| 1 Trademark of Trinseo PLC or its affiliates Second Quarter 2024 Financial Results & Third Quarter Outlook August 6, 2024 |

| 2 Introductions & Disclosure Rules Introductions • Frank Bozich, President & CEO • David Stasse, Executive Vice President & CFO • Andy Myers, Vice President of Investor Relations Disclosure Rules This presentation may contain forward-looking statements including, without limitation, statements concerning plans, objectives, goals, projections, forecasts, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts or guarantees or assurances of future performance. Forward-looking statements may be identified by the use of words like “expect,” “anticipate,” “believe,” “intend,” “forecast,” “outlook,” “will,” “may,” “might,” “see,” “tend,” “assume,” “potential,” “likely,” “target,” “plan,” “contemplate,” “seek,” “attempt,” “should,” “could,” “would” or expressions of similar meaning. Forward-looking statements reflect management’s evaluation of information currently available and are based on our current expectations and assumptions regarding our business, the economy, our current indebtedness, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Factors that might cause future results to differ from those expressed by the forward-looking statements include, but are not limited to, our ability to successfully implement proposed restructuring initiatives, including the closure of certain plants and product lines, and to successfully generate cost savings through restructuring and cost reduction initiatives; our ability to successfully execute our business and transformation strategy; the timing of, and our ability to complete, the sale of our interest in Americas Styrenics; increased costs or disruption in the supply of raw materials; deterioration of our credit profile limiting our access to commercial credit; increased energy costs; compliance with laws and regulations impacting our business; any disruptions in production at our chemical manufacturing facilities, including those resulting from accidental spills or discharges; conditions in the global economy and capital markets; our current and future levels of indebtedness and ability to service our debt; our ability to meet the covenants under our existing indebtedness; our ability to generate cash flows from operations and achieve our forecasted cash flows; and those discussed in our Annual Report on Form 10-K, under Part I, Item 1A —"Risk Factors" and elsewhere in our other reports, filings and furnishings made with the U.S. Securities and Exchange Commission from time to time. As a result of these or other factors, our actual results, performance or achievements may differ materially from those contemplated by the forward-looking statements. Therefore, we caution you against relying on any of these forward-looking statements. The forward-looking statements included in this press release are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. This presentation contains financial measures that are not in accordance with generally accepted accounting principles in the US (“GAAP”) including EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted EPS and Free Cash Flow. We believe these measures provide relevant and meaningful information to investors and lenders about the ongoing operating results and liquidity position of the Company. Such measures when referenced herein should not be viewed as an alternative to GAAP measures of performance or liquidity, as applicable. We have provided a reconciliation of these measures to the most comparable GAAP metric alongside of the respective measure or otherwise in the Appendix section and in the accompanying press release. |

| 3 Summary Q2 2024 Results • Net loss of $68 million and EPS of negative $1.92; included a $13 million non-cash, after-tax charge for an increase in valuation allowance on deferred tax assets in China • Adjusted EBITDA* of $67 million included a $10 million unfavorable impact from net timing • Highest Adjusted EBITDA result since Q2 2022 • Second consecutive quarter of sequential EBITDA improvement * See Appendix for a reconciliation of non-GAAP measures Cash Generation & Liquidity • Q2 cash used in operations of $42 million led to Free Cash Flow* of negative $56 million • Q2 ending cash of $108 million, of which $2 million is restricted, with $244 million of additional available liquidity under two committed financing facilities • Entered into a new Accounts Receivable Securitization Facility that extends the maturity date to January 2028 Q3 2024 Outlook • Net loss of $42 million to $52 million • Adjusted EBITDA* of $65 million to $75 million • Similar market conditions and Adjusted EBITDA as Q2 Key Initiatives • Announced the opening of our PMMA depolymerization plant in Rho, Italy • Agreed with Chevron Phillips Chemical Company LP to pursue a joint sale process for Americas Styrenics that is expected to begin in the third quarter and, in the ordinary course, lead to a definitive agreement in the first half of 2025 • Released our 14th annual Sustainability and Corporate Social Responsibility Report |

| 4 2024 Sustainability Report Highlights • Announced the launch of PC dissolution and PMMA depolymerization technologies • Achieved critical milestones in our decarbonization strategy • Generated 29% of electricity from non-fossil fuel sources • Decreased greenhouse gas emissions intensity by 11%1 • Increased renewable energy sources by 5%1 • Implemented a Scope 3 greenhouse gas emissions supplier program • Decreased freshwater intake by 12%1 • Achieved an injury rate of 0.30 in 2023, putting Trinseo in the top quartile of the chemical industry for safety • Certified one site for ISCC+ mass balance, bringing total to 11 sites as of April 2024 • Achieved a "B" in CDP score for Climate Change for the third straight year 1Compared to prior year |

| 5 Sustainability Highlight: PMMA Depolymerization Advancing Circular Infrastructure for Acrylic Solutions Pre- and Post-consumer PMMA waste Advanced continuous chemical recycling technology Fully-recycled PMMA resins and sheets New products made from fully-recycled PMMA (e.g. Automotive, Building & Construction) Trinseo’s advanced chemical recycling technology returns PMMA waste back to its constituent monomer MMA at comparable purity levels to virgin material Able to recycle a wider variety of PMMA-based materials, including end-of-life cast sheets High-purity recycled MMA enables use in high-end applications and higher recycled content in commodity applications Approximately three-fourths reduction in carbon footprint compared to virgin MMA production with yields exceeding industry standards No compromise on product design or performance Key Advantages High-purity recycled MMA comparable to virgin material |

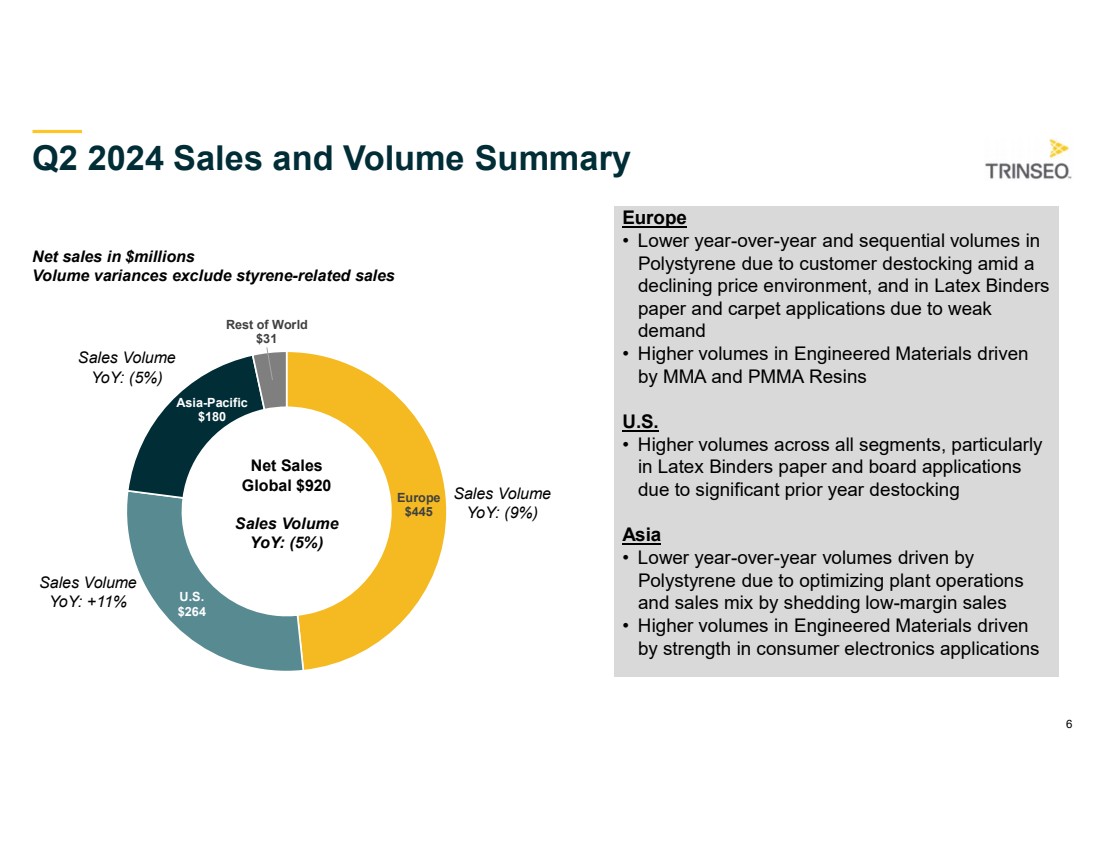

| 6 Q2 2024 Sales and Volume Summary Net sales in $millions Volume variances exclude styrene-related sales Europe • Lower year-over-year and sequential volumes in Polystyrene due to customer destocking amid a declining price environment, and in Latex Binders paper and carpet applications due to weak demand • Higher volumes in Engineered Materials driven by MMA and PMMA Resins U.S. • Higher volumes across all segments, particularly in Latex Binders paper and board applications due to significant prior year destocking Asia • Lower year-over-year volumes driven by Polystyrene due to optimizing plant operations and sales mix by shedding low-margin sales • Higher volumes in Engineered Materials driven by strength in consumer electronics applications Net Sales Global $920 Sales Volume YoY: (5%) Sales Volume YoY: (9%) Sales Volume YoY: (5%) Sales Volume YoY: +11% Europe $445 U.S. $264 Asia-Pacific $180 Rest of World $31 |

| 7 Trinseo Q2 2024 Financial Results $920 ($68) $963 ($349) Net Sales Net Income Net Sales & Net Income ($MM) Q2'24 Q2'23 ($1.92) ($1.46) ($9.93) ($1.92) Diluted EPS Adj EPS* EPS ($) Q2'24 Q2'23 $67 $57 Q2'24 Q2'23 Adjusted EBITDA* ($MM) Vol Price FX Total (6%) 1% (0%) (4%) Net Sales • Highest Adjusted EBITDA since the second quarter of 2022 despite a $10 million unfavorable impact from net timing due to falling styrene costs • Continued to see positive momentum in Engineered Materials as moderating input costs, normalization of MMA market dynamics, and steady demand for downstream applications led to highest segment volumes and Adjusted EBITDA in two years • Highest Adjusted EBITDA since the second quarter of 2022 despite a $10 million unfavorable impact from net timing due to falling styrene costs • Continued to see positive momentum in Engineered Materials as moderating input costs, normalization of MMA market dynamics, and steady demand for downstream applications led to highest segment volumes and Adjusted EBITDA in two years * See Appendix for a reconciliation of non-GAAP measures |

| 8 Engineered Materials • Higher year-over-year volumes driven by MMA and formulated products for automotive, consumer electronics and lighting applications • Adjusted EBITDA was $13 million above prior year due to higher volumes and higher margins as input costs moderated and MMA market dynamics normalized • Higher year-over-year volumes driven by MMA and formulated products for automotive, consumer electronics and lighting applications • Adjusted EBITDA was $13 million above prior year due to higher volumes and higher margins as input costs moderated and MMA market dynamics normalized $230 $206 Q2'24 Q2'23 Net Sales ($MM) Vol Price FX Total 17% (5%) (0%) 12% $25 $12 Q2'24 Q2'23 Adjusted EBITDA ($MM) 60 50 Q2'24 Q2'23 Volume (kt) |

| 9 • Lower year-over-year volumes in paper and carpet applications, primarily in Europe due to weak overall demand • Adjusted EBITDA was $3 million above prior year due to better regional and product mix and better plant utilization • CASE applications increased 8% year-over-year and accounted for a record 12% of total segment volumes • Lower year-over-year volumes in paper and carpet applications, primarily in Europe due to weak overall demand • Adjusted EBITDA was $3 million above prior year due to better regional and product mix and better plant utilization • CASE applications increased 8% year-over-year and accounted for a record 12% of total segment volumes Latex Binders $252 $255 Q2'24 Q2'23 Net Sales ($MM) $26 $23 Q2'24 Q2'23 Adjusted EBITDA ($MM) 111 117 Q2'24 Q2'23 Volume* (kt) Vol Price FX Total (5%) 4% (0%) (1%) *Volumes exclude styrene-related sales |

| 10 Plastics Solutions • Volumes below prior year due to a planned polycarbonate production turnaround in the current year partially offset by higher volume to automotive applications • Adjusted EBITDA was $8 million below prior year due to lower polycarbonate sales volumes and an unfavorable net timing variance from decreasing styrene costs during the quarter • Volumes below prior year due to a planned polycarbonate production turnaround in the current year partially offset by higher volume to automotive applications • Adjusted EBITDA was $8 million below prior year due to lower polycarbonate sales volumes and an unfavorable net timing variance from decreasing styrene costs during the quarter $263 $282 Q2'24 Q2'23 Net Sales ($MM) $16 $24 Q2'24 Q2'23 Adjusted EBITDA ($MM) 102 105 Q2'24 Q2'23 Volume* (kt) Vol Price FX Total (5%) (1%) (0%) (7%) *Volumes exclude styrene-related sales |

| 11 Polystyrene • Lower year-over-year volumes due to an intentional reduction of low-margin sales to optimize plant operations and sales mix and customer destocking amid a declining price environment • Adjusted EBITDA was $5 million above prior year due to higher margins in Europe from decreasing raw material costs • 114% year-to-date increase in sales volume of recycled-content-containing polystyrene with a significant margin premium • Lower year-over-year volumes due to an intentional reduction of low-margin sales to optimize plant operations and sales mix and customer destocking amid a declining price environment • Adjusted EBITDA was $5 million above prior year due to higher margins in Europe from decreasing raw material costs • 114% year-to-date increase in sales volume of recycled-content-containing polystyrene with a significant margin premium $175 $220 Q2'24 Q2'23 Net Sales ($MM) $7 $2 Q2'24 Q2'23 Adjusted EBITDA ($MM) 101 122 Q2'24 Q2'23 Volume* (kt) Vol Price FX Total (28%) 8% (0%) (21%) *Volumes exclude styrene-related sales |

| 12 $115 $1,769 $447 2024 2025 Senior Notes 2026 2027 2028 Term Loans 2029 Senior Notes $108 $150 $94 Debt and Liquidity Overview (as of June 30, 2024) Debt Maturity Schedule ($millions) May April Cash and Borrowing Facilities ($millions)* Revolving Credit Facility AR Securitization Cash** $352MM Combined Cash and Availability under Committed Facilities *2026 Revolving Credit Facility available funds of $93.5 million (net of $19.0 million outstanding letters of credit), as well as the Accounts Receivable Securitization Facility with borrowing capacity of $150 million. **Included restricted cash of $2.3 million September |

| 13 2024 Profitability Outlook *For the definition of Adjusted EBITDA, refer to the accompanying press release furnished as Exhibit 99.1 to our Form 8-K dated August 6, 2024 Q3 2024 Net loss of $42 million to $52 million and Adjusted EBITDA* of $65 million to $75 million • Decreasing styrene margins negatively impacting Americas Styrenics • Otherwise, underlying market conditions largely similar to Q2 Full-Year 2024 • Full-year outlook assumes a similar, constrained demand environment to 2023 • Normal year-end seasonality is expected to result in Q4 profitability that is sequentially lower than Q3 |

| 14 FY 2024 Cash Flow Components Item Assumption Capital Expenditures $70 million Cash Interest $200 million Cash Taxes $20 million Restructuring Cost $45 million Turnarounds $10 million Working Capital ~Neutral Net Cash Expenditures $345 million • Lower cash interest assumption compared to prior outlook reflects PIK election on a portion of interest associated with the 2028 Refinance Term Loan • Expect positive Free Cash Flow* in the second half of the year *For the definition of Adjusted EBITDA, refer to the accompanying press release furnished as Exhibit 99.1 to our Form 8-K dated August 6, 2024 |

| 15 Appendix |

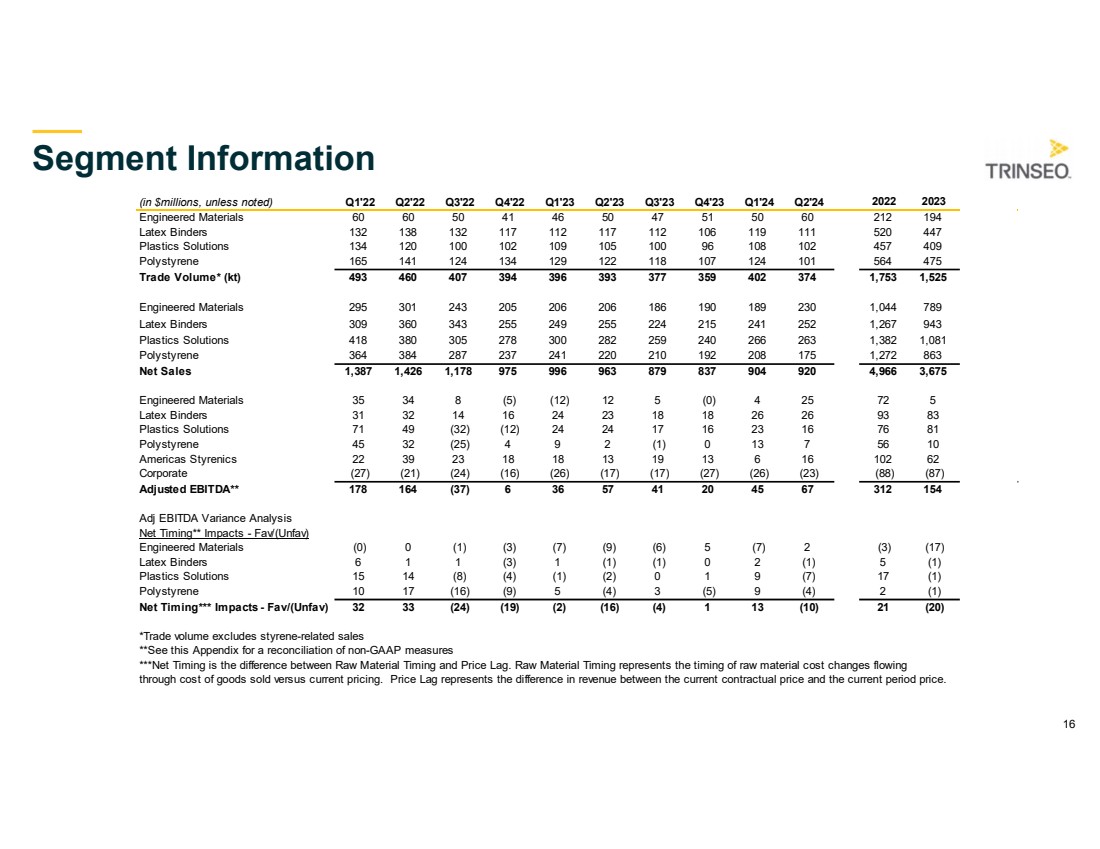

| 16 (in $millions, unless noted) Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 2022 2023 Engineered Materials 60 60 50 41 46 50 47 51 50 60 212 194 Latex Binders 132 138 132 117 112 117 112 106 119 111 520 447 Plastics Solutions 134 120 100 102 109 105 100 96 108 102 457 409 Polystyrene 165 141 124 134 129 122 118 107 124 101 564 475 Trade Volume* (kt) 493 460 407 394 396 393 377 359 402 374 1,753 1,525 Engineered Materials 295 301 243 205 206 206 186 190 189 230 1,044 789 Latex Binders 309 360 343 255 249 255 224 215 241 252 1,267 943 Plastics Solutions 418 380 305 278 300 282 259 240 266 263 1,382 1,081 Polystyrene 364 384 287 237 241 220 210 192 208 175 1,272 863 Net Sales 1,387 1,426 1,178 975 996 963 879 837 904 920 4,966 3,675 Engineered Materials 35 34 8 (5) (12) 12 5 (0) 4 25 72 5 Latex Binders 31 32 14 16 24 23 18 18 26 26 93 83 Plastics Solutions 71 49 (32) (12) 24 24 17 16 23 16 76 81 Polystyrene 45 32 (25) 4 9 2 (1) 0 13 7 56 10 Americas Styrenics 22 39 23 18 18 13 19 13 6 16 102 62 Corporate (27) (21) (24) (16) (26) (17) (17) (27) (26) (23) (88) (87) Adjusted EBITDA** 178 164 (37) 6 36 57 41 20 45 67 312 154 Adj EBITDA Variance Analysis Net Timing** Impacts - Fav/(Unfav) Engineered Materials (0) 0 (1) (3) (7) (9) (6) 5 (7) 2 (3) (17) Latex Binders 6 1 1 (3) 1 (1) (1) 0 2 (1) 5 (1) Plastics Solutions 15 14 (8) (4) (1) (2) 0 1 9 (7) 17 (1) Polystyrene 10 17 (16) (9) 5 (4) 3 (5) 9 (4) 2 (1) Net Timing*** Impacts - Fav/(Unfav) 32 33 (24) (19) (2) (16) (4) 1 13 (10) 21 (20) *Trade volume excludes styrene-related sales **See this Appendix for a reconciliation of non-GAAP measures ***Net Timing is the difference between Raw Material Timing and Price Lag. Raw Material Timing represents the timing of raw material cost changes flowing through cost of goods sold versus current pricing. Price Lag represents the difference in revenue between the current contractual price and the current period price. Segment Information |

| 17 (in $millions, unless noted) Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 2022 2023 Engineered Materials 60 60 50 41 46 50 47 51 50 60 212 194 Latex Binders 132 138 132 117 112 117 112 106 119 111 520 447 Plastics Solutions 134 120 100 102 109 105 100 96 108 102 457 409 Polystyrene 165 141 124 134 129 122 118 107 124 101 564 475 Trade Volume* (kt) 493 460 407 394 396 393 377 359 402 374 1,753 1,525 Engineered Materials 295 301 243 205 206 206 186 190 189 230 1,044 789 Latex Binders 307 354 341 255 248 254 222 215 241 252 1,256 939 Plastics Solutions 396 362 293 271 290 272 246 231 266 263 1,323 1,038 Polystyrene 318 312 248 216 209 193 175 166 208 175 1,093 743 Feedstocks 70 97 53 28 43 37 50 35 - - 249 166 Net Sales 1,387 1,426 1,178 975 996 963 879 837 904 920 4,966 3,675 Engineered Materials 35 34 8 (5) (12) 12 5 (0) 4 25 72 5 Latex Binders 30 29 31 20 26 25 23 19 26 26 111 93 Plastics Solutions 69 46 (15) (9) 26 25 22 16 23 16 91 89 Polystyrene 45 23 19 12 16 6 9 2 13 7 99 33 Feedstocks 4 14 (78) (16) (11) (7) (19) (4) - - (75) (41) Americas Styrenics 22 39 23 18 18 13 19 13 6 16 102 62 Corporate (27) (21) (24) (16) (26) (17) (17) (27) (26) (23) (88) (87) Adjusted EBITDA** 178 164 (37) 6 36 57 41 20 45 67 312 154 Adj EBITDA Variance Analysis Net Timing** Impacts - Fav/(Unfav) Engineered Materials (0) 0 (1) (3) (7) (9) (6) 5 (7) 2 (3) (17) Latex Binders 3 (3) 7 (1) (0) (0) (2) 1 2 (1) 6 (1) Plastics Solutions 11 10 (1) (2) (2) (1) (1) 2 9 (7) 17 (2) Polystyrene 5 7 (6) (4) 1 (2) 2 (3) 9 (4) 1 (1) Feedstocks 13 19 (23) (8) 6 (4) 4 (4) - - 1 1 Net Timing*** Impacts - Fav/(Unfav) 32 33 (24) (19) (2) (16) (4) 1 13 (10) 21 (20) *Trade volume excludes styrene-related sales **See this Appendix for a reconciliation of non-GAAP measures ***Net Timing is the difference between Raw Material Timing and Price Lag. Raw Material Timing represents the timing of raw material cost changes flowing through cost of goods sold versus current pricing. Price Lag represents the difference in revenue between the current contractual price and the current period price. Segment Information – Excluding Feedstocks Recast |

| 18 (in $millions, unless noted) Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 2022 2023 Net Income (Loss) 16.7 37.4 (119.8) (365.3) (48.9) (349.0) (38.4) (265.0) (75.5) (67.8) (430.9) (701.3) Net Income (Loss) from discontinued operations (0.4) 0.3 (1.9) (1.0) - - - - - - (2.9) 0.0 Net Income (Loss) from continuing operations 17.1 37.1 (117.9) (364.3) (48.9) (349.0) (38.4) (265.0) (75.5) (67.8) (428.0) (701.3) Interest expense, net 21.9 25.4 30.4 35.3 38.3 40.2 46.6 63.3 63.0 64.7 112.9 188.4 Provision for (benefit from) income taxes 22.6 30.8 (12.1) (83.0) (16.7) (25.1) (17.7) 127.9 5.4 20.3 (41.6) 68.4 Depreciation and amortization 53.0 48.1 45.9 89.8 56.0 52.5 38.2 74.4 45.0 46.6 236.9 221.2 EBITDA 114.6 141.4 (53.7) (322.2) 28.7 (281.4) 28.7 0.6 37.9 63.8 (119.8) (223.3) Other items 23.4 22.1 14.8 11.0 3.6 2.6 7.2 8.0 1.3 2.5 71.2 21.4 Restructuring and other charges 0.4 (1.5) - 17.0 3.7 1.5 13.8 12.5 9.4 4.0 15.9 31.5 Net gain on disposition of businesses and assets (0.3) (1.5) - - - (16.3) (9.3) 0.0 (3.6) (3.5) (1.8) (25.6) Acquisition transaction and integration net costs 3.2 2.7 0.4 0.4 - 0.1 - (1.5) - - 6.6 (1.4) Acquisition purchase price hedge loss (gain) - - - - - - - - - - - - European Commission request for information 35.6 - - 0.6 - - - - - - 36.2 - Goodwill impairment charges - - - 297.1 - 349.0 - - - - 297.1 349.0 Asset impairment charges or write-offs 0.7 1.3 1.9 2.4 0.3 1.3 0.5 0.6 - - 6.3 2.7 Adjusted EBITDA 177.6 164.5 (36.6) 6.3 36.3 56.8 40.9 20.2 45.0 66.8 311.7 154.3 Adjusted EBITDA to Adjusted Net Income Adjusted EBITDA 177.6 164.5 (36.6) 6.3 36.3 56.8 40.9 20.2 45.0 66.8 311.7 154.3 Interest expense, net 21.9 25.4 30.4 35.3 38.3 40.2 46.6 63.3 63.0 64.7 112.9 188.4 Provision for (benefit from) income taxes - Adjusted 25.6 25.7 (9.6) (18.8) (20.0) 34.8 (18.6) 12.1 4.2 5.9 22.8 8.3 Depreciation and amortization - Adjusted 50.9 47.2 45.1 49.9 53.3 49.5 49.2 50.0 46.3 47.9 193.1 202.0 Adjusted Net Income (Loss) 79.3 66.2 (102.5) (60.1) (35.3) (67.7) (36.3) (105.2) (68.5) (51.7) (17.1) (244.4) Wtd Avg Shares - Diluted (000) 38,139 36,996 35,176 34,974 35,032 35,153 35,191 35,200 35,250 35,307 35,941 35,274 Adjusted EPS - Diluted ($) 2.08 1.79 (2.91) (1.72) (1.01) (1.92) (1.03) (2.99) (1.94) (1.46) (0.48) (6.93) Adjustments by Statement of Operations Caption Cost of sales - - - - - 1.2 0.4 5.5 - - 0.0 7.1 SG&A 27.0 22.9 16.0 28.4 7.3 (12.1) 15.4 13.5 7.1 6.5 94.3 24.1 Impairment and other charges 36.3 1.3 1.9 300.1 0.3 349.1 - 0.6 - - 339.6 350.0 Acquisition purchase price hedge (gain) loss - - - - - - - - - - 0.0 0.0 Other expense (income), net (0.3) (1.1) (0.8) - - - (3.6) - - (3.5) (2.2) (3.6) Total EBITDA Adjustments 63.0 23.1 17.1 328.5 7.6 338.2 12.2 19.6 7.1 3.0 431.7 377.6 Free Cash Flow Reconciliation Cash provided by (used in) operating activities (5.0) (83.0) 97.6 33.9 45.4 56.5 29.3 17.5 (66.2) (41.9) 43.5 148.7 Capital expenditures (24.8) (31.5) (38.5) (54.2) (21.8) (13.8) (13.5) (20.6) (15.7) (14.2) (149.0) (69.7) Free Cash Flow (29.8) (114.5) 59.1 (20.3) 23.6 42.7 15.8 (3.1) (81.9) (56.1) (105.5) 79.0 US GAAP to Non-GAAP Reconciliation NOTE: For definitions of non-GAAP measures as well as descriptions of current period reconciling items from Net Income to Adjusted EBITDA and to Adjusted Net Income, refer to the accompanying press release furnished as Exhibit 99.1 to our Form 8-K dated August 7, 2024. Totals may not sum due to rounding. |

| 19 Third Quarter (In $millions, unless noted) September 30, 2024 Adjusted EBITDA 65 - 75 Interest expense, net 65 Provision for income taxes 5 Depreciation and amortization 47 Reconciling items to Adjusted EBITDA(1) 0 Net Income (loss) (52) - (42) Reconciling items to Adjusted Net Income (Loss) (1) 0 Adjusted Net Income (Loss) (52) - (42) Weighted avg shares - diluted (MM) 35.3 EPS - diluted ($) (1.45) - (1.17) Adjusted EPS ($) (1.45) - (1.17) US GAAP to Non-GAAP Reconciliation Profitability Outlook (1) Reconciling items to Adjusted EBITDA and Adjusted Net Income (Loss) are not typically forecasted by the Company based on their nature as being primarily driven by transactions that are not part of the core operations of the business and, as a result, cannot be estimated without unreasonable cost or uncertainty. For potential reconciling items to Adjusted EBITDA and Adjusted Net Income (Loss) during 2024 are not reflected. NOTE: For definitions of non-GAAP measures as well as descriptions of current period reconciling items from Net Income (Loss) to Adjusted EBITDA and to Adjusted Net Income (Loss), refer to the accompanying press release furnished as Exhibit 99.1 to our Form 8-K dated August 6, 2024. Totals may not sum due to rounding. |