Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

| EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2014

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35304

CurrencyShares® Chinese Renminbi Trust

Sponsored by Guggenheim Specialized Products, LLC,

d/b/a Guggenheim Investments

(Exact name of registrant as specified in its charter)

| New York | No. 45-6344265 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

(301) 296-5100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Chinese Renminbi Shares |

NYSE Arca | |

| (Title of class) | (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Aggregate market value of 100,000 shares of the registrant’s common stock held by non-affiliates of the registrant, based on the closing price of a share of the registrant’s common stock on April 30, 2014 as reported by NYSE Arca on that date: $7,950,000.

Table of Contents

CURRENCYSHARES® CHINESE RENMINBI TRUST

i

Table of Contents

Overview

The CurrencyShares® Chinese Renminbi Trust (the “Trust”) is a grantor trust that was formed on August 16, 2011. The Trust issues shares (the “Shares”) in blocks of 50,000 (a “Basket”) in exchange for deposits of Chinese Renminbi and distributes Chinese Renminbi in connection with the redemption of Baskets.

The investment objective of the Trust is for the Shares to reflect the price in USD of the Chinese Renminbi plus accrued interest, less the expenses of the Trust’s operations. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding the Chinese Renminbi. The Shares are bought and sold on NYSE Arca like any other exchange-listed security. The Shares are backed by the assets of the Trust, which does not hold or use derivative products. Investing in the Shares will not insulate the investor from certain risks, including price volatility. The value of the holdings of the Trust are reported on the Trust’s website, www.currencyshares.com, each business day.

The Trust

General

The Trust holds Chinese Renminbi and is expected from time to time to issue Baskets in exchange for deposits of Chinese Renminbi and distribute Chinese Renminbi in connection with redemptions of Baskets. The Chinese Renminbi held by the Trust will be sold only (1) if needed to pay Trust expenses, (2) in the event the Trust terminates and liquidates its assets or (3) as otherwise required by law or regulation.

The Sponsor

The Sponsor of the Trust generally oversees the performance of the Trustee and the Trust’s principal service providers, but does not exercise day-to-day oversight over the Trustee or the Trust’s service providers. The Sponsor is Guggenheim Specialized Products, LLC, a Delaware limited liability company. The Sponsor changed its name from Rydex Specialized Products LLC as of March 30, 2012.

The Trust’s only ordinary recurring expense is the Sponsor’s fee. The Sponsor is responsible for payment of the following administrative and marketing expenses of the Trust: the Trustee’s monthly fee, typical maintenance and transaction fees of the Depository, NYSE Arca listing fees, printing and mailing costs, audit fees and expenses, up to $100,000 year in legal fees and expenses, and applicable license fees. The Sponsor also paid the costs of the Trust’s organization, including the applicable SEC registration fees. The Sponsor’s fee accrues daily at an annual nominal rate of 0.40% of the Chinese Renminbi in the Trust (including all unpaid interest but excluding unpaid fees, each as accrued through the immediately preceding day). The Sponsor was paid $32,297 for the fiscal year ended October 31, 2014.

The Trustee

The Bank of New York Mellon, a banking corporation with trust powers organized under the laws of the State of New York, serves as the Trustee. The Trustee is responsible for the day-to-day administration of the Trust, including keeping the Trust’s operational records.

Net Asset Value

The Trustee calculates, and the Sponsor publishes, the Trust’s Net Asset Value (“NAV”) each business day. To calculate the NAV, the Trustee adds to the amount of Chinese Renminbi in the Trust at the end of the preceding day accrued but unpaid interest, Chinese Renminbi receivable under pending purchase orders and the value of other Trust assets, and subtracts the accrued but unpaid Sponsor’s fee, Chinese Renminbi payable under pending redemption orders and other Trust expenses and liabilities, if any. The NAV is expressed in U.S. Dollars (“USD”)

1

Table of Contents

based on the “Closing Spot Rate,” which is the USD/ Chinese Renminbi exchange rate as determined by The WM Company, as of 4:00 PM (London fixing) on each day that NYSE Arca is open for regular trading. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent Closing Spot Rate is used to determine the NAV of the Trust unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for the valuation.

The Trustee also determines the NAV per Share, which equals the NAV of the Trust, divided by the number of outstanding Shares. The NAV of the Trust and NAV per Share are published by the Sponsor on each day that NYSE Arca is open for regular trading and are posted on the Trust’s website, www.currencyshares.com.

Depository and Deposit Accounts

JPMorgan Chase Bank, N.A., London Branch, is the Depository. The Depository maintains two deposit accounts for the Trust, a primary deposit account that may earn interest and a secondary deposit account that does not earn interest (collectively, the “Deposit Accounts”). Interest on the primary deposit account, if any, accrues daily and is paid monthly. If the Sponsor believes that the interest rate paid by the Depository is not competitive, the Sponsor’s recourse is to remove the Depository by terminating the Deposit Account Agreement and closing the Deposit Accounts. The Depository is not paid a fee for its services to the Trust. The Depository may earn a “spread” or “margin” over the rate of interest it pays to the Trust on the Chinese Renminbi deposit balances.

The secondary deposit account is used to account for any interest that may be received and paid on creations and redemptions of Baskets. The secondary deposit account is also used to account for interest earned on the primary deposit account, if any, pay Trust expenses and distribute any excess interest to Shareholders on a monthly basis. In the event that the interest deposited exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, then the Trustee will direct that the excess be converted into USD at a prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own).

Trust Expenses

In certain exceptional cases the Trust may pay expenses in addition to the Sponsor’s fee. These exceptions include expenses not assumed by the Sponsor, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Trustee or the Sponsor on behalf of the Trust or action taken by the Trustee or the Sponsor to protect the Trust or the interests of Shareholders, indemnification of the Sponsor under the Depositary Trust Agreement, and legal expenses in excess of $100,000 per year.

Termination

The Trust will terminate upon the occurrence of any of the termination events listed in the Depositary Trust Agreement and will otherwise terminate on August 16, 2051.

The Shares

General

Each Share represents a proportional interest, based on the total number of Shares outstanding, in the Chinese Renminbi owned by the Trust, plus accrued and unpaid interest, if any, less accrued but unpaid expenses (both asset-based and non-asset based) of the Trust. All Shares are of the same class with equal rights and privileges. Each Share is transferable, is fully paid and non-assessable and entitles the holder to vote on the limited matters upon which Shareholders may vote under the Depositary Trust Agreement.

Limited Rights

The Shares are not a traditional investment. They are dissimilar from the shares of a corporation operating a business enterprise, with management and a board of directors. Trust Shareholders do not have rights normally associated with owning shares of a business corporation, including, for example, the right to bring “oppression” or “derivative” actions. Shareholders have only those rights explicitly set forth in the Depositary Trust Agreement. The Shares do not entitle their holders to any conversion or pre-emptive rights or, except as described herein, any redemption or distribution rights.

2

Table of Contents

Voting and Approvals

Shareholders have no voting rights under the Depositary Trust Agreement, except in limited circumstances. If the holders of at least 25% of the Shares outstanding determine that the Trustee is in material breach of its obligations under the Depositary Trust Agreement, they may provide written notice to the Trustee (or require the Sponsor to do so) specifying the default and requiring the Trustee to cure such default. If the Trustee fails to cure such breach within 30 days after receipt of the notice, the Sponsor, acting on behalf of the Shareholders, may remove the Trustee. The holders of at least 66 2/3% of the Shares outstanding may vote to remove the Trustee. The Trustee must terminate the Trust at the request of the holders of at least 75% of the outstanding Shares.

Creation and Redemption of Shares

The creation and redemption of Baskets requires the delivery to the Trust or the distribution by the Trust of the amount of Chinese Renminbi represented by the Baskets being created or redeemed. This amount is based on the combined NAV per Share of the number of Shares included in the Baskets being created or redeemed, determined on the day the order to create or redeem Baskets is accepted by the Trustee.

Only Authorized Participants may place orders to create and redeem Baskets. An Authorized Participant is a Depository Trust Company participant that is a registered broker-dealer or other securities market participant such as a bank or other financial institution that is not required to register as a broker-dealer to engage in securities transactions.

Before initiating a creation or redemption order, an Authorized Participant must have entered into a Participant Agreement with the Sponsor and the Trustee. The Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of Chinese Renminbi required for creations and redemptions. The Participant Agreements may be amended by the Trustee and the Sponsor. Authorized Participants pay a transaction fee of $500 to the Trustee for each order that they place to create or redeem one or more Baskets. In addition to the $500 transaction fee paid to the Trustee, Authorized Participants pay a variable fee to the Sponsor for creation orders and redemption orders of two or more Baskets to compensate the Sponsor for costs associated with the registration of Shares. The variable fee paid to the Sponsor by an Authorized Participant will not exceed $2,000 for each creation or redemption order, as set forth in the Participant Agreement. Authorized Participants who make deposits with the Trust in exchange for Baskets receive no fees, commissions or other form of compensation or inducement of any kind from either the Sponsor or the Trust. No Authorized Participant has any obligation or responsibility to the Sponsor or the Trust to effect any sale or resale of Shares.

Availability of SEC Reports and other Information

The Sponsor, on behalf of the Trust, files quarterly and annual reports and other information with the SEC. The reports and other information can be accessed through the Trust’s website at www.currencyshares.com.

You should consider carefully the risks described below before making an investment decision. You should also refer to the other information included in this report, including the Trust’s financial statements and the related notes.

The value of the Shares relates directly to the value of the Chinese Renminbi held by the Trust. Fluctuations in the price of the Chinese Renminbi could materially and adversely affect the value of the Shares.

The Shares are designed to reflect the price of the Chinese Renminbi, plus accumulated interest, if any, less the Trust’s expenses. Several factors may affect the price of the Chinese Renminbi, including:

| • | Sovereign debt levels and trade deficits; |

| • | Domestic and foreign inflation and interest rates and investors’ expectations concerning those rates; |

3

Table of Contents

| • | Currency exchange rates; |

| • | Investment and trading activities of mutual funds, hedge funds and currency funds; and |

| • | Global or regional political, economic or financial events and situations. |

In addition, the Chinese Renminbi may not maintain its long-term value in terms of purchasing power in the future. When the price of the Chinese Renminbi declines, the Sponsor expects the price of a Share to decline as well.

There is no assurance that the USD/Chinese Renminbi exchange rate will be stable or that the Chinese Renminbi will maintain its value or increase in value relative to the USD. Volatility is difficult to predict and could materially and adversely affect the performance of the Shares. Devaluation of the Chinese Renminbi relative to the USD would decrease the value of the Shares.

The Chinese government historically pegged the Chinese Renminbi to the USD. Amid international pressure to allow the currency to float freely, subject to market forces, in July 2010 China announced that the Chinese Renminbi would be pegged to a basket of currencies. The Chinese government has not formally stated what currencies are contained in the basket of currencies. Although the USD/Chinese Renminbi exchange rate has been relatively stable since July 2010, there is no assurance that the exchange rate will remain stable. Volatility in the USD/Chinese Renminbi exchange rate could materially and adversely affect the performance of the Shares. Devaluation of the Chinese Renminbi relative to the USD would decrease the value of the Shares.

Foreign exchange rates are influenced by the factors identified in the preceding risk factor and may also be influenced by: changing supply and demand for a particular currency; monetary policies of governments (including exchange control programs, restrictions on local exchanges or markets and limitations on foreign investment in a country or on investment by residents of a country in other countries); changes in balances of payments and trade; trade restrictions; and currency devaluations and revaluations. These events and actions are unpredictable. Also, in the past, the Chinese government has implemented a variety of capital controls in order to influence the price of the Chinese Renminbi relative to the USD. Capital controls include the prohibition of, or restrictions on, the ability to buy, sell or transfer Chinese Renminbi. The exercise of such controls by the Chinese government is unpredictable.

If interest earned by the Trust does not exceed the Trust’s expenses, the Trustee will withdraw Chinese Renminbi from the Trust to pay these excess expenses which will reduce the amount of Chinese Renminbi represented by each Share on an ongoing basis and may result in adverse tax consequences for Shareholders.

Each outstanding Share represents a fractional, undivided interest in the Chinese Renminbi held by the Trust. Although the Trust is expected to generate interest, it is possible that the amount of interest earned, if any, may not exceed expenses, in which case the Trustee will withdraw Chinese Renminbi from the Trust to pay these excess expenses. As a result, the amount of Chinese Renminbi represented by each Share may gradually decline over time. This is true even if additional Shares are issued in exchange for additional deposits of Chinese Renminbi into the Trust, as the amount of Chinese Renminbi required to create Shares will proportionately reflect the amount of Chinese Renminbi represented by the Shares outstanding at the time of creation. Assuming a constant Chinese Renminbi price, if expenses exceed interest earned, the trading price of the Shares will gradually decline relative to the price of the Chinese Renminbi as the amount of Chinese Renminbi represented by the Shares gradually declines. In this event, the Shares will only maintain their original price if the price of the Chinese Renminbi increases. There is no guarantee that interest earned by the Trust in the future will exceed the Trust’s expenses.

Investors should be aware that a gradual decline in the amount of Chinese Renminbi represented by the Shares may occur regardless of whether the trading price of the Shares rises or falls in response to changes in the price of the Chinese Renminbi. The estimated ordinary operating expenses of the Trust, which accrue daily, are described in “Business – The Trust – Trust Expenses.”

The payment of expenses by the Trust will result in a taxable event to Shareholders. To the extent Trust expenses exceed interest paid to the Trust, a gain or loss may be recognized by Shareholders depending on the tax basis of the tendered Chinese Renminbi.

4

Table of Contents

The interest rate paid by the Depository, if any, may not be the best rate available. If the Sponsor determines that the interest rate is inadequate, then its sole recourse is to remove the Depository and terminate the Deposit Accounts.

The Depository is committed to endeavor to pay a competitive interest rate on the balance of Chinese Renminbi in the primary deposit account of the Trust, but there is no guarantee of the amount of interest that will be paid, if any, on this account. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The initial annual nominal interest rate as set forth in the Deposit Account Agreement is 0.1%. The Depository may change the rate at which interest accrues, including reducing the interest rate to zero, based upon changes in market conditions or the Depository’s liquidity needs. The Depository notifies the Sponsor of the interest rate applied each business day after the close of such business day. The Sponsor discloses the current interest rate on the Trust’s website. If the Sponsor believes that the interest rate paid by the Depository is not adequate, the Sponsor’s sole recourse is to remove the Depository and terminate the Deposit Accounts. The Depository is not paid a fee for its services to the Trust; rather, it generates income or loss based on its ability to earn a “spread” or “margin” over the interest it pays to the Trust by using the Trust’s Chinese Renminbi to make loans or in other banking operations. For these reasons, you should not expect that the Trust will be paid the best available interest rate at any time or over time.

If the Trust incurs expenses in USD, the Trust would be required to sell Chinese Renminbi to pay these expenses. The sale of the Trust’s Chinese Renminbi to pay expenses in USD at a time of low Chinese Renminbi prices could adversely affect the value of the Shares.

The Trustee will sell Chinese Renminbi held by the Trust to pay Trust expenses, if any, incurred in USD, irrespective of then-current Chinese Renminbi prices. The Trust is not actively managed and no attempt will be made to buy or sell Chinese Renminbi to protect against or to take advantage of fluctuations in the price of the Chinese Renminbi. Consequently, if the Trust incurs expenses in USD, the Trust’s Chinese Renminbi may be sold at a time when the Chinese Renminbi price is low, resulting in a negative effect on the value of the Shares.

The Deposit Accounts are not entitled to payment at any office of JPMorgan Chase Bank, N.A. located in the United States.

The federal laws of the United States prohibit banks located in the United States from paying interest on unrestricted demand deposit accounts. Therefore, payments out of the Deposit Accounts will be payable only at the London branch of JPMorgan Chase Bank, N.A., located in England. The Trustee will not be entitled to demand payment of these accounts at any office of JPMorgan Chase Bank, N.A. that is located in the United States. JPMorgan Chase Bank, N.A. will not be required to repay the deposit if its London branch cannot repay the deposit due to an act of war, insurrection or civil strife or an action by a foreign government or instrumentality (whether de jure or de facto) in England.

Shareholders do not have the protections associated with ownership of a demand deposit account insured in the United States by the Federal Deposit Insurance Corporation nor the protection provided for bank deposits under English law.

Neither the Shares nor the Deposit Accounts and the Chinese Renminbi deposited in them are deposits insured against loss by the FDIC, any other federal agency of the United States or the Financial Services Compensation Scheme of England.

If the Depository becomes insolvent, its assets might not be adequate to satisfy a claim by the Trust or any Authorized Participant. In addition, in the event of the insolvency of the Depository, the U.S. bank of which it is a branch, or any local cash correspondent holding the currency on deposit for the benefit of the Trust, there may be a delay and costs incurred in recovering the Chinese Renminbi held in the Deposit Accounts.

Chinese Renminbi deposited in the Deposit Accounts by an Authorized Participant are commingled with Chinese Renminbi deposited by other Authorized Participants and are held by the Depository in either the primary deposit account or the secondary deposit account of the Trust. Chinese Renminbi held in the Deposit Accounts are not segregated from the Depository’s other assets.

The Trust has no proprietary rights in or to any specific Chinese Renminbi held by the Depository and will be an unsecured creditor of the Depository with respect to the Chinese Renminbi held in the Deposit Accounts in the event of the insolvency of the Depository, the U.S. bank of which it is a branch, or any local cash correspondent holding the currency on deposit for the benefit of the Trust. In the event the Depository or the U.S. bank of which it is a

5

Table of Contents

branch becomes insolvent, the Depository’s assets might not be adequate to satisfy a claim by the Trust or any Authorized Participant for the amount of Chinese Renminbi deposited by the Trust or the Authorized Participant and, in such event, the Trust and any Authorized Participant will generally have no right in or to assets other than those of the Depository.

In the case of insolvency of the Depository or JPMorgan Chase Bank, N.A., the U.S. bank of which the Depository is a branch, a liquidator may seek to freeze access to the Chinese Renminbi held in all accounts by the Depository, including the Deposit Accounts. In the case of insolvency of any local cash correspondent, a liquidator may seek to freeze access to the Chinese Renminbi held in all accounts by such local cash correspondent, including the Deposit Accounts held by such cash correspondent. The Trust and the Authorized Participants could incur expenses and delays in connection with asserting their claims. These problems would be exacerbated by the fact that the Deposit Accounts are not held in the U.S. but instead are held at the London branch of a U.S. national bank, or with a local cash correspondent, where they are subject to English and Chinese insolvency law. Further, under U.S. law, in the case of the insolvency of JPMorgan Chase Bank, N.A., the claims of creditors in respect of accounts (such as the Trust’s Deposit Accounts) that are maintained with an overseas branch of JPMorgan Chase Bank, N.A., or with a local cash correspondent, will be subordinate to claims of creditors in respect of accounts maintained with JPMorgan Chase Bank, N.A. in the U.S., greatly increasing the risk that the Trust and the Trust’s beneficiaries would suffer a loss.

Shareholders do not have the protections associated with ownership of shares in an investment company registered under the Investment Company Act of 1940.

The Investment Company Act is designed to protect investors by preventing: insiders from managing investment companies to their benefit and to the detriment of public investors; the issuance of securities having inequitable or discriminatory provisions; the management of investment companies by irresponsible persons; the use of unsound or misleading methods of computing earnings and asset value; changes in the character of investment companies without the consent of investors; and investment companies from engaging in excessive leveraging. To accomplish these ends, the Investment Company Act requires the safekeeping and proper valuation of fund assets, restricts greatly transactions with affiliates, limits leveraging, and imposes governance requirements as a check on fund management.

The Trust is not registered as an investment company under the Investment Company Act and is not required to register under that act. Consequently, Shareholders do not have the regulatory protections afforded to investors in registered investment companies.

Shareholders do not have the rights enjoyed by investors in certain other financial instruments.

As interests in a grantor trust, the Shares have none of the statutory rights normally associated with the ownership of shares of a business corporation, including, for example, the right to bring “oppression” or “derivative” actions. Apart from the rights afforded to them by federal and state securities laws, Shareholders have only those rights relative to the Trust, the Trust property and the Shares that are set forth in the Depositary Trust Agreement. In this connection, the Shareholders have limited voting and distribution rights. They do not have the right to elect directors. See “Business – The Shares – Limited Rights” for a description of the limited rights of the Shareholders.

The Shares may trade at a price which is at, above, or below the NAV per Share.

The NAV per Share fluctuates with changes in the market value of the Trust’s assets. The market price of Shares can be expected to fluctuate in accordance with changes in the NAV per Share, but also in response to market supply and demand. As a result, the Shares might trade at prices at, above or below the NAV per Share.

The Depository owes no fiduciary duties to the Trust or the Shareholders, is not required to act in their best interest and could resign or be removed by the Sponsor, which would trigger early termination of the Trust.

The Depository is not a trustee for the Trust or the Shareholders. As stated above, the Depository is not obligated to maximize the interest rate paid to the Trust. In addition, the Depository has no duty to continue to act as the depository of the Trust. The Depository can terminate its role as depository for any reason whatsoever upon 150 days’ notice to the Trust. If directed by the Sponsor, the Trustee must terminate the Depository. Such a termination might result, for example, if the Sponsor determines that the interest rate paid by the Depository is inadequate. In the event that the Depository was to resign or be removed, the Trust will be terminated.

6

Table of Contents

Shareholders may incur significant fees upon the termination of the Trust.

The occurrence of any one of several events would either require the Trust to terminate or permit the Sponsor to terminate the Trust. For example, if the Depository were to resign or be removed, then the Sponsor would be required to terminate the Trust. Authorized Participants tendering their Baskets within 90 days of the Trust’s termination will receive the amount of Chinese Renminbi represented by their Baskets. Shareholders may incur significant fees if they choose to convert the Chinese Renminbi they receive to USD.

Redemption orders are subject to rejection by the Trustee under certain circumstances.

The Trustee will reject a redemption order if the order is not in proper form as described in the Participant Agreement or if the fulfillment of the order, in the opinion of its counsel, might be unlawful. Any such rejection could adversely affect a redeeming Shareholder. For example, the resulting delay would adversely affect the value of the Shareholder’s redemption distribution if the NAV were to decline during the delay. In the Depositary Trust Agreement, the Sponsor and the Trustee disclaim any liability for any loss or damage that may result from any such rejection.

Substantial sales of Chinese Renminbi by the official sector could adversely affect an investment in the Shares.

The official sector consists of central banks, other governmental agencies and multi-lateral institutions that buy, sell and hold Chinese Renminbi as part of their reserve assets. The official sector holds a significant amount of Chinese Renminbi that can be mobilized in the open market. In the event that future economic, political or social conditions or pressures require members of the official sector to sell their Chinese Renminbi simultaneously or in an uncoordinated manner, the demand for Chinese Renminbi might not be sufficient to accommodate the sudden increase in the supply of Chinese Renminbi to the market. Consequently, the price of the Chinese Renminbi could decline, which would adversely affect an investment in the Shares.

Shareholders that are not Authorized Participants may only purchase or sell their Shares in secondary trading markets.

Only Authorized Participants may create or redeem Baskets through the Trust. All other investors that desire to purchase or sell Shares must do so through NYSE Arca or in other markets, if any, in which the Shares are traded.

The liability of the Sponsor and the Trustee under the Depositary Trust Agreement is limited and, except as set forth in the Depositary Trust Agreement, they are not obligated to prosecute any action, suit or other proceeding in respect of any Trust property.

The Depositary Trust Agreement provides that neither the Sponsor nor the Trustee assumes any obligation or is subject to any liability under the Trust Agreement to any Shareholder, except that they each agree to perform their respective obligations specifically set forth in the Depositary Trust Agreement without negligence or bad faith. Additionally, neither the Sponsor nor the Trustee is obligated to, although each may in its respective discretion, prosecute any action, suit or other proceeding in respect of any Trust property. The Depositary Trust Agreement does not confer upon Shareholders the right to prosecute any such action, suit or other proceeding.

The Depositary Trust Agreement may be amended to the detriment of Shareholders without their consent.

The Sponsor and the Trustee may amend most provisions (other than those addressing core economic rights) of the Depositary Trust Agreement without the consent of any Shareholder. Such an amendment could impose or increase fees or charges borne by the Shareholders. Any amendment that increases fees or charges (other than taxes and other governmental charges, registration fees or other expenses), or that otherwise prejudices any substantial existing rights of Shareholders, will not become effective until 30 days after written notice is given to Shareholders.

The License Agreement with The Bank of New York Mellon may be terminated by The Bank of New York Mellon in the event of a material breach. Termination of the License Agreement might lead to early termination and liquidation of the Trust.

The Bank of New York Mellon and an affiliate of the Sponsor have entered into a License Agreement granting the Sponsor’s affiliate a license to certain patent applications made by The Bank of New York Mellon covering systems and methods for securitizing a commodity. The Sponsor’s affiliate has sublicensed the license to the Sponsor. The license is limited to a non-exclusive grant for the life of The Bank of New York Mellon’s patents and patent

7

Table of Contents

applications. The License Agreement provides that each of the parties may provide notice of intent to terminate the License Agreement in the event the other party commits a material breach. If the License Agreement is terminated and one or more of The Bank of New York Mellon’s patent applications issue as patents, then The Bank of New York Mellon may claim that the operation of the Trust violates its patent or patents and seek an injunction forcing the Trust to cease operation and the Shares to cease trading. In that case, the Trust might be forced to terminate and liquidate, which would adversely affect Shareholders.

Item 1B. Unresolved Staff Comments

None.

The principal offices of the Sponsor and the Trust are at 805 King Farm Boulevard, Suite 600, Rockville, Maryland 20850 which is leased by an affiliate of the Sponsor. Neither the Sponsor nor the Trust owns or leases any other property.

None.

Item 4. Mine Safety Disclosures

Not applicable.

8

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Following are the high and low sale prices of the Shares as reported by the NYSE Arca for each of the quarters during the fiscal years ended October 31, 2014 and October 31, 2013:

| Fiscal Year Ended October 31, 2014: |

High | Low | ||||||

| Quarter Ended |

||||||||

| January 31, 2014 |

$ | 82.68 | $ | 81.28 | ||||

| April 30, 2014 |

$ | 82.81 | $ | 79.50 | ||||

| July 31, 2014 |

$ | 80.92 | $ | 78.80 | ||||

| October 31, 2014 |

$ | 81.06 | $ | 79.93 | ||||

| Fiscal Year Ended October 31, 2013: |

High | Low | ||||||

| Quarter Ended |

||||||||

| January 31, 2013 |

$ | 80.97 | $ | 79.60 | ||||

| April 30, 2013 |

$ | 83.43 | $ | 79.74 | ||||

| July 31, 2013 |

$ | 83.00 | $ | 79.99 | ||||

| October 31, 2013 |

$ | 83.51 | $ | 79.17 | ||||

The number of record holders of Shares of the registrant as of November 30, 2014 was approximately 29.

The Trust did not redeem Baskets from Authorized Participants in the fourth quarter of the fiscal year covered by this report.

The Trust did not distribute any cash dividends per Share during the fiscal years ended October 31, 2014 and October 31, 2013.

In the future, to the extent that the interest earned by the Trust exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trust will distribute, as a dividend, the excess interest earned in Chinese Renminbi effective on the first business day of the subsequent month. The Trustee will direct that the excess Chinese Renminbi be converted into USD at a prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own).

9

Table of Contents

Item 6. Selected Financial Data

Following are financial highlights for the fiscal years ended October 31, 2014, October 31, 2013, October 31, 2012, and the period from August 16, 2011 (date of inception) to October 31, 2011.

| Fiscal Year ended October 31, 2014 |

Fiscal Year ended October 31, 2013 |

Fiscal Year ended October 31, 2012 |

August 16, 2011 [Date of Inception] to October 31, 2011 |

|||||||||||||

| Income |

||||||||||||||||

| Interest income |

$ | 8,188 | $ | 6,156 | $ | 6,067 | $ | 605 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Income |

8,188 | 6,156 | 6,067 | 605 | ||||||||||||

| Expenses |

||||||||||||||||

| Sponsor’s fee |

(32,297 | ) | (24,550 | ) | (23,695 | ) | (2,385 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Expenses |

(32,297 | ) | (24,550 | ) | (23,695) | (2,385) | ||||||||||

| Net Loss |

$ | (24,109 | ) | $ | (18,394 | ) | $ | (17,628 | ) | $ | (1,780 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and Diluted Earnings per Share |

$ | (0.24 | ) | $ | (0.24 | ) | $ | (0.24 | ) | $ | (0.02 | ) | ||||

| Weighted-average Shares Outstanding |

100,000 | 76,027 | 75,000 | 100,001 | ||||||||||||

| Cash Dividends per Share |

$ | — | $ | — | $ | — | $ | — | ||||||||

| Other Comprehensive Loss: |

||||||||||||||||

| Currency translation adjustment |

8 | (48 | ) | (76 | ) | (11 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Comprehensive Loss |

$ | (24,101 | ) | $ | (18,442 | ) | $ | (17,704 | ) | $ | (1,791 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

As of October 31, 2014, total assets were $8,089,084, and for the fiscal year ended October 31, 2014, net cash flows were $(76,294).

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Statement Regarding Forward-Looking Information

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate” and other similar words. Forward-looking statements are based upon our current expectations and beliefs concerning future developments and their potential effects on us. Such forward-looking statements are not guarantees of future performance. Various factors may cause our actual results to differ materially from those expressed in our forward-looking statements. These factors include fluctuations in the price of the Chinese Renminbi, as the value of the Shares relates directly to the value of the Chinese Renminbi held by the Trust and price fluctuations could materially adversely affect an investment in the Shares. Readers are urged to review the “Risk Factors” section in this report for a description of other risks and uncertainties that may affect an investment in the Shares.

Neither Guggenheim Specialized Products, LLC d/b/a Guggenheim Investments (the “Sponsor”) nor any other person assumes responsibility for the accuracy or completeness of forward-looking statements contained in this report. The forward-looking statements are made as of the date of this report, and will not be revised or updated to reflect actual results or changes in the Sponsor’s expectations or predictions.

10

Table of Contents

Movements in the Price of Chinese Renminbi

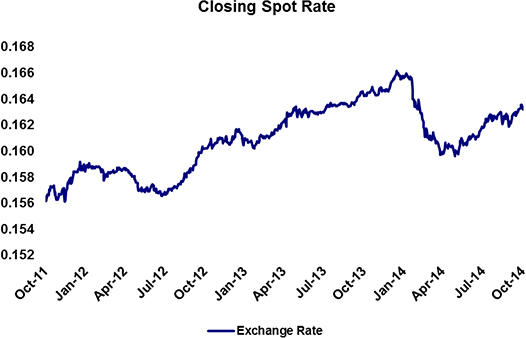

The investment objective of the Trust is for the Shares to reflect the price in USD of the Chinese Renminbi plus accrued interest, less the expenses of the Trust’s operations. The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding Chinese Renminbi. Each outstanding Share represents a proportional interest in the Chinese Renminbi held by the Trust. The following chart provides recent trends on the price of the Chinese Renminbi. The chart illustrates movements in the price of Chinese Renminbi in USD and is based on the Closing Spot Rate:

11

Table of Contents

NAV per Share; Valuation of the Chinese Renminbi

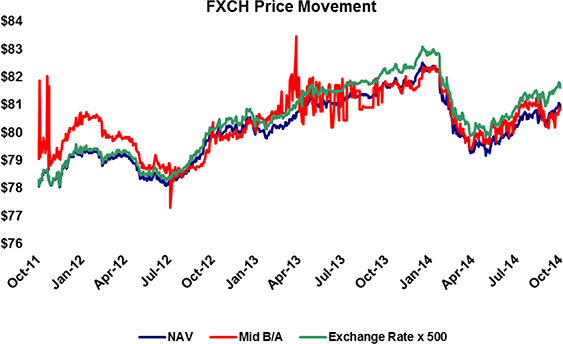

The following chart illustrates the movement in the price of the Shares based on (1) NAV per Share, (2) the “bid” and “ask” midpoint offered on NYSE Arca and (3) the Closing Spot Rate expressed as a multiple of 500 Chinese Yuan:

12

Table of Contents

Liquidity

The Sponsor is not aware of any trends, demands, conditions or events that are reasonably likely to result in material changes to the Trust’s liquidity needs. The Trust’s Depository, JPMorgan Chase Bank, N.A., London Branch, maintains two deposit accounts for the Trust, a primary deposit account that may earn interest and a secondary deposit account that does not earn interest. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The interest rate in effect as of October 31, 2014 was an annual nominal rate of 0.10%. The following chart provides the daily rate paid by the Depository since the Shares began trading:

In exchange for a fee, the Sponsor bears most of the expenses incurred by the Trust. As a result, the only ordinary expense of the Trust during the period covered by this report was the Sponsor’s fee. Each month the Depository deposits into the secondary deposit account accrued but unpaid interest, if any, and the Trustee withdraws Chinese Renminbi from the secondary deposit account to pay the accrued Sponsor’s fee for the previous month plus other Trust expenses, if any. When the interest deposited, if any, exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trustee converts the excess into USD at a prevailing market rate and distributes the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own). The Trust did not make any distributions during the quarter ended October 31, 2014.

Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Sponsor’s management to make estimates and assumptions that affect the reported amounts of the assets and liabilities and disclosures of contingent liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period covered by this report.

In addition to the description below, please refer to Note 2 to the financial statements for further discussion of our accounting policies.

The functional currency of the Trust is the Chinese Renminbi in accordance with ASC 830, Foreign Currency Translation.

13

Table of Contents

Results of Operations

As of October 31, 2012 the number of Chinese Yuan owned by the Trust was 24,926,567, resulting in a redeemable capital share value of $3,992,673. During the year ended October 31, 2013, an additional 50,000 shares were created in exchange for 24,884,414 Chinese Yuan and no shares were redeemed. In addition, 106,855 Chinese Yuan were withdrawn to pay the portion of the Sponsor’s fee that exceeded the interest earned. As of October 31, 2013, the number of Chinese Yuan owned by the Trust was 49,704,126, resulting in a redeemable capital share value of $8,162,610. During the year ended October 31, 2014, no additional shares were created and no additional shares were redeemed. In addition, 148,195 Chinese Yuan were withdrawn to pay the portion of the Sponsor’s fee that exceeded the interest earned. As of October 31, 2014, the number of Chinese Yuan owned by the Trust was 49,555,931, resulting in a redeemable capital share value of $8,086,336.

A decrease in the Trust’s redeemable capital share value from $8,162,610 at October 31, 2013 to $8,086,336 at October 31, 2014, was primarily the result of a decrease in the Closing Spot Rate from 0.16427 at October 31, 2013 to 0.16322 at October 31, 2014. An increase in the Trust’s redeemable capital share value from $3,992,673 at October 31, 2012 to $8,162,610 at October 31, 2013, was primarily the result of an increase in the number of shares outstanding from 50,000 at October 31, 2012 to 100,000 at October 31, 2013, and an increase in the Closing Spot Rate from 0.16022 at October 31, 2012 to 0.16427 at October 31, 2013.

Interest income increased from $6,156 for the year ended October 31, 2013 to $8,188 for the year ended October 31, 2014 attributable primarily to an increase in the weighted-average Chinese Yuan in the Trust. Interest income increased from $6,067 for the period ended October 31, 2012 to $6,156 for the year ended October 31, 2013 attributable primarily to an increase in the weighted-average Chinese Yuan in the Trust.

The Sponsor’s fee accrues daily at an annual nominal rate of 0.40% of the Chinese Renminbi in the Trust. Due primarily to an increase in the weighted-average Chinese Yuan in the Trust, the Sponsor’s fee increased from $24,550 for the year ended October 31, 2013 to $32,297 for the year ended October 31, 2014. The only expense of the Trust during the year ended October 31, 2014 was the Sponsor’s fee. Due primarily to an increase in the weighted-average Chinese Yuan in the Trust, the Sponsor’s fee increased from $23,695 for the year ended October 31, 2012 to $24,550 for the year ended October 31, 2013. The only expense of the Trust during the year ended October 31, 2013 was the Sponsor’s fee.

The Trust’s net loss for the period ended October 31, 2014 was $24,109, due to the Sponsor’s fee of $32,297 exceeding interest income of $8,188. The Trust’s net loss for the year ended October 31, 2013 was $18,394, due to the Sponsor’s fee of $24,550 exceeding interest income of $6,156. The Trust’s net loss for the period ended October 31, 2012 was $17,628 due to the Sponsor’s fee of $23,695 exceeding interest income of $6,067.

Cash dividends were not paid by the Trust in the years ended October 31, 2014, October 31, 2013, or October 31, 2012, as the Trust’s income did not exceed the Trust’s expenses during those periods.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Except as described above with respect to the USD/Chinese Renminbi exchange rate and the nominal annual interest rate to be paid by the Depository on Chinese Renminbi held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.

Item 8. Financial Statements and Supplementary Data

See Index to Financial Statements on page F-1 for a list of the financial statements filed with this report.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

14

Table of Contents

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

The chief executive officer and chief financial officer of the Sponsor have evaluated the effectiveness of the Trust’s disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of October 31, 2014. Based on that evaluation, the chief executive officer and chief financial officer of the Sponsor have concluded that the disclosure controls and procedures of the Trust were effective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

The Sponsor’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined under Rules 13a-15(f) and 15d-15(f) of the Exchange Act. The Trust’s internal control over financial reporting is based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (1992 framework) (COSO), and is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States. Internal control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Trust’s assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that the Trust’s receipts and expenditures are being made only in accordance with appropriate authorizations; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Trust’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become ineffective because of changes in conditions, or that the degree of compliance with policies or procedures may deteriorate.

The chief executive officer and chief financial officer of the Sponsor have assessed the effectiveness of the Trust’s internal control over financial reporting as of October 31, 2014. Their assessment included an evaluation of the design of the Trust’s internal control over financial reporting and testing of the operation effectiveness of its internal controls over financial reporting. Based on their assessment and those criteria, the chief executive officer and chief financial officer of the Sponsor believe that the Trust maintained effective internal control over financial reporting as of October 31, 2014.

Changes in Internal Control over Financial Reporting

There were no changes in the Trust’s internal control over financial reporting that occurred during the Trust’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Not applicable.

15

Table of Contents

Item 10. Directors, Executive Officers and Corporate Governance

Nikolaos Bonos and Joseph Arruda serve as the Chief Executive Officer and Chief Financial Officer of the Sponsor, respectively. The Sponsor’s Board of Managers is composed of Mr. Arruda, Mr. Bonos and Michael Byrum.

Nikolaos Bonos, 51, has been the Chief Executive Officer of the Sponsor since May 2009. Mr. Bonos has been a Manager of the Sponsor since September 2005. Prior to his appointment as Chief Executive Officer, Mr. Bonos served as the Chief Financial Officer of the Sponsor beginning in September 2005. Mr. Bonos has served as Executive Officer of Rydex Fund Services LLC, an affiliate of the Sponsor, from January 2009 to the present and as Senior Vice President of Rydex Fund Services LLC, from December 2003 to August 2006 and Vice President of Accounting of Rydex Fund Services LLC, from 2001 to December 2003. Mr. Bonos also serves as Treasurer and Vice President for certain funds in the Guggenheim fund complex. Mr. Bonos holds a Bachelor of Science in Business Administration with a major in Finance from Suffolk University.

Joseph Arruda, 48, has been the Chief Financial Officer of the Sponsor since May 2009. Mr. Arruda has been a Manager of the Sponsor since July 2009. Prior to his appointment as Chief Financial Officer, Mr. Arruda served as Vice President, Fund Accounting, and Administration, of the Sponsor beginning in 2003. Mr. Arruda also services as Assistant Treasurer for certain funds in the Guggenheim fund complex. From 1997 to 2003, Mr. Arruda served as Vice President, Fund Accounting at State Street Corporation. He holds a Bachelor of Science with a Finance and Accounting concentration from Bridgewater State College.

Michael Byrum, 44, has served as a Manager of the Sponsor since September 2005. Since August 2006, he has served as the Chief Investment Officer, of Rydex Advisors II, LLC (RAII), and Rydex Advisors, LLC (RA), affiliates of the Sponsor, and each of which were merged into Security Investors, LLC, also an affiliate of the Sponsor, as of January 3, 2011. Mr. Byrum served as the Executive Vice President of RAII from December 2002 to May 2004, and as President of RA from May 2004 until January 2011. He has served as Senior Vice President of Security Investors, LLC, since December 1, 2010. Mr. Byrum is a Chartered Financial Analyst and has a Bachelor of Science in Business Administration with a major in Finance from Miami University of Ohio.

Item 11. Executive Compensation

Not applicable.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

None.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Not applicable.

Item 14. Principal Accountant Fees and Services

The following fees were paid by the Sponsor and were for services performed by Ernst & Young LLP for the fiscal years ended October 31, 2014 and October 31, 2013:

| 2014 | 2013 | |||||||

| Audit Fees |

$ | 25,229 | $ | 23,361 | ||||

| Audit-related fees |

4,100 | 0 | ||||||

| Tax fees |

0 | 0 | ||||||

| All other Fees |

0 | 0 | ||||||

|

|

|

|

|

|||||

| $ | 29,329 | $ | 23,361 | |||||

|

|

|

|

|

|||||

16

Table of Contents

Item 15. Exhibits and Financial Statement Schedules

Financial Statements

See Index to Financial Statements on Page F-1 for a list of the financial statements being filed as a part of this report. Schedules have been omitted since they are either not required, not applicable or the information has otherwise been included.

Exhibits

| Exhibit No. |

Description | |

| 3.1 | Certificate of Formation of Guggenheim Specialized Products, LLC dated September 14, 2005, incorporated herein by reference to Exhibit 4.1 to the Registration Statement on Form S-1 (File No. 333-174640) filed by the Trust on June 1, 2011. | |

| 3.2 | Amendment to Certificate of Formation of Guggenheim Specialized Products, LLC dated March 27, 2012, incorporated herein by reference to Exhibit 3.2 to the Annual Report on Form 10-K filed by the Trust on January 14, 2013. | |

| 3.3 | Limited Liability Company Agreement of Guggenheim Specialized Products, LLC, incorporated herein by reference to Exhibit 4.1 to the Registration Statement on Form S-1 (File No. 333-174640) filed by the Trust on June 1, 2011. | |

| 4.1 | Depositary Trust Agreement dated as of August 16, 2011 between Guggenheim Specialized Products, LLC and The Bank of New York Mellon, incorporated herein by reference to Exhibit 4.1 to Amendment No. 2 to the Registration Statement on Form S-1 (File No. 333-174640) filed by the Trust on August 25, 2011. | |

| 4.2 | Global Amendment to Depositary Trust Agreement dated as of March 6, 2012 between Guggenheim Specialized Products, LLC and The Bank of New York Mellon, incorporated herein by reference to Exhibit 4.1 to the Quarterly Report on Form 10-Q filed by the Trust on March 12, 2012. | |

| 4.3 | Participant Agreement dated as of September 13, 2011 among Merrill Lynch Professional Clearing Corp., The Bank of New York Mellon, as Trustee, and Guggenheim Specialized Products, LLC (together with Schedule pursuant to Instruction 2 to Item 601 of Regulation S-K), incorporated herein by reference to Exhibit 4.3 to the Annual Report on Form 10-K filed by the Trust on January 14, 2014.. | |

| 10.1 | Sublicense Agreement dated as of June 1, 2011 between Security Investors, LLC and Guggenheim Specialized Products, LLC, , incorporated herein by reference to Exhibit 4.1 to the Registration Statement on Form S-1 (File No. 333-174640) filed by the Trust on June 1, 2011. | |

| 10.2 | Deposit Account Agreement dated as of August 16, 2011 between The Bank of New York Mellon, as Trustee, and JPMorgan Chase Bank, N.A., London Branch, as Depository, incorporated herein by reference to Exhibit 10.2 to Amendment No. 2 to the Registration Statement on Form S-1 (File No. 333-174640) filed by the Trust on August 25, 2011. | |

| 31.1 | Certification by Principal Executive Officer pursuant to Section 302(a) of the Sarbanes-Oxley Act of 2002. | |

| 31.2 | Certification by Principal Financial Officer pursuant to Section 302(a) of the Sarbanes-Oxley Act of 2002. | |

| 32.1 | Certification by Principal Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2 | Certification by Principal Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

17

Table of Contents

CurrencyShares® Chinese Renminbi Trust

Financial Statements as of October 31, 2014

| Page | ||||

| F-2 | ||||

| Statements of Financial Condition at October 31, 2014 and October 31, 2013 |

F-3 | |||

| F-4 | ||||

| F-5 | ||||

| F-6 | ||||

| F-7 | ||||

F-1

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders of CurrencyShares® Chinese Renminbi Trust:

We have audited the accompanying statements of financial condition of CurrencyShares® Chinese Renminbi Trust (the “Trust”) as of October 31, 2014 and 2013, and the related statements of comprehensive income, changes in shareholders’ equity and cash flows for each of the three years in the period ended October 31, 2014. These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Trust’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of CurrencyShares® Chinese Renminbi Trust at October 31, 2014 and 2013 and the results of its operations and its cash flows for each of the three years in the period ended October 31, 2014, in conformity with U.S. generally accepted accounting principles.

| /s/ Ernst & Young LLP |

McLean, VA

January 14, 2015

F-2

Table of Contents

CurrencyShares® Chinese Renminbi Trust

Statement of Financial Condition

| October 31, 2014 | October 31, 2013 | |||||||

| Assets |

||||||||

| Current Assets: |

||||||||

| Chinese Renminbi deposits, interest bearing |

$ | 8,088,387 | $ | 8,164,681 | ||||

| Chinese Renminbi deposits, non-interest bearing |

— | — | ||||||

| Receivable from accrued interest |

697 | 703 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

$ | 8,089,084 | $ | 8,165,384 | ||||

|

|

|

|

|

|||||

| Liabilities, Redeemable Capital Shares and Shareholders’ Equity |

||||||||

| Current Liabilities: |

||||||||

| Accrued Sponsor’s fee |

$ | 2,748 | $ | 2,774 | ||||

|

|

|

|

|

|||||

| Total Current Liabilities |

2,748 | 2,774 | ||||||

| Commitments and Contingent Liabilities (note 9) |

— | — | ||||||

| Redeemable Capital Shares, at redemption value, no par value, 7,000,000 authorized – 100,000 issued and outstanding |

8,086,336 | 8,162,610 | ||||||

| Shareholders’ Equity: |

||||||||

| Retained Earnings |

— | — | ||||||

| Cumulative Translation Adjustment |

— | — | ||||||

|

|

|

|

|

|||||

| Total Liabilities, Redeemable Capital Shares and Shareholders’ Equity |

$ | 8,089,084 | $ | 8,165,384 | ||||

|

|

|

|

|

|||||

See Notes to Financial Statements.

F-3

Table of Contents

CurrencyShares® Chinese Renminbi Trust

Statement of Comprehensive Income

| Year ended | Year ended | Year ended | ||||||||||

| October 31, 2014 | October 31, 2013 | October 31, 2012 | ||||||||||

| Income |

||||||||||||

| Interest Income |

$ | 8,188 | $ | 6,156 | $ | 6,067 | ||||||

|

|

|

|

|

|

|

|||||||

| Total Income |

8,188 | 6,156 | 6,067 | |||||||||

| Expenses |

||||||||||||

| Sponsor’s fee |

(32,297 | ) | (24,550 | ) | (23,695 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total Expenses |

(32,297 | ) | (24,550 | ) | (23,695 | ) | ||||||

| Net Loss |

$ | (24,109 | ) | $ | (18,394 | ) | $ | (17,628 | ) | |||

|

|

|

|

|

|

|

|||||||

| Basic and Diluted Earnings per Share |

$ | (0.24 | ) | $ | (0.24 | ) | $ | (0.24 | ) | |||

| Weighted-average Shares Outstanding |

100,000 | 76,027 | 75,000 | |||||||||

| Cash Dividends per Share |

$ | — | $ | — | $ | — | ||||||

| Other Comprehensive Income/(Loss): |

||||||||||||

| Currency translation adjustment |

8 | (48 | ) | (76 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Total Comprehensive Loss |

$ | (24,101 | ) | $ | (18,442 | ) | $ | (17,704 | ) | |||

|

|

|

|

|

|

|

|||||||

See Notes to Financial Statements.

F-4

Table of Contents

CurrencyShares® Chinese Renminbi Trust

Statement of Changes in Shareholders’ Equity

| Year ended October 31, 2014 |

Year ended October 31, 2013 |

Year ended October 31, 2012 |

||||||||||

| Retained Earnings, Beginning of Year |

$ | — | $ | — | $ | — | ||||||

| Net Loss |

(24,109 | ) | (18,394 | ) | (17,628 | ) | ||||||

| Adjustment of redeemable capital shares to redemption value |

24,109 | 18,394 | 17,628 | |||||||||

|

|

|

|

|

|

|

|||||||

| Retained Earnings, End of Year |

$ | — | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| Cumulative Translation Adjustment, Beginning of Year |

$ | — | $ | — | $ | — | ||||||

| Currency translation adjustment |

8 | (48 | ) | (76 | ) | |||||||

| Adjustment of redeemable capital shares to redemption value |

(8 | ) | 48 | 76 | ||||||||

|

|

|

|

|

|

|

|||||||

| Cumulative Translation Adjustment, End of Year |

$ | — | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

See Notes to Financial Statements.

F-5

Table of Contents

CurrencyShares® Chinese Renminbi Trust

| Year ended October 31, 2014 |

Year ended October 31, 2013 |

Year ended October 31, 2012 |

||||||||||

| Cash flows from operating activities |

||||||||||||

| Cash received for accrued income |

$ | 8,189 | $ | 5,796 | $ | 6,342 | ||||||

| Cash paid for expenses |

(32,302 | ) | (23,123 | ) | (24,784 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in operating activities |

(24,113 | ) | (17,327 | ) | (18,442 | ) | ||||||

| Cash flows from financing activities |

||||||||||||

| Cash received to purchase redeemable shares |

— | 4,035,313 | 3,942,389 | |||||||||

| Cash paid to redeem redeemable shares |

— | — | (7,883,359 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Net cash provided by/(used in) financing activities |

— | 4,035,313 | (3,940,970 | ) | ||||||||

| Adjustment to period cash flows due to currency movement |

(52,181 | ) | 153,013 | 131,428 | ||||||||

|

|

|

|

|

|

|

|||||||

| (Decrease)/Increase in cash |

(76,294 | ) | 4,170,999 | (3,827,984 | ) | |||||||

| Cash at beginning of year |

8,164,681 | 3,993,682 | 7,821,666 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash at end of year |

$ | 8,088,387 | $ | 8,164,681 | $ | 3,993,682 | ||||||

|

|

|

|

|

|

|

|||||||

| Reconciliation of net loss to net cash used in operating activities |

||||||||||||

| Net Loss |

$ | (24,109 | ) | $ | (18,394 | ) | $ | (17,628 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||||||

| Receivable from accrued interest |

(697 | ) | (703 | ) | (344 | ) | ||||||

| Prior period receivable from accrued interest |

703 | 344 | 608 | |||||||||

| Currency translation adjustment |

16 | 5 | (31 | ) | ||||||||

| Accrued sponsor fee |

2,748 | 2,774 | 1,353 | |||||||||

| Prior period accrued sponsor fee |

(2,774 | ) | (1,353 | ) | (2,400 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in operating activities |

$ | (24,113 | ) | $ | (17,327 | ) | $ | (18,442 | ) | |||

|

|

|

|

|

|

|

|||||||

See Notes to Financial Statements.

F-6

Table of Contents

CurrencyShares® Chinese Renminbi Trust

1. Organization and Description of the Trust

The CurrencyShares® Chinese Renminbi Trust (the “Trust”) was formed under the laws of the State of New York on August 16, 2011. On August 16, 2011, Guggenheim Specialized Products, LLC d/b/a “Guggenheim Investments” (the “Sponsor”) deposited 500 Chinese Yuan in the Trust’s primary deposit account held by JPMorgan Chase Bank, N.A., London Branch (the “Depository”). The Sponsor is a Delaware limited liability company whose sole member is Security Investors, LLC (also d/b/a “Guggenheim Investments”). The Sponsor is responsible for, among other things, overseeing the performance of The Bank of New York Mellon (the “Trustee”) and the Trust’s principal service providers, including the preparation of financial statements. The Trustee is responsible for the day-to-day administration of the Trust.

The investment objective of the Trust is for the Trust’s shares (the “Shares”) to reflect the price of the Chinese Renminbi plus accrued interest, if any, less the Trust’s expenses and liabilities. The Shares are intended to provide investors with a simple, cost-effective means of gaining investment benefits similar to those of holding Chinese Renminbi. The Trust’s assets primarily consist of Chinese Renminbi on demand deposit in two deposit accounts maintained by the Depository: a primary deposit account which earns interest and a secondary deposit account which does not earn interest. The secondary deposit account is used to account for any interest that may be received and paid out on creations and redemptions of blocks of 50,000 Shares (“Baskets”). The secondary account is also used to account for interest earned, if any, on the primary deposit account, pay Trust expenses and distribute any excess interest to holders of Shares (“Shareholders”) on a monthly basis.

The accompanying audited financial statements were prepared in accordance with accounting principles generally accepted in the United States.

2. Significant Accounting Policies

A. Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of the assets and liabilities and disclosures of contingent liabilities at the date of the financial statement and the evaluation of subsequent events through the issuance date of the financial statements. Actual results could differ from those estimates.

B. Foreign Currency Translation

The Trustee calculates the Trust’s net asset value (“NAV”) each business day, as described in Note 4 below. For NAV calculation purposes, Chinese Renminbi Deposits (cash) are translated at the Closing Spot Rate, which is the Chinese Renminbi /U.S. Dollar (“USD”) exchange rate as determined and published by The WM Company, at 4:00 PM (London time/London fixing) on each day that NYSE Arca is open for regular trading.

The functional currency of the Trust is the Chinese Renminbi in accordance with generally accepted accounting standards. For financial statement reporting purposes, the USD is the reporting currency. As a result, the financial statement is translated from Chinese Renminbi to USD. The Closing Spot Rate on the last day of the period is used for translation in the statement of financial condition. The average Closing Spot Rate for the period is used for translation in the statements of income and comprehensive income and the statements of cash flows. Any currency translation adjustment is included in comprehensive income.

C. Federal Income Taxes

The Trust is treated as a “grantor trust” for federal income tax purposes and, therefore, no provision for federal income taxes is required. Interest, gains and losses are passed through to the Shareholders.

F-7

Table of Contents

Shareholders generally will be treated, for U.S. federal income tax purposes, as if they directly owned a pro-rata share of the assets held in the Trust. Shareholders also will be treated as if they directly received their respective pro-rata portion of the Trust’s income, if any, and as if they directly incurred their respective pro-rata portion of the Trust’s expenses. The acquisition of Shares by a U.S. Shareholder as part of a creation of a Basket will not be a taxable event to the Shareholder.

The Sponsor’s fee accrues daily and is payable monthly. For U.S. federal income tax purposes, an accrual-basis U.S. Shareholder generally will be required to take into account as an expense its allocable portion of the USD-equivalent of the amount of the Sponsor’s fee that is accrued on each day, with such USD-equivalent being determined by the currency exchange rate that is in effect on the respective day. To the extent that the currency exchange rate on the date of payment of the accrued amount of the Sponsor’s fee differs from the currency exchange rate in effect on the day of accrual, the U.S. Shareholder will recognize a currency gain or loss for U.S. federal income tax purposes.

The Trust does not expect to generate taxable income except for interest income (if any) and gain (if any) upon the sale of Chinese Renminbi. A non-U.S. Shareholder generally will not be subject to U.S. federal income tax with respect to gain recognized upon the sale or other disposition of Shares, or upon the sale of Chinese Renminbi by the Trust, unless: (1) the non-U.S. Shareholder is an individual and is present in the United States for 183 days or more during the taxable year of the sale or other disposition, and the gain is treated as being from United States sources; or (2) the gain is effectively connected with the conduct by the non-U.S. Shareholder of a trade or business in the United States.

A non-U.S. Shareholder’s portion of any interest income earned by the Trust generally will not be subject to U.S. federal income tax unless the Shares owned by such non-U.S. Shareholder are effectively connected with the conduct by the non-U.S. Shareholder of a trade or business in the United States.

D. Revenue Recognition

Interest on the primary deposit account, if any, accrues daily as earned and is received on a monthly basis.

E. Dividends

To the extent that the interest earned by the Trust exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, the Trust will distribute, as a dividend (herein referred to as dividends or distributions), the excess interest earned in Chinese Renminbi effective on the first business day of the subsequent month. The Trustee will direct that the excess Chinese Renminbi be converted into USD at the prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own).

3. Chinese Renminbi Deposits

Chinese Renminbi principal deposits are held in a Chinese Renminbi-denominated, interest-bearing demand account. The Chinese Yuan is the unit of account for the Chinese Renminbi. For the year ended October 31, 2014, there were no Chinese Yuan principal deposits, no Chinese Yuan principal redemptions and Chinese Yuan withdrawals (to pay expenses) of 148,195, resulting in an ending Chinese Yuan principal balance of 49,555,931. This equates to 8,088,387 USD. For year ended October 31, 2013, there were Chinese Yuan principal deposits of 24,884,414, no Chinese Yuan principal redemptions and Chinese Yuan withdrawals (to pay expenses) of 106,855, resulting in an ending Chinese Yuan principal balance of 49,704,126. This equates to 8,164,681 USD. For the year ended October 31, 2012, there were Chinese Yuan principal deposits of 24,965,639, Chinese Yuan principal redemptions of 49,922,284 and Chinese Yuan withdrawals (to pay expenses) of 116,788, resulting in an ending Chinese Yuan principal balance of 24,926,567. This equates to 3,993,682 USD.

Net interest, if any, associated with creation and redemption activity is held in a Chinese Renminbi-denominated non-interest-bearing account, and any balance is distributed in full as part of the monthly income distributions, if any.

4. Redeemable Capital Shares

Shares are classified as “redeemable” for financial statement purposes, since they are subject to redemption. Shares are issued and redeemed continuously in Baskets in exchange for Chinese Renminbi. Individual investors cannot purchase or redeem Shares in direct transactions with the Trust. Authorized Participants (as defined below) may

F-8

Table of Contents

place orders to create and redeem Baskets. An Authorized Participant is a Depository Trust Company (“DTC”) participant that is a registered broker-dealer or other institution eligible to settle securities transactions though the book-entry facilities of DTC and which has entered into a contractual arrangement with the Trust and the Sponsor governing, among other matters, the creation and redemption process. Authorized Participants may redeem their Shares at any time in Baskets.

Due to expected continuing creations and redemptions of Baskets and the three-day period for settlement of each creation or redemption, the Trust reflects Shares created as a receivable on the trade date. Shares redeemed are reflected as a liability on the trade date. Outstanding Shares are reflected at a redemption value, which is the NAV per Share at the period end date. Adjustments to redeemable capital Shares at redemption value are recorded against retained earnings or, in the absence of retained earnings, by charges against the cumulative translation adjustment.

Activity in redeemable capital Shares is as follows:

| Year ended | Year ended | Year ended | ||||||||||||||||||||||