SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | ý |

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Vertical Capital Income Fund

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies:

| _______________________________________________________________________________ |

2) Aggregate number of securities to which transaction applies:

| _______________________________________________________________________________ |

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| _______________________________________________________________________________ |

4) Proposed maximum aggregate value of transaction:

| _______________________________________________________________________________ |

5) Total fee paid:

| _______________________________________________________________________________ |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

| _______________________________________________________________________________ |

2) Form, Schedule or Registration Statement No.:

| _______________________________________________________________________________ |

3) Filing Party:

| _______________________________________________________________________________ |

4) Date Filed:

| _______________________________________________________________________________ |

Vertical Capital Income Fund

80 Arkay Drive, Suite 110

Hauppauge, NY 11788

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held October 30, 2015

Dear Shareholders:

The Board of Trustees of Vertical Capital Income Fund (the "Fund"), a closed-end management investment company operating as an interval fund organized as a Delaware statutory trust, has called a special meeting of the shareholders of the Fund, to be held at the offices of the Fund's administrator, Gemini Fund Services, LLC, 80 Arkay Drive, Suite 110, Hauppauge, NY 11788, on October 30, 2015 at 10:00 a.m., Eastern Time, for the following purposes:

1. To approve a new investment advisory agreement between the Fund and Behringer Advisors, LLC. No fee increase is proposed.

2. To elect a new Trustee to the Board of Trustees of the Fund.

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Shareholders of record at the close of business on September 4, 2015 are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements thereof.

Important Notice Regarding the Availability

of Proxy Materials for the

Shareholder Meeting to be Held on October 30, 2015

A copy of the Notice of Shareholder Meeting, the Proxy Statement (including the proposed new Investment Advisory Agreement) and Proxy Voting Ballot are available at www.proxyonline.com.

By Order of the Board of Trustees

Stanton P. Eigenbrodt, Secretary

September 17, 2015

YOUR VOTE IS IMPORTANT

To assure your representation at the meeting, please complete the enclosed proxy and return it promptly in the accompanying envelope, by calling the number listed on your proxy card, by faxing it to the number listed on your proxy card, or via internet as indicated in the voting instruction materials whether or not you expect to be present at the meeting. If you attend the meeting, you may revoke your proxy and vote your shares in person.

Vertical Capital Income Fund

with its principal offices at

80 Arkay Drive, Suite 110

Hauppauge, NY 11788

____________

PROXY STATEMENT

____________

SPECIAL MEETING OF SHAREHOLDERS

To Be Held October 30, 2015

____________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the "Board" or the "Trustees") of Vertical Capital Income Fund (the "Fund") on behalf of the Fund, for use at a special meeting of shareholders of the Fund (the "Meeting") to be held at the offices of the Fund's administrator, Gemini Fund Services, LLC, 80 Arkay Drive, Suite 110, Hauppauge, NY 11788, on October 30, 2015 at 10:00 a.m., Eastern Time, and at any and all adjournments thereof. The Notice of Meeting, Proxy Statement and accompanying form of proxy will be mailed to shareholders on or about September 30, 2015.

The Meeting has been called by the Board for the following purposes:

- To approve a new investment advisory agreement between the Fund and Behringer Advisors, LLC. No fee increase is proposed.

- To elect a new Trustee to the Board of Trustees of the Fund.

- To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

Only shareholders of record at the close of business on September 4, 2015 (the "Record Date") are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

A copy of the Fund's

most recent annual and semi-annual report, including financial statements and schedules, is available at no charge by sending a

written request to the Fund, 80 Arkay Drive, Suite 110, Hauppauge, NY 11788 or by calling 1-866-277-8243.

| 1 |

PROPOSAL I

APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT BETWEEN

THE TRUST, ON BEHALF OF THE FUND, AND BEHRINGER ADVISORS, LLC

Background

The Fund was previously managed by Vertical Capital Asset Management, LLC ("VCAM") pursuant to an advisory agreement between the Fund and VCAM (the "VCAM Agreement"). VCAM was responsible for management of the Fund's portfolio and assuring that investments were made according to the Fund's investment objective, policies and restrictions. An affiliate of VCAM, Vertical Recovery Management ("VRM"), previously served as the servicing agent for mortgage notes held by the Fund.

On June 22, 2015, the Fund's Board of Trustees of the Fund (the "Board" or the "Trustees") terminated the VCAM Agreement. The Board determined, based on information provided by VCAM, that VCAM lacked sufficient resources to meet its obligations to the Fund, and failed to adequately monitor VRM's actions in connection with servicing the mortgage notes held by the Fund. VRM's primary duties to the Fund where to collect interest, principal, taxes, and insurance and other mortgage note related payments and either forward them on to the Fund or preserve them in an escrow account for payment when due. The Board believed that VRM did not keep adequate records of these functions and did not have adequate controls over the servicing-related bank account.

At a meeting held on June 29, 2015, the Board approved the appointment of a new investment adviser to the Fund - Behringer Advisors, LLC ("Behringer" or the "Advisor"). Behringer and its affiliates currently serve a variety of retail, registered investment adviser and institutional investor clients, managing approximately $787 million in assets across its non-listed real estate investment trust ("REIT"), closed end funds and DST/Net Lease platform (a real estate related investment vehicle.

Effective July 6, 2015, the Advisor manages the Fund pursuant to an interim advisory agreement ("Interim Agreement") with the Fund. The investment advisory fee paid by the Fund remains unchanged at an annual rate of 1.25% of the Fund's daily net assets. The Interim Agreement will terminate on November 19, 2015, or earlier if the definitive investment advisory agreement (the "New Agreement") is approved at the Meeting by a majority of the Fund's outstanding voting securities, as defined in the Investment Company Act of 1940, as revised (the "1940 Act"). Pursuant to the terms of the Interim Agreement, the Advisor manages the Fund's investments on a day-to-day basis and employs substantially the same investment strategies employed by the prior investment adviser to the Fund.

The Fund hired Statebridge Company, LLC ("Statebridge"), effective June 24, 2015, to serve as the servicing agent for mortgage notes held by the Fund, with VRM serving in a transition capacity until all servicing functions were assumed by Statebridge. Statebridge is not an affiliate of VCAM or the Advisor.

The VCAM Agreement

Under the terms of the VCAM Agreement, VCAM was entitled to receive an annual advisory fee from the Fund equal to 1.25% of the Fund's average daily net assets. The shareholders of the Fund last approved the VCAM Agreement on September 22, 2011. The

| 2 |

Board, including the Trustees who are not "interested persons" (the "Independent Trustees"), as that term is defined in the 1940 Act, unanimously approved the renewal of the VCAM Agreement at an in-person meeting held on November 14, 2014. During the fiscal year ended September 30, 2014, the Fund incurred $917,918 in advisory fee expenses of which $299,897 were waived by VCAM; and VRM earned $200,471.

VCAM contractually agreed to limit Fund expenses (the "VCAM Expense Limitation Agreement") by agreeing contractually to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that expenses exceed 1.85% per annum of the Fund's average daily net assets through at least January 31, 2016 and 2.50% through at least April 30, 2024 (the "Expense Limitation"). In consideration of VCAM's agreement to limit the Fund's expenses, the Fund agreed to repay VCAM the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the end of the fiscal year in which they were incurred; and (2) the reimbursement may not be made if it would cause the Expense Limitation to be exceeded.

The New Agreement

Under the New Agreement, the Advisor will receive an annual fee from the Fund equal to 1.25% of the Fund's average daily net assets. The Advisor also has contractually agreed to reduce its fees and to reimburse expenses (the "New Expense Limitation Agreement") from the date of effectiveness of the New Agreement as well as for the term of the Interim Agreement to 1.85% pursuant to the same terms as the existing VCAM Expense Limitation Agreement for at least the first year that the New Agreement is in place. The New Expense Limitation Agreement will not include the extended limitation limiting Fund expenses to 2.50% through at least April 30, 2024.

Subject to shareholder approval, the Fund will enter into the New Agreement with the Advisor. If the New Agreement is not approved by the shareholders of the Fund, the Board will consider other options, including a new or modified request for shareholder approval of a new advisory agreement or liquidating the Fund.

The New Agreement will become effective with respect to the Fund upon approval by the shareholders of the Fund. The New Agreement will be similar in all material respects to VCAM Agreement, except that the date of its execution, effectiveness, and expiration are changed. Under the VCAM Agreement, like the New Agreement, the Fund pays an advisory fee of 1.25% of the Fund's average daily net assets. The New Agreement, like the VCAM Agreement, provides that it will continue in force for an initial period of two years, and from year to year thereafter, but only so long as its continuance is approved at least annually by the Board at a meeting called for that purpose or by the vote of a majority of the outstanding shares of the Fund. Like the VCAM Agreement, the New Agreement automatically terminates on assignment, and it is terminable upon 60 days' prior written notice by (i) the Advisor given to the Fund or (ii) the Fund given to the Advisor.

The New Agreement, like the VCAM Agreement and the Interim Agreement, provides that the Advisor shall not be subject to any liability in connection with the performance of its services thereunder in the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations and duties.

| 3 |

The New Agreement is attached as Exhibit A. The New Expense Limitation Agreement is attached as Exhibit B. You should read the new agreements. The descriptions in this Proxy Statement of the new agreements are only summaries.

Comparative Fee Information

The Fund's Prospectus dated January 31, 2015 disclosed gross annual expenses of 2.32% and net expenses of 1.91%. VCAM limited Fund expenses, subject to certain exclusions, to 1.85% until January 31, 2016 and 2.50% at least through April 30, 2024. The fee table from the Fund’s January 31, 2015 Prospectus is shown here:

SUMMARY OF FUND EXPENSES

| Shareholder Transaction Expenses | ||

|

Maximum Sales Load (as a percent of offering price)1 |

4.50% | |

| Annual Expenses (as a percentage of net assets attributable to shares) | ||

| Management Fees | 1.25% | |

| Interest Payments and Fees on Borrowed Funds | 0.06% | |

| Other Expenses | 1.01% | |

| Total Annual Expenses | 2.32% | |

| Fee Waiver and Reimbursement 2 | (0.41)% | |

| Total Annual Expenses (after fee waiver and reimbursement) | 1.91% |

1 The Fund's transfer agent charges a $15 fee for repurchase proceeds transferred by wire.

2 The Adviser and the Fund have entered into an expense limitation and reimbursement agreement (the "Expense Limitation Agreement") under which the Adviser has agreed contractually to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that they exceed 1.85% per annum of the Fund's average daily net assets through at least January 31, 2016 and 2.50% through at least April 30, 2024 (the "Expense Limitation"). In consideration of the Adviser's agreement to limit the Fund's expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the end of the fiscal year in which they were incurred; and (2) the reimbursement may not be made if it would cause the Expense Limitation to be exceeded. The Expense Limitation Agreement will remain in effect as described above unless and until the Board approves its modification or termination. This agreement may be terminated only by the Fund's Board of Trustees on 60 days written notice to the Adviser. See "Management of the Fund."

The Summary of Expenses Table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of shares if you and your family invest, or agree to invest in the future, at least $25,000 in the Fund.

The following example illustrates the hypothetical expenses that you would pay on a $1,000 investment assuming annual expenses attributable to shares remain unchanged and shares earn a 5% annual return:

| Example | 1 Year | 3 Years | 5 Years | 10 Years |

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return | $64 | $110 | $160 | $296 |

Shareholders who choose to participate in repurchase offers by the Fund will not incur a repurchase fee. However, if shareholders request repurchase proceeds be paid by wire transfer, such shareholders will be assessed an outgoing wire transfer fee at prevailing rates charged by Gemini Fund Services, LLC currently $15. The purpose of the above table is to help a holder of shares understand the fees and expenses that such holder would bear directly or indirectly. The example should not be considered a representation of actual future expenses. Actual expenses may be higher or lower than those shown.

| 4 |

The Fund's estimated and restated expenses, pursuant to the New Agreement, are presented below. The Fund benefits from an expense limitation agreement provided by the Advisor that limits expense to 1.85% until January 31, 2017, subject to certain exclusions. Because the Fund expects to incur certain transition expenses, which are excluded from the expense limitation agreement, both gross and net expenses are projected to be higher. Current estimated gross annual expenses are 2.46% and estimated net expenses are 2.15%.

Pro Forma - SUMMARY OF FUND EXPENSES

| Shareholder Transaction Expenses | |

| Maximum Sales Load (as a percent of offering price)1 | 4.50% |

| Annual Expenses (as a percentage of net assets attributable to shares) | |

| Management Fees | 1.25% |

| Interest Payments and Fees on Borrowed Funds | 0.09% |

| Other Expenses | 1.12% |

| Total Annual Expenses | 2.46% |

| Fee Waiver 2 | (0.31)% |

| Total Annual Expenses (after fee waiver) | 2.15% |

|

(1)The Fund's transfer agent charges a $15 fee for repurchase proceeds transferred by wire. (2) The Advisor and the Fund have entered into the New Expense Limitation Agreement under which the Advisor has agreed to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that they exceed 1.85% per annum of the Fund's average daily net assets through at least January 31, 2017 (the "Expense Limitation"). In consideration of the Advisor's agreement to limit the Fund's expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the end of the fiscal year in which they were incurred; and (2) the reimbursement may not be made if it would cause the Expense Limitation to be exceeded. The New Expense Limitation Agreement will remain in effect as described above unless and until the Board approves its modification or termination; or, if shareholders do not vote to approve the Advisor, the New Expense Limitation Agreement will terminate on November 19, 2015. | |

The Summary of Expenses Table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of shares if you and your family invest, or agree to invest in the future, at least $25,000 in the Fund.

The following example illustrates the hypothetical expenses that you would pay on a $1,000 investment assuming annual expenses attributable to shares remain unchanged and shares earn a 5% annual return:

| Example | 1 Year | 3 Years | 5 Years | 10 Years |

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return | $67 | $119 | $173 | $322 |

Shareholders who choose to participate in repurchase offers by the Fund will not incur a repurchase fee. However, if shareholders request repurchase proceeds be paid by wire transfer, such shareholders will be assessed an outgoing wire transfer fee at prevailing rates charged by Gemini Fund Services, LLC, currently $15. The purpose of the above table is to help a holder of shares understand the fees and expenses that such holder would bear directly or indirectly. The example should not be considered a representation of actual future expenses. Actual expenses may be higher or lower than those shown.

| 5 |

Information Concerning Behringer Advisors, LLC

The Advisor is a Delaware limited lability company located at 15601 Dallas Parkway, Suite 600, Addison, Texas 75001. The names, titles, and addresses of the principal executive officers of the Advisor are set forth below. Each principal executive officer's principal occupation is as reflected by his title at Advisor:

| Name and Address*: | Title | Position with the Fund |

| Robert Steven Aisner | Chief Executive Officer | None |

| Robert Franklin Muller | President | None |

| Stanton Paul Eigenbrodt | Executive Vice President | Secretary |

| Peter Alfred Moore | Chief Compliance Officer | None |

| Robert J. Chapman | Executive Vice President | Trustee |

*Each officer's address is in care of Behringer Advisors, LLC, 15601 Dallas Parkway, Suite 600, Addison, Texas 75001.

Behringer Harvard Holdings, LLC ("Behringer Holdings") is the Advisor's principal owner and holds a majority of the firm's voting equity interests. Robert Michael Behringer is deemed to indirectly control the Advisor due to his majority interest in Behringer Holdings.

Evaluation by the Board of Trustees

The New Agreement was approved by a majority of the Board, including the Independent Trustees, at an in-person meeting held on June 29, 2015. The Board reviewed the materials provided by the Advisor in advance of the meeting. The Trustees were assisted by independent legal counsel throughout the New Agreement review process. The Board relied upon the advice of independent legal counsel and their own business judgment in determining the material factors to be considered in evaluating the New Agreement and the weight to be given to each such factor. The conclusions reached by the Trustees were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the New Agreement.

Nature, Extent and Quality of Services. The Trustees discussed the Advisor's history and portfolio management experience. They noted that the Advisor and its affiliates currently serves a variety of retail, registered investment adviser and institutional investor clients, managing approximately $787 million in assets across its non-listed real estate investment trust ("REIT"), closed end funds and DST/Net Lease platform (a real estate related investment vehicle). The Trustees reviewed the background and experience of the Advisor's team proposed to advise and service the Fund. They noted that although the Advisor had not provided advisory services to a registered investment company directly, they considered the varied and extensive experience of the portfolio management and compliance teams, and the Advisor’s ability to leverage the experience and expertise of its affiliates to the benefit of the Fund and shareholders. The Trustees discussed the investment advisory and related services to be provided to the Fund noting that the Advisor would oversee the day-to-day operations of the Fund, provide a variety of investment advisory services including execution and management of the Fund's investment portfolio, and provide oversight and compliance. They considered that although the Advisor does not have experience in the residential mortgage markets, it does have previous experience with REIT and real-estate related investments. The Trustees noted positively the significant support the Advisor has in the Advisor-affiliated entities which further strengthen the services available to the Fund and shareholders. The Trustees discussed the Advisor's proposal for the ongoing management and implementation of strategy changes for the

| 6 |

Fund over time, and agreed that it had given thoughtful consideration to the development of a strategic and promising plan for the Fund. After further discussion, the Trustees concluded that the Advisor has the potential to provide advisory services to the Fund in line with the Board's expectations.

Performance. The Trustees reviewed the performance of a variety of accounts currently managed by the Advisor. They noted that the Advisor does not currently manage a fund with a strategy substantially similar to that of the Fund, so the performance information provided was merely illustrative of the Advisor's general capabilities. They also reviewed the performance of multiple REITs managed by the Advisor noting the positive returns in each period shown. The Trustees considered that while the Advisor does not have experience in the residential mortgage market, its experience and successful track record in the commercial real-estate and REIT markets suggest it has the capacity to provide positive returns for shareholders.

Fees and Expenses. The Trustees noted that the Advisor proposed to charge an advisory fee of 1.25%, equal to that currently paid by the Fund. They considered that the proposed fee was higher than the Morningstar category of real estate related funds average but within the range of fees of the peer group. The Trustees noted that Morningstar does not have a closed-end interval fund category and, therefore, the Morningstar comparison, while informative is not directly on point as to the relative reasonableness of the proposed fee. The Trustees further considered that the Advisor would maintain a contractual fee waiver until January 31, 2017 limiting the Fund's total expense ratio to 1.85%. After further discussion, the Trustees concluded that the proposed advisory fee was reasonable.

Profitability. The Trustees reviewed a profitability analysis provided by the Advisor, and discussed the Advisor's estimated profitability in connection with its relationship with the Fund. They noted that the Advisor anticipates realizing a net profit during the initial term of the New Agreement but agreed that the amount of profit was not excessive in terms of actual dollars or as a percentage of revenue. The Trustees further noted that the Advisor had agreed, if shareholders approve the New Agreement, to pay a portion of an existing shortfall in the Fund's mortgage loan servicing account. They considered that the Advisor's profitability analysis did not take this expense into account, and if it had, the Advisor would realize a net loss in connection with its relationship with the Fund for the first year. After further discussion, the Trustees concluded the Advisor's estimated profitability was reasonable.

Economies of Scale. The Trustees considered whether there will be economies of scale with respect to the management of the Fund. The Trustees noted the absence of breakpoints in the Advisor's fee proposal. They considered the Advisor's representation that the Fund could benefit from economies as certain expenses of the Fund will be leveraged across the Advisor's shared services platform and firm resources. After further discussion, the Trustees agreed that the matter of economies of scale would be revisited in connection with the renewal of the New Agreement as the Advisor's costs are more clearly identified and prospects for Fund growth are better understood.

Conclusion. Having requested and received such information from the Advisor as the Trustees believed to be reasonably necessary to evaluate the terms of the New Agreement, and as assisted by the advice of Counsel, the Trustees concluded that the fee structure is reasonable and that approval of the New Agreement is in the best interests of the shareholders of Vertical Capital Income Fund.

The Board of Trustees of the Fund, including

the Independent Trustees, recommends that shareholders of the Fund vote "FOR" approval of the New Agreement.

| 7 |

PROPOSAL II

SHAREHOLDER ELECTION OF TRUSTEE

In this proposal, shareholders of the Fund are being asked to elect Robert J. Chapman to the Board of Trustees of the Fund. Mr. Chapman was elected to the Board by a majority of the existing Trustees, and has agreed to serve on the Board of Trustees for an indefinite term. The 1940 Act requires a certain percentage of the Trustees to have been elected by shareholders before the Board can appoint any new Trustees. To facilitate future compliance with this requirement, the Board of Trustees now proposes to have shareholders elect Mr. Chapman as a Trustee.

Mr. Chapman was nominated for election to the Board by the Fund's investment adviser. The Board approved the nomination effective August 24, 2015, and Mr. Chapman is considered an Interested Trustee. Even if he is not elected by shareholders, Mr. Chapman will continue to serve in his current capacity pursuant to his election to the Board.

Information about Robert J. Chapman

Below is information about Mr. Chapman and the attributes that qualify him to serve as a Trustee. The information provided below is not all-inclusive. Many Trustee attributes involve intangible elements, such as intelligence, work ethic and the willingness to work together, as well as the ability to communicate effectively, exercise judgment, ask incisive questions, manage people and problems, and develop solutions. The Board does not believe any one factor is determinative in assessing a Trustee's qualifications.

The Board believes that Mr. Chapman is qualified to serve as a Trustee of the Fund because of his extensive professional experience including eight years at Behringer Holdings, the parent company of the Advisor, and nearly 40 years in the investment management and real estate industries.

Mr. Chapman is executive vice president of the Advisor, a position held since July 2015. Mr. Chapman shares primary responsibility for management of the Fund's investment portfolio and has served in this capacity since July 2015. Mr. Chapman is also executive vice president of Behringer Holdings, a financial services holding company that is the parent of the Advisor. Prior to joining Behringer Holdings in 2007, Mr. Chapman was chief financial officer of AMLI Residential Properties Trust, a publicly traded multifamily real estate investment trust (NYSE:AML) from 1997-2007; managing director of Heitman Capital Management Corporation (1994-1997); managing director and chief financial officer of JMB Institutional Realty Corporation (1994); and managing director and chief financial Officer of JMB Realty Corporation (1976-1994).

Mr. Chapman has served as a member of the Advisory Board of the Graaskamp Center for Real Estate of the University of Wisconsin. He was a Member of the Board of Directors and Chairman of the Audit Committee of Behringer Harvard Opportunity REIT I, Inc., a non-traded publicly registered company, and served as a Founding Board Member of the National Association of Real Estate Companies (NAREC) and the Real Estate Advisory Council of the University of Cincinnati. Mr. Chapman has also been an adjunct professor of real estate finance at DePaul University in Chicago, Illinois.

| 8 |

Mr. Chapman received a BBA degree in accounting and an MBA degree in finance from the University of Cincinnati. He is a certified public accountant and, when previously affiliated with a broker-dealer, was a National Association Securities Dealers registered representative. He is, or has been, a member of the Association of Foreign Investors in Real Estate, the Mortgage Bankers Association, the National Association of Real Estate Investment Trusts, the National Multi Housing Council, Pension Real Estate Association, the Real Estate Investment Advisory Council, the Urban Land Institute, the International Council of Shopping Centers, the American Institute of Certified Public Accountants, and the Illinois CPA Society.

Additional information about Mr. Chapman is set forth in the following table:

|

Name, Address** and Year of Birth |

Position(s) Held with the Fund |

Term of Office and Length of Time Served |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in the Fund Complex to be Overseen by Trustee |

Other Trusteeships Held by the Trustee During the Past 5 Years |

|

Robert J. Chapman*

Year of Birth: 1947 |

Trustee | August 2015, Indefinite | Executive Vice President of Behringer Advisors, LLC (July 2015 to present), Behringer Harvard Holdings LLC (2007 - present). | 1 | None |

*Mr. Chapman is an interested Trustee because he is Executive Vice President of the Advisor.

** 80 Arkay Drive, Suite 110, Hauppauge, NY 11788

The Board of Trustees of the Fund, including the Independent Trustees, unanimously recommends that shareholders of the Fund vote "FOR" the election of Robert J. Chapman to the Board of Trustees.

| 9 |

ADDITIONAL INFORMATION ABOUT THE TRUSTEES AND OFFICERS

Trustee Ownership

The following table shows the dollar range of the Fund shares beneficially owned by Mr. Chapman and the other Trustees as of August 26, 2015.

|

Name of Trustee |

Dollar Range of Equity Securities in the Fund |

Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen or to be Overseen by Trustee or Trustee in Family of Investment Companies | ||

| Robert J. Chapman | None | None | ||

| Robert J. Boulware | $50,001 to $100,000 | $50,001 to $100,000 | ||

| Mark J. Schlafly | None | None | ||

| T. Neil Bathon | None | None |

Trustee Compensation

The table below details the amount of compensation the Trustees received from the Fund during the fiscal period ended September 30, 2014. Starting in 2015, each Trustee who is not affiliated with the Fund or Advisor receives an annual fee of $20,000 (previously, $10,000), as well as reimbursement for any reasonable expenses incurred attending the meetings. None of the executive officers receive compensation from the Fund. The Fund does not have a bonus, profit sharing, pension or retirement plan.

|

Name and Position |

Aggregate Compensation From Fund |

Pension or Retirement Benefits Accrued as Part of Fund Expenses |

Estimated Annual Benefits Upon Retirement |

Total Compensation From Fund Paid to Directors |

| Robert J. Boulware | $10,000 | None | None | $10,000 |

| Mark J. Schlafly | $10,000 | None | None | $10,000 |

| T. Neil Bathon | $10,000 | None | None | $10,000 |

| Jeffrey F. O'Donnell* | $10,000 | None | None | $10,000 |

| A. Bayard Closser* | None | None | None | None |

| Robert J. Chapman** | None | None | None | None |

* Mr. O'Donnell and Mr. Closser resigned from the Board effective August 28, 2015.

**Mr. Chapman was elected to the Board in August 2015. Mr. Chapman, as an Interested Trustee, receives no compensation from the Fund for his service as Trustee.

Board Leadership Structure

The Fund is led by Mr. Chapman as Chairman of the Board. Mr. Chapman is considered an interested person because he is Executive Vice President of the Advisor. The Trustees elected Mr. Chapman Chairman on September 9, 2015. The Board of Trustees is comprised of Mr. Chapman ("Interested Trustee") and three Independent Trustees. The Independent Trustees have selected Robert J. Boulware as the Lead Independent Trustee. Additionally, under certain 1940 Act governance guidelines that apply to the Trust, the Independent Trustees will meet in executive session, at least quarterly. Under the Trust's Agreement and Declaration of Trust and By-Laws, the Chairman and President are responsible, generally, for (a) presiding at board and shareholder meetings, (b) calling special meetings on an as-needed basis, and, more generally, in-practice (c) execution and administration of Fund policies including (i) setting the agendas for Board meetings and (ii) providing information to

| 10 |

Board members in advance of each Board meeting and between Board meetings. Generally, the Fund believes it best to have more than a single leader so as to be seen by shareholders, business partners and other stakeholders as providing strong leadership through a depth of leadership. The Fund believes that its Chairman, Lead Independent Trustee and President together with the Audit Committee and the full Board of Trustees, provide effective leadership that is in the best interests of the Fund and shareholders because of the Board's collective business acumen and understanding of the regulatory framework under which investment companies must operate. During the fiscal year ended September 30, 2014 the Board met four (4) times.

Generally, the Fund believes that each Trustee is competent to serve because of their individual overall merits including: (i) experience, (ii) qualifications, (iii) attributes and (iv) skills. Mr. Chapman's experience is described above under the heading "Information about Robert J. Chapman."

Robert J. Boulware has over 20 years of business experience in the financial services industry including executive positions with ING Funds Distributor, LLC, Bank of America and Wesav Financial Corporation. Mr. Boulware also holds a Bachelor of Science degree in Business Administration from Northern Arizona University. Mr. Boulware serves as a member of another investment company board outside of the Fund Complex and possesses a strong understanding of the regulatory framework under which investment companies must operate based on his years of service to a multiple-fund mutual fund complex.

T. Neil Bathon has over 20 years of business experience in the financial services industry including executive positions with financial; research and consulting firms. Mr. Bathon also holds a Master of Business Administration degree from DePaul University and a Bachelors of Business Administration degree from Marquette University. Mr. Bathon also served as a member of another investment company board outside of the Fund Complex and possesses a strong understanding of the regulatory framework under which investment companies must operate based on his years of service to a multiple-fund mutual fund complex.

Mark J. Schlafly has over 20 years of business experience in the financial services industry with a focus on brokerage firms including A.G. Edwards and LPL Financial Corporation. Mr. Schlafly also holds a Bachelor of Science degree in Finance from Saint Louis University.

The Fund does not believe any one factor is determinative in assessing a Trustee's qualifications, and that the collective experience of each Trustee makes them each highly qualified.

Following is a list of the Trustees and executive officers of the Fund and their principal occupation over the last five years. Unless otherwise noted, the address of each Trustee and Officer is 80 Arkay Drive, Suite 110, Hauppauge, NY 11788.

| 11 |

Independent Trustees

|

Name, Address and Age (Year of Birth) |

Position/Term of Office* |

Principal Occupation During the Past Five Years |

Number of Portfolios in Fund Complex** Overseen by Trustee |

Other Directorships held by Trustee During Last Five Years |

|

Robert J. Boulware 1956 |

Trustee since August 2011 |

Managing Director, Pilgrim Funds, LLC (private equity fund), Sept. 2006 to present. | 1 | Trustee, Met Investors Series Trust (77 portfolios), March 2008 to present; Director, Gainsco Inc. (auto insurance) May 2005 to present; SharesPost 100 Fund, March 2013 to present. |

|

Mark J. Schlafly 1961 |

Trustee since August 2011 |

Managing Director, Russell Investments, June 2013 to present; Staff Member, Weston Center, Washington University, August 2011 to present; President and Chief Executive Officer, FSC Securities Corporation, July 2008 to April 2011; Senior Vice President, LPL Financial Corporation, July 2006 to July 2008. | 1 | None. |

|

T. Neil Bathon 1961 |

Trustee since August 2011 |

Managing Partner, FUSE Research Network, LLC (financial services industry consulting firm), Aug. 2008 to present; Managing Director, PMR Associates LLC (consulting firm), July 2006 to Present; Financial Research Corp, Oct. 1987 to May 2006. | 1 |

Financial Investors Variable Insurance Trust (5 portfolios), Jan. 2007 to Feb. 2010; BNY Mellon Charitable Gift Fund, June 2013 to present

|

| 12 |

Interested Trustees, Officers

| Name, Address and Age (Year of Birth) | Position/Term of Office* |

Principal Occupation During the Past Five Years |

Number of Portfolios in Fund Complex Overseen by Trustee |

Other Directorships held by Trustee During Last 5 Years |

|

Robert J. Chapman *** 1947 |

Trustee, since August 2015 | Executive Vice President, Behringer Advisors, LLC (investment adviser), a position held since July 2015. Executive Vice President, Behringer Harvard Holdings, LLC (financial services holding company) a position held since 2007. | 1 | None |

| 13 |

|

Michael D. Cohen 1974 |

President, since July 2015 | President of Behringer Harvard Holdings, LLC, (financial services holding company) a position held since April 2015; Executive Vice President, Jan. 2013 to Apr. 2015. President of Harvard Property Trust, LLC, Apr. 2015 to present; Executive Vice President, Jan. 2011 to Apr. 2015; Senior Vice President, Sep. 2008 to Jan. 2011. Executive Vice President of Behringer Harvard Opportunity Advisors I, LLC, Jan. 2015 to present. Executive Vice President of Behringer Harvard Opportunity Advisors II, LLC, Jan. 2015 to present. Managing Director of Behringer Lodging Group, LLC, Nov. 2014 to present. Executive Vice President of Pathway Energy Infrastructure Management, LLC, Aug. 2014 to present. Director, Behringer Harvard Opportunity REIT I, Inc., July 2014 to present. Director, Behringer Harvard Opportunity REIT II, Inc., Feb. 2013 to present. Executive Vice President, Pathway Energy Infrastructure Fund, LLC, Feb 2013 to present. Chief Executive Officer of Behringer Harvard Europe Holdings, LLC. Jan. 2013 to present. Executive Vice President of Behringer Net Lease Advisors, LLC, Dec. 2012 to present. Executive Vice President of Priority Senior Secured Income Management, LLC, Oct. 2012 to present. Executive Vice President of Priority Income Fund, Inc., July 2012 to present. | n/a | n/a |

|

Jason Hall 1966 |

Treasurer since July 2015 |

Senior VP, Chief Financial Officer, Chief Accounting Officer and Treasurer, Behringer Harvard Opportunity REIT II Inc., positions held since Oct. 2014; Senior VP, Chief Accounting Officer, Treasurer, Sept. 2013 to Oct. 2014; Treasurer, Director of Financial Reporting, Senior Fund Controller, Jan 2012 to Sept. 2013, Director of Financial Reporting, Senior Fund Controller, Behringer Harvard Holdings, LLC (financial services holding company), Jan. 2011 to Dec. 2011; Director of Financial Reporting, Jan. 2010 to Dec. 2010; SEC Reporting Manager, Jan. 2005 to Dec. 2010. | n/a | n/a |

|

Harris Cohen 1981 |

Assistant Treasurer since August 2011 |

Manager of Fund Administration, Gemini Fund Services, LLC, Nov. 2004 to present. | n/a | n/a |

|

Stanton P. Eigenbrodt 1965 |

Secretary since July 2015 |

Executive Vice President and General Counsel of Behringer Harvard Holdings, LLC (financial services holding company) a position held since 2006. | n/a | n/a |

|

Emile R. Molineaux 1962 |

Chief Compliance Officer and Anti-Money Laundering Officer since August 2011 | Northern Lights Compliance Services, LLC (Secretary since 2003 and Senior Compliance Officer since 2011); General Counsel, CCO and Senior Vice President, Gemini Fund Services, LLC; Secretary and CCO, Northern Lights Compliance Services, LLC (2003-2011). | n/a | n/a |

|

* The term of office for each Trustee listed above will continue indefinitely and officers listed above serve subject to annual reappointment. ** The term "Fund Complex" refers to the Vertical Capital Income Fund. *** Mr. Chapman is an interested Trustee because he is also an officer of the Fund's investment adviser. |

| 14 |

Board Risk Oversight

The Board of Trustees is comprised of Mr. Boulware, one Interested Trustee and two other Independent Trustees with a standing independent Audit Committee with a separate chair. The Audit Committee is composed of only Independent Trustees. The Board is responsible for overseeing risk management, and the full Board regularly engages in discussions of risk management and receives compliance reports that inform its oversight of risk management from its Chief Compliance Officer at quarterly meetings and on an ad hoc basis, when and if necessary. The Audit Committee considers financial and reporting risk within its area of responsibilities. Generally, the Board believes that its oversight of material risks is adequately maintained through the compliance-reporting chain where the Chief Compliance Officer is the primary recipient and communicator of such risk-related information.

Board Committees

The Board has an Audit Committee that consists of all the Independent Trustees, each of whom is not an "interested person" of the Fund within the meaning of the 1940 Act. The Audit Committee's responsibilities include: (i) recommending to the Board the selection, retention or termination of the Trust's independent auditors; (ii) reviewing with the independent auditors the scope, performance and anticipated cost of their audit; (iii) discussing with the independent auditors certain matters relating to the Trust's financial statements, including any adjustment to such financial statements recommended by such independent auditors, or any other results of any audit; (iv) reviewing on a periodic basis a formal written statement from the independent auditors with respect to their independence, discussing with the independent auditors any relationships or services disclosed in the statement that may impact the objectivity and independence of the Trust's independent auditors and recommending that the Board take appropriate action in response thereto to satisfy itself of the auditor's independence; and (v) considering the comments of the independent auditors and management's responses thereto with respect to the quality and adequacy of the Trust's accounting and financial reporting policies and practices and internal controls. The Audit Committee operates pursuant to an Audit Committee Charter. The Audit Committee is responsible for seeking and reviewing nominee candidates for consideration as Independent Trustees as is from time to time considered necessary or appropriate. The Audit Committee generally will consider shareholder nominees to the extent required pursuant to rules under the Securities Exchange Act of 1934. The Audit Committee is also responsible for reviewing and setting Independent Trustee compensation from time to time when considered necessary or appropriate. During the fiscal year ended September 30, 2014, the Audit Committee held two meetings.

The Trust does not have a formal Nominating Committee, but the Audit Committee performs the duties of a Nominating Committee when and if necessary to evaluate the qualifications of candidates to the Board and of nominating qualified candidates for independent trustee membership on the Board, the Audit Committee serving as the Nominating Committee. The Board has not set specific minimum qualifications that must be met by a Trustee nominee. When evaluating a person as a potential nominee to serve as a Trustee, the Board may consider, among other factors, (i) whether the person is "independent" and whether the person is otherwise qualified under applicable laws and regulations to serve as a Trustee; (ii) whether the person is willing to serve, and willing and able to commit the time necessary for the performance of the duties of a Trustee; (iii) the contribution that the person can make to the Board and the Trust, with consideration being given to the person's business experience, education and such other factors as the Trustees may consider relevant; (iv) the character and integrity of the person; (v) desirable personality traits, including independence, leadership and

| 15 |

the ability to work with the other Trustees; and (vi) any other factors deemed relevant and consistent with the 1940 Act. The process of identifying nominees involves the consideration of candidates recommended by one or more of the following sources: current Trustees, officers, and any other source the Trustees consider appropriate. The Trustees seek diversity on the Board in terms of skills and experience and other factors.

OTHER INFORMATION

OPERATION OF THE FUND

The Fund is a continuously offered, diversified, closed-end management investment company that is operated as an interval fund. The Fund was organized as a Delaware statutory trust on April 8, 2011. The Fund's principal office is located at c/o Gemini Fund Services, LLC, 80 Arkay Drive, Suite 110, Hauppauge, NY 11788, and its telephone number is 1-866-277-8243. The Board supervises the business activities of the Fund. Like other funds, the Fund retains various organizations to perform specialized services. The Fund currently retains the Advisor as investment adviser. Northern Lights Distributors, LLC, located at 17605 Wright Street, Suite 2, Omaha, Nebraska 68130, serves as principal underwriter and distributor of the Fund. Gemini Fund Services, LLC, with principal offices located at 17605 Wright Street, Suite 2, Omaha, Nebraska 68130 provides the Fund with transfer agent, accounting, compliance, and administrative services.

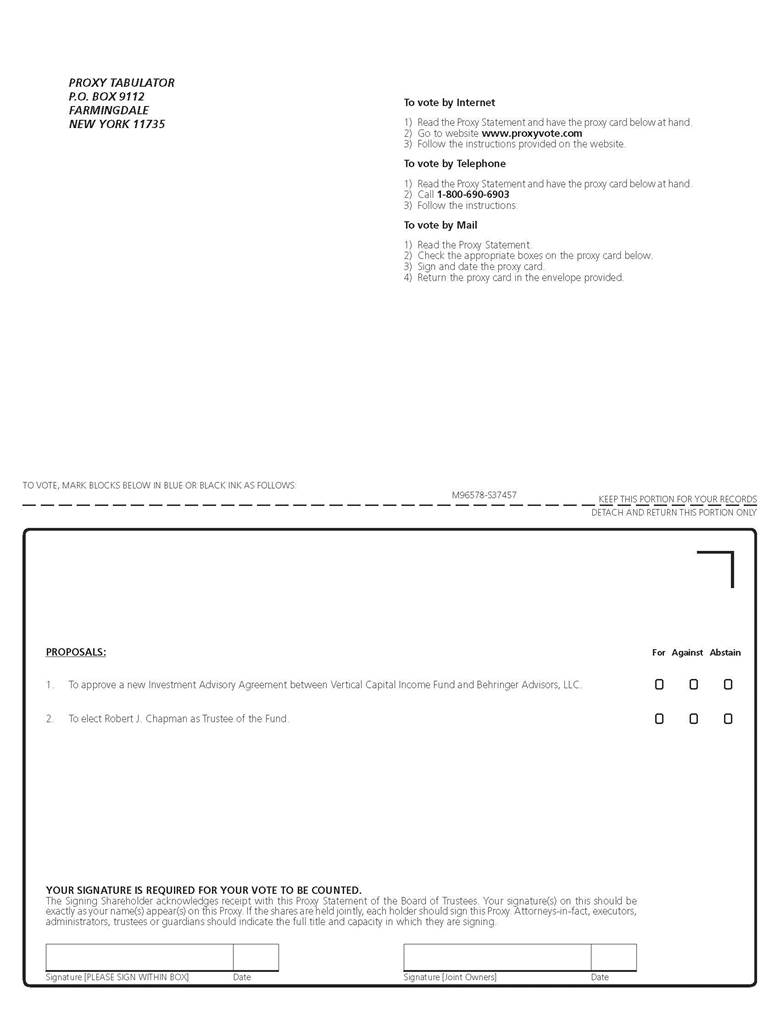

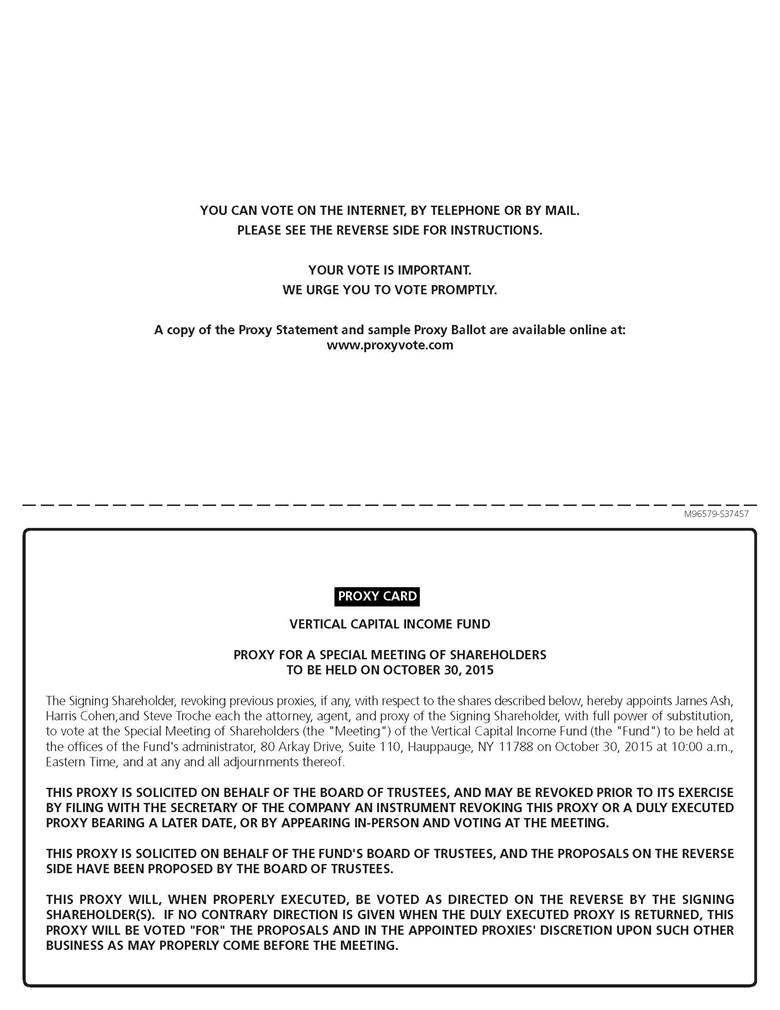

THE PROXY

The Board solicits proxies so that each shareholder has the opportunity to vote on the proposals to be considered at the Meeting. A proxy for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the Meeting as specified. If no specification is made, the shares represented by a duly executed proxy will be voted for approval of the proposed New Agreement and election of Mr. Chapman as Trustee, and at the discretion of the holders of the proxy on any other matter that may come before the Meeting that the Fund did not have notice of a reasonable time prior to the mailing of this Proxy Statement. You may revoke your proxy at any time before it is exercised by (i) submitting a duly executed proxy bearing a later date, (ii) submitting a written notice to the President of the Fund revoking the proxy, or (iii) attending and voting in person at the Meeting.

VOTING SECURITIES AND VOTING

As of the Record Date, there were 13,760,998.180 shares of beneficial interest of the Fund issued and outstanding.

All shareholders of record of the Fund on the Record Date are entitled to vote at the Meeting on Proposal I and Proposal II. Each shareholder is entitled to one (1) vote per share held, and fractional votes for fractional shares held, on any matter submitted to a vote at the Meeting.

An affirmative vote of the holders of a majority of the outstanding shares of the Fund is required for the approval of Proposal I. As defined in the 1940 Act, a vote of the holders of a majority of the outstanding shares of the Fund means the vote of (1) 67% or more of the voting shares of the Fund present at the meeting, if the holders of more than 50% of the outstanding shares of the Fund are present in person or represented by proxy, or (2) more than 50% of the outstanding voting shares of the Fund, whichever is less. Approval of this Proposal II requires

| 16 |

the affirmative vote of a plurality of all votes at the Meeting. Under this plurality system, Trustee positions are filled by nominees who receive the largest number of votes, with no majority approval requirement, until all vacancies are filled.

Broker non-votes and abstentions will be considered present for purposes of determining the existence of a quorum and the number of shares of the Fund represented at the meeting, but they are not affirmative votes for any proposal. As a result, with respect to approval of Proposal I, non-votes and abstentions will have the same effect as a vote against the proposal because the required vote is a percentage of the shares present or outstanding. Because Trustees are elected by a plurality, non-votes and abstentions will have no effect on Proposal II.

If (a) a quorum is not present at the Meeting, or (b) a quorum is present but sufficient votes in favor of a proposal have not been obtained, then the Meeting may be adjourned from time to time by the vote of a majority of the shares represented at the Meeting, whether or not a quorum is present, to permit further solicitation of proxies. The persons named as proxies may also adjourn the Meeting for any other reason in their discretion. Any adjourned meeting may be held, within a reasonable time after the date set for the original Meeting, without the necessity of further notice unless a new record date of the adjourned Meeting is fixed. The persons named as proxies will vote those proxies that such persons are required to vote FOR the proposal, as well as proxies for which no vote has been directed, in favor of such an adjournment and will vote those proxies required to be voted AGAINST such proposal against such adjournment. In determining whether to vote for adjournment, the persons named as proxies shall consider all relevant factors, including the nature of the proposal, the percentage of votes then cast, the percentage of negative votes then cast, the nature of the proposed solicitation activities and the nature of the reasons for such further solicitation, in determining that an adjournment and additional solicitation is reasonable and in the interests of shareholders. At any adjourned Meeting, the Fund may transact any business which might have been transacted at the original Meeting.

The individuals named as proxies will vote in accordance with the shareholder's direction, as indicated thereon, if the proxy card is received and is properly executed. If a shareholder properly executes a proxy and gives no voting instructions with respect to a proposal, the shares will be voted in favor of such proposal. The proxies, in their discretion, may vote upon such other matters as may properly come before the Meeting.

Security Ownership of Management AND Certain Beneficial Owners

To the best knowledge of the Fund, there were no Trustees or officers of the Fund who were the beneficial owners of more than 5% of the outstanding shares of the Fund on the Record Date. As of the Record Date, the following shareholders of record owned 5% or more of the outstanding shares of the Fund:

| Name & Address | Shares | Status | Percentage |

|

Charles

Schwab & Co. San Francisco, CA 94105 |

2,442,882.8890 | Record | 17.61% |

Shareholders owning more than 25% of the shares of the Fund are considered to "control" the Fund, as that term is defined under the 1940 Act. Persons controlling the Fund can determine the outcome of any proposal submitted to the shareholders for approval.

| 17 |

As a group, the Trustees and officers of the Fund owned less than 1% of the outstanding shares of the Fund as of the Record Date.

SHAREHOLDER PROPOSALS

The Fund has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the Securities & Exchange Commission, shareholder proposals may, under certain conditions, be included in the Fund's Proxy Statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Fund's proxy materials must be received by the Fund within a reasonable time before the solicitation is made. The fact that the Fund receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. You should be aware that annual meetings of shareholders are not required as long as there is no particular requirement under the 1940 Act, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Stanton P. Eigenbrodt, Secretary, Vertical Capital Income Fund, 80 Arkay Drive, Suite 110, Hauppauge, NY 11788. Shareholder proposals may also be raised from the floor at the Meeting without prior notice to the Fund.

COST OF SOLICITATION

The Board is making this solicitation of proxies. The Fund has engaged Broadridge Financial Services, Inc. ("Broadridge"), a proxy solicitation firm, to assist in the solicitation. The estimated fees anticipated to be paid to Broadridge are approximately $33,000. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting and proxy and any additional materials relating to the Meeting and the cost of soliciting proxies will be borne by the Fund. In addition to solicitation by mail, the Fund will request banks, brokers and other custodial nominees and fiduciaries, to supply proxy materials to the respective beneficial owners of shares of the Fund of whom they have knowledge, and the Fund will reimburse them for their expenses in so doing. Certain officers, employees and agents of the Fund and the Advisor may solicit proxies in person or by telephone, facsimile transmission, or mail, for which they will not receive any special compensation.

OTHER MATTERS

The Board knows of no other matters to be presented at the Meeting other than as set forth above. If any other matters properly come before the Meeting that the Fund did not have notice of a reasonable time prior to the mailing of this Proxy Statement, the holders of the proxy will vote the shares represented by the proxy on such matters in accordance with their best judgment, and discretionary authority to do so is included in the proxy.

| 18 |

PROXY DELIVERY

If you and another shareholder share the same address, the Fund may only send one Proxy Statement unless you or the other shareholder(s) request otherwise. Call or write to the Fund if you wish to receive a separate copy of the Proxy Statement, and the Fund will promptly mail a copy to you. You may also call or write to the Fund if you wish to receive a separate proxy in the future or if you are receiving multiple copies now and wish to receive a single copy in the future. For such requests, call the Fund at 1-866-277-8243, or write the Fund at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788.

Important Notice Regarding the Availability

of Proxy Materials for the

Shareholder Meeting to be Held on October 30, 2015

A copy of the Notice of Shareholder Meeting, the Proxy Statement (including the proposed new Investment Advisory Agreement) and Proxy Voting Ballot are available at www.proxyonline.com.

BY ORDER OF THE BOARD OF TRUSTEES

Stanton P. Eigenbrodt, Secretary

Dated: September 17, 2015

If you have any questions before you vote, please call our proxy information line at [PLEASE PROVIDE]. Representatives are available Monday through Friday 9 a.m. to 10 p.m., Eastern Time to answer your questions about the proxy material or about how to how to cast your vote. You may also receive a telephone call reminding you to vote your shares. Thank you for your participation in this important initiative.

Please date and sign the enclosed proxy and return it promptly in the enclosed reply envelope, fax YOUR PROXY CARD to THE NUMBER LISTED ON YOUR PROXY CARD OR VOTE YOUR SHARES ONLINE AT THE WEBSITE LISTED.

| 19 |

Exhibit A

INVESTMENT ADVISORY AGREEMENT

between

VERTICAL CAPITAL INCOME FUND

and

BEHRINGER ADVISORS, LLC

AGREEMENT, made as of [ ], 2015, between VERTICAL CAPITAL INCOME FUND, a Delaware statutory trust (the "Trust"), and BEHRINGER ADVISORS, LLC (the "Adviser") located at 15601 Dallas Parkway, Suite 600, Addison, Texas 75001.

RECITALS:

WHEREAS, the Trust is a closed-end management investment company operating as an interval fund and is registered as such under the Investment Company Act of 1940, as amended (the "Act");

WHEREAS, the Trust is authorized to issue shares of beneficial interest in separate series, each having its own investment objective or objectives, policies and limitations;

WHEREAS, the Trust offers shares in the series named on Appendix A hereto and made subject to this Agreement in accordance with Section 1.3, (being herein referred to as the "Fund");

WHEREAS, the Adviser is registered as an investment adviser under the Investment Advisers Act of 1940; and

WHEREAS, the Trust desires to retain the Adviser to render investment advisory services to the Trust with respect to the Fund in the manner and on the terms and conditions hereinafter set forth;

NOW, THEREFORE, the parties hereto agree as follows:

1. Services of the Adviser.

1.1 Investment Advisory Services. The Adviser shall act as the investment adviser to each Fund and, as such, shall (i) obtain and evaluate such information relating to the economy, industries, business, securities markets and securities as it may deem necessary or useful in discharging its responsibilities hereunder, (ii) formulate a continuing program for the investment of the assets of the Fund in a manner consistent with its investment objective(s), policies and restrictions, and (iii) determine from time to time securities to be purchased, sold, retained or lent by the Fund, and implement those decisions, including the selection of entities with or through which such purchases, sales or loans are to be effected; provided, that the Adviser will place orders pursuant to its investment determinations either directly with the issuer or with a broker or dealer, and if with a broker or dealer, (a) will attempt to obtain the best price and execution of its orders, and (b) may nevertheless in its discretion purchase and sell portfolio securities from and to brokers who provide the Adviser with research, analysis, advice and similar services and pay such brokers in return a higher commission than may be charged by other brokers.

The Trust hereby authorizes any entity or person associated with the Adviser or any sub-adviser retained by the Adviser pursuant to Section 9 of this Agreement, which is a member of a national securities exchange, to effect any transaction on the exchange for the account of the Trust which is permitted by Section 11(a) of the Securities Exchange Act of 1934 and Rule 11a2-2(T) thereunder, and the Trust hereby consents to the retention of compensation for such transactions in accordance with Rule 11a2-2(T)(a)(2)(iv).

The Adviser shall carry out its duties with respect to each Fund's investments in accordance with applicable law and the investment objectives, policies and restrictions set forth in each Fund's then-

| A-1 |

current Prospectus and Statement of Additional Information, and subject to such further limitations as the Trust may from time to time impose by written notice to the Adviser.

1.2 Administrative Services. The Trust has engaged the services of an administrator. The Adviser shall provide such additional administrative services as reasonably requested by the Board of Trustees or officers of the Trust; provided, that the Adviser shall not have any obligation to provide under this Agreement any direct or indirect services to Trust shareholders, any services related to the distribution of Trust shares, or any other services which are the subject of a separate agreement or arrangement between the Trust and the Adviser. Subject to the foregoing, in providing administrative services hereunder, the Adviser shall:

1.2.1 Office Space, Equipment and Facilities. Provide such office space, office equipment and office facilities as are adequate to fulfill the Adviser's obligations hereunder.

1.2.2 Personnel. Provide, without remuneration from or other cost to the Trust, the services of individuals competent to perform the administrative functions which are not performed by employees or other agents engaged by the Trust or by the Adviser acting in some other capacity pursuant to a separate agreement or arrangement with the Trust.

1.2.3 Agents. Assist the Trust in selecting and coordinating the activities of the other agents engaged by the Trust, including the Trust's shareholder servicing agent, custodian, administrator, independent auditors and legal counsel.

1.2.4 Trustees and Officers. Authorize and permit the Adviser's directors, officers and employees who may be elected or appointed as Trustees or officers of the Trust to serve in such capacities, without remuneration from or other cost to the Trust.

1.2.5 Books and Records. Assure that all financial, accounting and other records required to be maintained and preserved by the Adviser on behalf of the Trust are maintained and preserved by it in accordance with applicable laws and regulations.

1.2.6 Reports and Filings. Assist in the preparation of (but not pay for) all periodic reports by the Fund to its shareholders and all reports and filings required to maintain the registration and qualification of the Funds and Fund shares, or to meet other regulatory or tax requirements applicable to the Fund, under federal and state securities and tax laws.

1.3 Additional Series. In the event that the Trust establishes one or more series after the effectiveness of this Agreement ("Additional Series"), Appendix A to this Agreement may be amended to make such Additional Series subject to this Agreement upon the approval of the Board of Trustees of the Trust and the shareholder(s) of the Additional Series, in accordance with the provisions of the Act. The Trust or the Adviser may elect not to make any such series subject to this Agreement.

2. Expenses of the Fund.

2.1 Expenses to be Paid by Adviser. The Adviser shall pay all salaries, expenses and fees of the officers, Trustees and employees of the Trust who are officers, directors, members or employees of the Adviser.

In the event that the Adviser pays or assumes any expenses of the Trust not required to be paid or assumed by the Adviser under this Agreement, the Adviser shall not be obligated hereby to pay or assume the same or any similar expense in the future; provided, that nothing herein contained shall be deemed to relieve the Adviser of any obligation to the Funds under any separate agreement or arrangement between the parties.

2.2 Expenses to be Paid by the Fund. The Fund shall bear all expenses of its operations, except those specifically allocated to the Adviser under this Agreement or under any separate agreement between the Trust and the Adviser. Subject to any separate agreement or arrangement between the Trust

| A-2 |

and the Adviser, the expenses hereby allocated to the Fund, and not to the Adviser, include but are not limited to:

2.2.1 Custody. All charges of depositories, custodians, and other agents for the transfer, receipt, safekeeping, and servicing of the Fund's cash, securities, and other property.

2.2.2 Shareholder Servicing. All expenses of maintaining and servicing shareholder accounts, including but not limited to the charges of any shareholder servicing agent, dividend disbursing agent, transfer agent or other agent engaged by the Trust to service shareholder accounts.

2.2.3 Shareholder Reports. All expenses of preparing, setting in type, printing and distributing reports and other communications to shareholders.

2.2.4 Prospectuses. All expenses of preparing, converting to EDGAR format, filing with the Securities and Exchange Commission or other appropriate regulatory body, setting in type, printing and mailing annual or more frequent revisions of the Fund's Prospectus and Statement of Additional Information and any supplements thereto and of supplying them to shareholders.

2.2.5 Pricing and Portfolio Valuation. All expenses of computing the Fund's net asset value per share, including any equipment or services obtained for the purpose of pricing shares or valuing the Fund 's investment portfolio.

2.2.6 Communications. All charges for equipment or services used for communications between the Adviser or the Trust and any custodian, shareholder servicing agent, portfolio accounting services agent, or other agent engaged by the Trust.

2.2.7 Legal and Accounting Fees. All charges for services and expenses of the Trust's legal counsel and independent accountants.

2.2.8 Trustees' Fees and Expenses. All compensation of Trustees other than those affiliated with the Adviser, all expenses incurred in connection with such unaffiliated Trustees' services as Trustees, and all other expenses of meetings of the Trustees and committees of the Trustees.

2.2.9 Shareholder Meetings. All expenses incidental to holding meetings of shareholders, including the printing of notices and proxy materials, and proxy solicitations therefor.

2.2.10 Federal Registration Fees. All fees and expenses of registering and maintaining the registration of the Fund under the Act and the registration of the Fund's shares under the Securities Act of 1933 (the "1933 Act"), including all fees and expenses incurred in connection with the preparation, converting to EDGAR format, setting in type, printing, and filing of any Registration Statement, Prospectus and Statement of Additional Information under the 1933 Act or the Act, and any amendments or supplements that may be made from time to time.

2.2.11 State Registration Fees. All fees and expenses of taking required action to permit the offer and sale of the Fund's shares under securities laws of various states or jurisdictions, and of registration and qualification of the Fund under all other laws applicable to the Trust or its business activities (including registering the Trust as a broker-dealer, or any officer of the Trust or any person as agent or salesperson of the Trust in any state).

2.2.12 Confirmations. All expenses incurred in connection with the issue and transfer of Fund shares, including the expenses of confirming all share transactions.

2.2.13 Bonding and Insurance. All expenses of bond, liability, and other insurance coverage required by law or regulation or deemed advisable by the Trustees of the Trust, including, without limitation, such bond, liability and other insurance expenses that may from time to time be allocated to the Fund in a manner approved by its Trustees.

| A-3 |

2.2.14 Brokerage Commissions. All brokers' commissions and other charges incident to the purchase, sale or lending of the Fund's portfolio securities.

2.2.15 Taxes. All taxes or governmental fees payable by or with respect to the Fund to federal, state or other governmental agencies, domestic or foreign, including stamp or other transfer taxes.

2.2.16 Trade Association Fees. All fees, dues and other expenses incurred in connection with the Trust's membership in any trade association or other investment organization.

2.2.17 Compliance Fees. All charges for services and expenses of the Trust's Chief Compliance Officer.

2.2.18 Nonrecurring and Extraordinary Expenses. Such nonrecurring and extraordinary expenses as may arise including the costs of actions, suits, or proceedings to which the Trust is a party and the expenses the Trust may incur as a result of its legal obligation to provide indemnification to its officers, Trustees and agents.

3. Advisory Fee.

As compensation for all services rendered, facilities provided and expenses paid or assumed by the Adviser under this Agreement, each Fund shall pay the Adviser on the last day of each month, or as promptly as possible thereafter, a fee calculated by applying a monthly rate, based on an annual percentage rate, to the Fund's average daily net assets for the month. The annual percentage rate applicable to each Fund is set forth in Appendix A to this Agreement, as it may be amended from time to time in accordance with Section 1.3 of this Agreement. If this Agreement shall be effective for only a portion of a month with respect to a Fund, the aforesaid fee shall be prorated for the portion of such month during which this Agreement is in effect for the Fund.

4. Proxy Voting.

The Adviser will vote, or make arrangements to have voted, all proxies solicited by or with respect to the issuers of securities in which assets of a Fund may be invested from time to time. Such proxies will be voted in a manner that you deem, in good faith, to be in the best interest of the Fund and in accordance with your proxy voting policy. You agree to provide a copy of your proxy voting policy to the Trust prior to the execution of this Agreement, and any amendments thereto promptly.

5. Records.

5.1 Tax Treatment. Both the Adviser and the Trust shall maintain, or arrange for others to maintain, the books and records of the Trust in such a manner that treats each Fund as a separate entity for federal income tax purposes.

5.2 Ownership. All records required to be maintained and preserved by the Trust pursuant to the provisions or rules or regulations of the Securities and Exchange Commission under Section 31(a) of the Act and maintained and preserved by the Adviser on behalf of the Trust are the property of the Trust and shall be surrendered by the Adviser promptly on request by the Trust; provided, that the Adviser may at its own expense make and retain copies of any such records.

6. Reports to Adviser.

The Trust shall furnish or otherwise make available to the Adviser such copies of each Fund's Prospectus, Statement of Additional Information, financial statements, proxy statements, reports and other information relating to its business and affairs as the Adviser may, at any time or from time to time, reasonably require in order to discharge its obligations under this Agreement.

| A-4 |

7. Reports to the Trust.

The Adviser shall prepare and furnish to the Trust such reports, statistical data and other information in such form and at such intervals as the Trust may reasonably request.

8. Code of Ethics.

The Adviser has adopted a written code of ethics complying with the requirements of Rule 17j-1 under the Act and will provide the Trust with a copy of the code and evidence of its adoption. Within 45 days of the last calendar quarter of each year while this Agreement is in effect, the Adviser will provide to the Board of Trustees of the Trust a written report that describes any issues arising under the code of ethics since the last report to the Board of Trustees, including, but not limited to, information about material violations of the code and sanctions imposed in response to the material violations; and which certifies that the Adviser has adopted procedures reasonably necessary to prevent "access persons" (as that term is defined in Rule 17j-1) from violating the code.

9. Retention of Sub-Adviser.

Subject to the Trust's obtaining the initial and periodic approvals required under Section 15 of the Act, the Adviser may retain one or more sub-advisers, at the Adviser's own cost and expense, for the purpose of managing the investments of the assets of one or more Funds of the Trust. Retention of one or more sub-advisers shall in no way reduce the responsibilities or obligations of the Adviser under this Agreement and the Adviser shall, subject to Section 11 of this Agreement, be responsible to the Trust for all acts or omissions of any sub-adviser in connection with the performance of the Adviser's duties hereunder.

10. Services to Other Clients.

Nothing herein contained shall limit the freedom of the Adviser or any affiliated person of the Adviser to render investment management and administrative services to other investment companies, to act as investment adviser or investment counselor to other persons, firms or corporations, or to engage in other business activities.

11. Limitation of Liability of Adviser and its Personnel.

Neither the Adviser nor any director, manager, officer or employee of the Adviser performing services for the Trust at the direction or request of the Adviser in connection with the Adviser's discharge of its obligations hereunder shall be liable for any error of judgment or mistake of law or for any loss suffered by the Trust in connection with any matter to which this Agreement relates, and the Adviser shall not be responsible for any action of the Trustees of the Trust in following or declining to follow any advice or recommendation of the Adviser or any sub-adviser retained by the Adviser pursuant to Section 9 of this Agreement; PROVIDED, that nothing herein contained shall be construed (i) to protect the Adviser against any liability to the Trust or its shareholders to which the Adviser would otherwise be subject by reason of willful misfeasance, bad faith, or gross negligence in the performance of the Adviser's duties, or by reason of the Adviser's reckless disregard of its obligations and duties under this Agreement, or (ii) to protect any director, manager, officer or employee of the Adviser who is or was a Trustee or officer of the Trust against any liability of the Trust or its shareholders to which such person would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person's office with the Trust.

The Trust shall indemnify the Adviser, any director, manager, officer or employee of the Adviser, and their respective affiliates and controlling persons for any liability and expenses, including without limitation reasonable attorneys' fees and expenses, which they sustain as a result of responding to regulatory inquiries, actions, suits, private suits and related court-authorized actions for all Fund-related activity that commenced prior to, or is related to actions prior to, the effective date of any Interim Investment Advisory Agreement between the Trust and the Adviser.

| A-5 |

12. Effect of Agreement.