Table of Contents

As filed with the Securities and Exchange Commission on November 22, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-7

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Maudore Minerals Ltd.

(Exact name of Registrant as specified in its charter)

| Ontario, Canada | 1040 | Not Applicable | ||

| (Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2000 Peel Street, Suite 620, Montreal, Québec, Canada H3A 2W5 (514) 439-0990

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address and telephone number of agent for service in the United States)

Copies to:

| Riccardo Leofanti, Esq. | Jennifer Maxwell, Esq. | |

| Skadden, Arps, Slate, Meagher & Flom LLP | Blake, Cassels & Graydon LLP | |

| 222 Bay Street, Suite 1750, P.O. Box 258 | 23 College Hill, 5th Floor | |

| Toronto, Ontario, Canada M5K 1J5 | London, EC4R 2RP, England | |

| (416) 777-4700 | +44 (0)20 7429 3550 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this registration statement becomes effective.

This registration statement and any amendment thereto shall become effective upon filing with the Commission in accordance with Rule 467(a).

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box: ¨

CALCULATION OF REGISTRATION FEE (1)

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price per Unit |

Proposed Maximum Offering Price(2) |

Amount of Registration Fee | ||||

| Common shares |

47,241,522 | 100% | US$4,500,700 | US$579.69 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Calculation of Registration Fee is in accordance with General Instruction II.F of Form F-7. |

| (2) | Based on the noon buying rate for Canadian dollars published by the Bank of Canada on November 14, 2013 of Cdn$1.00 = US$0.9527. |

If, as a result of stock splits, stock dividends or similar transactions, the number of securities purported to be registered on this registration statement changes, the provisions of Rule 416 shall apply to this registration statement.

Table of Contents

PART I

INFORMATION REQUIRED TO BE SENT TO SHAREHOLDERS

Table of Contents

A copy of this preliminary short form prospectus has been filed with the securities regulatory authorities in each of the provinces of Canada but has not yet become final for the purpose of the sale of securities. Information contained in this preliminary short form prospectus may not be complete and may have to be amended. The securities may not be sold until a receipt for the short form prospectus is obtained from the securities regulatory authorities.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this prospectus from documents filed with the securities commissions or similar authorities in each of the provinces of Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Maudore Minerals Ltd. at 2000 Peel Street, Suite 620, Montreal, Quebec, Canada H3A 2W5, tel.: (514) 439-0990, and are also available electronically at www.sedar.com.

This document is important and requires you to make a decision prior to •p.m. (Montreal time) on •, 2013. If you are in doubt as to how to deal with the information herein, you should consult your investment dealer, stock broker, bank manager or other professional.

Preliminary Short Form Prospectus

| Rights Offering |

November 22, 2013 |

MAUDORE MINERALS LTD.

Cdn$4,724,152

Offering of Rights to Subscribe for Common Shares

at a Price of Cdn$0.10 per Common Share

Maudore Minerals Ltd. (the “Corporation” or “Maudore”) is distributing (the “Offering”) to the holders (the “Shareholders”) of its outstanding common shares (the “Common Shares”) of record at the close of business (Montreal time) on •, 2013 (the “Record Date”) one right (the “Right”) for each Common Share held, which will entitle the Shareholders to subscribe for up to an aggregate of 47,241,522 Common Shares for gross proceeds to the Corporation of Cdn$4,724,152.

The Rights are transferable into and within Canada and are evidenced by certificates in registered form (the “Rights Certificates”). Each Shareholder is entitled to one Right for each Common Share held on the Record Date. For each Right held, the holder thereof is entitled to purchase one Common Share (the “Basic Subscription Privilege”) at a price of Cdn$0.10 per Common Share (the “Subscription Price”) prior to 5:00 p.m. (Montreal time) (the “Expiry Time”) on •, 2013 (the “Expiry Date”). No fractional Common Shares will be issued. RIGHTS NOT EXERCISED BEFORE THE EXPIRY TIME WILL BE VOID AND OF NO VALUE. Holders who exercise in full the Basic Subscription Privilege for all of their Rights are also entitled to subscribe for additional Common Shares (the “Additional Shares”), if available, pursuant to an additional subscription privilege (the “Additional Subscription Privilege”). See “Description of Offered Securities — Additional Subscription Privilege”. Any subscription for Common Shares will be irrevocable and subscribers will be unable to withdraw their subscriptions for Common Shares once submitted.

| Offering Price | Proceeds to the Corporation(1) |

|||||||

| Per Common Share |

Cdn$ | 0.10 | Cdn$ | 0.10 | ||||

| Total (2) |

Cdn$ | 4,724,152 | Cdn$ | 4,724,152 | ||||

Note:

| (1) | Before deducting the expenses of the Offering, estimated to be approximately Cdn$417,000. |

| (2) | Assumes the exercise of all Rights. |

The Corporation has applied to list the Rights distributed under this prospectus, the Common Shares issuable upon the exercise of the Rights and the Standby Shares (as defined herein) on the TSX Venture Exchange (the “TSXV”). The approval of such listing is subject to the Corporation fulfilling all of the listing requirements of the TSXV. The currently outstanding Common Shares are listed and posted for trading on the TSXV under the symbol “MAO”. On November 21, 2013, the closing price for the Common Shares on the TSXV was Cdn$0.095 per share.

Table of Contents

CST Trust Company (the “Subscription Agent”), at its principal office in the City of Toronto (the “Subscription Office”), is the subscription agent for this Offering. See “Description of Offered Securities — Subscription and Transfer Agent”.

For Common Shares held in registered form, a Rights Certificate evidencing the number of Rights to which a Shareholder is entitled will be mailed with a copy of this prospectus to each registered Shareholder as of the close of business on the Record Date. In order to exercise the Rights represented by the Rights Certificate, the holder of Rights must complete and deliver the Rights Certificate to the Subscription Agent in the manner and upon the terms set out in this prospectus. All exercises of Rights are irrevocable once submitted. See “Description of Offered Securities — Rights Certificate — Common Shares Held in Registered Form”.

For Common Shares held through a securities broker or dealer, bank or trust company or other participant (a “CDS Participant”) in the book-based system administered by CDS Clearing and Depository Services Inc. (“CDS”), a subscriber may subscribe for Common Shares by instructing the CDS Participant holding the subscriber’s Rights to exercise all or a specified number of such Rights and forwarding the Subscription Price for each Common Share subscribed for to such CDS Participant in accordance with the terms of the Offering. Subscriptions for Common Shares made through a CDS Participant will be irrevocable and subscribers will be unable to withdraw their subscriptions for Common Shares once submitted. See “Description of Offered Securities — Rights Certificate — Common Shares Held Through CDS”.

Subscribers wishing to subscribe for Additional Shares under the Additional Subscription Privilege must forward their request to the Subscription Agent at the Subscription Office or to their CDS Participant, as applicable, prior to the Expiry Time on the Expiry Date. Payment for Additional Shares, in the same manner as required upon exercise of the Basic Subscription Privilege, must accompany the request when it is delivered to the Subscription Agent or a CDS Participant, as applicable. Any excess funds will be returned by mail by the Subscription Agent or credited to a subscriber’s account with its CDS Participant, as applicable, without interest or deduction.

If a Shareholder does not exercise, or sells or otherwise transfers, its Rights, then such Shareholder’s current percentage ownership in the Corporation will be diluted as a result of the exercise of Rights by other Shareholders.

This prospectus qualifies the distribution of the Rights as well as the Common Shares issuable upon exercise of the Rights and the Standby Shares in each province of Canada. This prospectus also covers the offer and sale of the Common Shares issuable upon exercise of the Rights within the United States under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”). The provinces of Canada and the United States are collectively referred to in this prospectus as the “Eligible Jurisdictions”. Except under the circumstances described herein, the Rights as well as the Common Shares issuable upon the exercise of the Rights and the Standby Shares are not being distributed or offered to Shareholders in any jurisdiction other than the Eligible Jurisdictions (each, an “Ineligible Jurisdiction”) and, except under the circumstances described herein, Rights may not be exercised by or on behalf of a holder of Rights who appears to be, or who the Corporation has reason to believe is, a resident in an Ineligible Jurisdiction (an “Ineligible Holder”). This prospectus is not, and under no circumstances is to be construed as, an offering of any Rights or Common Shares for sale in any Ineligible Jurisdiction or a solicitation therein of an offer to buy any securities. Except under the circumstances described herein, Rights Certificates will not be sent to Shareholders with addresses of record in any Ineligible Jurisdiction. Ineligible Holders who are not Approved Eligible Holders (as defined herein) will be sent a letter advising them that their Rights Certificates will be held by the Subscription Agent, who will hold such Rights as agent for the benefit of all such Ineligible Holders. See “Description of Offered Securities — Ineligible Holders and Approved Eligible Holder”.

This offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this prospectus in accordance with the disclosure requirements of Canada. Prospective purchasers of securities should be aware that such requirements are different from those of the United States. Financial statements included or incorporated herein, if any, have been prepared in accordance with International Financial Reporting Standards, and are subject to Canadian auditing and auditor independence standards, and thus may not be comparable to financial statements of United States companies.

Prospective purchasers of securities should be aware that the acquisition or disposition of the securities described in this prospectus may have tax consequences in Canada, the United States, or elsewhere. Such consequences for purchasers who are resident in, or citizens of, the United States are not described fully herein. Prospective purchasers should consult their own tax advisors with respect to such tax considerations.

The enforcement by purchasers of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of Ontario, that some or all of its officers and directors may be residents of a country other than the United States, that some or all of the experts named in the registration statement may be residents of Canada, and that all or a substantial portion of the assets of the Corporation and said persons may be located outside the United States.

These securities have not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”) nor has the SEC passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offence.

2

Table of Contents

Messrs. Kevin Tomlinson, Chairman of the Board of the Corporation, George Fowlie, Deputy Chairman of the Board of the Corporation, and Greg Struble, President and Chief Executive Officer of the Corporation (collectively, the “Standby Purchasers”) have entered into a standby purchase agreement dated as of November 8, 2013 (the “Standby Purchase Agreement”) under which they have agreed, severally and not jointly and severally, subject to certain terms and conditions, to: (i) exercise their respective Basic Subscription Privileges in full and thereby purchase, by themselves or through their respective affiliates, an aggregate of 1,250,448 Common Shares; and (ii) purchase, by themselves or through their respective affiliates, at the Subscription Price, an aggregate of 1,749,552 Common Shares offered pursuant to the Offering that are not otherwise purchased pursuant to the Offering (the “Standby Shares”), all for investment only and not with a view to resale or distribution. The Standby Purchasers have thereby committed to purchase an aggregate of 3,000,000 Common Shares and Standby Shares, representing total proceeds to the Corporation of Cdn$300,000. This prospectus qualifies the distribution of the Standby Shares in each province of Canada. See “Standby Commitments”.

The Standby Purchasers are not engaged as underwriters in connection with the Offering and no Standby Purchaser has been involved in the preparation of, or performed any review of, this prospectus in the capacity of an underwriter.

There is no managing or soliciting dealer for the Offering and the Corporation will pay no fee of any kind for the solicitation of the exercise of Rights. No underwriter has been involved in the preparation of this prospectus or performed any review of the contents of this prospectus.

There are risks associated with an investment in Common Shares. See “Risk Factors” for a discussion of factors that should be considered by prospective purchasers of such securities and their advisors in assessing the appropriateness of an investment in the Common Shares.

The Corporation’s registered office is located at Suite 4000, 199 Bay Street, Commerce Court West, Toronto, Ontario, Canada M5L 1A9, and its head office is located at 2000 Peel Street, Suite 620, Montreal, Quebec, Canada H3A 2W5.

Messrs. Kevin Tomlinson, Daniel Harbour, Robert L. Pevenstein and Greg Struble, each of whom is a director of the Corporation, reside outside of Canada and have appointed Maudore as their agent for service of process. Holders of Rights are advised that it may not be possible to enforce judgements obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service.

3

Table of Contents

4

Table of Contents

In this prospectus, “Maudore” and the “Corporation” refer collectively to the Corporation and its subsidiaries, unless the context otherwise requires. All references in this prospectus to “dollars”, “Cdn$” or “$” are to Canadian dollars unless otherwise noted. The Corporation’s annual financial statements incorporated herein by reference have been prepared in accordance with International Financial Reporting Standards and its interim financial statements have been prepared in accordance with International Accounting Standards 34, Interim Financial Reporting. The Corporation prepares its financial statements in Canadian dollars.

The Offering is a corporate transaction that will affect the Corporation’s outstanding Common Shares and its outstanding Warrants (as defined herein). The Corporation’s outstanding Warrants contain certain anti-dilution adjustment provisions that are intended to ensure that a holder of Warrants is entitled to acquire equivalent share capital after the occurrence of a relevant corporate transaction, such as the Offering. The effect of the Offering on the Warrants is that, upon exercise of a Warrant, the holder thereof will be entitled to acquire an additional Common Share at a supplemental price of Cdn$0.10 per Common Share. Unless otherwise specified, information provided in this prospectus with respect to the capitalization of the Corporation is given without giving effect to any such anti-dilution adjustment provisions.

Investors should rely only on the information contained in this prospectus. The Corporation has not authorized anyone to provide investors with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any issuance of the Rights or Common Shares.

CAUTIONARY STATEMENT WITH REGARD TO FORWARD-LOOKING STATEMENTS

Certain statements and information in this prospectus are not based on historical facts and constitute forward-looking statements or forward looking information within the meaning of applicable Canadian securities laws (“forward-looking statements”), including but not limited to, statements and information about future events or expectations of Maudore’s future performance, intentions and plans that are not historical fact.

All statements that are not clearly historical in nature or that necessarily depend on future events are forward-looking, and the words “intend”, “anticipate”, “believe”, “expect”, “estimate”, “plan” and similar expressions are generally intended to identify forward-looking statements. These forward-looking statements include, without limitation, statements about the future performance and achievements of the Corporation, business and financing plans, business trends and future operating revenues. These statements are inherently uncertain and actual achievements of the Corporation or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, risks related to commodity price fluctuations, currency fluctuations, uncertainty related to estimated mineral reserves or mineral resources, the Corporation’s ability to finance the development of its mineral properties through external financing, strategic alliances, the sale of property interests or otherwise, the implementation of the Consensual Restructuring (as defined herein), including the Cyrus Term Sheet (as defined herein), market events and general economic conditions, uncertainty related to the Corporation’s ability to meet production level and observe operating costs estimates relating to the Sleeping Giant property, mining and development activities, governmental regulation and permits, including environmental regulation, uncertainty related to title to the Corporation’s mineral properties, uncertainty related to the Corporation’s history of losses, uncertainty as to the outcome of potential litigation, the Corporation’s majority shareholders, increased competition in the mining industry, uncertainty as to the Corporation’s ability to acquire additional commercially mineable mineral rights, conflicts of interests of some of the directors of the Corporation, increases in demand for equipment, skilled labor and services needed for exploration and development of mineral properties, and related cost increases, the third parties on which the Corporation depends for its exploration and development activities, failure to obtain any required approvals of the TSXV or from shareholders, failure to complete any of the transactions described herein, and the other risks described in the Corporation’s continuous disclosure documents.

The Corporation believes that the expectations reflected in its forward-looking statements are reasonable, but no assurance can be given that any of the events or results anticipated by such forward looking statements will occur or, if they do occur, as to what benefit they will have on the Corporation’s operations or financial condition.

5

Table of Contents

For the above reason, investors are cautioned against relying on these forward-looking statements. These statements speak only as of the date of this prospectus. The Corporation has no intention or obligation to update or revise any forward looking statements, whether as a result of new information, future events or otherwise, except as required by law. The forward-looking statements contained in this prospectus are expressly qualified by this cautionary statement.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING PRESENTATION OF MINERAL RESERVE AND RESOURCE ESTIMATES

This prospectus has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Unless otherwise indicated, all reserve and resource estimates included in this prospectus and in the documents incorporated by reference herein have been, and will be, prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum classification system. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and reserve and resource information contained or incorporated by reference in this prospectus and in the documents incorporated by reference herein may not be comparable to similar information disclosed by companies reporting under United States standards. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by United States standards in documents filed with the SEC. United States investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource estimate is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with United States standards.

The following table reflects the high, low and average rates of exchange in Canadian dollars for one United States dollar for the twelve-month periods noted, based on the Bank of Canada noon spot rate of exchange:

12 months ended December 31

| 2012 | 2011 | |||||||

| High |

Cdn$ | 1.0418 | Cdn$ | 1.0604 | ||||

| Low |

Cdn$ | 0.9710 | Cdn$ | 0.9449 | ||||

| Average |

Cdn$ | 0.9996 | Cdn$ | 0.9891 | ||||

On November 21, 2013, the closing exchange rate for Canadian dollars in terms of United States dollars, as quoted by the Bank of Canada, was US$1.00 = Cdn$1.0506 or Cdn$1.00 = US$0.9518. The Canadian dollar/United States dollar exchange rate has varied significantly over the last several years and investors are cautioned that the exchange rates presented here are historical and not indicative of future exchange rates.

6

Table of Contents

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus from documents filed with the securities commissions or similar authorities in each of the provinces of Canada. Copies of the documents incorporated herein by reference may be obtained upon request without charge from the Corporate Secretary of the Corporation at 2000 Peel Street, Suite 620, Montreal, Quebec, Canada H3A 2W5, telephone: (514) 439-0990, and are also available electronically under the Corporation’s profile at www.sedar.com.

The following documents of the Corporation, filed with the securities commissions or similar authorities in each of the provinces of Canada, are specifically incorporated by reference into and form an integral part of this prospectus:

| (a) | annual information form dated October 21, 2013 for the year ended December 31, 2012 (the “AIF”); |

| (b) | audited financial statements as at December 31, 2012 and 2011 and statements of financial position, statements of comprehensive loss, statements of change in equity and statements of cash flows for the years ended December 31, 2012 and 2011, together with the notes thereto and the independent auditor’s report thereon (the “Audited Annual Financial Statements”); |

| (c) | management’s discussion and analysis of financial condition and results of operations for the year ended December 31, 2012 (the “Annual MD&A”); |

| (d) | unaudited condensed consolidated interim financial statements for the three- and six-month periods ended June 30, 2013, together with the notes thereto (the “Unaudited Interim Financial Statements”); |

| (e) | management’s discussion and analysis of financial condition and results of operations for the three- and six-month periods ended June 30, 2013 (the “Interim MD&A”); |

| (f) | management proxy circular dated as of May 27, 2013 relating to the annual meeting of shareholders of the Corporation held on June 26, 2013 (the “Circular”); |

| (g) | material change report dated March 28, 2013 relating to the completion of the Corporation’s acquisition of NAP Quebec Mines Ltd. (the “NAP MCR”); |

| (h) | material change report dated April 22, 2013 relating to the completion of the Corporation’s private placement of 17,039,835 Private Placement Units (as defined herein) (the “Private Placement MCR”); |

| (i) | material change report dated April 29, 2013 relating to the termination of a purchase and sale agreement made between the Corporation and Noront Resources Ltd. (“Noront”) to acquire Noront’s interest in the Windfall Lake Project (the “Noront MCR”); |

| (j) | business acquisition report dated June 5, 2013 relating to the Corporation’s acquisition of NAP Quebec Mines Ltd. (the “BAR”); |

| (k) | material change report dated October 25, 2013 relating to the entering into of agreements for the consensual restructuring of debts owed to Cyrus Capital Partners (“Cyrus”), in its capacity as a manager to FBC Holdings S.à r.l. (“FBC”) as well as to certain significant unsecured creditors (the “Consensual Restructuring MCR”); and |

| (l) | material change report dated November 14, 2013 relating to certain minor modifications to the terms of the consensual restructuring of debts owed to Cyrus, in its capacity as a manager to FBC, and the future resignation of Kevin Tomlinson as a director of the Corporation (the “Revised Restructuring Terms MCR”). |

Any documents of the Corporation of the type described in section 11.1 of Form 44-101F1 – Short Form Prospectus filed by the Corporation with any securities regulatory authorities after the date of this prospectus and prior to the termination of the Offering will be deemed to be incorporated by reference into this prospectus.

7

Table of Contents

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference herein will be deemed to be modified or superseded, for purposes of this prospectus, to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement will not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not, except as so modified or superseded, be deemed to constitute a part of this prospectus.

8

Table of Contents

The following is a summary of the principal features of the Offering and should be read together with, and is qualified in its entirety by, the more detailed information and financial data and statements contained elsewhere or incorporated by reference in this prospectus. Certain terms used in this summary and in the prospectus are defined elsewhere herein.

| Issuer: | Maudore Minerals Ltd. | |

| The Offering: | Rights to subscribe for up to an aggregate of 47,241,522 Common Shares. Each Shareholder at the close of business (Montreal time) on the Record Date will receive one Right for each Common Share held. | |

| Record Date: | •, 2013. | |

| Commencement Date: | •, 2013. | |

| Expiry Date: | •, 2013. | |

| Expiry Time: | 5:00 p.m. (Montreal time) on the Expiry Date. Rights not exercised before the Expiry Time will be void and of no value. | |

| Subscription Price: | Cdn$0.10 per Common Share. | |

| Net Proceeds: | Approximately Cdn$4,307,152, after deducting estimated expenses of the Offering of approximately Cdn$417,000, and assuming the exercise in full of the Rights. | |

| Basic Subscription Privilege: | Each Right entitles the holder thereof to subscribe for one Common Share upon payment of the Subscription Price. No fractional Common Shares will be issued. See “Description of Offered Securities — Basic Subscription Privilege”. | |

| Additional Subscription Privilege: | Holders of Rights who exercise in full the Basic Subscription Privilege for all of their Rights are also entitled to subscribe pro rata for additional Common Shares, if any, not otherwise purchased by the other holders of Rights pursuant to the Basic Subscription Privilege. See “Description of Offered Securities — Additional Subscription Privilege”. | |

| Exercise of Rights: | Shareholders whose Common Shares are held in registered form with an address of record in an Eligible Jurisdiction will be mailed a Rights Certificate representing the total number of Rights to which such Shareholder is entitled as at the Record Date together with a copy of this prospectus. In order to exercise the Rights represented by the Rights Certificate, such holder of Rights must complete and deliver the Rights Certificate in accordance with the instructions set out under “Description of Offered Securities — How to Complete the Rights Certificate”. Shareholders whose Common Shares are held through a CDS Participant will not receive physical certificates evidencing their ownership of Rights and may subscribe for Common Shares by instructing the CDS Participant holding their Rights to exercise all or a specified number of such Rights and forwarding the Subscription Price for each Common Share subscribed for in accordance with the terms of the Offering to such CDS Participant. | |

| Shareholders in Ineligible Jurisdictions: | This Offering is made in all of the Eligible Jurisdictions. No subscription under the Basic Subscription Privilege nor under the Additional Subscription Privilege will be accepted from any person, or such person’s agent, who appears to be, or who the Corporation has reason to believe is, an Ineligible Holder, except that under the circumstances described herein and in certain other circumstances, the Corporation may accept subscriptions from persons in jurisdictions other than an Eligible Jurisdiction if the Corporation determines that such offering to and subscription by such person or agent is lawful and in compliance with all securities and other laws applicable in the jurisdiction where such person or agent is resident (each, an “Approved Eligible Holder”). No Rights Certificates will be mailed to persons or such persons’ agent who appear to be or who the Corporation believes to | |

9

Table of Contents

| be Ineligible Holders. Ineligible Holders will not be permitted to exercise their Rights. Holders of Common Shares who have not received Rights Certificates but are resident in an Eligible Jurisdiction or who have not been but wish to be recognized as Approved Eligible Holders should contact the Subscription Agent at the earliest possible time. Rights of Ineligible Holders will be held by the Subscription Agent until 5:00 p.m. (Montreal time) on •, 2013 in order to provide such holders an opportunity to claim the Rights Certificates by satisfying the Corporation that the exercise of their Rights will not be in violation of the laws of the applicable jurisdiction. After such time, the Subscription Agent will attempt to sell the Rights of registered Ineligible Holders on such date or dates and at such price or prices as the Subscription Agent will determine in its sole discretion. The Subscription Agent will endeavour to effect sales of such Rights on the open market and any proceeds received by the Subscription Agent with respect to the sale of Rights, net of brokerage fees and costs incurred, will be divided on a pro rata basis among such registered Ineligible Holders and delivered by mailing cheques (in Canadian funds) of the Subscription Agent therefor as soon as practicable to such registered Ineligible Holders, net of any amount required to be withheld on account of applicable taxes, at their addresses recorded on the books of the Corporation. Amounts of less than Cdn$10.00 will not be remitted. The Subscription Agent will act in its capacity as agent of the registered Ineligible Holders on a best efforts basis only and the Corporation and the Subscription Agent do not accept responsibility for the price obtained on the sale of, or the inability to sell, the Rights on behalf of any registered Ineligible Holder. See “Description of Offered Securities — Ineligible Holders and Approved Eligible Holders”. | ||

| Standby Commitment: | Under the Standby Purchase Agreement, the Standby Purchasers have agreed, severally and not jointly and severally, subject to certain terms and conditions, to (i) exercise their respective Basic Subscription Privileges in full and thereby purchase, by themselves or through their respective affiliates, an aggregate of 1,250,448 Common Shares; and (ii) purchase, by themselves or through their respective affiliates, at the Subscription Price, an aggregate of 1,749,552 Standby Shares, all for investment only and not with a view to resale or distribution. The Standby Purchasers have thereby committed to purchase an aggregate of 3,000,000 Common Shares and Standby Shares, representing total proceeds to the Corporation of Cdn$300,000. See “Standby Commitments” | |

| Use of Proceeds: | The net proceeds from the Offering will be used by the Corporation to repay creditors (Cdn$362,000) and for working capital support and general corporate purposes (Cdn$1,638,000). Any net proceeds exceeding Cdn$2,000,000 will be applied equally toward the repayment of creditors and working capital. See “Use of Proceeds”. | |

| Listing and Trading: | The Corporation has applied to list the Rights, the Common Shares issuable upon the exercise of the Rights and the Standby Shares on the TSXV. The approval of such listing will be subject to the Corporation fulfilling all of the listing requirements of the TSXV. The Rights may be transferred only in transactions outside of the United States in accordance with Regulation S under the U.S. Securities Act (“Regulation S”), which will permit the resale of the Rights by persons through the facilities of the TSXV. The Common Shares issuable upon the exercise of the Rights and the Standby Shares will be eligible to be quoted for trading on the OTCQX. | |

| Risk Factors: | An investment in Common Shares is subject to a number of risk factors. See “Risk Factors”. | |

10

Table of Contents

Maudore was incorporated under the Business Corporations Act (Ontario) on September 20, 1996. The Corporation is primarily engaged in the acquisition, exploration and development of gold mining sites with the objective of becoming an important gold producer in Quebec. The Corporation’s portfolio comprises mining properties located in the Province of Quebec, Canada.

During the period from October 2012 to present, the market price of gold has been volatile and dropping steadily, as evidenced by the following table.

Monthly Gold Prices since October 2012

| Month | Month End Gold Price(1) |

|||

| 2012 |

||||

| October |

US$ | 1,719 | ||

| November |

US$ | 1,726 | ||

| December |

US$ | 1,664 | ||

| 2013 |

||||

| January |

US$ | 1,664 | ||

| February |

US$ | 1,588 | ||

| March |

US$ | 1,598 | ||

| April |

US$ | 1,469 | ||

| May |

US$ | 1,394 | ||

| June |

US$ | 1,192 | ||

| July |

US$ | 1,314 | ||

| August |

US$ | 1,394 | ||

| September |

US$ | 1,326 | ||

| October |

US$ | 1,324 | ||

| November 1 – 21 |

US$ | 1,242 | ||

| (1) | Source: Kitco. |

As illustrated below, the value of the Common Shares on the TSXV was highly correlated to the fluctuations in gold prices during that same period.

Gold Price vs. Common Share Price(1)

| (1) | The gold prices are presented in US$ and the Common Share prices are presented in Cdn$. |

11

Table of Contents

This trend in gold prices created a strain on the Corporation’s cash resources and caused the Corporation to experience difficulties in dealing with its creditors. As a result, on August 15, 2013, Entrepreneur minier Promec Inc. (“Promec”) registered a Notice of Legal Hypothec against the Corporation’s Vezza project and Sleeping Giant property (the “Promec Hypothec”). Promec later filed a petition in bankruptcy against Maudore’s wholly-owned subsidiary Aurbec Mines Inc. (“Aurbec”) on August 27, 2013. While vigorously working to have the petition in bankruptcy dismissed, the Corporation initiated the negotiation of a consensual restructuring (the “Consensual Restructuring”) with its senior lender, Cyrus, in its capacity as a manager to FBC, its four major unsecured creditors and other stakeholders with a view to implementing its ongoing business plan consisting of the recommencement of mining operations at its Sleeping Giant property.

On September 30, 2013, in order to preserve cash while the negotiation of the Consensual Restructuring continued, the Corporation elected to defer the payment of the interest due to FBC pursuant to its Cdn$22,000,000 secured term loan to the Corporation (the “Credit Facility”). On October 2, 2013, the Corporation received a letter from Cyrus regarding defaults under the Credit Facility and putting the Corporation on notice that, while it was still prepared to proceed with the Consensual Restructuring, Cyrus would move to enforce its security if agreements to implement the Consensual Restructuring were not signed by the Corporation’s four major unsecured creditors by October 7, 2013. This deadline was subsequently extended to October 15, 2013, on which date such agreements were entered into by the Corporation.

The Consensual Restructuring addresses approximately Cdn$2,360,000 of trade credit of Maudore, of which Cdn$300,000 is to be repaid by November 30, 2013, with the balance becoming due on October 30, 2014, with provision for additional payments which are tied directly to the success of the Offering such that the Maudore creditors are to receive an amount equal to 25% of the amount by which the net proceeds of the Offering exceed Cdn$2,000,000. The Consensual Agreement also covers approximately Cdn$4,330,000 of trade credit of Aurbec, of which Cdn$562,000 is to be repaid by November 30, 2013, and a further Cdn$562,000 is to be repaid by April 30, 2014, for a total reduction of Cdn$1,124,000. The balance will become due on October 31, 2014, with provision for additional payments which are tied directly to the success of the Offering such that the Aurbec creditors are to receive an amount equal to 25% of the amount by which the net proceeds of the Offering exceed Cdn$2,000,000. Under the Consensual Restructuring, the Aurbec trade creditors will be granted a first ranking charge on Aurbec’s immovable rights and mining claims in respect of the Corporation’s Vezza project to secure any outstanding balances owing (the “Vezza Hypothecs”). In consideration for the Vezza Hypothecs and the payments to be made by Aurbec, Promec has agreed to discharge the Promec Hypothec and to ask the court that its petition in bankruptcy against Aurbec be withdrawn or dismissed.

The implementation of the Consensual Restructuring is subject to the satisfaction of a number of conditions, including the negotiation of final documentation and the receipt of all requisite regulatory approvals.

On October 15, 2013, in the context of the Consensual Restructuring, the Corporation also entered into a non-binding term sheet (the “Cyrus Term Sheet”) with Cyrus, in its capacity as a manager to FBC, which provides for the restructuring of certain debt arrangements of the Corporation, subject to the satisfaction of certain terms and conditions. On November 7, 2013, in order to comply with the requirements of the TSXV, Maudore and Cyrus agreed to certain minor modifications to the Cyrus Term Sheet. The Cyrus Term Sheet may be summarized as follows:

| (i) | FBC would make available a new liquidity facility of up to Cdn$6,000,000, bearing interest at 15% per annum, payable quarterly in arrears in cash and having a maturity date of one year following its implementation, provided, however, that the Corporation will be required to immediately repay to FBC up to a maximum of Cdn$2,000,000 of any tax refunds received from the Province of Quebec; |

| (ii) | Cdn$3,000,000 of the existing Credit Facility would be converted into an equivalent amount of convertible debentures bearing interest at a rate of 5% per annum, having a three year maturity and convertible at FBC’s option into an aggregate of 25,000,000 Common Shares, based on a conversion price of Cdn$0.12 per share; |

| (iii) | FBC would allow the Corporation to access funds available in the interest escrow account established pursuant to the Credit Facility, with the net proceeds to be applied to pay approximately Cdn$500,000 as a pre-payment premium and to pay or prepay, as the case may be, approximately Cdn$2,800,000 of interest expenses relating to the Credit Facility which is due or coming due up to June 30, 2014; |

12

Table of Contents

| (iv) | FBC would commit to subscribe for not less than its proportionate share of the Offering, representing aggregate gross proceeds to Maudore of not less than Cdn$725,400 (the “FBC Subscription Commitment”); and |

| (v) | in consideration of this restructuring, the Corporation would issue 8,888,888 Common Shares to FBC, based on an issuance price of Cdn$0.12 per share. |

The transactions contemplated by the Cyrus Term Sheet and by the rest of the Consensual Restructuring are expected to be implemented by the Corporation in various phases, the last of which is expected to be closed contemporaneously with the closing of the Offering.

The implementation of the Consensual Restructuring (including the receipt of the net proceeds from the Offering) together with the Corporation’s current ongoing activities are expected to improve the Corporation’s financial position by providing the Corporation with additional working capital. See “Use of Proceeds”. However, the Corporation anticipates that its financial condition will be reliant upon its ability to add and exploit new and higher grade resources which are currently under evaluation at the Sleeping Giant property, with a view to replacing the lower quality remnant material currently being mined and thereby transitioning to full scale mining. See “—Implementation of the Current and Projected Mining Plans at Sleeping Giant” for a further discussion of the Corporation’s mining plans. There are a number of risks associated with such proposed transition, including the ability of the Corporation to successfully mine the remnant production areas at the estimated grades and productivity levels, the ability of the third party mining company with whom the Corporation has a tolling arrangement to achieve its production rate and thereby supply the Sleeping Giant mill with the toll milling revenues projected, the possibility that the development diamond drilling results provide less new higher grade material than projected by the Corporation and the emergence of other operational difficulties, including difficulties in securing the needed manpower and in encountering unexpected geological, governmental or other third party impacts.

See “Risk Factors” for a further discussion of the risks associated with the implementation of the Consensual Restructuring, including the Cyrus Term Sheet.

Implementation of the Current and Projected Mining Plans at Sleeping Giant

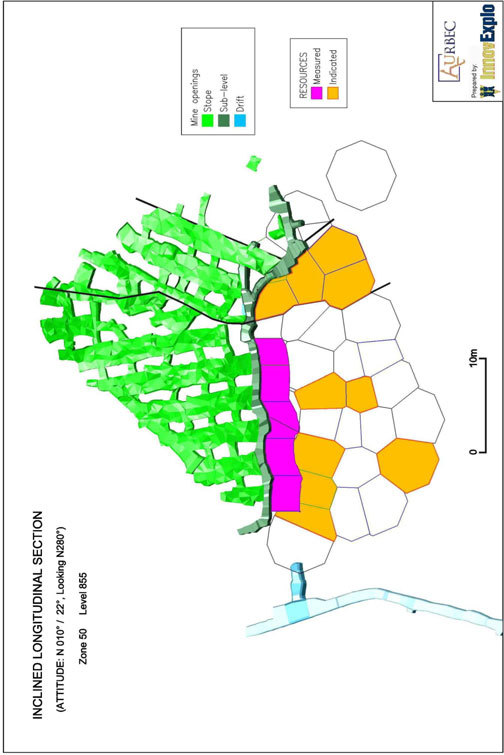

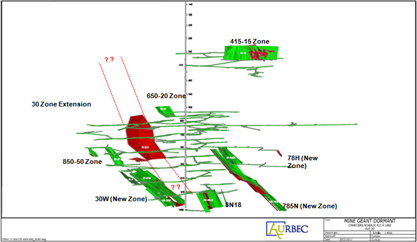

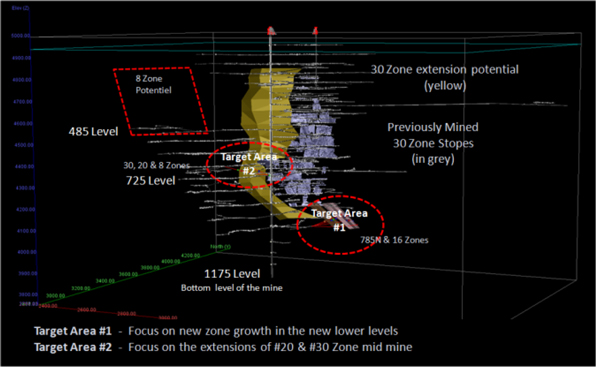

Following the implementation of the Consensual Restructuring, the Corporation anticipates that its financial condition will be reliant upon its ability to add and exploit new and higher grade resources which are currently under evaluation at the Sleeping Giant property. The Corporation’s mining plans include the transitioning to these new higher grade resources to replace the lower quality remnant material currently being mined. The following charts illustrate the approximate locations of these remnant resources as well as some of the new zone potential within the three-dimensional perspective of the mine workings.

Approximate Locations of Remnant and New Zone Locations

13

Table of Contents

3D Perspective of the New Zone Potential

The improvement of the Corporation’s financial position is contingent upon its ability to transition to full scale mining at the levels historically achieved between 1993 and 2008 at the Sleeping Giant property. During that period of time, the Corporation processed 3,127,031 tonnes at an average reserve grade of 10.5 grams per tonne to produce 1,058,924 ounces of gold. The tables below set forth the Corporation’s historical gold production record at the Sleeping Giant property.

Historical Gold Production Record

14

Table of Contents

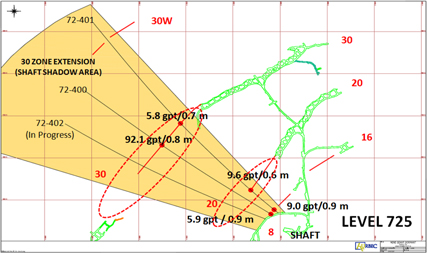

The diagram below illustrates the initial results from drilling on the 725 level for zones 30, 20 and 8 of the Sleeping Giant property.

While the Corporation is focused on the extensions to the higher grade historically mined zones as well as to new zones with no historical production history, and initial results from drilling have proven that the extensions to the historic high grade zones have significant potential as anticipated, there can be no certainty that these extensions or new zones will meet the same historic grade profiles. The risks associated with the Corporation’s proposed mining transition are more fully described in the AIF under the heading “Description of the Business - Competitive Conditions”.

The maximum net proceeds to be received by the Corporation from the Offering are estimated to be approximately Cdn$4,307,152, after deducting estimated expenses of the Offering of approximately Cdn$417,000. The minimum net proceeds to be received by the Corporation from the Offering, after giving effect to the FBC Subscription Commitment and the Standby Purchase Agreement, are estimated to be Cdn$608,400, after deducting estimated expenses of the Offering of approximately Cdn$417,000. Maudore intends to use the net proceeds of the Offering as follows:

| Use of Proceeds | Amount | |||

| Initial Cdn$2,000,000 of net proceeds: |

||||

| Repayment of creditors |

Cdn$ | 362,000 | ||

| Working capital support and general corporate purposes |

Cdn$ | 1,638,000 | (1) | |

Balance of net proceeds: Any net proceeds exceeding Cdn$2,000,000 will be applied equally toward the repayment of creditors and working capital.

| (1) | Cdn$246,400 if only the minimum net proceeds of the Offering are realized. |

The following table sets forth the consolidated capitalization of the Corporation as at December 31, 2012 and as at June 30, 2013, before and after giving effect to the Offering. This table should be read in conjunction with the Corporation’s audited financial statements as at December 31, 2012, the Corporation’s unaudited condensed consolidated interim financial statements as at and for the three- and six-month periods ended June 30, 2013, as well as the Annual MD&A and the Interim MD&A, all of which are incorporated herein by reference.

15

Table of Contents

| Unaudited (in Canadian dollars except number of Common Shares outstanding) |

As at December 31, 2012 |

As at June 30, 2013 |

As at June 30, 2013 |

As at June 30, 2013 |

||||||||||||

| (Actual) | (Actual) | (As adjusted, giving effect to the minimum Offering)(1) (2) |

(As adjusted, giving effect to the maximum Offering)(1) (3) |

|||||||||||||

| Cash and cash equivalents |

3,126,129 | 4,683,194 | 10,841,594 | (4) | 14,540,346 | (4) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Indebtedness |

||||||||||||||||

| Term loans |

3,091,383 | — | — | — | ||||||||||||

| Credit facility with FBC Holdings S.à r.l. |

— | 19,006,723 | 22,895,000 | (5) | 22,895,000 | (5) | ||||||||||

| Convertible Debentures |

— | — | 2,003,000 | (6) | 2,003,000 | (6) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Indebtedness |

3,091,383 | 19,006,723 | 24,898,000 | 24,898,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shareholders’ equity |

||||||||||||||||

| Capital stock |

43,348,994 | 60,585,641 | 62,260,708 | (4) | 65,959,460 | (4) | ||||||||||

| Equity component of the Convertible Debentures |

— | — | 1,676,000 | (6) | 1,676,000 | (6) | ||||||||||

| Contributed surplus |

5,979,425 | 6,579,202 | 6,579,202 | 6,579,202 | ||||||||||||

| Warrants |

599,777 | 1,089,203 | 1,089,203 | 1,089,203 | ||||||||||||

| Deficit |

(12,423,339 | ) | (26,132,422 | ) | (28,270,193 | ) | (28,270,193 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total shareholders’ equity |

37,504,857 | 42,121,624 | 43,334,920 | 47,033,672 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total capitalization |

40,596,240 | 61,128,347 | 68,232,920 | 71,931,672 | ||||||||||||

| Net capitalization |

37,470,111 | 56,445,153 | 57,391,326 | 57,391,326 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total number of Common Shares outstanding |

26,941,687 | 47,241,522 | 66,384,410 | 103,371,932 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Pursuant to the Consensual Restructuring, among other matters, (i) FBC will provide the Corporation with a new liquidity facility of up to Cdn$6,000,000, bearing interest at 15% per annum payable quarterly in arrears in cash and maturing one year following its implementation, provided, however, that the Corporation will be required to immediately repay to FBC up to a maximum of Cdn$2,000,000 of any tax refunds received from the Province of Quebec (ii) Cdn$3,000,000 of the existing Credit Facility will be converted into an equivalent amount of convertible debentures, bearing interest at 5% per annum payable quarterly in arrears in cash, having a three year maturity and convertible at FBC’s option into an aggregate of 25,000,000 Common Shares, based on a conversion price of Cdn$0.12 per share, (iii FBC will allow the Corporation to access funds available in the interest escrow account established pursuant to the Credit Facility, with the net proceeds to be applied to pay approximately Cdn$500,000 as a pre-payment premium and to pay or prepay, as the case may be, approximately Cdn$2,800,000 of interest expenses relating to the Credit Facility which is due or coming due up to June 30, 2014, and (iv) the Corporation will issue to FBC an aggregate of 8,888,888 Common Shares at a price of Cdn$0.12 per share, for a total of Cdn$1,066,667. See “Recent Developments”. |

| (2) | The minimum Rights subscription commitment comprises a Cdn$725,400 commitment from FBC and a Cdn$300,000 commitment from the Standby Purchasers. See “Recent Developments” and “Standby Commitments”. |

| (3) | The full Rights subscription assumes the exercise of 47,241,522 Rights for aggregate gross proceeds of Cdn$4,724,152. |

| (4) | Cash and cash equivalent is presented net of (i) issue expenses estimated at Cdn$417,000 on which a deferred tax recovery of Cdn$112,173 was recognized in the deficit on these issue expenses, (ii) pre-payment premium of approximately Cdn$500,000 on the existing credit facility. In addition, approximately Cdn$2,800,000 of the cash and cash equivalent balance is restricted in use to pay or prepay interest expenses relating to the credit facility which is due or coming due up to June 30, 2014. |

16

Table of Contents

| (5) | After reviewing IAS 39 (an IFRS standard), it is management’s interpretation that the Consensual Restructuring with FBC constitutes a substantial modification of the debt. Therefore (i) the unamortized transaction costs of Cdn$2,993,227 on the existing Cdn$22,000,000 credit facility must be expensed, (ii) the original Cdn$22,000,000 credit facility must be derecognized, (iii) the new credit facility of Cdn$19,000,000 must be recorded at its present value discounted at the effective rate of 20% (corresponding to the effective rate of the existing credit facility) for Cdn$16,895,000, (iv) the transaction costs of Cdn$1,066,667 and the prepayment premium of approximately Cdn$500,000 relating to the Consensual Restructuring must be expensed on the date of the restructuring, (v) a Cdn$1,426,000 gain on debt restructuring is recognized when taking into consideration the fair value of the Convertible Debentures, and (vi) a Cdn$834,000 deferred tax recovery is recognized on the new credit facility and the convertible debenture. |

| (6) | The Convertible Debentures were recognized at a fair value of Cdn$3,679,000. The Cdn$2,003,000 debt component was evaluated first using an effective rate of 20% (corresponding to the effective rate of the existing credit facility). The Cdn$1,676,000 equity component was determined using the Black-Scholes pricing model based on the following assumptions: risk free interest rate of 1.36%, expected volatility of 87.1%, no expected dividend yield and an expected life of the convertible option of 3 years. |

The authorized capital of the Corporation consists of an unlimited number of Common Shares without par value. On the date of this prospectus, 47,241,522 Common Shares were outstanding. For further details regarding the authorized capital of the Corporation, see the information appearing in the AIF under the heading “Description of Capital Structure” which is incorporated herein by reference.

The Offering is a corporate transaction that will affect the outstanding Common Shares and the outstanding warrants of the Corporation (“Warrants”), each of which Warrant entitles its holder to acquire one Common Share. The Corporation’s outstanding Warrants contain certain anti-dilution adjustment provisions that are intended to ensure that a holder of Warrants is entitled to acquire equivalent share capital after the occurrence of a relevant corporate transaction, such as the Offering. The effect of the Offering on the Warrants is that, upon exercise of a Warrant, the holder thereof will be entitled to acquire an additional Common Share at a supplemental price of Cdn$0.10 per Common Share. Information provided in this prospectus with respect to the capitalization of the Corporation is given without giving effect to any such anti-dilution adjustment provisions.

During the 12-month period prior to the date of this prospectus, the Corporation issued Common Shares or securities that are convertible into, exchangeable for or exercisable to acquire Common Shares, as follows:

| Date of Issue |

Issuance Type | Number of Securities Issued |

Price per Security | |||||||

| December 7, 2012 |

Stock Options (1) | 840,000 | n/a | |||||||

| March 22, 2013 |

Common Shares(2) | 1,500,000 | n/a | |||||||

| March 22, 2013 |

Common Shares(3) | 1,760,000 | n/a | |||||||

| March 22, 2013 |

Warrants(3) | 880,000 | n/a | |||||||

| April 12, 2013 |

Private Placement Units (4) | 17,039,835 | Cdn$ | 0.91 | ||||||

| April 12, 2013 |

Compensation Options (5) | 127,840 | n/a | |||||||

| (1) | The Stock Options were granted to directors, officers and consultants of the Corporation. Each Stock Option entitles its holder to acquire one Common Share at any time until December 7, 2017 at a price of Cdn$2.20. |

| (2) | The Common Shares were issued to North American Palladium Ltd. as partial consideration for the acquisition of Aurbec and its Sleeping Giant property. |

| (3) | The Common Shares and Warrants were issued by the Corporation to FBC as consideration for a commitment by FBC provided under a credit facility used by the Corporation to finance its acquisition of Aurbec. Each Warrant entitles FBC to acquire one Common Share at any time until March 22, 2015 at a price of Cdn$1.08. |

| (4) | Each Private Placement Unit consists of one Common Share and one-half of a Warrant, with each whole Warrant entitling its holder to acquire one Common Share at any time until April 12, 2015 at a price of Cdn$1.13. |

17

Table of Contents

| (5) | The Compensation Options were issued to brokers in connection with the private placement of the Private Placement Units on April 12, 2013. Each Compensation Option entitles its holder to acquire one Private Placement Unit at any time until April 12, 2015 at a price of Cdn$0.91. |

PRICE RANGE AND TRADING VOLUME

The Common Shares are listed for trading on the TSXV under the symbol “MAO”. The following table sets forth the market price ranges and trading volumes of the Common Shares on the TSXV for the periods indicated.

| Month | High | Low | Volume | |||||||||

| 2012 |

||||||||||||

| October |

Cdn$ | 3.350 | Cdn$ | 2.670 | 227,666 | |||||||

| November |

Cdn$ | 2.980 | Cdn$ | 2.050 | 218,933 | |||||||

| December |

Cdn$ | 2.250 | Cdn$ | 1.320 | 1,051,753 | |||||||

| 2013 |

||||||||||||

| January |

Cdn$ | 1.660 | Cdn$ | 1.120 | 471,912 | |||||||

| February |

Cdn$ | 1.390 | Cdn$ | 0.900 | 412,259 | |||||||

| March |

Cdn$ | 1.390 | Cdn$ | 0.900 | 579,156 | |||||||

| April |

Cdn$ | 1.040 | Cdn$ | 0.560 | 760,537 | |||||||

| May |

Cdn$ | 0.840 | Cdn$ | 0.520 | 855,313 | |||||||

| June |

Cdn$ | 0.810 | Cdn$ | 0.380 | 329,879 | |||||||

| July |

Cdn$ | 0.520 | Cdn$ | 0.220 | 414,369 | |||||||

| August |

Cdn$ | 0.510 | Cdn$ | 0.320 | 628,581 | |||||||

| September |

Cdn$ | 0.420 | Cdn$ | 0.170 | 1,063,963 | |||||||

| October |

Cdn$ | 0.195 | Cdn$ | 0.080 | 1,903,260 | |||||||

| November 1 – 21 |

Cdn$ | 0.125 | Cdn$ | 0.085 | 584,592 | |||||||

DESCRIPTION OF OFFERED SECURITIES

Issue of Rights and Record Date

Shareholders of record at the close of business (Montreal time) on the Record Date will receive Rights on the basis of one Right for each Common Share held at that time. The Rights permit the holders thereof (provided that such holders are resident in an Eligible Jurisdiction or are Approved Eligible Holders) to subscribe for and purchase from the Corporation up to an aggregate of 47,241,522 Common Shares, assuming the exercise in full of the Rights issued hereunder. The Rights are transferable in Canada by the holders thereof. The Rights may not be transferred to any person within the United States. Shareholders in the United States who receive Rights may resell them only outside the United States in accordance with Regulation S under the U.S. Securities Act. See “— Sale or Transfer of Rights”.

The Rights will be represented by the Rights Certificates that will be issued in registered form. Shareholders who hold their Common Shares in registered form will be mailed a Rights Certificate evidencing the number of Rights to which they are entitled as at the Record Date together with a copy of this prospectus. See “— Rights Certificate — Common Shares Held in Registered Form”.

Shareholders who hold their Common Shares through a CDS Participant will not receive physical certificates evidencing their ownership of Rights. On the Record Date, a global certificate representing such Rights will be issued in registered form to, and in the name of, CDS or its nominee. See “— Rights Certificate — Common Shares Held Through CDS”.

18

Table of Contents

For each Right held, the holder thereof is entitled to subscribe for one Common Shares at the Subscription Price of Cdn$0.10 per Common Share. Any subscription for Common Shares will be irrevocable once submitted.

Fractional Common Shares will not be issued upon the exercise of Rights. Where the exercise of Rights would appear to entitle a holder of Rights to receive fractional Common Shares, the holder’s entitlement will be reduced to the next lowest whole number of Common Shares without any compensation being paid to the holder. CDS Participants who hold Rights for more than one beneficial holder may, upon providing evidence satisfactory to the Corporation, exercise Rights on behalf of their accounts on the same basis as if the beneficial owners of the Common Shares were holders of record on the Record Date.

Commencement Date and Expiration Date

The Rights will be eligible for exercise following •, 2013 (the “Commencement Date”). The Rights will expire at the Expiry Time on the Expiry Date. Shareholders who exercise the Rights will thereafter become holders of Common Shares issued through the exercise of the Rights. RIGHTS NOT EXERCISED PRIOR TO THE EXPIRY TIME ON THE EXPIRY DATE WILL BE VOID AND OF NO VALUE.

Each Shareholder at the close of business (Montreal time) on the Record Date is entitled to receive one Right for each Common Share held. For each Right held, the holder (including any Approved Eligible Holder, but excluding any Ineligible Holder) is entitled to acquire one Common Share under the Basic Subscription Privilege at the Subscription Price by subscribing and making payment in the manner described herein prior to the Expiry Time on the Expiry Date. A holder of Rights that subscribes for some, but not all, of the Common Shares available to such holder pursuant to the Basic Subscription Privilege will be deemed to have elected to waive the unexercised balance of the Rights held by such holder and such unexercised balance of Rights will be void and of no value unless the Subscription Agent is otherwise specifically advised by such holder at the time the Rights Certificate is surrendered that the Rights are to be transferred to a third party or are to be retained by the holder. Holders of Rights who exercise in full the Basic Subscription Privilege for their Rights are also entitled to subscribe for the Additional Shares, if any, that are not otherwise subscribed for under the Offering by the other holders of Rights, on a pro rata basis, at any time prior to the Expiry Time on the Expiry Date pursuant to the Additional Subscription Privilege. See “— Additional Subscription Privilege”.

For Common Shares held in registered form, in order to exercise the Rights represented by a Rights Certificate, the holder of Rights must complete and deliver to the Subscription Agent the Rights Certificate in accordance with the terms of the Offering, in the manner and upon the terms set out in this prospectus, and pay the aggregate Subscription Price. All exercises of Rights are irrevocable and subscribers will be unable to withdraw their subscriptions for Common Shares once submitted.

For Common Shares held through a CDS Participant, a holder may subscribe for Common Shares by instructing the CDS Participant holding the subscriber’s Rights to exercise all or a specified number of such Rights and forwarding the Subscription Price for each Common Share subscribed for in accordance with the terms of the Offering to such CDS Participant. Subscriptions for Common Shares made in connection with the Offering through a CDS Participant will be irrevocable and subscribers will be unable to withdraw their subscriptions for Common Shares once submitted.

The Subscription Price is payable in Canadian funds by certified cheque, bank draft or money order payable to the order of the Subscription Agent. In the case of subscription through a CDS Participant, the Subscription Price is payable by certified cheque, bank draft or money order drawn to the order of such CDS Participant, by direct debit from the subscriber’s brokerage account or by electronic funds transfer or other similar payment mechanism. The entire Subscription Price for Common Shares subscribed for must be paid at the time of subscription and must be received by the Subscription Agent at the Subscription Office prior to the Expiry Time on the Expiry Date. Accordingly, a subscriber subscribing through a CDS Participant must deliver its payment and instructions sufficiently in advance of the Expiry Date to allow the CDS Participant to properly exercise the Rights on its behalf.

19

Table of Contents

Payment of the Subscription Price will constitute a representation to the Corporation and, if applicable, to the CDS Participant, by the subscriber (including by its agents) that: (a) either the subscriber is not a citizen or resident of an Ineligible Jurisdiction or the subscriber is an Approved Eligible Holder; and (b) the subscriber is not purchasing the Common Shares for resale to any person who is a citizen or resident of an Ineligible Jurisdiction.

Additional Subscription Privilege

Each holder of Rights who has exercised in full the Basic Subscription Privilege for its Rights may subscribe for Additional Shares, if available, at a price equal to the Subscription Price for each Additional Share. The total number of Additional Shares available for subscription under the Additional Subscription Privilege will be the difference, if any, between the total number of Common Shares issuable upon the exercise of all of the outstanding Rights and the total number of Common Shares subscribed and paid for pursuant to the Basic Subscription Privilege at the Expiry Time on the Expiry Date. Subscriptions for Additional Shares will be received subject to allotment only and the number of Additional Shares, if any, that may be allotted to each subscriber will be equal to the lesser of: (a) the number of Additional Shares that such subscriber has subscribed for; and (b) the product (disregarding fractions) obtained by multiplying the number of Additional Shares available to be issued by a fraction, the numerator of which is the number of Rights previously exercised by the subscriber and the denominator of which is the aggregate number of Rights previously exercised under the Offering by all holders of Rights that have subscribed for Additional Shares. If any holder of Rights has subscribed for fewer Additional Shares than such holder’s pro rata allotment of Additional Shares, the excess Additional Shares will be allotted in a similar manner among the holders who were allotted fewer Additional Shares than they subscribed for.

To apply for Additional Shares under the Additional Subscription Privilege, each holder of Rights must forward its request to the Subscription Agent at the Subscription Office or to its CDS Participant, as applicable, prior to the Expiry Time on the Expiry Date. Payment for Additional Shares, in the same manner as required upon exercise of the Basic Subscription Privilege, must accompany the request when it is delivered to the Subscription Agent or CDS Participant, as applicable. Any excess funds will be returned by mail by the Subscription Agent or credited to a subscriber’s account with its CDS Participant, as applicable, without interest or deduction. Payment of such price must be received by the Subscription Agent prior to the Expiry Time on the Expiry Date, failing which the subscriber’s entitlement to such Additional Shares will terminate. Accordingly, a subscriber subscribing through a CDS Participant must deliver its payment and instructions to its CDS Participant sufficiently in advance of the Expiry Time on the Expiry Date to allow the CDS Participant to properly exercise the Additional Subscription Privilege on its behalf.

Subscription and Transfer Agent

The Subscription Agent has been appointed the agent of the Corporation to receive subscriptions and payments from holders of Rights Certificates, to act as registrar and transfer agent for the Common Shares and to perform certain services relating to the exercise and transfer of Rights. The Corporation will pay for the services of the Subscription Agent. Subscriptions and payments under the Offering should be sent to the Subscription Agent at:

| By Hand or Courier |

By Mail | |

| CST Trust Company 320 Bay Street, Basement Level (B1 Level) Toronto, ON M5H 4A6 |

CST Trust Company P.O. Box 1036 Adelaide Street Postal Station Toronto, ON M5C 2K4 |

Enquiries relating to the Offering should be addressed to the Subscription Agent by telephone at 1-800-387-0825.

Rights Certificate — Common Shares Held in Registered Form

Shareholders with an address of record in an Eligible Jurisdiction whose Common Shares are held in registered form will be mailed a Rights Certificate representing the total number of Rights to which such Shareholder is entitled as at the Record Date together with a copy of this prospectus. In order to exercise the Rights represented by the Rights Certificate, such holder of Rights must complete and deliver the Rights Certificate in accordance with the instructions set out under “— How to Complete the Rights Certificate”. Rights not exercised by the Expiry Time on the Expiry Date will be void and of no value.

20

Table of Contents

Rights Certificate — Common Shares Held Through CDS

In respect of all Shareholders who hold their Common Shares through a securities broker or dealer, bank or trust company or other CDS Participant with an address of record in an Eligible Jurisdiction in the book-based system administered by CDS, a global certificate representing the total number of Rights to which all such Shareholders as at the Record Date are entitled will be issued in registered form to CDS and will be deposited with CDS on the Commencement Date. The Corporation expects that each beneficial Shareholder will receive a confirmation of the number of Rights issued to it from its CDS Participant in accordance with the practices and procedures of that CDS Participant. CDS will be responsible for establishing and maintaining book-entry accounts for CDS Participants holding Rights.

Neither the Corporation nor the Subscription Agent will have any liability for: (a) the records maintained by CDS or CDS Participants relating to the Rights or the book-entry accounts maintained by them; (b) maintaining, supervising or reviewing any records relating to such Rights; or (c) any advice or representations made or given by CDS or CDS Participants with respect to the rules and regulations of CDS or any action to be taken by CDS or CDS Participants.

The ability of a person having an interest in Rights held through a CDS Participant to pledge such interest or otherwise take action with respect to such interest (other than through a CDS Participant) may be limited due to the lack of a physical certificate.

Shareholders who hold their Common Shares through a CDS Participant must arrange purchases, transfers or exercises of Rights through their CDS Participant. It is anticipated by the Corporation that each purchaser of a Common Share or Right will receive a customer confirmation of issuance or purchase, as applicable, from the CDS Participant through which such Right is issued or such Common Share is purchased in accordance with the practices and policies of such CDS Participant.

How to Complete the Rights Certificate

| 1. | Form 1— Basic Subscription Privilege. The maximum number of Rights that may be exercised pursuant to the Basic Subscription Privilege is shown in the box on the upper right hand corner of the face of the Rights Certificate. Form 1 must be completed and signed to exercise all or some of the Rights represented by the Rights Certificate pursuant to the Basic Subscription Privilege. If Form 1 is completed so as to exercise some but not all of the Rights represented by the Rights Certificate, the holder of the Rights Certificate will be deemed to have waived the unexercised balance of such Rights, unless the Subscription Agent is otherwise specifically advised by such holder at the time the Rights Certificate is surrendered that the Rights are to be transferred to a third party or are to be retained by the holder. |

| 2. | Form 2 — Additional Subscription Privilege. Complete and sign Form 2 on the Rights Certificate only if you also wish to participate in the Additional Subscription Privilege. See “— Additional Subscription Privilege”. |

| 3. | Form 3 — Transfer of Rights. Complete and sign Form 3 on the Rights Certificate only if you wish to transfer the Rights. Your signature must be guaranteed by a Schedule I bank, a major trust company in Canada or a member of an acceptable Medallion Signature Guarantee Program, including STAMP, SEMP and MSP. Members of STAMP are usually members of a recognized stock exchange in Canada or members of the Investment Industry Regulatory Organization of Canada. The guarantor must affix a stamp bearing the actual words “Signature Guaranteed”. It is not necessary for a transferee to obtain a new Rights Certificate to exercise the Rights, but the signatures of the transferee on Forms 1 and 2 must correspond in every particular with the name of the transferee (or the bearer if no transferee is specified) as the absolute owner of the Rights Certificate for all purposes. If Form 3 is completed, the Subscription Agent will treat the transferee as the absolute owner of the Rights Certificate for all purposes and will not be affected by notice to the contrary. |

21

Table of Contents

The Rights may be transferred only in transactions outside of the United States in accordance with Regulation S under the U.S. Securities Act, which will permit the resale of the Rights by persons through the facilities of the TSXV, provided that the offer is not made to a person in the United States, neither the seller nor any person acting on its behalf knows that the transaction has been prearranged with a buyer in the United States, and no “directed selling efforts”, as that term is defined in Regulation S, are conducted in the United States in connection with the resale. Certain additional conditions are applicable to the Corporation’s “affiliates”, as that term is defined under the U.S. Securities Act. In order to enforce this resale restriction, U.S. holders of Rights will be required to execute a declaration certifying that such sale is being made outside the United States in accordance with Regulation S.

The transfer of the Rights or the Common Shares issuable on exercise of the Rights to or within the European Economic Area is restricted. See “— Ineligible Holders and Approved Eligible Holders”.