Exhibit (a)(51)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION

STATEMENT UNDER SECTION 14(d)(4) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. 18)

STRATASYS LTD.

(Name of Subject Company)

STRATASYS LTD.

(Name of Persons Filing Statement)

Ordinary Shares, par value NIS 0.01 per share

(Title of Class of Securities)

M85548101

(CUSIP Number of Class of Securities)

Vered Ben Jacob, Adv.

Chief Legal Officer

1 Holtzman Street

Science Park, P.O. Box 2496

Rehovot 76124, Israel

Tel: +972-74-745-4029

(Name, address, and telephone number of persons authorized to receive notices and

communications on behalf of the person filing

statement)

Copies to:

| J. David Chertok, Adv. Dr. Shachar Hadar, Adv. Jonathan Atha, Adv. Meitar Law Offices 16 Abba Hillel Road Ramat-Gan 5250608, Israel Tel: +972-3-6103186 |

Adam O. Emmerich, Esq. Viktor Sapezhnikov, Esq. Wachtell, Lipton, Rosen & Katz 51 West 52nd Street New York, New York 10019 Tel: (212) 403-1000 |

| ☐ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Amendment No. 18 to Schedule 14D-9 amends and supplements the Solicitation/Recommendation Statement on Schedule 14D-9 (as amended from time to time, the “Statement”) originally filed by Stratasys Ltd., an Israeli company (“Stratasys”), with the Securities and Exchange Commission (the “SEC”) on May 30, 2023. The Statement relates to the unsolicited tender offer by Nano Dimension Ltd., an Israeli company (“Nano”), to purchase up to 25,266,458 ordinary shares, par value NIS 0.01 per share, of Stratasys (“Stratasys ordinary shares”) not already owned by Nano, which, together with the Stratasys ordinary shares already owned by Nano, represent no more than 51% (and at least 46%) of the issued and outstanding Stratasys ordinary shares upon consummation of the tender offer, for $25.00 per share in cash, less any required withholding taxes and without interest, upon the terms and conditions set forth in the Offer to Purchase dated May 25, 2023, the Supplement to Offer to Purchase, dated June 27, 2023, the Second Supplement to Offer to Purchase, dated July 10, 2023, and the Third Supplement to Offer to Purchase, dated July 18, 2023, and in the related Third Amended Letter of Transmittal and the related Third Amended Notice of Objection contained in the Tender Offer Statement on Schedule TO filed by Nano with the SEC on July 18, 2023 and July 19, 2023. Except as specifically noted herein, the information set forth in the Statement remains unchanged.

Item 9. Exhibits

Item 9 of the Statement is hereby amended and supplemented by adding the following exhibits:

| Incorporated by Reference to Filings Indicated |

||||||||||||

| Exhibit Number | Exhibit Description | Form | File No. | Exhibit | Filing Date | Filed Herewith | ||||||

| (a)(50) | Press Release, dated July 20, 2023 | X | ||||||||||

| (a)(51) | Letter to Investors, dated July 20, 2023 | X | ||||||||||

| (a)(52) | Employee Letter, dated July 21, 2023 | X | ||||||||||

1

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: July 21, 2023 | ||

| STRATASYS LTD. | ||

| By: | /s/ Yoav Zeif | |

| Name: | Yoav Zeif | |

| Title: | Chief Executive Officer | |

2

Exhibit (a)(50)

Stratasys Mails Letter to Shareholders Highlighting the Risks of Nano Dimension’s Misleading Campaign

Outlines Dangers of Electing Nano’s Non-Independent Slate of Unqualified Director Nominees

Underscores the Coercive Nature of Nano’s Partial Tender Offer

Explains Why Yoav Stern, Nano’s CEO, Cannot be Trusted with Stratasys

Urges Shareholders to Vote on the WHITE Proxy Card Today “FOR” the Re-Election of Stratasys’ Directors

MINNEAPOLIS & REHOVOT, Israel—July 20, 2023—Stratasys Ltd. (Nasdaq: SSYS) (“Stratasys” or the “Company”), a leader in polymer 3D printing solutions, today mailed a letter to shareholders in connection with Stratasys’ Annual General Meeting of Shareholders (“the Meeting”) on August 8, 2023.

The full text of the letter follows:

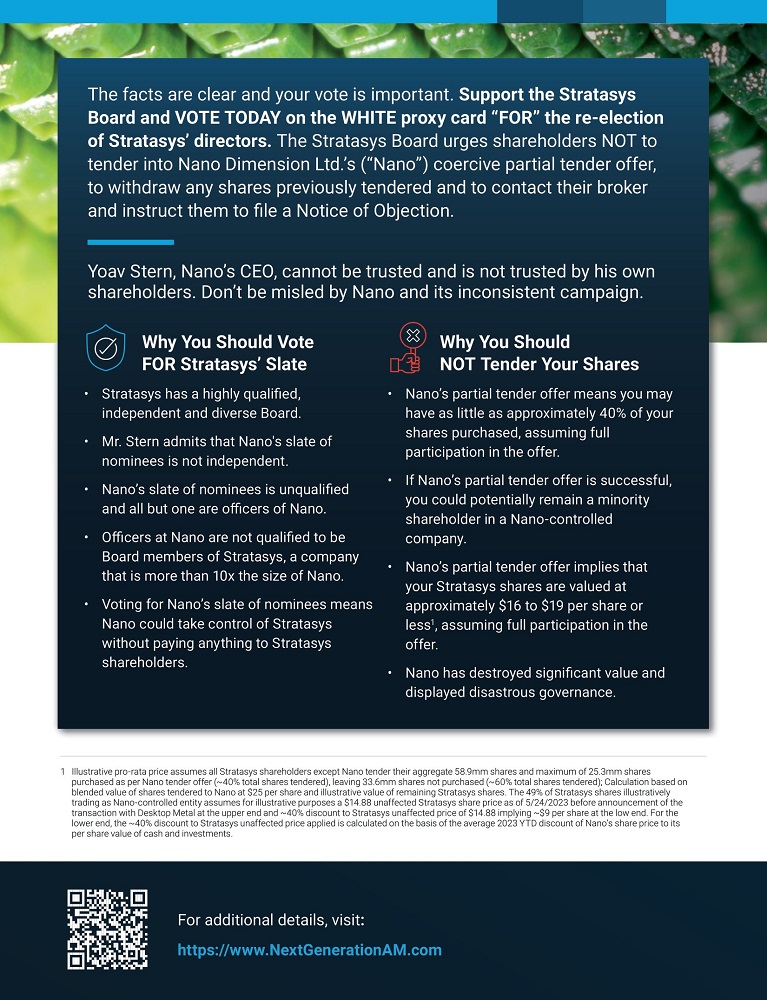

The facts are clear and your vote is important. Support the Stratasys Board and VOTE TODAY on the WHITE proxy card “FOR” the re-election of Stratasys’ directors. The Stratasys Board urges shareholders NOT to tender into Nano Dimension Ltd.’s (“Nano”) coercive partial tender offer, to withdraw any shares previously tendered and to contact their broker and instruct them to file a Notice of Objection.

Yoav Stern, Nano’s CEO, cannot be trusted and is not trusted by his own shareholders. Don’t be misled by Nano and its inconsistent campaign.

Why You Should Vote FOR Stratasys’ Slate

| ● | Stratasys has a highly qualified, independent and diverse Board. |

| ● | Mr. Stern admits that Nano’s slate of nominees is not independent. |

| ● | Nano’s slate of nominees is unqualified and all but one are officers of Nano. |

| ● | Officers at Nano are not qualified to be Board members of Stratasys, a company that is more than 10x the size of Nano. |

| ● | Voting for Nano’s slate of nominees means Nano could take control of Stratasys without paying anything to Stratasys shareholders. |

Why You Should NOT Tender Your Shares

| ● | Nano’s partial tender offer means you may have as little as approximately 40% of your shares purchased, assuming full participation in the offer. |

| ● | If Nano’s partial tender offer is successful, you could potentially remain a minority shareholder in a Nano-controlled company. |

| ● | Nano’s partial tender offer implies that your Stratasys shares are valued at approximately $16 to $19 per share or less1, assuming full participation in the offer. |

| ● | Nano has destroyed significant value and displayed disastrous governance. |

| 1 | Illustrative pro-rata price assumes all Stratasys shareholders except Nano tender their aggregate 58.9mm shares and maximum of 25.3mm shares purchased as per Nano tender offer (~40% total shares tendered), leaving 33.6mm shares not purchased (~60% total shares tendered); Calculation based on blended value of shares tendered to Nano at $25 per share and illustrative value of remaining Stratasys shares. The 49% of Stratasys shares illustratively trading as Nano-controlled entity assumes for illustrative purposes a $14.88 unaffected Stratasys share price as of 5/24/2023 before announcement of the transaction with Desktop Metal at the upper end and ~40% discount to Stratasys unaffected price of $14.88 implying ~$9 per share at the low end. For the lower end, the ~40% discount to Stratasys unaffected price applied is calculated on the basis of the average 2023 YTD discount of Nano's share price to its per share value of cash and investments. |

Dear Stratasys Shareholder,

Stratasys’ management team, overseen by the Stratasys Board of Directors, continues to successfully execute our “North Star” strategy with demonstrable progress toward becoming a $1 billion revenue company. With our winning growth strategy, strong governance practices and purpose-built Board, we are positioned to deliver outsized and enduring shareholder value. However, Nano’s coercive partial tender offer and proxy contest to take control of our Board could derail these efforts and destroy shareholder value.

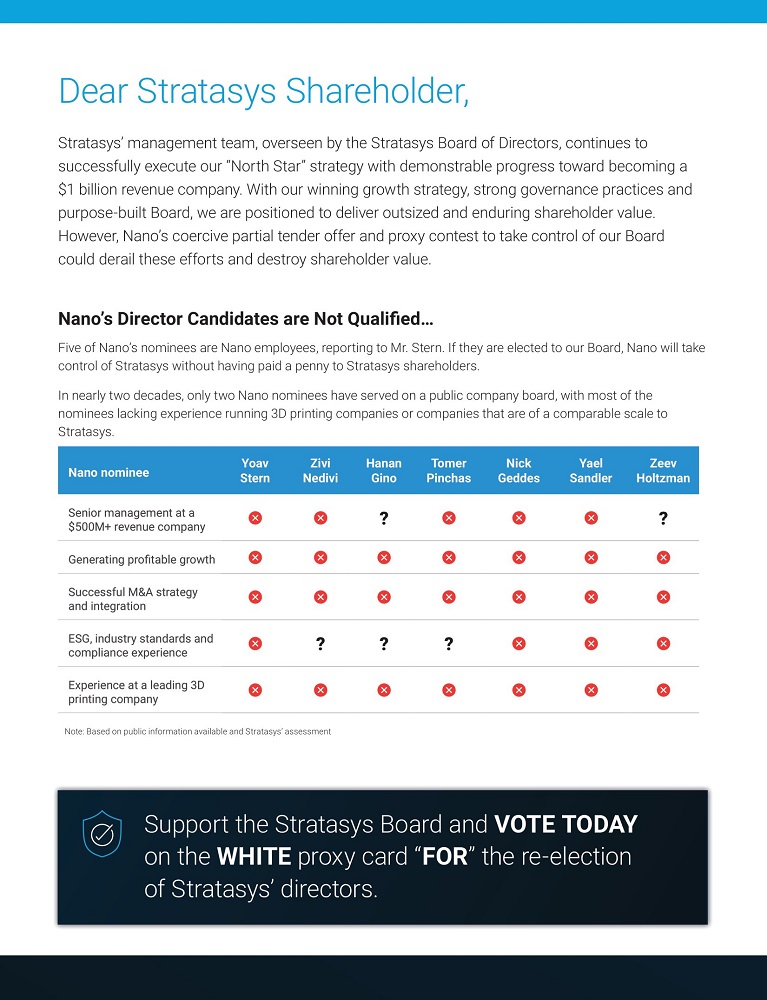

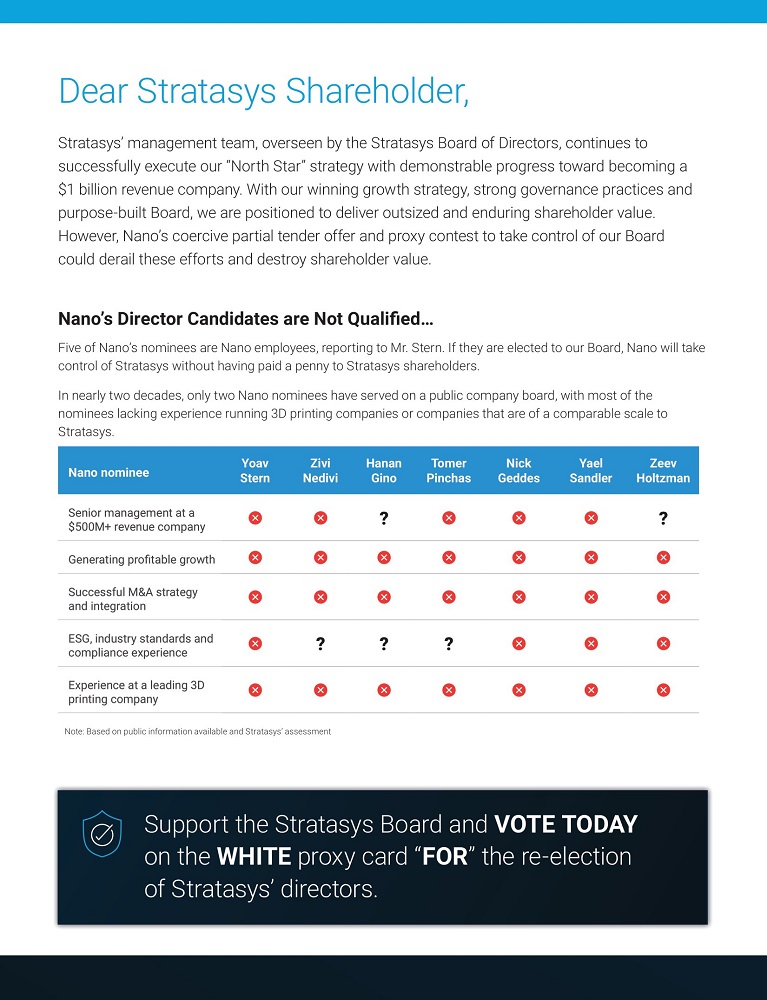

Nano’s Director Candidates are Not Qualified…

Five of Nano’s nominees are Nano employees, reporting to Mr. Stern. If they are elected to our Board, Nano will take control of Stratasys without having paid a penny to Stratasys shareholders.

In nearly two decades, only two Nano nominees have served on a public company board, with most of the nominees lacking experience running 3D printing companies or companies that are of a comparable scale to Stratasys.

Note: Based on public information available and Stratasys’ assessment

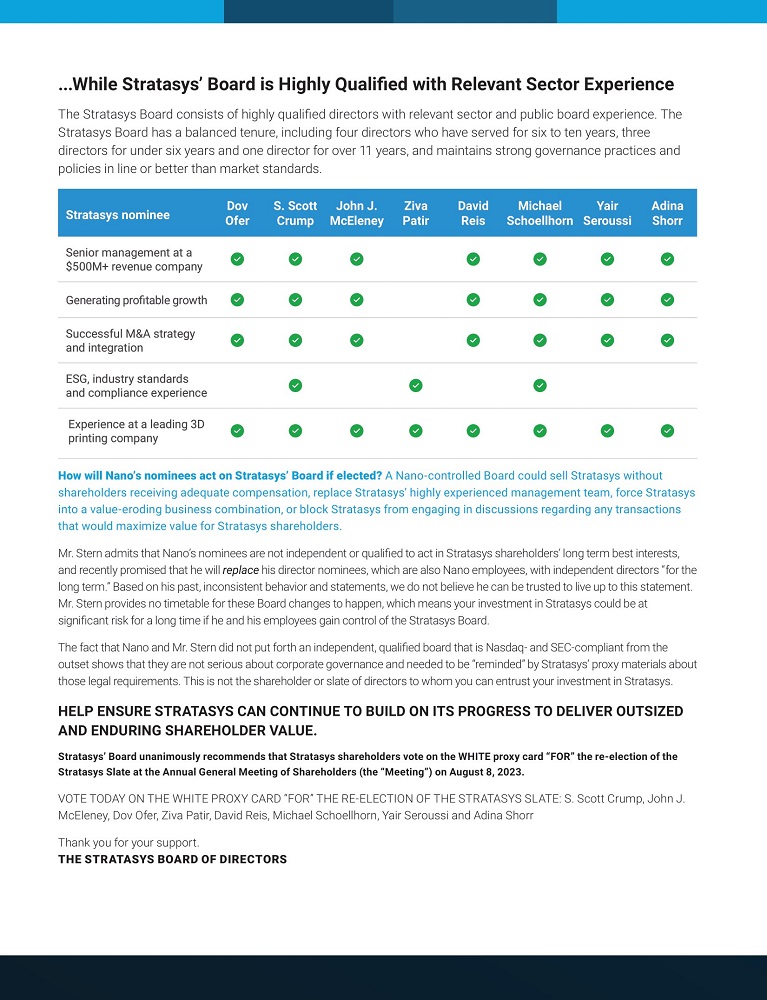

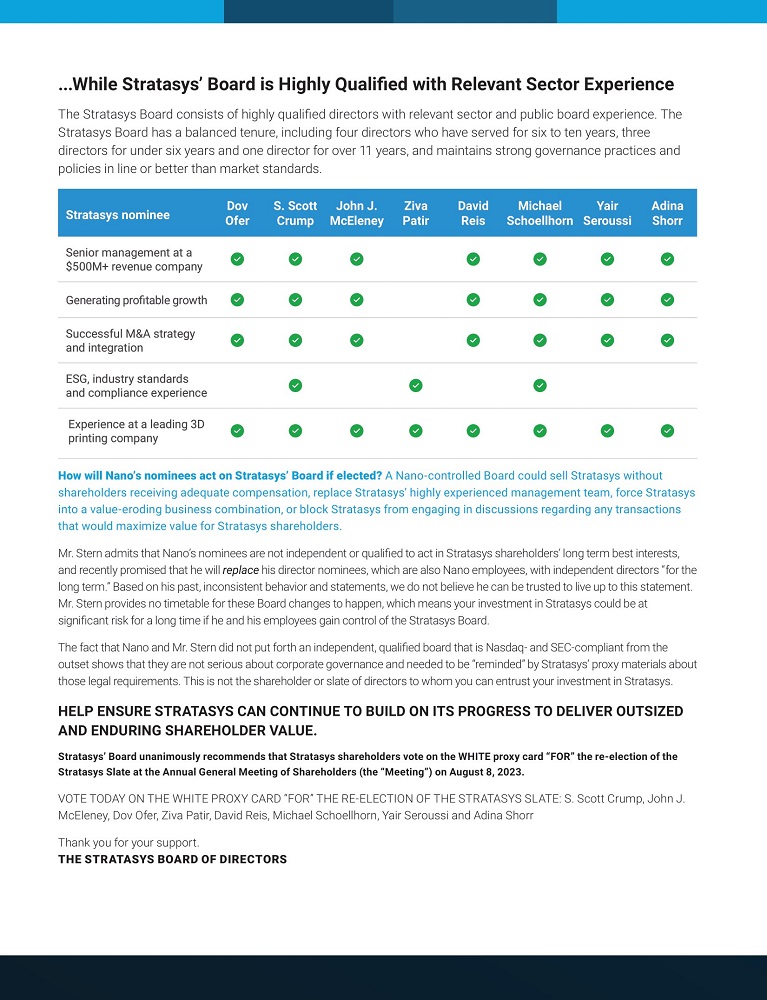

...While Stratasys’ Board is Highly Qualified with Relevant Sector Experience

The Stratasys Board consists of highly qualified directors with relevant sector and public board experience. The Stratasys Board has a balanced tenure, including four directors who have served for six to ten years, three directors for under six years and one director for over 11 years, and maintains strong governance practices and policies in line or better than market standards.

How will Nano’s nominees act on Stratasys’ Board if elected? A Nano-controlled Board could sell Stratasys without shareholders receiving adequate compensation, replace Stratasys’ highly experienced management team, force Stratasys into a value-eroding business combination, or block Stratasys from engaging in discussions regarding any transactions that would maximize value for Stratasys shareholders.

Mr. Stern admits that Nano’s nominees are not independent or qualified to act in Stratasys shareholders’ long term best interests, and recently promised that he will replace his director nominees, which are also Nano employees, with independent directors “for the long term.” Based on his past, inconsistent behavior and statements, we do not believe he can be trusted to live up to this statement. Mr. Stern provides no timetable for these Board changes to happen, which means your investment in Stratasys could be at significant risk for a long time if he and his employees gain control of the Stratasys Board.

2

The fact that Nano and Mr. Stern did not put forth an independent, qualified board that is Nasdaq- and SEC-compliant from the outset shows that they are not serious about corporate governance and needed to be “reminded” by Stratasys’ proxy materials about those legal requirements. This is not the shareholder or slate of directors to whom you can entrust your investment in Stratasys.

HELP ENSURE STRATASYS CAN CONTINUE TO BUILD ON ITS PROGRESS TO DELIVER OUTSIZED AND ENDURING SHAREHOLDER VALUE.

Stratasys’ Board unanimously recommends that Stratasys shareholders vote on the WHITE proxy card “FOR” the re-election of the Stratasys Slate at the Annual General Meeting of Shareholders (the “Meeting”) on August 8, 2023.

VOTE TODAY ON THE WHITE PROXY CARD “FOR” THE RE-ELECTION OF THE STRATASYS SLATE: S. Scott Crump, John J. McEleney, Dov Ofer, Ziva Patir, David Reis, Michael Schoellhorn, Yair Seroussi and Adina Shorr.

Thank you for your support.

The Stratasys Board of Directors

Materials related to the Meeting can be found at http://www.NextGenerationAM.com/ how-to-support-stratasys.

For assistance voting on your WHITE proxy card, please contact your broker or Stratasys’ information agent:

Morrow Sodali LLC 509 Madison Avenue, 12th Floor New York, NY 10022

Call toll-free (800) 662-5200 or (203) 658-9400

Email: SSYS@info.morrowsodali.com

Advisors

J.P. Morgan is acting as financial advisor to Stratasys, and Meitar Law Offices and Wachtell, Lipton, Rosen & Katz are serving as legal counsel.

About Stratasys

Stratasys is leading the global shift to additive manufacturing with innovative 3D printing solutions for industries such as aerospace, automotive, consumer products, healthcare, fashion and education. Through smart and connected 3D printers, polymer materials, a software ecosystem, and parts on demand, Stratasys solutions deliver competitive advantages at every stage in the product value chain. The world’s leading organizations turn to Stratasys to transform product design, bring agility to manufacturing and supply chains, and improve patient care.

3

To learn more about Stratasys, visit www.stratasys.com, the Stratasys blog, Twitter, LinkedIn, or Facebook. Stratasys reserves the right to utilize any of the foregoing social media platforms, including the Company’s websites, to share material, non-public information pursuant to the SEC’s Regulation FD. To the extent necessary and mandated by applicable law, Stratasys will also include such information in its public disclosure filings.

Stratasys is a registered trademark and the Stratasys signet is a trademark of Stratasys Ltd. and/or its subsidiaries or affiliates. All other trademarks are the property of their respective owners.

Forward-Looking Statements

This document contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the actual results of Stratasys Ltd. and its consolidated subsidiaries (“Stratasys”) may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements.

Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys with the SEC. These include, but are not limited to: factors relating to the partial tender offer commenced by Nano Dimension Ltd. (“Nano”), including actions taken by Nano in connection with the offer, actions taken by Stratasys or its shareholders in respect of the offer and the effects of the offer on Stratasys’ businesses, or other developments involving Nano, the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, Inc. (“Desktop Metal”), including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ Annual Reports on Form 20-F and its Form 6-K report that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023. The forward-looking statements included in this communication are made only as of the date hereof. Stratasys does not undertake any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

4

Important Additional Information

This communication is not an offer to purchase or a solicitation of an offer to sell the ordinary shares of Stratasys. In response to a tender offer commenced by Nano, Stratasys has filed with the Securities and Exchange Commission a Solicitation/Recommendation Statement on Schedule 14D-9. STRATASYS SHAREHOLDERS ARE ADVISED TO READ STRATASYS’ SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stratasys shareholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D-9, as well as any other documents filed by Stratasys in connection with the tender offer by Nano or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents from Stratasys by directing a request to Stratasys Ltd., 1 Holtzman Street, Science Park, P.O. Box 2496, Rehovot 7612, Israel, Attn: Yonah Lloyd, VP Investor Relations, or by calling +972-74-745-4029.

Investor

Relations

Yonah Lloyd

CCO / VP Investor Relations

Yonah.Lloyd@stratasys.com

Morrow Sodali

SSYS@info.morrowsodali.com

(800) 662-5200

(203) 658-9400

U.S. Media

Ed Trissel / Joseph Sala / Kara Brickman

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449

Israel Media

Rosa Coblens

VP Sustainability, Public Relations IL & Global Internal Communications

Rosa.Coblens@stratasys.com

Yael Arnon

Scherf Communications

yaela@scherfcom.com

+972527202703

5

Exhibit (a)(51)

Exhibit (a)(52)

With the multiple communications and parallel processes we wanted to make sure you are clear on your role, as Stratasys shareholders.

| 1- | Annual General Meeting of Stratasys Shareholder on August 8th: Take action today and VOTE by August 7th

on the Stratasys White Proxy card to keep our 8 highly qualified directors in place – a simple digital form has been

sent to you today by E*TRADE. YOUR ACTION IS REQUIRED, as soon as possible. |

| 2- | THIRD REVISED Nano Partial Tender Offer, now set at $25 per share: We have issued a Shareholder Letter and Press Release with a call to action to the general shareholder population. You will probably receive it from E*TRADE next week. We want to reiterate that NO ACTION IS REQUIRED. At this time, for this offer, there is no process in place that secures your data privacy with a workable submission process for your Notice of Objection. If and when we have an update, we will share it with you. |

Tamir Algranati

VP, Global Compensation, Benefits, and HR Operations

Forward-Looking Statements

This document contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the actual results of Stratasys Ltd. and its consolidated subsidiaries (“Stratasys”) may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements.

Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys with the SEC. These include, but are not limited to: factors relating to the partial tender offer commenced by Nano Dimension Ltd. (“Nano”), including actions taken by Nano in connection with the offer, actions taken by Stratasys or its shareholders in respect of the offer and the effects of the offer on Stratasys’ businesses, or other developments involving Nano, the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, Inc. (“Desktop Metal”), including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ Annual Reports on Form 20-F and its Form 6-K report that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023. The forward-looking statements included in this communication are made only as of the date hereof. Stratasys does not undertake any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

Important Additional Information

This communication is not an offer to purchase or a solicitation of an offer to sell the ordinary shares of Stratasys. In response to a tender offer commenced by Nano, Stratasys has filed with the Securities and Exchange Commission a Solicitation/Recommendation Statement on Schedule 14D-9. STRATASYS SHAREHOLDERS ARE ADVISED TO READ STRATASYS’ SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stratasys shareholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D-9, as well as any other documents filed by Stratasys in connection with the tender offer by Nano or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents from Stratasys by directing a request to Stratasys Ltd., 1 Holtzman Street, Science Park, P.O. Box 2496, Rehovot 7612, Israel, Attn: Yonah Lloyd, VP Investor Relations, or by calling +972-74-745-4029.

Team Stratasys,

As part of our commitment to keeping you informed, I wanted to provide an update regarding Nano Dimension’s revised unsolicited partial tender offer to acquire between 31.9% and 36.9% of the outstanding ordinary shares of Stratasys.

We issued a press release announcing that our Board, after consultation with its independent financial and legal advisors, unanimously determined that the revised partial tender offer by Nano Dimension for $25 per share is misleading, illusory, continues to significantly undervalue the Company as a whole and is NOT in the best interests of all Stratasys shareholders. Accordingly, the Board unanimously recommends that shareholders reject the revised partial offer, deliver a Notice of Objection against the partial offer and do NOT tender their Stratasys shares in the partial offer.

Previous objections remain viable and do not require additional action. That said, for employees who are shareholders, there is no workable, confidential avenue for submitting your Notice of Objection. As such, at this point no action is required. Any updates and/or new information regarding the process will be communicated.

It's important to remember that these ongoing developments regarding our company do not impact the progress we are making to strengthen our business. As we move forward, the most important thing for you to do is to stay focused on your day-to-day responsibilities and continue delivering the exceptional products and services our customers expect from Stratasys.

As always, please forward any calls you receive from outside parties, including members of the media, investors and analysts to Yonah Lloyd at Yonah.Lloyd@stratasys.com.

Thank you again and let’s keep up the good work.

Yours,

Yoav

Forward-Looking Statements

This document contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the actual results of Stratasys Ltd. and its consolidated subsidiaries (“Stratasys”) may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements.

Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties, which may cause Stratasys’ actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information - Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”), and in other filings by Stratasys with the SEC. These include, but are not limited to: factors relating to the partial tender offer commenced by Nano Dimension Ltd. (“Nano”), including actions taken by Nano in connection with the offer, actions taken by Stratasys or its shareholders in respect of the offer and the effects of the offer on Stratasys’ businesses, or other developments involving Nano, the ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, Inc. (“Desktop Metal”), including the possibility that Stratasys or Desktop Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including any necessary shareholder approvals); and other risks related to the completion of the proposed transaction and actions related thereto. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’ periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’ Annual Reports on Form 20-F and its Form 6-K report that published its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023. The forward-looking statements included in this communication are made only as of the date hereof. Stratasys does not undertake any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

2

Important Additional Information

This communication is not an offer to purchase or a solicitation of an offer to sell the ordinary shares of Stratasys. In response to a tender offer commenced by Nano, Stratasys has filed with the Securities and Exchange Commission a Solicitation/Recommendation Statement on Schedule 14D-9. STRATASYS SHAREHOLDERS ARE ADVISED TO READ STRATASYS’ SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY TENDER OFFER BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stratasys shareholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D-9, as well as any other documents filed by Stratasys in connection with the tender offer by Nano or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents from Stratasys by directing a request to Stratasys Ltd., 1 Holtzman Street, Science Park, P.O. Box 2496, Rehovot 7612, Israel, Attn: Yonah Lloyd, VP Investor Relations, or by calling +972-74-745-4029.

3

$[ 2"-;W4))$?[V1( O.PD"-RC

M&OD+]O/]E6Z_8H_:N\=?"VYU-=7;PM5CKNP=V>W2NX\"_&N\^'7PQ

MN]+6\-Y;SW,CWNG3$Q1A\8BDC*G<7!RP(Q@@=:Z(5HR21ZV7YE"%=^VE=27X

MGLWQY^&;3? [2M/TKQK=ZW):W206?A>152Z2;D,A523O0ENO&*XO0X?$7AOQ

MW9QZYI=G:ZA#I4=IA9QYT:CE3*N2?,PNT@].*\F^$NHZAHGQ7T6\AU0Z5J%Q

M>"1;RZ9I(XY"20[GGC/7ZUZ#XG2X@U;Q-K'C*9O^$C75,M

$_&OB&/Q#>1:GKL^G*)(X[58TVQ1.2%>T1P=PY.,8%>8?M9?M ^ ?C

MU?:#)X#^"WAWX-PZ7'<)>Q:5K5QJ0U8R&,QLYF1=GE[' "YSYIST%:8:A.GB

M)2<=&]/AM:R7^(RQ6(A4PT8J7O):_%>][_X?U/K#P=\&/V9?V=_^"