UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading symbol(s) |

| Name of each exchange on which registered |

Toronto Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☑ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of June 30, 2022, the aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $

As of June 26, 2023, the number of shares of Registrant’s common stock outstanding was

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

i

Notice Regarding Mineral Disclosure

Mineral Reserves and Resources

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and applicable Canadian securities laws, and as a result, we have separately reported our mineral reserves and mineral resources according to the standards applicable to those requirements. U.S. reporting requirements are governed by subpart 1300 of Regulation S-K (“S-K 1300”), as issued by the U.S. Securities and Exchange Commission (the “SEC”). Canadian reporting requirements are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), as adopted from the definitions provided by the Canadian Institute of Mining, Metallurgy and Petroleum. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of consistency and confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions. All disclosure of mineral resources and mineral reserves in this report is reported in accordance with S-K 1300. See “Item 1A. Risk Factors—Risks Related to Our Operations—Mineral reserve and mineral resource calculations at the CLG and at other deposits in the LGD are only estimates and actual production results and future estimates may vary significantly from the current estimates.”

The estimation of measured and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves, and therefore investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves reported pursuant to S-K 1300. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources, and, therefore, investors are cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically. Definitions of technical terms are included below for reference.

Technical Report Summaries and Qualified Persons

The technical information concerning our mineral projects in this Form 10-K have been reviewed and approved by Tony Scott P. Geo, Senior Vice President of Corporate Development and Technical Services. The technical information herein that relates to the CLG and Esther 2022 Mineral Resource set out in the Los Gatos Technical Report was prepared by or under the supervision of Ronald Turner, MAusIMM(CP), an employee of Golder Associates S.A. The technical information that relates to the 2022 Mineral Reserve, the 2022 LOM plan and other economic analyses was based upon information set out in the Los Gatos Technical Report and was based upon information prepared by or under the supervision of Paul Gauthier, P.Eng. an employee of WSP Canada Inc. (formerly Golder Associates Ltd.). Each of Mr. Scott, Mr. Turner and Mr. Gauthier is a “qualified person” under S-K 1300 and have reviewed the contents of this Form 10-K. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this Form 10-K, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Los Gatos Technical Report which is included as an exhibit to this Form 10-K.

1

Glossary of Technical Terms

Certain terms and abbreviations used in this Report are defined below:

“Ag” means the chemical symbol for the element silver.

“AISC” means all-in sustaining cost.

“Au” means the chemical symbol for the element gold.

“By-Product” is a secondary metal or mineral product recovered in the milling process. For the CLG operation, silver is the primary metal product by value and zinc, lead and gold are by-products.

“Concentrate” is the product of physical concentration processes, such as flotation or gravity concentration, which involves separating ore minerals from unwanted waste rock. Concentrates require subsequent processing (such as smelting or leaching) to break down or dissolve the ore minerals and obtain the desired elements, usually metals.

“Dilution” is an estimate of the amount of waste or low-grade mineralized rock which will be mined with the ore as part of normal mining practices in extracting an orebody.

“Feasibility Study” is a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a mining company and/or a financial institution to finance the development of the deposit for mineral production.

“Grade” means the concentration of each ore metal in a rock sample, usually given as weight percent. Where extremely low concentrations are involved, the concentration may be given in grams per tonne (g/t), the grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from the deposit.

“g/t” means grams per tonne.

“Hectare” is a metric unit of area equal to 10,000 square meters (2.471 acres).

“indicated mineral resources” or “indicated resources” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve.

“inferred mineral resources” or “inferred resources” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve.

“LOM” means life of mine.

“Los Gatos Technical Report” means the Technical Report titled “Mineral Resource and Reserve Update, Los Gatos Joint Venture, Chihuahua, Mexico,” prepared by Golder Associates, dated November 10, 2022 with an effective date of July 1, 2022, which was prepared in accordance with the requirements of S-K 1300 and NI 43-101.

“masl” is meters above sea level.

2

“mineral reserves” or “reserves” are the estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. Mineral reserves quantified herein are on a 100% basis unless otherwise stated.

“mineral resources” or “resources” are a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. Mineral resources quantified herein are on a 100% basis and stated exclusive of mineral reserves, unless otherwise stated.

“measured mineral resources” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve.

“M&I” means measured mineral resources and indicated mineral resources.

“NI 43-101” means National Instrument 43-101-Standards of Disclosure for Mineral Projects adopted by the Canadian Securities Administrators.

“NSR” means net smelter return: the proceeds returned from the smelter and/or refinery to the mine owner less certain costs.

“oz” means a troy ounce.

“Pb” means the chemical symbol for the element lead.

“probable mineral reserve” means the economically mineable part of an indicated and, in some cases, a measured mineral resource.

“proven mineral reserve” means the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

“S-K 1300” means 17.C.F.R § 229.1300 through § 229.1305.

“tailings” is the material that remains after all economically and technically recovered metals have been removed from the ore during processing.

“tonne,” means a metric tonne, equivalent to 1,000 kg or 2,204.6 pounds. “tonne” is referenced under the “Grade” definition.

“Zn” means the chemical symbol for the element zinc.

3

Cautionary Information about Forward-Looking Statements

This Report contains statements that constitute “forward looking information” and “forward-looking statements” within the meaning of U.S. and Canadian securities laws, including the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by words such as “may,” “might,” “could,” “would,” “achieve,” “budget,” “scheduled,” “forecasts,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements may include, but are not limited to, the following:

| ● | estimates of future mineral production and sales; |

| ● | estimates of future production costs, other expenses and taxes for specific operations and on a consolidated basis; |

| ● | estimates of future cash flows and the sensitivity of cash flows to gold, copper, silver, lead, zinc and other metal prices; |

| ● | estimates of future capital expenditures, construction, production or closure activities and other cash needs, for specific operations and on a consolidated basis, and expectations as to the funding or timing thereof; |

| ● | estimates as to the projected development of certain ore deposits, including the timing of such development, the costs of such development and other capital costs, financing plans for these deposits and expected production commencement dates; |

| ● | estimates of mineral reserves and mineral resources statements regarding future exploration results and mineral reserve and mineral resource replacement and the sensitivity of mineral reserves to metal price changes; |

| ● | statements regarding the availability of, and terms and costs related to, future borrowing or financing and expectations regarding future debt repayments; |

| ● | statements regarding future dividends and returns to shareholders; |

| ● | estimates regarding future exploration expenditures, programs and discoveries; |

| ● | statements regarding fluctuations in financial and currency markets; |

| ● | estimates regarding potential cost savings, productivity, operating performance and ownership and cost structures; |

| ● | expectations regarding statements regarding future transactions, including, without limitation, statements related to future acquisitions and projected benefits, synergies and costs associated with acquisitions and related matters; |

| ● | expectations of future equity and enterprise value; |

| ● | expectations regarding the start-up time, design, mine life, production and costs applicable to sales and exploration potential of our projects; |

| ● | statements regarding future hedge and derivative positions or modifications thereto; |

| ● | statements regarding local, community, political, economic or governmental conditions and environments; |

| ● | statements regarding the outcome of any legal, regulatory or judicial proceeding; |

| ● | statements and expectations regarding the impacts of COVID-19 and variants thereof and other health and safety conditions; |

| ● | statements regarding the impacts of changes in the legal and regulatory environment in which we operate, including, without limitation, relating to regional, national, domestic and foreign laws; |

| ● | statements regarding climate strategy and expectations regarding greenhouse gas emission targets and related operating costs and capital expenditures; |

4

| ● | statements regarding expected changes in the tax regimes in which we operate, including, without limitation, estimates of future tax rates and estimates of the impacts to income tax expense, valuation of deferred tax assets and liabilities, and other financial impacts; |

| ● | estimates of income taxes and expectations relating to tax contingencies or tax audits; |

| ● | estimates of future costs, accruals for reclamation costs and other liabilities for certain environmental matters, including without limitation, in connection with water treatment and tailings management; |

| ● | statements relating to potential impairments, revisions or write-offs, including without limitation, the result of fluctuation in metal prices, unexpected production or capital costs, or unrealized mineral reserve potential; |

| ● | estimates of pension and other post-retirement costs; |

| ● | statements regarding estimates of timing of adoption of recent accounting pronouncements and expectations regarding future impacts to the financial statements resulting from accounting pronouncements; |

| ● | estimates of future cost reductions, synergies, savings and efficiencies in connection with full potential programs and initiatives; and |

| ● | expectations regarding future exploration and the development, growth and potential of operations, projects and investments, including in respect of the Cerro Los Gatos Mine (“CLG”) and the Los Gatos District (“LGD”). |

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements.

All forward-looking statements speak only as of the date on which they are made. These statements are not a guarantee of future performance and involve certain risks, uncertainties and assumptions concerning future events that are difficult to predict. Therefore, actual future events or results may differ materially from these statements. Important factors that could cause our actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the risks set forth under “Risk Factors Summary” below, which are discussed in further detail in “Item 1A—Risk Factors.” Such factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements included in this Report and those described from time to time in our filings with the SEC. These risks and uncertainties, as well as other risks of which we are not aware or which we currently do not believe to be material, may cause our actual future results to be materially different than those expressed in our forward-looking statements. Undue reliance should not be placed on these forward-looking statements. We do not undertake any obligation to make any revisions to these forward-looking statements to reflect events or circumstances after the date of this filing or to reflect the occurrence of unanticipated events, except as required by law. Certain forward-looking statements are based on assumptions, qualifications and procedures which are set out only in the Los Gatos Technical Report. For a complete description of assumptions, qualifications and procedures associated with such information, reference should be made to the full text of the Los Gatos Technical Report.

5

Risk Factors Summary

We are subject to a variety of risks and uncertainties, including risks related to our business and industry; risks related to government regulations and international operations; risks related to the ownership of our common stock; and certain general risks, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. These risks include, but are not limited to, the following principal risks:

| ● | we are currently dependent on the CLG and the LGD for our future operations and may not be successful in identifying additional proven or probable mineral reserves; we may not be able to extend the current CLG life of mine by adding proven or probable mineral reserves; |

| ● | we may not sustain profitability; |

| ● | mineral reserve and mineral resource calculations at the CLG and other deposits in the CLG are only estimates and actual production results or future estimates may vary significantly from the current estimates; |

| ● | our and the Los Gatos Joint Venture’s (the “LGJV”) mineral exploration efforts are highly speculative in nature and may be unsuccessful; |

| ● | actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there are no assurances that any future development activities will result in profitable mining operations; |

| ● | our operations involve significant risks and hazards inherent to the mining industry; |

| ● | the ability to mine and process ore at the CLG or other future operations may be adversely impacted in certain circumstances, some of which may be unexpected and not in our control; |

| ● | land reclamation and mine closure may be burdensome and costly and such costs may exceed our estimates; |

| ● | we may be materially and adversely affected by challenges relating to stability of underground openings; |

| ● | the title to some of the mineral properties may be uncertain or defective and we may be unable to obtain necessary surface and other rights to explore and exploit some mineral properties; |

| ● | we are subject to the risk of labor disputes, which could adversely affect our business, and which risk may be increased due to the unionization in the LGJV workforce; |

| ● | our success depends on developing and maintaining relationships with local communities and stakeholders; |

| ● | the prices of silver, zinc and lead are subject to change and a substantial or extended decline in the prices of silver, zinc or lead could materially and adversely affect our revenues of the LGJV and the value of our mineral properties; |

| ● | the Mexican federal and state governments, as well as local governments, extensively regulate mining operations, which impose significant actual and potential costs on us, and future regulation could increase those costs, delay receipt of regulatory refunds or limit our ability to produce silver and other metals; |

| ● | the Mexican federal government recently promulgated significant amendments to laws affecting the mining industry; while it is difficult to ascertain if and when the amendments will be fully implemented, and there is some lack of clarity in their drafting including their intended retroactive effect, the amendments could have a material adverse effect on the mining industry, and the LGJV’s and our Mexican businesses, particularly in respect of any new concessions, new mining permits, and new operations; |

| ● | our operations are subject to additional political, economic and other uncertainties not generally associated with U.S. operations; |

6

| ● | we are required to obtain, maintain and renew environmental, construction and mining permits, which is often a costly and time-consuming process and may ultimately not be possible; |

| ● | Electrum and its affiliates and MERS have a substantial degree of influence over us, which could delay or prevent a change of corporate control or result in the entrenchment of our management and/or Board of Directors; |

| ● | we are currently, and may in the future be, subject to claims and legal proceedings, including class action lawsuits, that could materially and adversely impact our financial position, financial performance and results of operations; and |

| ● | we have identified material weaknesses in our internal control over financial reporting. If we fail to remediate these deficiencies (or fail to identify and/or remediate other possible material weaknesses), we may be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud, which may adversely affect investor confidence in us and, as a result, the value of our common stock. |

For a more complete discussion of the material risk factors applicable to us, see “Item 1A. Risk Factors.”

7

PART I

Item 1. Business

Our Company

We are a Canadian-headquartered, Delaware-incorporated precious metals exploration, development and production company with the objective of becoming a leading silver producer. We were formed on February 2, 2011, when our predecessor Precious Metals Opportunities LLC, which was formed in December 2009, converted to a Delaware corporation. On March 1, 2011, Los Gatos Ltd. merged with and into us to form Sunshine Silver Mines Corporation. In 2014, we changed our name to Sunshine Silver Mining & Refining Corporation.

We completed our initial public offering in October 2020, as part of which we distributed our equity interest in Silver Opportunity Partners LLC, which held our interest in the Sunshine Complex in Idaho, to our stockholders and changed our name to Gatos Silver, Inc.

Our primary efforts are focused on the operation of the LGJV in Chihuahua, Mexico. The LGJV was formed on January 1, 2015, when we entered into the Unanimous Omnibus Partner Agreement with Dowa Metals and Mining Co., Ltd. (“Dowa”) to further explore, and potentially develop and operate mining properties within the LGD. The entities comprising the LGJV are Minera Plata Real S. de R.L. de C.V. (‘‘MPR’’) and Operaciones San Jose de Plata S. de R.L. de C.V (“OSJ”) (collectively, the ‘‘LGJV Entities’’). The LGJV Entities own mineral rights and certain surface associated with the LGD. The LGJV ownership is currently 70% Gatos Silver and 30% Dowa. On September 1, 2019, the LGJV commenced commercial production at CLG, which produces silver-containing lead concentrate and zinc concentrate. The LGJV’s lead and zinc concentrates are sold to third-party customers. Pursuant to the Unanimous Omnibus Partner Agreement, Dowa has the right to purchase 100% of the zinc concentrate produced from the CLG, at rates negotiated in good faith based on industry pricing benchmarks, and agreed between Dowa and MPR. The Unanimous Omnibus Partner Agreement requires unanimous partner approval of all major operating decisions (such as annual budgets, the creation of security interests on property, and certain major expenditures); therefore, despite our 70% ownership of the LGJV, we do not exercise control of the LGJV.

In addition to our 70% interest in the LGD, we have 100% ownership of the Santa Valeria property, located in Chihuahua, Mexico, which comprises 1,543 hectares and could provide additional opportunities for resource growth.

Our Principal Projects

We are currently focused on the production and continued development of the CLG and the further exploration and development of the LGD:

| ● | The CLG, located within the LGD, described below, consists of a polymetallic mine and processing facility that commenced commercial production on September 1, 2019 and currently processes over 2,800 tonnes per day (“tpd”) of ore. The Los Gatos Technical Report estimates that, as of July 1, 2022, the deposit contains approximately 6.07 million diluted tonnes of proven and probable mineral reserves, with approximately 2.32 million diluted tonnes of proven mineral reserves and approximately 3.75 million tonnes of probable mineral reserves. Average proven and probable mineral reserve grades are 244 g/t silver, 4.48% zinc, 2.14% lead and 0.27 g/t gold. As of July 1, 2022, the measured and indicated mineral resource was 1.94 million tonnes grading 96 g/t silver, 3.01% zinc, 1.56% lead and 0.19 g/t gold with 0.38 million tonnes of measured resource and 1.55 million tonnes of indicated resource and the inferred mineral resource was 2.09 million tonnes grading 113 g/t silver, 4.30% zinc, 2.45% lead and 0.20 g/t gold at the CLG. The mineral reserve and resource estimates contained in the Los Gatos Technical Report have an effective date of July 1, 2022 and exclude material that was mined before that effective date. From July 1, 2022 to March 31, 2023, approximately 786,000 tonnes of material was processed by the CLG mill. This processed material included mineral reserve tonnes, and to a lesser extent mineral resource tonnes as well as mineralized material not included in the mineral resource estimates. The mineral resource estimates contained in the Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery. |

8

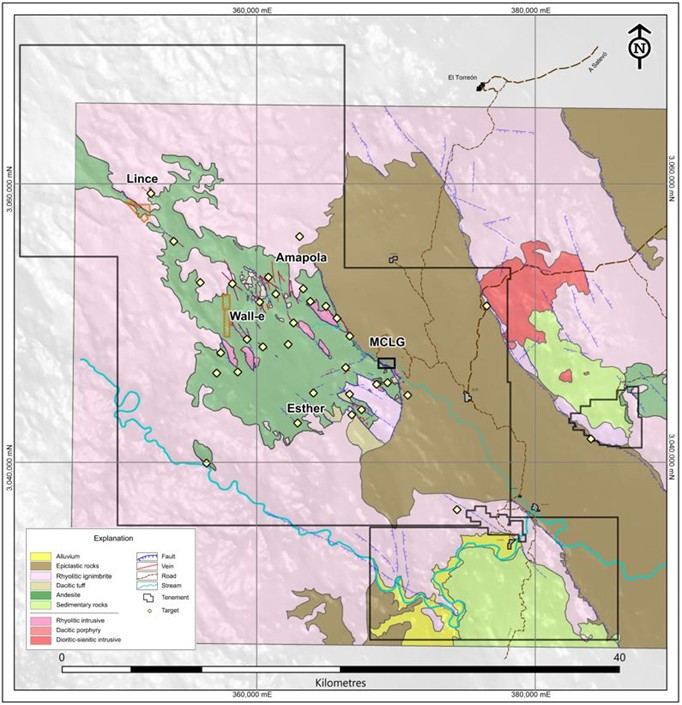

| ● | The LGD, located in Chihuahua, Mexico, is approximately 120 kilometers south of Chihuahua City and is comprised of a 103,087 hectare land position, constituting a new mining district. The LGD consists of multiple mineralized zones. Two of the identified mineralized zones, Cerro Los Gatos and Esther, have reported mineral resources. The Los Gatos Technical Report estimates that the Esther deposit contains 0.28 million tonnes of indicated mineral resources at average grades of 122 g/t silver, 4.30% zinc, 2.17% lead and 0.14 g/t gold, and 1.20 million tonnes of inferred mineral resources at average grades of 133 g/t silver, 3.69% zinc, 1.53% lead and 0.09 g/t gold. The mineral resource estimates for the Esther deposit have an effective date of July 1, 2022 and have not been updated since that time. The mineral resource estimates contained in the Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery. The deposits in the LGD are characterized by predominantly silver-lead-zinc epithermal mineralization. A core component of the LGJV’s business plan is to explore the highly prospective, underexplored LGD with the objective of identifying additional mineral deposits that can be developed, mined and processed, possibly utilizing the CLG plant infrastructure. The history of mineral exploration in relation to the LGD is described below. |

Prior to our initial acquisition of exploration concession rights in April 2006, very limited historical prospecting and exploration activities had been conducted in the LGD. We were able to acquire mineral concessions covering 103,087 hectares and, through our exploration, discovered a new silver region containing potential high-grade epithermal vein-style mineralization throughout the LGD concession package. In 2008, we negotiated certain surface access rights with local ranch owners and obtained the environmental permits for drilling and road construction necessary for the development of the CLG. Through 2015, we purchased all the surface lands required for the CLG development. Environmental baseline data collection began in May 2010 and was completed in 2016 and approved in 2017 to prepare for the development of future environmental studies required for the CLG. In 2014, we partnered with Dowa to finance and develop the CLG and pursue exploration in the LGD and, as noted above, entered into the Unanimous Omnibus Partner Agreement in early 2015.

We believe that we have strong support from the local community, with about 195 employees from the local community working across multiple areas involving the operation of the CLG, continued underground development, and construction of sustaining development projects. Over 99% of the approximate 824 employees at the CLG are from Mexico, highlighting our commitment to the local workforce.

Our primary areas of focus have been operating and developing the CLG, defining and expanding the mineral reserves and mineral resources associated with the CLG and exploring and delineating resources within the LGD. As of March 31, 2023, 1,926 exploration and definition drill holes have been completed in both CLG and the LGD, totaling 466,104 meters. In 2022, LGD exploration drilling was completed at Esther, Cascabel, Wall-e and El Valle targets and detailed mapping occurred and Wall-e and Cascabel. Definition and expansion drilling was completed around CLG both from surface and underground.

Our objectives at the CLG are to, among other things:

| ● | continue strong operating and cost performance; |

| ● | maximize margins and extend the LOM; |

| ● | complete key capital projects and other initiatives to enhance mining efficiencies and reduce operating costs; and |

| ● | perform additional in-fill and step-out drilling to convert mineral resources to reserves and delineate mineral resources and reserves from the recently discovered mineralization below the South-East zone of the CLG (“South-East Deeps”). |

Our objectives at the LGD are to realize the district potential through, among other things:

| ● | detailed mapping and drill testing at the Esther, Amapola and El Lince Area deposits; |

| ● | district mapping and geophysics in the Rio Conchos basin and additional exposed and underlying andesite in the region to identify additional drill targets; and |

| ● | continued expansion of the LGJV’s interest in prospective mineral and surface rights. |

9

For the years ended December 31, 2022 and 2021, the LGJV achieved the following production from CLG:

CLG Production (100% Basis) |

| 2022 |

| 2021 | |||

Tonnes milled (dmt - reconciled) |

| 971,595 |

| 909,586 | |||

Tonnes milled per day (dmt) |

| 2,662 |

| 2,492 | |||

Average Feed Grades |

|

|

| ||||

Silver grade (g/t) |

| 368 |

| 295 | |||

Zinc grade (%) |

| 4.37 |

| 3.94 | |||

Lead grade (%) |

| 2.31 |

| 2.27 | |||

Gold grade (g/t) |

| 0.33 |

| 0.32 | |||

Contained Metal |

|

|

| ||||

Silver ounces (millions) |

| 10.3 |

| 7.6 | |||

Zinc pounds - in zinc conc. (millions) |

| 60.7 |

| 49.6 | |||

Lead pounds - in lead conc. (millions) |

| 43.9 |

| 39.8 | |||

Gold ounces - in lead conc. (thousands) |

| 5.3 |

| 5.2 | |||

Recoveries* |

|

|

| ||||

Silver - in both lead and zinc concentrates |

| 89.8 | % | 88.3 | % | ||

Zinc - in zinc concentrate |

| 64.8 | % | 62.9 | % | ||

Lead - in lead concentrate |

| 88.7 | % | 87.6 | % | ||

Gold - in lead concentrate |

| 52.0 | % | 56.3 | % | ||

Average realized price per silver ounce | $ | 20.72 | $ | 24.38 | |||

Average realized price per zinc pound | $ | 1.58 | $ | 1.38 | |||

Average realized price per lead pound | $ | 0.90 | $ | 1.01 | |||

Average realized price per gold ounce | $ | 1,678 | $ | 1,761 | |||

* | Recoveries are reported for payable metals in the identified concentrate. |

Strategic Developments

Our business strategy is focused on creating value for stakeholders through the ownership and advancement of the CLG and the LGD and through the pursuit and the development of other attractive silver-focused projects. The following outlines key strategic developments since January 1, 2022:

| ● | Inaugural Dividends Paid to LGJV Partners. In 2022, the LGJV paid three dividends to its partners, totaling $55 million, of which the Company’s share was $29.2 million, net of withholding taxes and after initial priority distribution payments to Dowa. |

| ● | Reestablished and Extended our Revolving Credit Facility (the “Credit Facility”): On July 12, 2021, we entered into the Credit Facility with Bank of Montreal (“BMO”) that provides for a $50 million revolving line of credit with an accordion feature. On March 7, 2022, we amended the Credit Facility with BMO, to address potential loan covenant deficiencies, which resulted, inter alia, in the credit limit being reduced to $30 million. |

On December 19, 2022, we entered into an amended and restated Credit Facility with BMO, extending the maturity date to December 31, 2025, and re-establishing a credit limit of $50 million, with an accordion feature.

| ● | New Mineral Resource and Mineral Reserve Estimates. In the fourth quarter of 2022, we completed a full re-estimation of the Company’s mineral resources and mineral reserves as published in the Los Gatos Technical Report. The mineral resources and mineral reserves were completely rebuilt from base data, including data compilation of surface drilling, underground drilling, underground mapping and production data, comprehensive data validation, structural and geological interpretation, resource estimation, reconciliation to actual production, and a new mine design including updates to operating and capital costs. |

| ● | Discovery of South-East Deeps Zone at CLG and further exploration success. In 2022, through the LGJV, we discovered mineralization below the South-East zone of the CLG. This newly identified zone extends approximately 415 meters below the reported mineral reserve. On January 23, 2023 we announced continued exploration drilling success demonstrating significant mine life extension potential through resource conversion and expansion at CLG. On April 19, |

10

| 2023 we announced that we were continuing to intercept strong widths and grades of silver, zinc, lead, gold and, copper in the case of the South-East and South-East Deeps zones. We also announced encouraging results from our resource conversion and extension drilling which will be reflected in an updated mineral reserve and mineral resource estimate that is expected to be completed in the third quarter of 2023. We also announced that we continued to see significant potential for new discoveries beyond the CLG deposit, highlighted by progress in our district exploration program. |

| ● | Demonstrated Excellent Operational Performance. For 2022, we reported record silver production at the CLG, that exceeded our 2022 guidance. Silver production was 10.3 million ounces in 2022, up 36% from 7.6 million ounces in 2021, and above the high-end of the 2022 guidance range. Zinc, lead and gold production also increased during 2022, with zinc and gold near the high-end of guidance, and lead near the guidance midpoint. Compared with 2021, in 2022, zinc production increased by 22%, lead production increased by 10%, and gold production increased by 2%. The higher silver production for 2022 was primarily due to higher silver ore grades and higher mill throughput rates. Production sequencing in 2022 was from the highest-grade sections of the orebody, as considered in the LOM plan included in the Los Gatos Technical Report. We expect to produce 7.4 to 8.2 million ounces of silver, 57 to 63 million pounds of zinc, 36 to 40 million pounds of lead and 5.4 thousand to 6.2 thousand ounces of gold in 2023. On April 12, 2023, we announced record CLG production results for the first quarter ended March 31, 2023, with record mill throughput of 2,894 tonnes milled per day and production of 2.43 million ounces of silver, 14 million pounds of zinc, 9.5 million pounds of lead and 1.38 thousand ounces of gold. |

| ● | Fluorine Leach Plant Construction and Operation to Serve as Payment Towards Priority Distribution to Dowa. As agreed with Dowa, the initial payment of the priority distribution was reduced to reflect a portion of both the construction and future estimated operating costs of the new fluorine leach plant, subject to the successful construction and operation of the plant. |

| ● | Optimization of CLG Assets and Capital Improvements. Mill throughput averaged 2,847 tpd during the fourth quarter of 2022, an increase of 9% compared to the fourth quarter of 2021, and significantly exceeded the mill design rate of 2,500 tpd. During 2022, the mill achieved a record 2,662 tpd, which was 7% higher than in 2021. Silver, zinc and lead recoveries for 2022 were also higher than in 2021. During the fourth quarter of 2022, we completed the construction and commissioning of the paste backfill plant. The paste backfill plant is expected to increase operational flexibility and productivity as well as help lower operating costs going forward. Construction of the fluorine leach plant is progressing well and it is expected to be commissioned in the second quarter of 2023, and reduce the amount of deleterious content in zinc concentrates being sent to Dowa. The LGJV expects to spend $45 million on sustaining capital during 2023 of which $25 million is expected to be incurred on underground development to access the lower levels of the Northwest and Central zones and to further develop the Southeast zone. The remainder of capital expenditures for 2023 are expected to be primarily associated with equipment replacements and rebuilds, dewatering infrastructure, and for completion of the fluorine leach plant. Commissioning of the fluorine leach plant is expected to commence in the second half of June 2023. |

| ● | Strong Financial Performance. On June 6, 2023 we reported operating and select unaudited financial results for the three months ended March 31, 2023 (“Q1 2023”), the three months ended December 31, 2022 (“Q4 2022”) and the year ended December 31, 2022. For Q1 2023, cash flow from operations for the LGJV was $44.5 million, up 6% from $42.1 million a year earlier. For Q4 2022 and the full year 2022 cash flow from operations for the LGJV was $39.1 million in Q4 2022 and $157.4 million for the full year 2022, increases of 12% and 31%, respectively, compared with the year-earlier periods. We also announced that we were on track to achieve our previously stated production and cost guidance for 2023 noting that silver production is expected to be higher in the first half of 2023 than in the second half of 2023 based on sequencing of the mine plan while zinc and lead production are expected to be higher in the second half of the year than in the first half. |

| ● | Corporate Developments. We relocated our corporate office from Denver, Colorado, to Vancouver, British Columbia, providing improved access to experienced mining managerial talent. We strengthened the executive management team with the appointments of a new Chief Financial Officer, a General Counsel and Chief Compliance Officer, and a Senior Vice President, Corporate Development and Technical Services, all with extensive experience working for large multinational mining companies. |

11

Our Strengths

We believe the following provide us with significant competitive advantages:

| ● | Our Assets are High Quality: As noted above, the CLG achieved strong operational performance in 2022. Per the Los Gatos Technical Report, the CLG is expected to produce an average of 7.4 million ounces of silver per annum at low all-in-sustaining-costs over the LOM. |

| ● | Our Assets are Located in an Established Mining Region: The CLG and the LGD are located in one of the world’s premier silver mining regions: the Mexican Silver Belt, which was the world’s largest silver producing region in 2021. Mexico is a leading silver mining jurisdiction and has a long history of successful mineral development and operations. We have access to experienced and capable mining employees in Mexico. |

| ● | Further Optimization Potential at CLG: At the CLG, we apply continuous improvement practices designed to reduce costs, and improve throughput and recoveries. For example, during 2023, we anticipate completing a scoping study on the possible future expansion of the grinding circuit to 3,500 tpd to better utilize the capacity in the existing flotation circuit. |

| ● | Growth Potential in our Mineral Reserves and Resources from Further Exploration of the CLG and the LGD: Through the LGJV, we have continued our in-mine and near-mine exploration program in the CLG and our exploration activities in the LGD. In the CLG, we expect to convert inferred resources from higher-grade areas located adjacent to planned mine development and also expect there to be further LOM extension opportunity in the South-East Deeps area of the CLG. We expect to complete new mineral resource and mineral resource estimates for the Company in the third quarter of 2023. We also believe the LGD is a highly prospective area, with 103,087 contiguous hectares of mineral rights. The LGD is located in the Mexican Silver Belt, a geologic zone that hosts numerous significant silver producing operations. The LGD represents an underexplored property within this productive belt, where there has been little historical workings or previous exploration. On November 22, 2022, we disclosed our exploration strategy for the LGD which entails a focus on two key areas: an exposed section of andesite running from the northwest boundary of the district to Esther and the CLG, and a large basin southeast of the CLG underlain by andesite and which we anticipate may contain other large, district-scale fault structures conducive to large deposits. We are currently prioritizing exploration efforts on areas closer to the CLG and areas with the highest potential to leverage existing surface and underground infrastructure. The LGJV is expected to incur drilling and exploration expenditures of approximately $13 million in 2023. At the CLG, there are currently five active drill rigs on surface and three underground, with the primary focus on CLG life extension including drilling of the South-East Deeps zone and gradually shifting focus towards exploration drilling of the LGD in the second half of 2023. We also plan to conduct detailed mapping of the district and undertake a geophysics survey program aiming to define structures and future drilling targets across the property. |

| ● | Management Team and Board of Directors are Highly Experienced: We have an experienced management team whose members have successful track records in the mining industry. Our Chief Executive Officer, Dale Andres; Chief Financial Officer, André van Niekerk; Senior Vice President of Evaluations and Technical Services, Tony Scott; and General Counsel and Chief Compliance Officer, Stephen Bodley, each has significant experience in developing, financing, and operating successful mining projects. Our Board of Directors is comprised of senior mining, financial and business executives who have broad domestic and international experience in mineral exploration, development and mining operations at notable mining companies. We believe that the specialized skills and knowledge of the management team and the Board of Directors will significantly enhance our ability to cost-effectively operate the CLG and extend its LOM, explore and develop the LGD and pursue other growth opportunities. |

Summary of Mineral Reserves and Mineral Resources

Below is a summary table of estimated mineral resources and mineral reserves. Further information can be found in "Item 2. Properties." The mineral reserve and mineral resource estimates contained in the Los Gatos Technical Report have an effective date of July 1, 2022 and exclude mineral reserves that have previously been mined prior to this date. From July 1, 2022 to March 31, 2023, approximately 786,000 tonnes of material were processed by the CLG mill. This processed material included mineral reserve tonnes, and to a lesser extent mineral resource tonnes as well as mineralized material not included in the mineral resource estimates. The mineral resource estimates contained in the Los Gatos Technical Report are presented on an undiluted basis without adjustment for mining recovery.

12

Summary Mineral Reserves as of July 1, 2022

CLG Mineral Reserves Statement

Reserve |

|

| Ag |

| Zn |

| Pb |

| Au |

| Ag |

| Zn |

| Pb |

| Au | |

Classification | Mt | (g/t) | (%) | (%) | (g/t) | (Moz) | (Mlbs) | (Mlbs) | (koz) | |||||||||

Proven |

| 2.32 |

| 309 |

| 4.33 |

| 2.20 |

| 0.31 |

| 23.1 |

| 221.6 |

| 112.3 |

| 23.0 |

Probable |

| 3.75 |

| 204 |

| 4.57 |

| 2.11 |

| 0.24 |

| 24.6 |

| 377.4 |

| 174.4 |

| 28.7 |

Proven and Probable Reserve |

| 6.07 |

| 244 |

| 4.48 |

| 2.14 |

| 0.27 |

| 47.7 |

| 599.1 |

| 286.7 |

| 51.8 |

1. | Mineral Reserves are reported on a 100% basis and exclude all Mineral Reserve material mined prior to July 1, 2022. |

2. | Specific gravity has been assumed on a dry basis. |

3. | Tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. |

4. | Values are inclusive of mining recovery and dilution. Values are determined as of delivery to the mill and therefore not inclusive of milling recoveries. |

5. | Mineral Reserves are reported within stope shapes using a variable cut-off basis with a Ag price of US$22/oz, Zn price of US$1.20/lb, Pb price of US$0.90/lb and Au price of US$1,700/oz. The metal prices used for the Mineral Reserves are based on the three-year trailing prices from June 2019 to June 2020 and long-term analyst consensus estimates for the LOM. |

6. | The Mineral Reserve is reported on a fully diluted basis defined by mining method, stope geometry and ground conditions. |

7. | Contained Metal (CM) is calculated as follows: |

| ● | Zn and Pb, CM (Mlb) = Tonnage (Mt) * Grade (%) / 100 * 2204.6 |

| ● | Ag and Au, CM (Moz) = Tonnage (Mt) * Grade (g/t) / 31.1035 ; multiply Au CM (Moz) by 1000 to obtain Au CM (koz) |

8. | The SEC definitions for Mineral Reserves in S-K 1300 were used for Mineral Reserve classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions). |

9. | Mineral Reserves are those parts of Mineral Resources which, after the application of all mining factors, result in an estimated tonnage and grade which, in the opinion of the Qualified Person(s) making the estimates, is the basis of an economically viable project after taking account of all relevant Modifying Factors. Mineral Reserves are inclusive of diluting material that will be mined in conjunction with the Mineral Reserves and delivered to the treatment plant or equivalent facility. |

10. | Proven Reserves include a 15.4-kt stockpile at June 30, 2022. The in-situ Reserve is 6,052 kt. Rounding and significant figures may result in apparent summation differences between tonnes and grade. |

11. | The Mineral Reserve estimates were prepared by Mr. Paul Gauthier, P.Eng. an employee of WSP Canada Inc. who is the independent Qualified Person for these Mineral Reserve estimates. |

Summary Mineral Resources (Exclusive of Mineral Reserves) as of July 1, 2022

CLG Mineral Resource Estimate

|

|

| Zn |

| Pb |

|

|

|

|

| ||||||||

Resource Classification | Mt | Ag (g/t) | (%) | (%) | Au (g/t) | Ag (Moz) | Zn (Mlbs) | Pb (Mlbs) | Au (koz) | |||||||||

Measured |

| 0.38 |

| 151 |

| 2.63 |

| 1.49 |

| 0.26 |

| 1.9 |

| 22.1 |

| 12.6 |

| 3.2 |

Indicated |

| 1.55 |

| 82 |

| 3.11 |

| 1.57 |

| 0.17 |

| 4.1 |

| 106.4 |

| 53.8 |

| 8.6 |

Measured and Indicated |

| 1.94 |

| 96 |

| 3.01 |

| 1.56 |

| 0.19 |

| 6.0 |

| 128.5 |

| 66.4 |

| 11.8 |

Inferred |

| 2.09 |

| 113 |

| 4.30 |

| 2.45 |

| 0.20 |

| 7.6 |

| 198.4 |

| 113.1 |

| 13.3 |

1. | Mineral Resources are reported on a 100% basis and are exclusive of Mineral Reserves. |

2. | Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. |

3. | The SEC definitions for Mineral Resources in S-K 1300 were used for Mineral Resource classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions). |

4. | The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resource. It is uncertain if further exploration will result in upgrading Inferred Mineral Resources to an Indicated or Measured Mineral Resource category. |

13

5. | Specific gravity has been assumed on a dry basis. |

6. | Tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. |

7. | Mineral Resources exclude all Mineral Resource material mined prior to July 1, 2022. |

8. | Mineral Resources are reported within stope shapes using a $42/tonne or $52/tonne NSR cut-off basis depending on mining method with an Ag price of $22/oz, Zn price of $1.20/lb, Pb price of $0.90/lb and Au price of $1,700/oz. The metal prices used for the Mineral Resource are based on the three-year trailing prices from June 2019 to June 2020 and long-term analyst consensus estimates for the LOM. |

9. | No dilution was applied to the Mineral Resource. |

10. | Contained Metal (CM) is calculated as follows: |

| ● | Zn and Pb, CM (Mlb) = Tonnage (Mt) * Grade (%) / 100 * 2204.6 |

| ● | Ag and Au, CM (Moz) = Tonnage (Mt) * Grade (g/t) / 31.1035; multiply Au CM (Moz) by 1000 to obtain Au CM (koz) |

11. | The Mineral Resource estimates were prepared by Ronald Turner, MAusIMM(CP) an employee of Golder Associates S.A. who is the independent Qualified Person for these Mineral Resource estimates. |

Esther Mineral Resource Estimate

|

| Ag |

| Zn |

| Pb |

| Au |

| Ag |

| Zn |

| Pb |

| Au | ||

Resource Classification | Mt | (g/t) | (%) | (%) | (g/t) | (Moz) | (Mlbs) | (Mlbs) | (koz) | |||||||||

Indicated | 0.28 | 122 | 4.30 | 2.17 | 0.14 | 1.1 | 26.8 | 13.6 | 1.2 | |||||||||

Inferred |

| 1.20 |

| 133 |

| 3.69 |

| 1.53 |

| 0.09 |

| 5.1 |

| 98.0 |

| 40.6 |

| 3.3 |

1. | Mineral Resources are reported on a 100% basis. |

2. | Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. |

3. | The SEC definitions for Mineral Resources in S-K 1300 were used for Mineral Resource classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions). |

4. | The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resource. It is uncertain if further exploration will result in upgrading Inferred Mineral Resources to an Indicated or Measured Mineral Resource category. |

5. | Specific gravity has been assumed on a dry basis. |

6. | Tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. |

7. | Mineral Resources are reported within stope shapes using a $52/tonne NSR cut-off basis assuming processing recoveries equivalent to CLG with an Ag price of $22/oz, Zn price of $1.20/lb, Pb price of $0.90/lb and Au price of $1,700/oz. The metal prices used for the Mineral Resource are based on the three-year trailing prices from June 2019 to June 2020 and long-term analyst consensus estimates for the LOM. There is a portion of the Esther deposit that is oxidized and metallurgical test work is required to define processing recoveries. |

8. | No dilution was applied to the Mineral Resource. |

9. | Contained Metal (CM) is calculated as follows: |

| ● | Zn and Pb, CM (Mlb) = Tonnage (Mt) * Grade (%) / 100 * 2204.6 |

| ● | Ag and Au, CM (Moz) = Tonnage (Mt) * Grade (g/t) / 31.1035 ; multiply Au CM (Moz) by 1000 to obtain Au CM (koz) |

10. | The Mineral Resource estimates were prepared by Ronald Turner, MAusIMM(CP) an employee of Golder Associates S.A. who is the independent Qualified Person for these Mineral Resource estimates. |

Competition

There is aggressive competition within the mining and precious metals industry. We compete with other precious metals mining companies, as well as other mineral miners, in efforts to obtain financing to explore and develop projects. Many of these mining companies currently have greater resources than we do. In the future, we may compete with such companies to acquire additional properties.

In addition, we also encounter competition for the hiring of key personnel. The mining industry is currently facing a shortage of experienced mining professionals, particularly experienced mine construction and mine management personnel. This competition affects our operations. Larger regional companies can offer better employment terms than smaller companies such as us. In addition, the volatility in our stock price reduces our ability to attract and retain such personnel through the use of share-based compensation.

14

We also compete for the services of mine service companies, such as project coordinators and drilling companies. Potential suppliers may choose to provide better terms and scheduling to larger companies in the industry due to the scale and scope of their operations.

Environmental, Health and Safety Matters

We are subject to stringent and complex environmental laws, regulations and permits in the jurisdiction in which we operate. These requirements are a significant consideration for us as our operations involve, or may in the future involve, among other things, the removal, extraction and processing of natural resources, emission and discharge of materials into the environment, remediation of soil and groundwater contamination, workplace health and safety, reclamation and closure of waste impoundments and other properties, and handling, storage, transport and disposal of wastes and hazardous materials. Compliance with these laws, regulations and permits can require substantial capital or operating costs or otherwise delay, limit or prohibit our development or future operation of our properties. These laws, regulations and permits, and the enforcement and interpretation thereof, change frequently and generally have become more stringent over time. If we violate these environmental requirements, we may be subject to litigation, fines or other sanctions, including the revocation of permits and suspension of operations. Pursuant to such requirements, we also may be subject to inspections or reviews by governmental authorities.

Permits and Approvals

We were issued the major government approvals required to construct and operate the CLG facilities during 2017. While there are multiple approvals from multiple levels of government, the key government approval for the project is the MIA (Environmental Impact Assessment), issued in July 2017 and valid until 2041. As the mine plan changes, it may be necessary to conduct environmental studies and collect and present to governmental authorities data pertaining to the potential impact that our current or future operations may have upon the environment. Since the original MIA approval was granted in 2017, we have successfully achieved three amendments to the MIA approval to reflect changes to the mine plan and facilities.

We have the approvals necessary to extract and process the mineral reserve as described in the Los Gatos Technical Report. In 2022, the LGJV applied for a permit amendment for the operation of the fluorine leach project and timely submitted all required information. The LGJV has not received a final response from the relevant government authorities within the required timeframe and the permit amendment has, therefore, been presumptively approved by operation of Mexican law. Even if the approval were revoked, we would not expect a material impact to the economics of the CLG operation.

Our and the LGJV’s ability to obtain permits and approvals in future may be adversely affected by the significant amendments to laws affecting the mining industry promulgated by the Mexican federal government on May 8, 2023

Hazardous Substances and Waste Management

We could be liable for environmental contamination at or from our or our predecessors’ currently or formerly owned or operated properties or third-party waste disposal sites. Certain environmental laws impose joint and several strict liability for releases of hazardous substances at such properties or sites, without regard to fault or the legality of the original conduct. A generator of waste can be held responsible for contamination resulting from the treatment or disposal of such waste at any off-site location (such as a landfill), regardless of whether the generator arranged for the treatment or disposal of the waste in compliance with applicable laws. Costs associated with liability for removal or remediation of contamination or damage to natural resources could be substantial and liability under these laws may attach without regard to whether the responsible party knew of, or was responsible for, the presence of the contaminants. In addition to potentially significant investigation and remediation costs, such matters can give rise to claims from governmental authorities and other third parties for fines or penalties, natural resource damages, personal injury and property damage.

Mine Health and Safety Laws

All of our current properties are located in Mexico and are subject to regulation by the Political Constitution of the United Mexican States, and are subject to various legislation in Mexico, including the Mining Law, the Federal Law of Waters, the Federal Labor Law, the Federal Law of Firearms and Explosives, the General Law on Ecological Balance and Environmental Protection and the Federal Law on Metrology Standards, as well as the accompanying regulations and regulatory authorities. Mining, environmental and labor authorities may inspect our operations on a regular basis and issue various citations and orders when they believe a violation has occurred under the relevant statute. Regulations and the results of inspections may have a significant effect on our operating costs.

15

At this time, it is not possible to predict the full effect that the new or proposed statutes, regulations and policies will have on our operating costs, but it may increase our costs and those of our competitors.

Other Environmental Laws

We are required to comply with numerous other environmental laws, regulations and permits in addition to those previously discussed. These additional requirements include, for example, various permits regulating road construction and drilling at the Mexican properties.

We endeavor to conduct our mining operations in compliance with all applicable laws and regulations. However, because of extensive and comprehensive regulatory requirements, violations during mining operations occur from time to time in the industry.

Facilities and Employees

We own and lease land at our other exploration properties in Mexico and at the LGD through our ownership interest in the LGJV.

As of May 31, 2023, we had no full-time employees in the United States, twelve full time employees in Canada and eight full-time employees in Mexico. The LGJV had approximately 824 employees in Mexico, including approximately 577 unionized employees as of December 2022. We believe that our employee relations are good and plan to continue to hire employees as our operations expand at the LGJV. The health and safety of our employees and the employees of the LGJV is our highest priority, consistent with our business culture and values. In addition to tracking common lagging indicators, such as injury performance, we focus on leading indicators such as high potential incidents and safety observations, as well as other proactive actions taken at site to ensure worker safety. We are committed to operating in accordance with high ethical standards and believe this is a key motivational factor for our employees. In 2022, we updated our Code of Conduct as well as other core compliance policies and conducted training and compliance certification with all our employees, employees of our wholly-owned subsidiaries and employees of the LGJV. We continue to emphasize employee development and training to empower employees both at the corporate level and at the LGJV level to enhance employees’ potential and benefit the business. We leverage both formal and informal programs to identify, foster, and retain top talent at both the corporate and the LGJV level.

Available Information

Our internet address is www.gatossilver.com. We make available free of charge through our investor relations website, https://investor.gatossilver.com, copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the SEC. The information contained on our website is not included as a part of, or incorporated by reference into, this Report.

Item 1A. Risk Factors

The following risks could materially and adversely affect our business, financial condition, cash flows, and results of operations, and the trading price of our common stock could decline. These risk factors do not identify all risks that we face; we could also be affected by factors that are not presently known to us or that we currently consider to be immaterial. Due to risks and uncertainties, known and unknown, our past financial results may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. Refer also to the other information set forth in this this Report, including our consolidated financial statements and the related notes and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Risks Related to Our Financial Condition

We are currently dependent on the CLG and the LGD for our future operations and may not be successful in identifying additional proven or probable mineral reserves. We may not be able to extend the current CLG life of mine by adding proven or probable mineral reserves.

The LGD (other than the CLG) does not have identified proven and probable mineral reserves. Mineral exploration and development involve a high degree of risk that even a combination of careful evaluation, experience and knowledge cannot eliminate,

16

and few properties that are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration programs at the LGD will establish the presence of any additional proven or probable mineral reserves. The failure to establish additional proven or probable mineral reserves would severely restrict our ability to implement our strategies for long-term growth, which include extending the current CLG life of mine.

We may not sustain profitability.

Prior to 2022, we had a history of negative operating cash flows and cumulative net losses. For the years ended December 31, 2022 and 2021, we reported net income of $14.5 million and net loss of $65.9 million, respectively. For the years ended December 31, 2022 and 2021, operating activities provided $14.6 million and used 21.5 million, respectively, of cash flow.

We may not sustain profitability. To remain profitable, we must succeed in generating significant revenues at the LGJV, which will require us to be successful in a range of challenging activities and is subject to numerous risks, including the risk factors set forth in this “Risk Factors” section. In addition, we may encounter unforeseen expenses, difficulties, complications, delays, inflation and other unknown factors that may adversely affect our revenues, expenses and profitability. Our failure to achieve or sustain profitability would depress our market value, could impair our ability to execute our business plan, raise capital or continue our operations and could cause our shareholders to lose all or part of their investment.

Deliveries under concentrate sales agreements may be suspended or cancelled by our customers in certain cases.

Under concentrate sales agreements, our customers may suspend or cancel delivery of our products in some cases, such as force majeure. Events of force majeure under these agreements generally include, among others, acts of God, strikes, fires, floods, wars, government actions or other events that are beyond the control of the parties involved. Any suspension or cancellation by our customers of deliveries under our sales contracts that are not replaced by deliveries under new contracts would reduce our cash flow and could materially and adversely affect our financial condition and results of operations.

We do not currently intend to enter into hedging arrangements with respect to metal prices or currencies, which could expose us to losses. We are also subject to risks relating to exchange rate fluctuations.

We do not currently intend to enter into hedging arrangements with respect to metal prices or currencies. As a result, we will not be protected from a decline in the price of silver and other minerals or fluctuations in exchange rates. This strategy may have a material adverse effect upon our financial performance, financial position and results of operations.

We report our financial statements in U.S. dollars. A portion of our costs and expenses are incurred in Mexican pesos and, to a lesser extent, Canadian dollars. As a result, any significant and sustained appreciation of these currencies against the U.S. dollar may materially increase our costs and expenses. Even if we seek and are able to enter into hedging contracts, there is no assurance that such hedging program will be effective, and any hedging program would also prevent us from benefitting fully from applicable input cost or rate decreases. In addition, we may in the future experience losses if a counterparty fails to perform under a hedge arrangement.

We and/or the LGJV have historically had significant debt and may incur further debt in the future, which could adversely affect our and the LGJV’s financial health and limit our ability to obtain financing in the future and pursue certain business opportunities.

We have a Credit Facility providing for a revolving line of credit in the principal amount of $50 million that has an accordion feature, which allows for an increase in the total line of credit up to $75 million, subject to certain conditions. As of December 31, 2022, we had $9 million of outstanding indebtedness under the Credit Facility. The Credit Facility contains affirmative and negative covenants. If we are unable to comply with the requirements of the Credit Facility, the facility may be terminated or the credit available thereunder may be materially reduced, and we may not be able to obtain additional or alternate funding on satisfactory terms, if at all. See Note 11 — Debt in our consolidated financial statements included in “Item 8. Financial Statements and Supplementary Data” for additional information regarding our Credit Facility. Our borrowings under the Credit Facility accrues interest based on SOFR; therefore, any increases in interest rates could adversely affect our financial conditions and ability to service our indebtedness.

While the LGJV currently has no significant debt service obligations, the LGJV may in the future incur debt obligations and the above factors would apply to such debt. For more information, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Dowa Debt Agreements.”

17

The Company’s effective tax rate could be volatile and materially change as a result of changes in tax laws, mix of earnings and other factors.

We are subject to tax laws in the United States and foreign jurisdictions including Mexico and Canada.

Changes in tax laws or policy could have a negative impact on the Company’s effective tax rate. The Company operates in countries which have different statutory rates. Consequently, changes in the mix and source of earnings between countries could have a material impact on the Company’s overall effective tax rate.

The LGJV is subject to Mexican income and other taxes, and distributions from the LGJV are subject to Mexican withholding taxes. Any change in such taxes could materially adversely affect our effective tax rate and the quantum of cash available to be distributed to us.

Risks Related to Our Operations

Mineral reserve and mineral resource calculations at the CLG and at other deposits in the LGD are only estimates and actual production results and future estimates may vary significantly from the current estimates.

Calculations of mineral reserves and mineral resources at the CLG and of mineral resources at other deposits in the LGD are only estimates and depend on geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which might prove to be materially inaccurate. There is a degree of uncertainty attributable to the calculation of mineral reserves and mineral resources. Until mineral reserves and mineral resources are actually mined and processed, the quantity of metal and grades must be considered as estimates only and no assurance can be given that the indicated levels of metals will be produced. In making determinations about whether to advance any of our projects to development, we must rely upon estimated calculations for the mineral reserves and mineral resources and grades of mineralization on our properties.

The estimation of mineral reserves and mineral resources is a subjective process that is partially dependent upon the judgment of the persons preparing the estimates. The process relies on the quantity and quality of available data and is based on knowledge, mining experience, statistical analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available.

Estimated mineral reserves and mineral resources may have to be recalculated based on changes in metal prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence mineral reserves and mineral resources estimates. The extent to which mineral resources may ultimately be reclassified as mineral reserves is dependent upon the demonstration of their profitable recovery. Any material changes in volume and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital. We cannot provide assurance that mineralization can be mined or processed profitably.

Mineral reserve and mineral resource estimates have been determined and valued based on assumed future metal prices, cutoff grades and operating costs that may prove to be inaccurate. The mineral reserve and mineral resource estimates may be adversely affected by:

| ● | declines in the market price of silver, lead or zinc; |

| ● | increased production or capital costs; |

| ● | decreased throughput; |

| ● | reduction in grade; |

| ● | increase in the dilution of ore; |

| ● | inflation rates, future foreign exchange rates and applicable tax rates; |

| ● | changes in environmental, permitting and regulatory requirements; and |

18

| ● | reduced metal recovery. |

Extended declines in the market price for silver, lead and zinc may render portions of our mineralization uneconomic and result in reduced reported volume and grades, which in turn could have a material adverse effect on our financial performance, financial position and results of operations.

In addition, inferred mineral resources have a great amount of uncertainty as to their existence and their economic and legal feasibility. There should be no assumption that any part of an inferred mineral resource will be upgraded to a higher category or that any of the mineral resources not already classified as mineral reserves will be reclassified as mineral reserves.