Exhibit 99.2

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

------------------------------------------------------x

:

In re:Chapter 11

:

INSYS THERAPEUTICS, INC., et al.,:Case No. 19-11292 (KG)

:

Debtors.1:Jointly Administered

:

------------------------------------------------------x

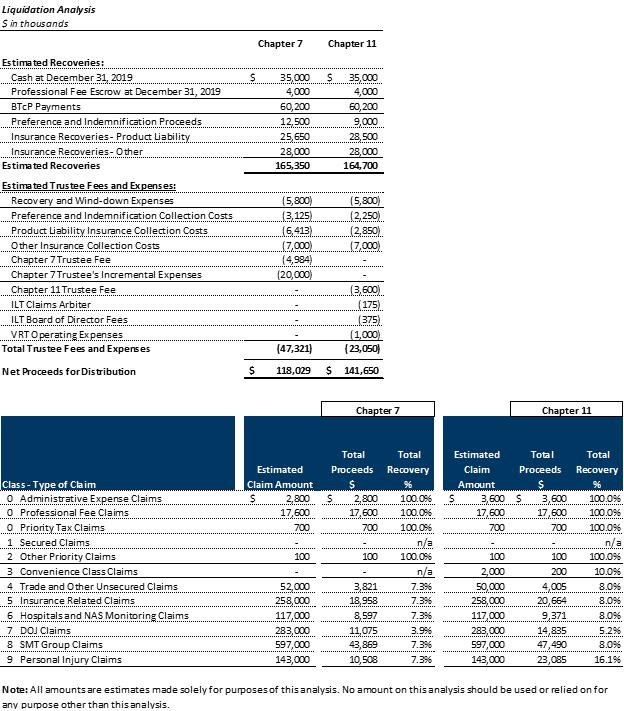

DISCLOSURE STATEMENT

FOR SECOND AMENDED JOINT CHAPTER 11 PLAN OF LIQUIDATION

PROPOSED BY INSYS THERAPEUTICS, INC. AND ITS AFFILIATED DEBTORS

|

WEIL, GOTSHAL & MANGES LLP Gary T. Holtzer (admitted pro hac vice) Ronit J. Berkovich (admitted pro hac vice) Candace M. Arthur (admitted pro hac vice) Brenda L. Funk (admitted pro hac vice) Olga F. Peshko (admitted pro hac vice) 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 Attorneys for the Debtors |

RICHARDS, LAYTON & FINGER, P.A. John H. Knight (No. 3848) Paul N. Heath (No. 3704) Amanda R. Steele (No. 5530) Zachary Shapiro (No. 5103) One Rodney Square 920 N. King Street Wilmington, Delaware 19801

Attorneys for the Debtors

|

|

|

1 |

The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable, are: Insys Therapeutics, Inc. (7886); IC Operations, LLC (9659); Insys Development Company, Inc. (3020); Insys Manufacturing, LLC (0789); Insys Pharma, Inc. (9410); IPSC, LLC (6577); and IPT 355, LLC (0155). The Debtors’ mailing address is 410 S. Benson Lane, Chandler, Arizona 85224. |

|

I. |

INTRODUCTION AND EXECUTIVE SUMMARY4 |

|

|

|

1.1 |

Background and the Debtors’ Approach to these Chapter 11 Cases4 |

|

|

|

1.2 |

Debtors’ Anticipated Assets as of the Effective Date5 |

|

|

|

1.3 |

Unsecured Claims against the Debtors’ Estates and Plan Classification6 |

|

|

|

1.4 |

Plan Negotiations, General Terms and Table of Summary Plan Treatment8 |

|

|

|

1.5 |

Confirmation under Section 1129(b)20 |

|

|

II. |

INTRODUCTION TO THE DISCLOSURE STATEMENT AND PLAN VOTING AND SOLICITATION PROCEDURES21 |

|

|

|

2.1 |

Purpose of the Disclosure Statement21 |

|

|

|

2.2 |

Disclosure Statement Enclosures21 |

|

|

|

2.3 |

Voting Procedures and Requirements22 |

|

|

|

2.4 |

Voting Deadline and Solicitation Agent.22 |

|

|

|

2.5 |

Parties Entitled to Vote.23 |

|

|

|

2.6 |

Voting Procedures.23 |

|

|

|

2.7 |

Confirmation Hearing and Objection Deadline24 |

|

|

III. |

OVERVIEW OF THE DEBTORS26 |

|

|

|

3.1 |

The Debtors’ Business and Employees26 |

|

|

|

3.2 |

The Debtors’ Corporate Structure27 |

|

|

|

3.3 |

The Debtors’ Capital Structure27 |

|

|

|

3.4 |

The Debtors’ Liquidity28 |

|

|

IV. |

KEY EVENTS LEADING TO THE COMMENCEMENT OF THE CHAPTER 11 CASES29 |

|

|

|

4.1 |

Opioid Investigations and Litigation29 |

|

|

|

4.2 |

Other Litigation and Claims35 |

|

|

|

4.3 |

Market Conditions and Decline in Business36 |

|

|

|

4.4 |

The Debtors’ Liquidity and Financial Resources36 |

|

|

|

4.5 |

Debtors’ Efforts to Restructure37 |

|

|

|

4.6 |

Changes in Management37 |

|

|

|

4.7 |

The Debtors Commence Prepetition Marketing and Sale Process38 |

|

|

V. |

OVERVIEW OF THE DEBTORS’ CHAPTER 11 CASES40 |

|

|

|

5.1 |

Commencement of the Chapter 11 Cases and First-Day Motions40 |

|

-i-

|

|

5.3 |

Public Entities Committee Motion41 |

|

|

|

5.4 |

Filings of Schedules of Assets and Liabilities and Statements of Financial Affairs42 |

|

|

|

5.5 |

Claims Bar Dates and Noticing Procedures42 |

|

|

|

5.6 |

Sales of Assets and Pursuit of Affirmative Claims44 |

|

|

|

5.7 |

Creditor Discussions, Mediation and Plan Settlement53 |

|

|

VI. |

Summary of the Plan61 |

|

|

|

6.1 |

Substantive Consolidation61 |

|

|

|

6.2 |

Equitable Subordination under Bankruptcy Code 510(c)63 |

|

|

|

6.3 |

Class Proofs of Claim64 |

|

|

VII. |

SUMMARY OF PLAN68 |

|

|

|

7.1 |

Administrative Expense and Priority Claims68 |

|

|

|

7.2 |

Classification of Claims and Interests70 |

|

|

|

7.3 |

Treatment of Claims and Interests.72 |

|

|

|

7.4 |

Means for Implementation.78 |

|

|

|

7.5 |

Distributions.102 |

|

|

|

7.6 |

Procedures for Disputed Claims.108 |

|

|

|

7.7 |

Executory Contracts and Unexpired Leases.110 |

|

|

|

7.8 |

Conditions Precedent to Confirmation of the Plan and the Occurrence of the Effective Date.115 |

|

|

|

7.9 |

Effect of Confirmation.116 |

|

|

VIII. |

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN123 |

|

|

|

8.1 |

Consequences to the Debtors124 |

|

|

|

8.2 |

Consequences to Holders of Certain Claims126 |

|

|

|

8.3 |

Tax Treatment of the Trusts and Holders of Beneficial Interests Therein128 |

|

|

|

8.4 |

Withholding on Distributions and Information Reporting131 |

|

|

IX. |

Release, Injunction, Exculpation and Related Provisions133 |

|

|

|

9.1 |

General133 |

|

|

|

9.2 |

Releases133 |

|

|

|

9.3 |

Injunction Related to Releases and Exculpation137 |

|

|

|

9.4 |

Pre-Confirmation Injunctions and Stays137 |

|

|

|

9.5 |

Injunction against Interference with Plan138 |

|

-ii-

|

|

9.7 |

Exculpation139 |

|

|

|

9.8 |

Injunction Related to Releases and Exculpation140 |

|

|

X. |

Certain Risk Factors to be Considered141 |

|

|

|

10.1 |

Risks Associated with the Bankruptcy Process141 |

|

|

|

10.2 |

Other Considerations, Risk Factors, and Disclaimers144 |

|

|

XI. |

Confirmation of the Plan147 |

|

|

|

11.1 |

Requirements of Section 1129(a) of the Bankruptcy Code147 |

|

|

XII. |

Alternatives to Confirmation and Consummation of the Plan152 |

|

|

|

12.1 |

Alternative Plan of Liquidation or Reorganization152 |

|

|

|

12.2 |

Liquidation Under Chapter 7 of the Bankruptcy Code152 |

|

|

XIII. |

Conclusion and Recommendation153 |

|

-iii-

THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT (THE “DISCLOSURE STATEMENT”) IS INCLUDED HEREIN FOR PURPOSES OF SOLICITING ACCEPTANCES OF THE DEBTORS’ SECOND AMENDED JOINT CHAPTER 11 PLAN OF LIQUIDATION OF INSYS THERAPEUTICS, INC. AND ITS AFFILIATED DEBTORS, DATED AS OF NOVEMBER [•], 2019, (INCLUDING ALL EXHIBITS AND SCHEDULES THERETO AND AS MAY BE FURTHER AMENDED, MODIFIED, OR SUPPLEMENTED FROM TIME TO TIME, THE “PLAN”) AND MAY NOT BE RELIED UPON FOR ANY PURPOSE OTHER THAN TO DETERMINE HOW TO VOTE ON THE PLAN.2 A COPY OF THE PLAN IS ATTACHED HERETO AS EXHIBIT A. NO SOLICITATION OF VOTES TO ACCEPT THE PLAN MAY BE MADE EXCEPT PURSUANT TO SECTION 1125 OF THE BANKRUPTCY CODE.

ALL CREDITORS ARE ADVISED AND ENCOURAGED TO READ THE DISCLOSURE STATEMENT AND THE PLAN IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. ALL HOLDERS OF CLAIMS SHOULD CAREFULLY READ AND CONSIDER FULLY THE RISK FACTORS SET FORTH IN SECTION X (CERTAIN RISK FACTORS TO BE CONSIDERED) OF THIS DISCLOSURE STATEMENT BEFORE VOTING TO ACCEPT OR REJECT THE PLAN. THE PLAN SUMMARIES AND STATEMENTS MADE IN THIS DISCLOSURE STATEMENT ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE PLAN AND THE EXHIBITS ATTACHED TO THE PLAN AND THIS DISCLOSURE STATEMENT. IN THE EVENT OF ANY CONFLICT BETWEEN THE DESCRIPTIONS SET FORTH IN THIS DISCLOSURE STATEMENT AND THE TERMS OF THE PLAN, THE TERMS OF THE PLAN WILL GOVERN.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND BANKRUPTCY RULE 3016(b) AND NOT NECESSARILY IN ACCORDANCE WITH OTHER NON-BANKRUPTCY LAW.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING WITH RESPECT TO PROJECTED CREDITOR RECOVERIES AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED HEREIN.

AS TO CONTESTED MATTERS, ADVERSARY PROCEEDINGS AND OTHER ACTIONS OR THREATENED ACTIONS, THIS DISCLOSURE STATEMENT WILL

|

|

2 |

Unless otherwise expressly set forth herein, capitalized terms used but not otherwise defined herein shall have the same meanings ascribed to such terms in the Plan. The exhibits to this Disclosure Statement are incorporated as if fully set forth herein and are a part of this Disclosure Statement. |

NOT CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT OR LIABILITY, STIPULATION OR WAIVER, BUT RATHER AS A STATEMENT MADE IN SETTLEMENT NEGOTIATIONS. THIS DISCLOSURE STATEMENT WILL NOT BE CONSTRUED TO BE CONCLUSIVE ADVICE ON THE TAX, SECURITIES, OR OTHER LEGAL EFFECTS OF THE PLAN AS TO HOLDERS OF CLAIMS AGAINST, OR INTERESTS IN, THE DEBTORS AND DEBTORS IN POSSESSION IN THESE CHAPTER 11 CASES.

THE PLAN, THE PLAN SETTLEMENT, THE PLAN DOCUMENTS AND THE CONFIRMATION ORDER CONSTITUTE A GOOD FAITH COMPROMISE AND SETTLEMENT OF CLAIMS AND CONTROVERSIES BASED UPON THE UNIQUE CIRCUMSTANCES OF THESE CHAPTER 11 CASES AND NONE OF THE FOREGOING DOCUMENTS, NOR ANY MATERIALS USED IN FURTHERANCE OF SUCH DOCUMENTS (INCLUDING, BUT NOT LIMITED TO, THE DISCLOSURE STATEMENT, NOTES AND DRAFTS), MAY BE OFFERED INTO EVIDENCE, DEEMED AN ADMISSION, USED AS PRECEDENT, OR USED IN ANY CONTEXT WHATSOEVER BEYOND THE PURPOSES OF THE PLAN, IN ANY OTHER LITIGATION OR PROCEEDING EXCEPT AS NECESSARY TO ENFORCE THEIR TERMS BEFORE THE BANKRUPTCY COURT OR ANY OTHER COURT OF COMPETENT JURISDICTION. THE PLAN, THE PLAN SETTLEMENT, THE PLAN DOCUMENTS AND THE CONFIRMATION ORDER WILL BE BINDING AS TO THE MATTERS AND ISSUES DESCRIBED THEREIN, BUT WILL NOT BE BINDING WITH RESPECT TO SIMILAR MATTERS OR ISSUES THAT MIGHT ARISE IN ANY OTHER LITIGATION OR PROCEEDING IN WHICH THE DEBTORS ARE NOT A PARTY. ANY PERSON’S SUPPORT OF, OR POSITION OR ACTION TAKEN IN CONNECTION WITH, THE PLAN, THE PLAN SETTLEMENT, THE PLAN DOCUMENTS AND THE CONFIRMATION ORDER MAY DIFFER FROM ITS POSITION OR TESTIMONY IN ANY OTHER LITIGATION OR PROCEEDING IN WHICH THE DEBTORS ARE NOT A PARTY. Further, and as all parties to the Mediation agreed, thE Plan Settlement is not intended to be a blueprint for other chapter 11 cases, nor is it intended to be used as precedent by any party.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS ANOTHER TIME IS SPECIFIED HEREIN, AND THE DELIVERY OF THIS DISCLOSURE STATEMENT WILL NOT CREATE AN IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE INFORMATION STATED SINCE THE DATE HEREOF.

-2-

-3-

This is the Disclosure Statement of Insys Therapeutics, Inc. (“Insys”); IC Operations, LLC; Insys Development Company, Inc.; Insys Manufacturing, LLC; Insys Pharma, Inc.; IPSC, LLC; and IPT 355, LLC as debtors and debtors in possession (collectively, the “Debtors”) in the above-captioned chapter 11 cases (the “Chapter 11 Cases”) pending in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), filed pursuant to chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) and in connection with the Joint Chapter 11 Plan of Liquidation Proposed by Insys Therapeutics, Inc., et al., a copy of which is annexed to this Disclosure Statement as Exhibit A.

SEE SECTION II (INTRODUCTION TO THE DISCLOSURE STATEMENT AND PLAN VOTING AND SOLICITATION PROCEDURES), BELOW, FOR INSTRUCTIONS ON VOTING ON THE PLAN.

The Debtors commenced these Chapter 11 Cases with the goal of resolving their mounting and varied unliquidated litigation claims in a fair and efficient process, while providing the highest possible recovery to all of their creditors. To these ends, the Debtors initiated a three-step strategy to accomplish these goals: (i) maximizing the value of their enterprise through pursuing a sale of their assets and pursuing affirmative causes of action (see Section 5.6(a)—(b)); (ii) preserving funds by seeking a stay of burdensome and asset-consuming litigation (see Section 5.6(c)); and (iii) further preserving funds by limiting their time in chapter 11 through estimation of categories of claims to facilitate confirmation of a plan and sooner distributions to creditors. The Debtors hoped and expected that this forward-looking strategy would bring creditors to the table and ultimately result in a more consensual process.

To that end, shortly after commencement of these Chapter 11 Cases, the Debtors began working with their creditors and, in particular, the Creditors’ Committee and certain States’ Attorneys General to implement a more consensual alternative to a formal estimation process with the goal of formulating a consensual chapter 11 plan. Following weeks of negotiations, a mediation facilitated by Judge Kevin Carey and a second, more limited mediation facilitated by Eric Green, as described below in more detail, the Debtors, the Creditors’ Committee, the SMT Group Participants,3 and certain key creditor constituencies reached a resolution on the framework of a consensual plan. The Plan attached to this Disclosure Statement is the result of those negotiations and settlements. Section 5.7 details how the Debtors achieved their objectives through working with the Debtors’ advisors, the Creditors’ Committee, and a number of interested parties in developing a Plan that maximizes recovery, is fair to all creditor groups, and best represents the interests of the Debtors’ creditors. The United States Department of Justice (the “DOJ”) is not a Settling Creditor and may object to the Plan. The Plan will consolidate all of the Debtors, including for the purpose of implementing the Plan, for voting, for assessing whether Confirmation standards have been met, for calculating and making distributions under the Plan, and for filing post-Confirmation reports and paying quarterly fees to the U.S. Trustee. The key

|

|

3 |

The SMT Group Participants include the MDL PEC and the States of New York, New Jersey, Maryland and Florida. |

-4-

components of the Debtors’ Plan – the claims against the Debtors, the assets available to satisfy those claims, and the mechanisms for distributing assets to creditors – are described below.

The Debtors anticipate having various assets on hand as of the Effective Date of the Plan, some of which will be unliquidated. These assets, and an estimated value thereof (which may be materially higher or lower), include:

|

|

• |

cash on hand in a current estimated amount of $34 million;4 |

|

|

• |

unliquidated business or operating assets (if any) that remain unsold as of the Effective Date (see Section 5.6) (estimated at negligible value); |

|

|

• |

royalty and other payments from the purchaser of SUBSYS® (“Subsys”) (estimated at approximately $60 million (nominal, and not net present, value) (see Section 5.6(a)(iii)); |

|

|

• |

potential claims against certain insurance policies of the Debtors (estimated at between $0 to $56 million (see Section 5.6(b)); and |

|

|

• |

unliquidated litigation claims and causes of action against numerous parties for, among other things, breaches of fiduciary duty, the receipt of preference payments, and potential fraudulent (and other avoidable) transfers (see Section 5.6(b)(i), (iii), and (iv)) (recoveries for potential preference and fraudulent transfers are estimated at approximately $9 million; the Debtors have not estimated potential recoveries for other causes of action, including potential recovery of legal fees and expenses paid to or on behalf of former officers and directors of the Debtors). |

The ability to liquidate and collect on the Debtors’ unliquidated assets is far from certain. The Debtors may not be able to sell their remaining business or operating assets and may instead incur additional expense to wind-down and dispose of those remaining business or operating assets. Similarly, the value of the royalties related to Subsys are uncertain. Moreover, in addition to the potential litigation risks inherent in reducing the Debtors’ litigation and insurance assets to judgment, there are significant risks associated with collecting on those judgements, if and when rendered in favor of the Debtors.

As a result of these various factors, it is impossible to place a precise value on the Debtors’ anticipated assets as of the Effective Date. It is expected, however, that the Debtors’ assets will be insufficient, by a wide margin, to satisfy unsecured claims against the Debtors’ estates.

|

|

4 |

This amount includes the professional fee escrow of $4 million, but is prior to the payment of administrative claims, priority claims and the costs of liquidation and wind-down of the Debtors’ estates, including taxes relating to implementation of the Plan and the costs of administering the two Trusts. The cost of administering the two Trusts, excluding recovery and wind-down expenses is estimated to total approximately $5.2 million. |

-5-

As described in further detail in Section 4.1, below, the Debtors face thousands of claims by public and private entities and individuals related, generally, to the Debtors’ business operations and the Debtors’ prior marketing and sales activities related to SUBSYS® (“Subsys”), their opioid product. The General Unsecured Claims against the Debtors, generally, fall into one of the following categories and have been classified under the Plan as follows:

|

|

• |

Class 3 Convenience Class Claims, which include any General Unsecured Claims asserted as liquidated or scheduled as neither contingent, disputed, nor unliquidated, in each case, in an amount no greater than $50,000. The Debtors estimate that Allowed Convenience Class Claims will not exceed $2 million in total; |

|

|

• |

Class 4 Trade and Other Unsecured Claims, which include creditors’ claims for, generally, goods and services provided prepetition, employee indemnification, contract rejection damages and other General Unsecured Claims not otherwise categorized in Classes 5—9 described below; |

|

|

• |

Class 5 Insurance Related Claims, which includes Claims by (1) health insurers, union health and welfare funds, and all other private providers of health care benefits, including providers of private employer sponsored self-insured health plans subject to the Employee Retirement Income Security Act of 1974 (the “ERISA Health Plan Claimants”), and including administrative service providers or agents on their behalf (collectively, the “Third Party Payors” or the “TPPs”) for fraud leading to the improper reimbursement and payment of prescription costs for Subsys, and (2) insurance rate payers (the “Insurance Ratepayers”) for the increase of insurance premium rates related to the Debtors’ conduct;5 |

|

|

• |

Class 6 Hospital Claims and NAS Monitoring Claims, which include Claims held by hospitals, other than those operated by the United States Government (the “Hospitals”), and children with neonatal abstinence syndrome (“NAS Children”) for damages6 caused by the Debtors’ alleged role in the worsening opioid crisis;7 |

|

|

5 |

As part of the Plan Settlement, the Debtors and Creditors’ Committee agreed to allow Third Party Payors and Insurance Ratepayers to file class proofs of claim, each of which will be determined and administered pursuant to the class claim procedures as set forth in the Plan and the Plan Supplement. |

|

6 |

The NAS Children assert claims relating to damages arising out of personal injury, as described above, as well as damages arising out of the marketing, distribution, and sale of Subsys (not including those arising out of personal injury). Personal injury claims are addressed in Class 9. |

|

7 |

As part of the Plan Settlement, the Debtors and Creditors’ Committee agreed to allow certain Hospitals and NAS Children to file class proofs of claim, both of which will be determined and administered pursuant to the class claim procedures as set forth in the Plan and Plan Supplement. Under the Plan, all Hospital Claims and NAS Monitoring Claims, other than the Hospital Class Claim and the NAS Monitoring Class Claim, are Disallowed and expunged as duplicative of either the Hospital Class Claim or the NAS Monitoring Class Claim. |

-6-

|

|

Restitution Claim will be Allowed in the amount filed or, if filed in an unliquidated amount, then in the amount subsequently liquidated by final order entered by the United States District Court for the District of Massachusetts; provided, however, that no DOJ Restitution Claim will be Allowed for Distribution purposes other than the DOJ Residual Restitution Claim, in an amount not to exceed $10 million; |

|

|

• |

Class 8(a) State Claims and Class 8(b) Municipality/Tribe Claims, which include Claims held by the SMT Group Participants and all other States, Municipalities, and Native American Tribes (collectively, the “SMT Group”) for, among other things, consumer fraud, deceptive practices, false claims, negligence, violations of RICO, public nuisance and abatement (the “SMT Group Claims”); and |

|

|

• |

Class 9 Personal Injury Claims, which include personal injury plaintiffs’ and similar claimants’ claims, including bodily injury claims of addicted individuals, the families of addicted individuals, and NAS Children (collectively, the “Personal Injury Claimants”), for, among other things, bodily injury, addiction, wrongful death and loss of consortium. |

Some unsecured claims were raised in litigation before the Petition Date. Others have been asserted since. Following the Petition Date, additional lawsuits have been filed against the Debtors, certain of those with existing litigation have asserted additional theories of recovery against the Debtors, and additional parties have informed the Debtors of their intention to make claims by the appropriate Bar Date. In addition, the TPPs, Insurance Ratepayers, NAS Children, Hospitals, and, separately from the TPPs, the ERISA Health Plan Claimants, have each sought the authority to file class proofs of claim in these Chapter 11 Cases on behalf of the class representatives as well as each putative member of those classes.8 As further described in Section 1.4 herein, the Plan will allow class proofs of claim to be filed by certain of the class representatives to expedite recovery and distribution.9

The Debtors submit that the Plan Classification scheme described above appropriately classifies creditors with similar claims and assists in the efficient administration of the Plan and the resolution of Claims within Classes.

The Debtors and Creditors’ Committee estimate that creditors have asserted (or will assert) over $16 billion in claims against Insys – again, far outstripping the Debtors’ assets available to satisfy such claims. The Debtors and Creditors’ Committee largely do not agree that the claims made against Insys should be allowed in the amounts asserted, but, based on the Debtors’ estimated value of such claims, the Debtors’ Assets are insufficient to pay all of the

|

|

8 |

See, respectively, D.I. 76, 486, 476, 404, and 610. As described more fully herein, the Settling Parties have agreed not to object to certain of these motions. Further, the ERISA Health Plan Claimants have agreed to withdraw their motion [D.I. 610]. |

|

9 |

The terms and procedures governing administration of each of the Class Claims are set forth in either the Plan or the Plan Supplement. |

-7-

Debtors’ creditors in full. Accordingly, the equity of Insys Therapeutics, Inc. is being cancelled under the Plan and will receive no value thereunder.10

Since the Petition Date and appointment of the Creditors’ Committee in these Chapter 11 Cases, the Debtors have been working steadily to develop a consensual chapter 11 plan (see Section 5.7). During the month of August, and concluding on August 31, 2019, the Debtors, the Creditors’ Committee, and representatives of each of the creditor groups listed above (other than the DOJ, who had previously entered into a settlement agreement with the Debtors) participated in mediation.11 Through the August mediation and subsequent mediations, as later described herein, the Debtors have been able to reach consensus and settlement with the Creditors’ Committee, the SMT Group Participants, the MDL PEC and certain other creditors (collectively the “Settling Creditors”) with respect to the Plan. The Plan and the Distributions contained therein are based on various agreed upon “settlement claim amounts,” which represent the aggregate Claim amounts for certain classes of Claims that the Debtors, the Creditors’ Committee, the SMT Group Representatives and the other Settling Creditors believe are fair and appropriate, but only when combined with the distribution scheme and all other provisions contained in the Plan. The various parties have not agreed upon the fair and appropriate “Allowed” amount of any Claim, other than in connection with the distribution scheme and all other aspects of the Plan. The Plan contains, generally, the following terms:

|

|

• |

On the Effective Date, or as soon as practicably possible thereafter and subject to reserves for administrative and priority claims against the Debtors’ estates, all Assets of the Debtors will be transferred to one of two trusts for the benefit of the Debtors’ creditors; |

|

|

• |

One such trust, the Victims Restitution Trust, will receive an assignment of the Debtors’ Products Liability Insurance Policies and any proceeds thereof for the benefit of (i) Class 9 – the Personal Injury Claimants and (ii) Class 8(a) – States and Class 8(b) – Municipalities and Native American Tribes; |

|

|

• |

The second trust, the Insys Liquidation Trust, will receive an assignment of all other Assets of the Debtors and will be charged with winding down the Debtors, liquidating their Assets, and making distributions to the Debtors’ creditors, other than the Personal Injury Claimants, whose sole recovery will be from the Victims Restitution Trust; |

|

|

10 |

One shareholder, S. Yu, filed an objection to the Debtors’ initial Plan and Disclosure Statement filed on September 17, 2019 [D.I. 719] (the “Yu Objection”). The Yu Objection challenges, among other things, the process by which Allowed Claims are determined and any presumption of validity afforded to claims that have or will be asserted against Insys. The Debtors and Ms. Yu have been unable to resolve the Yu Objection. The Debtors believe that Ms. Yu is asserting largely unsubstantiated legal theories to challenge the claims of creditors with the hope of obtaining a recovery for shareholders and the allegations contained in the Yu Objection are objections to confirmation rather than objections to the adequacy of the information in the Disclosure Statement. |

|

11 |

Following the filing of the original Disclosure Statement, the Debtors, Creditors’ Committee, and the SMT Group Participants undertook additional mediation on the limited issue of the Claims Analysis Protocol applicable to the Personal Injury Claimants. |

-8-

|

|

• |

The Debtors will make Distributions from the Insys Liquidation Trust to Classes 4 through 8(b) based on the Plan Settlement, and taking into account the following settlement claim amounts: |

|

|

o |

Aggregate Trade and Other Unsecured Claims in Class 4 at the TUC Class Amount (not to exceed $50 million);12 |

|

|

o |

Aggregate Insurance Related Claims in Class 5 of $258 million; |

|

|

o |

Aggregate Hospital Claims and NAS Monitoring Claims in Class 6 of $117 million; |

|

|

o |

Aggregate DOJ Claims in Class 7 at the DOJ Class Amount (not to exceed $28313 million); and |

|

|

o |

Aggregate State Claims and Municipality/Tribe Claims in Class 8(a) and 8(b), collectively, of $597 million. |

Based on the Debtors’ analyses and in consultation with the Creditors’ Committee (which itself conducted an independent and privileged analysis of certain of the claims listed above regarding the appropriate allocation of value in the exercise of its fiduciary duties) and various creditor constituencies and in the context of a settlement with the SMT Group and the other Settling Creditors, the Debtors and the Creditors’ Committee, in the exercise of their respective fiduciary duties, believe the allocations of value under the Plan based on the settlement claim amounts and distribution processes listed above, and the distribution process set forth therein are fair and in the best interests of the estates and their creditors.

|

|

• |

Pursuant to the Plan Settlement: |

|

|

• |

The first $38 million of Estate Distributable Value from the Insys Liquidation Trust will be split 50% to the Debtors’ private creditors (other than Personal Injury Claimants) in Classes 4, 5, and 6 and 50% to public creditors in Classes 7 and 8;14 and |

|

|

12 |

The Class Amount for Class 4 (Trade and Other Unsecured Claims), which the Debtors estimate will be less than $50 million, will be determined, if necessary, by the Liquidation Trustee and approved by the Bankruptcy Court within six (6) months of the Effective Date. |

|

13 |

The DOJ Civil Claim is Allowed at $243 million. The DOJ Forfeiture Claim, if filed, is capped at $30 million. The DOJ may file a claim for criminal restitution, the amount of which is currently unliquidated. |

|

14 |

Under the Plan, the Distributions to private creditors are defined as Category 1 Distributions and Distributions to public creditors are defined as Category 2 Distributions. |

-9-

|

|

• |

Distributions in excess of $38 million from the Insys Liquidation Trust will be split 17.5% to private creditors (other than Personal Injury Claimants) and 82.5% to public creditors. |

|

|

• |

Pursuant to an agreement with the DOJ, the DOJ agreed to not receive a distribution on account of its $243 million Allowed DOJ Civil Claim under the DOJ Stipulation until after other Allowed, general unsecured, unsubordinated Claims receive a recovery in aggregate equal to the amount of such Claims multiplied by four percent (4%). Under the Plan each holder of an Allowed Non-PI General Unsecured Claim (except the Allowed DOJ Civil Claim) benefits from this DOJ Distribution Reallocation up to the 4% threshold amount. This represents a compromise in favor of the DOJ, as the threshold amount does not take into account the allowed amount of Personal Injury Claims. |

|

|

• |

In addition to the benefit of the DOJ Distribution Reallocation, holders of Allowed Claims in Classes 4, 5 and 6 will receive the first $2 million of the DOJ Distribution Reallocation that would have otherwise been allocated to the SMT Group as a DOJ Distribution Reallocation. |

|

|

• |

Certain members of the SMT Group will also receive an administrative Claim of $800,000 for their substantial contributions to these Chapter 11 Cases. |

|

|

• |

Finally, the Personal Injury Claimants in Class 9 will receive their Pro Rata share of 90% of the proceeds (if any) of the Debtors’ Products Liability Insurance Proceeds, to the extent recovered, subject to the terms of the Claims Analysis Protocol. |

|

|

• |

The SMT Group will receive the other 10% of the proceeds (if any) of the Debtors’ Products Liability Insurance Proceeds, to the extent recovered, and 100% of the proceeds, if any, after the Personal Injury Claimants have been paid in full. |

|

|

• |

The Claims Analysis Protocol was negotiated and agreed to by representatives of the Creditors’ Committee, the SMT Group and certain Personal Injury Claimants after a second mediation approved by the Court and conducted with Eric Green as the mediator. |

|

|

• |

To conserve estate and trust resources, and to provide for allocations to creditors within Classes 5, 6 and 8, the Debtors are: |

|

|

o |

Providing after the Effective Date, for a limited time and with a cap on fees, the services of an ILT Claims Arbiter to determine certain disputes among the Hospitals, TPPs, ERISA Health Plan Claimants, Insurance Ratepayers, and NAS Children – saving the Debtors’ Estates the expense of litigating such disputes and claim objections in the Chapter 11 Cases. |

-10-

|

|

o |

Providing, at the election of the SMT Group, that the Pro Rata share of Distributions made in respect of Claims in Class 8 shall be determined by either (i) Class 8 distribution procedures, if any, filed with the Plan Supplement, (ii) the agreement of representatives of holders of SMT Group Claims if any such agreement is reached within twelve (12) months of the Effective Date and approved by the Bankruptcy Court, or (iii) such later date as extended by agreement of the SMT Representatives on the ILT Board prior to the expiration of the twelve (12) month period in Section 4.8(c)(i) of the Plan, with the expense of such process deducted from Estate Distributable Value attributable to Class 8. |

|

|

• |

In addition, to conserve estate and trust resources, and to provide for allocations to creditors within Class 9, the Debtors are providing for a Claims Administrator and Claims Analysis Protocol to determine the Allowed Claim of each Personal Injury Claimant. |

The following table (the “Treatment Table”) summarizes: (i) the treatment of Claims and Interests under the Plan; (ii) which Classes are impaired by the Plan; (iii) which Classes are entitled to vote on the Plan; and (iv) the estimated recoveries for holders of Claims and Interests based on the settlement claim amounts described herein. The table is qualified in its entirety by reference to the full text of the Plan. For a more detailed summary of the terms and provisions of the Plan, see Section 7.

Further, the estimated recoveries set forth in the Treatment Table are based upon settlement claim amounts and estimated recoveries on the Debtors’ unliquidated assets that could vary significantly. Many of these settlement claim amounts include claims which are in the preliminary stages of investigation and can only be estimated by using broad ranges. The resolution of these claims for distribution purposes, and the ultimate recoveries on unliquidated assets, could have a material effect on the estimated recoveries set forth in the Treatment Table. The Treatment Table below assumes Estate Distributable Value in a range of $60—$120 million from the ILT and approximately $25.7 million from the VRT.

|

|

15 |

The terms and procedures governing administration of each of the Class Claims are set forth in the Plan and the Plan Supplement. |

-11-

|

Type of Claim or Interest |

Treatment |

Impairment |

Entitled to Vote |

Estimated Recovery |

Estimated Claims |

||

|

None |

Administrative Expense Claims |

Except to the extent that a holder of an Allowed Administrative Expense Claim (other than a Professional Fee Claim) agrees to a different treatment, the holder of such Allowed Administrative Expense Claim shall receive, on account of such Allowed Claim, Cash in an amount equal to the Allowed amount of such Claim from the Claims Reserve within thirty (30) days following the later to occur of (i) the Effective Date and (ii) the date on which such Administrative Expense Claim shall become an Allowed Claim. |

Unimpaired |

No |

100% |

$3.6 million |

|

|

None |

Priority Tax Claims |

Except to the extent that a holder of an Allowed Priority Tax Claim agrees to a different treatment, on the Effective Date or as soon thereafter as is reasonably practicable, the holder of such Allowed Priority Tax Claim shall receive, on account of such Allowed Priority Tax Claim, either Cash in an amount equal to the Allowed amount of such Claim from the Claims Reserve or such other treatment as may satisfy section 1129(a)(9) of the Bankruptcy Code. |

Unimpaired |

No (Presumed to Accept) |

100% |

$700,000 |

|

|

Class 1 |

Secured Claims |

The legal, equitable, and contractual rights of the holders of Secured Claims are unaltered by the Plan. Except to the extent that a holder of an Allowed Secured Claim agrees to different treatment, on the Effective Date or as soon as reasonably practicable thereafter, each holder of an Allowed Secured Claim shall receive, on account of such Allowed Claim, (i) payment in full in Cash in accordance with section 506(a) of the Bankruptcy Code, (ii) reinstatement pursuant to section 1124 of the Bankruptcy Code, or (iii) such other treatment as may be necessary to render such Claim Unimpaired. |

Unimpaired |

No (Presumed to Accept) |

100% |

N/A |

-12-

|

Type of Claim or Interest |

Treatment |

Impairment |

Entitled to Vote |

Estimated Recovery |

Estimated Claims |

||

|

Other Priority Claims |

The legal, equitable, and contractual rights of holders of Other Priority Claims are unaltered by the Plan. Except to the extent that a holder of an Allowed Other Priority Claim agrees to different treatment, on the Effective Date or as soon as reasonably practicable thereafter, each holder of an Allowed Other Priority Claim shall receive, on account of such Allowed Claim, (i) payment in full in Cash or (ii) such other treatment consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code. |

Unimpaired |

No (Presumed to Accept) |

100% |

$100,000 |

||

|

Class 3 |

Convenience Class Claims |

Except to the extent that a holder of an Allowed Convenience Class Claim agrees to different treatment, in full and final satisfaction, settlement, release, and discharge of an Allowed Convenience Class Claim, each holder an Allowed Convenience Class Claim shall receive Available Cash equal to ten percent (10%) of such holder’s Allowed Convenience Class Claim on or as soon as reasonably practicable after the later of (i) the Effective Date and (ii) the date upon which such Convenience Class Claim becomes an Allowed Convenience Class Claim. |

Impaired |

Yes |

10% |

$2 million |

-13-

-14-

-15-

-16-

-17-

-18-

|

|

16 |

The Personal Injury Claims will be estimated and allowed by the VRT Claims Administrator and will recover solely from 90% of any Products Liability Insurance Proceeds. Accordingly, it is possible that Personal Injury Claimants will receive 0% if no proceeds are recovered from Products Liability Insurance Policies and 100% if there are sufficient proceeds of Products Liability Insurance Policies and the Allowed Personal Injury Claims are limited in amount. |

-19-

Pursuant to the provisions of the Bankruptcy Code, only those holders of claims or interests in classes that are impaired under a chapter 11 plan and that are not deemed to have rejected the plan are entitled to vote to accept or reject such proposed plan. Classes of claims or interests in which the holders of claims are unimpaired under a proposed plan are presumed to have accepted such proposed plan and are not entitled to vote to accept or reject the Plan. Classes of claims or interests in which the holders of claims receive no distribution under a proposed plan are deemed to have rejected such proposed plan and are not entitled to vote to accept or reject the Plan.

If a Class of Claims is deemed to reject the Plan or is entitled to vote on the Plan and does not vote to accept the Plan, the Debtors may (i) seek confirmation of the Plan under section 1129(b) of the Bankruptcy Code or (ii) amend or modify the Plan in accordance with the terms thereof and the Bankruptcy Code. If a controversy arises as to whether any Claims or Interests, or any class of Claims or Interests, are impaired, the Bankruptcy Court will, after notice and a hearing, resolve such controversy on or before the Confirmation Date. Section 1129(b) permits the confirmation of a chapter 11 plan notwithstanding the rejection of such plan by one or more impaired classes of claims or interests. Under section 1129(b), a plan may be confirmed by a bankruptcy court if it does not “discriminate unfairly” and is “fair and reasonable” with respect to each rejecting class. A more detailed description of the requirements for confirmation of a nonconsensual plan is set forth in Section 10.1(b) of this Disclosure Statement.

-20-

The purpose of the Disclosure Statement is to set forth information that (i) summarizes the Plan and alternatives to the Plan, (ii) advises holders of Claims and Interests of their rights under the Plan, (iii) assists creditors entitled to vote in making informed decisions as to whether they should vote to accept or reject the Plan, and (iv) assists the Bankruptcy Court in determining whether the Plan complies with the provisions of chapter 11 of the Bankruptcy Code and should be confirmed.

By order dated [__], 2019 [D.I. __] (the “Approval Order”), the Bankruptcy Court, among other things, approved this Disclosure Statement, finding that it contains “adequate information,” as that term is used in section 1125(a)(1) of the Bankruptcy Code, and authorized the Debtors to solicit votes on the Plan. However, the Bankruptcy Court has not ruled on the merits of the Plan. Creditors should carefully read the Disclosure Statement, in its entirety, before voting on the Plan. This Disclosure Statement and the attached Plan, including their respective exhibits, are the only materials creditors should use to determine whether to vote to accept or reject the Plan.

(a)Solicitation Packages. The Debtors will mail or cause to be mailed solicitation packages (the “Solicitation Packages”) containing the information described below no later than the date that is five (5) business days after entry of the Approval Order. The Solicitation Packages contain the following enclosures:

|

|

i. |

If the recipient is in a Voting Class (as defined herein) and is entitled to vote on the Plan, (i) the Approval Order (without exhibits); (ii) the Proposed Plan; (iii) the Disclosure Statement; (iv) the Confirmation Hearing Notice; (v) a Ballot for such holder (customized as appropriate); and (vi) a postage-prepaid, pre-addressed return envelope, and |

|

|

17 |

“Non-Voting Status Notices” means, collectively, (i) the form of notice applicable to holders of Claims and Interests in Class 1 and Class 2 (the “Non‑Voting Status Notice – Unimpaired Non-Voting”); (ii) the form of notice applicable to holders of Claims in Class 10, Class 12, and Class 13 (the “Non‑Voting Status Notice – General Impaired Non-Voting”) and (iii) the form of notice applicable to holders of Claims in Class 11 (the “Non‑Voting Status Notice – Class 11”), substantially in the forms attached as Exhibits 2-1, 2-2, and 2-3 to the Approval Order. |

-21-

(a)Eligible Holders. A claimant who holds a Claim in a Voting Class, as of the Record Date, is entitled to vote on the Plan (an “Eligible Holder”) unless:

|

|

i. |

As of the Voting Record Date (as defined below), the outstanding amount of such claimant’s Claim is not greater than zero ($0.00); |

|

|

ii. |

As of the Voting Record Date, such claimant’s Claim has been disallowed, expunged, disqualified, or suspended; |

|

|

iii. |

Such claimant’s Claim is not scheduled in the Debtors’ Schedules, or is scheduled as contingent, unliquidated, or disputed, and such claimant has not timely filed a proof of claim in accordance with the Bar Date Order; or |

|

|

iv. |

Such claimant’s Claim is subject to an objection or request for estimation as of the Voting Record Date, subject to the procedures set forth in the Approval Order. |

For the avoidance of doubt, because the Governmental and Native American Tribes Bar Date has not yet occurred, claimants holding Claims in Class 8 (SMT Group Claims), even if scheduled as contingent, unliquidated, or disputed, will be entitled to vote as set forth herein.

(b)Voting Record Date. The record date for determining which creditors are entitled to vote on the Plan is November 25, 2019 (the “Voting Record Date”).

(a)The Debtors have engaged Epiq Corporate Restructuring LLC, as solicitation and voting agent (the “Solicitation Agent”), to assist in the transmission of voting materials and in the tabulation of votes with respect to the Plan. IN ORDER FOR YOUR VOTE TO BE COUNTED, YOUR VOTE MUST BE ACTUALLY RECEIVED BY THE SOLICITATION AGENT AT THE ADDRESS SET FORTH BELOW OR ELECTRONICALLY RECEIVED IN ACCORDANCE WITH THE INSTRUCTIONS SET FORTH ON THE BALLOT ON OR BEFORE 5:00 P.M. (PREVAILING PACIFIC TIME) ON JANUARY 6, 2020 (THE “VOTING DEADLINE”), UNLESS EXTENDED BY THE DEBTORS.

If a Ballot is damaged or lost, claimants may contact the Solicitation Agent to receive a replacement Ballot. Any Ballot that is executed and returned but which does not indicate a vote for acceptance or rejection of the Plan will not be counted. If claimants have any questions concerning the voting procedures, claimants may contact the Solicitation Agent at:

-22-

Insys Therapeutics Inc.

Claims Processing Center

c/o Epiq Corporate Restructuring

10300 SW Allen Blvd.

Beaverton, OR 97005

Email: tabulation@epiqglobal.com with a reference to “INSYS” in the subject line or

Phone (Toll-Free): (855) 424-7683

Phone (if calling from outside the U.S. or Canada): (503) 520-4461

Copies of the Disclosure Statement are also available on the Solicitation Agent’s website (the “Case Website”), https://dm.epiq11.com/Insys.

(a)Under the Bankruptcy Code, only holders of Claims or interests in “impaired” classes are entitled to vote on a plan. Under section 1124 of the Bankruptcy Code, a class of Claims or interests is deemed to be “impaired” under a plan unless: (i) the plan leaves unaltered the legal, equitable, and contractual rights to which such Claim or interest entitles the holder thereof; or (ii) notwithstanding any legal right to an accelerated payment of such Claim or interest, the plan cures all existing defaults (other than defaults resulting from the occurrence of events of bankruptcy) and reinstates the maturity of such claim or interest as it existed before the default.

If, however, the holder of an impaired claim or interest will not receive or retain any distribution under the plan on account of such claim or interest, the Bankruptcy Code deems such holder to have rejected the plan, and, accordingly, holders of such claims and interests do not actually vote on the plan. If a claim or interest is not impaired by the plan, the Bankruptcy Code deems the holder of such claim or interest to have accepted the plan and, accordingly, holders of such claims and interests are not entitled to vote on the Plan.

A vote may be disregarded if the Bankruptcy Court determines, pursuant to section 1126(e) of the Bankruptcy Code, that it was not solicited or procured in good faith or in accordance with the provisions of the Bankruptcy Code.

The Bankruptcy Code defines “acceptance” of a plan by a class of claims as acceptance by creditors in that class that hold at least two-thirds (2/3) in dollar amount and more than one-half (1/2) in number of the claims that cast ballots for acceptance or rejection of the plan. As set forth below, the Claims in Classes 3, 4, 5, 6, 7, 8, and 9 are impaired and entitled to vote to accept or reject the Plan (the “Voting Classes”).

All Ballots must be signed by the holder of record of the Claim or such holder’s authorized signatory (or, if applicable, the Voting Representative of such holders) and comply with the procedures set forth in the Approval Order. As set forth in the Approval Order, unless otherwise ordered by the Bankruptcy Court, Ballots will not be counted if claimant fails to comply with the Solicitation and Voting Procedures, including by: (i) failing to indicate on the Ballot whether claimant votes to accept or reject the Plan; (ii) marking on the Ballot that claimant both

-23-

accepts and rejects the Plan; (iii) returning your Ballot to the Solicitation Agent after the Voting Deadline; (iv) returning a Ballot that is illegible or that contains insufficient information to permit the identification of the claimant; (v) returning a Ballot that is not signed in accordance with the procedures set forth in the Approval Order, and for the avoidance of doubt, a Ballot submitted by the E-Ballot platform shall be deemed to bear an original signature; or (vi) transmitting a Ballot to the Solicitation Agent by a means not specifically permitted under the Solicitation and Voting Procedures as approved by the Approval Order.

To assist in the solicitation process, the Solicitation Agent is authorized, but is not required, to contact parties that submit incomplete or otherwise deficient Ballots to cure such deficiencies.

Under the Bankruptcy Code, for purposes of determining whether the requisite votes for acceptance have been received, only holders of Claims within the Voting Classes who actually vote will be counted. The failure of a holder to timely deliver a duly executed Ballot to the Solicitation Agent will be deemed to constitute an abstention by such holder with respect to voting on the Plan and such abstentions will not be counted as votes for or against the Plan.

If a Ballot is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation, or another, acting in a fiduciary or representative capacity, such person should indicate such capacity when signing and, if requested, must submit proper evidence satisfactory to the Debtors of authority to so act. Authorized signatories should submit a separate Ballot for each Eligible Holder for whom they are voting.

UNLESS THE BALLOT IS SUBMITTED TO THE SOLICITATION AGENT ON OR PRIOR TO THE VOTING DEADLINE, SUCH BALLOT WILL BE REJECTED AS INVALID AND WILL NOT BE COUNTED AS AN ACCEPTANCE OR REJECTION OF THE PLAN; PROVIDED, HOWEVER, THAT THE DEBTORS AND THE CREDITORS’ COMMITTEE RESERVE THE RIGHT, EACH IN THEIR SOLE DISCRETION, TO REQUEST THE BANKRUPTCY COURT TO ALLOW SUCH BALLOT TO BE COUNTED.

(a)The Confirmation Hearing. The hearing on confirmation of the Plan (the “Confirmation Hearing”) will be held before the Honorable Kevin Gross, United States Bankruptcy Judge, in Courtroom No. 3 of the United States Bankruptcy Court for the District of Delaware, 824 Market Street N., Wilmington, Delaware, on January 16, 2020 at 9:00 a.m. (Prevailing Eastern Time), or as soon thereafter as counsel may be heard. The Confirmation Hearing may be adjourned from time to time by the Debtors or the Bankruptcy Court without further notice except for an announcement of the adjourned date made at the Confirmation Hearing or any subsequent adjourned confirmation hearing.

(b)The Plan Objection Deadline. The Bankruptcy Court has directed that objections, if any, to confirmation of the Plan be filed on or before January 6, 2020 at 4:00 p.m. (Prevailing Eastern Time) (the “Plan Objection Deadline”). Any objection to confirmation of the Plan must be in writing, must conform to the Bankruptcy Rules, must set forth the name of the objector, the nature and amount of the Claims held or asserted by the objector against the Estates,

-24-

the basis for the objection and the specific grounds therefore, and must be filed with the Bankruptcy Court, with a copy to the chambers of the Honorable Kevin Gross, together with proof of service thereof, and served upon the following parties (by regular or electronic mail), including such other parties as the Bankruptcy Court may order:

|

Counsel to the Debtors Ronit J. Berkovich Candace M. Arthur Brenda L. Funk Olga F. Peshko

|

Office of the U.S. Trustee |

|

Counsel to the Creditors’ Committee One Bryant Park New York, New York 10036 Mitchell Hurley Edan Lisovicz |

|

|

Co-Counsel to the Debtors Zachary Shapiro |

Co-Counsel to the Creditors’ Committee 600 N. King Street, Suite 400 Wilmington, Delaware 19801 Erin R. Fay Daniel N. Brogan |

|

|

-25-

The Debtors were, as of the Petition Date, a specialty pharmaceutical company that developed and commercialized innovative drugs and novel drug delivery systems of therapeutic molecules that improved patients’ quality of life. The Debtors’ primary operations included research and development (including preclinical and clinical trials and studies), manufacturing, marketing, and sales in support of certain drugs and novel drug delivery systems for targeted therapies. Insys had two marketed products: Subsys, a proprietary sublingual fentanyl spray, and SYNDROS®, a proprietary, orally administered liquid formulation of dronabinol, described further below.

In addition, the Debtors were developing other differentiated product candidates, described below, by leveraging their capabilities in cannabinoid formulation and manufacturing and their proprietary sublingual and nasal spray drug delivery technology. The Debtors expected that these product candidates would offer solutions to patients with unmet needs.

Insys maintains its headquarters in Chandler, Arizona. The Debtors historically maintained two manufacturing facilities under operating lease agreements, which are both located in Round Rock, Texas. As of the Petition Date, the Debtors employed 155 full-time employees, including 48 manufacturing employees, 38 sales and marketing employees, 34 employees engaged in research and development, and 35 employees in administration.

On August 9, 2019, the Debtors issued conditional notices pursuant to The Worker Adjustment and Retraining Notification Act (“WARN Notices”) to its employees required to receive WARN Notices, a group consisting of 98 of the Debtors’ then 128 full-time employees. The WARN Notices set forth the Debtors’ expectations that the closure or layoff will be permanent and will take place on October 8, 2019, unless a buyer of the Debtors’ assets offers employment or the employee is asked to continue their employment with the Debtor beyond October 8, 2019, to assist with the wind down of the Debtors business or the transfer of Debtor assets to a buyer.

As of October 22, 2019, the Debtors employed 69 full-time employees, including 31 manufacturing employees, 15 employees engaged in research and development and quality support, and 23 employees in administration.

As discussed below, pending the closing of the Pharmbio Subsys Transaction (as later defined), the Debtors will have sold substantially all of their business assets during the Chapter 11 Cases.

-26-

IPT 355, LLC

Insys Therapeutics, Inc.

Insys Pharma, Inc.

Insys

Manufacturing, LLC

IC Operations, LLC

IPSC, LLC

Insys Development Company, Inc.

There are seven Debtors in these Chapter 11 Cases: Insys, Insys Pharma, Inc., IC Operations, LLC, Insys Development Company, Inc., IPSC, LLC, IPT 355 LLC, and Insys Manufacturing, LLC. Insys is the direct parent of Insys Pharma, Inc., which is the direct parent of each of IC Operations, LLC, Insys Development Company, Inc., IPT 355 LLC, and IPSC, LLC. Insys Development Company, Inc. is the direct parent of Insys Manufacturing, LLC. Insys Therapeutics, Inc. was incorporated in Delaware in June 1990.

Insys is a publicly traded company with its shares formerly listed on the NASDAQ Global Market LLC under the ticker symbol INSY. On June 24, 2019, a Form 25 relating to the delisting and deregistration under section 12(b) of the Act of Insys’s common stock was filed by The Nasdaq Stock Market LLC. Insys’s common stock trades on the OTC Pink Sheets Market.

(a)Prepetition Equity Interests

Preferred Stock. As of March 31, 2019, Insys had 0 shares issued and outstanding and 10,000,000 shares authorized of preferred stock.

Common Stock. Insys had 74,569,163 shares of common stock outstanding at March 31, 2019. It is unlikely that holders of the Debtors’ common stock will receive any recovery on account of such securities.

-27-

On October 29, 2017, the Board accepted the resignation of John Kapoor as a board member. As part of his resignation, Kapoor agreed to place his shares of Insys, which at such time represented approximately 59% of the outstanding shares of common stock of Insys, into an independent trust. Effective as of February 27, 2018, Insys entered into a voting trust agreement (the “Voting Trust Agreement”) with Kapoor (and certain of his beneficiaries) and an independent trustee, Bessemer Trust Company of Delaware, N.A. (the “Voting Trustee”), that provided for, among other things, the Voting Trustee to have control over voting decisions over the shares of Insys common stock beneficially owned by Kapoor and his beneficiaries (except under limited circumstances) (the “Kapoor Voting Trust”).

On October 11, 2019, the Voting Trustee filed a motion seeking relief from the automatic stay to terminate the Voting Trust Agreement and the Kapoor Voting Trust. See D.I. 738. As of the date hereof, the motion remains pending but the Debtors and the Voting Trustee are in discussions to consensually resolve the motion.

As of the Petition Date, Insys had no outstanding funded debt obligations.

As of the Petition Date, Insys held approximately $37 million in cash and cash equivalents and investments. As of the date of this Disclosure Statement, the Debtors have approximately $46 million cash on hand, which includes the $4 million held in the Professional Fee Escrow Account, sale proceeds of $17 million from the sale of assets to Hikma, and sale proceeds of $12.3 million from the sale of assets to Chilion, but does not include any sale proceeds from the Pharmbio Transactions. Upon closing, the Pharmbio Transaction is expected to bring in an additional $1.2 million in sale proceeds. See Section 5.6 below for a further description of the Debtors’ asset sales.

-28-

Several factors culminated in creating a critical situation that threatened the Debtors’ ability to continue to operate as a going concern.

The Debtors began marketing and selling SUBSYS® (“Subsys”), a proprietary sublingual fentanyl spray, in 2012, approximately 20 years into the proliferation of opioid use in the United States. As measured in morphine milligram equivalents, sales of Subsys were dwarfed by sales of other legal opioids, without even taking into account illegal opioid use. Since 1992, approximately 4 trillion morphine milligram equivalents of opioid drugs were sold in the United States and Insys sold approximately 1.9 billion of those. Though tiny in comparison, Insys was swept up in the mass tort litigation filed against opioid manufacturers and distributors, alike, in which plaintiffs claim all defendants are responsible for remediation and abatement of, and compensation for, the effects of the decades-old opioid crisis. In addition to the sweeping litigation against the opioid industry, as a whole, Insys, because of certain of its marketing and sales activities related to Subsys, was also subject to litigation by certain States’ Attorneys General, insurance companies, hospitals, and personal injury plaintiffs with respect to allegations unrelated to abatement of the generalized opioid crisis.

The cost of litigating and settling these claims was overwhelming and unsustainable. At the same time, the Debtors’ revenues declined significantly, while spending to advance their pipeline products continued to be a drain on liquidity. The Debtors’ revenues from Subsys declined rapidly as a result of, among other factors, the increased national scrutiny of prescription of opioids by healthcare professionals, the resulting high-profile political and legal actions taken against manufacturers and distributors of opioids, and specific news relating to certain of the Debtors’ former executives’ criminal activity, as described herein.

Prior to the Petition Date, Insys took significant steps to address past wrongdoing, and new management of the Debtors was, and continues to be, committed to engaging in marketing practices that strictly complied with federal and state laws and regulations, including implementing an overhaul of key personnel (as described below), and focusing extensively on instilling the highest respect for fundamentally sound values among all of its employees.

As a smaller company than some other opioid manufacturers, and with over 90% of its current revenue coming from the sale of a single opioid product, Insys could not withstand the concurrent negative impact of massive litigation costs and significant opioid revenue deterioration. These factors caused a substantial cash drain on the company. Notwithstanding the Debtors’ efforts to cut costs and pursue liquidity-enhancing transactions, they determined that pursuit of these Chapter 11 Cases was the only path to avoid running out of money and to maximize recoveries for their numerous stakeholders.

Since 2013, the Debtors have faced an onslaught of investigative inquiries and litigation claims by both governmental and private parties in connection with Subsys, which claims continued to surge with the ongoing and heightened publicity surrounding the national opioid

-29-

crisis. As of the Petition Date, one or more of the Debtors had been named in over one thousand lawsuits, and additional lawsuits have been filed since the Petition Date. Some of the litigation is common to opioid manufacturers in general, while other claims are based on particular alleged conduct of the Debtors or activities of the Debtors’ former executives, many of whom either pleaded guilty to or were convicted after trial of federal criminal activity relating to such activities. Many of these inquiries and lawsuits against the Debtors (and certain of their former employees, officers, and directors) have focused on the marketing of Subsys and issues related to potential violations of the Anti-Kickback Statute and the Food, Drug & Cosmetic Act and the Debtors’ business unit created to secure prior authorizations required for insurance reimbursement of prescription costs for patients, known as the “Insys Reimbursement Center” or the patient services hub. Public and private parties allege, among other things, that this activity was illegal (and indeed, in some instances former employees have pleaded guilty) and that it led to improper use of, and reimbursement for, Subsys.

(a)U.S. Government Investigations and U.S. and State Qui Tam Litigation

Beginning in late 2013, the Debtors began receiving subpoenas and other requests for information relating to their sales and marketing of Subsys and the Insys Reimbursement Center from various government entities. The Debtors cooperated with these investigations and produced a substantial number of documents in response thereto.

Between August 2013 and October 2016, certain individuals (the “Qui Tam Plaintiffs”) filed actions against Insys related to the company’s marketing and sales of Subsys pursuant to the qui tam provisions of the False Claims Act, 31 U.S.C. § 3730(b) (the “Qui Tam Actions”). The United States and the states of California, Colorado, Indiana, Minnesota, New York, North Carolina, and Virginia intervened in part and declined to intervene in part in certain of the Qui Tam Actions. The United States’ Complaint in Intervention, which was ordered unsealed on May 11, 2018, brings claims on behalf of the Office of Inspector General for the U.S. Department of Health and Human Services (the “HHS-OIG”), the Centers for Medicare & Medicaid Services (Medicare program), and the Defense Health Agency (TRICARE program) (the “DOJ Civil Action”). The Debtors’ continuing discussions with federal agencies with respect to the federal investigations culminated in a resolution on June 5, 2019, described further below. As part of such resolution, the DOJ agreed to move to dismiss the United States’ claims with prejudice in the Qui Tam Actions, excepting certain claims for attorneys’ fees and retaliation claims.

In addition to the DOJ Civil Action, the DOJ commenced criminal investigations against Debtors Insys Pharma, Inc. and Insys Therapeutics, Inc. (the “DOJ Criminal Actions,” and, together with the DOJ Civil Action, the “DOJ Actions”). Additionally, HHS-OIG considered a potential action to exclude Insys from participation in certain federal healthcare programs, such as Medicare and Medicaid (the “HHS-OIG Potential Action”).

After months of negotiations, on June 5, 2019, the Debtors, the DOJ and the HHS-OIG agreed to a global resolution of the DOJ Actions and the HHS-OIG Potential Action, and in connection therewith entered into several interrelated, interdependent agreements and related documents, including the DOJ Civil Settlement, the Plea Agreement and the CIA, each as described below.

-30-

To resolve the DOJ Civil Action, the United States and the Debtors entered into the Settlement Agreement (the “DOJ Prepetition Civil Settlement Agreement”), pursuant to which the Debtors agreed to a $195 million restitution payment, with $5 million of that paid within one day of the execution of the agreement, and the United States agreed to a release of certain civil claims against the Debtors. In connection therewith, the parties agreed to the terms of a stipulation to be executed after the Petition Date and filed with a motion for approval pursuant to Bankruptcy Rule 9019 in this Court (the “DOJ Stipulation”). Pursuant to the DOJ Stipulation, among other things, (i) the Debtors agreed that the United States will have a $243 million allowed unsecured claim in the Chapter 11 Cases (capped at a $195 million recovery, inclusive of the $5 million prepetition payment) as the sole remedy for restitution under the DOJ Prepetition Civil Settlement Agreement and the “Covered Conduct” (as defined in the DOJ Prepetition Civil Settlement Agreement) and for any breach by Insys of the DOJ Prepetition Civil Settlement Agreement (which breach would result in much higher claims under the terms of such agreement), (ii) the United States agreed that, contingent on certain conditions being met, there would be no successor liability if Subsys were sold pursuant to section 363 of the Bankruptcy Code, and (iii) both parties agreed to certain other releases. The Debtors filed a motion to approve the DOJ Stipulation with the Bankruptcy Court on June 10, 2019. The State of Florida filed an objection to the Debtors’ motion. See D.I. 200. The Creditors’ Committee did not file a formal objection, but instead engaged in significant discussion and negotiation with the Debtors and the DOJ regarding the DOJ Stipulation.

The parties subsequently reached a resolution of the objections to the Debtors’ motion to approve the DOJ Stipulation, which resolution was approved by order of the Bankruptcy Court on October 7, 2019 [D.I. 707]. Pursuant to that resolution, the order approving the DOJ Stipulation was revised to provide that the DOJ would retain the $5 million paid to it before the Petition Date pursuant to the DOJ Prepetition Civil Settlement Agreement, but would not receive a distribution on account of its Allowed Claim under the DOJ Stipulation until after other Allowed, general unsecured, nonsubordinated Claims receive a recovery of four percent (4%) on account of such Claims.

To resolve the DOJ Criminal Actions, the United States Attorney for the District of Massachusetts entered into the Plea Agreement with Insys Pharma, Inc. (the “Plea Agreement”) and the related Deferred Prosecution Agreement with Insys Therapeutics, Inc. (the “DPA”). Pursuant to the Plea Agreement, Insys Pharma, Inc. pleaded guilty to five counts of mail fraud on June 7, 2019. As part of the resolution, the parties agreed to resolve claims against Insys Pharma, Inc., through its guilty plea to five counts of mail fraud and a recommended sentence for Insys Pharma, Inc. to pay a $2 million fine and $28 million in forfeiture. Pursuant to the Plea Agreement, the first payment totaling $5 million was due ten days after the criminal sentencing of Insys Pharma, Inc. on July 10, 2019; however, given, among other things, the pendency of the Chapter 11 Cases and the pending motion seeking approval of the DOJ Stipulation, Insys Pharma, Inc. did not make that payment. Pursuant to the DPA, among other things, the United States agreed to defer prosecution against Insys of its criminal mail fraud actions for a term of five years if Insys abides by the terms of the DPA, with Insys’s agreement that it is jointly and severally liable for the money owed by Insys Pharma, Inc. pursuant to the Plea Agreement, and with certain cooperation and compliance obligations.

-31-

The Plea Agreement also provided that the United States would seek court authority to solicit criminal restitution requests from Insys’ potential criminal victims. The United States obtained that authority from the District of Massachusetts and has solicited and is evaluating the potential criminal restitution requests that it received. A hearing to consider any restitution request actually made by the United States on behalf of Insys’ potential criminal victims currently is scheduled to proceed on or after January 10, 2020, and the Debtors have reserved all of their rights to object to any restitution request made by the United States. The parties have agreed that the fine, forfeiture, and any restitution claim, if any, would be treated as an unsecured claim in the Chapter 11 Cases.

To resolve the HHS-OIG Potential Action, on June 5, 2019, Insys entered into a Corporate Integrity Agreement and Conditional Exclusion Release (“CIA”) with the HHS-OIG, under which, among other things, the Debtors agreed to establish and maintain for a period of five years an extensive program intended to promote compliance with the statutes, regulations, and written directives of Medicare, Medicaid, and all other federal health care programs, and with the statutes, regulations, and written directives of the FDA, and the HHS-OIG agreed not to exclude the Debtors from federal health care programs for the covered time period, if it complies with the terms of the agreement. Pursuant to the CIA, the Debtors are required to take a number of actions which include, among other things: (a) ceasing the marketing and promotion of Subsys within 90 days of the effective date of the CIA or the divestiture of Subsys, whichever occurs first, and (b) divesting Subsys and its buprenorphine candidate product to a bona fide independent third party, and ceasing all business activities related to opioids within 12 months of the effective date of the CIA.

In addition, on May 21, 2019, the HHS-OIG provided the Debtors with a letter (the “OIG Side Letter”), in which, among other things, the HHS-OIG acknowledged that Insys is likely to file for bankruptcy and stated that its general rule is that in an asset sale under section 363 of the Bankruptcy Code, a bona fide unrelated third party purchaser of assets is not subject to the obligations of the CIA. The HHS-OIG also committed in the OIG Side Letter to work expeditiously with any purchaser of the Debtors’ assets to make a determination about successor liability issues associated with the purchases stemming from the bankruptcy.18

(b)State Attorneys General Investigations and Litigation

The Debtors have received information requests or subpoenas from at least fifteen states’ offices of the attorney general (or similarly named and authorized office), which have ongoing investigations regarding the Debtors’ sales and marketing practices related to Subsys and the Insys Reimbursement Center (the “AG Investigations”). In addition, the Debtors received an administrative subpoena from the California Insurance Commissioner. As of the Petition Date, the Debtors were cooperating with each of those investigations, and settled with the states of Oregon, New Hampshire, Illinois, and Massachusetts before the Petition Date. As of the Petition Date, Insys was also a defendant in legal proceedings commenced by ten states’ offices of the

|

|

18 |

On August 13, 2019, the HHS-OIG provided the Debtors with a letter in which, among other things, the HHS-OIG agreed to extend a sixty-day extension of the deadlines contained in the CIA and represented that December 2, 2019, is the due date for the Debtors’ report regarding implementation. |

-32-

attorney general (the “Attorney General Actions”). The Attorney General Actions are in various stages of litigation.

Certain Debtors have been named, together with various other defendants, including opioid manufacturers, distributors, prescribers, pharmacies, and others, in opioid-related complaints by various counties, states, Native American tribes, and third-party payors in many state and federal courts in approximately 32 states. The Debtors are defendants in approximately 1,000 of these cases filed prepetition and similar parties have continued to file after the Petition Date (the “Municipal Actions”).

The majority of the Municipal Actions have been consolidated into Multidistrict Litigation No. 2804 (the “MDL”) in the United States District Court for the Northern District of Ohio (the “MDL Court”). Most of the cases in the MDL are currently stayed while a limited number of cases were allowed to proceed. Specifically, the MDL Court ordered two litigation tracks of five total cases for accelerated discovery, motion practice, and bellwether trials, the first of which was scheduled to begin on October 21, 2019. Track 1 comprises three cases brought by plaintiffs located in the Northern District of Ohio. Certain of the Debtors are named in those cases alongside approximately 23 Defendant Families.19 The Track 1 trial has been postponed because four of the Defendants settled on the eve of trial, and the trial date has not yet been set for the claims against the remaining Track 1 Defendants. Track 2 includes the claims of Cabell County Commission, West Virginia and City of Huntington, West Virginia.

In addition, approximately 200 Municipal Actions against various Debtors are pending outside of the MDL, mostly in state courts in Arizona, California, Connecticut, New York, Oklahoma, Pennsylvania, South Carolina, Texas, and Virginia. These cases are in various stages of motion practice and discovery and parties continued to file actions after the Petition Date.

(d)Hospital and Insurance Ratepayer Litigation

On June 16, 2019, twenty-five individually named parties filed the Motion of the Class Claimants for Leave to File Class Proof of Claim [D.I. 76], seeking class action status on behalf of certain plaintiffs in the MDL that had filed putative class action lawsuits against Insys claiming that, as a result of the actions of Insys and others, all citizens of their states are paying higher insurance premiums. On August 7, 2019, four individually named parties filed the Motion by Hospital Class Action Claimants Pursuant to Bankr. P. 9014 and 7023 to Make Federal Rule of Civil Procedure 23 Applicable to These Proceedings and to Permit the Filing of a Class Proof of Claim [D.I. 404], seeking class action status on behalf of certain plaintiffs in the MDL that have filed lawsuits, including a putative class action lawsuit, claiming that they incurred unique losses as a result of the allegedly deceptive, false, and unfair marketing of prescription opioids by the Debtors and others.

|

|

19 |

“Defendant Families” are groups of related corporate entity defendants. |

-33-

(e)Private Insurance Litigation