UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22542

SSGA ACTIVE TRUST

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and Deputy General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: June 30

Date of reporting period: June 30, 2021

Item 1. Reports to Shareholders.

(a) The Reports to Shareholders are attached herewith.

| SPDR SSGA Multi-Asset Real Return ETF |

| SPDR SSGA Income Allocation ETF |

| SPDR SSGA Global Allocation ETF |

| SPDR SSGA Ultra Short Term Bond ETF |

| SPDR Nuveen Municipal Bond ETF |

|

|

1 |

| Management’s Discussion of Fund Performance, Performance Summaries & Portfolio Statistics (Unaudited) | |

|

|

2 |

|

|

5 |

|

|

8 |

|

|

11 |

| Schedules of Investments | |

|

|

15 |

|

|

17 |

|

|

19 |

|

|

21 |

|

|

27 |

|

|

32 |

|

|

38 |

|

|

43 |

|

|

52 |

|

|

54 |

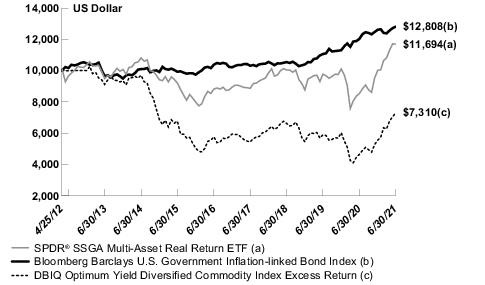

| Cumulative Total Return | Average Annual Total Return | ||||||||||

| Net

Asset Value |

Market

Value |

Bloomberg Barclays U.S. Government Inflation-linked Bond Index | DBIQ Optimum Yield Diversified Commodity Index Excess Return | Net

Asset Value |

Market

Value |

Bloomberg Barclays U.S. Government Inflation-linked Bond Index | DBIQ Optimum Yield Diversified Commodity Index Excess Return | ||||

| ONE YEAR | 37.12% | 37.12% | 6.51% | 57.54% | 37.12% | 37.12% | 6.51% | 57.54% | |||

| FIVE YEARS | 32.63% | 32.69% | 23.38% | 27.40% | 5.81% | 5.82% | 4.29% | 4.96% | |||

| SINCE INCEPTION(1) | 16.94% | 16.97% | 28.08% | (26.90)% | 1.72% | 1.72% | 2.73% | (3.36)% | |||

| (1) | For the period April 25, 2012 to June 30, 2021. Since shares of the Fund did not trade in the secondary market until the day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/25/12, 4/26/12, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

(Based on Net Asset Value)

| Description | % of Net Assets | ||

| Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF | 25.1% | ||

| SPDR S&P Global Natural Resources ETF | 24.6 | ||

| SPDR S&P Global Infrastructure ETF | 21.8 | ||

| SPDR Bloomberg Barclays 1-10 Year TIPS ETF | 8.5 | ||

| SPDR Dow Jones REIT ETF | 4.0 | ||

| TOTAL | 84.0% |

| % of Net Assets | |||

| Natural Resources | 28.4% | ||

| Commodities | 25.1 | ||

| International Equity | 23.8 | ||

| Inflation Linked | 8.5 | ||

| Real Estate | 6.0 | ||

| Domestic Equity | 3.9 | ||

| International Fixed Income | 3.8 | ||

| Short Term Investments | 10.0 | ||

| Liabilities in Excess of Other Assets | (9.5) | ||

| TOTAL | 100.0% |

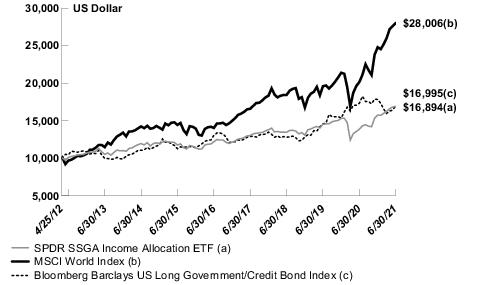

| Cumulative Total Return | Average Annual Total Return | ||||||||||

| Net

Asset Value |

Market

Value |

MSCI World Index | Bloomberg Barclays US Long Government /Credit Bond Index | Net

Asset Value |

Market

Value |

MSCI World Index | Bloomberg Barclays US Long Government /Credit Bond Index | ||||

| ONE YEAR | 21.90% | 21.92% | 39.04% | (1.86)% | 21.90% | 21.92% | 39.04% | (1.86)% | |||

| FIVE YEARS | 38.56% | 38.55% | 99.64% | 30.38% | 6.74% | 6.74% | 14.83% | 5.45% | |||

| SINCE INCEPTION(1) | 68.94% | 68.95% | 180.06% | 69.95% | 5.88% | 5.88% | 11.87% | 5.95% | |||

| (1) | For the period April 25, 2012 to June 30, 2021. Since shares of the Fund did not trade in the secondary market until the day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/25/12, 4/26/12, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

(Based on Net Asset Value)

| Description | % of Net Assets | ||

| SPDR Blackstone Senior Loan ETF | 20.3% | ||

| SPDR Portfolio S&P 500 High Dividend ETF | 15.4 | ||

| SPDR Bloomberg Barclays Emerging Markets Local Bond ETF | 9.9 | ||

| SPDR S&P International Dividend ETF | 8.8 | ||

| SPDR Portfolio Long Term Corporate Bond ETF | 7.9 | ||

| TOTAL | 62.3% |

| % of Net Assets | |||

| Domestic Fixed Income | 47.8% | ||

| Domestic Equity | 28.5 | ||

| International Equity | 13.7 | ||

| International Fixed Income | 9.9 | ||

| Short Term Investments | 8.2 | ||

| Liabilities in Excess of Other Assets | (8.1) | ||

| TOTAL | 100.0% |

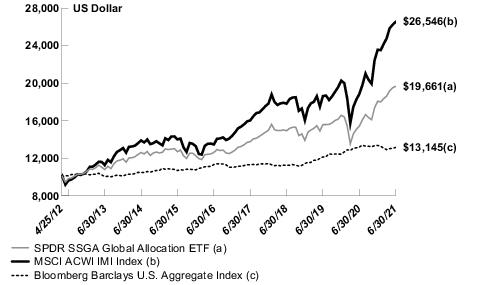

| Cumulative Total Return | Average Annual Total Return | ||||||||||

| Net

Asset Value |

Market

Value |

MSCI ACWI IMI Index | Bloomberg Barclays U.S. Aggregate Bond Index | Net

Asset Value |

Market

Value |

MSCI ACWI IMI Index | Bloomberg Barclays U.S. Aggregate Bond Index | ||||

| ONE YEAR | 27.51% | 27.39% | 40.94% | (0.33)% | 27.51% | 27.39% | 40.94% | (0.33)% | |||

| FIVE YEARS | 55.95% | 55.91% | 97.21% | 16.08% | 9.29% | 9.29% | 14.55% | 3.03% | |||

| SINCE INCEPTION(1) | 96.61% | 96.66% | 165.46% | 31.45% | 7.64% | 7.64% | 11.22% | 3.02% | |||

| (1) | For the period April 25, 2012 to June 30, 2021. Since shares of the Fund did not trade in the secondary market until the day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/25/12, 4/26/12, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

(Based on Net Asset Value)

| Description | % of Net Assets | ||

| SPDR S&P 500 ETF Trust | 21.5% | ||

| SPDR Portfolio Developed World ex-US ETF | 15.1 | ||

| SPDR Portfolio Emerging Markets ETF | 7.0 | ||

| SPDR Portfolio Intermediate Term Corporate Bond ETF | 6.1 | ||

| SPDR Portfolio Long Term Corporate Bond ETF | 5.2 | ||

| TOTAL | 54.9% |

| % of Net Assets | |||

| Domestic Equity | 34.4% | ||

| International Equity | 29.9 | ||

| Domestic Fixed Income | 21.0 | ||

| Inflation Linked | 5.1 | ||

| Commodities | 4.9 | ||

| Real Estate | 1.9 | ||

| International Fixed Income | 1.0 | ||

| Short Term Investments | 16.8 | ||

| Liabilities in Excess of Other Assets | (15.0) | ||

| TOTAL | 100.0% |

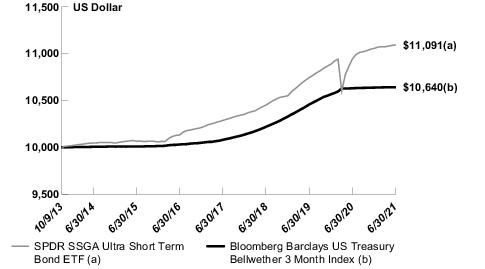

| Cumulative Total Return | Average Annual Total Return | ||||||

| Net

Asset Value |

Market

Value |

Bloomberg Barclays US Treasury Bellwether 3 Month Index | Net

Asset Value |

Market

Value |

Bloomberg Barclays US Treasury Bellwether 3 Month Index | ||

| ONE YEAR | 1.34% | 1.20% | 0.09% | 1.34% | 1.20% | 0.09% | |

| FIVE YEARS | 9.47% | 9.51% | 6.07% | 1.83% | 1.83% | 1.19% | |

| SINCE INCEPTION(1) | 10.91% | 10.94% | 6.40% | 1.35% | 1.35% | 0.81% | |

| (1) | For the period October 9, 2013 to June 30, 2021. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (10/9/13, 10/10/13, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

(Based on Net Asset Value)

| Description | % of Net Assets | ||

| Nissan

Master Owner Trust Receivables ABS 0.63% 2/15/2024 |

2.8% | ||

| U.S.

Treasury Bill 0.05% 7/13/2021 |

2.7 | ||

| BX

Commercial Mortgage Trust 0.74% 3/15/2037 |

2.3 | ||

| CenterPoint

Energy Resources Corp. 0.63% 3/2/2023 |

2.0 | ||

| Golden

Credit Card Trust ABS 0.59% 7/15/2024 |

1.9 | ||

| TOTAL | 11.7% |

| % of Net Assets | |||

| Corporate Bonds & Notes | 63.3% | ||

| Asset-Backed Securities | 10.1 | ||

| Mortgage-Backed Securities | 4.4 | ||

| Commercial Mortgage Backed Securities | 3.5 | ||

| U.S. Treasury Obligations | 2.7 | ||

| Short-Term Investment | 15.6 | ||

| Other Assets in Excess of Liabilities | 0.4 | ||

| TOTAL | 100.0% |

| Description | % of Net Assets | ||

| New

York, State Dormitory Authority Revenue, State Supported Debt 1.54% 3/15/2027 |

3.3% | ||

| Washington,

State General Obligation 5.00% 2/1/2037 |

2.9 | ||

| Energy

Northwest Revenue 5.00% 7/1/2033 |

2.9 | ||

| Los

Angeles Unified School District, General Obligation 5.00% 7/1/2029 |

2.9 | ||

| State

of Florida Revenue 5.00% 6/1/2029 |

2.9 | ||

| TOTAL | 14.9% |

| % of Net Assets | |||

| Municipal Bonds & Notes | 99.3% | ||

| Short-Term Investment | 3.0 | ||

| Liabilities in Excess of Other Assets | (2.3) | ||

| TOTAL | 100.0% |

| Description | Level

1 – Quoted Prices |

Level

2 – Other Significant Observable Inputs |

Level

3 – Significant Unobservable Inputs |

Total | ||||

| ASSETS: | ||||||||

| INVESTMENTS: | ||||||||

|

Mutual Funds and Exchange Traded

Products |

$129,687,694 | $— | $— | $129,687,694 | ||||

|

Short-Term

Investments |

13,027,853 | — | — | 13,027,853 | ||||

|

TOTAL

INVESTMENTS |

$142,715,547 | $— | $— | $142,715,547 |

| Number

of Shares Held at 6/30/20 |

Value

at 6/30/20 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation/ Depreciation |

Number

of Shares Held at 6/30/21 |

Value

at 6/30/21 |

Dividend

Income | |||||||||

|

SPDR Bloomberg Barclays 1-10 Year TIPS

ETF |

— | $ — | $ 11,400,024 | $ 389,136 | $ 685 | $ 81,935 | 524,888 | $ 11,093,508 | $ 96,059 | ||||||||

|

SPDR Dow Jones International Real Estate

ETF |

124,317 | 3,582,816 | 2,960,408 | 4,631,779 | (822,679) | 1,484,058 | 70,066 | 2,572,824 | 87,280 | ||||||||

|

SPDR Dow Jones REIT

ETF |

38,078 | 2,971,226 | 3,864,327 | 2,569,370 | (202,829) | 1,171,181 | 49,905 | 5,234,535 | 124,521 | ||||||||

|

SPDR FTSE International Government Inflation-Protected Bond

ETF |

80,439 | 4,223,048 | 4,806,881 | 4,399,543 | (8,031) | 308,780 | 87,385 | 4,931,135 | 100,674 | ||||||||

|

SPDR Portfolio TIPS

ETF |

313,232 | 9,440,812 | 2,669,389 | 12,227,003 | 556,464 | (439,662) | — | — | 120,632 | ||||||||

|

SPDR S&P Global Infrastructure

ETF |

129,115 | 5,650,072 | 23,626,525 | 1,995,413 | 46,774 | 1,010,951 | 542,787 | 28,338,909 | 335,128 | ||||||||

|

SPDR S&P Global Natural Resources

ETF |

309,534 | 11,431,091 | 20,007,718 | 4,120,392 | (26,750) | 4,778,792 | 605,103 | 32,070,459 | 606,096 | ||||||||

|

SPDR S&P Metals & Mining

ETF |

50,635 | 1,072,956 | 3,683,933 | 1,514,569 | 87,146 | 1,573,087 | 113,854 | 4,902,553 | 27,626 | ||||||||

|

State Street Institutional U.S. Government Money Market Fund, Class G

Shares |

228,808 | 228,808 | 3,542,629 | 3,165,127 | — | — | 606,310 | 606,310 | 87 | ||||||||

|

State Street Navigator Securities Lending Portfolio

II |

10,616,056 | 10,616,056 | 273,730,171 | 271,924,684 | — | — | 12,421,543 | 12,421,543 | 102,252 | ||||||||

|

The Energy Select Sector SPDR

Fund |

36,394 | 1,377,513 | 3,919,172 | 1,129,297 | (405,896) | 1,381,854 | 95,477 | 5,143,346 | 122,366 | ||||||||

|

Total |

$50,594,398 | $ 354,211,177 | $308,066,313 | $ (775,116) | $11,350,976 | $107,315,122 | $1,722,721 |

| Description | Level

1 – Quoted Prices |

Level

2 – Other Significant Observable Inputs |

Level

3 – Significant Unobservable Inputs |

Total | ||||

| ASSETS: | ||||||||

| INVESTMENTS: | ||||||||

|

Mutual Funds and Exchange Traded

Products |

$124,938,471 | $— | $— | $124,938,471 | ||||

|

Short-Term

Investments |

10,199,204 | — | — | 10,199,204 | ||||

|

TOTAL

INVESTMENTS |

$135,137,675 | $— | $— | $135,137,675 |

| Number

of Shares Held at 6/30/20 |

Value

at 6/30/20 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation/ Depreciation |

Number

of Shares Held at 6/30/21 |

Value

at 6/30/21 |

Dividend

Income | |||||||||

|

SPDR Blackstone Senior Loan

ETF |

301,443 | $ 13,076,597 | $ 26,118,609 | $ 14,706,468 | $ (4,266) | $ 942,486 | 549,297 | $ 25,426,958 | $ 756,038 | ||||||||

|

SPDR Bloomberg Barclays Convertible Securities

ETF |

110,491 | 6,684,706 | 4,224,800 | 6,393,918 | 1,597,418 | 508,223 | 76,343 | 6,621,229 | 149,123 | ||||||||

|

SPDR Bloomberg Barclays Emerging Markets Local Bond

ETF |

496,684 | 13,018,088 | 9,029,386 | 9,931,869 | 88,641 | 170,465 | 468,207 | 12,374,711 | 413,753 | ||||||||

|

SPDR Bloomberg Barclays High Yield Bond

ETF |

151,472 | 15,322,908 | 12,220,763 | 19,660,531 | 80,376 | 995,805 | 81,478 | 8,959,321 | 620,032 | ||||||||

|

SPDR Portfolio Europe

ETF |

120,535 | 3,787,511 | 3,958,174 | 8,535,989 | 573,348 | 216,956 | — | — | 41,949 | ||||||||

|

SPDR Portfolio Intermediate Term Corporate Bond

ETF |

254,744 | 9,305,798 | 5,967,065 | 15,409,302 | 354,397 | (217,958) | — | — | 97,326 | ||||||||

|

SPDR Portfolio Long Term Corporate Bond

ETF |

258,039 | 8,179,836 | 13,317,795 | 11,857,073 | 519,336 | (277,172) | 310,973 | 9,882,722 | 228,287 | ||||||||

|

SPDR Portfolio Long Term Treasury

ETF |

230,530 | 10,814,162 | 10,216,315 | 11,800,457 | 1,232,557 | (1,531,576) | 216,247 | 8,931,001 | 90,947 | ||||||||

|

SPDR Portfolio S&P 500 High Dividend

ETF |

579,022 | 16,125,763 | 20,788,369 | 24,970,922 | 1,125,071 | 6,184,060 | 480,228 | 19,252,341 | 1,098,576 | ||||||||

|

SPDR Portfolio TIPS

ETF |

112,242 | 3,382,974 | 69,840 | 3,523,572 | 233,124 | (162,366) | — | — | 12,157 | ||||||||

|

SPDR S&P Global Infrastructure

ETF |

137,414 | 6,013,237 | 4,108,579 | 4,928,162 | 44,316 | 908,818 | 117,732 | 6,146,788 | 146,360 | ||||||||

|

SPDR S&P International Dividend

ETF |

148,835 | 4,930,904 | 15,070,323 | 10,313,900 | (26,551) | 1,368,426 | 279,929 | 11,029,202 | 305,441 | ||||||||

|

SPDR Wells Fargo Preferred Stock

ETF |

155,828 | 6,521,402 | 7,864,939 | 5,782,142 | (14,027) | 332,672 | 201,783 | 8,922,844 | 346,058 | ||||||||

|

State Street Institutional U.S. Government Money Market Fund, Class G

Shares |

161,736 | 161,736 | 10,381,223 | 10,457,822 | — | — | 85,137 | 85,137 | 286 | ||||||||

|

State Street Navigator Securities Lending Portfolio

II |

21,343,138 | 21,343,138 | 407,501,265 | 418,730,336 | — | — | 10,114,067 | 10,114,067 | 195,598 | ||||||||

|

Total |

$138,668,760 | $550,837,445 | $577,002,463 | $5,803,740 | $ 9,438,839 | $127,746,321 | $4,501,931 |

| Description | Level

1 – Quoted Prices |

Level

2 – Other Significant Observable Inputs |

Level

3 – Significant Unobservable Inputs |

Total | ||||

| ASSETS: | ||||||||

| INVESTMENTS: | ||||||||

|

Mutual Funds and Exchange Traded

Products |

$277,659,613 | $— | $— | $277,659,613 | ||||

|

Short-Term

Investments |

47,542,254 | — | — | 47,542,254 | ||||

|

TOTAL

INVESTMENTS |

$325,201,867 | $— | $— | $325,201,867 |

| Number

of Shares Held at 6/30/20 |

Value

at 6/30/20 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation/ Depreciation |

Number

of Shares Held at 6/30/21 |

Value

at 6/30/21 |

Dividend

Income | |||||||||

|

SPDR Bloomberg Barclays Emerging Markets Local Bond

ETF |

91,620 | $ 2,401,360 | $ 756,952 | $ 395,295 | $ 1,631 | $ 35,637 | 105,951 | $ 2,800,285 | $ 92,804 | ||||||||

|

SPDR Bloomberg Barclays High Yield Bond

ETF |

257,809 | 26,079,959 | 21,788,619 | 38,248,827 | 273,698 | 1,612,655 | 104,639 | 11,506,104 | 1,206,513 | ||||||||

|

SPDR Bloomberg Barclays International Corporate Bond

ETF |

143,333 | 4,818,870 | 22,283 | 5,175,114 | 155,509 | 178,452 | — | — | 6,871 | ||||||||

|

SPDR Dow Jones International Real Estate

ETF |

153,639 | 4,427,876 | 2,815,446 | 4,843,760 | (898,691) | 1,227,755 | 74,309 | 2,728,626 | 51,173 | ||||||||

|

SPDR Dow Jones REIT

ETF |

— | — | 2,894,928 | 675,600 | 64,054 | 484,980 | 26,393 | 2,768,362 | 79,126 | ||||||||

|

SPDR Portfolio Aggregate Bond

ETF |

— | — | 22,098,387 | 14,826,057 | (108,640) | 10,831 | 239,071 | 7,174,521 | 33,929 | ||||||||

|

SPDR Portfolio Developed World ex-US

ETF |

1,424,858 | 39,354,578 | 21,466,444 | 30,756,283 | 2,019,604 | 10,522,524 | 1,158,110 | 42,606,867 | 1,060,432 | ||||||||

|

SPDR Portfolio Emerging Markets

ETF |

501,104 | 16,766,940 | 5,952,420 | 8,445,160 | 237,216 | 5,304,107 | 435,506 | 19,815,523 | 372,550 | ||||||||

|

SPDR Portfolio Europe

ETF |

— | — | 17,506,108 | 6,599,027 | 222,654 | (178,720) | 261,673 | 10,951,015 | 135,829 | ||||||||

|

SPDR Portfolio Intermediate Term Corporate Bond

ETF |

1,018,040 | 37,189,001 | 17,799,012 | 38,200,595 | 1,465,695 | (1,087,202) | 467,736 | 17,165,911 | 408,734 | ||||||||

|

SPDR Portfolio Long Term Corporate Bond

ETF |

158,470 | 5,023,499 | 19,787,409 | 10,056,638 | 150,312 | (246,851) | 461,225 | 14,657,731 | 284,051 | ||||||||

|

SPDR Portfolio Long Term Treasury

ETF |

— | — | 8,536,234 | 131,821 | 1,482 | 389,229 | 212,957 | 8,795,124 | 12,854 | ||||||||

|

SPDR Portfolio Small Cap

ETF |

— | — | 15,487,798 | 5,769,702 | 463,807 | 3,671,192 | 315,273 | 13,853,095 | 122,635 | ||||||||

|

SPDR Portfolio TIPS

ETF |

414,567 | 12,495,049 | 3,810,963 | 2,362,325 | 168,383 | 250,134 | 461,214 | 14,362,204 | 356,835 | ||||||||

|

SPDR S&P 500 ETF

Trust |

151,960 | 46,858,385 | 40,439,761 | 45,561,662 | 6,212,312 | 12,833,584 | 141,995 | 60,782,380 | 911,798 | ||||||||

|

SPDR S&P Emerging Markets SmallCap

ETF |

59,550 | 2,431,426 | 393,854 | 995,740 | 86,662 | 977,673 | 47,193 | 2,893,875 | 61,150 | ||||||||

|

SPDR S&P International Small Cap

ETF |

252,679 | 6,910,771 | 1,054,853 | 2,333,839 | 137,040 | 2,515,626 | 214,290 | 8,284,451 | 143,643 | ||||||||

|

SPDR S&P MidCap 400 ETF

Trust |

13,834 | 4,488,995 | 1,156,921 | 2,230,186 | 446,344 | 1,731,021 | 11,391 | 5,593,095 | 57,836 | ||||||||

|

State Street Institutional U.S. Government Money Market Fund, Class G

Shares |

4,054,699 | 4,054,699 | 22,678,684 | 21,852,238 | — | — | 4,881,145 | 4,881,145 | 3,124 | ||||||||

|

State Street Navigator Securities Lending Portfolio

II |

61,808,691 | 61,808,691 | 1,549,071,332 | 1,568,218,914 | — | — | 42,661,109 | 42,661,109 | 330,190 | ||||||||

|

The Communication Services Select Sector SPDR

Fund |

— | — | 16,158,027 | 16,735,859 | 577,832 | — | — | — | 4,062 | ||||||||

|

The Consumer Discretionary Select Sector SPDR

Fund |

— | — | 12,872,291 | 13,601,962 | 729,671 | — | — | — | 14,821 | ||||||||

|

The Consumer Staples Select Sector SPDR

Fund |

— | — | 5,419,158 | 5,895,872 | 476,714 | — | — | — | 71,722 | ||||||||

|

The Energy Select Sector SPDR

Fund |

— | — | 8,967,424 | 6,102,690 | (11,516) | (108,003) | 50,960 | 2,745,215 | 79,103 | ||||||||

|

The Financial Select Sector SPDR

Fund |

183,714 | 4,251,142 | 5,503,751 | 10,279,803 | (492,708) | 1,017,618 | — | — | 23,596 | ||||||||

|

The Health Care Select Sector SPDR

Fund |

47,216 | 4,724,905 | 7,170 | 4,747,238 | (173,440) | 188,603 | — | — | — | ||||||||

|

The Industrial Select Sector SPDR

Fund |

— | — | 5,369,706 | 2,645,596 | 106,278 | (44,596) | 27,205 | 2,785,792 | 18,436 | ||||||||

|

The Materials Select Sector SPDR

Fund |

— | — | 8,315,824 | 2,700,230 | 82,515 | (299,149) | 65,593 | 5,398,960 | 35,558 | ||||||||

|

The Technology Select Sector SPDR

Fund |

48,236 | 5,040,180 | 6,378,567 | 6,870,230 | 1,366,215 | 188,351 | 41,332 | 6,103,083 | 32,913 | ||||||||

|

Total |

$289,126,326 | $1,844,510,326 | $1,877,258,263 | $13,760,633 | $41,175,451 | $311,314,473 | $6,012,288 |

| Description | Level

1 – Quoted Prices |

Level

2 – Other Significant Observable Inputs |

Level

3 – Significant Unobservable Inputs |

Total | ||||

| ASSETS: | ||||||||

| INVESTMENTS: | ||||||||

|

Corporate Bonds &

Notes |

$ — | $254,806,969 | $— | $254,806,969 | ||||

|

Asset-Backed

Securities |

— | 40,875,597 | — | 40,875,597 | ||||

|

U.S. Treasury

Obligations |

— | 10,999,844 | — | 10,999,844 | ||||

|

Mortgage-Backed

Securities |

— | 17,583,847 | — | 17,583,847 | ||||

|

Commercial Mortgage Backed

Securities |

— | 14,197,100 | — | 14,197,100 | ||||

|

Short-Term

Investment |

62,702,468 | — | — | 62,702,468 | ||||

|

TOTAL

INVESTMENTS |

$62,702,468 | $338,463,357 | $— | $401,165,825 |

| Number

of Shares Held at 6/30/20 |

Value

at 6/30/20 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation/ Depreciation |

Number

of Shares Held at 6/30/21 |

Value

at 6/30/21 |

Dividend

Income | |||||||||

|

State Street Institutional U.S. Government Money Market Fund, Class G

Shares |

11,722,245 | $11,722,245 | $225,450,511 | $174,470,288 | $— | $— | 62,702,468 | $62,702,468 | $17,835 |

| Description | Level

1 – Quoted Prices |

Level

2 – Other Significant Observable Inputs |

Level

3 – Significant Unobservable Inputs |

Total | ||||

| ASSETS: | ||||||||

| INVESTMENTS: | ||||||||

|

Municipal Bonds &

Notes |

$ — | $44,831,451 | $— | $44,831,451 | ||||

|

Short-Term

Investment |

1,374,817 | — | — | 1,374,817 | ||||

|

TOTAL

INVESTMENTS |

$1,374,817 | $44,831,451 | $— | $46,206,268 |

| Number

of Shares Held at 2/3/2021* |

Value

at 2/3/2021* |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation/ Depreciation |

Number

of Shares Held at 6/30/21 |

Value

at 6/30/21 |

Dividend

Income | |||||||||

|

State Street Institutional U.S. Government Money Market Fund, Class G

Shares |

— | $— | $52,848,299 | $51,473,482 | $— | $— | 1,374,817 | $1,374,817 | $631 |

| * | Commencement of operations. |

| SPDR SSGA Multi-Asset Real Return ETF | SPDR SSGA Income Allocation ETF | SPDR SSGA Global Allocation ETF | |||

| ASSETS | |||||

|

Investments in unaffiliated issuers, at

value* |

$ 35,400,425 | $ 7,391,354 | $ 13,887,394 | ||

|

Investments in affiliated issuers, at

value |

107,315,122 | 127,746,321 | 311,314,473 | ||

|

Total

Investments |

142,715,547 | 135,137,675 | 325,201,867 | ||

|

Receivable for fund shares

sold |

34,187 | — | — | ||

|

Dividends receivable — unaffiliated

issuers |

— | — | 209,019 | ||

|

Dividends receivable — affiliated

issuers |

16 | 9 | 110 | ||

|

Interest receivable — unaffiliated

issuers |

— | — | — | ||

|

Securities lending income receivable — unaffiliated

issuers |

27,298 | 8,423 | 184 | ||

|

Securities lending income receivable — affiliated issuers

|

12,973 | 19,171 | 42,871 | ||

|

TOTAL ASSETS

|

142,790,021 | 135,165,278 | 325,454,051 | ||

| LIABILITIES | |||||

|

Payable upon return of securities

loaned |

12,421,543 | 10,114,067 | 42,661,109 | ||

|

Payable for investments

purchased |

— | — | — | ||

|

Payable for fund shares

repurchased |

— | — | 55,580 | ||

|

Advisory fee

payable |

10,127 | 12,579 | 47,503 | ||

|

Trustees’ fees and expenses

payable |

64 | 92 | 181 | ||

|

TOTAL LIABILITIES

|

12,431,734 | 10,126,738 | 42,764,373 | ||

|

NET ASSETS

|

$130,358,287 | $125,038,540 | $282,689,678 | ||

| NET ASSETS CONSIST OF: | |||||

|

Paid-in

Capital |

$164,484,016 | $132,066,876 | $232,423,743 | ||

|

Total distributable earnings

(loss) |

(34,125,729) | (7,028,336) | 50,265,935 | ||

|

NET ASSETS

|

$130,358,287 | $125,038,540 | $282,689,678 | ||

| NET ASSET VALUE PER SHARE | |||||

|

Net asset value per

share |

$ 28.52 | $ 35.62 | $ 46.04 | ||

|

Shares outstanding (unlimited amount authorized, no par

value) |

4,570,000 | 3,510,000 | 6,140,000 | ||

| COST OF INVESTMENTS: | |||||

|

Investments in unaffiliated

issuers |

$ 31,417,122 | $ 6,899,774 | $ 12,405,298 | ||

|

Investments in affiliated

issuers |

102,765,626 | 124,658,621 | 262,655,352 | ||

|

Total cost of

investments |

$134,182,748 | $131,558,395 | $275,060,650 | ||

|

* Includes investments in securities on loan, at

value |

$ 18,674,023 | $ 21,491,633 | $ 48,247,191 |

| SPDR SSGA Ultra Short Term Bond ETF | SPDR Nuveen Municipal Bond ETF | |

| $338,463,357 | $44,831,451 | |

| 62,702,468 | 1,374,817 | |

| 401,165,825 | 46,206,268 | |

| 1,011,567 | — | |

| — | — | |

| 1,134 | 59 | |

| 488,616 | 407,947 | |

| — | — | |

| — | — | |

| 402,667,142 | 46,614,274 | |

| — | — | |

| — | 1,435,249 | |

| — | — | |

| 63,557 | 14,862 | |

| 122 | — | |

| 63,679 | 1,450,111 | |

| $402,603,463 | $45,164,163 | |

| $402,100,832 | $44,949,896 | |

| 502,631 | 214,267 | |

| $402,603,463 | $45,164,163 | |

| $ 40.46 | $ 30.11 | |

| 9,950,000 | 1,500,000 | |

| $337,607,097 | $44,821,241 | |

| 62,702,468 | 1,374,817 | |

| $400,309,565 | $46,196,058 | |

| $ — | $ — |

| SPDR SSGA Multi-Asset Real Return ETF | SPDR SSGA Income Allocation ETF | SPDR SSGA Global Allocation ETF | |||

| INVESTMENT INCOME | |||||

|

Interest income — unaffiliated

issuers |

$ — | $ — | $ — | ||

|

Dividend income — unaffiliated

issuers |

20,163 | 208,499 | 1,943 | ||

|

Dividend income — affiliated

issuers |

1,620,469 | 4,306,333 | 5,682,098 | ||

|

Unaffiliated securities lending

income |

81,755 | 80,920 | 59,564 | ||

|

Affiliated securities lending

income |

102,252 | 195,598 | 330,190 | ||

|

TOTAL INVESTMENT INCOME

(LOSS) |

1,824,639 | 4,791,350 | 6,073,795 | ||

| EXPENSES | |||||

|

Advisory

fee |

55,778 | 177,566 | 435,891 | ||

|

Trustees’ fees and expenses

|

1,138 | 1,918 | 3,831 | ||

|

Miscellaneous

expenses |

1 | 1 | 3 | ||

|

TOTAL

EXPENSES |

56,917 | 179,485 | 439,725 | ||

|

NET INVESTMENT INCOME

(LOSS) |

$ 1,767,722 | $ 4,611,865 | $ 5,634,070 | ||

| REALIZED AND UNREALIZED GAIN (LOSS) | |||||

| Net realized gain (loss) on: | |||||

|

Investments — unaffiliated

issuers |

(998,515) | (1,683,189) | 2,026,144 | ||

|

Investments — affiliated

issuers |

(1,085,680) | 89,770 | 7,809,110 | ||

|

In-kind redemptions — unaffiliated

issuers |

(67,492) | 1,103,587 | 354,363 | ||

|

In-kind redemptions — affiliated

issuers |

310,564 | 5,713,970 | 5,951,523 | ||

|

Net realized gain

(loss) |

(1,841,123) | 5,224,138 | 16,141,140 | ||

| Net change in unrealized appreciation/depreciation on: | |||||

|

Investments — unaffiliated

issuers |

8,582,231 | 3,237,387 | (700,333) | ||

|

Investments — affiliated

issuers |

11,350,976 | 9,438,839 | 41,175,450 | ||

|

Net change in unrealized

appreciation/depreciation |

19,933,207 | 12,676,226 | 40,475,117 | ||

|

NET REALIZED AND UNREALIZED GAIN

(LOSS) |

18,092,084 | 17,900,364 | 56,616,257 | ||

|

NET INCREASE (DECREASE) IN NET ASSETS FROM

OPERATIONS |

$19,859,806 | $22,512,229 | $62,250,327 |

| SPDR SSGA Ultra Short Term Bond ETF | SPDR Nuveen Municipal Bond ETF(a) | |

| $2,822,942 | 156,039 | |

| — | — | |

| 17,835 | 631 | |

| — | — | |

| — | — | |

| 2,840,777 | 156,670 | |

| 650,007 | 64,580 | |

| 4,422 | 116 | |

| 2 | — | |

| 654,431 | 64,696 | |

| $2,186,346 | $ 91,974 | |

| 478,164 | 252,383 | |

| — | — | |

| — | — | |

| — | — | |

| 478,164 | 252,383 | |

| 1,451,941 | 10,210 | |

| — | — | |

| 1,451,941 | 10,210 | |

| 1,930,105 | 262,593 | |

| $ 4,116,451 | $354,567 |

| (a) | For the period February 03, 2021 (commencement of operations) through June 30, 2021. |

| SPDR SSGA Multi-Asset Real Return ETF | SPDR SSGA Income Allocation ETF | ||||||

| Year

Ended 6/30/21 |

Year

Ended 6/30/20 |

Year

Ended 6/30/21 |

Year

Ended 6/30/20 | ||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | |||||||

|

Net investment income

(loss) |

$ 1,767,722 | $ 2,892,612 | $ 4,611,865 | $ 5,476,550 | |||

|

Net realized gain

(loss) |

(1,841,123) | (8,254,262) | 5,224,138 | (7,106,570) | |||

|

Net change in unrealized

appreciation/depreciation |

19,933,207 | (8,998,515) | 12,676,226 | (10,551,272) | |||

|

Net increase (decrease) in net assets resulting from

operations |

19,859,806 | (14,360,165) | 22,512,229 | (12,181,292) | |||

|

Net equalization credits and

charges |

54,735 | (81,758) | 149,449 | 115,750 | |||

|

Distributions to

shareholders |

(1,750,442) | (2,878,161) | (4,629,430) | (5,787,114) | |||

| FROM BENEFICIAL INTEREST TRANSACTIONS: | |||||||

|

Proceeds from shares

sold |

67,513,380 | 7,725,150 | 73,221,393 | 115,985,875 | |||

|

Cost of shares

redeemed |

(9,014,313) | (49,528,810) | (92,104,724) | (76,591,192) | |||

|

Net income

equalization |

(54,735) | 81,758 | (149,449) | (115,750) | |||

|

Other

Capital |

— | — | — | — | |||

|

Net increase (decrease) in net assets from beneficial interest transactions

|

58,444,332 | (41,721,902) | (19,032,780) | 39,278,933 | |||

|

Net increase (decrease) in net assets during the

period |

76,608,431 | (59,041,986) | (1,000,532) | 21,426,277 | |||

|

Net assets at beginning of

period |

53,749,856 | 112,791,842 | 126,039,072 | 104,612,795 | |||

|

NET ASSETS AT END OF

PERIOD |

$130,358,287 | $ 53,749,856 | $125,038,540 | $126,039,072 | |||

| SHARES OF BENEFICIAL INTEREST: | |||||||

|

Shares

sold |

2,420,000 | 340,000 | 2,120,000 | 3,590,000 | |||

|

Shares

redeemed |

(380,000) | (2,290,000) | (2,760,000) | (2,580,000) | |||

|

Net increase (decrease) from share

transactions |

2,040,000 | (1,950,000) | (640,000) | 1,010,000 | |||

| SPDR SSGA Global Allocation ETF | SPDR SSGA Ultra Short Term Bond ETF | SPDR Nuveen Municipal Bond ETF | ||||||

| Year

Ended 6/30/21 |

Year

Ended 6/30/20 |

Year

Ended 6/30/21 |

Year

Ended 6/30/20 |

For

the Period 2/3/21*- 6/30/21 | ||||

| $ 5,634,070 | $ 7,213,512 | $ 2,186,346 | $ 4,704,035 | $ 91,974 | ||||

| 16,141,140 | (3,729,837) | 478,164 | (390,164) | 252,383 | ||||

| 40,475,117 | (8,480,933) | 1,451,941 | (896,263) | 10,210 | ||||

| 62,250,327 | (4,997,258) | 4,116,451 | 3,417,608 | 354,567 | ||||

| (16,635) | 19,354 | 31,941 | 135,058 | 2,273 | ||||

| (5,588,244) | (7,327,692) | (2,605,083) | (4,951,989) | (140,300) | ||||

| 23,982,836 | 22,973,653 | 130,443,856 | 167,508,423 | 44,904,991 | ||||

| (35,804,943) | (28,488,708) | (28,304,057) | (34,951,266) | — | ||||

| 16,635 | (19,354) | (31,941) | (135,058) | (2,273) | ||||

| — | 2,474 | 44,894 | 165,286 | 44,905 | ||||

| (11,805,472) | (5,531,935) | 102,152,752 | 132,587,385 | 44,947,623 | ||||

| 44,839,976 | (17,837,531) | 103,696,061 | 131,188,062 | 45,164,163 | ||||

| 237,849,702 | 255,687,233 | 298,907,402 | 167,719,340 | — | ||||

| $282,689,678 | $237,849,702 | $402,603,463 | $298,907,402 | $45,164,163 | ||||

| 550,000 | 600,000 | 3,225,000 | 4,150,000 | 1,500,000 | ||||

| (860,000) | (820,000) | (700,000) | (875,000) | — | ||||

| (310,000) | (220,000) | 2,525,000 | 3,275,000 | 1,500,000 | ||||

| * | Commencement of operations. |

| SPDR SSGA Multi-Asset Real Return ETF | |||||||||

| Year

Ended 6/30/21 |

Year

Ended 6/30/20 |

Year

Ended 6/30/19 |

Year

Ended 6/30/18(a) |

Year

Ended 6/30/17(a) | |||||

|

Net asset value, beginning of

period |

$ 21.25 | $ 25.18 | $ 26.62 | $ 23.97 | $ 24.38 | ||||

| Income (loss) from investment operations: | |||||||||

|

Net investment income (loss)

(b) |

0.65 | 0.78 | 0.69 | 0.53 | 0.56 | ||||

|

Net realized and unrealized gain (loss)

(c) |

7.15 | (3.89) | (1.43) | 2.64 | (0.44) | ||||

|

Total from investment

operations |

7.80 | (3.11) | (0.74) | 3.17 | 0.12 | ||||

|

Net equalization credits and charges

(b) |

0.02 | (0.02) | 0.00(d) | (0.00)(d) | 0.01 | ||||

| Distributions to shareholders from: | |||||||||

|

Net investment

income |

(0.55) | (0.80) | (0.70) | (0.52) | (0.54) | ||||

|

Net asset value, end of

period |

$ 28.52 | $ 21.25 | $ 25.18 | $ 26.62 | $ 23.97 | ||||

|

Total return

(e) |

37.12% | (12.71)% | (2.71)% | 13.26% | 0.56% | ||||

| Ratios and Supplemental Data: | |||||||||

|

Net assets, end of period (in

000s) |

$130,358 | $53,750 | $112,792 | $143,742 | $115,075 | ||||

| Ratios to average net assets: | |||||||||

|

Total expenses

(f) |

0.08% | 0.08% | 0.12% | 0.22% | 0.22% | ||||

|

Net investment income

(loss) |

2.56% | 3.30% | 2.76% | 2.04% | 2.28% | ||||

|

Portfolio turnover

rate |

49% | 30% | 28% | 44% | 46%(g) | ||||

| (a) | The per share amounts and percentages include the Fund’s proportionate share of income and expenses of the Portfolio prior to discontinuance of the master feeder structure. |

| (b) | Per share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the year. |

| (c) | Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund. |

| (d) | Amount is less than $0.005 per share. |

| (e) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net asset value per share on the respective payment dates of each distribution. Total returns for periods of less than one year are not annualized. Broker commission charges are not included in this calculation. |

| (f) | Does not include expenses of the Underlying Funds in which the Fund invests. |

| (g) | Portfolio turnover is from the Fund's Portfolio prior to discontinuance of master-feeder structure. |

| SPDR SSGA Income Allocation ETF | |||||||||

| Year

Ended 6/30/21 |

Year

Ended 6/30/20 |

Year

Ended 6/30/19 |

Year

Ended 6/30/18(a) |

Year

Ended 6/30/17(a) | |||||

|

Net asset value, beginning of

period |

$ 30.37 | $ 33.32 | $ 32.42 | $ 32.33 | $ 31.23 | ||||

| Income (loss) from investment operations: | |||||||||

|

Net investment income (loss)

(b) |

1.35 | 1.43 | 1.53 | 1.02 | 1.10 | ||||

|

Net realized and unrealized gain (loss)

(c) |

5.18 | (2.95) | 0.91 | 0.09 | 0.98 | ||||

|

Total from investment

operations |

6.53 | (1.52) | 2.44 | 1.11 | 2.08 | ||||

|

Net equalization credits and charges

(b) |

0.04 | 0.03 | 0.03 | (0.01) | (0.01) | ||||

|

Other capital

(b) |

— | — | 0.00(d) | — | — | ||||

| Distributions to shareholders from: | |||||||||

|

Net investment

income |

(1.32) | (1.46) | (1.57) | (1.01) | (0.97) | ||||

|

Net asset value, end of

period |

$ 35.62 | $ 30.37 | $ 33.32 | $ 32.42 | $ 32.33 | ||||

|

Total return

(e) |

21.90% | (4.56)% | 7.93% | 3.34% | 6.78% | ||||

| Ratios and Supplemental Data: | |||||||||

|

Net assets, end of period (in

000s) |

$125,039 | $126,039 | $104,613 | $92,389 | $95,376 | ||||

| Ratios to average net assets: | |||||||||

|

Total expenses

(f) |

0.16% | 0.18% | 0.18% | 0.39% | 0.37% | ||||

|

Net investment income

(loss) |

4.02% | 4.41% | 4.71% | 3.07% | 3.49% | ||||

|

Portfolio turnover

rate |

60% | 38% | 71% | 29% | 47%(g) | ||||

| (a) | The per share amounts and percentages include the Fund’s proportionate share of income and expenses of the Portfolio prior to discontinuance of the master feeder structure. |

| (b) | Per share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the year. |

| (c) | Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund. |

| (d) | Amount is less than $0.005 per share. |

| (e) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net asset value per share on the respective payment dates of each distribution. Total returns for periods of less than one year are not annualized. Broker commission charges are not included in this calculation. |

| (f) | Does not include expenses of the Underlying Funds in which the Fund invests. |

| (g) | Portfolio turnover is from the Fund's Portfolio prior to discontinuance of master-feeder structure. |

| SPDR SSGA Global Allocation ETF | |||||||||

| Year

Ended 6/30/21 |

Year

Ended 6/30/20 |

Year

Ended 6/30/19 |

Year

Ended 6/30/18(a) |

Year

Ended 6/30/17(a) | |||||

|

Net asset value, beginning of

period |

$ 36.88 | $ 38.33 | $ 37.72 | $ 35.52 | $ 33.35 | ||||

| Income (loss) from investment operations: | |||||||||

|

Net investment income (loss)

(b) |

0.91 | 1.07 | 1.03 | 0.81 | 0.99 | ||||

|

Net realized and unrealized gain (loss)

(c) |

9.16 | (1.44) | 0.57 | 2.18 | 2.03 | ||||

|

Total from investment

operations |

10.07 | (0.37) | 1.60 | 2.99 | 3.02 | ||||

|

Net equalization credits and charges

(b) |

(0.00)(d) | 0.00(d) | 0.01 | 0.01 | 0.00(d) | ||||

|

Other capital

(b) |

— | 0.00(d) | — | — | — | ||||

| Distributions to shareholders from: | |||||||||

|

Net investment

income |

(0.91) | (1.08) | (1.00) | (0.80) | (0.85) | ||||

|

Total

distributions |

(0.91) | (1.08) | (1.00) | (0.80) | (0.85) | ||||

|

Net asset value, end of

period |

$ 46.04 | $ 36.88 | $ 38.33 | $ 37.72 | $ 35.52 | ||||

|

Total return

(e) |

27.51% | (1.00)% | 4.37% | 8.46% | 9.14% | ||||

| Ratios and Supplemental Data: | |||||||||

|

Net assets, end of period (in

000s) |

$282,690 | $237,850 | $255,687 | $248,929 | $207,780 | ||||

| Ratios to average net assets: | |||||||||

|

Total expenses

(f) |

0.17% | 0.09% | 0.15% | 0.20% | 0.20% | ||||

|

Net

expenses |

0.17% | 0.09% | 0.15% | 0.09% | 0.01% | ||||

|

Net investment income

(loss) |

2.16% | 2.84% | 2.76% | 2.14% | 2.91% | ||||

|

Portfolio turnover

rate |

110% | 94% | 71% | 43% | 90%(g) | ||||

| (a) | The per share amounts and percentages include the Fund’s proportionate share of income and expenses of the Portfolio prior to discontinuance of the master feeder structure. |

| (b) | Per share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the year. |

| (c) | Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund. |

| (d) | Amount is less than $0.005 per share. |

| (e) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net asset value per share on the respective payment dates of each distribution. Total returns for periods of less than one year are not annualized. Broker commission charges are not included in this calculation. |

| (f) | Does not include expenses of the Underlying Funds in which the Fund invests. |

| (g) | Portfolio turnover is from the Fund's Portfolio prior to discontinuance of master-feeder structure. |

| SPDR SSGA Ultra Short Term Bond ETF | |||||||||

| Year

Ended 6/30/21 |

Year

Ended 6/30/20 |

Year

Ended 6/30/19 |

Year

Ended 6/30/18(a) |

Year

Ended 6/30/17(a) | |||||

|

Net asset value, beginning of

period |

$ 40.26 | $ 40.41 | $ 40.27 | $ 40.26 | $ 40.06 | ||||

| Income (loss) from investment operations: | |||||||||

|

Net investment income (loss)

(b) |

0.27 | 0.81 | 1.02 | 0.68 | 0.44 | ||||

|

Net realized and unrealized gain (loss)

(c) |

0.25 | (0.11) | 0.04 | (0.14) | 0.13 | ||||

|

Total from investment

operations |

0.52 | 0.70 | 1.06 | 0.54 | 0.57 | ||||

|

Net equalization credits and charges

(b) |

0.00(d) | 0.02 | 0.03 | 0.04 | (0.00)(d) | ||||

|

Other capital

(b) |

0.01 | 0.03 | 0.02 | 0.06 | 0.05 | ||||

| Distributions to shareholders from: | |||||||||

|

Net investment

income |

(0.33) | (0.90) | (0.97) | (0.63) | (0.42) | ||||

|

Total

distributions |

(0.33) | (0.90) | (0.97) | (0.63) | (0.42) | ||||

|

Net asset value, end of

period |

$ 40.46 | $ 40.26 | $ 40.41 | $ 40.27 | $ 40.26 | ||||

|

Total return

(e) |

1.34% | 1.86% | 2.79% | 1.60% | 1.53% | ||||

| Ratios and Supplemental Data: | |||||||||

|

Net assets, end of period (in

000s) |

$402,603 | $298,907 | $167,719 | $50,344 | $18,117 | ||||

| Ratios to average net assets: | |||||||||

|

Total

expenses |

0.20% | 0.20% | 0.20% | 0.20% | 0.20% | ||||

|

Net investment income

(loss) |

0.67% | 2.02% | 2.54% | 1.70% | 1.09% | ||||

|

Portfolio turnover

rate |

76% | 71% | 100% | 76% | 83%(f) | ||||

| (a) | The per share amounts and percentages include the Fund’s proportionate share of income and expenses of the Portfolio prior to discontinuance of the master feeder structure. |

| (b) | Per share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the year. |

| (c) | Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund. |

| (d) | Amount is less than $0.005 per share. |

| (e) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net asset value per share on the respective payment dates of each distribution. Total returns for periods of less than one year are not annualized. Broker commission charges are not included in this calculation. |

| (f) | Portfolio turnover is from the Fund's Portfolio prior to discontinuance of master-feeder structure. |

| SPDR Nuveen Municipal Bond ETF | |

| For

the Period 2/3/21*- 6/30/21 | |

|

Net asset value, beginning of

period |

$ 30.00 |

| Income (loss) from investment operations: | |

|

Net investment income (loss)

(a) |

0.07 |

|

Net realized and unrealized gain (loss)

(b) |

0.11 |

|

Total from investment

operations |

0.18 |

|

Net equalization credits and charges

(a) |

0.00(c) |

|

Other capital

(a) |

0.03 |

| Distributions to shareholders from: | |

|

Net investment

income |

(0.10) |

|

Net asset value, end of

period |

$ 30.11 |

|

Total return

(d) |

0.69% |

| Ratios and Supplemental Data: | |

|

Net assets, end of period (in

000s) |

$45,164 |

| Ratios to average net assets: | |

|

Total

expenses |

0.40%(e) |

|

Net investment income

(loss) |

0.57%(e) |

|

Portfolio turnover rate

(f) |

51%(g) |

| * | Commencement of operations. |

| (a) | Per share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the year. |

| (b) | Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund. |

| (c) | Amount is less than $0.005 per share. |

| (d) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net asset value per share on the respective payment dates of each distribution. Total returns for periods of less than one year are not annualized. Broker commission charges are not included in this calculation. |

| (e) | Annualized. |

| (f) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

| (g) | Not annualized. |

| SPDR SSGA Multi-Asset Real Return ETF |

| SPDR SSGA Income Allocation ETF |

| SPDR SSGA Global Allocation ETF |

| SPDR SSGA Ultra Short Term Bond ETF |

| SPDR Nuveen Municipal Bond ETF |

| Annual Rate* | |

|

SPDR SSGA Multi-Asset Real Return

ETF |

0.50% |

|

SPDR SSGA Income Allocation

ETF |

0.50 |

|

SPDR SSGA Global Allocation

ETF |

0.35 |

|

SPDR SSGA Ultra Short Term Bond

ETF |

0.20 |

|

SPDR Nuveen Municipal Bond

ETF |

0.40 |

| * | The Advisory fee is reduced for SPDR SSGA Multi-Asset Real Return ETF, SPDR SSGA Income Allocation ETF and SPDR SSGA Global Allocation ETF by the acquired fund fees and expenses. For the year ended June 30, 2021, the net annualized advisory fee was 0.08%, 0.16%, and 0.17% for the SPDR SSGA Multi-Asset Real Return ETF, SPDR SSGA Income Allocation ETF, SPDR SSGA Global Allocation ETF, respectively. |

| Purchases | Sales | ||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$ 34,711,664 | $ 33,972,513 | |

|

SPDR SSGA Income Allocation

ETF |

68,848,997 | 69,024,626 | |

|

SPDR SSGA Global Allocation

ETF |

278,398,480 | 279,743,158 | |

|

SPDR SSGA Ultra Short Term Bond

ETF |

278,615,616 | 214,483,192 | |

|

SPDR Nuveen Municipal Bond

ETF |

65,421,380 | 20,620,345 |

| In-kind

Contributions |

In-kind

Redemptions |

In-kind

Net Realized Gains/(Losses) | |||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$66,162,829 | $ 8,833,376 | $ 243,072 | ||

|

SPDR SSGA Income Allocation

ETF |

70,730,721 | 89,126,566 | 6,817,557 | ||

|

SPDR SSGA Global Allocation

ETF |

22,134,357 | 33,256,043 | 6,305,886 |

| Ordinary

Income |

Tax

Exempt Income |

Long-Term

Capital Gains |

Total | ||||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$1,750,442 | $ — | $— | $1,750,442 | |||

|

SPDR SSGA Income Allocation

ETF |

4,629,430 | — | — | 4,629,430 | |||

|

SPDR SSGA Global Allocation

ETF |

5,588,244 | — | — | 5,588,244 | |||

|

SPDR SSGA Ultra Short Term Bond

ETF |

2,605,083 | — | — | 2,605,083 | |||

|

SPDR Nuveen Municipal Bond

ETF |

3,922 | 136,378 | — | 140,300 |

| Ordinary

Income |

Long-Term

Capital Gains |

Total | |||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$ 2,878,161 | $ — | $ 2,878,161 | ||

|

SPDR SSGA Income Allocation ETF

|

5,787,114 | — | 5,787,114 | ||

|

SPDR SSGA Global Allocation ETF

|

7,327,692 | — | 7,327,692 | ||

|

SPDR SSGA Ultra Short Term Bond

ETF |

4,951,989 | — | 4,951,989 |

| Undistributed

Ordinary Income |

Undistributed

Tax Exempt Income |

Capital

Loss Carryforwards |

Undistributed

Long-Term Capital Gains |

Net

Unrealized Gains (Losses) |

Total | ||||||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$ 5,007 | $ — | $(42,274,980) | $ — | $ 8,144,244 | $(34,125,729) | |||||

|

SPDR SSGA Income Allocation

ETF |

— | — | (10,432,789) | — | 3,404,453 | (7,028,336) | |||||

|

SPDR SSGA Global Allocation

ETF |

32,107 | — | — | 1,513,610 | 48,720,218 | 50,265,935 | |||||

|

SPDR SSGA Ultra Short Term Bond

ETF |

— | — | (300,137) | — | 802,768 | 502,631 | |||||

|

SPDR Nuveen Municipal Bond

ETF |

231,630 | 43,145 | — | — | (60,508) | 214,267 |

| Non-Expiring

Short Term |

Non-Expiring

Long Term | ||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$11,267,651 | $31,007,329 | |

|

SPDR SSGA Income Allocation

ETF |

6,609,405 | 3,823,384 | |

|

SPDR SSGA Ultra Short Term Bond

ETF |

— | 300,137 |

| Tax

Cost |

Gross

Unrealized Appreciation |

Gross

Unrealized Depreciation |

Net

Unrealized Appreciation (Depreciation) | ||||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$134,571,303 | $ 8,144,244 | $ — | $ 8,144,244 | |||

|

SPDR SSGA Income Allocation

ETF |

131,733,222 | 3,739,684 | 335,231 | 3,404,453 | |||

|

SPDR SSGA Global Allocation

ETF |

276,481,649 | 49,845,640 | 1,125,422 | 48,720,218 | |||

|

SPDR SSGA Ultra Short Term Bond

ETF |

400,363,057 | 876,983 | 74,215 | 802,768 | |||

|

SPDR Nuveen Municipal Bond

ETF |

46,266,776 | 143,889 | 204,397 | (60,508) |

| Fund | Market

Value of Securities on Loan |

Cash

Collateral Received |

Non-Cash

Collateral Received* |

Total

Collateral Received | ||||

|

SPDR SSGA Multi-Asset Real Return

ETF |

$ 18,674,023 | $ 12,421,543 | $ 6,581,098 | $ 19,002,641 | ||||

|

SPDR SSGA Income Allocation ETF

|

21,491,633 | 10,114,067 | 11,885,682 | 21,999,749 |

| Fund | Market

Value of Securities on Loan |

Cash

Collateral Received |

Non-Cash

Collateral Received* |

Total

Collateral Received | ||||

|

SPDR SSGA Global Allocation ETF

|

$48,247,191 | $42,661,109 | $ 6,740,579 | $49,401,688 |

| * | The non-cash collateral includes U.S. Treasuries and U.S. Government Agency securities. |

| Remaining

Contractual Maturity of the Agreements as of June 30, 2021 | ||||||||||||||

| Fund | Securities

Lending Transactions |

Overnight

and Continuous |

<30 Days | Between

30 & 90 Days |

>90 Days | Total

Borrowings |

Gross

Amount of Recognized Liabilities for Securities Lending Transactions | |||||||

|

SPDR SSGA Multi-Asset Real Return

ETF |

Mutual Funds and Exchange Traded Products | $12,421,543 | $— | $— | $— | $12,421,543 | $12,421,543 | |||||||

|

SPDR SSGA Income Allocation

ETF |

Mutual Funds and Exchange Traded Products | 10,114,067 | — | — | — | 10,114,067 | 10,114,067 | |||||||

|

SPDR SSGA Global Allocation

ETF |

Mutual Funds and Exchange Traded Products | 42,661,109 | — | — | — | 42,661,109 | 42,661,109 | |||||||

| Individual Fund constituting the SSGA Active Trust | Statement of operations | Statement of changes in net assets | Financial highlights |

| SPDR

SSGA Multi-Asset Real Return ETF SPDR SSGA Income Allocation ETF SPDR SSGA Global Allocation ETF SPDR SSGA Ultra Short Term Bond ETF |

For the year ended June 30, 2021 | For each of the two years in the period ended June 30, 2021 | For each of the five years in the period ended June 30, 2021 |

| SPDR Nuveen Municipal Bond ETF | For

the period from February 3, 2021 (commencement of operations) to June 30, 2021 | ||

August 30, 2021

| Actual | Hypothetical

(assuming a 5% return before expenses) | ||||||||

| Annualized

Expense Ratio |

Ending

Account Value |

Expenses

Paid During Period(a) |

Ending

Account Value |

Expenses

Paid During Period(a) | |||||

|

SPDR SSGA Multi-Asset Real Return

ETF |

0.08% | $1,167.90 | $0.43 | $1,024.40 | $0.40 | ||||

|

SPDR SSGA Income Allocation

ETF |

0.14 | 1,072.10 | 0.72 | 1,024.10 | 0.70 | ||||

|

SPDR SSGA Global Allocation

ETF |

0.20 | 1,088.30 | 1.04 | 1,023.80 | 1.00 | ||||

|

SPDR SSGA Ultra Short Term Bond

ETF |

0.20 | 1,003.20 | 0.99 | 1,023.80 | 1.00 | ||||

|

SPDR Nuveen Municipal Bond

ETF |

0.40(b) | 1,006.90 | 1.62 | 1,018.50 | 1.63 | ||||

| (a) | Expenses are equal to the Fund's annualized net expense ratio multiplied by the average account value of the period, multiplied by 181, then divided by 365. |

| (b) | Actual period is from commencement of operations on 02/03/2021. |

| Amount | |

|

SPDR SSGA Global Allocation

ETF |

$1,523,983 |

| Percentage | |

|

SPDR Nuveen Municipal Bond

ETF |

97.20% |

| Name,

Address and Year of Birth |

Position(s)

with Funds |

Term

of Office and Length of Time Served |

Principal

Occupation(s) During Past 5 Years |

Number

of Portfolios in Fund Complex Overseen by Trustee† |

Other

Directorships Held by Trustee During the Past 5 Years | |||||

| Trustees | ||||||||||

| Independent Trustees | ||||||||||

| DWIGHT

D. CHURCHILL c/o SSGA Active Trust One Iron Street Boston, MA 02210 1953 |

Independent

Trustee, Audit Committee Chair |

Term:

Unlimited Served: since March 2011 |

Self-employed

consultant since 2010; CEO and President, CFA Institute (June 2014 - January 2015). |

126 | Affiliated Managers Group, Inc. (Chairman, Director and Audit Committee Chair). | |||||

| CLARE

S. RICHER c/o SSGA Active Trust One Iron Street Boston, MA 02210 1958 |

Independent

Trustee |

Term:

Unlimited Served: since July 2018 |

Retired.

Chief Financial Officer, Putnam Investments LLC (December 2008 - May 2017). |

126 | Principal

Financial Group (Director); Bain Capital Specialty Finance (Director); Putnam Acquisition Financing Inc. (Director); Putnam Acquisition Financing LLC (Director); Putnam GP Inc. (Director); Putnam Investor Services, Inc. (Director); University of Notre Dame (Trustee). | |||||

| SANDRA

G. SPONEM c/o SSGA Active Trust One Iron Street Boston, MA 02210 1958 |

Independent

Trustee |

Term:

Unlimited Served: since July 2018 |

Retired.

Chief Financial Officer, M.A. Mortenson Companies, Inc. (February 2007- April 2017). |

126 | Rydex

Series Funds (Trustee); Rydex Dynamic Funds (Trustee); Rydex Variable Trust (Trustee); Guggenheim Funds Trust (Trustee); Guggenheim Variable Funds Trust (Trustee); Guggenheim Strategy Funds Trust (Trustee); Transparent Value Trust (Trustee); Fiduciary/Claymore Energy Infrastructure Fund (Trustee); Guggenheim Taxable Municipal Managed Duration Trust (Trustee); Guggenheim Strategic Opportunities Fund (Trustee); Guggenheim Enhanced, Equity Income Fund (Trustee); Guggenheim Credit Allocation Fund (Trustee); Guggenheim Energy & Income Fund (Trustee). | |||||

| CARL

G. VERBONCOEUR c/o SSGA Active Trust One Iron Street Boston, MA 02210 1952 |

Independent

Trustee, Trustee Committee Chair |

Term:

Unlimited Served: since March 2011 |

Self-employed

consultant since 2009. |

126 | The

Motley Fool Funds Trust (Trustee). |

| Name,

Address and Year of Birth |

Position(s)

with Funds |

Term

of Office and Length of Time Served |

Principal

Occupation(s) During Past 5 Years |

Number

of Portfolios in Fund Complex Overseen by Trustee† |

Other

Directorships Held by Trustee During the Past 5 Years | |||||

| Interested Trustee | ||||||||||

| JAMES

E. ROSS* c/o SSGA Active Trust One Iron Street Boston, MA 02210 1965 |

Interested

Trustee |

Term:

Unlimited Served as Trustee: since March 2011 |

Non-Executive

Chairman, Fusion Acquisition Corp. (June 2020 - Present); Retired Chairman and Director, SSGA Funds Management, Inc. (2005 - March 2020); Retired Executive Vice President, State Street Global Advisors (2012 - March 2020); Retired Chief Executive Officer and Manager, State Street Global Advisors Funds Distributors, LLC (May 2017 - March 2020); Director, State Street Global Markets, LLC (2013 - April 2017); President, SSGA Funds Management, Inc. (2005 - 2012); Principal, State Street Global Advisors (2000 - 2005). |

137 | SSGA SPDR

ETFs Europe I plc (Director) (November 2016 - March 2020); SSGA SPDR ETFs Europe II plc (Director) (November 2016 - March 2020); State Street Navigator Securities Lending Trust (July 2016 - March 2020); SSGA Funds (January 2014 - March 2020); State Street Institutional Investment Trust (February 2007 - March 2020); State Street Master Funds (February 2007 - March 2020); Elfun Funds (July 2016 - December 2018). | |||||

| † For the purpose of determining the number of portfolios overseen by the Trustees, “Fund Complex” comprises registered investment companies for which SSGA Funds Management, Inc. serves as investment adviser. | ||||||||||

| * Mr. Ross is an Interested Trustee because of his former position with the Adviser and ownership interest in an affiliate of the Adviser. | ||||||||||

| Name,

Address and Year of Birth |

Position(s)

with Funds |

Term

of Office and Length of Time Served |

Principal Occupation(s) During the Past 5 Years | |||

| Officers | ||||||

| ELLEN

M. NEEDHAM SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1967 |

President | Term:

Unlimited Served: since October 2012 |

Chairman, SSGA Funds Management, Inc. (March 2020 - present)*; President and Director, SSGA Funds Management, Inc. (2001 - present)*; Senior Managing Director, State Street Global Advisors (1992 - present)*; Manager, State Street Global Advisors Funds Distributors, LLC (May 2017 - present). | |||

| BRUCE

S. ROSENBERG SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1961 |

Treasurer | Term:

Unlimited Served: since February 2016 |

Managing Director, State Street Global Advisors and SSGA Funds Management, Inc. (July 2015 - present); Director, Credit Suisse (April 2008 - July 2015). | |||

| ANN

M. CARPENTER SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1966 |

Vice

President; Deputy Treasurer |

Term:

Unlimited Served: since August 2012 (with respect to Vice President); Unlimited Served: since February 2016 (with respect to Deputy Treasurer) |

Chief Operating Officer, SSGA Funds Management, Inc. (April 2005 - Present)*; Managing Director, State Street Global Advisors (April 2005 - present).* | |||

| MICHAEL

P. RILEY SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1969 |

Vice

President |

Term:

Unlimited Served: since March 2011 |

Managing Director, State Street Global Advisors (2005 - present).* | |||

| SEAN

O’MALLEY SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1969 |

Chief

Legal Officer |

Term:

Unlimited Served: since August 2019 |

Senior Vice President and Deputy General Counsel, State Street Global Advisors (November 2013 -present). | |||

| DAVID

URMAN SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1985 |

Assistant

Secretary |

Term:

Unlimited Served: since August 2019 |

Vice President and Senior Counsel, State Street Global Advisors (April 2019 - present); Vice President and Counsel, State Street Global Advisors (August 2015 - April 2019); Associate, Ropes & Gray LLP (November 2012 - August 2015). | |||

| DAVID

BARR SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1974 |

Assistant

Secretary |

Term:

Unlimited Served: since November 2020 |

Vice President and Senior Counsel, State Street Global Advisors (October 2019 - present); Vice President and Counsel, Eaton Vance Corp. (2010 - 2019). | |||

| CHAD

C. HALLETT SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1969 |

Deputy

Treasurer |

Term:

Unlimited Served: since February 2016 |

Vice President, State Street Global Advisors and SSGA Funds Management, Inc. (November 2014 - present); Vice President, State Street Bank and Trust Company (2001 - November 2014).* | |||

| DARLENE

ANDERSON-VASQUEZ SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1968 |

Deputy

Treasurer |

Term:

Unlimited Served: since November 2016 |

Managing Director, State Street Global Advisors and SSGA Funds Management, Inc. (May 2016 - present); Senior Vice President, John Hancock Investments (September 2007 - May 2016). |

| Name,

Address and Year of Birth |

Position(s)

with Funds |

Term

of Office and Length of Time Served |

Principal Occupation(s) During the Past 5 Years | |||

| ARTHUR

A. JENSEN SSGA Funds Management, Inc. 1600 Summer Street Stamford, CT 06905 1966 |

Deputy

Treasurer |

Term:

Unlimited Served: Since August 2017 |

Vice President, State Street Global Advisors and SSGA Funds Management, Inc. (July 2016 - present); Mutual Funds Controller of GE Asset Management Incorporated (April 2011 - July 2016). | |||

| DAVID

LANCASTER SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1971 |

Assistant

Treasurer |

Term:

Unlimited Served: since November 2020 |

Vice President, State Street Global Advisors and SSGA Funds Management, Inc. (July 2017 - present); Assistant Vice President, State Street Bank and Trust Company (November 2011 - July 2017). | |||

| BRIAN

HARRIS SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 1973 |

Chief

Compliance Officer; Anti-Money Laundering Officer; Code of Ethics Compliance Officer |

Term:

Unlimited Served: since November 2013 |

Managing Director, State Street Global Advisors and SSGA Funds Management, Inc. (June 2013 - present)*; Senior Vice President and Global Head of Investment Compliance, BofA Global Capital Management (2010 - 2013); Director of Compliance, AARP Financial Inc. (2008 - 2010). | |||

| * Served in various capacities and/or with various affiliated entities during noted time period. | ||||||

| The Statement of Additional Information (SAI) includes additional information about the Funds' trustees and is available, without charge, upon request and by calling 1-866-787-2257. | ||||||

| SPDR SSGA Fixed Income Sector Rotation ETF |

| SPDR SSGA US Sector Rotation ETF |

|

|

1 |

| Management’s Discussion of Fund Performance, Performance Summaries & Portfolio Statistics (Unaudited) | |

|

|

2 |

|

|

5 |

| Schedules of Investments | |

|

|

8 |

|

|

10 |

|

|

12 |

|

|

15 |

|

|

17 |

|

|

28 |

|

|

30 |

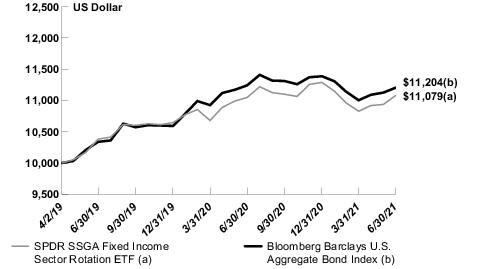

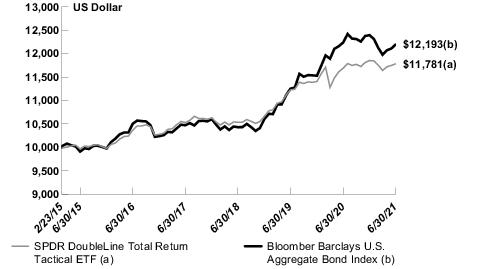

| Cumulative Total Return | Average Annual Total Return | ||||||

| Net

Asset Value |

Market

Value |

Bloomberg Barclays U.S. Aggregate Bond Index | Net

Asset Value |

Market

Value |

Bloomberg Barclays U.S. Aggregate Bond Index | ||

| ONE YEAR | 0.29% | 0.31% | (0.33)% | 0.29% | 0.31% | (0.33)% | |

| SINCE INCEPTION(1) | 10.79% | 10.76% | 12.04% | 4.67% | 4.66% | 5.20% | |

| (1) | For the period April 2, 2019 to June 30, 2021. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/2/19, 4/3/19, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

(Based on Net Asset Value)

| Description | % of Net Assets | ||

| SPDR Portfolio Mortgage Backed Bond ETF | 30.3% | ||

| SPDR Portfolio Long Term Corporate Bond ETF | 24.3 | ||

| SPDR Portfolio Intermediate Term Corporate Bond ETF | 22.5 | ||

| SPDR Portfolio Intermediate Term Treasury ETF | 11.4 | ||

| SPDR Portfolio Long Term Treasury ETF | 7.0 | ||

| TOTAL | 95.5% |

| % of Net Assets | |||

| Domestic Fixed Income | 99.9% | ||

| Short Term Investments | 29.8 | ||

| Liabilities in Excess of Other Assets | (29.7) | ||

| TOTAL | 100.0% |

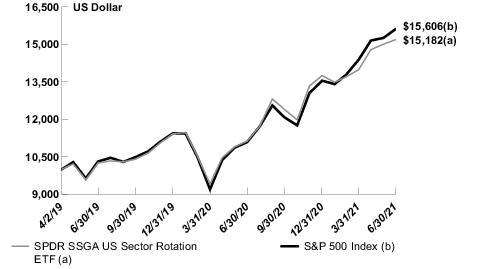

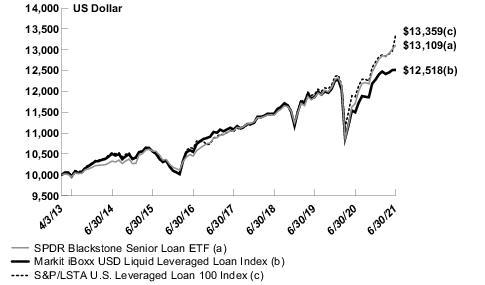

| Cumulative Total Return | Average Annual Total Return | ||||||

| Net

Asset Value |

Market

Value |

S&P 500 Index | Net

Asset Value |

Market

Value |

S&P 500 Index | ||

| ONE YEAR | 36.48% | 36.31% | 40.79% | 36.48% | 36.31% | 40.79% | |

| SINCE INCEPTION(1) | 51.82% | 51.84% | 56.06% | 20.45% | 20.46% | 21.94% | |

| (1) | For the period April 2, 2019 to June 30, 2021. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (4/2/19, 4/3/19, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

(Based on Net Asset Value)

| Description | % of Net Assets | ||

| The Technology Select Sector SPDR Fund | 41.7% | ||

| The Materials Select Sector SPDR Fund | 16.6 | ||

| The Industrial Select Sector SPDR Fund | 16.1 | ||

| The Financial Select Sector SPDR Fund | 12.6 | ||

| The Communication Services Select Sector SPDR Fund | 7.0 | ||

| TOTAL | 94.0% |

| % of Net Assets | |||

| Domestic Equity | 99.8% | ||

| Short Term Investments | 28.6 | ||

| Liabilities in Excess of Other Assets | (28.4) | ||

| TOTAL | 100.0% |

| Security Description | Shares | Value | ||||

| MUTUAL FUNDS AND EXCHANGE TRADED PRODUCTS — 99.9% | ||||||

| DOMESTIC FIXED INCOME — 99.9% | ||||||

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF

(a)(b) |

39,726 | $ 3,633,737 | ||||

|

SPDR Portfolio Intermediate Term Corporate Bond ETF

(a)(b) |

508,248 | 18,652,702 | ||||

|

SPDR Portfolio Intermediate Term Treasury ETF

(a) |

292,929 | 9,485,041 | ||||

|

SPDR Portfolio Long Term Corporate Bond ETF

(a)(b) |

634,102 | 20,151,762 | ||||

|

SPDR Portfolio Long Term Treasury ETF

(a) |

139,338 | 5,754,659 | ||||

|

SPDR Portfolio Mortgage Backed Bond ETF

(a)(b) |

973,311 | 25,169,822 | ||||

|

TOTAL MUTUAL FUNDS AND EXCHANGE TRADED PRODUCTS (Cost

$82,670,441) |

82,847,723 | |||||

| SHORT-TERM INVESTMENTS — 29.8% | ||||||

|

State Street Institutional U.S. Government Money Market Fund, Class G Shares 0.03%

(c)(d) |

136,849 | 136,849 | ||||

|

State Street Navigator Securities Lending Portfolio II

(e)(f) |

24,628,973 | 24,628,973 | ||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost

$24,765,822) |

$ 24,765,822 | |||||

|

TOTAL INVESTMENTS—129.7% (Cost

$107,436,263) |

107,613,545 | |||||

|

LIABILITIES IN EXCESS OF OTHER

ASSETS—(29.7)% |

(24,639,701) | |||||

|

NET

ASSETS—100.0% |

$ 82,973,844 | |||||

| The Fund invests in other funds and financial statements of underlying funds can be found at www.sec.gov. | |

| (a) | Affiliated fund managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended June 30, 2021 are shown in the Affiliate Table below. |

| (b) | All or a portion of the shares of the security are on loan at June 30, 2021. |

| (c) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended June 30, 2021 are shown in the Affiliate Table below. |

| (d) | The rate shown is the annualized seven-day yield at June 30, 2021. |

| (e) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended June 30, 2021 are shown in the Affiliate Table below. |

| (f) | Investment of cash collateral for securities loaned. |

| Description | Level

1 – Quoted Prices |

Level

2 – Other Significant Observable Inputs |

Level

3 – Significant Unobservable Inputs |

Total | ||||

| ASSETS: | ||||||||

| INVESTMENTS: | ||||||||

|

Mutual Funds and Exchange Traded

Products |

$ 82,847,723 | $— | $— | $ 82,847,723 | ||||

|

Short-Term

Investments |

24,765,822 | — | — | 24,765,822 | ||||

|

TOTAL

INVESTMENTS |

$107,613,545 | $— | $— | $107,613,545 |

| Number

of Shares Held at 6/30/20 |

Value

at 6/30/20 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation/ Depreciation |

Number

of Shares Held at 6/30/21 |

Value

at 6/30/21 |

Dividend

Income | |||||||||

|

SPDR Bloomberg Barclays 1-3 Month T-Bill

ETF |

— | $ — | $ 9,741,170 | $ 6,103,656 | $ (2,842) | $ (935) | 39,726 | $ 3,633,737 | $ — | ||||||||

|

SPDR Bloomberg Barclays High Yield Bond

ETF |

43,696 | 4,420,287 | 2,706,432 | 7,324,826 | 298,320 | (100,213) | — | — | 104,963 | ||||||||

|

SPDR Portfolio Intermediate Term Corporate Bond

ETF |

362,090 | 13,227,148 | 19,283,435 | 14,010,513 | 261,114 | (108,482) | 508,248 | 18,652,702 | 219,640 | ||||||||

|

SPDR Portfolio Intermediate Term Treasury

ETF |

239,904 | 7,969,611 | 12,226,097 | 10,462,221 | 138,940 | (387,386) | 292,929 | 9,485,041 | 35,705 | ||||||||

|

SPDR Portfolio Long Term Corporate Bond

ETF |

151,623 | 4,806,450 | 27,332,547 | 11,512,564 | (381,262) | (93,409) | 634,102 | 20,151,762 | 415,748 | ||||||||

|

SPDR Portfolio Long Term Treasury

ETF |

— | — | 10,332,144 | 4,596,683 | (159,847) | 179,045 | 139,338 | 5,754,659 | 10,398 | ||||||||

|

SPDR Portfolio Mortgage Backed Bond

ETF |

578,818 | 15,506,534 | 21,360,024 | 11,053,427 | (36,370) | (606,939) | 973,311 | 25,169,822 | 514,167 | ||||||||

|

State Street Institutional U.S. Government Money Market Fund, Class G

Shares |

1,091,555 | 1,091,555 | 1,738,586 | 2,693,292 | — | — | 136,849 | 136,849 | 377 | ||||||||

|

State Street Navigator Securities Lending Portfolio

II |

9,882,034 | 9,882,034 | 494,143,581 | 479,396,642 | — | — | 24,628,973 | 24,628,973 | 91,988 | ||||||||

|

Total |

$56,903,619 | $598,864,016 | $547,153,824 | $ 118,053 | $(1,118,319) | $107,613,545 | $1,392,986 |

| Security Description | Shares | Value | ||||

| MUTUAL FUNDS AND EXCHANGE TRADED PRODUCTS — 99.8% | ||||||

| DOMESTIC EQUITY — 99.8% | ||||||

|

The Communication Services Select Sector SPDR Fund

(a)(b) |

150,287 | $ 12,168,738 | ||||

|

The Consumer Staples Select Sector SPDR Fund

(a) |

67,445 | 4,719,127 | ||||

|

The Energy Select Sector SPDR Fund

(a) |

100,084 | 5,391,525 | ||||

|

The Financial Select Sector SPDR Fund

(a) |

599,399 | 21,991,949 | ||||

|

The Industrial Select Sector SPDR Fund

(a)(b) |

274,818 | 28,141,363 | ||||

|