0001517375DEF 14AFALSE00015173752023-01-012023-12-31iso4217:USD00015173752022-01-012022-12-3100015173752021-01-012021-12-3100015173752020-01-012020-12-310001517375spt:EquityAwardsReportedValueMemberecd:PeoMember2023-01-012023-12-310001517375ecd:PeoMemberspt:EquityAwardAdjustmentsMember2023-01-012023-12-310001517375spt:EquityAwardsGrantedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310001517375ecd:PeoMemberspt:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001517375ecd:PeoMemberspt:EquityAwardsGrantedDuringTheYearVestedMember2023-01-012023-12-310001517375ecd:PeoMemberspt:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001517375ecd:PeoMemberspt:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001517375spt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2023-01-012023-12-310001517375spt:EquityAwardsReportedValueMemberecd:NonPeoNeoMember2023-01-012023-12-310001517375spt:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310001517375spt:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001517375spt:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001517375spt:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001517375ecd:NonPeoNeoMemberspt:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001517375spt:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2023-01-012023-12-310001517375spt:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-31000151737512023-01-012023-12-31000151737522023-01-012023-12-31000151737532023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

______________________________

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

Sprout Social, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in the exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | |

SPROUT SOCIAL, INC. 131 SOUTH DEARBORN STREET, SUITE 700 CHICAGO, ILLINOIS 60603 Notice of 2024 Annual Meeting of Stockholders and 2024 Message to Our Stockholders

|

Fellow Stockholders: I am pleased to invite you to attend the 2024 annual meeting of stockholders (the “Annual Meeting”) of Sprout Social, Inc., a Delaware corporation (referred to herein as “Sprout Social,” “we,” “us” or the “Company”), to be held virtually via live webcast at www.virtualshareholdermeeting.com/SPT2024 at 10:00 a.m. Central Time on Wednesday, May 22, 2024. Our Annual Meeting will be held in a virtual meeting format only, via live webcast. You will not be able to attend our 2024 Annual Meeting in-person. Using the instructions provided in the accompanying proxy statement, you will be able to vote your shares and submit your questions at the virtual meeting. In order to attend the Annual Meeting, please follow the instructions in “Questions and Answers About the Proxy Materials and Our Annual Meeting—What do I need to do to attend the Annual Meeting virtually?” We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement: 1. to elect two Class II directors to serve until our 2027 annual meeting of stockholders or until their successors are duly elected and qualified; 2. to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; 3.to conduct an advisory vote to approve the compensation of our named executive officers; and 4. to transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. Our board of directors has fixed the close of business on March 28, 2024, as the record date (the “Record Date”) for the Annual Meeting. Stockholders of record as of the Record Date are entitled to notice of and to vote at the Annual Meeting. | Further information regarding how to vote prior to the annual meeting, voting rights and the matters to be voted upon is presented in the accompanying proxy statement. We have elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) instead of paper copies of this proxy statement and our annual report. On or about April 8, 2024, we expect to mail to our stockholders the Notice containing instructions on how to access our proxy statement and our annual report, including how to receive a paper copy of these materials by mail. The proxy statement and our annual report can be accessed directly at www.virtualshareholdermeeting.com/SPT2024. You will be asked to enter the control number located on your proxy card. YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the virtual meeting, please submit your proxy as soon as possible so that your shares may be represented at the 2024 Annual Meeting. We’re building a company that our employees, customers, families, communities and investors can be proud of. On behalf of the Sprout Social board of directors, I thank you for your support and guidance. |

| Sincerely, | |

| | |

| | Justyn Howard Chairman of the Board of Directors and Chief Executive Officer Chicago, Illinois April 8, 2024 |

TABLE OF CONTENTS

| | | | | | | | |

Corporate Governance | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Voting Proposals | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Executive Officers & Compensation | | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SPROUT SOCIAL, INC.

PROXY STATEMENT

FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 10:00 a.m. Central Time on Wednesday, May 22, 2024

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2024 annual meeting of stockholders of Sprout Social, Inc., a Delaware corporation, and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on Wednesday, May 22, 2024 at 10:00 a.m. Central Time.

The Annual Meeting will be a virtual meeting of stockholders, which will be conducted via live audio webcast. You will be able to virtually attend and listen to the Annual Meeting live, submit questions and vote your shares electronically at the Annual Meeting. In order to virtually attend and vote at the Annual Meeting, please follow the instructions in the section titled “Questions and Answers About the Proxy Materials and Our Annual Meeting—What do I need to do to attend the Annual Meeting virtually?”

The Notice containing instructions on how to access this proxy statement and our annual report is first being mailed on or about April 8, 2024 to all stockholders entitled to vote at the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You are encouraged to read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

Why are you holding a virtual Annual Meeting?

Our Annual Meeting will be conducted via live audio webcast and online stockholder tools. We are excited to be using the virtual format in order to facilitate stockholder attendance and participation by enabling stockholders to participate fully, and equally, from any location around the world, at no cost. However, you will bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. We believe this is the right choice for a company with a global reach and worldwide stockholder base. We also believe a virtual annual meeting allows more stockholders (regardless of physical location, size or resources) to have direct access to information in real time, while saving the Company and our stockholders time and money and reducing the environmental impact of our Annual Meeting, especially as physical attendance at stockholder meetings generally has dwindled. We remain very conscious of any concerns that virtual meetings may diminish stockholder’s voice or reduce accountability. Accordingly, we have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication. For example, the virtual format allows stockholders to communicate with us during the Annual Meeting so they can ask questions of our board of directors and management. We plan to answer questions that comply with the meeting rules of conduct as they come in and address those asked in advance as time permits. However, we reserve the right to edit profanity or other inappropriate language, or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. A replay of the meeting will be made publicly available on www.virtualshareholdermeeting.com/SPT2024.

What matters am I voting on and how does the board of directors recommend that I vote?

| | | | | | | | |

PROPOSAL | SPROUT SOCIAL BOARD OF DIRECTORS VOTING RECOMMENDATION | PAGE REFERENCE (FOR MORE DETAIL) |

PROPOSAL NO. 1 The election of two Class II directors to serve until our 2027 annual meeting of stockholders or until their successors are duly elected and qualified. | FOR each nominee | |

PROPOSAL NO. 2 Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. | FOR | |

PROPOSAL NO. 3 Advisory vote to approve the compensation of our named executive officers (“say-on-pay vote”). | FOR | |

Other than the three items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. You may be asked to consider any other business that properly comes before the Annual Meeting.

Who is entitled to vote?

Holders of our Class A common stock and Class B common stock as of the close of business on March 28, 2024, the date our board of directors has set as the record date (the “Record Date”), may vote at the Annual Meeting. As of the Record Date, there were 49,774,937 shares of our Class A common stock and 6,762,638 shares of our Class B common stock outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Each share of Class A common stock is entitled to one vote on each proposal and each share of Class B common stock is entitled to 10 votes on each proposal. Our Class A common stock and Class B common stock are collectively referred to in this proxy statement as our “common stock.” We do not have cumulative voting rights for the election of directors.

Stockholders of Record: Shares Registered in Your Name

If shares of our common stock are registered directly in your name with our transfer agent then you are considered to be the stockholder of record with respect to those shares, and the Notice will be provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy and indicate your voting choices directly to the individuals listed on the proxy card or to vote virtually at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders

If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice will be forwarded to you by your broker, bank or other nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares in the manner provided in the voting instructions you receive from your broker, bank or other nominee.

If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Street name stockholders are also invited to virtually attend the Annual Meeting. However, because a street name stockholder is not the stockholder of record, you may not vote your shares of our common stock virtually at the Annual Meeting unless you follow your broker, bank or other nominee’s procedures for obtaining a legal proxy. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

Both stockholders of record and street name stockholders will be able to virtually attend the Annual Meeting via live audio webcast and submit questions during the meeting. For more information on how to virtually attend the Annual Meeting, please see the section titled “What do I need to do to attend the Annual Meeting virtually?”

How many votes are needed for approval of each proposal?

| | | | | |

PROPOSAL | VOTE NEEDED FOR APPROVAL AND EFFECT OF ABSTENTIONS AND BROKER NON-VOTES |

PROPOSAL NO. 1 The election of two Class II directors to serve until our 2027 annual meeting of stockholders or until their successors are duly elected and qualified. | Our amended and restated Bylaws (“Bylaws”) provide for plurality voting for the election of directors. “Plurality” means that the nominees who receive the highest number of “FOR” votes will be elected as directors. Withheld votes and broker non-votes will have no effect on the outcome of this proposal. |

PROPOSAL NO. 2 Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. | For this proposal to be approved, it must receive more votes “FOR” than “AGAINST” the proposal. Abstentions will have no effect on the outcome of this proposal. We do not anticipate broker non-votes on this proposal. |

PROPOSAL NO. 3 Say-on-pay vote. | For this proposal to be approved, it must receive more votes “FOR” than “AGAINST” the proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.* |

* Because this vote is advisory only, it will not be binding on us or on our board of directors. However, our board of directors and compensation committee will consider the outcome of the vote when making future decisions regarding executive compensation.

Voting results will be tabulated and certified by the inspector of election appointed for the Annual Meeting.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting to properly hold the annual meeting and conduct business under our Bylaws and Delaware law. The presence, including by proxy, of the holders of a majority in voting power of all issued and outstanding shares of our capital stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

•By Internet before the Annual Meeting at www.ProxyVote.com, 24 hours a day, seven days a week until 11:59 p.m. Eastern Time on May 21, 2024 (have your Notice or proxy card in hand when you visit the website);

•By toll-free telephone at 1-800-690-6903, 24 hours a day, seven days a week until 11:59 p.m. Eastern Time on May 21, 2024 (have your Notice or proxy card in hand when you call);

•By mobile device by scanning the QR code included on your Notice of proxy card;

•By completing and mailing your proxy card (if you received printed proxy materials) to be received prior to the Annual Meeting; or

•By attending the virtual meeting by visiting www.virtualshareholdermeeting.com/SPT2024, where you may also vote (have your Notice or proxy card in hand when you visit the website).

For more information on how to attend and vote at the Annual Meeting, please see “What do I need to do to attend the Annual Meeting virtually?”

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to direct your broker, bank or other nominee on how to vote your shares. As discussed above, if you are a street name stockholder, you may not vote your shares electronically at the virtual Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

What do I need to do to attend the Annual Meeting virtually?

Both stockholders of record and street name stockholders will be able to attend the Annual Meeting via live audio webcast and submit their questions during the meeting and vote their shares electronically at the Annual Meeting by visiting www.virtualshareholdermeeting.com/SPT2024. To participate in the Annual Meeting, you will need the control number included on your Notice or proxy card.

The Annual Meeting live audio webcast will begin promptly at 10:00 a.m. Central Time on Wednesday, May 22, 2024. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:45 a.m. Central Time, and you should allow ample time for the check-in procedures.

What if I have technical difficulties during the check-in time or during the Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual Annual Meeting platform log in page. Please be sure to check in by 9:45 a.m. Central Time on May 22, 2024, the day of the Annual Meeting, so we may address any technical difficulties before the Annual Meeting live audio webcast begins.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

•entering a new vote by Internet or by telephone;

•completing and returning a later-dated proxy card;

•notifying the Secretary of Sprout Social, Inc., in writing, at Sprout Social, Inc., Legal Department, Attention Secretary, 131 South Dearborn Street, Suite 700, Chicago, Illinois 60603; or

•virtually attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

If you are a street name stockholder, your broker, bank or other nominees can provide you with instructions on how to change your vote.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Justyn Howard (our Chairman and Chief Executive Officer), Joe Del Preto (our Chief Financial Officer and Treasurer) and Heidi Jonas (our General Counsel and Secretary) have been designated as proxy holders by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

Why did I receive a Notice instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 8, 2024, to all stockholders entitled to vote at the Annual Meeting.

Stockholders may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and the costs of our annual meetings of stockholders.

What does it mean if I receive more than one Notice?

You may receive more than one Notice, more than one e-mail or multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate Notice, a separate e-mail or a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you may receive more than one Notice, more than one e-mail or more than one proxy card. To vote all of your shares by proxy, you must complete, sign, date and return each proxy card and voting instruction card that you receive and vote over the Internet the shares represented by each Notice that you receive (unless you have requested and received a proxy card or voting instruction card for the shares represented by one or more of those Notices).

Who pays for the Company’s solicitation of proxies?

Our board of directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers, banks and other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

How may my broker, bank or other nominee vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. Your broker, bank or other nominee will not have discretion to vote on the remaining proposals, which are “non-routine” matters, absent direction from you. If the broker, bank or other nominee that holds your shares in “street name” returns a proxy card without voting on a non-routine proposal because it did not receive voting instructions from you on that proposal, this is referred to as a “broker non-vote.” “Broker non-votes” are considered in determining whether a quorum exists at the Annual Meeting. The effect of broker non-votes on the outcome of each proposal to be voted on at the Annual Meeting is explained above.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K as soon as they become available.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at next year’s annual meeting of stockholders by submitting their proposals in writing to our Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2025 annual meeting of stockholders, our Secretary must receive the written proposal at our principal executive offices not later than December 9, 2024. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

Sprout Social, Inc.

Legal Department

Attention: Secretary

131 South Dearborn Street, Suite 700

Chicago, Illinois 60603

If a stockholder who has notified us of their intention to present a proposal at an annual meeting does not appear to present their proposal at such annual meeting, such nomination shall be disregarded and we are not required to present the proposal for a vote at such annual meeting.

Our Bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our Bylaws provide that for business to be properly brought before an annual meeting by a stockholder, the business (i) must constitute a proper matter for stockholder action and (ii) must be properly brought before the meeting by a stockholder who was a stockholder of record at the time of the notice given and at the time of the annual meeting and who is entitled to vote at the meeting. The stockholder must provide timely written notice to our Secretary, which notice must contain the information specified in our Bylaws. To be timely for our 2025 annual meeting of stockholders, our Secretary must receive the written notice at our principal executive offices:

•not earlier than January 22, 2025; and

•not later than February 21, 2025.

In the event that we hold our 2025 annual meeting of stockholders more than 30 days before or more than 70 days after the one-year anniversary of the Annual Meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no later than:

•the 90th day prior to our 2025 annual meeting of stockholders; or, if later

•the 10th day following the day on which public announcement of the date of the 2025 annual meeting of stockholders is first made.

If a stockholder who has notified us of their intention to present a proposal at an annual meeting does not appear to present their proposal at such annual meeting, such nomination shall be disregarded and we are not required to present the proposal for a vote at such annual meeting.

Nomination of Director Candidates

Our Bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our Bylaws. The stockholder must also give timely notice to our Secretary in accordance with our Bylaws, which, in general, require that the notice be received by our Secretary within the time periods described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement. For additional information regarding stockholder recommendations for director candidates, please see “Board of Directors and Corporate Governance—Stockholder Recommendations and Nominations to the Board of Directors.”

You are advised to review our Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. A copy of our Bylaws is available via the SEC’s website at https://www.sec.gov. You may also contact our Secretary at the address set forth above for a copy of the relevant Bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our board of directors, which is currently composed of seven members. All of our directors, other than Justyn Howard, our Chairman and Chief Executive Officer (“CEO”), and Aaron Rankin, our Co-Founder and former Chief Technology Officer, are independent within the meaning of the listing standards of the Nasdaq Stock Market LLC (“Nasdaq”). Our board of directors is divided into three classes of directors each serving a staggered three-year term. At each annual meeting of stockholders, a class of directors is elected for a three-year term to succeed the class whose term is then expiring.

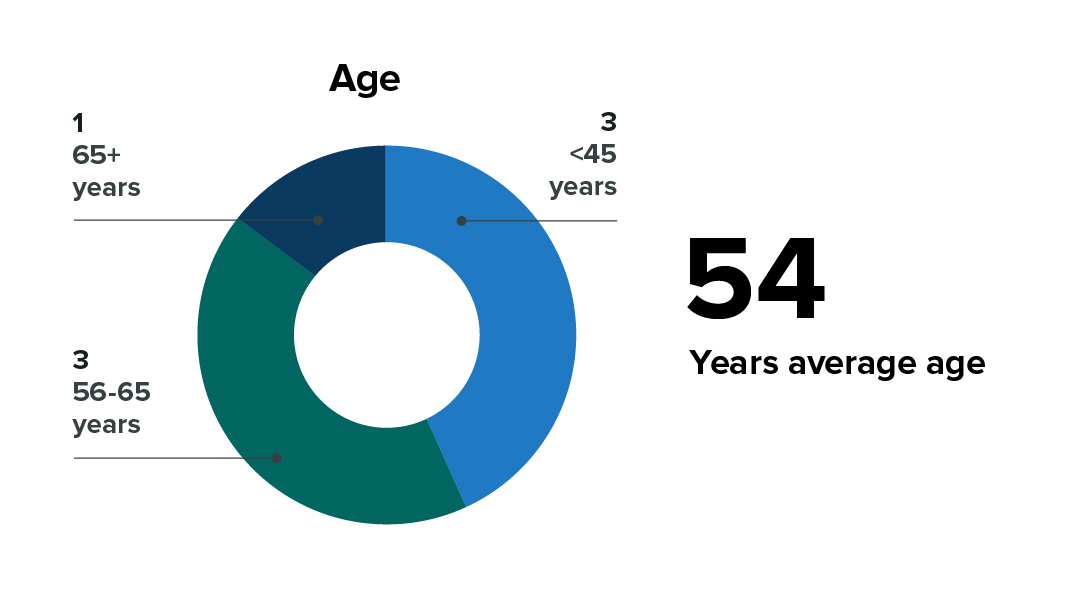

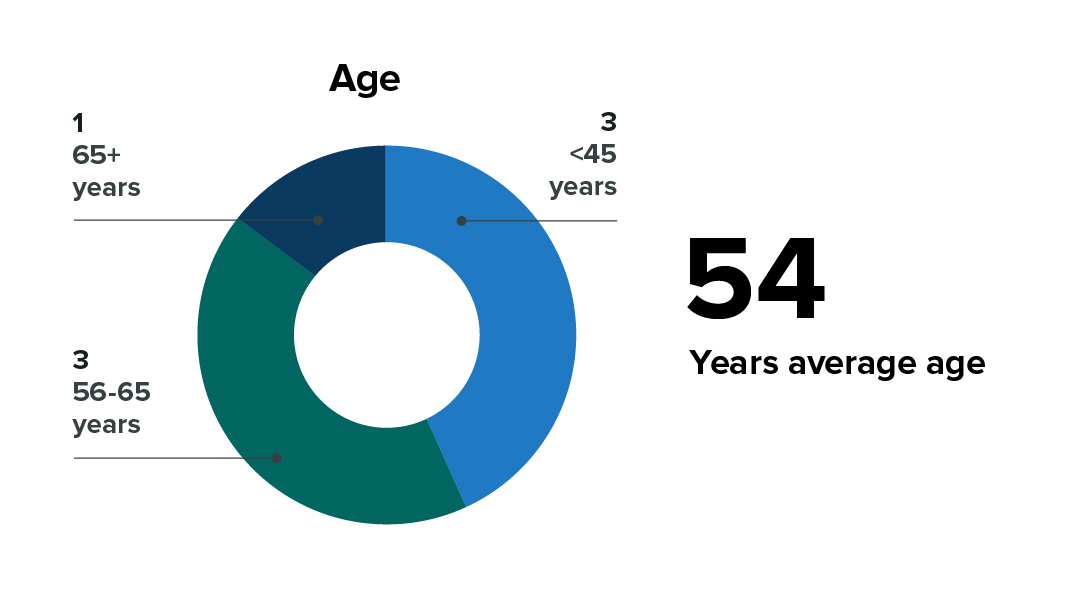

The following table sets forth the names, ages as of the Record Date, and certain other information for each of the members of our board of directors with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our board of directors. Full biographical information is below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CLASS | AGE | POSITION | DIRECTOR SINCE | CURRENT TERM EXPIRES | EXPIRATION

OF TERM

FOR

WHICH

NOMINATED | INDEPENDENT | AUDIT

COMMITTEE | COMPENSATION

COMMITTEE | NOMINATING

AND

CORPORATE

GOVERNANCE

COMMITTEE |

| Directors with Terms Expiring at the Annual Meeting/Nominees | | | | | | | | | | |

| Justyn Howard | II | 44 | Chairman and Chief Executive Officer | 2010 | 2024 | 2027 | | | | |

| Thomas Stanley | II | 57 | Director | 2021 | 2024 | 2027 | X | | | |

| Continuing Directors | | | | | | | | | | |

| Steven Collins | III | 59 | Director | 2019 | 2025 | — | X | | | |

| Aaron Rankin | III | 41 | Co-Founder and Director | 2010 | 2025 | — | | | | |

| Peter Barris | I | 72 | Lead Independent Director | 2011 | 2026 | — | X | | | |

| Raina Moskowitz | I | 41 | Director | 2020 | 2026 | — | X | | | |

| Karen Walker | I | 62 | Director | 2019 | 2026 | — | X | | | |

________________________________

Legend:  Chair |

Chair |  Member |

Member |  Audit committee financial expert

Audit committee financial expert

Considerations in Evaluating Director Nominees

The nominating and corporate governance committee, in recommending director candidates for election to the board of directors, and the board of directors, in nominating director candidates, considers candidates who have a high level of personal and professional integrity, strong ethics and values and the ability to make mature business judgments.

In evaluating director candidates, the nominating and corporate governance committee and the board of directors may also consider the following criteria as well as any other factor that they deem to be relevant:

•the candidate’s experience in corporate management, such as serving as an officer or former officer of a public company;

•the candidate’s experience as a board member of another public company;

•the candidate’s professional and academic experience relevant to the Company’s industry;

•the strength of the candidate’s leadership skills;

•the candidate’s experience in finance and accounting and/or executive compensation practices;

•whether the candidate has the time required for preparation, participation and attendance at board of directors meetings and committee meetings, if applicable; and

•the candidate’s geographic background, gender, age and ethnicity.

In addition, the board of directors will consider whether there are potential conflicts of interest with the candidate’s other personal and professional pursuits. The board of directors monitors the mix of specific experience, qualifications and skills of its directors in order to assure that it, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure.

Nominees for Director

JUSTYN HOWARD

Co-Founder, Chairman of the Board of Directors, and Chief Executive Officer of Sprout Social, Inc.

Director since 2010

Age 44

Committees: None

Justyn Howard co-founded Sprout Social and has served as our Chief Executive Officer and as the Chairman of our board of directors since April 2010. From April 2010 until December 2020, he also served as our President. Mr. Howard has won a number of awards and honors as our Chief Executive Officer, including recognition in Glassdoor’s “Highest Rated CEOs” in 2019, 2018 and 2017 for U.S. companies with less than 1,000 employees, winning Built in Chicago’s Moxie Awards CEO of the Year for 2017. Prior to founding Sprout Social, Mr. Howard held Enterprise Sales roles for Saas Learning Management provider Learn.com. As our founding CEO, we believe that Mr. Howard’s in-depth knowledge and leadership provide him with the qualifications and skills to serve on our board of directors.

THOMAS STANLEY

Former President and Chief Revenue Officer of Chainalysis Inc.

Director since 2021

Age 57

Committees: Compensation Committee, Nominating and Corporate Governance Committee

Thomas Stanley has served as a member of our board of directors since June 2021. From December 2021 until September 2023, Mr. Stanley served as the President and Chief Revenue Officer of Chainalysis, Inc., a global blockchain data platform that provides block chain-related data, software, services, and research. Prior to that, Mr. Stanley was the Chief Revenue Officer of Tanium, Inc., an information technology company focused on enterprise-scale information security and systems management from September 2019 until December 2021, and from August 2006 to September 2019, Mr. Stanley was employed by NetApp, Inc. (NASDAQ: NTAP), a hybrid cloud data services and data management company, where his most recent position was Senior Vice President and General Manager, Americas. Mr. Stanley currently serves on the board of directors for Nasuni, Inc., Boys Hope Girls Hope International and the North Carolina A&T Real Estate Foundation.

Mr. Stanley holds a Bachelor’s degree in Computer Science from North Carolina State University and Master’s degree in Business Administration from the Carlton School of Management at the University of Minnesota. We believe Mr. Stanley is qualified to serve on our board of directors because of his software executive experience in sales, go-to-market strategy, and partnerships.

Continuing Directors

PETER BARRIS

Chairman Emeritus and Retired General Partner of New Enterprise Associates, Inc.

Lead Independent Director since 2024

Director since 2011

Age 72

Committee: Nominating and Corporate Governance Committee

Peter Barris has served as a member of our board of directors since February 2011. In April 2024, Mr. Barris was appointed lead independent director of the Company’s board of directors. Mr. Barris joined New Enterprise Associates, Inc. (“NEA”), a global venture capital fund investing in technology and healthcare, where he specialized in information technology investing, in 1992 and retired at the end of 2019. Prior to his retirement, Mr. Barris held several roles at NEA, including Managing General Partner of NEA. Mr. Barris currently serves on the board of directors for private companies Tamr, Inc., Tempus Labs, Inc., and ThreatQuotient, Inc. In addition, Mr. Barris is Chairman of the Board of Trustees of Northwestern University, and serves on the boards of the Brookings Institution, P33 and In-Q-Tel. He has been named several times to the Forbes Midas List of top technology investors, to Washington Tech Council’s Hall of Fame, and to the Washington Business Hall of Fame. In the previous five years, Mr. Barris was a member of the board of directors or Berkshire Grey, Inc. (NASDAQ: BGRY), ZeroFox Holdings, Inc. (NASDAQ: ZFOX), Catalytic, Inc., Upskill, Inc., Groupon, Inc. (NASDAQ: GRPN) and NextNav, Inc. (NASDAQ: NN).

Mr. Barris holds a Bachelor’s degree in Electrical Engineering from Northwestern University and a Master’s degree in Business Administration from the Tuck School of Business at Dartmouth University. Mr. Barris brings to our board of directors a sophisticated knowledge of information technology companies that includes investments in over three dozen information technology companies that have completed public offerings or successful mergers as well as experience serving as a director of several public companies. We believe that Mr. Barris is qualified to serve on our board of directors because he has more than 20 years of experience in finance and has served on other public company boards of directors.

STEVEN COLLINS

Former Executive Vice President and Chief Financial Officer of ExactTarget, Inc.

Director since 2019

Age 59

Committees: Audit Committee (Chair), Compensation Committee

Steven Collins has served as a member of our board of directors since August 2019. From June 2011 to February 2014, Mr. Collins served as the Executive Vice President and Chief Financial Officer of ExactTarget, Inc., a cross-channel digital marketing company that was acquired by Salesforce.com, Inc. Prior to that, Mr. Collins held the position of Senior Vice President and Chief Financial Officer of NAVTEQ Corporation, a digital mapping company. Mr. Collins was with NAVTEQ Corporation from 2003 through 2011 and served as the Vice President of Finance and the Senior Vice President of Finance & Accounting prior to being named Chief Financial Officer. Mr. Collins currently serves on the board of directors of nCino, Inc. (NASDAQ: NCNO), Paycor HCM, Inc. (NASDAQ: PYCR) and one private software company. In the previous five years, Mr. Collins was a member of the board of directors of MuleSoft, Inc., Shopify, Inc. (NYSE: SHOP), and Instructure, Inc (NYSE: INST).

Mr. Collins holds a Bachelor’s degree in Industrial Engineering from Iowa State University and a Master’s degree in Business Administration from the Wharton School of the University of Pennsylvania. We believe that Mr. Collins is qualified to serve on our board of directors because of his extensive finance and software industry experience as well as his strong business acumen and leadership skills.

RAINA MOSKOWITZ

Chief Operating and Marketing Officer at Etsy, Inc.

Director since 2020

Age 41

Committee: Audit Committee, Compensation Committee (Chair)

Raina Moskowitz has served as a member of our board of directors since December 2020. In January 2024, Ms. Moskowitz became the Chief Operating and Marketing Officer at Etsy, Inc. (NASDAQ: ETSY) (“Etsy”), a global e-commerce marketplace for unique and creative goods. Prior to that, Ms. Moskowitz served as Etsy’s Chief Operating Officer since March 2022, Chief Operations, Strategy, and People Officer from August 2020 to March 2022, and the Senior Vice President of People, Strategy and Services from April 2018 to August 2020. Prior to joining Etsy, Ms. Moskowitz was employed by the American Express Company (NYSE: AXP), a financial services company, from 2005 to 2018.

Ms. Moskowitz holds a Bachelor’s degree in economics from the Wharton School at the University of Pennsylvania. She also serves on the board of Tech:NYC, a non-profit organization. We believe that Ms. Moskowitz is qualified to serve on our board of directors because of her significant experience growing and leading online customer-facing businesses.

AARON RANKIN

Co-Founder and Former Chief Technology Officer of Sprout Social, Inc.

Director since 2010

Age 41

Committees: None

Aaron Rankin co-founded Sprout Social. He has served as a member of our board of directors since April 2010. From April 2010 to December 2023, Mr. Rankin served as our Chief Technology Officer. Prior to founding Sprout Social, Mr. Rankin was a software engineer at Endeca Technologies, Inc., a software company, from August 2006 until February 2010 and was an IT Architect at IBM Corporation (NYSE: IBM), a technology company, from August 2004 until August 2006.

Mr. Rankin holds Bachelor’s and Master’s degrees in Information Systems from Carnegie Mellon University. We believe that Mr. Rankin’s in-depth knowledge of our business from serving as one of our founders and as our former Chief Technology Officer provides him with the qualifications and skills to serve on our board of directors.

KAREN WALKER

Operating Partner at Goldman Sachs

Director since 2019

Age 62

Committees: Audit Committee, Nominating and Corporate Governance Committee (Chair)

Karen Walker has been a member of our board of directors since August 2019. Since February 2023, Ms. Walker has served as an Operating Partner of the Value Accelerator Practice of the Merchant Banking Division at Goldman Sachs & Co. LLC, a global investment banking, securities and investment management firm. From September 2019 to February 2023, Ms. Walker was the Chief Marketing Officer and Senior Vice President of Intel Corporation (NASDAQ: INTC), a multinational technology company. From 2009 until July 2019, Ms. Walker was employed by Cisco Systems, Inc. (NASDAQ: CSCO) (“Cisco”), a multinational digital communications technology company, where her last position was as Senior Vice President and Chief Marketing Officer. Ms. Walker was recognized by Forbes as being one of the Top 10 World’s Most Influential CMOs (2017, 2019). Cisco was also recognized as having an award-winning Digital Marketing Foundation by Oracle and Martech. Prior to joining Cisco, Ms. Walker worked at Hewlett-Packard, Inc. (NYSE: HPE), a multinational information technology company, as Vice President of Strategy and Marketing for both the Consumer Digital Entertainment and Personal Systems groups. Ms. Walker currently serves as a member of the board of directors of Eli Lilly and Company (NYSE: LLY), a global healthcare and pharmaceutical company, where she serves on the Audit Committee and Compensation Committee. Ms. Walker is an Executive Committee and Board Member of the Association of National Advertisers, the industry-leading marketing professionals association, and the Salvation Army Advisory Board of Silicon Valley.

Ms. Walker holds a Bachelor’s degree with joint honors in chemistry and business studies from Loughborough University and an honorary Doctorate of Business Administration from Sunderland University, both in England. We believe that Ms. Walker is qualified to serve on our board of directors because of her extensive experience in the information technology industry and her business expertise in marketing and digital experience.

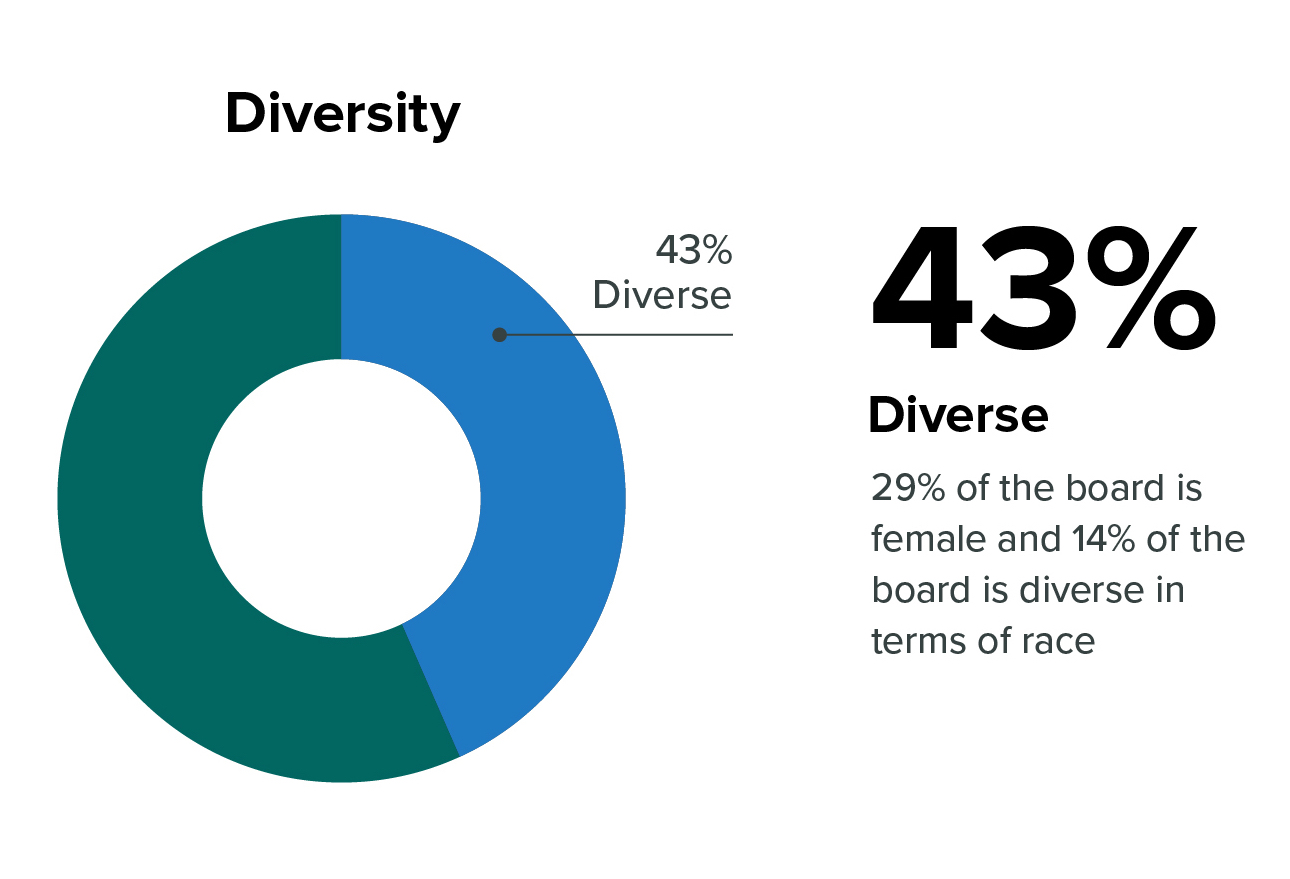

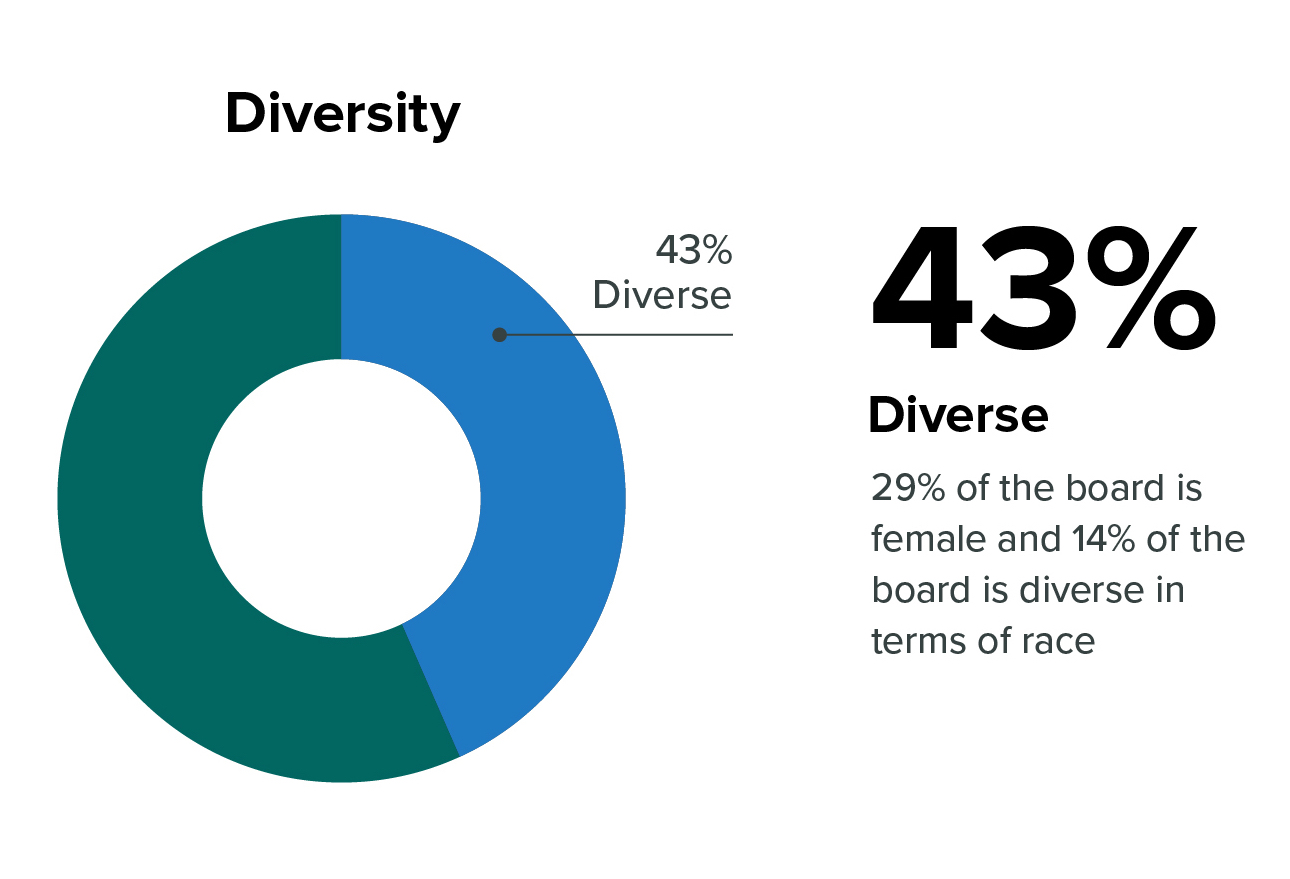

Board Composition

The following tables describes the gender identity and demographic background of our board of directors.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 8, 2024) |

| Total Number of Directors | 7 |

| Female | Male | Non-

Binary | Did Not

Disclose

Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 5 | 0 | 0 |

| Part II: Demographic Background | | | | |

| African American or Black | 0 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latin | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 4 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

Board Leadership Structure

We believe that the structure of our board of directors and its committees provides strong overall management of our Company. In accordance with our corporate governance guidelines, a copy of which is posted in the Corporate Governance section of our website at https://investors.sproutsocial.com, our board of directors does not currently have a policy as to whether the offices of the Chair of the Board and CEO should be separate. Our board of directors, in consultation with our nominating and corporate governance committee, believes that it should have the flexibility to make this determination as circumstances require, and in a manner that it believes is best to provide appropriate leadership.

Our corporate governance guidelines provide that if the Chair of the Board is not an independent director, our independent directors may designate one of the independent directors to serve as a lead independent director. Because Mr. Howard is our chair and chief executive officer, our board of directors, including the independent directors, has appointed Mr. Barris to serve as our lead independent director. As lead independent director, Mr. Barris assists the chair of the board of directors and board itself in assuring compliance with and implementation of the Company’s corporate governance guidelines, coordinates the agenda for and moderates sessions of the board’s non-management directors, acts as principal liaison between the non-management directors and the chair of the board of directors on sensitive issues and performs such other functions as the board may delegate.

Our nominating and corporate governance committee will periodically consider our board of directors’ leadership structure and make recommendations to change the structure as it deems appropriate.

Currently, Mr. Howard serves as Chairman of the Board and Chief Executive Officer. As a co-founder of our Company, Mr. Howard is best positioned to identify strategic priorities, lead critical discussion and execute our business plans. The board of directors believes that this overall structure meets the current corporate governance needs and oversight responsibilities of the board of directors. Moreover, each of the directors, other than Messrs. Howard and Rankin, are independent. Mr. Howard and Mr. Rankin do not serve on any committees of the board of directors. The board of directors believes that the independent directors, including our lead independent director, provide effective oversight of management.

Board Meetings and Committees

We have an active and engaged board of directors that is committed to fulfilling its fiduciary duty to act in good faith in the best interests of our Company and all of our stockholders. During our fiscal year ended December 31, 2023, our board of directors held seven meetings (including regularly scheduled and special meetings) and each director attended at least 75% of the (i) total number of meetings of our board of directors held during the period for which they have been a director and (ii) the total number of meetings held by all committees of our board of directors on which they served during the periods that they served.

Under our Corporate Governance Guidelines, a director is expected to spend the time and effort necessary to properly discharge their responsibilities. Accordingly, a director is expected to regularly prepare for and attend meetings of the board and all committees on which the director sits. A director who is unable to attend a meeting of the board of directors or a committee is expected to notify the Chair of the board or the chair of the appropriate committee in advance of such meeting, and, whenever possible, participate in such meeting via teleconference in the case of an in-person meeting. At our 2023 annual meeting of stockholders held on May 22, 2023, six members of the board of directors were in attendance.

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each of the committees of our board of directors are described below. Members will serve on these committees until their resignation or until as otherwise determined by our board of directors.

Audit Committee

Our audit committee consists of Mr. Collins and Mses. Moskowitz and Walker, each of whom meets the requirements for independence under the listing standards of Nasdaq and SEC rules and regulations. Our board of directors has also affirmatively determined that Mr. Collins and Mses. Moskowitz and Walker each meet the definition of “independent director” for purposes of serving on the audit committee under Rule 10A-3 and Nasdaq rules. Each member of our audit committee meets the financial literacy requirements under Nasdaq listing standards. Mr. Collins is the chair of our audit committee and an “audit committee financial expert” as that term is defined under the SEC rules implementing Section 407 of the Sarbanes-Oxley Act. Our audit committee is responsible for, among other things:

•appointing, compensating, retaining and overseeing our independent registered public accounting firm;

•discussing with our independent registered public accounting firm its independence from management;

•reviewing with management and our independent registered public accounting firm the results of their audit;

•approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

•overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC;

•reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements;

•reviewing and discussing with management, internal auditors and, if applicable, our independent registered public accounting firm the adequacy and effectiveness of our internal controls and reviewing and discussing the adequacy and effectiveness of the Company’s disclosure controls and procedures;

•reviewing our processes and policies with respect to risk identification, management and assessment;

•overseeing management of risks associated with financial reporting, accounting and auditing matters;

•reviewing related party transactions; and

•establishing procedures for the confidential and anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

The audit committee operates under a written charter, which satisfies the applicable rules of the SEC and the listing standards of Nasdaq and is available on our website at https://investors.sproutsocial.com. During our fiscal year ended December 31, 2023, our audit committee held four meetings.

Compensation Committee

Our compensation committee consists of Ms. Moskowitz and Messrs. Collins and Stanley, each of whom meets the requirements for independence under the listing standards of Nasdaq and SEC rules and regulations. In addition, our board of directors has determined that Messrs. Collins and Stanley and Ms. Moskowitz are also “non-employee directors” as defined pursuant to Rule 16b-3 of the Exchange Act. Ms. Moskowitz is the chair of our compensation committee. Our compensation committee is responsible for, among other things:

•establishing, reviewing and modifying, as appropriate, the Company’s compensation philosophy and general policies related to executive compensation;

•reviewing and approving the compensation of our Chief Executive Officer and other executive officers;

•reviewing and making recommendations to our board of directors with respect to the compensation of our directors;

•overseeing our submission to stockholders on executive compensation matters, including advisory votes on executive compensation and the frequency of such votes and considering the results of any related advisory votes;

•overseeing the management of risks associated with our compensation policies, programs and practices;

•overseeing our talent and employee development programs, employee recruitment, retention and attrition, and the development of policies and strategies regarding diversity, equity and inclusion;

•reviewing succession planning for the role of Chief Executive Officer and other key roles;

•reviewing and approving, or making recommendations to our board of directors with respect to, incentive compensation and equity plans; and

•appointing and overseeing any compensation consultants.

The compensation committee operates under a written charter, which satisfies the applicable rules of the SEC and the listing standards of Nasdaq and is available on our website at https://investors.sproutsocial.com. During our fiscal year ended December 31, 2023, our compensation committee held five meetings.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Ms. Walker and Messrs. Barris and Stanley, each of whom meets the requirements for independence under the listing standards of Nasdaq and SEC rules and regulations. Ms. Walker is the chair of our nominating and corporate governance committee. The nominating and corporate governance committee is responsible for, among other things:

•identifying qualified individuals to serve as members of our board of directors;

•reviewing the structure and membership of our board of directors and its committees;

•advising the board of directors on matters of board of director diversity, including with respect to gender, gender identity, race, ethnicity, sexual orientation and age, as well as recommend, as necessary, measures contributing to a board of directors that, as a whole, reflects a range of viewpoints, backgrounds, skills, experience and expertise;

•reviewing our corporate governance guidelines; and

•overseeing self-evaluations of our board of directors and management.

The nominating and corporate governance committee operates under a written charter, which satisfies the applicable rules of the SEC and the listing standards of Nasdaq and is available on our website at https://www.sproutsocial.com. During our fiscal year ended December 31, 2023, our nominating and corporate governance committee held four meetings.

Board and Committee Performance Evaluations

Our board of directors and each of its committees conduct periodic self-evaluations to determine whether they are functioning effectively and whether any changes are necessary to improve their performance. The nominating and corporate governance committee is responsible for overseeing such periodic self-evaluations.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Stockholder Recommendations and Nominations to the Board of Directors

Our Bylaws provide that stockholders seeking to nominate candidates for election as directors at an annual or special meeting of stockholders must provide timely notice thereof in writing. To provide timely notice of a nomination at an annual meeting, a stockholder’s notice must generally be received in writing by the Secretary at our principal executive offices with such notice being served not less than 90 nor more than 120 days before the anniversary of the preceding year’s annual meeting. To be considered timely notice of a nomination at a special meeting, a stockholder’s notice must generally be received not more than 120 days prior to the special meeting nor later than the close of business on the later of (i) the 90th day prior to the special meeting and (ii) the 10th day following the day on which public announcement of the date of the special meeting of stockholders is first made.

With respect to director nominees, submissions must, among other requirements, include (i) such individual’s name, age and business address, (ii) such individual’s principal occupation or employment, (iii) the class(es) and number of shares of common stock directly or indirectly beneficially owned by such individual, (iv) any other information that must be disclosed pursuant to Regulation 14A under the Exchange Act and (v) any other information required under our Bylaws.

Although our Bylaws do not give our board of directors the power to approve or disapprove stockholder nominations of candidates to be elected at an annual meeting (although our board of directors does have the power to determine whether any such nomination has been made in accordance with our Bylaws), our Bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed or may discourage or deter a potential acquirer from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempting to obtain control of the Company. Furthermore, our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors and evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees.

Eligible stockholders wishing to recommend a candidate for nomination should contact our Secretary in writing at Sprout Social, Inc., Legal Department, Attention: Secretary, 131 South Dearborn Street, Suite 700, Chicago, Illinois 60603. Such recommendations must include all of the information required by our Bylaws. For more information, see the section above titled “Questions and Answers About the Proxy Materials and Our Annual Meeting—What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?”

Communications with the Board of Directors

Interested parties wishing to communicate with our board of directors or with an individual member or members of our board of directors may do so by writing to our board of directors or to the particular member or members of our board of directors, as applicable, and mailing the correspondence to our Secretary at Sprout Social, Inc., Legal Department, Attention: Secretary, 131 South Dearborn Street, Suite 700, Chicago, Illinois 60603.

Each communication should set forth (i) the name and address of the stockholder, as it appears in our records, and if the shares of our common stock are held by a nominee, the name and address of the beneficial owner of such shares, and (ii) the number of shares of our common stock that are owned of record by the record holder and beneficially by the beneficial owner.

Our Secretary, in consultation with appropriate members of our board of directors as necessary, will review all incoming communications and, if appropriate, such communications will be forwarded to the appropriate member or members of our board of directors, or if none is specified, to the Chair of our board of directors.

Corporate Governance Overview

We regularly monitor developments and trends in the area of corporate governance and review our processes and procedures in light of such developments. As part of those efforts, we review federal and state laws affecting corporate governance, as well as rules adopted by the SEC and Nasdaq and we consider industry best practices for corporate governance. We believe that we have in place corporate governance procedures and practices that are designed to enhance our stockholders’ interests.

Corporate Governance-related Policies

Corporate Governance Guidelines

Our board of directors has adopted our Corporate Governance Guidelines that address items such as:

•director qualifications and criteria;

•director orientation and continuing education;

•service on other boards;

•independence and separate sessions of independent directors;

•the potential for a lead director;

•board access to senior management and independent advisors;

•succession planning;

•board of director committees; and

•board of directors meetings.

Code of Ethics and Conduct Policy

In addition, our board of directors has adopted our Code of Ethics and Conduct Policy which applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, that addresses items such as:

•conflicts of interest;

•disclosures;

•compliance with laws, rules and regulations;

•insider trading;

•reporting, accountability and enforcement;

•corporate opportunities;

•confidentiality and protection and proper use of Company assets;

•fair dealing;

•corporate loans and guarantees;

•gifts and favors and personal investments;

•retaliation, discrimination and harassment;

•political contributions; and

•personal conduct and social media.

The full text of our Corporate Governance Guidelines and our Code of Ethics and Conduct Policy is posted in the Corporate Governance section of our website at https://investors.sproutsocial.com. We intend to promptly disclose on our website or in a Current Report on Form 8-K in the future (i) the date and nature of any amendment (other than technical, administrative or other non-substantive amendments) to the Code of Ethics and Conduct Policy that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions and relates to any element of the code of ethics definition enumerated in Item 406(b) of Regulation S-K and (ii) the nature of any waiver, including an implicit waiver, from a provision of the Code of Ethics and Conduct that is granted to one of these specified individuals that relates to one or more of the elements of the code of ethics definition enumerated in Item 406(b) of Regulation S-K, the name of such person who is granted the waiver and the date of the waiver.

Incentive Compensation Recoupment Policy

On October 25, 2023, in accordance with Rule 10D-1 promulgated under the Exchange Act and Nasdaq Listing Rule 5608, our compensation committee adopted the Sprout Social, Inc. Incentive Compensation Recoupment Policy (the “Clawback Policy”).

More details on the Clawback Policy can be found below under the heading “Clawback Policy” in our Compensation Discussion & Analysis.

Stock Ownership Guidelines

To further align management and stockholder interests, on February 16, 2024, the board of directors adopted the Sprout Social, Inc. Stock Ownership Guidelines (the “Stock Ownership Guidelines”) which are applicable to our non-employee directors and our Chief Executive Officer. The Stock Ownership Guidelines require that non-employee directors hold equity in the Company with a value equal to at least three times the annual board service cash retainer and the Chief Executive Officer own equity in the Company with a value equal to at least five times their annual base salary.

Compliance with the Stock Ownership Guidelines will be measured on the last day of each calendar year. The applicable guideline of stock ownership is expected to be achieved by the end of the calendar year in which occurs the date that is five years after the later of (i) the effective date of the Stock Ownership Guidelines and (ii) the date the individual first becomes subject to the Stock Ownership Guidelines. If an individual fails to satisfy a guideline by the applicable date, the board of directors may take a number of actions as it determines appropriate, including prohibiting the individual from selling more than 50% of the remaining number of any shares acquired from the Company through the vesting or the exercise of equity awards after a portion of those shares are withheld and sold to pay applicable taxes and exercise prices, until the guideline is met.

More details on the Stock Ownership Guidelines can be found below under the heading “Stock Ownership Guidelines” in our Compensation Discussion & Analysis.

Risk Management

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, competitive, legal and compliance, cybersecurity, privacy, platform and product innovation and reputational. We have designed and implemented processes to manage such risks. Although management is responsible for the day-to-day risks we face, one of the key functions of our board of directors is to oversee our risk management process. Our board of directors focuses on our general risk management strategy and the most significant risks facing us and oversees the implementation of risk mitigation strategies by management.

Our board of directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters and significant transactions. The committees of our board of directors oversee and review risks that are inherent in their respective areas of oversight.

The board of directors periodically receives reports by each committee chair regarding the committee’s considerations and actions. The board of directors’ allocation of risk oversight responsibility may change from time to time based on the evolving needs of the Company.

Audit Committee

Our audit committee is primarily responsible for reviewing our audit results, earnings releases, major financial risk exposures, internal controls over financial reporting, disclosure controls and procedures, related party transactions and legal and regulatory compliance. The audit committee oversees our independent auditors and our risk assessments and risk managements practices related to financial reporting, accounting and auditing matters.

Compensation Committee

Our compensation committee is primarily responsible for overseeing the management of risks associated with the Company’s compensation policies, programs and practices, including the review of an annual compensation risk assessment and whether any of the Company’s compensation policies, programs or practices encourage inappropriate risk-taking.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is primarily responsible for reviewing our risks and exposures associated with board membership, structure, function, background, governance and overall effectiveness.

Succession Planning

Our board of directors (or a committee delegated by our board of directors) will work on a periodic basis with our Chief Executive Officer to evaluate the Company’s succession plans for our Chief Executive Officer to ensure adequate succession plans are in place and periodically review the performance of our Chief Executive Officer.

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Our board of directors is currently composed of seven members. In accordance with our amended and restated certificate of incorporation, our board of directors is divided into three staggered classes of directors. At the Annual Meeting, two Class II directors will be elected for a three-year term to succeed the Class II directors whose terms are then expiring. Each director’s term continues until the election and qualification of their successor, or such director’s earlier death, resignation, disqualification or removal.

Nominees

Our nominating and corporate governance committee has recommended, and our board of directors has approved, Messrs. Howard and Stanley as nominees for election as Class II directors at the Annual Meeting. If elected, Messrs. Howard and Stanley will serve as Class II directors until our 2027 annual meeting of stockholders, and until their successor is duly elected and qualified, or until their earlier death, resignation, disqualification or removal. Each of the nominees is currently a director of our Company and has agreed to serve if elected. For information concerning the nominees, please see “Board of Directors and Corporate Governance.”

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet but do not give instructions with respect to the voting of directors, your shares will be voted “FOR” the election of Messrs. Howard and Stanley. We expect that each of Messrs. Howard and Stanley will accept such nomination; however, in the event that a director nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by our board of directors to fill such vacancy. If you are a street name stockholder and you do not give voting instructions to your broker, bank or other nominee, your broker, bank or other nominee will not vote your shares on this matter.

Vote Required

Our Bylaws provide for plurality voting for the election of directors. “Plurality” means that the individuals who receive the largest number of “FOR” votes will be elected as directors. Broker non-votes will have no effect on the outcome of this proposal.

Full details of our plurality voting policy for director nominees are set forth in our Bylaws, which are available via the SEC’s website at https://www.sec.gov.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH OF THE NOMINEES NAMED ABOVE.

NON-EMPLOYEE DIRECTOR COMPENSATION

The following table sets forth information regarding the compensation earned by our non-employee directors for the year ended December 31, 2023.

| | | | | | | | | | | |

| Director Compensation |

| NAME | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | Total ($) |

| Peter Barris | 42,500 | 179,988 | 222,488 |

| Steven Collins | 62,500 | 179,988 | 242,488 |

| Raina Moskowitz | 60,000 | 179,988 | 239,988 |

| Thomas Stanley | 50,000 | 179,988 | 229,988 |

| Karen Walker | 57,000 | 179,988 | 236,988 |

(1)Amounts reported in this column reflect cash retainer fees paid to our non-employee directors with respect to their 2023 service on the Company’s board of directors and its committees.

(2)Amounts reported in this column reflect the full grant-date fair value of restricted stock unit (“RSU”) awards granted to our non-employee directors during 2023 computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of all stock awards made to directors in 2023 in Note 10 to our audited consolidated financial statements included in our annual report on Form 10-K for the fiscal year ended December 31, 2023.

(3)As of December 31, 2023, our non-employee directors held the following unvested equity awards: Messrs. Barris and Collins and Mses. Moskowtiz and Walker held 3,895 RSUs; and Mr. Thomas held 4,364 RSUs.

Non-Employee Director Compensation Policy

Under our non-employee director compensation policy effective for the fiscal year ended December 31, 2023, our non-employee directors were eligible to receive cash compensation for service on the board of directors and additional annual cash compensation for committee membership, in each case, payable quarterly in arrears and pro-rated for partial quarters served, as follows:

| | | | | |

| Position | Annual Cash

Retainer

($) |

| Board Member | 35,000 |

| Audit Committee Chair | 20,000 |

| Lead Independent Director | 15,000 |

| Compensation Committee Chair | 15,000 |

| Nominating and Corporate Governance Committee Chair | 12,000 |

| Audit Committee Member (other than Chair) | 10,000 |

| Compensation Committee Member (other than Chair) | 7,500 |

| Nominating and Corporate Governance Committee Member (other than Chair) | 7,500 |

In addition to cash compensation described above, under our non-employee director compensation policy effective for the fiscal year ended December 31, 2023, new non-employee directors will each be eligible to receive an initial RSU award with a grant date value of $360,000 on the date of their appointment or election to the board, which shall vest as to one-third (1/3) of the total number of RSUs subject to such award on the first anniversary of the date of grant and as to an additional 1/12th of the total number of RSUs subject to such award on each quarterly anniversary of the date of grant thereafter (and if there is no corresponding day, the last day of the month), subject to the non-employee director continuing in service on the board of directors through the applicable vesting date. Each director will also receive an annual RSU award with a grant date value of $180,000 (with one-time prorated awards made to directors who were elected or appointed to the board of directors on a date other than an annual meeting, only with respect to the first annual meeting following the grant of such director’s award on their board service start date), which will generally vest in full on the day immediately prior to the date of our annual stockholder meeting immediately following the date of grant, subject to the non-employee director continuing in service through such meeting date. The vesting of the RSU awards will accelerate and vest in full upon a change in control, as defined in the Sprout Social, Inc. 2019 Incentive Award Plan (the “2019 Equity Incentive Plan”).

Non-Employee Director Stock Ownership Guidelines

On February 16, 2024, our board of directors adopted stock ownership guidelines that require each of our non-employee directors to own Sprout Social stock having a value of at least three times the annual board service cash retainer. See "Compensation Discussion and Analysis — Stock Ownership Guidelines."

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed PricewaterhouseCoopers LLP (“PwC”) as our independent registered public accounting firm, to audit our consolidated financial statements for our fiscal year ending December 31, 2024. PwC served as our independent registered public accounting firm beginning with our financial statements for the year ended December 31, 2017. Representatives of PwC will be present at the Annual Meeting, and they will have an opportunity to make a statement and will be available to respond to appropriate questions from our stockholders.

At the Annual Meeting, our stockholders are being asked to ratify the appointment of PwC as our independent registered public accounting firm for our fiscal year ending December 31, 2024. Our audit committee is submitting the appointment of PwC to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance.

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet but do not give instructions with respect to the ratification of the appointment of PwC, your shares will be voted “FOR” the approval of the ratification of the appointment of PwC as our independent registered public accounting firm for our fiscal year ending December 31, 2024. If you are a street name stockholder and you do not give voting instructions to your broker, bank or other nominee, your broker, bank or other nominee may vote your shares on this matter.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees for professional audit services and other services rendered to our Company by PwC for our fiscal years ended December 31, 2023 and December 31, 2022.

| | | | | | | | |

| 2023 | 2022 |

| (IN THOUSANDS) |

Audit Fees(1) | $ | 1,660 | | $ | 1,303 | |

| Audit-Related Fees | | |

| Tax Fees | | |

All Other Fees(2) | $ | 1 | | $ | 1 | |

| Total Fees | $ | 1,661 | | $ | 1,304 | |

(1)Audit Fees consist of fees for professional services rendered in connection with the audit of our annual financial statements and internal control over financial reporting, reviews of our unaudited quarterly financial statements and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years.

(2)All Other Fees consist of aggregate fees billed for products and services provided by the independent registered public accounting firm other than those disclosed above, which related to research subscriptions each year presented.

Auditor Independence

In our fiscal year ended December 31, 2023, there were no other professional services provided by PwC, other than those listed above, that would have required our audit committee to consider their compatibility with maintaining the independence of PwC.