Table of Contents

As filed with the Securities and Exchange Commission on August 24,

2011.

Registration No. 333- 174640

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

CurrencyShares® Chinese Renminbi Trust

Sponsored by Rydex Specialized Products LLC,

d/b/a Rydex Investments

(Exact name of registrant as specified in its charter)

New York

(State or other jurisdiction of incorporation or organization)

6189

(Primary Standard Industrial Classification Code Number)

45-6344265

(IRS Employer Identification No.)

805 King Farm Boulevard

Suite 600

Rockville, Maryland 20850

Phone: (301) 296-5100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nikolaos Bonos

Chief Executive Officer

Rydex Investments

805 King Farm Boulevard

Suite 600

Rockville, Maryland 20850

(301) 296-5100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Patrick Daugherty, Esq.

Foley & Lardner LLP

321 N. Clark Street

Suite 2800

Chicago, Illinois 60654-5313

Phone: (312) 832-4500

Fax: (312) 832-4700

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

Calculation of Registration Fee

|

| ||||||||

| Amount to be registered |

Proposed maximum offering price per Share |

Proposed maximum aggregate offering price |

Amount of registration fee | |||||

| Chinese Renminbi Shares |

7,000,000 Shares | $78.42(1) | $548,940,000(1) | $63,731.93 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(d) under the Securities Act of 1933. The initial Shares will each represent 500 Chinese Yuan per Share and will be issued at a per Share price equal to 500 divided by The World Markets Company’s Closing Spot Rate, or exchange rate of Chinese Yuan per U.S. Dollar. The exchange rate used to calculate the fee paid to the Commission is the Closing Spot Rate of 6.376 Chinese Renminbi per U.S. Dollar on August 19, 2011. |

| (2) | A registration fee in the aggregate amount of $62,862.35 was previously paid to the Commission in connection with the registrant’s initial filing of this registration statement on June 1, 2011 and amended filing of this registration statement on July 26, 2011. This amount has been credited against the registration fee shown in the table as permitted by Rule 457(a). Accordingly, the registrant is paying $869.58 with this filing. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and the Sponsor and the trust are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Preliminary Prospectus | Subject to Completion |

7,000,000 Shares

Chinese Renminbi Shares

The CurrencyShares® Chinese Renminbi Trust (Trust) issues Chinese Renminbi Shares (Shares) that represent units of fractional undivided beneficial interest in, and ownership of, the Trust. Rydex Specialized Products LLC, d/b/a Rydex Investments, is the sponsor of the Trust (Sponsor) and may be deemed the “issuer” of the Shares pursuant to Section 2(a)(4) of the Securities Act of 1933, as amended (the Securities Act). The Bank of New York Mellon is the trustee of the Trust (Trustee), JPMorgan Chase Bank, N.A., London Branch, is the depository for the Trust (Depository), and Rydex Distributors, LLC is the distributor for the Trust (Distributor). The Trust intends to issue additional Shares on a continuous basis through the Trustee.

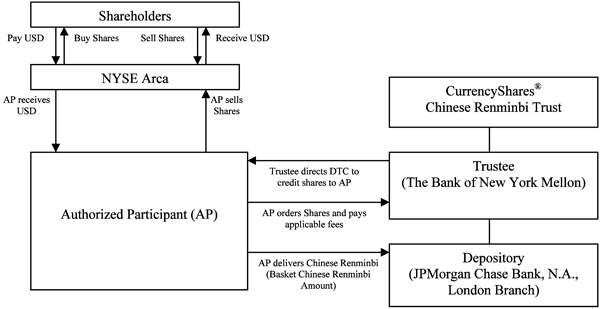

The Shares may be purchased from the Trust only in one or more blocks of 50,000 Shares, as described in “Creation and Redemption of Shares.” A block of 50,000 Shares is called a Basket. The Trust issues Shares in Baskets on a continuous basis to certain authorized participants (Authorized Participants) as described in “Plan of Distribution.” Each Basket, when created, is offered and sold to an Authorized Participant at a price in Chinese Renminbi equal to the net asset value (NAV) of 50,000 Shares on the day that the order to create the Basket is accepted by the Trustee.

The Shares are offered and sold to the public by Authorized Participants at varying prices in U.S. Dollars (USD) determined by reference to, among other things, the market price of the Chinese Renminbi and the trading price of the Shares on NYSE Arca, Inc. (NYSE Arca) at the time of each sale. Authorized Participants will not receive from the Trust, the Sponsor or any of their affiliates, any fee or other compensation in connection with the sale of Shares. Authorized Participants may receive commissions or fees from investors who purchase Shares through their commission- or fee-based brokerage accounts.

The Shares are listed and trade on NYSE Arca under the symbol “FXCH.” The Shares may also trade in other markets, but the Sponsor has not sought to have the Shares listed by any other market.

Investing in the Shares involves significant risks. See “Risk Factors,” starting on page 9.

Neither the Securities and Exchange Commission (SEC) nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Shares are neither interests in nor obligations of the Sponsor, the Trustee, the Depository or the Distributor.

Neither the Shares nor the Trust’s two deposit accounts maintained at the Depository and the Chinese Renminbi deposited in them are deposits insured against loss by the Federal Deposit Insurance Corporation (FDIC), any other federal agency of the United States or the Financial Services Compensation Scheme of England.

On August 16, 2011 the Sponsor deposited 500 Chinese Yuan into the primary deposit account of the Trust in exchange for one Share and the Trustee recorded the Share as owned by the Sponsor. The Sponsor purchased the Share solely for the purpose of forming the Trust and the Sponsor will redeem the Share for 500 Chinese Yuan after the SEC declares effective the registration statement. In order to provide liquidity for the Shares at the commencement of trading, the Initial Purchaser, [ ], will deposit 50 million Chinese Yuan in the primary deposit account of the Trust and the Trustee will instruct DTC to record, and DTC will record, two Baskets totaling 100,000 Shares (constituting 500 Chinese Yuan per Share) as owned by the Initial Purchaser.

The Initial Purchaser intends to offer to the public these 100,000 Shares at a per-Share offering price that will vary depending on, among other factors, the price of the Shares on NYSE Arca at the time of the offer. Shares offered by the Initial Purchaser at different times may have different offering prices. The Initial Purchaser will not receive from the Trust, the Sponsor, the Distributor or any of their affiliates any fee or other compensation in connection with the sale of the Shares.

The date of this prospectus is August [ ], 2011

Table of Contents

This prospectus contains information you should consider when making an investment decision about the Shares. You may rely on the information contained in this prospectus. The Trust and the Sponsor have not authorized any person to provide you with different information and, if anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell the Shares in any jurisdiction where the offer or sale of the Shares is not permitted. The Shares are not registered for public sale in any jurisdiction other than the United States.

| 1 | ||||

| 3 | ||||

| 8 | ||||

| 9 | ||||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

i

Table of Contents

Authorized Participants may be subject to the prospectus delivery requirements of the Securities Act when effecting transactions in the Shares. See “Plan of Distribution.”

This prospectus summarizes certain

documents and other information in a manner the Sponsor believes to be accurate. The information contained in the sections captioned “Overview of the Foreign Exchange Industry,” “The Chinese Renminbi” and “Investment

Attributes of the Trust” is based on information obtained from sources that the Sponsor believes to be reliable. In making an investment decision, you must rely on your own examination of the Trust, the foreign

exchange market, the market for Chinese Renminbi, the terms of the offering and the Shares, including the merits and risks involved.

ii

Table of Contents

This is a summary of the prospectus. You should read the entire prospectus, including “Risk Factors” beginning on page 9 before making an investment decision about the Shares. See “Glossary of Terms” beginning on page 14 for a description of certain terms used in this prospectus.

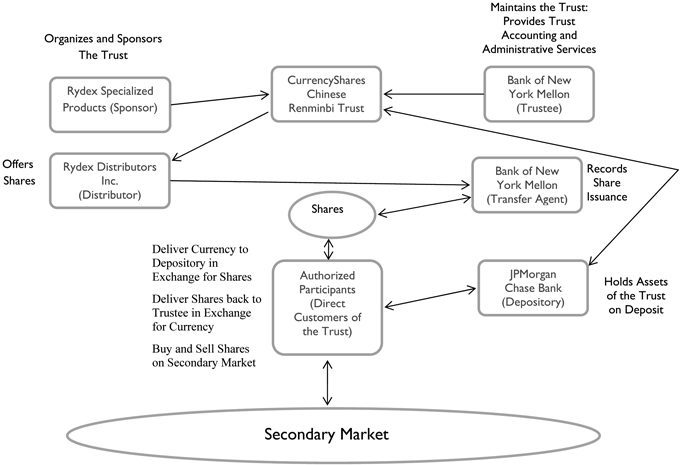

TRUST STRUCTURE

The Trust is a grantor trust formed under the laws of the State of New York pursuant to the Depositary Trust Agreement. The Trust holds Chinese Renminbi and from time to time issues Baskets in exchange for deposits of Chinese Renminbi and distributes Chinese Renminbi in connection with redemptions of Baskets. The investment objective of the Trust is for the Shares to reflect the price in USD of the Chinese Renminbi. Earning income for Shareholders is not the objective of the Trust. Whether investors earn income primarily depends on the relative value of the Chinese Renminbi and the USD. If the Chinese Renminbi appreciates relative to the USD and a Shareholder sells Shares, the Shareholder will earn income. If the Chinese Renminbi depreciates relative to the USD and a Shareholder sells Shares, the Shareholder will incur a loss.

The Sponsor believes that, for many investors, the Shares represent a cost-effective investment in Chinese Renminbi. The Shares represent units of fractional undivided beneficial interest in, and ownership of, the Trust. The Shares are listed and trade on NYSE Arca under the symbol “FXCH.” The Shares may also trade in other markets, but the Sponsor has not sought to have the Shares listed by any other market.

The Sponsor, Rydex Specialized Products LLC d/b/a “Rydex Investments,” a Delaware limited liability company, established the Trust and is responsible for registering the Shares. The Sponsor generally oversees the performance of the Trustee and the Trust’s principal service providers, but does not exercise day-to-day oversight over the Trustee or the Trust’s service providers. The Sponsor may remove the Trustee if any of various events occur. See “Description of the Depositary Trust Agreement — The Trustee — Resignation, discharge or removal of trustee; successor trustees” for more information.

The Sponsor maintains a public website on behalf of the Trust containing information about the Trust and the Shares. The internet address of the Trust’s website is www.currencyshares.com. This internet address is provided here only as a convenience to you; the information contained on or connected to the Trust’s website is not considered part of this prospectus. The general role and responsibilities of the Sponsor are discussed further under “The Sponsor.”

The Trustee is The Bank of New York Mellon, a banking corporation formed under the laws of the State of New York with trust powers. The Trustee is generally responsible for the day-to-day administration of the Trust. This includes calculating the NAV of the Trust and the NAV per Share each business day, paying the Trust’s expenses (which are accrued daily but paid monthly), including withdrawing the Trust’s Chinese Renminbi, if needed, receiving and processing orders from Authorized Participants to create and redeem Baskets and coordinating the processing of such orders with the Depository and DTC. The general role, responsibilities and regulation of the Trustee are further described under “The Trustee.”

The Depository is JPMorgan Chase Bank, N.A., London Branch. The Depository and the Trustee have elected the laws of England to govern the Deposit Account Agreement between them. The Depository accepts Chinese Renminbi deposited with it by Authorized Participants in connection with the creation of Baskets. The Depository facilitates the transfer of Chinese Renminbi into and out of the Trust through the two deposit accounts maintained with it by the Trust. The Depository may pay interest on the primary deposit account but does not pay interest on the secondary deposit account. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The material terms of the Depositary Trust Agreement are discussed in greater detail in “Description of the Depositary Trust Agreement.” The general role, responsibilities and regulation of the Depository and the two deposit accounts are further described under “The Depository” and “Description of the Deposit Account Agreement.”

Detailed descriptions of certain specific rights and duties of the Trustee and the Depository are set forth under “Description of the Shares,” “Description of the Depositary Trust Agreement” and “Description of the Deposit Account Agreement.”

1

Table of Contents

The Distributor, Rydex Distributors, LLC, is a limited liability company formed under the laws of the State of Kansas. The Distributor assists the Sponsor in marketing the Shares. Specifically, the Distributor prepares marketing materials regarding the Shares, including the content of the Trust’s website, executes the marketing plan for the Trust and provides strategic and tactical research on the foreign exchange markets, in each case in compliance with applicable laws and regulations. The Distributor and the Sponsor are affiliates of one another. There is no written agreement between them, and no compensation is paid by the Sponsor to the Distributor in connection with services performed by the Distributor for the Trust. See “The Distributor” for more information.

INVESTMENT ATTRIBUTES OF THE TRUST

The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding Chinese Renminbi. The costs of purchasing Shares should not exceed the costs associated with purchasing any other publicly-traded equity securities. The Shares are an investment that is:

Easily Accessible. Investors are able to access the market for Chinese Renminbi through a traditional brokerage account. The Shares are bought and sold on NYSE Arca like any other exchange-listed security.

Exchange-Traded. Because they are traded on NYSE Arca, the Shares will provide investors with an efficient means of implementing investment tactics and strategies that involve Chinese Renminbi. NYSE Arca-listed securities are eligible for margin accounts. Accordingly, investors are able to purchase and hold Shares with borrowed money to the extent permitted by law.

Transparent. The Shares are backed by the assets of the Trust, which does not hold or use derivative products. The value of the holdings of the Trust are reported on the Trust’s website, www.currencyshares.com, every business day.

Investing in the

Shares will not insulate the investor from price volatility or other risks. Further, the ratio of Chinese Renminbi to Shares may decrease due to withdrawals made to pay Trust expenses in the event that the interest

income of the Trust is not sufficient to cover the entirety of the Trust expenses. See “Risk Factors” and “The Depository.”

PRINCIPAL OFFICES

The principal offices of the Sponsor, the Trust and the Distributor are the offices of Rydex Investments at 805 King Farm Boulevard, Suite 600, Rockville, Maryland 20850. The telephone number of Rydex Investments at that address is (800) 820-0888. Neither the Sponsor, the Trust nor the Distributor own or lease any other real estate. The Trustee has a trust office at 2 Hanson Place, Brooklyn, New York 11217. The Depository is located at 125 London Wall, London, EC2Y 5AJ, United Kingdom.

2

Table of Contents

| Offering |

The Shares represent units of fractional undivided beneficial interest in, and ownership of, the Trust. |

| Use of proceeds |

The proceeds received by the Trust from the issuance and sale of Baskets are Chinese Renminbi. In accordance with the Depositary Trust Agreement, during the life of the Trust these proceeds will only be (1) owned by the Trust and held by the Depository, (2) disbursed or sold as needed to pay the Trust’s expenses and (3) distributed to Authorized Participants upon the redemption of Baskets. |

| NYSE Arca symbol |

FXCH |

| CUSIP |

23131C107 |

| Creation and redemption |

The Trust creates and redeems the Shares on a continuous basis, but only in Baskets. A Basket is a block of 50,000 Shares. The creation and redemption of Baskets requires the delivery to the Trust or the distribution by the Trust of the amount of Chinese Renminbi represented by the Baskets being created or redeemed, the amount of which is based on the combined NAV per Share of the number of Shares included in the Baskets being created or redeemed. The amount of Chinese Renminbi required to create a Basket or to be delivered upon the redemption of a Basket may gradually decrease over time if the Trust’s Chinese Renminbi are withdrawn to pay the Trust’s expenses. See “Investment Attributes of the Trust — Trust Expenses.” Baskets may be created or redeemed only by Authorized Participants. Authorized Participants pay a transaction fee for each order to create or redeem Baskets and may sell to other investors the Shares included in the Baskets that they create. See “Creation and Redemption of Shares” for more details. |

| Interest on deposits |

JPMorgan Chase Bank, N.A., London Branch, will maintain two Chinese Renminbi-denominated, demand deposit accounts for the Trust: a primary deposit account that may earn interest and a secondary deposit account that does not earn interest. The secondary deposit account will be used to account for any interest that may be received and paid on creations and redemptions of Baskets. The secondary deposit account will also be used to account for interest earned on the primary deposit account, if any, to pay Trust expenses and to distribute any excess interest to Shareholders on a monthly basis. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The initial annual nominal interest rate as set forth in the Deposit Account Agreement is 0.1%. The Depository may change this rate in the future based upon changes in market conditions or the Depository’s liquidity needs. The Depository will notify the Sponsor of the interest rate applied each business day after the close of such business day. The Sponsor will disclose the interest rate on the Trust’s website. If the Sponsor believes that the interest rate paid by the Depository is not competitive, the Sponsor’s sole |

3

Table of Contents

| recourse will be to remove the Depository by terminating the Deposit Account Agreement and closing the accounts. See “Description of the Deposit Account Agreement.” Neither the Trustee nor the Sponsor has the power or authority to deposit the Trust’s Chinese Renminbi with any other person, entity or account. Interest earned on the deposited Chinese Renminbi, if any, will be used to pay the Trust’s expenses. Any excess interest will be distributed to Shareholders monthly. Such interest is not expected to form a significant part of the Shareholders’ investment return. If the Trust’s expenses exceed interest earned, the Trustee will withdraw Chinese Renminbi held by the Trust to pay the excess, thereby reducing the number of Chinese Renminbi per Share. The payment of expenses by the Trust is a taxable event to Shareholders. See “United States Federal Tax Consequences — Taxation of U.S. Shareholders. |

| Neither the Shares nor the Deposit Accounts and the Chinese Renminbi deposited in them are deposits insured against loss by the FDIC, any other federal agency of the United States or the Financial Services Compensation Scheme of England. |

| Net Asset Value |

The NAV of the Trust is the aggregate value, expressed in USD, of the Trust’s assets, less its liabilities (which include estimated accrued but unpaid fees and expenses). The Trustee calculates, and the Sponsor publishes, the Trust’s net asset value (NAV) each business day. To calculate the NAV, the Trustee adds to the amount of Chinese Renminbi in the Trust at the end of the preceding business day accrued but unpaid interest, if any, Chinese Renminbi receivable under pending purchase orders and the value of other Trust assets, and subtracts the accrued but unpaid Sponsor’s fee, Chinese Renminbi payable under pending redemption orders and other Trust expenses and liabilities, if any. The NAV is expressed in USD based on the Closing Spot Rate as determined by The WM Company at 4:00 PM (London time) on each day that NYSE Arca is open for regular trading. If, on a particular evaluation day, the Closing Spot Rate has not been determined and announced by 6:00 PM (London time), then the most recent determination of the Closing Spot Rate by The WM Company shall be used to determine the NAV of the Trust unless the Sponsor determines that such price is inappropriate to use as the basis for such valuation. In the event that the Sponsor determines that the most recent determination of the Closing Spot Rate is not an appropriate basis for valuation of the Trust’s Chinese Renminbi, the Sponsor will |

4

Table of Contents

| determine an alternative basis for such evaluation to be employed by the Trustee. Such an alternative basis may include reference to other exchange-traded securities that reflect the value of the Chinese Renminbi relative to the USD. The use of any alternative basis to determine NAV would be disclosed on the Trust’s website. The Trustee also determines the NAV per Share, which equals the NAV of the Trust divided by the number of outstanding Shares. The Sponsor publishes the NAV and NAV per Share on each day that NYSE Arca is open for regular trading on the Trust’s website, www.currencyshares.com. |

| Trust expenses |

The Trust’s only ordinary recurring expense is the Sponsor’s fee. The Sponsor is obligated under the Depositary Trust Agreement to assume and pay the following administrative and marketing expenses of the Trust: the Trustee’s monthly fee, typical maintenance and transaction fees of the Depository, SEC registration fees, printing and mailing costs, audit fees and expenses, up to $100,000 per annum in legal fees and expenses, applicable license fees and NYSE Arca listing fees. The Trust may incur additional expenses in certain other circumstances. These additional expenses include expenses not assumed by the Sponsor, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Trustee or the Sponsor on behalf of the Trust or action taken by the Trustee or the Sponsor to protect the Trust or the interests of Shareholders, indemnification of the Sponsor and the Trustee (to the extent not paid by the Sponsor) under the Depositary Trust Agreement and legal fees and expenses in excess of $100,000 per year. If these additional expenses are incurred, the Trust will be required to pay these expenses by withdrawing deposited Chinese Renminbi and the amount of Chinese Renminbi represented by a Share will decline at such time. Accordingly, the Shareholders will effectively bear the cost of these other expenses, if incurred. Although the Sponsor cannot definitively state the frequency or magnitude of such expenses, the Sponsor predicts that they will occur infrequently, if at all. See “Description of the Depositary Trust Agreement — Expenses of the Trust.” |

| The Sponsor’s fee accrues daily at an annual nominal rate of |

5

Table of Contents

| Expenses of the Trust.” The payment of expenses in Chinese Renminbi and the conversion of Chinese Renminbi to USD, if required to pay expenses of the Trust, are generally taxable events to U.S. Shareholders. See “United States Federal Tax Consequences — Taxation of U.S. Shareholders.” The Sponsor does not anticipate any non-ordinary recurring expenses that will be paid from the Trust. | ||

| Termination events |

The Trustee will terminate the Trust if any of the following events occur: | |

| • the Sponsor has given notice of resignation or is unable to perform its duties or becomes bankrupt or insolvent and the Trustee does not appoint a successor sponsor or agree to act as sponsor; | ||

| • Shareholders holding at least 75% of the outstanding Shares notify the Trustee that they elect to terminate the Trust; | ||

| • the Depository resigns or is removed; or | ||

| • the Trustee receives notice from the IRS or from counsel for the Trust or the Sponsor that the Trust fails to qualify for treatment, or will not be treated, as a grantor trust under the Internal Revenue Code of 1986, as amended (Internal Revenue Code). | ||

| The Sponsor may, in its sole discretion, direct the Trustee to terminate the Trust if any of the following events occur: | ||

| • the Shares are delisted from NYSE Arca and are not listed for trading on another U.S. national securities exchange within five business days from the date the Shares are delisted; | ||

| • the SEC determines that the Trust is an investment company under the Investment Company Act; | ||

| • the NAV of the Trust remains less than $100 million for 30 consecutive business days; | ||

| • all of the Trust’s assets are sold; | ||

| • the aggregate market capitalization of the Trust, based on the closing price for the Shares, remains less than $300 million for five consecutive trading days; or | ||

| • DTC stops providing book-entry settlement services for the Shares. | ||

| If the Trustee notifies the Sponsor of the Trustee’s election to resign and the Sponsor does not appoint a successor trustee within 60 days, the Trustee may terminate the Trust. | ||

| The Trust will terminate on August 16, 2051 if it has not been terminated prior to that date. | ||

6

Table of Contents

| Upon termination of the Trust, Authorized Participants may surrender Baskets and will receive the amount of Chinese Renminbi represented by their Baskets. 90 days or more after the termination of the Trust, the Trustee will sell the Trust’s remaining Chinese Renminbi and, after payment or provision for the Trust’s liabilities, will distribute USD to the Shareholders. See “Description of the Trust Agreement — Termination of the Trust.” |

| Authorized Participants |

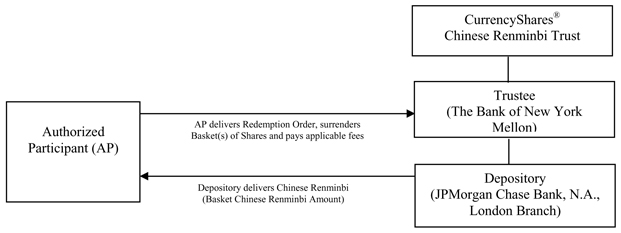

An Authorized Participant is a DTC Participant that is a registered broker-dealer or other securities market participant such as a bank or other financial institution that is not required to register as a broker-dealer to engage in securities transactions and has entered into a Participant Agreement with the Trustee. Only Authorized Participants may place orders to create or redeem Baskets. The Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of Chinese Renminbi required for creation or redemption. A list of the current Authorized Participants can be obtained from the Trustee or the Sponsor. See “Creation and Redemption of Shares” for more details. |

| Shareholders trading via NYSE Arca |

A Shareholder who buys or sells Shares from, to, or through a broker-dealer should expect to be charged a commission by the broker-dealer for effecting the transaction. Investors are encouraged to review the terms of their brokerage accounts for details on applicable commissions or charges. |

| Clearance and settlement |

All Shares are evidenced by one or more global certificates issued by the Trustee to DTC. The Shares are available only in book-entry form. Shareholders may hold their Shares through DTC, if they are DTC Participants, or through Authorized Participants or Indirect Participants. |

7

Table of Contents

As of August 16, 2011, the date of formation of the Trust and the date the Sponsor deposited 500 Chinese Yuan in the Trust’s primary deposit account with the Depository, the NAV of the Trust, which represents the value of the Chinese Renminbi deposited into the Trust in exchange for the initial Share, was $78 and the NAV per Share was $78. See “Statement of Financial Condition” on page F-3.

8

Table of Contents

You should consider carefully the risks described below before making an investment decision. You should also refer to the other information included in this prospectus, including the Trust’s financial statements and the related notes. See “Glossary of Terms” beginning on page 14 for a description of certain terms used in this prospectus.

The value of the Shares relates directly to the value of the Chinese Renminbi held by the Trust. Fluctuations in the price of the Chinese Renminbi could materially and adversely affect the value of the Shares.

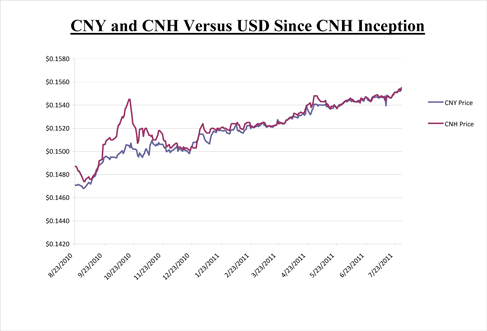

The Shares are designed to reflect the price of the Chinese Renminbi, plus accumulated interest, less the Trust’s expenses. From August 23, 2010, which is the first date a spot rate for the offshore Chinese Renminbi to USD is available, to July 29, 2011, the exchange rate of Chinese Renminbi to one U.S. Dollar has ranged from a high of 6.7850 on September 1, 2010 to a low of 6.4300 on July 29, 2011 and averaged 6.5643. Several factors may affect the price of the Chinese Renminbi, including:

| • | Debt level and trade deficit or surplus of China; |

| • | Inflation rates of the United States and China and investors’ expectations concerning inflation rates; |

| • | Interest rates of the United States and China and investors’ expectations concerning interest rates; |

| • | Investment and trading activities of mutual funds, hedge funds and currency funds; and |

| • | Global or regional political, economic or financial events and situations. |

In addition, the Chinese Renminbi may not maintain its long-term value in terms of purchasing power in the future. When the price of the Chinese Renminbi declines, the Sponsor expects the price of a Share to decline as well.

There is no assurance that the USD/Chinese Renminbi exchange rate will be stable or that the Chinese Renminbi will maintain its value or increase in value relative to the USD. Volatility is difficult to predict and could materially and adversely affect the performance of the Shares. Devaluation of the Chinese Renminbi relative to the USD would decrease the value of the Shares.

The Chinese government historically pegged the Chinese Renminbi to the USD. Amid international pressure to allow the currency to float freely, subject to market forces, in July 2010 China announced that the Chinese Renminbi would be pegged to a basket of currencies. The Chinese government has not formally stated what currencies are contained in the basket of currencies. Although the USD/Chinese Renminbi exchange rate has been relatively stable since July 2010, there is no assurance that the exchange rate will remain stable. Volatility in the USD/Chinese Renminbi exchange rate could materially and adversely affect the performance of the Shares. Devaluation of the Chinese Renminbi relative to the USD would decrease the value of the Shares.

Foreign exchange rates are influenced by the factors identified in the preceding risk factor and may also be influenced by: changing supply and demand for a particular currency; monetary policies of governments (including exchange control programs, restrictions on local exchanges or markets and limitations on foreign investment in a country or on investment by residents of a country in other countries); changes in balances of payments and trade; trade restrictions; and currency devaluations and revaluations. These events and actions are unpredictable. Also, in the past, the Chinese government has implemented a variety of capital controls in order to influence the price of the Chinese Renminbi relative to the USD. Capital controls include the prohibition of, or restrictions on, the ability to buy, sell or transfer Chinese Renminbi. The exercise of such controls by the Chinese government is unpredictable.

If interest earned by the Trust does not exceed expenses, the Trustee will withdraw Chinese Renminbi from the Trust to pay these excess expenses which will reduce the amount of Chinese Renminbi represented by each Share and potentially result in adverse tax consequences for Shareholders.

Each outstanding Share will represent a fractional, undivided interest in the Chinese Renminbi held by the Trust. Although the Trust will generate interest, it is possible that the amount of interest earned may not exceed expenses, in which case the Trustee will withdraw Chinese Renminbi from the Trust to pay these excess expenses. As a result, the amount of Chinese Renminbi represented by each Share may gradually decline over time. This is true even if additional Shares are issued in exchange for additional deposits of Chinese Renminbi into the Trust, as the amount of Chinese Renminbi required to create Shares will proportionately reflect the amount of Chinese Renminbi represented by the Shares outstanding at the time of creation. Assuming a constant Chinese Renminbi price, if expenses exceed interest earned, the trading price of the Shares will gradually decline relative to the price of the Chinese Renminbi as the amount of Chinese Renminbi represented by the Shares gradually declines. In this event, the Shares will only maintain their original price if the price of the Chinese Renminbi increases. There is no guarantee that interest earned by the Trust in the future will exceed the Trust’s expenses.

9

Table of Contents

Investors should be aware that a gradual decline in the amount of Chinese Renminbi represented by the Shares may occur regardless of whether the trading price of the Shares rises or falls in response to changes in the price of the Chinese Renminbi. The estimated ordinary operating expenses of the Trust, which accrue daily, are described in “Investment Attributes of the Trust — Trust Expenses.”

The payment of expenses by the Trust will result in a taxable event to Shareholders. To the extent Trust expenses exceed interest paid to the Trust, a gain or loss may be recognized by Shareholders depending on the tax basis of the tendered Chinese Renminbi. See “United States Federal Tax Consequences – Taxation of U.S. Shareholders” for more information.

The interest rate paid by the Depository, if any, may not be the best rate available. If the Sponsor determines that the interest rate is inadequate, then its sole recourse is to remove the Depository and terminate the Deposit Accounts.

The Depository is committed to endeavor to pay a competitive interest rate on the balance of Chinese Renminbi in the primary deposit account of the Trust, but there is no guarantee of the amount of interest that will be paid, if any, on this account. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The initial annual nominal interest rate as set forth in the Deposit Account Agreement is 0.1%. The Depository may change the rate at which interest accrues, including reducing the interest rate to zero, based upon changes in market conditions or the Depository’s liquidity needs. The Depository will notify the Sponsor of the interest rate applied each business day after the close of such business day. The Sponsor will disclose the current interest rate on the Trust’s website. If the Sponsor believes that the interest rate paid by the Depository is not adequate, the Sponsor’s sole recourse is to remove the Depository and terminate the Deposit Accounts. The Depository is not paid a fee for its services to the Trust; rather, it generates income or loss based on its ability to earn a “spread” or “margin” over the interest it pays to the Trust by using the Trust’s Chinese Renminbi to make loans or in other banking operations. For these reasons, you should not expect that the Trust will be paid the best available interest rate at any time or over time.

If the Trust incurs expenses in USD, the Trust would be required to sell Chinese Renminbi to pay these expenses. The sale of the Trust’s Chinese Renminbi to pay expenses in USD at a time of low Chinese Renminbi prices could adversely affect the value of the Shares.

The Trustee will sell Chinese Renminbi held by the Trust to pay Trust expenses, if any, incurred in USD, irrespective of then-current Chinese Renminbi prices. The Trust is not actively managed and no attempt will be made to buy or sell Chinese Renminbi to protect against or to take advantage of fluctuations in the price of the Chinese Renminbi. Consequently, if the Trust incurs expenses in USD, the Trust’s Chinese Renminbi may be sold at a time when the Chinese Renminbi price is low, resulting in a negative effect on the value of the Shares.

The Deposit Accounts are not entitled to payment at any office of JPMorgan Chase Bank, N.A. located in the United States.

The federal laws of the United States prohibit banks located in the United States from paying interest on unrestricted demand deposit accounts. Therefore, payments out of the Deposit Accounts will be payable only at the London branch of JPMorgan Chase Bank, N.A., located in England. The Trustee will not be entitled to demand payment of these accounts at any office of JPMorgan Chase Bank, N.A. that is located in the United States. JPMorgan Chase Bank, N.A. will not be required to repay the deposit if its London branch cannot repay the deposit due to an act of war, insurrection or civil strife or an action by a foreign government or instrumentality (whether de jure or de facto) in England.

Shareholders do not have the protections associated with ownership of a demand deposit account insured in the United States by the Federal Deposit Insurance Corporation nor the protection provided for bank deposits under English law.

Neither the Shares nor the Deposit Accounts and the Chinese Renminbi deposited in them are deposits insured against loss by the FDIC, any other federal agency of the United States or the Financial Services Compensation Scheme of England.

If the Depository becomes insolvent, its assets might not be adequate to satisfy a claim by the Trust or any Authorized Participant. In addition, in the event of the insolvency of the Depository or the U.S. bank of which it is a branch, there may be a delay and costs incurred in recovering the Chinese Renminbi held in the Deposit Accounts.

Chinese Renminbi deposited in the Deposit Accounts by an Authorized Participant are commingled with Chinese Renminbi deposited by other Authorized Participants and are held by the Depository in either the primary deposit account or the secondary deposit account of the Trust. Chinese Renminbi held in the Deposit Accounts are not segregated from the Depository’s other assets.

10

Table of Contents

The Trust has no proprietary rights in or to any specific Chinese Renminbi held by the Depository and will be an unsecured creditor of the Depository with respect to the Chinese Renminbi held in the Deposit Accounts in the event of the insolvency of the Depository or the U.S. bank of which it is a branch. In the event the Depository or the U.S. bank of which it is a branch becomes insolvent, the Depository’s assets might not be adequate to satisfy a claim by the Trust or any Authorized Participant for the amount of Chinese Renminbi deposited by the Trust or the Authorized Participant and, in such event, the Trust and any Authorized Participant will generally have no right in or to assets other than those of the Depository.

In the case of insolvency of the Depository or JPMorgan Chase Bank, N.A., the U.S. bank of which the Depository is a branch, a liquidator may seek to freeze access to the Chinese Renminbi held in all accounts by the Depository, including the Deposit Accounts. The Trust and the Authorized Participants could incur expenses and delays in connection with asserting their claims. These problems would be exacerbated by the fact that the Deposit Accounts are not held in the U.S. but instead are held at the London branch of a U.S. national bank, where they are subject to English insolvency law. Further, under U.S. law, in the case of the insolvency of JPMorgan Chase Bank, N.A., the claims of creditors in respect of accounts (such as the Trust’s Deposit Accounts) that are maintained with an overseas branch of JPMorgan Chase Bank, N.A. will be subordinate to claims of creditors in respect of accounts maintained with JPMorgan Chase Bank, N.A. in the U.S., greatly increasing the risk that the Trust and the Trust’s beneficiaries would suffer a loss.

Shareholders do not have the protections associated with ownership of shares in an investment company registered under the Investment Company Act.

The Investment Company Act is designed to protect investors by preventing: insiders from managing investment companies to their benefit and to the detriment of public investors; the issuance of securities having inequitable or discriminatory provisions; the management of investment companies by irresponsible persons; the use of unsound or misleading methods of computing earnings and asset value; changes in the character of investment companies without the consent of investors; and investment companies from engaging in excessive leveraging. To accomplish these ends, the Investment Company Act requires the safekeeping and proper valuation of fund assets, restricts greatly transactions with affiliates, limits leveraging, and imposes governance requirements as a check on fund management.

The Trust is not registered as an investment company under the Investment Company Act and is not required to register under that act. Consequently, Shareholders do not have the regulatory protections afforded to investors in registered investment companies.

Shareholders do not have the rights enjoyed by investors in certain other financial instruments.

As interests in a grantor trust, the Shares have none of the statutory rights normally associated with the ownership of shares of a business corporation, including, for example, the right to bring “oppression” or “derivative” actions. Apart from the rights afforded to them by federal and state securities laws, Shareholders have only those rights relative to the Trust, the Trust property and the Shares that are set forth in the Depositary Trust Agreement. In this connection, the Shareholders have limited voting and distribution rights. They do not have the right to elect directors. See “Description of the Shares” for a description of the limited rights of the Shareholders.

The Shares may trade at a price which is at, above, or below the NAV per Share.

The NAV per Share fluctuates with changes in the market value of the Trust’s assets. The market price of Shares can be expected to fluctuate in accordance with changes in the NAV per Share, but also in response to market supply and demand. As a result, the Shares might trade at prices at, above or below the NAV per Share.

The Depository owes no fiduciary duties to the Trust or the Shareholders, is not required to act in their best interest and could resign or be removed by the Sponsor, which would trigger early termination of the Trust.

The Depository is not a trustee for the Trust or the Shareholders. As stated above, the Depository is not obligated to maximize the interest rate paid to the Trust. In addition, the Depository has no duty to continue to act as the depository of the Trust. The Depository can terminate its role as depository for any reason whatsoever upon 150 days’ notice to the Trust. If directed by the Sponsor, the Trustee must terminate the Depository. Such a termination might result, for example, if the Sponsor determines that the interest rate paid by the Depository is inadequate. In the event that the Depository were to resign or be removed, the Trust will be terminated.

11

Table of Contents

Shareholders may incur significant fees upon the termination of the Trust.

The occurrence of any one of several events would either require the Trust to terminate or permit the Sponsor to terminate the Trust. For example, if the Depository were to resign or be removed, then the Sponsor would be required to terminate the Trust. Authorized Participants tendering Baskets within 90 days of the Trust’s termination will receive the amount of Chinese Renminbi represented by their Baskets. Shareholders may incur significant fees if they choose to convert the Chinese Renminbi they receive to USD. See “Description of the Depositary Trust Agreement — Termination of the Trust” for more information about the termination of the Trust, including when the termination of the Trust may be triggered by events outside the direct control of the Sponsor, the Trustee or the Shareholders.

Redemption orders are subject to rejection by the Trustee under certain circumstances.

The Trustee will reject a redemption order if the order is not in proper form as described in the Participant Agreement or if the fulfillment of the order, in the opinion of its counsel, might be unlawful. Any such rejection could adversely affect a redeeming Shareholder. For example, the resulting delay would adversely affect the value of the Shareholder’s redemption distribution if the NAV were to decline during the delay. See “Creation and Redemption of Shares — Redemption Procedures — Suspension or rejection of redemption orders.” In the Depositary Trust Agreement, the Sponsor and the Trustee disclaim any liability for any loss or damage that may result from any such rejection.

Substantial sales of Chinese Renminbi by the official sector could adversely affect an investment in the Shares.

The official sector consists of central banks, other governmental agencies and multi-lateral institutions that buy, sell and hold Chinese Renminbi as part of their reserve assets. The official sector holds a significant amount of Chinese Renminbi that can be mobilized in the open market. In the event that future economic, political or social conditions or pressures require members of the official sector to sell their Chinese Renminbi simultaneously or in an uncoordinated manner, the demand for Chinese Renminbi might not be sufficient to accommodate the sudden increase in the supply of Chinese Renminbi to the market. Consequently, the price of the Chinese Renminbi could decline, which would adversely affect an investment in the Shares.

Shareholders that are not Authorized Participants may only purchase or sell their Shares in secondary trading markets.

Only Authorized Participants may create or redeem Baskets through the Trust. All other investors that desire to purchase or sell Shares must do so through NYSE Arca or in other markets, if any, in which the Shares are traded.

The liability of the Sponsor and the Trustee under the Depositary Trust Agreement is limited and, except as set forth in the Depositary Trust Agreement, they are not obligated to prosecute any action, suit or other proceeding in respect of any Trust property.

The Depositary Trust Agreement provides that neither the Sponsor nor the Trustee assumes any obligation or is subject to any liability under the Trust Agreement to any Shareholder, except that they each agree to perform their respective obligations specifically set forth in the Depositary Trust Agreement without negligence or bad faith. Additionally, neither the Sponsor nor the Trustee is obligated to, although each may in its respective discretion, prosecute any action, suit or other proceeding in respect of any Trust property. The Depositary Trust Agreement does not confer upon Shareholders the right to prosecute any such action, suit or other proceeding.

The Depositary Trust Agreement may be amended to the detriment of Shareholders without their consent.

The Sponsor and the Trustee may amend most provisions (other than those addressing core economic rights) of the Depositary Trust Agreement without the consent of any Shareholder. Such an amendment could impose or increase fees or charges borne by the Shareholders. Any amendment that increases fees or charges (other than taxes and other governmental charges, registration fees or other expenses), or that otherwise prejudices any substantial existing rights of Shareholders, will not become effective until 30 days after written notice is given to Shareholders.

The License Agreement with The Bank of New York Mellon may be terminated by The Bank of New York Mellon in the event of a material breach. Termination of the License Agreement might lead to early termination and liquidation of the Trust.

The Bank of New York Mellon and an affiliate of the Sponsor have entered into a License Agreement granting the Sponsor’s affiliate a license to certain patent applications made by The Bank of New York Mellon covering systems and methods for securitizing a commodity. The Sponsor’s affiliate has sublicensed the license to the Sponsor. The

12

Table of Contents

license is limited to a non-exclusive grant for the life of The Bank of New York Mellon’s patents and patent applications. The License Agreement provides that each of the parties may provide notice of intent to terminate the License Agreement in the event the other party commits a material breach. If the License Agreement is terminated and one or more of The Bank of New York Mellon’s patent applications issue as patents, then The Bank of New York Mellon may claim that the operation of the Trust violates its patent or patents and seek an injunction forcing the Trust to cease operation and the Shares to cease trading. In that case, the Trust might be forced to terminate and liquidate, which would adversely affect Shareholders.

13

Table of Contents

In this prospectus, each of the following terms has the meaning assigned to it here:

“Authorized Participant” — A DTC Participant that is a registered broker-dealer or other securities market participant such as a bank or other financial institution that is not required to register as a broker-dealer to engage in securities transactions and that has entered into a Participant Agreement with the Sponsor and the Trustee. Only Authorized Participants may place orders to create or redeem Baskets.

“Basket Chinese Renminbi Amount” — The deposit required to create one or more Baskets pursuant to a purchase order. This deposit will be an amount of Chinese Renminbi bearing the same proportion to the number of Baskets to be created as the total assets of the Trust (net of estimated accrued but unpaid expenses) bears to the number of Baskets outstanding on the date that the order to purchase is accepted by the Trustee.

“Chinese Renminbi” — The official currency of the People’s Republic of China.

“Chinese Yuan” — The unit of account for Chinese Renminbi.

“Closing Spot Rate” — The USD/Chinese Renminbi exchange rate as determined by The WM Company at 4:00 PM (London fixing) on each day that NYSE Arca is open for regular trading.

“Deposit Accounts” — The primary and secondary Chinese Renminbi-denominated, demand accounts of the Trust established with the Depository by the Deposit Account Agreement. The Deposit Accounts hold the Chinese Renminbi deposited with the Trust.

“Deposit Account Agreement” — The agreements, including the Account Application and the JPMorgan Chase Bank, N.A. Global Account Terms, between the Trustee and the Depository establishing the Deposit Accounts with the Depository.

“Depositary Trust Agreement” – The agreement between the Trustee and the Sponsor establishing and governing the operations of the Trust.

“DTC” — The Depository Trust Company. DTC is a limited purpose trust company organized under the laws of the State of New York, a member of the U.S. Federal Reserve System and a clearing agency registered with the SEC. DTC acts as the securities depository for the Shares.

“DTC Participant” — Participants in DTC, such as banks, brokers, dealers and trust companies.

“Foreign exchange” — The exchange of one currency for another.

“Indirect Participants” — Those banks, brokers, dealers, trust companies and others that maintain, either directly or indirectly, a custodial relationship with a DTC Participant.

“Internal Revenue Code” — The Internal Revenue Code of 1986, as amended.

“Investment Company Act” — The Investment Company Act of 1940, as amended.

“NAV” — Net asset value. The Trustee calculates, and the Sponsor publishes, the Trust’s NAV each business day as soon as practicable after The WM Company announces the Closing Spot Rate. To calculate the NAV, the Trustee adds to the amount of Chinese Renminbi in the Trust at the end of the preceding day accrued but unpaid interest, if any, Chinese Renminbi receivable under pending purchase orders and the value of other Trust assets, and subtracts the accrued but unpaid Sponsor’s fee, Chinese Renminbi payable under pending redemption orders and other Trust expenses and liabilities, if any.

“Participant Agreement” — An agreement entered into by each Authorized Participant with the Sponsor and the Trustee that states the procedures for the creation and redemption of Baskets and for the delivery of Chinese Renminbi required for creation and redemption.

“Securities Act” — The Securities Act of 1933, as amended.

“Securities Exchange Act” — The Securities Exchange Act of 1934, as amended.

“Shareholder” — Any owner of a Share (whether such owner owns through DTC, a DTC Participant or an Indirect Participant).

“Sponsor Indemnified Party” — The Sponsor, its members, officers, employees and agents.

“SWIFT” — Society for Worldwide Interbank Financial Telecommunication.

“The WM Company” — The World Markets Company PLC, a State Street business.

14

Table of Contents

“USD” or “$” — United States Dollar or Dollars.

15

Table of Contents

Statement Regarding Forward-Looking Statements

This prospectus includes “forward-looking statements” which generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this prospectus that address activities, events or developments that will or may occur in the future, including such matters as changes in currency prices and market conditions (for the Chinese Renminbi and the Shares), the Trust’s operations, the Sponsor’s plans and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor made, based on its perceptions of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic, market and business conditions, changes in laws and regulations, including those concerning taxes, made by governmental authorities and regulatory bodies and other world economic and political developments. See “Risk Factors.” Consequently, all forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments that the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of the Shares. Moreover, neither the Sponsor nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the Trust nor the Sponsor is under a duty to update any of the forward-looking statements to conform such statements to actual results or to reflect a change in the Sponsor’s expectations or predictions.

The proceeds received by the Trust from the issuance and sale of Baskets are Chinese Renminbi. Such proceeds will be deposited into the Deposit Accounts. In accordance with the Depositary Trust Agreement, during the life of the Trust these proceeds will only be (1) owned by the Trust and held by the Depository, (2) disbursed or sold as needed to pay the Trust’s expenses, and (3) distributed to Authorized Participants upon the redemption of Baskets.

16

Table of Contents

Overview of the Foreign Exchange Industry

There are three major kinds of transactions in the traditional foreign exchange markets: spot transactions, outright forwards and foreign exchange swaps. “Spot” trades are foreign exchange transactions that settle typically within two business days with the counterparty to the trade. “Forward” trades are transactions that settle on a date beyond spot and “swap” transactions are transactions in which two parties exchange two currencies on one or more specified dates over an agreed period and exchange them again when the period ends. There also are transactions in currency options, which trade both over-the-counter and, in the U.S., on the Philadelphia Stock Exchange. Currency futures are transactions in which an institution buys or sells a standardized amount of foreign currency on an organized exchange for delivery on one of several specified dates. Currency futures are traded in a number of regulated markets, including the International Monetary Market division of the Chicago Mercantile Exchange, the Singapore Exchange Derivatives Trading Limited (formerly the Singapore International Monetary Exchange, or SIMEX) and the London International Financial Futures Exchange (LIFFE).

Participants in the foreign exchange market have various reasons for participating. Multinational corporations and importers need foreign currency to acquire materials or goods from abroad. Banks and multinational corporations sometimes require specific wholesale funding for their commercial loan or other foreign investment portfolios. Some participants hedge open currency exposure through off-balance-sheet products.

The primary market participants in foreign exchange are banks (including government-controlled central banks), investment banks, money managers, multinational corporations and institutional investors. The most significant participants are the major international commercial banks that act both as brokers and as dealers. In their dealer role, these banks maintain long or short positions in a currency and seek to profit from changes in exchange rates. In their broker role, the banks handle buy and sell orders from commercial customers, such as multinational corporations. The banks earn commissions when acting as agent. They profit from the spread between the rates at which they buy and sell currency for customers when they act as principal.

Much of the foregoing information is taken from A Foreign Exchange Primer by Shani Shamah (John Wiley & Sons Ltd., 2003).

17

Table of Contents

In 2010, China became the world’s largest exporter and the second largest economy in the world. China has sustained average economic growth of over 9.5% for the past 26 years. With the world’s largest population of approximately 1.3 billion people, China’s 2010 gross domestic product per capita was $7,600.

Chinese Renminbi has been the official currency of China since 1949. The People’s Bank of China has been functioning as the central bank of China since 1983. After keeping its currency pegged to the USD, in July 2005 China revalued its currency by 2.1% against the USD and moved to an exchange rate system that referenced a basket of currencies said by the Chinese government to include currencies of China’s major trading partners such as the USD, Euro, Japanese Yen and Singapore Dollar. In 2008, during the global financial crisis, China pegged the Chinese Renminbi to the USD again. Amid international pressure to allow the currency to float freely, subject to market forces, China announced a return to the basket-based approach in July 2010. The mix of currencies contained in the “basket” is controlled by the Chinese government, and the exact allocations are unknown to the public.

As part of China’s plans to make Chinese Renminbi a more flexible currency for settling cross-border trade, with the ultimate aim of creating a freely floating (unpegged) currency, China has implemented two versions of its currency: the onshore version (CNY) and the offshore version (CNH). The reason for using two versions is to facilitate a controlled roll-out of Chinese Renminbi as an international currency for trade, investment and reserve, without exposing the Chinese economy to possible shocks.

The advent of CNH began in 2003 when the People’s Bank of China and the Hong Kong Monetary Authority agreed that Hong Kong banks could conduct personal business in Chinese Renminbi on a trial basis and The Bank of China (Hong Kong) was designated as the Chinese Renminbi clearing bank. The roll-out progressed slowly until the summer of 2010, when a flurry of government initiatives led to, among other things, expansion of the CNY trade settlement scheme to include businesses from 20 provinces in mainland China, creation of CNH investment products, and increased opportunity for movement of CNH onto the mainland.

The Chinese Renminbi deposited into and held by the Trust, and accordingly represented by Shares, are the CNH version of the currency.

Although CNY and CNH are the same currency, they have different exchange rates due to different supply and demand conditions. The chart below demonstrates a comparison of the spot rates for the CNY and CNH:

Source: Bloomberg Professional Service

In addition, China has adopted restrictive regulations concerning international transfer and settlement of, and other transactions involving, CNY, while CNH, in contrast, is less-regulated.

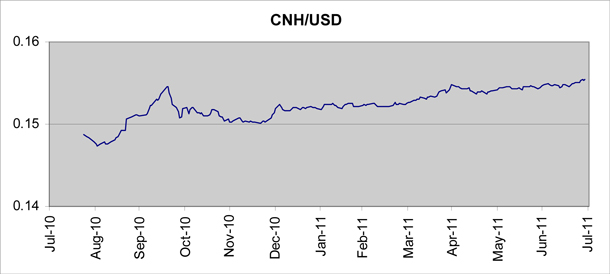

The following chart illustrates movements in the price of the Chinese Renminbi in USD as reported by the Bloomberg Professional Service.

18

Table of Contents

19

Table of Contents

Investment Attributes of the Trust

The investment objective of the Trust is for the Shares to reflect the price in USD of the Chinese Renminbi. The Sponsor believes that, for many investors, the Shares represent a cost-effective means of investing in the foreign exchange market. As the value of the Shares is tied to the value of the Chinese Renminbi held by the Trust, it is important in understanding the investment attributes of the Shares to first understand the investment attributes of the Chinese Renminbi.

REASONS FOR INVESTING IN THE CHINESE RENMINBI

All forms of investment carry some degree of risk. Although the Shares have certain unique risks described in “Risk Factors,” generally these are the same risks as investing directly in the Chinese Renminbi. Moreover, investment in the Shares may help to balance a portfolio or protect against currency swings, thereby reducing overall risk.

Investors may wish to invest in the Chinese Renminbi in order to take advantage of short-term tactical or long-term strategic opportunities. From a tactical perspective, an investor that believes that the USD is weakening relative to the Chinese Renminbi may choose to buy Shares in order to capitalize on the potential movement. An investor that believes that the Chinese Renminbi is overvalued relative to the USD may choose to sell Shares. Sales may also include short sales that are permitted under SEC and exchange regulations.

From a strategic standpoint, since currency movements can affect returns on cross-border investments and businesses, both individual investors and businesses may choose to hedge their currency risk through the purchase or sale of Chinese Renminbi. For example, in the case where a U.S. investor has a portfolio consisting of Chinese equity and fixed income securities, the investor may decide to hedge the currency exposure that exists within the Chinese portfolio by selling an appropriate amount of Shares. Again, such sales may include short sales in accordance with applicable SEC regulations. In doing this, the U.S. investor may be able to mitigate the impact that changes in exchange rates have on the returns associated with Chinese equity and fixed income components of the portfolio.

Similarly, a business that has currency exposure because it manufactures or sells its products abroad is exposed to exchange rate risk. Buying or selling Shares in appropriate amounts can reduce the business’s exchange rate risk.

More generally, investors that wish to diversify their investment portfolios with a wider range of non-correlative investments may desire to invest in foreign currencies. Non-correlative asset classes, such as foreign currencies, are often used to enhance investment portfolios by making them more consistent and less volatile. Less volatility means lower risk and closer proximity to an expected return.

COST-EFFICIENT PARTICIPATION IN THE MARKET FOR THE CHINESE RENMINBI

The Shares are intended to provide institutional and retail investors with a simple, cost-effective means of gaining investment benefits similar to those of holding Chinese Renminbi. The costs of purchasing Shares should not exceed the costs associated with purchasing any other publicly-traded equity securities. The Shares are an investment that is:

Easily Accessible. Investors are able to access the market for the Chinese Renminbi through a traditional brokerage account. The Shares are bought and sold on NYSE Arca like any other exchange-listed security.

Exchange-Traded. Because they are traded on NYSE Arca, the Shares provide investors with an efficient means of implementing investment tactics and strategies that involve Chinese Renminbi. NYSE Arca-listed securities are eligible for margin accounts. Accordingly, investors are able to purchase and hold Shares with borrowed money to the extent permitted by law.

Transparent. The Shares are backed by the assets of the Trust, which does not hold or use derivative products. The value of the holdings of the Trust are reported on the Trust’s website, www.currencyshares.com, every business day.

Investing in the Shares will not insulate the investor from price volatility or other risks. See “Risk Factors.”

INTEREST ON DEPOSITED CHINESE RENMINBI

JPMorgan Chase Bank, N.A., London Branch, maintains two deposit accounts for the Trust: a primary deposit account that may earn interest and a secondary deposit account that does not earn interest. Interest on the primary deposit account, if any, accrues daily and is paid monthly. The initial annual nominal interest rate as set forth in the Deposit Account Agreement is 0.1%. The Depository may change the rate at which interest accrues based upon

20

Table of Contents

changes in market conditions or the Depository’s liquidity needs. The Depository will notify the Sponsor of the interest rate applied each business day after the close of such business day. The Sponsor will disclose the current interest rate on the Trust’s website. If the Sponsor believes that the interest rate paid by the Depository is not competitive, the Sponsor’s sole recourse will be to remove the Depository by terminating the Deposit Account Agreement and closing the accounts.

The secondary deposit account is used to account for any interest that may be received and paid on creations and redemptions of Baskets. The secondary deposit account is also used to account for interest earned on the primary deposit account, if any, pay Trust expenses and distribute any excess interest to Shareholders on a monthly basis. In the event that the interest deposited exceeds the sum of the Sponsor’s fee for the prior month plus other Trust expenses, if any, then the Trustee will direct that the excess be converted into USD at a prevailing market rate and the Trustee will distribute the USD as promptly as practicable to Shareholders on a pro-rata basis (in accordance with the number of Shares that they own).

TRUST EXPENSES

The Trust’s only ordinary recurring expense is expected to be the

Sponsor’s fee. The Sponsor has agreed to assume and pay the following administrative and marketing expenses of the Trust: the Trustee’s monthly fee, typical maintenance and transaction fees of the Depository, NYSE Arca listing fees, SEC

registration fees, printing and mailing costs, audit fees and expenses, up to $100,000 per annum in legal fees and expenses, and applicable license fees. The Sponsor will also pay the costs of the Trust’s organization and the costs of the

initial sale of the Shares, including the applicable SEC registration fees. The Sponsor’s fee accrues daily at an annual nominal rate of 0.40% of the Chinese Renminbi in the Trust. Each month, the Trust first withdraws Chinese

Renminbi the Trust has earned as interest, if any, to pay the Sponsor’s fee and any other Trust expenses that have been incurred. If that interest is not sufficient to fully pay the Sponsor’s fee and other Trust expenses, then the Trustee

will withdraw Chinese Renminbi as needed from the primary deposit account to pay these expenses. Shareholders do not have the option of choosing to pay their proportionate share of the excess expenses in lieu of having their share of expenses paid

by withdrawing Chinese Renminbi from the primary deposit account. If the Trust were to incur expenses in USD (which is not anticipated), Chinese Renminbi will be converted to USD at a prevailing market rate at the time of conversion to pay these

expenses. An example of when the Trust may incur expenses in USD would be in the unanticipated instance where the Sponsor determines that it will resign, thereby terminating the Trust, and the Trust then undertakes an orderly dissolution, all due to

changes or restrictions imposed by the Chinese government requiring reversion of Chinese Renminbi into USD. The payment of expenses in Chinese Renminbi and the conversion of Chinese Renminbi to USD, if required to pay expenses of the Trust, are

taxable events to Shareholders. See “United States Federal Tax Consequences — Taxation of U.S. Shareholders.”

In certain exceptional cases the Trust will pay for some expenses in addition to the Sponsor’s fee. These exceptions include expenses not assumed by the Sponsor, taxes and governmental charges, expenses and costs of any extraordinary services performed by the Trustee or the Sponsor on behalf of the Trust or action taken by the Trustee or the Sponsor to protect the Trust or the interests of Shareholders, indemnification of the Sponsor under the Depositary Trust Agreement, and legal expenses in excess of $100,000 per year.

In the event that none of the extraordinary expenses described in the immediately preceding paragraph are charged to the Trust, an investment of $10,000 in Shares will incur an annual fee of approximately $40, or approximately $200 over five years. Additionally, investors should expect to pay customary brokerage fees and expenses for each purchase or sale of Shares. An Authorized Participant will pay transaction fees to the Trustee, which will not be contributed to the Trust, for each creation or redemption order.

The Trust was formed under the laws of the State of New York on August 16, 2011 when the Sponsor and the Trustee signed the Depositary Trust Agreement and the Sponsor deposited 500 Chinese Yuan in the primary deposit account. The Trust holds Chinese Renminbi and is expected from time to time to issue Baskets in exchange for deposits of Chinese Renminbi and to distribute Chinese Renminbi in connection with redemptions of Baskets. The investment objective of the Trust is for the Shares to reflect the price in USD of the Chinese Renminbi. The material terms of the Depositary Trust Agreement are discussed under “Description of the Depositary Trust Agreement.” The Shares represent units of fractional undivided beneficial interest in, and ownership of, the Trust. The Trust is not managed like a business corporation or an active investment vehicle. The Chinese Renminbi held by the Trust will only be sold (1) if needed to pay Trust expenses, (2) in the event the Trust terminates and liquidates its assets or (3) as otherwise required by law or regulation. The payment of expenses in Chinese Renminbi and the conversion of Chinese Renminbi to USD, if necessary to pay expenses of the Trust, are taxable events to Shareholders. See “United States Federal Tax Consequences — Taxation of U.S. Shareholders.”

21

Table of Contents

The Trust is not registered as an investment company under the Investment Company Act and is not required to register under such Act.

The Trust creates and redeems Shares from time to time, but only in whole Baskets. A Basket is a block of 50,000 Shares. The number of Shares outstanding is expected to increase and decrease from time to time as a result of the creation and redemption of Baskets. Authorized Participants pay for Baskets with Chinese Renminbi. Shareholders pay for Shares with USD.

The creation and redemption of Baskets requires the delivery to the Trust or the distribution by the Trust of the amount of Chinese Renminbi represented by the Baskets being created or redeemed. This amount is based on the total Chinese Renminbi represented by the number of Shares included in the Baskets being created or redeemed. Baskets may be created or redeemed only by Authorized Participants. Authorized Participants will pay transaction fees for each order to create or redeem Baskets. See “Creation and Redemption of Shares.” Authorized Participants may sell to other investors all or part of the Shares included in the Baskets that they purchase from the Trust. See “Plan of Distribution.”

The Trustee will calculate, and the Sponsor will publish, the Trust’s NAV each business day. To calculate the NAV, the Trustee will add to the amount of Chinese Renminbi in the Trust at the end of the preceding day accrued but unpaid interest, Chinese Renminbi receivable under pending purchase orders and the value of other Trust assets, and will subtract the accrued but unpaid Sponsor’s fee, Chinese Renminbi payable under pending redemption orders and other Trust expenses and liabilities, if any. The NAV will be expressed in USD based on the Closing Spot Rate. The Trustee also determines the NAV per Share, which equals the NAV of the Trust divided by the number of outstanding Shares. See “Description of the Depositary Trust Agreement — Valuation of the Chinese Renminbi; Definition of Net Asset Value” for a more detailed description of how the NAV of the Trust and the NAV per Share are calculated.