Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-175137

PROSPECTUS

Tomkins, LLC

Tomkins, Inc.

OFFER TO EXCHANGE

Up to $1,035,000,000 aggregate principal amount of 9% Senior Secured Second Lien Notes due 2018 issued by Tomkins, LLC and Tomkins, Inc., as co-issuers, which have been registered under the Securities Act of 1933, for any and all outstanding 9% Senior Secured Second Lien Notes due 2018 (CUSIP Nos. 693492 AC4 and U72209 AB2) issued by Tomkins, LLC and Tomkins, Inc., as co-issuers.

The exchange notes and the guarantees thereof will be the senior obligations of Tomkins, Inc. and Tomkins, LLC, as co-issuers. The exchange notes will be fully and unconditionally guaranteed jointly and severally on a second priority secured basis by Pinafore Holdings B.V., the indirect parent company of Tomkins, LLC and Tomkins, Inc., and certain of Pinafore Holdings B.V.’s domestic and foreign subsidiaries.

We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered notes for freely tradable notes that have been registered under the Securities Act.

Terms of the Exchange Offer:

| • | We will exchange all initial notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| • | You may withdraw tenders of initial notes at any time prior to the expiration date of the exchange offer. |

| • | The exchange offer expires at 5:00 p.m., New York City time, on November 18, 2011, unless extended. |

| • | We will not receive any proceeds from the exchange offer. |

| • | We believe that the exchange of initial notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

| • | The terms of the exchange notes are substantially identical to the initial notes, except that the exchange notes have been registered under the Securities Act, and transfer restrictions and registration rights relating to the initial notes do not apply to the exchange notes. |

All untendered initial notes will continue to be subject to the restrictions on transfer set forth in the initial notes and in the indenture. In general, the initial notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the initial notes under the Securities Act.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The Letter of Transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for the initial notes where such initial notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period beginning on the date the exchange offer is consummated and ending on the earlier of 180 days after the date of this prospectus and the date on which a broker-dealer is no longer required to deliver a prospectus in connection with market-making activities or other trading activities, we will make this prospectus, as amended or supplemented, available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

See “Risk Factors” beginning on page 23 for a discussion of certain risks that you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be issued in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

The date of this prospectus is October 21, 2011.

Table of Contents

| i | ||||

| i | ||||

| i | ||||

| iii | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 23 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 55 | ||||

| 56 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

58 | |||

| 114 | ||||

| 130 | ||||

| 131 | ||||

| 137 | ||||

| 138 | ||||

| 141 | ||||

| 151 | ||||

| 201 | ||||

| 203 | ||||

| 204 | ||||

| 206 | ||||

| 207 | ||||

| 207 | ||||

| F-1 | ||||

We have not authorized any dealer, salesperson or other person to give any information or represent anything to you other than the information contained in this prospectus. You must not rely on unauthorized information or representations.

This prospectus does not offer to sell nor ask for offers to buy any of the securities in any jurisdiction where it is unlawful, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities. The information in this prospectus is current only as of the date on its cover, and may change after that date.

Table of Contents

Following the date of this prospectus, we will be subject to reporting obligations and any filings we make will be available via the website of the United States Securities and Exchange Commission, or SEC, at www.sec.gov. You can also obtain any filed documents regarding us without charge by written or oral request to:

Pinafore Holdings B.V.

Fred. Roeskestraat 123

1076 EE

Amsterdam

The Netherlands

Attn. Thomas C. Reeve

Executive Vice President and General Counsel – Tomkins Limited

Tel: +31.20577.1177

Please note that copies of documents provided to you will not include exhibits.

In order to receive timely delivery of requested documents in advance of the expiration date of the exchange offer, you should make your request no later than November 11, 2011, which is five business days before you must make a decision regarding the exchange offer.

See “Where You Can Obtain More Information.”

Table of Contents

IMPORTANT INFORMATION ABOUT THIS PROSPECTUS

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell or a solicitation of an offer to buy any of these securities to any person in any jurisdiction where it is unlawful to make this type of an offer or solicitation.

ENFORCEMENT OF FOREIGN JUDGMENTS AND SERVICE OF PROCESS

Pinafore Holdings B.V. (“Holdings” or the “Company”) is a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of The Netherlands, and certain of its directors and executive officers are residents of The Netherlands. In addition, a substantial portion of the assets owned by us and the aforesaid individuals are located outside the United States. Similarly, many of the guarantors of the notes are organized under the laws of various jurisdictions outside of the United States. As a result, it may be difficult or impossible for you to effect service of process upon us or any of the aforesaid persons within the United States with respect to matters arising under the U.S. federal securities laws or to enforce against us or any of such persons judgments of U.S. courts predicated upon the civil liability provisions of the U.S. federal securities laws. Service of process in U.S. proceedings on persons in The Netherlands, however, is regulated by a multilateral treaty guaranteeing service of writs and other legal documents in civil cases if the current address of the defendant is known. The competent Dutch court will apply Dutch private international law to determine which laws will be applicable to any private law claim brought before it and apply that law to such claim. It is uncertain whether a Dutch court would apply or enforce the civil liability provisions of U.S. Federal securities laws.

We have been advised by our Dutch counsel that in the absence of an applicable treaty or convention providing for the recognition and enforcement of judgments in civil and commercial matters, other than arbitral awards, between the United States of America and the Netherlands, a judgment of a court in the United States of America (the “U.S. Judgment”) is not automatically enforceable in the Netherlands.

To obtain an enforceable judgment against the Dutch subsidiaries in the Netherlands, the matter will need to be re-litigated before the competent court in The Netherlands. In the course of such proceedings, the U.S. Judgment will have to be submitted to the relevant court in the Netherlands, and the Dutch court may give the effect to the U.S. Judgment as it deems appropriate.

According to current practice, however, based upon case law, Dutch courts will be expected to render a judgment in accordance with the U.S. Judgment, if and to the extent that: (i) the court rendering the U.S. Judgment had jurisdiction over the subject matter of the litigation on internationally acceptable grounds and has conducted the proceedings in accordance with general principles of fair trial; (ii) the U.S. Judgment is final and definite; and (iii) such recognition is not in conflict with an existing Dutch judgment or with Dutch public policy (i.e. a fundamental principle of Dutch Law).

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements.” All statements other than statements of historical facts included in this prospectus, including without limitation, statements under the captions “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” and included elsewhere in this prospectus regarding the prospects of our industry and our prospects, plans, financial position and business strategy, may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “foresee,” “believe” or “continue” or the negatives of these terms or variations of them or similar terminology. You are cautioned not to place undue reliance on the forward-looking statements which speak only as of the date that the statement was made. Important factors that could cause actual results to differ materially from our expectations are disclosed in this prospectus, including in conjunction with the forward-looking statements included in this prospectus and under “Risk Factors.” All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements included in this prospectus.

i

Table of Contents

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed in this prospectus under the headings “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

| • | global and general economic conditions, including those specific to our end markets; |

| • | significant global operations and global expansion; |

| • | the impact of natural disasters and terrorist attacks; |

| • | regulations applicable to our global operations; |

| • | our ability to compete successfully with other companies in our industry; |

| • | the cost and availability of raw materials; |

| • | the cyclical nature of the non-residential construction industry; |

| • | the downturn in the residential construction industry; |

| • | the potential loss of key personnel; |

| • | product liability claims against us; |

| • | the sufficiency of our insurance policies to cover losses, including liabilities arising from litigation; |

| • | failure to develop and maintain intellectual property rights; |

| • | the demand for our products by automakers; |

| • | our ability to integrate acquired companies into our business and the success of our acquisition strategy; |

| • | environmental, health and safety laws and regulations; |

| • | currency fluctuations from our international sales; |

| • | labor shortages, labor costs and collective bargaining agreements; |

| • | equipment failures, explosions and adverse weather; |

| • | potential inability to obtain necessary capital; |

| • | the few principal stockholders who control us; |

| • | risks related to the notes, to the collateral and to high yield securities generally; |

| • | our significant indebtedness; |

ii

Table of Contents

| • | the dependence on the subsidiaries of Holdings for cash to meet our debt obligations; and |

| • | other risks and uncertainties, including those listed under the caption “Risk Factors.” |

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this prospectus are made only as of the date hereof. Readers are cautioned that the foregoing list of risk factors is not exhaustive and that the forward-looking statements contained in this prospectus are expressly qualified by this cautionary statement. We do not undertake and specifically decline any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments.

Financial and Other Information

On July 27, 2010, the Independent Directors of Tomkins plc (“Tomkins”) and the Board of Directors of Pinafore Acquisitions Limited (now known as Tomkins Acquisitions Limited) announced that they had reached an agreement on the terms of a recommended cash acquisition (the “Acquisition”) for the entire share capital of Tomkins, including the Tomkins shares underlying the Tomkins ADRs and certain employee equity awards, implemented by way of a scheme of arrangement under Part 26 of the U.K.’s Companies Act 2006. Predecessor results for periods prior to the Acquisition on September 24, 2010 (“Predecessor”) have been presented separately from Successor results subsequent to the Acquisition (“Successor”).

Prior to the Acquisition, Tomkins drew up its annual financial statements to the Saturday nearest December 31. Accordingly, Predecessor consolidated financial statements are presented for the 53-week period from December 30, 2007 to January 3, 2009 (“Fiscal 2008”), the 52-week period from January 4, 2009 to January 2, 2010 (“Fiscal 2009”), and the 38-week period from January 3, 2010 to September 24, 2010 (“9M 2010”). The Predecessor financial statements do not reflect the effects of the accounting for, or the financing of, the Acquisition. Holdings draws up its annual financial statements to December 31. Although Holdings was incorporated on September 1, 2010, it had no assets or liabilities (other than the proceeds of the ordinary shares issued on incorporation) and no operations prior to the Acquisition. Accordingly, this prospectus contains Successor consolidated financial statements that present the results of the Successor’s operations for the 14-week period from September 25, 2010 to December 31, 2010 (“Q4 2010”).

Holdings draws up its quarterly financial statements to the Saturday nearest the end of the relevant fiscal quarter. We have included in this prospectus the unaudited condensed consolidated financial statements of Holdings for the 26-week period from January 1, 2011 to July 2, 2011 (“6M 2011”) that were made available to holders of the Notes on August 9, 2011.

The audited consolidated financial statements do not contain results for the year ended December 31, 2010 (“Fiscal 2010”). As Holdings had and has no interest in any operations other than those of Tomkins, comparison of the results of the Successor with those of the Predecessor is hindered only by the effects of the accounting for, and the financing of, the Acquisition. For the purposes of facilitating the discussion of Fiscal 2010 compared with Fiscal 2009 and 6M 2011 with 6M 2010, we therefore refer in Management’s Discussion and Analysis to our unaudited pro forma condensed consolidated income statement for Fiscal 2010 and for 6M 2010 that is presented in “Unaudited Pro Forma Financial Information” included elsewhere in this prospectus. The unaudited pro forma financial information has been prepared in accordance with SEC Regulation S-X Article 11 and incorporates adjustments that give effect to the Transactions as if they had occurred on January 3, 2010 but excludes items of income and expense that arose in connection with the Transactions but will not have a continuing impact for us beyond the twelve months following completion of the Transactions. The unaudited pro forma financial information for Fiscal 2010 and for 6M 2010 does not comply with International Financial Reporting Standards (“IFRS”) or accounting principles generally accepted in the United States of America (“U.S. GAAP”) and does not purport either to represent actual results or to be indicative of results we might achieve in future periods.

iii

Table of Contents

During Fiscal 2009, we substantially completed our long-term program of exiting our non-core businesses. We distinguish within our continuing operations between those of our operating segments that are ongoing, which we identify as “ongoing segments”, and those that we have exited but do not meet the conditions to be classified as discontinued operations, which we identify as “exited segments.”

During the second quarter of 2011, management began actively seeking a buyer for the businesses that comprise our Sensors & Valves operating segment within Industrial & Automotive. This operating segment is now classified as a discontinued operation. Historical financial information presented in this prospectus has accordingly been re-presented to reflect this classification.

Our consolidated financial statements have been prepared in accordance with IFRS, which differs in certain respects from U.S. GAAP.

We assess the performance of our businesses using a variety of measures. Certain of these measures are not explicitly defined under IFRS and are therefore termed “non-GAAP measures.” Under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” we identify and explain the relevance of each of the non-GAAP measures referenced herein, show how they are calculated and present a reconciliation to the most directly comparable measure defined under IFRS. We do not regard these non-GAAP measures as a substitute for, or superior to, the equivalent measures defined under IFRS. The non-GAAP measures that we use may not be directly comparable with similarly-titled measures used by other companies.

Certain market, ranking and industry data included in this prospectus, including the size of certain markets and our size or position and the positions of our competitors within these markets, including our products and services relative to our competitors, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. You should not place undue reliance on them as estimates are inherently uncertain. Additionally, we have cited information compiled by certain industry sources and third parties, including:

| • | Automotive Aftermarket Industry Association, “Digital Automotive Aftermarket Factbook, 20th Edition, 2011” (“AAIA”); |

| • | CSM Worldwide, Inc., a division of IHS Global Insight Inc. (“IHS/CSM”); |

| • | JD Power and Associates, “Automotive Forecasting Report, June 30, 2010” (“J.D. Power”); |

| • | McGraw-Hill Companies, “Dodge Construction Potential Bulletin, December 2010 (“Dodge”); |

| • | McGraw-Hill Companies, “Dodge Construction Potential Bulletin, June 2011 (“Dodge June 2011”); |

| • | McGraw-Hill Companies, “Construction Market Forecasting Service, Sneak-Peek Third Quarter 2011” (“McGraw-Hill”); |

| • | U.S. Bureau of the Census, “Construction Reports, Series C-20, Housing Starts” (“U.S. Census Bureau Housing Starts”); |

| • | Housingeconomics.com, National Association of Home Builders, “Executive Level Forecast, July 29, 2011” (“NAHB”); and |

| • | U.S. Bureau of the Census, “Construction Reports, Series C-30, Value of New Construction Put-in-Place” (“U.S. Census Bureau”). |

While we believe the data from these sources to be accurate and complete, we have not independently verified data from these sources or obtained third party verification of market share data and do not guarantee the accuracy or completeness of this information. In addition, these sources may use different definitions of the relevant markets. Data regarding our industry is intended to provide general guidance, but is inherently imprecise. Market share data is subject to change and cannot always be verified with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. In addition, customer preferences can and do change. As a result,

iv

Table of Contents

you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be reliable. References herein to our being a leader in a market or product category refers to our belief that we have a leading market share position in each specified market, unless the context otherwise requires. In addition, the discussion herein regarding our various markets is based on how we define the markets for our products, which products may be either part of larger overall markets or markets that include other types of products and services.

The term “emerging markets” as used in this prospectus refers to those countries defined by the International Monetary Fund as “emerging and developing economies” for the purposes of their “World Economic Outlook Database, October 2010.”

WHERE YOU CAN OBTAIN MORE INFORMATION

We have filed with the SEC a registration statement on Form F-4 under the Securities Act with respect to the exchange notes being offered in this prospectus. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us and the exchange notes, reference is made to the registration statement. Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and, where such contract or other document is an exhibit to the registration statement, each such statement is qualified by the provisions in such exhibit to which reference is hereby made.

We are not currently, and prior to the effectiveness under the Securities Act of this registration statement, are not expected to be, required to file reports with the SEC for the unregistered notes or to deliver an annual report to holders of the unregistered notes under the Exchange Act. However, we are subject to the disclosure obligations described in “Description of Senior Secured Second Lien Notes—Certain Covenants—Reports and Other Information.” Under these obligations, as long as the notes are outstanding, we will furnish you with certain annual and quarterly financial information and, for as long as the notes are “restricted securities” within the meaning of Rule 144(a)(3) under the Securities Act, we will furnish you, or any prospective purchaser of the exchange notes you designate, with the information required to be delivered by Rule 144A(d)(4) under the Securities Act when we receive a written request to do so from you. Written requests for the information should be addressed to Thomas C. Reeve, Executive Vice President and General Counsel – Tomkins Ltd., Pinafore Holdings B.V., Fred. Roeskestraat 123, 1076 EE, Amsterdam, The Netherlands.

As a result of the offering of the exchange notes, we will become subject to the informational requirements of the Exchange Act and, in accordance therewith, will file reports and other information with the SEC. The registration statement and other information can be inspected and copied at the Public Reference Room of the SEC located at Room 1580, 100 F Street, N.E., Washington D.C. 20549. Copies of such materials, including copies of all or any portion of the registration statement, can be obtained from the Public Reference Room of the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room. Such materials may also be accessed electronically by means of the SEC’s home page on the Internet (http://www.sec.gov).

v

Table of Contents

This summary highlights information included elsewhere in this prospectus. You should read the entire prospectus carefully, including the risks discussed in the “Risk Factors” section and the historical financial statements and the notes thereto before making an investment decision. This summary may not contain all of the information that may be important to you.

On July 27, 2010, the Independent Directors of Tomkins plc (“Tomkins”) and the Board of Directors of Pinafore Acquisitions Limited (now known as Tomkins Acquisitions Limited) (“Tomkins Acquisitions”) announced that they had reached an agreement on the terms of a recommended cash acquisition (the “Acquisition”) for the entire share capital of Tomkins, including the Tomkins shares underlying the Tomkins American Depositary Receipts and certain employee equity awards, implemented by way of a scheme of arrangement under Part 26 of the U.K.’s Companies Act 2006 (the “Scheme”). Tomkins Acquisitions was a newly incorporated company formed for the purpose of implementing the Acquisition at the direction of Onex Corporation (“Onex”) and Canada Pension Plan Investment Board (“CPPIB,” collectively the “Sponsors”). Tomkins, LLC and Tomkins, Inc. are indirect wholly owned subsidiaries of Tomkins Acquisitions. On August 31, 2010, the requisite majorities of Tomkins’ shareholders voted to approve the Acquisition. On September 21, 2010, the High Court of Justice in England and Wales (the “Court”) sanctioned the Scheme and a Court hearing to confirm the corresponding reduction in share capital of Tomkins plc occurred on September 23, 2010. The Court-issued orders pursuant to the Court hearings were registered and became effective on September 24, 2010.

When used in this prospectus, the terms “Tomkins,” the “Company,” “we,” “our” and “us,” except as otherwise indicated or as the context otherwise indicates, means Pinafore Holdings B.V. (“Holdings”) and its subsidiaries, including, Tomkins Acquisitions, Tomkins, LLC and Tomkins, Inc., after giving effect to the consummation of the Acquisition.

During the second quarter of 2011, management began actively seeking a buyer for the businesses that comprise our Sensors & Valves operating segment within Industrial & Automotive. This operating segment is now classified as a discontinued operation. Historical financial information presented in this prospectus has accordingly been re-presented to reflect this classification and, unless stated otherwise, all amounts presented in this summary relate to continuing operations only.

Furthermore, unless stated otherwise, all references to amounts for Fiscal 2010 presented in this summary are on a pro forma basis as described in “Unaudited Pro Forma Financial Information.”

Our Company

We are a diversified global engineering and manufacturing company with a portfolio of market-leading businesses. Our products are highly engineered and used in the industrial, automotive and construction end markets. We have a broad collection of premier brands that are among the most globally recognized in their respective end markets. We estimate that approximately 80% of our sales for Fiscal 2010 were derived from businesses that we believe hold the number one position in the markets in which they operate. As there are no publicly available sources supporting this belief, it is based solely on our internal analysis of our sales as compared to our estimates of sales for our competitors. Approximately 40% of our Fiscal 2010 sales were generated from the global industrial replacement end market and automotive aftermarket, where we achieve higher margins. Our industrial replacement business provides us with exposure to a broad range of industrial end market segments that have an ongoing need for replacement parts, while the automotive aftermarket provides us with a stable source of revenue. The significant majority of our products, including those useful for the reduction of energy consumption and for safety improvement, are positioned in the premium end of their respective end markets, and as a result, allow for associated premium pricing. The prices of our products are low relative to the potential cost of their failure within the critical systems in which they are used, such as industrial machinery, automotive engines and heating, ventilating and air conditioning (“HVAC”) systems. We attribute our end market leadership positions to a combination of our brand strength, product quality and breadth and customer service and support. We are led by an experienced, proven management team that has successfully streamlined our portfolio to focus on our core businesses, and implemented wide-ranging, significant cost-saving restructuring initiatives.

Our revenue and earnings base is highly diversified by product, geography, end market and customer. We derive revenues from nearly every developed country across the globe and are well-positioned in most emerging markets with our industrial and automotive component products. In addition, our top ten customers represented only 22% of our Fiscal 2010 sales. We maintain long-standing customer relationships and have served our top 20 customers for an average of over 35 years, while some of our largest customer relationships span over 50 years. We also have developed strong relationships with industry-leading customers in emerging markets including Chery, Tata and Mahindra & Mahindra.

1

Table of Contents

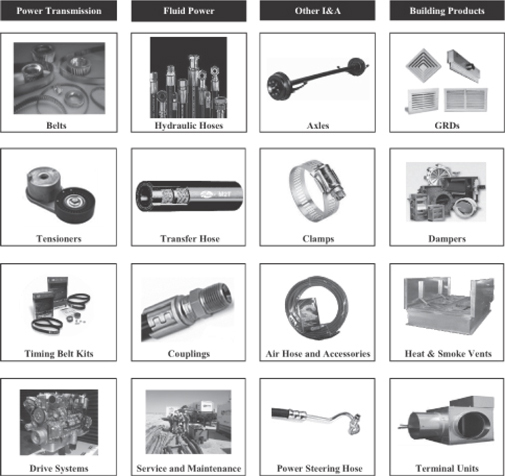

Our product portfolio consists of tens of thousands of SKUs, and we believe it comprises the broadest range of power transmission belts, fluid power hoses and air distribution products in the end markets in which we operate. This breadth, combined with our brand reputation, product quality, superior field sales and service support, long-standing customer relationships and ability to deliver on short lead times, has allowed us to establish and maintain our leading market positions.

During Fiscal 2010, we generated sales of $4.5 billion and our pro forma Adjusted EBITDA was $671.0 million. Our loss for the period in Q4 2010 was $270.2 million and our profit for the period in 9M 2010 was $243.6 million. Capital expenditure during Fiscal 2010 was $142.9 million. For a discussion of our pro forma Adjusted EBITDA, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our Fiscal 2010 sales from continuing operations can be broken down as follows:

Our Segments

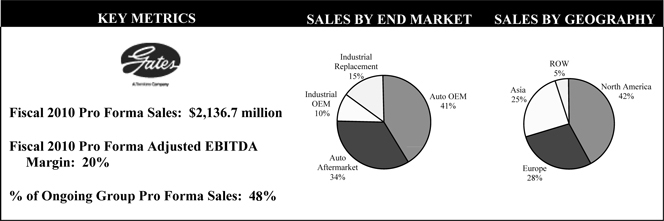

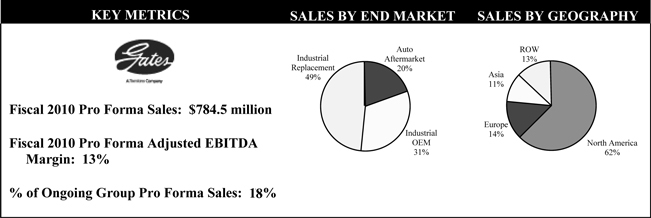

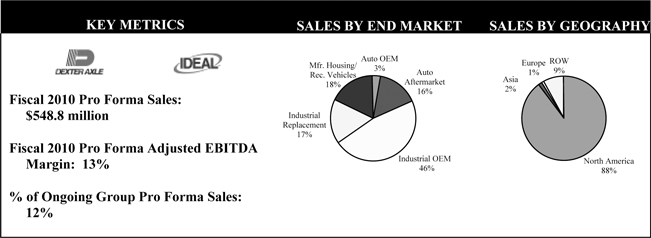

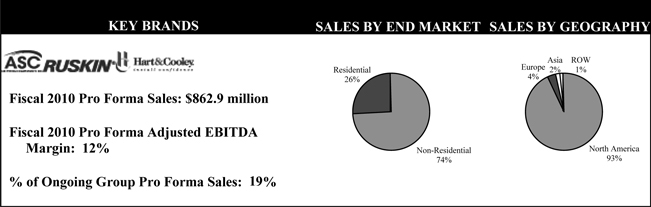

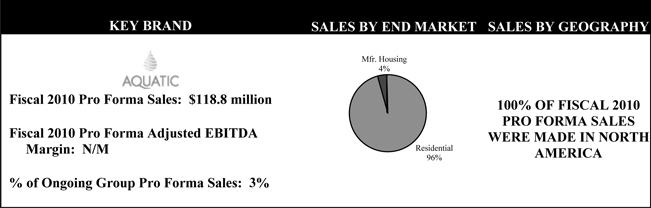

Our business is divided into two business groups: Industrial & Automotive (“I&A”), which accounted for 78% of our Fiscal 2010 sales and Building Products (“BP”), which comprised the remaining 22% of our Fiscal 2010 sales. Our continuing I&A businesses include: (i) Gates—which we believe is the leading global manufacturer of power transmission belts and related products, as well as hydraulic and industrial hose and couplings; (ii) Dexter—which we believe is the leading North American manufacturer of axles used in utility, industrial and recreational trailers; and (iii) several other businesses. As there are no publicly available sources supporting these beliefs, they are based solely on our internal analysis of our sales as compared to our estimates of sales for our competitors. Based on comparison of our non-public data, such as our business unit’s sales with our estimates of market size, in addition to our review of certain publicly available third party market data from Air Movement and Control Association International, Inc. and the Air-Conditioning, Heating, and Refrigeration Institute, we believe our BP businesses collectively are the leading North American manufacturer of products used in the HVAC systems of commercial and residential buildings, including grilles, registers, diffusers (“GRDs”), terminal units, dampers, louvers and smoke vents, among other products. We also manufacture bathtubs and shower enclosures primarily used in residential applications.

The following table illustrates our business groups’ Fiscal 2010 sales, Fiscal 2010 Pro Forma Adjusted EBITDA and market position and estimated market share.

| INDUSTRIAL & AUTOMOTIVE 78% OF SALES AND 86% OF PRO FORMA ADJUSTED EBITDA |

BUILDING PRODUCTS 22% OF SALES AND 14% OF PRO FORMA ADJUSTED EBITDA | |||||||||

| Power Transmission |

Fluid Power |

Other I&A |

Air Distribution |

Bathware | ||||||

| SALES $ IN MILLIONS |

2,136.7 | 784.5 | 548.8 | 862.9 | 118.8 | |||||

| % OF TOTAL | 48% | 18% | 12% | 19% | 3% | |||||

| KEY PRODUCTS | • Accessory drive and synchronous belts • Idler pulleys and tensioners • Fuel efficient oil pumps • Powder metal components |

• Hydraulic hoses and couplings • Transfer hoses • Engine hoses and assemblies • Hose service and management |

• Axles • Chassis components • Standard and specialty hose clamps • Aftermarket accessories |

• GRDs • Terminal units • Dampers • Louvers • Smoke vents • Chimney products • Air filters |

• Fiberglass bathtubs • Acrylic bathtubs • Shower enclosures | |||||

2

Table of Contents

| INDUSTRIAL & AUTOMOTIVE 78% OF SALES AND 86% OF PRO FORMA ADJUSTED EBITDA |

BUILDING PRODUCTS 22% OF SALES AND 14% OF PRO FORMA ADJUSTED EBITDA | |||||||||

| Power |

Fluid Power |

Other I&A |

Air Distribution |

Bathware | ||||||

| BRANDS / BUSINESSES |

|

|

|

| ||||||

| LEADING MARKET POSITION (MARKET SHARE %) |

• #1 in North America, Central America and South America industrial power transmission (35%) • #1 in North America auto aftermarket power transmission and fluid power (30%) • #1 in European auto aftermarket for synchronous belts (65%) and accessory drive belts (35%) • U.S. fluid power (25%) |

• Dexter #1 in U.S. industrial axles (50%) • Ideal #1 in U.S. standard gear clamps (60%) |

• ASC #1 in U.S. Commercial GRDs (50%) • Ruskin #1 in U.S. dampers (30%) • Hart & Cooley #1 in U.S. venting products (30%) |

• #1 in U.S. fiberglass bathtubs (30%) | ||||||

| FISCAL 2010 SALES BREAKDOWN BY END MARKET (1) |

• Auto AM: 34% • Auto OEM:41% • Ind. Rep: 15% • Ind. OEM: 10% |

• Auto AM: 20% • Auto OEM: 0% • Ind. Rep: 49% • Ind. OEM: 31% |

• Auto AM: 16% • Auto OEM: 3% • Ind. Rep: 17% • Ind. OEM: 46% • Mfr. Housing/ Rec. Vehicles: 18% |

• Non-Res.: 74% • Res.: 26% |

• Res.: 96% • Mfr. Housing: 4% | |||||

| SELECT CUSTOMERS |

• GM • Genuine Parts (NAPA & Motion Industries) • Ford • Renault Nissan • O’Reilly • SKF Autoparts • ADI • CARQUEST |

• Genuine Parts (NAPA & Motion Industries) • John Deere • JCB • O’Reilly • Bobcat • CARQUEST • CNH Global • Caterpillar |

• Redneck Trailer Supplies • Jayco • Forest River • Thor Industries • Nuera • Home Depot • Textrail • Repco • Fernco |

• York Intl • Lennox • Tom Barrow • Home Depot • Norman S. Wright • Carrier Group • Trane Co • Watsco • Ferguson |

• Home Depot • Ferguson • Hajoca • WinWholesale • Morrison | |||||

| (1) | “Auto AM”=Auto Aftermarket, “Auto OEM”=Auto Original Equipment Manufacturers, “Ind. Rep”=Industrial Replacement, “Ind. OEM”=Industrial Original Equipment Manufacturers, “Mfr. Housing” = Manufactured Housing (i.e., trailer homes), “Rec. Vehicles”=Recreational Vehicles (i.e., motorhomes), “Non-Res.”=Non-Residential Construction, “Res.”=Residential Construction. |

Industrial & Automotive

Power Transmission. We believe we are the world’s largest manufacturer of power transmission belts used in industrial equipment and automotive applications. Our Power Transmission products are sold under the Gates brand and include highly-engineered rubber and polyurethane accessory drives and synchronous belts, idler pulleys and tensioners. We are globally integrated with operations in 21 countries and maintain research, development and engineering capabilities worldwide. The largest component of our Power Transmission sales is to leading distributors for use in the industrial replacement end market and automotive aftermarket, which are higher margin businesses. The industrial replacement end market covers a broad range of industries, which have an ongoing need for replacement parts. The automotive aftermarket provides us with a stable source of revenue. We supply aftermarket belts and related components for substantially all light vehicles in North America and Europe. We also sell Power Transmission products directly to industrial and automotive original equipment manufacturers (“OEMs”). For Fiscal 2010, 63% of Power Transmission’s automotive OEM sales were to customers located outside of North America, primarily in continental Europe and Asia, including Renault, PSA/Peugeot, Mercedes, Hyundai and Chery. The end market segments for our industrial products are broad and primarily cover applications such as general industrial, agricultural equipment and motorcycles. We also have a nascent presence in elevators, white goods and wind turbines. The industrial replacement end market and automotive aftermarket collectively represented 49% of Power Transmission’s Fiscal 2010 sales, while 41% of Fiscal 2010 sales were to the automotive OEM end market. The remaining 10% of Fiscal 2010 sales were generated from the industrial OEM end market. On August 2, 2011, we finalized the sale of our Stackpole business, which specializes in powder metal and engineered powertrain components. Stackpole is included in the Power Transmission operating segment and operates predominantly in North America and Europe, generating annual sales of approximately $290 million. The business was sold to an affiliated investment fund of the Sterling Group, a Houston based private equity investment firm, for a cash consideration of $285 million.

3

Table of Contents

Fluid Power. We are a leading manufacturer of hydraulic hoses, couplings and transfer hoses used in industrial applications and in the automotive aftermarket. Our hydraulic hoses and couplings are used in technically demanding operations and must be able to withstand extreme operating conditions. Our Fluid Power products are sold under the Gates brand and are used in a variety of end market segments, such as general industrial, construction, agriculture, oil and gas, mining and energy. We have continued to broaden our Fluid Power platform by providing hydraulic service offerings (e.g., tracking, monitoring and replacement, as well as hydraulic flushing services) to the oil and gas, marine and mining end market segments. Fluid Power has a global footprint across 13 countries and serves customers worldwide such as Motion Industries, John Deere, JCB, Bobcat and Caterpillar. The industrial replacement end market accounted for 49% of Fluid Power’s Fiscal 2010 sales, while 31% of Fiscal 2010 sales were to the industrial OEM end market and 20% of Fiscal 2010 sales were to the automotive aftermarket.

Other I&A. Other I&A is comprised of three businesses, Dexter, Ideal and Plews. Dexter accounts for more than half of Other I&A’s sales. Dexter is the leading manufacturer of axle components for the utility, industrial trailer and recreational vehicle end market segments in the United States. Dexter sells products directly to OEMs and through national distributors. Ideal is the leading manufacturer of gear clamps primarily for the automotive aftermarket and sells principally in the United States, Mexico and China under a variety of brands. Plews, a wholly-owned manufacturer of automotive lubrication products and repair tools, was sold on April 20, 2011 to a consortium of investors in the US led by the private equity firm, Eigen Capital LLC. In Fiscal 2010, Plews’ sales were approximately $70 million. The cash consideration of $25 million received on the disposal approximated to the carrying amount of the net assets sold.

Building Products

Air Distribution. Based on comparison of our non-public data, such as our business unit’s sales with our estimates of market size, in addition to our review of certain publicly available third party market data from Air Movement and Control Association International, Inc. and the Air-Conditioning, Heating, and Refrigeration Institute, we believe we are the leading North American manufacturer of products that are used to distribute, recycle and vent air, and which are critical components of HVAC systems within non-residential and residential buildings. We design and manufacture a broad range of products, including, among others, GRDs, terminal units, fire and smoke dampers, louvers and fans for customers throughout North America. Our products are marketed under many established and well-known brand names including, Titus, Krueger, Ruskin and Hart & Cooley. We believe that we are the only nationwide U.S. provider of air distribution products across many of the primary categories in which we compete and we have an extensive multi-channel distribution network across the country. The majority of our products are sold through manufacturers’ representatives and building products wholesalers. The balance of our products are sold directly to HVAC OEMs, such as Carrier Group, York International and Lennox, as well as to home centers, specialty retailers and national accounts. We maintain a competitive advantage in this business by offering the broadest range of products, providing industry-leading customer service and delivering customized products on short lead times. We believe our portfolio of brands is recognized as representing the highest quality products, and building architects and engineers often specify them by name in building designs. The non-residential construction end market represented 74% of Air Distribution’s Fiscal 2010 sales, while 26% of Fiscal 2010 sales were to the residential construction end market. Within Air Distribution, 75% of Fiscal 2010 sales were into the new construction end market segment, while 25% of Fiscal 2010 sales were into the repair and refurbishment (“R&R”) end market segment, which includes all sales to home centers such as Home Depot and Lowes.

Bathware. We are a leading manufacturer of bathtubs and shower enclosures in the United States, accounting for approximately 30% of all fiberglass bathtubs sold in 2009. Our products are sold under the Aquatic brand name primarily through building products wholesalers, home center retailers and specialty distributors. Aquatic operates manufacturing plants and distribution warehouses across the United States, providing national distribution capabilities. The residential end market accounted for 96% of Bathware’s Fiscal 2010 sales, while the remaining 4% of Bathware’s Fiscal 2010 sales comprised sales to the manufactured housing industry.

4

Table of Contents

Our End Markets

We operate a portfolio of global, market-leading businesses that manufacture and sell branded products for the industrial OEM and replacement, automotive OEM, automotive aftermarket, non-residential construction and residential construction end markets. Each end market has unique characteristics and drivers that contribute to our overall revenue diversification, stability and provide broad exposure to general economic growth. We expect that the cyclical nature of the industrial and automotive OEM end markets and the industrial aftermarket will benefit us to the extent there continues to be a recovery from recessionary lows. Additional end market demand characteristics that we believe we will continue to benefit from are: (i) the resilience, stability and higher-margin nature of the automotive aftermarket principally in North America and Europe and (ii) the continued secular growth in industrial and automotive OEM and replacement end markets in emerging markets globally. We also anticipate benefiting from the eventual recovery in the U.S. non-residential construction and residential construction end markets.

Industrial OEM & Replacement

We generated 34% of our Fiscal 2010 sales from the global industrial OEM and replacement end markets. Our Power Transmission and Fluid Power segments operating under the Gates brand accounted for 77% of our Fiscal 2010 sales to the industrial OEM and replacement end markets. Our industrial belts are used in manufacturing equipment, commercial vehicles, agricultural and construction equipment as well as a broad range of consumer and industrial products and applications. Our industrial fluid power products are used within hydraulic systems, for example, on construction equipment and to transfer and convey fluids, as well as food, water, steam, oil, chemicals, gas and air and serve the general industrial, construction, agriculture, oil and gas, marine and mining industries.

We believe the demand for our products in the industrial OEM and replacement end markets will continue to be driven by (i) the level of industrial production and capacity utilization, both of which still remain below long-term averages in North America and Europe, (ii) the level of durable goods orders and operating expenditures related to consumable items used in industrial production, (iii) the level of construction activity which drives demand for construction equipment that utilize our products, (iv) the level of global commodity prices that impact demand and utilization of equipment in a number of our end market segments including agriculture and oil and gas and (v) continued emerging market growth and infrastructure build.

Automotive OEM

We generated 20% of our Fiscal 2010 sales from supplying the global automotive OEM end market. Our Power Transmission segment operating under the Gates brand accounted for 98% of our Fiscal 2010 sales for this end market. The demand in this end market is directly related to global vehicle production. According to IHS/CSM, from 2000 through 2010, annual light vehicle production averaged 14.6 million units in North America and 19.5 million units in Europe. Current automotive industry conditions in North America and Europe have demonstrated early signs of recovery, though are still significantly below long-run averages. In 2010, North American production recovered to 11.9 million units from 8.6 million units the year before. In Europe, production increased by 13%, rising from 16.3 million units in 2009 to 18.5 million units in 2010. Approximately 11% of our automotive OEM sales are derived from the Chinese market where production grew at an annualized growth rate of 24% between 2004 and 2010. IHS/CSM forecasts 2011 to 2015 annualized light vehicle production growth of 6% globally, with 6% in North America, 3% in Europe and 11% in China. Evolving consumer preferences and recent regulations have made fuel economy and safety systems a growth area for automotive OEM suppliers, which we believe will benefit our business. Many of the products that we sell to the automotive OEM end market have been shown to improve safety and fuel economy, which positions us well to benefit from the trend toward safer, more fuel-efficient vehicles.

We believe the demand for our products in the automotive OEM end market will continue to be driven by (i) the level of global vehicle production, (ii) our ability to secure positions on new vehicle platforms relative to our competitors and (iii) evolving regulatory requirements related to fuel economy and safety.

5

Table of Contents

Automotive Aftermarket

We generated 22% of our Fiscal 2010 sales from the automotive aftermarket primarily through our Gates products. Though the automotive aftermarket is influenced by fuel prices and consumer confidence, it is typically resilient during economic downturns. This resilience is a result of the stable underlying demand for replacement products, which is more influenced by non-discretionary maintenance and repair needs than it is by economic factors. For example, according to IHS/CSM, U.S. light vehicle production fell 34% in 2009 compared with the prior year, whereas, according to AAIA, aggregate U.S. automotive aftermarket sales declined only 2% during 2009 compared with the prior year. The U.S. light vehicle aftermarket represented $207 billion in aggregate sales in 2009 and is expected to reach over $230 billion by 2012, a compound annual growth rate (“CAGR”) of 4%, according to AAIA estimates. Global vehicle production is also an aftermarket revenue growth driver as it adds to the aggregate global vehicle population. JD Power estimates that the world’s total vehicle population in 2009 was 1.0 billion and expects it to grow at a CAGR of 3% from 2009 through 2015. In particular, JD Power expects that total vehicle population in emerging markets will continue to grow significantly during that period, with CAGRs of 14% in China and 10% in India, which should aid the development of the still nascent automotive aftermarket in those countries.

We believe that the demand for our products in the automotive aftermarket will continue to be driven by: (i) the size of the global vehicle population, which increases by the level of annual new vehicle production less the annual scrap rate, (ii) the average age of the global vehicle population as older vehicles typically require greater maintenance and repair and (iii) annual miles driven which correlates to the rate of vehicle wear and consequently demand for aftermarket products.

Non-Residential Construction

We generated 14% of our Fiscal 2010 sales from the non-residential construction end market, primarily from our Air Distribution segment. U.S. non-residential construction activity has been in decline since 2008, and, according to Dodge, in 2010, U.S. non-residential construction starts totaled 635 million square feet as compared with an average of 1.2 billion square feet over the 2006 to 2010 time period. McGraw-Hill is forecasting that the market will continue to stabilize in 2011 followed by more rapid growth in 2012 and 2013. Approximately 25% of our Building Products business group’s Fiscal 2010 sales were derived from R&R activities within our Air Distribution segment. We believe this will be a growth area given the increasing global drive to reduce energy consumption in buildings, which many of our products achieve. Globally, buildings use approximately one-third of the world’s energy, 25% of which is attributable to buildings’ air distribution systems. Our energy efficient air distribution products can help reduce energy consumption in this area.

We believe that demand in the non-residential construction end market, which is inherently local in nature, will be driven by underlying dynamics including: (i) local office vacancy rates, which are tied to employment levels, (ii) the availability of financing for new construction projects, (iii) public and private spending on healthcare, education and other social services and (iv) trends in the development of new urban areas and the re-development of existing urban areas.

Residential Construction

We generated 8% of our Fiscal 2010 sales from the residential construction end market, including the R&R end market segment. The U.S. residential construction end market has been weak throughout 2010 and early 2011, with seasonally adjusted annualized housing starts standing at 549,000 at the end of March 2011, compared with the total housing starts in 2010 of 587,000 units and the historical average housing start rate between 1980 and 2010 of 1.4 million units (as measured by the U.S. Census Bureau Housing Starts). According to the NAHB, housing starts are expected to recover to approximately 730,000 units by 2012 as long-term demographic factors and an expected economic recovery lead to absorption of the current excess housing supply. However, despite signs of recent stabilization and the long-term positive outlook for new residential construction, recent housing starts data suggests that near-term demand will continue to be restrained. According to the U.S. Census Bureau, R&R spending has declined 23% since 2006, and we expect it to resume growth as consumer confidence and unemployment improve.

We believe that demand in the new residential construction end market segment will continue to be driven by: (i) consumer confidence and employment levels, (ii) availability of financing along with interest rate stability, (iii) on-going population growth and relocation trends and (iv) the level of existing home sales which impacts housing inventory levels as well as the level of R&R activity.

6

Table of Contents

Our Competitive Strengths

Industry Leading Businesses with Premier Brands. We believe that we hold the number one market position in businesses that comprise approximately 80% of our Fiscal 2010 sales. As there are no publicly available sources supporting this belief, it is based solely on our internal analysis of our sales as compared to our estimates of sales for our competitors. We believe we have achieved this leadership position by offering high quality products, industry-leading product portfolios that typically consist of tens of thousands of SKUs and superior customer service and field sales support, all of which drive brand loyalty and secure our long-standing brand reputations and customer relationships. The strength of our brands has been highlighted by our demonstrated ability to pass through or adjust prices for changes in input costs, and in certain markets to charge a premium price relative to our competitors. Our principal brands include the following:

| • | Gates, which we believe is the world’s largest manufacturer of power transmission belts and a leader in hydraulic and industrial hoses and couplings. The Gates brand has existed since 1917 and is globally synonymous with premium quality, reliability and customer service. Gates has approximately a 30% share of the overall automotive aftermarket for power transmission and fluid power products in North America. In its target market, which is the “do-it-for-me” traditional and retail, light vehicle automotive aftermarket in North America, Gates has a 40% share. In Europe, we estimate that Gates has approximately a 65% share of the synchronous belt market and approximately a 35% share of the accessory drive belt market. |

| • | ASC, Ruskin and Hart & Cooley are three of the leading manufacturers of air distribution products in North America. Each of our primary Air Distribution brands maintains a share in excess of 30% of their respective product categories, and ASC, through several brands, has a share in excess of 50% of the market for commercial GRDs in the United States. |

| • | Dexter is North America’s leading manufacturer of axles used in specialty utility, industrial and recreational trailers, which are typically made-to-order, with a U.S. market share in excess of 50% for those products. |

| • | Ideal is the leading gear clamp manufacturer with a market share in the United States of approximately 60%. |

| • | Aquatic is the leading producer of value-oriented fiberglass bathtubs, accounting for approximately 30% of all fiberglass bathtubs sold in 2009 in the United States. |

Diversified Revenue and Earnings Base. We benefit from serving a diverse group of end markets and customers across the globe. This diversity helps mitigate the impact of any individual decline in any one end market during a given year. Approximately 40% of our Fiscal 2010 sales were generated from the global industrial replacement end market and automotive aftermarket, where we achieve higher margins. Our industrial replacement business provides us with exposure to a broad range of industrial end market segments that have an ongoing need for replacement parts. Our customer base consists of many of the world’s leading companies in their respective end markets, and it is broad and distinct across our segments, with no single customer representing more than 7% of our Fiscal 2010 sales. We generate revenue in most developed countries across the globe, and our emerging market presence has grown rapidly to now represent approximately 23% of our Fiscal 2010 I&A sales.

Broad Product Offering of Highly Engineered and Critical Components. Our broad product portfolio consists of tens of thousands of SKUs, which allows us to provide our customers with a comprehensive range of products. Most of our products are highly engineered components that perform critical functions within larger and more expensive systems, including industrial machinery, automotive engines and commercial HVAC applications.

7

Table of Contents

The prices of our products are low relative to the potential cost of their failure within the critical systems in which they are used. Our engineering and new product development capabilities have contributed to our reputation as an innovator, solidifying our leadership position across our product categories. Additionally, our extensive product portfolio, strong brand reputation, intellectual property, knowledge and expertise applied across our broad range of SKUs, make us a valued partner to our customers and increases their reluctance to switch suppliers. Working with our customers to design and develop solutions tailored to their individual specifications is a valuable service that we provide, which further decreases their propensity to switch suppliers.

Long-Standing Customer and Distributor Relationships. We have cultivated long-standing customer relationships due to our strong brand reputation, consistent ability to meet product availability requirements, superior customer service and best-in-class quality. Some of our relationships with our largest customers span over 50 years. Our relationships with our top 20 customers have existed for more than 35 years on average. We believe we have cultivated relationships with an estimated 75% of the U.S. and European wholesale distributors to the automotive aftermarket, and are a key supplier to three of the largest North American distributors and retailers, NAPA, O’Reilly Auto Parts (both more than 50 years) and CARQUEST (approximately 45 years). In Europe, we have long-standing customer relationships with the leading automotive aftermarket distributors in each of Germany, France and the U.K. We maintain relationships with the largest global industrial replacement distributors, including Motion Industries (approximately 45 years) and Kaman (approximately 40 years). We have also cultivated exclusive relationships with over 100 leading distributors in the North American non-residential and residential construction end markets and maintain thousands of relationships for broad market coverage. Our extensive distribution network, comprehensive product portfolio and made-to-order components make it difficult for smaller domestic and emerging market competitors to penetrate our end markets.

Low-Cost Manufacturing and Global Engineering Footprint. Many of our manufacturing facilities are located in low-cost, emerging markets, including China, Mexico, Brazil, India, Eastern Europe and Turkey. We have substantially rebased our manufacturing footprint towards lower cost, higher growth regions, as we have opened, among other things, three new facilities in China, India and Turkey, while closing approximately 30% of our North American and European facilities in 2008 and 2009. As a result, we are positioned to realize continued margin growth as our end markets recover. We have already realized some of this margin expansion with the ongoing Adjusted EBITDA margin increasing 540 basis points (“bps”) between the first half of 2009 and Fiscal 2010. Continued international expansion allows us to conduct our engineering and manufacturing activities close to our customers across the globe, as well as to develop new relationships and to benefit from the higher growth rates in emerging markets.

Strong Margins and Free Cash Flow Generation. Our operating model generates strong profit margins and stable cash flows. In Fiscal 2010 we achieved an ongoing Adjusted EBITDA margin of 15.1%, compared with 11.4% in Fiscal 2009 and 11.8% in Fiscal 2008. We achieved this improvement in part through our two broad plant rationalization programs that were largely completed in 2008 and 2009, which we refer to as projects Eagle and Cheetah. Under these initiatives we closed more than 30 loss-making, redundant and underperforming facilities in North America and Western Europe and exited low-margin and unprofitable automotive OEM businesses, which were capital intensive, as well as unprofitable Building Products businesses. After significant investments in lower cost regions, we currently have relatively lower capital expenditure requirements than we did in the past, which we expect to continue even if the end market recovery accelerates.

Experienced and Proven Management Team. We are led by an experienced management team that implemented a significant restructuring program and reshaped our business portfolio through an extensive divestiture and rationalization program. Our management team is led by Jim Nicol who joined Tomkins in 2002 as CEO. Under his leadership, we have:

| • | Executed projects Eagle and Cheetah, which we estimate will generate approximately $150 million in annual savings from 2011 onwards. |

| • | Divested or closed 26 non-core lower margin and commodity businesses to focus on higher margin, less capital intensive businesses. |

8

Table of Contents

| • | Established a portfolio of industry-leading industrial, automotive and building product businesses. |

| • | Improved the ongoing Adjusted EBITDA margin by 330 bps in Fiscal 2010 compared with Fiscal 2008, despite sales being approximately 10% below the pre-restructuring levels of Fiscal 2007. |

| • | Embedded a culture of pay for performance throughout our organization. |

Our Business Strategy

Leverage the Gates Brand. We will continue to leverage our Gates brand and footprint, which we believe, based on an internally commissioned study, is globally recognized by our customers as the highest quality power transmission belt brand and a leader in the fluid power market. We aim to enhance Gates’ strong reputation for superior quality, reliability and customer service by growing our service and distribution capabilities in the global industrial OEM and replacement end market and automotive aftermarket. We will also continue to invest in: (i) product development, such as our polyaramid-reinforced belts for motorcycles, carbon cord polychain belts, molded fabric belts used in high torque engines, belt boxes within wind turbines, ocean wave power generation systems and oil and gas applications and (ii) service capabilities, such as installing, monitoring, refurbishing and advising on system design for hydraulic applications in the oil and gas, marine and mining end market segments.

Utilize Global Presence and Brand Strength to Further Penetrate Emerging Markets. We continue to expand our market share in emerging markets such as China, Brazil, India and Eastern Europe, and our sales to emerging markets have grown from approximately 10% of I&A sales in 2004 to approximately 23% in Fiscal 2010. Gates has established and maintained a sales and manufacturing presence in both China and India since 1995. We have authorized distributors in almost all of China’s provinces, that have a total of over 130 retail stores across the country. We have recently completed new facilities to serve these markets, including our Fluid Power plant in Changzhou, China, which became operational in early 2010 and is the largest fluid power facility in our portfolio. We have also expanded our operations in India, Eastern Europe and Turkey, where we believe the recent high growth of light vehicle sales and industrial activity are expected to continue in the future. The automotive aftermarket opportunity in many of these emerging markets remains in its early stages as the average age of vehicles in these markets is currently lower than the age range that generates the most aftermarket activity, which is approximately five to ten years. Additionally, industrial activity is expected to increase with economic growth, which drives the industrial OEM and replacement end markets. We believe that exposure to these geographies will continue to drive our growth as automotive production increases, the aftermarket develops and general infrastructure and economic growth continues to expand at attractive rates.

Capitalize on Demand for Energy Efficient Products. We believe that we were among the first manufacturers to identify the growing environmentally-focused product trends in our industries and end markets. We continue to engineer products to enhance their energy and fuel efficiency. Such products include synchronous timing belts for micro-hybrid systems and variable vane oil pumps in our I&A businesses and energy recovery ventilators in our BP business. Demand for the advanced technology content integrated into these products continues to grow. In addition, a number of new regulatory guidelines in North America have emerged to promote energy efficient products in new non-residential and residential construction.

Further Enhance Margins and Free Cash Flow Generation. We will continue to develop product offerings across our businesses that contain proprietary technology and leverage our strong brands resulting in an ability to offer premium products and generate attractive margins. In response to a difficult economic climate, we have also reduced our fixed cost base. In 2008 and 2009, we substantially completed all of our comprehensive restructuring initiatives (projects Eagle and Cheetah), closing over 30 facilities and reducing headcount under these initiatives by 7,800. We anticipate reaching the full run-rate savings of $150 million during 2011. Our continual performance improvement initiatives within our plants is expected to enhance our margins further. We also believe our available manufacturing capacity and existing geographical plant footprint is sufficient to support significant increases in volume, which will result in positive operating leverage as the economy recovers. Additionally, many of our more capital-intensive operations, including several of our low-margin, more commodity-oriented automotive OEM businesses, have been divested over the past few years as part of a full-scale management initiative to focus on higher margin, lower capital intensity businesses.

9

Table of Contents

Target Opportunities for Which There is a Significant Replacement Market. We will continue to develop our technology to manufacture market-leading products and then follow with aftermarket sales and support using such technology. This strategy has been successful across the Gates brand where products were customized for use in systems designed by OEMs then sold directly to the aftermarket to satisfy replacement needs. R&R activities, which are becoming a growing revenue driver in our BP business group, accounted for 25% of Air Distribution’s Fiscal 2010 sales.

Capitalize on Eventual Cyclical End Market Recovery. Although all of our end markets were impacted by the recent global economic recession to varying degrees, we believe many of our end markets have troughed and are experiencing varying degrees of recovery, with ongoing sales up 16% in Fiscal 2010 over Fiscal 2009, driven by increased demand throughout our global industrial and automotive end markets, as well as some amount of inventory re-stocking at our customers.

Continue to Evaluate Strategic Opportunities. We will continue to evaluate our portfolio on a strategic basis and seek to expand our presence in emerging markets. We may also consider divesting non-core businesses that may be less strategic in order to accelerate the deleveraging of our balance sheet.

Our Equity Sponsors

Onex Corporation

Onex is one of North America’s oldest and most successful investment firms committed to acquiring and building high-quality businesses in partnership with talented management teams. It was founded in 1984, is listed on the Toronto Stock Exchange and operates out of offices in Toronto and New York. Onex manages investment platforms focused on private equity, real estate and credit securities. In total, Onex manages approximately $15 billion, which includes both third-party and proprietary capital. Onex’ businesses generate annual revenues of $35 billion, have assets of $40 billion and employ more than 212,000 people worldwide.

Over Onex’ history, it has had extensive experience investing in industrial, automotive and building products businesses. Onex’ recent investments in these sectors include Allison Transmission, TMS International, RSI Home Products and Spirit Aerosystems.

Canada Pension Plan Investment Board

CPPIB is a professional investment management organization that invests the funds not needed by the Canada Pension Plan to pay current benefits on behalf of 17 million Canadian contributors and beneficiaries. In order to build a diversified portfolio of CPPIB assets, CPPIB invests in public equities, private equities, real estate, inflation-linked bonds, infrastructure and fixed income instruments. Headquartered in Toronto, with offices in London and Hong Kong, CPPIB is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At March 31, 2011, the assets of the Canada Pension Plan Fund totaled C$148 billion, of which C$32 billion was invested in private investments.

The Transactions

On July 27, 2010, Tomkins Acquisitions and the independent directors of Tomkins announced that they had agreed to the terms of a recommended cash acquisition of the entire issued and to be issued share capital of Tomkins, including the shares underlying the ADRs, by Tomkins Acquisitions for approximately £2.89 billion, to be implemented by way of the Scheme. The Scheme became effective on September 24, 2010. In connection with the Acquisition the following transactions occurred:

| • | the Sponsors capitalized Tomkins Acquisitions (through its parent companies) with an aggregate equity contribution of approximately $2.1 billion; |

10

Table of Contents

| • | we drew down on the term loan portion of our senior secured credit facilities consisting of (i) a senior secured Term Loan A facility of $300.0 million; (ii) a senior secured Term Loan B facility of $1,700.0 million and (iii) a senior secured revolving credit facility of $300.0 million (no amounts were initially drawn) (collectively, our “senior secured credit facilities”); |

| • | we received the net proceeds from the sale of the initial notes; |

| • | we commenced a tender offer for Tomkins’ 8% medium term notes due 2011 (the “2011 Notes”) and Tomkins Finance plc’s 6.125% medium term notes due 2015 (the “2015 Notes” and together with the 2011 Notes, the “medium term notes”); |

| • | on the effective date of the Scheme, each ordinary share in the capital of Tomkins held by shareholders of Tomkins (except those shares held by shareholders of Tomkins who validly elected to receive loan notes in respect of some or all of their shares) were automatically cancelled and shareholders received 325 pence for each ordinary share held prior to cancellation, and upon cancellation of such shares, ordinary shares of $0.09 each in the capital of Tomkins (which have an aggregate nominal value equal to the aggregate nominal value of the cancelled shares) were issued to Tomkins Acquisitions; and |

| • | those shares held by shareholders of Tomkins who validly elected to receive loan notes in respect of some or all of their shares were transferred to Tomkins Acquisitions, and such shareholders received loan notes with a nominal value of £1.00 per loan note on the basis of £1.00 worth of loan notes for every £1.00 of cash consideration that would otherwise be payable to such shareholder. |

We refer to the Scheme, the Acquisition, the equity contribution, the borrowings under our senior secured credit facilities, the initial notes, the tender for the medium term notes and the other transactions described above as the “Transactions.” Subsequent to the completion of the Transactions, on November 19, 2010, we informed the medium term noteholders that a ratings downgrade had occurred, and certain holders of the medium term notes put their medium term notes to us. On December 30, 2010, we made a further offer to purchase the outstanding 2011 Notes at a price of 105.00% (plus accrued and unpaid interest). Acceptances were received in respect of £4.9 million of the 2011 Notes. Settlement took place on January 19, 2011. On February 11, 2011, we agreed with the providers of the senior secured credit facilities to a re-pricing of Term Loan A and term loan B and amendments to certain of the covenants and other provisions of the senior secured credit facilities. The re-pricing became effective on February 17, 2011 and attracted a one-off premium payment by us of $16.8 million.

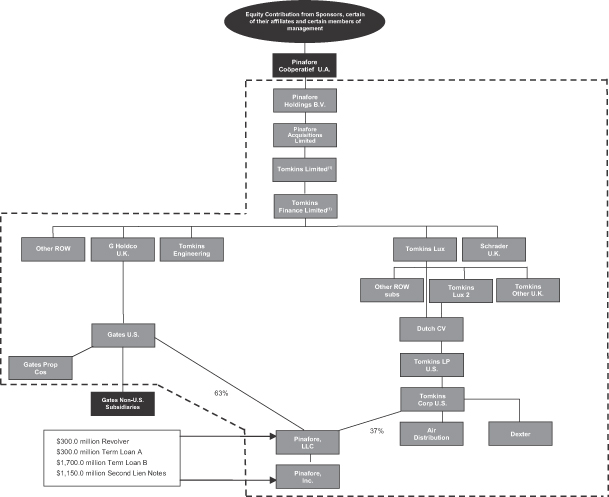

Ownership and Corporate Structure

Our simplified corporate structure following the Transactions is shown below. Except for entities in certain jurisdictions of organization, the entities inside the dotted box represent the Guarantors of the notes and the senior secured credit facilities. In addition, Pinafore Coöperatief (“Top Co-op”) and the entities represented by Gates Non-U.S. Subsidiaries are non-guarantors. The non-guarantor subsidiaries and any future non-guarantor subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due pursuant to the notes, or to make any funds available therefore, whether by dividends, loans, distribution or other payments. The non-guarantor subsidiaries accounted for the following proportion of our ongoing operations: (i) 43% of pro forma sales in Fiscal 2010 and of sales in 6M 2011; (ii) 49% of pro forma Adjusted EBITDA in Fiscal 2010 and 51% of Adjusted EBITDA in 6M 2011; (iii) 45% of total assets at the end of Fiscal 2010 and at the end of 6M 2011; and (iv) 14% of total liabilities at the end of Fiscal 2010 and at the end of 6M 2011. Both (i) and (ii) are calculated excluding corporate center entities. See “Description of Senior Secured Second Lien Notes—Note Guarantees.”

11

Table of Contents

Company Information

Tomkins was formed in London in 1925 under the name F. H. Tomkins Buckle Company Limited. On February 25, 1988, we changed our name to Tomkins plc and on September 24, 2010, Tomkins plc was converted into a private limited company, Tomkins Limited. Pinafore, LLC was formed as a Delaware limited liability company and Pinafore, Inc. was organized as a Delaware corporation for purposes of undertaking the offering of initial notes as co-issuers. On December 8, 2010, Pinafore, LLC and Pinafore, Inc. changed their names to Tomkins, LLC and Tomkins Inc., respectively. Pinafore Holdings B.V. is a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of The Netherlands. registered offices are located at Fred. Roeskestraat 123, 1076 EE, Amsterdam, The Netherlands. Our telephone number at this address is +31.20577.1177. Our website is www.tomkins.co.uk. Information on, or accessible through, our website is not part of this prospectus, nor is such content incorporated by reference herein.

12

Table of Contents

THE EXCHANGE OFFER

The following summary contains basic information about the exchange offer and the exchange notes. It does not contain all the information that may be important to you. For a more complete understanding of the exchange notes, please refer to the sections of this prospectus entitled “The Exchange Offer” and “Description of Senior Secured Second Lien Notes.”

On September 29, 2010, the issuers issued an aggregate of $1,150,000,000 million principal amount of 9% Senior Secured Second Lien Notes due October 1, 2018 (the “initial notes”) to a group of initial purchasers in reliance on exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. As part of the offering, we entered into a registration rights agreement with the initial purchasers of the initial notes in which we agreed, among other things, to deliver this prospectus and to complete an exchange offer for such initial notes. Below is a summary of the exchange offer.