Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission file number 1-35166

Fortune Brands Home & Security, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 62-1411546 | |||||

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

520 Lake Cook Road, Deerfield, IL 60015-5611

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (847) 484-4400

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this annual report on Form 10-K or any amendment to this annual report on Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller

reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the registrant’s voting common equity held by non-affiliates of the registrant at June 30, 2014 (the last day of the registrant’s most recent second quarter) was $6,406,202,013. The number of shares outstanding of the registrant’s common stock, par value $0.01 per share, at February 6, 2015, was 158,667,693.

Table of Contents

DOCUMENTS INCORPORATED BY REFERENCE

Certain information contained in the registrant’s proxy statement for its Annual Meeting of Stockholders to be held on April 28, 2015 (to be filed not later than 120 days after the end of the registrant’s fiscal year) (the “2015 Proxy Statement”) is incorporated by reference into Part III hereof.

Table of Contents

PART I

Cautionary Statement Concerning Forward-Looking Statements

This Annual Report on Form 10-K contains certain “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding business strategies, market potential, future financial performance and other matters. Statements that include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations at the time this report is filed with the Securities and Exchange Commission (the “SEC”) or, with respect to any documents incorporated by reference, available at the time such document was prepared or filed with the SEC. Although we believe that these statements are based on reasonable assumptions, they are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those indicated in such statements. These factors include those listed in the section below entitled “Risk Factors.” Except as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, new information or changes to future results over time or otherwise.

Unless the context otherwise requires, references in this Annual Report on Form 10-K to (i) “Fortune Brands,” the “Company,” “we,” “our” or “us” refer to Fortune Brands Home & Security, Inc. and its consolidated subsidiaries, after giving effect to the spin-off of Fortune Brands from Fortune Brands, Inc. in 2011 and (ii) “Former Parent” refer to Fortune Brands, Inc.

Our Company

We are a leading home and security products company that competes in attractive long-term growth markets in our categories. With a foundation of market-leading brands across a diversified mix of channels, and lean and flexible supply chains, as well as a tradition of strong product innovation and customer service, we are focused on outperforming our markets in both growth and returns, and driving increased shareholder value. We sell our products through a wide array of sales channels, including kitchen and bath dealers, wholesalers oriented toward builders or professional remodelers, industrial and locksmith distributors, “do-it-yourself” remodeling-oriented home centers and other retail outlets. We believe the Company’s track record reflects the long-term attractiveness and potential of our categories and our leading brands. Our performance over the past three years demonstrates the strength of our operating model and our ability to generate profitable growth as sales volume increases and we leverage our structural competitive advantages to gain share in our categories.

Our Strategy

Build on leading business and brand positions in attractive growth and return categories. We believe that we have leading market positions and brands in many of our product categories. We continue to invest in targeted advertising and other strategic initiatives aimed at enhancing brand awareness and educating consumers regarding the breadth, features and benefits of our product lines. We also strive to leverage our brands by expanding into adjacent product categories and continue to develop new programs through working closely with our customers.

1

Table of Contents

Continue to develop innovative products for customers, designers, installers and consumers. Sustained investments in consumer-driven product innovation and customer service, along with our lower cost structures, have contributed to our success in winning in the marketplace and creating consumer demand. MasterBrand Cabinets launched innovative new cabinet door designs, color palettes and features in a range of styles that allows consumers to create a custom kitchen look at an affordable price. MasterBrand Cabinets launched new door styles ranging from transitional styles to acrylics, new color palettes ranging from gray stains to rich brown stains, Omega full access cabinetry and innovative lighting solutions. MasterBrand Cabinets continues to provide cabinetry solutions for the whole home ranging from home offices or bathroom vanities to kitchens. We continue to provide channel support with a responsive website featuring our cabinet brands in one convenient location that drives leads to our dealerships. Moen offers an extensive line of eco-friendly faucets and showerheads that carry the EPA’s WaterSense designation. Moen’s track record of continued innovation includes offerings such as finishes that incorporate Microban anti-microbial protection, market-leading Spot Resist finish, our touchless Motionsense electronic faucets and our new pull-out and pull-down faucets with Reflex self-retraction. Therma-Tru has leveraged advanced materials to deliver products that combine aesthetic beauty and energy efficiency. Therma-Tru expanded both clear and decorative glass offerings and introduced new styles to its Fiber-Classic Mahogany collection of fiberglass doors, including additions to the Pulse line of modern style entry doors. Master Lock has long been an innovative leader in security products, such as the easy-to-use Dial Speed combination padlocks, and has continued to grow by entering adjacent security categories such as life safety and commercial electronic access control solutions designed to secure high value sites such as cellular telephone towers and other facilities. John D. Brush & Co., Inc. (“SentrySafe”), acquired in July 2014, provides quality and innovative fire-resistant safes that secure consumers’ property and important documents.

Expand in international markets. We have opportunities to expand sales by further penetrating international markets, which represented approximately 17% of net sales in 2014. Moen continues to expand in China. In cabinets, Kitchen Craft remains a leading cabinetry brand in Canada in 2014, while WoodCrafters provides presence in Mexico. Master Lock continues to expand its presence in Europe and Asia, while Therma-Tru has made inroads in Canada as consumers transition from traditional entry door materials to more advanced and energy-efficient fiberglass doors.

Leverage our global supply chains. We are using lean manufacturing, design-to-manufacture and distributive assembly techniques to make our supply chains more flexible and improve supply chain quality, cost, response times and asset efficiency. We view our supply chains as a strategic asset not only to support strong operating leverage as volumes increase, but also to enable the profitable growth of new products, adjacent market expansion and international growth.

Enhance returns and deploy our cash flow to high-return opportunities. We believe our most attractive opportunities are to invest in profitable organic growth initiatives, pursue accretive strategic acquisitions and joint ventures, and return cash to shareholders through a combination of dividends and repurchases of shares of our common stock under our share repurchase programs. Both add-on acquisitions and share repurchase opportunities may be particularly attractive in the next few years.

Our Competitive Strengths

We believe our competitive strengths include the following:

Leading brands. We have leading brands in many of our product categories. We believe that established brands are meaningful to both consumers and trade customers in their respective categories and that we have the opportunity to, among other things, expand many of our brands into adjacent product categories and international markets.

2

Table of Contents

Strategic focus on attractive consumer-facing categories. We believe we operate in categories that, while very competitive, are among the more attractive categories in the home products and security products markets. Some of the key characteristics that make these categories attractive in our view include the following:

| > | product quality, innovation, fashion, finish, durability and functionality, which are key determinants of product selection in addition to price; |

| > | established brands, which are meaningful to both consumers and trade customers; |

| > | the opportunity to add value to a complex consumer purchasing decision with excellent service propositions, reliability of products, ease of installation and superior delivery lead times; |

| > | the value our products add to a home, particularly with kitchen and bath remodeling and additions, and the curb appeal offered by stylish entry door systems; |

| > | favorable long-term trends in household formations that benefit the outlook for our markets over time; |

| > | the relatively stable demand for plumbing and security products; and |

| > | the opportunity to expand into adjacent categories. |

Operational excellence. We believe our investments in lean manufacturing and productivity initiatives have resulted in supply chain flexibility and the ability to cost-effectively add capacity in order to match demand levels. In 2014, we invested in incremental capacity to support long-term growth potential and we plan to continue investing in 2015. In addition, our supply chains and lower cost structures are creating favorable operating leverage as volumes grow without sacrificing customer service levels. We believe that margin improvement will continue to be driven predominantly by organic volume growth that can be readily accommodated by additional production shifts and equipment as necessary.

Commitment to innovation. We have a long track record of successful product and process innovations that introduce valued new products and services to our customers and consumers. We are committed to continuing to invest in new product development and enhance customer service to strengthen our leading brands and penetrate adjacent markets.

Diverse sales end-use mix. We sell in a variety of product categories in the U.S. home and security products markets. In addition, our exposure to changing levels of U.S. residential new home construction activity is balanced with repair-and-remodel activity, which comprises a substantial majority of the overall U.S. home products market and about two-thirds of our U.S. home products sales. We also benefit from a stable market for plumbing and security products and international sales growth opportunities.

Diverse sales channels. We sell through a wide array of sales channels, including kitchen and bath dealers, wholesalers oriented to builders or professional remodelers, industrial and locksmith distributors, “do-it-yourself” remodeling-oriented home centers and other retail outlets. We also sell security products to locksmiths, industrial distributors and mass merchants. We are able to leverage existing sales channels to expand into adjacent product categories. In 2014, sales to our top ten customers represented less than half of total sales.

Decentralized business model. Our business segments are focused on distinct product categories and are responsible for their own performance. This structure enables each of our segments to independently best position itself within each category in which it competes and reinforces strong accountability for operational and financial performance. Each of our segments focus on its unique set of consumers, customers, competitors and suppliers, while also sharing best practices.

3

Table of Contents

Strong capital structure. We exited 2014 with a strong balance sheet, even as we completed the $116.7 million acquisition of SentrySafe in July and repurchased $439.8 million of our shares in 2014. As of December 31, 2014, we had $191.9 million of cash and cash equivalents and total debt was $670.0 million, resulting in a net debt position of $478.1 million. In addition, we had $830.0 million available under our credit facilities as of December 31, 2014.

Business Segments

We have four business segments: Cabinets, Plumbing, Doors and Security. The following table shows net sales for each of these segments, including key brands within each segment:

| Segment | 2014 Net Sales (in millions) |

Percentage of Total 2014 Net Sales |

Key Brands | |||||||

| Cabinets | $ | 1,788 | 45 | % | Aristokraft, Kitchen Craft, Kitchen Classics, Omega, Homecrest, Diamond, Schrock, Decorá, Kemper, St. Paul, Thomasville(a), Martha Stewart Living(a) | |||||

| Plumbing | 1,331 | 33 | % | Moen, Cleveland Faucet Group (CFG) | ||||||

| Doors |

414 | 10 | % | Therma-Tru, Fypon | ||||||

| Security | 481 | 12 | % | Master Lock, American Lock, SentrySafe | ||||||

| Total |

$ | 4,014 | 100 | % | ||||||

| (a) | Thomasville is a registered trademark of Hhg Global Designs LLC and Martha Stewart Living is a registered trademark of Martha Stewart Living Omnimedia, Inc. |

Our segments compete on the basis of innovation, fashion, quality, price, service and responsiveness to distributor, retailer and installer needs, as well as end-user consumer preferences. Our markets are very competitive. Approximately 17% of 2014 net sales were to international markets, and sales to two of the Company’s customers, The Home Depot, Inc. (“The Home Depot”) and Lowe’s Companies, Inc. (“Lowe’s”), each accounted for more than 10% of the Company’s net sales in 2014. Sales to all U.S. home centers in the aggregate were approximately 30% of net sales in 2014.

Cabinets. Our Cabinets segment manufactures custom, semi-custom and stock cabinetry, as well as vanities, for the kitchen, bath and other parts of the home through a regional supply chain footprint to deliver high quality and service to our customers. This segment sells a portfolio of brands that enables our customers to differentiate themselves against competitors. This portfolio includes brand names such as Aristokraft, Kitchen Craft, Kitchen Classics, Omega, Homecrest, Diamond, Schrock, Decorá, Kemper, St. Paul, Thomasville and Martha Stewart Living. Substantially all of this segment’s sales are in North America. This segment sells directly to kitchen and bath dealers, home centers, wholesalers and large builders. Sales to The Home Depot and Lowe’s comprised approximately 39% of net sales of the Cabinets segment in 2014. This segment’s competitors include Masco, American Woodmark and RSI, as well as a large number of smaller suppliers.

Plumbing. Our Plumbing segment manufactures or assembles and sells faucets, accessories and kitchen sinks in North America and China, predominantly under the Moen brand. Although this segment sells plumbing products principally in the U.S., Canada and China, this segment also sells in Mexico, Southeast Asia and South America. Approximately 26% of 2014 net sales were to international markets. This segment sells directly through its own sales force and indirectly through independent manufacturers’ representatives, primarily to wholesalers, home centers, mass merchandisers and industrial distributors. Sales to The Home Depot and Lowe’s comprised

4

Table of Contents

approximately 26% of net sales of the Plumbing segment in 2014. This segment’s chief competitors include Delta (owned by Masco), Kohler, Pfister (owned by Spectrum Brands), American Standard (owned by LIXIL Group) and imported private-label brands.

Doors. Our Doors segment manufactures and sells fiberglass and steel entry door systems under the Therma-Tru brand and urethane millwork product lines under the Fypon brand. This segment benefits from the long-term trend away from traditional materials, such as wood, steel and aluminum, toward more energy-efficient and durable synthetic materials. Therma-Tru products include fiberglass and steel residential entry door and patio door systems, primarily for sale in the U.S. and Canada. This segment’s principal customers are home centers, millwork building products and wholesale distributors, and specialty dealers that provide products to the residential new construction market, as well as to the remodeling and renovation markets. Sales to The Home Depot and Lowe’s comprised approximately 11% of net sales of the Doors segment in 2014. This segment’s competitors include Masonite, JELD-WEN, Plastpro and Pella.

Security. Our Security segment’s products consist of locks, safety and security devices, and electronic security products manufactured, sourced and distributed under the Master Lock brand and fire resistant safes, security containers and commercial cabinets manufactured, sourced and distributed under the SentrySafe brand. This segment sells products principally in the U.S., Canada, Europe, Central America and Australia. Approximately 29% of 2014 net sales were to international markets. This segment manufactures and sells key-controlled and combination padlocks, bicycle and cable locks, built-in locker locks, door hardware, automotive, trailer and towing locks, electronic access control solutions, and other specialty safety and security devices for consumer use to hardware, home center and other retail outlets. In addition, the segment sells lock systems to locksmiths, industrial and institutional users, and original equipment manufacturers. Sales to The Home Depot and Lowe’s comprised approximately 16% of the net sales of the Security segment in 2014. Master Lock competes with Abus, W.H. Brady, Hampton, Kwikset (owned by Spectrum Brands), Schlage (owned by Allegion), Assa Abloy and various imports, and SentrySafe competes with First Alert, Magnum, Fortress, Stack-On and Fire King.

Annual net sales for each of the last three fiscal years for each of our business segments were as follows:

| (In millions) | 2014 | 2013 | 2012 | |||||||||

| Cabinets |

$ | 1,787.5 | $ | 1,642.2 | $ | 1,326.6 | ||||||

| Plumbing |

1,331.0 | 1,287.0 | 1,100.7 | |||||||||

| Doors |

413.9 | 371.6 | 321.5 | |||||||||

| Security |

481.2 | 402.8 | 386.0 | |||||||||

| Total |

$ | 4,013.6 | $ | 3,703.6 | $ | 3,134.8 | ||||||

For additional financial information for each of our business segments, refer to Note 18, “Information on Business Segments,” to the Consolidated Financial Statements in Item 8 of this Annual Report on Form 10-K.

5

Table of Contents

Other Information

Raw materials. The table below indicates the principal raw materials used by each of our segments. These materials are available from a number of sources. Volatility in the prices of commodities and energy used in making and distributing our products impacts the cost of manufacturing our products.

| Segment | Raw Materials | |

| Cabinets |

Hardwoods (maple, cherry and oak), plywood and particleboard | |

| Plumbing |

Brass, zinc, copper, resins and stainless steel | |

| Doors |

Resins, glass, foam, steel, wood and aluminum | |

| Security |

Rolled steel and brass | |

Intellectual property. Product innovation and branding are important to the success of our business. In addition to the brand protection offered by our trademarks, patent protection helps distinguish our unique product features in the market by preventing copying and making it more difficult for competitors to benefit unfairly from our design innovation. We hold U.S. and foreign patents covering various features used in products sold within all of our business segments. Although each of our segments relies on a number of patents and patent groups that, in the aggregate, provide important protections to the Company, no single patent or patent group is material to any of the Company’s segments.

Employees. As of December 31, 2014, we had approximately 18,000 full-time employees. Approximately 13% of these employees are covered by collective bargaining agreements, none of which are subject to agreements that will expire within one year. Employee relations are generally good.

Information about geographic areas. For additional information about net sales and assets by geographic areas, refer to Note 18, “Information on Business Segments,” to the Consolidated Financial Statements in Item 8 of this Annual Report on Form 10-K.

Seasonality. All of our operating segments traditionally experience lower sales in the first quarter of the year when new home construction, repair-and-remodel activity and security buying are lowest. As a result of sales seasonality and associated timing of working capital fluctuations, our cash flow from operating activities is typically higher in the second half of the year.

Environmental matters. We are involved in remediation activities to clean up hazardous wastes as required by federal and state laws. Liabilities for remediation costs of each site are based on our best estimate of undiscounted future costs, excluding possible insurance recoveries or recoveries from other third parties. Uncertainties about the status of laws, regulations, technology and information related to individual sites make it difficult to develop estimates of environmental remediation exposures. Some of the potential liabilities relate to sites we own, and some relate to sites we no longer own or never owned. Several of our subsidiaries have been designated as potentially responsible parties (“PRP”) under “Superfund” or similar state laws. As of December 31, 2014, nine such instances have not been dismissed, settled or otherwise resolved. In the calendar year 2014, our subsidiaries were identified as a PRP in three new instances and we settled two of these new instances in 2014. In most instances where our subsidiaries are named as a PRP, we enter into cost-sharing arrangements with other PRPs. We give notice to insurance carriers of potential PRP liability, but very rarely, if ever, receive reimbursement from insurance for PRP costs. We believe that the cost of complying with the present environmental protection laws, before considering estimated recoveries

6

Table of Contents

either from other PRPs or insurance, will not have a material adverse effect on our results of operations, cash flows or financial condition. At December 31, 2014 and 2013, we had accruals of $2.8 million and $4.8 million, respectively, relating to environmental compliance and clean up including, but not limited to, the above mentioned Superfund sites.

Legal proceedings. We are defendants in lawsuits associated with the normal conduct of our businesses and operations. It is not possible to predict the outcome of the pending actions and, as with any litigation, it is possible that some of these actions could be decided unfavorably to us. We believe that there are meritorious defenses to these actions, which we are vigorously contesting and that these actions will not have a material adverse effect upon our results of operations, cash flows or financial condition.

Legal structure. Fortune Brands Home & Security, Inc. is a holding company that was organized as a Delaware corporation in 1988. Wholly-owned subsidiaries of the Company include MasterBrand Cabinets, Inc., Moen Incorporated, Fortune Brands Doors, Inc. and Fortune Brands Storage & Security LLC. As a holding company, Fortune Brands is a legal entity separate and distinct from our subsidiaries. Accordingly, the rights of the Company, and thus the rights of our creditors (including holders of debt securities and other obligations) and stockholders to participate in any distribution of the assets or earnings of any subsidiary is subject to the claims of creditors of the subsidiary, except to the extent that claims of the Company itself as a creditor of such subsidiary may be recognized, in which event the Company’s claims may in certain circumstances be subordinate to certain claims of others. In addition, as a holding company, the source of our unconsolidated revenues and funds is dividends and other payments from subsidiaries. Our subsidiaries are not limited by long-term debt or other agreements in their abilities to pay cash dividends or to make other distributions with respect to their capital stock or other payments to the Company.

Available Information. The Company’s website address is www.FBHS.com. The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports are available free of charge on the Company’s website as soon as reasonably practicable after the reports are filed or furnished electronically with the SEC. These documents also are made available to read and copy at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information about the Public Reference Room by contacting the SEC at 1-800-SEC-0330. Reports filed with the SEC are also made available on its website at www.sec.gov. We also make available on our website, or in printed form upon request, free of charge, our Corporate Governance Principles, Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers, Charters for the Committees of our Board of Directors and certain other information related to the Company.

7

Table of Contents

You should carefully consider the risks described below and all of the other information included in this Annual Report on Form 10-K when deciding whether to invest in our common stock or otherwise evaluating our business. If any of the following risks materialize, our business, financial condition or operating results could suffer. In this case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Our business primarily relies on North American home improvement, repair and remodel and new home construction activity levels, all of which are impacted by risks associated with fluctuations in the housing market. Downward changes in the general economy, the housing market or other business conditions could adversely affect our results of operations, cash flows and financial condition.

Our business primarily relies on home improvement, repair and remodel, and new home construction activity levels, principally in North America. The housing market is sensitive to changes in economic conditions and other factors, such as the level of employment, consumer confidence, consumer income, availability of financing and interest rate levels. Adverse changes in any of these conditions generally, or in any of the markets where we operate, could decrease demand and could adversely impact our businesses. Consumers may reduce discretionary spending or may prefer lower-priced value-oriented products. In addition, consumer price consciousness may intensify resulting in the delay or decrease in home ownership and household formation, as well as cause a shift in demand to smaller, less expensive homes. The new home construction market is still recovering from a major downturn in 2008 and 2009, and while improving, the new home construction market remains below historical levels.

We operate in very competitive consumer and trade brand categories.

The markets in which we operate are very competitive. Although we believe that competition in our businesses is based largely on product quality, consumer and trade brand reputation, customer service and product features, as well as fashion, innovation and ease of installation, price is a significant factor for consumers as well as our trade customers. In addition, some of our competitors may resort to price competition to sustain market share and manufacturing capacity utilization. Also, certain large customers continue to offer private-label brands that compete with some of our product offerings as a lower-cost alternative. The strong competition that we face in all of our businesses may adversely affect our profitability and revenue levels, as well as our results of operations, cash flows and financial condition.

Risks associated with strategic acquisitions could adversely affect our results of operations, cash flows and financial condition.

We consider acquisitions and joint ventures as a means of enhancing shareholder value. Acquisitions and joint ventures involve risks and uncertainties, including difficulties integrating acquired companies and operating joint ventures; difficulties retaining the acquired businesses’ customers and brands; the inability to achieve the expected financial results and benefits of transactions; the loss of key employees from acquired companies; implementing and maintaining consistent standards, controls, policies and information systems; and diversion of management’s attention from other business matters. Future acquisitions could cause us to incur additional debt or issue shares, resulting in dilution in earnings per share and return on capital.

8

Table of Contents

We may not successfully develop new products or improve existing products.

Our success depends on meeting consumer needs and anticipating changes in consumer preferences with successful new products and product improvements. We aim to introduce products and new or improved production processes proactively to offset obsolescence and decreases in sales of existing products. While we devote significant focus to the development of new products, we may not be successful in product development and our new products may not be commercially successful. In addition, it is possible that competitors may improve their products more rapidly or effectively, which could adversely affect our sales. Furthermore, market demand may decline as a result of consumer preferences trending away from our categories or trending down within our brands or product categories, which could adversely impact our results of operations, cash flows and financial condition.

Risks associated with our ability to improve organizational productivity and global supply chain efficiency and flexibility could adversely affect our results of operations, cash flows and financial condition.

We regularly evaluate our organizational productivity and global supply chains and assess opportunities to increase capacity, reduce costs and enhance quality. We strive to enhance quality, speed and flexibility to meet changing and uncertain market conditions, as well as manage cost inflation, including wages, pension and medical costs. Our success depends in part on refining our cost structure and supply chains to promote consistently flexible and low cost supply chains that can respond to market changes to protect profitability and cash flow or ramp up quickly and effectively to meet demand. Failure to achieve the desired level of quality, capacity or cost reductions could impair our results of operations, cash flows and financial condition.

Risks associated with global commodity and energy availability and price volatility, as well as the possibility of sustained inflation, could adversely affect our results of operations, cash flows and financial condition.

We are exposed to risks associated with global commodity price volatility arising from restricted or uneven supply conditions, the sustained expansion and volatility of demand from emerging markets, potentially unstable geopolitical and economic variables, weather and other unpredictable external factors. We buy raw materials that contain commodities such as copper, zinc, steel, glass, wood and petroleum-based products such as resins. In addition, our distribution costs are significantly impacted by the price of oil and diesel fuel. Decreased availability and increased or volatile prices for these commodities, as well as energy used in making, distributing and transporting our products, could increase the costs of our products. While in the past we have been able to mitigate the impact of these cost increases through productivity improvements and passing on increasing costs to our customers over time, there is no assurance that we will be able to offset such cost increases in the future, and the risk of potentially sustained high levels of inflation could adversely impact our results of operations, cash flows and financial condition. While we may use derivative contracts to limit our short-term exposure to commodity price volatility, the exposures under these contracts could still be material to our results of operations, cash flows and financial condition. In addition, in periods of declining commodity prices, these derivative contracts may have the short-term effect of increasing our expenditures for these raw materials.

We manufacture, source and sell products internationally and are exposed to risks associated with doing business globally.

We manufacture, source or sell our products in a number of locations throughout the world, predominantly in the U.S., Canada, China, Europe and Mexico. Accordingly, we are subject to risks associated with potential disruption caused by changes in political, economic and social

9

Table of Contents

environments, including civil and political unrest, terrorism, possible expropriation, local labor conditions, changes in laws, regulations and policies of foreign governments and trade disputes with the U.S., and U.S. laws affecting activities of U.S. companies abroad. Risks inherent to international operations include: potentially adverse tax laws, uncertainty regarding clearance and enforcement of intellectual property rights, risks associated with the Foreign Corrupt Practices Act and difficulty enforcing contracts. While we hedge certain foreign currency transactions, a change in the value of the currencies will impact our financial statements when translated into U.S. dollars. In addition, fluctuations in currency can adversely impact the cost position of our products in local currency, making it more difficult for us to compete. Our success will depend, in part, on our ability to effectively manage our businesses through the impact of these potential changes. In addition, we source certain raw materials, components and finished goods from China where we have experienced higher manufacturing costs and longer lead times due to currency fluctuations, higher wage rates, labor shortages and higher raw material costs.

Changes in government and industry regulatory standards could adversely affect our results of operations, cash flows and financial condition.

Government regulations pertaining to health and safety (including protection of employees as well as consumers) and environmental concerns continue to emerge domestically, as well as internationally. It is necessary for us to comply with current requirements (including requirements that do not become effective until a future date), and even more stringent requirements could be imposed on our products or processes in the future. Compliance with these regulations (such as the restrictions on lead content in plumbing products and on volatile organic compounds and formaldehyde emissions that are applicable to many of our businesses) may require us to alter our manufacturing and installation processes and our sourcing. Such actions could increase our capital expenditures and adversely impact our results of operations, cash flows and financial condition, and our inability to effectively and timely meet such regulations could adversely impact our competitive position.

Our inability to secure and protect our intellectual property rights could negatively impact revenues and brand reputation.

We have many patents, trademarks, brand names and trade names that are important to our business. Unauthorized use of these intellectual property rights may not only erode sales of our products, but may also cause significant damage to our brand name and reputation, interfere with our ability to effectively represent the Company to our customers, contractors and suppliers, and increase litigation costs. There can be no assurance that our efforts to protect our brands and trademark rights will prevent violations. In addition, existing patent, trade secret and trademark laws offer only limited protection, and the laws of some countries in which our products are or may be developed, manufactured or sold may not fully protect our intellectual property from infringement by others. There can be no assurance that our efforts to assess possible third party intellectual property rights will ensure that Company’s ability to manufacture, distribute, market or sell in any given country or territory. Furthermore, others may assert intellectual property infringement claims against us or our customers.

Our businesses rely on the performance of wholesale distributors, dealers and other marketing arrangements and could be adversely affected by poor performance or other disruptions in our distribution channels and customers.

We rely on a distribution network comprised of consolidating customers. Any disruption to the existing distribution channels could adversely affect our results of operations, cash flows and financial condition. The consolidation of distributors or the financial instability or default of a distributor or one of its major customers could potentially cause such a disruption. In addition to our own sales force,

10

Table of Contents

we offer our products through a variety of third-party distributors, representatives and retailers. Certain of our distributors, representatives or retailers may also market other products that compete with our products. The loss or termination of one or more of our major distributors, representatives or retailers, the failure of one or more of our distributors or representatives to effectively promote our products, or changes in the financial or business condition of these distributors or representatives could affect our ability to bring products to market.

Our pension costs and funding requirements could increase as a result of volatility in the financial markets and changes in interest rates and actuarial assumptions.

Increases in the costs of pension benefits may continue and negatively affect our business as a result of: the effect of potential declines in the stock and bond markets on the performance of our pension plan assets; potential reductions in the discount rate used to determine the present value of our benefit obligations; and changes to our investment strategy that may impact our expected return on pension plan assets assumptions. U.S. generally accepted accounting principles require that we calculate income or expense for the plans using actuarial valuations. These valuations reflect assumptions about financial markets and interest rates, which may change based on economic conditions. Our accounting policy for defined benefit plans may subject earnings to volatility due to the recognition of actuarial gains and losses and amortization of liability savings, particularly due to the change in the fair value of pension assets and interest rates. Funding requirements for our U.S. pension plans may become more significant. However, the ultimate amounts to be contributed are dependent upon, among other things, interest rates, underlying asset returns and the impact of legislative or regulatory changes related to pension funding obligations.

Risks associated with the disruption of operations could adversely affect our results of operations, cash flows and financial condition.

We manufacture a significant portion of the products we sell. Any prolonged disruption in our operations, whether due to technical or labor difficulties, weather, lack of raw material or component availability, startup inefficiencies for new operations, disputes with strategic joint venture partners, destruction of or damage to any facility (as a result of natural disasters, fires and explosions, use and storage of hazardous materials or other events) or other reasons, could negatively impact our profitability and competitive position and adversely affect our results of operations, cash flows and financial condition.

Our inability to obtain raw materials and finished goods in a timely manner from suppliers would adversely affect our ability to manufacture and market our products.

We purchase raw materials to be used in manufacturing our products and also rely on third-party manufacturers as a source for finished goods. We typically do not enter into long-term contracts with our suppliers or sourcing partners. Instead, most raw materials and sourced goods are obtained on a “purchase order” basis. In addition, in some instances we maintain single-source or limited-source sourcing relationships, either because multiple sources are not available or the relationship is advantageous due to performance, quality, support, delivery, capacity or price considerations. Financial, operating or other difficulties encountered by our suppliers or sourcing partners or changes in our relationships with them could result in manufacturing or sourcing interruptions, delays and inefficiencies, and prevent us from manufacturing or obtaining the finished goods necessary to meet customer demand. If we are unable to meet customer demand, there could be an adverse effect on our results of operations, cash flows and financial condition.

11

Table of Contents

Our failure to attract and retain qualified personnel could adversely affect our results of operations, cash flows and financial condition.

Our success depends in part on the efforts and abilities of qualified personnel at all levels, including our senior management team and other key employees. Their motivation, skills, experience, contacts and industry knowledge significantly benefit our operations and administration. The failure to attract, motivate and retain members of our senior management team and key employees could have a negative effect on our results of operations, cash flows and financial condition.

Future tax law changes or the interpretation of existing tax laws may materially impact our effective income tax rate, the resolution of unrecognized tax benefits and cash tax payments.

Our businesses are subject to income taxation in the U.S., as well as internationally. We are routinely audited by income tax authorities in many jurisdictions. Although we believe that the recorded tax estimates are reasonable and appropriate, there are significant uncertainties in these estimates. As a result, the ultimate outcome from any audit could be materially different from amounts reflected in our income tax provisions and accruals. Future settlements of income tax audits may have a material adverse effect on earnings between the period of initial recognition of tax estimates in our financial statements and the point of ultimate tax audit settlement.

In connection with the divestiture of businesses and the separation from our Former Parent, we have retained and may further retain tax liabilities and the rights to tax refunds for periods before any divestiture or separation. As a result, from time to time, we may be required to make payments related to tax matters associated with these transactions.

Potential liabilities and costs from claims and litigation could adversely affect our results of operations, cash flows and financial condition.

We are, from time to time, involved in various claims, litigation matters and regulatory proceedings that arise in the ordinary course of our business and that could have an adverse effect on us. These matters may include contract disputes, intellectual property disputes, product recalls, personal injury claims, construction defects and home warranty claims, warranty disputes, environmental claims or proceedings, other tort claims, employment and tax matters and other proceedings and litigation, including class actions. It is not possible to predict the outcome of pending or future litigation, and, as with any litigation, it is possible that some of the actions could be decided unfavorably and could have an adverse effect on our results of operations, cash flows and financial condition.

We are subject to product safety regulations, recalls and direct claims for product liability that can result in significant liability and, regardless of the ultimate outcome, can be costly to defend. As a result of the difficulty of controlling the quality of products or components sourced from other manufacturers, we are exposed to risks relating to the quality of such products and to limitations on our recourse against such suppliers.

An impairment in the carrying value of goodwill or other acquired intangible assets could negatively affect our results of operations and financial condition.

The carrying value of goodwill represents the fair value of acquired businesses in excess of identifiable assets and liabilities as of the acquisition date. The carrying value of other intangible assets represents the fair value of trademarks, tradenames and other acquired intangible assets as of the acquisition date. Goodwill and other acquired intangible assets expected to contribute indefinitely to our cash flows are not amortized, but must be evaluated for impairment by our management at least annually. If the carrying value exceeds the implied fair value of goodwill, the goodwill is

12

Table of Contents

considered impaired and is reduced to fair value via a non-cash charge to earnings. If the carrying value of an indefinite-lived intangible asset is greater than its fair value, the intangible asset is considered impaired and is reduced to fair value via a non-cash charge to earnings. Events and/or circumstances that could have a potential negative effect on the estimated fair value of our reporting units and indefinite-lived tradenames include: actual new construction and repair and remodel growth rates that lag our assumptions, actions of key customers, volatility of discount rates, continued economic uncertainty, higher levels of unemployment, weak consumer confidence, lower levels of discretionary consumer spending and a decline in the price of our common stock. If the value of goodwill or other acquired intangible assets is impaired, our results of operations and financial condition could be adversely affected.

We may experience delays or outages in our information technology system and computer networks.

We, like most companies, may be subject to information technology system failures and network disruptions. These may be caused by delays or disruptions due to system updates, natural disasters, malicious attacks, accidents, power disruptions, telecommunications failures, acts of terrorism or war, computer viruses, physical or electronic break-ins, or similar events or disruptions. Our businesses may implement enterprise resource planning systems or add applications to replace outdated systems and to operate more efficiently. Predictions regarding benefits resulting from the implementation of these projects are subject to uncertainties. We may not be able to successfully implement the projects without experiencing difficulties. In addition, any expected benefits of implementing projects might not be realized or the costs of implementation might outweigh the benefits realized.

We may be subject to breaches of our information technology systems, which could damage our reputation and consumer relationships. Such breaches could subject us to significant financial, legal, and operational consequences.

Information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of perpetrators of cyber-attacks. In particular, our Security business is increasingly utilizing digital elements that allow third parties to use and store personally identifiable information and other information pertaining to their customers and their employees and businesses through online services operated by Master Lock. Such information may include names, passwords, addresses, phone numbers, access to facilities, email addresses, contact preferences, tax identification numbers and payment account information. We devote appropriate resources to network security, data encryption, and other security measures to protect our systems and data, but these security measures cannot provide absolute security. In the event of a breach, we would be exposed to a risk of loss or litigation and possible liability, which could have an adverse effect on our business, results of operations, cash flows, and financial condition.

We are subject to credit risk on our accounts receivable.

Our outstanding trade receivables are generally not covered by collateral or credit insurance. While we have procedures to monitor and limit exposure to credit risk on our trade receivables, there can be no assurance that such procedures will effectively limit our credit risk and avoid losses, which could have an adverse effect on our results of operations, cash flows and financial condition. In addition, it is possible that weak economic conditions may cause significantly higher levels of customer defaults and bad debt expense in future periods than is contemplated by our current allowances for doubtful accounts.

There can be no assurance that we will have access to the capital markets on terms acceptable to us.

From time to time we may need to access the long-term and short-term capital markets to obtain financing. Although we believe that the sources of capital currently in place permit us to finance our

13

Table of Contents

operations for the foreseeable future on acceptable terms and conditions, our access to, and the availability of, financing on acceptable terms and conditions in the future will be impacted by many factors, including, but not limited to: (i) our financial performance, (ii) our credit ratings or absence of a credit rating, (iii) the liquidity of the overall capital markets and (iv) the state of the economy, including the U.S. housing market. There can be no assurance that we will have access to the capital markets on terms acceptable to us. In addition, a prolonged global economic downturn may also adversely impact our access to long-term capital markets, result in increased interest rates on our corporate debt, and weaken operating cash flow and liquidity. Decreased cash flow and liquidity could potentially adversely impact our ability to pay dividends, fund acquisitions and repurchase shares in the future.

Item 1B. Unresolved Staff Comments.

None.

Our principal executive office is located at 520 Lake Cook Road, Deerfield, Illinois 60015. We operate 25 U.S. manufacturing facilities in 13 states and have 11 manufacturing facilities in international locations (7 in Mexico, 2 in Asia and 2 in Canada). In addition, we have 26 distribution centers and warehouses worldwide, of which 23 are leased. The following table provides additional information with respect to these properties.

| Manufacturing Facilities |

Distribution Centers and Warehouses |

|||||||||||||||||||||||

| Segment | Owned | Leased | Total | Owned | Leased | Total | ||||||||||||||||||

| Cabinets |

16 | 5 | 21 | 2 | 3 | 5 | ||||||||||||||||||

| Plumbing |

3 | 1 | 4 | 1 | 9 | 10 | ||||||||||||||||||

| Doors |

4 | 2 | 6 | — | 1 | 1 | ||||||||||||||||||

| Security |

4 | 1 | 5 | — | 10 | 10 | ||||||||||||||||||

| Totals |

27 | 9 | 36 | 3 | 23 | 26 | ||||||||||||||||||

We are of the opinion that the properties are suitable to our respective businesses and have production capacities adequate to meet the current needs of our businesses.

We are defendants in lawsuits associated with the normal conduct of our businesses and operations. It is not possible to predict the outcome of the pending actions and, as with any litigation, it is possible that some of these actions could be decided unfavorably to us. We believe that there are meritorious defenses to these actions, which we are vigorously contesting, and that these actions will not have a material adverse effect upon our results of operations, cash flows or financial condition.

Item 4. Mine Safety Disclosures.

Not applicable.

14

Table of Contents

Executive Officers of the Registrant.

| Name | Age | Position | ||||

| Christopher J. Klein |

51 | Chief Executive Officer | ||||

| E. Lee Wyatt, Jr. |

62 | Senior Vice President and Chief Financial Officer | ||||

| Michael P. Bauer |

50 | President, The Master Lock Company LLC | ||||

| David B. Lingafelter |

50 | President, Moen Incorporated | ||||

| David M. Randich |

53 | President, MasterBrand Cabinets, Inc. | ||||

| Mark Savan |

50 | President, Fortune Brands Doors, Inc. | ||||

| Robert K. Biggart |

60 | Senior Vice President — General Counsel and Secretary | ||||

| Sheri R. Grissom |

50 | Senior Vice President — Human Resources | ||||

| Dan Luburic |

43 | Vice President — Corporate Controller | ||||

Christopher J. Klein has served as Chief Executive Officer of Fortune Brands since January 2010. From April 2009 to December 2009, Mr. Klein served as President and Chief Operating Officer of Fortune Brands. From February 2009 through April 2009, Mr. Klein served as Senior Vice President of our Former Parent and, from April 2003 to February 2009, Mr. Klein served as Senior Vice President — Strategy & Corporate Development of our Former Parent.

E. Lee Wyatt, Jr. has served as Senior Vice President and Chief Financial Officer of Fortune Brands since July 2011. Mr. Wyatt served as Executive Vice President, Chief Financial Officer of Hanesbrands Inc., a global consumer goods company, from September 2006 to June 2011.

Michael P. Bauer has served as President of The Master Lock Company LLC since December 2014. From April 2011 through December 2014, Mr. Bauer served as the President of the U.S. Businesses at Moen Incorporated, a subsidiary of Fortune Brands. Mr. Bauer served as the Vice President and General Manager of U.S. Retail at Moen Incorporated from January 2010 to April 2011.

David B. Lingafelter has served as President of Moen Incorporated, a subsidiary of Fortune Brands, since October 2007.

David M. Randich has served as President of MasterBrand Cabinets, Inc., a subsidiary of Fortune Brands, since October 2012. From November 2007 to October 2012, Mr. Randich served as President of Therma-Tru Corp., a subsidiary of Fortune Brands.

Mark Savan has served as President, Fortune Brands Doors, Inc., a subsidiary of Fortune Brands, since January 2013. Mr. Savan also serves as President of Therma-Tru Corp. since October 2012 and served as President of Fortune Brands Windows, Inc., a subsidiary of Fortune Brands, from October 2006 to September 2014.

Robert K. Biggart has served as Senior Vice President, General Counsel and Secretary of Fortune Brands since December 2013. From March 2005 through December 2013, Mr. Biggart served as Senior Vice President — General Counsel of PepsiCo Americas Beverages, a business division of PepsiCo, Inc., a global food and beverage company.

Sheri R. Grissom has served as Senior Vice President — Human Resources of Fortune Brands since February 2015. Prior to that, Ms. Grissom served as Executive Vice President — Global Human Resources of Actuant Corporation, a diversified industrial company, since October 2010.

Dan Luburic has served as Vice President — Corporate Controller of Fortune Brands since October 2011. Prior to that, Mr. Luburic served as Assistant Corporate Controller of our Former Parent from December 2007 through September 2011.

15

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information, Dividends and Holders of Record

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the ticker symbol “FBHS”. The following table presents the high and low prices for our common stock as reported on the NYSE.

| 2014 | 2013 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 47.92 | $ | 39.83 | $ | 38.16 | $ | 29.91 | ||||||||

| Second Quarter |

43.51 | 37.28 | 44.04 | 33.20 | ||||||||||||

| Third Quarter |

44.24 | 36.65 | 43.69 | 35.80 | ||||||||||||

| Fourth Quarter |

46.00 | 36.54 | 46.08 | 37.75 | ||||||||||||

In December 2014, our Board of Directors increased the quarterly cash dividend by 17% to $0.14 per share of our common stock. We currently expect to pay quarterly cash dividends in the future, but such payments are dependent upon our financial condition, results of operations, capital requirements and other factors, including those set forth under “Item 1A. Risk Factors.”

On February 6, 2015, there were 12,942 record holders of the Company’s common stock, par value $0.01 per share.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

Below are the repurchases of common stock by the Company or any “affiliated purchaser” (as defined in Rule 10b-18(a)(3) under the Exchange Act) for the three months ended December 31, 2014:

| Three months ended December 31, 2014 |

Total number of shares purchased(a) |

Average price paid per share |

Total number of shares purchased as part of publicly announced plans or programs(a) |

Approximate

dollar under the plans or |

||||||||||||

| October 1 – October 31 |

748,598 | $ | 38.05 | 748,598 | $ | 300,000,000 | ||||||||||

| November 1 – November 30 |

— | — | — | 300,000,000 | ||||||||||||

| December 1 – December 31 |

— | — | — | 300,000,000 | ||||||||||||

| Total |

748,598 | $ | 38.05 | 748,598 | — | |||||||||||

| (a) | Information on the Company’s share repurchase programs follows: |

| Authorization and announcement date |

Authorization amount of shares of outstanding common stock |

Expiration date | ||

| June 2, 2014 |

$250 million | June 2, 2016 | ||

| September 30, 2014 |

$250 million | September 30, 2016 | ||

16

Table of Contents

Stock Performance

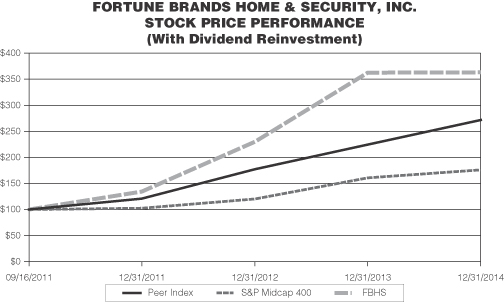

The above graph compares the relative performance of our common stock, the S&P Midcap 400 Index and a Peer Group Index. This graph covers the period from September 16, 2011 (the first day our common stock began “when-issued” trading on the NYSE) through December 31, 2014. This graph assumes $100 was invested in the stock or the index on September 16, 2011 and also assumes the reinvestment of dividends. The foregoing performance graph is being furnished as part of this Annual Report on Form 10-K solely in accordance with the requirement under Rule 14a-3(b)(9) to furnish our stockholders with such information, and therefore, shall not be deemed to be filed or incorporated by reference into any filings by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Peer Group Index The Peer Group is composed of the following publicly traded companies corresponding to the Company’s core businesses:

Armstrong World Industries, Inc., Fastenal Company, Leggett & Platt Incorporated, Lennox International Inc., Masco Corporation, Mohawk Industries, Inc., Newell Rubbermaid Inc., The Sherwin-Williams Company, Stanley Black & Decker, Inc., USG Corporation and The Valspar Corporation.

Calculation of Peer Group Index

The weighted-average total return of the entire Peer Group, for the period of September 16, 2011 (the first day of “when-issued” trading on the NYSE of Fortune Brands Home & Security, Inc. common stock) through December 31, 2014, is calculated in the following manner:

| (1) | the total return of each Peer Group member is calculated by dividing the change in market value of a share of its common stock during the period, assuming reinvestment of any dividends, by the value of a share of its common stock at the beginning of the period; and |

| (2) | each Peer Group member’s total return is then weighted within the index based on its market capitalization relative to the market capitalization of the entire index, and the sum of such weighted returns results in a weighted-average total return for the entire Peer Group Index. |

17

Table of Contents

Item 6. Selected Financial Data.

Five-year Consolidated Selected Financial Data

| Years Ended December 31, | ||||||||||||||||||||

| (In millions, except per share amounts) | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

| Income statement data(a) |

||||||||||||||||||||

| Net sales |

$ | 4,013.6 | $ | 3,703.6 | $ | 3,134.8 | $ | 2,877.8 | $ | 2,748.5 | ||||||||||

| Cost of products sold(a) |

2,646.7 | 2,408.5 | 2,093.2 | 1,985.7 | 1,815.1 | |||||||||||||||

| Selling, general and administrative expenses(b) |

943.3 | 938.7 | 873.1 | 797.1 | 733.9 | |||||||||||||||

| Amortization of intangible assets |

13.1 | 9.4 | 7.4 | 10.2 | 11.1 | |||||||||||||||

| Restructuring charges |

7.0 | 2.8 | 4.7 | 3.6 | 4.3 | |||||||||||||||

| Business separation costs |

— | — | — | 2.4 | — | |||||||||||||||

| Asset impairment charges |

— | 21.2 | 13.2 | 24.0 | — | |||||||||||||||

| Operating income |

403.5 | 323.0 | 143.2 | 54.8 | 184.1 | |||||||||||||||

| Income from continuing operations, net of tax |

273.6 | 209.0 | 108.3 | 5.6 | 60.5 | |||||||||||||||

| Basic earnings per share — continuing operations |

1.68 | 1.26 | 0.67 | 0.03 | 0.38 | |||||||||||||||

| Diluted earnings per share — continuing operations |

1.64 | 1.21 | 0.65 | 0.03 | 0.38 | |||||||||||||||

| Other data(a) | ||||||||||||||||||||

| Depreciation and amortization |

$ | 98.8 | $ | 90.4 | $ | 101.3 | $ | 111.5 | $ | 111.6 | ||||||||||

| Cash flow provided by operating activities |

253.7 | 297.8 | 282.8 | 175.4 | 138.9 | |||||||||||||||

| Capital expenditures |

(127.5 | ) | (96.7 | ) | (75.0 | ) | (68.5 | ) | (58.3 | ) | ||||||||||

| Proceeds from the disposition of assets |

0.7 | 2.2 | 13.5 | 3.5 | 2.6 | |||||||||||||||

| Dividends declared per common share |

0.50 | 0.42 | — | — | — | |||||||||||||||

| Dividends paid per common share to Former Parent |

— | — | — | 3.54 | — | |||||||||||||||

| Balance sheet data | ||||||||||||||||||||

| Total assets |

$ | 4,052.9 | $ | 4,178.1 | $ | 3,873.9 | $ | 3,637.9 | $ | 4,257.6 | ||||||||||

| Third party long-term debt |

643.7 | 350.0 | 297.5 | 389.3 | 16.8 | |||||||||||||||

| Total invested capital(c) |

2,933.0 | 3,009.2 | 2,710.2 | 2,535.2 | 2,605.5 | |||||||||||||||

| Short-term loans to Former Parent (included in total assets above)(d) |

— | — | — | — | 571.7 | |||||||||||||||

| Long-term loans from Former Parent(d) |

— | — | — | — | 3,214.0 | |||||||||||||||

| (a) | Income statement data excludes discontinued operations. Other data is derived from the Statement of Cash Flows and therefore includes discontinued operations. For additional information, refer to Note 18, “Information on Business Segments.” |

| (b) | The Company’s defined benefit expense included pre-tax actuarial (losses) gains in each of the last five years as follows: |

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Pre-tax actuarial (losses) gains |

$ | (13.7 | ) | $ | (5.2 | ) | $ | (42.2 | ) | $ | (80.0 | ) | $ | 3.5 | ||||||

| Portion in cost of products sold |

(3.0 | ) | (2.7 | ) | (14.2 | ) | (41.0 | ) | 2.5 | |||||||||||

| Portion in selling, general and administrative expenses |

(10.7 | ) | (2.5 | ) | (28.0 | ) | (39.0 | ) | 1.0 | |||||||||||

| (c) | Total invested capital consists of equity and short-term and long-term debt, including loans payable to our Former Parent, net of loans receivable from our Former Parent. |

| (d) | In 2011, our Former Parent made equity contributions totaling $2.7 billion to the Company, capitalizing all loan balances with our Former Parent. |

18

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Introduction

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is a supplement to the accompanying consolidated financial statements and provides additional information on our business, recent developments, financial condition, liquidity and capital resources, cash flows and results of operations. MD&A is organized as follows:

| > | Overview: This section provides a general description of our business, and a discussion of management’s general outlook regarding market demand, our competitive position and product innovation, as well as recent developments we believe are important to understanding our results of operations and financial condition or in understanding anticipated future trends. |

| > | Basis of Presentation: This section provides a discussion of the basis on which our consolidated financial statements were prepared. |

| > | Results of Operations: This section provides an analysis of our results of operations for each of the three years ended December 31, 2014, 2013 and 2012. |

| > | Liquidity and Capital Resources: This section provides a discussion of our financial condition and an analysis of our cash flows for each of the three years ended December 31, 2014, 2013 and 2012. This section also provides a discussion of our contractual obligations, other purchase commitments and customer credit risk that existed at December 31, 2014, as well as a discussion of our ability to fund our future commitments and ongoing operating activities through internal and external sources of capital. |

| > | Critical Accounting Policies and Estimates: This section identifies and summarizes those accounting policies that significantly impact our reported results of operations and financial condition and require significant judgment or estimates on the part of management in their application. |

Overview

The Company is a leader in home and security products focused on the design, manufacture and sale of market-leading branded products in the following categories: kitchen and bath cabinetry, plumbing and accessories, entry door systems, and security products.

For the year ended December 31, 2014, net sales based on country of destination were:

| (In millions) | ||||||||

| United States |

$ | 3,313.1 | 83 | % | ||||

| Canada |

405.8 | 10 | ||||||

| China and other international |

294.7 | 7 | ||||||

| Total |

$ | 4,013.6 | 100 | % | ||||

We believe the Company has certain competitive advantages including market-leading brands, a diversified mix of customer channels, and lean and flexible supply chains, as well as a tradition of strong innovation and customer service. We are focused on outperforming our markets in growth, profitability and returns in order to drive increased shareholder value. We believe the Company’s track record reflects the long-term attractiveness and potential of our categories and our leading brands. As consumer demand and the housing market grow, we expect the benefits of operating leverage and strategic spending will help us to continue to achieve profitable organic growth.

19

Table of Contents

We believe our most attractive opportunities are to invest in profitable organic growth initiatives. We also believe that as the market grows, we have the potential to generate additional growth from leveraging our cash flows and balance sheet strength by pursuing accretive strategic acquisitions and joint ventures, and returning cash to shareholders through a combination of dividends and repurchases under our share repurchase programs as explained in further detail under “Liquidity and Capital Resources” below.

The U.S. market for our home products consists of spending on both new home construction and repair and remodel activities within existing homes, with the substantial majority of the markets we serve consisting of repair and remodel spending. We believe that the U.S. market for our home products is in the midst of a multi-year recovery from the U.S. economic recession that ended in mid-2009 and that a continued recovery will largely depend on consumer confidence, employment, home prices, stable mortgage rates and credit availability. Over the long term, we believe that the U.S. home products market will benefit from favorable population and immigration trends, which will drive demand for new housing units, and from aging existing housing stock that will continue to need to be repaired and remodeled.

We may be impacted by fluctuations in raw material and transportation costs and promotional activity among our competitors. We strive to offset the potential unfavorable impact of these items with productivity initiatives and price increases.

During the past two years ended December 31, 2014, our net sales grew at a compounded annual rate of 13% as we benefited from an improving U.S. home products market, share gains, growth in international markets and acquisitions. Operating income grew at a compounded annual rate of 68% with operating margins improving from 5% in 2012 to 10% in 2014. Growth in operating income was primarily due to higher sales volume, control and leverage of our operating expenses, changes to our portfolio of businesses, the benefits of productivity programs, and lower restructuring and impairment charges.

During 2014, the U.S. home products market grew due to expansion of both new home construction and repair and remodel activities. We believe new housing construction experienced high-single digit growth in 2014 compared to 2013 and spending for home repair and remodeling increased approximately 4 to 5%. In 2014, net sales grew 8% and operating income increased 25% due to higher sales volume primarily resulting from U.S. home products market growth, the acquisitions of WoodCrafters Home Products Holding, LLC (“WoodCrafters”) in 2013 and John D. Brush & Co., Inc. (“SentrySafe”) in 2014, and productivity improvements.

During 2013, the U.S. home products market also grew due to expansion of both new home construction and repair and remodel activities. We believe new housing construction grew in the high teens (%) in 2013 compared to 2012 and spending for home repair and remodeling increased approximately 5% to 6%. We experienced strengthening in larger ticket repair and remodel activities, which had previously been lagging the overall market, and are particularly impactful to our cabinet products. In 2013, net sales grew 18% and operating income increased 126% on the benefit of higher volume from our growth initiatives, improving U.S. home products market conditions and productivity improvements, as well as the benefit of the acquisition of WoodCrafters.

In December 2014, we acquired Anaheim Manufacturing Company, which markets and sells garbage disposals, for $30.6 million in cash, subject to certain post-closing adjustments. In July 2014, we acquired SentrySafe, a leading manufacturer of home safes, for a purchase price of $116.7 million in cash. The financial results of SentrySafe were included in the Company’s results of operations and cash flows beginning in August of 2014. The purchase prices were funded from cash on hand and our existing credit facilities.

20

Table of Contents

In December 2014, we committed to a plan to sell the Waterloo tool storage business. In September 2014, we sold the Simonton windows business for $130 million in cash. For additional information on these discontinued operations, refer to the Basis of Presentation section below.

In June 2013, the Company acquired WoodCrafters, a manufacturer of bathroom vanities and tops, for a purchase price of $302.0 million. We paid the purchase price using a combination of cash on hand and borrowings under our existing credit facilities. The financial results of WoodCrafters were included in the Company’s results of operations and cash flows beginning in the third quarter of 2013. This acquisition greatly expanded our offering of bathroom cabinetry products.

Basis of Presentation

The consolidated financial statements in this Annual Report on Form 10-K have been derived from the accounts of the Company and its majority-owned subsidiaries. In September 2014, we sold of all of the shares of stock of Fortune Brands Windows, Inc., our subsidiary that owned and operated the Simonton windows business (“Simonton”). In December 2014, we committed to a plan to sell Waterloo Industries, Inc. (“Waterloo”), our tool storage business, Therefore, in accordance with Accounting Standards Codification (“ASC”) requirements, the results of operations of Waterloo and Simonton were reclassified and separately stated as discontinued operations in the accompanying consolidated statements of comprehensive income for 2014, 2013 and 2012. The assets and liabilities of Simonton were reclassified as a discontinued operation in the accompanying consolidated balance sheets as of December 31, 2013. The assets and liabilities of Waterloo were reclassified as a discontinued operation in the accompanying consolidated balance sheets as of December 31, 2014 and 2013. The cash flows from discontinued operations for 2014, 2013 and 2012 were not separately classified on the accompanying condensed consolidated statements of cash flows. Information on Business Segments was revised to exclude this discontinued operation.

The following discussion of both consolidated results of operations and segment results of operations refers to the year ended December 31, 2014 compared to the year ended December 31, 2013, and the year ended December 31, 2013 compared to the year ended December 31, 2012. The discussion of consolidated results of operations should be read in conjunction with the discussion of segment results of operations and our financial statements and notes thereto included in this Annual Report on Form 10-K. Unless otherwise noted, all discussion of results of operations are for continuing operations.

Years Ended December 31, 2014, 2013 and 2012

| (In millions) | 2014 | % change | 2013 | % change | 2012 | |||||||||||||||

| Net Sales: |

||||||||||||||||||||

| Cabinets |

$ | 1,787.5 | 8.8 | % | $ | 1,642.2 | 23.8 | % | $ | 1,326.6 | ||||||||||

| Plumbing |

1,331.0 | 3.4 | 1,287.0 | 16.9 | 1,100.7 | |||||||||||||||

| Doors |

413.9 | 11.4 | 371.6 | 15.6 | 321.5 | |||||||||||||||

| Security |

481.2 | 19.5 | 402.8 | 4.4 | 386.0 | |||||||||||||||

| Total Fortune Brands |

$ | 4,013.6 | 8.4 | % | $ | 3,703.6 | 18.1 | % | $ | 3,134.8 | ||||||||||

| Operating Income (Loss): |