Table of Contents

As filed with the United States Securities and Exchange Commission on December 24, 2013

Registration No. 333-191460

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Trinseo Materials Operating S.C.A. | Trinseo Materials Finance, Inc. | |

| (Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) |

| Luxembourg | Delaware | |

| (State or other jurisdiction of incorporation or organization) |

(State or other jurisdiction of incorporation or organization) |

| 2821 | 2821 | |

| (Primary Standard Industrial Classification Code Number) |

(Primary Standard Industrial Classification Code Number) |

| 98-0663708 | 46-2429861 | |

| (I.R.S. Employer Identification No.) |

(I.R.S. Employer Identification No.) |

1000 Chesterbrook Boulevard, Suite 300

Berwyn, Pennsylvania 19312

(610) 240-3200

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Curtis S. Shaw

Executive Vice President, General Counsel and Corporate Secretary

1000 Chesterbrook Boulevard, Suite 300

Berwyn, Pennsylvania 19312

(610) 240-3200

(Address, including zip code, and telephone number, including area code, of registrants’ agent for service of process)

and the Guarantors identified in Table of Additional Registrant Guarantors below

Ronald L. Francis, Jr.

Nicholas A. Bonarrigo

Reed Smith LLP

Reed Smith Centre

225 Fifth Avenue

Pittsburgh, Pennsylvania 15222

412-288-3131

(Copies of all communications, including communications sent to agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per share |

Proposed maximum aggregate |

Amount of registration fee | ||||

| 8.750% Senior Secured Notes due 2019 |

$1,325,000,000 | 100% | $1,325,000,000 | $180,730(2) | ||||

| Guarantees of 8.750% Senior Secured Notes due 2019(3) |

N/A | N/A | N/A | N/A(4) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) of the Securities Act of 1933. |

| (2) | Previously paid. |

| (3) | Certain subsidiaries of Trinseo S.A. guarantee the 8.750% Senior Secured Notes due 2019. See the table below for a complete list of the guarantors. |

| (4) | Pursuant to Rule 457(n) under the Securities Act, no separate consideration will be received for the Guarantees of the 8.750% Senior Secured Notes due 2019. Therefore, no registration fee is attributed to them. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

The address and telephone number of the principal executive offices of each registrant is 1000 Chesterbrook Boulevard, Suite 300, Berwyn, Pennsylvania 19312, (610) 240-3200. The agent for service of process for each registrant is Curtis S. Shaw, Executive Vice President, General Counsel and Corporate Secretary, 1000 Chesterbrook Boulevard, Suite 300, Berwyn, Pennsylvania 19312, (610) 240-3200.

| Exact Name of Registrant Guarantor as Specified in its Charter |

State or Other Jurisdiction of Organization |

I.R.S. Employer Identification No. (if applicable) | ||

| Styron Australia Pty Ltd |

Australia | 98-0650032 | ||

| Styron Belgium B.V.B.A. |

Belgium | 98-0646254 | ||

| Styron Canada ULC |

Canada | N/A | ||

| Styron LLC |

Delaware | 80-0512509 | ||

| Styron US Holding, Inc. |

Delaware | 27-2552128 | ||

| Styron Deutschland GmbH |

Germany | 98-0647265 | ||

| Styron Deutschland Anlagengesellschaft mbH |

Germany | 98-0646376 | ||

| Styron (Hong Kong) Limited |

Hong Kong | 98-0664499 | ||

| Styron Investment Holdings Ireland |

Ireland | N/A | ||

| Styron Materials Ireland |

Ireland | 98-0665096 | ||

| Trinseo S.A. |

Luxembourg | N/A | ||

| Styron Luxco S.à r.l. |

Luxembourg | 98-0651660 | ||

| Styron Holding S.à r.l. |

Luxembourg | N/A | ||

| Trinseo Materials S.à r.l. |

Luxembourg | 98-1019768 | ||

| Styron Finance Luxembourg S.à r.l. |

Luxembourg | 98-0651660 | ||

| Styron Netherlands B.V. |

Netherlands | 98-0646258 | ||

| Styron Holding B.V. |

Netherlands | 98-0646256 | ||

| Styron Singapore Pte. Ltd. |

Singapore | 98-0646253 | ||

| Styron Holdings Asia Pte. Ltd. |

Singapore | N/A | ||

| Styron Sverige AB |

Sweden | 98-0603119 | ||

| Styron Europe GmbH |

Switzerland | 98-0598139 | ||

| Styron UK Limited |

United Kingdom | 98-0595816 |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is neither an offer to sell nor a solicitation of an offer to purchase these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION—DATED DECEMBER 24, 2013

PROSPECTUS

TRINSEO MATERIALS OPERATING S.C.A.

TRINSEO MATERIALS FINANCE, INC.

OFFER TO EXCHANGE

$1,325,000,000 aggregate principal amount of outstanding

8.750% Senior Secured Notes due 2019 and Related Guarantees

for

$1,325,000,000 aggregate principal amount of

8.750% Senior Secured Notes due 2019 and Related Guarantees

that have been registered under the Securities Act of 1933

We are offering to exchange up to $1,325,000,000 of our outstanding 8.750% Senior Secured Notes due 2019 and certain related guarantees, which were issued on January 29, 2013, which have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) (which we refer to collectively as the “Original Notes”), for an equal aggregate principal amount of our 8.750% Senior Secured Notes due 2019 and certain related guarantees, which have been registered under the Securities Act (which we refer to collectively as the “Exchange Notes”). The terms of the Exchange Notes to be issued in this exchange offer are substantially identical to the terms of the Original Notes, except that provisions relating to transfer restrictions, registration rights and additional interest will not apply to the Exchange Notes. The Exchange Notes will represent the same debt as the Original Notes, and will be issued under the same indenture, as supplemented (which we refer to as the “Indenture”). The Exchange Notes will be guaranteed by the issuers’ direct and indirect parent companies, including Trinseo S.A., Styron Luxco S.à r.l., Styron Holding S.à r.l., Trinseo Materials S.à r.l. and Styron Investment Holdings Ireland, and certain existing and future 100% owned subsidiaries of Trinseo S.A., other than Styron France S.A.S. and Styron Spain S.L. The guarantees of the guarantors are joint and several, full and unconditional, provided that guarantees of the subsidiary Guarantors are subject to customary release provisions. We are offering the Exchange Notes pursuant to a registration rights agreement relating to the Original Notes. We refer to the Original Notes and the Exchange Notes collectively as the “notes.”

Terms of the Exchange Offer

| • | This exchange offer expires at 5:00 p.m., New York City time, on , 2013 (such date and time, the “Expiration Date” unless we extend or terminate the exchange offer, in which case the “Expiration Date” will mean the latest time to which we extend the exchange offer). |

| • | Tenders of outstanding Original Notes may be withdrawn at any time prior to the Expiration Date. |

| • | The exchange offer is subject to customary conditions that may be waived by us. |

| • | We will not receive any proceeds from the exchange offer. |

| • | The exchange of Original Notes for the Exchange Notes will not be a taxable exchange for U.S. federal income tax purposes (see “Certain U.S. Federal Income Tax Considerations”). |

| • | All Original Notes that are validly tendered and not validly withdrawn prior to the Expiration Date will be exchanged for the Exchange Notes. |

| • | There is no established trading market for the Original Notes or Exchange Notes and we do not intend to list the Exchange Notes on any securities exchange or automated dealer quotation system. |

Each broker-dealer that receives Exchange Notes for its own account pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for outstanding Original Notes where such outstanding Original Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for the period required by the Securities Act, we will make available to any such broker-dealer a prospectus meeting the requirements of the Securities Act, for use in connection with any such resale. See “Plan of Distribution.”

Investing in the Exchange Notes involves a high degree of risk. See “Risk Factors ” beginning on page 26 for a discussion of certain risks that you should consider in connection with participation in the exchange offer.

We are not making an offer to exchange any notes in any jurisdiction where the offer is not permitted.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2013.

Table of Contents

| Page | ||||

| i | ||||

| i | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 10 | ||||

| 15 | ||||

| 25 | ||||

| 26 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 63 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

73 | |||

| 108 | ||||

| 133 | ||||

| 139 | ||||

| 154 | ||||

| SECURITY OWNERSHIP AND CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

159 | |||

| 161 | ||||

| 165 | ||||

| 249 | ||||

| 251 | ||||

| 252 | ||||

| 253 | ||||

| 253 | ||||

| 253 | ||||

| F-1 | ||||

You should rely only upon the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document does not extend to you. You should assume the information appearing in this prospectus and the documents incorporated by reference herein are accurate only as of their respective dates. Our business, financial condition, results of operations, and prospects may have changed since those dates.

Table of Contents

NOTICE TO NEW HAMPSHIRE RESIDENTS ONLY

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE REVISED STATUTES (“RSA”) WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

NOTICE TO CERTAIN EUROPEAN INVESTORS

Luxembourg. The terms and conditions relating to this prospectus have not been approved by and will not be submitted for approval to the Luxembourg Financial Services Authority (Commission de Surveillance du Secteur Financier) (the “CSSF”) for the purposes of public offering or sale in the Grand Duchy of Luxembourg (“Luxembourg”). Accordingly, the notes may not be offered or sold to the public in Luxembourg, directly or indirectly, and neither this prospectus nor any other circular, prospectus, form of application, advertisement, communication or other material may be distributed, or otherwise made available in or from, or published in, Luxembourg except in circumstances which do not constitute a public offer of securities to the public pursuant to the provisions of the Luxembourg act dated July 10, 2005, as amended from time to time (the “Prospectus Act”), relating to prospectuses for securities and implementing the directive 2003/71/EC of November 4, 2003 on prospectus to be published when securities are offered to the public or admitted to trading (and any amendments thereto, including the amending directive 2010/73/EU of November 24, 2010).

Germany. This exchange offer is not a public offering in the Federal Republic of Germany. The notes may only be offered, sold and acquired in accordance with the provisions of the Securities Prospectus Act of the Federal Republic of Germany (the “Securities Prospectus Act,” Wertpapierprospektgesetz, WpPG), as amended, the Commission Regulation (EC) No. 809/2004 of April 29, 2004, as amended, and any other applicable German law. No application has been made under German law to permit a public offer of notes in the Federal Republic of Germany. This prospectus has not been approved for purposes of a public offering of the notes in Germany, and accordingly, the notes may not be, and are not being, offered, sold or advertised publicly or by public promotion in Germany. The notes will only be available to, and this prospectus and any other offering material in relation to the notes is directed only at, and will be distributed only to, persons who are qualified investors (qualifizierte Anleger) within the meaning of Section 2, No. 6 of the Securities Prospectus Act. Any resale of the notes in Germany may only be made in accordance with the Securities Prospectus Act and other applicable laws.

The Netherlands. The notes may not be offered into the Netherlands unless such offer is made exclusively to qualified investors (as defined in the Dutch Financial Supervision Act (Wet op het financieel toezicht)) and to authorized discretionary asset managers acting for the account of retail investors under a discretionary investment management contract.

- i -

Table of Contents

TRADEMARKS, SERVICE MARKS AND COPYRIGHTS

This prospectus includes our trademarks such as TRINSEO™, LOMAX™, TYRIL™, PULSE™, EMERGE™, MAGNUM™, STYRON™, STYRON A-TECH™ and CALIBRE™, which are protected under applicable intellectual property laws and are owned by Trinseo S.A. through its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

MARKET, RANKING, INDUSTRY DATA AND FORECASTS

We obtained the market, industry and competitive position data throughout this prospectus from our own internal estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. We believe our internal company estimates and research are reliable and the definitions of our market and industry are appropriate. However, neither such research nor these definitions have been verified by any independent source. While we are not aware of any misstatements regarding our market, industry or competitive position data presented or relied on herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus. References in this prospectus to our “leading” market positions and similar disclosures are measured based upon production capacity, which our management believes to be the most reliable measure of our market position.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the U.S. Securities and Exchange Commission (the “SEC”), a registration statement on Form S-4 under the Securities Act, relating to the exchange offer. Following the exchange offer, we will commence filing periodic reports and other information with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This prospectus, which forms part of the registration statement, does not contain all of the information included in the registration statement.

This information is available from us without charge to holders of the notes, upon written or oral request. You should address your request to Trinseo Materials Operating S.C.A., c/o Trinseo S.A., 1000 Chesterbrook Boulevard, Suite 300, Berwyn, PA 19312, Attention: Investor Relations. In order to obtain timely delivery of any documents requested from us, requests must be made no later than five (5) business days before the Expiration Date of the exchange offer.

You may read and copy the registration statement, including the attached exhibits, and any reports, statements or other information that we file, at the Public Reference Room of the SEC’s headquarters located at 100 F Street, N.E. Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 800-SEC-0330. These SEC filings will also be available to the public from commercial document retrieval services and at the SEC’s internet site (http://www.sec.gov).

We maintain a website at www.trinseo.com. Our website and the information contained on that site, or accessible through that site, are not incorporated into and are not a part of this prospectus.

- ii -

Table of Contents

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. Forward looking statements may be identified by the use of words like “expect,” “anticipate,” “intend,” “forecast,” “outlook,” “will,” “may,” “might,” “potential,” “likely,” “target,” “plan,” “contemplate,” “seek,” “attempt,” “should,” “could,” “would” or expressions of similar meaning. Forward-looking statements reflect management’s good faith evaluation of information currently available and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Specific factors that may impact performance or other predictions of future actions have, in many but not all cases, been identified in connection with specific forward-looking statements. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. We caution you therefore against relying on any of these forward-looking statements.

Important factors that could cause actual results to differ materially from those in the forward-looking statements include economic, business, competitive, market and regulatory conditions and the following:

| • | our substantial level of indebtedness; |

| • | conditions in the global economy and capital markets; |

| • | volatility in costs or disruption in the supply of the raw materials utilized for our products; |

| • | our loss of market share to other producers of styrene-based chemical products or to producers of other products that can be substituted for our products; |

| • | our compliance with environmental, health and safety laws; |

| • | changes in laws and regulations applicable to our business; |

| • | the unknown future impact, including cost, on our business from the Patient Protection and Affordable Care Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Exchange Act, to which we are not currently subject (including, but not limited to, requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”)), and the rules to be promulgated thereunder; |

| • | our continued synergistic relationship with The Dow Chemical Company; |

| • | losses due to lawsuits arising out of environmental damage or potential injuries associated with exposure to our chemicals; |

| • | local business risks in different countries in which we operate; |

| • | our dependence upon key executive management and our inability to attract and retain other qualified management personnel; |

| • | fluctuations in currency exchange rates; |

| • | failure of our assumptions and projections to be accurate; |

| • | hazards associated with chemical manufacturing; |

| • | our inability to continue technological innovation and successful introduction of new products; |

| • | our inability to protect our trademarks, patents or other intellectual property rights; |

| • | system security risk issues that could disrupt our internal operations or information technology services; |

- iii -

Table of Contents

| • | fluctuations in global energy markets driving commodity feedstock costs; |

| • | the loss of customers; |

| • | seasonality of our business; and |

| • | other risks described in the “Risk Factors” section of this prospectus. |

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements as well as other cautionary statements that are made from time to time in our other public communications. You should evaluate all forward-looking statements made in this prospectus in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this prospectus are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

- iv -

Table of Contents

This summary highlights the information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this offering, we encourage you to read this entire prospectus and the documents to which we refer you. You should read the following summary together with the more detailed information and our historical consolidated financial statements and the related notes included elsewhere in this prospectus.

Unless otherwise indicated or required by context, as used in this prospectus, the term “Trinseo” refers to Trinseo S.A., a public limited liability company (société anonyme) existing under the laws of Luxembourg, and not its subsidiaries. The terms “Company,” “we,” “us” and “our” refer to Trinseo and its consolidated subsidiaries, taken as a combined entity and as required by context, may also include our business as owned by our predecessor Dow (as defined below) for any dates prior to June 17, 2010. The terms “Trinseo Materials Operating S.C.A. and Trinseo Materials Finance, Inc.” and “the Issuers” refer to Trinseo’s indirect subsidiaries, Trinseo Materials Operating S.C.A., a Luxembourg partnership limited by shares incorporated under the laws of Luxembourg, and Trinseo Materials Finance, Inc., a Delaware corporation, and not their subsidiaries. All financial data provided in this prospectus is the financial data of Trinseo and its consolidated subsidiaries unless otherwise indicated.

Prior to our formation, our business was wholly owned by The Dow Chemical Company (“Dow”). On June 17, 2010, we were acquired by investment funds advised or managed by Bain Capital Partners, LLC (collectively, “Bain Capital”). We refer to our acquisition by Bain Capital as the “Acquisition.”

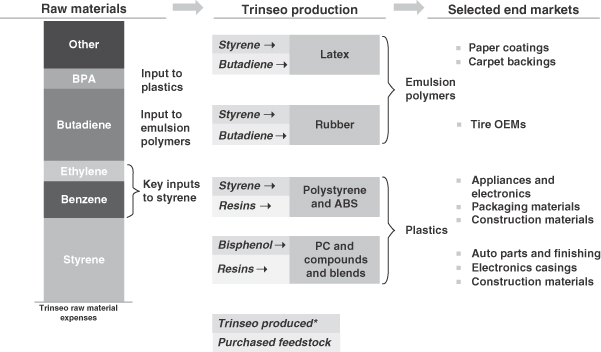

Our Company

We are a leading global materials company engaged in the manufacture and marketing of standard, specialty and customized emulsion polymers and plastics. We believe that we have leading market positions in many of the markets in which we compete and that we have developed these strong market positions due to our technological differentiation, diverse global manufacturing base, long-standing customer relationships, commitment to sustainable solutions and advantaged cost positions. We compete in growing global market segments driven in part by improving living standards in emerging markets and increasing environmental awareness leading to increased demand for higher fuel efficiency and lighter-weight materials. We develop new and improved products and processes that enhance our customers’ sustainability. In addition, we believe our increasing business presence in developing regions such as China, Southeast Asia and Eastern Europe further enhances our prospects.

We develop customized products for global, diversified end markets including coated paper and packaging board, carpet and artificial turf backing, automotive applications including tires, food service packaging, appliances, medical, consumer electronics and construction applications, among others. We have long-standing relationships with a diverse base of global customers, many of whom are leaders in their markets and rely on us for formulation, customization, and compounding expertise. Certain of our customized products typically represent a low portion of finished product production costs, but impart critical functionality contributing to substantial customer loyalty. We partner with our customers to find sustainable solutions for our products. We operate under four segments: Latex, Synthetic Rubber, Styrenics and Engineered Polymers. Our major products include styrene-butadiene latex (“SB latex”), styrene-acrylate latex (“SA latex”), solution styrene-butadiene rubber (“SSBR”), lithium polybutadiene rubber (“Li-PBR”), emulsion styrene-butadiene rubber (“ESBR”), nickel polybutadiene rubber (“Ni-PBR”), polystyrene, acrylonitrile-butadiene-styrene (“ABS”), styrene-acrylonitrile (“SAN”), ignition resistant polystyrene, polycarbonate (“PC”) resins, compounds and blends, and polypropylene compounds.

- 1 -

Table of Contents

We are a global business with a diverse revenue mix by geography and significant operations around the world. Our operations in Europe and the Middle East; Asia Pacific (which includes Asia as well as Australia and New Zealand), Latin America (including Mexico) and others; and the United States, generated approximately 61.0%, 26.5%, and 12.5%, respectively, of our net sales for the year ended December 31, 2012 and 60.0%, 27.3%, and 12.7%, respectively, of our net sales for the nine month period ended September 30, 2013. Our production facilities include 35 manufacturing plants (which include a total of 83 production units) at 27 sites in 14 countries, inclusive of joint ventures and contract manufacturers, allowing us to serve our customers on a global basis. Our manufacturing locations include sites in high-growth emerging markets such as China, Indonesia and Brazil. Additionally, we operate a number of R&D facilities globally, including mini plants, development centers and pilot coaters, and we believe these to be critical to our global presence and innovation capabilities.

Segment Overview

We operate four segments under two principal business units. Our Emulsion Polymers business unit includes a Latex segment and a Synthetic Rubber segment. Our Plastics business unit includes a Styrenics segment and an Engineered Polymers segment.

| Emulsion Polymers | Plastics | |||||||

| Latex | Synthetic Rubber | Styrenics | Engineered Polymers | |||||

| Major products |

• Styrene- butadiene latex (“SB latex”) |

• Solution styrene- butadiene rubber (“SSBR”) |

• Polystyrene | • Polycarbonate resins (“PC”) | ||||

| • Styrene- acrylate latex (“SA latex”) |

• Lithium polybutadiene rubber (“Li- PBR”) |

• Acrylonitrile- butadiene- styrene (“ABS”) |

• Compounds and blends | |||||

| • Emulsion styrene- butadiene rubber (“ESBR”) |

• Styrene- acrylonitrile (“SAN”) |

• Polypropylene compounds | ||||||

| • Nickel polybutadiene rubber (“Ni- PBR”) |

• Ignition resistant polystyrene |

|||||||

- 2 -

Table of Contents

| Emulsion Polymers | Plastics | |||||||

| Latex | Synthetic Rubber | Styrenics | Engineered Polymers | |||||

| Major end-use market |

• Coated paper and packaging board

• Carpet

• Tape

• Cement

• Building |

• Performance tires

• Standard

• Polymer

• Technical |

• Appliances

• Construction/

• Packaging

• Automotive

• Consumer

• Consumer |

• Automotive

• Consumer

• Construction

• Electrical and

• Medical

• Others (including | ||||

Latex Segment

We are a global leader in SB latex, holding a strong market position across the geographies and applications in which we participate, including leading market positions in North America and Europe. We produce SB latex primarily for coated paper used in advertising and magazines, packaging board coatings, carpet and artificial turf backings, as well as a number of performance latex applications.

We believe our development and formulation capabilities contribute to our strong position. Further, we believe our growth prospects in latex are enhanced by our leading position in China, which we believe will contribute a significant portion of global growth in the paper and board market segment over the next decade. We believe our growth prospects could also be enhanced if the recent trends of desirable industry capacity reduction and consolidation, such as the business combinations of the BASF Group and Ciba Holding AG, Omnova Solutions and Eliokem, and Yule Catto & Co plc and PolymerLatex GmbH continued. While the price of one of our principal raw materials, Styrene is still on the rise, the price for Butadiene has gone down significantly. In addition to the advantage gained by the falling Butadiene price, we believe that latex manufacturers who, like us, are offering products made with different chemistries using less expensive raw materials altogether, including vinyl-acetate monomer (“VAM”) based latex and natural binders, may be able to improve their position.

Synthetic Rubber Segment

We are a significant producer of styrene-butadiene and polybutadiene-based rubber products and we have a leading European merchant market position in SSBR. We have very broad synthetic rubber technology and product portfolios in the industry, focusing on specialty products, such as SSBR and Li-PBR, while also producing core products, such as ESBR and Ni-PBR. Our Synthetic Rubber products are extensively used in tires, with additional applications including polymer modification and technical rubber goods. We have strong relationships with most of the top global tire manufacturers and believe we have remained a supplier of choice as a result of our broad rubber portfolio and product customization capabilities.

Our most advanced rubber technology, SSBR, is a critical material for tires with low rolling resistance, which leads to increased fuel efficiency and improved wet-grip, which leads to better traction and safety

- 3 -

Table of Contents

characteristics (“high-performance tires”). We believe our growth prospects are enhanced by increasing demand for high-performance tires, resulting from European Union (“EU”), Korean and Japanese regulatory reforms that are aimed at improving fuel efficiency and reducing CO2 emissions. Our management estimates that through 2014, demand for SSBR will grow substantially faster than global GDP. We believe global increases in fuel efficiency standards will drive additional demand growth for our SSBR technology. Our newly constructed 50 metric kilotons (“kMT”) capacity expansion at our Schkopau, Germany facility started production on October 1, 2012. Based on management’s assumptions, including projected utilization levels, we currently believe the Schkopau capacity expansion could contribute approximately an additional $30 million of EBITDA to our business in 2013.

Styrenics Segment

Our Styrenics segment includes polystyrene, ABS and SAN products, as well as our internal production and sourcing of styrene monomer, a raw material common in SB latex, synthetic rubber and styrenics products. We are a leading producer of polystyrene and mass ABS (“mABS”). We focus our marketing efforts on applications such as appliances and consumer electronics. Within these applications, we have worked collaboratively with customers to develop more advanced grades of plastics such as our high impact polystyrene (“HIPS”) and mABS products. These products offer superior properties, such as rigidity, insulation and colorability, and, in some cases, an improved environmental footprint versus general purpose polystyrene or emulsion ABS. The Styrenics segment also serves the packaging and construction end-use markets, where we have launched a new general purpose polystyrene (“GPPS”) product for improved performance in foam insulation applications.

We believe our growth prospects in Styrenics are enhanced by periodic trends of industry capacity reduction and consolidation in Europe and North America, such as the completed formation of the Styrolution joint venture combining certain INEOS and BASF assets and the prior acquisition of INEOS Nova by INEOS, as well as INEOS’ most recent asset rationalizations in styrene monomer and polystyrene. We expect further consolidation in certain regions of Asia having numerous producers and low asset utilization, which will create opportunities for us, given our scale and geographic reach. We believe our growth prospects are further enhanced by our established manufacturing footprint in the high economic growth regions of Asia and our focus on attractive end markets where improving living standards drive demand for growing appliances and consumer electronics markets.

Engineered Polymers Segment

We are a leading producer of engineered polymers. Our products are predominantly used in the automotive, consumer electronics, construction, and medical markets. We are focused on differentiated products, which we produce in our polymer and compounds and blends manufacturing facilities located across Europe, Asia, North America and Latin America. We believe that the strategic locations of these facilities combined with close customer collaboration offers us a strategic advantage in serving our customers. We believe many of our PC products and more than half of our compounds and blends products are differentiated, based on their physical properties, performance, aesthetic advantages and value chain management that helps us achieve premium pricing. Our history of innovation has contributed to long-standing relationships with customers who are recognized leaders in their respective end markets. We have established a strong market presence in the global automotive and electronics sector, targeting both component suppliers and final product manufacturers. Our Engineered Polymers segment also compounds and blends our PC and mABS plastics into differentiated products within these sectors, as well as compounds of polypropylene. We have also developed compounds containing post-consumer recycle polymers to answer what we believe is a growing need for some leading customers to include recycled content in their products. We are currently focused on reducing costs in order to improve competitiveness in polycarbonate. However, the market for polycarbonate remains very challenging.

- 4 -

Table of Contents

Our Competitive Strengths

We believe we have a number of competitive strengths that differentiate us from our competitors, including:

Leading Market Positions in Attractive Segments and End Markets

We believe that we have leading positions in several of the markets in which we compete, including SB latex, synthetic rubber, mABS products, polystyrene and our engineered polymers products. We attribute our strong market positions to our technological differentiation, diverse global manufacturing base, long-standing customer relationships, superior product and advantaged cost positions. Our strategy is to focus on what we believe are the most attractive segments of the market, where demand is underpinned by global trends driving long-term volume growth. Amongst others, we are focused on the following global trends: improving living standards in emerging markets, fuel efficiency and the increasing use of light-weight materials. We believe that our focus on segments of the market levered to these trends provides us with significant long-term growth opportunities.

Our products serve applications that are affected by improving living standards and increased environmental awareness. For example, our Latex products impart high gloss properties to coated paper that is particularly used in advertising and magazines in emerging markets; our Synthetic Rubber products help to improve fuel efficiency; our Styrenics products and Engineered Polymer products help reduce the weight of vehicles by substituting lighter plastic materials for heavier ones, resulting in improved fuel efficiency.

Technological Advantage and Product Innovation

Most of our materials are critical inputs that significantly impact the functionality, cost to produce and quality of our customers’ products. Many of our products are differentiated by their performance, reliability, customization and value, which are critical factors in our customers’ selection and retention of materials suppliers. For example, our Latex products are critically important to coated paper applications in paper mills that typically have high fixed costs. We believe our technology offers customers a reduced risk of expensive shut-downs, as well as the potential to reduce ongoing total materials costs when SB latex replaces higher cost paper pulp. In addition, we are innovating and developing new and improved products and processes that enhance our customers’ sustainability. Our advanced SSBR technology reduces rolling resistance, resulting in better mileage and fuel efficiency and lower CO2 emissions while at the same time improving the tire’s wet-grip, a measure of braking effectiveness and traction. We believe these are key performance attributes sought by the final customer and also important in meeting European CO2 emissions legislation, which we expect to become a global standard. The plastic parts developed by the Company reduce potential weight per car. Energy usage is substantially reduced by using our plastic in lighting applications. We have a strong track record of continued product innovation, consistently launching improved grades and new products as well as customizing materials for many of our customers.

Diverse Global Reach with Extensive Presence in Emerging Markets

Our production facilities currently include 35 manufacturing plants (which include a total of 83 production units) at 27 sites in 14 countries, inclusive of joint ventures and contract manufacturers. We believe our diverse locations provide us with a competitive advantage in meeting and anticipating the needs of our global and local customers in both well-established and growing markets. We have a strong presence in Asia, where we supply custom formulated latex products for new paper mills, as well as differentiated engineered polymers, synthetic rubber, and other products.

Long-Standing, Collaborative Customer Relationships

We have long-standing relationships with a diverse base of customers, many of which are well known industry leaders in their respective markets. We have had relationships with many of our customers for 20 years

- 5 -

Table of Contents

or more, helping them to develop and commercialize multiple generations of their products. No single customer accounted for more than 6.0% of our net sales in 2012 and through the first nine months of 2013. We believe we have developed strong relationships through our highly collaborative process, whereby we work with our customers to develop products that meet their critical needs. As part of this process, we test our products at customer sites and work with customers to optimize and customize our product offerings. As a result of our close collaboration, we have historically achieved a high success rate of retaining customers.

Competitive Cost Positions and Flexible Feedstock Sourcing

We believe that our global scale, efficient operations and site integration with Dow have provided us with a competitive cost position for our products. We believe our plants compare favorably across key operational benchmarks, including quality tracking, maintenance costs, and employee productivity. We source our raw materials through a mix of long-term raw material contracts with strategic suppliers and procure raw materials on the open market through short-term contracts or spot transactions.

Experienced Management Team

Our executive leadership team has significant industry experience, including leadership positions within our business units, and significant public chemical company leadership experience.

Our Growth Strategy

We intend to enhance our position as a leading global materials company engaged in the manufacture and marketing of both standard and specialty and customized emulsion polymers and plastics. The key elements of our growth strategy include:

Continue Product Innovation and Technological Differentiation

We intend to continue to address our customers’ critical materials needs by utilizing our technological expertise and leading development capabilities to create specialty grades, new and sustainable products and customized formulations. We believe our technological differentiation positions us to participate in the most attractive, highest growth areas of the markets in which we compete, such as advanced SSBR within Synthetic Rubber, a segment of the market that we believe will grow substantially faster than global GDP through 2014. Our global scale in SB latex allows us to cost-effectively support two pilot coaters where we collaborate with our customers in the development of next generation formulations and leverage regional innovations across our global product platform. We also expect to continue to shift our product mix towards more differentiated products, which offer higher-margin potential, improving the profitability of our business across our portfolio.

Strategic Investments in the Most Attractive Segments of the Market

We plan to make strategic capital investments in what we believe are the most attractive market segments to extend our leadership in these segments, and to meet growing demand. Our new SSBR production line in Schkopau, Germany began production on October 1, 2012, which now expands our capabilities at that facility.

Expand and Deepen Our Presence in Emerging Markets

We believe emerging markets such as China, Southeast Asia, Eastern Europe and the Middle East represent significant, rapidly growing opportunities. Improving living standards, globalization of automotive car platforms and growth in gross domestic product in general in these emerging markets are creating strong demand for our end products. We expect to capitalize on growing demand for our products in emerging markets and expand our share of local demand by deepening our customer base and local capabilities in these geographies.

- 6 -

Table of Contents

Continue to Implement Cost Saving Measures and Focus on Cash Flow Generation

We have launched several corporate-wide initiatives intended to further reduce our costs and increase our competitiveness. These initiatives have identified various opportunities that we believe will enhance cost-saving and productivity. We realized savings of approximately $60.0 million in fiscal year 2012. We continue to actively pursue additional cost savings initiatives which will result in incremental cost savings for 2013.

In addition, we continue to focus on cash flow generation through working capital and capital expenditure management. Following the completion of the SSBR expansion in 2012, management expects capital expenditures will be reduced from approximately $120.0 million in 2012 to approximately $70.0 million in 2013. Our expected annualized cost savings are forward-looking statements based on preliminary estimates and reflect the best judgment of our management but involve a number of risks and uncertainties which could cause actual results to differ materially from those set forth in our estimates and from past results, performance or achievements.

Recent Developments

On July 11, 2013, we announced plans to close our latex manufacturing facility at Altona, Australia. Production has ceased in the third quarter of 2013, which we expect will be followed by decommissioning in the fourth quarter and demolition in early 2014. Our Altona manufacturing facility currently employs 14 individuals, whose roles will be eliminated. The customers supplied by our Altona manufacturing facility will now be supplied by our facility in Merak, Indonesia.

On July 19, 2013, we entered into an asset purchase agreement with Ravago S.A., a Luxembourg corporation. Pursuant to the asset purchase agreement, we agreed to sell to RP Compounds, a subsidiary of Ravago, our Expandable Polystyrene (“EPS”) business, including our EPS manufacturing facility in Schkopau, Germany, as well as related intellectual property and the SCONOPOR™ brand. The sale closed on September 30, 2013. Our EPS manufacturing facility employed 35 individuals and accounted for $99.0 million, or 1.8%, of our net sales revenue for the year ended December 31, 2012 and $69.2 million, or 1.7%, for the nine months ended September 30, 2013. In connection with the EPS asset purchase agreement, we entered into a long-term supply agreement of styrene monomer from our Boehlen, Germany facility. EPS business results of operations were not classified as discontinued operations as the Company will have significant continuing cash flows as a result of a long-term supply agreement of styrene monomer to the EPS business, which was entered into contemporaneously with the sale and purchase agreement. The supply agreement will have an initial term of approximately 10 years from the closing date of the sale and will continue year-to-year thereafter. Under the supply agreement, we will supply a minimum of approximately 77 million pounds and maximum of approximately 132 million pounds of styrene monomer annually or equivalent to 70% to 100% of the EPS business’s historical production consumption.

On October 17, 2013, Brian W. Chu was appointed as a director of Trinseo, to fill in the vacancy so created by Mark A. Verdi’s resignation.

Our History and Structure

Trinseo Materials Operating S.C.A. was incorporated on June 3, 2010, under the name Styron S.à r.l. as a société à responsabilité limitée under Luxembourg law. On July 8, 2011, its name was changed to Trinseo Materials Operating S.à r.l. On July 29, 2011, its corporate form was changed to a Luxembourg partnership limited by shares (société en commandite par actions), and its name was changed to Trinseo Materials Operating S.C.A. Trinseo Materials Finance, Inc., the co-issuer of the notes, was formed as a Delaware corporation by Trinseo Materials Operating S.C.A. Trinseo Materials Finance, Inc. did not receive any proceeds from the notes, does not hold any assets and does not have any

- 7 -

Table of Contents

activities, liabilities, or obligations other than those arising by virtue of being a co-issuer of the notes and other indebtedness to be issued in the future. Trinseo Materials Operating S.C.A. and Trinseo Materials Finance Inc.’s obligations under the Exchange Notes are joint and several. Many of our subsidiaries currently use the company name Styron, and we expect that they will be renamed Trinseo in the future.

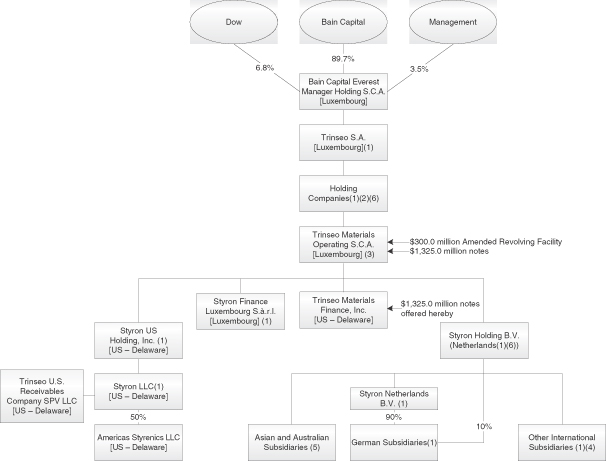

Prior to our formation, our business was wholly owned by Dow. On June 17, 2010, we were acquired by investment funds advised or managed by Bain Capital, with Dow investing $48.8 million for an approximately 7.5% interest in our indirect parent and shareholder, Bain Capital Everest Manager Holding S.C.A. (“Parent”). As of September 30, 2013, Dow held an approximately 6.8% interest in our Parent.

The following chart summarizes our corporate ownership structure as of September 30, 2013.

| (1) | Such entities are guarantors of the notes and guarantors under our Senior Secured Credit Facility. |

| (2) | These holding companies include the following entities: Styron Luxco S.à r.l., Styron Holding S.à r.l. Trinseo Materials S.à r.l. and Styron Investment Holdings Ireland. |

| (3) | Formerly known as Styron S.à r.l. and Trinseo Materials Operating S.à r.l. |

| (4) | Styron France S.A.S., our subsidiary in France, and Styron Spain S.L., our subsidiary in Spain, are guarantors under our Senior Secured Credit Facility but do not guarantee the notes. |

| (5) | Our subsidiary, Styron Holdings Asia Pte. Ltd. and certain of its subsidiaries, are guarantors under our Senior Secured Credit Facility and guarantee the notes. |

| (6) | Styron Investment Holdings Ireland holds 1 Class B Share of Styron Holding B.V. (Netherlands). |

- 8 -

Table of Contents

Corporate Information

Our global operating center is located at 1000 Chesterbrook Boulevard, Suite 300, Berwyn, Pennsylvania 19312, and our telephone number at this address is (610) 240-3200. We maintain a website at www.trinseo.com. Our website and the information contained on that site, or accessible through that site, are not incorporated into and are not a part of this prospectus.

- 9 -

Table of Contents

| Background |

On January 29, 2013, we sold $1,325.0 million aggregate principal amount of 8.750% Senior Secured Notes due 2019 and related guarantees in a private placement exempt from the registration requirements of the Securities Act (the “Original Notes”). All of the Original Notes are eligible to be exchanged for notes which have been registered under the Securities Act (the “Exchange Notes”). The Original Notes and the Exchange Notes are referred to together as the “notes.” |

| Simultaneously with the private placement, we entered into a registration rights agreement with the initial purchasers of the Original Notes (the “Registration Rights Agreement”). Under the Registration Rights Agreement, we are required to prepare and file with the SEC a registration statement covering an offer to the holders of the Original Notes to exchange all of their notes for Exchange Notes. Additionally, we are required to use our reasonable best efforts to (1) cause that registration statement to be declared effective by the SEC and to remain effective for at least 180 days thereafter (or such earlier time when a broker dealer is no longer required to deliver a prospectus in connection with market-making or other trading activities); (2) complete the exchange offer within 60 days of such registration statement becoming effective; and (3) complete the exchange offer no later than January 29, 2014. |

| You may exchange your Original Notes for Exchange Notes in this exchange offer. You should read the discussion under the headings “Summary Description of the Exchange Notes,” “Description of the Exchange Offer” and “Description of the Exchange Notes” for further information regarding the Exchange Notes. |

| Exchange Notes |

Up to $1,325.0 million aggregate principal amount of 8.750% Senior Secured Notes due 2019 and related guarantees, the issuance of which has been registered under the Securities Act. The form and terms of the Exchange Notes are identical to the Original Notes (except that the offer of the Exchange Notes is registered under the Securities Act, the Exchange Notes will not bear legends restricting their transfer, and specified rights under the Registration Rights Agreement, including the provisions providing for payment of additional interest in specified circumstances relating to the exchange offer, will be eliminated for all of the Exchange Notes). |

| The Exchange Offer |

We are offering to issue up to $1,325.0 million aggregate principal amount of the Exchange Notes in exchange for a like principal amount of the Original Notes to satisfy our obligations under the Registration Rights Agreement. Original Notes may be tendered in minimum denominations of principal amount of $2,000 and integral multiples of $1,000 in excess thereof. We will issue the Exchange Notes promptly after expiration of the exchange offer. See |

- 10 -

Table of Contents

| “Description of the Exchange Offer—Terms of the Exchange Offer; Period for Tendering Original Notes.” If all Original Notes are tendered for exchange, there will be $1,325.0 million aggregate principal amount of Exchange Notes that have been registered under the Securities Act, and no Original Notes, outstanding after this exchange offer is completed. |

| The Exchange Notes will bear interest at the same rate and on the same terms as the Original Notes. Interest on the Exchange Notes will accrue from the last interest payment date on which interest was paid on the Original Notes prior to consummation of the exchange offer or, if no interest has been paid on the Original Notes, from January 29, 2013, the date of initial issuance of the Original Notes. We will deem the right to receive any interest accrued but unpaid on the Original Notes waived by you if we accept your Original Notes for exchange. |

| Expiration Date |

This exchange offer will expire at 5:00 p.m. New York City time, on [—], 2013 (the “Expiration Date” unless we extend or terminate the exchange offer in which case the “Expiration Date” will mean the latest date and time to which we extend the exchange offer). |

| Withdrawal of Tenders; Non-Acceptance |

You may withdraw your tender of Original Notes at any time prior to 5:00 p.m., New York City time, on the Expiration Date by delivering a written notice of withdrawal to the exchange agent in conformity with the procedures discussed under “Description of the Exchange Offer —Withdrawal Rights.” If we decide for any reason not to accept any Original Notes tendered for exchange, the Original Notes will be returned to the registered holder at our expense promptly after the expiration or termination of the exchange offer. In the case of the Original Notes tendered by book-entry transfer into the exchange agent’s account at the Depository Trust Company (“DTC”), any withdrawn or unaccepted Original Notes will be credited to the tendering holders participants’ account at DTC. |

| Effect of Not Tendering |

Original Notes that are not tendered or are tendered but not accepted will, following the consummation of the exchange offer, continue to accrue interest and to be subject to the provisions in the Indenture regarding the transfer and exchange of the Original Notes and the existing restrictions on transfer set forth in the legend on the Original Notes. After completion of this exchange offer, we will have no further obligation to provide for the registration under the Securities Act of those Original Notes except in limited circumstances with respect to specific types of holders of Original Notes, and we do not intend to register the Original Notes under the Securities Act. In general, Original Notes, unless registered under the Securities Act, may not be offered or sold except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. |

- 11 -

Table of Contents

| Holders who desire to tender their Original Notes in exchange for Exchange Notes registered under the Securities Act should allow sufficient time to ensure timely delivery. Neither the exchange agent nor we are under any duty to give notification of defects or irregularities with respect to the tenders of Original Notes for exchange. |

| Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions, some of which we may assert or waive. For more information, see “Description of the Exchange Offer—Conditions to the Exchange Offer.” |

| Procedures for Tendering |

You must do the following on or prior to the expiration or termination of the exchange offer to participate in the exchange offer: |

| • | tender your Original Notes by sending (1) the certificates for your Original Notes, in proper form for transfer, (2) a properly completed and duly executed letter of transmittal, with any required signature guarantees, and (3) all other documents required by the letter of transmittal, to Wilmington Trust, National Association, as exchange agent, at the address listed below under the caption “Description of the Exchange Offer—Exchange Agent,” or |

| • | tender your Original Notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly executed letter of transmittal, with any required signature guarantees, or an agent’s message instead of the letter of transmittal, to the exchange agent. In order for a book-entry transfer to constitute a valid tender of your Original Notes in the exchange offer, the exchange agent must receive a confirmation of book-entry transfer of your Original Notes into the exchange agent’s account at DTC prior to the expiration or termination of the exchange offer. For more information regarding the use of book-entry transfer procedures, including a description of the required agent’s message, see the discussion below under the caption “Description of the Exchange Offer—Book-Entry Transfers.” |

| Special Procedures for Beneficial Owners |

If you beneficially own Original Notes registered in the name of a broker, dealer, commercial bank, trust company, or other nominee and you wish to tender your Original Notes in the exchange offer, you should contact the registered holder promptly and instruct it to tender on your behalf. If you wish to tender an Original Note on your own behalf, prior to executing the letter of transmittal and delivering your Original Notes, you must either arrange to have your Original Notes registered in your name or obtain a properly completed bond power from the person in whose name the Original Notes are registered. |

- 12 -

Table of Contents

| Acceptance of Original Notes and Delivery of Exchange Notes |

For each Original Note accepted for exchange, the holder will receive an Exchange Note registered under the Securities Act having a principal amount equal to, and in the denomination of, that of the surrendered Original Note. See “Description of the Exchange Offer—Terms of the Exchange Offer; Period for Tendering Original Notes” and “—Acceptance of Original Notes for Exchange; Delivery of Exchange Notes.” |

| Tenders; Broker-Dealers |

By tendering your Original Notes, you represent to us that: |

| • | you are not our “affiliate,” as defined in Rule 405 under the Securities Act; |

| • | any Exchange Notes you receive in the exchange offer are being acquired by you in the ordinary course of your business; |

| • | neither you nor anyone receiving Exchange Notes from you has any arrangement or understanding with any person to participate in a distribution of the Exchange Notes, as defined in the Securities Act; and |

| • | you are not holding Original Notes that have, or are reasonably likely to have, the status of an unsold allotment in the initial offering of the Original Notes. |

| In addition, each broker-dealer that receives Exchange Notes for its own account in the exchange offer must acknowledge that it acquired the Original Notes for its own account as a result of market-making or other trading activities and must agree that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the Exchange Notes. A participating broker-dealer may use this prospectus, as it may be amended or supplemented from time to time, in connection with resales of Exchange Notes received in exchange for Original Notes where such Original Notes were acquired as a result of market-making activities or other trading activities. For further information regarding resales of Exchange Notes by participating broker-dealers, see “Plan of Distribution.” |

| Resales of Exchange Notes |

Based on interpretations by the staff of the SEC as set forth in no-action letters issued to third parties, we believe that you can offer for resale, resell and otherwise transfer the Exchange Notes you receive in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act so long as: |

| • | you acquire the Exchange Notes in the ordinary course of business; |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in a distribution of the Exchange Notes; |

| • | you are not holding Original Notes that have or are reasonably likely to have the status of an unsold allotment in the initial offering of such Original Notes; |

- 13 -

Table of Contents

| • | you are not an affiliate of ours; and |

| • | you are not a broker-dealer. |

| If any of these conditions is not satisfied and you transfer any Exchange Notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We do not assume, or indemnify you against, any such liability. See the discussion below under the caption “Description of the Exchange Offer—Procedures for Tendering Original Notes” for more information. |

| Guaranteed Delivery Procedures |

If you wish to tender your Original Notes and time will not permit your required documents to reach the exchange agent by the expiration time, or the procedures for book-entry transfer cannot be completed by the expiration time, you may tender your Original Notes according to the guaranteed delivery procedures described in “Description of the Exchange Offer—Guaranteed Delivery.” |

| Minimum Condition |

The exchange offer is not conditioned on any minimum aggregate principal amount of Original Notes being tendered for exchange. |

| Certain Income Tax Considerations |

The exchange of Original Notes for Exchange Notes pursuant to the exchange offer will not be a taxable event for United States federal income tax purposes. You should consult your tax advisor about the tax consequences of this exchange. See “Certain U.S. Federal Income Tax Considerations.” |

| Use of Proceeds |

We will not receive any cash proceeds from the issuance of the Exchange Notes in this exchange offer. |

| Exchange Agent |

Wilmington Trust, National Association is serving as exchange agent in connection with the exchange offer. You can find the address and telephone number of the exchange agent below under the caption “Description of the Exchange Offer—Exchange Agent.” |

| Additional Registration Rights |

We and the guarantors have agreed to file a shelf registration statement for the resale of the notes (and guarantees) if we cannot affect the exchange offer within the time periods listed above and in other circumstances described under the caption “Description of the Exchange Offer—Additional Registration Rights.” |

| Risk Factors |

You should consider carefully all of the information included in this prospectus, and, in particular, the information under the heading “Risk Factors” beginning on page 26 prior to deciding whether to participate in the exchange offer. |

- 14 -

Table of Contents

SUMMARY DESCRIPTION OF THE EXCHANGE NOTES

The summary below describes the principal terms of the Exchange Notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. You should carefully review the “Description of the Exchange Notes” section of this prospectus, which contains a more detailed description of the terms and conditions of the Exchange Notes.

| Issuers |

Trinseo Materials Operating S.C.A., a Luxembourg partnership limited by shares (société en commandite par actions), and Trinseo Materials Finance, Inc., a Delaware corporation. The Issuers’ obligations under the Exchange Notes are joint and several. |

| Securities Offered |

$1,325.0 million aggregate principal amount of 8.750% senior secured notes due 2019 and related guarantees. |

| Maturity |

The Exchange Notes will mature on February 1, 2019. |

| Interest Rate |

Interest on the Exchange Notes will be payable in cash and will accrue at a rate of 8.750% per annum. We will not pay accrued and unpaid interest on the Original Notes that we acquire in the exchange offer. Instead, interest on the notes will accrue from the most recent interest payment date to which interest has been paid or duly provided for, or if no interest has been paid, from and including January 29, 2013, the date on which we issued the Original Notes. |

| Interest Payment Dates |

February 1 and August 1, commencing on February 1, 2014. Interest will accrue from August 1, 2013, the date on which interest was last paid on the Original Notes. |

| Use of Proceeds |

This exchange offer is intended to satisfy certain of our obligations under the Registration Rights Agreement. We will not receive any proceeds from the issuance of the Exchange Notes in the exchange offer. In exchange for each of the Exchange Notes, we will receive Original Notes in like principal amount. We will retire or cancel all of the Original Notes tendered in the exchange offer. Accordingly, issuance of the Exchange Notes will not result in any change in our capitalization. |

| Optional Redemption |

The Issuers may redeem all or part of the Exchange Notes at any time prior to August 1, 2015 by paying a make-whole premium, plus accrued and unpaid interest to the redemption date. The Issuers may redeem all or part of the Exchange Notes at any time after August 1, 2015 at the redemption prices specified in “Description of the Exchange Notes—Optional Redemption.” In addition at any time prior to August 1, 2015, the Issuers may redeem up to 35% of the aggregate principal amount of the notes at a redemption price equal to 108.750% of the face amount thereof plus accrued and unpaid interest, if any, to the redemption date, with the net cash proceeds that we raise in certain equity offerings. The Issuers may also redeem, during any 12-month period commencing from the issue date until August 1, 2015, up to 10% of the original principal amount of the |

- 15 -

Table of Contents

| notes at a redemption price equal to 103% of the principal amount thereof, plus accrued and unpaid interest, if any, to, but not including, the date of redemption. |

| Change of Control Offer |

Upon the occurrence of specific kinds of changes of control, you will have the right, as holders of the Exchange Notes, to cause the Issuers to repurchase some or all of your Exchange Notes at 101% of their face amount, plus accrued and unpaid interest to, but not including, the redemption date. See “Description of the Exchange Notes—Change of Control.” |

| Asset Disposition Offers |

If the Issuers or their restricted subsidiaries sell assets, under certain circumstances, the Issuers will be required to use the net proceeds to make an offer to purchase Exchange Notes at an offer price in cash in an amount equal to 100% of the principal amount of the Exchange Notes plus accrued and unpaid interest to the redemption date. See “Description of the Exchange Notes—Certain Covenants—Limitation on Sales of Assets and Subsidiary Stock.” |

| Security |

Subject to certain exceptions and permitted liens, the notes and the guarantees are secured by a first-priority lien, pari passu (subject to the intercreditor agreement described below) with the liens granted to secure our Senior Secured Credit Facility, on substantially all of the Issuers’ and the Guarantors’ existing and future assets, including but not limited to accounts, chattel paper, documents, equipment, general intangibles, intellectual property, instruments, inventory, investment property, letter of credit rights, goods, material real property and the capital stock held by the Issuers or any of the Guarantors. See “Description of the Exchange Notes—Collateral and Security Documents.” |

| Intercreditor Agreement |

The trustee and the collateral agent under the Indenture and the administrative agent and collateral agent under the Senior Secured Credit Facility have entered into an intercreditor agreement as to the relative priorities of their respective entitlement to proceeds of the assets securing the notes and obligations under the Senior Secured Credit Facility. See “Description of the Exchange Notes—Intercreditor Agreement.” The intercreditor agreement provides, amongst other things, that the proceeds of any collection, sale, disposition or other realization of collateral received in connection with the exercise of remedies (including distributions of cash, securities or other property on account of the value of the collateral in any bankruptcy, insolvency, reorganization or similar proceedings) will be applied first to pay in full all “superpriority obligations,” including amounts due under our Senior Secured Credit Facility, including any post-petition interest with respect thereto, certain hedging obligations and certain cash management obligations of us and the guarantors owed to the lenders under Senior Secured Credit Facility before the holders of the notes and any other pari passu lien indebtedness receive any proceeds. As a result, the claims of holders |

- 16 -

Table of Contents

| of notes to such proceeds will rank behind such claims, including interest. |

| Ranking |

The Exchange Notes and the related guarantees will be the Issuers’ and the Guarantors’ senior secured obligations and will: |

| • | rank equally in right of payment with all existing and future senior secured indebtedness of the Issuers and each Guarantor and pari passu with the Issuers’ and the Guarantors’ indebtedness that is secured by first-priority liens, including our Senior Secured Credit Facility, to the extent of the value of the collateral securing such indebtedness; |

| • | rank senior in right of payment to any existing and future subordinated indebtedness of the Issuers and each Guarantor; |

| • | be effectively senior to any of the Issuers’ and the Guarantors’ junior priority secured indebtedness and unsecured indebtedness to the extent of the value of the collateral for the Exchange Notes; and |

| • | be structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of our non-guarantor subsidiaries. |

| Claims under the Exchange Notes of guarantees thereof will effectively rank behind the claims of holders of “superpriority” obligations, including interest, under our Senior Secured Credit Facility, in respect of proceeds from any enforcement action with respect to the collateral or in any bankruptcy, insolvency or liquidation proceeding. See “Description of the Exchange Notes—Intercreditor Agreement.” |

| As of September 30, 2013: |

| • | the Issuers had $1,330.8 million of total indebtedness (including the notes and other short term borrowings but excluding inter-company indebtedness); and |

| • | our non-guarantor subsidiaries had total liabilities, including trade payables but excluding intercompany liabilities, of $152.5 million, all of which would have been structurally senior to the notes. |

| Guarantees |

The Exchange Notes will be unconditionally guaranteed on a senior secured basis by Trinseo, S.A. (“Trinseo”), Styron Luxco S.à r.l., Styron Holding S.à r.l., Trinseo Materials S.à r.l. and Styron Investment Holdings Ireland, and each of Trinseo’s existing and future wholly-owned subsidiaries that guarantee our Senior Secured Credit Facility, other than its subsidiaries, Styron France S.A.S. and Styron Spain S.L. (together, the “Guarantors”). The guarantees of the Guarantors will be joint and several, full and unconditional, provided that the guarantees of the subsidiary Guarantors are subject to customary release provisions. |

- 17 -

Table of Contents

| For the year ended December 31, 2012 and the nine-months ended September 30, 2013, our non-guarantor subsidiaries represented approximately 24.6% and 23.5% of our consolidated net sales before eliminations, respectively. |

| As of December 31, 2012 and September 30, 2013, our non-guarantor subsidiaries: |

| • | represented 26.3% and 30.4% of our consolidated total assets, excluding intercompany balances, respectively; and |

| • | had 8.2% and 6.9% of our consolidated total liabilities, including trade payables but excluding intercompany liabilities, respectively. |

| Covenants |

The Indenture contains covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| • | incur additional indebtedness or issue certain preferred shares; |

| • | pay dividends on or make other distributions in respect of our membership interests or capital stock or make other restricted payments; |