Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-173828

PROSPECTUS

![]()

ClubCorp Club Operations, Inc.

Offer to Exchange

We are offering to exchange up to $415,000,000 aggregate principal amount at maturity of our new 10% Senior Notes due 2018 (the "exchange notes"), which have been registered under the Securities Act of 1933, as amended (the "Securities Act"), for any and all of our outstanding 10% Senior Notes due 2018 (the "outstanding notes"). We are offering to exchange the exchange notes for the outstanding notes to satisfy our obligations contained in the registration rights agreement that we entered into when the outstanding notes were sold pursuant to Rule 144A and Regulation S under the Securities Act.

The Exchange Offer

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount

of exchange notes that are freely tradable.

- •

- You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer.

- •

- The exchange offer expires at 5:00 p.m., New York City time, on July 27, 2011, unless extended. We do not

currently intend to extend the expiration date.

- •

- The exchange notes to be issued in the exchange offer will not be a taxable event for U.S. federal income tax purposes.

- •

- We will not receive any proceeds from the exchange offer.

The Exchange Notes

- •

- The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable, except in limited circumstances described below.

Resales of the Exchange Notes

- •

- The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the notes on a national market.

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act or except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

See "Risk Factors" beginning on page 16 for a discussion of certain risks that you should consider before participating in the exchange offer.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. In addition, all dealers effecting transactions in the exchange notes may be required to deliver a prospectus. We have agreed that, for a period of 90 days after the date of this prospectus (subject to extension as provided in the registration rights agreement), we will make this prospectus available to any broker-dealer for use in connection with such resale. See "Plan of Distribution."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 27, 2011.

You should rely only on the information contained in this prospectus or in any additional written communication prepared by or authorized by us. We have not authorized anyone to provide you with any information or to represent anything about us, our financial results or the exchange offer that is not contained in this prospectus or in any additional written communication prepared by or on behalf of us. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We are not making an offer to exchange the outstanding notes in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus or in any additional written communication prepared by or on behalf of us is accurate only as of the date on its cover page.

i

This summary highlights selected information contained in this prospectus and does not contain all of the information that you should consider before tendering your notes in the exchange offer. To understand all of the terms of the exchange offer and for a more complete understanding of our business, you should read this summary together with the entire prospectus. Unless the context otherwise requires, the terms "ClubCorp," "we," "us," "our" in this prospectus refer to ClubCorp Club Operations, Inc. and its subsidiaries (ClubCorp, Inc. and subsidiaries prior to November 30, 2010).

Our fiscal year consists of a 52/53 week period ending on the last Tuesday of December. Each of our first, second and third fiscal quarters consists of 12 weeks and our fourth fiscal quarter consists of 16 weeks, with an extra week added onto the fourth quarter every five to six years. Unless the context indicates otherwise, whenever we refer in this prospectus to a particular year, with respect to ourselves, we mean the fiscal year ending in that particular calendar year.

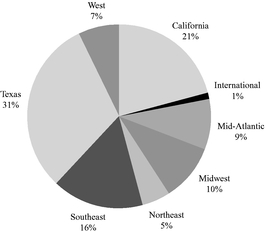

We are one of the largest owners and managers of private golf, country, business, sports and alumni clubs in North America, with a network of clubs that includes over 146,000 memberships and 350,000 individual members. As of March 22, 2011, we owned or operated 98 golf and country clubs and 53 business, sports and alumni clubs in 25 states, the District of Columbia, and two foreign countries. We believe that our expansive network of clubs and our focus on facilities, recreation and social programming, allows us to attract members across a number of demographic groups. Our clubs' offerings are designed to appeal to the entire family, resulting in member loyalty, which we believe translates financially into a more economically resilient leisure product and allows us a greater ability to capture discretionary leisure spending than traditional clubs. For the year ended December 28, 2010 and the twelve weeks ended March 22, 2011, we had total revenues of $696.6 million and $144.8 million, respectively, and net income (loss) attributable to ClubCorp of $254.5 million and $(10.8) million, respectively.

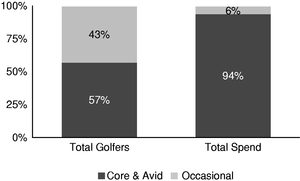

Our portfolio of golf properties includes a broad offering of clubs designed to appeal to a diverse membership base but with a focus on the mass affluent market segment (which we define as those individuals with an annual household income of $75,000 or greater). These clubs include marquee world renowned golf clubs and established regional and local private golf and country clubs that we believe are conveniently located to our members. We also own and manage well known business, sports and alumni clubs. Our alumni clubs are associated with universities with significant alumni networks and are designed to provide a connection between the university and its alumni and faculty. Our business clubs are generally located in office towers or business complexes and cater to business executives, professionals and entrepreneurs with a need to meet, network and socialize in a private, upscale location. Our sports clubs include a variety of fitness and racquet facilities. In addition, we offer a network of products, services and amenities through membership upgrades that provide access to our extensive network of clubs and leverage our alliances with other clubs, facilities and properties.

Founded in 1957 with one country club in Dallas, Texas, we were one of the first companies to enter into the professional ownership and operation of golf and country club businesses. In 1966, we established our first business club on the belief that we could profitably expand our operations by delivering quality service and focusing on member satisfaction in a related line of business. In 1999, we began selling various upgrade programs that offer participating members access to virtually all of our clubs and other clubs, facilities and properties through usage arrangements, providing our members more choices for a wide variety of products, services and amenities. We remained family owned until December 2006, when we were acquired by affiliates of KSL Capital Partners, LLC ("KSL" or "Sponsor"), a private equity firm specializing in travel and leisure businesses.

1

Competitive Strengths

We believe that we became a leader in the private club industry by following our commitment to quality of service and focus on member satisfaction, as well as by taking advantage of a variety of organic growth opportunities, including the implementation of network offerings of products, services and amenities, and external growth opportunities, such as through the acquisition and rehabilitation of underperforming clubs. We intend to maintain our leadership position by continuing to capitalize on the following competitive strengths:

- •

- Strong and Diverse Network of Clubs. We believe we have a

diverse portfolio of clubs anchored by marquee assets and complimented by local clubs woven into the communities of our members.

- •

- Marquee Collection of Assets. We believe that we have

assembled a portfolio of some of the best known golf and business clubs across the United States and that these properties help distinguish us from our competitors.

- •

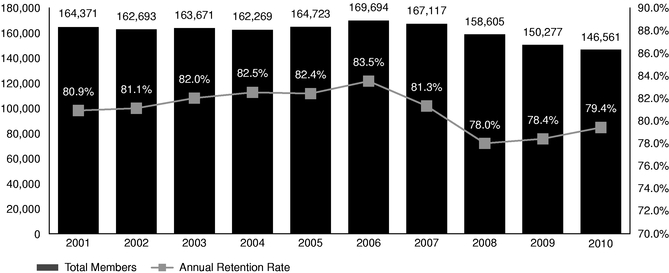

- Large Membership Base with Attractive Member

Demographics. Our large base of memberships creates a significant recurring revenue stream, despite the fact that our membership count

stands at a 10 year low and as of the fiscal year ended December 28, 2010, we experienced a 17.2% and 24.2% attrition in member-count in our golf and country clubs and business and sports

clubs, respectively.

- •

- Host of High Profile Golf Events and Winner of National

Accolades. Each year, we host a number of high profile events and win numerous local and national awards, which generate substantial

publicity and help drive new membership and club utilization.

- •

- Experienced Management Team. We believe we have some of the most experienced and dedicated professional managers and executives in the private club industry.

Business Strategy

Fundamental to ClubCorp's business is the belief that private clubs represent a significant business opportunity for a company that can combine professional development and management skills with the dedication to personal service necessary to attract and retain members. Our principal objective is to maximize our revenues and profitability by providing a superior delivery of high quality club and golf experiences to our members and guests. To achieve this objective, we intend to continue to:

- •

- Grow Membership Enrollment and Increase Facility Usage. We

believe that providing our members and their guests with a high-quality and personalized experience will increase demand for our facilities and services and allow us to add new

memberships.

- •

- Leverage Our Existing Customer Base by Cross-Selling Our Products and Services to Existing Members

and Guests. We believe that there are significant opportunities to increase operating revenues by marketing our interrelated products and innovative programs to our existing

members.

- •

- Distinguish and Market Our Properties and Company Brand

Names. We believe that many of our country clubs offer members an experience that combines world class golf facilities and dining

opportunities, in an attractive and desirable setting.

- •

- Profit From Previous Significant Capital Expenditure Projects. Since the beginning of fiscal year 2007, we have invested over $255.0 million to complete significant expansion and replacement projects at many of our clubs and facilities, exclusive of the discontinued Non-Core Entities discussed in the ClubCorp Formation.

2

- •

- Focus on Selected Acquisitions and Opportunities to Expand our Business. We continually evaluate opportunities to expand our business through select acquisitions, joint ventures and management agreements.

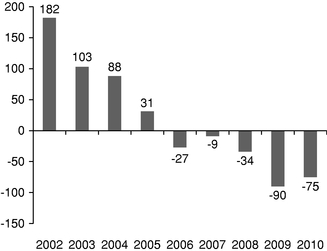

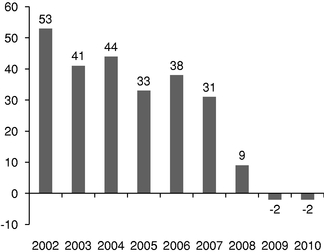

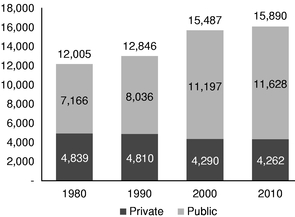

Industry Trends

The golf industry is characterized by varied ownership structures, including properties owned by corporations, member equityholders, developers, municipalities and others. Data from the National Golf Foundation shows that, since 2006, total golf facility supply has declined, indicating the industry is still overcoming a supply and demand imbalance caused by a dramatic increase in the number of total facilities in the 1990s. According to the National Golf Foundation, 2010 represented the fifth consecutive year in which total facility closures outnumbered openings with 75 net 18-hole equivalent golf facility closures.

Private golf facilities, however, have not seen the same rate of facility closures. According to the National Golf Foundation, private golf facility openings have outnumbered closures every year except 2009 and 2010, which only saw net closures of two 18-hole equivalent golf facility closures each year. This combined with public golf facility net closures in 2006 through 2010 creates attractive supply/demand dynamics for private golf facilities.

We believe demand for private golf and country clubs is generally more resilient to economic cycles than public golf facilities and other hospitality assets. Characteristics of private clubs that support our belief, include: (1) attractive supply/demand dynamics, (2) member demographic profiles and (3) stable recent and long-term performance.

ClubCorp is a holding company that was formed on November 30, 2010, as part of a reorganization of ClubCorp, Inc. ("CCI") for the purpose of operating and managing golf, country, business, sports and alumni clubs.

Prior to November 30, 2010, CCI was a holding company that through its subsidiaries owned and operated golf, country, business, sports and alumni clubs, two full-service resorts and certain other equity and realty interests. The two full service resorts and certain other equity, realty and future royalty interests are referred to as the "Non-Core Entities." ClubCorp decided to sell the Non-Core Entities to allow management to concentrate on our core business of golf, country, business, sports and alumni clubs. On November 30, 2010, the following transactions occurred (the "ClubCorp Formation") which were structured to complete the contribution of the golf, country, business, sports and alumni clubs into ClubCorp. A summary of the transactions relevant to ClubCorp are described below:

- •

- Fillmore CCA Holdings, Inc. ("Fillmore Inc.") formed two wholly owned subsidiaries, ClubCorp and CCA Club

Operations Holdings, LLC ("Parent"), and transferred its interests through a contribution of 100% of the stock of CCI to ClubCorp.

- •

- Investment vehicles controlled by KSL contributed $260.5 million as equity capital to ClubCorp.

- •

- Fillmore Inc. reincorporated in Nevada through a merger into a newly formed Nevada corporation, ClubCorp

Holdings, Inc. ("Holdings"), with Holdings as the surviving entity. CCI merged into ClubCorp USA, Inc. ("CCUSA"), with CCUSA surviving as a wholly-owned subsidiary of ClubCorp.

- •

- ClubCorp issued and sold $415.0 million of unsecured notes and borrowed $310.0 million of secured term loans

under our new secured credit facilities.

- •

- ClubCorp sold its Non-Core Entities to affiliates of KSL.

3

- •

- ClubCorp repaid a portion of the loans under its then existing secured credit facilities. The lenders under such

facilities forgave the remaining $342.3 million of debt owed under such facilities and such facilities were terminated.

- •

- ClubCorp settled certain balances owed to affiliates of KSL.

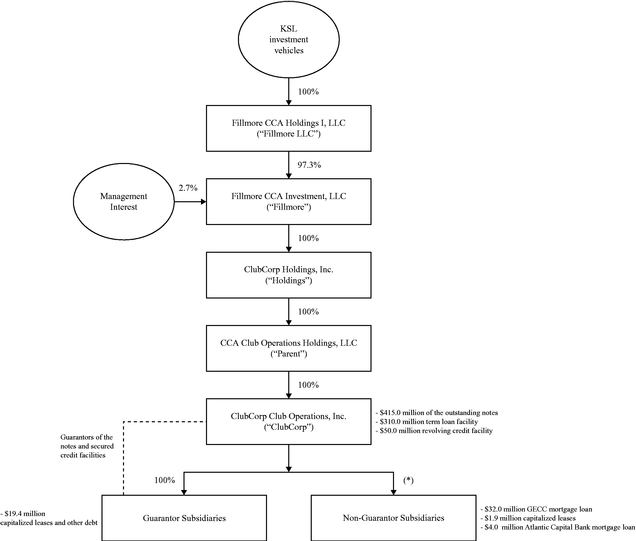

The following chart illustrates ClubCorp's parent companies, subsidiaries and debt capitalization as of March 22, 2011:

- (*)

- Certain of our non-guarantor subsidiaries are not 100% owned by us.

As of March 22, 2011, ClubCorp and its subsidiary guarantors accounted for approximately 91.7% of our total assets, excluding intercompany items. For the fiscal year ended December 28, 2010 and for the twelve weeks ended March 22, 2011, ClubCorp and its subsidiary guarantors accounted for 93.4% and 92.3%, respectively, of our revenues.

As of March 22, 2011, affiliates of KSL owned indirectly 97.3% of the equity interests of Fillmore, our indirect parent company, with the remaining 2.7% owned by members of management of ClubCorp

4

USA, Inc. KSL, with $3.5 billion under management, is a leading U.S. private equity firm dedicated to investments in travel and leisure businesses. KSL was founded in 2005 and has offices in Denver and New York.

We were incorporated as a Delaware corporation in 2010. Our principal executive offices are located at 3030 LBJ Freeway, Suite 600, Dallas, TX 75234. Our telephone number is (972) 243-6191. We maintain various websites, including our corporate website at www.clubcorp.com. Our websites, and the information contained on them, are not part of this prospectus.

Market Share and Similar Information

The market share and other information contained in this prospectus is based on our own estimates, independent industry publications, reports by market research firms, or other published independent sources. In each case, we believe that they are reliable and reasonable estimates, although we have not independently verified market and industry data provided by third parties. Market share information is subject to changes, however, and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data-gathering process and other limitations and uncertainties inherent in any statistical survey of market share. In addition, customer preferences can and do change and the definition of the relevant market is a matter of judgment and analysis.

5

In this prospectus, the term "outstanding notes" refers to the 10% Senior Notes due 2018 issued in a private placement on November 30, 2010. The term "exchange notes" refers to the 10% Senior Notes due 2018, as registered under the Securities Act of 1933, as amended (the "Securities Act"), offered by this prospectus. The term "notes" refers collectively to the outstanding notes and the exchange notes. The summary below describes the principal terms of the exchange offer. See also the section of this prospectus titled "The Exchange Offer," which contains a more detailed description of the terms and conditions of the exchange offer.

General |

In connection with the private placement, we entered into a registration rights agreement with the purchasers in which we agreed, among other things, to deliver this prospectus to you and to obtain the effectiveness of the registration statement on Form S-4 of which this prospectus is a part within 360 days after the date of original issuance of the outstanding notes. You are entitled to exchange in the exchange offer your outstanding notes for exchange notes, which are substantially identical in all material respects to the outstanding notes except: | |

|

• the exchange notes have been registered under the Securities Act; |

|

|

• the terms with respect to transfer restrictions no longer apply, provided that the resale conditions described below are satisfied; |

|

|

• the exchange notes are not entitled to any registration rights that are applicable to the outstanding notes under the registration rights agreement; and |

|

|

• the provisions of the registration rights agreement that provide for payment of additional amounts upon a registration default are no longer applicable. |

|

The Exchange Offer |

We are offering to exchange up to $415,000,000 aggregate principal amount at maturity of 10% Senior Secured Notes due 2018 and the related guarantees, which have been registered under the Securities Act, for any and all of our outstanding 10% Senior Notes due 2018 and the related guarantees. |

|

|

Outstanding notes may be exchanged only in denominations of $2,000 and in integral multiples of $1,000 in excess thereof. |

|

|

Subject to the satisfaction or waiver of specified conditions, we will exchange the exchange notes for all outstanding notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. We will cause the exchange to be effected promptly after the expiration of the exchange offer. |

6

Resale |

Based on an interpretation by the staff of the Securities and Exchange Commission (the "SEC") set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our "affiliate" within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

|

|

• you are acquiring the exchange notes in the ordinary course of your business; and |

|

|

• you have not engaged in, do not intend to engage in and have no arrangement or understanding with any person to participate in a distribution of the exchange notes. |

|

|

If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See "Plan of Distribution." |

|

|

Any holder of outstanding notes who: |

|

|

• is our affiliate; |

|

|

• does not acquire exchange notes in the ordinary course of its business; or |

|

|

• tenders its outstanding notes in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes |

|

|

cannot rely on the position of the staff of the SEC enunciated in Morgan Stanley & Co. Incorporated (available June 5, 1991) and Exxon Capital Holdings Corporation (available May 13, 1988), as interpreted in the SEC's letter to Shearman & Sterling (available July 2, 1993), or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

|

Expiration Date |

The exchange offer will expire at 5:00 p.m., New York City time, on July 27, 2011, unless extended by us. We do not currently intend to extend the expiration of the exchange offer. |

|

Withdrawal |

You may withdraw the tender of your outstanding notes at any time prior to the expiration of the exchange offer. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

7

Interest on the Exchange Notes and the Outstanding Notes |

Each exchange note bears interest at the rate of 10% per annum from the original issuance date of the outstanding notes or from the most recent date on which interest has been paid on the notes. The interest on the notes is payable on June 1 and December 1 of each year, beginning on June 1, 2011. No interest will be paid on outstanding notes following their acceptance for exchange. |

|

Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions, which we may waive. See "The Exchange Offer—Conditions to the Exchange Offer." |

|

Procedures for Tendering Outstanding Notes |

If you wish to participate in the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of such letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of such letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

|

|

If you hold outstanding notes through The Depository Trust Company ("DTC") and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC by which you will agree to be bound by the letter of transmittal. |

|

|

By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

|

|

• you are not our "affiliate" within the meaning of Rule 405 under the Securities Act; |

|

|

• you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes in violation of the provisions of the Securities Act; |

|

|

• you are not engaged in, and do not intend to engage in, a distribution of the exchange notes in violation of the provisions of the Securities Act; |

|

|

• you are acquiring the exchange notes in the ordinary course of your business; and |

|

|

• if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

8

Special Procedures for Beneficial Owners |

If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

|

Guaranteed Delivery Procedures |

If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC's Automated Tender Offer Program for transfer of book-entry interests, prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under "The Exchange Offer—Guaranteed Delivery Procedures." |

|

Effect on Holders of Outstanding Notes |

As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offer, we will have fulfilled a covenant under the registration rights agreement. Accordingly, there will be no payments of additional amounts on the outstanding notes under the circumstances described in the registration rights agreement. If you do not tender your outstanding notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture, except we will not have any further obligation to you to provide for the exchange and registration of the outstanding notes under the registration rights agreement. To the extent that outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes could be adversely affected. |

9

Consequences of Failure to Exchange |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act or except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not intend to register the outstanding notes under the Securities Act, except as otherwise required by the registration rights agreement. |

|

United States Federal Income Tax Consequences of the Exchange Offer |

The exchange of outstanding notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. See "Material U.S. Federal Income Tax Consequences—Exchange Offer." |

|

Use of Proceeds |

We will not receive any cash proceeds from the issuance of exchange notes in the exchange offer. See "Use of Proceeds." |

|

Exchange Agent |

Wilmington Trust FSB is the exchange agent for the exchange offer. The addresses and telephone numbers of the exchange agent are set forth in the section captioned "The Exchange Offer—Exchange Agent." |

10

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The "Description of Notes" section of this prospectus contains more detailed descriptions of the terms and conditions of the outstanding notes and the exchange notes. The exchange notes will have terms substantially identical to the outstanding notes, except that the exchange notes will be registered under the Securities Act and will not contain terms with respect to transfer restrictions, registration rights and additional payments upon a failure to fulfill certain of our obligations under the registration rights agreement.

| Issuer | ClubCorp Club Operations, Inc. | |

Securities Offered |

$415,000,000 million aggregate principal amount of 10% Senior Notes due 2018 and the related guarantees. |

|

Maturity Date |

December 1, 2018. |

|

Interest Rate |

10% per annum. |

|

Interest Payment Dates |

Payable semiannually in cash in arrears on June 1 and December 1 of each year, beginning June 1, 2011. Interest accrues from the original issuance date of the outstanding notes or from the most recent date on which interest has been paid on the notes. |

|

Guarantees |

Each wholly owned subsidiary of ClubCorp Club Operations, Inc. that guarantees our obligations under our secured credit facilities will also fully and unconditionally guarantee the notes on a senior unsecured basis. The guarantees by the guarantors of the notes will be pari passu to all existing and future senior indebtedness of the guarantors. |

|

Ranking |

The exchange notes will be our senior unsecured obligations. They will rank equal in right of payment with our existing and future senior indebtedness and senior in right of payment to any of our existing and future subordinated indebtedness. The notes will be effectively subordinated to all of our secured debt to the extent of the value of the assets securing such debt and structurally subordinated to all of the existing and future liabilities of our subsidiaries that do not guarantee the notes. As of March 22, 2011, ClubCorp Club Operations, Inc., and its guarantor subsidiaries had approximately $744.4 million of indebtedness and our non-guarantor subsidiaries had $37.8 million of indebtedness, of which $32.0 million was non-recourse to us. |

11

| Optional Redemption | At any time prior to December 1, 2014, we may redeem the notes, in whole or in part, at a price equal to 100% of the principal amount, plus an applicable "make-whole" premium and accrued and unpaid interest, if any, to the redemption date, as described under the caption "Description of the Notes—Optional Redemption." On and after December 1, 2014, we may redeem the notes, in whole or in part, at the redemption prices specified under the caption "Description of the Notes—Optional Redemption," plus accrued and unpaid interest, if any, to the date of redemption. | |

In addition, at any time prior to December 1, 2013, we may redeem up to 35% of the aggregate principal amount of the notes together with any additional notes issued under the indenture with the net cash proceeds of certain equity offerings as described under the caption "Description of the Notes—Optional Redemption." |

||

Change of Control |

If a change of control occurs, we must give holders of the notes the opportunity to sell us their notes at 101% of their face amount, plus accrued and unpaid interest. For more details, you should read "Description of Notes—Repurchase at the Option of Holders—Change of Control." |

|

Restrictive Covenants |

The indenture governing the notes contains covenants that limit our ability and the ability of certain of our subsidiaries to: |

|

|

• incur, assume or guarantee additional indebtedness; |

|

|

• pay dividends or distributions on capital stock or redeem or repurchase capital stock; |

|

|

• make investments; |

|

|

• enter into agreements that restrict the payment of dividends or other amounts by subsidiaries to us; |

|

|

• sell stock of our subsidiaries; |

|

|

• transfer or sell assets; |

|

|

• create liens; |

|

|

• enter into transactions with affiliates; and |

|

|

• enter into mergers or consolidations. |

|

Original Issue Discount |

The exchange notes will be issued with original issue discount ("OID") for U.S. federal income tax purposes. U.S. Holders, whether on the cash or accrual method of tax accounting, will be required to include any amounts representing OID in gross income (as ordinary income) on a constant yield to maturity basis for U.S. federal income tax purposes in advance of the receipt of cash payments to which such income is attributable. For further discussion, see "Material U.S. Federal Income and Estate Tax Considerations." |

12

| No Prior Market | The exchange notes are a new issue of securities, and there is currently no established trading market for the exchange notes. We do not intend to apply for a listing of the exchange notes on any securities exchange or an automated dealer quotation system. Accordingly, there can be no assurance as to the development or liquidity of any market for the exchange notes. |

You should carefully consider all the information in the prospectus prior to exchanging your outstanding notes. In particular, we urge you to carefully consider the factors set forth under the heading "Risk Factors."

Summary Financial and Other Data

The following table sets forth our summary financial information and other data for the periods presented. The statements of operations data set forth below for the fiscal years ended December 30, 2008, December 29, 2009 and December 28, 2010, and the balance sheet data as of December 29, 2009 and December 28, 2010, are derived from our audited consolidated financial statements that are included elsewhere in this prospectus. The consolidated balance sheet data as of December 30, 2008 is derived from our unaudited consolidated financial statements not included in this prospectus. The consolidated statements of operations data for the twelve weeks ended March 23, 2010 and March 22, 2011, and the consolidated balance sheet data as of March 22, 2011, are derived from our unaudited consolidated condensed financial statements for such periods and dates, which are included elsewhere in this prospectus. The consolidated balance sheet data as of March 23, 2010 is derived from our unaudited consolidated financial statements not included in this prospectus. The unaudited consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and include, in the opinion of management, all adjustments necessary for the fair presentation of the financial information contained in those statements.

Prospective investors should read this summary consolidated financial and other data together with "Summary—ClubCorp Formation," "Use of Proceeds," "Capitalization," "Selected Financial Data" and

13

"Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| |

Twelve Weeks Ended | Fiscal Years Ended(1) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

March 22, 2011 |

March 23, 2010 |

December 28, 2010(4) |

December 29, 2009 |

December 30, 2008 |

|||||||||||

| |

(in thousands, except for ratios) |

|||||||||||||||

Statements of operations data: |

||||||||||||||||

Revenues: |

||||||||||||||||

Club operations |

$ | 107,848 | $ | 105,651 | $ | 501,733 | $ | 515,388 | $ | 560,862 | ||||||

Food and beverage |

36,106 | 34,629 | 192,022 | 191,778 | 218,960 | |||||||||||

Other revenues |

865 | 614 | 2,882 | 2,467 | 3,637 | |||||||||||

Total revenues |

144,819 | 140,894 | 696,637 | 709,633 | 783,459 | |||||||||||

Club operating costs exclusive of depreciation |

97,288 | 97,364 | 458,241 | 461,260 | 530,152 | |||||||||||

Cost of food and beverage sales exclusive of depreciation |

12,336 | 11,534 | 60,596 | 61,209 | 63,195 | |||||||||||

Depreciation and amortization |

21,180 | 21,278 | 92,673 | 98,619 | 101,724 | |||||||||||

Provision for doubtful accounts |

856 | 1,263 | 3,248 | 4,815 | 4,550 | |||||||||||

Loss (gain) on disposals and acquisitions of assets |

2,195 | 109 | (5,351 | ) | 6,473 | 3,880 | ||||||||||

Impairment of assets |

— | — | 9,243 | 11,808 | 2,642 | |||||||||||

Selling, general and administrative expenses |

8,995 | 7,971 | 38,946 | 39,266 | 45,136 | |||||||||||

Operating income from continuing operations |

1,969 | 1,375 | 39,041 | 26,183 | 32,180 | |||||||||||

Interest and investment income |

33 | 297 | 714 | 2,684 | 4,290 | |||||||||||

Equity in earnings from unconsolidated ventures |

259 | 89 | 1,309 | 706 | 1,514 | |||||||||||

Interest expense |

(19,982 | ) | (12,587 | ) | (57,165 | ) | (58,383 | ) | (94,583 | ) | ||||||

Change in fair value of interest rate cap agreements |

(75 | ) | (2,510 | ) | (3,529 | ) | 2,624 | (10,454 | ) | |||||||

Gain on extinguishment of debt |

— | — | 334,412 | — | — | |||||||||||

Other income |

861 | 909 | 3,929 | 6,006 | 7,387 | |||||||||||

(Loss) income before income taxes |

(16,935 | ) | (12,427 | ) | 318,711 | (20,180 | ) | (59,666 | ) | |||||||

Income tax benefit (expense) |

6,209 | 3,338 | (57,109 | ) | 958 | 17,803 | ||||||||||

(Loss) income from continuing operations |

(10,726 | ) | (9,089 | ) | 261,602 | (19,222 | ) | (41,863 | ) | |||||||

(Loss) income from discontinued operations, net of tax |

(130 | ) | (69 | ) | 54 | (795 | ) | (23,584 | ) | |||||||

Loss from discontinued Non-Core Entities, net of tax |

— | (5,253 | ) | (8,779 | ) | (11,487 | ) | (4,134 | ) | |||||||

Net (loss) income |

$ | (10,856 | ) | $ | (14,411 | ) | $ | 252,877 | $ | (31,504 | ) | $ | (69,581 | ) | ||

Balance sheet data: |

||||||||||||||||

Cash and cash equivalents |

$ | 72,694 | $ | 87,737 | $ | 56,531 | $ | 73,568 | $ | 213,288 | ||||||

Restricted cash |

122 | 13,731 | 525 | 14,100 | 9,324 | |||||||||||

Total assets |

1,772,357 | 2,150,946 | 1,780,929 | 2,163,515 | 2,429,663 | |||||||||||

Membership deposits—current portion(2) |

56,219 | 40,741 | 51,704 | 38,161 | 31,240 | |||||||||||

Long-term debt (net of current portion) |

770,492 | 1,389,349 | 772,079 | 1,391,367 | 1,512,994 | |||||||||||

Membership deposits(2) |

211,752 | 207,195 | 211,624 | 205,253 | 192,624 | |||||||||||

Total (deficit) equity |

219,994 | (258,781 | ) | 231,029 | (244,357 | ) | (116,074 | ) | ||||||||

Other data: |

||||||||||||||||

Ratio of earnings to fixed charges(3) |

— | — | 5.93x | — | — | |||||||||||

- (1)

- Our fiscal year consists of a 52/53 week period ending on the last Tuesday of December. For 2008, our fiscal year was comprised of the 53 weeks ended December 30, 2008. For 2009 and 2010, our fiscal years were comprised of the 52 weeks ended December 29, 2009 and December 28, 2010, respectively.

14

- (2)

- The

liability for membership deposits is the difference between the amount paid by the member and the present value of the refund obligation. The present

value of the refund obligation of the membership deposit liability accretes over the nonrefundable term using the effective interest method with an interest rate defined as our weighted average

borrowing rate adjusted to reflect a 30-year time frame.

- (3)

- The

ratio of earnings to fixed charges is computed by dividing income (or loss) from continuing operations before income taxes and fixed charges less

interest capitalized during such period, net of amortization of previously capitalized interest, by fixed charges. Fixed charges consist of interest, expensed or capitalized, on borrowings (including

or excluding deposits, as applicable) and the portion of rental expense that is representative of interest. Fixed charges exceeded earnings by $17.0 million, $12.4 million, $20.7 million and $60.1

million for the twelve weeks ended March 22, 2011 and March 23, 2010 and for the fiscal years ended December 29, 2009, and December 30, 2008, respectively.

- (4)

- The statement of operations and balance sheet data reflect the ClubCorp Formation from November 30, 2010, which was treated as reorganization of entities under common control.

15

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before deciding to tender your outstanding notes in the exchange offer. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. In such a case, the trading price of the notes could decline or we may not be able to make payments of interest and principal on the notes, and you may lose all or part of your original investment.

Risks Relating to the Exchange Offer

If you do not exchange your outstanding notes in the exchange offer, the transfer restrictions currently applicable to your outstanding notes will remain in force, and the market price of your outstanding notes could decline.

If you do not exchange your outstanding notes for exchange notes in the exchange offer, you will continue to be subject to restrictions on transfer of your outstanding notes as set forth in the offering memorandum distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to "Prospectus Summary—The Exchange Offer" and "The Exchange Offer" for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offer will reduce the aggregate principal amount of the outstanding notes, which may have an adverse effect upon, and increase the volatility of, the market prices of the outstanding notes due to a reduction in liquidity. In addition, if you do not exchange your outstanding notes in the exchange offer, you will no longer be entitled to exchange your outstanding notes for exchange notes registered under the Securities Act, and you will no longer be entitled to have your outstanding notes registered for resale under the Securities Act.

Risks Related to our Indebtedness and the Notes

Our level of indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to plan for and react to changes in the economy, our industry or our business and prevent us from meeting our obligations under the notes.

As of March 22, 2011, we were significantly leveraged and our total indebtedness was approximately $782.2 million. Our substantial degree of leverage could have important consequences for you, including the following:

- •

- it may limit our ability to obtain additional debt or equity financing for working capital, capital expenditures, product

development, debt service requirements, acquisitions or general corporate or other purposes;

- •

- a substantial portion of our cash flows from operations will be dedicated to the payment of principal and interest on our

indebtedness and will not be available for other purposes, including our operations, capital expenditures, and other business opportunities;

- •

- the debt service requirements of our other indebtedness could make it more difficult for us to satisfy our financial

obligations, including those related to the notes;

- •

- certain of our borrowings, including borrowings under our secured credit facilities, are at variable rates of interest, exposing us to the risk of increased interest rates;

16

- •

- it may limit our flexibility in planning for, or our ability to adjust to, changes in our business or the industry in

which we operate, and place us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- we may be vulnerable to a downturn in general economic conditions or in our business, or we may be unable to carry out capital spending that is important to our growth.

Although our total indebtedness decreased as a result of the ClubCorp Formation, our interest expense is substantially higher after giving effect to the ClubCorp Formation, as compared to our interest expense for prior periods, as a result of higher aggregate interest rates on our debt.

We may not be able to generate sufficient cash to service all of our indebtedness, including the notes, and be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments or to refinance our debt obligations depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness. See "Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources." If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness, including the notes. We cannot assure you that we would be able to take any of these actions, that these actions would be successful and permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, including our secured credit facilities or the indenture that governs the notes. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. Our secured credit facilities and the indenture that governs the notes restrict our ability to dispose of assets and use the proceeds from the disposition. We may not be able to consummate those dispositions or to obtain the proceeds which we could realize from them and these proceeds may not be adequate to meet any debt service obligations then due. See "Description of Other Indebtedness" and "Description of the Notes."

If we cannot make scheduled payments on our debt, we will be in default and, as a result:

- •

- our debt holders could declare all outstanding principal and interest to be due and payable;

- •

- the lenders under our secured credit facilities could terminate their commitments to lend us money and foreclose against

the assets securing their borrowings; and

- •

- we could be forced into bankruptcy or liquidation, which could result in you losing your investment in the notes.

Despite current indebtedness levels, we may still be able to incur substantially more debt. This could further exacerbate the risks described above.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of the indenture governing the notes do not fully prohibit us or our subsidiaries from doing so. If we incur any additional indebtedness that ranks pari passu with the notes, the holders of that debt will be entitled to share ratably with you in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. This may have the effect of reducing the amount of proceeds paid to you. On November 30, 2010, we entered into a senior secured debt facility with Citigroup ("Senior Secured Credit Facility") comprised of (i) a $310.0 million term loan facility and (ii) a revolving credit facility with a maximum borrowing limit of $50.0 million, which

17

includes letter of credit and swing line facilities. As of March 22, 2011, $32.7 million was available for borrowing under the revolving credit facility. Additionally, ClubCorp has the option to increase the term loan facility by up to $50.0 million and the revolving credit facility by up to an additional $25.0 million, both subject to conditions and restrictions in the Senior Secured Credit Facility. If new debt is added to our current debt levels, the related risks that we and our subsidiaries now face could intensify. The subsidiaries that guarantee the notes also guarantee under our Senior Secured Credit Facility. See "Description of Other Indebtedness" and "Description of the Notes."

Restrictive covenants may adversely affect our operations.

Our Senior Secured Credit Facility and the indenture governing the notes contain various covenants that limit our ability to, among other things:

- •

- incur or guarantee additional indebtedness;

- •

- pay dividends or distributions on capital stock or redeem or repurchase capital stock;

- •

- make investments;

- •

- create restrictions on the payment of dividends or other amounts to us;

- •

- sell stock of our subsidiaries;

- •

- transfer or sell assets;

- •

- create liens;

- •

- enter into transactions with affiliates; and

- •

- enter into mergers or consolidations.

In addition, the restrictive covenants in our Senior Secured Credit Facility require us to maintain specified financial ratios and satisfy other financial condition tests. Our ability to meet those financial ratios and tests can be affected by events beyond our control, and we cannot assure you that we will meet them. A breach of any of these covenants could result in a default under our Senior Secured Credit Facility. Upon the occurrence of an event of default under our Senior Secured Credit Facility, the lenders could elect to declare all amounts outstanding thereunder to be immediately due and payable and terminate all commitments to extend further credit. If we were unable to repay those amounts, the lenders under our Senior Secured Credit Facility could proceed against the collateral granted to them to secure that indebtedness. We have pledged a significant portion of our assets as collateral under our Senior Secured Credit Facility. If the lenders under our Senior Secured Credit Facility accelerate the repayment of borrowings, we cannot assure you that we will have sufficient assets to repay our Senior Secured Credit Facility and our other indebtedness, including the notes, or borrow sufficient funds to refinance such indebtedness. Even if we are able to obtain new financing, it may not be on commercially reasonable terms, or terms that are acceptable to us. See "Description of Other Indebtedness."

The notes are structurally subordinated to all indebtedness of our existing or future subsidiaries that do not become guarantors of the notes.

You will not have any claim as a creditor against any of our existing subsidiaries that are not guarantors of the notes or against any of our future subsidiaries that do not become guarantors of the notes. Indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries are effectively senior to your claims against those subsidiaries.

For the fiscal year ended December 28, 2010 and the twelve weeks ended March 22, 2011, our non-guarantor subsidiaries collectively represented approximately 6.6% and 7.7%, respectively, of our

18

consolidated revenues. At March 22, 2011, our non-guarantor subsidiaries collectively represented 8.3% of our total assets, excluding intercompany items, and had approximately $137.3 million of outstanding total liabilities, including trade payables, all of which is structurally senior to the notes.

In addition, the indenture governing the notes, subject to some limitations, permits these subsidiaries to incur additional indebtedness and does not contain any limitation on the amount of other liabilities, such as trade payables, that may be incurred by these subsidiaries.

Your right to receive payments on the notes is effectively junior to those lenders who have a security interest in our assets.

Our obligations under the notes and the guarantors' obligations under their guarantees of the notes are unsecured. As a result, the notes and the related guarantees are effectively subordinated to all of our and the guarantors' secured indebtedness to the extent of the value of the assets securing such indebtedness. Our obligations under our Senior Secured Credit Facility are secured by a pledge of substantially all of our and our guarantors' tangible and intangible assets. In the event that we or a guarantor are declared bankrupt, become insolvent or are liquidated or reorganized, our obligations under our Senior Secured Credit Facility and any other secured obligations will be entitled to be paid in full from our assets or the assets of such guarantor, as the case may be, pledged as security for such obligation before any payment may be made with respect to the notes. Holders of the notes would participate ratably in our remaining assets or the remaining assets of the guarantor, as the case may be, with all holders of unsecured indebtedness that are deemed to rank equally with the notes, based upon the respective amount owed to each creditor. In addition, if we default under our Senior Secured Credit Facility, the lenders could declare all of the funds borrowed thereunder, together with accrued interest, immediately due and payable. If we were unable to repay such indebtedness, the lenders could foreclose on the pledged assets to the exclusion of holders of the notes, even if an event of default exists under the indenture under which the notes were issued at such time. Furthermore, if the lenders foreclose and sell the pledged equity interests in any subsidiary guarantor under the notes, then that subsidiary guarantor will be released from its guarantee of the notes automatically and immediately upon such sale. In any such event, because the notes will not be secured by any of our assets or the equity interests in subsidiary guarantors, it is possible that there would be no assets remaining from which your claims could be satisfied or, if any assets remained, they might be insufficient to satisfy your claims fully. See "Description of Other Indebtedness."

As of March 22, 2011, ClubCorp, and its guarantor subsidiaries had approximately $744.4 million of indebtedness and our non-guarantor subsidiaries had $37.8 million of indebtedness, of which $32.0 million was non-recourse to us. The indenture governing the notes permits the incurrence of substantial additional indebtedness by us and our restricted subsidiaries in the future, including secured indebtedness. Any secured indebtedness incurred would rank senior to the notes to the extent of the value of the assets securing such indebtedness.

If we default on our obligations to pay our indebtedness we may not be able to make payments on the notes.

Any default under the agreements governing our indebtedness, including a default under our Senior Secured Credit Facility that is not waived by the required lenders, and the remedies sought by the holders of such indebtedness, could make us unable to pay principal, premium, if any, and interest on the notes and substantially decrease the market value of the notes. If we are unable to generate sufficient cash flows and are otherwise unable to obtain funds necessary to meet required payments of principal, premium (if any) and interest on our indebtedness, or if we otherwise fail to comply with the various covenants, including financial and operating covenants, in the instruments governing our indebtedness (including covenants in the indentures and our Senior Secured Credit Facility), we could be in default under the terms of the agreements governing such indebtedness, including our Senior Secured Credit Facility and the indenture governing the notes. In the event of such default, the holders

19

of such indebtedness could elect to declare all the funds borrowed thereunder to be due and payable, together with accrued and unpaid interest, the lenders under our Senior Secured Credit Facility could elect to terminate their commitments thereunder and cease making further loans and institute foreclosure proceedings against our assets and we could be forced into bankruptcy or liquidation. If our operating performance declines, we may in the future need to obtain waivers from the required lenders under our Senior Secured Credit Facility to avoid being in default. If we breach our covenants under our Senior Secured Credit Facility and seek a waiver, we may not be able to obtain a waiver from the required lenders. If this occurs, we would be in default under our Senior Secured Credit Facility, the lenders could exercise their rights, as described above, and we could be forced into bankruptcy or liquidation. See "Description of Other Indebtedness" and "Description of the Notes."

The exchange notes will be issued with original issue discount for U.S. federal income tax purposes.

The exchange notes will be issued with original issue discount, or OID, for U.S. federal income tax purposes. U.S. Holders (as defined in "Material U.S. Federal Income and Estate Tax Considerations") will be required to include amounts representing the OID in gross income on a constant yield basis for U.S. federal income tax purposes, in advance of the receipt of cash payments to which such income is attributable. For more information, see "Material U.S. Federal Income and Estate Tax Considerations."

We may not be able to repurchase the notes upon a change of control.

If a change of control event occurs, as described in "Description of the Notes—Repurchase at the Option of Holders—Change of Control," we will be required to offer to repurchase all outstanding notes at 101% of their principal amount, plus accrued and unpaid interest. We may not be able to repurchase the notes upon a change of control triggering event because we may not have sufficient funds. Further, we may be contractually restricted under the terms of our Senior Secured Credit Facility from repurchasing all of the notes tendered by holders upon a change of control event. Accordingly, we may not be able to satisfy our obligations to purchase your notes unless we are able to refinance or obtain waivers under our Senior Secured Credit Facility. Our failure to repurchase the notes upon a change of control event would cause a default under the indenture governing the notes and a cross-default under our Senior Secured Credit Facility. Our Senior Secured Credit Facility also provides that a change of control, as defined in such agreement, will be a default that permits lenders to accelerate the maturity of borrowings thereunder and, if such debt is not paid, to enforce security interests in the collateral securing such debt, thereby limiting our ability to raise cash to purchase the notes, and reducing the practical benefit of the offer-to-purchase provisions to the holders of the notes. Any of our future debt agreements may contain similar provisions. In addition, the change of control provisions in the indenture governing the notes may not protect you from certain important corporate events, such as a leveraged recapitalization (which would increase the level of our indebtedness), reorganization, restructuring, merger or other similar transaction. Such a transaction may not involve a change in voting power or beneficial ownership or, even if it does, may not involve a change that constitutes a "change of control" as defined in the indenture governing the notes that could trigger our obligation to repurchase the notes. If an event occurs that does not constitute a "change of control" as defined in the indenture governing the notes, we will not be required to make an offer to repurchase the notes and you may be required to continue to hold your notes despite the event. See "Description of Other Indebtedness" and "Description of the Notes—Repurchase at the Option of Holders—Change of Control."

Variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Certain of our borrowings, primarily borrowings under our Senior Secured Credit Facility, are subject to variable rates of interest and expose us to interest rate risk. If interest rates increase, our

20

debt service obligations on our variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income would decrease. The interest rate on our Senior Secured Credit Facility is the higher of (i) 6.0% ("Floor") or (ii) an elected LIBOR plus a margin of 4.5% less the impact of the interest rate cap agreement that limits our exposure on the elected LIBOR to 3.0% on a notional amount of $155.0 million. In connection with the Floor, if the LIBOR rate exceeds 1.5%, our interest rate will become variable. A hypothetical 0.50% increase in LIBOR rates applicable to borrowings under our variable rate debt instruments would result in an estimated increase of $0.2 million per year of interest expense.

Federal and state fraudulent transfer laws permit a court to void the notes and the guarantees, and, if that occurs, you may not receive any payments on the notes.

The issuance of the notes and the guarantees may be subject to review under federal and state fraudulent transfer and conveyance statutes. While the relevant laws may vary from state to state, under such laws the payment of consideration will be a fraudulent conveyance if (1) we paid the consideration with the intent of hindering, delaying or defrauding creditors or (2) we or any of our guarantors, as applicable, received less than reasonably equivalent value or fair consideration in return for issuing either the notes or a guarantee and, in the case of (2) only, one of the following is also true:

- •

- we or any of our guarantors were insolvent or rendered insolvent by reason of the incurrence of the indebtedness;

- •

- payment of the consideration left us or any of our guarantors with an unreasonably small amount of capital to carry on the

business; or

- •

- we or any of our guarantors intended to, or believed that we or it would, incur debts beyond our or its ability to pay as they mature.

If a court were to find that the issuance of the notes or a guarantee was a fraudulent conveyance, the court could void the payment obligations under the notes or such guarantee or subordinate the notes or such guarantee to presently existing and future indebtedness of ours or such guarantor, or require the holders of the notes to repay any amounts received with respect to the notes or such guarantee. In the event of a finding that a fraudulent conveyance occurred, you may not receive any repayment on the notes. Further, the voidance of the notes could result in an event of default with respect to our other debt and that of our guarantors that could result in acceleration of such debt.

Generally, an entity would be considered insolvent if at the time it incurred indebtedness:

- •

- the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all its assets;

- •

- the present fair saleable value of its assets was less than the amount that would be required to pay its probable

liability on its existing debts and liabilities, including contingent liabilities, as they become absolute and mature; or

- •

- it could not pay its debts as they become due.

We cannot be certain as to the standards a court would use to determine whether or not we or the guarantors were solvent at the relevant time, or regardless of the standard that a court uses, that the issuance of the notes and the guarantees would not be subordinated to our or any guarantor's other debt.

If the guarantees were legally challenged, any guarantee could also be subject to the claim that, since the guarantee was incurred for our benefit, and only indirectly for the benefit of the guarantor, the obligations of the applicable guarantor were incurred for less than fair consideration. A court could thus void the obligations under the guarantees, subordinate them to the applicable guarantor's other debt or take other action detrimental to the holders of the notes.

21

Your ability to transfer the notes may be limited by the absence of an active trading market, and there is no assurance that any active trading market will develop for the notes.

The exchange notes are a new issue of securities for which there is no established public market. We do not intend to have the exchange notes listed on a national securities exchange or to arrange for quotation on any automated dealer quotation systems. The initial purchaser of the outstanding notes has advised us that they intend to make a market in the exchange notes, as permitted by applicable laws and regulations; however, the initial purchaser is not obligated to make a market in the exchange notes and it may discontinue their market making activities at any time without notice. In addition, such market making activities may be limited during the exchange offer or while the effectiveness of a shelf registration statement is pending. Therefore, we cannot assure you as to the development or liquidity of any trading market for the exchange notes. The liquidity of any market for the exchange notes will depend on a number of factors, including:

- •

- the number of holders of notes;

- •

- our operating performance and financial condition;

- •

- our ability to complete the exchange offer;

- •

- the market for similar securities;

- •

- the interest of securities dealers in making a market in the notes; and

- •

- prevailing interest rates.

Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. We cannot assure you that the market, if any, for the exchange notes will be free from similar disruptions or that any such disruptions may not adversely affect the prices at which you may sell your exchange notes. Therefore, we cannot assure you that you will be able to sell your exchange notes at a particular time or the price that you receive when you sell will be favorable.

Ratings of the notes may affect the market price and marketability of the notes.

The notes are currently rated by Moody's Investors Service, Inc. and Standard & Poor's Ratings Services, a division of The McGraw-Hill Companies, Inc. Such ratings are limited in scope, and do not address all material risks relating to an investment in the notes, but rather reflect only the view of each rating agency at the time the rating is issued. An explanation of the significance of such rating may be obtained from such rating agency. There is no assurance that such credit ratings will remain in effect for any given period of time or that such ratings will not be lowered, suspended or withdrawn entirely by the rating agencies, if, in each rating agency's judgment, circumstances so warrant. It is also possible that such ratings may be lowered in connection with the application of the proceeds of this offering or in connection with future events, such as future acquisitions. Holders of notes will have no recourse against us or any other parties in the event of a change in or suspension or withdrawal of such ratings. Any lowering, suspension or withdrawal of such ratings may have an adverse effect on the market price or marketability of the notes.

Risks Related to Our Business

Economic recessions or downturns could harm our business, financial condition and results of operations, and the recent economic downturn and financial crisis has negatively affected and will continue to negatively affect our business, financial condition and results of operations.

A substantial portion of our revenue is derived from discretionary or leisure spending by our members and guests and such spending can be particularly sensitive to changes in general economic

22

conditions. The recent global recession and financial crisis has led to slower economic activity, increased unemployment, concerns about inflation and energy costs, decreased business and consumer confidence, reduced corporate profits and capital spending, adverse business conditions and lower levels of liquidity in many financial markets, which has negatively affected our business, financial condition and results of operations. For example, for the fiscal year ended December 28, 2010, we experienced 17.2% and 24.2% attrition in member count in our golf and country clubs and business, sports and alumni clubs, respectively, as consumers and businesses cut back on discretionary spending. The continuation of this global recession and financial crisis may lead to further increases in unemployment and loss of consumer confidence which would likely translate into additional resignations of existing members, a decrease in the rate of new memberships and reduced spending by our members. As a result, our business, financial condition and results of operations could continue to be materially adversely affected if the downturn continues.

Our businesses will remain susceptible to future economic recessions or downturns, and any significant adverse shift in general economic conditions, whether local, regional or national, would likely have a material adverse effect on our business, financial condition and results of operations. During such periods of adverse economic conditions, we may be unable to increase membership dues or the price of our products and services and experience resignations of existing members, a decrease in the rate of new memberships or reduced spending by our members, any of which may result in, among other things, decreased revenues and financial losses. In addition, during periods of adverse economic conditions, we may have difficulty accessing financial markets or face increased funding costs, which could make it more difficult or impossible for us to obtain funding for additional investments and harm our results of operations.

We may not be able to attract and retain club members, which could harm our business, financial condition and results of operations.

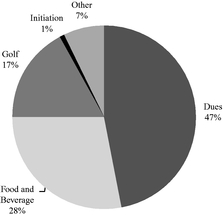

Our success depends on our ability to attract and retain members at our clubs and maintain or increase usage of our facilities. Changes in consumer tastes and preferences, particularly those affecting the popularity of golf and private dining, and other social and demographic trends could adversely affect our business. Historically, we have experienced varying levels of membership enrollment and attrition rates and, in certain areas, decreased levels of usage of our facilities. Significant periods where attrition rates exceed enrollment rates or where facilities usage is below historical levels would have a material adverse effect on our business, results of operations and financial condition. By comparison, for the fiscal year ended December 28, 2010, 47.4% of our total operating revenues came from monthly membership dues. During the same period, 24.2% of our business, sports and alumni club memberships (17,535 memberships), and 17.2% of our private country club and semi-private golf memberships (13,665 memberships) were cancelled, resulting in a net loss in memberships of 5.2% and 1.2%, respectively, after the addition of new memberships. If we cannot attract new members or retain our existing members, our business, financial condition and results of operations could be harmed.

Competition in the industry in which we compete could have a material adverse effect on our business and results of operations.

We operate in a highly competitive industry, and compete primarily on the basis of management expertise, reputation, featured facilities, location, quality and breadth of member product offerings and price. As a result, competition for market share in the industry in which we compete is intense. In order to succeed, we must take market share from local and regional competitors and sustain our membership base in the face of increasing recreational alternatives available to our existing and potential members.

Our business clubs compete on a local and regional level with restaurants and other business and social clubs. The number and variety of competitors in this business varies based on the location and

23

setting of each facility, with some situated in intensely competitive upscale urban areas characterized by frequent innovations in the products and services offered by competing restaurants and other business, dining and social clubs. In addition, in most regions these businesses are in constant flux as new restaurants and other social and meeting venues open or expand their amenities. As a result of these characteristics, the supply in a given region often exceeds the demand for such facilities, and any increase in the number or quality of restaurants and other social and meeting venues, or the products and services they provide, in a given region could significantly impact the ability of our clubs to attract and retain members, which could harm our business and results of operations.

Our country clubs and golf facilities compete on a local and regional level with other country clubs and golf facilities. The level of competition in the country club and golf facility business varies from region to region and is subject to change as existing facilities are renovated or new facilities are developed. An increase in the number or quality of similar clubs and other facilities in a particular region could significantly increase competition, which could have a negative impact on our business and results of operations.

Our results of operations also could be affected by a number of additional competitive factors, including the availability of, and demand for, alternative venues for recreational pursuits, such as multi-use sports and athletic centers. In addition, individual member-owned private clubs may be able to create a perception of exclusivity that we have difficulty replicating given the diversity of our product portfolio and the scope of our holdings. To the extent these alternatives succeed in diverting actual or potential members away from our facilities or affect our membership rates, our business and results of operations could be harmed.

Changes in consumer spending patterns, particularly discretionary expenditures for leisure, travel and recreation, are susceptible to factors beyond our control that may reduce demand for our products and services.

Consumer spending patterns, particularly discretionary expenditures for leisure, travel and recreation, are particularly susceptible to factors beyond our control that may reduce demand for our products and services, including demand for memberships, golf, vacation and business travel and food and beverage sales. These factors include:

- •

- low consumer confidence;

- •

- depressed housing prices;

- •

- changes in the desirability of particular locations, residential neighborhoods, office space, or travel patterns of

members;