THIRD QUARTER

2017

Nasdaq:HMST

as of November 17, 2017

Important Disclosures

Forward-Looking Statements

This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance and business plans

and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are

based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not

historical facts, as well as a number of assumptions concerning future events. Forward-looking statements in this release include, among other matters, statements regarding our business plans

and strategies (including our expansion strategies) and the expected effects of those initiatives, general economic trends (particularly those that affect mortgage origination and refinance

activity) and growth scenarios and performance targets. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in

nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our quarterly report on Form 10-Q for

the quarter ended September 30, 2107, which we filed on November 3, 2017. Many of these factors and events that affect the volatility in our stock price and shareholders’ response to those

events and factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These limitations

and risks include without limitation changes in general political and economic conditions that impact our markets and our business, actions by the Federal Reserve Board and financial market

conditions that affect monetary and fiscal policy, regulatory and legislative findings or actions that may increase capital requirements or otherwise constrain our ability to do business, including

restrictions that could be imposed by our regulators on certain aspects of our operations or on our growth initiatives and acquisition activities, risks related to our ability to realize the expected

cost savings from our recent restructuring activities in our single family mortgage lending operations, continue to expand our commercial and consumer banking operations, grow our franchise

and capitalize on market opportunities, manage our overall growth efforts cost-effectively to attain the desired operational and financial outcomes, manage the losses inherent in our loan

portfolio, make accurate estimates of the value of our non-cash assets and liabilities, maintain electronic and physical security of customer data, respond to restrictive and complex regulatory

environment, and attract and retain key personnel. In addition, the volume of our mortgage banking business as well as the ratio of loan lock to closed loan volume may fluctuate due to

challenges our customers may face in meeting current underwriting standards, a change in interest rates, an increase in competition for such loans, changes in general economic conditions,

including housing prices and inventory levels, the job market, consumer confidence and spending habits either nationally or in the regional and local market areas in which the Company does

business, and legislative or regulatory actions or reform that may affect our business or the banking or mortgage industries more generally. Actual results may fall materially short of our

expectations and projections, and we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future

performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to the Company as of the date hereof, and we do

not undertake to update or revise any forward-looking statements, for any reason.

Basis of Presentation of Financial Data

Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending September 30, 2017, and is unaudited, although certain information related to

the year ended December 31, 2016, has been derived from our audited financial statements. All financial data should be read in conjunction with the notes in our consolidated financial

statements.

Non-GAAP Financial Measures

Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures,

may also be found in the appendix, our SEC filings, and in the earnings release available on our web site.

2

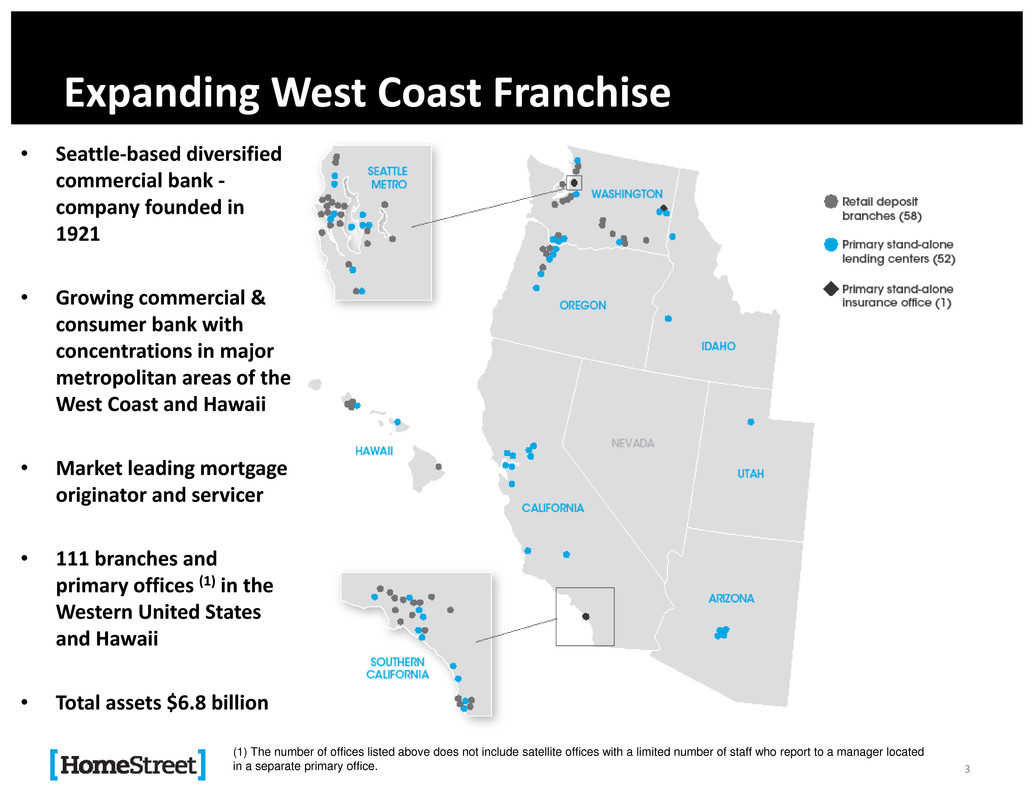

Expanding West Coast Franchise

• Seattle‐based diversified

commercial bank ‐

company founded in

1921

• Growing commercial &

consumer bank with

concentrations in major

metropolitan areas of the

West Coast and Hawaii

• Market leading mortgage

originator and servicer

• 111 branches and

primary offices (1) in the

Western United States

and Hawaii

• Total assets $6.8 billion

3

(1) The number of offices listed above does not include satellite offices with a limited number of staff who report to a manager located

in a separate primary office.

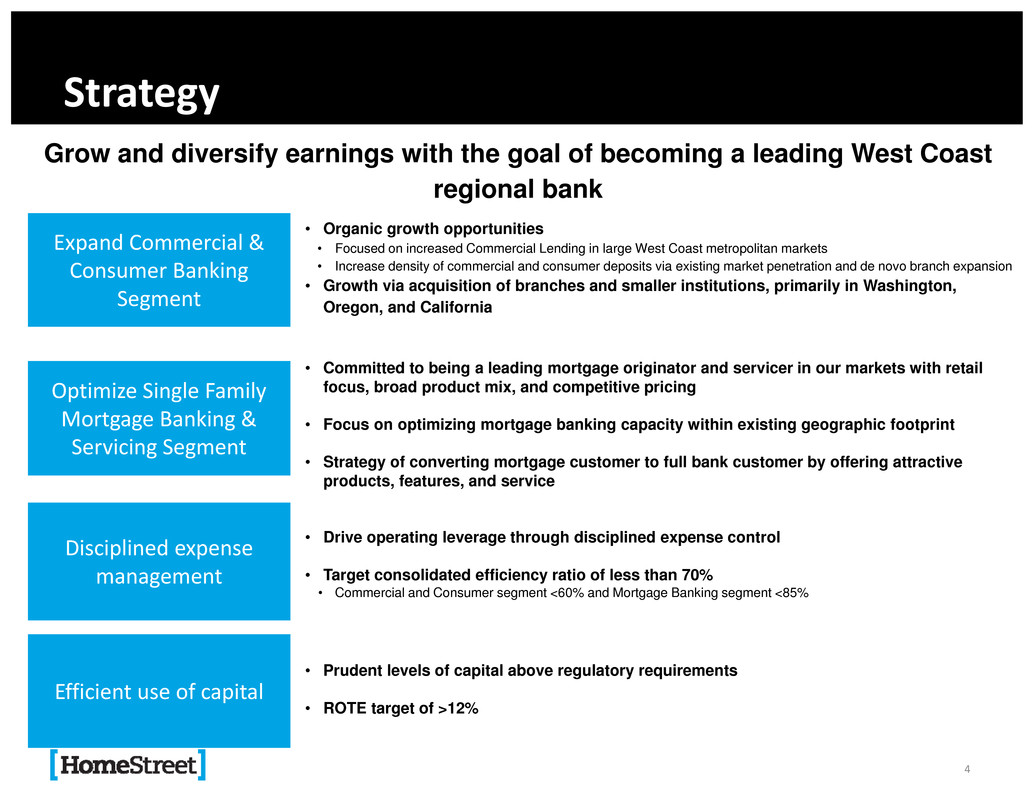

Strategy

Optimize Single Family

Mortgage Banking &

Servicing Segment

• Organic growth opportunities

• Focused on increased Commercial Lending in large West Coast metropolitan markets

• Increase density of commercial and consumer deposits via existing market penetration and de novo branch expansion

• Growth via acquisition of branches and smaller institutions, primarily in Washington,

Oregon, and California

• Committed to being a leading mortgage originator and servicer in our markets with retail

focus, broad product mix, and competitive pricing

• Focus on optimizing mortgage banking capacity within existing geographic footprint

• Strategy of converting mortgage customer to full bank customer by offering attractive

products, features, and service

• Drive operating leverage through disciplined expense control

• Target consolidated efficiency ratio of less than 70%

• Commercial and Consumer segment <60% and Mortgage Banking segment <85%

• Prudent levels of capital above regulatory requirements

• ROTE target of >12%

Expand Commercial &

Consumer Banking

Segment

Disciplined expense

management

Efficient use of capital

Grow and diversify earnings with the goal of becoming a leading West Coast

regional bank

4

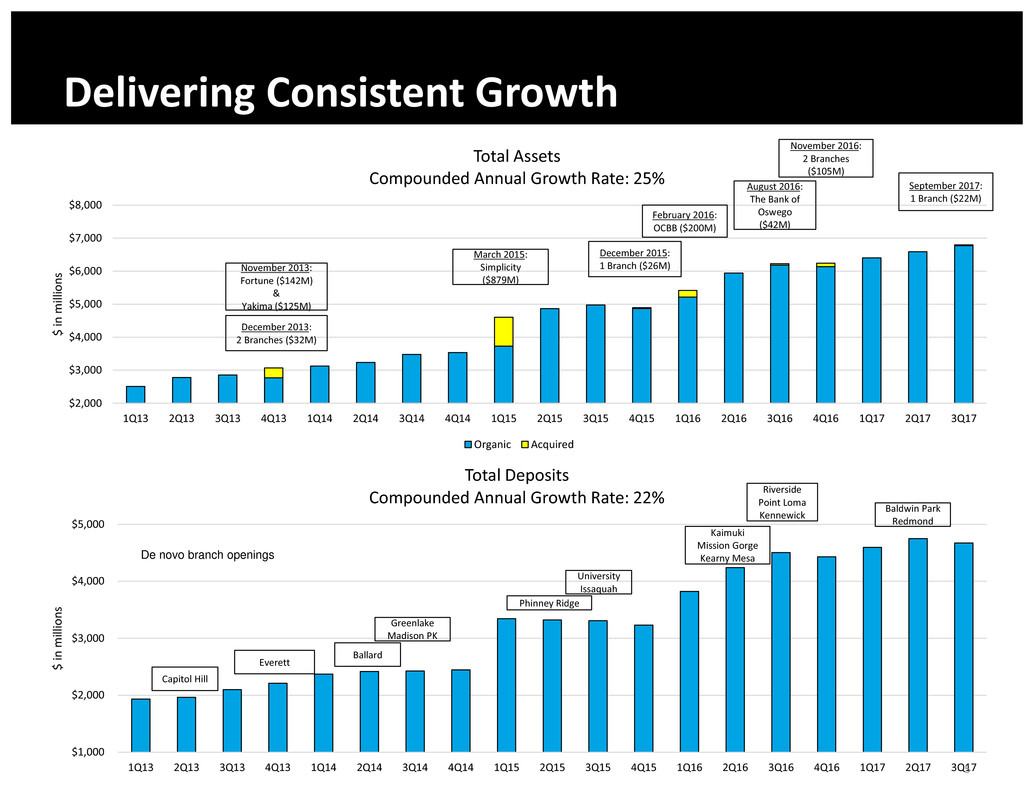

$1,000

$2,000

$3,000

$4,000

$5,000

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

$

i

n

m

i

l

l

i

o

n

s

Total Deposits

Compounded Annual Growth Rate: 22%

Capitol Hill

Everett

Ballard

Greenlake

Madison PK

Phinney Ridge

University

Issaquah

Kaimuki

Mission Gorge

Kearny Mesa

Riverside

Point Loma

Kennewick

Baldwin Park

Redmond

Delivering Consistent Growth

5

De novo branch openings

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

$

i

n

m

i

l

l

i

o

n

s

Total Assets

Compounded Annual Growth Rate: 25%

Organic Acquired

November 2013:

Fortune ($142M)

&

Yakima ($125M)

March 2015:

Simplicity

($879M)

February 2016:

OCBB ($200M)

August 2016:

The Bank of

Oswego

($42M)

December 2015:

1 Branch ($26M)

December 2013:

2 Branches ($32M)

November 2016:

2 Branches

($105M)

September 2017:

1 Branch ($22M)

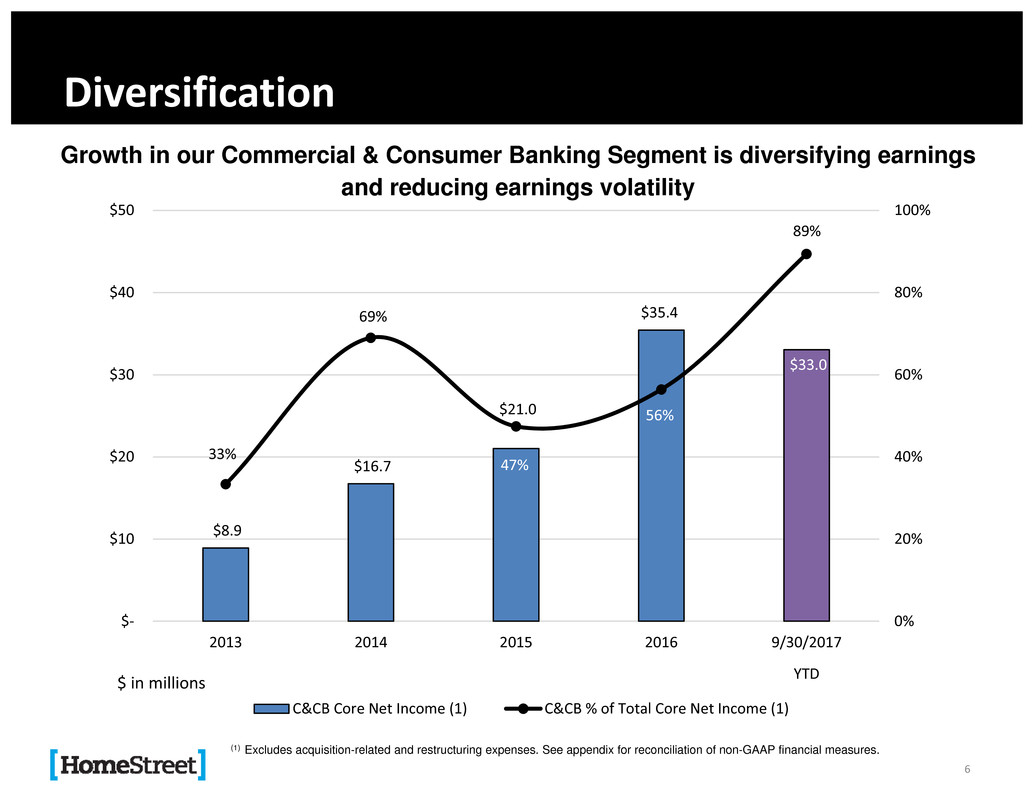

$8.9

$16.7

$21.0

$35.4

$33.0

33%

69%

47%

56%

89%

0%

20%

40%

60%

80%

100%

$‐

$10

$20

$30

$40

$50

2013 2014 2015 2016 9/30/2017

YTD$ in millions

C&CB Core Net Income (1) C&CB % of Total Core Net Income (1)

Diversification

Growth in our Commercial & Consumer Banking Segment is diversifying earnings

and reducing earnings volatility

6

(1) Excludes acquisition-related and restructuring expenses. See appendix for reconciliation of non-GAAP financial measures.

7

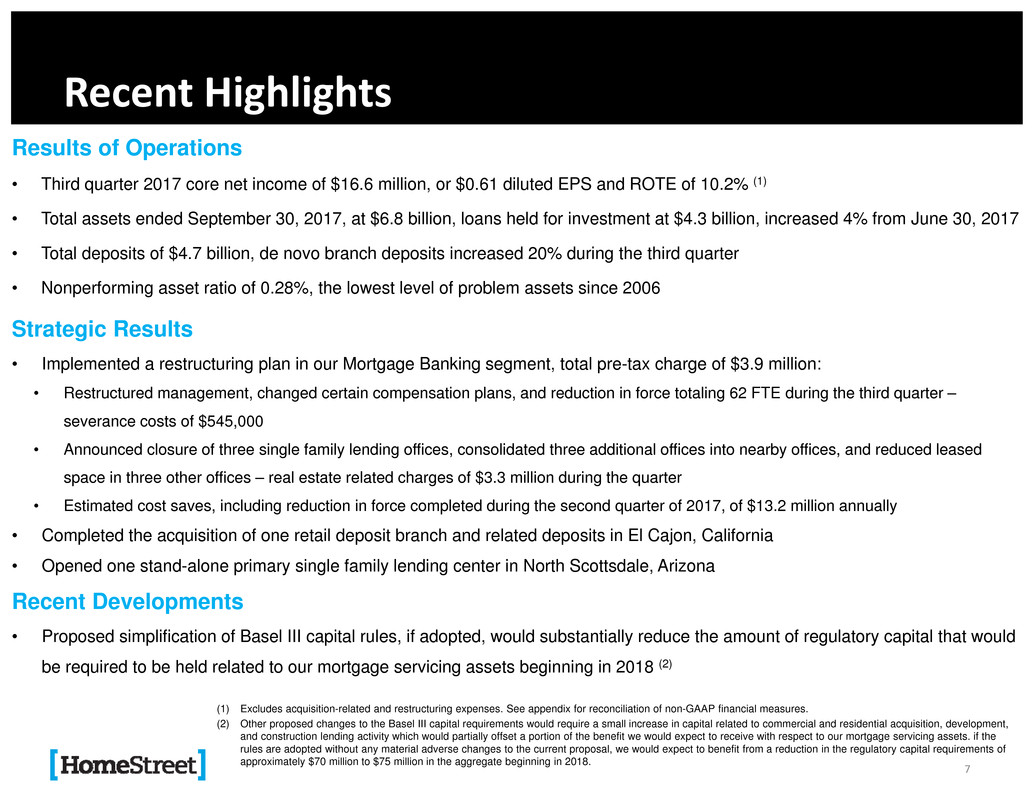

Recent Highlights

Results of Operations

• Third quarter 2017 core net income of $16.6 million, or $0.61 diluted EPS and ROTE of 10.2% (1)

• Total assets ended September 30, 2017, at $6.8 billion, loans held for investment at $4.3 billion, increased 4% from June 30, 2017

• Total deposits of $4.7 billion, de novo branch deposits increased 20% during the third quarter

• Nonperforming asset ratio of 0.28%, the lowest level of problem assets since 2006

Strategic Results

• Implemented a restructuring plan in our Mortgage Banking segment, total pre-tax charge of $3.9 million:

• Restructured management, changed certain compensation plans, and reduction in force totaling 62 FTE during the third quarter –

severance costs of $545,000

• Announced closure of three single family lending offices, consolidated three additional offices into nearby offices, and reduced leased

space in three other offices – real estate related charges of $3.3 million during the quarter

• Estimated cost saves, including reduction in force completed during the second quarter of 2017, of $13.2 million annually

• Completed the acquisition of one retail deposit branch and related deposits in El Cajon, California

• Opened one stand-alone primary single family lending center in North Scottsdale, Arizona

Recent Developments

• Proposed simplification of Basel III capital rules, if adopted, would substantially reduce the amount of regulatory capital that would

be required to be held related to our mortgage servicing assets beginning in 2018 (2)

(1) Excludes acquisition-related and restructuring expenses. See appendix for reconciliation of non-GAAP financial measures.

(2) Other proposed changes to the Basel III capital requirements would require a small increase in capital related to commercial and residential acquisition, development,

and construction lending activity which would partially offset a portion of the benefit we would expect to receive with respect to our mortgage servicing assets. if the

rules are adopted without any material adverse changes to the current proposal, we would expect to benefit from a reduction in the regulatory capital requirements of

approximately $70 million to $75 million in the aggregate beginning in 2018.

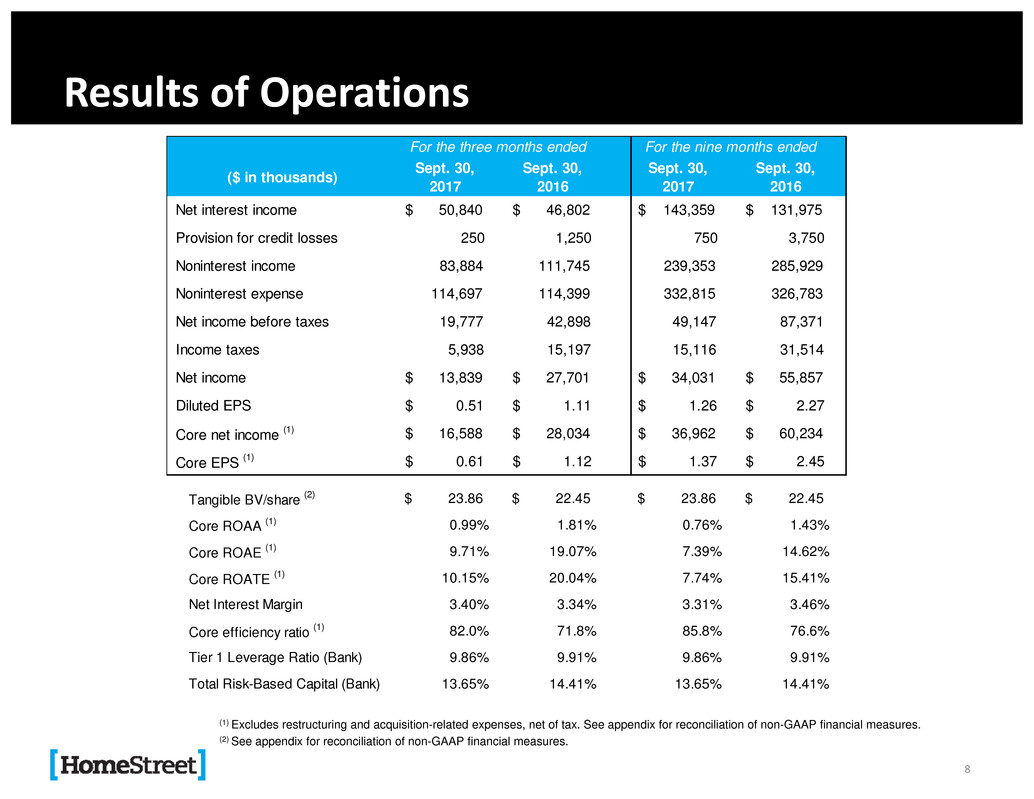

Results of Operations

For the three months ended

(1) Excludes restructuring and acquisition-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

(2) See appendix for reconciliation of non-GAAP financial measures.

For the nine months ended

8

($ in thousands)

Sept. 30,

2017

Sept. 30,

2016

Sept. 30,

2017

Sept. 30,

2016

Net interest income $ 50,840 $ 46,802 $ 143,359 $ 131,975

Provision for credit losses 250 1,250 750 3,750

Noninterest income 83,884 111,745 239,353 285,929

Noninterest expense 114,697 114,399 332,815 326,783

Net income before taxes 19,777 42,898 49,147 87,371

Income taxes 5,938 15,197 15,116 31,514

Net income $ 13,839 $ 27,701 $ 34,031 $ 55,857

Diluted EPS $ 0.51 $ 1.11 $ 1.26 $ 2.27

Core net income (1) $ 16,588 $ 28,034 $ 36,962 $ 60,234

Core EPS (1) $ 0.61 $ 1.12 $ 1.37 $ 2.45

Tangible BV/share (2) $ 23.86 $ 22.45 $ 23.86 $ 22.45

Core ROAA (1) 0.99% 1.81% 0.76% 1.43%

Core ROAE (1) 9.71% 19.07% 7.39% 14.62%

Core ROATE (1) 10.15% 20.04% 7.74% 15.41%

Net Interest Margin 3.40% 3.34% 3.31% 3.46%

Core efficiency ratio (1) 82.0% 71.8% 85.8% 76.6%

Tier 1 Leverage Ratio (Bank) 9.86% 9.91% 9.86% 9.91%

Total Risk-Based Capital (Bank) 13.65% 14.41% 13.65% 14.41%

For the three months ended For the nine months ended

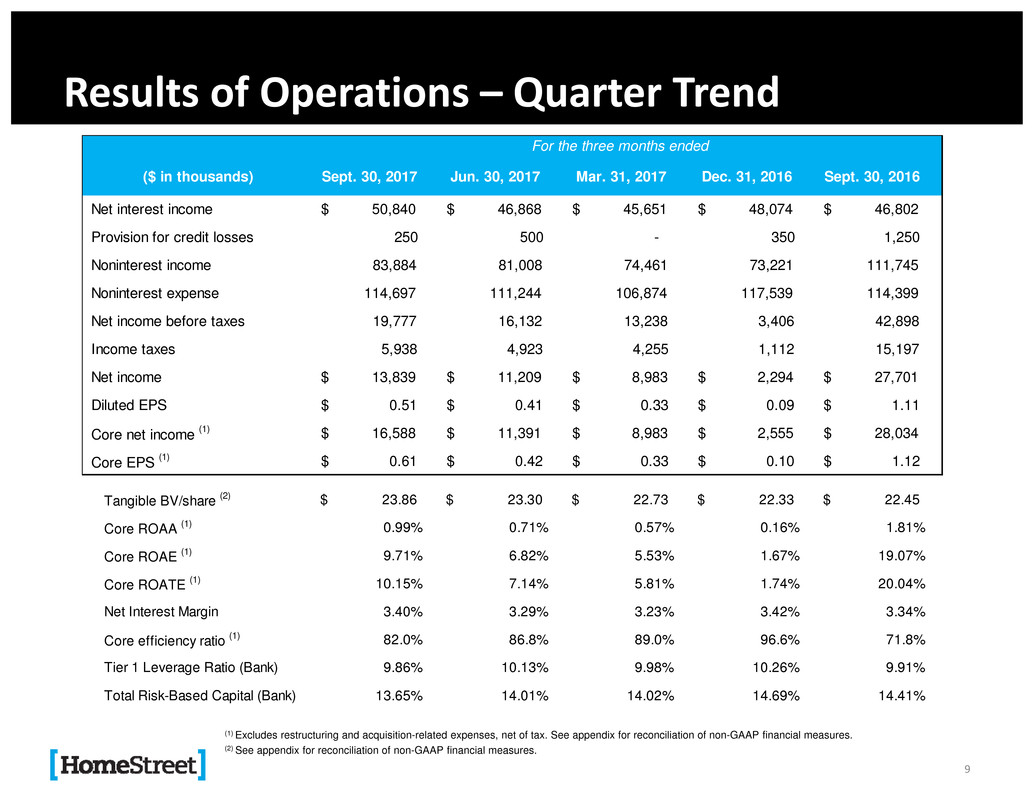

Results of Operations – Quarter Trend

For the three months ended

(1) Excludes restructuring and acquisition-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

(2) See appendix for reconciliation of non-GAAP financial measures.

For the nine months ended

9

($ in thousands) Sept. 30, 2017 Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016

Net interest income $ 50,840 $ 46,868 $ 45,651 $ 48,074 $ 46,802

Provision for credit losses 250 500 - 350 1,250

Noninterest income 83,884 81,008 74,461 73,221 111,745

Noninterest expense 114,697 111,244 106,874 117,539 114,399

Net income before taxes 19,777 16,132 13,238 3,406 42,898

Income taxes 5,938 4,923 4,255 1,112 15,197

Net income $ 13,839 $ 11,209 $ 8,983 $ 2,294 $ 27,701

Diluted EPS $ 0.51 $ 0.41 $ 0.33 $ 0.09 $ 1.11

Core net income (1) $ 16,588 $ 11,391 $ 8,983 $ 2,555 $ 28,034

Core EPS (1) $ 0.61 $ 0.42 $ 0.33 $ 0.10 $ 1.12

Tangible BV/share (2) $ 23.86 $ 23.30 $ 22.73 $ 22.33 $ 22.45

Core ROAA (1) 0.99% 0.71% 0.57% 0.16% 1.81%

Core ROAE (1) 9.71% 6.82% 5.53% 1.67% 19.07%

Core ROATE (1) 10.15% 7.14% 5.81% 1.74% 20.04%

Net Interest Margin 3.40% 3.29% 3.23% 3.42% 3.34%

Core efficiency ratio (1) 82.0% 86.8% 89.0% 96.6% 71.8%

Tier 1 Leverage Ratio (Bank) 9.86% 10.13% 9.98% 10.26% 9.91%

Total Risk-Based Capital (Bank) 13.65% 14.01% 14.02% 14.69% 14.41%

For the three months ended

3.34%

0.03

0.032

0.034

0.036

0.038

0.04

0.042

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

N

e

t

I

n

t

e

r

e

s

t

M

a

r

g

i

n

(

%

)

N

e

t

I

n

t

e

r

e

s

t

I

n

c

o

m

e

(

i

n

m

i

l

l

i

o

n

s

) $46.8

$48.1

$45.7 $46.9

$50.8

3.34%

3.42%

3.23%

3.29%

3.40%

2.80%

3.00%

3.20%

3.40%

3.60%

3.80%

4.00%

$‐

$10.0

$20.0

$30.0

$40.0

$50.0

$6 .0

3Q16 4Q16 1Q17 2Q17 3Q17

N

e

t

I

n

t

e

r

e

s

t

M

a

r

g

i

n

(

%

)

N

e

t

I

n

t

e

r

e

s

t

I

n

c

o

m

e

(

i

n

m

i

l

l

i

o

n

s

)

Net Interest Income & Margin

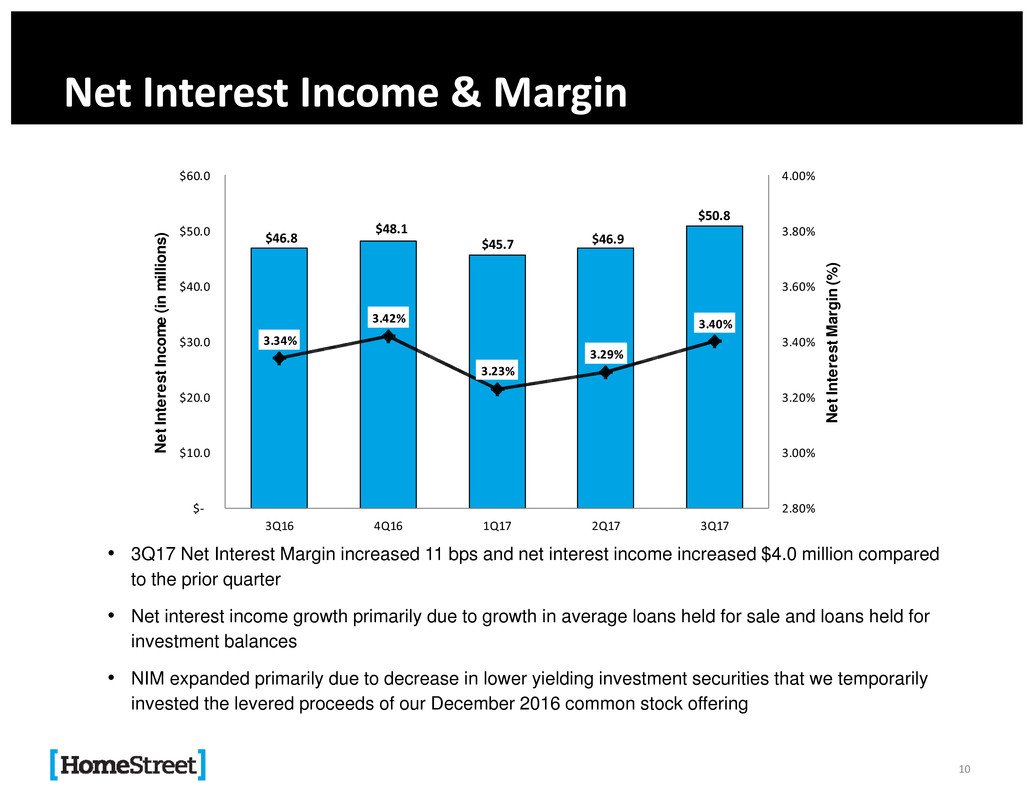

• 3Q17 Net Interest Margin increased 11 bps and net interest income increased $4.0 million compared

to the prior quarter

• Net interest income growth primarily due to growth in average loans held for sale and loans held for

investment balances

• NIM expanded primarily due to decrease in lower yielding investment securities that we temporarily

invested the levered proceeds of our December 2016 common stock offering

10

$5.69 $5.71 $5.78 $5.84

$6.10

3.60%

3.70%

3.80%

3.90%

4.00%

4.10%

4.20%

4.30%

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

3Q16 4Q16 1Q17 2Q17 3Q17

A

v

e

r

a

g

e

Y

i

e

l

d

A

v

e

r

a

g

e

B

a

l

a

n

c

e

s

(

i

n

b

i

l

l

i

o

n

s

)

Loans Held for Sale

Cash & Cash Equivalents

Investment Securities

Loans Held for Investment

Average Yield

Interest‐Earning Assets

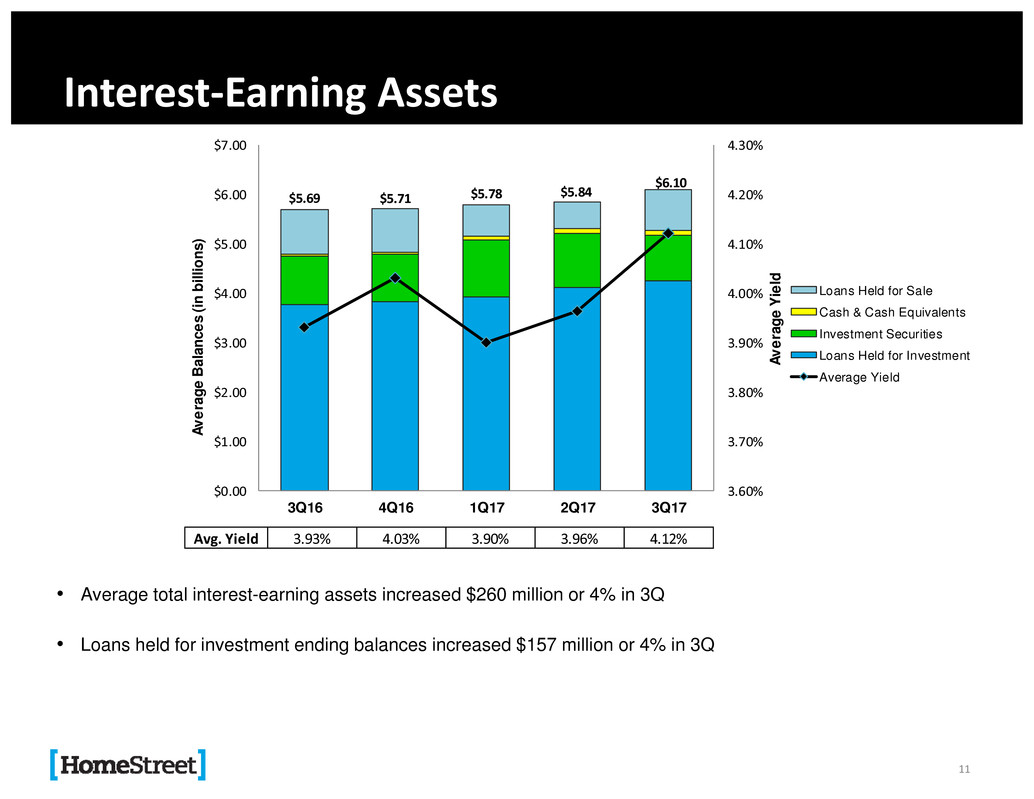

• Average total interest-earning assets increased $260 million or 4% in 3Q

• Loans held for investment ending balances increased $157 million or 4% in 3Q

Avg. Yield 3.93% 4.03% 3.90% 3.96% 4.12%

11

HomeStreet Investment Securities Portfolio Yield

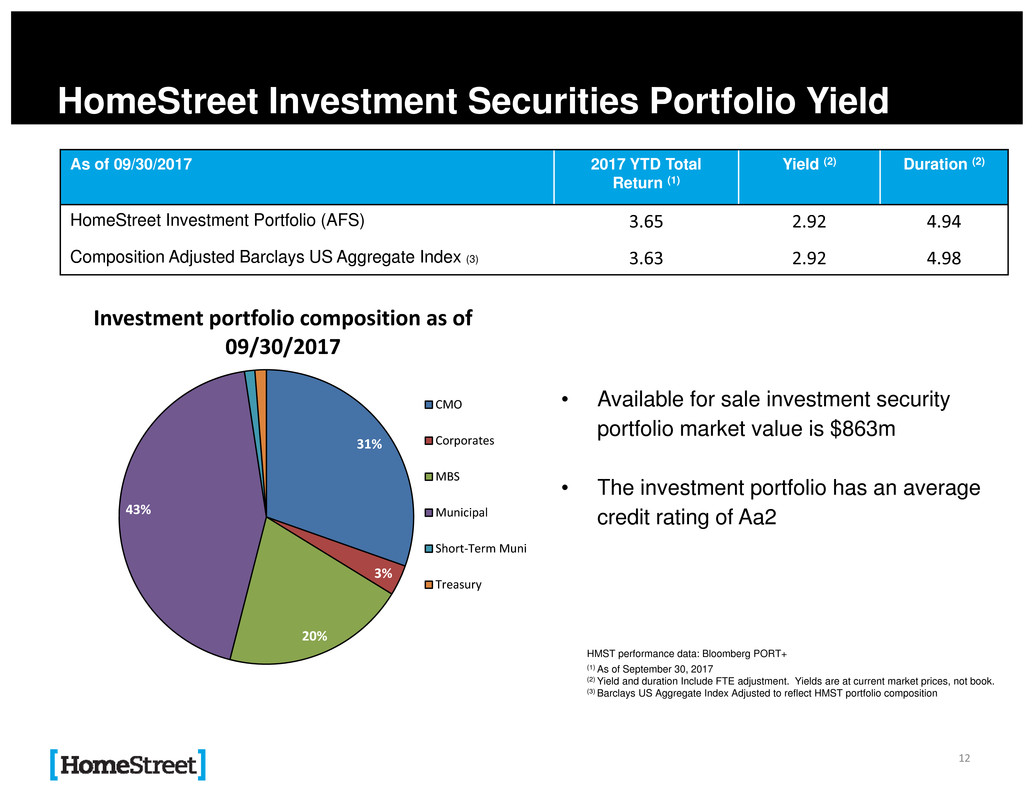

As of 09/30/2017 2017 YTD Total

Return (1)

Yield (2) Duration (2)

HomeStreet Investment Portfolio (AFS) 3.65 2.92 4.94

Composition Adjusted Barclays US Aggregate Index (3) 3.63 2.92 4.98

HMST performance data: Bloomberg PORT+

(1) As of September 30, 2017

(2) Yield and duration Include FTE adjustment. Yields are at current market prices, not book.

(3) Barclays US Aggregate Index Adjusted to reflect HMST portfolio composition

• Available for sale investment security

portfolio market value is $863m

• The investment portfolio has an average

credit rating of Aa2

12

31%

3%

20%

43%

1%

1%

Investment portfolio composition as of

09/30/2017

CMO

Corporates

MBS

Municipal

Short‐Term Muni

Treasury

$6.5 $5.7 $4.9 $6.3 $4.6

$12.6

$9.2 $8.8 $8.3

$92.6

$67.8

$60.3

$65.9 $71.0

$111.7

$73.2 $74.5

$81.0

$83.9

$‐

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

3Q16 4Q16 1Q17 2Q17 3Q17

N

o

n

i

n

t

e

r

s

t

I

n

c

o

m

e

(

i

n

m

i

l

l

i

o

n

s

)

Net gain on mortgage loan

origination and sale activities

Loan servicing income

Other noninterest income

Noninterest Income

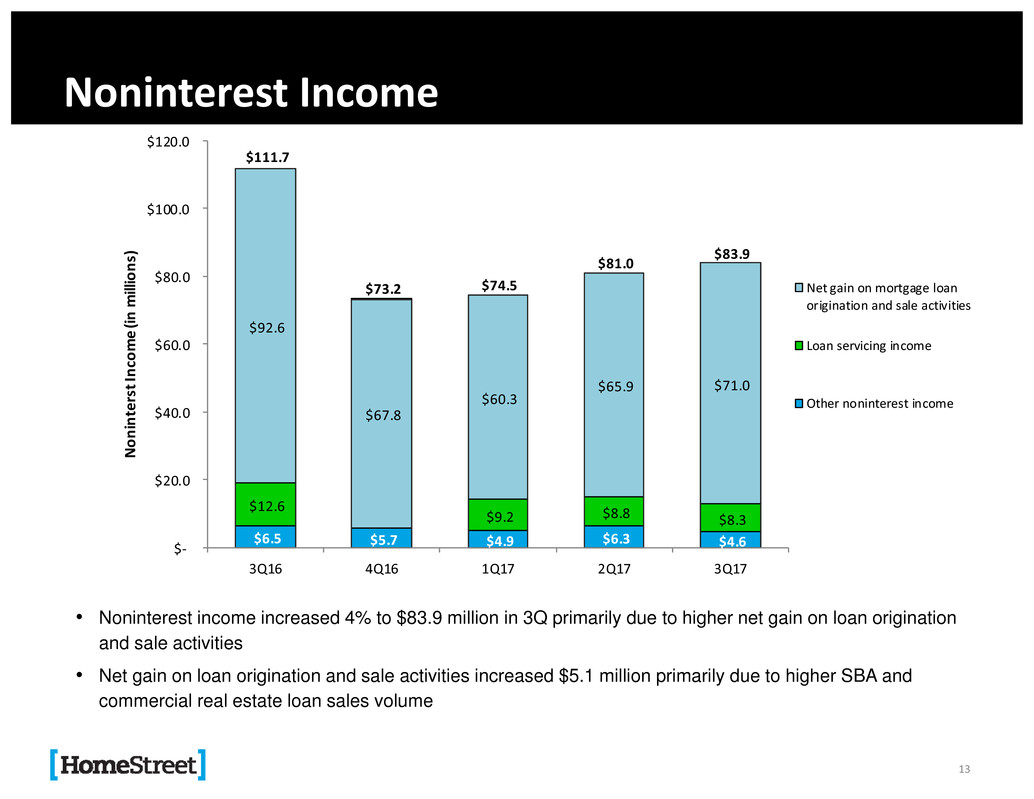

• Noninterest income increased 4% to $83.9 million in 3Q primarily due to higher net gain on loan origination

and sale activities

• Net gain on loan origination and sale activities increased $5.1 million primarily due to higher SBA and

commercial real estate loan sales volume

13

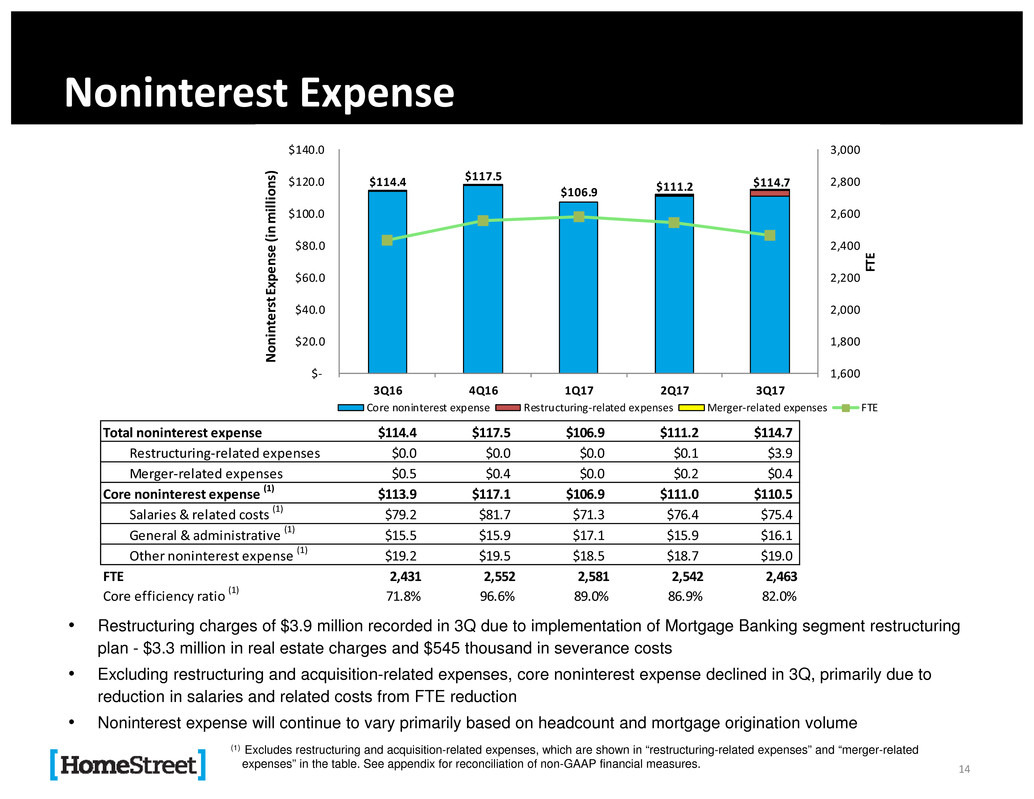

$114.4 $117.5

$106.9 $111.2

$114.7

1,600

1,800

2,000

2,200

2,400

2,600

2,800

3,000

$‐

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

3Q16 4Q16 1Q17 2Q17 3Q17

F

T

E

N

o

n

i

n

t

e

r

s

t

E

x

p

e

n

s

e

(

i

n

m

i

l

l

i

o

n

s

)

Core noninterest expense Restructuring‐related expenses Merger‐related expenses FTE

Total noninterest expense $114.4 $117.5 $106.9 $111.2 $114.7

Restructuring‐related expenses $0.0 $0.0 $0.0 $0.1 $3.9

Merger‐related expenses $0.5 $0.4 $0.0 $0.2 $0.4

Core noninterest expense (1) $113.9 $117.1 $106.9 $111.0 $110.5

Salaries & related costs (1) $79.2 $81.7 $71.3 $76.4 $75.4

General & administrative (1) $15.5 $15.9 $17.1 $15.9 $16.1

Other noninterest expense (1) $19.2 $19.5 $18.5 $18.7 $19.0

FTE 2,431 2,552 2,581 2,542 2,463

Core efficiency ratio (1) 71.8% 96.6% 89.0% 86.9% 82.0%

Noninterest Expense

• Restructuring charges of $3.9 million recorded in 3Q due to implementation of Mortgage Banking segment restructuring

plan - $3.3 million in real estate charges and $545 thousand in severance costs

• Excluding restructuring and acquisition-related expenses, core noninterest expense declined in 3Q, primarily due to

reduction in salaries and related costs from FTE reduction

• Noninterest expense will continue to vary primarily based on headcount and mortgage origination volume

(1) Excludes restructuring and acquisition-related expenses, which are shown in “restructuring-related expenses” and “merger-related

expenses” in the table. See appendix for reconciliation of non-GAAP financial measures. 14

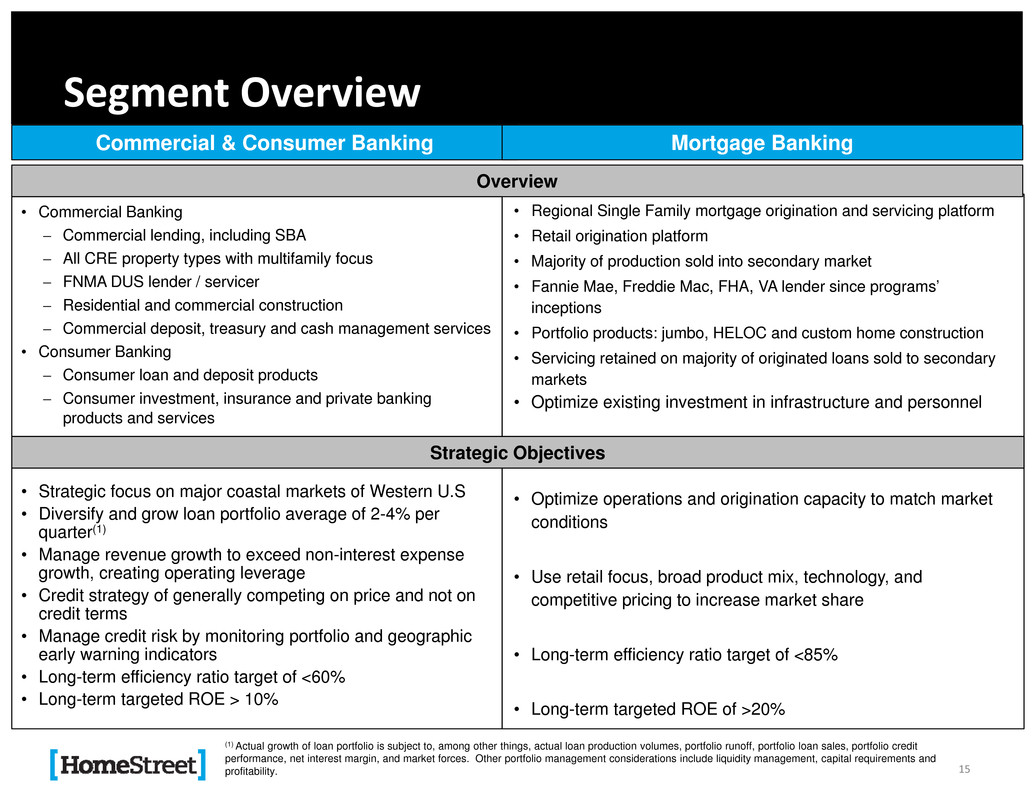

Segment Overview

Commercial & Consumer Banking

• Regional Single Family mortgage origination and servicing platform

• Retail origination platform

• Majority of production sold into secondary market

• Fannie Mae, Freddie Mac, FHA, VA lender since programs’

inceptions

• Portfolio products: jumbo, HELOC and custom home construction

• Servicing retained on majority of originated loans sold to secondary

markets

• Optimize existing investment in infrastructure and personnel

• Optimize operations and origination capacity to match market

conditions

• Use retail focus, broad product mix, technology, and

competitive pricing to increase market share

• Long-term efficiency ratio target of <85%

• Long-term targeted ROE of >20%

Mortgage Banking

Overview

• Commercial Banking

Commercial lending, including SBA

All CRE property types with multifamily focus

FNMA DUS lender / servicer

Residential and commercial construction

Commercial deposit, treasury and cash management services

• Consumer Banking

Consumer loan and deposit products

Consumer investment, insurance and private banking

products and services

• Strategic focus on major coastal markets of Western U.S

• Diversify and grow loan portfolio average of 2-4% per

quarter(1)

• Manage revenue growth to exceed non-interest expense

growth, creating operating leverage

• Credit strategy of generally competing on price and not on

credit terms

• Manage credit risk by monitoring portfolio and geographic

early warning indicators

• Long-term efficiency ratio target of <60%

• Long-term targeted ROE > 10%

Strategic Objectives

(1) Actual growth of loan portfolio is subject to, among other things, actual loan production volumes, portfolio runoff, portfolio loan sales, portfolio credit

performance, net interest margin, and market forces. Other portfolio management considerations include liquidity management, capital requirements and

profitability. 15

Commercial & Consumer Banking

16

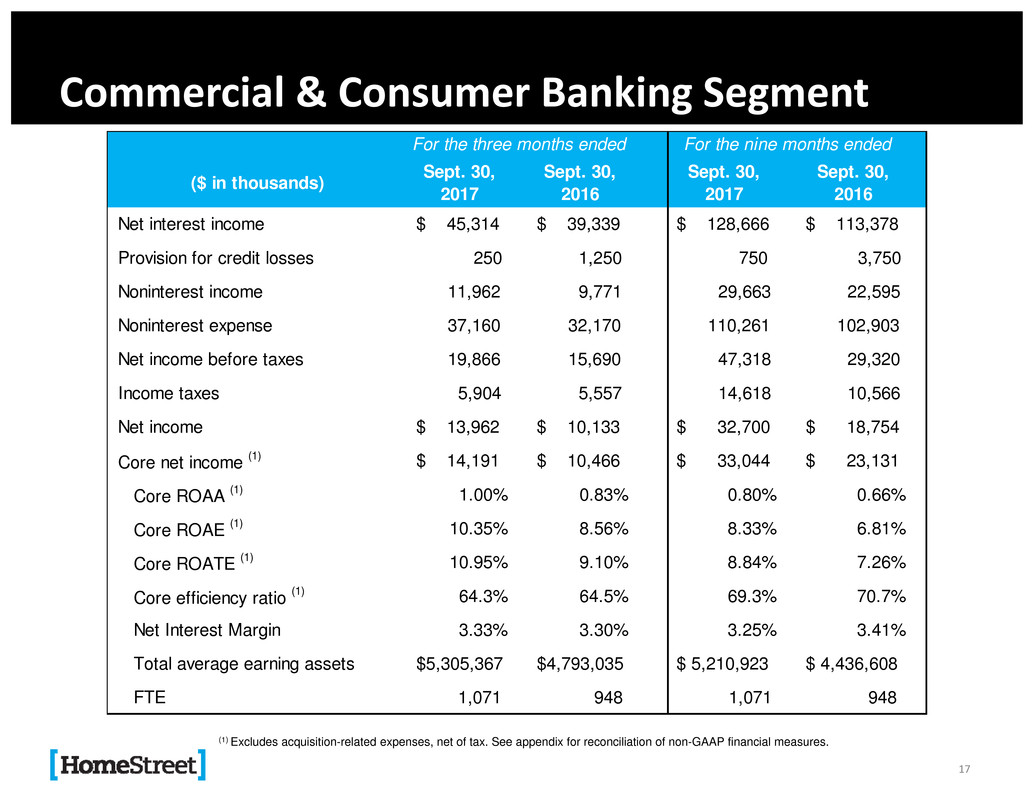

Commercial & Consumer Banking Segment

17

(1) Excludes acquisition-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

($ in thousands)

Sept. 30,

2017

Sept. 30,

2016

Sept. 30,

2017

Sept. 30,

2016

Net interest income $ 45,314 $ 39,339 $ 128,666 $ 113,378

Provision for credit losses 250 1,250 750 3,750

Noninterest income 11,962 9,771 29,663 22,595

Noninterest expense 37,160 32,170 110,261 102,903

Net income before taxes 19,866 15,690 47,318 29,320

Income taxes 5,904 5,557 14,618 10,566

Net income $ 13,962 $ 10,133 $ 32,700 $ 18,754

Core net income (1) $ 14,191 $ 10,466 $ 33,044 $ 23,131

Core ROAA (1) 1.00% 0.83% 0.80% 0.66%

Core ROAE (1) 10.35% 8.56% 8.33% 6.81%

Core ROATE (1) 10.95% 9.10% 8.84% 7.26%

Core efficiency ratio (1) 64.3% 64.5% 69.3% 70.7%

Net Interest Margin 3.33% 3.30% 3.25% 3.41%

Total average earning assets $5,305,367 $4,793,035 $ 5,210,923 $ 4,436,608

FTE 1,071 948 1,071 948

For the three months ended For the nine months ended

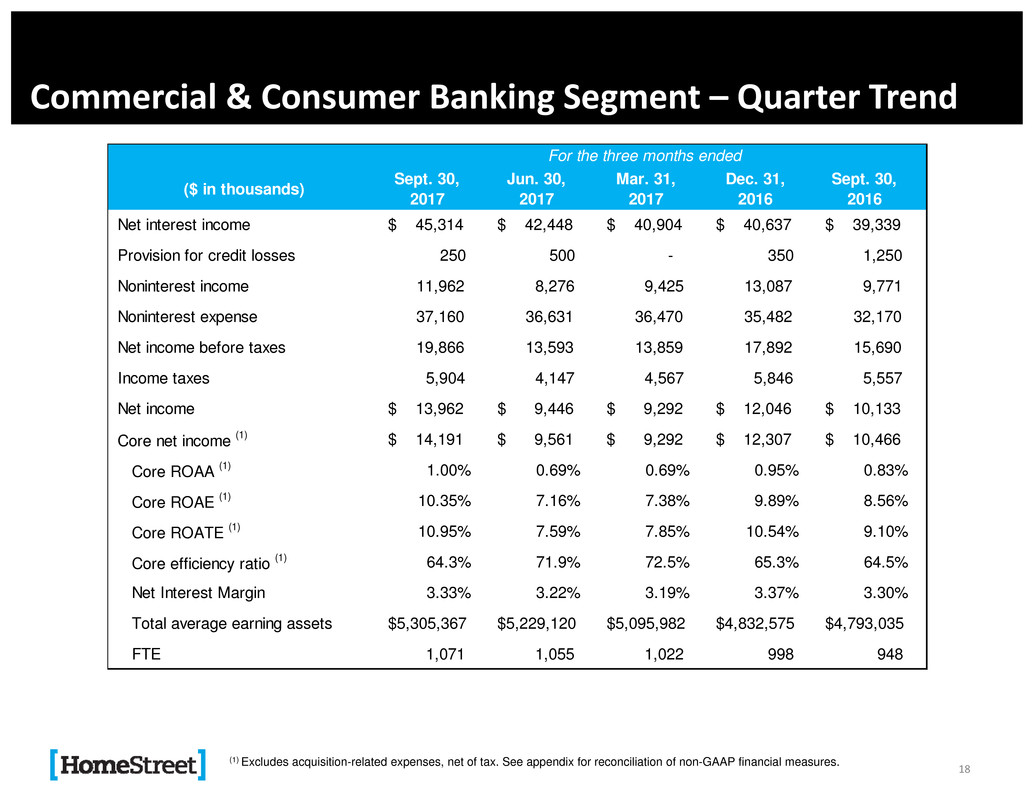

Commercial & Consumer Banking Segment – Quarter Trend

18

(1) Excludes acquisition-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

($ in thousands)

Sept. 30,

2017

Jun. 30,

2017

Mar. 31,

2017

Dec. 31,

2016

Sept. 30,

2016

Net interest income $ 45,314 $ 42,448 $ 40,904 $ 40,637 $ 39,339

Provision for credit losses 250 500 - 350 1,250

Noninterest income 11,962 8,276 9,425 13,087 9,771

Noninterest expense 37,160 36,631 36,470 35,482 32,170

Net income before taxes 19,866 13,593 13,859 17,892 15,690

Income taxes 5,904 4,147 4,567 5,846 5,557

Net income $ 13,962 $ 9,446 $ 9,292 $ 12,046 $ 10,133

Core net income (1) $ 14,191 $ 9,561 $ 9,292 $ 12,307 $ 10,466

Core ROAA (1) 1.00% 0.69% 0.69% 0.95% 0.83%

Core ROAE (1) 10.35% 7.16% 7.38% 9.89% 8.56%

Core ROATE (1) 10.95% 7.59% 7.85% 10.54% 9.10%

Core efficiency ratio (1) 64.3% 71.9% 72.5% 65.3% 64.5%

Net Interest Margin 3.33% 3.22% 3.19% 3.37% 3.30%

Total average earning assets $5,305,367 $5,229,120 $5,095,982 $4,832,575 $4,793,035

FTE 1,071 1,055 1,022 998 948

For the three months ended

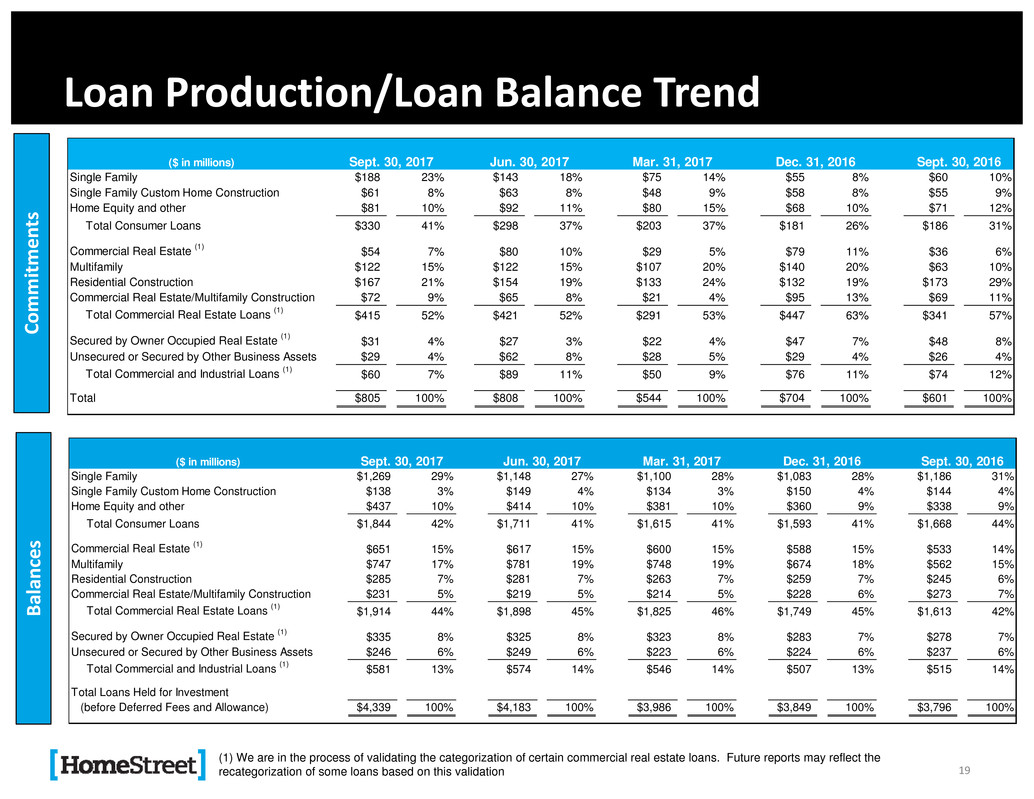

Loan Production/Loan Balance Trend

19

C

o

m

m

i

t

m

e

n

t

s

B

a

l

a

n

c

e

s

(1) We are in the process of validating the categorization of certain commercial real estate loans. Future reports may reflect the

recategorization of some loans based on this validation

($ in millions)

Single Family $188 23% $143 18% $75 14% $55 8% $60 10%

Single Family Custom Home Construction $61 8% $63 8% $48 9% $58 8% $55 9%

Home Equity and other $81 10% $92 11% $80 15% $68 10% $71 12%

Total Consumer Loans $330 41% $298 37% $203 37% $181 26% $186 31%

Commercial Real Estate (1) $54 7% $80 10% $29 5% $79 11% $36 6%

Multifamily $122 15% $122 15% $107 20% $140 20% $63 10%

Residential Construction $167 21% $154 19% $133 24% $132 19% $173 29%

Commercial Real Estate/Multifamily Construction $72 9% $65 8% $21 4% $95 13% $69 11%

Total Commercial Real Estate Loans (1) $415 52% $421 52% $291 53% $447 63% $341 57%

Secured by Owner Occupied Real Estate (1) $31 4% $27 3% $22 4% $47 7% $48 8%

Unsecured or Secured by Other Business Assets $29 4% $62 8% $28 5% $29 4% $26 4%

Total Commercial and Industrial Loans (1) $60 7% $89 11% $50 9% $76 11% $74 12%

Total $805 100% $808 100% $544 100% $704 100% $601 100%

Sept. 30, 2017 Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016

($ in millions)

Single Family $1,269 29% $1,148 27% $1,100 28% $1,083 28% $1,186 31%

Single Family Custom Home Construction $138 3% $149 4% $134 3% $150 4% $144 4%

Home Equity and other $437 10% $414 10% $381 10% $360 9% $338 9%

Total Consumer Loans $1,844 42% $1,711 41% $1,615 41% $1,593 41% $1,668 44%

Commercial Real Estate (1) $651 15% $617 15% $600 15% $588 15% $533 14%

Multifamily $747 17% $781 19% $748 19% $674 18% $562 15%

Residential Construction $285 7% $281 7% $263 7% $259 7% $245 6%

Commercial Real Estate/Multifamily Construction $231 5% $219 5% $214 5% $228 6% $273 7%

Total Commercial Real Estate Loans (1) $1,914 44% $1,898 45% $1,825 46% $1,749 45% $1,613 42%

Secured by Owner Occupied Real Estate (1) $335 8% $325 8% $323 8% $283 7% $278 7%

Unsecured or Secured by Other Business Assets $246 6% $249 6% $223 6% $224 6% $237 6%

Total Commercial and Industrial Loans (1) $581 13% $574 14% $546 14% $507 13% $515 14%

Total Loans Held for Investment

(before Deferred Fees and Allowance) $4,339 100% $4,183 100% $3,986 100% $3,849 100% $3,796 100%

Sept. 30, 2017 Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016

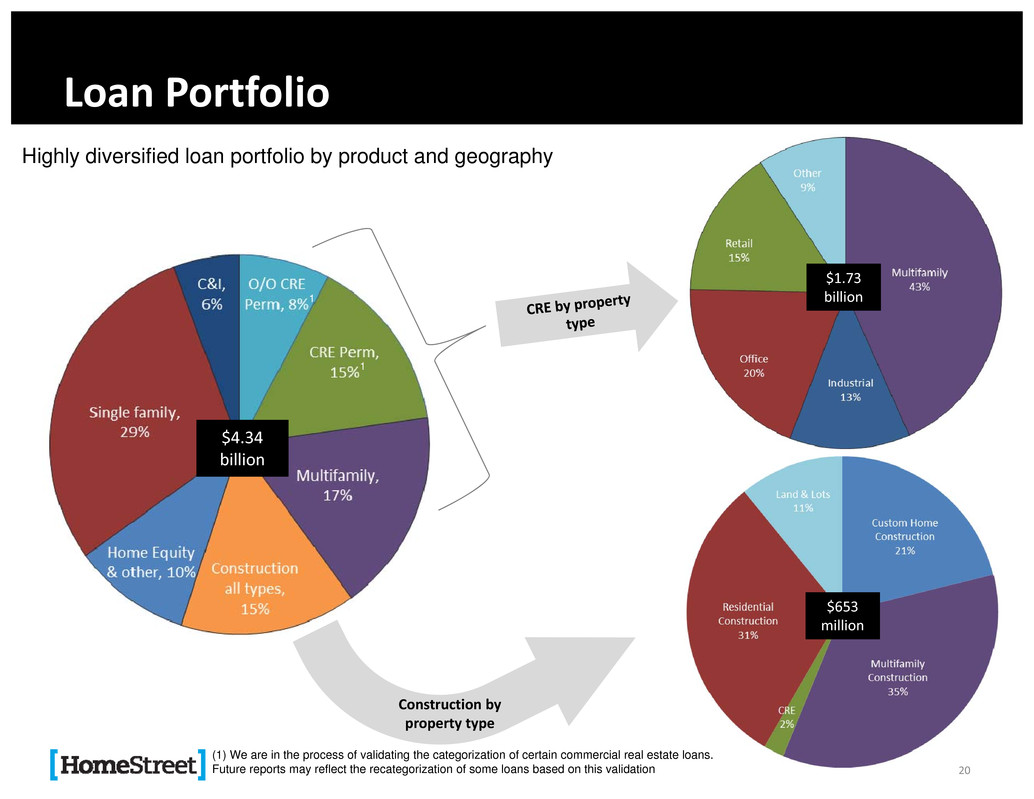

$1.73

billion

20

Highly diversified loan portfolio by product and geography

$4.34

billion

$653

million

Construction by

property type

Loan Portfolio

(1) We are in the process of validating the categorization of certain commercial real estate loans.

Future reports may reflect the recategorization of some loans based on this validation

1

1

Other Includes: AK,AZ, CO,HI,ID,NV,TX,UTCA‐Los Angeles County

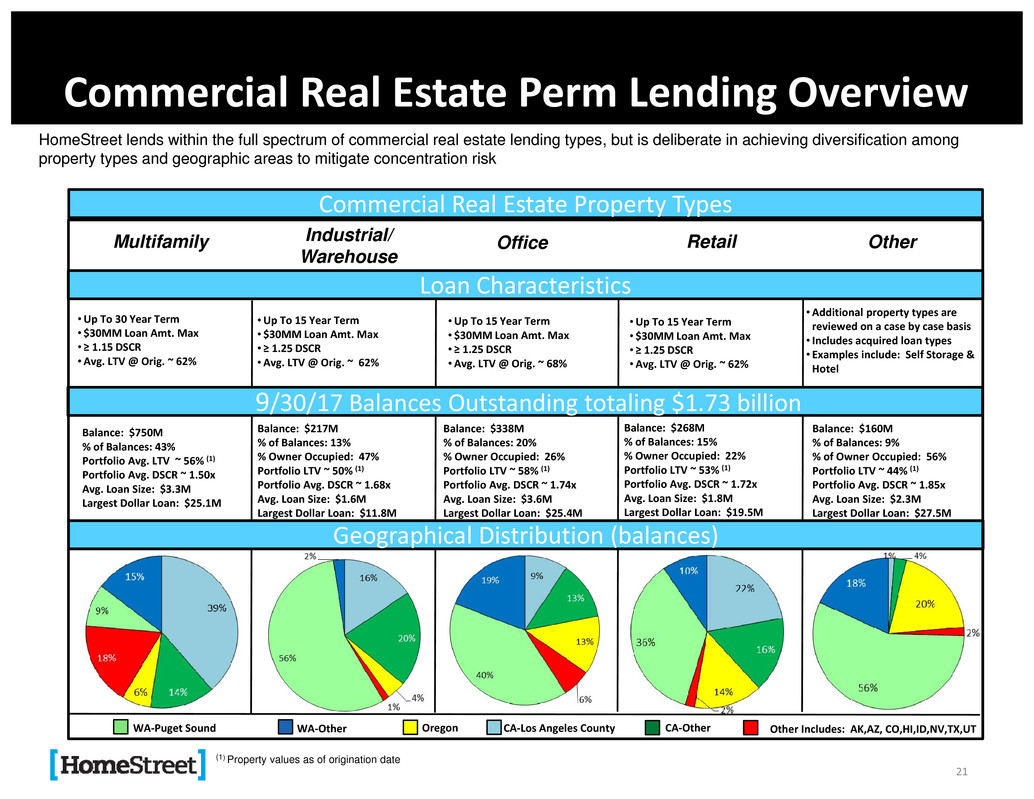

•Additional property types are

reviewed on a case by case basis

• Includes acquired loan types

• Examples include: Self Storage &

Hotel

•Up To 15 Year Term

• $30MM Loan Amt. Max

• ≥ 1.25 DSCR

•Avg. LTV @ Orig. ~ 62%

•Up To 15 Year Term

• $30MM Loan Amt. Max

• ≥ 1.25 DSCR

•Avg. LTV @ Orig. ~ 68%

•Up To 30 Year Term

• $30MM Loan Amt. Max

• ≥ 1.15 DSCR

•Avg. LTV @ Orig. ~ 62%

•Up To 15 Year Term

• $30MM Loan Amt. Max

• ≥ 1.25 DSCR

•Avg. LTV @ Orig. ~ 62%

CA‐OtherOregonWA‐OtherWA‐Puget Sound

Commercial Real Estate Perm Lending Overview

21

HomeStreet lends within the full spectrum of commercial real estate lending types, but is deliberate in achieving diversification among

property types and geographic areas to mitigate concentration risk

Balance: $268M

% of Balances: 15%

% Owner Occupied: 22%

Portfolio LTV ~ 53% (1)

Portfolio Avg. DSCR ~ 1.72x

Avg. Loan Size: $1.8M

Largest Dollar Loan: $19.5M

9/30/17 Balances Outstanding totaling $1.73 billion

Loan Characteristics

Commercial Real Estate Property Types

Multifamily OfficeIndustrial/

Warehouse

Retail Other

Balance: $750M

% of Balances: 43%

Portfolio Avg. LTV ~ 56% (1)

Portfolio Avg. DSCR ~ 1.50x

Avg. Loan Size: $3.3M

Largest Dollar Loan: $25.1M

Geographical Distribution (balances)

Balance: $217M

% of Balances: 13%

% Owner Occupied: 47%

Portfolio LTV ~ 50% (1)

Portfolio Avg. DSCR ~ 1.68x

Avg. Loan Size: $1.6M

Largest Dollar Loan: $11.8M

Balance: $338M

% of Balances: 20%

% Owner Occupied: 26%

Portfolio LTV ~ 58% (1)

Portfolio Avg. DSCR ~ 1.74x

Avg. Loan Size: $3.6M

Largest Dollar Loan: $25.4M

Balance: $160M

% of Balances: 9%

% of Owner Occupied: 56%

Portfolio LTV ~ 44% (1)

Portfolio Avg. DSCR ~ 1.85x

Avg. Loan Size: $2.3M

Largest Dollar Loan: $27.5M

(1) Property values as of origination date

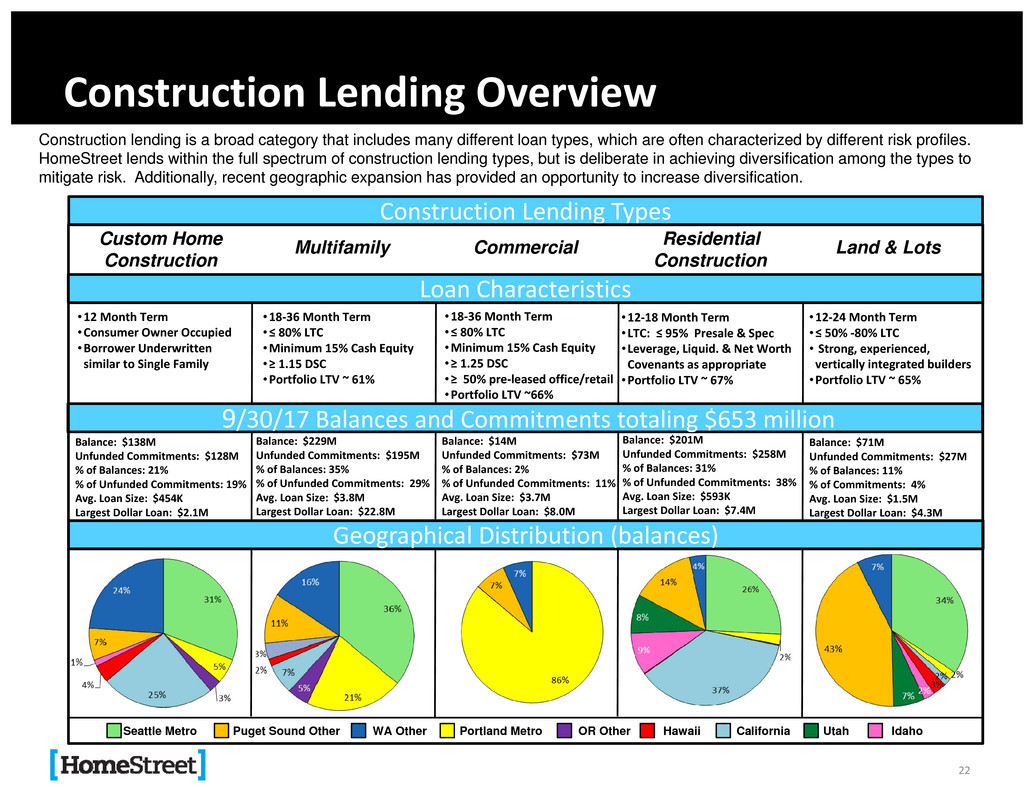

Construction Lending Overview

22

Construction lending is a broad category that includes many different loan types, which are often characterized by different risk profiles.

HomeStreet lends within the full spectrum of construction lending types, but is deliberate in achieving diversification among the types to

mitigate risk. Additionally, recent geographic expansion has provided an opportunity to increase diversification.

Balance: $201M

Unfunded Commitments: $258M

% of Balances: 31%

% of Unfunded Commitments: 38%

Avg. Loan Size: $593K

Largest Dollar Loan: $7.4M

9/30/17 Balances and Commitments totaling $653 million

Loan Characteristics

Construction Lending Types

Custom Home

Construction

Multifamily Commercial Residential

Construction

Land & Lots

•12 Month Term

•Consumer Owner Occupied

•Borrower Underwritten

similar to Single Family

Balance: $138M

Unfunded Commitments: $128M

% of Balances: 21%

% of Unfunded Commitments: 19%

Avg. Loan Size: $454K

Largest Dollar Loan: $2.1M

Geographical Distribution (balances)

Balance: $229M

Unfunded Commitments: $195M

% of Balances: 35%

% of Unfunded Commitments: 29%

Avg. Loan Size: $3.8M

Largest Dollar Loan: $22.8M

Balance: $14M

Unfunded Commitments: $73M

% of Balances: 2%

% of Unfunded Commitments: 11%

Avg. Loan Size: $3.7M

Largest Dollar Loan: $8.0M

Balance: $71M

Unfunded Commitments: $27M

% of Balances: 11%

% of Commitments: 4%

Avg. Loan Size: $1.5M

Largest Dollar Loan: $4.3M

Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho

•18‐36 Month Term

•≤ 80% LTC

•Minimum 15% Cash Equity

•≥ 1.15 DSC

•Portfolio LTV ~ 61%

•18‐36 Month Term

•≤ 80% LTC

•Minimum 15% Cash Equity

•≥ 1.25 DSC

•≥ 50% pre‐leased office/retail

•Portfolio LTV ~66%

•12‐18 Month Term

•LTC: ≤ 95% Presale & Spec

•Leverage, Liquid. & Net Worth

Covenants as appropriate

•Portfolio LTV ~ 67%

•12‐24 Month Term

•≤ 50% ‐80% LTC

• Strong, experienced,

vertically integrated builders

•Portfolio LTV ~ 65%

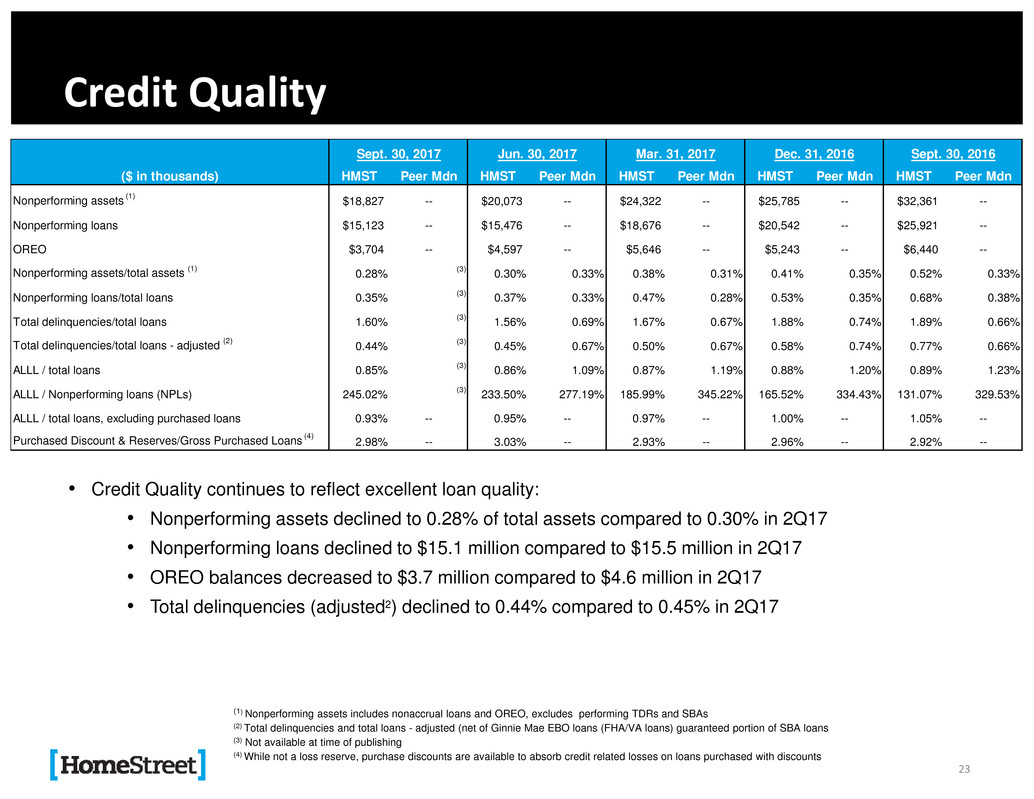

Credit Quality

23

• Credit Quality continues to reflect excellent loan quality:

• Nonperforming assets declined to 0.28% of total assets compared to 0.30% in 2Q17

• Nonperforming loans declined to $15.1 million compared to $15.5 million in 2Q17

• OREO balances decreased to $3.7 million compared to $4.6 million in 2Q17

• Total delinquencies (adjusted2) declined to 0.44% compared to 0.45% in 2Q17

(1) Nonperforming assets includes nonaccrual loans and OREO, excludes performing TDRs and SBAs

(2) Total delinquencies and total loans - adjusted (net of Ginnie Mae EBO loans (FHA/VA loans) guaranteed portion of SBA loans

(3) Not available at time of publishing

(4) While not a loss reserve, purchase discounts are available to absorb credit related losses on loans purchased with discounts

($ in thousands) HMST Peer Mdn HMST Peer Mdn HMST Peer Mdn HMST Peer Mdn HMST Peer Mdn

Nonperforming assets (1) $18,827 -- $20,073 -- $24,322 -- $25,785 -- $32,361 --

Nonperforming loans $15,123 -- $15,476 -- $18,676 -- $20,542 -- $25,921 --

OREO $3,704 -- $4,597 -- $5,646 -- $5,243 -- $6,440 --

Nonperforming assets/total assets (1) 0.28% (3) 0.30% 0.33% 0.38% 0.31% 0.41% 0.35% 0.52% 0.33%

Nonperforming loans/total loans 0.35% (3) 0.37% 0.33% 0.47% 0.28% 0.53% 0.35% 0.68% 0.38%

Total delinquencies/total loans 1.60% (3) 1.56% 0.69% 1.67% 0.67% 1.88% 0.74% 1.89% 0.66%

Total delinquencies/total loans - adjusted (2) 0.44% (3) 0.45% 0.67% 0.50% 0.67% 0.58% 0.74% 0.77% 0.66%

ALLL / total loans 0.85% (3) 0.86% 1.09% 0.87% 1.19% 0.88% 1.20% 0.89% 1.23%

ALLL / Nonperforming loans (NPLs) 245.02% (3) 233.50% 277.19% 185.99% 345.22% 165.52% 334.43% 131.07% 329.53%

ALLL / total loans, excluding purchased loans 0.93% -- 0.95% -- 0.97% -- 1.00% -- 1.05% --

Purchased Discount & Reserves/Gross Purchased Loans (4) 2.98% -- 3.03% -- 2.93% -- 2.96% -- 2.92% --

Mar. 31, 2017 Dec. 31, 2016Sept. 30, 2017 Sept. 30, 2016Jun. 30, 2017

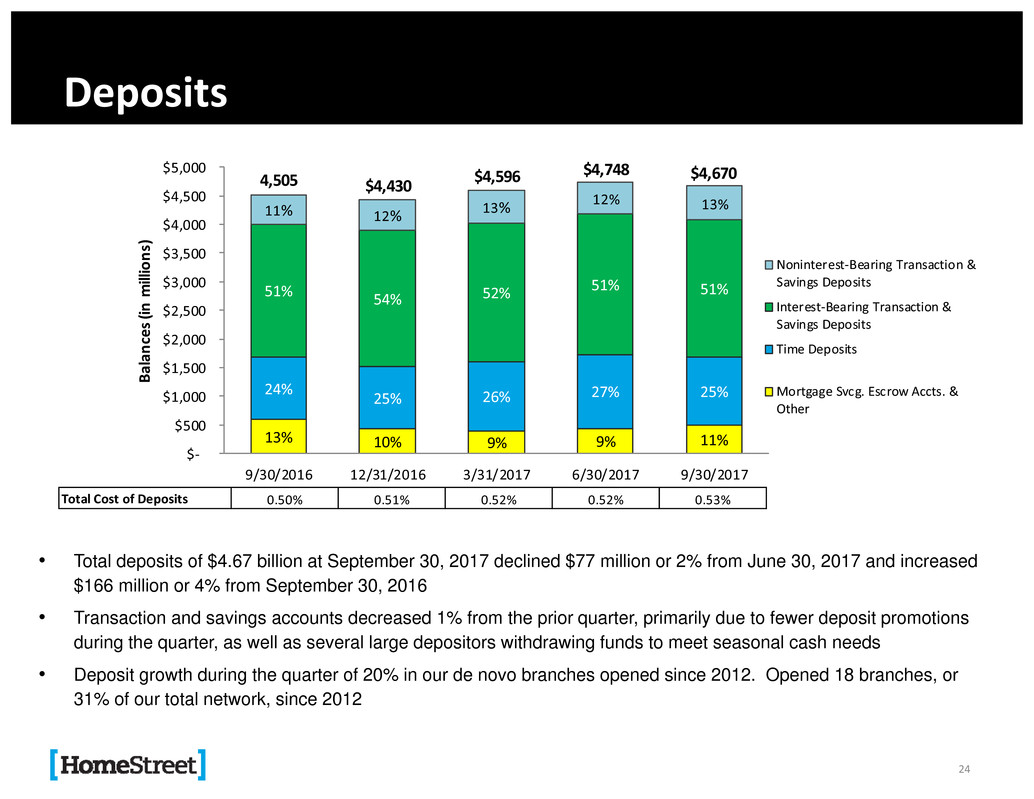

Deposits

24

13% 10% 9% 9% 11%

24%

25% 26% 27% 25%

51% 54% 52%

51% 51%

11% 12% 13%

12% 13%

4,505 $4,430 $4,596

$4,748 $4,670

$‐

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

9/30/2016 12/31/2016 3/31/2017 6/30/2017 9/30/2017

B

a

l

a

n

c

e

s

(

i

n

m

i

l

l

i

o

n

s

)

Noninterest‐Bearing Transaction &

Savings Deposits

Interest‐Bearing Transaction &

Savings Deposits

Time Deposits

Mortgage Svcg. Escrow Accts. &

Other

Total Cost of Deposits 0.50% 0.51% 0.52% 0.52% 0.53%

• Total deposits of $4.67 billion at September 30, 2017 declined $77 million or 2% from June 30, 2017 and increased

$166 million or 4% from September 30, 2016

• Transaction and savings accounts decreased 1% from the prior quarter, primarily due to fewer deposit promotions

during the quarter, as well as several large depositors withdrawing funds to meet seasonal cash needs

• Deposit growth during the quarter of 20% in our de novo branches opened since 2012. Opened 18 branches, or

31% of our total network, since 2012

Mortgage Banking

25

West Coast Housing Shortage

26

• December 2016 forecast by the Mortgage Bankers Association predicted sales of existing homes to increase 5%

during 2017

• According to Zillow, the seasonally adjusted number of homes listed for sale in September 2017 is actually down

13% nationwide compared to September 2016

• Down 26% in Washington

• Down 25% in California

• New home development and construction timeline exceeds five years and is constrained by:

• Geography of West Coast

• Lack of suitable land or zoning restrictions

• Municipal planning departments that shrank following the recession leaving them unable to process increased

demand

• Supply constraints reducing inventory and marketing time of homes to historical lows in major west coast

markets

• However, our application volume without property information, which represents customers seeking pre-

qualification to shop for a home, remains a substantial part of our single family mortgage loan pipeline

• Consequently, we lowered our expectations for mortgage lock volume by 21% and mortgage closing

volume by 20% since the beginning of 2017, and we also implemented cost reduction strategies that

included changing certain compensation structures, reducing mortgage origination personnel, and

closing or consolidating office space

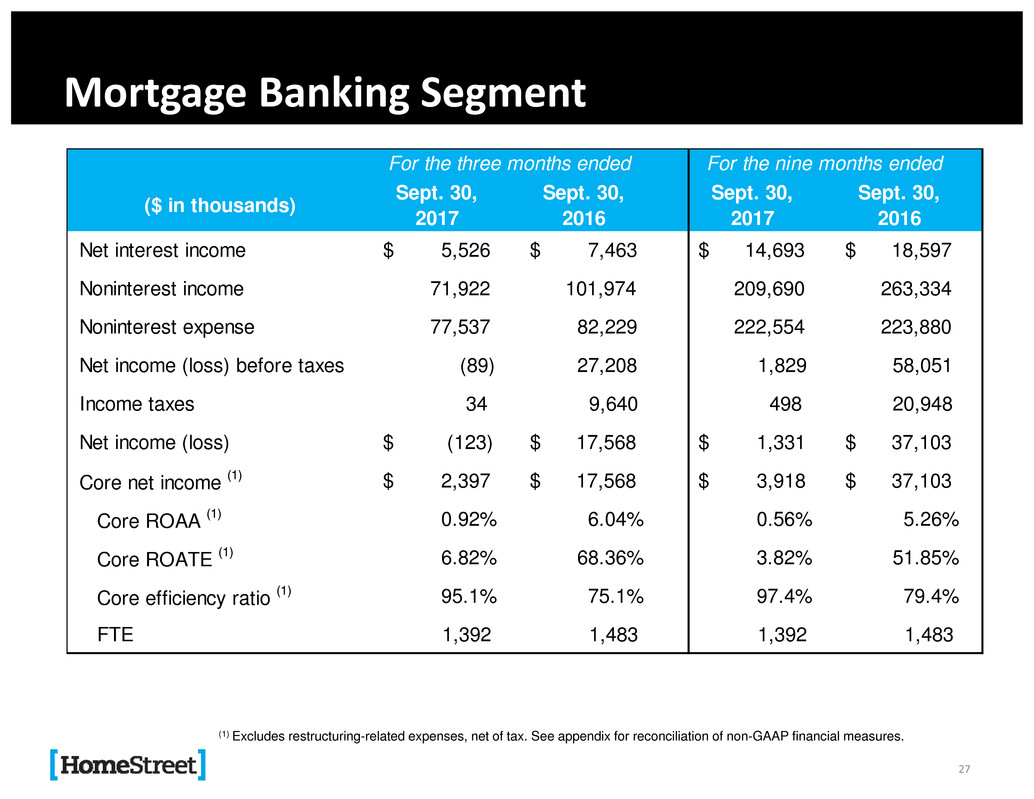

Mortgage Banking Segment

27

($ in thousands)

Sept. 30,

2017

Sept. 30,

2016

Sept. 30,

2017

Sept. 30,

2016

Net interest income $ 5,526 $ 7,463 $ 14,693 $ 18,597

Noninterest income 71,922 101,974 209,690 263,334

Noninterest expense 77,537 82,229 222,554 223,880

Net income (loss) before taxes (89) 27,208 1,829 58,051

Income taxes 34 9,640 498 20,948

Net income (loss) $ (123) $ 17,568 $ 1,331 $ 37,103

Core net income (1) $ 2,397 $ 17,568 $ 3,918 $ 37,103

Core ROAA (1) 0.92% 6.04% 0.56% 5.26%

Core ROATE (1) 6.82% 68.36% 3.82% 51.85%

Core efficiency ratio (1) 95.1% 75.1% 97.4% 79.4%

FTE 1,392 1,483 1,392 1,483

For the three months ended For the nine months ended

(1) Excludes restructuring-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

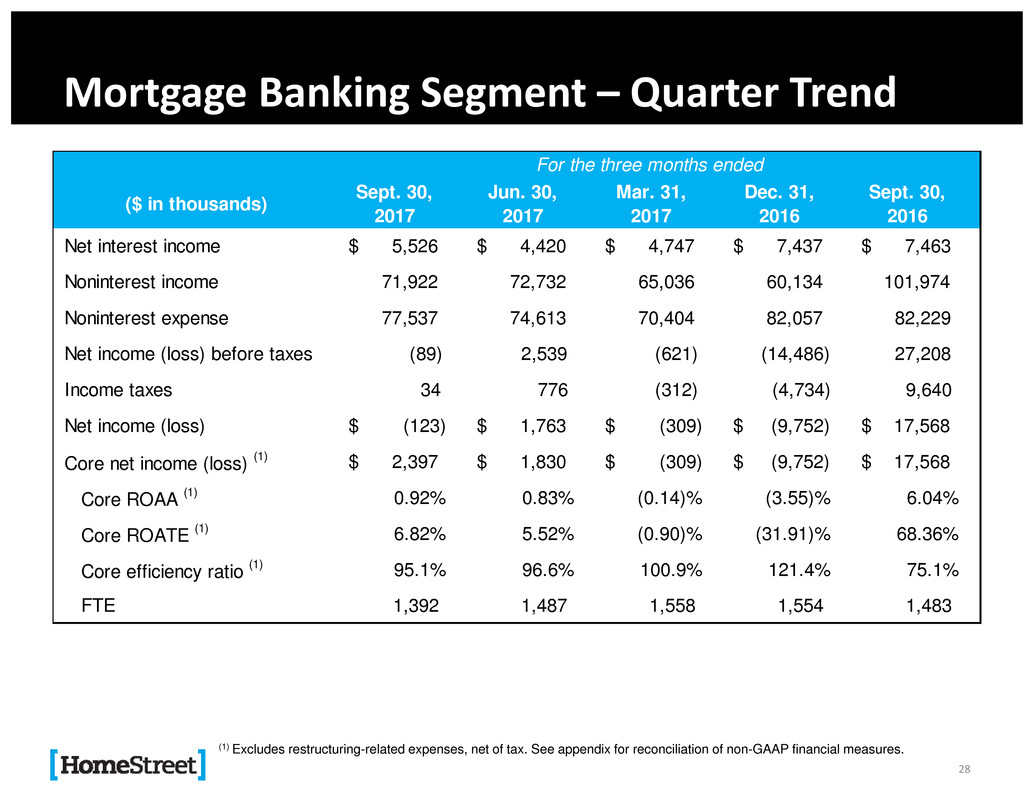

Mortgage Banking Segment – Quarter Trend

28

($ in thousands)

Sept. 30,

2017

Jun. 30,

2017

Mar. 31,

2017

Dec. 31,

2016

Sept. 30,

2016

Net interest income $ 5,526 $ 4,420 $ 4,747 $ 7,437 $ 7,463

Noninterest income 71,922 72,732 65,036 60,134 101,974

Noninterest expense 77,537 74,613 70,404 82,057 82,229

Net income (loss) before taxes (89) 2,539 (621) (14,486) 27,208

Income taxes 34 776 (312) (4,734) 9,640

Net income (loss) $ (123) $ 1,763 $ (309) $ (9,752) $ 17,568

Core net income (loss) (1) $ 2,397 $ 1,830 $ (309) $ (9,752) $ 17,568

Core ROAA (1) 0.92% 0.83% (0.14)% (3.55)% 6.04%

Core ROATE (1) 6.82% 5.52% (0.90)% (31.91)% 68.36%

Core efficiency ratio (1) 95.1% 96.6% 100.9% 121.4% 75.1%

FTE 1,392 1,487 1,558 1,554 1,483

For the three months ended

(1) Excludes restructuring-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

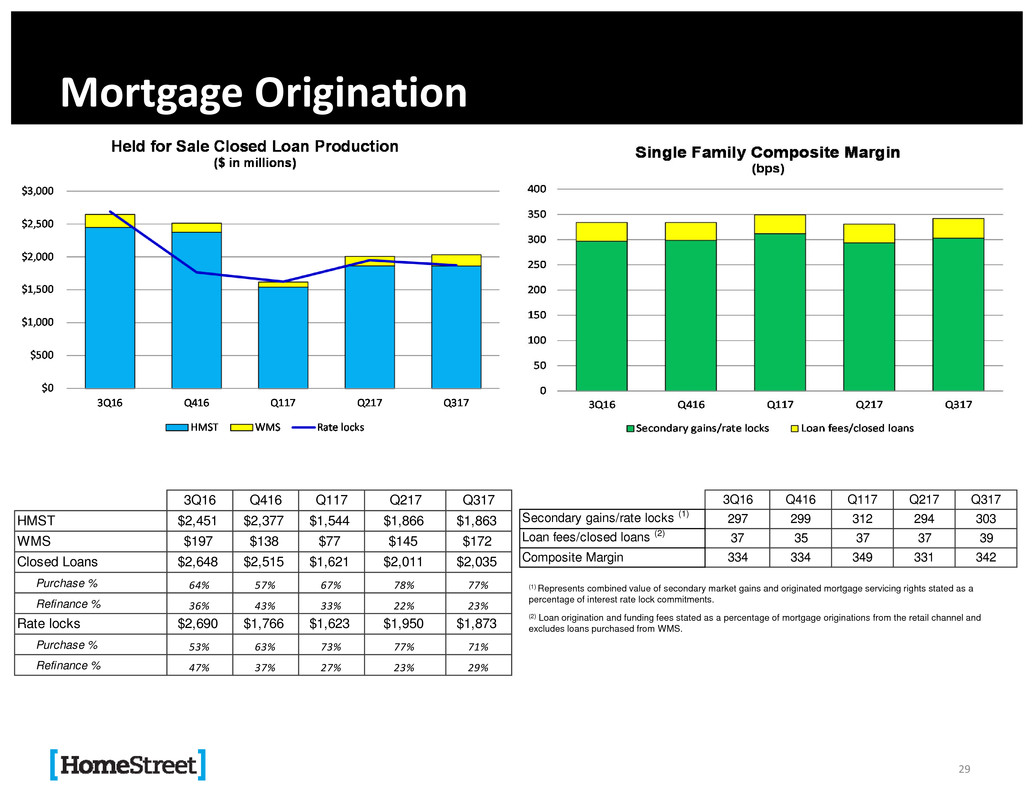

Mortgage Origination

(1) Represents combined value of secondary market gains and originated mortgage servicing rights stated as a

percentage of interest rate lock commitments.

(2) Loan origination and funding fees stated as a percentage of mortgage originations from the retail channel and

excludes loans purchased from WMS.

29

3Q16 Q416 Q117 Q217 Q317

Secondary gains/rate locks (1) 297 299 312 294 303

Loan fees/closed loans (2) 37 35 37 37 39

Composite Margin 334 334 349 331 342

3Q16 Q416 Q117 Q217 Q317

HMST $2,451 $2,377 $1,544 $1,866 $1,863

WMS $197 $138 $77 $145 $172

Closed Loans $2,648 $2,515 $1,621 $2,011 $2,035

Purchase % 64% 57% 67% 78% 77%

Refinance % 36% 43% 33% 22% 23%

Rate locks $2,690 $1,766 $1,623 $1,950 $1,873

Purchase % 53% 63% 73% 77% 71%

Refinance % 47% 37% 27% 23% 29%

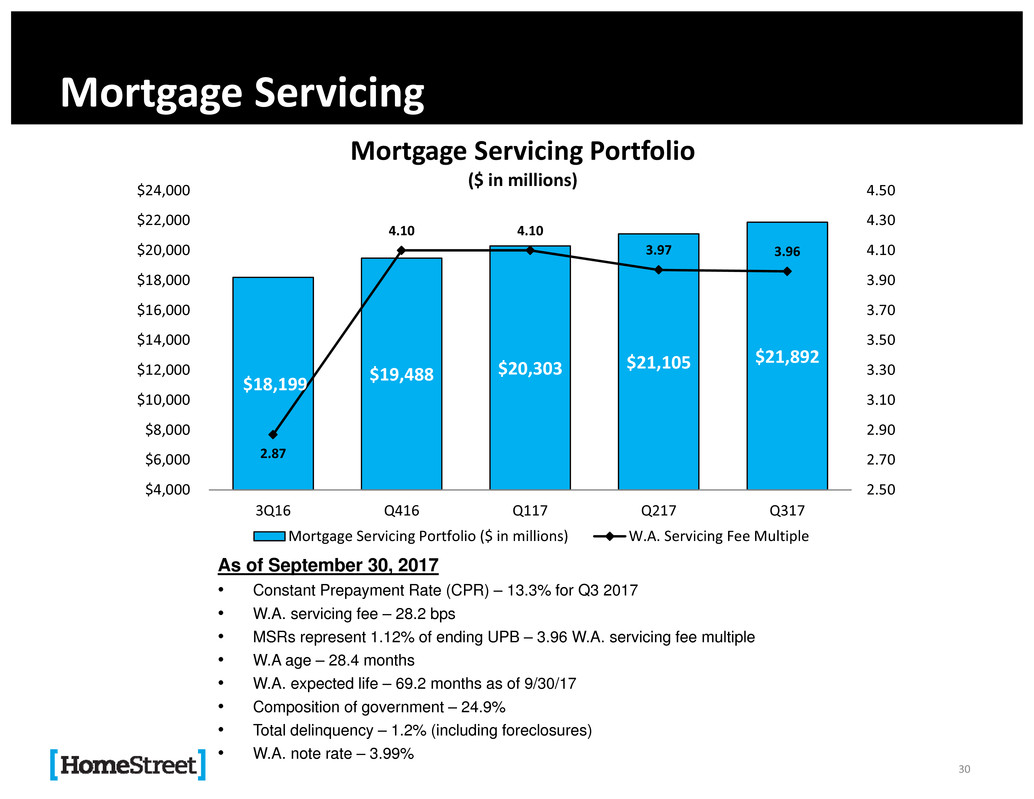

Mortgage Servicing

As of September 30, 2017

• Constant Prepayment Rate (CPR) – 13.3% for Q3 2017

• W.A. servicing fee – 28.2 bps

• MSRs represent 1.12% of ending UPB – 3.96 W.A. servicing fee multiple

• W.A age – 28.4 months

• W.A. expected life – 69.2 months as of 9/30/17

• Composition of government – 24.9%

• Total delinquency – 1.2% (including foreclosures)

• W.A. note rate – 3.99%

30

$18,199 $19,488

$20,303 $21,105

$21,892

2.87

4.10 4.10

3.97 3.96

2.50

2.70

2.90

3.10

3.30

3.50

3.70

3.90

4.10

4.30

4.50

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

$22,000

$24,000

3Q16 Q416 Q117 Q217 Q317

Mortgage Servicing Portfolio

($ in millions)

Mortgage Servicing Portfolio ($ in millions) W.A. Servicing Fee Multiple

Mortgage Market & Competitive Landscape

31

Mortgage Market

• The most recent Mortgage Bankers Association monthly forecast projects total loan originations to decrease 17.7% in

2017 over last year, and to decrease 5.4% in 2018.

• Despite the recent increase in mortgage rates, rates remain historically low on an absolute basis. Low rates should

continue to support housing affordability. Nationally, purchases are expected to increase by 3.4% from 2016 and

comprise 64% of volume in 2017.

• Purchases comprised 68% of originations nationally and 60% in the Pacific Northwest in the third quarter. HomeStreet

continues to perform above the national and regional averages, with purchases accounting for 77% of our closed loans

and 71% of our interest rate lock commitments in the quarter.

Competitive Landscape

• HomeStreet maintained its position as the number one loan originator by volume of purchase mortgages in the Pacific

Northwest and in the Puget Sound region, and increased market share to number one for total originations in the same

areas.

• Purchase demand continues to remain strong in many of our markets, however limited inventory continues to be a

significant constraining issue. Months supply of inventory and time on the market are both down significantly in most of

our major markets.

• New home construction in our markets is constrained by the geography of the West Coast and the lingering effects of the

last recession.

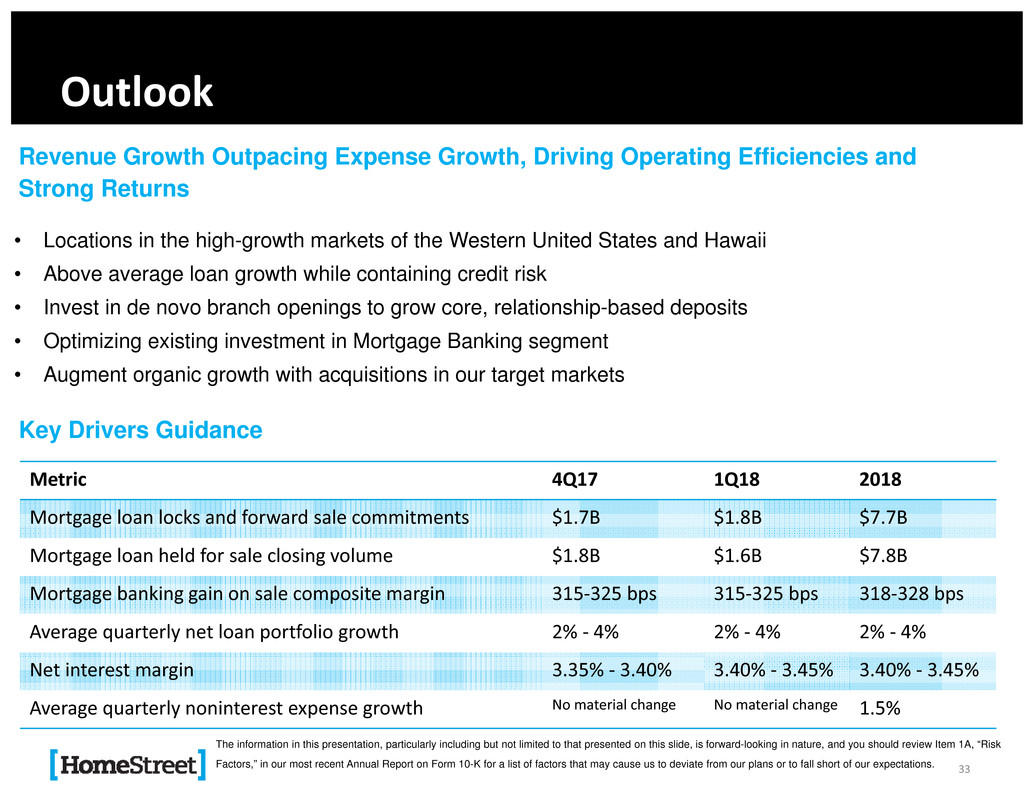

Outlook

32

Outlook

33

The information in this presentation, particularly including but not limited to that presented on this slide, is forward-looking in nature, and you should review Item 1A, “Risk

Factors,” in our most recent Annual Report on Form 10-K for a list of factors that may cause us to deviate from our plans or to fall short of our expectations.

• Locations in the high-growth markets of the Western United States and Hawaii

• Above average loan growth while containing credit risk

• Invest in de novo branch openings to grow core, relationship-based deposits

• Optimizing existing investment in Mortgage Banking segment

• Augment organic growth with acquisitions in our target markets

Metric 4Q17 1Q18 2018

Mortgage loan locks and forward sale commitments $1.7B $1.8B $7.7B

Mortgage loan held for sale closing volume $1.8B $1.6B $7.8B

Mortgage banking gain on sale composite margin 315‐325 bps 315‐325 bps 318‐328 bps

Average quarterly net loan portfolio growth 2% ‐ 4% 2% ‐ 4% 2% ‐ 4%

Net interest margin 3.35% ‐ 3.40% 3.40% ‐ 3.45% 3.40% ‐ 3.45%

Average quarterly noninterest expense growth No material change No material change 1.5%

Key Drivers Guidance

Revenue Growth Outpacing Expense Growth, Driving Operating Efficiencies and

Strong Returns

.

Appendix

34

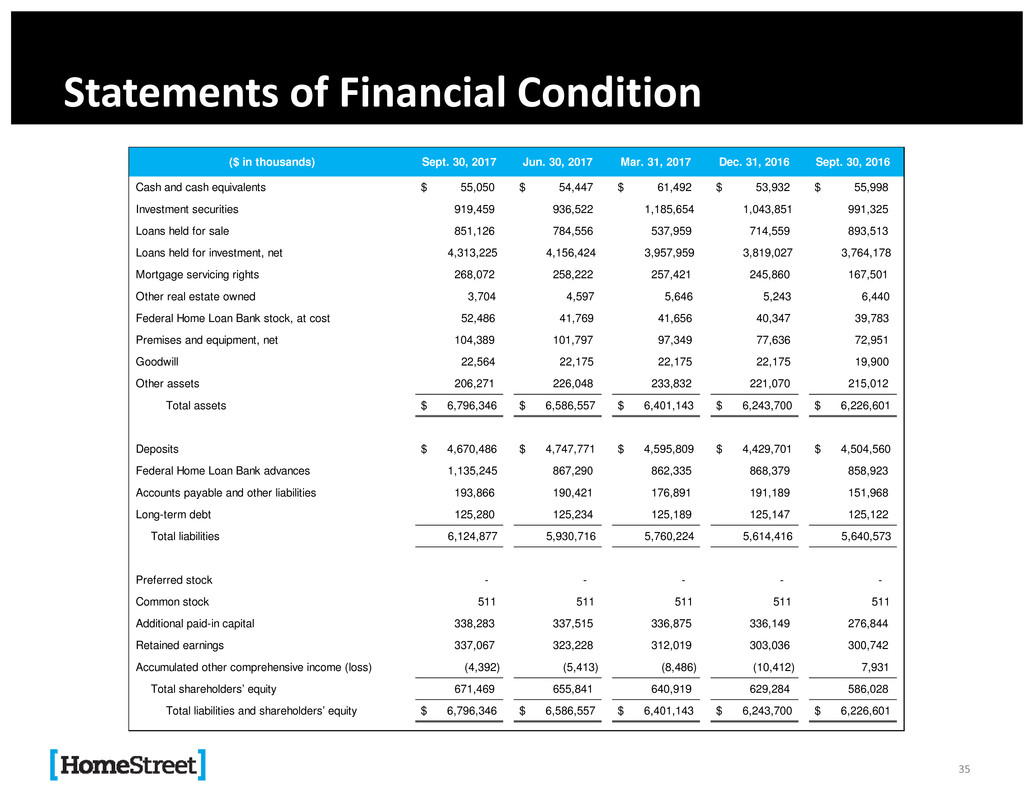

Statements of Financial Condition

35

($ in thousands) Sept. 30, 2017 Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016

Cash and cash equivalents $ 55,050 $ 54,447 $ 61,492 $ 53,932 $ 55,998

Investment securities 919,459 936,522 1,185,654 1,043,851 991,325

Loans held for sale 851,126 784,556 537,959 714,559 893,513

Loans held for investment, net 4,313,225 4,156,424 3,957,959 3,819,027 3,764,178

Mortgage servicing rights 268,072 258,222 257,421 245,860 167,501

Other real estate owned 3,704 4,597 5,646 5,243 6,440

Federal Home Loan Bank stock, at cost 52,486 41,769 41,656 40,347 39,783

Premises and equipment, net 104,389 101,797 97,349 77,636 72,951

Goodwill 22,564 22,175 22,175 22,175 19,900

Other assets 206,271 226,048 233,832 221,070 215,012

Total assets $ 6,796,346 $ 6,586,557 $ 6,401,143 $ 6,243,700 $ 6,226,601

Deposits $ 4,670,486 $ 4,747,771 $ 4,595,809 $ 4,429,701 $ 4,504,560

Federal Home Loan Bank advances 1,135,245 867,290 862,335 868,379 858,923

Accounts payable and other liabilities 193,866 190,421 176,891 191,189 151,968

Long-term debt 125,280 125,234 125,189 125,147 125,122

Total liabilities 6,124,877 5,930,716 5,760,224 5,614,416 5,640,573

Preferred stock - - - - -

Common stock 511 511 511 511 511

Additional paid-in capital 338,283 337,515 336,875 336,149 276,844

Retained earnings 337,067 323,228 312,019 303,036 300,742

Accumulated other comprehensive income (loss) (4,392) (5,413) (8,486) (10,412) 7,931

Total shareholders’ equity 671,469 655,841 640,919 629,284 586,028

Total liabilities and shareholders’ equity $ 6,796,346 $ 6,586,557 $ 6,401,143 $ 6,243,700 $ 6,226,601

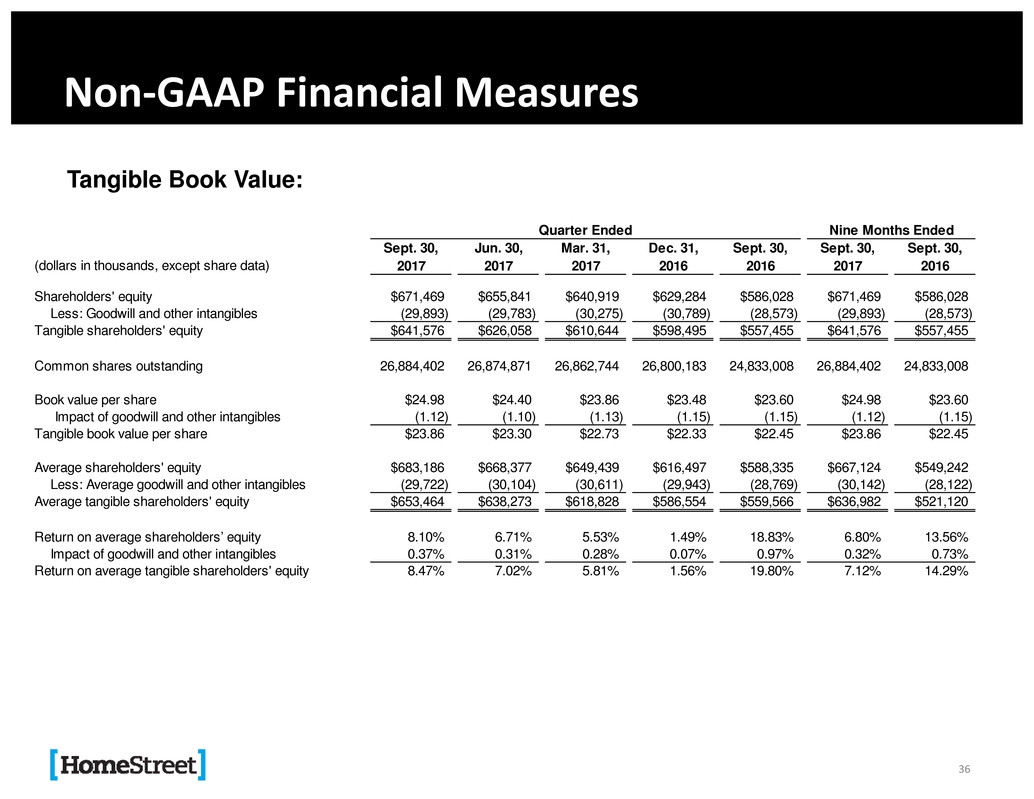

Non‐GAAP Financial Measures

Tangible Book Value:

36

Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30,

(dollars in thousands, except share data) 2017 2017 2017 2016 2016 2017 2016

Shareholders' equity $671,469 $655,841 $640,919 $629,284 $586,028 $671,469 $586,028

Less: Goodwill and other intangibles (29,893) (29,783) (30,275) (30,789) (28,573) (29,893) (28,573)

Tangible shareholders' equity $641,576 $626,058 $610,644 $598,495 $557,455 $641,576 $557,455

Common shares outstanding 26,884,402 26,874,871 26,862,744 26,800,183 24,833,008 26,884,402 24,833,008

Book value per share $24.98 $24.40 $23.86 $23.48 $23.60 $24.98 $23.60

Impact of goodwill and other intangibles (1.12) (1.10) (1.13) (1.15) (1.15) (1.12) (1.15)

Tangible book value per share $23.86 $23.30 $22.73 $22.33 $22.45 $23.86 $22.45

Average shareholders' equity $683,186 $668,377 $649,439 $616,497 $588,335 $667,124 $549,242

Less: Average goodwill and other intangibles (29,722) (30,104) (30,611) (29,943) (28,769) (30,142) (28,122)

Average tangible shareholders' equity $653,464 $638,273 $618,828 $586,554 $559,566 $636,982 $521,120

Return on average shareholders’ equity 8.10% 6.71% 5.53% 1.49% 18.83% 6.80% 13.56%

Impact of goodwill and other intangibles 0.37% 0.31% 0.28% 0.07% 0.97% 0.32% 0.73%

Return on average tangible shareholders' equity 8.47% 7.02% 5.81% 1.56% 19.80% 7.12% 14.29%

Quarter Ended Nine Months Ended

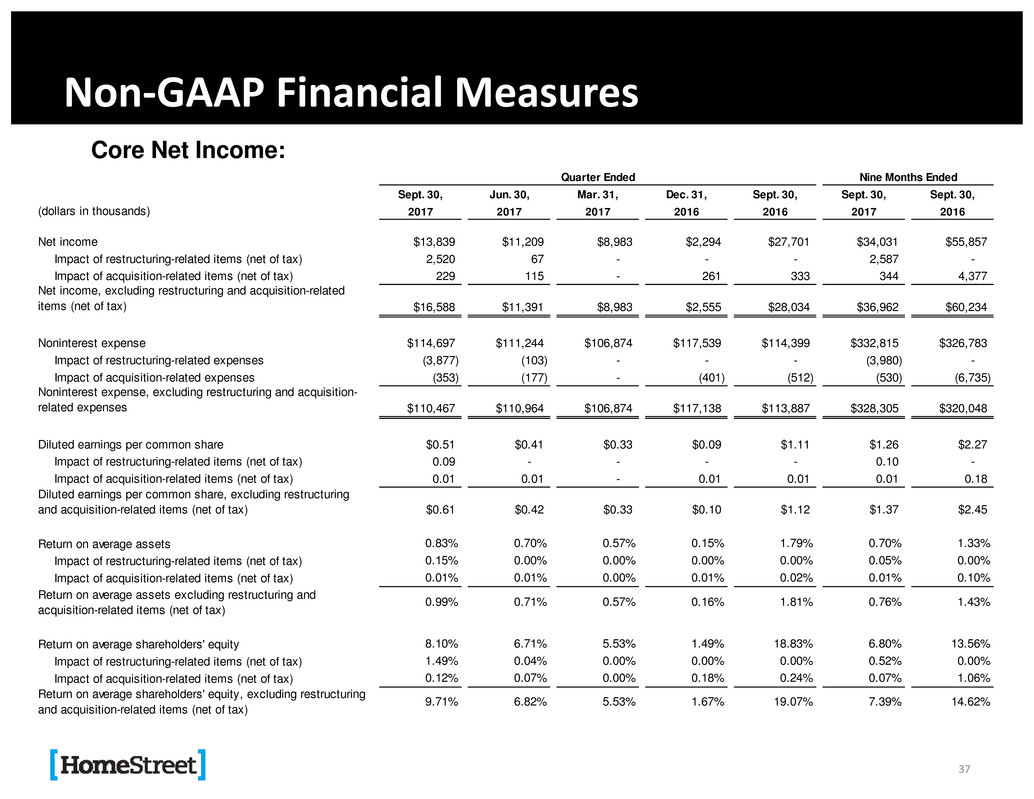

Non‐GAAP Financial Measures

Core Net Income:

37

Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30,

(dollars in thousands) 2017 2017 2017 2016 2016 2017 2016

Net income $13,839 $11,209 $8,983 $2,294 $27,701 $34,031 $55,857

Impact of restructuring-related items (net of tax) 2,520 67 - - - 2,587 -

Impact of acquisition-related items (net of tax) 229 115 - 261 333 344 4,377

Net income, excluding restructuring and acquisition-related

items (net of tax) $16,588 $11,391 $8,983 $2,555 $28,034 $36,962 $60,234

Noninterest expense $114,697 $111,244 $106,874 $117,539 $114,399 $332,815 $326,783

Impact of restructuring-related expenses (3,877) (103) - - - (3,980) -

Impact of acquisition-related expenses (353) (177) - (401) (512) (530) (6,735)

Noninterest expense, excluding restructuring and acquisition-

related expenses $110,467 $110,964 $106,874 $117,138 $113,887 $328,305 $320,048

Diluted earnings per common share $0.51 $0.41 $0.33 $0.09 $1.11 $1.26 $2.27

Impact of restructuring-related items (net of tax) 0.09 - - - - 0.10 -

Impact of acquisition-related items (net of tax) 0.01 0.01 - 0.01 0.01 0.01 0.18

Diluted earnings per common share, excluding restructuring

and acquisition-related items (net of tax) $0.61 $0.42 $0.33 $0.10 $1.12 $1.37 $2.45

Return on average assets 0.83% 0.70% 0.57% 0.15% 1.79% 0.70% 1.33%

Impact of restructuring-related items (net of tax) 0.15% 0.00% 0.00% 0.00% 0.00% 0.05% 0.00%

Impact of acquisition-related items (net of tax) 0.01% 0.01% 0.00% 0.01% 0.02% 0.01% 0.10%

Return on average assets excluding restructuring and

acquisition-related items (net of tax)

0.99% 0.71% 0.57% 0.16% 1.81% 0.76% 1.43%

Return on average shareholders' equity 8.10% 6.71% 5.53% 1.49% 18.83% 6.80% 13.56%

Impact of restructuring-related items (net of tax) 1.49% 0.04% 0.00% 0.00% 0.00% 0.52% 0.00%

Impact of acquisition-related items (net of tax) 0.12% 0.07% 0.00% 0.18% 0.24% 0.07% 1.06%

Return on average shareholders' equity, excluding restructuring

and acquisition-related items (net of tax)

9.71% 6.82% 5.53% 1.67% 19.07% 7.39% 14.62%

Nine Months EndedQuarter Ended

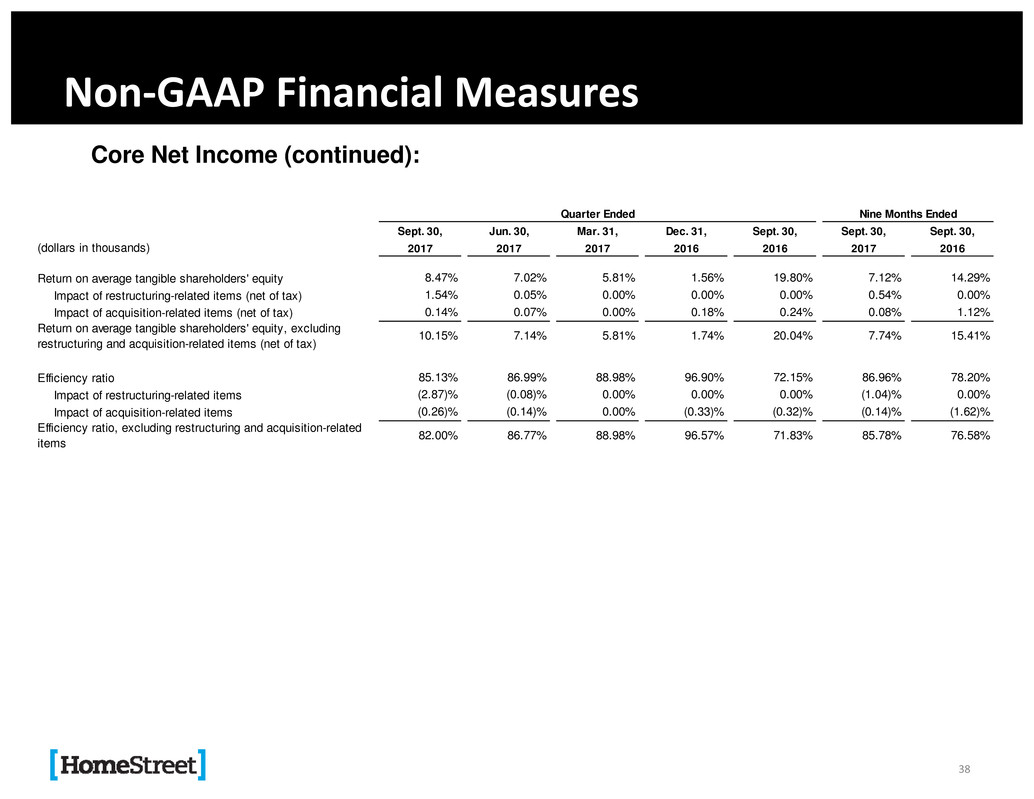

Non‐GAAP Financial Measures

Core Net Income (continued):

38

Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30,

(dollars in thousands) 2017 2017 2017 2016 2016 2017 2016

Return on average tangible shareholders' equity 8.47% 7.02% 5.81% 1.56% 19.80% 7.12% 14.29%

Impact of restructuring-related items (net of tax) 1.54% 0.05% 0.00% 0.00% 0.00% 0.54% 0.00%

Impact of acquisition-related items (net of tax) 0.14% 0.07% 0.00% 0.18% 0.24% 0.08% 1.12%

Return on average tangible shareholders' equity, excluding

restructuring and acquisition-related items (net of tax)

10.15% 7.14% 5.81% 1.74% 20.04% 7.74% 15.41%

Efficiency ratio 85.13% 86.99% 88.98% 96.90% 72.15% 86.96% 78.20%

Impact of restructuring-related items (2.87)% (0.08)% 0.00% 0.00% 0.00% (1.04)% 0.00%

Impact of acquisition-related items (0.26)% (0.14)% 0.00% (0.33)% (0.32)% (0.14)% (1.62)%

Efficiency ratio, excluding restructuring and acquisition-related

items

82.00% 86.77% 88.98% 96.57% 71.83% 85.78% 76.58%

Quarter Ended Nine Months Ended

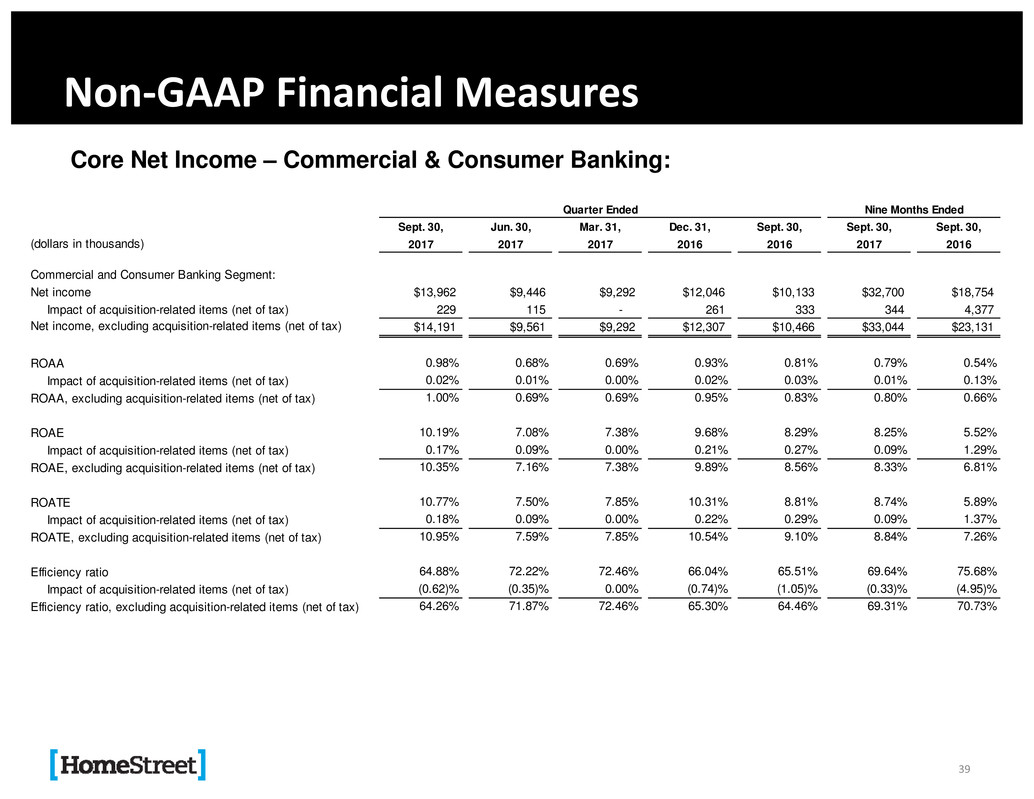

Non‐GAAP Financial Measures

Core Net Income – Commercial & Consumer Banking:

39

Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30,

(dollars in thousands) 2017 2017 2017 2016 2016 2017 2016

Commercial and Consumer Banking Segment:

Net income $13,962 $9,446 $9,292 $12,046 $10,133 $32,700 $18,754

Impact of acquisition-related items (net of tax) 229 115 - 261 333 344 4,377

Net income, excluding acquisition-related items (net of tax) $14,191 $9,561 $9,292 $12,307 $10,466 $33,044 $23,131

ROAA 0.98% 0.68% 0.69% 0.93% 0.81% 0.79% 0.54%

Impact of acquisition-related items (net of tax) 0.02% 0.01% 0.00% 0.02% 0.03% 0.01% 0.13%

ROAA, excluding acquisition-related items (net of tax) 1.00% 0.69% 0.69% 0.95% 0.83% 0.80% 0.66%

ROAE 10.19% 7.08% 7.38% 9.68% 8.29% 8.25% 5.52%

Impact of acquisition-related items (net of tax) 0.17% 0.09% 0.00% 0.21% 0.27% 0.09% 1.29%

ROAE, excluding acquisition-related items (net of tax) 10.35% 7.16% 7.38% 9.89% 8.56% 8.33% 6.81%

ROATE 10.77% 7.50% 7.85% 10.31% 8.81% 8.74% 5.89%

Impact of acquisition-related items (net of tax) 0.18% 0.09% 0.00% 0.22% 0.29% 0.09% 1.37%

ROATE, excluding acquisition-related items (net of tax) 10.95% 7.59% 7.85% 10.54% 9.10% 8.84% 7.26%

Efficiency ratio 64.88% 72.22% 72.46% 66.04% 65.51% 69.64% 75.68%

Impact of acquisition-related items (net of tax) (0.62)% (0.35)% 0.00% (0.74)% (1.05)% (0.33)% (4.95)%

Efficiency ratio, excluding acquisition-related items (net of tax) 64.26% 71.87% 72.46% 65.30% 64.46% 69.31% 70.73%

Nine Months EndedQuarter Ended

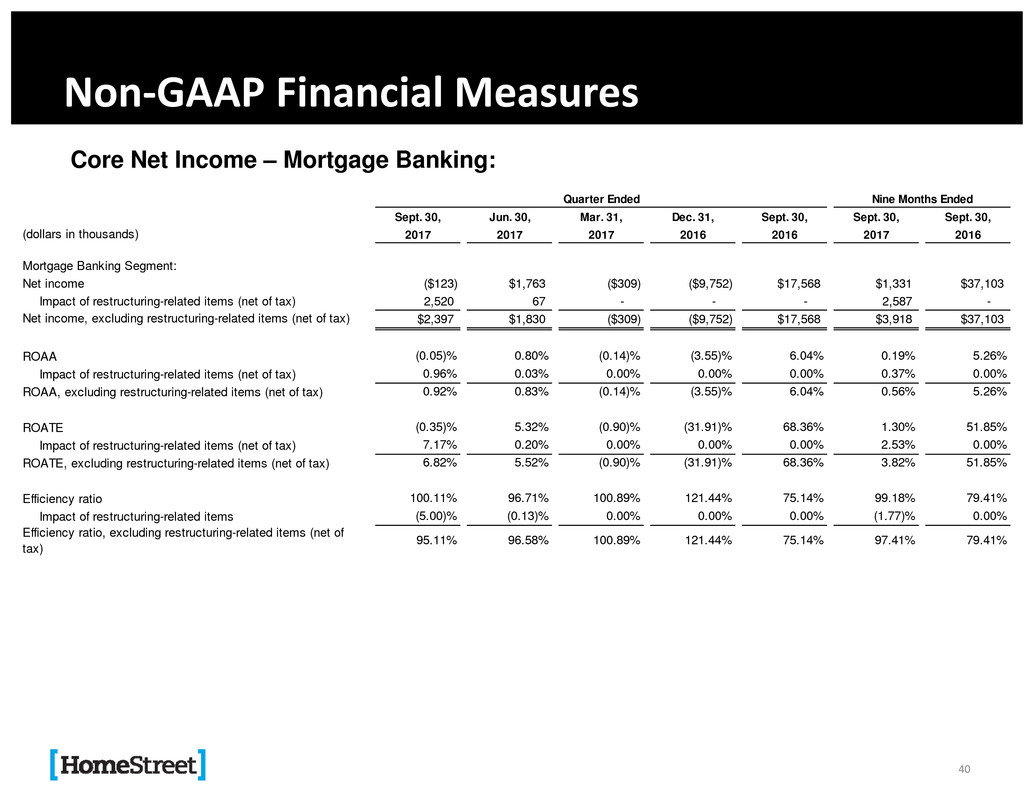

Non‐GAAP Financial Measures

Core Net Income – Mortgage Banking:

40

Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, Sept. 30, Sept. 30,

(dollars in thousands) 2017 2017 2017 2016 2016 2017 2016

Mortgage Banking Segment:

Net income ($123) $1,763 ($309) ($9,752) $17,568 $1,331 $37,103

Impact of restructuring-related items (net of tax) 2,520 67 - - - 2,587 -

Net income, excluding restructuring-related items (net of tax) $2,397 $1,830 ($309) ($9,752) $17,568 $3,918 $37,103

ROAA (0.05)% 0.80% (0.14)% (3.55)% 6.04% 0.19% 5.26%

Impact of restructuring-related items (net of tax) 0.96% 0.03% 0.00% 0.00% 0.00% 0.37% 0.00%

ROAA, excluding restructuring-related items (net of tax) 0.92% 0.83% (0.14)% (3.55)% 6.04% 0.56% 5.26%

ROATE (0.35)% 5.32% (0.90)% (31.91)% 68.36% 1.30% 51.85%

Impact of restructuring-related items (net of tax) 7.17% 0.20% 0.00% 0.00% 0.00% 2.53% 0.00%

ROATE, excluding restructuring-related items (net of tax) 6.82% 5.52% (0.90)% (31.91)% 68.36% 3.82% 51.85%

Efficiency ratio 100.11% 96.71% 100.89% 121.44% 75.14% 99.18% 79.41%

Impact of restructuring-related items (5.00)% (0.13)% 0.00% 0.00% 0.00% (1.77)% 0.00%

Efficiency ratio, excluding restructuring-related items (net of

tax)

95.11% 96.58% 100.89% 121.44% 75.14% 97.41% 79.41%

Quarter Ended Nine Months Ended