chef-202303290001517175DEF 14AFALSE00015171752021-12-252022-12-30iso4217:USD00015171752020-12-262021-12-2400015171752019-12-282020-12-25xbrli:pure0001517175chef:StockAwardsAdjustmentsReportedInSummaryCompensationTableMemberecd:PeoMember2021-12-252022-12-300001517175ecd:NonPeoNeoMemberchef:StockAwardsAdjustmentsReportedInSummaryCompensationTableMember2021-12-252022-12-300001517175chef:StockAwardsAdjustmentsReportedInSummaryCompensationTableMemberecd:PeoMember2020-12-262021-12-240001517175ecd:NonPeoNeoMemberchef:StockAwardsAdjustmentsReportedInSummaryCompensationTableMember2020-12-262021-12-240001517175chef:StockAwardsAdjustmentsReportedInSummaryCompensationTableMemberecd:PeoMember2019-12-282020-12-250001517175ecd:NonPeoNeoMemberchef:StockAwardsAdjustmentsReportedInSummaryCompensationTableMember2019-12-282020-12-250001517175ecd:PeoMemberchef:EquityAwardsGrantedDuringTheYearUnvestedMember2021-12-252022-12-300001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedDuringTheYearUnvestedMember2021-12-252022-12-300001517175ecd:PeoMemberchef:EquityAwardsGrantedDuringTheYearUnvestedMember2020-12-262021-12-240001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedDuringTheYearUnvestedMember2020-12-262021-12-240001517175ecd:PeoMemberchef:EquityAwardsGrantedDuringTheYearUnvestedMember2019-12-282020-12-250001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedDuringTheYearUnvestedMember2019-12-282020-12-250001517175chef:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-12-252022-12-300001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedInPriorYearsUnvestedMember2021-12-252022-12-300001517175chef:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-12-262021-12-240001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedInPriorYearsUnvestedMember2020-12-262021-12-240001517175chef:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2019-12-282020-12-250001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedInPriorYearsUnvestedMember2019-12-282020-12-250001517175chef:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-12-252022-12-300001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedDuringTheYearVestedMember2021-12-252022-12-300001517175chef:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-12-262021-12-240001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedDuringTheYearVestedMember2020-12-262021-12-240001517175chef:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2019-12-282020-12-250001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedDuringTheYearVestedMember2019-12-282020-12-250001517175chef:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-12-252022-12-300001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedInPriorYearsVestedMember2021-12-252022-12-300001517175chef:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-12-262021-12-240001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedInPriorYearsVestedMember2020-12-262021-12-240001517175chef:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2019-12-282020-12-250001517175ecd:NonPeoNeoMemberchef:EquityAwardsGrantedInPriorYearsVestedMember2019-12-282020-12-250001517175chef:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2021-12-252022-12-300001517175ecd:NonPeoNeoMemberchef:EquityAwardsThatFailedToMeetVestingConditionsMember2021-12-252022-12-300001517175chef:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2020-12-262021-12-240001517175ecd:NonPeoNeoMemberchef:EquityAwardsThatFailedToMeetVestingConditionsMember2020-12-262021-12-240001517175chef:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2019-12-282020-12-250001517175ecd:NonPeoNeoMemberchef:EquityAwardsThatFailedToMeetVestingConditionsMember2019-12-282020-12-25000151717512021-12-252022-12-30000151717522021-12-252022-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | | | | | | | |

| Filed by the Registrant | | ☒ | |

| Filed by a Party other than the Registrant | | ☐ | |

Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

The Chefs’ Warehouse, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ☒ | | No fee required. |

| | |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | | | | | | | |

| ☐ | | Fee paid previously with preliminary materials. |

| | |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | | | | |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

The Chefs’ Warehouse, Inc.

Notice Of Annual Meeting Of Stockholders

To Be Held On May 12, 2023

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of The Chefs’ Warehouse, Inc. (the “Company”), which will be held on Friday, May 12, 2023, at 10:00 a.m. EDT. We are pleased to announce that the Annual Meeting will be a virtual meeting, which will be conducted via live webcast. If you attend the Annual Meeting online, you will be able to vote your shares electronically and submit your questions during the Annual Meeting through a virtual web conference at www.virtualshareholdermeeting.com/chef23.

We are holding the Annual Meeting for the following purposes:

1. To elect Ivy Brown, Dominick Cerbone, Joseph Cugine, Steven F. Goldstone, Alan Guarino, Stephen Hanson, Aylwin Lewis, Katherine Oliver, Christopher Pappas and John Pappas as directors to hold office until the next annual meeting of stockholders and until their respective successors are elected and qualified;

2. To ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 29, 2023;

3. To approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the proxy statement that accompanies this notice;

4. To approve The Chefs' Warehouse, Inc. Employee Stock Purchase Plan; and

5. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

These matters are more fully described in the accompanying proxy statement. We are not aware of any other business to be transacted at the Annual Meeting.

Only stockholders of record on our books at the close of business on March 20, 2023 will be entitled to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting. For 10 days prior to the Annual Meeting, a list of stockholders entitled to vote will be available for inspection by any stockholder for any purpose germane to the Annual Meeting at our principal executive offices located at 100 East Ridge Road, Ridgefield, Connecticut 06877. If you would like to view the stockholder list, please call our General Counsel, Corporate Secretary, Chief Government Relations Officer and Chief Administrative Officer, Alexandros Aldous, at (203) 894-1345, to schedule an appointment. The stockholder list will also be available on the internet through the virtual web conference during the Annual Meeting.

In accordance with rules approved by the Securities and Exchange Commission, we are furnishing proxy materials to our stockholders over the internet. On or about March 29, 2023, we mailed to all stockholders of record, as of the close of business on March 20, 2023, a notice containing instructions on how to access our Annual Report to Stockholders, which contains our audited consolidated financial statements for the fiscal year ended December 30, 2022, our proxy statement, proxy card and other items of interest to stockholders on the internet website indicated in our notice, as well as instructions on how to vote. The March 29, 2023 notice also provides instructions on how you can request a paper copy of our proxy materials and Annual Report to Stockholders.

You may vote your shares at the Annual Meeting via the internet, by telephone or by completing, dating, signing and promptly returning a proxy card to us in the envelope provided if you requested and received a paper copy of the proxy card by mail. The proxy materials provide you with details on how to vote by these methods. We encourage you to vote in the method that suits you best so that your shares will be voted at the Annual Meeting.

| | | | | | | | | | | |

| | | By Order of the Board of Directors, |

| | | /s/ Christopher Pappas |

| | | Christopher Pappas |

| March 29, 2023 | | Chairman of the Board |

PLEASE VOTE. STOCKHOLDERS MAY VOTE VIRTUALLY AT THE ANNUAL MEETING OR BY INTERNET, TELEPHONE OR MAIL. PLEASE REFER TO YOUR PROXY CARD OR THE NOTICE OF PROXY AVAILABILITY DISTRIBUTED TO YOU ON OR ABOUT MARCH 29, 2023 FOR INFORMATION ON HOW TO VOTE BY INTERNET, TELEPHONE OR MAIL.

PROXY STATEMENT SUMMARY

Below are the highlights of important information you will find in this Proxy Statement. Please review the full Proxy Statement before casting your vote.

| | | | | | | | | | | | | | |

| Meeting Information | | Voting Matters |

| Time and Date: | | Voting Matter | Board Recommendation | Page |

10:00 a.m. EDT, on Friday, May 12, 2023 | | Proposal 1 - Election of Directors | FOR EACH NOMINEE | |

| Attending the Meeting: | | Proposal 2 - Ratification of Independent Registered Public Accounting Firm | FOR | |

The Annual Meeting will be held on the internet through a virtual web conference at www.virtualshareholdermeeting.com/chef23. | | Proposal 3 - Advisory Vote on Executive Compensation | FOR | |

| | Proposal 4 - Approval of The Chefs' Warehouse, Inc. Employee Stock Purchase Plan | FOR | |

Recent Highlights and Achievements

Business Highlights: The Company made significant progress in reaching its strategic goals:

•Selective Acquisitions including Chef Middle East, LLC – Specialty (UAE, Oman, Qatar), Alexis Foods, Inc. – Specialty (Pacific Northwest), CGC Holdings, Inc. – Produce, Center of the Plate, and Specialty (Mid Atlantic), Down East & Seafood, Inc. – Center of the Plate (New York), Meat Traders, Inc. – Center of the Plate (Florida), Guaranteed Fresh Produce, Inc. – Produce (New England).

•Net sales for fiscal 2022 increased approximately 49% to approximately $2.61 billion from approximately $1.75 billion in fiscal 2021.

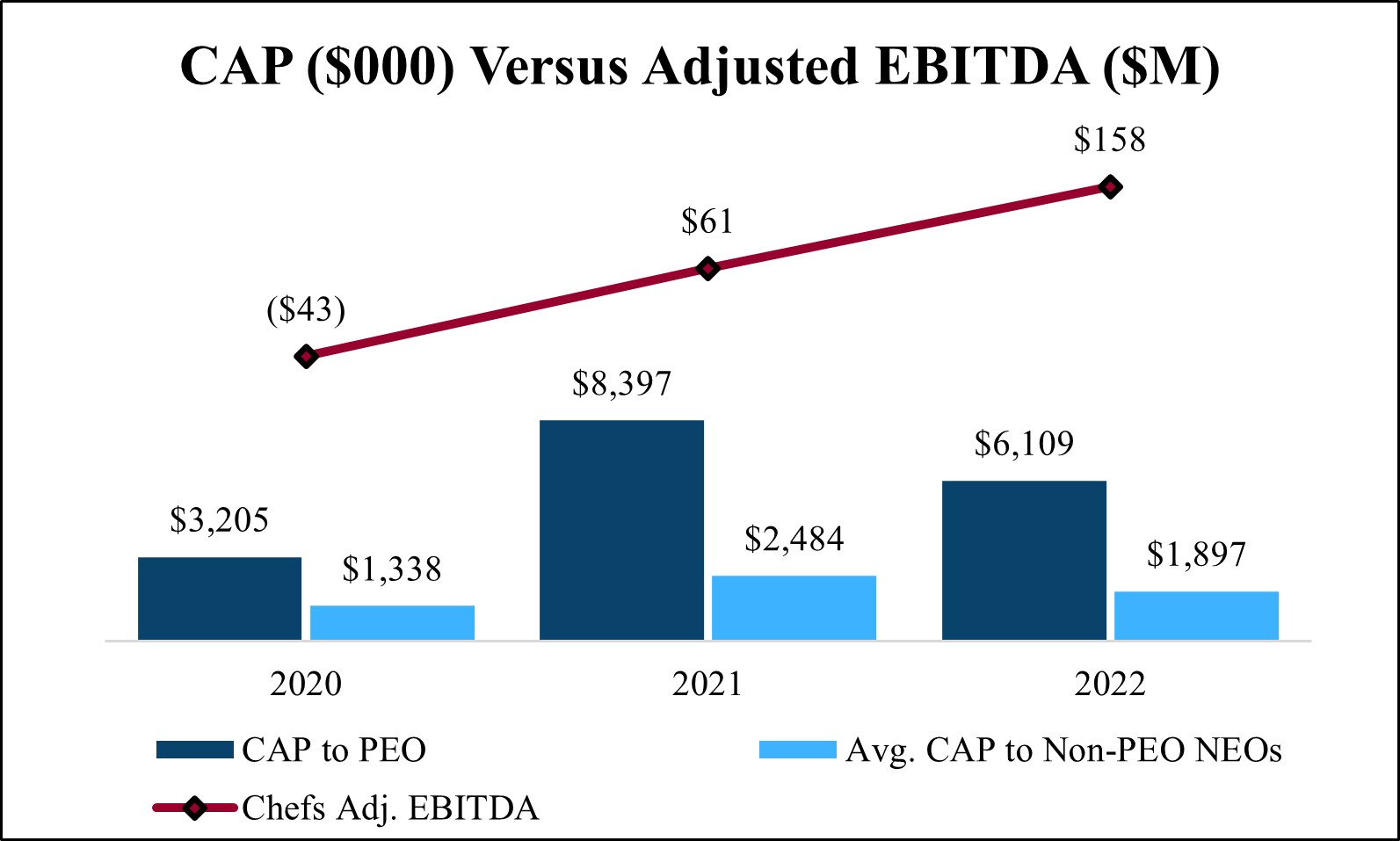

•The Company reported approximately $158 million of adjusted EBITDA in fiscal year 2022.

Corporate Strategy: The Company’s management and the Board have identified and developed the following key strategies for the Company:

•Maintaining and expanding the customer base in key culinary markets, including the metro New York, New England, Washington, D.C., Philadelphia, Miami, Chicago, Las Vegas, Austin, Dallas, Houston, San Antonio, Los Angeles, San Francisco, Portland, Oregon and Seattle markets;

•Expanding the base of premier customer relationships;

•Increasing penetration with our existing customer base;

•Continuing to expand facility capacity in key markets such as Florida, Southern California, Northern California, Portland, Oregon and Seattle;

•Continuing to invest in category growth including Specialty, Produce, Center-of-the-Plate, and Pastry categories in many of our key markets;

•Exploring international growth outside North America;

•Pursuing selective acquisitions; and

•Engaging in operational initiatives focused on unit cost reduction.

Social and Environmental Responsibility

We are committed to upholding ethical, socially responsible and environmentally conscious business practices, consistent with

our corporate values, to promote long-term and sustainable change. In 2022, our board of directors formed an Environmental,

Social and Governance Committee (the “ESG Committee”) to oversee our environmental, social and governance activities and

practices. Among other things, the ESG Committee reviews and evaluates: our progress towards meeting our diversity goals

and compliance with our responsibilities as an equal opportunity employer; our workplace safety, employee health and

wellness, inclusion, employee training and skill improvement and other human capital management initiatives; and our

programs and activities relating to environmental sustainability, product quality and quality assurance, social and community

relations (including labor relations) and other related economic and regulatory compliance requirements.

Our corporate policies, overseen by the ESG Committee, are intended to further strengthen and promote our commitment to social and environmental responsibility with our directors, employees, leaders and business partners. Our policy on salient human rights risks identifies key human rights issues related to our business activities and business relationships, including promoting a safe and healthy workplace, providing a fair and inclusive work environment and combating forced and underage labor. Our Human Rights Policy details our commitment to upholding fundamental human rights, and our Code of Conduct for Suppliers reflects our commitment to extending ethical business practices throughout our supply chain. Our Environmental, Health and Safety Policy promotes and protects the health and safety of our employees and reinforces our commitment to environmental stewardship, such as through our endorsement of the United Nations Global Compact CEO Water Mandate. Further, during fiscal 2022 thru fiscal 2025 we expect to replace over 50% of our current fleet with vehicles with an average of approximately 30% improved fuel efficiency over the current fleet average. In addition, we are working with a primary fleet supplier to begin the process of ordering our first electric powered trucks estimated to start delivering in late 2025 or early 2026.

Governance Highlights

We believe that good governance practices benefit our stockholders by improving the Company’s accountability and transparency. The Company is committed to maintaining and improving its corporate governance practices. The Company has the following governance features in place as of March 29, 2023:

| | | | | | | | | | | | | | | | | |

| Annual Elections with Majority Vote Standard | | Yes | Stock Ownership Guidelines for Executives | | Yes |

| Lead Independent Director | | Yes | Anti-Hedging Policy | | Yes |

| Board Independence | | 80% | Code of Conduct and Ethics | | Yes |

| Committee Independence | | 100% | Board Member Recruiting Guidelines | | Yes |

| Number of Financial Experts | | 2 | Executive Sessions of the Board | | Yes |

| Board Diversity (female) | | 20% | Board Diversity (underrepresented groups) | | 20% |

| Board Diversity (LGBTQ+) | | 10% | Board Committees Complete Annual Self-Evaluations | | Yes |

| Anonymous Reporting | | Yes | Over-Boarding Policy | | Yes |

| Clawback Policy | | Yes | | | |

Director Nominees

At the Annual Meeting, you are being asked to vote on the election of the following ten director nominees. Detailed information on each director is available starting on page 17. Additional information on the executive officers of the Company can be found in the Company’s most recent Form 10-K.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Committee Membership |

| Name | Age | Director Since | Experience | Independent | Audit | Compensation & Human Capital | Nominating/

Governance | ESG |

| Christopher Pappas | 63 | 2011 | Founder, Chairman, President and CEO, The Chefs’ Warehouse, Inc. | No | | | | |

| John Pappas | 59 | 2011 | Founder, Vice Chairman and COO, The Chefs’ Warehouse, Inc. | No | | | | |

| Ivy Brown | 60 | 2021 | Former President of United Parcel Service, Inc., Northeast District | Yes | • | | | • |

| Dominick Cerbone | 78 | 2012 | Former Partner, Ernst & Young | Yes | Chair | • | | • |

| Joseph Cugine | 62 | 2012 | Former President, BarFresh Food Group Inc. | Yes | • | • | Chair | |

| Steven F. Goldstone | 77 | 2016 | Former Non-Executive Chairman, ConAgra Foods, Inc. | Yes | | | • | |

| Alan Guarino | 63 | 2012 | Vice Chairman of CEO and Board Services, Korn Ferry International | Yes | | Chair | • | • |

| Stephen Hanson | 73 | 2011 | Former President, B.R. Guest Restaurants | Yes | • | | • | |

| Aylwin Lewis | 68 | 2021 | Former Chairman, Chief Executive Officer and President of Potbelly Corporation | Yes | | • | | • |

| Katherine Oliver | 60 | 2015 | Principal, Bloomberg Associates | Yes | | • | • | Chair |

Stockholder Outreach

We believe an open and transparent dialogue with our stockholders is an essential element of good corporate governance. Last year, members of our Board and management met with the top actively managed stockholders. We hold calls with our top investors each quarter and also hold periodic calls on an ad hoc basis. During our calls, we discuss corporate governance practices, the Company’s strategy and performance, executive compensation programs, board composition and other items of stockholder interest. Our management’s dialogue with the stockholders holding approximately 31% of voting shares helped us to improve our corporate governance practices and executive compensation programs during fiscal 2022. The Company met with investors and stockholders in person, along with video and phone calls in fiscal 2022.

Each spring, we make available to all stockholders a copy of the Company’s Annual Report and Proxy Statement. Stockholders may access our Annual Report, Proxy Statement, committee charters, investor presentations, Code of Business Conduct and Ethics, Corporate Governance Guidelines, Insider Trading Policy and Bylaws at www.chefswarehouse.com. Stockholders may contact any director, committee of the Board, or the Board:

via U.S. Mail at:

The Chefs’ Warehouse, Inc.

Attn: Alexandros Aldous, General Counsel, Corporate Secretary, Chief Government Relations Officer and Chief Administrative Officer

100 East Ridge Road

Ridgefield, Connecticut 06877

via e-mail at:

ir@chefswarehouse.com

Executive Compensation Overview

The Company’s executive compensation program, as approved by the Compensation and Human Capital Committee (the “Compensation Committee”), is designed to implement our executive pay philosophy to:

•Attract and retain talented and experienced executives and other key employees;

•Align the interests of executives with our business plans through the use of Company-wide performance metrics based on those plans (“pay for performance”) and retention programs intended to retain employees key to their implementation;

•Incentivize achievement of annual financial, functional and individual objectives; and

•Create a fair and measurable compensation model for rewarding performance and attracting and retaining key members of management.

Compensation Practices

| | | | | |

| What We Do | What We Don’t Do |

| Pay for Performance | No Repricing or Cash Buyouts of Underwater Options |

| Double Trigger Change in Control Provisions | No Hedging or Pledging of Company Stock |

| Independent Compensation Advisor | No Supplemental Retirement Benefits for Executives |

| Clawback Policy and Stock Ownership Guidelines | No “Spring-Loaded” Equity Awards |

Elements of Compensation for Fiscal 2022

Taking into account the above-described objectives and our peer group comparisons, the Compensation Committee designed a fiscal 2022 compensation package for our named executive officers that consisted of the following principal components.

| | | | | | | | |

| Element | Description, Objective & Performance Metrics | Form |

| Base Salary | The guaranteed part of our executives’ pay. Base salary reflects the different levels of responsibility within the Company, the skills and experience required for the job, individual performance and labor market conditions. Provides a competitive level of fixed compensation. | • Cash |

| Performance-Based Annual Cash Incentive | Performance-based payments to incentivize bottom-line growth as measured by fiscal 2022 adjusted EBITDA (“AEBITDA”). We capped such payments at 100% of target due to the uncertain economic environment and related challenges with setting performance targets with precision. | • Cash |

| Long-Term Equity Incentives | Equity-based incentives earned based on the attainment of performance objectives and continued service with the Company to align the interests of our executives with stockholders and reward performance that enhances long-term value. A portion of the performance-based restricted stock component for named executed officers is earned based on attainment of AEBITDA and challenging share price goals over a three-year measurement period. | • Performance-based restricted stock

• Time-based restricted stock

|

| Retirement and Other Welfare Benefits | Health and welfare benefits and methods for individuals to save for retirement to align with market practice and provide for the wellness of our executives and their families. | • 401(k) savings plan

• Health, dental, and vision insurance

• Short-term disability coverage

• Life insurance

|

| Termination Benefits | Severance, termination benefits and accelerated vesting of equity upon qualifying terminations and in connection with changes in control of the Company in order to retain our executives and help enable them to focus on executing our business plans. | • Cash severance

• Accelerated equity

• In kind termination benefits |

| Limited Perquisites | Limited perquisites targeted to be market competitive. | • Transportation

• Cash |

| | | | | |

| TABLE OF CONTENTS | |

| | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Potential Payments upon Termination or Change in Control | |

| |

| |

| |

| |

| |

| |

| |

| |

THE CHEFS’ WAREHOUSE, INC.

100 East Ridge Road

Ridgefield, Connecticut 06877

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 12, 2023

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors (which we sometimes refer to as the “Board” in this proxy statement) of The Chefs’ Warehouse, Inc. (the “Company”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Friday, May 12, 2023, at 10:00 a.m. EDT, on the internet through a virtual web conference at www.virtualshareholdermeeting.com/chef23, and at any adjournments or postponements of the Annual Meeting. The Board is soliciting proxies for the purposes set forth in the accompanying Notice of the Annual Meeting. The Company will bear the cost of soliciting the proxies.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on May 12, 2023:

As outlined in the notice we mailed to you on or about March 29, 2023 (the “Notice of Proxy Availability”), the proxy statement, proxy card and Annual Report to Stockholders for the fiscal year ended December 30, 2022 are available on the internet at www.proxyvote.com.

INFORMATION ABOUT THE MEETING

Record Date and Share Ownership

Only stockholders of record on our books at the close of business on March 20, 2023 (the “Record Date”) will be entitled to vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting. As of the close of business on the Record Date, we had 39,551,165 shares of common stock outstanding and eligible to vote on each matter brought before the Annual Meeting. Each share of common stock entitles the record holder to one vote on each matter to be voted upon at the Annual Meeting. Copies of the Notice of Annual Meeting of Stockholders, this proxy statement, the proxy card and our Annual Report to Stockholders for the fiscal year ended December 30, 2022 are being made available to stockholders of record on or about March 29, 2023. We are making these materials available to you on the internet or, upon your request, by delivering printed versions of these materials to you without charge by mail. On or about March 29, 2023, we mailed to all stockholders of record, as of the Record Date, the Notice of Proxy Availability, which contains instructions on how to access these materials and vote their shares of our common stock.

We will, upon written request of any stockholder, furnish without charge a copy of our Annual Report on Form 10-K for the fiscal year ended December 30, 2022, as filed with the Securities and Exchange Commission (the “SEC”), without exhibits. Please address all such requests to the attention of Alexandros Aldous, General Counsel, Corporate Secretary, Chief Government Relations Officer and Chief Administrative Officer, The Chefs’ Warehouse, Inc., 100 East Ridge Road, Ridgefield, Connecticut 06877. Exhibits will be provided upon written request to Mr. Aldous and payment of an appropriate processing fee.

Submitting and Revoking Your Proxy

If you complete and submit a proxy, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy but do not complete the voting instructions, the persons named as proxies will vote the shares represented by your proxy as follows:

•FOR the election of Ivy Brown, Dominick Cerbone, Joseph Cugine, Steven F. Goldstone, Alan Guarino, Stephen Hanson, Aylwin Lewis, Katherine Oliver, Christopher Pappas, and John Pappas as directors to hold office until the next annual meeting of stockholders and until their respective successors are elected and qualified (Proposal 1);

•FOR the ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 29, 2023 (Proposal 2);

•FOR the advisory vote on the compensation of our named executive officers as disclosed in this proxy statement (Proposal 3); and

•FOR the approval of The Chefs' Warehouse, Inc. Employee Stock Purchase Plan (Proposal 4).

If other matters come before the Annual Meeting, the persons named as proxies will vote on such matters in accordance with their best judgment. We have not received notice of other matters that may properly be presented at the Annual Meeting.

You may revoke or revise your proxy at any time before it is exercised by (1) delivering to us a signed proxy card with a date later than your previously delivered proxy, (2) voting via the internet while attending the virtual Annual Meeting, (3) granting a subsequent proxy through the internet or telephone or (4) sending a written revocation to our corporate secretary at 100 East Ridge Road, Ridgefield, Connecticut 06877. Attendance at the Annual Meeting through the internet will not itself be deemed to revoke your proxy unless you vote via the internet while attending the Annual Meeting. If you attend the Annual Meeting via the internet and want to vote via the internet, you can request that your previously submitted proxy not be used. If your shares are held through a broker, bank or other institution in “street name”, you will need to obtain a proxy form from the institution that holds your shares. Your most current proxy card or telephone or internet proxy is the one that is counted.

If you hold shares of common stock in a stock brokerage account or through a bank or other nominee, you are considered to be the beneficial owner of shares held in “street name” and these proxy materials are being made available to you by your broker, bank or nominee. You may not vote directly any shares held in “street name”; however, as the beneficial owner of the shares, you have the right to direct your broker, bank or nominee on how to vote your shares. If you do not provide your broker, bank or nominee instructions on how to vote your shares on non-discretionary items, a “broker non-vote” will occur. Proposal 1 (election of ten nominees as directors), Proposal 3 (advisory vote on executive compensation) and Proposal 4 (approval of The Chefs' Warehouse, Inc. Employee Stock Purchase Plan (the "Employee Stock Purchase Plan")) are non-discretionary items for which your broker, bank or nominee will not be able to vote your shares without your instructions. Proposal 2 (ratification of the selection of BDO USA, LLP) is a discretionary, routine item, and your broker, bank or nominee may vote your shares in their discretion in the event that they do not receive voting instructions from you. Accordingly, it is possible for there to be broker non-votes for Proposals 1, 3 and 4, but not for Proposal 2. In the case of a broker non-vote, your shares would be included in the number of shares considered present at the meeting for the purpose of determining whether there is a quorum. A broker non-vote, being shares not entitled to vote, would not have any effect on the outcome of the vote on Proposals 1, 3 or 4.

In addition to solicitations by mail and the internet, our directors, officers and employees may, without additional remuneration, solicit proxies by telephone, facsimile and personal interviews. We will request brokerage houses, banks and nominees to forward copies of the proxy materials to those persons for whom they hold shares and request instructions for voting the proxies. We will reimburse such brokerage houses, banks and other nominees for their reasonable expenses in connection with this distribution.

How to Vote

For Proposal 1 (election of ten nominees as directors), the ten candidates will be elected by a majority vote. Pursuant to our amended and restated bylaws, the voting standard for the election of directors of the Company in an uncontested election is a majority voting standard. The majority voting standard provides that to be elected in an uncontested election, a director nominee must receive a majority of the votes cast in the election such that the number of shares properly cast “for” the nominee exceeds the number of votes properly cast “against” that nominee, with abstentions and broker non-votes not counting as votes “for” or “against.” The “majority of votes cast” means that the number of shares voted “for” a director nominee must exceed the number of votes cast “against” the nominee’s election, not including abstentions and broker non-votes. “Votes cast” means the votes actually cast “for” or “against” a particular proposal, whether in person or by proxy. You may vote “FOR” or “AGAINST” each director, or “ABSTAIN” from voting for such director. Under our majority voting standard, if an incumbent director nominee fails to receive a majority of votes cast, the nominee must immediately offer to tender his or her resignation to the Board. The Nominating and Corporate Governance Committee would make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board would act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision as well as the rationale behind it within 90 days from the date of the certification of the election results.

For Proposal 2 (ratification of the selection of BDO USA, LLP), Proposal 3 (advisory vote on executive compensation) and Proposal 4 (approval of the Employee Stock Purchase Plan), you may vote “FOR” or “AGAINST” each proposal or “ABSTAIN” from voting on the proposal.

Stockholders of Record: If you are a stockholder of record on the Record Date, there are four ways to vote:

•by voting at the Annual Meeting in person or via the internet at www.virtualshareholdermeeting.com/chef23;

•by completing, signing, dating and returning your proxy card by mail, if you request a paper copy of the proxy materials;

•by making a toll-free telephone call within the United States or Canada using a touch-tone telephone to the toll-free number provided on your proxy card; or

•by voting on the internet. To vote on the internet, go to the website address indicated on your Notice of Proxy Availability to complete an electronic proxy card. You will be asked to provide the control number from the Notice of Proxy Availability.

If you plan to vote by telephone or internet in advance of the Annual Meeting, your vote must be received by 11:59 p.m., eastern daylight time, on May 11, 2023 to be counted. Internet voting during the Annual Meeting is also permissible through the virtual web meeting hosted at www.virtualshareholdermeeting.com/chef23.

Street Name Holders: If you hold your shares in “street name,” the Notice of Proxy Availability was forwarded to you by your brokerage firm, bank or other nominee and you should follow the voting instructions provided by your broker, bank or nominee. You may complete and return a voting instruction card to your broker, bank or nominee. Please check your Notice of Proxy Availability for more information. If you hold your shares in street name and wish to vote at the Annual Meeting, you must have your 12-digit control number from your Notice of Proxy Availability.

We provide internet proxy voting to allow you to vote your shares online both before and during the Annual Meeting, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

Quorum

Presence by attendance at the Annual Meeting virtually through the virtual web meeting or by proxy of a majority of the shares of common stock outstanding at the close of business on the Record Date and entitled to vote at the Annual Meeting will be required for a quorum. Shares of common stock present by attendance at the Annual Meeting or represented by proxy (including shares that abstain or do not vote with respect to one or more of the matters presented for stockholder approval and broker non-votes) will be counted for purposes of determining whether a quorum exists at the Annual Meeting.

Votes Required

Proposal 1 (election of ten nominees as directors) is an uncontested director election. Our bylaws require that each nominee be elected by an affirmative majority of the shares represented at the Annual Meeting in person (including by webcast) or by properly executed proxy and entitled to vote on Proposal 1 to approve the election of each of the nominees for election as a director. Abstentions and broker non-votes will have no effect on Proposal 1 because they are not considered votes cast.

With respect to Proposal 2 (ratification of the selection of BDO USA, LLP), Proposal 3 (advisory vote on executive compensation) and Proposal 4 (approval of the Employee Stock Purchase Plan), the affirmative vote of a majority of the shares represented at the meeting and entitled to vote on the proposal is necessary for approval. Abstentions will be equivalent to a vote against Proposals 2, 3 and 4. Broker non-votes will have no effect on the results of Proposals 1, 3 and 4 because they are not considered votes cast. However, regarding Proposal 2, the ratification of the appointment of our independent registered public accounting firm is considered a “routine” item and brokerage firms may vote in their discretion on this matter on behalf of beneficial owners who have not furnished voting instructions before the date of the Annual Meeting.

Attending the Annual Meeting

We will be hosting the Annual Meeting on the internet through a virtual web conference at www.virtualshareholdermeeting.com/chef23. Our stockholders will continue to have the opportunity to engage with our Board and our independent auditors during the meeting. Our optional virtual meeting platform provided by our proxy solicitor, Broadridge Financial Solutions, allows all participating stockholders to submit questions at any point in the meeting. In addition, it also allows our stockholders to vote on proposals online. We believe that our virtual platform will increase stockholder participation while at the same time affording the same rights and opportunities to participate, as stockholders would have if we held a physical annual meeting.

A summary of the information you need to attend the Annual Meeting online is provided below:

•Any stockholder can attend the Annual Meeting live via the internet at www.virtualshareholdermeeting.com/chef23.

•The webcast will start at 10:00 a.m. EDT.

•Please have your 12-digit control number to enter the Annual Meeting.

•Stockholders may vote and submit questions while attending the Annual Meeting via the internet.

•Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com.

•Questions regarding how to attend and participate via the internet can be addressed by calling 1-800-690-6903 on the day before the Annual Meeting and the day of the Annual Meeting.

•Webcast replay of the Annual Meeting will be available at www.virtualshareholdermeeting.com/chef23 until the sooner of May 13, 2024 or the date of the next annual meeting of stockholders to be held in 2024.

Householding

The SEC has adopted a rule concerning the delivery of annual reports and proxy statements. It permits us, with your permission, to send a single Notice of Proxy Availability and, to the extent requested, a single set of these proxy materials to any household at which two or more stockholders reside if we believe they are members of the same family. This rule is called “householding” and its purpose is to help reduce printing and mailing costs of proxy materials. To date, the Company has not instituted this procedure, but may do so in the future.

A number of brokerage firms have instituted householding. If you and members of your household have multiple accounts holding shares of the Company’s common stock, you may have received a householding notification from your broker. Please contact your broker directly if you have questions, require additional copies of this proxy statement, the Annual Report or other proxy materials or wish to revoke your decision to household. These options are available to you at any time. Separate reports and proxies are available at The Chefs' Warehouse, Inc., 100 East Ridge Road, Ridgefield, Connecticut 06877, or by calling our General Counsel, Corporate Secretary, Chief Government Relations Officer and Chief Administrative Officer, Alexandros Aldous, at (203) 894-1345.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

This table includes information regarding the amount of our common stock beneficially owned as of March 20, 2023 by the following persons as of such date: (i) each of our directors, (ii) each of our executive officers named in “EXECUTIVE COMPENSATION - Summary Compensation Table - Fiscal Years 2020-2022,” (iii) all of our directors and current executive officers as a group, and (iv) each other person or entity known to us to own more than 5% of our outstanding common stock.

| | | | | | | | | | | | | | |

Name and Address of Beneficial Owner(1) | | Number of Shares Beneficially Owned(2) | | Percentage Ownership |

| | | | |

| Directors and Named Executive Officers: | | | | |

Christopher Pappas(3) | | 2,650,792 | | 6.7% |

John Pappas(4) | | 1,341,355 | | 3.4% |

Ivy Brown(5) | | 9,163 | | * |

| Dominick Cerbone | | 34,825 | | * |

| Joseph Cugine | | 39,978 | | * |

| Steven F. Goldstone | | 26,280 | | * |

Alan Guarino(6) | | 35,232 | | * |

| Stephen Hanson | | 76,092 | | * |

| Aylwin Lewis | | 9,163 | | * |

| Katherine Oliver | | 32,334 | | * |

| James Leddy | | 181,772 | | * |

| Alexandros Aldous | | 167,603 | | * |

| Timothy McCauley | | 96,055 | | * |

All directors and executive officers, as a group (14 persons)(7) | | 4,721,832 | | 11.9% |

| Principal Stockholders (> 5% of outstanding common stock) | | | | |

BlackRock, Inc.(8) | | 5,493,065 | | 13.9% |

AllianceBernstein L.P.(9) | | 2,672,315 | | 6.8% |

The Vanguard Group, Inc.(10) | | 2,556,760 | | 6.5% |

Greenhouse Funds LLLP(11) | | 2,181,795 | | 5.5% |

Greenhouse GP LLC(11) | | 2,181,795 | | 5.5% |

Joseph Milano(11) | | 2,181,795 | | 5.5% |

| | | | |

*Indicates less than 1% beneficial ownership of common stock.

(1) The address for each listed director and executive officer is c/o The Chefs’ Warehouse, Inc., 100 East Ridge Road, Ridgefield, Connecticut 06877. The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. The address of AllianceBernstein L.P. is 1345 Avenue of the Americas, New York, New York 10105. The address of The Vanguard Group is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. The address for Greenhouse Funds LLLP, Greenhouse GP LLC and Joseph Milano is 605 South Eden Street, Suite 250, Baltimore, Maryland 21231.

(2) The number of shares of common stock beneficially owned by each stockholder is determined under SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which a person has sole or shared voting power or investment power and also any shares which a person has the right to acquire within 60 days after March 20, 2023 through the vesting or exercise of any equity award or other right. The inclusion herein of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. Unless otherwise indicated, each person named in the table has sole voting power and investment power (or shares such power with his or her spouse) with respect to all shares of common stock listed as owned by such person. The number of shares listed includes: (i) 364,083 shares of our common stock for which Mr. C. Pappas has all rights granted to a stockholder pursuant to certain performance restricted share award agreements, dated February 28, 2023, February 24, 2022 and February 23, 2021, including the right to vote such shares subject to certain restrictions in such performance share award agreements; (ii) 200,084 shares of our common stock for which Mr. J. Pappas has all rights granted to a stockholder pursuant to certain performance restricted share award agreements, dated February 28, 2023, February 24, 2022 and February 23, 2021, including the right to vote such shares subject to certain restrictions in such performance share award agreements; (iii) 72,417 shares of our common stock for which Mr. Aldous has all the rights granted to a stockholder pursuant to certain performance restricted share award agreements, dated February 28, 2023, February 24, 2022 and

February 23, 2021, including the right to vote such shares subject to certain restrictions in such performance share award agreements; (iv) 77,590 shares of our common stock for which Mr. Leddy has all the rights granted to a stockholder pursuant to certain performance restricted share award agreements, dated February 28, 2023, February 24, 2022 and February 23, 2021, including the right to vote such shares subject to certain restrictions in such performance share award agreements; (v) 36,552 shares of our common stock for which Mr. McCauley has all the rights granted to a stockholder pursuant to certain performance restricted share award agreements, dated February 28, 2023, February 24, 2022 and February 23, 2021, including the right to vote such shares subject to certain restrictions in such performance share award agreements; and (vi) 3,130 restricted stock unit awards granted to each of our non-employee directors vesting within 60 days of March 20, 2023. For our executive officers, the shares subject to performance measures are listed at the maximum achievement possible.

(3) Includes 300,121 shares of our common stock held by a grantor retained annuity trust established by Mr. C. Pappas and of which Mr. C. Pappas is the sole trustee and annuity beneficiary. Includes 95,908 shares subject to presently exercisable options.

(4) Includes 400,000 shares of our common stock which are held by a single member LLC the sole member of which is a grantor retained annuity trust established by Mr. J. Pappas and of which Mr. J. Pappas is the sole trustee and sole annuity beneficiary.

(5) Includes restricted stock unit awards deferred under our Non-Employee Director Deferral Plan.

(6) Excludes 10,269 shares held by an irrevocable trust for the benefit of Mr. Guarino's children.

(7) This group includes all of our current directors and executive officers as of the date of this table.

(8) BlackRock, Inc. has the sole power to vote or direct the vote of 5,442,952 shares and sole power to dispose or to direct the disposition of 5,493,065 shares. The foregoing information is based solely on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on January 26, 2023.

(9) AllianceBernstein L.P. has sole power to vote or direct the vote of 2,526,028 shares, sole power to dispose or direct the disposition of 2,644,064 shares and shared power to dispose or direct the disposition of 28,251 shares. The foregoing information is based solely on a Schedule 13G/A filed by AllianceBernstein L.P. with the SEC on February 14, 2023

(10) The Vanguard Group has the sole power to dispose or to direct the disposition of 2,479,437 shares, shared power to vote or direct the vote of 48,317 shares and shared power to dispose or direct the disposition of 77,323 shares. The foregoing information is based solely on a Schedule 13G/A filed by The Vanguard Group, Inc. with the SEC on February 9, 2023.

(11) Greenhouse Funds LLLP, Greenhouse GP LLC and Joseph Milano have shared power to vote or direct the vote of and shared power to dispose or direct the disposition of 2,181,796 shares. The foregoing information is based solely on a Schedule 13G filed by Greenhouse Funds LLLP, Greenhouse GP LLC and Joseph Milano with the SEC on January 26, 2023.

CORPORATE GOVERNANCE

Summary

We are committed to maintaining strong corporate governance practices and principles. The Board actively monitors developments relating to the corporate governance of public corporations, and the Board has consulted with our legal counsel and independent registered public accounting firm to evaluate our current corporate governance and other practices in light of these developments. We believe our policies and practices reflect corporate governance best practices and compliance with the requirements of the Sarbanes-Oxley Act of 2002, SEC rules and regulations and the Listing Rules (“Nasdaq Listing Rules”) of the Nasdaq Stock Market LLC (“Nasdaq”). For example:

•The Board has adopted our Corporate Governance Guidelines, which outline the roles and responsibilities of the Board and its committees and establish policies regarding governance matters such as Board meetings and communications, performance evaluations of the Board and our chief executive officer, director stock ownership guidelines, and director orientation and continuing education;

•A majority of the members of the Board are “independent directors” within the Nasdaq Listing Rules’ definition, and the Board makes an affirmative determination regarding the independence of each director annually;

•All members of the Board’s standing committees—the Audit Committee, the Compensation and Human Capital Committee (which we refer to in this Proxy Statement as the “Compensation Committee”), the Nominating and Corporate Governance Committee and the ESG Committee—are “independent directors” as determined by the Board and within the meaning Nasdaq Listing Rules;

•The independent members of the Board meet regularly without the presence of management;

•We have designated an independent director to serve as our “Lead Director” to coordinate the activities of the other independent members of the Board;

•We have a Code of Business Conduct and Ethics that applies to our principal executive officer and all members of our finance department, including our principal financial officer, principal accounting officer and controller;

•We have an Insider Trading Policy that is applicable to all of our employees and directors and their affiliates which, among other things, prohibits hedging of Company securities by such persons;

•The charters of the Board’s committees clearly establish their respective roles and responsibilities; and

•The Audit Committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters.

In addition, our Corporate Governance Guidelines limit the directors serving on our Audit Committee from serving on more than three public company audit committees without the Board’s determination that such simultaneous service would not impair the ability of such member to effectively serve on the Company’s Audit Committee. Directors must notify the chairman of the Nominating and Corporate Governance Committee in advance of accepting an invitation to serve on another corporate board. Directors are also required to notify the Board when their principal occupation or business association changes, at which point the Board will evaluate the propriety of continued Board service.

We maintain a corporate governance page on our website that includes key information about our corporate governance initiatives. The corporate governance page can be found at www.chefswarehouse.com, by clicking on “Investors,” and then clicking on “Corporate Governance.” Copies of our Corporate Governance Guidelines, our Insider Trading Policy and the charters for each of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and ESG Committee can be found on the corporate governance page of our website (www.chefswarehouse.com). We have also adopted a Code of Business Conduct and Ethics (“Code of Ethics”) that applies to all of our employees, including our principal executive officer, principal financial officer, principal accounting officer and controller. Our Code of Ethics is publicly available on the corporate governance page of our website (www.chefswarehouse.com) and can be found by clicking on “Investors,” and then clicking on “Corporate Governance.” If we make any substantive amendments to the Code of Ethics or grant any waiver, including any implicit waiver, from a provision of the Code of Ethics to our principal executive officer, principal financial officer, principal accounting officer or

controller, or persons performing similar functions, we intend to make any legally required disclosures regarding such amendments or waivers on the Investors section of our website (www.chefswarehouse.com). Information contained on our website is not incorporated by reference into this proxy statement or considered to be part of this document.

Director Independence

Our Corporate Governance Guidelines require a majority of the members of the Board to be “independent directors” as such term is defined in the Nasdaq Listing Rules. The Board, upon the recommendation of the Nominating and Corporate Governance Committee, has determined that eight of its ten members nominated for election at the Annual Meeting are independent. Our eight independent directors are Ms. Brown, Mr. Cerbone, Mr. Cugine, Mr. Goldstone, Mr. Guarino, Mr. Hanson, Mr. Lewis and Ms. Oliver. Mr. C. Pappas and Mr. J. Pappas are our employees; therefore, Mr. C. Pappas and Mr. J. Pappas are not independent directors.

Our Corporate Governance Guidelines and the charters for each of the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the ESG Committee require all members of these committees to be “independent” within the meaning of the SEC’s rules and regulations and the Nasdaq Listing Rules. The charter of the Audit Committee also requires each of its members to meet the definition of independence under Section 10A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the SEC’s rules thereunder. The charter of the Compensation Committee requires each of its members to be a non-employee director within the meaning of Rule 16b-3 under the Exchange Act and an outside director within the meaning of Section 162(m) of the Internal Revenue Code, as amended (the “Code”).

Lead Director

The Board has created the position of Lead Director. Mr. Cerbone, chairman of the Audit Committee, currently serves as the Lead Director. As of the Annual Meeting, pending his re-election to the Board, Mr. Cerbone shall continue to serve as the Lead Director. In accordance with our Corporate Governance Guidelines, the Lead Director must be “independent” within the meaning of the SEC’s rules and regulations and the Nasdaq Listing Rules. The Lead Director is responsible for coordinating the activities of the other independent directors and for performing such other duties and responsibilities as the Board may determine from time to time, including the following:

•Serving as a liaison between Mr. C. Pappas, our chief executive officer and chairman of the Board, and the independent directors of the Board;

•Advising the chairman of the Board as to an appropriate schedule of and agenda for the Board’s meetings and ensuring the Board’s input into the agenda for the Board’s meetings;

•Advising the chief executive officer as to the quality, quantity, and timeliness of the information submitted by the Company’s management that is necessary or appropriate for the independent directors to effectively and responsibly perform their duties;

•Assisting the Board, the Nominating and Corporate Governance Committee and our officers in better ensuring compliance with and implementation of our corporate governance principles; and

•Serving as the chairman for executive sessions of the Board’s independent directors and acting as chairman of the Board’s regular and special meetings when the chairman of the Board is unable to preside.

Certain Relationships and Related Transactions

Review and Approval of Related Person Transactions

The Board recognizes that transactions or relationships with us and our subsidiaries and our directors, director nominees, executive officers and greater than 5% beneficial owners of our common stock, and the immediate family members of each of the foregoing, may involve potential conflicts of interest. As a result, the Board adopted a written Related Party Transaction Policy (the “Policy”) requiring the prior approval of the Audit Committee before a related party may enter into a transaction or relationship in which we or a subsidiary of ours is a participant and the related party would have a direct or indirect interest, unless such transaction involves less than $120,000. Under the Policy, any proposed related party transactions are reviewed at the regularly scheduled meetings of the Audit Committee. Additionally, ongoing relationships are periodically reviewed and assessed to determine whether, based on all relevant facts, information and circumstances (including our and our subsidiaries’ contractual obligations), the related party transaction remains appropriate or should otherwise be modified or terminated. Any member of the Audit Committee who is a related party with respect to a transaction under review will not be able to vote on the approval or ratification of the transaction; however, the director shall provide all material information and may, if so requested by the chairman of the Audit Committee, participate in some or all of the Audit Committee’s discussions concerning the related party transaction. We require that any related party transaction must be on terms no less favorable to the Company than could be obtained from unaffiliated third parties. As required under SEC regulations, those transactions or series of similar transactions to which we or a subsidiary of ours is or will be a participant in which the amount involved exceeded or will exceed $120,000 and in which any related person had or will have a direct or indirect material interest is disclosed in this proxy statement if such disclosure is required by SEC regulations.

Other than the transactions described below and the arrangements described under “EXECUTIVE COMPENSATION - Compensation Discussion and Analysis,” since December 26, 2020, there has not been, and there is not currently proposed, any transaction or series of similar transactions required to be disclosed by SEC regulations to which we or any of our subsidiaries were or will be a participant in which the amount involved exceeded or will exceed $120,000 and in which any related person had or will have a direct or indirect material interest.

Transactions with Related Persons

Warehouse and Office Leases

The Company leases one warehouse facility from related parties. The facility is owned by an entity owned 100% by Mr. C. Pappas, the Company’s chairman, president and chief executive officer, and Mr. J. Pappas, the Company’s vice chairman, chief operating officer and one of its directors, and which is deemed to be an affiliate of these individuals. The amount paid in connection with the lease of this facility was $492,983 for fiscal 2022.

Employment of Family Members

Mr. J. Pappas’ brother-in-law, Constantine Papataros, is one of the Company’s employees. The Company paid him approximately $418,416 during fiscal 2022. The compensation paid to Mr. Papataros during fiscal 2022 was consistent with that of other employees at the same level.

Mr. J. Pappas’ son, Aristotle Pappas, is one of the Company’s employees. The Company paid him approximately $256,069 during fiscal 2022. The compensation paid to Mr. A. Pappas during fiscal 2022 was consistent with that of other employees at the same level.

Customers

Mr. C. Pappas has served on the board of Hudson National Golf Club (“Hudson”) since October 20, 2018. The Company sold $337,048 worth of products to Hudson during fiscal 2022.

Board Leadership Structure

The Board currently combines the roles of chairman of the Board and chief executive officer. Our Corporate Governance Guidelines do not require the chairman of the Board to be independent and do not specify whether the positions of chairman of the Board and chief executive officer must be separated. Considering the Company’s successful performance

over extended periods under Mr. C. Pappas’ leadership, the Board believes that the Company benefits from Mr. C. Pappas’ services in both roles. Mr. C. Pappas has served as our chief executive officer since 1985. The Board believes Mr. C. Pappas to be the most qualified to serve as our chairman because he is the director most familiar with the Company’s business and the foodservice distribution industry and as a result is best suited to effectively identify strategic priorities and lead the discussion and execution of strategy. The Board believes the combined position of chairman and chief executive officer promotes a unified direction and leadership for the Board and gives a single, clear focus for the chain of command for our organization, strategy, and business plans. In addition, the Board believes that the combined position of chairman and chief executive officer is better positioned to act as a bridge between management and the Board, facilitating the regular flow of information.

As discussed above, the Board also maintains an independent Lead Director. Mr. Cerbone currently serves as our Lead Director. We believe it is important to have a Lead Director to establish a system of checks and balances between the independent directors of the Board and Mr. C. Pappas. The Lead Director provides leadership to the Board to ensure it operates in an independent, cohesive manner. The Board believes that having a Lead Director vested with key duties and responsibilities (as discussed above) and the Board’s standing committees comprised of and chaired by independent directors (as discussed below) provides a formal structure for strong independent oversight of our management team. As of the Annual Meeting, pending his re-election to the Board, Mr. Cerbone, chairman of the Audit Committee, shall continue to serve as the Lead Director.

Risk Oversight

The Board has overall responsibility for risk oversight. The Board oversees risk management with a focus on our primary areas of risk: risk related to our business strategy, financial risk, legal/compliance risk and operational risk. Our president and chief executive officer and each of our other executive officers are responsible for managing risk in their respective areas of authority and expertise, identifying key risks to the Board and explaining to the Board how those risks are being addressed.

Certain standing committees of the Board also have responsibility for risk oversight. The Audit Committee focuses on financial risk, including fraud risk and risks relating to our internal controls over financial reporting. The Compensation Committee addresses risks relating to our executive compensation strategies and is tasked with monitoring our executive compensation program to ensure that it does not encourage our executive officers to take unnecessary and excessive risks. The Board receives regular reports from the chairs of the Audit Committee and Compensation Committee regarding these committees’ risk management efforts and receives reports and other meeting materials provided to each of the committees. In addition, we have established a Disclosure Committee, consisting of our executive officers, which assists the Board in fulfilling its oversight responsibility with respect to regulatory compliance and receives regular reports from our general counsel and other employees responsible for our regulatory compliance. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks we face.

Compensation Risk

Our Compensation Committee is comprised solely of independent directors and is principally responsible for establishing, overseeing and administering our compensation plans and policies for our executive officers, including our equity incentive plans. Our Compensation Committee is also responsible for overseeing risks related to our compensation programs and practices. Our Compensation Committee has assessed the risk associated with our compensation policies and practices for our employees and determined that the risks associated with such policies and practices are not reasonably likely to have a material adverse effect on us. Our Compensation Committee utilizes compensation practices that it believes discourage our employees from excessive risk-taking that could be reasonably likely to have a materially adverse effect on us, including the following:

•The base salary component of compensation does not encourage risk-taking because it is a fixed amount.

•A combination of both short-term and long-term elements of executive compensation minimizes risks by ensuring a focus on performance over time.

•Our equity awards are designed to mitigate risk. The time-based vesting structure discourages short-term risk-taking at the expense of long-term stockholder value and a performance-based award can be earned only upon

the achievement of challenging yet achievable corporate or share price goals selected to motivate executives to achieve our corporate objectives and enhance stockholder value.

•Our chief executive officer and vice chairman and chief operating officer both maintain a significant ownership interest in the Company, which closely aligns their interests with our stockholders’ interests and disincentivizes them from engaging in, or encouraging our other executive officers to engage in, unreasonable or excessive risk-taking.

•We have instituted a clawback, or recoupment, policy on awards granted under our annual cash incentive compensation program.

•Provided that there is an achievement of a threshold level of performance, payouts under our annual cash incentive compensation program may result in some compensation at levels below full target achievement, rather than an “all-or-nothing” approach, which could encourage excessive risk-taking.

•Our Compensation Committee determines achievement levels under the Company’s annual cash incentive compensation plan after reviewing Company and executive performance.

•Our Compensation Committee is being advised by an independent compensation consultant who also reviews the results of our annual analysis and assessment of our compensation programs.

Nomination of Directors

The Nominating and Corporate Governance Committee reviews the qualifications of every person recommended as a nominee to the Board to determine whether the recommended nominees are qualified to serve on the Board. The Nominating and Corporate Governance Committee has adopted qualitative standards by which it determines if nominees are qualified to serve on the Board. The Nominating and Corporate Governance Committee evaluates recommended nominees in accordance with the following criteria:

•Personal characteristics. The Nominating and Corporate Governance Committee considers the personal characteristics of each nominee, including the nominee’s integrity, accountability, ability to make informed judgments, financial literacy, professionalism and willingness to meaningfully contribute to the Board (including by possessing the ability to communicate persuasively and address difficult issues). In addition, the Nominating and Corporate Governance Committee evaluates whether the nominee’s previous experience reflects a willingness to establish and meet high standards of performance, both for him or herself and for others.

•Core Competencies. The Nominating and Corporate Governance Committee considers whether the nominee’s knowledge and experience would contribute to the Board’s achievement of certain core competencies. The Nominating and Corporate Governance Committee believes that the Board, as a whole, should possess competencies in accounting and finance, business judgment, management best practices, crisis response, industry knowledge, leadership, strategy and vision.

•Board Independence. The Nominating and Corporate Governance Committee considers whether the nominee would qualify as an “independent director” under the Nasdaq Listing Rules.

•Director Commitment. The Nominating and Corporate Governance Committee expects that each of our directors will prepare for and actively participate in meetings of the Board and its committees, provide advice and counsel to our management, develop a broad knowledge of our business and industry and, with respect to an incumbent director, maintain the expertise that led the Nominating and Corporate Governance Committee to initially select the director as a nominee. The Nominating and Corporate Governance Committee evaluates each nominee on his or her ability to provide this level of commitment if elected to the Board.

•Additional Considerations. Each nominee is also evaluated based on the overall needs of the Board and the diversity of experience he or she can bring to the Board, whether in terms of specialized knowledge, skills or expertise. The Company has met the Nasdaq diversity goals. The Compensation Committee is charged with developing diversity goals and the Company has adopted such goals to ensure Board representation for underrepresented populations as well as women. Although we do not have a formal policy with regard to the consideration of diversity in identifying director nominees, the Nominating and Corporate Governance

Committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee the Company’s businesses.

Following this evaluation, the Nominating and Corporate Governance Committee will make recommendations for membership on the Board and review such recommendations with the Board, which will decide whether to invite the candidate to be a nominee for election to the Board.

Director Nominees Recommended by Stockholders

The Nominating and Corporate Governance Committee evaluates nominees recommended by stockholders on the same basis as nominees recommended by any other sources, including making a determination whether the candidate is qualified to serve on the Board based on the qualitative standards described above. To be considered by the Nominating and Corporate Governance Committee, a stockholder who wishes to recommend a director nominee must deliver or send by first class U.S. mail a written notice addressed to Alexandros Aldous, General Counsel, Corporate Secretary, Chief Government Relations Officer and Chief Administrative Officer, The Chefs’ Warehouse, Inc., 100 East Ridge Road, Ridgefield, Connecticut 06877. The written notice must be received by our corporate secretary not less than 90 days nor more than 120 days prior to the date of the annual meeting; provided, however, that in the event the annual meeting is scheduled to be held on a date more than 30 days prior to or delayed by more than 60 days after the anniversary date of the last annual meeting of stockholders, notice by the stockholder in order to be timely must be so received not later than the close of business on the 10th day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure of the meeting was first made.

The notice to our corporate secretary must include the information specified in our bylaws, including the following: (a) as to each proposed nominee (i) the name, age, business address and, if known, residence address of each such nominee, (ii) the principal occupation or employment of each such nominee, (iii) the class or series and number of our shares that are owned beneficially or of record by each such nominee, (iv) any other information concerning the nominee that must be disclosed as to nominees in proxy solicitations pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to be named as a nominee and to serve as a director if elected), and (v) a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among such stockholder and beneficial owner, if any, and their respective affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, or others acting in concert therewith, on the other hand, including without limitation all information that would be required to be disclosed pursuant to Rule 404 promulgated under the SEC’s Regulation S-K if the stockholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, were the “registrant” for purposes of such rule and the nominee were a director or executive officer of such registrant; and (b) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the proposal is made (i) the name and record address of such stockholder, as it appears on the Company’s books, and of such beneficial owner, if applicable, and of their respective affiliates or associates or others acting in concert therewith, (ii)(A) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such stockholder and such beneficial owner, as applicable, and their respective affiliates or associates or others acting in concert therewith, (B) any option, warrant, convertible security, stock appreciation right, or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Company or with a value derived in whole or in part from the value of any class or series of shares of the Company, any derivative or synthetic arrangement having the characteristics of a long position in any class or series of shares of the Company, or any contract, derivative, swap or other transaction or series of transactions designed to produce economic benefits and risks that correspond substantially to the ownership of any class or series of shares of the Company, including due to the fact that the value of such contract, derivative, swap or other transaction or series of transactions is determined by reference to the price, value or volatility of any class or series of shares of the Company, whether or not such instrument, contract or right shall be subject to settlement in the underlying class or series of shares of the Company, through the delivery of cash or other property, or otherwise, and without regard of whether the stockholder of record, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith, may have entered into transactions that hedge or mitigate the economic effect of such instrument, contract or right, or any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Company (any of the foregoing, a “Derivative Instrument”) directly or indirectly owned beneficially by such stockholder, the beneficial owner, if any, or any affiliates or associates or others acting in concert therewith, (C) any proxy, contract, arrangement, understanding, or relationship pursuant to which such stockholder has a right to vote any class or series of shares of the Company, (D) any agreement, arrangement, understanding, relationship or otherwise, including any repurchase or similar so-called “stock borrowing” agreement or arrangement, involving such stockholder, directly or indirectly, the purpose or effect of which is to mitigate loss to, reduce the economic risk (of ownership or otherwise) of any class or series of the shares of the Company by, manage the risk of share price changes for, or increase or decrease the voting power of, such stockholder with respect to any class or series of the shares of the Company, or which provides, directly or indirectly, the opportunity to profit or share in any profit derived from any decrease in the price or value of any class or series of the shares of the Company (any of the foregoing, a “Short Interest”), (E) any rights to dividends on the shares of the Company owned beneficially by such stockholder that are separated or separable from the underlying shares of the Company, (F) any proportionate interest in shares of the Company or

Derivative Instruments held, directly or indirectly, by a general or limited partnership in which such stockholder is a general partner or, directly or indirectly, beneficially owns an interest in a general partner of such general or limited partnership, (G) any performance-related fees (other than an asset-based fee) that such stockholder is entitled to based on any increase or decrease in the value of shares of the Company or Derivative Instruments, if any, including without limitation any such interests held by members of such stockholder’s immediate family sharing the same household, (H) any significant equity interests or any Derivative Instruments or Short Interests in any principal competitor of the Company held by such stockholder, and (I) any direct or indirect interest of such stockholder in any contract with the Company, any affiliate of the Company or any principal competitor of the Company (including, in any such case, any employment agreement, collective bargaining agreement or consulting agreement), (iii) a description of all arrangements or understandings between such stockholder and/or beneficial owner, if applicable, and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder, (iv) a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice and (v) any other information relating to such stockholder and beneficial owner, if any, that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to the SEC’s Regulation 14A under the Exchange Act. We may require any proposed nominee to furnish such other information as may be reasonably required by the Nominating and Corporate Governance Committee to determine the eligibility of such proposed nominee to serve as a member of the Board.

Board Meetings