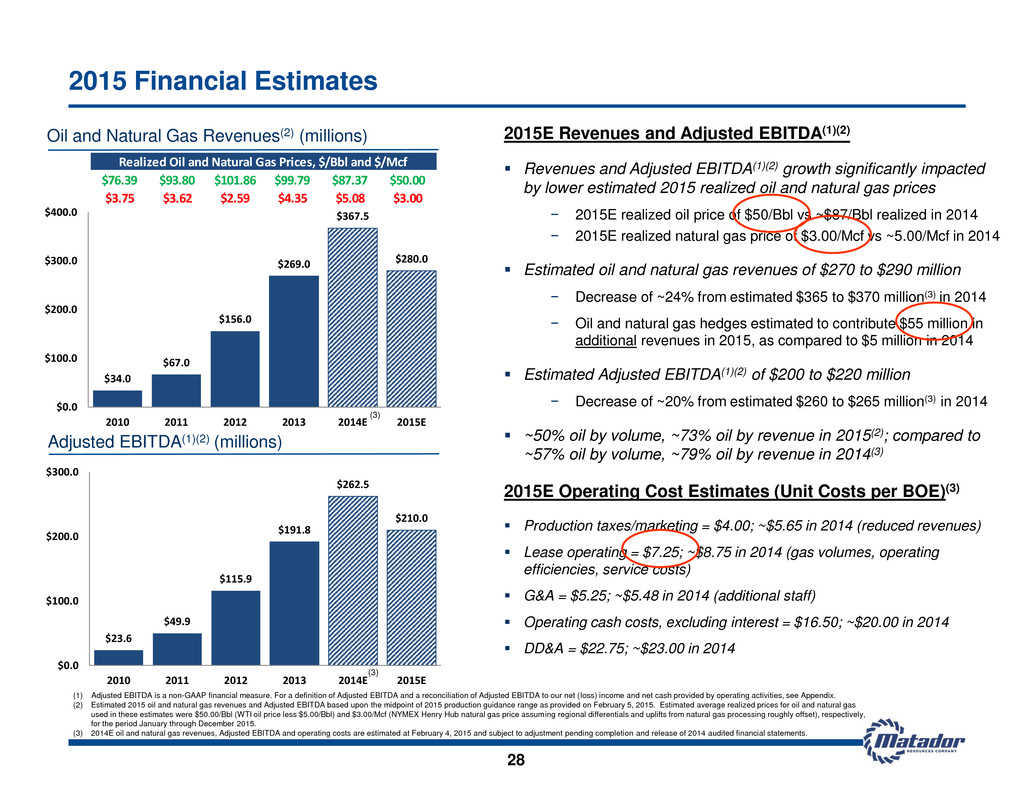

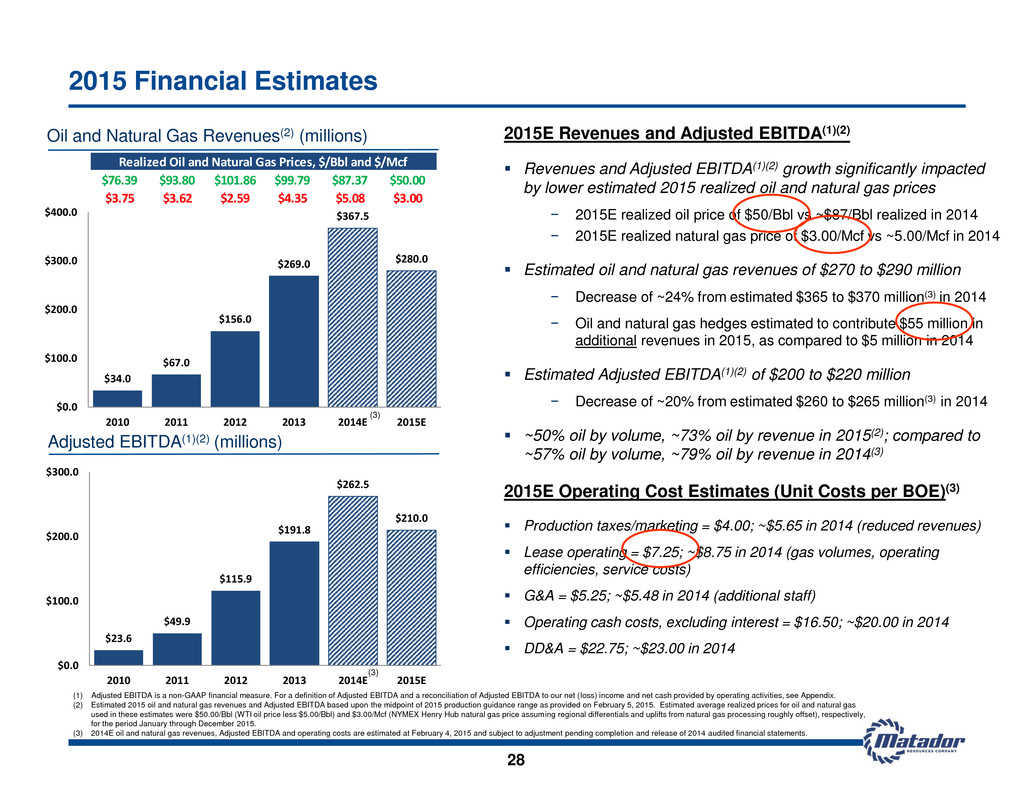

2015E Revenues and Adjusted EBITDA(1)(2) Revenues and Adjusted EBITDA(1)(2) growth significantly impacted by lower estimated 2015 realized oil and natural gas prices − 2015E realized oil price of $50/Bbl vs ~$87/Bbl realized in 2014 − 2015E realized natural gas price of $3.00/Mcf vs ~5.00/Mcf in 2014 Estimated oil and natural gas revenues of $270 to $290 million − Decrease of ~24% from estimated $365 to $370 million(3) in 2014 − Oil and natural gas hedges estimated to contribute $55 million in additional revenues in 2015, as compared to $5 million in 2014 Estimated Adjusted EBITDA(1)(2) of $200 to $220 million − Decrease of ~20% from estimated $260 to $265 million(3) in 2014 ~50% oil by volume, ~73% oil by revenue in 2015(2); compared to ~57% oil by volume, ~79% oil by revenue in 2014(3) 2015E Operating Cost Estimates (Unit Costs per BOE)(3) Production taxes/marketing = $4.00; ~$5.65 in 2014 (reduced revenues) Lease operating = $7.25; ~$8.75 in 2014 (gas volumes, operating efficiencies, service costs) G&A = $5.25; ~$5.48 in 2014 (additional staff) Operating cash costs, excluding interest = $16.50; ~$20.00 in 2014 DD&A = $22.75; ~$23.00 in 2014 2015 Financial Estimates (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net (loss) income and net cash provided by operating activities, see Appendix. (2) Estimated 2015 oil and natural gas revenues and Adjusted EBITDA based upon the midpoint of 2015 production guidance range as provided on February 5, 2015. Estimated average realized prices for oil and natural gas used in these estimates were $50.00/Bbl (WTI oil price less $5.00/Bbl) and $3.00/Mcf (NYMEX Henry Hub natural gas price assuming regional differentials and uplifts from natural gas processing roughly offset), respectively, for the period January through December 2015. (3) 2014E oil and natural gas revenues, Adjusted EBITDA and operating costs are estimated at February 4, 2015 and subject to adjustment pending completion and release of 2014 audited financial statements. 28 Oil and Natural Gas Revenues(2) (millions) Adjusted EBITDA(1)(2) (millions) $34.0 $67.0 $156.0 $269.0 $367.5 $280.0 $0.0 $100.0 $200.0 $300.0 $400.0 2010 2011 2012 2013 2014E 2015E $23.6 $49.9 $115.9 $191.8 $262.5 $210.0 $0.0 $100.0 $200.0 $300.0 2010 2011 2012 2013 2014E 2015E $76.39 $93.80 $101.86 $99.79 $87.37 $50.00 $3.75 $3.62 $2.59 $4.35 $5.08 $3.00 Realized Oil and Nat ral Gas Prices, $/Bbl and $/Mcf (3) (3)

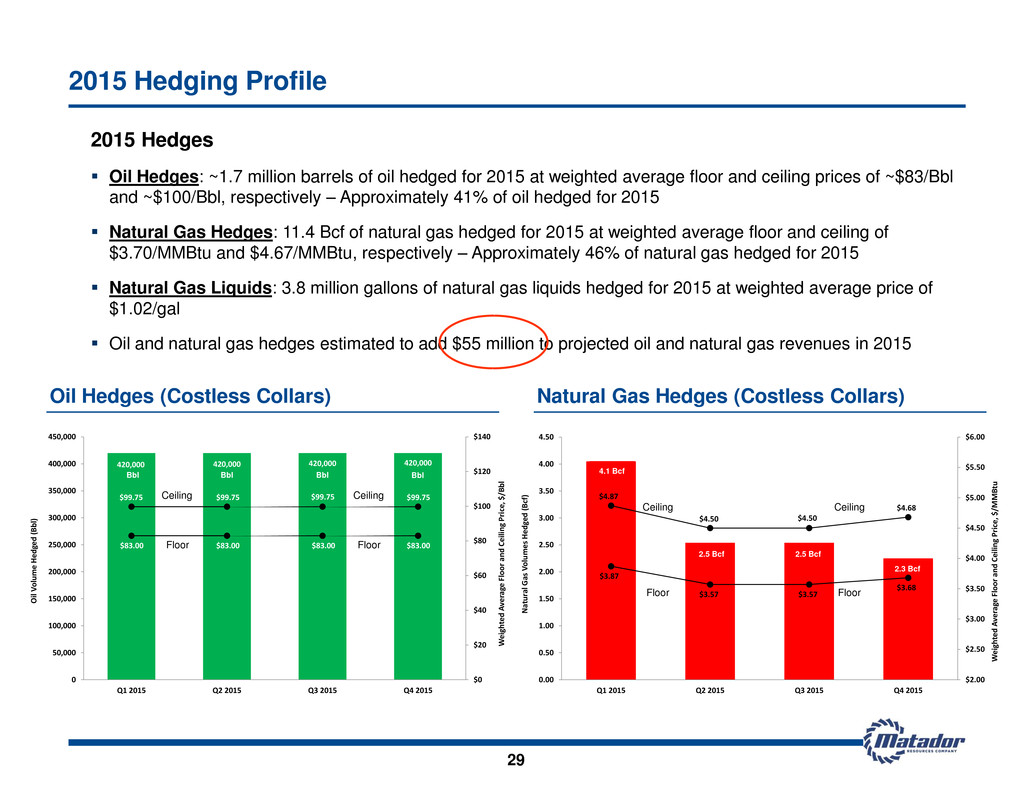

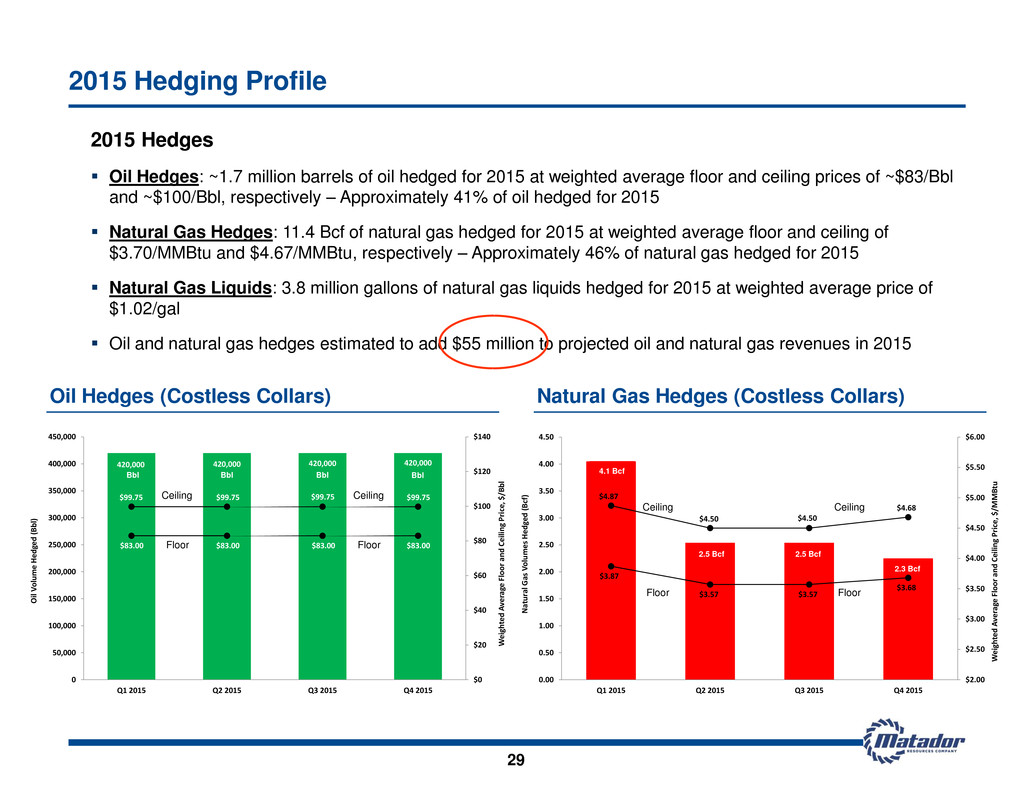

2015 Hedging Profile 2015 Hedges Oil Hedges: ~1.7 million barrels of oil hedged for 2015 at weighted average floor and ceiling prices of ~$83/Bbl and ~$100/Bbl, respectively – Approximately 41% of oil hedged for 2015 Natural Gas Hedges: 11.4 Bcf of natural gas hedged for 2015 at weighted average floor and ceiling of $3.70/MMBtu and $4.67/MMBtu, respectively – Approximately 46% of natural gas hedged for 2015 Natural Gas Liquids: 3.8 million gallons of natural gas liquids hedged for 2015 at weighted average price of $1.02/gal Oil and natural gas hedges estimated to add $55 million to projected oil and natural gas revenues in 2015 29 Oil Hedges (Costless Collars) Natural Gas Hedges (Costless Collars) 420,000 420,000 420,000 420,000 $99.75 $99.75 $99.75 $99.75 $83.00 $83.00 $83.00 $83.00 $0 $20 $40 $60 $80 $100 $120 $140 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 Q1 2015 Q2 2015 Q3 2015 Q4 2015 W eig ht ed Av er ag e F loo r a nd Ce iling Pr ice, $/ Bb l Oil Vol ume He dg ed (B bl) Ceiling Ceiling Floor Floor Bbl Bbl Bbl Bbl 4.1 2.5 2.5 2.3 $4.87 $4.50 $4.50 $4.68 $3.87 $3.57 $3.57 $3.68 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 Q1 2015 Q2 2015 Q3 2015 Q4 2015 W eig ht ed Av er ag e F loo r a nd Ce iling Pr ice, $/ M M Bt u Na tu ra l G as Vol umes He dg ed (B cf) Ceiling Ceiling Floor Floor 4.1 Bcf 2.5 Bcf 2.5 Bcf 2.3 Bcf

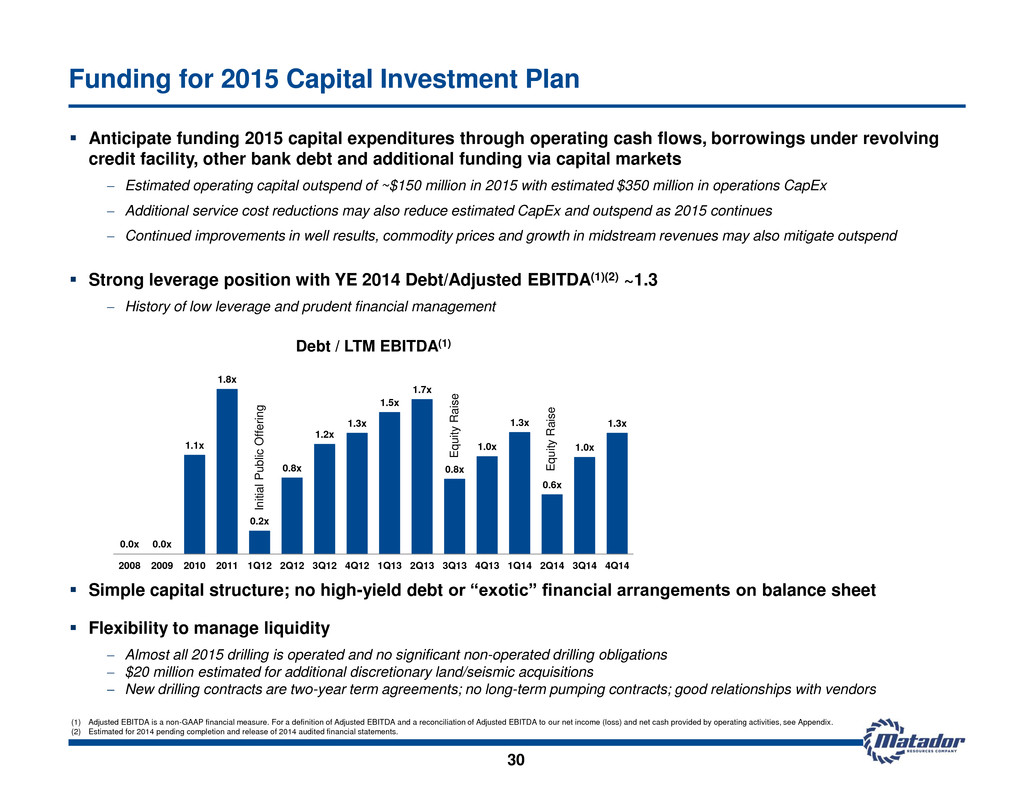

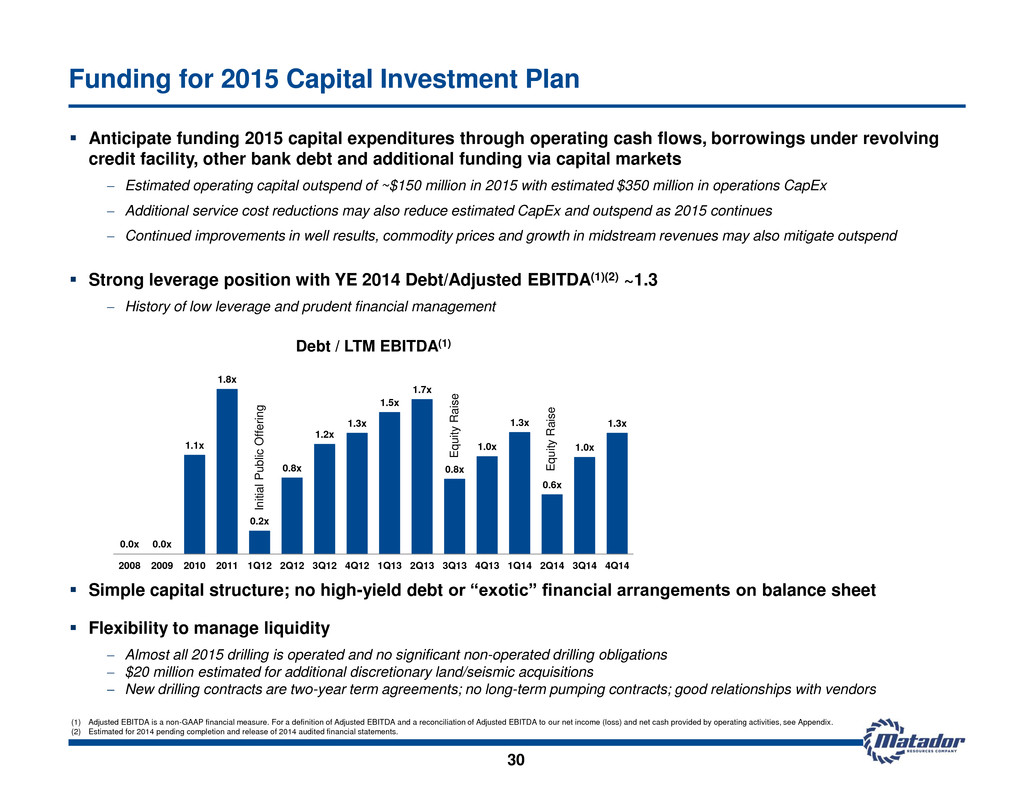

Funding for 2015 Capital Investment Plan 30 Anticipate funding 2015 capital expenditures through operating cash flows, borrowings under revolving credit facility, other bank debt and additional funding via capital markets Estimated operating capital outspend of ~$150 million in 2015 with estimated $350 million in operations CapEx Additional service cost reductions may also reduce estimated CapEx and outspend as 2015 continues Continued improvements in well results, commodity prices and growth in midstream revenues may also mitigate outspend Strong leverage position with YE 2014 Debt/Adjusted EBITDA(1)(2) ~1.3 History of low leverage and prudent financial management Simple capital structure; no high-yield debt or “exotic” financial arrangements on balance sheet Flexibility to manage liquidity Almost all 2015 drilling is operated and no significant non-operated drilling obligations $20 million estimated for additional discretionary land/seismic acquisitions New drilling contracts are two-year term agreements; no long-term pumping contracts; good relationships with vendors (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (2) Estimated for 2014 pending completion and release of 2014 audited financial statements. 0.0x 0.0x 1.1x 1.8x 0.2x 0.8x 1.2x 1.3x 1.5x 1.7x 0.8x 1.0x 1.3x 0.6x 1.0x 1.3x 2008 2009 2010 2011 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Debt / LTM EBITDA(1) In it ial P u b lic O ff e rin g E q u it y R a is e E q u it y R a is e

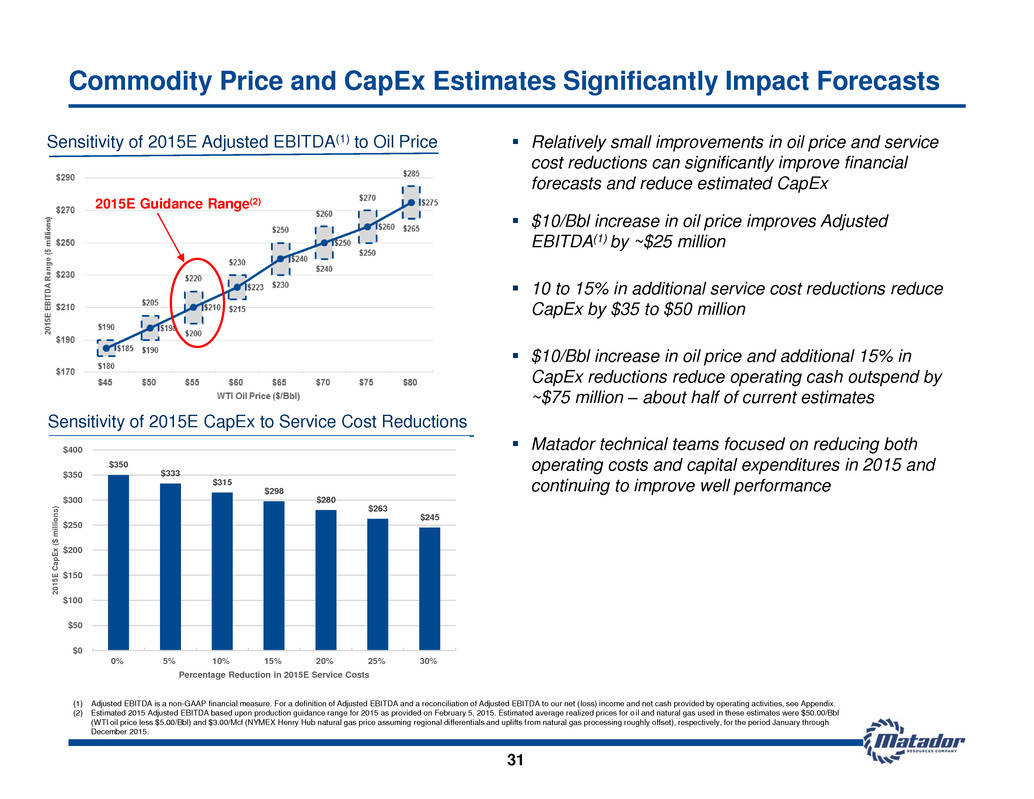

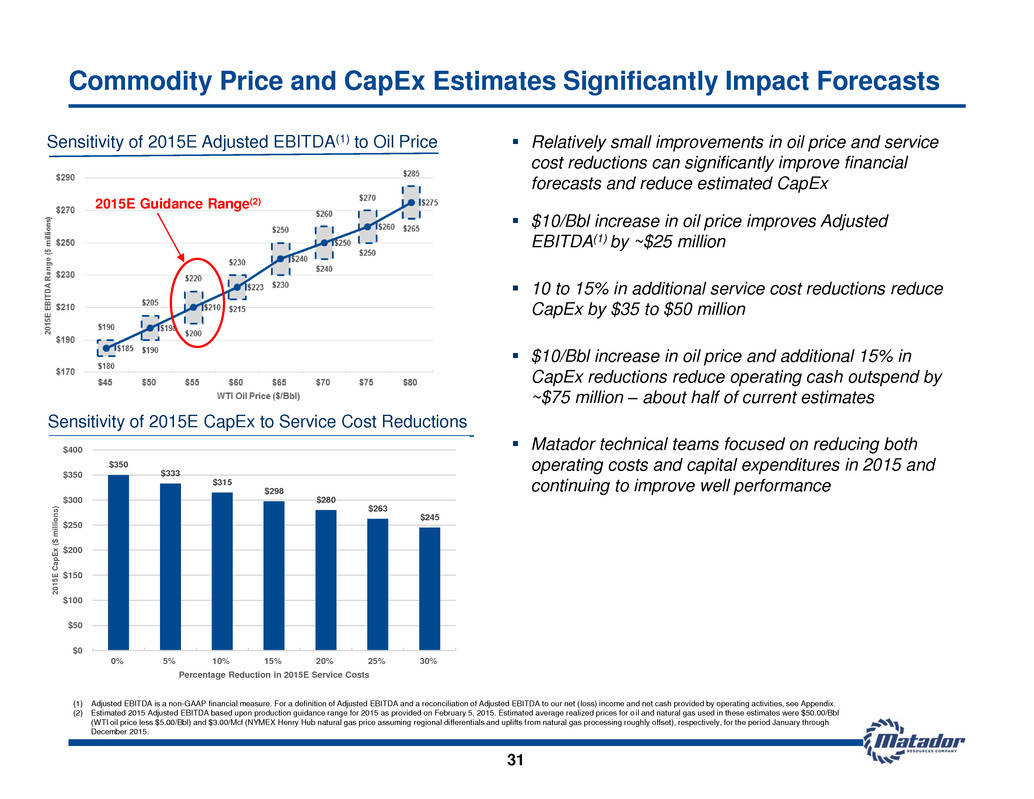

Relatively small improvements in oil price and service cost reductions can significantly improve financial forecasts and reduce estimated CapEx $10/Bbl increase in oil price improves Adjusted EBITDA(1) by ~$25 million 10 to 15% in additional service cost reductions reduce CapEx by $35 to $50 million $10/Bbl increase in oil price and additional 15% in CapEx reductions reduce operating cash outspend by ~$75 million – about half of current estimates Matador technical teams focused on reducing both operating costs and capital expenditures in 2015 and continuing to improve well performance Commodity Price and CapEx Estimates Significantly Impact Forecasts (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net (loss) income and net cash provided by operating activities, see Appendix. (2) Estimated 2015 Adjusted EBITDA based upon production guidance range for 2015 as provided on February 5, 2015. Estimated average realized prices for oil and natural gas used in these estimates were $50.00/Bbl (WTI oil price less $5.00/Bbl) and $3.00/Mcf (NYMEX Henry Hub natural gas price assuming regional differentials and uplifts from natural gas processing roughly offset), respectively, for the period January through December 2015. 31 2015E Guidance Range(2) Sensitivity of 2015E CapEx to Service Cost Reductions Sensitivity of 2015E Adjusted EBITDA(1) to Oil Price $350 $333 $315 $298 $280 $263 $245 $0 $50 $100 $150 $200 $250 $300 $350 $400 0% 5% 10% 15% 20% 25% 30% 20 15 E Ca pE x ($ m ill io ns ) Percentage Reduction in 2015E Service Costs

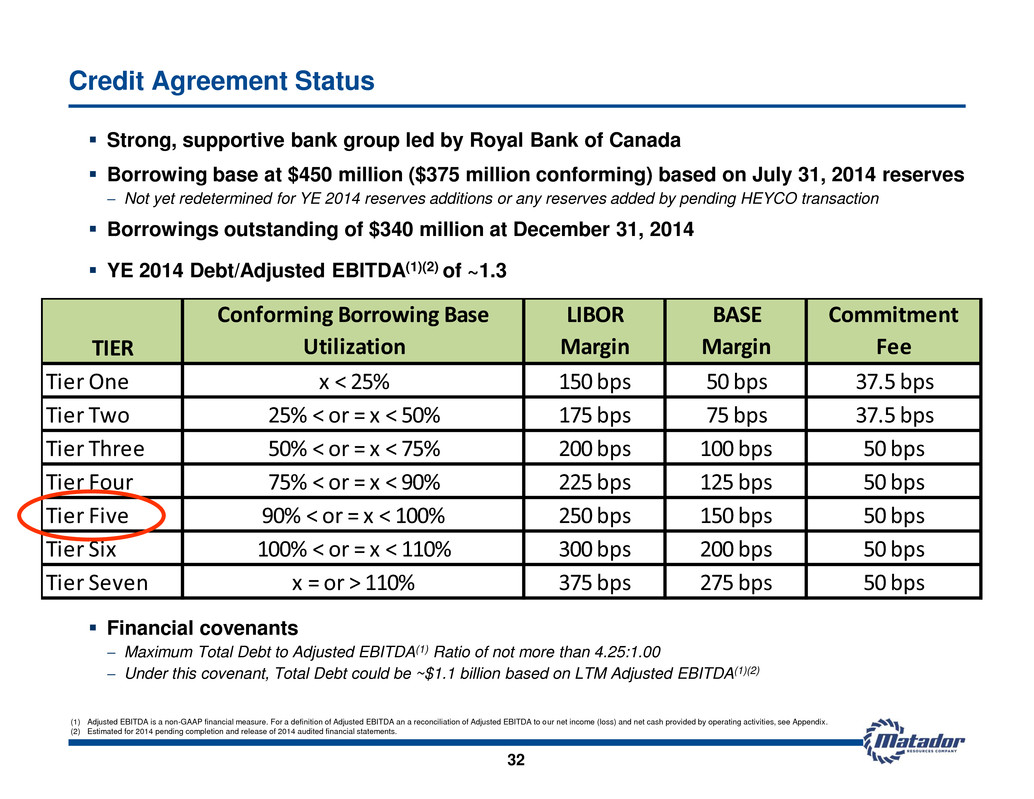

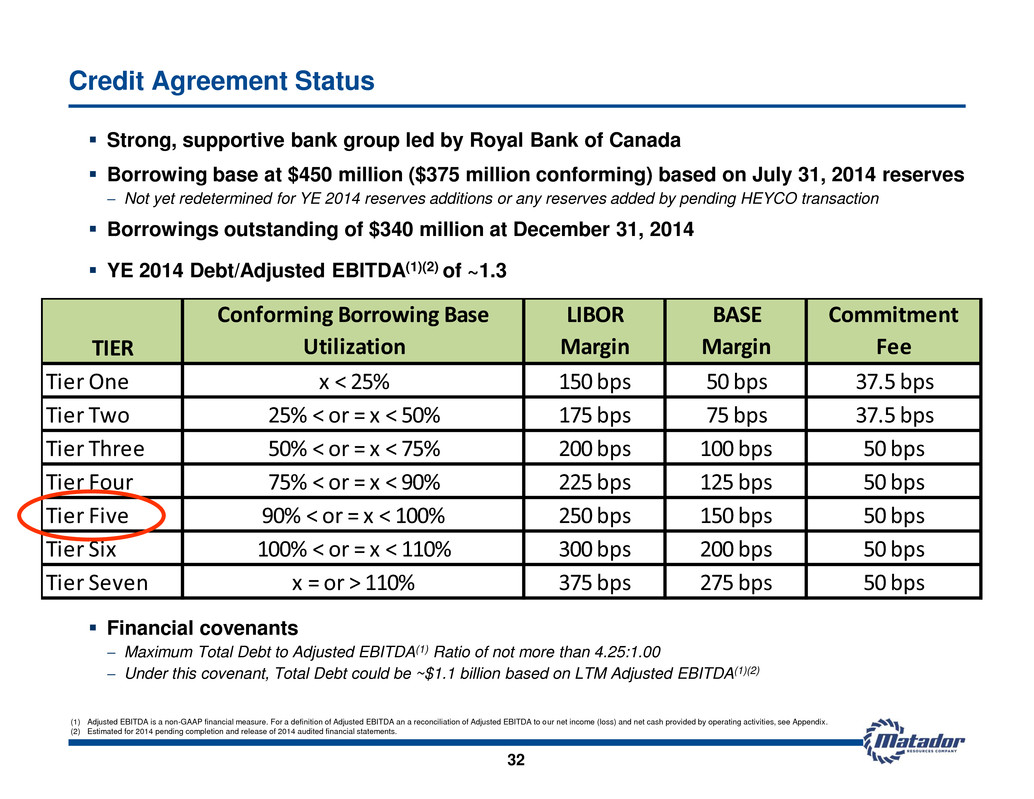

Strong, supportive bank group led by Royal Bank of Canada Borrowing base at $450 million ($375 million conforming) based on July 31, 2014 reserves Not yet redetermined for YE 2014 reserves additions or any reserves added by pending HEYCO transaction Borrowings outstanding of $340 million at December 31, 2014 YE 2014 Debt/Adjusted EBITDA(1)(2) of ~1.3 Financial covenants Maximum Total Debt to Adjusted EBITDA(1) Ratio of not more than 4.25:1.00 Under this covenant, Total Debt could be ~$1.1 billion based on LTM Adjusted EBITDA(1)(2) 32 Credit Agreement Status (1) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA an a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. (2) Estimated for 2014 pending completion and release of 2014 audited financial statements. TIER Conforming Borrowing Base Utilization LIBOR Margin BASE Margin Commitment Fee Ti r One x < 25% 150 bps 50 bps 37.5 bps Tier Two 25% < or = x < 50% 175 bps 75 bps 37.5 bps Tier Three 50% < or = x < 75% 200 bps 100 bps 50 bps Tier Four 75% < or = x < 90% 225 bps 125 bps 50 bps Tier Five 90% < or = x < 100% 250 bps 150 bps 50 bps Tier Six 100% < or = x < 110% 300 bps 200 bps 50 bps Tier Seven x = or > 110% 375 bps 275 bps 50 bps

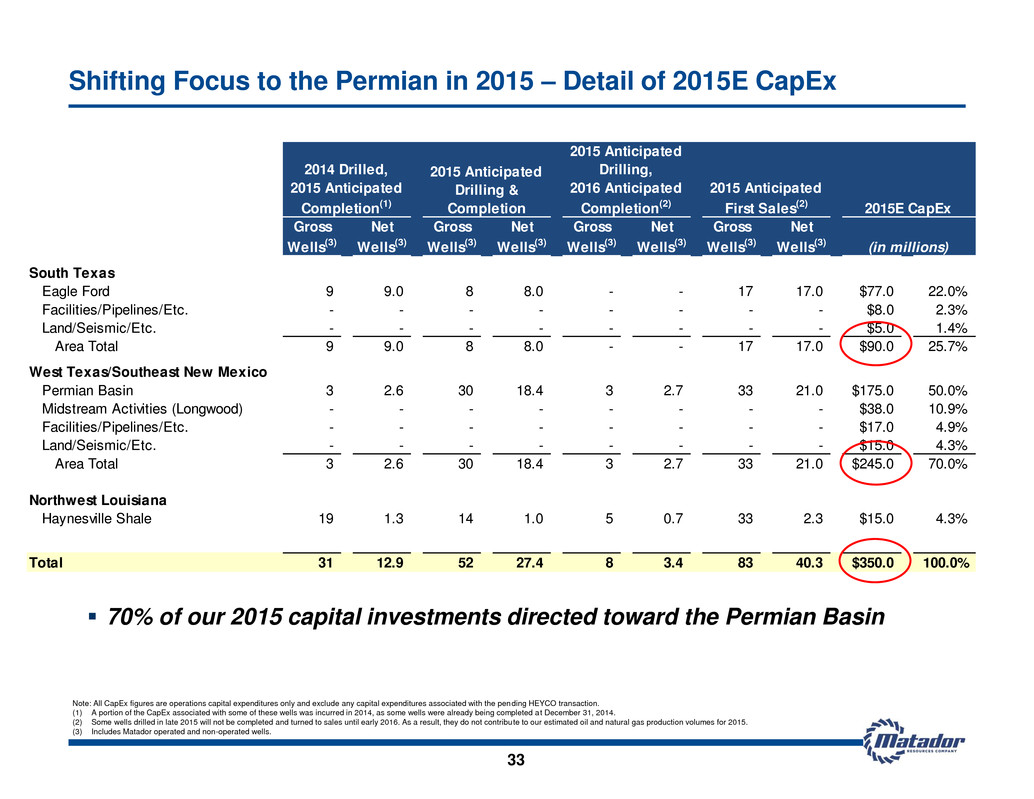

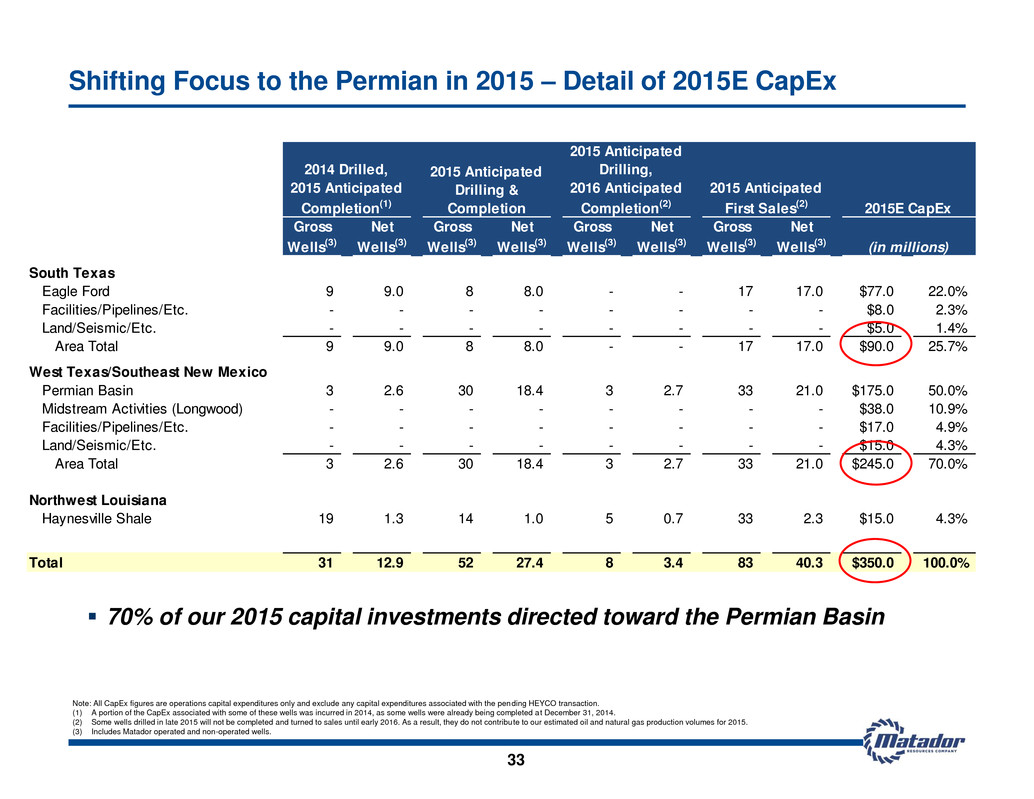

2014 Drilled, 2015 Anticipated Completion(1) 2015 Anticipated Drilling & Completion 2015 Anticipated Drilling, 2016 Anticipated Completion(2) 2015 Anticipated First Sales(2) 2015E CapEx Gross Wells(3) Net Wells(3) Gross Wells(3) Net Wells(3) Gross Wells(3) Net Wells(3) Gross Wells(3) Net Wells(3) (in millions) South Texas Eagle Ford 9 9.0 8 8.0 - - 17 17.0 $77.0 22.0% Facilities/Pipelines/Etc. - - - - - - - - $8.0 2.3% Land/Seismic/Etc. - - - - - - - - $5.0 1.4% Area Total 9 9.0 8 8.0 - - 17 17.0 $90.0 25.7% West Texas/Southeast New Mexico Permian Basin 3 2.6 30 18.4 3 2.7 33 21.0 $175.0 50.0% Midstream Activities (Longwood) - - - - - - - - $38.0 10.9% Facilities/Pipelines/Etc. - - - - - - - - $17.0 4.9% Land/Seismic/Etc. - - - - - - - - $15.0 4.3% Area Total 3 2.6 30 18.4 3 2.7 33 21.0 $245.0 70.0% Northwest Louisiana Haynesville Shale 19 1.3 14 1.0 5 0.7 33 2.3 $15.0 4.3% Total 31 12.9 52 27.4 8 3.4 83 40.3 $350.0 100.0% 33 Shifting Focus to the Permian in 2015 – Detail of 2015E CapEx Note: All CapEx figures are operations capital expenditures only and exclude any capital expenditures associated with the pending HEYCO transaction. (1) A portion of the CapEx associated with some of these wells was incurred in 2014, as some wells were already being completed at December 31, 2014. (2) Some wells drilled in late 2015 will not be completed and turned to sales until early 2016. As a result, they do not contribute to our estimated oil and natural gas production volumes for 2015. (3) Includes Matador operated and non-operated wells. 70% of our 2015 capital investments directed toward the Permian Basin

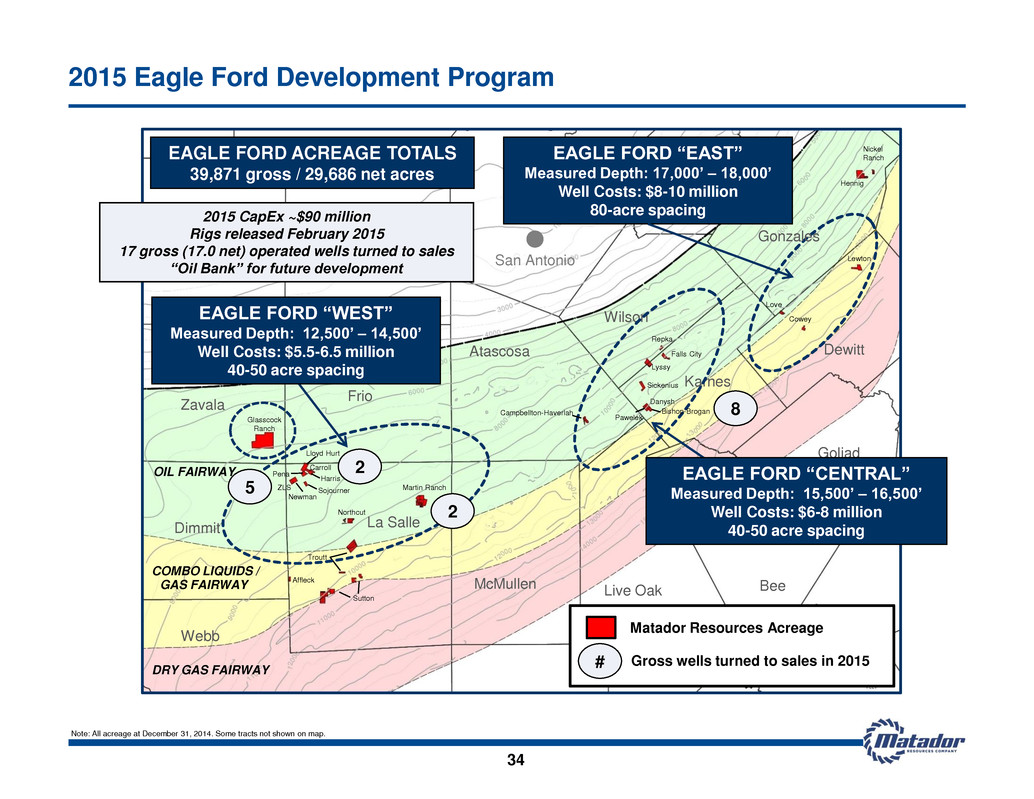

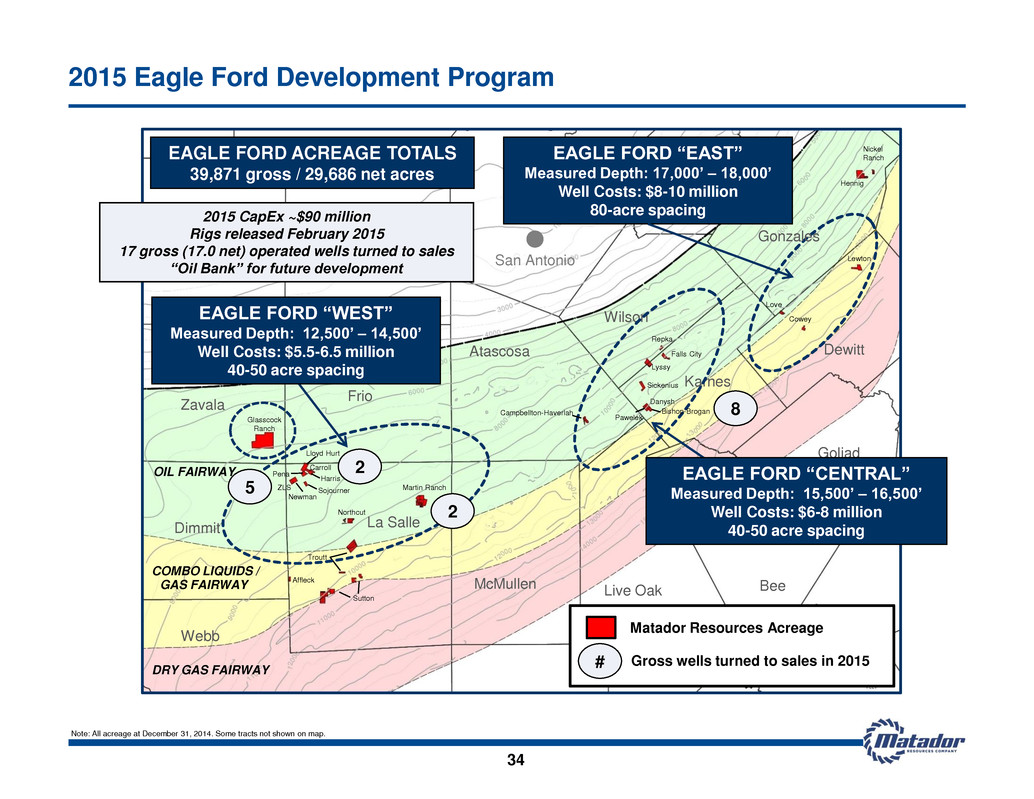

34 2015 Eagle Ford Development Program Note: All acreage at December 31, 2014. Some tracts not shown on map. Karnes Uvalde Medina Zavala Frio Dimmit La Salle Webb Atascosa McMullen Live Oak Bee Goliad Dewitt Gonzales Wilson San Antonio Glasscock Ranch Martin Ranch Northcut Affleck Troutt Sutton Love Cowey Lewton Hennig Nickel Ranch COMBO LIQUIDS / GAS FAIRWAY DRY GAS FAIRWAY OIL FAIRWAY EAGLE FORD “EAST” Measured Depth: 17,000’ – 18,000’ Well Costs: $8-10 million 80-acre spacing EAGLE FORD ACREAGE TOTALS 39,871 gross / 29,686 net acres Harris Newman Pena ZLS Carroll Lloyd Hurt Sojourner Sickenius Lyssy Repka Falls City Pawelek Danysh Bishop-Brogan Campbellton-Haverlah 8 5 2 2 Matador Resources Acreage Gross wells turned to sales in 2015 2015 CapEx ~$90 million Rigs released February 2015 17 gross (17.0 net) operated wells turned to sales “Oil Bank” for future development EAGLE FORD “CENTRAL” Measured Depth: 15,500’ – 16,500’ Well Costs: $6-8 million 40-50 acre spacing # EAGLE FORD “WEST” Measured Depth: 12,500’ – 14,500’ Well Costs: $5.5-6.5 million 40-50 acre spacing

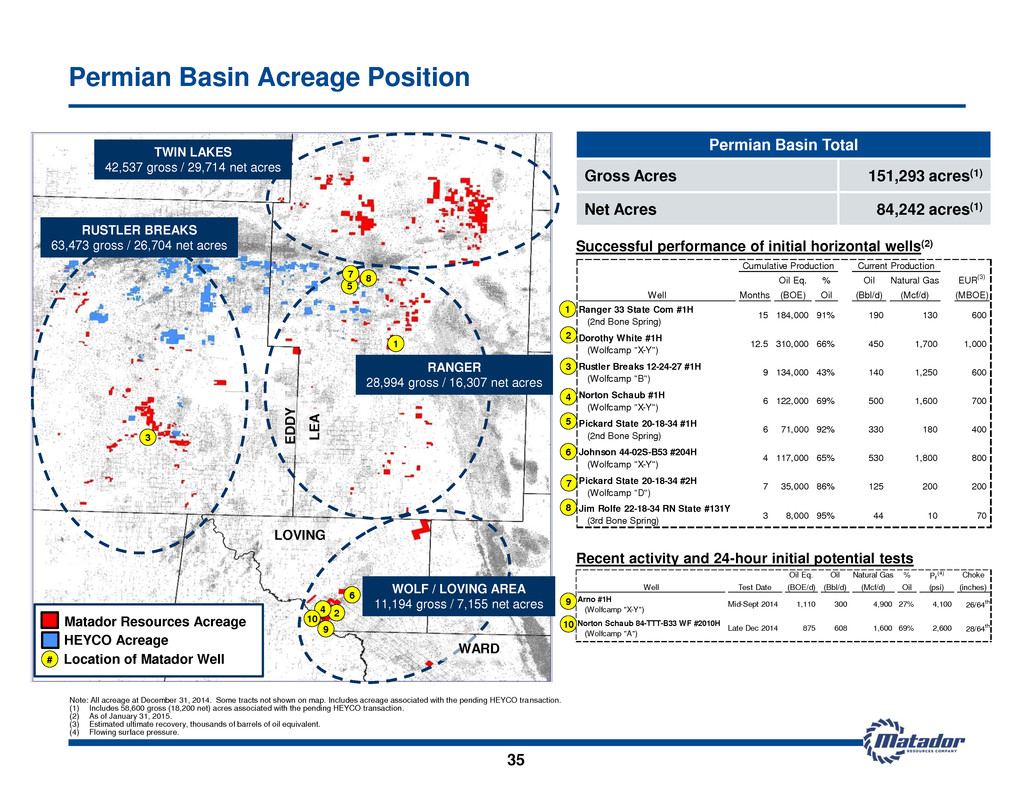

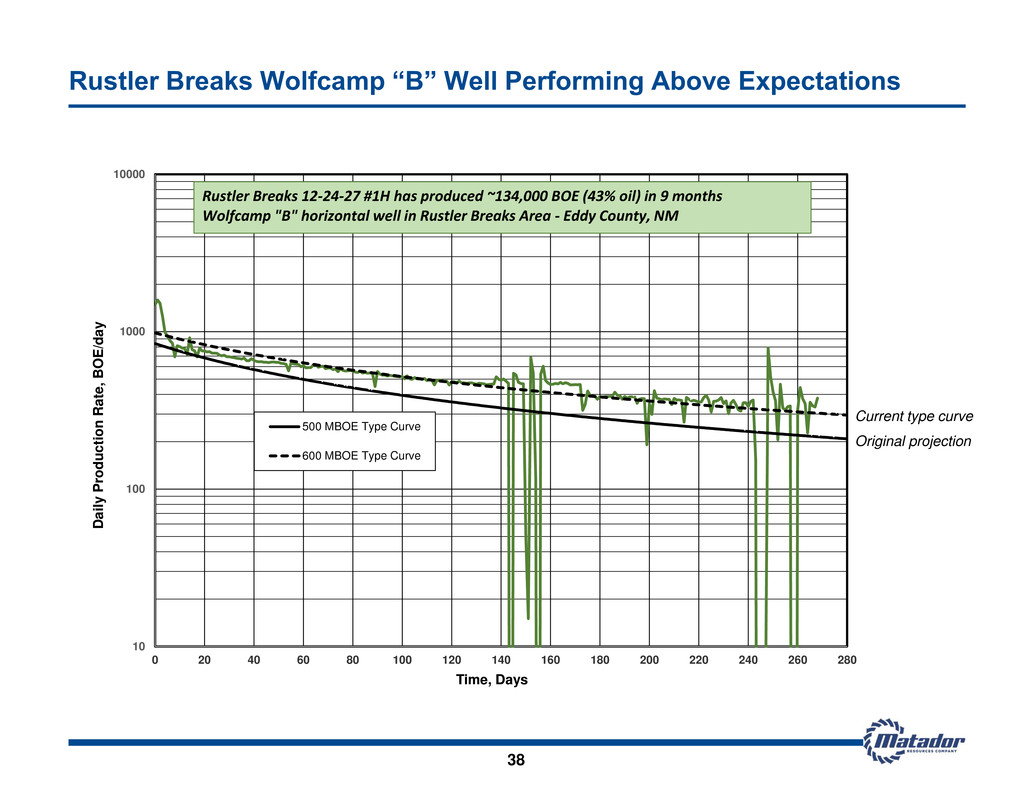

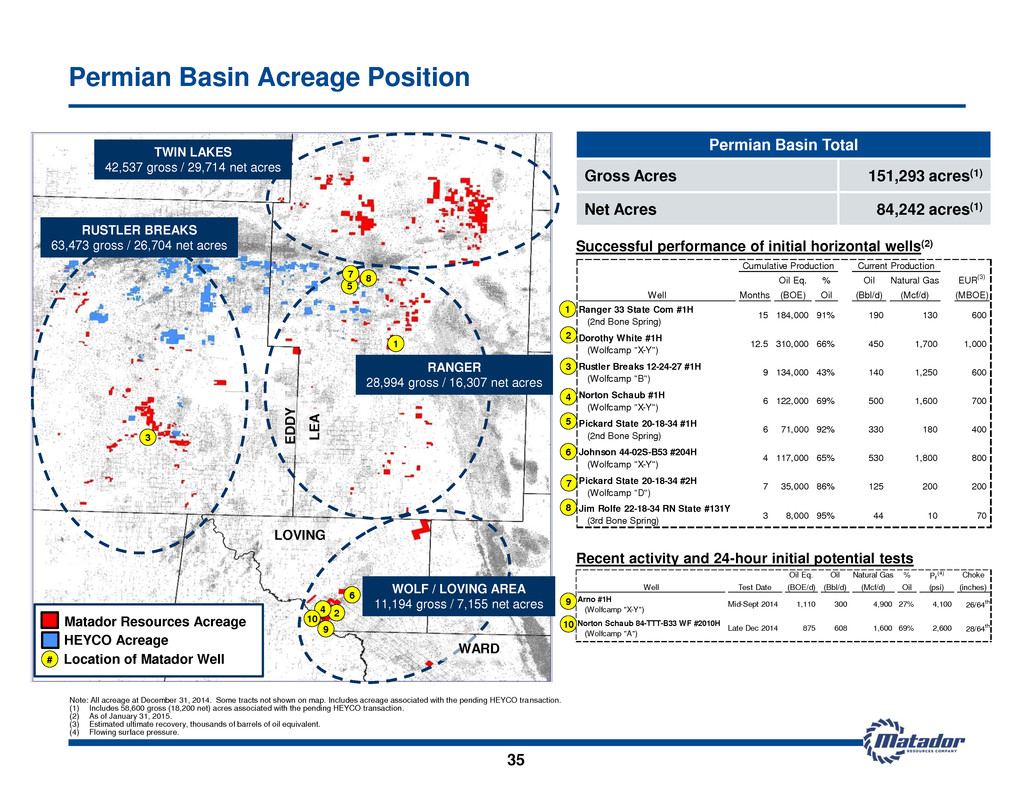

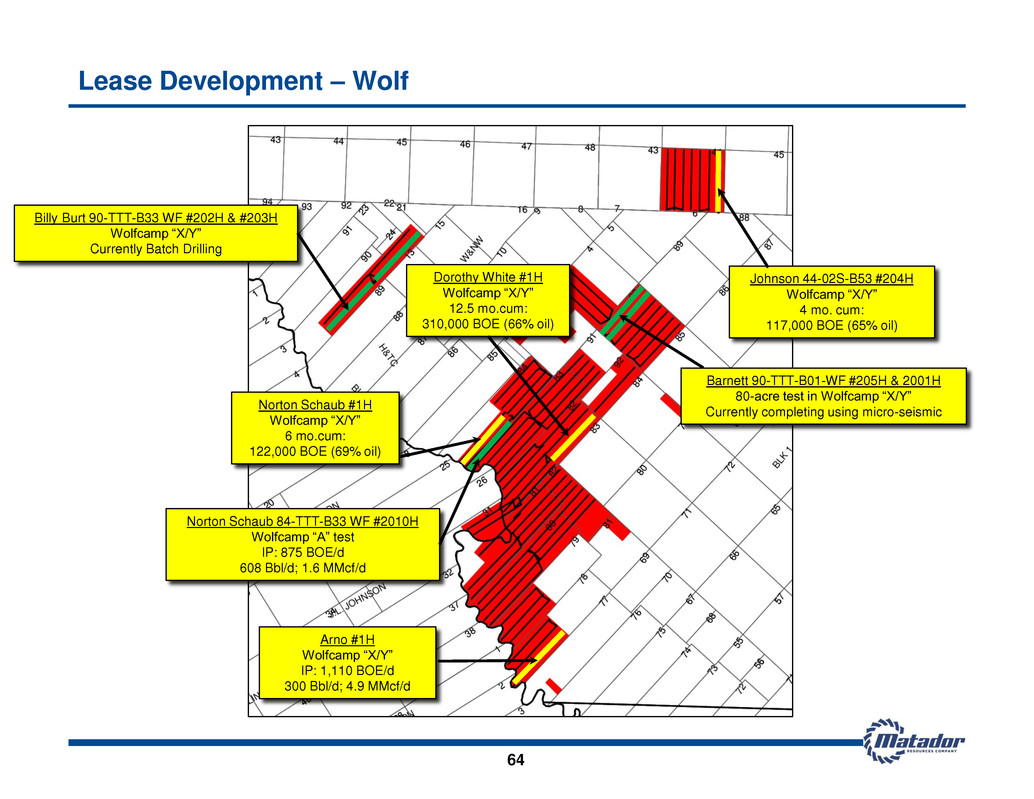

Oil Eq. Oil Natural Gas % Pf (4) Choke Well Test Date (BOE/d) (Bbl/d) (Mcf/d) Oil (psi) (inches) Arno #1H (Wolfcamp "X-Y") Mid-Sept 2014 1,110 300 4,900 27% 4,100 26/64th Norton Schaub 84-TTT-B33 WF #2010H (Wolfcamp "A") Late Dec 2014 875 608 1,600 69% 2,600 28/64th Successful performance of initial horizontal wells(2) Recent activity and 24-hour initial potential tests E DD Y L E A LOVING WARD TWIN LAKES 42,537 gross / 29,714 net acres RUSTLER BREAKS 63,473 gross / 26,704 net acres RANGER 28,994 gross / 16,307 net acres WOLF / LOVING AREA 11,194 gross / 7,155 net acres 2 4 1 3 9 6 5 10 8 Permian Basin Total Gross Acres 151,293 acres(1) Net Acres 84,242 acres(1) Permian Basin Acreage Position Note: All acreage at December 31, 2014. Some tracts not shown on map. Includes acreage associated with the pending HEYCO transaction. (1) Includes 58,600 gross (18,200 net) acres associated with the pending HEYCO transaction. (2) As of January 31, 2015. (3) Estimated ultimate recovery, thousands of barrels of oil equivalent. (4) Flowing surface pressure. 35 7 1 2 3 4 5 6 7 8 9 10 # Matador Resources Acreage HEYCO Acreage Location of Matador Well Cumulative Production Current Production Oil Eq. % Oil Natural Gas EUR(3) Well Months (BOE) Oil (Bbl/d) (Mcf/d) (MBOE) Ranger 33 State Com #1H (2nd Bone Spring) 15 184,000 91% 190 130 600 Dorothy White #1H (Wolfcamp "X-Y") 12.5 310,000 66% 450 1,700 1,000 Rustler Breaks 12-24-27 #1H (Wolfcamp "B") 9 134,000 43% 140 1,250 600 Norton Schaub #1H (Wolfcamp "X-Y") 6 122,000 69% 500 1,600 700 Pickard State 20-18-34 #1H (2nd Bone Spring) 6 71,000 92% 330 180 400 Johnson 44-02S-B53 #204H (Wolfcamp "X-Y") 4 117,000 65% 530 1,800 800 Pickard State 20-18-34 #2H (Wolfcamp "D") 7 35,000 86% 125 200 200 Jim Rolfe 22-18-34 RN State #131Y (3rd Bone Spring) 3 8,000 95% 44 10 70

10 100 1000 10000 0 50 100 150 200 250 300 350 400 Da ily P roduction Rat e, BO E/d ay Time, Days Dorothy White #1H Norton Schaub #1H Johnson 44-02S-B53 #204H 500 MBOE Type Curve 700 MBOE Type Curve 1,000 MBOE Type Curve Dorothy White #1H has produced ~310,000 BOE (66% oil) in 12.5 months Norton Schaub #1H has produced ~122,000 BOE (69% oil) in 6 months Johnson 44-02S-B53 #204H has produced ~117,000 BOE (65% oil) in 4 months Wolfcamp "X-Y" horizontal wells in Wolf Area - Loving County, Texas 36 Wolf Area Wolfcamp “X-Y” Wells Performing Above Expectations Original projection Current type curves Production increase following offset frac

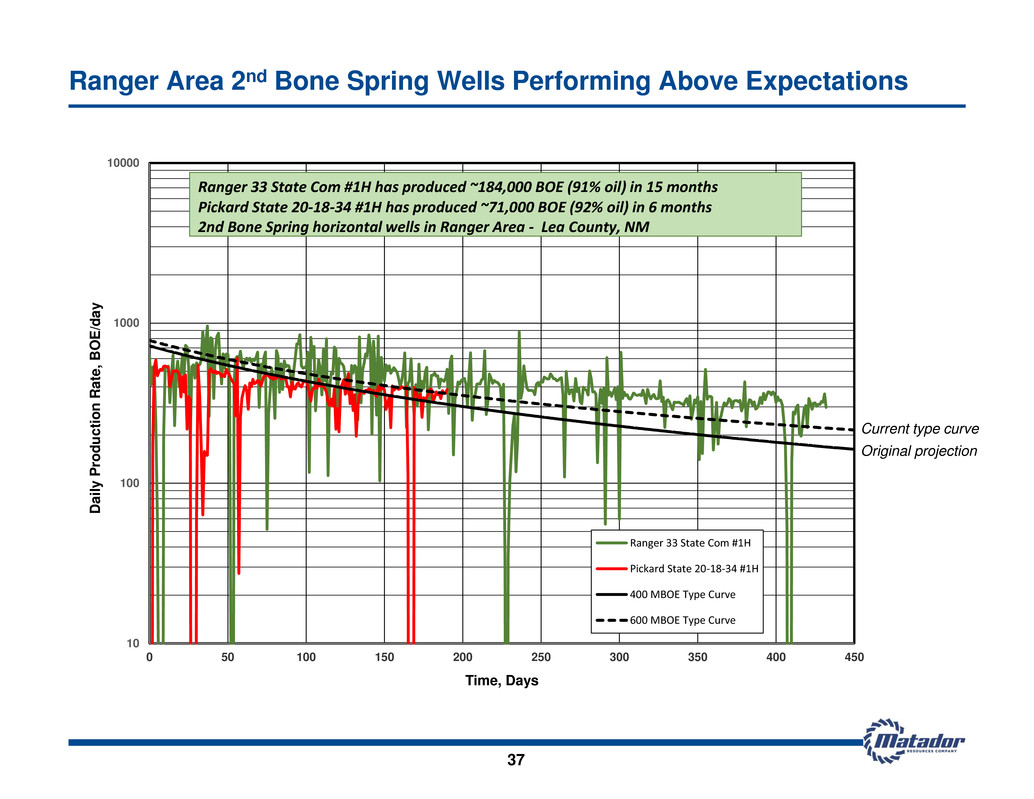

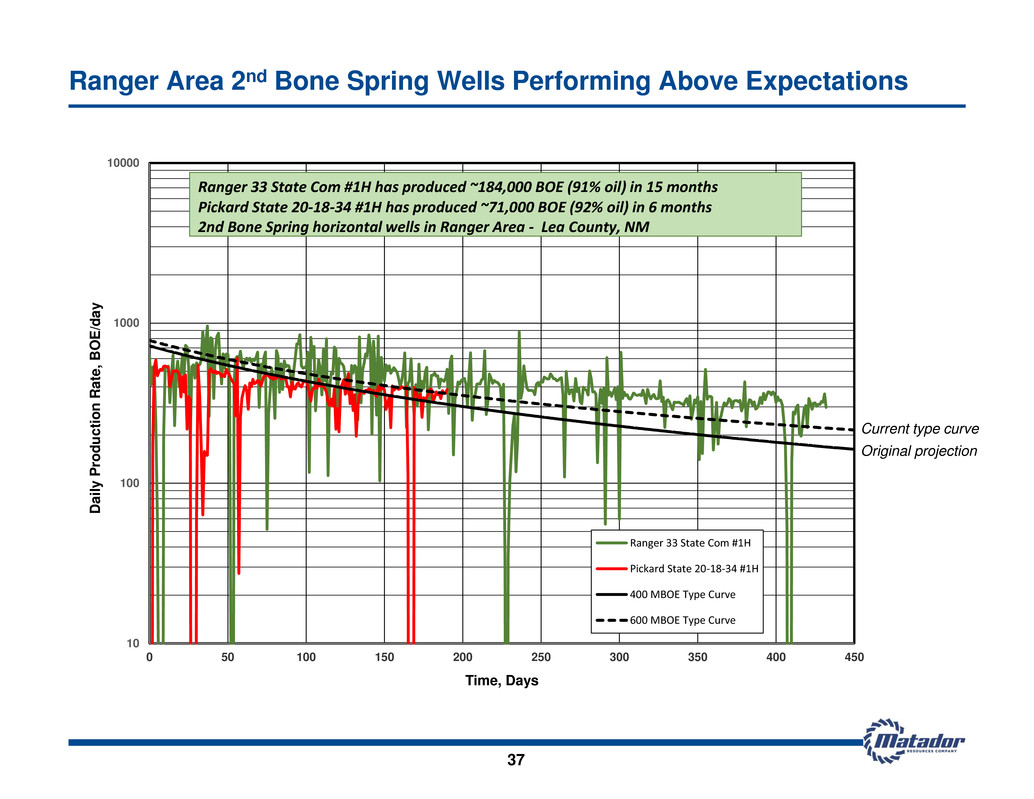

37 Ranger Area 2nd Bone Spring Wells Performing Above Expectations 10 100 1000 10000 0 50 100 150 200 250 300 350 400 450 Da ily P roduction Rat e, BO E/d ay Time, Days Ranger 33 State Com #1H Pickard State 20-18-34 #1H 400 MBOE Type Curve 600 MBOE Type Curve Ranger 33 State Com #1H has produced ~184,000 BOE (91% oil) in 15 months Pickard State 20-18-34 #1H has produced ~71,000 BOE (92% oil) in 6 months 2nd Bone Spring horizontal wells in Ranger Area - Lea County, NM Original projection Current type curve

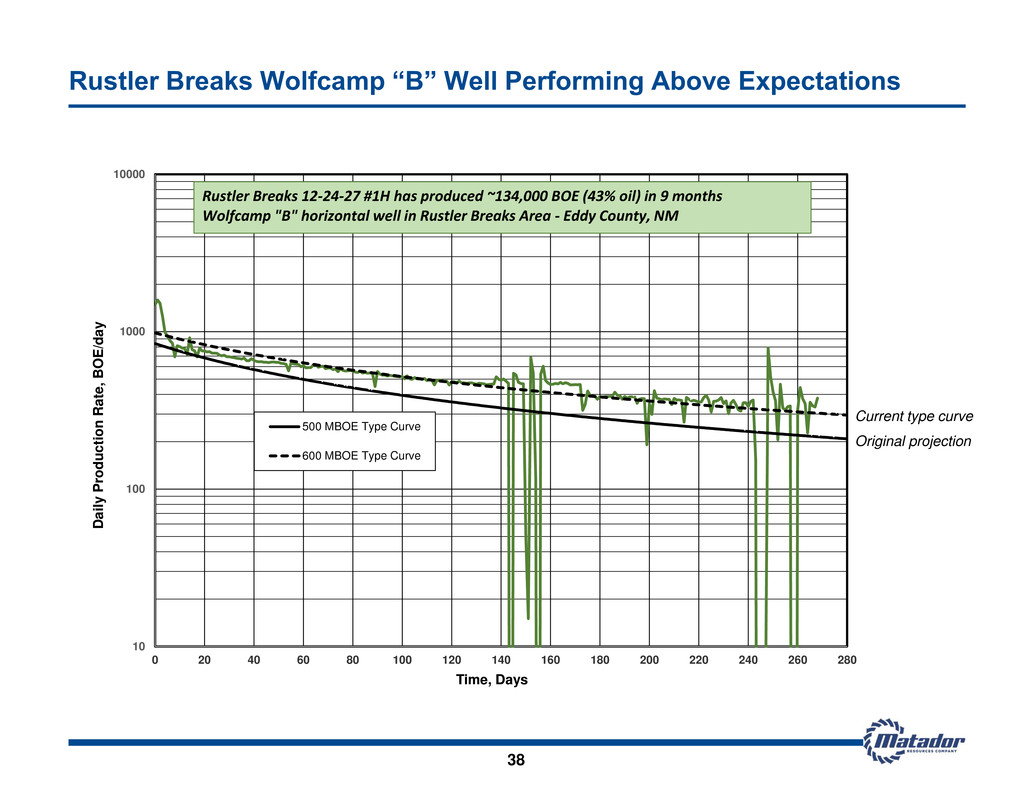

10 100 1000 10000 0 20 40 60 80 100 120 140 160 180 200 220 240 260 280 Da ily P roduction Rat e, BO E/d ay Time, Days 500 MBOE Type Curve 600 MBOE Type Curve Rustler Breaks 12-24-27 #1H has produced ~134,000 BOE (43% oil) in 9 months Wolfcamp "B" horizontal well in Rustler Breaks Area - Eddy County, NM 38 Rustler Breaks Wolfcamp “B” Well Performing Above Expectations Original projection Current type curve

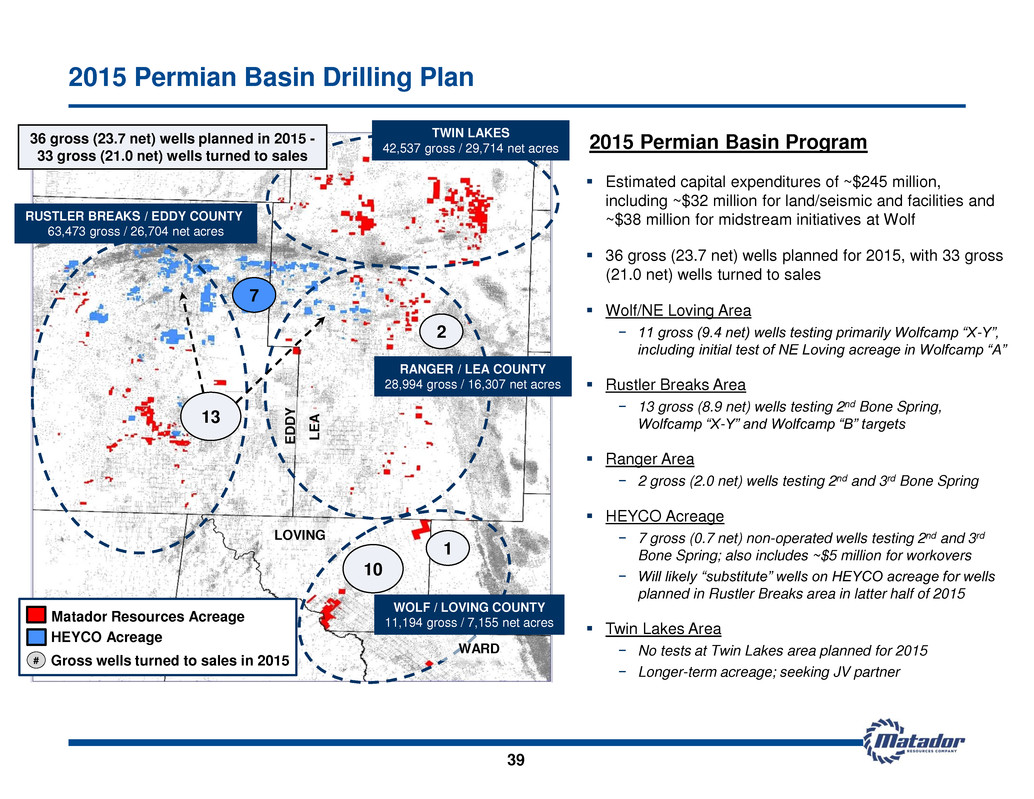

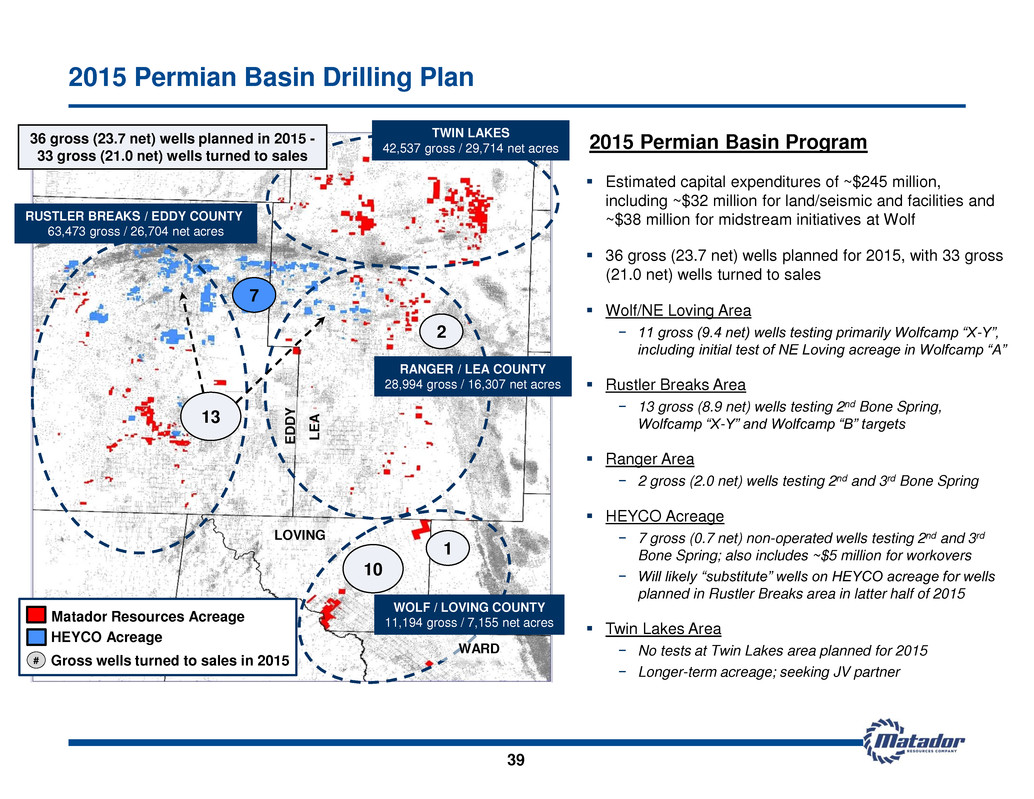

E DD Y L E A LOVING WARD TWIN LAKES 42,537 gross / 29,714 net acres RUSTLER BREAKS / EDDY COUNTY 63,473 gross / 26,704 net acres RANGER / LEA COUNTY 28,994 gross / 16,307 net acres WOLF / LOVING COUNTY 11,194 gross / 7,155 net acres 39 Estimated capital expenditures of ~$245 million, including ~$32 million for land/seismic and facilities and ~$38 million for midstream initiatives at Wolf 36 gross (23.7 net) wells planned for 2015, with 33 gross (21.0 net) wells turned to sales Wolf/NE Loving Area − 11 gross (9.4 net) wells testing primarily Wolfcamp “X-Y”, including initial test of NE Loving acreage in Wolfcamp “A” Rustler Breaks Area − 13 gross (8.9 net) wells testing 2nd Bone Spring, Wolfcamp “X-Y” and Wolfcamp “B” targets Ranger Area − 2 gross (2.0 net) wells testing 2nd and 3rd Bone Spring HEYCO Acreage − 7 gross (0.7 net) non-operated wells testing 2nd and 3rd Bone Spring; also includes ~$5 million for workovers − Will likely “substitute” wells on HEYCO acreage for wells planned in Rustler Breaks area in latter half of 2015 Twin Lakes Area − No tests at Twin Lakes area planned for 2015 − Longer-term acreage; seeking JV partner 2015 Permian Basin Program 2015 Permian Basin Drilling Plan 36 gross (23.7 net) wells planned in 2015 - 33 gross (21.0 net) wells turned to sales # Matador Resources Acreage HEYCO Acreage Gross wells turned to sales in 2015 1 2 10 7 13

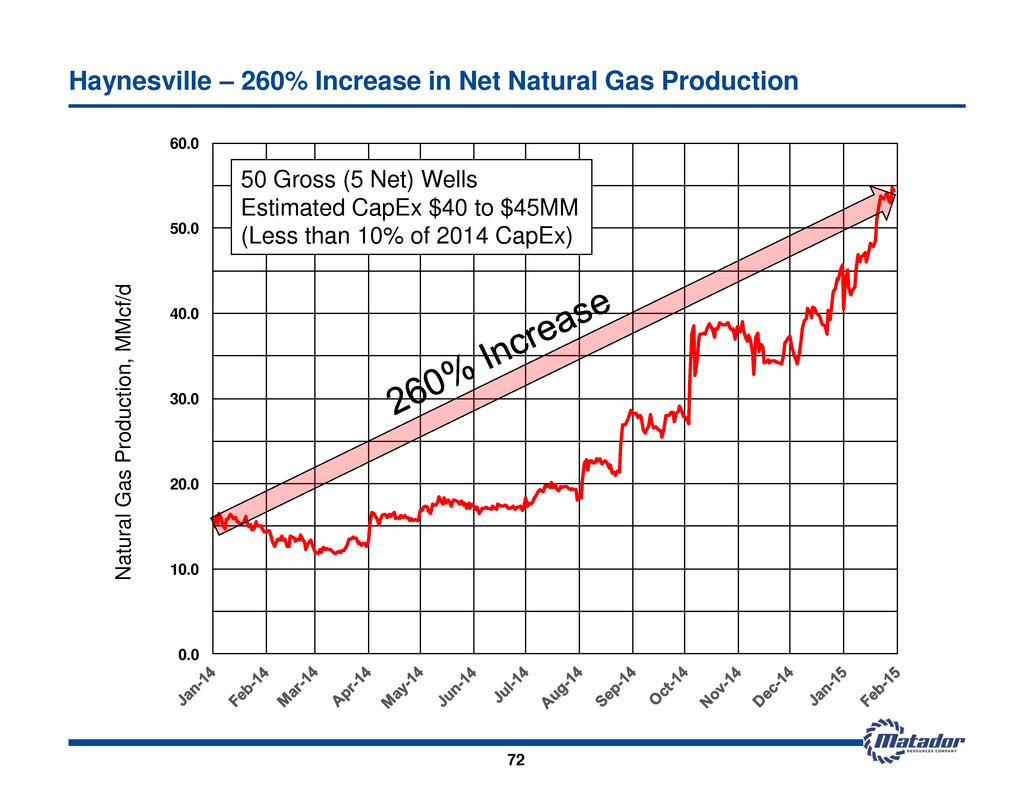

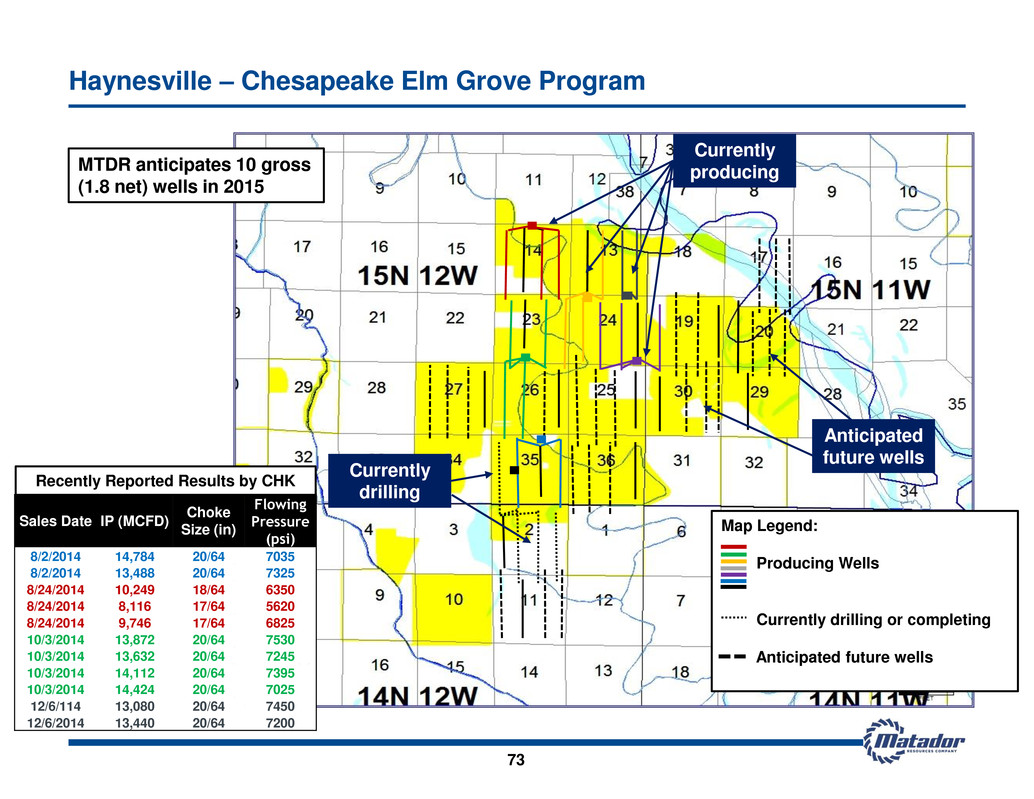

Haynesville – Chesapeake Elm Grove Operations 40 Currently producing Currently drilling Anticipated future wells Producing wells Currently drilling or completing Anticipated future wells Date IP (Mcf/d) Choke Size (in) Flowing Pressure (psi) 8/2/2014 14,784 20/64 7035 8/2/2014 13,488 20/64 7325 8/24/2014 10,249 18/64 6350 8/24/2014 8,116 17/64 5620 8/24/2014 9,746 17/64 6825 10/3/2014 13,872 20/64 7530 10/3/2014 13,632 20/64 7245 10/3/2014 14,112 20/64 7395 10/3/2014 14,424 20/64 7025 12/6/114 13,080 20/64 7450 12/6/2014 13,440 20/64 7200 IP’s Reported for Elm Grove Wells Estimated capital expenditures of ~$15 million for non-operated well participation interests − Represents only ~4% of 2015 estimated capital expenditures 38 gross (3.0 net) wells throughout Tier 1 Haynesville; 33 gross (2.3 net) wells turned to sales Includes 10 gross (1.8 net) wells turned to sales on Elm Grove properties operated by Chesapeake in 2015 (shown on map at left) 2015 Haynesville Non-Op Drilling Program 2014 non-op drilling program, primarily by Chesapeake at Elm Grove, very successful − 17 gross (3.8 net) wells with estimated recoveries of 8 to 12 Bcf and well costs of $7 to $8 million Haynesville average daily natural gas production up over 3-fold to 35.0 MMcf/d in Q4 2014 from 11.1 MMcf/d in Q4 2013 – currently ~55 MMcf/d

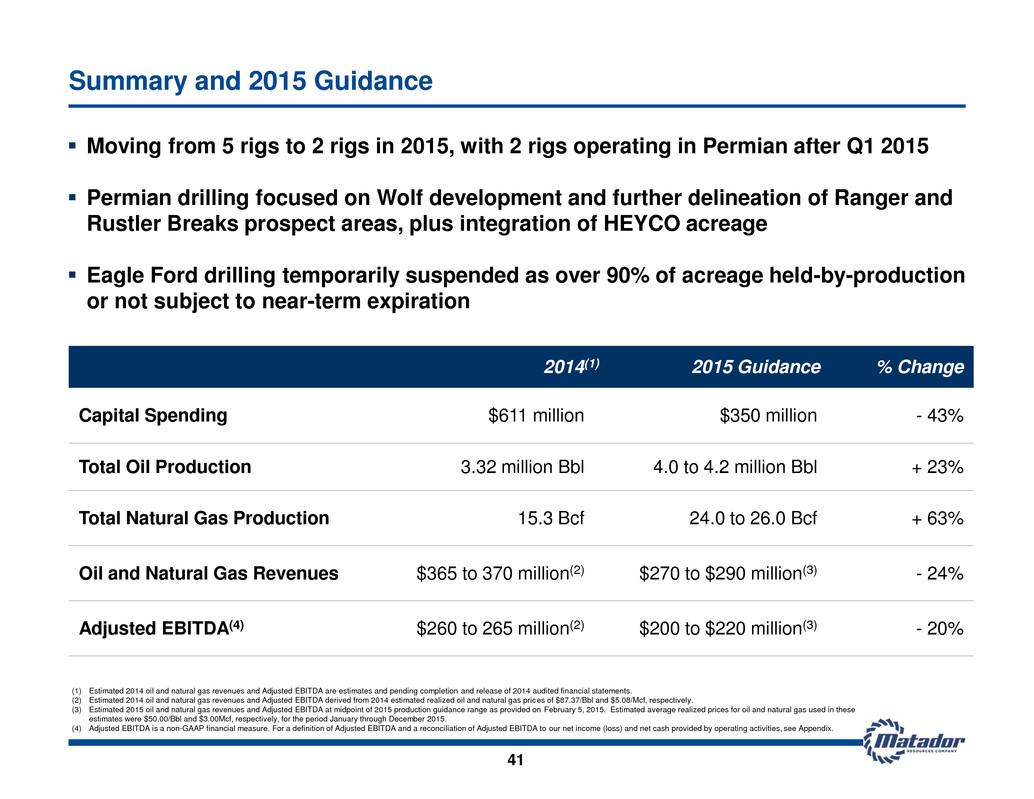

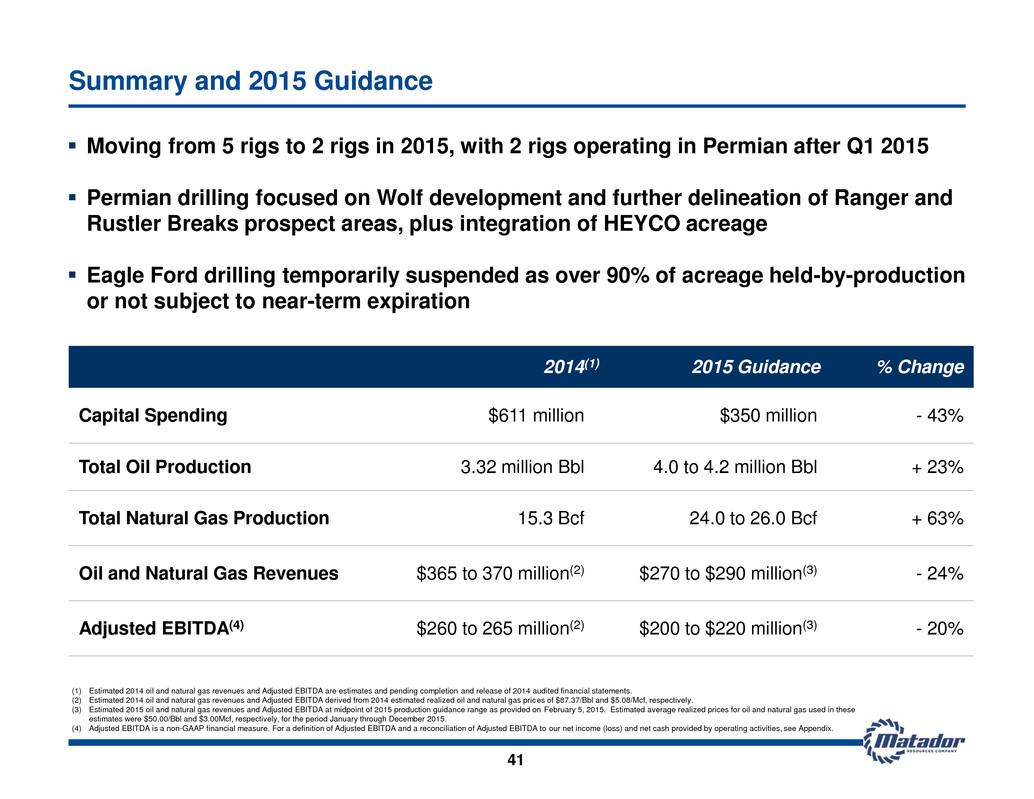

41 Summary and 2015 Guidance (1) Estimated 2014 oil and natural gas revenues and Adjusted EBITDA are estimates and pending completion and release of 2014 audited financial statements. (2) Estimated 2014 oil and natural gas revenues and Adjusted EBITDA derived from 2014 estimated realized oil and natural gas prices of $87.37/Bbl and $5.08/Mcf, respectively. (3) Estimated 2015 oil and natural gas revenues and Adjusted EBITDA at midpoint of 2015 production guidance range as provided on February 5, 2015. Estimated average realized prices for oil and natural gas used in these estimates were $50.00/Bbl and $3.00Mcf, respectively, for the period January through December 2015. (4) Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see Appendix. Moving from 5 rigs to 2 rigs in 2015, with 2 rigs operating in Permian after Q1 2015 Permian drilling focused on Wolf development and further delineation of Ranger and Rustler Breaks prospect areas, plus integration of HEYCO acreage Eagle Ford drilling temporarily suspended as over 90% of acreage held-by-production or not subject to near-term expiration 2014(1) 2015 Guidance % Change Capital Spending $611 million $350 million - 43% Total Oil Production 3.32 million Bbl 4.0 to 4.2 million Bbl + 23% Total Natural Gas Production 15.3 Bcf 24.0 to 26.0 Bcf + 63% Oil and Natural Gas Revenues $365 to 370 million(2) $270 to $290 million(3) - 24% Adjusted EBITDA(4) $260 to 265 million(2) $200 to $220 million(3) - 20%

Eagle Ford

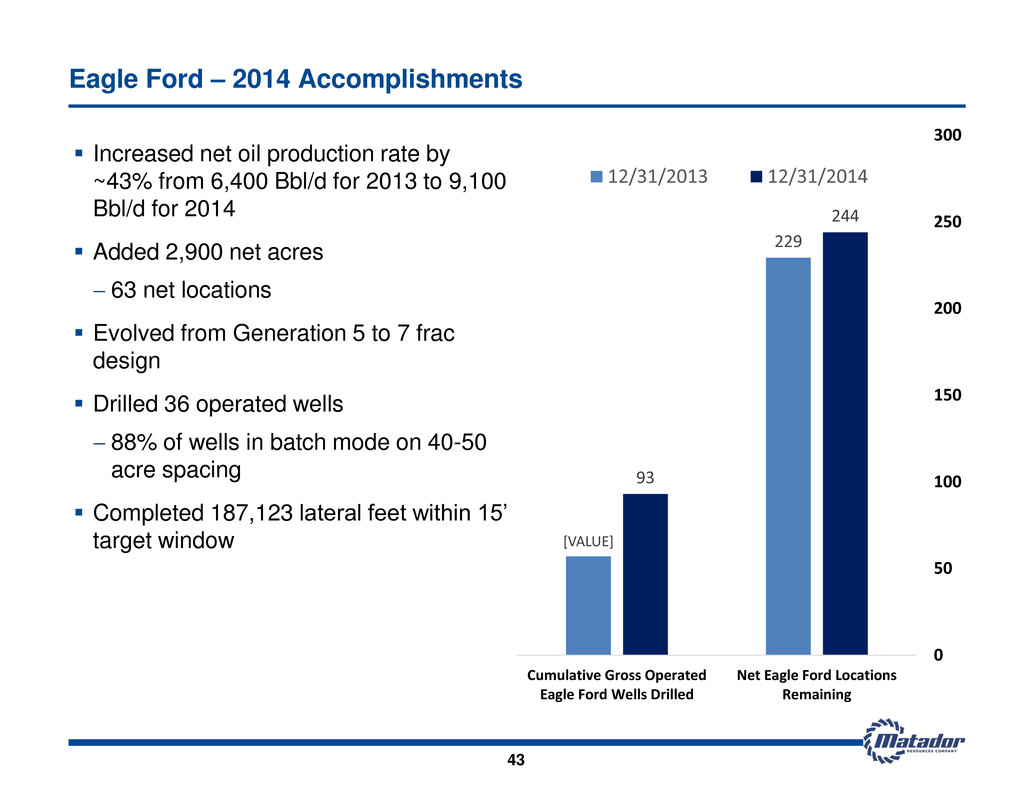

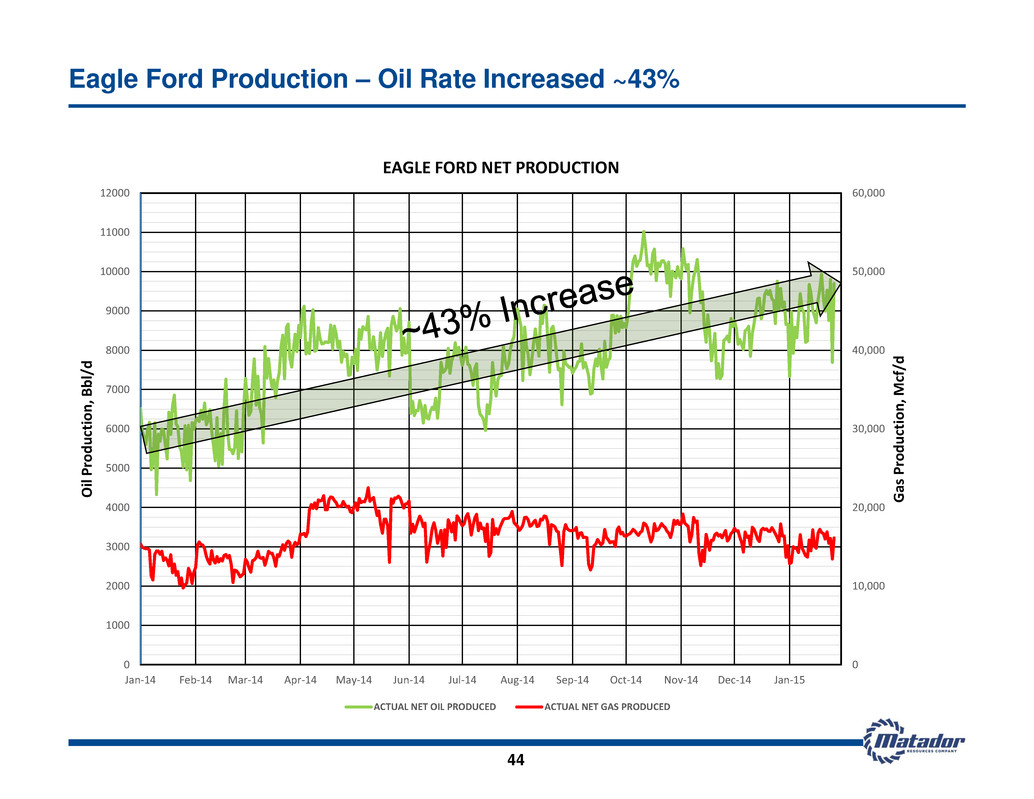

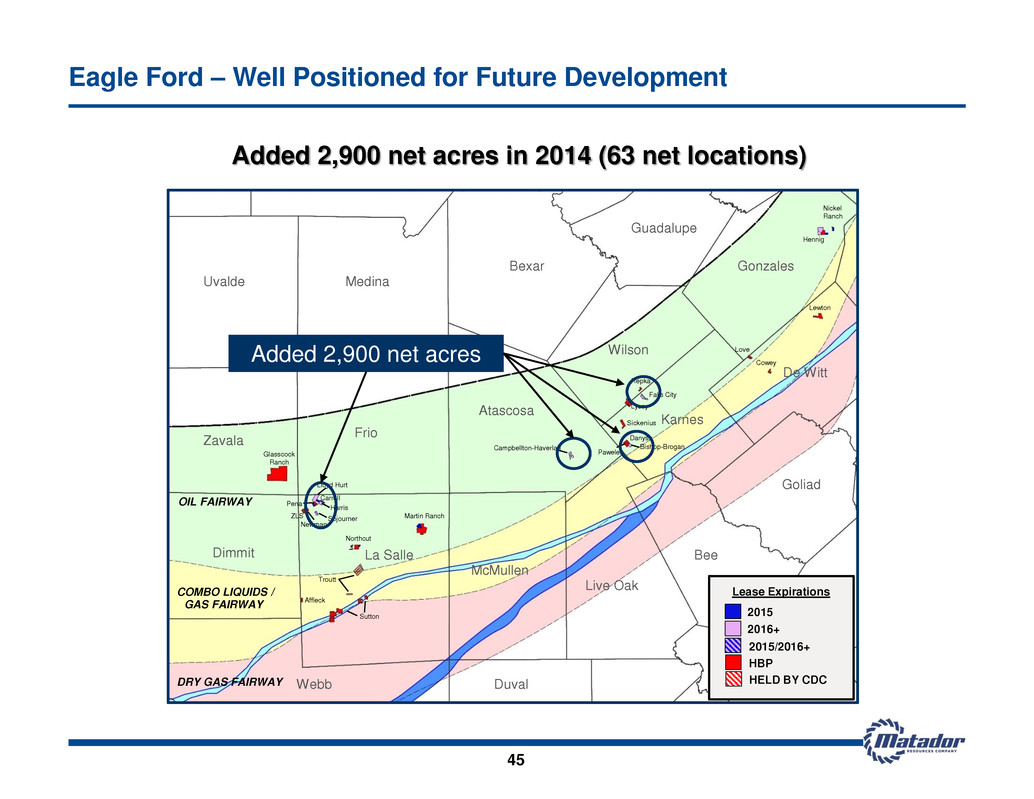

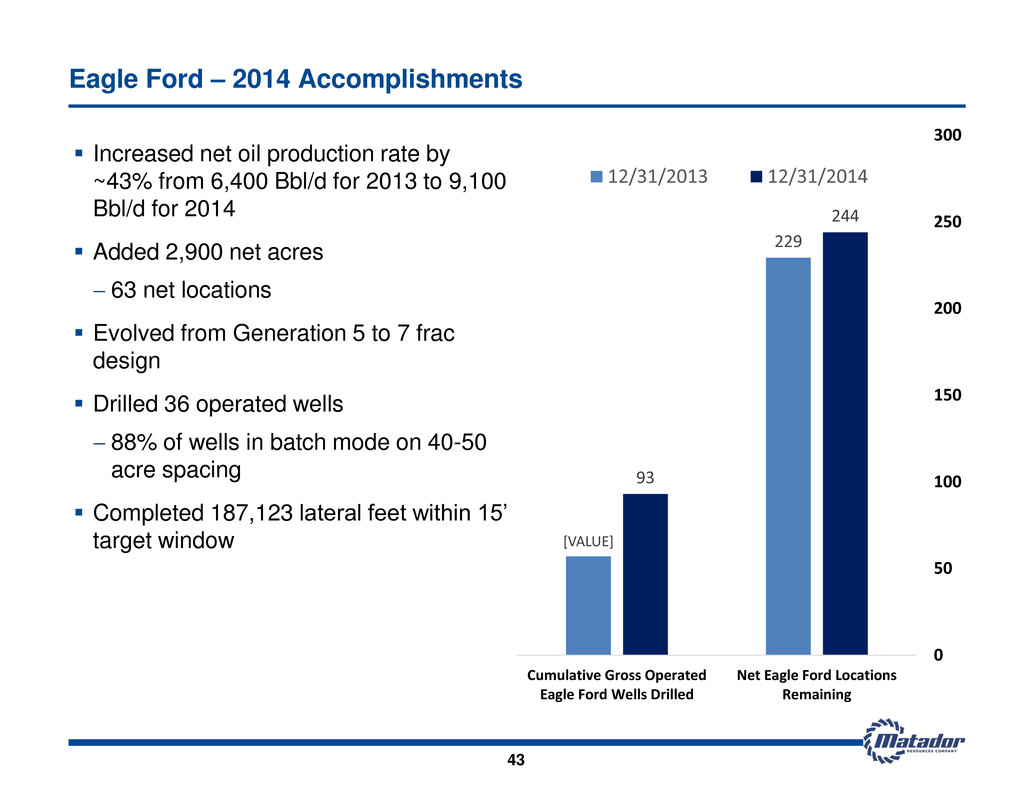

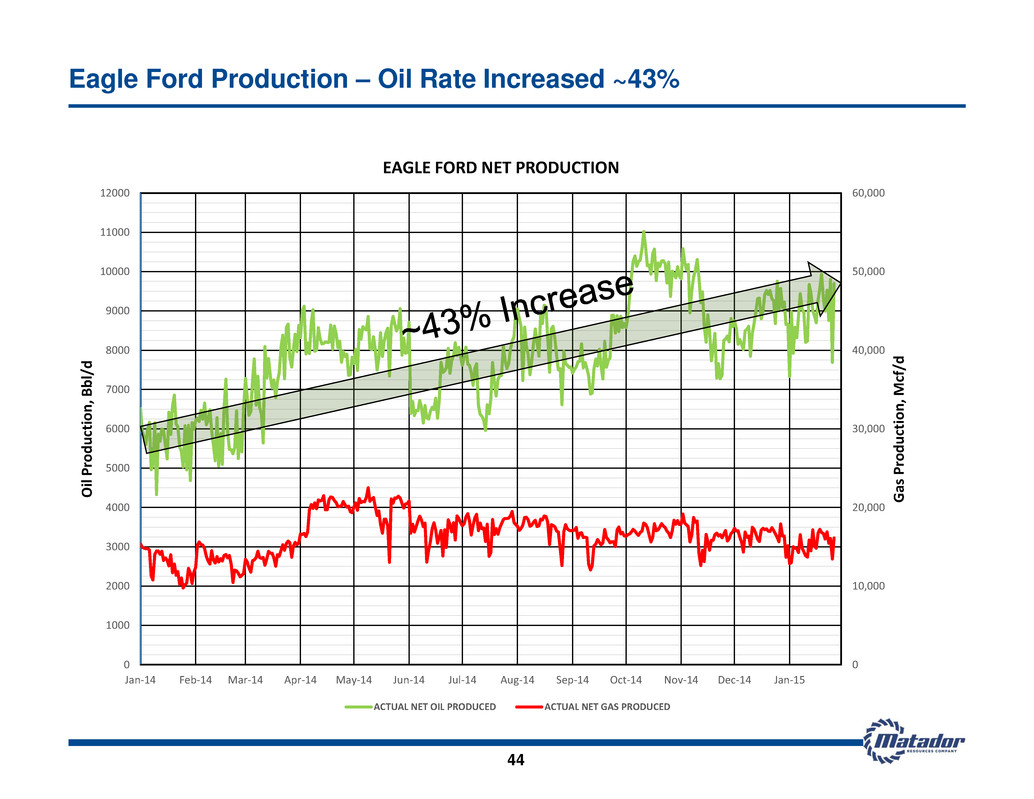

Eagle Ford – 2014 Accomplishments 43 Increased net oil production rate by ~43% from 6,400 Bbl/d for 2013 to 9,100 Bbl/d for 2014 Added 2,900 net acres 63 net locations Evolved from Generation 5 to 7 frac design Drilled 36 operated wells 88% of wells in batch mode on 40-50 acre spacing Completed 187,123 lateral feet within 15’ target window [VALUE] 229 93 244 0 50 100 150 200 250 300 Cumulative Gross Operated Eagle Ford Wells Drilled Net Eagle Ford Locations Remaining 12/31/2013 12/31/2014

0 10,000 20,000 30,000 40,000 50,000 60,000 0 1000 2000 3000 4000 5000 6000 7000 8000 9000 10000 11000 12000 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Gas P ro d u ct io n , M cf /d O il P ro d u ct io n , Bb l/ d EAGLE FORD NET PRODUCTION ACTUAL NET OIL PRODUCED ACTUAL NET GAS PRODUCED Eagle Ford Production – Oil Rate Increased ~43% 44

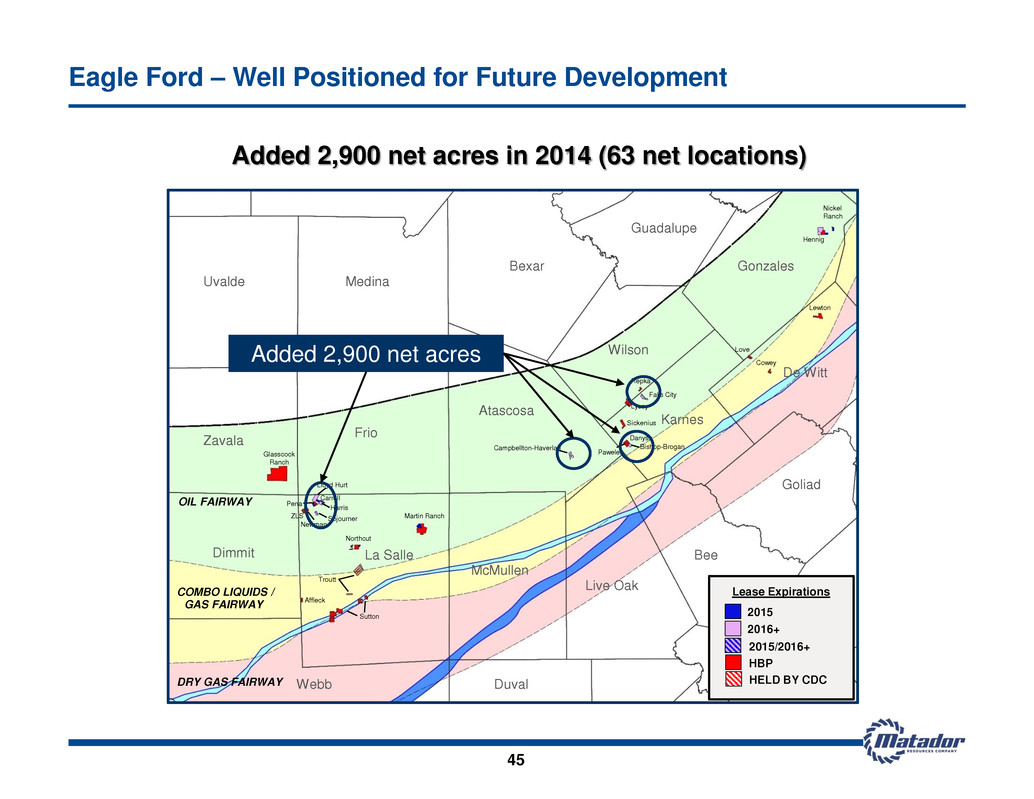

45 Eagle Ford – Well Positioned for Future Development Karnes Uvalde Medina Zavala Frio Dimmit La Salle Webb Atascosa McMullen Live Oak Bee Goliad De Witt Gonzales Wilson Glasscock Ranch Martin Ranch Northcut Affleck Troutt Sutton Love Cowey Lewton Hennig Nickel Ranch COMBO LIQUIDS / GAS FAIRWAY DRY GAS FAIRWAY OIL FAIRWAY Harris Newman Pena ZLS Carroll Lloyd Hurt Sojourner Sickenius Lyssy Repka Falls City Pawelek Danysh Bishop-Brogan Campbellton-Haverlah Bexar Guadalupe Duval 2015 2016+ 2015/2016+ HBP HELD BY CDC Added 2,900 net acres Added 2,900 net acres in 2014 (63 net locations) Lease Expirations

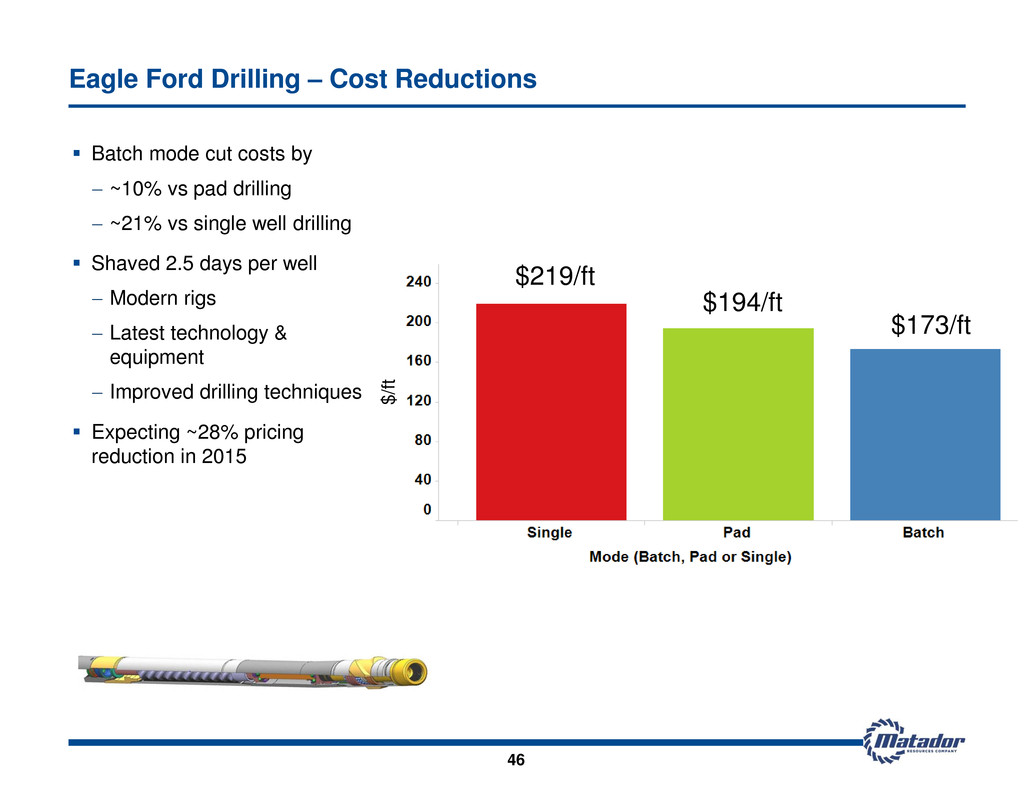

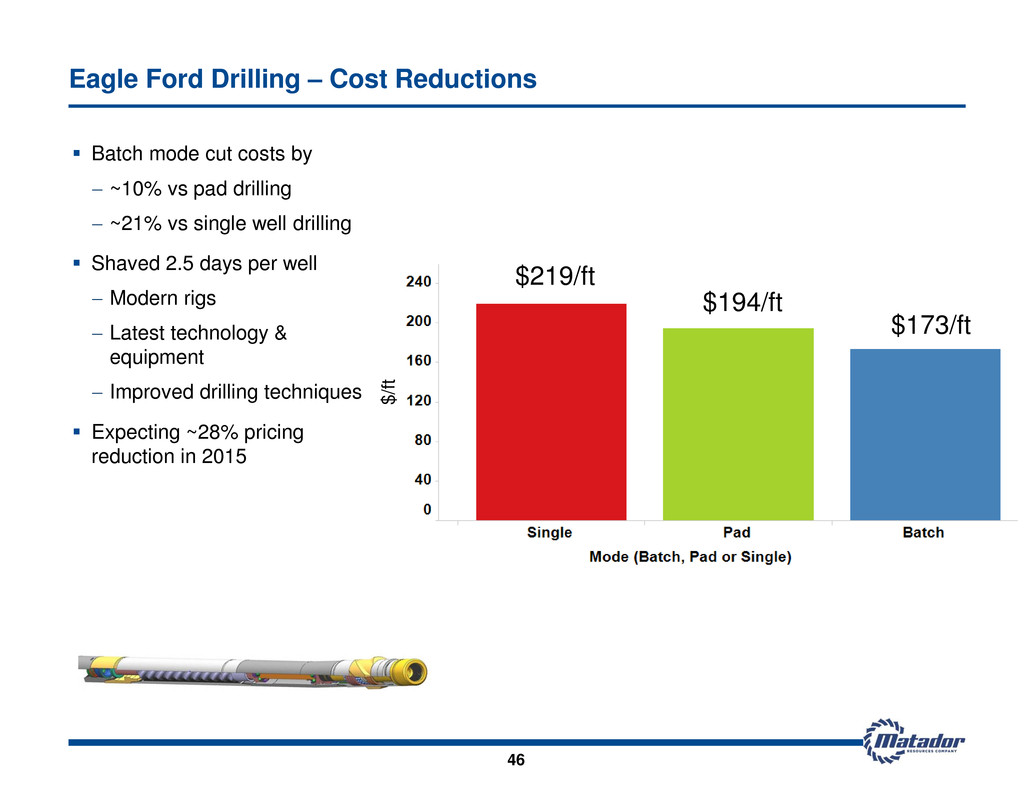

46 Batch mode cut costs by ~10% vs pad drilling ~21% vs single well drilling Shaved 2.5 days per well Modern rigs Latest technology & equipment Improved drilling techniques Expecting ~28% pricing reduction in 2015 Eagle Ford Drilling – Cost Reductions $219/ft $194/ft $173/ft $ /f t

5,380 5,040 6,430 6,970 5,450 5,500 5,690 4,910 7,360 4,830 6,360 5,110 5,510 4,590 5,220 4,890 5,230 5,650 4,960 0 500 1,000 1,500 2,000 2,500 3,000 3,500 P ro p p ant Co n ce n tr atio n ( #/ft of perf’d la ter al) 2012 2013 2014 Eagle Ford Completions – Industry Comparison Matador designs some of the biggest fracs in the Eagle Ford 47 Source: ITG Investment Research. EOG MTDR COG CRZO MUR SM CHK COP XCO ECA CRK SN PXD DVN EPE BHP ROSE MRO APC Average 2014 Lateral Length (ft) Average Proppant Conc. Matador Gen 7

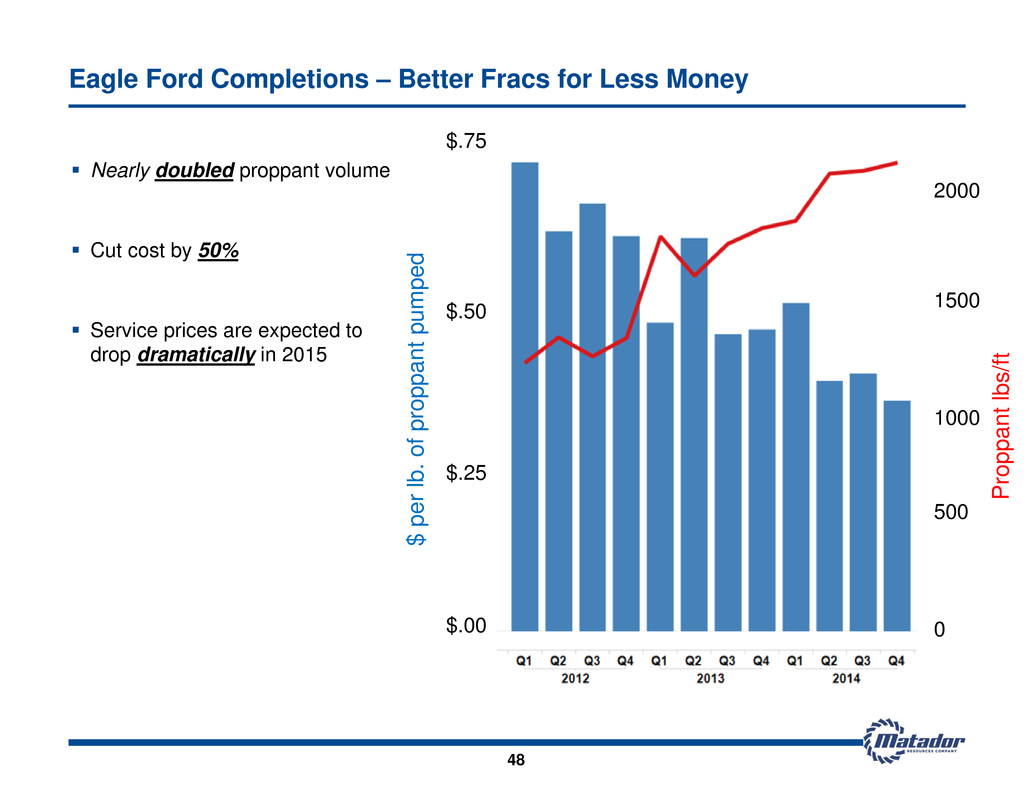

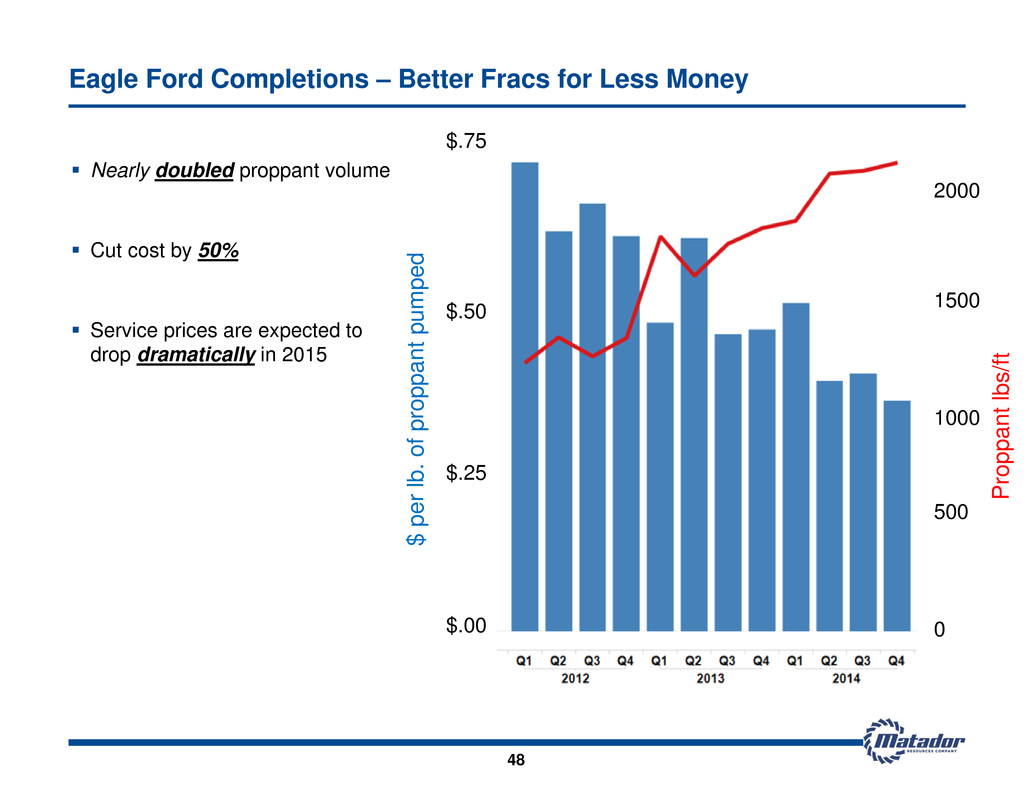

Eagle Ford Completions – Better Fracs for Less Money Nearly doubled proppant volume Cut cost by 50% Service prices are expected to drop dramatically in 2015 48 Prop p ant l b s/ ft $ per l b . of p roppa n t pumpe d $.25 $.50 $.75 $.00 0 500 1000 1500 2000

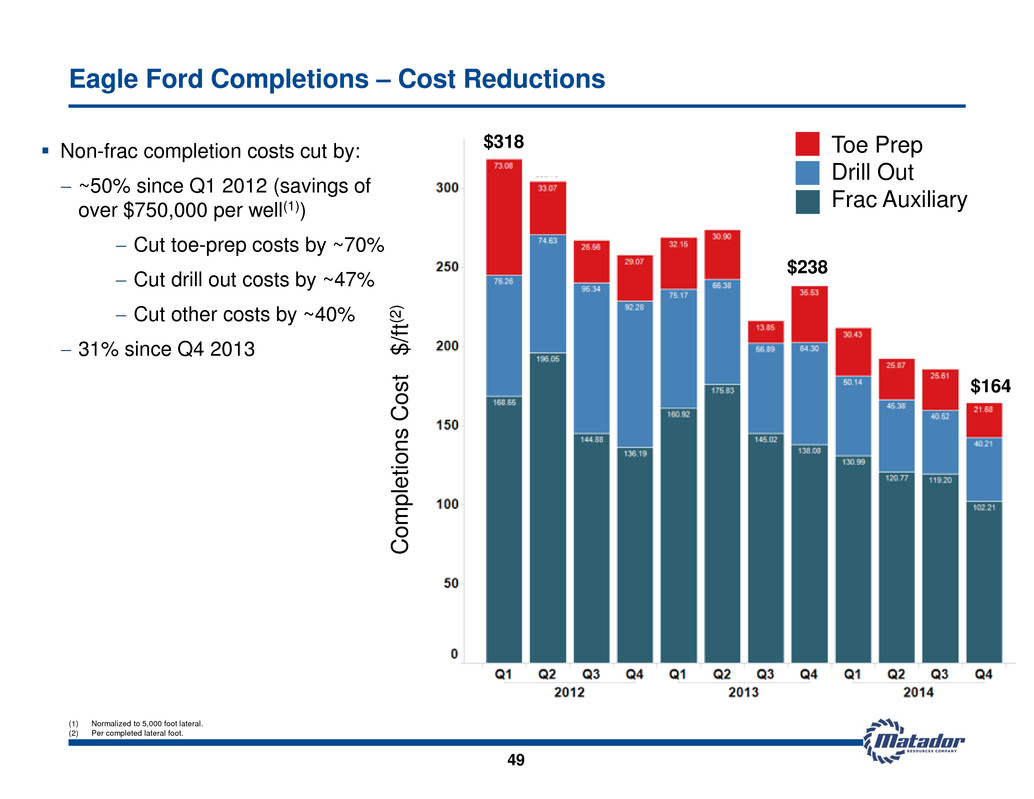

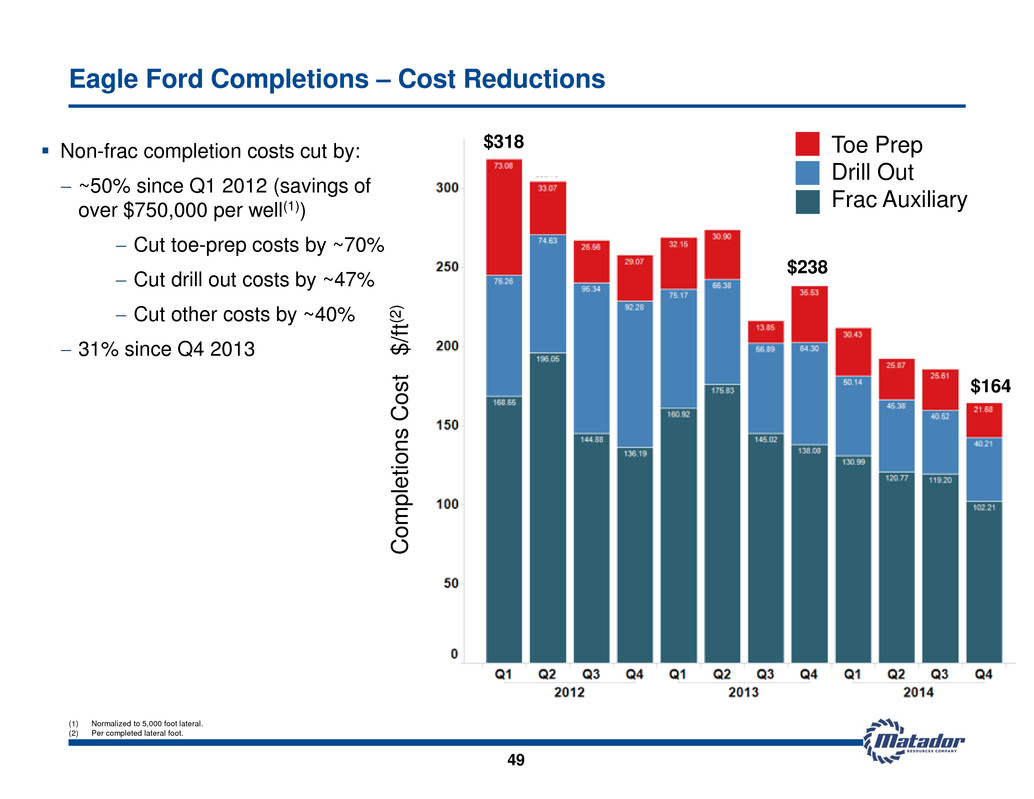

Eagle Ford Completions – Cost Reductions (1) Normalized to 5,000 foot lateral. (2) Per completed lateral foot. Non-frac completion costs cut by: ~50% since Q1 2012 (savings of over $750,000 per well(1)) Cut toe-prep costs by ~70% Cut drill out costs by ~47% Cut other costs by ~40% 31% since Q4 2013 49 C o mpleti o ns C o st $ /f t( 2 ) Toe Prep Drill Out Frac Auxiliary $238 $318 $164

Permian Basin

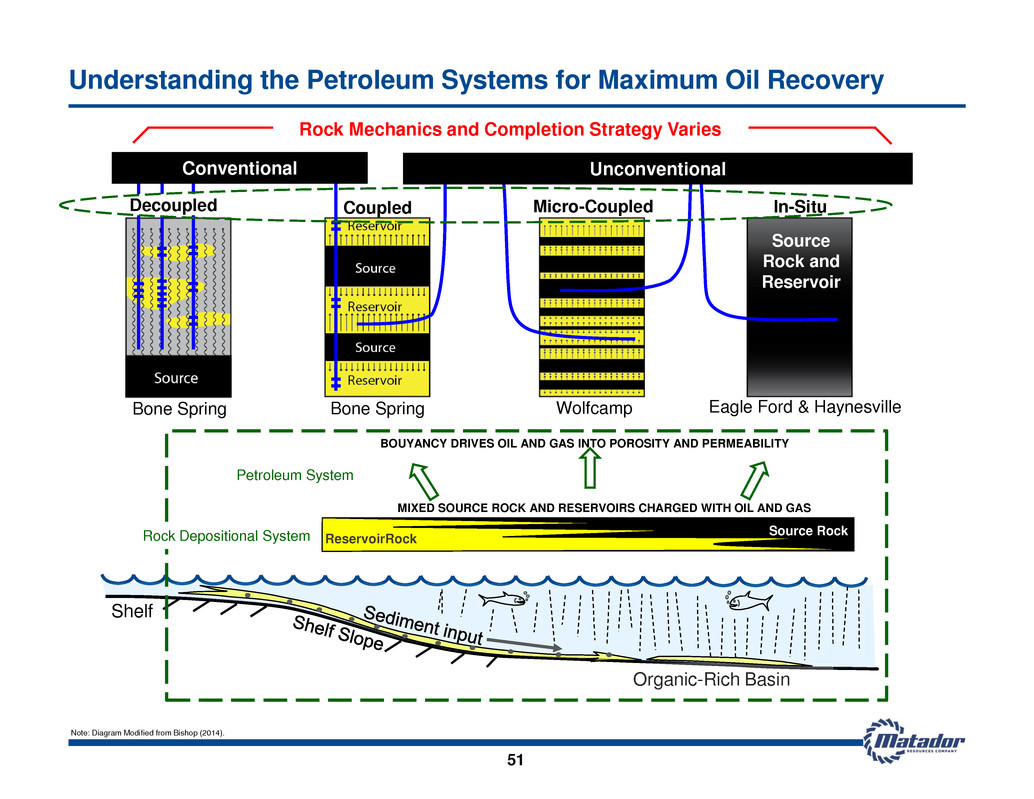

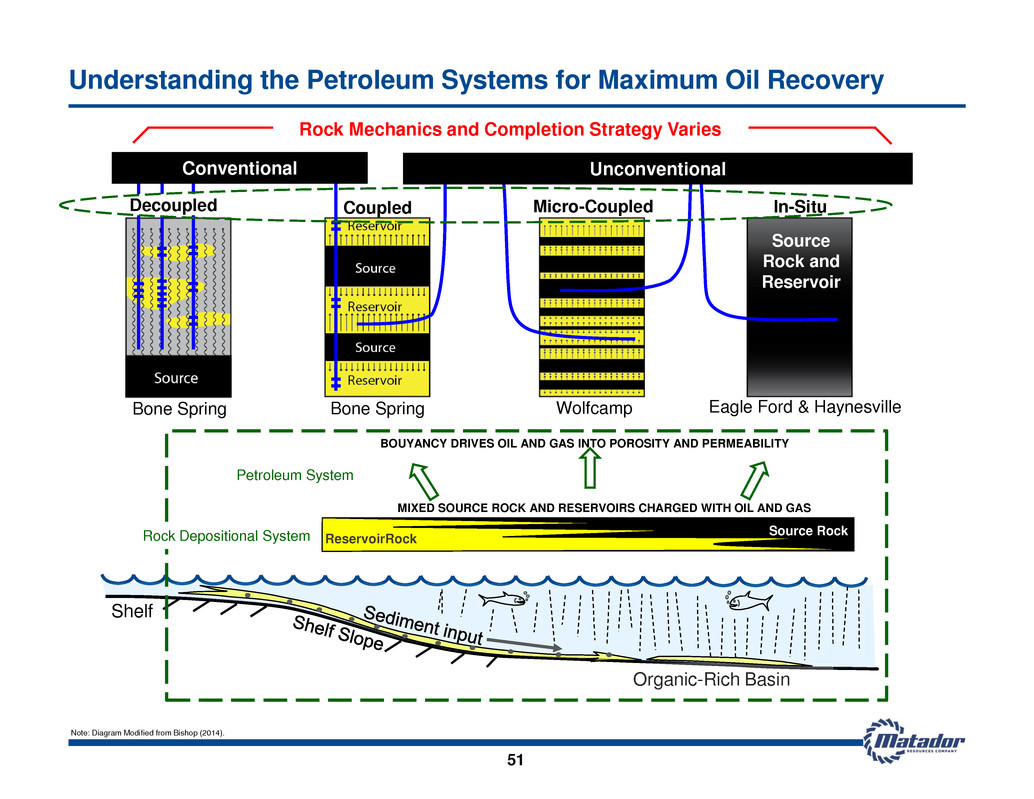

Understanding the Petroleum Systems for Maximum Oil Recovery Note: Diagram Modified from Bishop (2014). Eagle Ford & Haynesville Wolfcamp Bone Spring Conventional Unconventional Shelf Organic-Rich Basin Decoupled Coupled Micro-Coupled In-Situ Bone Spring Source Rock and Reservoir ReservoirRock Source Rock MIXED SOURCE ROCK AND RESERVOIRS CHARGED WITH OIL AND GAS BOUYANCY DRIVES OIL AND GAS INTO POROSITY AND PERMEABILITY Rock Mechanics and Completion Strategy Varies Rock Depositional System Petroleum System 51

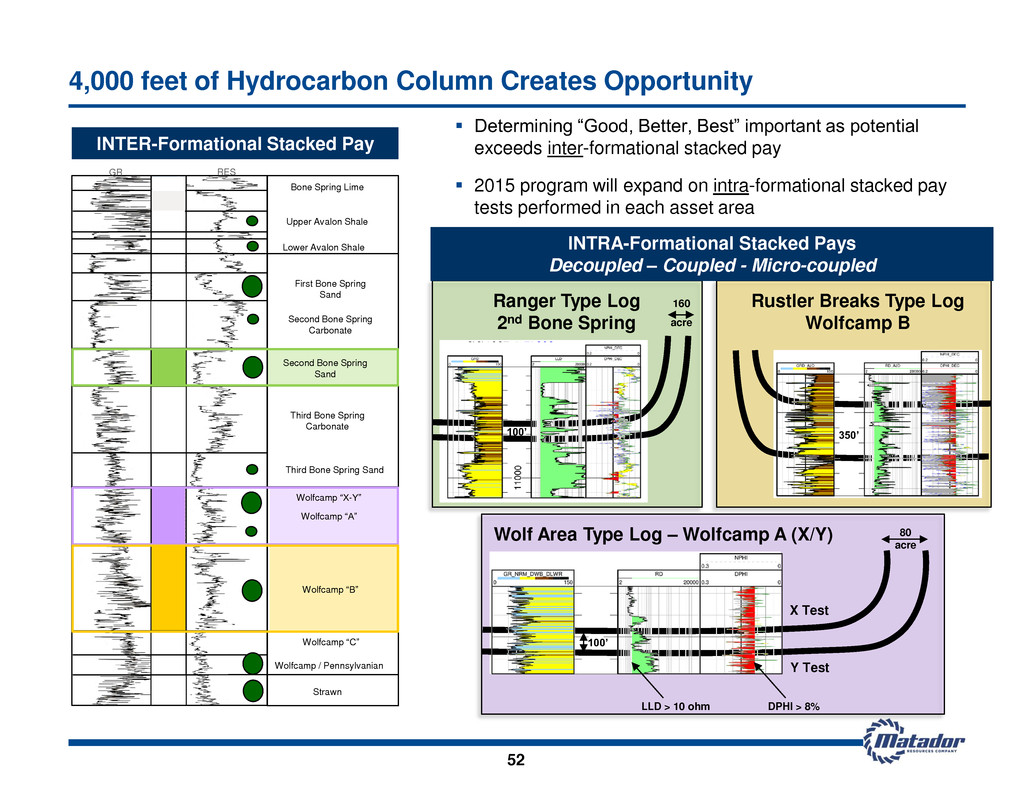

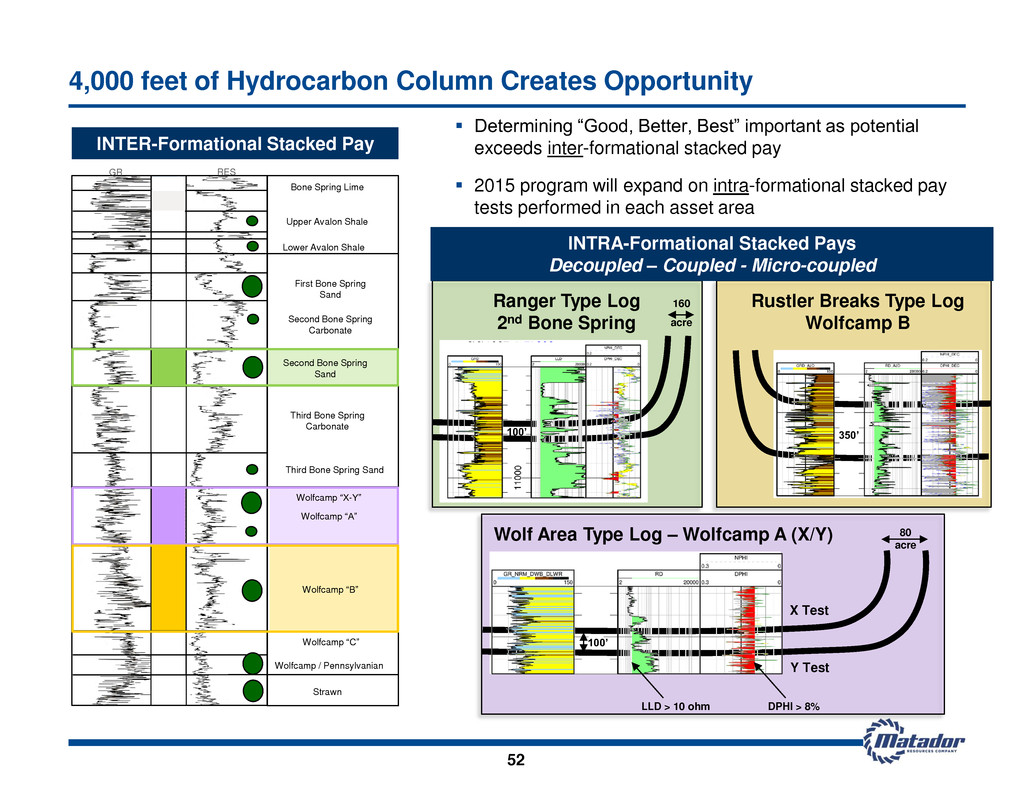

Determining “Good, Better, Best” important as potential exceeds inter-formational stacked pay 2015 program will expand on intra-formational stacked pay tests performed in each asset area 4,000 feet of Hydrocarbon Column Creates Opportunity Wolf Area Type Log – Wolfcamp A (X/Y) X Test Y Test 80 acre 100’ Rustler Breaks Type Log Wolfcamp B 350’ X Test Y Test 160 acre Ranger Type Log 2nd Bone Spring DPHI > 8% LLD > 10 ohm INTRA-Formational Stacked Pays Decoupled – Coupled - Micro-coupled Bone Spring Lime Upper Avalon Shale Lower Avalon Shale First Bone Spring Sand Second Bone Spring Carbonate Third Bone Spring Carbonate Wolfcamp / Pennsylvanian Strawn Wolfcamp “C” Third Bone Spring Sand GR RES INTER-Formational Stacked Pay Second Bone Spring Sand Wolfcamp “A” Wolfcamp “B” 100’ Wolfcamp “X-Y” 52

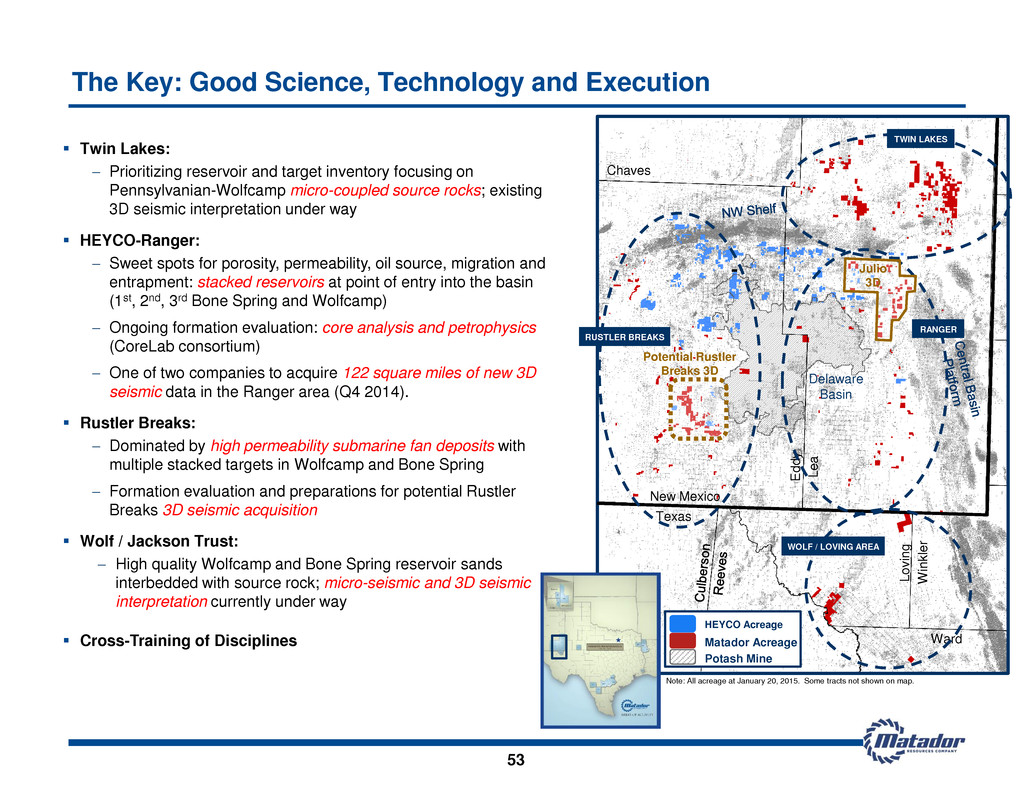

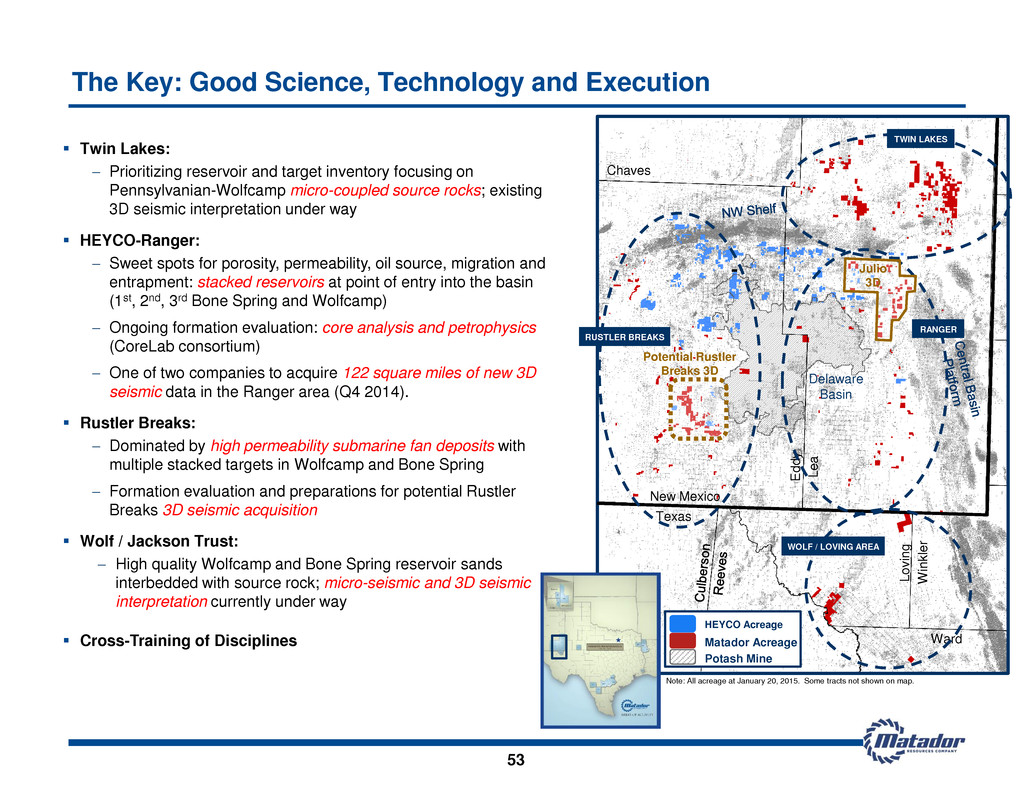

Twin Lakes: Prioritizing reservoir and target inventory focusing on Pennsylvanian-Wolfcamp micro-coupled source rocks; existing 3D seismic interpretation under way HEYCO-Ranger: Sweet spots for porosity, permeability, oil source, migration and entrapment: stacked reservoirs at point of entry into the basin (1st, 2nd, 3rd Bone Spring and Wolfcamp) Ongoing formation evaluation: core analysis and petrophysics (CoreLab consortium) One of two companies to acquire 122 square miles of new 3D seismic data in the Ranger area (Q4 2014). Rustler Breaks: Dominated by high permeability submarine fan deposits with multiple stacked targets in Wolfcamp and Bone Spring Formation evaluation and preparations for potential Rustler Breaks 3D seismic acquisition Wolf / Jackson Trust: High quality Wolfcamp and Bone Spring reservoir sands interbedded with source rock; micro-seismic and 3D seismic interpretation currently under way Cross-Training of Disciplines The Key: Good Science, Technology and Execution Note: All acreage at January 20, 2015. Some tracts not shown on map. E d d y L e a L o v in g W in k le r Ward Texas New Mexico Chaves Delaware Basin TWIN LAKES RUSTLER BREAKS RANGER WOLF / LOVING AREA Matador Acreage HEYCO Acreage Potash Mine Julio 3D Potential Rustler Breaks 3D 53

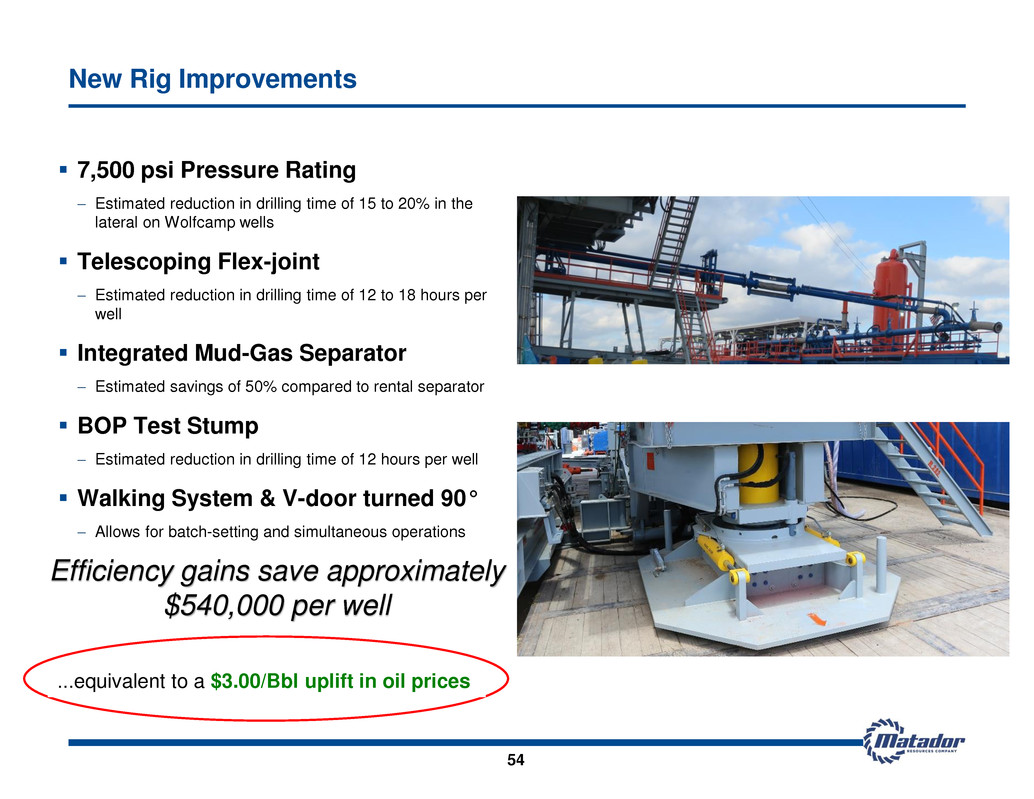

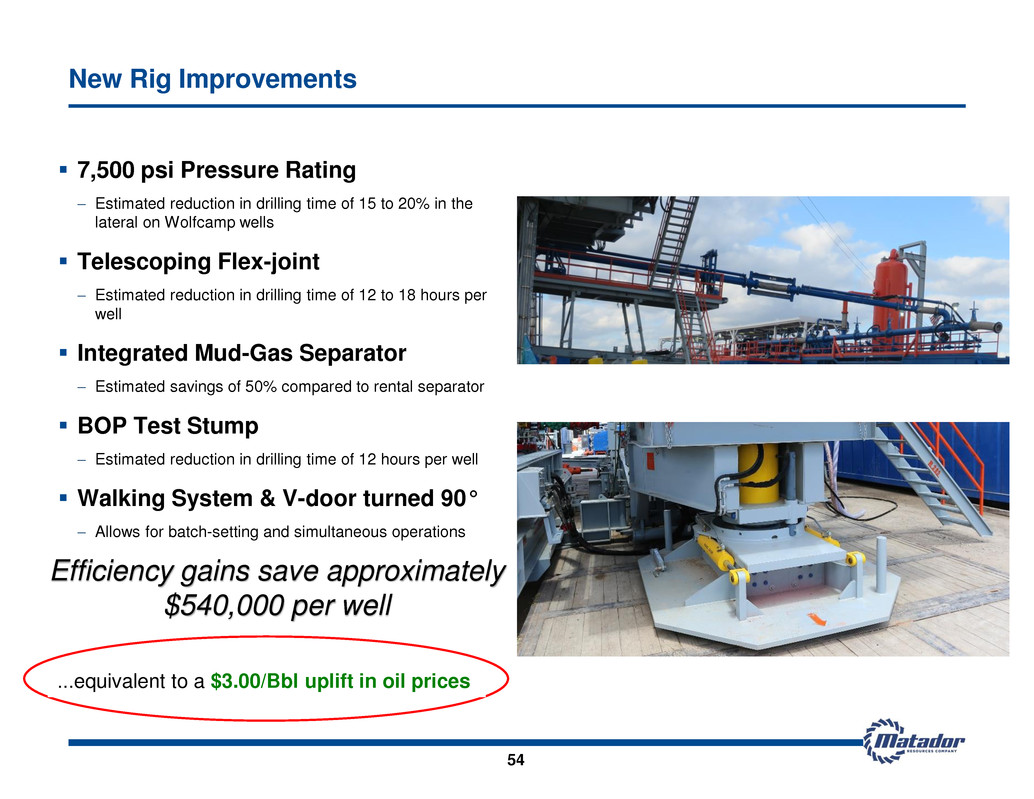

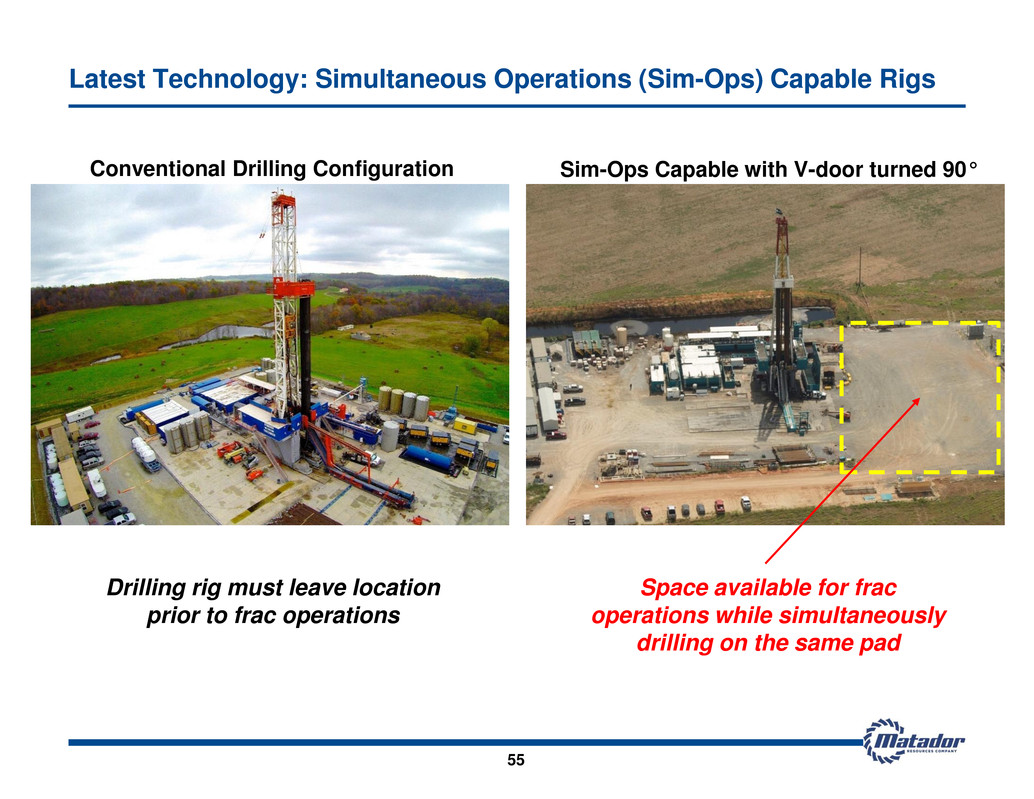

New Rig Improvements 7,500 psi Pressure Rating Estimated reduction in drilling time of 15 to 20% in the lateral on Wolfcamp wells Telescoping Flex-joint Estimated reduction in drilling time of 12 to 18 hours per well Integrated Mud-Gas Separator Estimated savings of 50% compared to rental separator BOP Test Stump Estimated reduction in drilling time of 12 hours per well Walking System & V-door turned 90° Allows for batch-setting and simultaneous operations 54 Efficiency gains save approximately $540,000 per well ...equivalent to a $3.00/Bbl uplift in oil prices

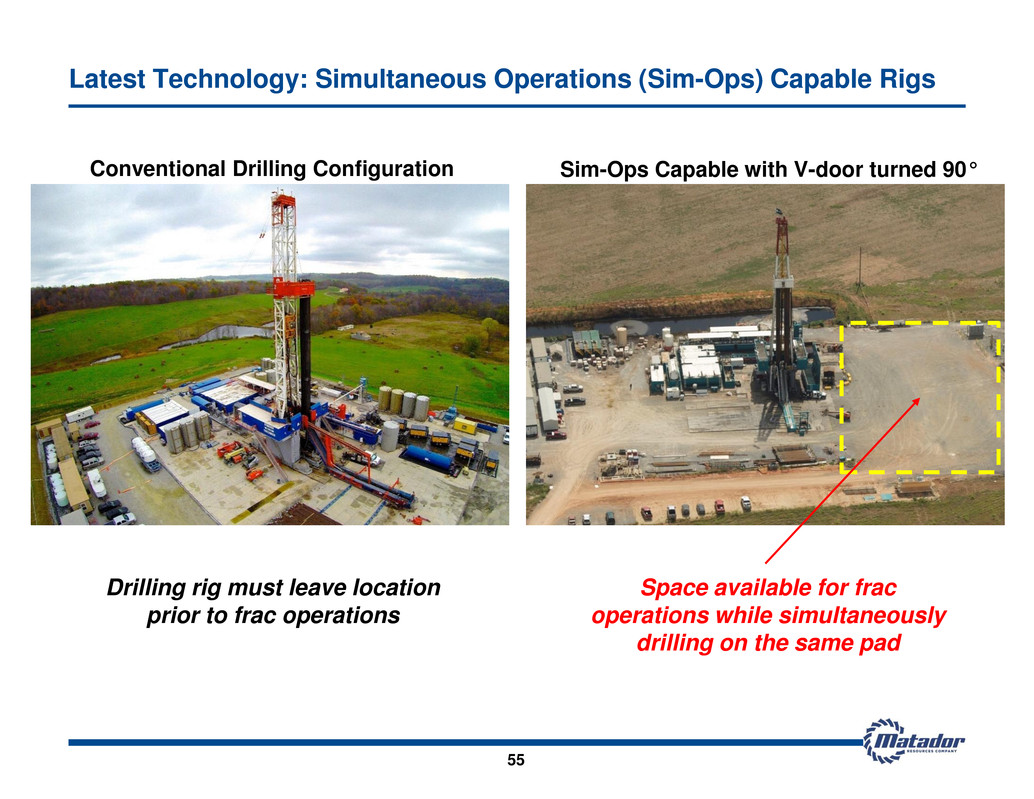

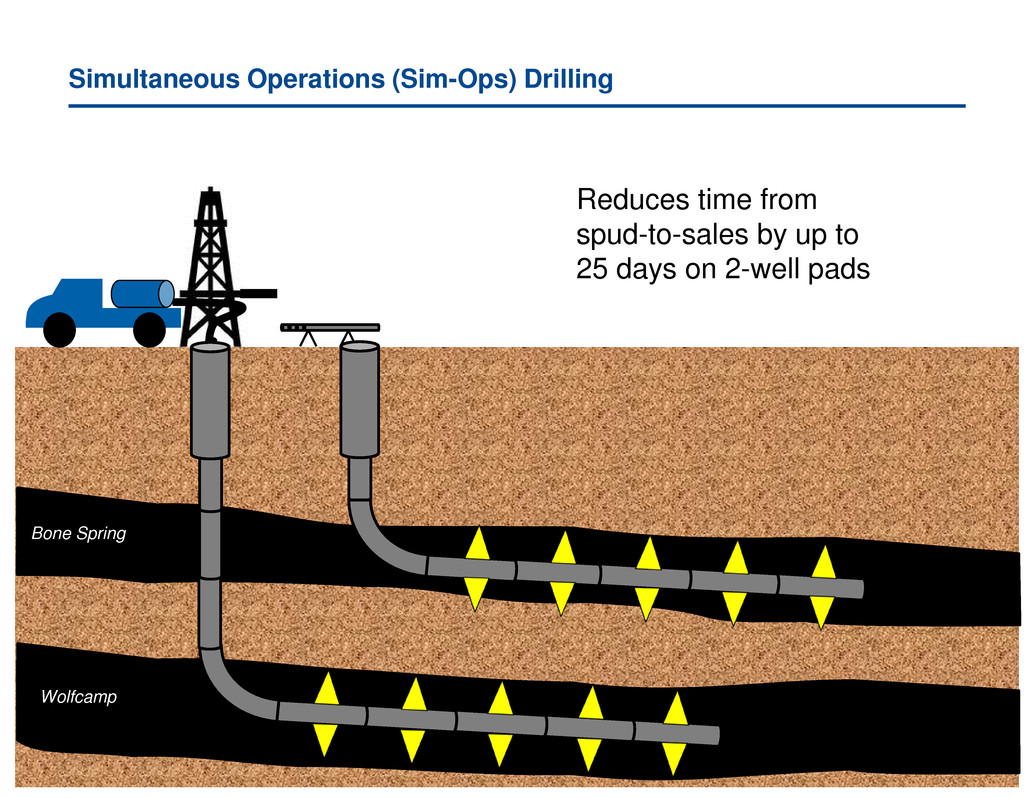

Latest Technology: Simultaneous Operations (Sim-Ops) Capable Rigs 55 Conventional Drilling Configuration Sim-Ops Capable with V-door turned 90° Space available for frac operations while simultaneously drilling on the same pad Drilling rig must leave location prior to frac operations

Simultaneous Operations (Sim-Ops) Drilling Bone Spring Wolfcamp Reduces time from spud-to-sales by up to 25 days on 2-well pads

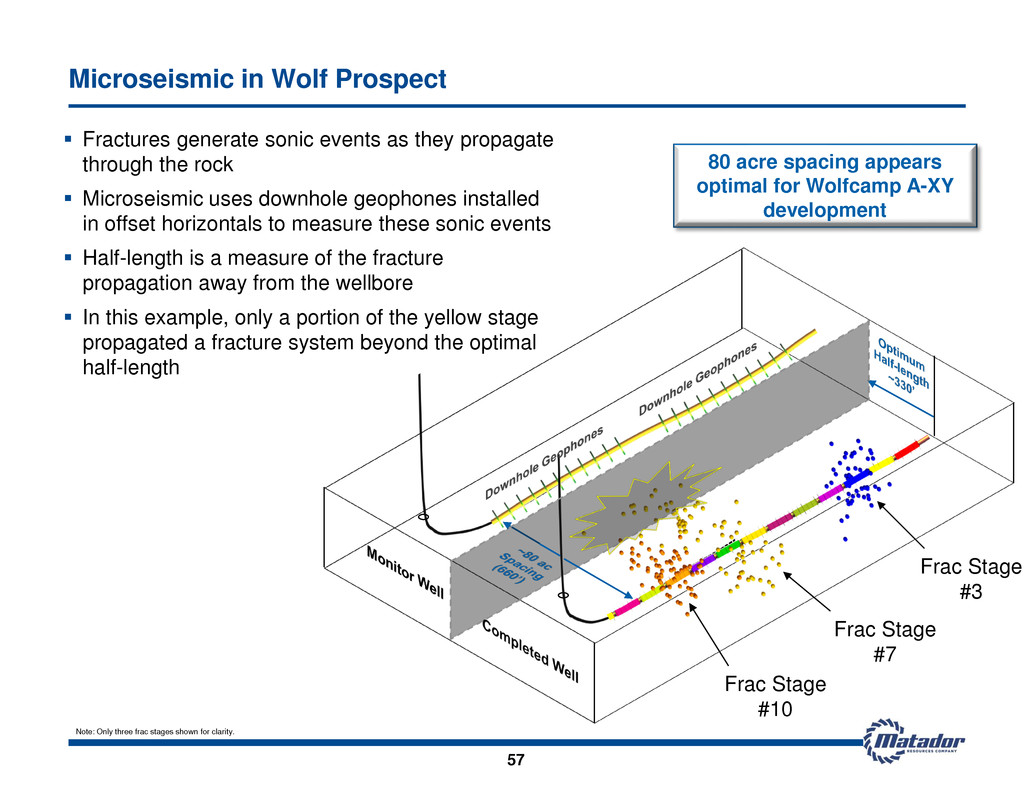

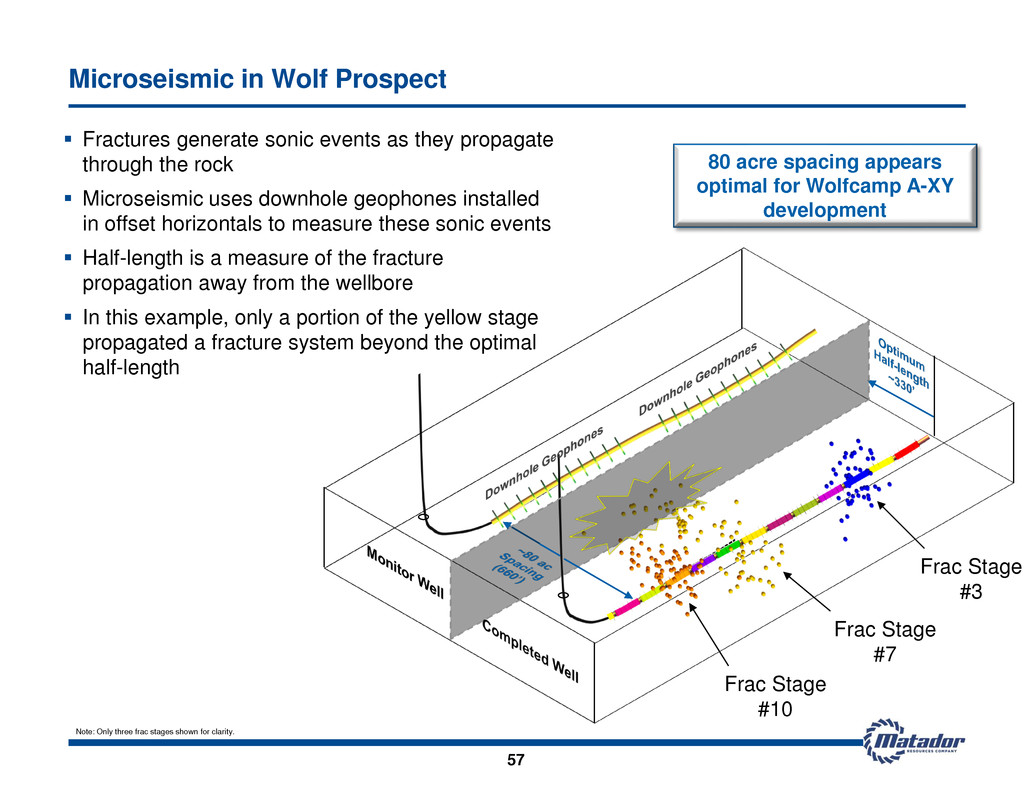

Microseismic in Wolf Prospect Fractures generate sonic events as they propagate through the rock Microseismic uses downhole geophones installed in offset horizontals to measure these sonic events Half-length is a measure of the fracture propagation away from the wellbore In this example, only a portion of the yellow stage propagated a fracture system beyond the optimal half-length 57 80 acre spacing appears optimal for Wolfcamp A-XY development Frac Stage #3 Frac Stage #7 Frac Stage #10 Note: Only three frac stages shown for clarity.

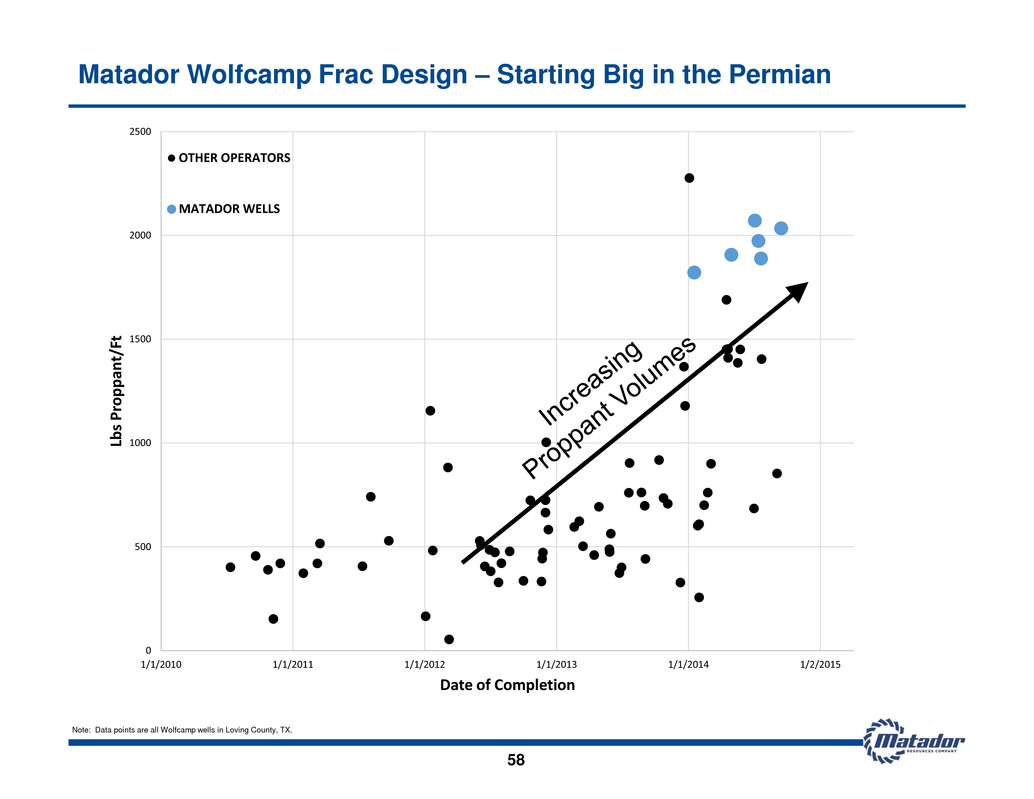

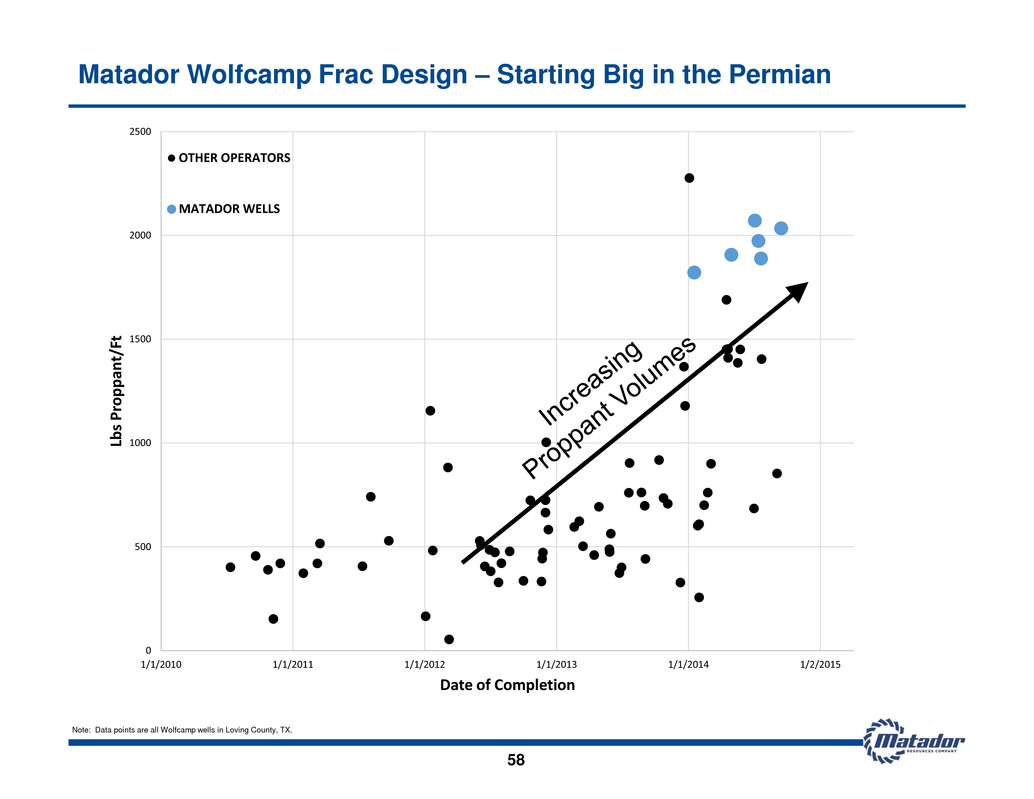

0 500 1000 1500 2000 2500 1/1/2010 1/1/2011 1/1/2012 1/1/2013 1/1/2014 1/2/2015 Lb s P rop pa nt /F t Date of Completion OTHER OPERATORS MATADOR WELLS 58 Matador Wolfcamp Frac Design – Starting Big in the Permian Note: Data points are all Wolfcamp wells in Loving County, TX.

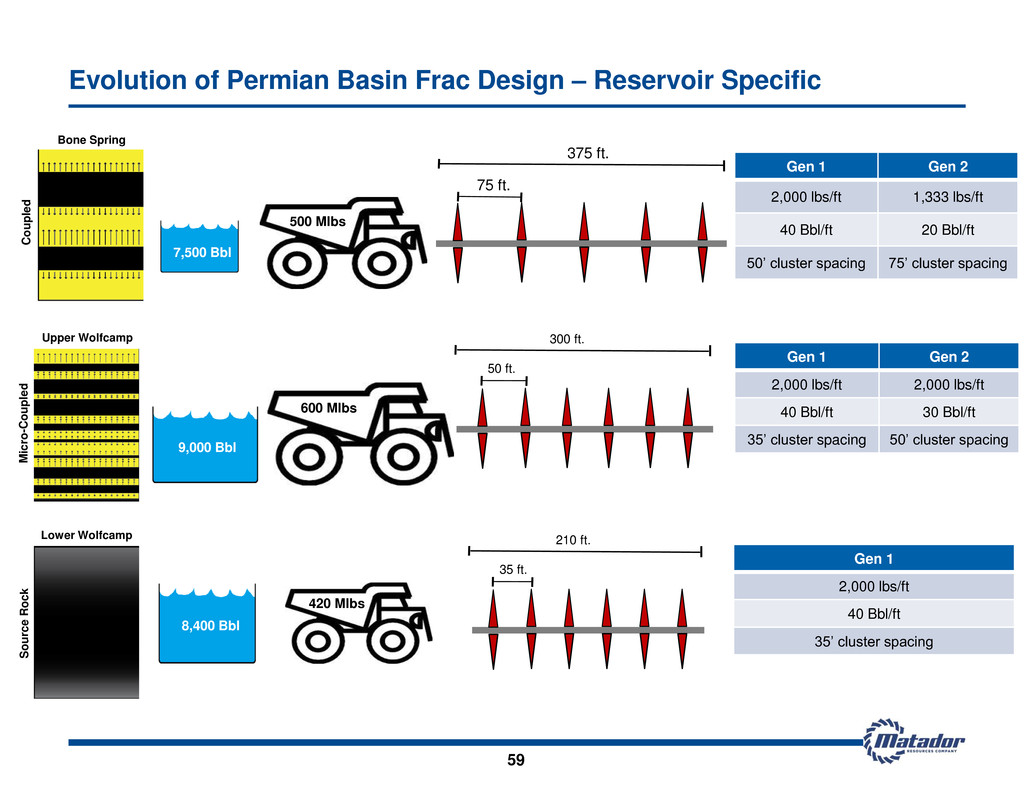

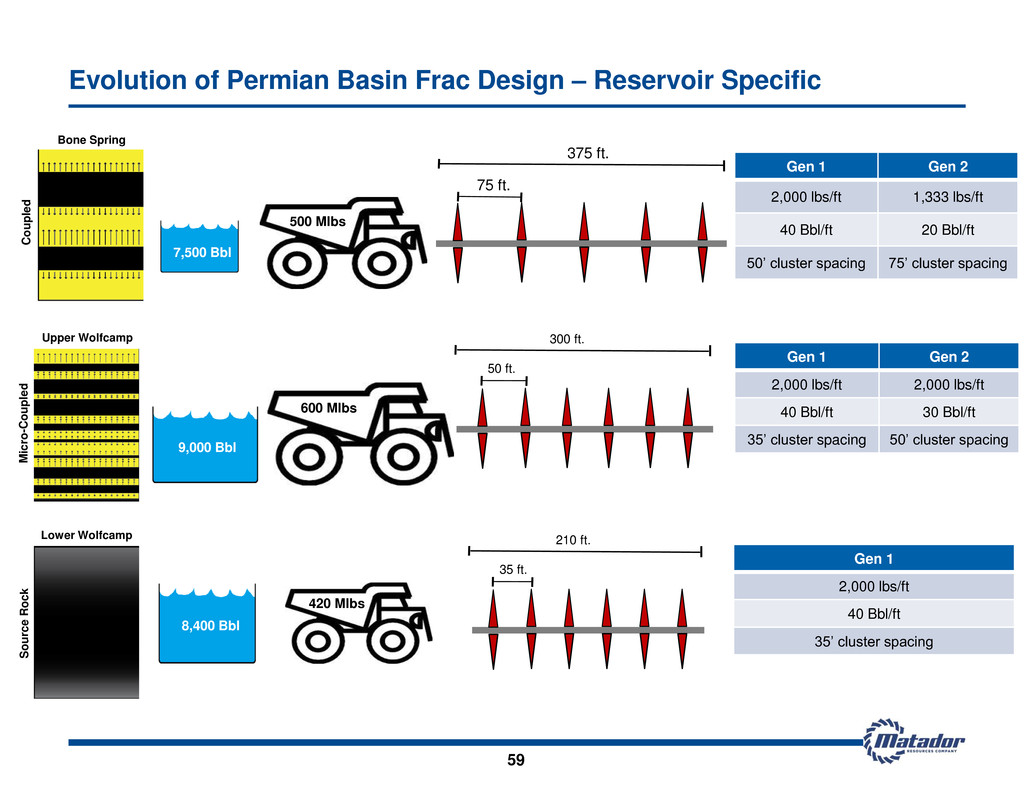

59 7,500 Bbl 9,000 Bbl 8,400 Bbl 600 Mlbs 420 Mlbs 500 Mlbs Evolution of Permian Basin Frac Design – Reservoir Specific 375 ft. 300 ft. 50 ft. 75 ft. 210 ft. 35 ft. Gen 1 Gen 2 2,000 lbs/ft 1,333 lbs/ft 40 Bbl/ft 20 Bbl/ft 50’ cluster spacing 75’ cluster spacing Gen 1 Gen 2 2,000 lbs/ft 2,000 lbs/ft 40 Bbl/ft 30 Bbl/ft 35’ cluster spacing 50’ cluster spacing Gen 1 2,000 lbs/ft 40 Bbl/ft 35’ cluster spacing Bone Spring Upper Wolfcamp Lower Wolfcamp C o u p le d Mi c ro -C o u p le d S o u rc e R o c k

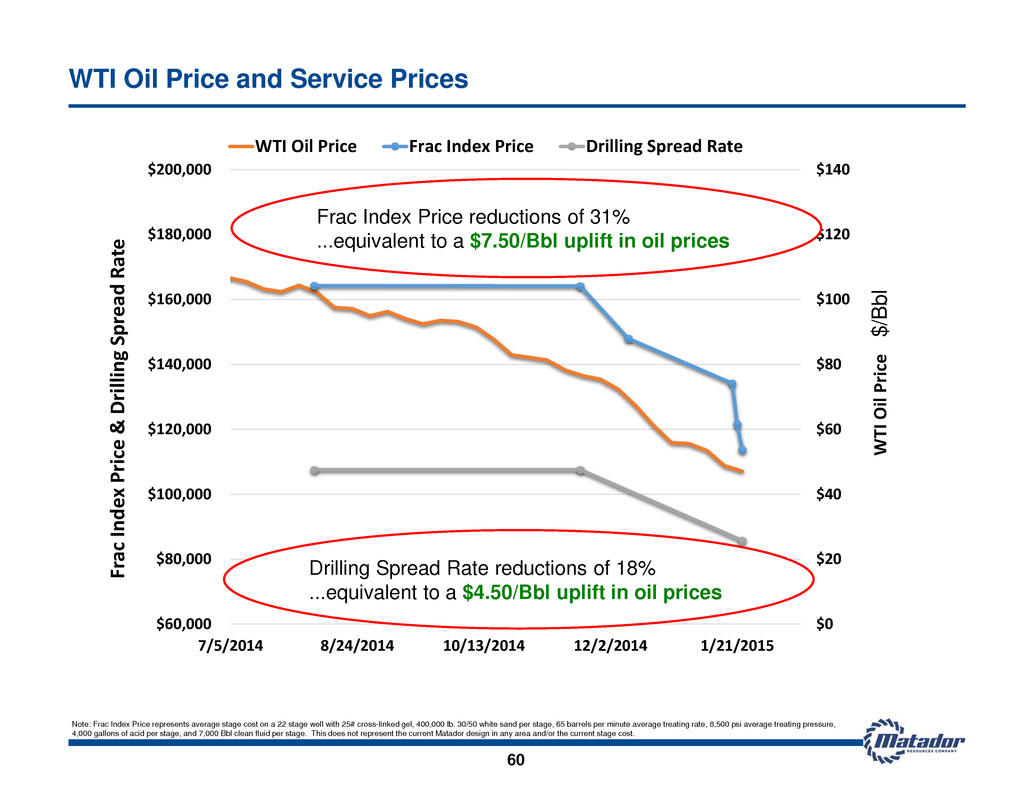

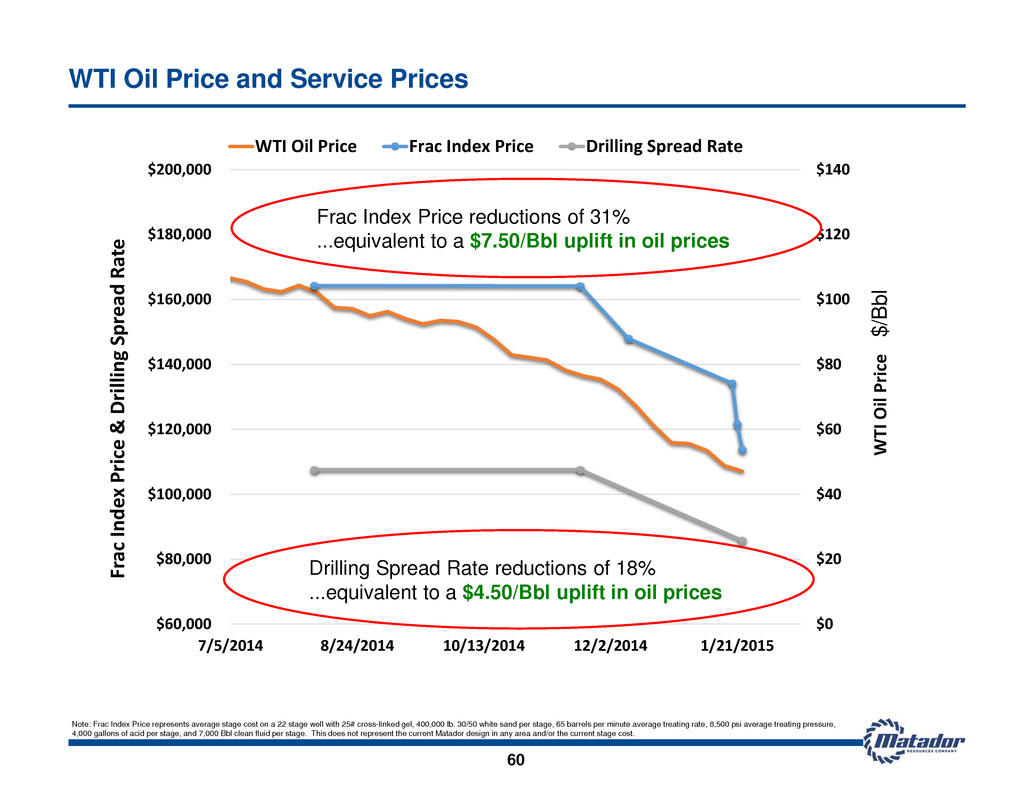

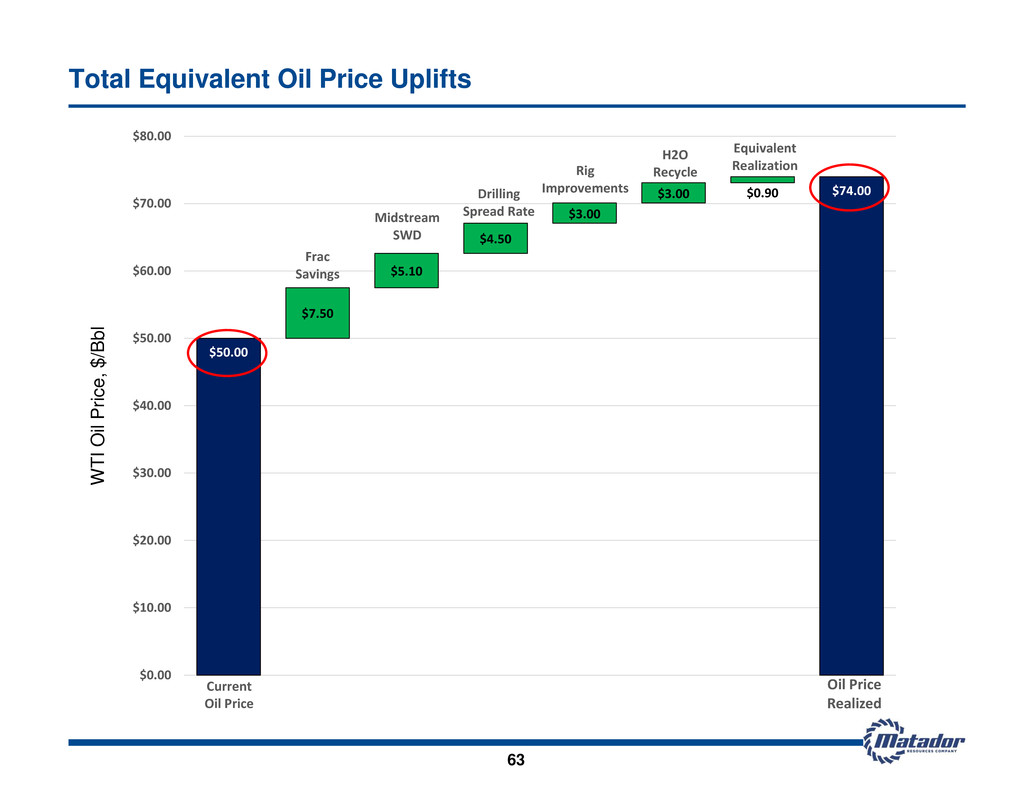

$60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 7/5/2014 8/24/2014 10/13/2014 12/2/2014 1/21/2015 $0 $20 $40 $60 $80 $100 $120 $140 Fr ac In de x Pric e & Drilli ng Sp rea d Ra te W TI Oi l Pri ce WTI Oil Price Frac Index Price Drilling Spread Rate WTI Oil Price and Service Prices 60 Frac Index Price reductions of 31% ...equivalent to a $7.50/Bbl uplift in oil prices Drilling Spread Rate reductions of 18% ...equivalent to a $4.50/Bbl uplift in oil prices Note: Frac Index Price represents average stage cost on a 22 stage well with 25# cross-linked gel, 400,000 lb. 30/50 white sand per stage, 65 barrels per minute average treating rate, 8,500 psi average treating pressure, 4,000 gallons of acid per stage, and 7,000 Bbl clean fluid per stage. This does not represent the current Matador design in any area and/or the current stage cost. $/B b l

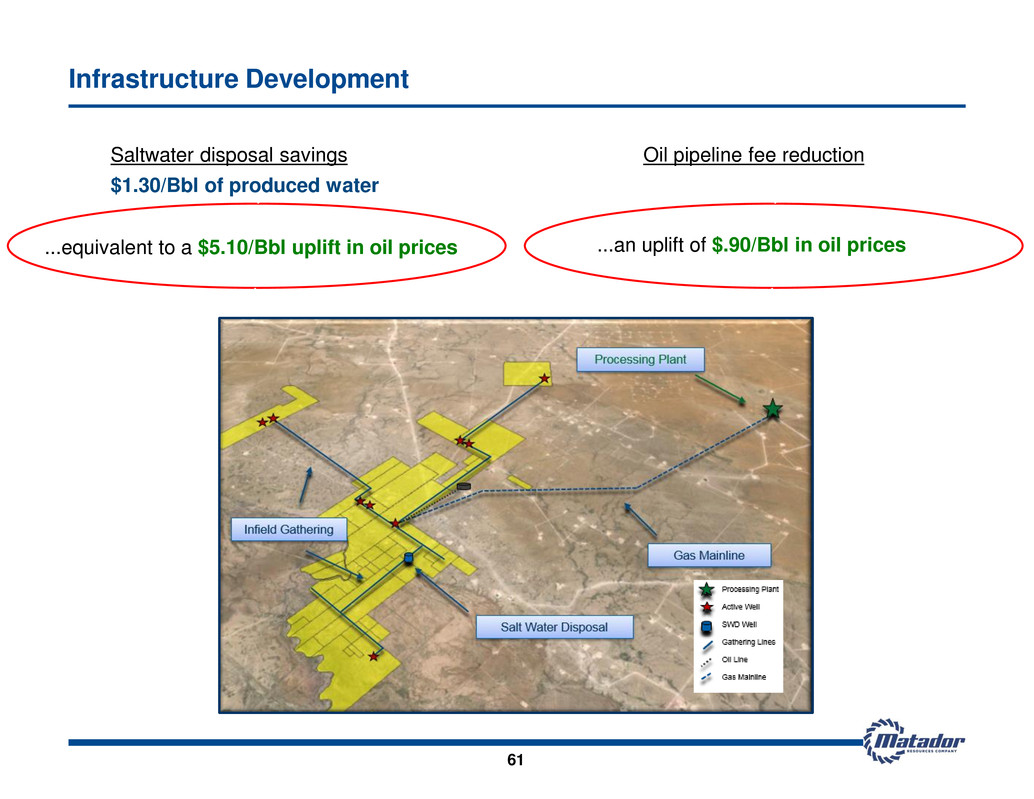

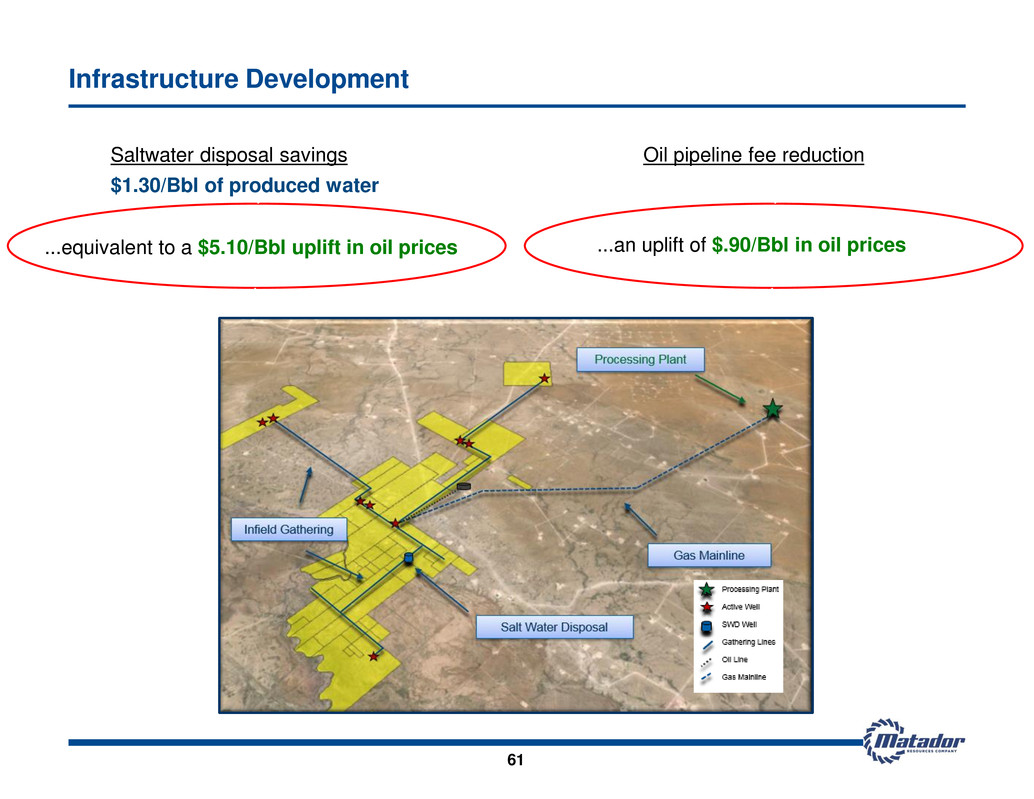

Saltwater disposal savings $1.30/Bbl of produced water Infrastructure Development ...equivalent to a $5.10/Bbl uplift in oil prices Oil pipeline fee reduction ...an uplift of $.90/Bbl in oil prices 61

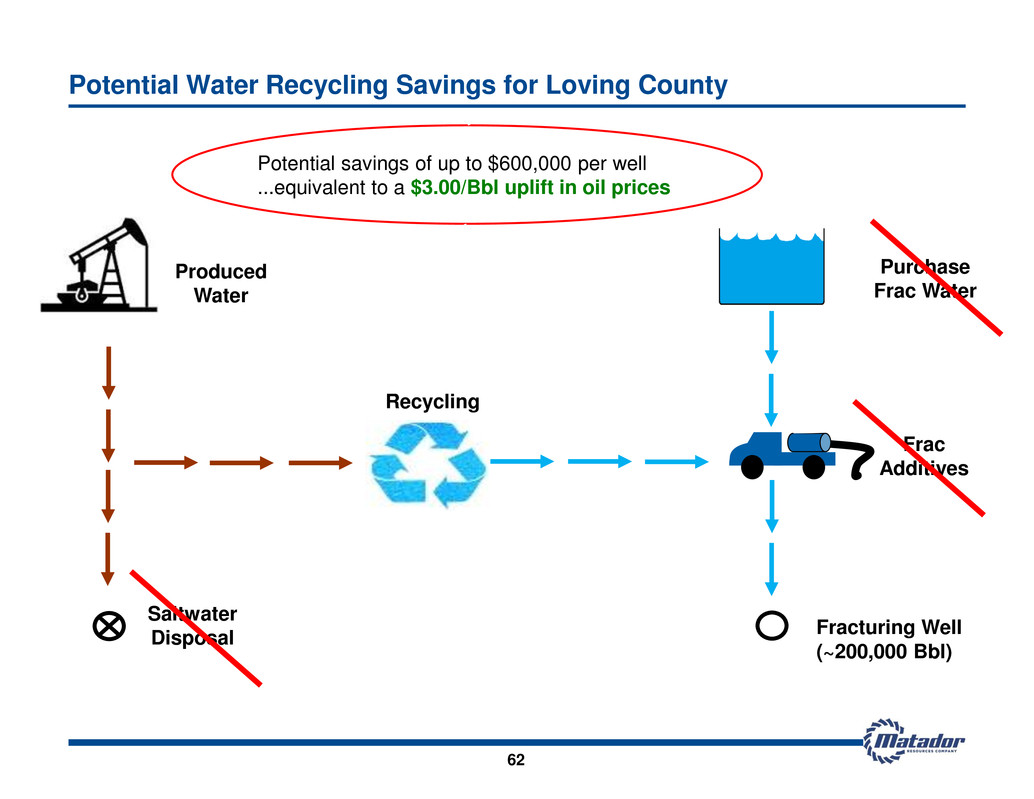

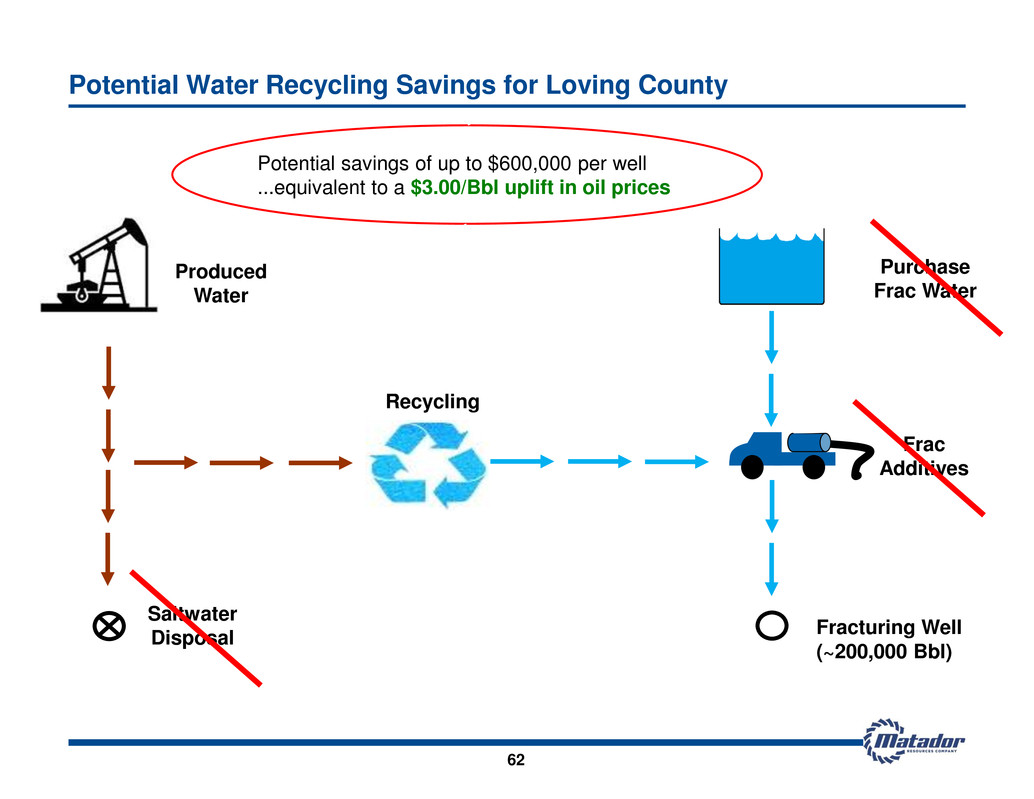

Potential Water Recycling Savings for Loving County Saltwater Disposal Produced Water Purchase Frac Water Frac Additives Fracturing Well (~200,000 Bbl) Recycling Potential savings of up to $600,000 per well ...equivalent to a $3.00/Bbl uplift in oil prices 62

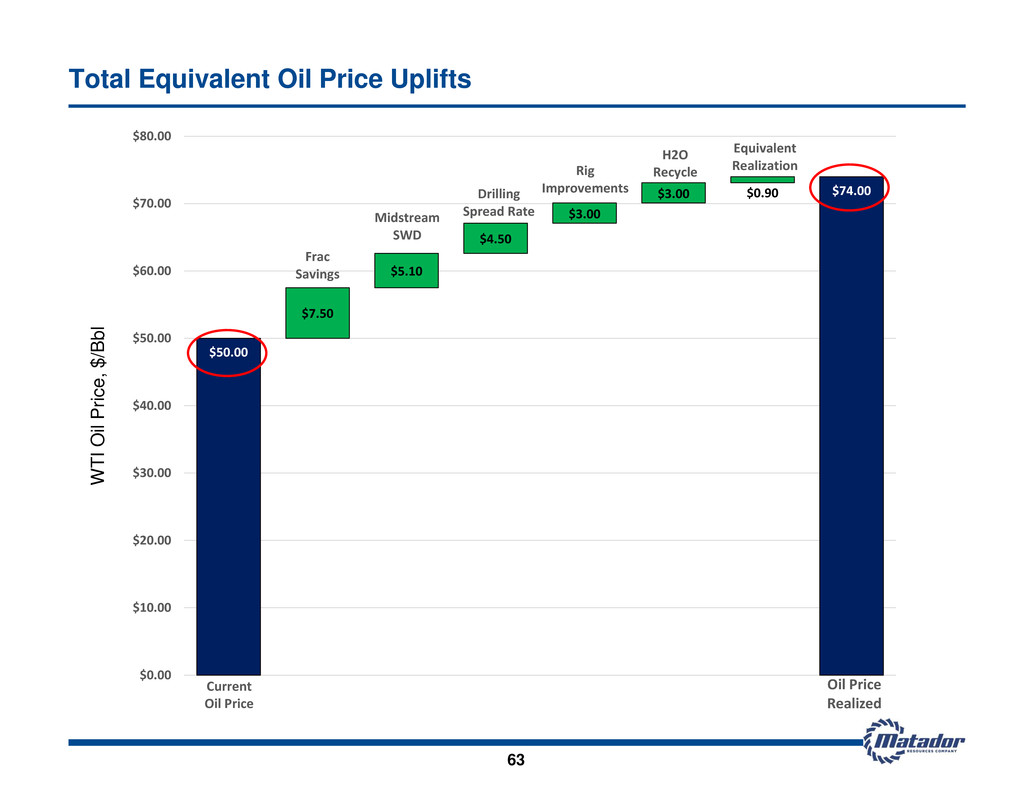

$50.00 $7.50 $5.10 $4.50 $3.00 $3.00 $0.90 $74.00 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 Total Equivalent Oil Price Uplifts 63 $50.00 $7.50 $6.00 $4.50 $3.00 $3.00 $74.00 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 Current Oil Price Frac Savings Midstream SWD Drilling Spread Rate Rig Improvements H2O Recycle Equivalent Realization $50.00 $7.50 $6.00 $4.50 $3.00 $3.00 $74.00 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 Current Oil Price Frac Savings Midstream SWD Drilling Spread Rate Rig Improvements H2O Recycle Equivalent Realization $50. 0 $7.50 $6.00 $4.50 $3.00 $3.00 $74.00 0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.00 $80.00 Current Oil Price Frac Savings Midstream SWD Drilling Spread Rate Rig Improvements H2O Recycle Equivalent Realization $50.00 $7.50 $6.00 $4.50 $3.00 $3.00 $74.00 0.0 $1 . 20.0 $3 . 40.0 $5 . 60.0 $7 . 80.00 Current il Price Frac Savings Midstream SWD Drilling Spread Rate Rig Improvements H2O Recycle Equivalent Realization $50.00 $7.50 $6.00 $4.50 $3.00 $3.00 $74.00 $0.0 $1 . 20.0 $3 . 40.0 $5 . 60.0 $7 . 80.00 Current Oil Price Frac S vings Midstream SWD Drilling Spread Rate Rig Improvements H2O Recycle Equivalent Realization $50.00 $7.50 $6.00 $4.50 $3.00 $3.00 $74.00 $ . 0 $1 . 0 $2 . 0 $3 . 0 $4 .00 $5 .00 $6 .00 $70.00 $80.00 Current Oil Price Frac Savings Midstream SWD Drilling Spread Rate Rig Improvements H2O Recycle Equivalent Realization $50.00 $7.50 $6.00 $4.50 $3.00 $3.0 $74.00 $ . 1 . 2 . 3 . 4 . 5 . $6 . $70.00 $80.00 Cur ent Oil P ic Frac S vings Midstream SWD Drilling Spread Rate Rig Improvements H2O ecycle Equivalent Realization $50.00 $7.50 $5.10 $4.50 $3.00 $3.00 $0.90 $74.00 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 Current Oil Price Frac Savings Midstream SWD Drilling Spread Rate Rig Improvements H2O Recycle Oil Price Realized W T I Oil Price , $/Bb l

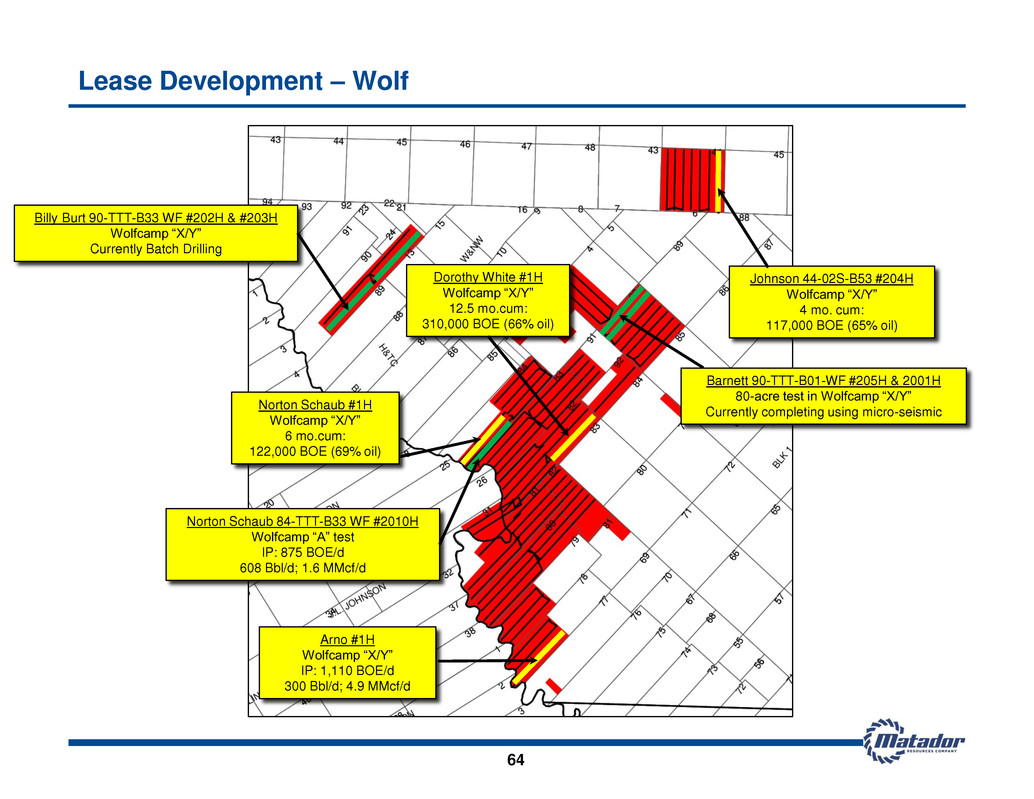

64 Lease Development – Wolf Dorothy White #1H Wolfcamp “X/Y” 12.5 mo.cum: 310,000 BOE (66% oil) Norton Schaub #1H Wolfcamp “X/Y” 6 mo.cum: 122,000 BOE (69% oil) Arno #1H Wolfcamp “X/Y” IP: 1,110 BOE/d 300 Bbl/d; 4.9 MMcf/d Johnson 44-02S-B53 #204H Wolfcamp “X/Y” 4 mo. cum: 117,000 BOE (65% oil) Barnett 90-TTT-B01-WF #205H & 2001H 80-acre test in Wolfcamp “X/Y” Currently completing using micro-seismic Norton Schaub 84-TTT-B33 WF #2010H Wolfcamp “A” test IP: 875 BOE/d 608 Bbl/d; 1.6 MMcf/d Billy Burt 90-TTT-B33 WF #202H & #203H Wolfcamp “X/Y” Currently Batch Drilling

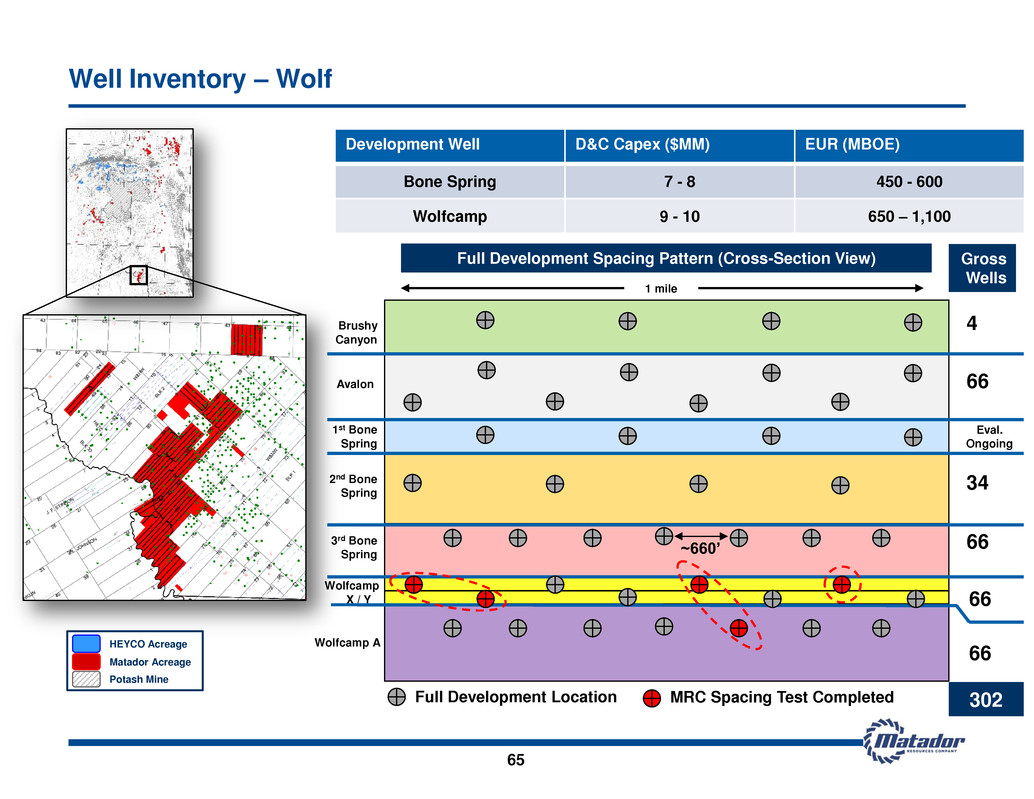

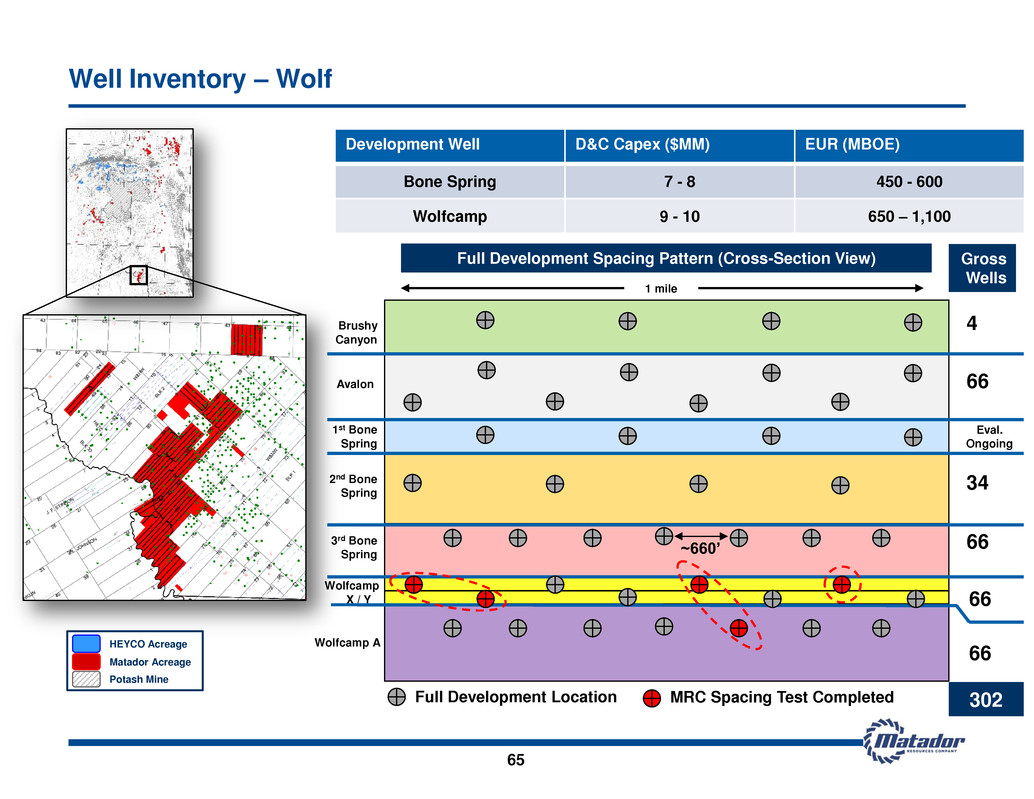

Well Inventory – Wolf ~660’ Brushy Canyon Avalon 1st Bone Spring 2nd Bone Spring 3rd Bone Spring Wolfcamp X / Y Wolfcamp A 4 66 Eval. Ongoing 34 66 66 66 302 Full Development Location Gross Wells Development Well D&C Capex ($MM) EUR (MBOE) Bone Spring 7 - 8 450 - 600 Wolfcamp 9 - 10 650 – 1,100 Potash Mine HEYCO Acreage Matador Acreage 1 mile MRC Spacing Test Completed Full Development Spacing Pattern (Cross-Section View) 65

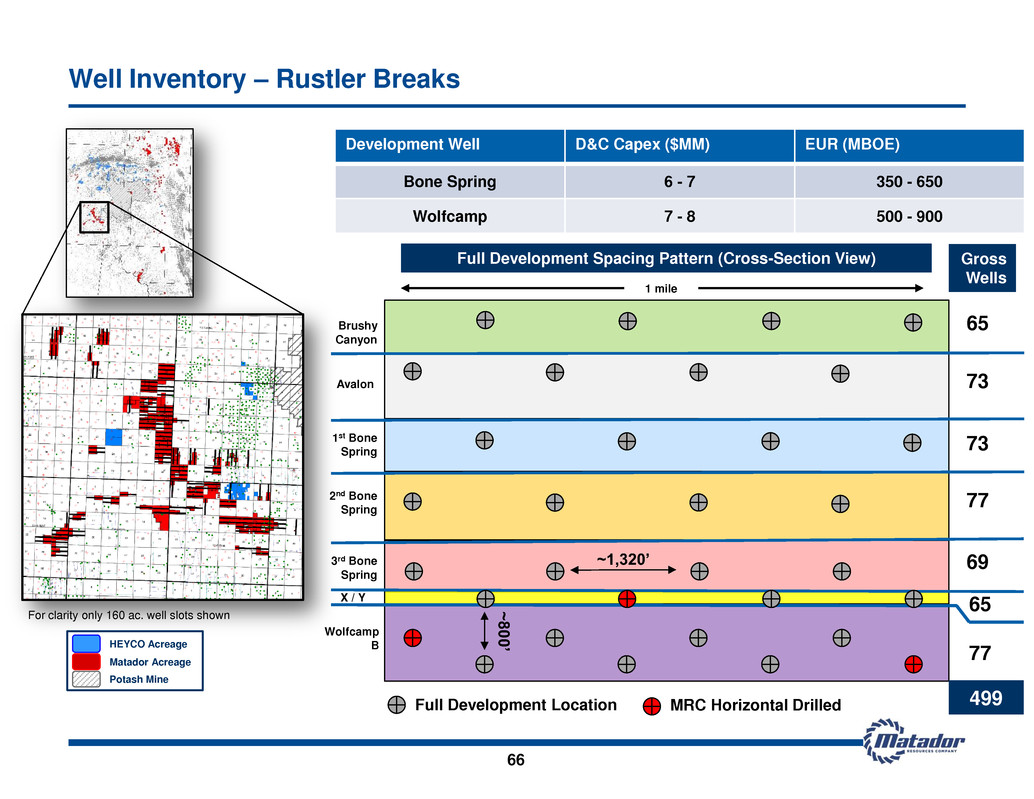

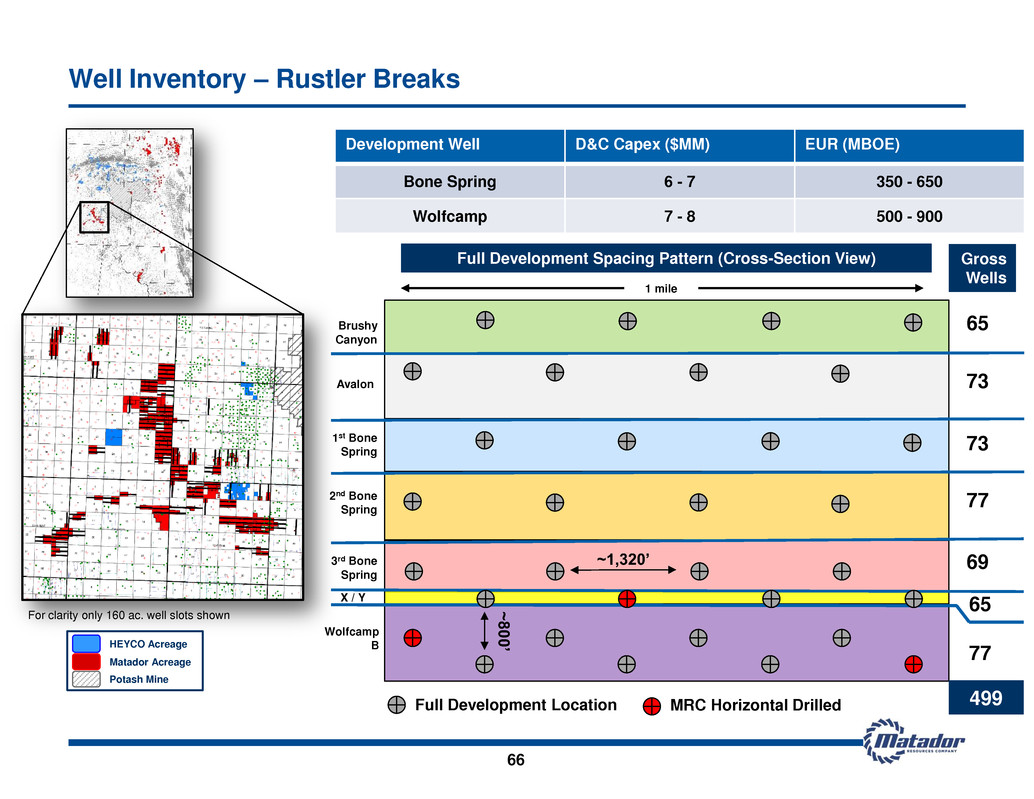

Well Inventory – Rustler Breaks Brushy Canyon Avalon 1st Bone Spring 2nd Bone Spring 3rd Bone Spring X / Y Wolfcamp B ~800 ’ 65 73 73 77 69 77 65 499 Full Development Location Gross Wells Development Well D&C Capex ($MM) EUR (MBOE) Bone Spring 6 - 7 350 - 650 Wolfcamp 7 - 8 500 - 900 Potash Mine HEYCO Acreage Matador Acreage For clarity only 160 ac. well slots shown 1 mile MRC Horizontal Drilled Full Development Spacing Pattern (Cross-Section View) ~1,320’ 66

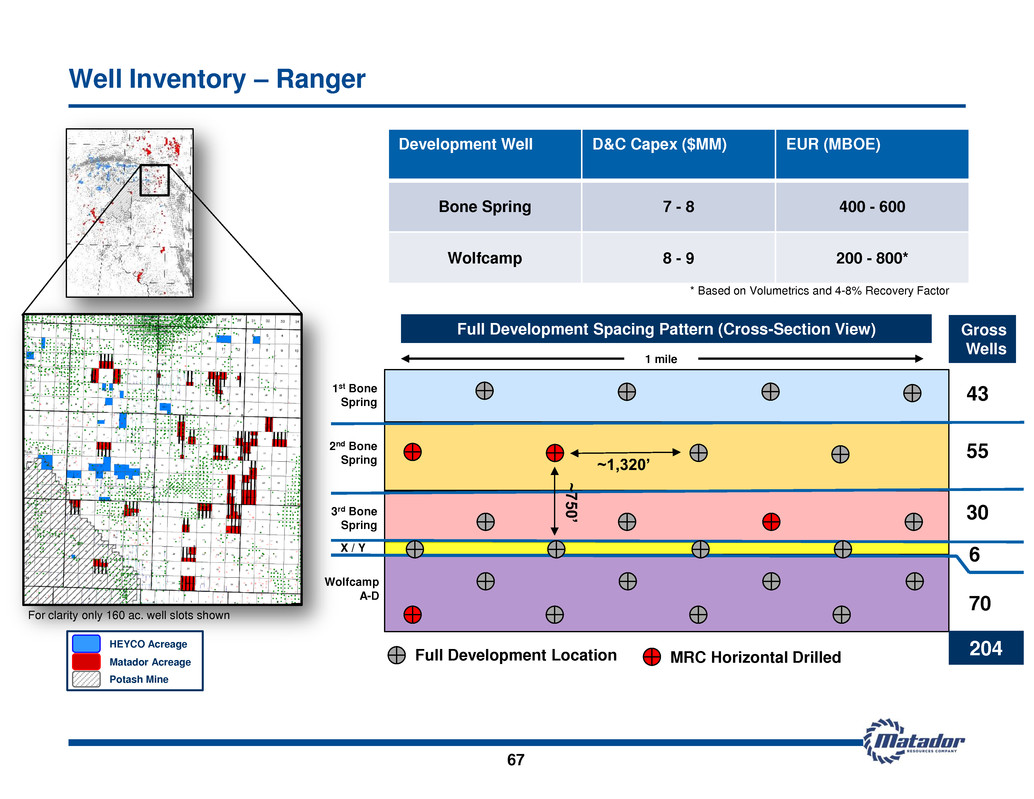

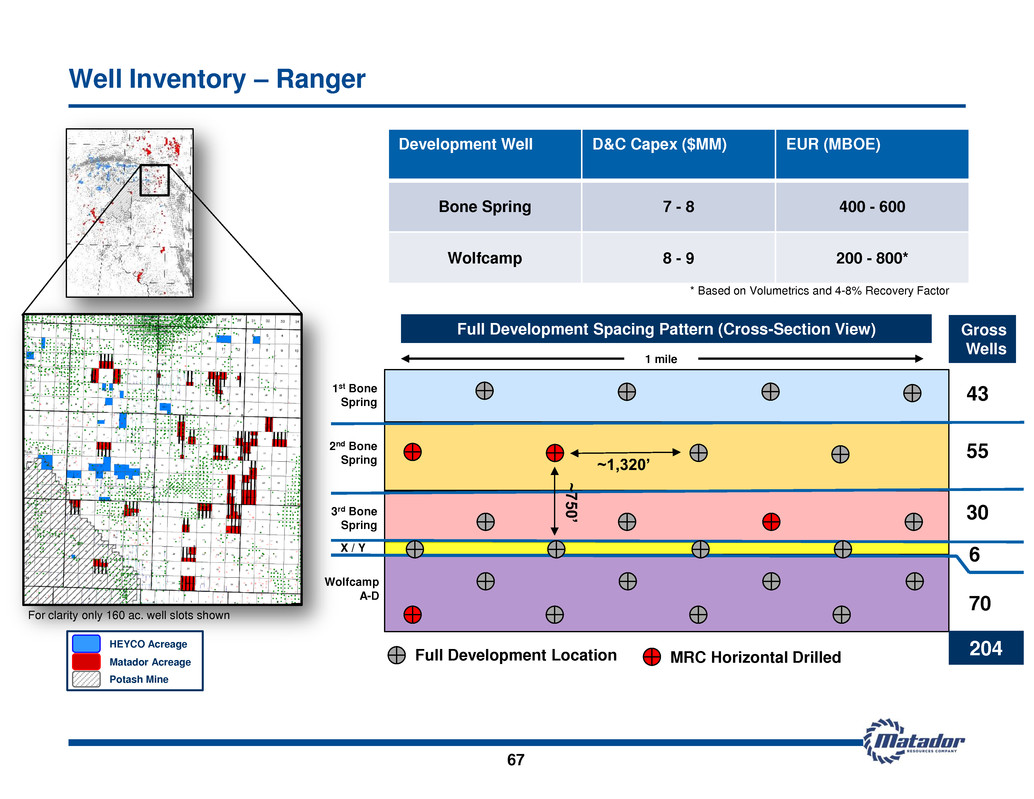

Well Inventory – Ranger Potash Mine HEYCO Acreage Matador Acreage ~1,320’ 1st Bone Spring 2nd Bone Spring 3rd Bone Spring X / Y Wolfcamp A-D ~750 ’ 43 55 30 70 6 204 1 mile MRC Horizontal Drilled Full Development Location Full Development Spacing Pattern (Cross-Section View) Gross Wells Development Well D&C Capex ($MM) EUR (MBOE) Bone Spring 7 - 8 400 - 600 Wolfcamp 8 - 9 200 - 800* For clarity only 160 ac. well slots shown * Based on Volumetrics and 4-8% Recovery Factor 67

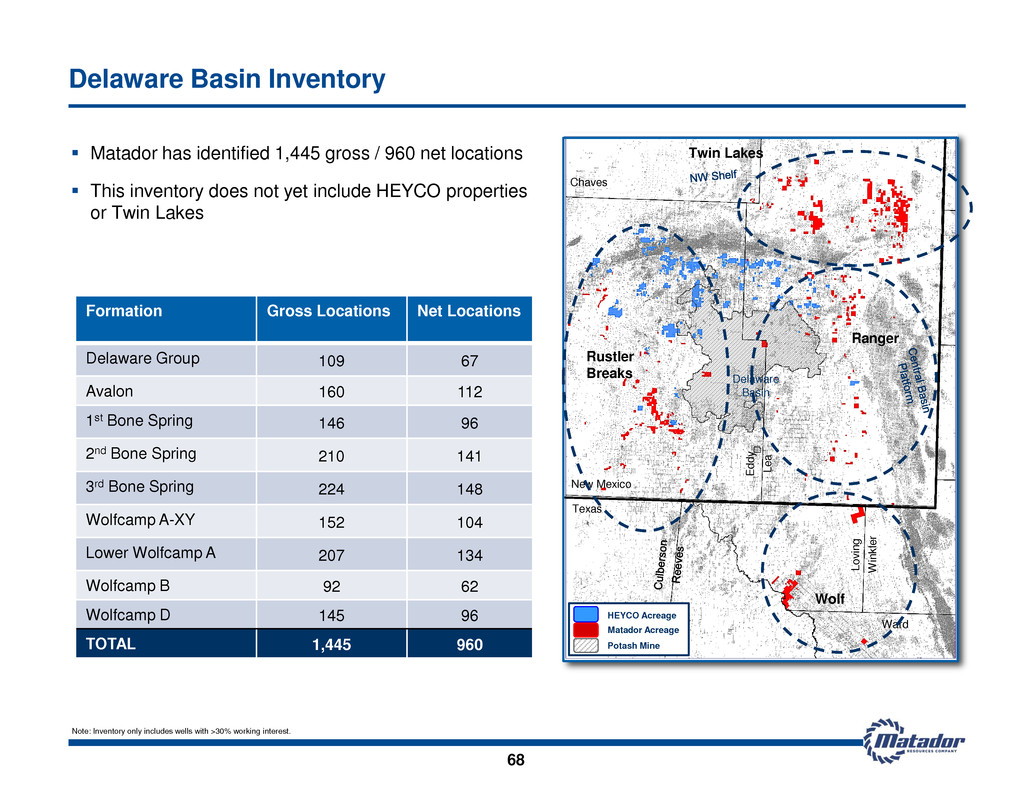

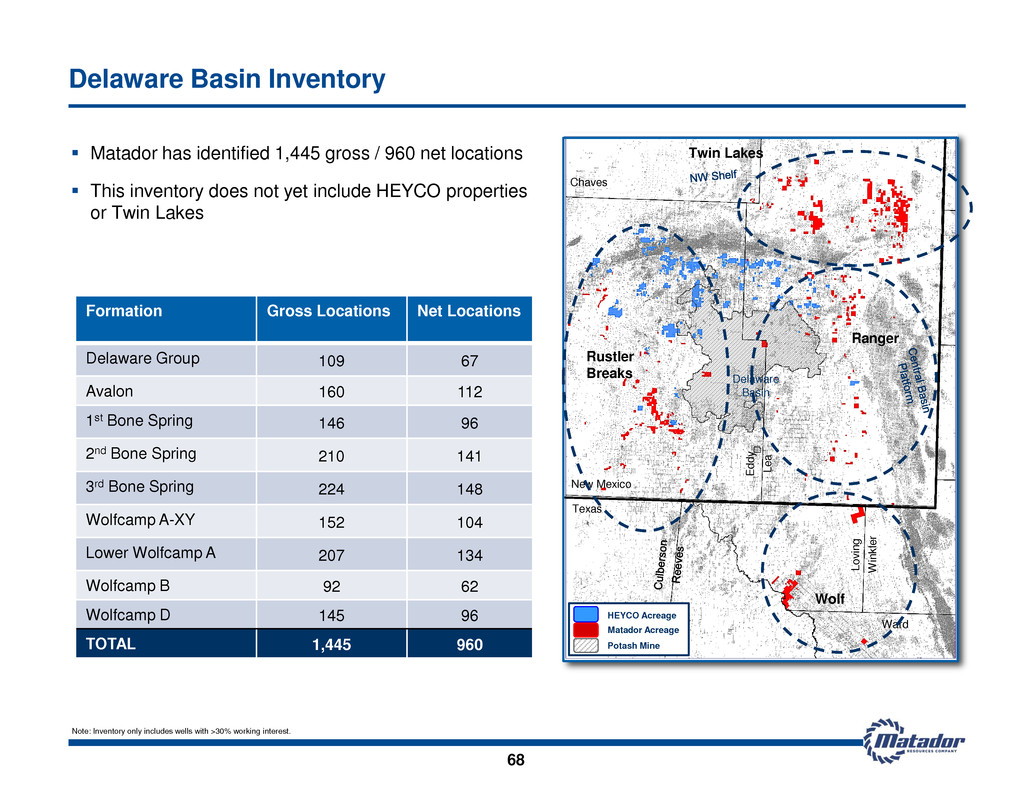

Delaware Basin Inventory Matador has identified 1,445 gross / 960 net locations This inventory does not yet include HEYCO properties or Twin Lakes Delaware Basin E d d y L e a L o v in g W in k le r Ward Texas New Mexico Chaves Ranger Rustler Breaks Wolf Potash Mine HEYCO Acreage Matador Acreage Formation Gross Locations Net Locations Delaware Group 109 67 Avalon 160 112 1st Bone Spring 146 96 2nd Bone Spring 210 141 3rd Bone Spring 224 148 Wolfcamp A-XY 152 104 Lower Wolfcamp A 207 134 Wolfcamp B 92 62 Wolfcamp D 145 96 TOTAL 1,445 960 68 Note: Inventory only includes wells with >30% working interest. Twin Lakes

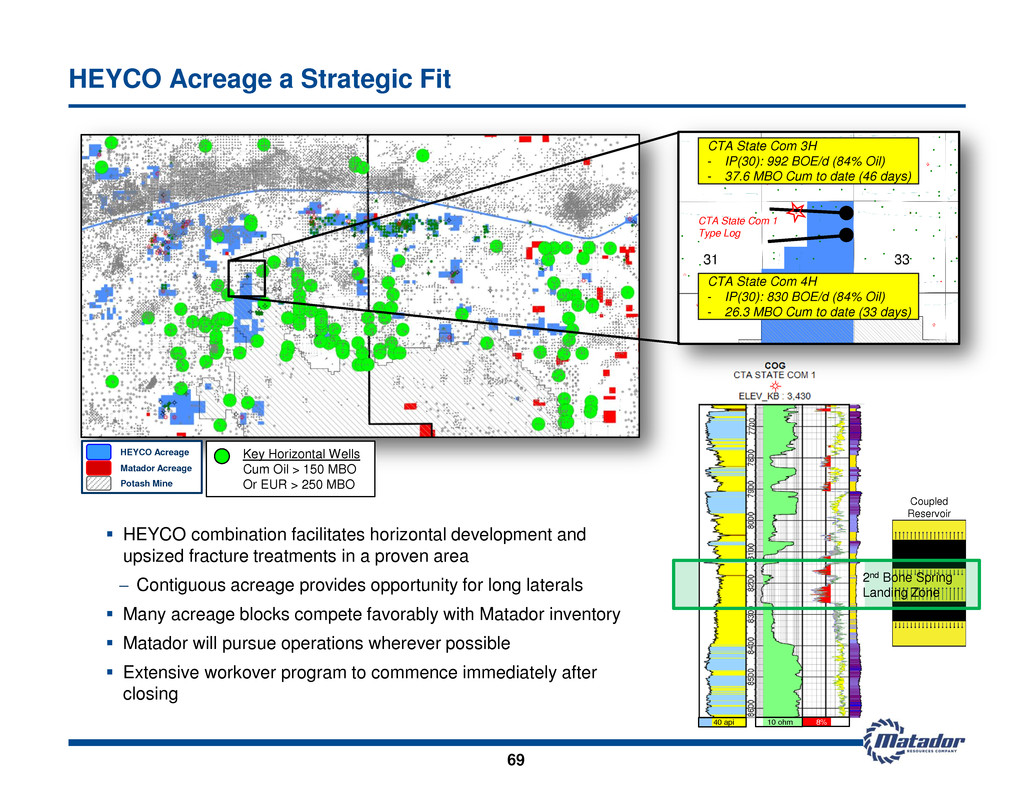

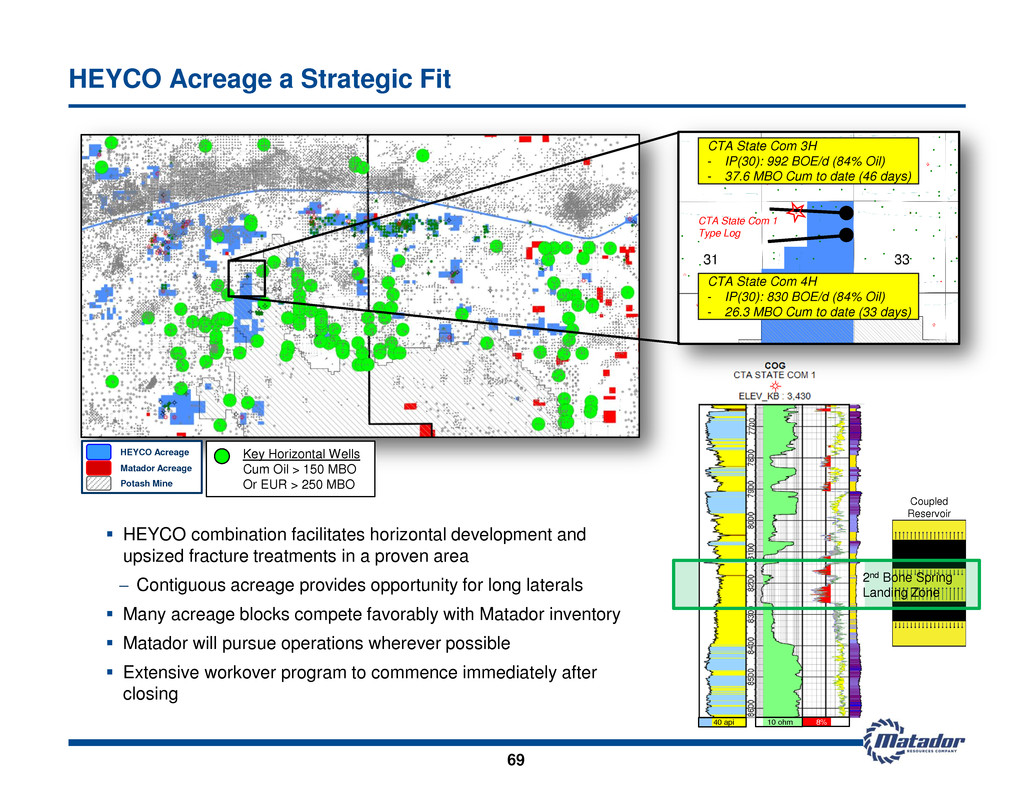

HEYCO Acreage a Strategic Fit 69 HEYCO combination facilitates horizontal development and upsized fracture treatments in a proven area Contiguous acreage provides opportunity for long laterals Many acreage blocks compete favorably with Matador inventory Matador will pursue operations wherever possible Extensive workover program to commence immediately after closing 2nd Bone Spring Landing Zone CTA State Com 3H - IP(30): 992 BOE/d (84% Oil) - 37.6 MBO Cum to date (46 days) CTA State Com 1 Type Log 40 api 10 ohm 8% CTA State Com 4H - IP(30): 830 BOE/d (84% Oil) - 26.3 MBO Cum to date (33 days) Key Horizontal Wells Cum Oil > 150 MBO Or EUR > 250 MBO Potash Mine HEYCO Acreage Matador Acreage Coupled Reservoir

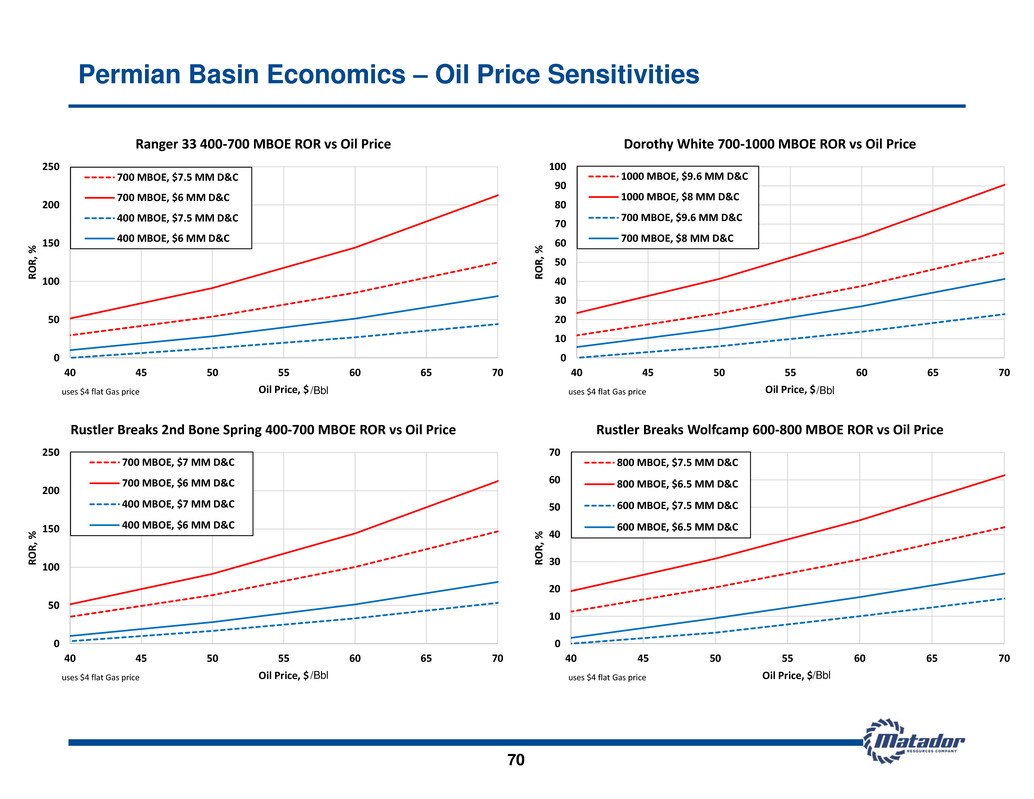

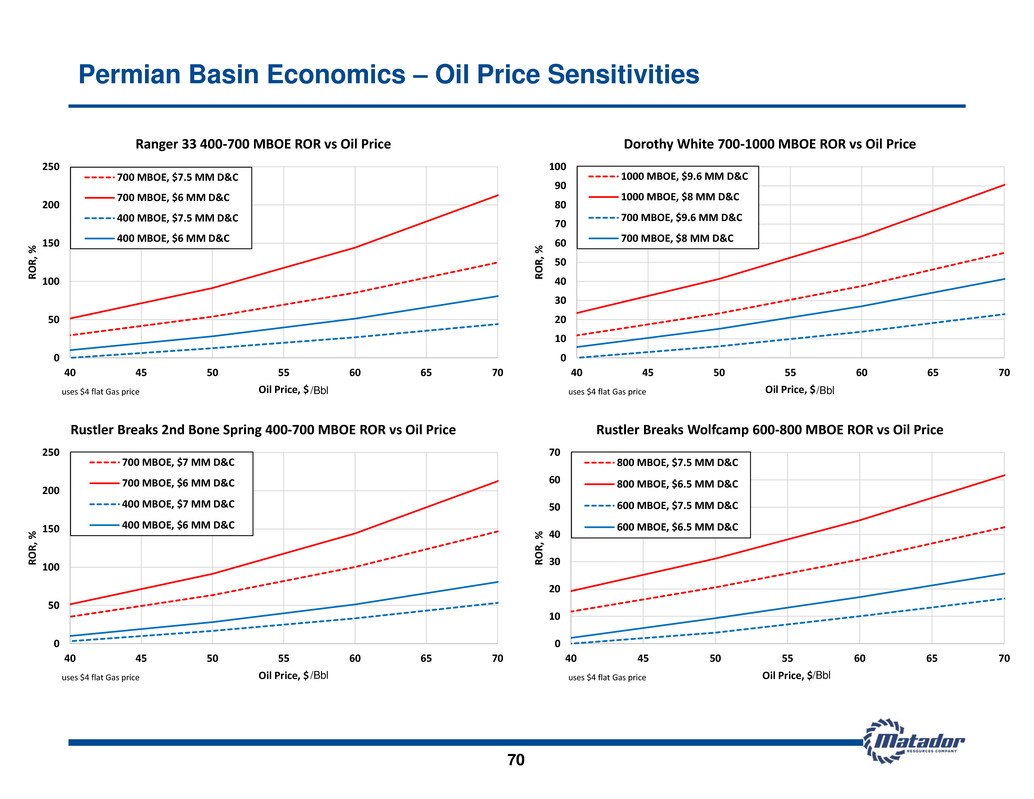

70 Permian Basin Economics – Oil Price Sensitivities 0 50 100 150 200 250 40 45 50 55 60 65 70 ROR , % Oil Price, $ Ranger 33 400-700 MBOE ROR vs Oil Price 700 MBOE, $7.5 MM D&C 700 MBOE, $6 MM D&C 400 MBOE, $7.5 MM D&C 400 MBOE, $6 MM D&C uses $4 flat Gas price 0 10 20 30 40 50 60 70 80 90 100 40 45 50 55 60 65 70 ROR , % Oil Price, $ Dorothy White 700-1000 MBOE ROR vs Oil Price 1000 MBOE, $9.6 MM D&C 1000 MBOE, $8 MM D&C 700 MBOE, $9.6 MM D&C 700 MBOE, $8 MM D&C uses $4 flat Gas price 0 50 100 150 200 250 40 45 50 55 60 65 70 ROR , % Oil Price, $ Rustler Breaks 2nd Bone Spring 400-700 MBOE ROR vs Oil Price 700 MBOE, $7 MM D&C 700 MBOE, $6 MM D&C 400 MBOE, $7 MM D&C 400 MBOE, $6 MM D&C uses $4 flat Gas price 0 10 20 30 40 50 60 70 40 45 0 55 60 65 70 ROR , % Oil Price, $ Rustler Breaks Wolfcamp 600-800 MBOE ROR vs Oil Price 800 MBOE, $7.5 MM D&C 800 MBOE, $6.5 MM D&C 600 MBOE, $7.5 MM D&C 600 MBOE, $6.5 MM D&C uses $4 flat Gas price /Bbl /Bbl /Bbl /Bbl

Haynesville Shale Update

0.0 10.0 20.0 30.0 40.0 50.0 60.0 G as P ro du ct io n, M M cf /D ay Haynesville – 260% Increase in Net Natural Gas Production 72 50 Gross (5 Net) Wells Estimated CapEx $40 to $45MM (Less than 10% of 2014 CapEx) Natural G a s Produ c ti on, M M c f/ d

Haynesville – Chesapeake Elm Grove Program 73 Currently producing Currently drilling Map Legend: Producing Wells Currently drilling or completing Anticipated future wells Sales Date IP (MCFD) Choke Size (in) Flowing Pressure (psi) 8/2/2014 14,784 20/64 7035 8/2/2014 13,488 20/64 7325 8/24/2014 10,249 18/64 6350 8/24/2014 8,116 17/64 5620 8/24/2014 9,746 17/64 6825 10/3/2014 13,872 20/64 7530 10/3/2014 13,632 20/64 7245 10/3/2014 14,112 20/64 7395 10/3/2014 14,424 20/64 7025 12/6/114 13,080 20/64 7450 12/6/2014 13,440 20/64 7200 Anticipated future wells Recently Reported Results by CHK MTDR anticipates 10 gross (1.8 net) wells in 2015

Economics of Tier 1 (10 Bcf) Haynesville at Elm Grove 74 Note: Individual well economics only. Excludes costs prior to drilling (i.e. acquisition or acreage costs). Economics use a NRI / WI of 85% but actual interests vary. Natural gas price differential = ($0.55)/Mcf. D&C cost = drilling and completion cost. 0 50 100 150 200 250 300 350 400 450 500 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 R a te o f R e turn , % Natural Gas Price, $/Mcf $7.0MM D&C Cost $8.0MM D&C Cost $9.0MM D&C Cost

February 5, 2015 2015 Analyst Day Presentation NYSE: MTDR

Appendix

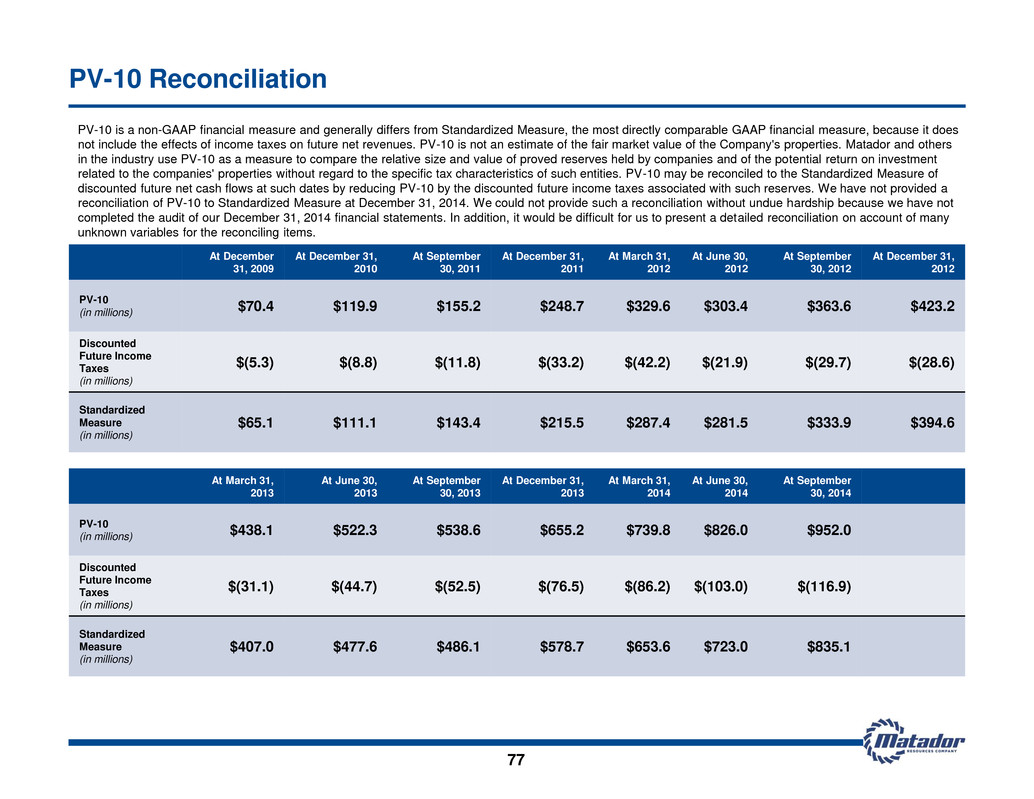

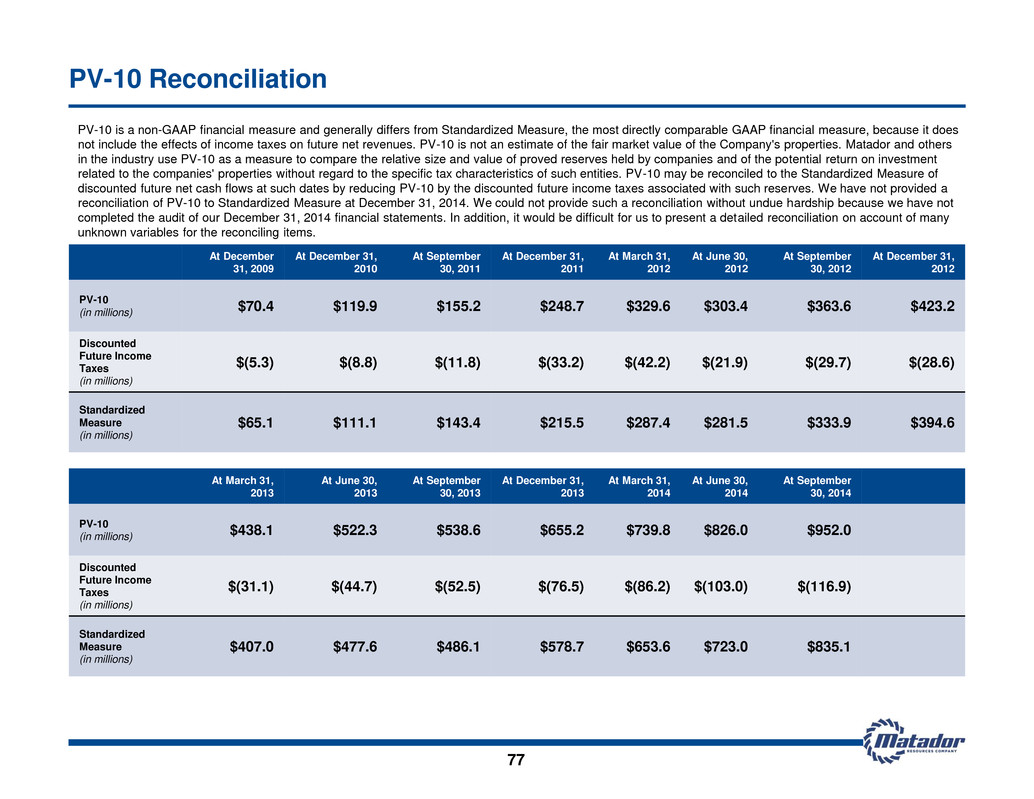

77 PV-10 Reconciliation PV-10 is a non-GAAP financial measure and generally differs from Standardized Measure, the most directly comparable GAAP financial measure, because it does not include the effects of income taxes on future net revenues. PV-10 is not an estimate of the fair market value of the Company's properties. Matador and others in the industry use PV-10 as a measure to compare the relative size and value of proved reserves held by companies and of the potential return on investment related to the companies' properties without regard to the specific tax characteristics of such entities. PV-10 may be reconciled to the Standardized Measure of discounted future net cash flows at such dates by reducing PV-10 by the discounted future income taxes associated with such reserves. We have not provided a reconciliation of PV-10 to Standardized Measure at December 31, 2014. We could not provide such a reconciliation without undue hardship because we have not completed the audit of our December 31, 2014 financial statements. In addition, it would be difficult for us to present a detailed reconciliation on account of many unknown variables for the reconciling items. At December 31, 2009 At December 31, 2010 At September 30, 2011 At December 31, 2011 At March 31, 2012 At June 30, 2012 At September 30, 2012 At December 31, 2012 PV-10 (in millions) $70.4 $119.9 $155.2 $248.7 $329.6 $303.4 $363.6 $423.2 Discounted Future Income Taxes (in millions) $(5.3) $(8.8) $(11.8) $(33.2) $(42.2) $(21.9) $(29.7) $(28.6) Standardized Measure (in millions) $65.1 $111.1 $143.4 $215.5 $287.4 $281.5 $333.9 $394.6 At March 31, 2013 At June 30, 2013 At September 30, 2013 At December 31, 2013 At March 31, 2014 At June 30, 2014 At September 30, 2014 PV-10 (in millions) $438.1 $522.3 $538.6 $655.2 $739.8 $826.0 $952.0 Discounted Future Income Taxes (in millions) $(31.1) $(44.7) $(52.5) $(76.5) $(86.2) $(103.0) $(116.9) Standardized Measure (in millions) $407.0 $477.6 $486.1 $578.7 $653.6 $723.0 $835.1

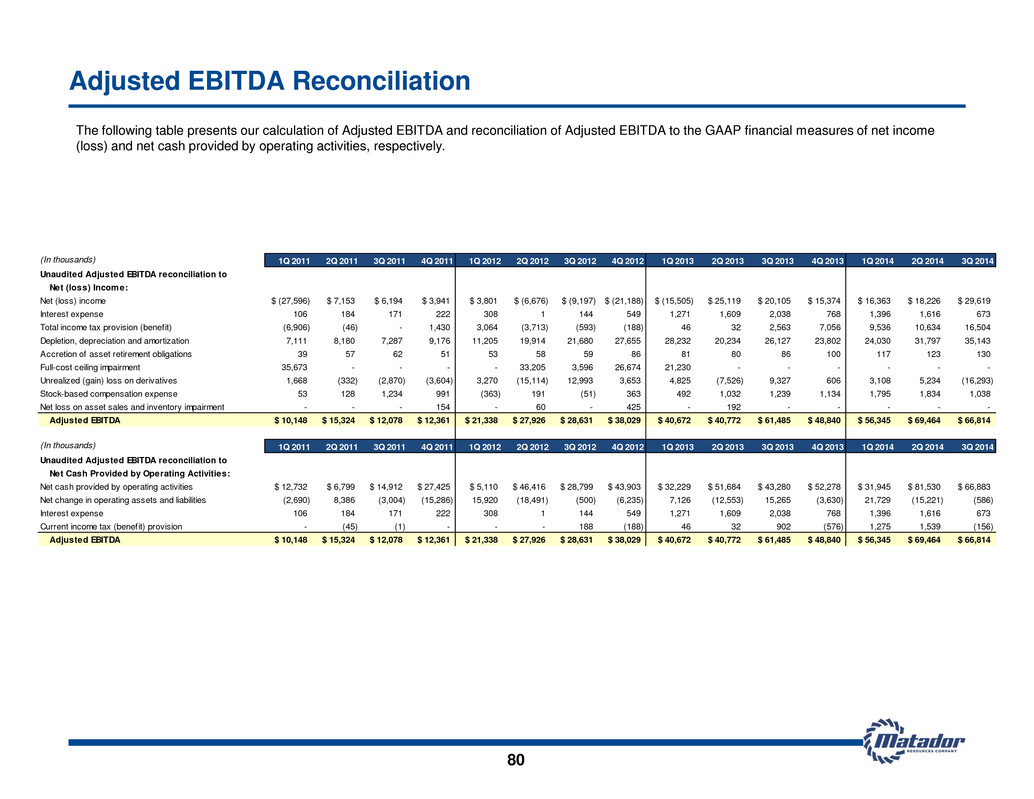

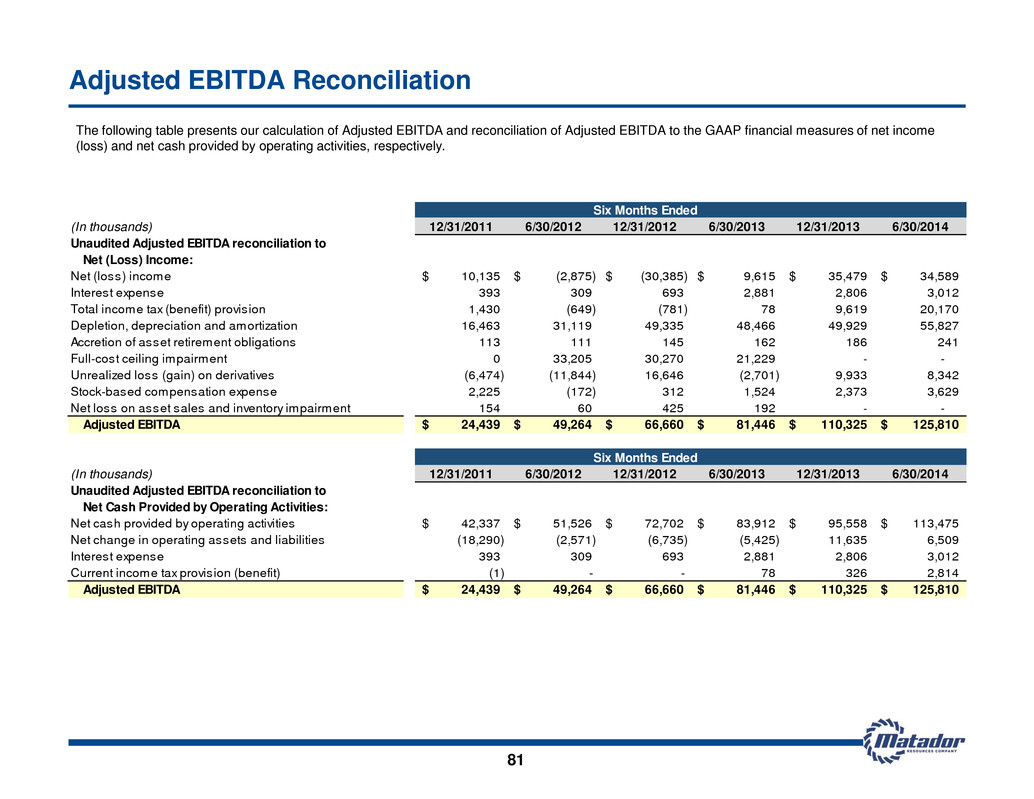

78 Adjusted EBITDA Reconciliation This investor presentation includes the non-GAAP financial measure of Adjusted EBITDA. Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. “GAAP” means Generally Accepted Accounting Principles in the United States of America. The Company believes Adjusted EBITDA helps it evaluate its operating performance and compare its results of operations from period to period without regard to its financing methods or capital structure. The Company defines Adjusted EBITDA as earnings before interest expense, income taxes, depletion, depreciation and amortization, accretion of asset retirement obligations, property impairments, unrealized derivative gains and losses, certain other non-cash items and non- cash stock-based compensation expense, and net gain or loss on asset sales and inventory impairment. Adjusted EBITDA is not a measure of net income (loss) or net cash provided by operating activities as determined by GAAP. Adjusted EBITDA should not be considered an alternative to, or more meaningful than, net income (loss) or net cash provided by operating activities as determined in accordance with GAAP or as an indicator of the Company’s operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components of understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure. Adjusted EBITDA may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDA in the same manner. The following table presents the calculation of Adjusted EBITDA and the reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively, that are of a historical nature. Where references are forward-looking or prospective in nature, and not based on historical fact, the table does not provide a reconciliation. Similarly, the table does not provide a reconciliation with respect to the estimated Adjusted EBITDA range provided for the year ended December 31, 2014. The Company could not provide such reconciliations without undue hardship because such Adjusted EBITDA numbers are estimations, approximations and/or ranges. In addition, it would be difficult for the Company to present a detailed reconciliation on account of many unknown variables for the reconciling items.

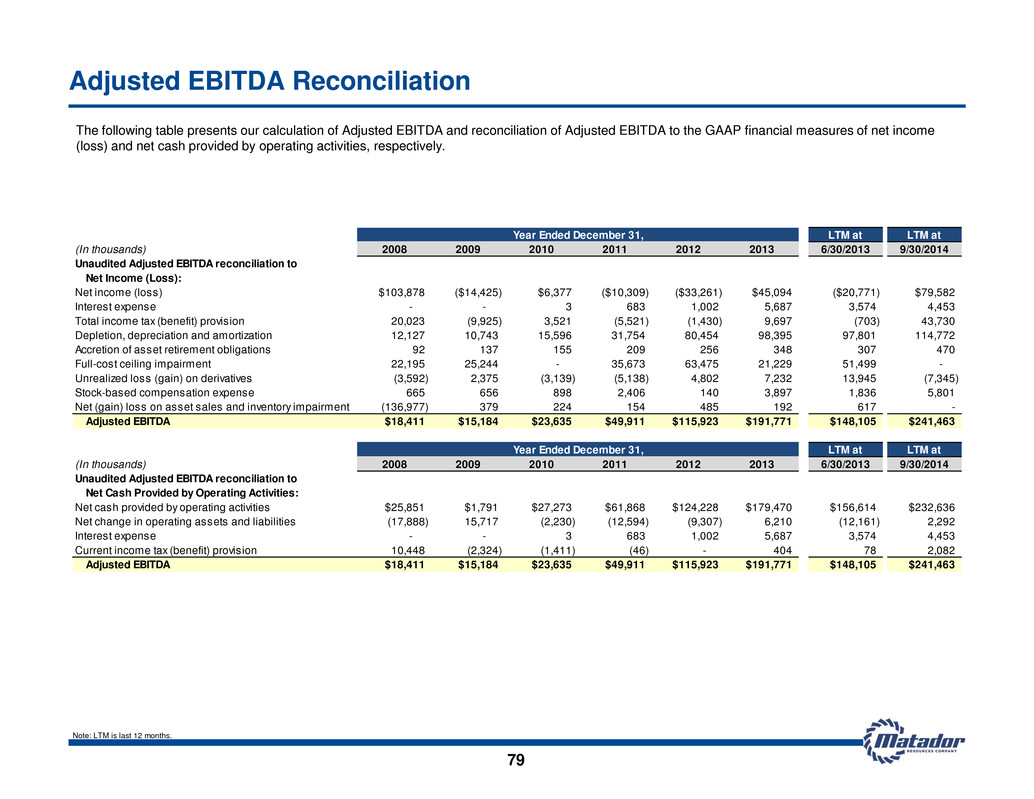

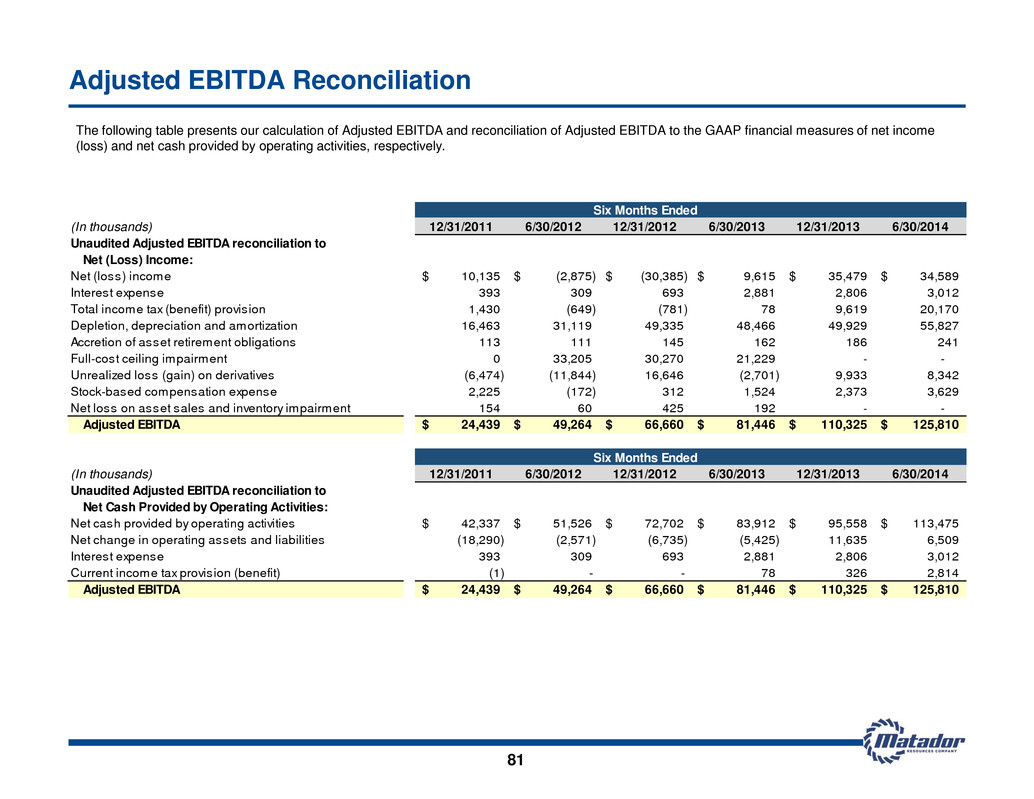

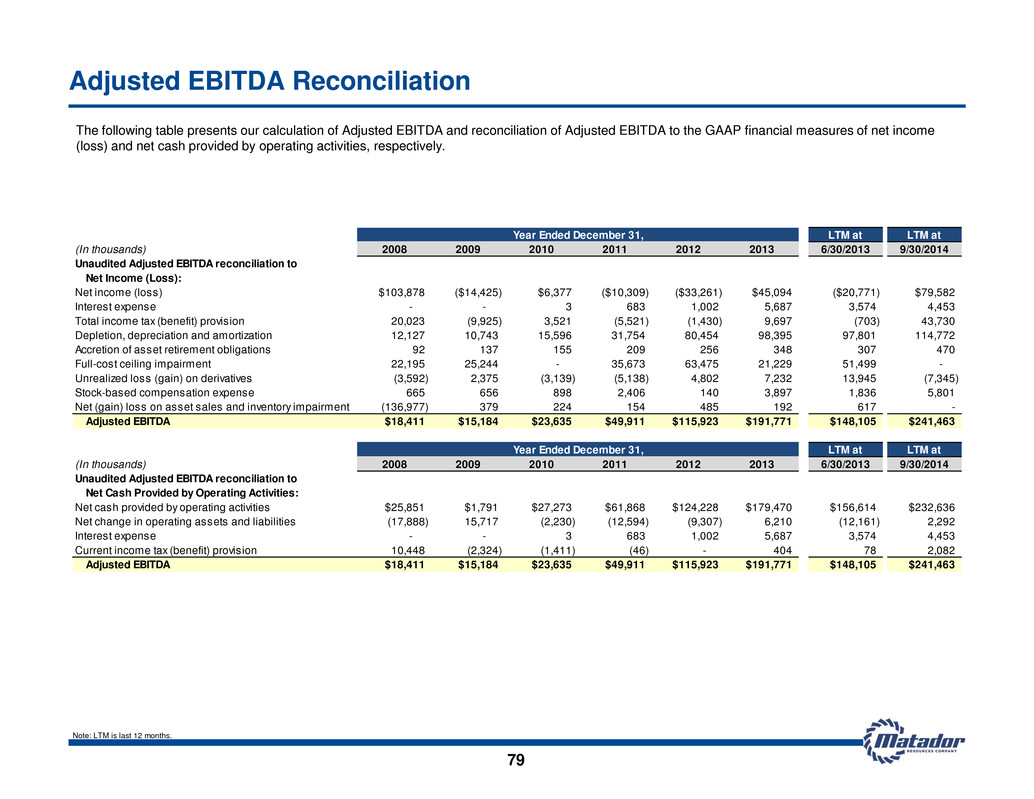

Adjusted EBITDA Reconciliation The following table presents our calculation of Adjusted EBITDA and reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively. Note: LTM is last 12 months. LTM at LTM at (In thousands) 2008 2009 2010 2011 2012 2013 6/30/2013 9/30/2014 Unaudited Adjusted EBITDA reconciliation to Net Income (Loss): Net income (loss) $103,878 ($14,425) $6,377 ($10,309) ($33,261) $45,094 ($20,771) $79,582 Interest expense - - 3 683 1,002 5,687 3,574 4,453 Total income tax (benefit) provision 20,023 (9,925) 3,521 (5,521) (1,430) 9,697 (703) 43,730 Depletion, depreciation and amortization 12,127 10,743 15,596 31,754 80,454 98,395 97,801 114,772 Accretion of asset retirement obligations 92 137 155 209 256 348 307 470 Full-cost ceiling impairment 22,195 25,244 - 35,673 63,475 21,229 51,499 - Unrealized loss (gain) on derivatives (3,592) 2,375 (3,139) (5,138) 4,802 7,232 13,945 (7,345) Stock-based compensation expense 665 656 898 2,406 140 3,897 1,836 5,801 Net (gain) loss on asset sales and inventory impairment (136,977) 379 224 154 485 192 617 - Adjusted EBITDA $18,411 $15,184 $23,635 $49,911 $115,923 $191,771 $148,105 $241,463 LTM at LTM at (In thousands) 2008 2009 2010 2011 2012 2013 6/30/2013 9/30/2014 Unaudited Adjusted EBITDA reconciliation to Net Cash Provided by Operating Activities: Net cash provided by operating activities $25,851 $1,791 $27,273 $61,868 $124,228 $179,470 $156,614 $232,636 Net change in operating assets and liabilities (17,888) 15,717 (2,230) (12,594) (9,307) 6,210 (12,161) 2,292 Interest expense - - 3 683 1,002 5,687 3,574 4,453 Current income tax (benefit) provision 10,448 (2,324) (1,411) (46) - 404 78 2,082 Adjusted EBITDA $18,411 $15,184 $23,635 $49,911 $115,923 $191,771 $148,105 $241,463 Year Ended December 31, Year Ended December 31, 79

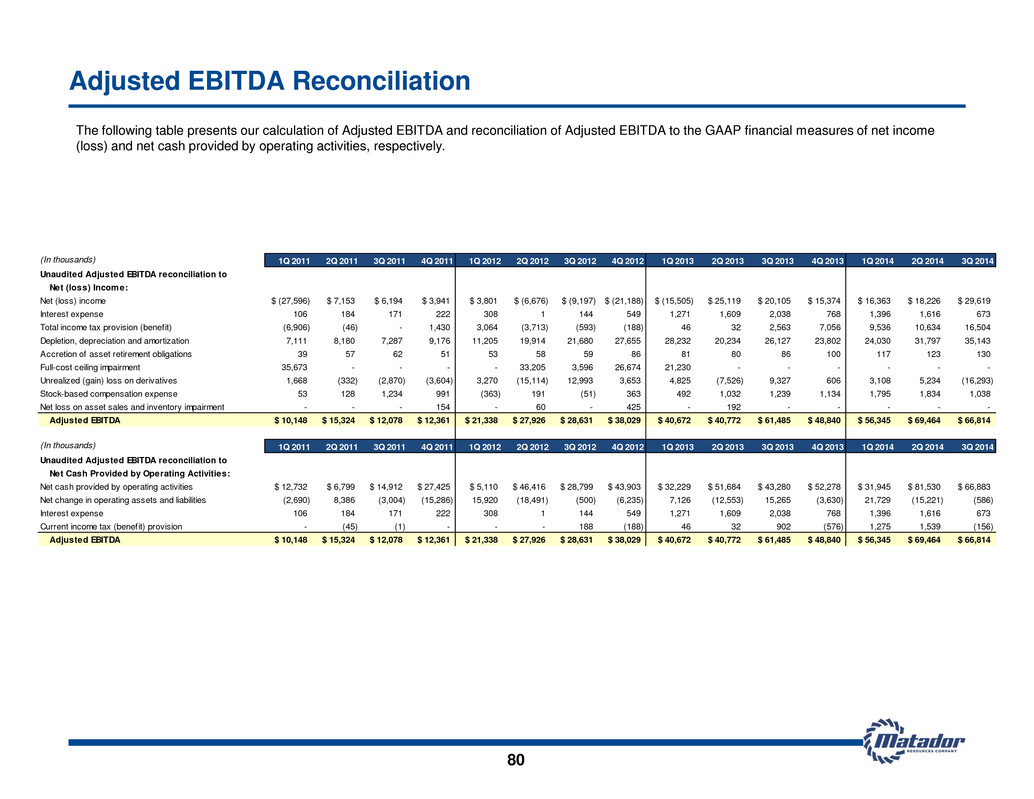

Adjusted EBITDA Reconciliation The following table presents our calculation of Adjusted EBITDA and reconciliation of Adjusted EBITDA to the GAAP financial measures of net income (loss) and net cash provided by operating activities, respectively. (In thousands) 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 Unaudited Adjusted EBITDA reconciliation to Net (loss) Income: Net (loss) income $ (27,596) $ 7,153 $ 6,194 $ 3,941 $ 3,801 $ (6,676) $ (9,197) $ (21,188) $ (15,505) $ 25,119 $ 20,105 $ 15,374 $ 16,363 $ 18,226 $ 29,619 Interest expense 106 184 171 222 308 1 144 549 1,271 1,609 2,038 768 1,396 1,616 673 Total income tax provision (benefit) (6,906) (46) - 1,430 3,064 (3,713) (593) (188) 46 32 2,563 7,056 9,536 10,634 16,504 Depletion, depreciation and amortization 7,111 8,180 7,287 9,176 11,205 19,914 21,680 27,655 28,232 20,234 26,127 23,802 24,030 31,797 35,143 Accretion of asset retirement obligations 39 57 62 51 53 58 59 86 81 80 86 100 117 123 130 Full-cost ceiling impairment 35,673 - - - - 33,205 3,596 26,674 21,230 - - - - - - Unrealized (gain) loss on derivatives 1,668 (332) (2,870) (3,604) 3,270 (15,114) 12,993 3,653 4,825 (7,526) 9,327 606 3,108 5,234 (16,293) Stock-based compensation expense 53 128 1,234 991 (363) 191 (51) 363 492 1,032 1,239 1,134 1,795 1,834 1,038 Net loss on asset sales and inventory impairment - - - 154 - 60 - 425 - 192 - - - - - Adjusted EBITDA $ 10,148 $ 15,324 $ 12,078 $ 12,361 $ 21,338 $ 27,926 $ 28,631 $ 38,029 $ 40,672 $ 40,772 $ 61,485 $ 48,840 $ 56,345 $ 69,464 $ 66,814 (I thousands) 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 Unaudited Adjusted EBITDA reconciliation to Net Cash Provided by Operating Activities: Net cash provided by operating activities $ 12,732 $ 6,799 $ 14,912 $ 27,425 $ 5,110 $ 46,416 $ 28,799 $ 43,903 $ 32,229 $ 51,684 $ 43,280 $ 52,278 $ 31,945 $ 81,530 $ 66,883 Net change in operating assets and liabilities (2,690) 8,386 (3,004) (15,286) 15,920 (18,491) (500) (6,235) 7,126 (12,553) 15,265 (3,630) 21,729 (15,221) (586) Interest expense 106 184 171 222 308 1 144 549 1,271 1,609 2,038 768 1,396 1,616 673 Current income tax (benefit) provision - (45) (1) - - - 188 (188) 46 32 902 (576) 1,275 1,539 (156) Adjusted EBITDA $ 10,148 $ 15,324 $ 12,078 $ 12,361 $ 21,338 $ 27,926 $ 28,631 $ 38,029 $ 40,672 $ 40,772 $ 61,485 $ 48,840 $ 56,345 $ 69,464 $ 66,814 80