UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM

___________________________

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from January 1, 2023 to December 31, 2023

Commission file number

___________________________

(Exact name of registrant as specified in its charter) |

___________________________

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of Principal Executive Offices) |

| (Zip Code) |

(

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

The | ||

|

|

|

|

|

|

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any annual report filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

Table of Contents

| 2 |

| Table of Contents |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that involve risks and uncertainties. You should not place undue reliance on these forward-looking statements. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in “Item 1A. Risk Factors,” “Item 7. Management Discussion and Analysis of Financial Condition and Result of Operations,” and “Item 1. Business” sections of this annual report. In some cases, you can identify these forward-looking statements by terms such as “anticipate,” “believe,” “continue,” “could,” “depends,” “estimate,” “expects,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms or other similar expressions, although not all forward-looking statements contain those words.

Our operations and business prospects are always subject to risks and uncertainties including, among others:

| ● | Our ability to obtaining any financing we may require to enable us to restart our financing of our customer’s purchase of solar systems and to finance any solar projects in China; |

|

|

|

| ● | Our ability to pay or finance our existing debt to related parties, which was approximately $17.0 million at December 31, 2023 as well as money owned to chief executive officer, and the potential market impact of our proposed refinancing of our EB-5 debt through the issuance of secured convertible notes and the issuance of common stock upon conversion of the $14.25 million principal amount of outstanding convertible notes at March 31, 2024 as well as any convertible notes which may be issued in the future; |

|

|

|

| ● | Our ability to enter into agreements for the construction of solar farms in China and to price such agreements in a manner to enable us to make a profit on the transaction; |

|

|

|

| ● | Our dependence for revenue for our Chinese segment on agreements with SPIC, which is a large state-owned enterprise under the administration of the Chinese government and which was the sole source of revenue for our China segment for 2021 and 2020; |

|

|

|

| ● | Our ability to provide services for SPIC, and the effect of government policies which may affect the procurement practices of SPIC; |

|

|

|

| ● | The availability of tax incentives and other benefits sufficient to justify a customer’s purchase of a solar system; |

|

|

|

| ● | Our ability to comply with present and future laws and regulations of China; |

|

|

|

| ● | The ability of the solar user to sell excess power to local utility companies on reasonable terms; |

|

|

|

| ● | The effect of the recent changes in California’s net metering laws on the market for residential solar systems in California; |

|

|

|

| ● | Assumptions regarding the size of the available market, benefits of our products, product pricing, timing of product installations; |

|

|

|

| ● | Our ability to engage and retain qualified executive and management personnel in both the United States and China; |

|

|

|

| ● | Our ability to implement an effective financing program for our products that enable us to generate revenue from customers in the United States segment who meet our credit criteria; |

|

|

|

| ● | Our dependence upon a small number of key executive officers, principally our chief executive officer; |

|

|

|

| ● | Competition with both local utility companies and other companies offering electricity service as well as other solar energy companies; |

| 3 |

| Table of Contents |

| ● | The effect of changes in climate and weather patterns in the areas we serve, including the effects of increased wildfires, rain and flooding in California; |

|

|

|

| ● | Delays in our ability to purchase solar panels and other raw materials for our systems; |

|

|

|

| ● | The effect that changes of government regulations affecting fossil fuel and renewable energy and trade and tariff policies have on the solar power industry; |

|

|

|

| ● | Our ability to implement and maintain an effective cybersecurity program and our ability to recover from and address any cybersecurity breaches; |

|

|

|

| ● | Our ability to reduce our costs and expenses; |

|

|

|

| ● | Our ability to operate profitably; |

|

|

|

| ● | The effect of prices of raw materials, including solar panels, and our ability to source raw materials at reasonable prices and the effect on our costs of inflationary pressure and supply chain issues which may increase our cost without being able to pass on the increased cost to customers; |

|

|

|

| ● | Our compliance with all applicable regulations; |

|

|

|

| ● | Our ability to install systems in a timely manner; |

|

|

|

| ● | Our ability to develop and maintain an effective system of disclosure controls and internal control over financial reporting, and our ability to produce timely and accurate financial statements and comply with applicable regulations; |

|

|

|

| ● | Our ability to operate without infringing the intellectual property rights of others; |

|

|

|

| ● | Our ability to comply with applicable secrecy laws; |

|

|

|

| ● | The effect of general economic and financial conditions in the United States, China and the rest of the world as well as the relationship between the United States and China, including trade disputes and policies between the United States and China, which could adversely affect our operations; |

|

|

|

| ● | Other factors which affect the solar energy industry in general; |

|

|

|

| ● | Our initial public offering and any future financing not being subject to filing with the CSRC or, if filing is required, obtaining approval of the CSRC; |

|

|

|

| ● | The effect of the COVID-19 pandemic or any other pandemic or epidemic and the steps taken by governments in California and China to address the pandemic or epidemic, including business closures, including the potential effects of the change in China’s zero COVID policy; and |

|

|

|

| ● | Other factors which affect companies with significant operations in China. |

The forward-looking statements in this annual report represent our views as of the date of this annual report. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention to do so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this annual report.

| 4 |

| Table of Contents |

Part I

Item 1. Business

Introduction

We are an integrated solar and renewable energy company. A solar energy system retains the direct current (DC) electricity from the sun and converts it to alternating current (AC) electricity that can be used to power residential homes and commercial businesses. The solar business is based on the ability of the users of solar energy systems to save on energy costs and reduce their carbon imprint as compared with power purchased from the local electricity utility company. We were founded in 2008 to engage in the solar business in the United States.

We operate in two segments – the United States segment and the China segment. Our United States operations primarily consist of the sale and installation of photovoltaic and battery backup systems for residential and commercial customers, and sales of LED systems and services to government and commercial users. Prior to 2020, we also financed the purchase of solar equipment from us. Since early 2020, because we did not have the capital to support such operations, we suspended making loans to our solar customers, and we are not currently financing the purchase of solar systems and we do not anticipate engaging in such activities in the near future, if at all. Our finance revenue reflects revenue earned on our current portfolio, with no new loans having been added since early 2020.

Our United States operations generated revenue of $54.1 million for the year ended December 31, 2023, consisting of solar and battery revenue of $50.5 million, LED revenue of $3.1 million and finance revenue of $0.6 million. Our United States operations generated revenue of $45.5 million for the year ended December 31, 2022, consisting of solar and battery revenue of $40.6 million, LED revenue of $3.3 million and finance revenue of $0.8 million.

| · | We commenced operations in China following the completion of two acquisitions on April 28, 2015. |

|

|

|

| · | We acquired the ownership of Chengdu Zhonghong Tianhao Technology Co., Ltd., (“Chengdu ZHTH”), through a share exchange agreement among us, one of our PRC subsidiaries and the equity owners of Chengdu ZHTH (together with its subsidiaries thereunder, “ZHTH”). |

|

|

|

| · | We acquired the ownership of Jiangsu Zhonghong Photovoltaic Electric Co., Ltd., or ZHPV, through a share exchange agreement, as subsequently amended, between us and the holders of the stock of Accumulate Investment Co. Ltd., (“Accumulate”). Accumulate owns ZHPV through a Hong Kong subsidiary. |

|

|

|

Our business in China is conducted through our subsidiaries, primarily ZHTH and ZHPV, and their subsidiaries. Our China operations consist primarily of identifying and procuring solar farm projects for resale to third parties and performing engineering, procurement and construction services,, which are referred to as EPC services, primarily for solar farm projects. Our China operations did not generate any revenue for the years ended December 31, 2023 and December 31, 2022. Our China segment last generated revenue for the year ended December 31, 2021, substantially all of which was generated in the second quarter of the year.

Initial Public Offering

On February 27, 2024, we sold 4,500,000 shares of common stock, at a price of $4.00 per share in our initial public offering. The gross proceeds of the offering were $18 million, prior to deducting the underwriting discounts, commissions and offering expenses payable by the Company. In addition, we granted the underwriters a 45-day option to purchase an additional 675,000 shares of common stock at the initial public offering price, less underwriting discounts and commissions, to cover over-allotments. On March 5, 2024, the underwriters purchased 539,950 shares of common stock upon the partial exercise of the over-allotment option. Net proceeds received by us from our initial public offering, including the partial exercise of the over-allotment option, were approximately $18.6 million. We also issued to Kingswood, a division of Kingswood Capital Partners, LLC, the representative of the underwriters, and its designees warrants to purchase 403,196 shares. On March 13, 2024, these warrants were fully exercised on a cashless basis. Based on the formula for cashless exercise, we issued a total of 207,311 shares of common stock, and, as result of the exercise, no warrants remained outstanding.

| 5 |

| Table of Contents |

Effects of COVID-19 Pandemic

The United States Center for Disease Control announced that the COVID-19 public health emergency ended in May 2023, with the result that the COVID restrictions in the United States are no longer in effect and restrictions have been terminated worldwide. We believe our United States operations are not, and have not since mid-2022 been, materially affected by COVID. However, the effects of China’s zero tolerance policy with respect to COVID-19, which is no longer in effect, has impaired our ability to negotiate both new contracts with and payment schedules with State Power Investment Corporation Guizhou Jinyuan Weining Energy Co., Ltd. (“SPIC”), a state-owned entity which has been the only customer for our China segment since 2020, with the result that we have no pending agreement with SPIC and we are continuing to negotiate payment of outstanding receivables from SPIC.

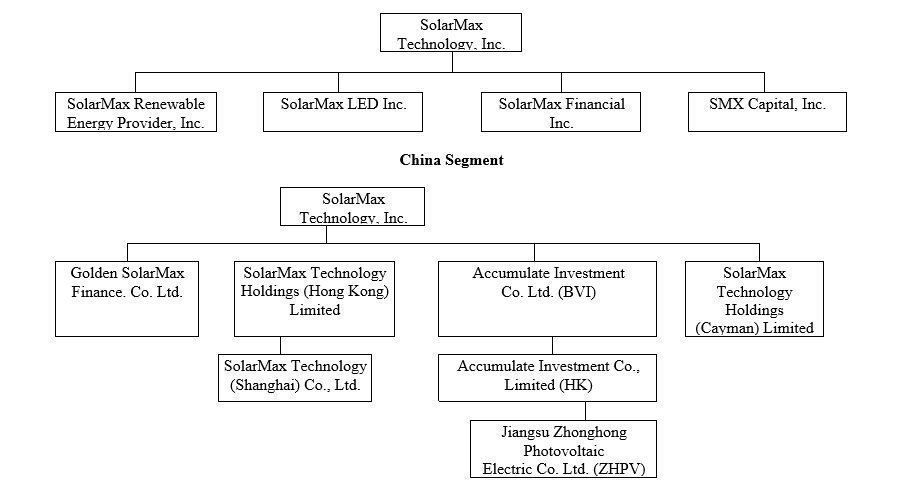

Our Corporate Structure

We are a Nevada corporation formed in January 2008. We have four wholly-owned subsidiaries in the United States: SolarMax Renewable Energy Provider, Inc., SolarMax Financial, Inc. (“SolarMax Financial”), SolarMax LED, Inc. (“LED”) and SMX Capital, Inc. (“SMX Capital”).

Our wholly-owned subsidiaries outside the United States are Accumulate Investment Co. Ltd. (BVI), a British Virgin Islands corporation (“Accumulate’), SolarMax Technology Holdings (Hong Kong) Limited, a Hong Kong corporation (“SolarMax Hong Kong”), Golden SolarMax Finance Co., Ltd, a Chinese corporation (“Golden SolarMax”) and SolarMax Technology Holdings (Cayman) Limited, a Cayman Islands corporation (“SolarMax Cayman”).

Accumulate has one wholly-owned subsidiary, Accumulate Investment Hong Kong, a Hong Kong corporation, which has one wholly-owned subsidiary, ZHPV.

SolarMax Hong Kong has one wholly-owned subsidiary, SolarMax Shanghai. SolarMax Shanghai is a wholly foreign-owned entity, which is referred to as a WFOE. SolarMax Shanghai currently has subsidiaries that are not significant, but forms subsidiaries which acquire permits for solar farms with a view to selling the project subsidiaries pursuant to the terms of agreements with the ultimate buyer, which during 2020 and 2021 was SPIC. We refer to SolarMax Shanghai and its subsidiaries collectively as ZHTH.

The following charts show our corporate structure for our United States and China segments. The chart for the China segment does not include the subsidiaries of ZHPV, which are either project subsidiaries or subsidiaries which are formed to perform services for a specific contract; or subsidiaries of SolarMax Shanghai.

United States Segment

| 6 |

| Table of Contents |

Our principal executive offices are located at 3080 12th Street, Riverside, California 92507. Our telephone number is (951) 300-0788. Our website is http://www.solarmaxtech.com. Any information contained on, or that can be accessed through, our website or any other website or any social media is not a part of this annual report.

United States Operations

Solar Energy Systems

The photovoltaic market in the United States was the second largest in the world in 2021, with an installed capacity of more than 97 GW that accounted for approximately 11% of the world’s total installed capacity, The United States photovoltaic market has been projected to grow at a compound annual growth rate of 17% between 2021 and 2025. Renewable energy accounted for 13% of the United States electricity generation, with solar being the fastest-growing source of renewable energy. The United States market is projected to reach $125 million by 2030. California is the leading state in the United States for installed solar capacity, with 32% of total U.S. installations. California state law set California’s renewable electricity procurement goal at 50% by 2050. 1

We design, install and sell high performance photovoltaic solar energy systems and battery systems, and we have installations at more than 12,000 homes and businesses. A photovoltaic system generates electricity directly from sunlight via an electric process that occurs naturally in certain types of materials. A system consists of one or more photovoltaic modules and an inverter. Photovoltaic modules, which are manufactured in different sizes and shapes, generate direct current (DC) electricity. The electricity current is then fed through an inverter to produce the alternating current (AC) electricity that can be used to power residences and commercial businesses. The major components of our solar energy systems include solar panels that convert sunlight into electrical current, inverters that convert the DC electrical output from the panels to AC current compatible with the electric grid, racking that attaches the solar panels to the roof or ground and electrical hardware that connects the solar energy system to the electric grid. The battery systems we sell are rechargeable and can be used not only to store solar energy for backup protection when the power grid goes down, but also to reduce the reliance on the electrical grid by storing solar energy to be used when the sun in not shining or when power costs are the highest during the day. We currently install solar systems only in California.

We provide and install both grid-tied and off-grid systems. Grid-tied systems remain connected to the electric grid, so that the energy generated by the system is sent back to the grid during the day and power is drawn back at night. The electric grid thus serves as a “storage device” for photovoltaic-generated power. If consumers use more power than is generated by their solar energy system, they can purchase power from the regional utility company. If consumers use less power than the system generates, they can sell the electricity back to their local utility companies and receive a credit on their electric bills. In order to sell power back to the utility company, the owners need to make an application to the utility company and the utility company then gives the owners a standard agreement covering the purchase of the excess power. Grid-tied systems generally represent the most common, affordable and feasible option for urban and suburban residences.

Off-grid systems are not connected to the utility grid and therefore require battery backup. Off-grid solutions are less common and are mostly employed for residences that do not have the option of connecting to the utility grid. Almost all of our installations are grid-tied systems.

Sale and Installation Process

Our system sale and installation process consists of five stages – feasibility, design, permitting, procurement and installation. In addition, when a customer requests additional services, we will enter into post-installation maintenance agreements with customers who own the systems. We have a dedicated team to handle every detail of the customer’s solar panel, battery or LED installation.

We market to our customers using print ad, internet, radio and television advertising along with customer referrals. We are in the process of shifting our focus from traditional radio advertisements to sponsorships and other public relation initiatives. After the initial contact with a prospective customer, our construction and solar engineers visit the customer to conduct an on-site evaluation and assess the customer’s electricity needs. The site assessment includes a shading analysis, roof inspection and review of any existing mechanical systems. Additionally, we review the customer’s recent utility bills so that we can present a proposal designed to meet the customer’s energy requirements and answer the customer’s questions. At this stage, the customer has not made any commitment to purchase a system from us.

___________________________

1 IHS Markit; International Energy Agency; GlobalData; mordorintelligence.com; Wikipedia, Solar power by country, April 2023; National Renewable Energy Laboratory; PV Magazine; BNEF (https://about.bnef,com); Bloomberg (https://www.bloomberg.com); https://www.energy.ca.gov/rules-and-regulations/energy-suppliers-reporting/clean-energy-and-pollution-reduction-act-sb-350.

| 7 |

| Table of Contents |

At the design stage, we analyze the information obtained during the feasibility stage to design a proposed solar energy solution, based on the customer’s stated energy needs, financial means and the specifics of the building location. Upon completion of the design stage, we present the customer with a detailed written proposal outlining the components of the system, the proposed timeline of the system implementation, the estimated price and estimated energy savings as well as the expected return on the investment based on existing rate information. Approved customers who purchase our systems sign a purchase agreement and tender to us a down payment equal to the lesser of 10% of the overall cost or $1,000, which can be refunded within three days.

The period of time between the initial customer contact at the feasibility stage and the signing of the contract upon the completion of the design stage (the negotiation period) may range from less than a month to more than a year, with six to twelve months being the average negotiation period for larger commercial projects.

Before installing any solar or backup battery system, we must obtain required permits and approvals from the local fire department and the department of building and safety and other applicable state and local agencies, as well as from utility companies. We prepare a full permitting package and apply for these permits on behalf of the customer. We may also assist the customer with necessary paperwork to apply for and obtain the tax rebates and incentives. The permitting process typically takes four to eight weeks. Upon completion of this stage, we require customers to pay 40% of the total purchase price.

Once the customer orders the system, we order products, parts and materials necessary to implement the project. Upon delivery of the materials to the customer’s site, we require an additional 40% of the purchase price.

Finally, we assemble and install the system at the customer’s site. Once installation is complete, we meet with the customer to conduct a final walk-through of the system and review its components. Upon the final walk-through and sign-off by the city inspector, the system becomes fully operational, and we require the remaining 20% of the purchase price. The payment schedules do not apply to customers for whom we are providing financing. We provide end-to-end customer service during the lifetime of the product.

Source of Supply

We do not have a supply agreement with any supplier. We purchase solar panels from a number of suppliers. Battery systems are available from a number of suppliers, including Tesla, Enphase and LG.

One supplier, Consolidated Electrical Distributors, accounted for 10% or more of the purchases for our United States operations. This supplier accounted for purchases of approximately $4.9 million, or 12% of our purchases, for the year ended December 31, 2023, and $5.2 million, or 18% of our purchases, for the year ended December 31, 2022.

Warranty Obligations; Production Guarantee

All parts of the system provided by us are under manufacturers’ warranties, typically for 25 years for the panels and inverters. The manufacturer’s warranty on the solar energy systems’ components, which is typically passed through to the customers, ranges from one to ten years. We provide a limited installation services warranty that warrants the installation services related to the system owner’s photovoltaic modules and inverters to be free from defects in the installation services under normal application, use and service conditions for a period of ten years from the date of the original installation services. Our agreement with our customers provides that we are not responsible for damage resulting from natural disasters, such as hurricanes, floods or other weather conditions. For leased systems we require the customer to maintain insurance covering these risks.

Prior to 2015, we entered into power purchase agreements that have a term of up to 20 years. We own and maintain the systems and sell the power generated by the systems to commercial customers pursuant to the power purchase agreement. Revenue from power purchase agreements is not material.

Commencing in 2015, our standard contract for residential systems provides for a production guarantee, which means that we guarantee that the system will generate a specified minimum solar energy during a given year. The agreements generally have a ten-year term. In the standard form of contract, we specify a minimum annual production and provide that if the power generated by the system is less than 95% of the estimate, we will reimburse the owner for the cost of the shortfall. Because our obligations are not contingent upon external factors, such as sunlight, changes in weather patterns, forest fires, or increases in air pollution, these factors could affect the amount of solar power that is generated and could increase our exposure under the production guarantee. The contract also provides that the purchasers of these systems shall not be entitled to reimbursement for shortfalls caused by overshadowing, shading or other interference not attributable to the design of the system and the accompanying equipment. Our only production guarantees are pursuant to agreements with our customers.

| 8 |

| Table of Contents |

In 2017, we incurred unanticipated liability based on the failure to of our systems to meet the production guarantee or otherwise perform in accordance with our warranty. Our only production guarantees are pursuant to agreements with our customers. Although we believe we have taken steps designed to prevent a misalignment of system designs and production guarantees which affected us in 2017, we cannot assure you that we will not be subject to unanticipated liability based on the failure of our systems to meet production guarantees or otherwise perform in accordance with our warranty.

With respect to leases with a leasing company, the leasing company establishes its own production guarantees, conducts its own review of those guarantees in conjunction with system design, and is responsible for any necessary modification in its contracts.

Our warranty for the LED products sold and services rendered ranges from one year for labor and up to seven years for certain products sold to governmental municipalities,

Leasing Agreements with us as the Lessor

Prior to 2014, we leased systems primarily to commercial and not-for-profit customers through our subsidiaries and three entities in which we have a 30% interest. These leases are operating leases and we own the systems, which we lease to the customers. Although we no longer lease new systems, we continue to own the equipment subject to the existing leases. The leases do not include a production guarantee. At the end of the lease, the customer has an option to purchase the equipment at its then fair market value for commercial customers. For not-for-profit customers, we generally have agreed up front to donate the system to the customers at the end of the lease. We have not leased systems for our account after 2014. Instead, leases are made with a third-party leasing company.

Our customers may lease systems pursuant to third-party leasing companies selected by the customer. During the years ended December 31, 2023 and 2022, revenues from leasing companies with which we had an agreement did not account for any significant percentage of our revenues.

Power Purchase Agreements

Prior to 2015, we entered into solar power purchase agreements with some commercial customers, and many of these agreements remain in effect. Pursuant to these agreements, we were responsible for the design, permitting, financing and installation of a solar energy system on a customer’s property after which we sell the power generated by the system to the customer at an agreed upon rate. To the extent that the system does not generate sufficient power to meet its obligations, we may have to purchase power from a local utility company, which will be a cost of revenues. We receive the income from the sales of electricity pursuant to these agreements as well as any tax credits and other incentives generated from the system, and we are responsible for the operation and maintenance of the system for the duration of the agreement. At the end of the term, a customer may extend the agreement, have us remove the system or buy the solar energy system from us. We have generated nominal revenue from power purchase agreements. From 2015 until March 2019, we did not offer power purchase agreements.

Seasonality

Since the inception of our business in 2008, we have experienced different levels of seasonality for our residential sales, small commercial and large commercial projects.

Our residential sales are prone to seasonal fluctuations. It has been our experience that we generate a larger percentage of sales in March and April, when residential customers focus on possible tax advantages of solar energy, and in the summer months of July and August, when utility rates and bills typically increase. We believe that the increase in residential sales during March and April results from consumers’ increased awareness of the tax benefits of solar energy system systems. We believe that the higher volume of sales in the summer months results from typically higher electrical bills in the summer, when electricity use is highest, which we think heightens consumers’ awareness of the opportunity to reduce their energy costs in the future through the use of solar energy.

We have historically experienced a slight increase for small commercial projects during the summer season. As with residential sales, we attribute higher volume in small commercial sales to small business owners’ reaction to the generally higher electricity bills during the summer months.

We have generally not experienced any significant seasonal fluctuations for our large commercial projects in the United States. We suspect that customers committing to large commercial purchases or leases of solar energy systems have generally made more studied decisions and are therefore less sensitive to seasonal variations or immediate market conditions. The negotiation period for larger projects may range from a couple of months to a year or more. We therefore believe that the timing of the execution of large commercial deals depends largely on the progress of contract negotiations.

| 9 |

| Table of Contents |

Financing Activities

Because we believe the high cost of buying and installing solar energy systems remains a major barrier for a typical residential customer, we had developed financing programs to enable customers who meet our credit standards to finance the purchase of our solar energy systems through SolarMax Financial. Since early 2020, because we did not have the capital to support such operations, we suspended making loans to our solar customers but may resume lending if we have sufficient funds, including from the proceeds of our initial public offering. Our finance revenue currently reflects revenue earned on our current portfolio, with no new loans having been added since early 2020. We have no present plans to re-commence financing operations.

The following table sets forth customer loan receivables at December 31, 2023 and December 31, 2022:

|

| December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Customer loan receivable, gross |

| $ | 6,795 |

|

| $ | 10,625 |

|

Less: unamortized loan discounts |

|

| (2 | ) |

|

| (56 | ) |

Less, allowance for loan losses |

|

| (257 | ) |

|

| (289 | ) |

Customer loans receivable, net |

|

| 6,536 |

|

|

| 10,280 |

|

Less, current portion, net |

|

| (2,213 | ) |

|

| (3,437 | ) |

Customer loans receivable, long-term |

|

| 4,323 |

|

|

| 6,843 |

|

Financing Program

We have financing programs with third-party financing companies, the most significant of which is a home improvement financing program agreement executed on October 12, 2021, with GoodLeap, LLC (“GoodLeap” formerly known as LoanPal, LLC), pursuant to which GoodLeap provides financing to our customers who meet GoodLeap’s credit criteria. We sell the systems to our customers, and GoodLeap pays us the purchase price, less a program fee. The financing agreement is between the customer and GoodLeap, and we are not a party to the agreement.

LED Projects

We provide LED products that help commercial customers save money by lowering electricity costs through the advanced technology of LED light bulbs. The energy-saving incandescent bulbs use approximately 25% less energy than traditional varieties, while the LED light bulbs use approximately 75% less energy, last 40 times longer, and are considered safer to use.

We have relationships with a number of LED system manufacturers that provide us with access to a variety of high-performance products and ultimately enables us to meet customers’ energy needs and budgets. Our LED streetlight system has an exclusive ETL Mark under our company name, which is evidence that our product complies with North American safety standards and is a requirement for contracts with municipal customers.

There are several steps to completing an LED installation with a customer. The first step is to review the customer’s previous year’s power bill and to look at its financial statements for the last three years. The next step is to conduct a lighting survey to effectively present an energy saving proposal to the potential customer. We typically offer financing services similar to our solar system financing. Some commercial projects require us to engage a third-party vendor to help install the LED lighting systems for our clients while other projects customers choose to be responsible for the installation of the system.

Marketing

We have an in-house sales and marketing staff of 30, of which 25 market solar and battery backup projects and five market LED products and systems. While we use a variety of marketing and advertising tools, we believe that word of mouth is one of our most effective marketing strategies. We estimate that approximately 40% of our sales are generated through referrals by our customers.

We also participate in industry trade shows, use telemarketing, radio, television, Internet advertising and social media as well as participating in local community events such as local festivals and door-to-door sales.

| 10 |

| Table of Contents |

Personal meetings with prospective customers and site visits at the feasibility stage are also part of our advertising budget. In our experience, on average, we make three to four visits at the feasibility stage before we can generate a contract from the customer. As we expand the breadth of our operations, we plan to hire additional professionals and general sales personnel to market our systems to a larger number of prospective customers.

Our marketing effort includes our ability to offer financing in connection with purchases of our systems. We do not have a separate marketing staff for our financing activities.

Competition

Solar energy systems in general compete with both the local or regional providers of electricity as well as a number of independent companies that offer to provide electricity at prices that are lower than the regional utility company. Our primary competition is with the local utility companies that supply power to our potential customers.

Within the solar energy industry, we face intense and increasing competition from other solar energy system providers. The solar energy industry is highly fragmented, consisting of many small, privately-held companies with limited resources and operating histories, and we believe that no solar energy provider has a significant percentage of the California market. We also compete with major companies, as well as a large number of smaller companies. We have experienced price erosion as a result of increased competition which has affected our gross margin. Because California has much sun and little rain, solar power companies seek to market in California rather than in states with less sun and more rain. We cannot estimate the effects of the recent increased rain and flooding in Southern California on our business and the solar market in general. We believe that the number of new solar energy installation companies that have entered the industry in California has increased significantly since 2008 when we commenced business, and the increased competition is reflected in lower margins as we may have to reduce our prices to generate business. We expect additional companies to enter the business in the future, considering that the entry barrier in this industry is relatively low and the government incentives currently remain high.

We believe that competition is primarily based on price and, if financing is required, the availability and terms of financing, and, to a lesser extent, the ability to schedule installation to meet the customer’s schedule. Some of our competitors may offer financing terms with payments over a longer period and with either a lower down payment or no down payments than are available with third party lessors with whom we work, which may make them more attractive to potential customers.

Government Regulation

Although we are not a regulated utility company, our operations are subject to regulation, supervision and licensing under various federal, state and local statutes, regulations and ordinances. Additionally, our business is materially affected by federal and state programs and policies related to financial incentives for solar energy users and providers. Local utility companies work with all solar companies to connect their systems to the grid. Title 24 of the California Code of Regulations governs energy savings and efficiency standards for new and remodeled construction for indoor and outdoor lighting requirements.

Construction Licenses and Permits

As a company performing general contractor and design work, we must take steps such that we obtain and timely renew appropriate general contractor and other required licenses. In connection with each installation, we are required to obtain building permits and comply with local ordinances and building codes for each project. Our operations are also subject to generally applicable laws and regulations relating to discharge of materials into the environment and protection of the environment. We are also subject to federal and state occupational health and safety regulations. We may also be subject to federal or state wage requirements, at least in connection with any solar projects on government land or buildings or other public works projects.

Consumer Protection Laws

In negotiating and entering into contracts with our residential customers, we must comply with state and federal consumer protection laws. In conducting our marketing campaigns, we must comply with the federal Telemarketing and Consumer Fraud and Abuse Prevention Act, and Telemarketing Sales Rule promulgated by the Federal Trade Commission, as well as state regulations governing telemarketing and door-to-door sales practices. In negotiating and entering into contracts with our residential customers, we must comply with a number of state regulations governing home solicitation sales, home improvement contracts and installment sales contracts.

| 11 |

| Table of Contents |

Consumer Financing Regulations

In the event that we recommence financing operations in California, our finance subsidiary, SolarMax Financial will have to be registered as a California finance lender pursuant to a license issued by the California Department of Corporations, which regulates and enforces laws relating to consumer finance companies, and SolarMax Financial would be required to comply with regulations pertaining to consumer financing. Such rules and regulations generally provide for licensing of consumer finance companies, limitations on the amount of financing provided, duration and charges, including finance charge rates, for various categories of contracts, requirements as to the form and content of the loans and other documentation, and restrictions on collection practices and creditors’ rights. As a licensed finance lender, SolarMax Financial will be subject to periodic examination by state regulatory authorities.

SolarMax Financial would also be subject to extensive federal regulation, including the Truth in Lending Act, the Equal Credit Opportunity Act, Fair Debt Collection Practices Act and the Fair Credit Reporting Act and other laws. These laws would require SolarMax Financial to provide certain disclosures to prospective customers and protect against discriminatory lending practices and unfair credit practices. The principal disclosures required under the Truth in Lending Act include the terms of repayment, the total finance charge and the annual percentage rate charged on each contract. The Equal Credit Opportunity Act prohibits creditors from discriminating against loan applicants on the basis of race, color, sex, age, or marital status, among other things. Pursuant to Regulation B promulgated under the Equal Credit Opportunity Act, lenders are required to make certain disclosures regarding consumer rights and advise consumers whose credit applications are not approved of the reasons for the rejection. The Fair Credit Reporting Act requires SolarMax Financial to provide certain information to consumers whose applications were not approved or were conditionally approved on terms materially less favorable than the most favorable terms normally offered on the basis of a report obtained from a consumer-reporting agency.

In addition, SolarMax Financial would be subject to the provisions of the federal Gramm-Leach-Bliley financial reform legislation, which imposes additional privacy obligations on SolarMax Financial with respect to our applicants and our customers. SolarMax Financial has appropriate policies in place to comply with these additional obligations. SolarMax Financial does not presently engage, and has not since early 2020, engaged, in lending activities, and has no present plans to do so since we do not have the capital to enable us to engage in these activities.

Government Subsidies and Incentives

The solar energy industry depends on the continued effectiveness of various government subsidies and tax incentive programs existing at the federal and state level to encourage the adoption of solar power. Government policies, in the form of both regulation and incentives, have accelerated the adoption of solar technologies by businesses and consumers. We and our customers benefit from these regulations in the form of federal tax incentives, state utility rebates and depreciation. Because of the high cost of installing solar energy systems, the existence of tax incentives as well as regulations requiring utility companies to purchase excess power from solar energy systems connected to the grid are important incentives to the installation of a solar energy system.

Federal Tax Incentive. Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. The Inflation Reduction Act has made changes to the existing tax credit and extends the provisions of the Solar Investment Tax Credit so owners who install designated solar energy systems between January 1, 2022 through the end of 2032 will receive a tax credit of 30% of the cost of the solar energy system from their federal income taxes. Owners who owe less federal income tax than the 30% tax credit can carry over any unused credit until January 1, 2032. After 2032, the residential investment tax credit will be reduced to 26% for installations completed in 2033 and to 22% for -installations completed in 2034, and tax credit will no longer be available for installations completed after December 31, 2034.

State Incentives and Utility Company Rebates. In addition to federal income tax credit, utility companies in California and other states offer various incentives and rebate programs. Capital cost rebates provide funds to customers based on the cost and size of a customer’s solar energy system. The value of the rebate is subtracted from the total purchase price, resulting in a net adjusted cost for the purpose of determining the value of the federal tax credit. Performance-based rebates provide funding to customers based on the energy produced by their systems. Under a feed-in tariff subsidy, the government sets prices that regulated utility companies are required to pay for renewable electricity generated by end-users. Under that subsidy program, prices are set above market rates and may be differentiated based on system size or application.

The building standard approved by the California Energy Commission in May 2018 mandates the installation of solar arrays on new single-family residences and on multi-family buildings of up to three stories starting in 2020. The Building Standards Commission has adopted these recommendations without change, and we cannot assure you that the Building Standards Commission will not change this standard or that the standard will survive any legal challenges which may be brought in opposition to the standard.

| 12 |

| Table of Contents |

The California Public Utilities Commission may consider a proposal to significantly reduce the incentives homeowners receive for installing rooftop solar systems. If such a change or any significant change in the benefits provided to homeowners for installing rooftop solar systems, our U.S. business will be materially impaired. We cannot assure you that the present benefits provided to homeowners for installing solar systems will not be adopted.

Depreciation. Certain qualified clean energy facilities, property and technology placed in service after 2024 may be classified as 5-year property under the modified accelerated cost recovery system (MACRS) under Inflation Reduction Act of 2022. Under Internal Revenue Code Section 168(e)(3)(B), qualified facilities, qualified property and energy storage technology are considered 5-year property. These types of property are recoverable under the MACRS. A business with a solar PV system placed in service between January 1, 2018 and December 31, 2022 can elect to claim a 100% bonus depreciation. Starting in 2023, the percentage of capital equipment that can be expensed immediately drops 20% per year (e.g., 80% in 2023 and 60% in 2024) until the provision drops to 0% in 2027.

Tariffs and Trade Policies. The solar energy industry has recently experienced decreasing prices in solar panels, a principal component in any solar energy system. Most solar panels are imported and the price of the solar panels is impacted by trade policies, such as tariffs and quotas. The U.S. government has imposed tariffs on solar cells, solar panels and aluminum that is used in solar panels manufactured overseas. Based on determinations by the U.S. government under the 2012 solar trade case, the anti-dumping and countervailing tariff rates range from approximately 33%-255%. Such anti-dumping and countervailing tariffs are subject to annual review and may be increased or decreased. These tariffs have increased the price of solar panels containing China-manufactured solar cells. We do not purchase panels from China or Taiwan for our United States operations. The purchase price of solar panels containing solar cells manufactured in China reflects these tariff penalties. While solar panels containing solar cells manufactured outside of China are not subject to these tariffs, the prices of these solar panels are, and may continue to be, more expensive than panels produced using Chinese solar cells, before giving effect to the tariff penalties.

On January 23, 2018, the United States placed tariffs on imported solar cells and modules for a period of four years with an effective date of February 7, 2018. The tariff level was set at 30%, with a 5% declining rate per year for the four- year term of the tariff. The tariff includes a 2.5 GW exemption for cells per year, which does not include any sub quotas for individual countries. Additionally, the only countries excluded from the tariff are those that the U.S. government deems as developing nations, with the exception of the Philippines and Thailand that are eligible for the U.S. Generalized System of Preferences program.

While the state and federal incentives benefit the industry by making solar energy systems more affordable and attractive to consumers, they also expose the industry to the risk of negative consequences should these incentives be discontinued or reduced. The market for solar energy products is, and will continue to be, heavily dependent on public policies that support growth of solar energy. There can be no assurances that such policies will continue. Decreases in the level of rebates, incentives or other governmental support for solar energy would materially and adversely affect the demand for solar energy products, including our business.

Net Metering. Net metering is a billing mechanism that credits solar energy system owners for the electricity that they add to the electricity grid. If the owner of a solar system generates more electricity than it consumes, the excess electricity is sold back to the grid.

The California Public Utilities Commission (CPUC) introduced “Net Metering 3.0” (NEM 3.0) as the latest iteration of net metering policies. Under NEM 3.0, customers continue to receive credit for the electricity they produce; however, the calculation of this credit is based on avoided cost rates. These rates align more closely with wholesale rates for electricity, reflecting what utilities themselves pay for electricity rather than the conventional rates paid by customers.

Under NEM 3.0 the economic viability of combining solar panel systems with battery storage is enhanced. As a result, the payback period for the combined installations has accelerated, surpassing that of solar-only installations. We may need to revise our pricing metrics to reflect this change in order for the purchase of a solar system to be economically attractive to the customer, which may result in lower prices and reduced margins.

To the extent that utility companies are not required to purchase excess electricity from owners of solar systems or are permitted to lower the amounts paid, the market for solar systems may be impaired. Because net metering can enable the solar system owner to further reduce the cost of electricity by selling excess electricity to the utility company, any elimination or reduction of this benefit would reduce the cost savings from solar energy. The recent changes in California’s net metering payments may have reduce the market for residential solar installations to the extent that the installation of the homeowner’s decision to install a solar system is based on the benefits of the net metering structure, which has been modified to reduce the benefits to the homeowner. We cannot assure you that net metering will not be eliminated or the benefits significantly reduced for future solar systems, which may dampen the market for solar energy.

| 13 |

| Table of Contents |

California Consumer Privacy Act

In June 2018, California passed the CCPA, which became effective in 2020. As a practical matter, companies needed to have their data tracking systems in place by the start of 2019, since the law gives consumers the right to request all the data a company has collected on them over the previous 12 months. This law covers all companies that serve California residents and have at least $25 million in annual revenue. Under the law, any California consumer has a right to demand to see all the information a company has saved on the consumer, as well as a full list of all the third parties that data is shared with. The consumer also has the right to request that the company delete the information it has on the resident. The CCPA broadly defined broadly defines “protected data.” The CCPA also has specific requirements for companies subject to the law. For example, the law specifies that companies must have a clear and conspicuous link on their websites to a page from which consumers may exercise their right to opt out of data sharing. The CCPA provides for a private right of action for unauthorized access, theft or disclosure of personal information in certain situations, with possible damage awards of $100 to $750 per consumer per incident, or actual damages, whichever is greater. The CCPA also permits class action lawsuits. Because the law was recently adopted, we have not been able to determine the extent to which the law applies to us, our website and our privacy policies.

Employment Regulations

California labor law is more pro-employee than the laws of other states, and the damages and penalties an employee can recover are higher under California labor law than under federal labor law. California has numerous laws and regulations relating to the relationship between an employer and our employees, including wage and hour laws, laws relating to anti-discrimination, and laws mandating expanded training to employees to prevent sexual harassment. In 2004, California passed a law requiring employers with 50 or more employees to provide two hours of sexual-harassment-prevention training to supervisors every two years. A recently passed law requires that by January 1, 2020, employers with five or more employees provide at least two hours of sexual-harassment-prevention training to supervisory employees and one hour of training to nonsupervisory employees. The law also requires that, beginning January 1, 2020, seasonal, temporary and other employees hired to work for less than six months need to be trained within the earlier of 30 calendar days of hire or within 100 hours worked. Our professional employer organization has implemented our sexual harassment prevention program.

Intellectual Property

We do not have any intellectual property that is material to our business.

Operations in China

General

The photovoltaic market in China was the largest in the world in 2021, reaching a cumulative total installed capacity of 253 GW in 2020, which accounted for more than one-third of the world’s cumulative total installed capacity. China’s photovoltaic market has been projected to grow at a compound annual growth rate of 14.1% between 2021 and 2025. The ground-market segment (i.e., solar farm installations) is expected to dominate the market during this forecast period. The China market is projected to reach $137 billion by 2030. The growth is driven by increasing government support and the continued decline in the cost of solar energy generation. 2

We commenced operations in China following the acquisition on April 28, 2015, of the ownership of Chengdu ZHTH, which is currently a subsidiary of ZHTH, and ZHPV, through share exchange agreements with the equity owners of these companies.

Our business in China is conducted through ZHTH and ZHPV and their subsidiaries. Unlike systems that we sell in the United States, which are installations for residential and small business users, the projects in China are generally solar farms, which are constructed on large land areas where multiple ground-mount solar tracking towers are installed. While a typical residential or small business installation in the United States generally generates between 6.5KW and 0.2MW of power, the solar farms can generate in the range of 30MW to more than 100MW of power. To comply with the local requirements to own and operate the EPC business in China, ZHTH and ZHPV establish subsidiaries for different purposes. These special purpose subsidiaries include project subsidiaries which were formed by ZHTH or ZHPV to own the solar farms and the permits to construct and operate solar farms and the equity in the subsidiaries, or, in the case of the agreements with SPIC, are sold to the buyer of the projects upon completion. ZHTH was primarily engaged in the business of identifying and procuring solar system projects for resale to third party developers and related services in China. ZHPV’s core business is to provide EPC services.

_________________________________

2 IHS Markit; International Energy Agency; GlobalData; mordorintelligence.com; Wikipedia, Solar power by country, April 2023; National Renewable Energy Laboratory; PV Magazine;

BNEF (https://about.bnef,com); Bloomberg (https://www.bloomberg.com)

| 14 |

| Table of Contents |

Our business in China initially consisted primarily of identifying and procuring solar farm system projects for resale to third party developers and related services in China, identifying potential buyers of solar farms, and providing engineering, procuring and construction services, which are referred to in the industry as EPC services, for solar farms and, to a significantly lesser extent, rooftop solar systems in China. Approximately 95% of our China revenue in 2019 was generated from Changzhou Almaden Co., Ltd., which is a related party that we refer to in this annual report as AMD. We have not generated any revenue from AMD since 2019. Since the second half of 2019, our business in China consisted of EPC services pursuant to agreements with SPIC. Substantially all of our China revenues for the years ended December 31, 2021 and December 31, 2020 were generated from projects for SPIC. During 2022, 2023 and 2024 through the date of this annual report, we did not generate revenues in the China segment.

Based on the effective light resource and available land use, we are focusing on provinces with large tracts of available land and solar resources sufficient for the development of solar farms. We look to work with local entities on the project development. As part of this process, we need to discuss the potential development with local government agencies, which may involve discussions with several departments. The local government agencies publish the availability of permits for solar farms, and we need to obtain the permit for the solar farm from the applicable government agency. We may also find the buyer who will own the solar farm. If we find a buyer to operate the solar farm, we transfer the equity of the project subsidiary related to the solar farm to the buyer. If we identify the buyer, we seek to both obtain the contract to perform the EPC work as well as to operate and maintain the project after completion. For our contracts with SPIC, SolarMax and SPIC jointly selected the location of the project and the project subsidiary is formed pursuant to a co-development agreement.

We do not operate any solar farms as an owner, and we have no present plans to operate solar farms for our own account. To the extent that, in the future, we propose to construct and operate a solar farm for our own account, any decision would be subject to obtaining sufficient financing to enable us to construct and operate the project and complying with government regulations relating to the ownership of a solar farm.

For the EPC services in the PRC, we generally provide a one-year quality warranty on our EPC services from the date of completion of the EPC work.

ZHPV holds a construction enterprise qualification certificate for Level III of general contractor for power engineering constructor issued on December 18, 2022, which permits ZHPV to conduct business as a contractor in power engineering construction. The qualification certificate expires on June 30, 2024. The certificate is granted by the local government and enables ZHPV to perform its services throughout China. We engage local licensed engineering firms to perform the initial design work through a bidding process. When the engineering firm completes its design proposal, we obtain owner approval prior to procurement and construction. Following the acquisition of Chengdu ZHTH, the business of Chengdu ZHTH was assumed and developed by its parent company SolarMax Shanghai. Chengdu ZHTH has since ceased to be active and we are in the process of deregistering Chengdu ZHTH with local authorities in China. We refer to SolarMax Shanghai and its subsidiaries collectively as ZHTH.

Seasonal weather patterns affect our PRC subsidiaries’ construction of large-scale solar projects. Northern provinces often experience below zero temperatures along with snowstorms which could cause a closure of transportation options along with frozen ground which needs to be cleared for solar equipment, all of which can cause slowdowns in construction and increase our cost. Our EPC contracts to date have been in the southern provinces where cold weather does not have the same effect although the southern provinces may be subject to other adverse weather conditions.

Effective on May 12, 2016, in connection with the execution of the amendment to the share exchange agreement for the acquisition of ZHPV, ZHPV entered into a debt settlement agreement with Uonone Group Co., Ltd., one of the former owners of ZHPV. Pursuant to the debt settlement agreement, ZHPV and Uonone agreed to settle a list of pending business transactions entered by them during the period from December 31, 2012 to December 31, 2015. As of December 31, 2023, the Uonone Group has repaid all amounts agreed to under the debt settlement agreement except for a RMB 3.0 million contingent receivable, which does not arise until and unless we become obligated under a contingent liability. We have not become obligated under the contingent liability. The contingent liability is a potential obligation of ZHPV which existed at the time of our acquisition of ZHPV and related to the estimated costs of a project ZHPV had completed, and we cannot estimate whether or when ZHPV may have any obligation under the contract. However, in the event ZHPV becomes liable, it has an offsetting receivable from Uonone. As of the date of this annual report, no claim and no indication of any claim have been made against ZHPV. Additionally, under the debt settlement agreement, to the extent ZHPV receives settlement proceeds on matters that relate to events prior to the acquisition, ZHPV shall repay to Uonone the amount received less taxes, fees and expenses in connection with such settlement. As of December 31, 2022, the payable balance due to Uonone Group related to the legal settlement received by ZHPV was $2.1 million. During the year ended December 31, 2023, we received additional legal settlement proceeds of $6.6 million and paid Uonone and expenses on behalf of Uonone $6.9 million.

| 15 |

| Table of Contents |

Agreements with SPIC

We have not generated any revenue from our China operations during 2022, 2023 and 2024 through the date of this annual report. Substantially all of our China revenue for the year ended December 31, 2021 of $7.8 million and for the year ended December 31, 2020, of $96.1 million, was generated from four contracts with SPIC, and included revenue from SPIC and revenue from the sale of power by the project subsidiaries for the projects prior to the transfer of control to SPIC. As of December 31, 2023, we had a receivable from SPIC in the amount of $7.7 million, which we expect to collect during 2024. Although we are negotiating with SPIC for additional projects, we cannot give any assurance that we will be successful in our negotiations or that any agreements we enter into with SPIC will be profitable to us. The COVID-19 restrictions and the residual effects of the COVID-19 restrictions impaired our ability to obtain payment of the receivable from SPIC and to negotiate contracts with SPIC.

Source of Supply

Our PRC subsidiaries purchase the equipment for the project from local suppliers pursuant to a bidding process. The construction team will remain on site to perform the EPC services, using local licensed subcontractor as needed. The EPC services include continuing negotiations with local government and utility companies to resolve any issues that may occur on-site until the project is fully connected to the grid.

Solar panels and other components are available from a number of suppliers. We did not make any purchases during the year ended December 31, 2022 or the year ended December 31, 2023.

Competition

Within the solar farm industry in China, our China segment faces increasing competition from other project developers and EPC companies. The solar energy industry is very competitive, consisting of state-owned enterprises and a large number of private companies. Because China’s central government has announced a policy in favor of renewable energy sources, solar companies worldwide seek to develop and expand their business in China. We believe the number of new solar farm installation companies entering the industry in China has increased significantly since 2015 when we commenced business through our PRC subsidiaries in China. This increased competition has caused some price erosion, which has affected our margins and could result in further reductions in our margins as our PRC subsidiaries may reduce prices to generate new business and could impair their ability to enter into EPC agreements with non-related parties. As the interest in solar farms in China increases, there is increased competition for permits, and the government entities that issue the permits may prefer Chinese companies over companies that are owned by a United State company. Since our only customer in China since 2019 was SPIC, our PRC subsidiaries are dependent upon SPIC’s policies in engaging contractors for the development of solar farm projects. Since SPIC is state-owned enterprise, our procurement policies may be subject to government policies which may favor a Chinese company rather than a subsidiary of a United States company.

Government Subsidies

The solar investment and the development of the solar industry in China depend on continued government subsidies. Government policies have, and will continue to have, a significant impact on the solar industry in general. Government agencies set the rates that the utility company pays the solar farm owner. In general, the rate set at the beginning of the contract period remains the same during the period, although there is a risk that the rate will be changed. The rate varies from province to province. The government has announced that there will be a yearly decrease in the payment. After 2016, all the solar projects in China are required to be involved with the local government to help alleviate poverty in the region. In addition, solar farm construction needs to be integrated with local agriculture, tourism or animal husbandry, which leads to increases in the cost of our EPC services.

PRC Government Regulations

Renewable Energy Law and Other Government Directive

The Renewable Energy Law of PRC, which originally became effective on January 1, 2006 and was amended on December 26, 2009, sets forth policies to encourage the development and on-grid application of renewable energy, including solar energy. Renewable energy under this law refers to non-fossil fuel energy, including wind energy, solar energy, water energy, biomass energy, geothermal energy, ocean energy and other forms of renewable energy. The law also sets forth a national policy to encourage the installation and use of solar energy water heating systems, solar energy heating and cooling systems, photovoltaic systems and other systems that use solar energy. It also provides economic incentives, such as the establishment of national funding, preferential loans provided by financial institutions with financial interest subsidies to certain renewable energy development and utilization projects, and tax preferential treatment for the development of certain renewable energy projects.

| 16 |

| Table of Contents |

The PRC Energy Conservation Law, which was amended on October 28, 2007, July 2, 2016 and October 26, 2018, encourages utilization of energy-saving building materials like new wall materials and energy-saving equipment, and encourage the installation and application of renewable energy use systems such as solar energy. The law also encourages and supports the vigorous development of methane in rural areas, promotes the utilization of renewable energy resources such as biomass energy, solar energy and wind power, develops small-scale hydropower generation based on the principles of scientific planning and orderly development, promotes energy-saving-type rural houses and furnaces, encourages the utilization of non-cultivated lands for energy plants, and energetically develops energy forests such as firewood forests.

On September 4, 2006, the Ministry of Finance, or MOF, and Ministry of Construction jointly promulgated the Interim Measures for Administration of Special Funds for Application of Renewable Energy in Building Construction, pursuant to which the MOF will arrange special funds to support the application of Building Integrated Photovoltaics systems, or BIPV applications, to enhance building energy efficiency, protect the environment and reduce consumption of fossil fuel energy. Under these measures, applications to provide hot water supply, refrigeration, heating and lighting are eligible for such special funds.

On October 10, 2010, the State Council of the PRC promulgated a decision to accelerate the development of seven strategic new industries. Pursuant to this decision, the PRC government will promote the popularization and application of solar thermal technologies by increasing tax and financial policy support, encouraging investment and providing other forms of beneficial support.

In March 2011, the National People’s Congress approved the Outline of the Twelfth Five-Year Plan for National Economic and Social Development of the PRC, which includes a national commitment to promoting the development of renewable energy and enhancing the competitiveness of the renewable energy industry. Accordingly, in January 2012, the Ministry of Industry and Information Technology and the Ministry of Science and Technology respectively promulgated the Twelfth Five-Year Special Plans Regarding the New Materials Industry and the High-tech Industrialization to support the development of the PRC solar power industry.

On March 8, 2011, the MOF and the Ministry of Housing and Urban-Rural Development jointly promulgated the Circular on Further Application of Renewable Energy in Building Construction to increase the utilization of renewable energy in buildings.

On March 27, 2011, the NDRC promulgated the revised Guideline Catalogue for Industrial Restructuring which categorizes the solar power industry as an encouraged item. This Guideline Catalogue was revised on February 16, 2013 (effective on May 1, 2013) and on October 30, 2019 (effective on January 1, 2020). The solar power industry is still categorized as an encouraged item.

In March 2016, the National People’s Congress approved the Outline of the Thirteenth Five-Year Plan for National Economic and Social Development of the PRC, which mentions a national commitment to continuing to support the development of PV generation industry.

On February 14, 2019, the NDRC issued the Green Industry Guidance Catalogue (2019 Edition) to include solar power equipment manufacturing into the green industry guidance catalogue, to further encourage the development of solar industry.

On January 20, 2020, the NEA, the NDRC, and the Ministry of Finance jointly issued Opinions on Promoting the Healthy Development of Non-hydroelectric Renewable Energy Power Generation, aiming at (i) improving the current subsidy method, (ii) improving market allocation of resources and subsidy decline mechanism, and (iii) optimizing subsidy redemption process.

On March 5, 2020, the NEA issued Notice on Matters Related to the Construction of Wind Power and Photovoltaic Power Generation Projects in 2020, in order to adjust and improve the specific plans for the construction and management of wind power and photovoltaic power generation projects.

On September 29, 2020, the NDRC, the NEA and the MOF jointly issued Supplementary Notice on Matters Relating to Several Opinions on Promoting the Sound Development of Non-Hydro-Renewable Energy Power Generation, in order to further clarify relevant policies of additional subsidy funds for renewable energy electricity prices and stabilize industry expectations.

| 17 |

| Table of Contents |

On February 2, 2021, the State Council issued Guiding Opinions on Accelerating the Establishment and Improvement of the Green and Low-Carbon Circular Development Economic System, in order to accelerate the establishment of a robust economic system of green and low-carbon circular development.

On February 24, 2021, the NDRC, the MOF, the People’s Bank of China, the China Banking and Insurance Regulatory Commission and the NEA issued Notice on Guiding to Increase Financial Support to Promote the Healthy and Orderly Development of Wind Power and Photovoltaic Power Generation Industries, in order to help solving the problems of renewable energy companies such as tight cash flow and difficulties in production and operation.

On January 30, 2022, the NDRC and NEA jointly released the Opinions on Improving Institutional Mechanisms and Measures for Green and Low-carbon Energy Transition. The Opinions systematically propose institutional mechanisms and measures to support the green and low-carbon transformation of the energy supply side, request to promote the construction of clean, low-carbon energy as the main energy supply system and to promote the construction of energy infrastructure to adapt to the green and low-carbon transition.