UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020

| OR | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| FOR THE TRANSITION PERIOD FROM TO | |||||

Commission file number: 001-35826

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

(414 ) 390-6100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class) | (Trading Symbol) | (Name of each exchange on which registered) | ||||||

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer o | |||||||||||

Non-accelerated filer o | Smaller reporting company | ||||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of common equity held by non-affiliates of the registrant at June 30, 2020, which was the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $2.0 billion based on the closing price of $32.50 for one share of Class A common stock, as reported on the New York Stock Exchange on that date. For purposes of this calculation only, it is assumed that the affiliates of the registrant include only directors and executive officers of the registrant.

The number of outstanding shares of the registrant’s Class A common stock, par value $0.01 per share, Class B common stock, par value $0.01 per share, and Class C common stock, par value $0.01 per share, as of February 19, 2021 were 62,981,300 , 4,457,958 and 10,983,145 , respectively.

TABLE OF CONTENTS

| Page | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

Except where the context requires otherwise, in this report:

•“Artisan Funds” refers to each series of Artisan Partners Funds, Inc., an open-ended management investment company, registered with the Securities and Exchange Commission.

•“Artisan Global Funds” refers to each sub-fund of Artisan Partners Global Funds plc, an open-ended investment company registered with the Central Bank of Ireland pursuant to the European UCITS Directive.

•“Artisan Private Funds” refers to private investment funds sponsored by Artisan.

•“Client” and “clients” refer to investors who access our investment management services by investing in funds, including Artisan Funds, Artisan Global Funds, Artisan Private Funds, or other pooled investment vehicles (including collective investment trusts) for which we serve as investment adviser, or by engaging us to manage a separate account in one or more of our investment strategies.

•“Company”, “Artisan”, “we”, “us” or “our” refer to Artisan Partners Asset Management Inc. (“APAM”) and its direct and indirect subsidiaries, including Artisan Partners Holdings LP (“Artisan Partners Holdings” or “Holdings”), and, for periods prior to our IPO, “Artisan,” the “company,” “we,” “us” and “our” refer to Artisan Partners Holdings and, unless the context otherwise requires, its direct and indirect subsidiaries. On March 12, 2013, APAM closed its IPO and related IPO Reorganization. Prior to that date, APAM was a subsidiary of Artisan Partners Holdings. The IPO Reorganization and IPO are described in the notes to our consolidated financial statements included in Part II of this Form 10-K.

i

•“IPO” means the initial public offering of 12,712,279 shares of Class A common stock of Artisan Partners Asset Management Inc. completed on March 12, 2013.

•“IPO Reorganization” means the series of transactions Artisan Partners Asset Management Inc. and Artisan Partners Holdings completed on March 12, 2013, immediately prior to the IPO, in order to reorganize their capital structures in preparation for the IPO.

•“2018 Follow-On Offering” means the registered offering of 644,424 shares of Class A common stock of Artisan Partners Asset Management Inc. completed on February 27, 2018.

•“2020 Follow-On Offering” means the registered offering of 1,802,326 shares of Class A common stock of Artisan Partners Asset Management Inc. completed on February 24, 2020.

Forward-Looking Statements

This report contains, and from time to time our management may make, forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements regarding future events and our future performance, as well as management’s current expectations, beliefs, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. In some cases, you can identify these statements by forward-looking words such as “may”, “might”, “will”, “should”, “expects”, “intends”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue”, the negative of these terms and other comparable terminology. Forward-looking statements are only predictions based on current expectations and projections about future events. Forward-looking statements are subject to a number of risks and uncertainties, and there are important factors that could cause actual results, level of activity, performance, actions or achievements to differ materially from the results, level of activity, performance, actions or achievements expressed or implied by the forward-looking statements. These factors include: the loss of key investment professionals or senior management, adverse market or economic conditions, poor performance of our investment strategies, change in the legislative and regulatory environment in which we operate, operational or technical errors or other damage to our reputation, the long-term impact of the COVID-19 pandemic and other factors disclosed in the Company’s filings with the Securities and Exchange Commission, including those factors listed under the caption entitled “Risk Factors” in Item 1A of this Form 10-K. We undertake no obligation to publicly update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this report, except as required by law.

Forward-looking statements include, but are not limited to, statements about:

•our anticipated future results of operations;

•our potential operating performance and efficiency; including our ability to operate under different and unique circumstances;

•our expectations with respect to the performance of our investment strategies;

•our expectations with respect to future levels of assets under management, including the capacity of our strategies and client cash inflows and outflows;

•our expectations with respect to industry trends and how those trends may impact our business;

•our financing plans, cash needs and liquidity position;

•our intention to pay dividends and our expectations about the amount of those dividends;

•our expected levels of compensation of our employees, including equity- or cash-based long-term incentive compensation;

•our expectations with respect to future expenses and the level of future expenses;

•our expected tax rate, and our expectations with respect to deferred tax assets; and

•our estimates of future amounts payable pursuant to our tax receivable agreements.

ii

Performance and Assets Under Management Information Used in this Report

We manage investments primarily through pooled investment funds and separate accounts. We serve as investment adviser to Artisan Funds, Artisan Global Funds and Artisan Private Funds. We refer to funds and other accounts that are managed by us with a broadly common investment objective and substantially in accordance with a single model account as being part of the same investment “strategy”.

We measure investment performance based upon the results of our “composites”, which represent the aggregate performance of all discretionary client accounts, including pooled investment vehicles, invested in the same strategy, except those accounts with respect to which we believe client-imposed investment restrictions (such as socially-based restrictions) may have a material impact on portfolio construction and those accounts managed in a currency other than U.S. dollars (the results of these excluded accounts, which represented approximately 10% of our assets under management at December 31, 2020, are maintained in separate composites the results of which are not presented in this report).

The performance of accounts with investment restrictions differs from the performance of accounts included in our principal composite for the applicable strategy because one or more securities may be omitted from the portfolio in order to comply with client restrictions and the weightings in the portfolio of other securities are correspondingly altered. The performance of non-U.S. dollar accounts differs from the performance of the principal composite for the applicable strategy because of the fluctuations in currency exchange rates between the currencies in which portfolio securities are traded and the currency in which the account is managed or U.S. dollars, respectively. Our assets under management in accounts with investment restrictions and non-U.S. dollar accounts represented approximately 2% and 8%, respectively, of our assets under management as of December 31, 2020. Results for any investment strategy described herein, and for different investment vehicles within a strategy, are affected by numerous factors, including: different material market or economic conditions; different investment management fee rates, brokerage commissions and other expenses; and the reinvestment of dividends or other earnings.

The returns for any strategy may be positive or negative, and past performance does not guarantee future results. In this report, we refer to the date on which we began tracking the performance of an investment strategy as that strategy’s “inception date”.

In this report, we present the average annual returns of our composites on a “gross” basis, which represent average annual returns before payment of fees payable to us by any portfolio in the composite and are net of commissions and transaction costs. We also present the average annual returns of certain market indices or “benchmarks” for the comparable period. The indices are unmanaged and have differing volatility, credit and other characteristics. You should not assume that there is any material overlap between the securities included in the portfolios of our investment strategies during these periods and those that comprise any of the strategy’s comparator index in this report. At times, this can cause material differences in relative performance. It is not possible to invest directly in any of the indices. The returns of these indices, as presented in this report, have not been reduced by fees and expenses associated with investing in securities, but do include the reinvestment of dividends.

The MSCI EAFE Index, the MSCI EAFE Growth Index, the MSCI ACWI ex-USA SMID Index, the MSCI EAFE Value Index, the MSCI ACWI Index, the MSCI ACWI ex-USA Small Cap and the MSCI Emerging Markets Index are trademarks of MSCI Inc. MSCI Inc. is the owner of all copyrights relating to these indices and is the source of the performance statistics of these indices that are referred to in this report. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This document is not approved or produced by MSCI.

The Russell 2000® Index, the Russell 2000® Value Index, the Russell Midcap® Index, the Russell Midcap® Value Index, the Russell 1000® Index, the Russell 1000® Value Index, the Russell Midcap® Growth Index, the Russell 1000® Growth Index and the Russell 2000® Growth Index are trademarks of Russell Investment Group. Russell Investment Group is the source and owner of the Russell Index data contained or reflected in this report and all trademarks and copyrights related thereto.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC (S&P DJI) and/or its affiliates and has been licensed for use. Copyright© 2021 S&P Dow Jones Indices LLC, a division of S&P Global, Inc. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones). None of S&P DJI, Dow Jones, their affiliates or third party licensors makes any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The ICE BofA US High Yield Master II Total Return Index is owned by ICE Data Indices, LLC, used with permission. ICE Data Indices, LLC permits use of the ICE BofA indices and related data on an "as is" basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing, and does not sponsor, endorse, or recommend Artisan Partners or any of its products or services.

iii

In this report, we present ratings from Morningstar, Inc., for the series of Artisan Funds. The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. The ratings which form the basis for the information reflected in this report, and the fund categories in which they are rated, relating to each Fund's Investor Share Class are: Artisan Developing World Fund—Diversified Emerging Markets; Artisan Focus Fund—Large Growth; Artisan Global Discovery—World Large Stock; Artisan Global Equity Fund—World Large Stock; Artisan Global Opportunities Fund—World Large Stock; Artisan Global Value Fund—World Large Stock; Artisan High Income Fund—High Yield Bond; Artisan International Fund—Foreign Large Growth; Artisan International Small-Mid Fund—Foreign Small/Mid Growth; Artisan International Value Fund—Foreign Large Blend; Artisan Mid Cap Fund—Mid-Cap Growth; Artisan Mid Cap Value Fund—Mid-Cap Value; Artisan Small Cap Fund—Small Growth; Artisan Sustainable Emerging Markets Fund—Diversified Emerging Markets; and Artisan Value Fund—Large Value. Morningstar ratings are initially given on a fund's three year track record and change monthly.

Throughout this report, we present historical information about our assets under management, including information about changes in our assets under management due to client cash flows, investment returns and transfers between investment vehicles (e.g., pooled investment vehicles and separate accounts). Client cash flows represent client fundings, terminations and client initiated contributions and withdrawals (which could be in cash or in securities), but generally exclude Artisan Funds’ income and capital gain distributions not reinvested. Investment returns and other represents realized gains and losses, the change in unrealized gains and losses, net income and certain miscellaneous items, immaterial in the aggregate, which may include payment of Artisan’s management fees or payment of custody expenses to the extent a client causes these fees to be paid from the account we manage. The effect of translating into U.S. dollars the value of portfolio securities denominated in currencies other than the U.S. dollar is included in investment returns and other. We also present information about our average assets under management for certain periods.

We use our information management systems to track our assets under management, the components of investment returns, and client cash flows, and we believe the information set forth in this report regarding our assets under management, investment returns, and client cash flows is accurate in all material respects. We also present information regarding the amount of our assets under management and client cash flows sourced through particular investment vehicles and distribution channels. The allocation of assets under management and client cash flows sourced through particular distribution channels involves estimates because precise information on the sourcing of assets invested in Artisan Funds or Artisan Global Funds through intermediaries is not available on a complete or timely basis and involves the exercise of judgment because the same assets, in some cases, might fairly be said to have been sourced from more than one distribution channel. We have presented the information on our assets under management and client cash flows sourced by distribution channel in the way in which we prepare and use that information in the management of our business. Non-financial data, including information about our investment performance, client cash flows, and assets under management sourced by distribution channel are not subject to our internal controls over financial reporting.

None of the information in this report constitutes either an offer or a solicitation to buy or sell any fund securities, nor is any such information a recommendation for any fund security or investment service.

iv

PART I

Item 1. Business

Overview

Founded in 1994, Artisan is an investment management firm focused on providing high valued added, active investment strategies to sophisticated clients globally. Our autonomous investment teams manage a broad range of U.S., non-U.S. and global investment strategies that are diversified by asset class, market cap and investment style.

Since our founding, we have maintained a business model that is designed to maximize our ability to produce attractive investment results for our clients, and we believe this model has contributed to our success in doing so. We focus on attracting, retaining and developing talented investment professionals by creating an environment in which each investment team is provided ample resources and support, transparent and direct financial incentives, and a high degree of investment autonomy. Each of our investment teams is led by one or more experienced portfolio managers and applies its own unique investment philosophy and process. We believe this autonomous investment team structure promotes independent analysis and accountability among our investment professionals, which we believe promotes superior investment results.

Each of our investment teams manages one or more investment strategies, each of which is designed to have a clearly articulated, consistent and replicable investment process that is well-understood by clients and managed to achieve long-term performance. Over our firm’s history, we have created new investment strategies that can use a broad array of securities, instruments and techniques (which we call degrees of freedom) to differentiate returns and manage risk.

We launch a new strategy when we believe it has the potential to achieve superior investment performance in an area that we believe will have sustained client demand at attractive fee rates over the long term. We strive to maintain the integrity of the investment process followed in each of our strategies by rigorous adherence to the investment parameters we have communicated to our clients. We also carefully monitor our investment capacity in each investment strategy. We believe that management of our investment capacity protects our ability to manage assets successfully, which protects the interests of our clients and, in the long term, protects our ability to retain client assets and maintain our profit margins. In order to better achieve our long-term goals, we are willing to close a strategy to new investors or otherwise take action to slow or restrict its growth, even though our short-term results may be impacted.

In addition to our investment teams, we have a management team that is focused on our business objectives of achieving profitable growth, expanding our investment capabilities, diversifying the sources of our assets under management, delivering superior client service, developing our investment teams into investment franchises with multiple decision-makers and investment strategies, and maintaining the firm’s fiduciary mindset and culture of compliance. Our management team supports our investment management capabilities and manages our operational infrastructure, which allows our investment professionals to focus primarily on making investment decisions and generating returns for our clients.

We offer our investment management capabilities primarily to institutions and through intermediaries that operate with institutional-like decision-making processes by means of separate accounts and pooled vehicles. We access traditional institutional clients primarily through relationships with investment consultants. We access other institutional-like investors primarily through consultants, alliances with major defined contribution/401(k) platforms and relationships with financial advisors and broker-dealers.

We derive essentially all of our revenues from investment management fees, which primarily are based on a specified percentage of clients’ average assets under management. A small but growing percentage of our revenues is derived from performance fees, which primarily are based on the performance of clients’ accounts relative to a benchmark. These investment advisory fees are determined by the investment advisory and sub-advisory agreements that are terminable by clients upon short notice or no notice.

Investment Teams

We offer clients a broad range of actively managed investment strategies diversified by asset class, market cap and investment style. Each strategy is managed by one of the investment teams described below. The table below sets forth total assets under management and certain performance information for our investment teams and strategies as of December 31, 2020.

1

| Investment Team and Strategy | AUM as of December 31, 2020 | Composite Inception Date | Value-Added Since Inception Date (1) as of December 31, 2020 | Fund Rating(2) as of December 31, 2020 | |||||||||||||

| (in millions) | |||||||||||||||||

| Growth Team | |||||||||||||||||

| Global Opportunities | 26,487 | February 1, 2007 | 690 | ««««« | |||||||||||||

| Global Discovery | 2,148 | September 1, 2017 | 1,551 | ««««« | |||||||||||||

| US Mid-Cap Growth | 17,504 | April 1, 1997 | 616 | «««« | |||||||||||||

| US Small-Cap Growth | 6,546 | April 1, 1995 | 414 | ««««« | |||||||||||||

| Global Equity Team | |||||||||||||||||

| Global Equity | 2,829 | April 1, 2010 | 545 | ««««« | |||||||||||||

| Non-US Growth | 21,684 | January 1, 1996 | 528 | «« | |||||||||||||

| Non-US Small-Mid Growth | 7,543 | January 1, 2019 | 1,975 | ««« | |||||||||||||

| US Value Team | |||||||||||||||||

| Value Equity | 3,479 | July 1, 2005 | 134 | ««« | |||||||||||||

| US Mid-Cap Value | 3,670 | April 1, 1999 | 282 | ««« | |||||||||||||

| International Value Team | |||||||||||||||||

| International Value | 24,107 | July 1, 2002 | 544 | «««« | |||||||||||||

International Small Cap Value (3) | 16 | October 1, 2020 | 182 | Not Applicable | |||||||||||||

| Global Value Team | |||||||||||||||||

| Global Value | 22,400 | July 1, 2007 | 285 | ««« | |||||||||||||

| Select Equity | 17 | March 1, 2020 | -646 | Not yet rated | |||||||||||||

| Sustainable Emerging Markets Team | |||||||||||||||||

| Sustainable Emerging Markets | 679 | July 1, 2006 | 97 | ««« | |||||||||||||

| Credit Team | |||||||||||||||||

| High Income | 6,241 | April 1, 2014 | 270 | ««««« | |||||||||||||

Credit Opportunities (3) | 97 | July 1, 2017 | 759 | Not Applicable | |||||||||||||

| Developing World Team | |||||||||||||||||

| Developing World | 8,853 | July 1, 2015 | 1,482 | ««««« | |||||||||||||

Antero Peak Group (4) | |||||||||||||||||

| Antero Peak | 2,573 | May 1, 2017 | 1,348 | «««« | |||||||||||||

Antero Peak Hedge (3) | 903 | November 1, 2017 | 551 | Not Applicable | |||||||||||||

| Total AUM as of December 31, 2020 | 157,776 | ||||||||||||||||

(1) Value-added is the amount in basis points by which the average annual gross composite return of each of our strategies has outperformed or underperformed the benchmark most commonly used by our separate account clients to compare the performance of the relevant strategy. The benchmark most commonly used by clients in the US Mid-Cap Growth, US Small-Cap Growth, Value Equity and US Mid-Cap Value strategies is the style benchmark and for all other strategies is the broad market benchmark. Reporting on this metric prior to September 30, 2020, compared all composite performance to the broad benchmark. Value-added for periods less than one year is not annualized. The Artisan High Income and Credit Opportunities strategies hold loans and other security types that are not be included in the ICE BofA U.S. High Yield Master II Total Return Index. At times, this causes material differences in relative performance. The Antero Peak and Antero Peak Hedge strategies’ investments in initial public offerings (IPOs) made a material contribution to performance. IPO investments may contribute significantly to a small portfolio’s return, an effect that will generally decrease as assets grow. IPO investments may be unavailable in the future. | |||||||||||||||||

(2) The Overall Morningstar RatingTM applicable to the Artisan Fund managed to each investment strategy is derived from a weighted average of the performance figures associated with its three-year, five-year, and ten-year (if applicable) Morningstar Ratings metrics. | |||||||||||||||||

(3) Prior to this report, assets under management in the International Small Cap Value, Credit Opportunities and Antero Peak Hedge strategies were aggregated and reported as “other assets under management” and performance information was intentionally omitted. | |||||||||||||||||

(4) Effective October 1, 2020, the Thematic investment team was renamed Antero Peak Group. The team's investment strategies and investment products were also renamed during 2020. | |||||||||||||||||

2

Growth Team

Our Growth team, which was formed in 1997 and is based in Milwaukee, Wisconsin, manages four investment strategies: Global Opportunities, Global Discovery, US Mid-Cap Growth and US Small-Cap Growth. James D. Hamel, Matthew H. Kamm, Craigh A. Cepukenas, and Jason L. White are the portfolio managers of all four strategies. Mr. Hamel is the lead portfolio manager of the Global Opportunities strategy; Mr. White is the lead portfolio manager of the Global Discovery strategy; Mr. Kamm is the lead portfolio manager of the US Mid-Cap Growth strategy; and Mr. Cepukenas is the lead portfolio manager of the US Small-Cap Growth strategy.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| Global Opportunities (February 1, 2007) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 41.48 | % | 21.28 | % | 20.09 | % | 16.03 | % | 13.14 | % | |||||||||||||||||||

MSCI ACWI® Index | 16.25 | % | 10.05 | % | 12.24 | % | 9.12 | % | 6.24 | % | |||||||||||||||||||

| Global Discovery (September 1, 2017) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 47.94 | % | 27.90 | % | — | % | — | % | 26.98 | % | |||||||||||||||||||

MSCI ACWI® Index | 16.25 | % | 10.05 | % | — | % | — | % | 11.47 | % | |||||||||||||||||||

| US Mid-Cap Growth (April 1, 1997) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 59.81 | % | 29.49 | % | 21.56 | % | 17.22 | % | 16.79 | % | |||||||||||||||||||

Russell Midcap® Index | 17.10 | % | 11.60 | % | 13.38 | % | 12.40 | % | 10.67 | % | |||||||||||||||||||

Russell Midcap® Growth Index | 35.59 | % | 20.48 | % | 18.64 | % | 15.03 | % | 10.63 | % | |||||||||||||||||||

| US Small-Cap Growth (April 1, 1995) | |||||||||||||||||||||||||||||

Average Annual Gross Returns | 62.99 | % | 33.75 | % | 26.83 | % | 20.12 | % | 13.04 | % | |||||||||||||||||||

Russell 2000® Index | 19.96 | % | 10.24 | % | 13.24 | % | 11.19 | % | 9.64 | % | |||||||||||||||||||

Russell 2000® Growth Index | 34.63 | % | 16.18 | % | 16.34 | % | 13.47 | % | 8.90 | % | |||||||||||||||||||

Global Equity Team

Our Global Equity team was formed in 1996 and is primarily based in San Francisco and New York. The Global Equity team currently manages three investment strategies: Global Equity, Non-US Growth, and Non-US Small-Mid Growth.

Mark L. Yockey serves as portfolio manager of the Global Equity and Non-US Growth strategies. Charles-Henri Hamker and Andrew J. Euretig are also portfolio managers of the Global Equity strategy and associate portfolio managers of the Non-US Growth strategy. Rezo Kanovich serves as the sole portfolio manager of the Non-US Small-Mid Growth strategy.

During the fourth quarter of 2020, Tiffany Hsiao and Yuanyuan Ji joined Artisan’s Global Equity team. Ms. Hsiao and Ms. Ji are building a group and designing an investment strategy that will invest in post-venture firms in greater China. We currently expect the new investment strategy will launch during the first half of 2021.

3

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| Global Equity (April 1, 2010) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 30.10 | % | 19.20 | % | 17.57 | % | 14.57 | % | 14.80 | % | |||||||||||||||||||

MSCI ACWI® Index | 16.25 | % | 10.05 | % | 12.24 | % | 9.12 | % | 9.35 | % | |||||||||||||||||||

| Non-US Growth (January 1, 1996) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 8.61 | % | 8.59 | % | 9.11 | % | 8.62 | % | 10.30 | % | |||||||||||||||||||

MSCI EAFE® Index | 7.82 | % | 4.28 | % | 7.44 | % | 5.50 | % | 5.02 | % | |||||||||||||||||||

| Non-US Small-Mid Growth (January 1, 2019) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 35.36 | % | — | % | — | % | — | % | 36.80 | % | |||||||||||||||||||

| MSCI All Country World Index Ex USA Small Mid Cap (Net) | 12.01 | % | — | % | — | % | — | % | 17.05 | % | |||||||||||||||||||

US Value Team

Our US Value team, which was formed in 1997 and is based in Atlanta and Chicago, manages two investment strategies: Value Equity and US Mid-Cap Value. Thomas A. Reynolds, Daniel L. Kane, and Craig Inman are the portfolio managers for both strategies. James C. Kieffer, who has been with the US Value team since its founding, relinquished portfolio management responsibilities effective February 1, 2021. Mr. Kieffer remains a managing director of Artisan Partners and an active member of the US Value team.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| Value Equity (July 1, 2005) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 10.86 | % | 7.90 | % | 13.85 | % | 11.15 | % | 8.78 | % | |||||||||||||||||||

Russell 1000® Index | 20.96 | % | 14.80 | % | 15.58 | % | 14.00 | % | 10.14 | % | |||||||||||||||||||

Russell 1000® Value Index | 2.80 | % | 6.06 | % | 9.73 | % | 10.49 | % | 7.44 | % | |||||||||||||||||||

| US Mid-Cap Value (April 1, 1999) | |||||||||||||||||||||||||||||

Average Annual Gross Returns | 6.90 | % | 5.27 | % | 10.43 | % | 9.88 | % | 12.34 | % | |||||||||||||||||||

Russell Midcap® Index | 17.10 | % | 11.60 | % | 13.38 | % | 12.40 | % | 9.90 | % | |||||||||||||||||||

Russell Midcap® Value Index | 4.96 | % | 5.36 | % | 9.72 | % | 10.48 | % | 9.52 | % | |||||||||||||||||||

International Value Team

Our International Value team, led by N. David Samra, is based in San Francisco. N. David Samra serves as lead portfolio manager of the International Value strategy and Ian P. McGonigle and Joseph Vari serve as co-portfolio managers.

In September 2020, Beini Zhou and Anand Vasagiri joined Artisan’s International Value team and, together with Mr. Samra, designed and launched the International Small Cap Value strategy. Mr. Zhou and Mr. Vasagiri serve as co-portfolio managers of the International Small Cap Value strategy.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| International Value (July 1, 2002) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 9.76 | % | 5.56 | % | 9.42 | % | 9.26 | % | 11.78 | % | |||||||||||||||||||

MSCI EAFE® Index | 7.82 | % | 4.28 | % | 7.44 | % | 5.50 | % | 6.34 | % | |||||||||||||||||||

International Small Cap Value (October 1, 2020)1 | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | — | % | — | % | — | % | — | % | 23.62 | % | |||||||||||||||||||

| MSCI All Country World Index Ex USA Small Cap (Net) | — | % | — | % | — | % | — | % | 21.80 | % | |||||||||||||||||||

1 Periods less than one year are not annualized.

4

Global Value Team

Our Global Value team, led by Daniel J. O’Keefe, is primarily based in Chicago. Mr. O’Keefe serves as lead portfolio manager and Michael J. McKinnon serves as portfolio manager of the team’s Global Value and Select Equity strategies. In January 2021, Justin V. Bandy, who previously served as a co-portfolio manager on the team, stepped down from portfolio management and provided notice of his intent to retire in June 2021.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| Global Value (July 1, 2007) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 7.74 | % | 5.93 | % | 10.31 | % | 10.98 | % | 8.62 | % | |||||||||||||||||||

MSCI ACWI® Index | 16.25 | % | 10.05 | % | 12.24 | % | 9.12 | % | 5.77 | % | |||||||||||||||||||

| Select Equity (March 1, 2020) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | — | % | — | % | — | % | — | % | 22.61 | % | |||||||||||||||||||

S&P 500 Index | — | % | — | % | — | % | — | % | 29.07 | % | |||||||||||||||||||

Sustainable Emerging Markets Team

Our Sustainable Emerging Markets team, which was formed in 2006 and is based in New York, manages a single investment strategy. Maria Negrete-Gruson is the portfolio manager for the Sustainable Emerging Markets strategy.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| Sustainable Emerging Markets (July 1, 2006) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 23.06 | % | 8.81 | % | 16.29 | % | 4.41 | % | 7.28 | % | |||||||||||||||||||

MSCI Emerging Markets Index | 18.31 | % | 6.17 | % | 12.79 | % | 3.63 | % | 6.31 | % | |||||||||||||||||||

Credit Team

Our Credit team, which was formed in 2014 and is based in Denver, manages two investment strategies: High Income and Credit Opportunities. Bryan L. Krug is the portfolio manager for both strategies.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| High Income (April 1, 2014) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 11.00 | % | 8.24 | % | 10.03 | % | — | % | 8.05 | % | |||||||||||||||||||

| ICE BofA U.S. High Yield Master II Total Return Index | 6.17 | % | 5.88 | % | 8.43 | % | — | % | 5.35 | % | |||||||||||||||||||

| Credit Opportunities (July 1, 2017) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 23.71 | % | 12.98 | % | --- | --- | 13.33 | % | |||||||||||||||||||||

| ICE BofA U.S. High Yield Master II Total Return Index | 6.17 | % | 5.88 | % | --- | --- | 5.74 | % | |||||||||||||||||||||

Developing World Team

Our Developing World team, which was formed in 2015 and is based in San Francisco, manages a single investment strategy. Lewis S. Kaufman is the portfolio manager for the Developing World strategy.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| Developing World (July 1, 2015) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 83.46 | % | 30.98 | % | 28.29 | % | — | % | 22.59 | % | |||||||||||||||||||

| MSCI Emerging Markets Index | 18.31 | % | 6.17 | % | 12.79 | % | — | % | 7.77 | % | |||||||||||||||||||

5

Antero Peak Group

Antero Peak Group (formerly named the Artisan Thematic team) was formed in 2016 and is based in Denver and New York. The Antero Peak Group manages two investment strategies: Antero Peak and Antero Peak Hedge (formerly, Thematic and Thematic Long/Short strategies, respectively). Chris Smith is the portfolio manager for both strategies.

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Investment Strategy (Composite Inception Date) | 1 Year | 3 Years | 5 Years | 10 Years | Inception | ||||||||||||||||||||||||

| Antero Peak (May 1, 2017) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 30.81 | % | 25.05 | % | — | % | — | % | 28.88 | % | |||||||||||||||||||

| S&P 500 Index | 18.40 | % | 14.17 | % | — | % | — | % | 15.40 | % | |||||||||||||||||||

| Antero Peak Hedge (November 1, 2017) | |||||||||||||||||||||||||||||

| Average Annual Gross Returns | 22.97 | % | 20.32 | % | — | % | — | % | 20.37 | % | |||||||||||||||||||

| S&P 500 Index | 18.40 | % | 14.17 | % | — | % | — | % | 14.86 | % | |||||||||||||||||||

Distribution, Investment Products and Client Relationships

The goal of our marketing, distribution and client service efforts is to grow and maintain a client base that is diversified by investment strategy, investment vehicle (for example, across mutual funds and separate accounts), distribution channel and geographic region. We focus our distribution and marketing efforts on sophisticated investors and asset allocators, including institutions and intermediaries that operate with institutional-like, centralized decision-making processes and longer-term investment horizons. We have designed our distribution strategies and structured our distribution teams to use knowledgeable, seasoned marketing and client service professionals in a way intended to limit the time our investment professionals spend on marketing and client service activities. We believe that minimizing other demands allows our portfolio managers and other investment professionals to focus their energies and attention on the investment decision-making process, which we believe enhances the opportunity to achieve superior investment returns. Our distribution efforts are centrally managed by our head of Global Distribution, who oversees and coordinates the efforts of our marketing and client service professionals.

Institutional Channel

Our institutional distribution channel includes institutional clients, such as U.S.-registered mutual funds, non-U.S. funds and collective investment trusts we sub-advise; state and local governments; employee benefit plans including Taft-Hartley plans; foundations; and endowments. Our institutional channel also includes assets under management sourced from defined contribution plans. We offer our investment products to institutional clients directly and by marketing our services to the investment consultants and advisors that advise them. As of December 31, 2020, approximately 43% of our assets under management were attributed to clients represented by investment consultants.

As of December 31, 2020, 65% of our assets under management were sourced through our institutional channel.

Intermediary Channel

We maintain relationships with a number of major brokerage firms and larger private banks and trust companies at which the process for identifying which funds to offer has been centralized to a relatively limited number of key decision-makers that exhibit institutional-like decision-making behavior. We also maintain relationships with a number of financial advisory firms and broker-dealer advisors that offer our investment products to their clients. These advisors range from relatively small firms to large organizations.

As of December 31, 2020, approximately 31% of our assets under management were sourced through our intermediary channel.

Retail Channel

We primarily access retail investors indirectly through mutual fund supermarkets through which investors have the ability to purchase and redeem fund shares. U.S. investors can also invest directly in Artisan Funds. Our subsidiary, Artisan Partners Distributors LLC, a registered broker-dealer, distributes shares of Artisan Funds. Publicity and ratings and rankings from Morningstar, Lipper and others are important in building the Artisan Partners brand, which is important in attracting retail investors. As a result, we publicize the ratings and rankings received by Artisan Funds and work to ensure that potential retail investors have appropriate information to evaluate a potential investment in Artisan Funds. We do not generally use direct marketing campaigns as we believe that their cost outweighs their potential benefits.

As of December 31, 2020, approximately 4% of our assets under management were sourced from investors we categorize as retail investors.

6

Access Through a Range of Investment Vehicles

Our clients access our investment strategies through a range of investment vehicles, including separate accounts and pooled vehicles. As of December 31, 2020, approximately 53% of our assets under management were in separate accounts, and Artisan Funds and Artisan Global Funds accounted for approximately 47% of our total assets under management. Separate accounts include Artisan Private Funds, which comprise less than 1% of our assets under management in the aggregate.

Separate Accounts

We manage separate account assets within most of our investment strategies. As of December 31, 2020, we managed 228 separate accounts spanning 138 client relationships and our largest separate account relationship represented approximately 7% of our assets under management. Our separate account clients include both institutional and intermediary channel relationships, such as pension and profit sharing plans, corporations, trusts, endowments, foundations, charitable organizations, high net worth individuals, governmental entities, insurance companies, commingled investment vehicles, investment advisers and other financial institutions, trustees of collective investment trusts and investment companies and similar pooled investment vehicles. We also offer access to a number of our strategies through Artisan-branded collective investment trusts and Artisan Private Funds. We generally require a minimum relationship of $20 million to $100 million, depending on the strategy, to manage a separate account. The fees we charge on separate accounts vary by client, investment strategy and the size of the account. Fees are accrued monthly, but generally are paid quarterly in arrears.

In our reporting materials, unless otherwise stated, our separate account AUM includes assets we manage in traditional separate accounts, as well as assets we manage in Artisan-branded collective investment trusts and Artisan Private Funds.

Artisan Funds and Artisan Global Funds

U.S. investors that do not meet our minimum account size for a separate account, or who otherwise prefer to invest through a mutual fund, can invest in our strategies through Artisan Funds. We serve as the investment adviser to each series of Artisan Funds, SEC-registered mutual funds that offer no-load, no 12b-1 share classes designed to meet the needs of a range of investors. Each series of Artisan Funds corresponds to an investment strategy we offer to clients. We earn management fees, which are based on the average daily net assets of each Artisan Fund and are paid monthly, for serving as investment adviser to these funds. As of December 31, 2020, Artisan Funds represented approximately 44% of our assets under management.

We also serve as investment manager of Artisan Global Funds, a family of Ireland-based UCITS funds. Artisan Global Funds provides non-U.S. investors with access to a number of our investment strategies in a pooled vehicle structure. We earn investment management fees, which are based on the average daily net assets of each sub-fund and are generally paid monthly, for serving as investment adviser to these funds. As of December 31, 2020, Artisan Global Funds represented approximately 3% of our assets under management.

Regulatory Environment and Compliance

Our business is subject to extensive regulation in the United States at the federal level and, to a lesser extent, the state level, as well as by self-regulatory organizations and regulators located outside the United States. Under these laws and regulations, agencies that regulate investment advisers, investment funds and other entities have broad administrative powers, including the power to limit, restrict or prohibit the regulated entity from conducting business in the event that it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines. A regulatory proceeding, regardless of whether it results in a sanction, can require substantial expenditures and can have an adverse effect on our reputation or business.

We are subject to various domestic, international and extra-territorial laws and regulations that are applicable to our business, including securities, compliance, corporate governance, disclosure, privacy and data protection, information security, anti-bribery and anti-corruption, anti-money laundering and anti-terrorist financing laws and regulations. These laws and regulations continue to change and evolve over time. As a result, there is uncertainty associated with the regulatory environments in which we operate. The rules and regulations applicable to investment management organizations are very detailed and technical. Accordingly, the discussion below is general in nature, does not purport to be complete and is current only as of the date of this report.

U.S. Regulation

As a publicly traded company, we are subject to U.S. federal securities laws, state securities and corporate laws, and the rules and regulations of U.S. regulatory and self-regulatory organizations. In particular, we are subject to the Securities Act of 1933, the Securities Exchange Act of 1934, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank”), the Sarbanes-Oxley Act of 2002 and, because we are listed on the New York Stock Exchange, the NYSE listed company rules.

7

Artisan Partners Limited Partnership and Artisan Partners UK LLP are registered with the SEC as investment advisers under the Investment Advisers Act of 1940, or Advisers Act, and Artisan Funds and several of the investment companies we sub-advise are registered under the Investment Company Act of 1940, or 1940 Act. The Advisers Act and the 1940 Act, together with other applicable securities laws and the SEC’s regulations and interpretations thereunder, impose substantive and material restrictions and requirements on the operations of investment advisers and mutual funds. The SEC is authorized to institute proceedings and impose sanctions for violations, ranging from fines and censures to, in the case of investment advisers, the termination of an adviser’s registration.

Artisan Partners Distributors LLC, our SEC-registered limited purpose broker-dealer subsidiary, is subject to the Securities Exchange Act of 1934, the SEC’s rules promulgated thereunder and the rules and regulations of the Financial Industry Regulatory Authority, which generally relate to sales practices, registration of personnel, compliance and supervision, and compensation and disclosure. FINRA has the authority to conduct periodic examinations of member broker-dealers, and may initiate administrative proceedings. Artisan Partners Distributors LLC is also subject to the SEC’s Uniform Net Capital Rule and the National Securities Clearing Corporation’s excess net capital requirement, which require that at least a minimum part of a registered broker-dealer’s assets be kept in relatively liquid form.

Artisan Partners Limited Partnership is a fiduciary under the Employee Retirement Income Security Act of 1974, as amended, with respect to assets that we manage for benefit plan clients subject to ERISA. ERISA imposes duties on persons who are ERISA fiduciaries, and prohibits certain transactions between related parties to a retirement plan. The U.S. Department of Labor administers ERISA and regulates plan fiduciaries, including investment advisers who service retirement plan clients.

The legislative and regulatory environment in the U.S. is subject to continual change. New legal or regulatory requirements may add further complexity to our business and operations, and addressing such new requirements may require substantial expenditures of time and capital. Certain regulatory reforms in the U.S. that have, or may in the future, impact our business include the following items:

•In recent years there has been an increased focus on the protection of customer privacy and data, and the need to secure sensitive information. We are currently subject to the California Consumer Privacy Act, which took effect in January 2020, and provides for enhanced consumer protections for California residents. We anticipate that additional jurisdictions will adopt similar laws in the future with which we will be required to comply.

•The SEC has, in recent years, proposed and/or adopted several new rules impacting registered investment advisers (e.g. amended advertising rule, proxy voting guidance) and registered investment companies (e.g. new or amended rules on mutual fund use of derivatives, liquidity risk management, reporting modernization, valuation). These rules impact us and the mutual funds we manage to varying degrees.

Non-U.S. Regulation

In addition to the extensive regulation we are subject to in the United States, a number of our subsidiaries and certain of our non-U.S. operations are subject to regulation in non-U.S. jurisdictions. Some laws in non-U.S. jurisdictions are also extra-territorial and may apply to our business.

Artisan Partners UK LLP is authorized and regulated by the U.K. Financial Conduct Authority, which is responsible for the conduct of business and supervision of financial firms in the United Kingdom. The FCA imposes a comprehensive system of regulation that is primarily principles-based (compared to the primarily rules-based U.S. regulatory system).

Artisan Partners Europe is authorized and regulated by the Central Bank of Ireland, which regulates our Irish business activities. Artisan Partners Europe has a branch office in Sweden, which is also regulated by the Central Bank of Ireland and is further subject to the regulation of the Swedish financial supervisory authority.

Artisan Global Funds, a family of Ireland-domiciled UCITS funds, are regulated by the Central Bank of Ireland. Artisan Global Funds are registered for sale in many countries around the world, both in the EU and beyond, and thus are also subject to the laws of, and supervision by, the governmental authorities of those countries.

Artisan Partners Hong Kong Limited, our Hong Kong subsidiary, is in the process of applying for an asset management license with the Hong Kong Securities and Futures Commission. Once the license is obtained, our subsidiary will be subject to the Securities and Futures Ordinance as administered by the SFC, and its employees conducting any regulated activities will be required to be licensed by the SFC and subject to the relevant rules, codes and guidelines.

Artisan Partners Australia Pty Ltd has historically operated in Australia on the basis of a “sufficient equivalence relief” exemption from local licensing with the Australian Securities and Investments Commission. This relief is expiring for foreign financial service providers like us and, as a result, Artisan Partners Australia Pty Ltd will need to apply for and obtain a securities license by April 1, 2022.

Certain Artisan Private Funds are regulated as mutual funds under the Mutual Funds Law (as amended) of the Cayman Islands, and the Cayman Islands Monetary Authority has supervisory and enforcement powers to ensure the funds’ compliance with the Mutual Funds Law.

8

Our business is also subject to the rules and regulations of the countries in which we conduct distribution or investment management activities. As of December 31, 2020, we had over 200 relationships with clients located outside of the United States, which relationships may be subject to laws and regulations of the jurisdictions in which the client is domiciled. Separately, 42% of our assets under management were invested in securities denominated in currencies other than the U.S. dollar as of December 31, 2020. Our investments in these non-U.S. securities may subject us to certain laws and regulations of the jurisdictions in which the issuer resides. We may also be subject to U.S. laws and regulations regarding our distribution or investment management activities in non-U.S. markets, including in jurisdictions that may be considered higher risk.

Further expansion of our business into new international jurisdictions and regulatory reforms in jurisdictions in which we currently operate or invest, further complicate our compliance efforts. Addressing these legal and regulatory matters may require substantial time and expense. Certain non-U.S. regulatory reforms or guidance regarding such regulations that have, or may in the future, impact our business include the following items:

•In October 2020, the Central Bank of Ireland issued further guidance regarding the fund company management effectiveness framework (“CP86”). As a result of the guidance, fund management companies, including Artisan Global Funds, are assessing their operational resources and governance arrangements and considering how best to increase their level of resources to meet the new minimum requirements. Increasing Artisan Global Funds’ resources in Ireland will require time and will result in additional expense to the Company.

•The EU’s Markets in Financial Instruments Directive II regulates the use of soft dollars to pay for research and other soft dollar services. MiFID II’s soft dollar rules do not directly apply to our business because we currently conduct our investment management activities in the United States. However, in response to MiFID II and the industry-wide changes prompted by it, we have experienced requests from clients to bear research expenses that are currently paid for using soft dollars. In response to such requests or as a result of changes in our operations, we may eventually bear a significant portion or all of the costs of research that are currently paid for using soft dollars, which would increase our operating expenses materially.

We may become subject to additional regulatory demands in the future to the extent we expand our business in existing and new jurisdictions. See “Risk Factors—Risks Related to our Industry—We are subject to extensive, complex and sometimes overlapping rules, regulations and legal interpretations.” and “Risk Factors—Risks Related to our Industry—The regulatory environment in which we operate is subject to continual change, and regulatory developments may adversely affect our business.”

Competition

In order to grow our business, we must be able to compete effectively for assets under management. We compete to attract clients and investors principally on the basis of:

•the performance of our investment strategies

•the continuity of our investment and distribution professionals

•the quality of the service we provide to our clients

•the range of investment strategies and vehicles we offer

•our brand recognition and reputation within the investing community

We compete in all aspects of our business with a large number of investment management firms, commercial banks, broker-dealers, insurance companies and other financial institutions. For additional information concerning the competitive risks that we face, see “Risks Factors—Risks Related to Our Industry—The investment management industry is intensely competitive.”

Human Capital Resources

Since Artisan Partners was founded in 1994, we have recognized that our success as an investment management firm is predicated on having talented associates throughout the organization in every role, at every level. We understand that attracting, developing and retaining talented professionals is an essential component of our business strategy. As a result, we are committed to providing an environment that is attractive to our current and prospective associates and that allows our talented associates to be successful throughout the course of their careers.

We commit significant energy to the recruitment of our associates as they are critical to ensuring the long-term success of our firm. We strive to recruit and hire outstanding associates who thrive in broad roles and want the freedom to grow their talents and careers. We are also committed to seeking professionals from different backgrounds, experiences and locations to foster creative thinking and differentiated perspectives that remain a pillar of the firm’s culture. We have built relationships with a variety of recruitment partners and community organizations to broaden our candidate pools and increase our access to diverse talent.

9

We actively support associate development, both formally and informally, and encourage advancement from within the firm. Our tuition reimbursement program is available to associates who are pursuing applicable undergraduate and graduate degrees or certifications or licenses relevant to the business. We also actively support a number of associate-led groups including the Diversity and Inclusion Committee, the Training, Education and Development (T.E.D.) program, the Mentoring Program and the Women’s Networking Initiative. These programs provide our associates with a variety of educational and cross-functional knowledge sharing opportunities and professional development. Our support of these and other associate-led programs are part of our ongoing commitment to providing an environment that allows our talented associates to thrive.

In terms of retention of our associates, we believe it is critical that we continue to foster an engaging environment and provide attractive compensation and benefits programs. We regularly review compensation paid to associates to ensure it is competitive and fair for the role, experience, location and individual contribution. We provide equity or equity-linked incentives to all of our associates in order to align their economic interests with those of our clients and stockholders. We encourage our associates to save for retirement. In the U.S., we match 100% of associate 401(k) contributions dollar for dollar (fully vested), up to the IRS limit. We also maintain competitive retirement programs or benefits for all non-U.S. associates. In addition, we offer a comprehensive benefits program that is available to all associates regardless of title, role, or responsibility. As of December 31, 2020, we employed 453 employees.

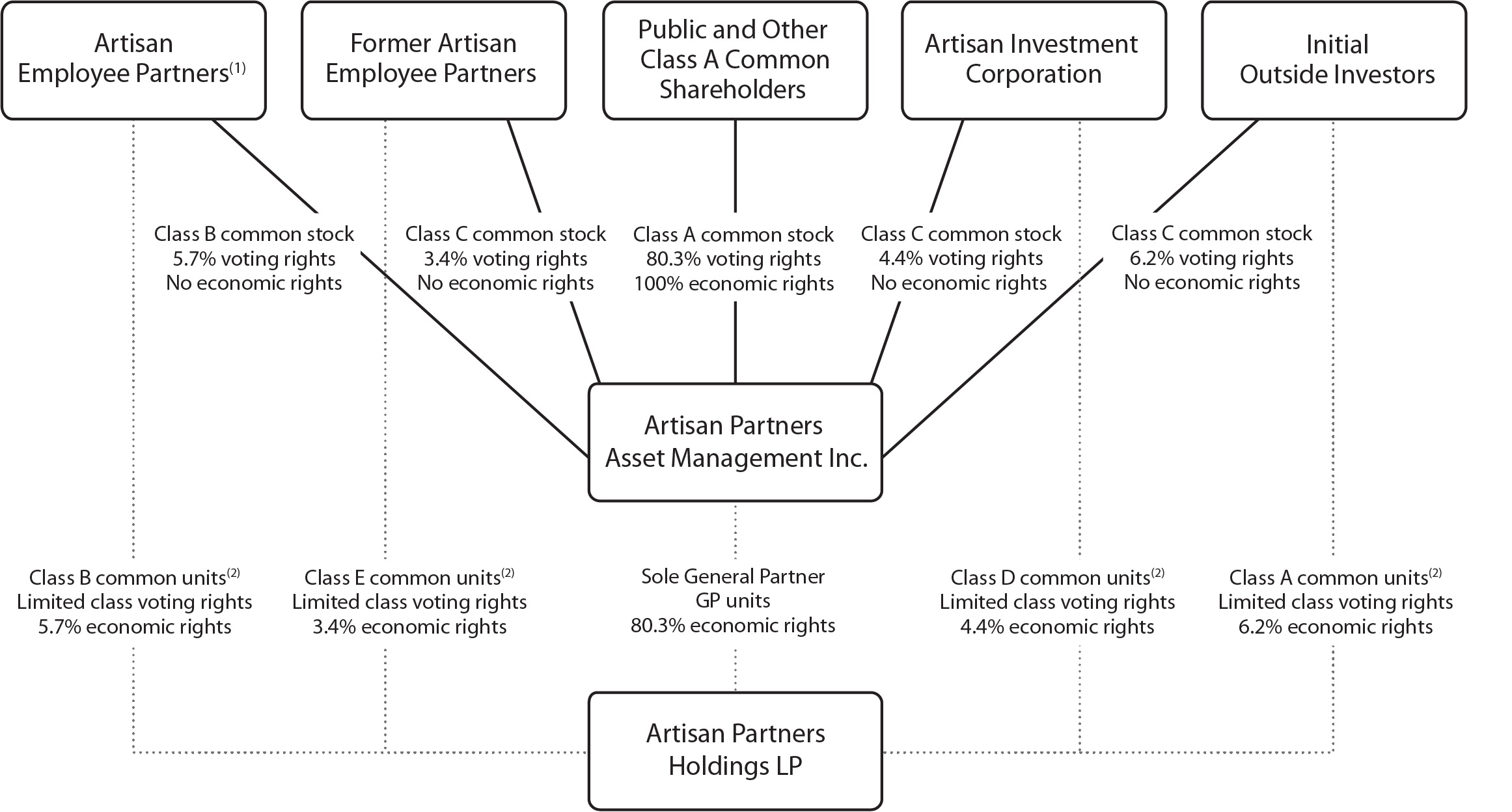

Our Structure and Reorganization

Holding Company Structure

We are a holding company and our assets principally consist of our ownership of partnership units of Artisan Partners Holdings, deferred tax assets and cash. As the sole general partner of Artisan Partners Holdings, we operate and control all of its business and affairs, subject to certain voting rights of its limited partners. We conduct all of our business activities through operating subsidiaries of Artisan Partners Holdings. Net profits and net losses are allocated based on the ownership of partnership units of Artisan Partners Holdings. As of December 31, 2020, we owned approximately 80% of Artisan Partners Holdings, and the other 20% was owned by the limited partners of Artisan Partners Holdings.

IPO Reorganization

In March 2013, we completed our IPO. In connection with the IPO, we and Artisan Partners Holdings completed a series of reorganization transactions, which we refer to as the IPO Reorganization, in order to reorganize our capital structures in preparation for the IPO. The IPO Reorganization included, among other changes, the following:

•Our appointment as the sole general partner of Artisan Partners Holdings.

•The modification of our capital structure into three classes of common stock and a series of convertible preferred stock. We issued shares of our Class B common stock, Class C common stock and convertible preferred stock to pre-IPO partners of Artisan Partners Holdings. Each share of Class B common stock corresponds to a Class B common unit of Artisan Partners Holdings. Each share of Class C common stock corresponds to either a Class A, Class D or Class E common unit of Artisan Partners Holdings. Subject to certain restrictions, each common unit of Artisan Partners Holdings (together with the corresponding share of Class B or Class C common stock) is exchangeable for a share of our Class A common stock.

•A corporation (“H&F Corp”) merged with and into Artisan Partners Asset Management, which we refer to in this document as the H&F Corp Merger. As consideration for the merger, the shareholder of H&F Corp received shares of our convertible preferred stock, contingent value rights, or CVRs, issued by Artisan Partners Asset Management and the right to receive an amount of cash. In November 2013, the CVRs issued by Artisan Partners Asset Management were terminated with no amounts paid or payable thereunder. In June 2014, the shareholder of H&F Corp converted all of its then-remaining shares of convertible preferred stock into shares of Class A common stock and sold those shares. We no longer have any outstanding shares of convertible preferred stock, and Artisan Partners Holdings no longer has any outstanding preferred units.

•The voting and certain other rights of each class of limited partnership units of Artisan Partners Holdings were modified. In addition, Artisan Partners Holdings separately issued CVRs to the holders of the preferred units. In November 2013, the CVRs issued by Artisan Partners Holdings were terminated with no amounts paid or payable thereunder.

•We entered into two tax receivable agreements (“TRAs”), one with a private equity fund (the “Pre-H&F Corp Merger Shareholder”) and the other with each limited partner of Artisan Partners Holdings. Pursuant to the first TRA, APAM pays to the assignees of the Pre-H&F Corp Merger Shareholder a portion of certain tax benefits APAM realizes as a result of the H&F Corp Merger. Pursuant to the second TRA, APAM pays to current or former limited partners of Artisan Partners Holdings (or their assignees) a portion of certain tax benefits APAM realizes as a result of the purchase or exchange of their limited partnership units of Artisan Partners Holdings.

10

The diagram below depicts our organizational structure as of December 31, 2020:

| (1) | Our employees to whom we have granted equity have entered into a stockholders agreement with respect to all shares of our common stock they have acquired from us and any shares they may acquire from us in the future, pursuant to which they granted an irrevocable voting proxy to a stockholders committee currently consisting of Eric R. Colson (Chairman and Chief Executive Officer), Charles J. Daley, Jr. (Chief Financial Officer) and Gregory K. Ramirez (Executive Vice President). The stockholders committee, by vote of a majority of its members, will determine the vote of all of the shares subject to the stockholders agreement. In addition to owning all of the shares of our Class B common stock, our employee-partners, together with our other employees, owned unvested restricted shares of our Class A common stock representing approximately 8% of our outstanding Class A common stock as of December 31, 2020. | ||||

| (2) | Each class of common units generally entitles its holders to the same economic and voting rights in Artisan Partners Holdings as each other class of common units, except that the Class E common units have no voting rights except as required by law. | ||||

Available Information

Our website address is www.artisanpartners.com. We make available free of charge through our website all of the materials we file or furnish with the SEC as soon as reasonably practicable after we electronically file or furnish such materials with the SEC. Information contained on our website is not part of, nor is it incorporated by reference into, this Form 10-K. The company was incorporated in Wisconsin on March 21, 2011 and converted to a Delaware corporation on October 29, 2012.

11

Item 1A. Risk Factors

An investment in our Class A common stock involves substantial risks and uncertainties. You should carefully consider each of the risks below, together with all of the other information contained in this document, before deciding to invest in our Class A common stock. If any of the following risks occurs, our business, financial condition or results of operations could be negatively affected, the market price of your shares could decline and you could lose all or part of your investment.

Risks Related to our Business

The loss of key investment professionals or senior members of our distribution and management teams could have a material adverse effect on our business.

Our success depends on our ability to retain the portfolio managers who manage our investment strategies and have been primarily responsible for the historically strong investment performance we have achieved. Because of the long tenure and stability of many of our portfolio managers, our clients generally attribute the investment performance we have achieved to these individuals. The departure of a portfolio manager, even for strategies with multiple portfolio managers, could cause clients to withdraw funds from the strategy which would reduce our assets under management, investment advisory fees and our net income, and these reductions could be material if our assets under management in that strategy and the related revenues were material. The departure of a portfolio manager or other senior members of investment teams also could cause consultants and intermediaries to stop recommending a strategy, and clients to refrain from allocating additional funds to a strategy or delay such additional funds until a sufficient new track record has been established.

In addition to our key investment professionals, we also depend on the contributions of our senior management team led by Eric R. Colson and Jason A. Gottlieb, and our senior marketing and client service personnel who have direct contact with our institutional clients, consultants, intermediaries and other key individuals within each of our distribution channels. The loss of any of these key professionals could limit our ability to successfully execute our business strategy or adversely affect our ability to retain existing and attract new client assets and related revenues.

Any of our key professionals may resign at any time, join our competitors or form a competing company. Although many of our portfolio managers and each of our named executive officers are subject to post-employment non-compete obligations, these non-competition provisions may not be enforceable or may not be enforceable to their full extent. In addition, we may agree to waive non-competition provisions or other restrictive covenants applicable to former key professionals in light of the circumstances surrounding their relationship with us. We do not carry “key man” insurance that would provide us with proceeds in the event of the death or disability of any of our key professionals.

Changes to our investment environment or compensation structures could cause instability within our investment teams and/or have an adverse effect on the performance of our investment strategies, our financial results and our ability to grow.

Attracting, developing and retaining talented investment professionals is an essential component of our business strategy. To do so, it is critical that we continue to foster an environment and provide compensation that is attractive for existing and prospective investment professionals. If we are unsuccessful in maintaining such an environment or compensation levels or structures for any reason, our existing investment professionals may leave our firm or fail to produce their best work on a consistent, long-term basis and/or we may be unsuccessful in attracting talented new investment professionals, any of which could negatively impact the performance of our investment strategies, our financial results and our ability to grow.

Over our firm’s history we have sought to successfully design and implement compensation structures that align our investment professionals’ economic interests with those of our clients, investors, partners, and stockholders. We believe our historical structures have been important to our long-term growth and that objective, predictable, and transparent structures work best to incentivize investment professionals to perform over the long-term.

With respect to asset-based revenues, we use a single revenue share arrangement across all of our investment teams. Under the revenue share, each team shares a bonus pool consisting of 25% of the asset-based revenues earned by the strategies managed by the respective team. The revenue share directly links the majority of the investment teams’ cash compensation to long-term growth in revenues, which, over the long-term, we believe is primarily linked to investment performance. The asset-based revenue share is objective, predictable, transparent, and the same for all teams. In addition, each team is generally entitled to a share of performance-based revenues earned by the strategies managed by the team. In the future, we expect that performance fees will represent a higher proportion of our total revenues.

Over our firm’s history we have used a variety of equity incentives to align the long-term interests of our investment professionals with the interests of clients, investors, partners and stockholders. Prior to our IPO in 2013, firm equity awards consisted of partnership profits interests. Award recipients had the right to cash out their profits interests only after the end of their careers, and 50% of the awards were subject to forfeiture if the recipient left Artisan without proper notice or was terminated. Prior to the IPO Reorganization, the profits interests were converted into partnership units and, as part of the IPO Reorganization, the 50% forfeiture feature was eliminated and employee-partners were given the right to liquidate a portion of their partnership units during each year that they remained employed by Artisan.

12

Since our IPO, the equity we’ve awarded to our investment professionals has consisted of APAM restricted share-based awards. In general, equity awarded to our investment professionals consists of a mix of standard restricted shares which vest pro rata over five years from the date of grant, and career or franchise shares that generally only vest on, or 18 months after, a qualified retirement. Franchise shares are further subject to the Franchise Protection Clause, which applies to current or former portfolio managers and may reduce the number of shares ultimately vesting to the extent that cumulative net client cash outflows from the portfolio manager’s investment team during a 3-year measurement period beginning on the date of the portfolio manager’s retirement notice exceeds a set threshold.

Beginning in 2021, under our new capital alignment program, our long-term incentive awards for investment professionals will consist of both APAM restricted share-based awards and franchise capital awards. Under this program, we will continue to grant restricted share-based awards, which we believe are an effective way to align the interests of our investment professionals with those of our stockholders. In addition, in 2021 we will make our first award of franchise capital awards to investment professionals. We designed the franchise capital awards as an added feature to our long-term incentive program to enhance the alignment between our investment professionals and clients, and to provide investment professionals with greater control over their long-term economic outcome. Franchise capital awards are cash awards that are subject to the same long-term vesting and forfeiture provisions as the restricted share-based awards described above. Prior to vesting, though, the franchise capital awards will generally be invested in one or more of the investment strategies managed by the award recipient’s investment team.

As we have since our founding, we continue to assess the effectiveness of our compensation arrangements and equity structures in aligning the long-term interests of our investment professionals, clients, investors, partners, and stockholders and whether different types of, or modified, awards or structures would enhance incentives for long-term growth and succession planning.