UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR (G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2017

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-37968

YATRA ONLINE, INC.

(Exact name of registrant as specified in its charter)

| Not Applicable | Cayman Islands |

| (Translation of Registrant’s Name Into English) | (Jurisdiction of Incorporation or Organization) |

Alok Vaish

Chief Financial Officer

1101-03, 11th Floor, Tower-B,

Unitech Cyber Park,

Sector 39, Gurgaon, Haryana 122002,

India

0124 399 5500

(Name, Telephone, E-mail and/or facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Ordinary Shares, par value $0.0001 per share | Nasdaq Global Market |

| (Title of Class) | (Name of Exchange On Which Registered) |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report.

As of March 31, 2017, 23,803,803 ordinary shares, par value $0.0001 per share, 6,865,676 Class A non-voting shares, par value $0.0001 per share and 3,159,375 Class F shares, par value $0.0001 per share, were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ¨ | No x |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| Yes ¨ | No x |

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes x | No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes x | No ¨ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

| Emerging growth company x |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other ¨ |

If “Other” has been checked in the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| Item 17 ¨ | Item 18 ¨ |

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

| Yes ¨ | No x |

(APPLICABLE ONLY TO ISSUERS INVOLVED IN

BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d)

of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court:

| Yes ¨ | No ¨ |

TABLE OF CONTENTS

| 1 |

CONVENTIONS USED IN THIS ANNUAL REPORT

In this Annual Report, references to “U.S.,” the “United States” or “USA” are to the United States of America, its territories and its possessions. References to “India” are to the Republic of India. References to “$”, “US$” and “U.S. Dollars” are to the lawful currency of the United States of America, and references to “Rs.” “INR” and “rupee” each refer to the Indian rupee, the official currency of the Republic of India.

On December 16, 2016, we converted our preference shares into ordinary shares and effectuated a reverse 5.4242194-for-one share split of our ordinary shares as well as a 5.4242194-for-one adjustment with respect to the number of ordinary shares underlying our share options and a corresponding adjustment to the exercise prices of such options. Unless otherwise specifically stated or the context otherwise requires, all share information and per share data included in this Annual Report prior to December 16, 2016 has been presented on a post-share split basis.

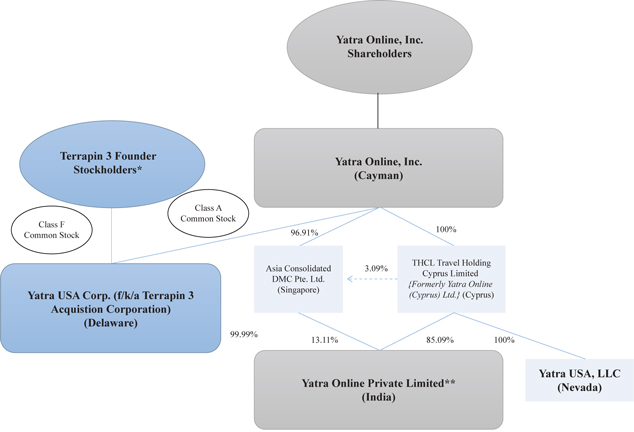

In addition, on December 16, 2016, we completed the business combination with Terrapin 3 Acquisition Corporation, or Terrapin 3, pursuant to which Terrapin 3 became our partially owned subsidiary, which is referred to herein as the Business Combination.

Unless otherwise indicated, our consolidated financial statements and related notes as of and for the fiscal years ended March 31, 2017 and 2016 included elsewhere in this Annual Report have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. References to a particular “fiscal year” are to our fiscal year ended March 31 of that year. Our fiscal quarters end on June 30, September 30, December 31 and March 31. References to a year other than a “fiscal” year are to the calendar year ended December 31. We refer in various places within this Annual Report to Revenue Less Service Cost and Adjusted EBITDA, which are non-IFRS measures. The presentation of non-IFRS measures is not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with IFRS. See “Operating and Financial Review and Prospects.”

In this Annual Report, we rely on and refer to information and statistics regarding the travel service industry and our competitors from market research reports and other publicly available sources. We have supplemented such information where necessary with our own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry participants and our management’s best view as to information that is not publicly available. While we believe that all such information is reliable, we have not independently verified industry and market data from third party sources. In addition, while we believe that our internal company research is reliable and the definitions of our industry and market are appropriate, neither our research nor these definitions have been verified by any independent source. Further, while we believe the market opportunity information included in this Annual Report is generally reliable, such information is inherently imprecise. Projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. See “Special Note Regarding Forward-Looking Statements.”

We operate under a number of trademarks and trade names, including, among others, “Yatra” and “Travelguru.” This Annual Report contains references to our trademarks and trade names and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trademarks, trade names or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this Annual Report constitute forward-looking statements that do not directly or exclusively relate to historical facts. You should not place undue reliance on such statements because they are subject to numerous uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following:

| • | our future financial performance, including our revenue, cost of revenue, operating expenses and our ability to achieve and maintain profitability; |

| • | our ability to generate positive cash flow and the sufficiency of our operating cash flow to meet our liquidity needs; |

| • | our expectations regarding the development of our industry and the competitive environment in which we operate; |

| • | our ability to realize the anticipated benefits of the Business Combination with Terrapin 3; |

| • | our ability to increase the number of visits to our search platform and referrals to our advertisers; |

| • | our ability to maintain and/or expand relationships with, and develop new relationships with, travel companies and travel research companies as well as Online travel agents (OTAs); |

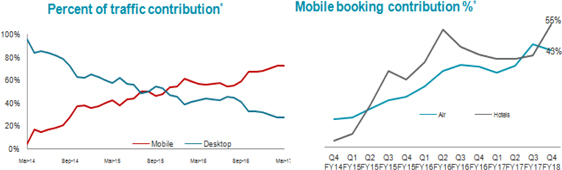

| • | the growth in the usage of mobile devices and our ability to successfully monetize this usage; |

| • | our ability to successfully implement our growth strategy; |

| • | our ability to maintain and increase our brand awareness; |

| • | our reliance on search engines, which may change their algorithms; |

| • | the ability to adapt services to changes in technology or the marketplace; |

| • | our ability to attract, train and retain executives and other qualified employees; |

| • | increasing competition in the Indian travel industry; |

| • | risks associated with online commerce security; |

| • | geopolitical risk and changes in applicable laws and regulations; |

| • | political and economic stability in and around India and other key travel destinations; |

| • | litigation and regulatory enforcement risks; |

| • | fluctuations in exchange rates between the Indian rupee and the U.S. dollar; and |

| • | the risk that compliance with rules and requirements applicable to public companies, including fulfilling our obligations as a foreign private issuer, will be expensive and time consuming. |

These and other factors are more fully discussed in the “Risk Factors” section and elsewhere in this Annual Report. These risks could cause actual results to differ materially from those implied by forward-looking statements in this Annual Report.

| 3 |

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Consolidated Financial Data

The following selected consolidated statement of profit or loss and other comprehensive loss data for fiscal years 2017, 2016 and 2015 and the selected consolidated statement of financial position data as of March 31, 2017 and 2016 have been derived from our audited consolidated financial statements included elsewhere in this Annual Report. The selected consolidated balance sheets data as of March 31, 2015 have been derived from our audited consolidated financial statements that were part of the final prospectus included in the Registration Statement on Form F-4 filed on November 21, 2016 but are not included in this Annual Report. The financial data set forth below should be read in conjunction with, and is qualified by reference to, “Item 5. Operating and Financial Review and Prospects” and the consolidated financial statements and notes thereto included elsewhere in this Annual Report. Our consolidated financial statements are prepared and presented in accordance with IFRS as issued by the IASB. Our historical results do not necessarily indicate results expected for any future period.

We have adopted IFRS as issued by the IASB with a transition date of April 1, 2014 and have prepared consolidated financial statements with effect from that date. We have not included financial information for the year ended March 31, 2014 and March 31, 2013 or consolidated balance sheet data as of March 31, 2014 and 2013, as such information is not available on a basis that is consistent with the consolidated financial information for the fiscal years ended March 31, 2017, 2016 and 2015 and cannot be obtained without unreasonable effort.

| 4 |

The following information should be read in conjunction with, and is qualified in its entirety by reference to, “Item 5. Operating and Financial Review and Prospects” and the audited consolidated financial statements and the notes thereto included elsewhere in this Annual Report.

| Consolidated statement of | ||||||||||||||||

| profit or loss and other | ||||||||||||||||

| comprehensive loss (amounts | ||||||||||||||||

| in thousands, except per | Fiscal Year Ended March 31, | |||||||||||||||

| share data and number of | 2017 | 2017 | 2016 | 2015 | ||||||||||||

| shares) | INR | USD | INR | INR | ||||||||||||

| Revenue: | ||||||||||||||||

| Air ticketing | 3,656,976 | 56,501 | 2,876,688 | 2,331,028 | ||||||||||||

| Hotels and packages | 5,314,749 | 82,115 | 5,217,934 | 4,007,138 | ||||||||||||

| Other services | 49,888 | 771 | 28,886 | 14,525 | ||||||||||||

| Other revenue | 323,535 | 4,999 | 214,524 | 175,003 | ||||||||||||

| Total revenue | 9,345,148 | 144,386 | 8,338,032 | 6,527,694 | ||||||||||||

| Other income | 48,357 | 747 | 40,879 | 53,293 | ||||||||||||

| - | ||||||||||||||||

| Service cost | 4,190,896 | 64,751 | 4,171,366 | 3,140,865 | ||||||||||||

| Personnel expenses | 2,104,723 | 32,519 | 1,515,581 | 1,155,332 | ||||||||||||

| Marketing and sales promotion expenses | 2,457,242 | 37,965 | 1,687,542 | 1,471,126 | ||||||||||||

| Other operating expenses | 2,228,472 | 34,431 | 1,975,636 | 1,590,188 | ||||||||||||

| Depreciation and amortization | 275,587 | 4,258 | 233,703 | 208,939 | ||||||||||||

| Results from operations | (1,863,415 | ) | (28,791 | ) | (1,204,917 | ) | (985,463 | ) | ||||||||

| Share of loss of joint venture | (9,441 | ) | (146 | ) | (11,802 | ) | (11,005 | ) | ||||||||

| Finance income | 369,269 | 5,705 | 95,072 | 93,559 | ||||||||||||

| Finance costs | (149,863 | ) | (2,315 | ) | (115,140 | ) | (87,578 | ) | ||||||||

| Loss before exceptional items and income taxes | (1,653,450 | ) | (25,547 | ) | (1,236,787 | ) | (990,487 | ) | ||||||||

| Exceptional items | (4,242,526 | ) | (65,548 | ) | - | - | ||||||||||

| Loss before income taxes | (5,895,976 | ) | (91,095 | ) | (1,236,787 | ) | (990,487 | ) | ||||||||

| Income tax (expense) / credits | (40,987 | ) | (633 | ) | (6,515 | ) | 42,720 | |||||||||

| Loss for the period | (5,936,963 | ) | (91,728 | ) | (1,243,302 | ) | (947,767 | ) | ||||||||

| Loss attributable to: | ||||||||||||||||

| Owners of the Parent Company | (5,901,483 | ) | (91,180 | ) | (1,218,824 | ) | (936,504 | ) | ||||||||

| Non-controlling interest | (35,480 | ) | (548 | ) | (24,478 | ) | (11,263 | ) | ||||||||

| Loss for the year | (5,936,963 | ) | (91,728 | ) | (1,243,302 | ) | (947,767 | ) | ||||||||

| Loss per share (in INR) | ||||||||||||||||

| Basic | (237.89 | ) | (3.68 | ) | (58.10 | )* | (47.98 | )* | ||||||||

| Diluted | (237.89 | ) | (3.68 | ) | (58.10 | )* | (47.98 | )* | ||||||||

| Weighted average number of ordinary shares outstanding used in computing basic/diluted earnings per share | 24,807,122 | ** | 24,807,122 | ** | 20,976,502 | ** | 19,518,909 | ** | ||||||||

* Includes ordinary shares which have been issued on account of conversion of mandatorily convertible Preference Shares (Series A to Series F), and have been used in the calculation of weighted average basic earnings per share.

Loss attributable to shareholders is allocated equally for each class of share.

At March 31, 2017 555,941 ordinary shares (March 31, 2016: 342,917 and March 31, 2015: 277,606), issuable against employee share options, 742,402 ordinary shares (March 31, 2016: 716,721 and March 31, 2015: 367,419) issuable against conversion right with subsidiary’s ordinary shares and 791 ordinary shares (March 31, 2016: 286 and March 31, 2015: 233), issuable against equity instruments, issuable against restricted employee share options, were excluded from the diluted weighted average number of ordinary shares calculation as their effect would have been anti-dilutive.

For calculation of diluted earnings per share, since the exercise price of certain warrants is greater than fair market value, they are assumed to be out of money and considered not to be exercisable as of the balance sheet date. These potential ordinary shares are not considered for calculation of dilutive impact of earning per share.

** On December 16, 2016, preference shares issued by Yatra Online, Inc. were converted into ordinary shares of Yatra Online, Inc. We thereafter effectuated a reverse 5.4242194-for-one share split of our ordinary shares as well as a 5.4242194-for-one adjustment with respect to the number of ordinary shares underlying our share options. Consequently, the basic and diluted earnings per share for all periods presented is adjusted retrospectively to reflect the share split.

| 5 |

The following table sets forth a summary of our consolidated statement of financial position as of March 31, 2017, 2016 and 2015:

| Consolidated statement of financial | March 31, | |||||||||||||||

| position data (amounts | 2017 | 2017 | 2016 | 2015 | ||||||||||||

| in thousands) | INR | USD | INR | INR | ||||||||||||

| Trade and other receivables | 1,970,375 | 30,443 | 1,362,838 | 1,364,840 | ||||||||||||

| Term deposits | 3,027,861 | 46,781 | 1,024,890 | 777,405 | ||||||||||||

| Cash and cash equivalents | 1,532,629 | 23,680 | 389,664 | 234,474 | ||||||||||||

| Total assets | 9,574,433 | 147,928 | 5,354,026 | 4,680,673 | ||||||||||||

| Total equity attributable to equity holders of the Company | 3,137,487 | 48,475 | 429,472 | 728,206 | ||||||||||||

| Borrowings | 44,876 | 693 | 469,433 | 235,985 | ||||||||||||

| Trade and other payables | 3,148,544 | 48,646 | 2,267,824 | 2,106,123 | ||||||||||||

| Total liabilities | 6,384,864 | 98,648 | 4,912,968 | 3,945,715 | ||||||||||||

| Total equity and liabilities | 9,574,433 | 147,928 | 5,354,026 | 4,680,673 | ||||||||||||

Other Data:

The following table sets forth for the periods indicated; certain selected consolidated financial and other data:

| Fiscal Year Ended March 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| Unaudited | ||||||||||||

| Figures in thousands | ||||||||||||

| Quantitative details * | ||||||||||||

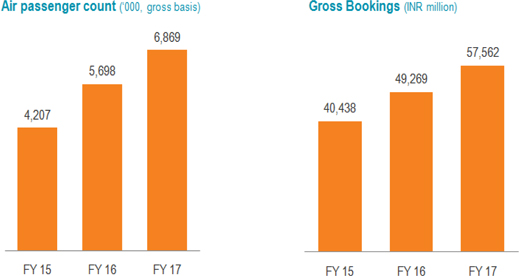

| Air passengers | 6,869 | 5,698 | 4,207 | |||||||||

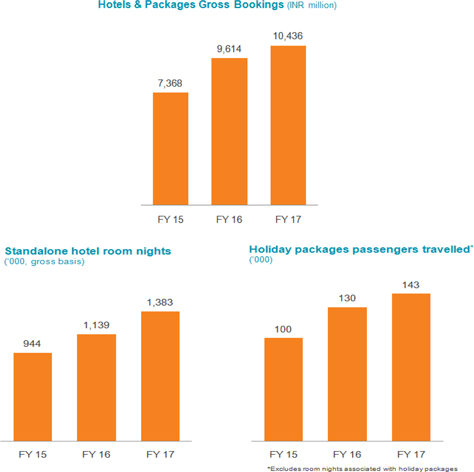

Standalone Hotel room nights | 1,383 | 1,139 | 944 | |||||||||

| Holiday packages passengers travelled | 143 | 130 | 100 | |||||||||

| Amount in INR thousands except % | ||||||||||||

| Gross Bookings** | ||||||||||||

| Air Ticketing | 57,562,263 | 49,268,781 | 40,438,326 | |||||||||

| Hotels and Packages | 10,435,643 | 9,614,004 | 7,368,475 | |||||||||

| Other | 1,054,078 | 614,406 | 464,745 | |||||||||

| Total | 69,051,984 | 59,497,191 | 48,271,546 | |||||||||

| Revenue (including other income) Less Service Cost*** | ||||||||||||

| Air Ticketing | 3,656,976 | 2,876,688 | 2,331,028 | |||||||||

| Hotels and Packages | 1,123,853 | 1,046,568 | 866,273 | |||||||||

| Others (including other income) | 421,780 | 284,289 | 242,821 | |||||||||

| Total | 5,202,609 | 4,207,545 | 3,440,122 | |||||||||

| Net Revenue Margin %**** | ||||||||||||

| Air Ticketing | 6.4 | % | 5.8 | % | 5.8 | % | ||||||

| Hotels and Packages | 10.8 | % | 10.9 | % | 11.8 | % | ||||||

| * | Quantitative details are considered on Gross basis. |

| ** | Gross Bookings represent the total amount paid by our customers for the travel services and products booked through us, including fees and other charges, and are net of cancellations and refunds. |

| 6 |

| *** | As certain parts of our revenue are recognized on a “net” basis and other parts of our revenue are recognized on a “gross” basis, we evaluate our financial performance based on Revenue Less Service Cost, which is a non-IFRS measure. We believe that Revenue Less Service Cost provides investors with useful supplemental information about the financial performance of our business and more accurately reflects the value addition of the travel services that we provide to our customers. The presentation of this non-IFRS information is not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with IFRS as issued by the IASB. Our Revenue Less Service Cost may not be comparable to similarly titled measures reported by other companies due to potential differences in the method of calculation. |

| **** | Net Revenue Margins are defined as Revenue Less Service Cost as a percentage of Gross Bookings. |

The following table reconciles our revenue and other income, which is an IFRS measure, to Revenue and Other Income Less Service Cost, which is a non-IFRS measure:

| Amount in INR | Air Ticketing | Hotels and Packages | Others (Including Other Income) | Total | ||||||||||||||||||||||||||||

| thousands | Fiscal Year Ended March 31, | |||||||||||||||||||||||||||||||

| except % | 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||

| Revenue | 3,656,976 | 2,876,688 | 5,314,749 | 5,217,934 | 421,780 | 284,289 | 9,393,505 | 8,378,911 | ||||||||||||||||||||||||

| Service cost | - | - | (4,190,896 | ) | (4,171,366 | ) | - | - | (4,190,896 | ) | (4,171,366 | ) | ||||||||||||||||||||

| Revenue Less Service Cost | 3,656,976 | 2,876,688 | 1,123,853 | 1,046,568 | 421,780 | 284,289 | 5,202,609 | 4,207,545 | ||||||||||||||||||||||||

| % of revenue | 100.0 | % | 100.0 | % | 21.1 | % | 20.1 | % | 100.0 | % | 100.0 | % | 55.4 | % | 50.2 | % | ||||||||||||||||

| Amount in | Air Ticketing | Hotels and Packages | Others (Including Other Income) | Total | ||||||||||||||||||||||||||||

| INR thousands | Fiscal Year Ended March 31, | |||||||||||||||||||||||||||||||

| except % | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | ||||||||||||||||||||||||

| Revenue | 2,876,688 | 2,331,028 | 5,217,934 | 4,007,138 | 284,289 | 242,821 | 8,378,911 | 6,580,987 | ||||||||||||||||||||||||

| Service cost | - | - | (4,171,366 | ) | (3,140,865 | ) | - | - | (4,171,366 | ) | (3,140,865 | ) | ||||||||||||||||||||

| Revenue Less Service Cost | 2,876,688 | 2,331,028 | 1,046,568 | 866,273 | 284,289 | 242,821 | 4,207,545 | 3,440,122 | ||||||||||||||||||||||||

| % of revenue | 100.0 | % | 100.0 | % | 20.1 | % | 21.6 | % | 100.0 | % | 100.0 | % | 50.2 | % | 52.3 | % | ||||||||||||||||

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

| 7 |

D. Risk Factors

This Annual Report contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those described in the following risk factors and elsewhere in this Annual Report. If any of the following risks actually occur, our business, financial condition and results of operations could suffer.

Risks Related to Our Business and Industry

We have a history of operating losses.

We have a history of losses and may continue to incur operating and net losses for the foreseeable future. Yatra’s loss for fiscal year 2017 was INR 5,937 million as compared to a loss of INR 1,243 million in fiscal year 2016, and we have experienced losses for all prior periods. If our revenues grow slower than anticipated, or if our operating expenses exceed expectations, then we may not be able to achieve profitability in the near future or at all, which may depress the price of our ordinary shares.

The Indian travel industry is highly competitive and we may not be able to effectively compete in the future.

The Indian travel industry is highly competitive. Our success depends upon our ability to compete effectively against numerous established and emerging competitors, including other online travel agencies, or OTAs, traditional offline travel companies, travel research companies, payment wallets, search engines and meta-search companies, both in India and abroad, such as Cleartrip Pvt. Ltd., Expedia Southeast Asia Pte. Ltd., One97 Communications Limited, Le Travenues Technology Pvt. Ltd. India, MakeMyTrip (India) Pvt. Ltd., Ibibo Group Pvt. Ltd., Booking.com B.V., and Agoda Company Pte. Ltd. Our competitors may have significantly greater financial, marketing, personnel and other resources than we have. Factors affecting our competitive success include price, availability of travel products, ability to package travel products across multiple suppliers, brand recognition, customer service and customer care, fees charged to customers, ease of use, accessibility, reliability and innovation. If we are not able to compete effectively against our competitors, our business and results of operations may be adversely affected. In October 2016, MakeMyTrip and Ibibo Group Holdings (Singapore) Pte. Ltd. agreed to pursue a transaction that will combine the two businesses under MakeMyTrip. The transaction closed on January 31, 2017. To the extent this merger enhances MakeMyTrip’s ability to compete with us, particularly in India, which is our company’s, MakeMyTrip’s and Ibibo Group’s largest market, our market share, business and results of operations could be adversely affected.

Large, established Internet search engines with a global presence and meta-search companies who can aggregate travel search results compete against us for customers. Certain of our competitors have launched brand marketing campaigns to increase their visibility with customers. Some of our competitors have significantly greater financial, marketing, personnel and other resources than we do and certain of our competitors have a longer history of established businesses and reputations in the Indian travel market (particularly in the Hotels and Packages business) as compared with us. Some meta-search sites, including TripAdvisor and Kayak, offer users the ability to make reservations directly on their websites, which may reduce the amount of traffic and transactions available to us through referrals from these sites. If additional meta-search sites begin to offer the ability to make reservations directly, that will further affect our ability to generate traffic to our sites. From time to time, we may be required to reduce service fees and Net Revenue Margins in order to compete effectively and maintain or gain market share.

We may also face increased competition from new entrants in our industry. The travel industry is extremely dynamic and new channels of distribution in the travel industry may negatively affect our market share. Additional sources of competition include large companies that offer online travel services as one part of their business model, such as One97 Communications Limited, as well as “daily deal” websites, such as Groupon, Inc.’s Getaways, or peer-to-peer inventory sources, such as Airbnb Inc., HomeAway.com, Inc. and Oravel Stays Pvt. Ltd., which provide home and apartment rentals as an alternative to hotel rooms. The growth of peer-to-peer inventory sources could affect the demand for our services in facilitating reservations at hotels. We cannot assure you that we will be able to successfully compete against existing or new competitors in our existing lines of business as well as new lines of business into which we may venture. If we are not able to compete effectively, our business and results of operations may be adversely affected.

| 8 |

In addition, many airlines, hotels, car rental companies and tour operators have call centers and have established their own travel distribution websites and mobile applications. Suppliers may offer advantages for customers to book directly, such as member-only fares, bonus miles or loyalty points, which could make their offerings more attractive to customers. Some low-cost airlines distribute their online supply exclusively through their own websites and other airlines have stopped providing inventory to certain online channels and attempt to drive customers to book directly on their websites by eliminating or limiting sales of certain airline tickets through third party distributors. Additionally, airline suppliers are increasingly promoting hotel supply on their websites in connection with airline tickets. If we are unable to compete effectively with travel supplier-related channels or other competitors, our business and results of operations may be adversely affected.

We also face increasing competition from search engines like Google, Bing and Yahoo! Search engines have grown in popularity and may offer comprehensive travel planning or shopping capabilities, which may drive more traffic directly to the websites of our suppliers or competitors. Google has increased its focus on appealing to travel customers through its launches of Google Places, Google Flights and Google Hotel Price Ads. Google’s efforts around these products, as well as possible future developments, may change or undermine our ability to obtain prominent placement in paid or unpaid search results at a reasonable cost or at all.

There can be no assurance that we will be able to compete successfully against any current and future competitors or on emerging platforms, or provide differentiated products and services to our customer base. Increasing competition from current and emerging competitors, the introduction of new technologies and the continued expansion of existing technologies, such as meta-search and other search engine technologies, may force us to make changes to our business models, which could affect our financial condition and results of operations. Increased competition has resulted in and may continue to result in reduced margins, as well as loss of customers, transactions and brand recognition.

Declines or disruptions in the Indian economy in general and travel industry in particular could adversely affect our business and financial performance.

Substantially all of our operations are located in India and therefore our financial performance and growth are necessarily dependent on economic conditions prevalent in India. The Indian economy may be materially and adversely affected by political instability or regional conflicts, a general rise in interest rates, inflation, and adverse economic conditions occurring elsewhere in the world, such as a slowdown in economic growth in China, the repercussions from the June 2016 United Kingdom referendum to withdraw from the European Union and other matters. While the Indian economy has grown significantly in recent years, it has experienced economic slowdowns in the past. The Indian economy could be adversely impacted by inflationary pressures, any increase or volatility in oil prices, currency depreciation, the poor performance of its large agricultural and manufacturing sectors, trade deficits, recent initiatives by the Indian government towards demonetization of certain Indian currency and other factors. India also faces major challenges in sustaining its growth, which include the need for substantial infrastructure development and improving access to healthcare and education.

In the past, economic slowdowns in the Indian economy may have harmed the travel industry as customers had less disposable income for their travels, especially holiday travel. Any continued or future slowdown in the Indian economy could have a material adverse effect on the demand for the travel products we sell and, as a result, on our financial condition and results of operations. We do nearly all of our business with a wide variety of travel-related companies based in India, including airlines, large hotel chains and others. We are exposed to risks associated with these Indian businesses, including bankruptcies, restructurings, consolidations and alliances of its partners, the credit worthiness of these partners, and the possible obligation to make payments to our partners. For example, the Indian airline industry in recent years has experienced significant losses and has undergone bankruptcies, restructurings, consolidations and other similar events. Future bankruptcies and increasing consolidation could create challenges for our relationships with airlines, including by reducing the profitability of our airline ticketing business.

If the growth in the Indian travel industry or the Indian economy as a whole cannot be sustained or otherwise slows down significantly, our business and results of operations could be adversely affected.

| 9 |

The travel industry is particularly sensitive to safety concerns, and terrorist attacks, regional conflicts, health concerns, natural calamities or other catastrophic events could have a negative impact on the Indian travel industry and cause our business to suffer.

The travel industry is particularly sensitive to safety concerns, such as terrorist attacks, regional conflicts, health concerns, natural calamities or other catastrophic events. Our business has in the past declined and may in the future decline after incidents, such as those described below, that cause travelers to be concerned about their safety. Decreased travel expenditures could reduce the demand for our services, thereby causing a reduction in revenue.

India has experienced terror attacks in the past, including the coordinated attacks in 2008 in multiple locations in Mumbai, and may experience similar attacks in the future. In recent years, hotels, airlines, airports and cruises have been the targets of terrorist attacks, including in the Gulf of Aden, India, Spain, Egypt, Russia, Turkey, Sri Lanka, France, United Kingdom and Belgium. As many terrorist attacks tend to be focused on tourists or tourist destinations, such acts, even those outside of India or other neighboring countries, may result in a decline in the travel industry and adversely impact our business and prospects.

In addition, South Asia has, from time to time, experienced instances of civil unrest and hostilities among neighboring countries, including between India and Pakistan. There have also been incidents in and near India such as troop mobilizations along the border. Such military activity or other adverse social and political events in India in the future could adversely affect the Indian economy by disrupting communications and making travel more difficult. Resulting political tensions could create a greater perception that investments in Indian companies involve a high degree of risk and could have an adverse impact on our business and the price of our ordinary shares. Furthermore, if India were to become engaged in armed hostilities, we may not be able to continue our operations. The occurrence of any of these events may result in a loss of business confidence and have an adverse effect on our business and results of operations.

The outbreak of severe illnesses, such as the Ebola virus, Middle East Respiratory Syndrome, Severe Acute Respiratory Syndrome, malaria, H1N1 influenza virus, avian flu and the Zika virus, could materially affect the travel industry, reduce our revenues and adversely impact travel behavior, particularly if they were to persist for an extended period.

India has experienced natural calamities such as earthquakes, tsunamis, floods and drought in past years. For example, in September 2014, the state of Jammu and Kashmir in northern India, a popular tourism destination, experienced widespread floods and landslides, and in April 2015, an earthquake occurred in the Federal Democratic Republic of Nepal with aftershocks and landslides subsequently affecting the country. The extent and severity of these natural disasters determines their impact on the Indian economy. Substantially all of our operations and employees are located in India and there can be no assurance that we will not be affected by natural disasters in the future. Furthermore, if any of these natural disasters occur in tourist destinations in India, travel to and within India could be adversely affected, which could have an adverse impact on our business and results of operations.

The occurrence of any of these events could result in changes to customers’ travel plans and related costs and lost revenue for our company, as well as the risk of a prolonged and substantial decrease in travel volume, any of which could have a material adverse effect on our business, financial condition and results of operations.

Our business and financial results are subject to fluctuations in currency exchange rates.

Given the nature of our business, any fluctuation in the value of the Indian rupee against the U.S. dollar, Euro, British pound sterling or other major currencies will affect customers’ travel behavior and, therefore, will have an impact on our results of operations. For example, in fiscal year 2016, the drop in the average value of the Indian rupee as compared to the U.S. dollar adversely impacted the Indian travel industry as it made outbound travel for Indian consumers more expensive. In addition, our exposure to foreign currency risk also arises in respect of our non-Indian rupee-denominated trade and other receivables, trade and other payables, and cash and cash equivalents. We currently do not have any hedging agreements or similar arrangements with any counter-party to cover our exposure to any fluctuations in foreign exchange rates.

| 10 |

We have not previously operated as a public company, and fulfilling our obligations as a U.S. reporting company may be expensive and time consuming.

As a U.S. reporting company, we will incur significant legal, accounting and other expenses. For example, prior to becoming a U.S. reporting company, we had not previously been required to prepare or file periodic and other reports with the SEC or to comply with the other requirements of U.S. federal securities laws applicable to public companies, such as Section 404 of the Sarbanes Oxley Act of 2002. We have not previously been required to establish and maintain disclosure controls and procedures and internal controls over financial reporting applicable to a public company with securities registered in the United States. Compliance with reporting and corporate governance obligations from which foreign private issuers are not exempt may require members of our management and our finance and accounting staff to divert time and resources from other responsibilities to ensuring these additional regulatory requirements are fulfilled and may increase our legal, insurance and financial compliance costs. We cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, if we fail to comply with any significant rule or requirement associated with being a public company, such failure could result in the loss of investor confidence and could harm our reputation and cause the market price of our ordinary shares to decline.

Our business depends on our relationships with a broad range of travel suppliers, and any adverse changes in these relationships, or our inability to enter into new relationships, could negatively affect our business and results of operations.

We rely significantly on our relationships with airlines, hotels, railways, bus lines, activity vendors, global distribution system, or GDS, service providers and other travel suppliers to enable us to offer our customers comprehensive access to travel services and products. Adverse changes in any of our relationships with travel suppliers, or the inability to enter into new relationships with travel suppliers, could reduce the amount of inventory that we may be able to offer. Our arrangements with travel suppliers are not typically subject to long-term commitments and may not remain in effect on current or similar terms, and the net impact of future pricing options may adversely impact our revenue. Travel suppliers are increasingly focused on driving online demand to their own websites and may cease to supply us with the same level of access to travel inventory in the future.

A significant change in our relationships with our major suppliers for a sustained period of time, including an inability by any travel supplier to fulfill their payment obligation to us in a timely manner or a supplier’s complete withdrawal of inventory, could have a material adverse effect on our business, financial condition or results of operations. Furthermore, no assurance can be given that our travel suppliers will not further reduce or eliminate fees or commissions or attempt to charge us for content, terminate our contracts, make their products or services unavailable to us as part of exclusive arrangements with our competitors or default on or dispute their payment or other obligations towards us, any of which could reduce our revenue and Net Revenue Margins or may require us to initiate legal or arbitration proceedings to enforce their contractual payment obligations, which may adversely affect our business and results of operations.

Any disruption or adverse change in third parties on which we rely may have a material adverse effect on our business.

We currently rely on a variety of third parties to operate our business, including third-party computer systems, software and service providers, including the computerized reservation systems of accommodations, payment processors, call center services, airlines and third-party service providers such as the GDS as well as our distribution partners, to make reservations and confirmations, issue air, rail and bus tickets, book hotel rooms, arrange for car services, make deliveries, interact with customers and receive payments.

These third parties are subject to general business risks, including system downtime, hacker attack, fraudulent access, natural disaster, human error or other causes leading to unexpected business interruptions.

Any interruption in these or other third party services or deterioration in their performance could impair the quality of our service. For example, technical glitches in third party systems may result in the information provided by us to our customers, such as the availability of hotel rooms on a central reservations system of a hotel supplier, to not be accurate, and we may incur monetary and/or reputational loss as a result. Furthermore, if our arrangements with any of these third parties are suspended, terminated or no longer available on commercially acceptable terms, we may not be able to find an alternate source of support on a timely basis and on commercially reasonable terms, or at all.

| 11 |

As we increase the number of third party services available through our platform, we may not be able to adequately monitor or assure the quality of these services, and increases in customer dissatisfaction may adversely impact our business.

We have recently launched a marketplace platform that enables us to sell our own inventory and the inventory of third party vendors to provide travelers a wider selection of products and services on a single platform. This platform allows third party suppliers or travel services to manage and sell products and services on yatra.com directly to consumers. We may not be able to adequately monitor these third party vendors to ensure that they provide high-quality travel products and services to our customers on a consistent basis. Certain travel service providers may lack adequate quality control for their travel products and customer service. Similarly, we cannot ensure that every travel service provider has obtained, and duly maintained, all of the licenses and permits required for it to provide travel products to consumers. If our travelers are dissatisfied with the travel products and services provided by third party vendors they find through our marketplace platform, they may reduce their use of, or completely forgo, our marketplace platform as well as our core platform, including our mobile apps. Increases in customer dissatisfaction with third party vendors could damage our brand, reduce our traffic and materially and adversely affect our business and results of operations.

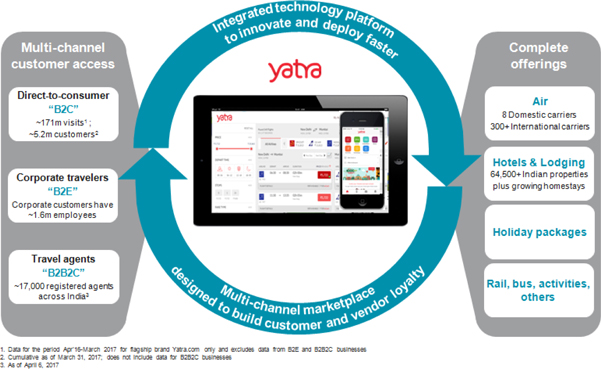

We depend on a small number of airline suppliers in India for a significant percentage of our Air Ticketing revenue.

Our growth strategy is heavily dependent on the continued expansion of our Air Ticketing business and our airline supplier relationships. We currently provide our customers with access to eight domestic airlines as well as over 300 international airlines; however, a substantial portion of our Air Ticketing revenue is represented by five domestic airlines. Our dependence on a limited number of domestic airlines means that a reduction or elimination in base commissions and incentive payments by one or more of these airlines could have a material adverse effect on our revenue. Furthermore, our reliance on these Indian airlines exposes us to the risks associated with the domestic airline industry, such as rising fuel costs, high taxes, currency depreciation and liquidity constraints. In addition, our reliance on these airlines increases their bargaining power in price and contract negotiations, and further consolidation of domestic airline suppliers may exacerbate these trends. If one or all of these domestic airlines exert significant price and margin pressure on us, it could materially and adversely affect our business, financial condition and results of operations.

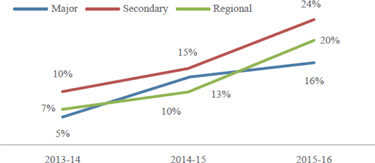

Any failure to maintain the quality of our brand and reputation could have a material adverse effect on our business.

We have invested considerable time and resources in developing and promoting our “Yatra” brand. We expect to continue to spend on maintaining the high quality of our brand in order to compete against a large and growing number of competitors. We also believe that the strength of our brand is one of our key assets that will allow us to expand into new geographies, such as Tier 2 and Tier 3 cities in India, where our brand is not as well known. These efforts may not be successful and, even if we are successful in our branding efforts, such efforts may not be cost-effective. If we are unable to maintain or enhance consumer awareness of our brands or generate demand in a cost-effective manner, it could have a material adverse effect on our business and financial performance.

In addition, we receive significant media coverage in India and other geographic markets. Unfavorable publicity regarding, for example, our practices relating to privacy and data protection, product changes, competitive pressures, the accuracy of user-generated content, product quality, litigation or regulatory activity, could adversely affect our reputation with our users and advertisers. Such potential negative publicity also could have an adverse effect on the size, engagement and loyalty of our user base and result in decreased revenue, which could adversely affect our business and results of operations.

| 12 |

We rely on assumptions and estimates to calculate certain of our key metrics, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect its business.

We believe that certain metrics are key to our business, including travel expenditures, customers, repeat customers, total transaction volume, customer traffic, monthly visitors, app downloads, travel agents and bookings. As the industry in which we operate continues to evolve, the metrics by which we evaluate our business may change over time. While these numbers are based on what we believe to be reasonable estimates, our internal tools have a number of limitations and our methodologies for tracking these metrics may change over time. For example, a single person may have multiple accounts or browse the Internet on multiple browsers or devices, some users may restrict our ability to accurately identify them across visits, some mobile applications automatically contact our servers for regular updates with no user action, and we are not always able to capture user information on all of our platforms. As such, the calculations of our traffic and monthly visitors may not accurately reflect the number of people actually visiting our platforms. Also, if the internal tools we use to track these metrics under-count or over-count performance or contain algorithmic or other technical errors, the data and/or reports we generate may not be accurate. In addition, historically, certain metrics were calculated by independent third parties, and have not been verified by us. We calculate metrics using internal tools, which are not independently verified by a third party. In addition, we continue to improve upon our tools and methodologies to capture data and believe that our current metrics are more accurate; however, the improvement of these tools and methodologies could cause inconsistencies between current data and previously reported data, which could confuse investors or lead to questions about the integrity of the data.

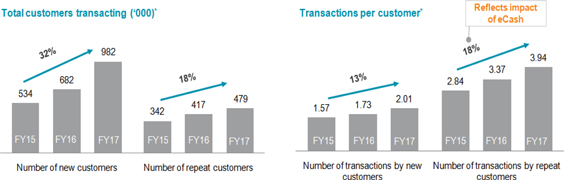

The roll-out of new features and improvements may not meet our expectations.

We are constantly working to improve our websites and mobile applications and roll-out new features to improve our user experience, attract new users, expand our market reach and develop new sources of revenue. However, there is no guarantee that these initiatives will ultimately be successful and, if they are not, our business and results of operations may be materially adversely affected. For example, we launched our eCash program to reward customers for repeat purchases. Customers accumulate eCash points on travel booked through us, and these points work as a currency that can be redeemed by customers during future bookings. This program may not have the positive impact on total transaction volume and customer retention that we originally anticipated. For example, we currently expect that customers who book business travel through our corporate platform will receive the eCash points associated with that travel. However, if the eCash is held by the employer rather than the employee, the impact of this initiative may not be as significant as expected. With any new product roll out, there may be other challenges and setbacks that we do not anticipate. Our failure to address these challenges and effectively manage the roll out of new features could negatively impact our reputation, business and results of operations.

The online homestay market is rapidly evolving and if we fail to compete successfully, our business and results of operations may suffer.

We recently added homestays through our Yatra and Travelguru websites. The online homestay market is a rapidly evolving market. Since we began offering such services, there have been and continue to be significant business, marketing and regulatory developments. Operating in new and relatively untested markets requires significant management attention and financial resources. We cannot provide any assurance that our efforts to expand in this market will be successful, and the investment and additional resources required to establish operations and manage growth may not produce the desired financial results.

We may not be successful in pursuing strategic partnerships and acquisitions, and future partnerships and acquisitions may not bring us anticipated benefits.

Part of our growth strategy is the pursuit of strategic partnerships and acquisitions. There can be no assurance that we will succeed in implementing this strategy as we are subject to many factors which are beyond our control, including our ability to identify, attract and successfully execute suitable acquisition opportunities and partnerships. This strategy may also subject us to uncertainties and risks, including acquisition and financing costs, potential ongoing and unforeseen or hidden liabilities, diversion of management resources and the costs of integrating acquired businesses. We could face difficulties integrating the technology of acquired businesses with our existing technology, and employees of the acquired business into various departments and ranks in our company, and it could take substantial time and effort to integrate the business processes being used in the acquired businesses with our existing business processes. Moreover, there is no assurance that such partnerships or acquisitions will achieve our intended objectives or enhance our business. Any such failure could negatively impact our ability to compete in the travel industry and have a material adverse effect on our business or results of operations.

| 13 |

As we increase our sales efforts toward larger corporate customers and B2B2C travel agents, our sales cycle, customer support efforts and collection efforts may become more time consuming and expensive.

In recent years, we have increased our sales efforts toward larger corporate customers, including leading organizations from around India. As we increase our sales efforts targeted to large corporate customers, we expect to face greater costs, longer sales cycles and less predictability in completing some of our sales. A prospective corporate customer’s decision to use our travel services may be an enterprise-wide decision and, if so, these sales would require us to provide greater education to the prospective customer. Consequently, these customers may require us to devote greater sales, implementation and customer support resources to them. In addition, we typically extend credit periods to our corporate, B2B2C travel agents and some retail customers. We may experience difficulty collecting payment fully and in a timely manner on our outstanding accounts receivable from our customers. As a result, we may face a greater risk of non-payment of our accounts receivable and, as our corporate travel business and B2B2C travel agents business grows in scale, we may need to make increased provisions for doubtful accounts. We cannot provide any assurance that we will be able to increase our corporate customer base and B2B2C travel agents, and our sales efforts to obtain such customers may become time consuming, costly and harmful to our business and results of operations.

Our failure to raise additional capital or generate cash flows necessary to expand our operations and invest in new technologies in the future could reduce our ability to compete successfully and harm our results of operations.

We believe that our existing cash and cash equivalents will be sufficient to meet our anticipated cash requirements for at least the next 12 months. However, we may need to raise additional funds, and we may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our shareholders may experience significant dilution of their ownership interests and the value of our ordinary shares could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness, force us to maintain specified liquidity or other ratios or restrict our ability to pay dividends or make acquisitions. In addition, the availability of funds depends in significant measure on capital markets and liquidity factors over which we exert no control. In light of periodic uncertainty in the capital and credit markets, we can provide no assurance that sufficient financing will be available on desirable terms or at all to fund investments, acquisitions, stock repurchases, dividends, debt refinancing or other corporate needs, or that our counterparties in any such financings would honor their contractual commitments. If we need additional capital and cannot raise it on acceptable terms, or at all, we may not be able to execute on our growth strategy, which could reduce our ability to compete successfully and harm our business and results of operations.

We could be negatively affected by changes in Internet search engine algorithms and dynamics, or search engine disintermediation.

We rely heavily on Internet search engines, such as Google and Yahoo! India, to generate traffic to our websites, principally through the purchase of travel-related keywords. Search engines, including Google, frequently update and change the logic that determines the placement and display of results of a user’s search, such that the purchased or algorithmic placement of links to our websites can be negatively affected. In addition, a search engine could, for competitive or other purposes, alter its search algorithms or results, causing our websites to place lower in search query results. If a major search engine changes its algorithms in a manner that negatively affects the search engine ranking of our websites or those of our partners, or if competitive dynamics impact the cost or effectiveness of our search engine optimization or search engine monetization in a negative manner, our business and financial performance would be adversely affected, potentially to a material extent. Furthermore, our failure to successfully manage our search engine optimization and search engine monetization strategies could result in a substantial decrease in traffic to our websites, as well as increased costs if we were to replace free traffic with paid traffic. In addition, to the extent that Google, Yahoo! India or other leading search or metasearch engines in India disrupt the businesses of OTAs or travel content providers by offering comprehensive travel planning or shopping capabilities, or refer those leads to suppliers directly, or to other favored partners, there could be a material adverse impact on our business. To the extent these actions have a negative effect on our search traffic, whether on desktop, tablet or mobile devices, our business and results of operations could be adversely affected.

| 14 |

Any inability or failure to adapt to technological developments, the evolving competitive landscape or industry trends could harm our business and competitiveness.

We depend upon the use of sophisticated information technology and systems. Our competitiveness and future results depend on our ability to maintain and make timely and cost-effective enhancements, upgrades and additions to our products, services, technologies and systems in response to new technological developments, industry standards and trends and customer demands. Adapting to new technological and marketplace developments may require substantial expenditures and lead time and we cannot guarantee that projected benefits will actually materialize. We may experience difficulties that could delay or prevent the successful development, marketing and implementation of enhancements, upgrades and additions. Moreover, we may fail to maintain, upgrade or introduce new products, services, technologies and systems as quickly as our competitors or in a cost-effective manner. In addition, the travel industry is marked by continuous innovation and the development of new products, services and technologies. As a result, in order to maintain its competitiveness, we must continue to invest significant resources to continually improve the speed, accuracy and comprehensiveness of our travel offerings. Changes to our technology platforms or increases in our investments in technology could adversely affect our results of operations. If we face material delays in adapting to technological developments, our customers may forego the use of our services in favor of those of our competitors. Any of these events could have a material adverse effect on our business and results of operations.

Our success depends on maintaining the integrity of our systems and infrastructure, which may suffer from failures, capacity constraints, business interruptions and forces outside of our control.

Our business relies significantly on computer systems to facilitate and process transactions and we have experienced rapid growth in consumer traffic to our websites and through our mobile apps. However, we may not be able to maintain and improve the efficiency, reliability and integrity of our systems. Unexpected increases in the volume of our business could exceed system capacity, resulting in service interruptions, outages and delays. Such constraints can also lead to the deterioration of our services or impair our ability to process transactions. System interruptions may prevent us from efficiently providing services to our customers, travel suppliers or other third parties, which could cause damage to our reputation and result in us losing customers and revenues or cause us to incur litigation costs and liabilities. Although we contractually limit our liability for damages, we cannot guarantee that we will not be subject to lawsuits or other claims for compensation from our customers in connection with such outages for which we may not be indemnified or compensated.

Our systems may also be susceptible to external damage or disruption. Our systems could be damaged or disrupted by power, hardware, software or telecommunication failures, human errors, natural events including floods, hurricanes, fires, winter storms, earthquakes and tornadoes, terrorism, break-ins, hostilities, war or similar events. Computer viruses, denial of service attacks, physical or electronic break-ins and similar disruptions affecting the Internet, telecommunication services or our systems could cause service interruptions or the loss of critical data, and could prevent us from providing timely services. Failure to efficiently provide services to customers or other third parties could cause damage to our reputation and result in the loss of customers and revenues, significant recovery costs or litigation and liabilities. Moreover, such risks might increase as we expand our business and as the tools and techniques involved become more sophisticated. Disasters affecting our facilities, systems or personnel might be expensive to remedy and could significantly diminish our reputation and our brands, and we may not have adequate insurance to cover such costs.

We are exposed to risks associated with the payments business, including online security and credit card fraud.

The secure transmission of confidential information over the Internet is essential in maintaining customer and supplier confidence in us. Security breaches, whether instigated internally or externally on our system or other Internet-based systems, could significantly harm our business. We currently require customers to guarantee their transactions with their credit cards online. We rely on licensed encryption and authentication technology to effect secure transmission of confidential customer information, including credit card numbers, over the Internet. However, advances in technology or other developments could result in a compromise or breach of the technology that we use to protect customer and transaction data. We incur substantial expense to protect against and remedy security breaches and their consequences. However, our security measures may not prevent security breaches and we may be unsuccessful in or incur additional costs in connection with implementing a remediation plan to address these potential exposures.

| 15 |

We also have agreements with banks and certain companies that process customer credit card transactions for the facilitation of customer bookings of travel services from us. If any of these third parties experience business interruptions or otherwise are unable to provide the services we need, or if they increase the fees associated with those services, we will be adversely impacted. In addition, the online payment gateway for certain of our sales made through our mobile platform and through international credit and debit cards are secured by the respective card’s security features and we may be liable for credit card acceptance on our websites. We may also be subject to other payment disputes with our customers for such sales. If we are unable to combat the use of fraudulent credit cards, our revenue from such sales would be susceptible to demands from the relevant banks and credit card processing companies, and our results of operations and financial condition could be adversely affected.

Our processing, storage, use and disclosure of customer data of our customers or visitors to our website could give rise to liabilities as a result of governmental regulation, conflicting legal requirements, differing views of personal privacy rights or data security breaches.

In the processing of our customer transactions, we receive and store a large volume of customer information. Such information is increasingly subject to legislation and regulations in various jurisdictions and governments are increasingly acting to protect the privacy and security of personal information that is collected, processed and transmitted in or from the governing jurisdiction. We could be adversely affected if legislation or regulations are expanded or amended to require changes in our business practices or if governing jurisdictions interpret or implement their legislation or regulations in ways that negatively affect our business. As privacy and data protection become more sensitive issues in India, we may also become exposed to potential liabilities. For example, under the Indian Information Technology Act, 2000, as amended, we are subject to civil liability for wrongful loss or gain arising from any negligence by us in implementing and maintaining reasonable security practices and procedures with respect to sensitive personal data or information on our computer systems, networks, databases and software. India has also implemented privacy laws, including the Information Technology (Reasonable Security Practices and Procedures and Sensitive Personal Data or Information) Rules, 2011, which impose limitations and restrictions on the collection, use and disclosure of personal information. Any liability we may incur for violation of such laws and regulations and related costs of compliance and other burdens may adversely affect our business and results of operations.

We cannot guarantee that our security measures will prevent data breaches. Companies that handle such information have also been subject to investigations, lawsuits and adverse publicity due to allegedly improper disclosure of personally identifiable information. Security breaches could damage our reputation, cause interruptions in our operations, expose us to a risk of loss or litigation and possible liability, and could also cause customers and potential customers to lose confidence in the security of our transactions, which would have a negative effect on the demand for our services and products. Moreover, public perception concerning security and privacy on the Internet could adversely affect customers’ willingness to use our websites or mobile applications. A publicized breach of security in India or in other countries in which we have operations, even if it only affects other companies conducting business over the Internet, could inhibit the growth of the Internet as a means of conducting commercial transactions, and, therefore, our business.

These and other privacy and security developments that are difficult to anticipate could adversely affect our business, financial condition and results of operations.

| 16 |

Intellectual property rights are important to our business and we cannot be sure that our intellectual property is protected from copying or use by others, and we may be subject to third party claims for intellectual property rights infringement.

Our intellectual property rights are important to our business. We rely on a combination of copyright and trademark laws, trade secrets, confidentiality procedures and contractual provisions to protect our intellectual property. Our websites and mobile applications rely on content and in-house customizations and enhancements of third party technology, much of which is not subject to intellectual property protection. We protect our logos, brand name, websites’ domain names and, to a more limited extent, our content by relying on copyrights, trademarks, trade secret laws and confidentiality agreements. We have inter alia applied for trademark registration of our logos, and word marks for yatra.com in India and such applications are currently pending with the Registry of Trademarks. We have filed responses to objections raised by the Registry of Trademarks to certain of these applications. We have also filed oppositions with the Registry of Trademarks against certain trademarks in pursuance of the protection of our trademarks. Even with all of these precautions, there can be no assurance that our intellectual property will be protected. It is possible for someone else to copy or otherwise obtain and use our content, techniques and technology without our authorization or to develop similar technology. While our domain names cannot be copied, another party could create an alternative domain name resembling ours that could be passed off as our domain name.

Our efforts to protect our intellectual property may not be adequate. Unauthorized parties may infringe upon or misappropriate our services or proprietary information. In addition, the global nature of the Internet makes it difficult to control the ultimate destination of our services. The misappropriation or duplication of our intellectual property could disrupt our ongoing business, distract our management and employees, reduce our revenues and increase our expenses. In the future, litigation may be necessary to enforce our intellectual property rights or to determine the validity and scope of the proprietary rights of others. Any such litigation could be time consuming and costly.

We could be subject to intellectual property infringement claims as the number of our competitors grows and the content and functionality of our websites or other service offerings overlap with competitive offerings. As competition in our industry increases and the functionality of technology offerings further overlaps, such claims and counterclaims could increase. There can be no assurance that we have not or will not inadvertently infringe on the intellectual property rights of third parties. Our defenses against these claims, even if not meritorious, could be expensive and divert management’s attention from operating our business. If we become liable to third parties for infringing their intellectual property rights, we could be required to pay a substantial award as damage and forced to develop non-infringing technology, obtain a license or cease selling the applications that contain the infringing technology. We may be unable to develop non-infringing technology or obtain a license on commercially reasonable terms or at all.

Our quarterly results may fluctuate for a variety of reasons and may not fully reflect the underlying performance of our business.

Our quarterly operating results may vary significantly in the future, and period-to-period comparisons of its operating results may not be meaningful. Accordingly, the results of any one quarter should not be relied upon as an indication of future performance. Our quarterly financial results may fluctuate as a result of a variety of factors, many of which are outside of our control and, as a result, may not fully reflect the underlying performance of our business. For example, we tend to experience higher revenue from our Hotels and Packages business in the second and fourth calendar quarters of each year, which coincide with the summer holiday travel season and the year-end holiday travel season for our customers in India and other markets. In our Air Ticketing business, we may have higher revenues in a particular quarter arising out of periodic discounted sales of tickets by our suppliers. Other factors that may cause fluctuations in our quarterly financial results include, but are not limited to:

| • | foreign exchange rates; |

| • | our ability to attract new customers and cross-sell to existing customers; |

| • | the amount and timing of operating expenses related to the maintenance and expansion of our business, operations and infrastructure; |

| • | general economic, industry and market conditions; |

| • | changes in our pricing policies or those of our competitors and suppliers; and |

| • | the timing and success of new services and service introductions by us and our competitors or any other change in the competitive dynamics of the Indian travel industry, including consolidation among competitors, customers or strategic partners. |

| 17 |

Fluctuations in quarterly results may negatively impact the value of our ordinary shares and make quarter-to-quarter comparisons of our results less meaningful.

We may need to make additional investments in the event of any slowdowns or disruptions in ongoing efforts to upgrade Internet infrastructure in India.

The majority of our bookings are made through our Indian website and mobile offerings. According to the Internet and Mobile Association of India’s forecasts, India is projected to have 420 million mobile Internet users by June 2017. There can be no assurance that Internet penetration in India will increase in the future, as slowdowns or disruptions in upgrading efforts for infrastructure in India could reduce the rate of increase in the use of the Internet. As such, we may need to make additional investments in alternative distribution channels. Further, any slowdown or negative deviation in the anticipated increase in Internet penetration in India may adversely affect our business and results of operations.

Our large shareholders exercise significant influence over our company and may have interests that are different from those of our other shareholders.