SSGA Active Trust

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22542

SSGA ACTIVE TRUST

(Exact name of registrant as specified in charter)

One Iron

Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and Deputy General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston,

Massachusetts 02210

(Name and address of agent for service)

Copy to:

W.

John McGuire, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: June 30

Date of reporting period: June 30, 2019

Item 1. Reports to Shareholders.

Annual Report

June 30, 2019

SSGA Active Trust

| State

Street Defensive Global Equity Portfolio |

The information contained in this report is intended for the

general information of shareholders of the Portfolio and shareholders of any fund or private client invested in the Portfolio. Generally, shares of the Portfolio may be purchased only by or on behalf of other registered investment companies or

private clients for which the Adviser or an affiliate serves as investment adviser (or in a similar capacity). This report is not authorized for distribution (i) to prospective investors in any fund invested in the Portfolio unless preceded or

accompanied by a current offering document for such fund or (ii) to prospective eligible investors in the Portfolio unless preceded or accompanied by a current offering document of the Portfolio. Eligible investors in the Portfolio may obtain a

current prospectus and SAI from the Distributor by calling 1-800-997-7327. Please read the offering document carefully before investing in the Portfolio.

TABLE OF CONTENTS

The information contained in this report is intended

for the general information of shareholders of the Portfolio and shareholders of any fund or private client invested in the Portfolio. Generally, shares of the Portfolio may be purchased only by or on behalf of other registered investment companies

or private clients for which the Adviser or an affiliate serves as investment adviser (or in a similar capacity). This report is not authorized for distribution (i) to prospective investors in any fund invested in the Portfolio unless preceded or

accompanied by a current offering document for such fund or (ii) to prospective eligible investors in the Portfolio unless preceded or accompanied by a current offering document of the Portfolio. Eligible investors in the Portfolio may obtain a

current prospectus and SAI from the Distributor by calling 1-800-997-7327. Please read the offering document carefully before investing in the Portfolio.

[This Page Intentionally Left Blank]

Notes to Performance Summary (Unaudited)

The following performance chart of the Portfolio’s

total return at net asset value, the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. The Portfolio’s per share net asset value (“NAV”) is the

value of one share of the Portfolio and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Portfolio. NAV and market returns assume that dividends

and capital gain distributions have been reinvested in the Portfolio at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be

lower.

An index is a statistical measure of a

specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, the Portfolio’s performance is negatively impacted by these

deductions.

The MSCI World Index is a free

float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

See accompanying notes to financial statements.

1

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

Management's Discussion of Fund Performance (Unaudited)

The State Street Defensive Global Equity Portfolio (the

“Portfolio”) seeks to provide competitive long-term returns while maintaining low long-term volatility relative to the broad global equity market. The Portfolio’s benchmark is the MSCI World Index (the “Index”).

For the 12-month period ended June 30, 2019 (the

“Reporting Period”), the total return for the Portfolio was 8.38%, and the Index was 6.33%. The Portfolio and Index returns reflect the reinvestment of dividends and other income. The Portfolio’s performance reflects the expenses

of managing the Portfolio, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

The Portfolio’s defensive positioning, sector

allocation and stock selection were primary drivers of performance during the Reporting Period relative to the Index. The market performance was weak during the first half of the Reporting Period and the Portfolio’s defensive posture delivered

a substantial reduction in downside participation. A resumption of global risk sentiments over the second half of the Reporting Period drove strong global equity market gains and the Portfolio had a challenging relative performance. However, over

the full Reporting Period, the Portfolio’s defensive approach proved effective in delivering outperformance versus the market with a substantial reduction in realized portfolio risk. The Portfolio’s overweight of defensive sectors

– utilities, consumer staples and telecommunication contributed to relative performance. The underweight to poor performing Energy sector also added to relative performance. However, the Portfolio’s underweight of the best performing

Information Technology sector was the most significant detractor from the Portfolios relative performance. Stock selection performance was weak over the Reporting Period. The poor performance of valuation based factors was the key challenge.

The Portfolio did not invest in derivatives during the

Reporting Period.

On an individual security level,

the top positive contributors to the Portfolio’s performance on an absolute basis during the Reporting Period were Waste Management, Motorola Solutions and Merck. The top negative contributors to the Portfolio’s performance on an

absolute basis during the Reporting Period were Danske Bank, Taisei Corp. and Cigna.

The views expressed above reflect those of the

Portfolio’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser

disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of

any fund.

See accompanying notes to financial statements.

2

State Street Defensive Global Equity Portfolio

Performance Summary (Unaudited)

Performance as of June 30, 2019

| |

|

|

|

|

|

|

|

|

|

| |

|

Cumulative

Total Return |

|

Average

Annual Total Return |

|

| |

|

Net

Asset

Value |

Market

Value |

MSCI

World Index |

|

Net

Asset

Value |

Market

Value |

MSCI

World Index |

|

| |

ONE

YEAR |

8.38%

|

N/A

|

6.33%

|

|

8.38%

|

N/A

|

6.33%

|

|

| |

SINCE

INCEPTION(1) |

43.82%

|

N/A

|

51.05%

|

|

11.40%

|

N/A

|

13.05%

|

|

| |

|

|

|

|

|

|

|

|

|

| (1)

|

For

the period February 18, 2016 to June 30, 2019. |

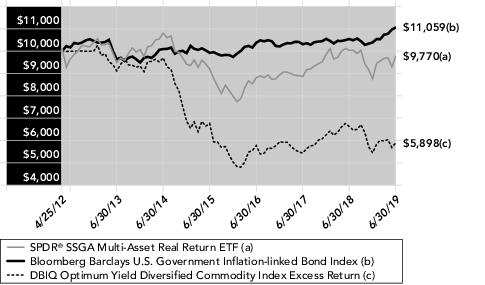

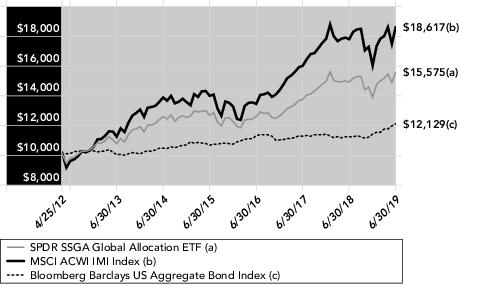

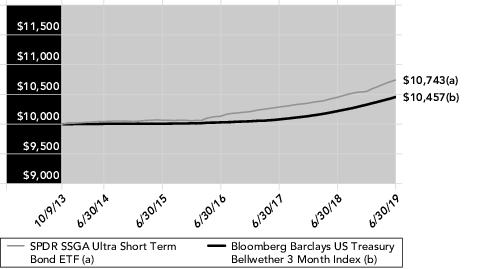

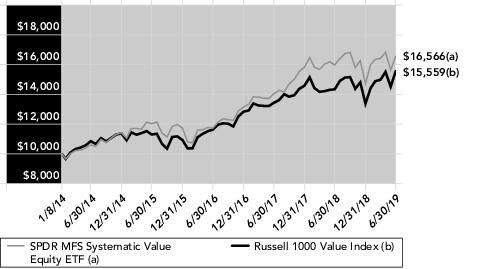

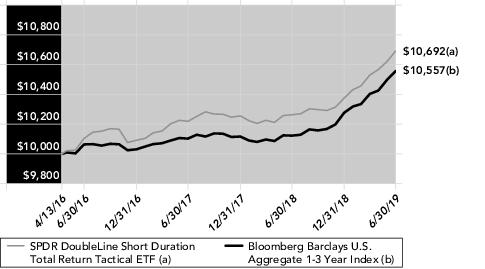

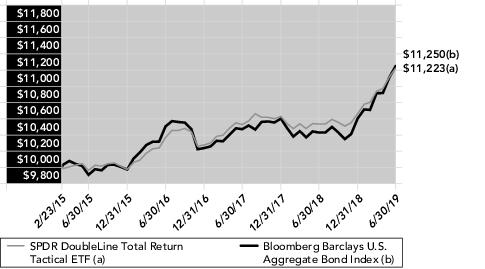

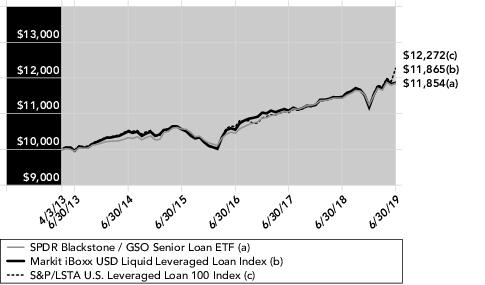

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line

graph is based on cumulative total return.

The total

expense ratio for State Street Defensive Global Equity Portfolio as stated in the Fees and Expenses table of the most recent prospectus is 0.30%.

Performance quoted represents past performance, which is no

guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end

performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption or sale of Portfolio shares. See "Notes to Performance Summary" on page 1 for more information.

See accompanying notes to financial

statements.

3

State Street Defensive Global Equity Portfolio

Portfolio Statistics (Unaudited)

Top Five Holdings as of June 30, 2019

|

|

|

|

|

| |

Description

|

Market

Value |

%

of Net Assets |

|

| |

Waste

Management, Inc. |

35,649

|

1.6%

|

|

| |

McDonald's

Corp. |

34,679

|

1.5

|

|

| |

DTE

Energy Co. |

34,144

|

1.5

|

|

| |

Merck

& Co., Inc. |

34,127

|

1.5

|

|

| |

Baxter

International, Inc. |

33,661

|

1.5

|

|

| |

TOTAL

|

172,260

|

7.6%

|

|

(The five largest holdings are subject to

change, and there are no guarantees the Portfolio will continue to remain invested in any particular company.)

Industry Breakdown as of June 30, 2019

|

|

|

|

| |

|

%

of Net Assets |

|

| |

Insurance

|

11.8%

|

|

| |

Pharmaceuticals

|

11.8

|

|

| |

Electric

Utilities |

7.1

|

|

| |

Diversified

Telecommunication Services |

6.3

|

|

| |

Multi-Utilities

|

4.9

|

|

| |

Banks

|

4.9

|

|

| |

Food

& Staples Retailing |

4.9

|

|

| |

Equity

Real Estate Investment Trusts (REITs) |

3.8

|

|

| |

Specialty

Retail |

3.7

|

|

| |

Food

Products |

3.1

|

|

| |

Health

Care Providers & Services |

3.0

|

|

| |

Hotels,

Restaurants & Leisure |

2.8

|

|

| |

Health

Care Equipment & Supplies |

2.7

|

|

| |

Household

Products |

2.5

|

|

| |

Trading

Companies & Distributors |

2.4

|

|

| |

Beverages

|

2.2

|

|

| |

Automobiles

|

2.2

|

|

| |

Communications

Equipment |

2.0

|

|

| |

Aerospace

& Defense |

2.0

|

|

| |

Commercial

Services & Supplies |

2.0

|

|

| |

Oil,

Gas & Consumable Fuels |

2.0

|

|

| |

Tobacco

|

1.9

|

|

| |

Consumer

Finance |

1.4

|

|

| |

Airlines

|

1.3

|

|

| |

Gas

Utilities |

1.2

|

|

| |

Metals

& Mining |

1.2

|

|

| |

Multiline

Retail |

1.2

|

|

| |

Construction

& Engineering |

1.1

|

|

| |

Technology

Hardware, Storage & Peripherals |

0.9

|

|

| |

Chemicals

|

0.5

|

|

| |

Mortgage

Real Estate Investment Trust (REITs) |

0.3

|

|

| |

Short-Term

Investment |

0.5

|

|

| |

Other

Assets in Excess of Liabilities |

0.4

|

|

| |

TOTAL

|

100.0%

|

|

(The Portfolio’s industry breakdown is

expressed as a percentage of net assets and may change over time.)

See accompanying notes to financial statements.

4

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

SCHEDULE OF INVESTMENTS

June 30, 2019

| Security

Description |

|

|

Shares

|

|

Value

|

| COMMON

STOCKS — 99.1% |

|

|

|

|

|

| AUSTRALIA

— 3.8% |

|

|

|

|

|

|

BHP Group,

Ltd.

|

|

|

634

|

|

$

18,313 |

|

Mirvac Group

REIT

|

|

|

3,259

|

|

7,158

|

|

Qantas Airways,

Ltd.

|

|

|

1,986

|

|

7,526

|

|

Scentre Group

REIT

|

|

|

4,249

|

|

11,450

|

|

Sonic Healthcare,

Ltd.

|

|

|

517

|

|

9,832

|

|

Wesfarmers,

Ltd.

|

|

|

858

|

|

21,772

|

|

Woodside Petroleum,

Ltd.

|

|

|

400

|

|

10,206

|

| |

|

|

|

|

86,257

|

| BELGIUM

— 0.5% |

|

|

|

|

|

|

Ageas

|

|

|

237

|

|

12,337

|

| CANADA

— 3.5% |

|

|

|

|

|

|

Loblaw Cos.,

Ltd.

|

|

|

85

|

|

4,361

|

|

Royal Bank of

Canada

|

|

|

141

|

|

11,229

|

|

Sun Life Financial,

Inc.

|

|

|

341

|

|

14,152

|

|

TELUS

Corp.

|

|

|

610

|

|

22,598

|

|

Toronto-Dominion

Bank

|

|

|

465

|

|

27,229

|

| |

|

|

|

|

79,569

|

| DENMARK

— 1.3% |

|

|

|

|

|

|

Novo Nordisk A/S Class

B

|

|

|

601

|

|

30,674

|

| FRANCE

— 1.6% |

|

|

|

|

|

|

Peugeot

SA

|

|

|

764

|

|

18,854

|

|

Sanofi

|

|

|

209

|

|

18,067

|

| |

|

|

|

|

36,921

|

| GERMANY

— 4.3% |

|

|

|

|

|

|

Allianz

SE

|

|

|

120

|

|

28,971

|

|

Deutsche Telekom

AG

|

|

|

1,636

|

|

28,341

|

|

Merck

KGaA

|

|

|

130

|

|

13,614

|

|

Muenchener Rueckversicherungs-Gesellschaft AG in

Muenchen

|

|

|

109

|

|

27,396

|

| |

|

|

|

|

98,322

|

| HONG

KONG — 3.6% |

|

|

|

|

|

|

CLP Holdings,

Ltd.

|

|

|

2,500

|

|

27,584

|

|

Hang Seng Bank,

Ltd.

|

|

|

500

|

|

12,448

|

|

HKT Trust & HKT,

Ltd.

|

|

|

7,000

|

|

11,110

|

|

Link

REIT

|

|

|

2,500

|

|

30,720

|

| |

|

|

|

|

81,862

|

| ITALY

— 1.3% |

|

|

|

|

|

|

Eni

SpA

|

|

|

1,470

|

|

24,451

|

|

Snam

SpA

|

|

|

1,138

|

|

5,665

|

| |

|

|

|

|

30,116

|

| JAPAN

— 11.5% |

|

|

|

|

|

|

Astellas Pharma,

Inc.

|

|

|

1,800

|

|

25,645

|

|

FUJIFILM Holdings

Corp.

|

|

|

300

|

|

15,212

|

|

ITOCHU

Corp.

|

|

|

900

|

|

17,212

|

|

Japan Airlines Co.,

Ltd.

|

|

|

700

|

|

22,370

|

|

Japan Post Holdings Co.,

Ltd.

|

|

|

2,400

|

|

27,176

|

|

Mitsubishi

Corp.

|

|

|

700

|

|

18,452

|

|

Mitsui & Co.,

Ltd.

|

|

|

1,200

|

|

19,536

|

| Security

Description |

|

|

Shares

|

|

Value

|

|

Mitsui Chemicals,

Inc.

|

|

|

500

|

|

$

12,377 |

|

Mizuho Financial Group,

Inc.

|

|

|

7,800

|

|

11,301

|

|

Nippon Telegraph & Telephone

Corp.

|

|

|

500

|

|

23,283

|

|

Sumitomo Mitsui Trust Holdings,

Inc.

|

|

|

300

|

|

10,876

|

|

Taisei

Corp.

|

|

|

300

|

|

10,901

|

|

Tokio Marine Holdings,

Inc.

|

|

|

200

|

|

10,022

|

|

Tokyo Gas Co.,

Ltd.

|

|

|

300

|

|

7,066

|

|

Toyota Motor

Corp.

|

|

|

500

|

|

31,038

|

| |

|

|

|

|

262,467

|

| NETHERLANDS

— 1.1% |

|

|

|

|

|

|

Koninklijke Ahold Delhaize

NV

|

|

|

1,099

|

|

24,753

|

| NEW

ZEALAND — 0.6% |

|

|

|

|

|

|

Spark New Zealand,

Ltd.

|

|

|

4,835

|

|

12,990

|

| NORWAY

— 0.4% |

|

|

|

|

|

|

DNB

ASA

|

|

|

501

|

|

9,325

|

| SINGAPORE

— 0.4% |

|

|

|

|

|

|

DBS Group Holdings,

Ltd.

|

|

|

500

|

|

9,594

|

| SPAIN

— 0.8% |

|

|

|

|

|

|

ACS Actividades de Construccion y Servicios

SA

|

|

|

325

|

|

12,995

|

|

Enagas

SA

|

|

|

193

|

|

5,158

|

| |

|

|

|

|

18,153

|

| SWEDEN

— 1.0% |

|

|

|

|

|

|

Swedish Match

AB

|

|

|

554

|

|

23,406

|

| SWITZERLAND

— 8.2% |

|

|

|

|

|

|

Nestle

SA

|

|

|

299

|

|

30,992

|

|

Novartis

AG

|

|

|

342

|

|

31,288

|

|

Roche Holding

AG

|

|

|

111

|

|

31,268

|

|

Swiss Life Holding

AG

|

|

|

39

|

|

19,352

|

|

Swiss Re

AG

|

|

|

286

|

|

29,110

|

|

Swisscom

AG

|

|

|

39

|

|

19,604

|

|

Zurich Insurance Group

AG

|

|

|

76

|

|

26,495

|

| |

|

|

|

|

188,109

|

| UNITED

KINGDOM — 0.6% |

|

|

|

|

|

|

Direct Line Insurance Group

PLC

|

|

|

3,228

|

|

13,631

|

| UNITED

STATES — 54.6% |

|

|

|

|

|

|

Aflac,

Inc.

|

|

|

539

|

|

29,543

|

|

AGNC Investment Corp.

REIT

|

|

|

369

|

|

6,207

|

|

Allstate

Corp.

|

|

|

320

|

|

32,541

|

|

Ameren

Corp.

|

|

|

435

|

|

32,673

|

|

American Electric Power Co.,

Inc.

|

|

|

187

|

|

16,458

|

|

American Express

Co.

|

|

|

254

|

|

31,354

|

|

Anthem,

Inc.

|

|

|

68

|

|

19,190

|

|

AutoZone, Inc.

(a)

|

|

|

29

|

|

31,885

|

|

Baxter International,

Inc.

|

|

|

411

|

|

33,661

|

|

Bristol-Myers Squibb

Co.

|

|

|

6

|

|

272

|

|

CenterPoint Energy,

Inc.

|

|

|

706

|

|

20,213

|

|

Cisco Systems,

Inc.

|

|

|

275

|

|

15,051

|

|

Coca-Cola

Co.

|

|

|

386

|

|

19,655

|

|

DTE Energy

Co.

|

|

|

267

|

|

34,144

|

|

Duke Energy

Corp.

|

|

|

121

|

|

10,677

|

|

Eli Lilly &

Co.

|

|

|

266

|

|

29,470

|

See accompanying notes to financial statements.

5

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

SCHEDULE OF

INVESTMENTS (continued)

June 30, 2019

| Security

Description |

|

|

Shares

|

|

Value

|

|

Entergy

Corp.

|

|

|

283

|

|

$

29,129 |

|

Eversource

Energy

|

|

|

244

|

|

18,485

|

|

Exelon

Corp.

|

|

|

658

|

|

31,544

|

|

HCA Healthcare,

Inc.

|

|

|

209

|

|

28,250

|

|

Hershey

Co.

|

|

|

135

|

|

18,094

|

|

Home Depot,

Inc.

|

|

|

105

|

|

21,837

|

|

HP,

Inc.

|

|

|

232

|

|

4,823

|

|

Johnson &

Johnson

|

|

|

199

|

|

27,717

|

|

JPMorgan Chase &

Co.

|

|

|

156

|

|

17,441

|

|

Kellogg

Co.

|

|

|

232

|

|

12,428

|

|

Kimberly-Clark

Corp.

|

|

|

199

|

|

26,523

|

|

Lockheed Martin

Corp.

|

|

|

71

|

|

25,811

|

|

McDonald's

Corp.

|

|

|

167

|

|

34,679

|

|

Medtronic

PLC

|

|

|

289

|

|

28,146

|

|

Merck & Co.,

Inc.

|

|

|

407

|

|

34,127

|

|

Mondelez International, Inc. Class

A

|

|

|

215

|

|

11,588

|

|

Motorola Solutions,

Inc.

|

|

|

180

|

|

30,011

|

|

Newmont Goldcorp

Corp.

|

|

|

244

|

|

9,387

|

|

PepsiCo,

Inc.

|

|

|

235

|

|

30,816

|

|

Pfizer,

Inc.

|

|

|

656

|

|

28,418

|

|

Philip Morris International,

Inc.

|

|

|

277

|

|

21,753

|

|

Pinnacle West Capital

Corp.

|

|

|

286

|

|

26,910

|

|

Procter & Gamble

Co.

|

|

|

271

|

|

29,715

|

|

Public Service Enterprise Group,

Inc.

|

|

|

438

|

|

25,763

|

|

Raytheon

Co.

|

|

|

125

|

|

21,735

|

|

Republic Services,

Inc.

|

|

|

107

|

|

9,270

|

|

Simon Property Group, Inc.

REIT

|

|

|

157

|

|

25,082

|

|

Starbucks

Corp.

|

|

|

358

|

|

30,011

|

|

Sysco

Corp.

|

|

|

415

|

|

29,349

|

|

Target

Corp.

|

|

|

324

|

|

28,062

|

|

TJX Cos.,

Inc.

|

|

|

561

|

|

29,666

|

|

UGI

Corp.

|

|

|

372

|

|

19,868

|

|

UnitedHealth Group,

Inc.

|

|

|

52

|

|

12,688

|

|

Ventas, Inc.

REIT

|

|

|

139

|

|

9,501

|

|

VEREIT,

Inc.

|

|

|

608

|

|

5,478

|

| Security

Description |

|

|

Shares

|

|

Value

|

|

Verizon Communications,

Inc.

|

|

|

491

|

|

$

28,051 |

|

Walmart,

Inc.

|

|

|

275

|

|

30,385

|

|

Waste Management,

Inc.

|

|

|

309

|

|

35,649

|

| |

|

|

|

|

1,251,184

|

|

TOTAL COMMON STOCKS

(Cost

$2,016,826)

|

|

|

|

|

2,269,670

|

| |

|

|

|

| RIGHTS

— 0.0% (b) |

|

|

|

| SPAIN

— 0.0% (b) |

|

|

|

|

ACS Actividades de Construccion y Servicios SA (expiring 07/11/19) (a)

(Cost:

$534)

|

|

325

|

511

|

| SHORT-TERM

INVESTMENT — 0.5% |

|

|

State Street Institutional U.S. Government Money Market Fund, Class G Shares 2.35% (c) (d)

(Cost

$10,308)

|

10,308

|

10,308

|

|

TOTAL INVESTMENTS — 99.6%

(Cost

$2,027,668)

|

2,280,489

|

|

OTHER ASSETS IN EXCESS OF LIABILITIES — 0.4%

|

9,385

|

|

NET ASSETS — 100.0%

|

$

2,289,874 |

| (a)

|

Non-income

producing security. |

| (b)

|

Amount

is less than 0.05% of net assets. |

| (c)

|

The

Portfolio invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended June 30, 2019 are shown in the Affiliate Table below. |

| (d)

|

The

rate shown is the annualized seven-day yield at June 30, 2019. |

| REIT

|

=

Real Estate Investment Trust |

The following table summarizes the value

of the Portfolio's investments according to the fair value hierarchy as of June 30, 2019.

| Description

|

|

Level

1 –

Quoted Prices |

|

Level

2 –

Other Significant

Observable Inputs |

|

Level

3 –

Significant

Unobservable Inputs |

|

Total

|

| ASSETS:

|

|

|

|

|

|

|

|

|

| INVESTMENTS:

|

|

|

|

|

|

|

|

|

|

Common

Stocks

|

|

$2,269,670

|

|

$—

|

|

$—

|

|

$2,269,670

|

|

Rights

|

|

511

|

|

—

|

|

—

|

|

511

|

|

Short-Term

Investment

|

|

10,308

|

|

—

|

|

—

|

|

10,308

|

|

TOTAL

INVESTMENTS

|

|

$2,280,489

|

|

$—

|

|

$—

|

|

$2,280,489

|

Affiliate

Table

| |

Number

of

Shares Held

at

6/30/18 |

|

Value

at

6/30/18 |

|

Cost

of

Purchases |

|

Proceeds

from

Shares Sold |

|

Realized

Gain (Loss) |

|

Change

in

Unrealized

Appreciation/

Depreciation |

|

Number

of

Shares Held

at

6/30/19 |

|

Value

at

6/30/19 |

|

Dividend

Income |

|

State Street Institutional U.S. Government Money Market Fund, Class G

Shares

|

33,569

|

|

$33,569

|

|

$912,324

|

|

$935,585

|

|

$—

|

|

$—

|

|

10,308

|

|

$10,308

|

|

$778

|

See accompanying notes to financial statements.

6

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2019

| ASSETS

|

|

|

Investments in unaffiliated issuers, at

value

|

$2,270,181

|

|

Investments in affiliated issuers, at

value

|

10,308

|

|

Total

Investments

|

2,280,489

|

|

Foreign currency, at

value

|

6,485

|

|

Dividends receivable — unaffiliated

issuers

|

2,820

|

|

Dividends receivable — affiliated

issuers

|

61

|

|

Receivable from

Adviser

|

472

|

|

Receivable for foreign taxes

recoverable

|

4,529

|

|

TOTAL ASSETS

|

2,294,856

|

| LIABILITIES

|

|

|

Payable for fund shares

repurchased

|

4,503

|

|

Advisory fee

payable

|

472

|

|

Trustees’ fees and expenses

payable

|

7

|

|

TOTAL LIABILITIES

|

4,982

|

|

NET ASSETS

|

$2,289,874

|

| NET

ASSETS CONSIST OF: |

|

|

Paid-in

Capital

|

$1,905,167

|

|

Total distributable earnings

(loss)

|

384,707

|

|

NET ASSETS

|

$2,289,874

|

| NET

ASSET VALUE PER SHARE |

|

|

Net asset value per

share

|

$

11.00 |

|

Shares outstanding (unlimited amount authorized, no par

value)

|

208,245

|

| COST

OF INVESTMENTS: |

|

|

Investments in unaffiliated

issuers

|

$2,017,360

|

|

Investments in affiliated

issuers

|

10,308

|

|

Total cost of

investments

|

$2,027,668

|

|

Foreign currency, at

cost

|

$

6,458 |

See accompanying notes to financial

statements.

7

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

STATEMENT OF OPERATIONS

For the Year Ended June 30, 2019

| INVESTMENT

INCOME |

|

|

Dividend income — unaffiliated

issuers

|

$

105,980 |

|

Dividend income — affiliated

issuers

|

778

|

|

Foreign taxes

withheld

|

(5,288)

|

|

TOTAL INVESTMENT INCOME

(LOSS)

|

101,470

|

| EXPENSES

|

|

|

Advisory

fee

|

9,302

|

|

Trustees’ fees and expenses

|

79

|

|

Miscellaneous

expenses

|

700

|

|

TOTAL

EXPENSES

|

10,081

|

|

Expenses waived/reimbursed by the

Adviser

|

(10,081)

|

|

NET

EXPENSES

|

—

|

|

NET INVESTMENT INCOME

(LOSS)

|

$

101,470 |

| REALIZED

AND UNREALIZED GAIN (LOSS) |

|

| Net

realized gain (loss) on: |

|

|

Investments — unaffiliated

issuers

|

85,100

|

|

Foreign currency

transactions

|

(1,558)

|

|

Net realized gain

(loss)

|

83,542

|

| Net

change in unrealized appreciation/depreciation on: |

|

|

Investments — unaffiliated

issuers

|

(205,040)

|

|

Foreign currency

translations

|

337

|

|

Net change in unrealized

appreciation/depreciation

|

(204,703)

|

|

NET REALIZED AND UNREALIZED GAIN

(LOSS)

|

(121,161)

|

|

NET INCREASE (DECREASE) IN NET ASSETS FROM

OPERATIONS

|

$

(19,691) |

See accompanying notes to financial statements.

8

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

STATEMENTS OF CHANGES

IN NET ASSETS

| |

Year

Ended

6/30/19 |

|

Year

Ended

6/30/18 |

| INCREASE

(DECREASE) IN NET ASSETS FROM OPERATIONS: |

|

|

|

|

Net investment income

(loss)

|

$

101,470 |

|

$

168,284 |

|

Net realized gain

(loss)

|

83,542

|

|

222,062

|

|

Net change in unrealized

appreciation/depreciation

|

(204,703)

|

|

(82,662)

|

|

Net increase (decrease) in net assets resulting from

operations

|

(19,691)

|

|

307,684

|

|

Distributions to shareholders (Note

9)

|

(351,241)

|

|

(211,763)

|

| FROM

BENEFICIAL INTEREST TRANSACTIONS: |

|

|

|

|

Proceeds from sale of shares

sold

|

631,379

|

|

348,917

|

|

Reinvestment of

distributions

|

351,241

|

|

211,763

|

|

Cost of shares

redeemed

|

(3,326,507)

|

|

(282,814)

|

|

Net increase (decrease) in net assets from beneficial interest transactions

|

(2,343,887)

|

|

277,866

|

|

Net increase (decrease) in net assets during the

period

|

(2,714,819)

|

|

373,787

|

|

Net assets at beginning of

period

|

5,004,693

|

|

4,630,906

|

|

NET ASSETS AT END OF

PERIOD

|

$

2,289,874 |

|

$5,004,693

|

| SHARES

OF BENEFICIAL INTEREST: |

|

|

|

|

Shares

sold

|

51,951

|

|

27,995

|

|

Reinvestment of

distributions

|

36,856

|

|

17,050

|

|

Shares

redeemed

|

(288,025)

|

|

(22,549)

|

|

Net increase (decrease) from share

transactions

|

(199,218)

|

|

22,496

|

See accompanying notes to financial statements.

9

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

FINANCIAL HIGHLIGHTS

Selected data for a share outstanding throughout each period

| |

State

Street Defensive Global Equity Portfolio |

| |

Year

Ended

6/30/19 |

|

Year

Ended

6/30/18 |

|

Year

Ended

6/30/17 |

|

For

the

Period

2/19/16* -

6/30/16 |

|

Net asset value, beginning of

period

|

$12.28

|

|

$12.03

|

|

$10.89

|

|

$10.00

|

|

Net investment income (loss)

(a)

|

0.33

|

|

0.42

|

|

0.31

|

|

0.15

|

|

Net realized and unrealized gain

(loss)

|

0.39

|

|

0.36

|

|

1.21

|

|

0.74

|

|

Total from investment

operations

|

0.72

|

|

0.78

|

|

1.52

|

|

0.89

|

| Distributions

to shareholders from: |

|

|

|

|

|

|

|

|

Net investment

income

|

(0.74)

|

|

(0.38)

|

|

(0.28)

|

|

—

|

|

Net realized

gains

|

(1.26)

|

|

(0.15)

|

|

(0.10)

|

|

—

|

|

Total

distributions

|

(2.00)

|

|

(0.53)

|

|

(0.38)

|

|

—

|

|

Net asset value, end of

period

|

$11.00

|

|

$12.28

|

|

$12.03

|

|

$10.89

|

|

Total return

(b)

|

8.38%

|

|

6.48%

|

|

14.43%

|

|

8.90%(c)

|

| Ratios

and Supplemental Data: |

|

|

|

|

|

|

|

|

Net assets, end of period (in

000s)

|

$2,290

|

|

$5,005

|

|

$4,631

|

|

$3,270

|

| Ratios

to average net assets: |

|

|

|

|

|

|

|

|

Total

expenses

|

0.27%

|

|

0.30%

|

|

0.33%

|

|

0.27%(d)

|

|

Net

expenses

|

—%(e)

|

|

—%(e)

|

|

—%(e)

|

|

—%(d)(e)

|

|

Net investment income

(loss)

|

2.73%

|

|

3.37%

|

|

2.75%

|

|

4.00%(d)

|

|

Portfolio turnover

rate

|

72%

|

|

47%

|

|

30%

|

|

21%(c)

|

| *

|

Commencement

of operations. |

| (a)

|

Per

share numbers have been calculated using average shares outstanding, which more appropriately presents the per share data for the year. |

| (b)

|

Total

return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of each period reported. Distributions are assumed, for the purpose of this calculation, to be reinvested at net

asset value per share on the respective payment dates. Total return for periods of less than one year is not annualized. Results represent past performance and are not indicative of future results. |

| (c)

|

Not

annualized. |

| (d)

|

Annualized.

|

| (e)

|

Amount

is less than 0.005%. |

See accompanying notes to financial statements.

10

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

June 30, 2019

1. Organization

SSGA Active Trust (the “Trust”), a

Massachusetts business trust registered under the Investment Company Act of 1940, as amended (“1940 Act”), is an open-end management investment company.

As of June 30, 2019, the Trust consists of fourteen

(14) series, each of which represents a separate series of beneficial interest in the Trust. The Declaration of Trust permits the Board of Trustees of the Trust (the “Board”) to authorize the issuance of an unlimited number of shares of

beneficial interest with no par value. The financial statements herein relate only to the following Portfolio (the “Portfolio”):

| Portfolio

|

Commencement

of Operations |

Diversification

Classification |

| State

Street Defensive Global Equity Portfolio |

February

19, 2016 |

Diversified

|

The Portfolio serves as a

master fund in a master-feeder structure.

Under the Trust’s organizational documents,

its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain

general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

2. Summary of Significant

Accounting Policies

The following is a summary

of significant accounting policies followed by the Trust in the preparation of its financial statements:

The preparation of financial statements in

accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ

from those estimates. The Portfolio is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies.

Security Valuation

The Portfolio's investments are valued at fair value

each day that the New York Stock Exchange (“NYSE”) is open and, for financial reporting purposes, as of the report date should the reporting period end on a day that the NYSE is not open. Fair value is generally defined as the price a

fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. By its nature, a fair value price is a good faith estimate of the valuation in a current sale and may

not reflect an actual market price. The investments of the Portfolio are valued pursuant to the policy and procedures developed by the Oversight Committee (the “Committee”) and approved by the Board. The Committee provides oversight of

the valuation of investments for the Portfolio. The Board has responsibility for overseeing the determination of the fair value of investments.

Valuation techniques used to value the Portfolio's

investments by major category are as follows:

• Equity

investments traded on a recognized securities exchange for which market quotations are readily available are valued at the last sale price or official closing price, as applicable, on the primary market or exchange on which they trade. Equity

investments traded on a recognized exchange for which there were no sales on that day are valued at the last published sale price or at fair value.

• Investments

in registered investment companies (including money market funds) or other unitized pooled investment vehicles that are not traded on an exchange are valued at that day’s published net asset value (“NAV”) per share or unit.

In the event prices or quotations are not readily

available or that the application of these valuation methods results in a price for an investment that is deemed to be not representative of the fair value of such investment, fair value will be determined in good faith by the Committee, in

accordance with the valuation policy and procedures approved by the Board.

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2019

Various inputs are used in determining the value of

the Portfolio’s investments.

The

Portfolio values its assets and liabilities at fair value using a fair value hierarchy consisting of three broad levels that prioritize the inputs to valuation techniques giving the highest priority to readily available unadjusted quoted prices in

active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements) when market prices are not readily available or reliable. The categorization of a value determined for an

investment within the hierarchy is based upon the pricing transparency of the investment and is not necessarily an indication of the risk associated with investing in it.

The three levels of the fair value hierarchy are as

follows:

• Level 1 –

Unadjusted quoted prices in active markets for an identical asset or liability;

• Level

2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical

or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities,

prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and

• Level

3 – Unobservable inputs for the asset or liability, including the Committee’s assumptions used in determining the fair value of investments.

The value of the Portfolio’s investments

according to the fair value hierarchy as of June 30, 2019 is disclosed in the Schedule of Investments.

Investment Transactions and Income Recognition

Investment transactions are accounted for on trade

date for financial reporting purposes. Realized gains and losses from the sale or disposition of investments and foreign exchange transactions, if any, are determined using the identified cost method.

Dividend income and capital gain distributions, if

any, are recognized daily on the ex-dividend date or when the information becomes available, net of any foreign taxes withheld at source, if any.

The Portfolio invests in Real Estate Investment

Trusts (“REITs”). REITs determine the tax character of their distributions annually and may characterize a portion of their distributions as a return of capital or capital gain. The Portfolio’s policy is to record all REIT

distributions initially as dividend income and re-designate the prior calendar years to return of capital or capital gains distributions at year end based on information provided by the REIT.

Expenses

Certain expenses, which are directly identifiable to

a specific Portfolio, are applied to that Portfolio within the Trust. Other expenses which cannot be attributed to a specific Portfolio are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and

the relative net assets of the Portfolio within the Trust.

Foreign Currency Translation

The accounting records of the Portfolio are

maintained in U.S. dollars. Foreign currencies as well as investment securities and other assets and liabilities denominated in a foreign currency are translated to U.S. dollars using exchange rates at period end. Purchases and sales of securities,

income receipts and expense payments denominated in foreign currencies are translated into U.S. dollars at the prevailing exchange rate on the respective dates of the transactions.

The effects of exchange rate fluctuations on

investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2019

Foreign Taxes

The Portfolio may be subject to foreign taxes (a

portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with SSGA Funds Management, Inc.’s (the

“Adviser” or “SSGA FM”) understanding of the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the Portfolio invests. These foreign taxes, if any, are paid by the Portfolio and are

reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred as of June 30, 2019, if any, are disclosed in the Portfolio’s Statement of Assets and Liabilities.

Distributions

Distributions from net investment income, if any,

are declared and paid annually. Net realized capital gains, if any, are distributed annually, unless additional distributions are required for compliance with applicable tax regulations. The amount and character of income and capital gains to be

distributed are determined in accordance with applicable tax regulations which may differ from net investment income and realized gains recognized for U.S. GAAP purposes.

3. Fees and Transactions with

Affiliates

Advisory Fee

The Portfolio has entered into an Investment

Advisory Agreement with SSGA FM. For its advisory services, the Portfolio pays the Adviser a fee accrued daily and paid monthly, at a rate of 0.25% of the Portfolio’s average daily net assets.

The Adviser has contractually agreed to waive its

management fee and/or reimburse expenses in such an amount equal to the total annual Portfolio operating expenses until the later of April 30, 2020 or such time as the shares of the Portfolio cease to be the only investment security held by the

State Street Defensive Global Equity Fund. The waiver may be terminated prior to April 30, 2020 only by the Board. Additionally, the Adviser has contractually agreed to waive its management fee and/or reimburse expenses in an amount equal to any

acquired fund fees and expenses (excluding holdings in acquired funds for cash management purposes, if any) for the Portfolio until October 31, 2019. This waiver and/or reimbursement does not provide for the recoupment by the Adviser of any amounts

waived or reimbursed. This waiver and/or reimbursement may not be terminated prior to October 31, 2019 except with the approval of the Board. The Adviser pays all expenses of the Portfolio other than the management fee, brokerage, taxes, interest,

fees and expenses of the Independent Trustees (including any Trustee’s counsel fees), litigation expenses and other extraordinary expenses. The Adviser has agreed to pay all costs associated with the organization of the Trust and the

Portfolio. For the period ended June 30, 2019, fees waived and expenses reimbursed by the Adviser, pursuant to the agreement, were $10,081.

Administrator, Custodian, Sub-Administrator and

Transfer Agent Fees

SSGA FM serves as

administrator and State Street Bank and Trust Company (“State Street”), an affiliate of the Adviser, serves as custodian, sub-administrator and transfer agent. State Street receives fees for its services as custodian, sub-administrator

and transfer agent from the Adviser.

Other

Transactions with Affiliates

The Portfolio may

invest in affiliated entities, including securities issued by State Street Corporation, affiliated funds, or entities deemed to be affiliates as a result of the Portfolio owning more than five percent of the entity’s voting securities or

outstanding shares. Amounts relating to these transactions during the period ended June 30, 2019, are disclosed in the Schedule of Investments.

4. Trustees’ Fees

The fees and expenses of the Trust’s trustees,

who are not “interested persons” of the Trust, as defined in the 1940 Act (“Independent Trustees”), are paid directly by the Portfolio. The Independent Trustees are reimbursed for travel and other out-of-pocket expenses in

connection with meeting attendance and industry seminars.

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2019

5. Investment

Transactions

Purchases and sales of

investments (excluding short term investments) for the period ended June 30, 2019, were as follows:

| |

Purchases

|

|

Sales

|

|

State Street Defensive Global Equity

Portfolio

|

$2,613,446

|

|

$5,111,777

|

6. Income Tax Information

The Portfolio has qualified and intends to continue

to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended. The Portfolio will not be subject to federal income taxes to the extent it distributes its taxable income, including any net realized

capital gains, for each fiscal year. Therefore, no provision for federal income tax is required.

The Portfolio files federal and various state and

local tax returns as required. No income tax returns are currently under examination. Generally, the federal returns are subject to examination by the Internal Revenue Service (the “IRS”) for a period of three years from date of filing,

while the state returns may remain open for an additional year depending upon jurisdiction. SSGA FM has analyzed the Portfolio’s tax positions taken on tax returns for all open years and does not believe there are any uncertain tax positions

that would require recognition of a tax liability.

Distributions to shareholders are recorded on

ex-dividend date. Income dividends and gain distributions are determined in accordance with income tax rules and regulations, which may differ from generally accepted accounting principles.

Certain capital accounts in the financial statements

have been adjusted for permanent book- tax differences. These adjustments have no impact on NAVs or results of operations. Temporary book-tax differences will reverse in the future. These book-tax differences are primarily due to differing

treatments for foreign currency transactions, wash sales, distribution re-designations, and passive foreign investment companies.

The tax character of distributions paid during the

year ended June 30, 2019, was as follows:

| |

Ordinary

Income |

|

Long-Term

Capital Gains |

|

Total

|

|

State Street Defensive Global Equity

Portfolio

|

$165,202

|

|

$186,039

|

|

$351,241

|

The tax character of

distributions paid during the year ended June 30, 2018, was as follows:

| |

Ordinary

Income |

|

Long-Term

Capital Gains |

|

Total

|

|

State Street Defensive Global Equity Portfolio

|

$

186,089 |

|

$

25,674 |

|

$

211,763 |

At June 30, 2019,

the components of distributable earnings on a tax basis were as follows:

| |

Undistributed

Ordinary Income |

|

Capital

Loss

Carryforwards |

|

Undistributed

Long-Term

Capital Gains |

|

Net

Unrealized

Gains (Losses) |

|

Qualified

Late-Year

Losses |

|

Total

|

|

State Street Defensive Global Equity

Portfolio

|

$56,472

|

|

$—

|

|

$88,690

|

|

$239,545

|

|

$—

|

|

$384,707

|

As of June 30, 2019,

gross unrealized appreciation and gross unrealized depreciation of investments based on cost for federal income tax purposes were as follows:

| |

Tax

Cost |

|

Gross

Unrealized

Appreciation |

|

Gross

Unrealized

Depreciation |

|

Net

Unrealized

Appreciation

(Depreciation) |

|

State Street Defensive Global Equity

Portfolio

|

$2,041,022

|

|

$273,004

|

|

$33,537

|

|

$239,467

|

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2019

7. Line of Credit

The Portfolio and other affiliated funds (each a

“Participant” and, collectively, the “Participants”) participate in a $500 million revolving credit facility provided by a syndication of banks under which the Participants may borrow to fund shareholder redemptions. This

agreement expires in October 2019 unless extended or renewed.

The Participants are charged an annual commitment

fee which is calculated based on the unused portion of the shared credit line. Commitment fees are allocated among each of the Participants based on relative net assets. Commitment fees are ordinary fund operating expenses. A Participant incurs and

pays the interest expense related to its borrowing. Interest is calculated at a rate per annum equal to the sum of 1% plus the greater of the New York Fed Bank Rate and 1-month LIBOR rate.

The Portfolio had no outstanding loans as of June

30, 2019.

8. Risks

Concentration Risk

As a result of the Portfolio's ability to invest a

large percentage of its assets in obligations of issuers within the same country, state, region, currency or economic sector, an adverse economic, business or political development may affect the value of the Portfolio’s investments more than

if the Portfolio was more broadly diversified.

Foreign and Emerging Markets Risk

Investing in foreign markets involves risks and

considerations not typically associated with investing in the U.S. Foreign securities may be subject to risk of loss because of government regulation, economic, political and social instability in the countries in which the Portfolio invests.

Foreign markets may be less liquid than investments in the U.S. and may be subject to the risks of currency fluctuations. To the extent that the Portfolio invests in securities of issuers located in emerging markets, these risks may be even more

pronounced.

Market and Credit Risk

In the normal course of business, the Portfolio

trades financial instruments and enters into transactions where risk of potential loss exists due to changes in the general economic conditions and fluctuations of the market (market risk). Additionally, the Portfolio may also be exposed to credit

risk in the event that an issuer or guarantor fails to perform or that an institution or entity with which the Portfolio has unsettled or open transactions defaults.

9. New Accounting

Pronouncements

In August 2018, the U.S.

Securities and Exchange Commission (the “SEC”) released its Final Rule on Disclosure Update and Simplification (the “Final Rule”) which is intended to simplify an issuer’s disclosure compliance efforts by removing

redundant or outdated disclosure requirements without significantly altering the mix of information provided to investors. The Portfolio has adopted the Final Rule for the current period with the most notable impacts being that the Portfolio is no

longer required to present the components of distributable earnings on the Statement of Assets and Liabilities or the sources of distributions to shareholders and the amount of undistributed net investment income on the Statements of Changes in Net

Assets.

For the period ended June 30, 2018,

distributions to shareholders and undistributed (distributions in excess of) net investment income were as follows:

| |

Net

Investment

Income |

|

Net

Realized

Capital

Gains |

|

Total

Distributions |

|

Undistributed

Net Investment

Income (Loss) |

|

State Street Defensive Global Equity

Portfolio

|

$151,316

|

|

$60,447

|

|

$211,763

|

|

$77,508

|

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2019

10. Subsequent Events

Management has evaluated the impact of all

subsequent events on the Portfolio through the date the financial statements were issued and has determined that there were no subsequent events requiring adjustment or disclosure in the financial statements.

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of

State Street Defensive Global Equity Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets

and liabilities of State Street Defensive Global Equity Portfolio (the “Portfolio”) (one of the funds constituting SSGA Active Trust (the “Trust”)), including the schedule of investments, as of June 30, 2019, and the related

statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three years in the period then ended and the period from

February 19, 2016 (commencement of operations) through June 30, 2016, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the

financial position of the Portfolio (one of the funds constituting SSGA Active Trust) at June 30, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its

financial highlights for each of the three years in the period then ended and the period from February 19, 2016 (commencement of operations) through June 30, 2016, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of

the Trust’s management. Our responsibility is to express an opinion on the Portfolio’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United

States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the

standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to

have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of

expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess

the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures

in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2019, by correspondence with the custodian, brokers and others or by other appropriate auditing procedures where replies from brokers and others

were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a

reasonable basis for our opinion.

We have served

as the auditor of one or more State Street Global Advisors investment companies since 2000.

Boston, Massachusetts

August 26, 2019

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

OTHER INFORMATION

June 30, 2019 (Unaudited)

Expense Example

As a shareholder of the Portfolio, you incur two

types of costs: (1) transaction costs, including sales charges (loads), if applicable, on purchase payments, reinvested dividends, or other distributions and (2) ongoing costs, including advisory fees and other Portfolio expenses. This example is

intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 made at the beginning of the

period shown and held for the entire period from January 1, 2019 to June 30, 2019.

The table below illustrates your Portfolio's cost in

two ways:

Based on actual fund return ——This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio's actual return, and the third column shows

the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply

divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Portfolio under the heading “Expenses Paid During Period”.

Based on hypothetical 5% return ——This section is intended to help you compare your Portfolio's costs with those of other mutual funds. It assumes that the Portfolio had a yearly return of 5% before expenses, but that the expense ratio is

unchanged. In this case, because the return used is not the Portfolio's actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on

a 5% return. You can assess your Portfolio's costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are

meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales load charges (loads). Therefore, the hypothetical 5% return section of the table is useful in comparing ongoing costs only, and will not help you

determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| |

|

|

Actual

|

|

Hypothetical

(assuming a 5%

return before expenses) |

| |

Annualized

Expense Ratio |

|

Ending

Account

Value |

|

Expenses

Paid

During Period(a) |

|

Ending

Account

Value |

|

Expenses

Paid

During Period(a) |

|

State Street Defensive Global Equity

Portfolio

|

0.00%

|

|

$1,129.40

|

|

$0.00

|

|

$1,024.80

|

|

$0.00

|

| (a)

|

Expenses

are equal to the Portfolio's annualized net expense ratio multiplied by the average account value of the period, multiplied by 181, then divided by 365. |

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

OTHER INFORMATION (continued)

June 30, 2019 (Unaudited)

Tax Information

For federal income tax purposes, the following

information is furnished with respect to the distributions of the Trust for its fiscal year ended June 30, 2019.

Dividends Received Deduction

The Portfolio reports the maximum amount allowable

of its net taxable income as eligible for the corporate dividends received deduction.

Qualified Business Income Deduction

The Portfolio reports the maximum amount allowable

of qualified REIT dividends eligible for the 20% qualified business income deduction under Section 199A.

Qualified Dividend Income

A portion of dividends distributed by the Portfolio

during the fiscal year ended June 30, 2019 are considered qualified dividend income and are eligible for reduced tax rates. These lower rates range from 5% to 20% depending on the individual’s tax bracket. The Portfolio reports the maximum

amount allowable of its net taxable income as qualified dividend income as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Capital Gain Dividend

The Portfolio hereby designates as a capital gain

dividend the amount reflected below, or if subsequently determined to be different, the net capital gain of such fiscal period.

Long term capital gains dividends were paid from the

Portfolio during the year ended June 30, 2019 in the amount of $186,039.

Proxy Voting Policies and Procedures and Records

A description of the Trust’s proxy voting

policies and procedures that are used by the Portfolio's investment adviser to vote proxies relating to the Portfolio’s portfolio of securities are available (i) without charge, upon request by calling 1-800-997-7327 (toll free) or (ii) on the

SEC's website at www.sec.gov.

Information

regarding how the investment adviser voted for the 12-month period ended June 30 is available by August 31 of each year by calling the same number and on the SEC’s website at www.sec.gov, and on the Portfolio's website at

www.ssgafunds.com.

Quarterly Portfolio

Schedule

Following the Portfolio's first and

third fiscal quarter-ends, a complete schedule of investments is filed with the SEC as an exhibit on Form N-PORT, which can be found on the SEC's website at www.sec.gov. The Portfolio's schedule of investments is available upon request, without

charge, by calling 1-800-997-7327 (toll free) and on the Portfolio's website at www.ssgafunds.com.

SSGA ACTIVE TRUST

STATE STREET DEFENSIVE GLOBAL EQUITY PORTFOLIO

OTHER INFORMATION (continued)

June 30, 2019 (Unaudited)

Approval of Advisory Agreement

At in-person meetings held prior to June 30, 2019,

the Board of Trustees of the Trust (the “Board”) evaluated proposals to continue the Investment Advisory Agreement (the “Agreement”) between the Trust and SSGA Funds Management, Inc. (the “Adviser” or “SSGA

FM”) with respect to the State Street Defensive Global Equity Portfolio, a series of SSGA Active Trust (the “Fund”). The Trustees who are not “interested persons” of the Trust within the meaning of the Investment

Company Act of 1940, as amended (the “Independent Trustees”), also met separately to consider the Agreement. The Independent Trustees were advised by their independent legal counsel throughout the process.

To evaluate the Agreement, the Board requested, and

SSGA FM, the Trust’s investment adviser and administrator, and State Street Bank and Trust Company, the Trust’s sub-administrator, transfer agent and custodian (“State Street”) provided, such materials as the Board, with the

advice of counsel, deemed reasonably necessary. In deciding whether to approve the Agreement, the Board considered various factors, including the (i) nature, extent and quality of services provided by the Adviser with respect to the Fund under the

Agreement, (ii) investment performance of the Fund, (iii) profits realized by the Adviser and its affiliates from its relationship with the Trust, (iv) fees charged to comparable funds, (v) other benefits to the Adviser, and (vi) extent to which

economies of scale would be shared as the Fund grows.

Nature, Extent and Quality of Services

The Board considered the nature, extent and quality

of services provided by the Adviser. In doing so, the Trustees relied on their prior experience in overseeing the management of the Trust and materials provided prior to and at the meeting. The Board reviewed the Agreement and the Adviser’s

responsibilities for managing investment operations of the Fund in accordance with the Fund’s investment objectives and policies, and applicable legal and regulatory requirements. The Board considered the background and experience of the

Adviser’s senior management, including those individuals responsible for portfolio management and regulatory compliance of the Fund. The Board also considered the portfolio management resources, structures and practices of the Adviser,

including those associated with monitoring and securing the Fund’s compliance with its investment objectives and policies and with applicable laws and regulations. The Board also considered information about the Adviser’s best execution