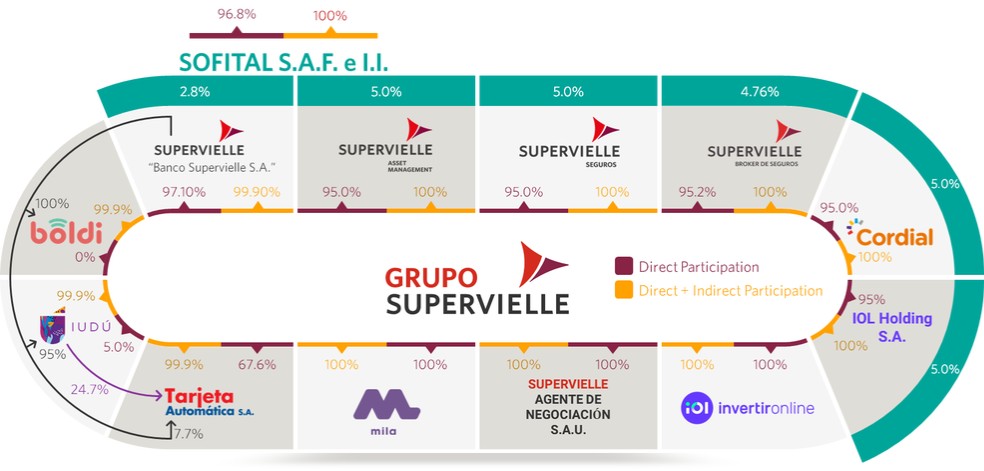

shares of Supervielle Productores Asesores de Seguros, respectively, which have a par value of Ps.1 per share and confer the right to one vote per share.

On February 25, 2022, Grupo Supervielle and the Bank made capital contributions of Ps.12,500,000 and Ps.237,500,000, respectively, to IUDÚ, as a result of which Grupo Supervielle and the Bank subscribed and 18,347,111 book-entry ordinary shares of Supervielle Productores Asesores de Seguros, respectively, which have a par value of Ps.1 per share and confer the right to one vote per share.

On March 30, 2022, Grupo Supervielle and Banco Supervielle S.A. approved capital contributions of Ps.62,500,000 and Ps.1,187,500,000, respectively, to IUDÚ to be allocated to working capital. On the same date, IUDÚ approved a capital contribution of Ps.150,000,000 to Tarjeta to be allocated to working capital.

Transfer of shares

On June 30, 2021, Grupo Supervielle transferred its 41,747,121 common shares of Modo to its subsidiary Banco Supervielle S.A. These shares have a par value of Ps.1 and Banco Supervielle S.A. is entitled to 1 vote for each share. On March 4, 2021 Grupo Supervielle made an irrevocable capital contribution to Modo in the amount of Ps.6,832,612.

On August 5, 2021, Grupo Supervielle transferred its shares of Bolsillo Digital, which amount to Ps.112,886,316.43 to its subsidiary Banco Supervielle S.A. as part of Grupo Supervielle’s commercial strategy for its payment services business.

Operator Services Agreement with the Bank

In March 2016, we entered into an agreement with the Bank pursuant to which the Bank will provide accounting, administrative, legal and treasury services to us. The Bank’s services include, among others: accounting records of transactions and preparation of financial statements, management of institutional relations, structuring and management of funding instruments, liquidity investment operations management, maintenance of our corporate records, management of compliance with disclosure requirements, registration of corporate acts and compliance with information requirements. Pursuant to this agreement, we paid to the Bank in 2021 a total amount of Ps.868,537. The term of the agreement is one year and may be renewed automatically at maturity for equal and successive periods. This agreement is renewed automatically and it is in force as of the date of this annual report.

Trademark Licenses

In 2013, we signed agreements with Espacio Cordial and IUDÚ granting them licenses to use certain of our trademarks (including our trademarks for “Cordial,” “Carta App” and “Tienda Supervielle.” We granted these trademark licenses to these subsidiaries to enhance the marketing of certain their products and services related to insurance, health, tourism, credit cards and loans, among others. Pursuant to these agreements, we received fees from these companies in 2021 in a total amount of Ps.1,818,724.10.

Financial Loans

Some of our directors and the directors of the Bank have been involved in certain credit transactions with the Bank as permitted by Argentine law. The Argentine General Corporations Law and the Central Bank’s regulations allow directors of a limited liability company to enter into a transaction with such company if such transaction follows prevailing market conditions. Additionally, a bank’s total financial exposure to related individuals or legal entities is subject to the regulations of the Central Bank. Such regulations set limits on the amount of financial exposure that can be extended by a bank to affiliates based on, among other things, a percentage of a bank’s RPC.

The Bank is required by the Central Bank to present to its Board of Directors, on a monthly basis, the outstanding amounts of financial assistance granted to directors, controlling shareholders, officers and other related entities, which are transcribed in the minute books of the Board of Directors. The Central Bank establishes that the financial assistance to directors, controlling shareholders, officers and other related entities must be granted on an equal basis with respect to rates, tenor and guarantees as loans granted to the general public.

The financial assistance granted to our directors, officers and related parties by the Bank was granted in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable